Platinum Australia WKN 578957 - 500 Beiträge pro Seite

eröffnet am 31.05.06 09:03:11 von

neuester Beitrag 09.04.15 08:23:13 von

neuester Beitrag 09.04.15 08:23:13 von

Beiträge: 196

ID: 1.063.296

ID: 1.063.296

Aufrufe heute: 0

Gesamt: 48.293

Gesamt: 48.293

Aktive User: 0

ISIN: AU000000PLA8 · WKN: 578957

0,0000

USD

-95,00 %

-0,0001 USD

Letzter Kurs 23.12.15 Nasdaq OTC

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 29,17 | +14,48 | |

| 0,7999 | +14,27 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 30,30 | -9,28 | |

| 17,310 | -9,98 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 | |

| 0,5550 | -29,30 |

Australischer Explorer mit vier Projekten.

Das Panton Projekt im North West Territorium von Australien,

die anderen drei in Südafrika.

Exploriert wird haupsächlich nach Platin, Palladium und Rhodium.

Ich habe diesen Wert schon seit ein paar Wochen beobachtet und bin gestern zu 0.45 Euro eingestiegen.

Dieser Wert ist relativ unbekannt in Deutschland und wird bisher nur in geringen Stückzahlen gehandelt, was sich hoffentlich bald ändert!

Die Hompage lautet: http://www.platinumaus.com.au

Das Panton Projekt im North West Territorium von Australien,

die anderen drei in Südafrika.

Exploriert wird haupsächlich nach Platin, Palladium und Rhodium.

Ich habe diesen Wert schon seit ein paar Wochen beobachtet und bin gestern zu 0.45 Euro eingestiegen.

Dieser Wert ist relativ unbekannt in Deutschland und wird bisher nur in geringen Stückzahlen gehandelt, was sich hoffentlich bald ändert!

Die Hompage lautet: http://www.platinumaus.com.au

Hab noch etwas vergessen, Kürzel an der ASX ist PLA!

Hab noch etwas vergessen, Kürzel an der ASX ist PLA!SK heute Morgen war 0.88 AUD also umgerechnet 0.52 Euro.

Niemand von den W:O's dabei?

Ich sehe Platinum als eine langfristige Investition, werde mich demnächst in meinem lang ersehnten Urlaub in Australien ein wenig schlauer machen.

Bis dahin erst einmal ein schönes Pfingstfest für alle User!!

Gruß, Sb!

Ich sehe Platinum als eine langfristige Investition, werde mich demnächst in meinem lang ersehnten Urlaub in Australien ein wenig schlauer machen.

Bis dahin erst einmal ein schönes Pfingstfest für alle User!!

Gruß, Sb!

Da ist er wieder!

Immer noch niemand von der W

Gemeinde hier investiert?http://sa.iguana2.com/cache/f6ca26ed0b7c566bd1c6cd395f557480…

Gemeinde hier investiert?http://sa.iguana2.com/cache/f6ca26ed0b7c566bd1c6cd395f557480…

Resultate aus der Smokey Hills Durchführbarkeitsstudie.

Thread: Kein Titel für Thread 2832067542288792872636632823628320675422887928726366

Thread: Kein Titel für Thread 2832067542288792872636632823628320675422887928726366

Antwort auf Beitrag Nr.: 22.564.521 von strongbuy61 am 13.07.06 13:19:20Der Link funktioniert wegen dem Wort "Thread" am Anfang nicht.

Grüße

Grüße

Aus gegebenem Anlass enthistorisieren wir diesen Thread.

MfG

MaatMOD

MfG

MaatMOD

Antwort auf Beitrag Nr.: 28.048.219 von odin1603 am 01.03.07 15:20:13Ich glaube wir fangen den Thread erst mal ganz neu an!!!!

Erst mal zu den Fakten.

Platinum ist ein Austr.Explorer der in Kürze den Sprung zum Produzenten machen wird.

Company Name: Platinum Australia

Exchange: Sydney ASX

Shares Outstanding: 184,530,521

Market Cap: 258.3 Million AUD (ca.154 Mio €)

Gelistet in

Australien an der ASX

London LSE

Frankfurt

Erst mal zu den Fakten.

Platinum ist ein Austr.Explorer der in Kürze den Sprung zum Produzenten machen wird.

Company Name: Platinum Australia

Exchange: Sydney ASX

Shares Outstanding: 184,530,521

Market Cap: 258.3 Million AUD (ca.154 Mio €)

Gelistet in

Australien an der ASX

London LSE

Frankfurt

Antwort auf Beitrag Nr.: 28.054.310 von odin1603 am 01.03.07 19:12:22Platinum hat vier sehr aussichtsreiche Projekte in Arbeit.

Es handelt sich um 3 Projekte im weltgrößten Platinabbaugebiet der Welt im Bushvelt-Complex in Südafrika und einem Gebiet in Australien.

http://www.platinumaus.com.au

Es handelt sich um 3 Projekte im weltgrößten Platinabbaugebiet der Welt im Bushvelt-Complex in Südafrika und einem Gebiet in Australien.

http://www.platinumaus.com.au

Antwort auf Beitrag Nr.: 28.054.425 von odin1603 am 01.03.07 19:16:2424 Rivers Project

The 24 Rivers PGM Project is located on the northern limb of the Bushveld Complex and covers a fault displaced section of the complex with a strike length of approximately 2 Kilometres.

The part of the Bushveld Complex present on the project, known as the Rustenburg Layered Suite, hosts the Platreef which is mined by Anglo Platinum at its PPRust mine north of the 24 Rivers Project. The Platreef is known to extend along strike to the north and south if the PPRust mine, having been identified in numerous prospects currently under evaluation and the Company is confident that it should be present on 24 Rivers.

The Platreef varies in thickness from a few metres to approximately 30 metres wide and tends to be of low to medium grade in the region of 1 to 5 g/t PGM. It is generally outcropping or sub outcropping and is mined by open cut method.

The 24 Rivers PGM Project is located on the northern limb of the Bushveld Complex and covers a fault displaced section of the complex with a strike length of approximately 2 Kilometres.

The part of the Bushveld Complex present on the project, known as the Rustenburg Layered Suite, hosts the Platreef which is mined by Anglo Platinum at its PPRust mine north of the 24 Rivers Project. The Platreef is known to extend along strike to the north and south if the PPRust mine, having been identified in numerous prospects currently under evaluation and the Company is confident that it should be present on 24 Rivers.

The Platreef varies in thickness from a few metres to approximately 30 metres wide and tends to be of low to medium grade in the region of 1 to 5 g/t PGM. It is generally outcropping or sub outcropping and is mined by open cut method.

Antwort auf Beitrag Nr.: 28.054.507 von odin1603 am 01.03.07 19:19:06Kalplats Project

The Kalahari Platinum ("Kalplats") project is located in the North West Province of South Africa, 330 kilometres west of Johannesburg.

Platinum Australia Limited ("PLA") has signed a formal Joint Venture Agreementwith African Rainbow Minerals Platinum (Proprietary) Ltd ("ARMplatinum") which provides for PLA to earn up to 49% of the Kalplats Project by completing a Bankable Feasibility Study ("BFS") on the project and making the "Panton Metallurgical Process" available for the project at no cost.

The Kalplats Project is well advanced with over 45,000 metres of drilling having been completed between 2000 and 2003 to define a combined Indicated and Inferred Resource of 3.4 million ounces of 3E PGM (Pt + Pd + Au), including a high grade resource of 12 million tonnes @ 3.6 g/t 3E PGM for 1.4 million ounces 3E PGM.

PLA believes that subject to the completion of a Bankable Feasibility Study ("BFS"), the Kalplats Project has the potential to be developed initially as a major open cut mine producing 160,000 to 200,000 ounces of 3E PGM per annum with a life of +10 years. This could be followed by a similar sized underground operation more than doubling the life of the project.

GEOLOGY and MINERALISATION

The project lies in within the western limb of the Kraaipan Greenstone Belt, some 45km to the west of the existing Kalahari Goldridge mining project ("Kalgold"). The Platinum Group Metal ("PGM) mineralisation is developed within the Stella Layered Intrusion hosted within the Kraaipan greenstones.

The PGM mineralisation occurs as magmatic segregation reef deposits that are hosted in a magnetite gabbro within the steeply dipping Stella Layered Intrusion (SLI). A total of seven separate PGM deposits and three prospects have been identified over the 12km strike length of intrusion, and potential exists for further discoveries in the project area.

The host Kraaipan greenstone lithologies comprise deformed and metamorphosed volcanosedimentary rocks and associated granitoids; while the SLI comprises a series of layered, relatively unfoliated cumulate-textured gabbros, leucogabbros and magnetite gabbros. The magnetite content ranges from finely disseminated (1-2%) to strong segregations forming discrete

Rocks from the SLI have been dated in the order of 3.0 billion years (Archaean), which is substantially older than the 2.0 billion years of the Bushveld Igneous Complex that hosts the Merensky and UG2 reefs. This Archaean age make the Kalplats deposit one of the oldest known PGM deposits.

The SLI has undergone multiple stages of deformation including an initial folding event, layer parallel thrusting and cross-cutting brittle faulting. This late stage faulting has also seen the emplacement of felsic and mafic intrusive dykes. This complex structural history has resulted in localised duplication of the mineralised package, the emplacement of barren waste material into the mineralised package and dextral en echelon fault block displacement.

The Kalplats PGM deposit consists of a package of higher grade reefs separated by lower grade material. The full package varies in thickness with an average of approximately 50 metres. The full reef package is divided into a total of 6 individual reefs based on both PGM grade and metal ratios. The three high grade reefs (MR, LM & UM) with a combined grade and thickness of 8m @ 3.8 g/t Pt+Pd+Au, will be the main focus of resource development and subsequent feasibility studies by PLA.

The high grade MR, LM & UM reefs are noted to be associated with single massive magnetite reefs, with a surrounding lower grade halo. Current modelling is based on a grade rather than a geological cut-off; however PLA believes that the visual identification of these magnetite reefs along with elemental ratios, potentially utilising onsite hand-held XRF (X-Ray Fluorescence) technology, similar to that used for reef identification at the Panton Project; will lead to in-field identification of the mineralised reefs, and significantly improve geological interpretations and subsequent modelling.

RESOURCE

A SAMREC (South African Mineral Resource Committee) code compliant resource estimate was completed by previous owners over all seven deposits for the full mineralised package. The table below indicates this global resource, with a break down of the 'Main Reef Package' and the 'High grade Reefs' as indicated.

1) LG Reef, Mid Reef Package and Main Reef package

2) Included UM, Main and LM Reefs

3) Included UM, LM and MR1 Reefs

This resource is based on an estimated 46,000m of RC and Diamond drilling over the full length of the deposit. The Crater and Orion deposits have been the focus of much of this work, where drill sections are spaced at 25m intervals, while drill spacing in the remaining 5 deposits is between 50 and 200m. The resource has been estimated to a vertical depth of between 150-200m; with the deepest Main reef intersection at Crater, Orion and Crux of 165m, 190m and 220m respectively.

PROJECT DEVELOPMENT

PLA has completed a low level airborne geophysical survey at 50 metre line spacing on the project. The results from this work have provided more detailed information on the geology and structure of the project and identified a number of targets outside of the known deposits.

[/url]

[/url]

PLA is undertaking an extensive two phase resource development drilling program aimed at raising the status the currently identified deposits, testing the additional prospects and targets that have been identified by PLA and others and infilling between the know deposits.

The first phase results will provide an updated resource which will be the basis of the Pre Feasibility Study to be completed in 2005. The study will focus on the development of an open cut mining operation producing a flotation or high grade concentrate for smelting and/or refining by others.

The second phase of drilling will be completed as part of a Bankable Feasibility Study scheduled to be completed on the project in 2006. It is anticipated that this drilling will focus on further upgrading the total resource identified in the first phase of drilling to a level suitable to form the basis of the BFS. The BFS will also continue to focus on the development of an open cut mining operation, but will also provide an indication of the longer term underground potential of the project.

The Kalahari Platinum ("Kalplats") project is located in the North West Province of South Africa, 330 kilometres west of Johannesburg.

Platinum Australia Limited ("PLA") has signed a formal Joint Venture Agreementwith African Rainbow Minerals Platinum (Proprietary) Ltd ("ARMplatinum") which provides for PLA to earn up to 49% of the Kalplats Project by completing a Bankable Feasibility Study ("BFS") on the project and making the "Panton Metallurgical Process" available for the project at no cost.

The Kalplats Project is well advanced with over 45,000 metres of drilling having been completed between 2000 and 2003 to define a combined Indicated and Inferred Resource of 3.4 million ounces of 3E PGM (Pt + Pd + Au), including a high grade resource of 12 million tonnes @ 3.6 g/t 3E PGM for 1.4 million ounces 3E PGM.

PLA believes that subject to the completion of a Bankable Feasibility Study ("BFS"), the Kalplats Project has the potential to be developed initially as a major open cut mine producing 160,000 to 200,000 ounces of 3E PGM per annum with a life of +10 years. This could be followed by a similar sized underground operation more than doubling the life of the project.

GEOLOGY and MINERALISATION

The project lies in within the western limb of the Kraaipan Greenstone Belt, some 45km to the west of the existing Kalahari Goldridge mining project ("Kalgold"). The Platinum Group Metal ("PGM) mineralisation is developed within the Stella Layered Intrusion hosted within the Kraaipan greenstones.

The PGM mineralisation occurs as magmatic segregation reef deposits that are hosted in a magnetite gabbro within the steeply dipping Stella Layered Intrusion (SLI). A total of seven separate PGM deposits and three prospects have been identified over the 12km strike length of intrusion, and potential exists for further discoveries in the project area.

The host Kraaipan greenstone lithologies comprise deformed and metamorphosed volcanosedimentary rocks and associated granitoids; while the SLI comprises a series of layered, relatively unfoliated cumulate-textured gabbros, leucogabbros and magnetite gabbros. The magnetite content ranges from finely disseminated (1-2%) to strong segregations forming discrete

Rocks from the SLI have been dated in the order of 3.0 billion years (Archaean), which is substantially older than the 2.0 billion years of the Bushveld Igneous Complex that hosts the Merensky and UG2 reefs. This Archaean age make the Kalplats deposit one of the oldest known PGM deposits.

The SLI has undergone multiple stages of deformation including an initial folding event, layer parallel thrusting and cross-cutting brittle faulting. This late stage faulting has also seen the emplacement of felsic and mafic intrusive dykes. This complex structural history has resulted in localised duplication of the mineralised package, the emplacement of barren waste material into the mineralised package and dextral en echelon fault block displacement.

The Kalplats PGM deposit consists of a package of higher grade reefs separated by lower grade material. The full package varies in thickness with an average of approximately 50 metres. The full reef package is divided into a total of 6 individual reefs based on both PGM grade and metal ratios. The three high grade reefs (MR, LM & UM) with a combined grade and thickness of 8m @ 3.8 g/t Pt+Pd+Au, will be the main focus of resource development and subsequent feasibility studies by PLA.

The high grade MR, LM & UM reefs are noted to be associated with single massive magnetite reefs, with a surrounding lower grade halo. Current modelling is based on a grade rather than a geological cut-off; however PLA believes that the visual identification of these magnetite reefs along with elemental ratios, potentially utilising onsite hand-held XRF (X-Ray Fluorescence) technology, similar to that used for reef identification at the Panton Project; will lead to in-field identification of the mineralised reefs, and significantly improve geological interpretations and subsequent modelling.

RESOURCE

A SAMREC (South African Mineral Resource Committee) code compliant resource estimate was completed by previous owners over all seven deposits for the full mineralised package. The table below indicates this global resource, with a break down of the 'Main Reef Package' and the 'High grade Reefs' as indicated.

1) LG Reef, Mid Reef Package and Main Reef package

2) Included UM, Main and LM Reefs

3) Included UM, LM and MR1 Reefs

This resource is based on an estimated 46,000m of RC and Diamond drilling over the full length of the deposit. The Crater and Orion deposits have been the focus of much of this work, where drill sections are spaced at 25m intervals, while drill spacing in the remaining 5 deposits is between 50 and 200m. The resource has been estimated to a vertical depth of between 150-200m; with the deepest Main reef intersection at Crater, Orion and Crux of 165m, 190m and 220m respectively.

PROJECT DEVELOPMENT

PLA has completed a low level airborne geophysical survey at 50 metre line spacing on the project. The results from this work have provided more detailed information on the geology and structure of the project and identified a number of targets outside of the known deposits.

[/url]

[/url]PLA is undertaking an extensive two phase resource development drilling program aimed at raising the status the currently identified deposits, testing the additional prospects and targets that have been identified by PLA and others and infilling between the know deposits.

The first phase results will provide an updated resource which will be the basis of the Pre Feasibility Study to be completed in 2005. The study will focus on the development of an open cut mining operation producing a flotation or high grade concentrate for smelting and/or refining by others.

The second phase of drilling will be completed as part of a Bankable Feasibility Study scheduled to be completed on the project in 2006. It is anticipated that this drilling will focus on further upgrading the total resource identified in the first phase of drilling to a level suitable to form the basis of the BFS. The BFS will also continue to focus on the development of an open cut mining operation, but will also provide an indication of the longer term underground potential of the project.

Antwort auf Beitrag Nr.: 28.054.646 von odin1603 am 01.03.07 19:24:18 PANTON PLATINUM PALLADIUM PROJECT

The Panton Project is located adjacent to the Great Northern Highway, 60km north of Halls Creek in the Kimberly region of Western Australia. The Project is 100% owned by Platinum Australia Limited and is secured by three granted mining leases

The company completed a Bankable Level Feasibility Study on the Project in August 2003. The FS showed that the project was technically sound but not commercially viable at the prevailing palladium price and US$ exchange rate. During the term of the Feasibility Study the palladium price has dropped from over US$600 per ounce to US$200 per ounce and the Australian dollar has climbed from US$0.52 to over US$0.65. The increase in the platinum price from US$600 to US$700 per ounce, and the gold price from US$270 to US$375 per ounce during this time frame was insufficient to offset the far greater negative impact of the palladium price and exchange rate.

The Company believes that the project is well positioned to be developed when the palladium price recovers from its recent lows and the Australian dollar retreats from the current levels.

Based on the outcomes of the FS and further work completed internally the Company believes the Project would be commercially viable at a palladium price of US$350 and an exchange rate of US$0.58 assuming other prices used remain unchanged. This compares favourably with the average palladium price over the last four years of US$470 per ounce and the average exchange rate over the same timeframe of US$0.56.

Tenements and Ownership

The project ground is secured by three granted mining leases, M80/103, 104 and 105, with all three leases pre-dating the Native Title Act. PLA must pay a 2% net smelter royalty on PGM production to Minsaco, the original tenement owners, under the purchase agreement between Helix and Minsaco.

Geology and Mineralisation

The Panton Intrusive is a layered, differentiated mafic to ultramafic body that has been intruded into the sediments of the Proterozoic Lamboo Complex in the Kimberley Region of Western Australia. The Panton Intrusive is a structurally complex body that has undergone several folding and faulting events that have resulted in a southwesterly plunging synclinal structure some 10 kilometres long and 3 kilometres wide.

High grade PGM mineralisation is hosted within a number of stratiform chromitite reefs within the ultramafic sequence. The focus of the FS has been the Top Reef, which is situated approximately 150 metres below the mafic/ultramafic interface, and the parallel Middle Reef, which is approximately 15 metres below the Top Reef. The average true thickness of the Top Reef is over one metre and the average grade is 6.1 g/t PGM + Au. The Middle Reef averages 0.5 metres true thickness and has an average grade of 3.4 g/t PGM + Au.

Resource

During the 2003 field season a further six diamond holes were completed to infill an area of widely spaced drilling in the C sub block. The results were then incorporated into an updated Top Reef resource estimate of 10.1 million tonnes at 6.13 g/t PGM + Au.

A breakdown of the updated high grade resource is provided in the table below.

FEASIBILITY STUDY

Mining

The Mining Study as completed by AMC Consultants envisages an initial development of an open cut mine followed by the sequential development of two underground mines commencing in the second year of the project. The mining rate would be 600,000 tonnes per annum and mine life will be dependent on the metal prices and US$ exchange rate.

For example, at a palladium price of US$350, platinum price of US$700, gold price of US$350 and exchange rate of US$0.60, a mine life of approximately 10 years is estimated.

The underground mining operation would be developed as two separate mines accessed through independent declines. The A mine accessing the A and B sub blocks would be developed first, followed by the C mine which would access the BC and C sub blocks. Mining would be mechanised using a long hole, up-hole stoping method.

Processing

The Sudy envisages processing ore at a rate of 600,000 tonnes per annum at an average head grade of 5.5 g/t and a recovery of 79% Pt+Pd+Au, producing an average of over 80,000 ozs per annum in a high grade concentrate.

The proposed plant incorporates a standard crushing - grinding - flotation circuit to produce a low grade concentrate which is then treated on site through the patented Calcine-Leach-Metals Recovery Process developed by Platinum Australia and Lonmin Plc.

The design of the process plant is based on extensive laboratory test work of open cut and underground samples, combined with pilot plant test work for milling - flotation and the Calcine-Leach-Metals Recovery Process. The predicted recovery for the processing of primary Panton ore is as follows:

This overall recovery compares favourably with the overall recovery achieved through the traditional recovery route for many South African ores.

The final products from Panton would be a high grade PGM concentrate, with a grade of +50% PGM + Au, which would be shipped by air direct to a PGM refinery and a base metal concentrate, with a grade of +40% Ni + Cu, suitable as feed to a base metal refinery.

Environmental & Heritage

Environmental and heritage surveys have been completed on the project and have not identified any significant environmental issues that would adversely affect the project.

Exploration

Work on the evaluation of PGM bearing chromitite horizons outside of the currently defined resource continued during the year. The areas on which work was carried out included the southern limb, the south western extension of the D sub block, a fault offset intrusive block west of the Panton River and an interpreted fault offset extension of the A sub block.

Activities included Reverse Circulation (RC) and Diamond drilling; costeaning; detailed mapping of surface geology, regolith and structure; rock chip sampling.

Rock chip sampling of the fault offset A block extensions and the untested intrusive block west of the Panton river returned encouraging results with best results of 4.94 g/t Pt+Pd+Au and 5.52 g/t Pt + Pd + Au respectively. The best results from the southern limb were from holes PS 376 and PS 374 woth 1.0 metre at 2.35 g/t Pt + Pd + Au and 1.0 metre at 2.09 g/t Pt + Pd + Au respectively.

Interpretation of all results, along with conceptual 3 dimensional modelling of the intrusive, with the aim of generating new down dip and strike extension / fault offset targets, is an ongoing process.

PANTON PGM RECOVERY PROCESS

As part of the Feasibility Study undertaken on the Panton Project the Company has, in conjuncion with Lonmin Plc, developed a new metallurgical process for the recovery of PGM + Au. The development of this new "Panton Process" was driven by the refractory nature of the Panton ore which resulted in uneconomic recoveries of 65% or less and the production of low flotation concentrate grades of less than 100 g/t PGM + Au, which would be difficult to market.

The new process consists of two distinct parts, a Calcine-Leach Process in which a low grade flotation concentrate is subjected to low temperature calcination followed by cyanide leaching at elevated temperatures to dissolve the PGM's, gold and base metals; and a Metals Recovery Process which recovers the dissolved metals from the leach solution by precipitation and then further upgrades the precipitate to a high grade PGM concentrate and a separate base metal concentrate.

Following extensive laboratory scale testing, the Company, inconjunction with Lonmin Plc, has now tested the process at a pilot plant scale over a continuous 24 day period. Based on the results from this testwork the recoveries predicted for the primary Panton ore are as follows:

This new process offers significant benefits over the traditional smelter route for the Panton Project and potentially for other similar projects. These include:

* Increased or comparable recoveries;

* Reduced concentrate transport costs;

* Shorter processing pipeline and therefore more rapid payment for products;

* Increased payment for products by up to 20%; and

* Reduced environmental impact.

Platinum Australia believes that the advantages offered by the "Panton Process" have the potential to make it an attractive option for projects other than Panton. The Board is therefore actively seeking opportunities to apply this technology to other PGM projects for the benefit of the Company.

The Panton Project is located adjacent to the Great Northern Highway, 60km north of Halls Creek in the Kimberly region of Western Australia. The Project is 100% owned by Platinum Australia Limited and is secured by three granted mining leases

The company completed a Bankable Level Feasibility Study on the Project in August 2003. The FS showed that the project was technically sound but not commercially viable at the prevailing palladium price and US$ exchange rate. During the term of the Feasibility Study the palladium price has dropped from over US$600 per ounce to US$200 per ounce and the Australian dollar has climbed from US$0.52 to over US$0.65. The increase in the platinum price from US$600 to US$700 per ounce, and the gold price from US$270 to US$375 per ounce during this time frame was insufficient to offset the far greater negative impact of the palladium price and exchange rate.

The Company believes that the project is well positioned to be developed when the palladium price recovers from its recent lows and the Australian dollar retreats from the current levels.

Based on the outcomes of the FS and further work completed internally the Company believes the Project would be commercially viable at a palladium price of US$350 and an exchange rate of US$0.58 assuming other prices used remain unchanged. This compares favourably with the average palladium price over the last four years of US$470 per ounce and the average exchange rate over the same timeframe of US$0.56.

Tenements and Ownership

The project ground is secured by three granted mining leases, M80/103, 104 and 105, with all three leases pre-dating the Native Title Act. PLA must pay a 2% net smelter royalty on PGM production to Minsaco, the original tenement owners, under the purchase agreement between Helix and Minsaco.

Geology and Mineralisation

The Panton Intrusive is a layered, differentiated mafic to ultramafic body that has been intruded into the sediments of the Proterozoic Lamboo Complex in the Kimberley Region of Western Australia. The Panton Intrusive is a structurally complex body that has undergone several folding and faulting events that have resulted in a southwesterly plunging synclinal structure some 10 kilometres long and 3 kilometres wide.

High grade PGM mineralisation is hosted within a number of stratiform chromitite reefs within the ultramafic sequence. The focus of the FS has been the Top Reef, which is situated approximately 150 metres below the mafic/ultramafic interface, and the parallel Middle Reef, which is approximately 15 metres below the Top Reef. The average true thickness of the Top Reef is over one metre and the average grade is 6.1 g/t PGM + Au. The Middle Reef averages 0.5 metres true thickness and has an average grade of 3.4 g/t PGM + Au.

Resource

During the 2003 field season a further six diamond holes were completed to infill an area of widely spaced drilling in the C sub block. The results were then incorporated into an updated Top Reef resource estimate of 10.1 million tonnes at 6.13 g/t PGM + Au.

A breakdown of the updated high grade resource is provided in the table below.

FEASIBILITY STUDY

Mining

The Mining Study as completed by AMC Consultants envisages an initial development of an open cut mine followed by the sequential development of two underground mines commencing in the second year of the project. The mining rate would be 600,000 tonnes per annum and mine life will be dependent on the metal prices and US$ exchange rate.

For example, at a palladium price of US$350, platinum price of US$700, gold price of US$350 and exchange rate of US$0.60, a mine life of approximately 10 years is estimated.

The underground mining operation would be developed as two separate mines accessed through independent declines. The A mine accessing the A and B sub blocks would be developed first, followed by the C mine which would access the BC and C sub blocks. Mining would be mechanised using a long hole, up-hole stoping method.

Processing

The Sudy envisages processing ore at a rate of 600,000 tonnes per annum at an average head grade of 5.5 g/t and a recovery of 79% Pt+Pd+Au, producing an average of over 80,000 ozs per annum in a high grade concentrate.

The proposed plant incorporates a standard crushing - grinding - flotation circuit to produce a low grade concentrate which is then treated on site through the patented Calcine-Leach-Metals Recovery Process developed by Platinum Australia and Lonmin Plc.

The design of the process plant is based on extensive laboratory test work of open cut and underground samples, combined with pilot plant test work for milling - flotation and the Calcine-Leach-Metals Recovery Process. The predicted recovery for the processing of primary Panton ore is as follows:

This overall recovery compares favourably with the overall recovery achieved through the traditional recovery route for many South African ores.

The final products from Panton would be a high grade PGM concentrate, with a grade of +50% PGM + Au, which would be shipped by air direct to a PGM refinery and a base metal concentrate, with a grade of +40% Ni + Cu, suitable as feed to a base metal refinery.

Environmental & Heritage

Environmental and heritage surveys have been completed on the project and have not identified any significant environmental issues that would adversely affect the project.

Exploration

Work on the evaluation of PGM bearing chromitite horizons outside of the currently defined resource continued during the year. The areas on which work was carried out included the southern limb, the south western extension of the D sub block, a fault offset intrusive block west of the Panton River and an interpreted fault offset extension of the A sub block.

Activities included Reverse Circulation (RC) and Diamond drilling; costeaning; detailed mapping of surface geology, regolith and structure; rock chip sampling.

Rock chip sampling of the fault offset A block extensions and the untested intrusive block west of the Panton river returned encouraging results with best results of 4.94 g/t Pt+Pd+Au and 5.52 g/t Pt + Pd + Au respectively. The best results from the southern limb were from holes PS 376 and PS 374 woth 1.0 metre at 2.35 g/t Pt + Pd + Au and 1.0 metre at 2.09 g/t Pt + Pd + Au respectively.

Interpretation of all results, along with conceptual 3 dimensional modelling of the intrusive, with the aim of generating new down dip and strike extension / fault offset targets, is an ongoing process.

PANTON PGM RECOVERY PROCESS

As part of the Feasibility Study undertaken on the Panton Project the Company has, in conjuncion with Lonmin Plc, developed a new metallurgical process for the recovery of PGM + Au. The development of this new "Panton Process" was driven by the refractory nature of the Panton ore which resulted in uneconomic recoveries of 65% or less and the production of low flotation concentrate grades of less than 100 g/t PGM + Au, which would be difficult to market.

The new process consists of two distinct parts, a Calcine-Leach Process in which a low grade flotation concentrate is subjected to low temperature calcination followed by cyanide leaching at elevated temperatures to dissolve the PGM's, gold and base metals; and a Metals Recovery Process which recovers the dissolved metals from the leach solution by precipitation and then further upgrades the precipitate to a high grade PGM concentrate and a separate base metal concentrate.

Following extensive laboratory scale testing, the Company, inconjunction with Lonmin Plc, has now tested the process at a pilot plant scale over a continuous 24 day period. Based on the results from this testwork the recoveries predicted for the primary Panton ore are as follows:

This new process offers significant benefits over the traditional smelter route for the Panton Project and potentially for other similar projects. These include:

* Increased or comparable recoveries;

* Reduced concentrate transport costs;

* Shorter processing pipeline and therefore more rapid payment for products;

* Increased payment for products by up to 20%; and

* Reduced environmental impact.

Platinum Australia believes that the advantages offered by the "Panton Process" have the potential to make it an attractive option for projects other than Panton. The Board is therefore actively seeking opportunities to apply this technology to other PGM projects for the benefit of the Company.

Antwort auf Beitrag Nr.: 28.054.842 von odin1603 am 01.03.07 19:31:25Das wohl am weitesten fortgeschrittene Projekt ist Smokey Hills.

Dort ist man bereits dabei eine funktionierende Minen aufzubauen.

siehe Meldung

http://www.gtp.com.au/platinumaus/inews_files/ASX0727JDL_250…

http://www.gtp.com.au/platinumaus/inews_files/inews.96777.1.…

http://www.gtp.com.au/platinumaus/inews_files/ASX0683JDL_121…

Smokey Hills Project

The Smokey Hills project is located on the Eastern limb of the Bushveld Complex in the Limpopo Province of South Africa, 300 kilometres north east of Johannesburg.

Platinum Australia Limited ("PLA") has signed an agreement to acquire up to 80% of the Smokey Hills PGM Project. Under the terms of the agreement, PLA will acquire an intial 59% of the project for A$3.4 million, with the option for a further 21% to be acquired following completion of a Feasibility Study, for 15 million fully paid shares in PLA

The Project has over 6 kilometres of mapped UG2 PGM reef outcropping around the margin of two hills. Prior to the acquisition of the project, PLA completed channel sampling across the full width of the reef along a 3.5 kilometre section, which has been cleard by bulldozing, and drilled 3 diamond drill holes to intersect the reef. The results from this work indicated an average grade of 8.75g/t 4E (Pt+Pd+Rh+Au) over an average width of approximately 0.6 metres.

Based on the above results and mapping of the outcropping UG2 reef, assuming reasonable reef continuity, PLA believes there is a target of up to 1 million ounces of 4E PGM in the Smokey Hills project area. Subject to a Bankable Feasibilty Study, PLA believes that a target of this size has a potential to produce approximately 75,000 ounces of 4E PGM per year.

GEOLOGY and MINERALISATION

Smokey Hills is situated in the Critical Zone of the Eastern Limb of the Bushveld Igneous Complex (BIC), Figure 1. The Critical Zone is divided into Upper and Lower Sub zones; with the Upper Critical Zone comprising mainly norite, gabbronorite, anorthosite, and pyroxenite lithgologies, hosting a series of Chromitite Reefs. In total there are three groups of chromitite reefs: the Upper Group (UG); the middle group (MG) and the Lower Group (LG). The UG chromitite reefs are the major source of PGM within the chromitite reefs of the BVI; while the LG and MG reefs are exploited for their Chromium content.

The Upper chromitite group (UG) consists of four cyclic units (UG1, UG2, UG3 and UG3A) with the chromitite layers generally forming the base of each cycle with overlying melanorite to leuconorite and "stringer" leader chromitite layers and anorthosite marker units. Within the Upper Group, the UG2 reef is the major economic PGM source.

Variation in both grade and reef thickness is mapped across the extent of the BIC, ranging from 3.5 g/t to 19.16 g/t in grade and from approximately 0.5m to 1.5m in thickness. Generally, grade and thickness have an inverse relationship, with grade decreasing where the reef thickness increases.

On Smokey Hills, the UG2 reef has an average thickness and grade is 0.65m @ 8.83 g/t 4E (platinum + palladium + rhodium + gold), obtained from drilling to date, and has been mapped over a distance of some 3km along strike (Figure 2.). The specific gravity of reef outcrop on the Smokey Hills project has been calculated at 4.17 gm/cc.

Based on the mapping, channel sampling and drilling, and assuming reef continuity under cover, PLA believes there is a target of over 1 million ounces of 4E PGM in the Smokey Hills project area. Subject to the completion of a Bankable Feasibility Study ("BFS"), PLA believes that a target of this size has the potential to produce approximately 90,000 ounces 4E PGM per year.

PROJECT DEVELOPMENT

PLA believes that the shallow outcropping nature and geometry of the UG2 reef at Smokey Hills facilitates a rapid and low cost completion of the resource definition and project evaluation phases necessary to bring the project into production. It is anticipated, subject to obtaining necesary approvals, that the resource definition drilling of the project could be completed in 2005 and the BFS completed within 3 months thereafter.

The development envisaged at this point would involve an inital open cut operation to mine approximately 25% of the UG2 reef, with the balance mined from relatively shallow underground operations with simple low cost decline access. On site treatment of the ore would require a standard UG2 plant, incorporating milling and flotation with the flotation concentrate delivered to one of the local smelters.

The project is adjacent to the new Modwika Platinum Mine, a 50:50 joint venture between African Rainbow Minerals and Anglo Platinum, and in close proximity to the Marula Platinum Mine owned by Impala Platinum. As these are both underground operations which are still building up to full production, there is considerable potential to consider toll treatment or sale of ore from Smokey Hills to these operations while the treatment facility is constructed at the site, allowing commercial production to commence some 12 months than would otherwise be possible.

Dort ist man bereits dabei eine funktionierende Minen aufzubauen.

siehe Meldung

http://www.gtp.com.au/platinumaus/inews_files/ASX0727JDL_250…

http://www.gtp.com.au/platinumaus/inews_files/inews.96777.1.…

http://www.gtp.com.au/platinumaus/inews_files/ASX0683JDL_121…

Smokey Hills Project

The Smokey Hills project is located on the Eastern limb of the Bushveld Complex in the Limpopo Province of South Africa, 300 kilometres north east of Johannesburg.

Platinum Australia Limited ("PLA") has signed an agreement to acquire up to 80% of the Smokey Hills PGM Project. Under the terms of the agreement, PLA will acquire an intial 59% of the project for A$3.4 million, with the option for a further 21% to be acquired following completion of a Feasibility Study, for 15 million fully paid shares in PLA

The Project has over 6 kilometres of mapped UG2 PGM reef outcropping around the margin of two hills. Prior to the acquisition of the project, PLA completed channel sampling across the full width of the reef along a 3.5 kilometre section, which has been cleard by bulldozing, and drilled 3 diamond drill holes to intersect the reef. The results from this work indicated an average grade of 8.75g/t 4E (Pt+Pd+Rh+Au) over an average width of approximately 0.6 metres.

Based on the above results and mapping of the outcropping UG2 reef, assuming reasonable reef continuity, PLA believes there is a target of up to 1 million ounces of 4E PGM in the Smokey Hills project area. Subject to a Bankable Feasibilty Study, PLA believes that a target of this size has a potential to produce approximately 75,000 ounces of 4E PGM per year.

GEOLOGY and MINERALISATION

Smokey Hills is situated in the Critical Zone of the Eastern Limb of the Bushveld Igneous Complex (BIC), Figure 1. The Critical Zone is divided into Upper and Lower Sub zones; with the Upper Critical Zone comprising mainly norite, gabbronorite, anorthosite, and pyroxenite lithgologies, hosting a series of Chromitite Reefs. In total there are three groups of chromitite reefs: the Upper Group (UG); the middle group (MG) and the Lower Group (LG). The UG chromitite reefs are the major source of PGM within the chromitite reefs of the BVI; while the LG and MG reefs are exploited for their Chromium content.

The Upper chromitite group (UG) consists of four cyclic units (UG1, UG2, UG3 and UG3A) with the chromitite layers generally forming the base of each cycle with overlying melanorite to leuconorite and "stringer" leader chromitite layers and anorthosite marker units. Within the Upper Group, the UG2 reef is the major economic PGM source.

Variation in both grade and reef thickness is mapped across the extent of the BIC, ranging from 3.5 g/t to 19.16 g/t in grade and from approximately 0.5m to 1.5m in thickness. Generally, grade and thickness have an inverse relationship, with grade decreasing where the reef thickness increases.

On Smokey Hills, the UG2 reef has an average thickness and grade is 0.65m @ 8.83 g/t 4E (platinum + palladium + rhodium + gold), obtained from drilling to date, and has been mapped over a distance of some 3km along strike (Figure 2.). The specific gravity of reef outcrop on the Smokey Hills project has been calculated at 4.17 gm/cc.

Based on the mapping, channel sampling and drilling, and assuming reef continuity under cover, PLA believes there is a target of over 1 million ounces of 4E PGM in the Smokey Hills project area. Subject to the completion of a Bankable Feasibility Study ("BFS"), PLA believes that a target of this size has the potential to produce approximately 90,000 ounces 4E PGM per year.

PROJECT DEVELOPMENT

PLA believes that the shallow outcropping nature and geometry of the UG2 reef at Smokey Hills facilitates a rapid and low cost completion of the resource definition and project evaluation phases necessary to bring the project into production. It is anticipated, subject to obtaining necesary approvals, that the resource definition drilling of the project could be completed in 2005 and the BFS completed within 3 months thereafter.

The development envisaged at this point would involve an inital open cut operation to mine approximately 25% of the UG2 reef, with the balance mined from relatively shallow underground operations with simple low cost decline access. On site treatment of the ore would require a standard UG2 plant, incorporating milling and flotation with the flotation concentrate delivered to one of the local smelters.

The project is adjacent to the new Modwika Platinum Mine, a 50:50 joint venture between African Rainbow Minerals and Anglo Platinum, and in close proximity to the Marula Platinum Mine owned by Impala Platinum. As these are both underground operations which are still building up to full production, there is considerable potential to consider toll treatment or sale of ore from Smokey Hills to these operations while the treatment facility is constructed at the site, allowing commercial production to commence some 12 months than would otherwise be possible.

Antwort auf Beitrag Nr.: 28.055.220 von odin1603 am 01.03.07 19:42:50Ich halte Platinum für ein sehr solides und sicheres Invest in der Rohstoff-Branche das dem "Geduldigen" mit ziemlicher Sicherheit Gewinne im 3 stelligen Prozentbereich auf Sicht von ca. 2-4 Jahren bringen wird.

Dies ist mit Sicherheit kein Zockerwert!

Die Aktie wird hier in Deutschland sehr spärlich gehandelt und wenn meist mit einem "kräftigem"Aufschlag zu Australien.

Deshalb rate ich jedem der in Platinum investieren möchte,direkt in Australien zu kaufen.(über Maxblue problemlos möglich)

Trotz erhöhter Orderkosten spart man meistens erheblich.Rechnen lohnt!!

Dies ist mit Sicherheit kein Zockerwert!

Die Aktie wird hier in Deutschland sehr spärlich gehandelt und wenn meist mit einem "kräftigem"Aufschlag zu Australien.

Deshalb rate ich jedem der in Platinum investieren möchte,direkt in Australien zu kaufen.(über Maxblue problemlos möglich)

Trotz erhöhter Orderkosten spart man meistens erheblich.Rechnen lohnt!!

Hier noch was interessantes.Diese präsentation ist zwar schon etwas älter aber sehr informativ!!

http://www.gtp.com.au/platinumaus/inews_files/PLA%20Diggers%…

http://www.gtp.com.au/platinumaus/inews_files/PLA%20Diggers%…

Hier noch ein paar Zahlen und Fakten!!

http://www.gtp.com.au/platinumaus/inews_files/QR%2030%20Sept…

http://www.gtp.com.au/platinumaus/inews_files/QR%2030%20June…

http://www.gtp.com.au/platinumaus/inews_files/QR%2030%20Sept…

http://www.gtp.com.au/platinumaus/inews_files/QR%2030%20June…

http://www.gtp.com.au/platinumaus/inews_files/PLA_Annual_Rep…

Under conservative base case

price assumptions, Smokey Hills

will generate a pre-tax cash

flow of US$139 million over

the seven year life of the mine.

Using the average metal prices

and exchange rate for July 2006,

the cash flow generated rises to

US$396 million.

Under conservative base case

price assumptions, Smokey Hills

will generate a pre-tax cash

flow of US$139 million over

the seven year life of the mine.

Using the average metal prices

and exchange rate for July 2006,

the cash flow generated rises to

US$396 million.

Schlußkurs heute in FFM 0,77

Das heutige BID und ASK aus Frankfurt

Bid 0,80

Bidsize 2.500

Uhrzeit Datum 13:51 01.03.

Ask 0,85

Asksize 1.180

Das heutige BID und ASK aus Frankfurt

Bid 0,80

Bidsize 2.500

Uhrzeit Datum 13:51 01.03.

Ask 0,85

Asksize 1.180

Schlußkurs heute Morgen in Australien war

6:50 pm PLA 1.40 +0.05 +3.7% Vol.674,572

6:50 pm PLA 1.40 +0.05 +3.7% Vol.674,572

Antwort auf Beitrag Nr.: 28.057.755 von odin1603 am 01.03.07 21:27:51

1,40 AUD entspr. ca.0,835 €

FFM ist also fett unter Pari.

1,40 AUD entspr. ca.0,835 €

FFM ist also fett unter Pari.

Antwort auf Beitrag Nr.: 28.054.425 von odin1603 am 01.03.07 19:16:24aha, enthistorisieren!

Aber trotzdem schön im Plus... jedem das Seine.

Korektur beendet, Kaufsignal auf grün!

Aber trotzdem schön im Plus... jedem das Seine.

Korektur beendet, Kaufsignal auf grün!

Antwort auf Beitrag Nr.: 28.058.569 von strongbuy61 am 01.03.07 21:59:01Ja ich war so frei und hab den Thread mal enthistorisieren lassen.

Ich hoffe du hast nix dagegen?

Sehr interessanter Wert.

Ich hoffe du hast nix dagegen?

Sehr interessanter Wert.

Antwort auf Beitrag Nr.: 28.058.569 von strongbuy61 am 01.03.07 21:59:01Immerhin heute schon über 100 mal gelesen.

Ein bisschen mehr als die letzten Monate!!!

Geht ja ganz gut los.

Ein bisschen mehr als die letzten Monate!!!

Geht ja ganz gut los.

Alles wichtige zu Platinum Australia findet Ihr in den Post´s 8-21.

Ich hoffe es gefällt!

Das wichtigste zu Platinum Australia findet Ihr in den Post´s 8-21.

Das wichtigste zu Platinum Australia findet Ihr in den Post´s 8-21.

Moin,moin....

Schlußkurs heute Morgen in Australien.

PLA 1.35 -0.05 -3.6% Vol. 302,359

das entspr. ca.0,805 €

Schlußkurs heute Morgen in Australien.

PLA 1.35 -0.05 -3.6% Vol. 302,359

das entspr. ca.0,805 €

Eigentlich unverständlich das Platinum in Deutschland so gänzlich unbekannt und unbeachtet ist.

Platinum bewegt sich seit Monaten in einem "gesunden"Aufwärtstrend.

Platinum bewegt sich seit Monaten in einem "gesunden"Aufwärtstrend.

Antwort auf Beitrag Nr.: 28.073.901 von odin1603 am 02.03.07 18:14:46Platinum bewegt sich seit Monaten in einem "gesunden"Aufwärtstrend.

Korrigiere mich,seit Jahren.

Korrigiere mich,seit Jahren.

Die kleine chin.Schwächephase schon wieder überwunden.

Hätte nicht gedacht das es so schnell geht.

RT FFM 0,81

Bid 0,83

Bidsize 2.000

Uhrzeit Datum 15:14 07.03.

Ask 0,88

Asksize 7.000

Hätte nicht gedacht das es so schnell geht.

RT FFM 0,81

Bid 0,83

Bidsize 2.000

Uhrzeit Datum 15:14 07.03.

Ask 0,88

Asksize 7.000

Das sieht recht positiv für den Montag aus!!

Halbjahres-Report ist seit dem 15.03. raus.

Sieht extrem gut aus.

Geplanter Produktionsbeginn auf der Smokey Hills Liegenschaft ist 2008!

""Dependent on the issuing of the necessary permits PLA proposes to commence construction and mining operations in the

second quarter of 2007 with plant commissioning occurring in first quarter 2008.""

Sieht extrem gut aus.

Geplanter Produktionsbeginn auf der Smokey Hills Liegenschaft ist 2008!

""Dependent on the issuing of the necessary permits PLA proposes to commence construction and mining operations in the

second quarter of 2007 with plant commissioning occurring in first quarter 2008.""

Ein weiteres Highlight aus dem Report.

PLA verfügt zur Zeit über liquide Mittel in Höhe von ca.22 Mio AUD und das bei einer MK von momentan ca.240 Mio AUD.

""Cash and cash equivalents 22,139,355 AUD""

http://www.asx.com.au/asx/research/CompanyInfoSearchResults.…

PLA verfügt zur Zeit über liquide Mittel in Höhe von ca.22 Mio AUD und das bei einer MK von momentan ca.240 Mio AUD.

""Cash and cash equivalents 22,139,355 AUD""

http://www.asx.com.au/asx/research/CompanyInfoSearchResults.…

Smokey Hills Platinum Project

The Smokey Hills PGM Project is located on the eastern limb of the Bushveld Complex in the Limpopo Province, 300

kilometres north of Johannesburg.

The Bankable Feasibility Study (“BFS”) on the Smokey Hills PGM Project was completed in July 2006 and the results

confirmed that the project is extremely attractive and very robust and able to generate returns of over 70% on the Base

Case assumptions and in excess 600% using July average metal prices and exchange rate.

The study also showed that the project had a relatively low capital cost of US$40 million and low production costs of less

than US$230 per oz 4E PGM due to the shallow nature of the deposit and the relatively high grade.

The Smokey Hills PGM Project is located on the eastern limb of the Bushveld Complex in the Limpopo Province, 300

kilometres north of Johannesburg.

The Bankable Feasibility Study (“BFS”) on the Smokey Hills PGM Project was completed in July 2006 and the results

confirmed that the project is extremely attractive and very robust and able to generate returns of over 70% on the Base

Case assumptions and in excess 600% using July average metal prices and exchange rate.

The study also showed that the project had a relatively low capital cost of US$40 million and low production costs of less

than US$230 per oz 4E PGM due to the shallow nature of the deposit and the relatively high grade.

Kaufsignale bei Platinum.

MACD,EMA38

MACD,EMA38

Konsolidierung scheint vorrüber zu sein.

Auf zu alten Höhen?

Auf zu alten Höhen?

Schlußkurs heute in Australien.

Wochenhöchstkurs und das an einem Freitag.

PLA 1.380 +2.22% Vol. 193,806

Wochenhöchstkurs und das an einem Freitag.

PLA 1.380 +2.22% Vol. 193,806

Moin,moin..

Platinum steigt kontinuierlich weiter.

SK in Australien heute Morgen war:

PLA 1.400 +1.45% Vol. 170,806

Platinum steigt kontinuierlich weiter.

SK in Australien heute Morgen war:

PLA 1.400 +1.45% Vol. 170,806

Und weiter geht es.Aufwärts.

PLA 1.430 2.14% Vol. 416,200

PLA 1.430 2.14% Vol. 416,200

Platinum vorbörslich:

Bid 1,60

Ask 1,40

Bid 1,60

Ask 1,40

Das Orderbuch sieht sehr gut aus.

Da geht heute was!!!

Da geht heute was!!!

Ich sag ja schon seit einigen Tagen ,daß die Konso vorbei ist und es zu auf neuen Höhen geht.

Es scheint mir nur niemand zu glauben,wenn ich die Resonanz des Threads anschaue.

Bin momentan immer noch,seit Wiederfreischaltung des Threads,hier Alleinunterhalter!!

Platinum ist immernoch viel zu unbekannt hier in Deutschland.

Viel zu gut,zu solide und ungepusht!!!

Es scheint mir nur niemand zu glauben,wenn ich die Resonanz des Threads anschaue.

Bin momentan immer noch,seit Wiederfreischaltung des Threads,hier Alleinunterhalter!!

Platinum ist immernoch viel zu unbekannt hier in Deutschland.

Viel zu gut,zu solide und ungepusht!!!

Aufwärtstrend wird fortgesetzt!!

SK heute Morgen in Australien

PLA 1.430 +1.78% Volumen 294,650

Weitere sehr aussichtsreiche Australien Werte.

PACMAG METALS LIMITED (PMH)WKN A0HG58

http://www.pacmag.com.au

GME RESOURCES LIMITED (GME)WKN 865745

http://www.gmeresources.com.au/" target="_blank" rel="nofollow ugc noopener">

http://www.gmeresources.com.au/

NKWE PLATINUM LIMITED (NKP)WKN A0DNRD

http://www.nkweplatinum.com/

SK heute Morgen in Australien

PLA 1.430 +1.78% Volumen 294,650

Weitere sehr aussichtsreiche Australien Werte.

PACMAG METALS LIMITED (PMH)WKN A0HG58

http://www.pacmag.com.au

GME RESOURCES LIMITED (GME)WKN 865745

http://www.gmeresources.com.au/" target="_blank" rel="nofollow ugc noopener">

http://www.gmeresources.com.au/

NKWE PLATINUM LIMITED (NKP)WKN A0DNRD

http://www.nkweplatinum.com/

Antwort auf Beitrag Nr.: 28.578.899 von odin1603 am 30.03.07 10:19:13News bei Platinum!!!!!!!

http://www.gtp.com.au/platinumaus/inews_files/ASX0741JDL_040…

Super Bohrergebnisse vom Kalplats Project.

PtPdAu-Höchst-Grad von 14,89 g/t über einen Meter !!!!

Pt : Pd Verhältnis 1:1

PLA is due to complete a Bankable Feasibility Study on the Kalplats Project by end of 2007 which

will include approximately 45,000 metres of RC and diamond drilling. By the end of March PLA had

completed over 17,000 metres of drilling. The significant results from the program are provided in

Table 1 below.

http://www.gtp.com.au/platinumaus/inews_files/ASX0741JDL_040…

Super Bohrergebnisse vom Kalplats Project.

PtPdAu-Höchst-Grad von 14,89 g/t über einen Meter !!!!

Pt : Pd Verhältnis 1:1

PLA is due to complete a Bankable Feasibility Study on the Kalplats Project by end of 2007 which

will include approximately 45,000 metres of RC and diamond drilling. By the end of March PLA had

completed over 17,000 metres of drilling. The significant results from the program are provided in

Table 1 below.

News!!!

14,89 g/t PtPdAu

SK Australien

PLA 1.450 +6.62% Volumen 449,897

14,89 g/t PtPdAu

SK Australien

PLA 1.450 +6.62% Volumen 449,897

1,45 Aud entspr.ca.0,87 €

Link zur News

http://www.gtp.com.au/platinumaus/inews_files/ASX0741JDL_040…

Link zur News

http://www.gtp.com.au/platinumaus/inews_files/ASX0741JDL_040…

RT FFM 0,855 +1,79%

Volumen

36.638

Bid 0,85

Bidsize 26.000

Uhrzeit Datum 13:44 10.04.

Ask 0,93

Asksize 2.000

Volumen

36.638

Bid 0,85

Bidsize 26.000

Uhrzeit Datum 13:44 10.04.

Ask 0,93

Asksize 2.000

Auf zu neuen Höhen.

SK in Australien

4:13 pm PLA 1.57 +0.085 +5.7% Vol.465,228

entspr.ca.0,96 €

SK in Australien

4:13 pm PLA 1.57 +0.085 +5.7% Vol.465,228

entspr.ca.0,96 €

RT FFM

0,93

Bid 0,90

Bidsize 25.000

Uhrzeit Datum 10:37 11.04.

Ask 0,98

Asksize 1.021

0,93

Bid 0,90

Bidsize 25.000

Uhrzeit Datum 10:37 11.04.

Ask 0,98

Asksize 1.021

SK in Australien

PLA 1.585 +0.015 +0.96% Volumen 233,878

entspr.ca. 0,97 €

PLA 1.585 +0.015 +0.96% Volumen 233,878

entspr.ca. 0,97 €

Antwort auf Beitrag Nr.: 28.773.976 von odin1603 am 12.04.07 12:08:11Bid 0,93

Bidsize 23.670

Uhrzeit Datum 11:30 12.04.

Ask 1,01

Asksize 23.670

Bidsize 23.670

Uhrzeit Datum 11:30 12.04.

Ask 1,01

Asksize 23.670

http://www.gtp.com.au/platinumaus/inews_files/ASX0741JDL_040…

Super Bohrergebnisse vom Kalplats Project.

PtPdAu-Höchst-Grad von 14,89 g/t über einen Meter !!!!

Super Bohrergebnisse vom Kalplats Project.

PtPdAu-Höchst-Grad von 14,89 g/t über einen Meter !!!!

SK Australien

PLA 1.680 +0.095 +5.99% Vol. 335,220(entspr.ca.1,03€)

Vol. 335,220(entspr.ca.1,03€)

Das bedeutet neuer Höchststand.

PLA 1.680 +0.095 +5.99%

Vol. 335,220(entspr.ca.1,03€)

Vol. 335,220(entspr.ca.1,03€)Das bedeutet neuer Höchststand.

Weiter geht es!!!!

SK Australien

PLA 1.76 +0.08% +4.8% Vol.562,367

SK Australien

PLA 1.76 +0.08% +4.8% Vol.562,367

1,76 AUD entspr. ca.1,08 €!!!!!!!!!

Wait & See

Wait & See

Das aktuelle BID und ASK aus FFM!

Bid 0,945

Bidsize 1.059

Uhrzeit Datum 08:39 16.04.

Ask 1,01

Asksize 1.470

Das Frankfurter Ask liegte 0,07 € unter dem SK von Australien.

Kaufen marsch,marsch!!!

Strong Buy!!

Bid 0,945

Bidsize 1.059

Uhrzeit Datum 08:39 16.04.

Ask 1,01

Asksize 1.470

Das Frankfurter Ask liegte 0,07 € unter dem SK von Australien.

Kaufen marsch,marsch!!!

Strong Buy!!

SK Australien

PLA 1.84 +0.08 +4.5% Vol.866,050

Das entspr.ca. 1,13 €

PLA 1.84 +0.08 +4.5% Vol.866,050

Das entspr.ca. 1,13 €

FFM

Bid 1,18

Bidsize 5.550

Uhrzeit Datum 15:17 17.04.

Ask - -

Asksize - -

Bid 1,18

Bidsize 5.550

Uhrzeit Datum 15:17 17.04.

Ask - -

Asksize - -

Moin,moin.

Der Aufwärtstrend geht weiter.

RT Australien

3:06 pm PLA 1.90 +0.11 +6.1% Vol.502,005

Der Aufwärtstrend geht weiter.

RT Australien

3:06 pm PLA 1.90 +0.11 +6.1% Vol.502,005

Schlußkurs in Australien.

4:10pm PLA 1.91 +0.12 +6.7% Vol. 738,584

entspr.ca. 1,17 €

4:10pm PLA 1.91 +0.12 +6.7% Vol. 738,584

entspr.ca. 1,17 €

Platinum rosige Aussichten?! Mit den Drei Projekten Smokey Hills,Kalplats (Südafrika) und Panton (Australien) kommen sie auf zusammen 6,4 Millionen Unzen PGM wovon ein großer Teil Palladium ist. Für das kommende Jahr wird eine Produktion von 40.000 Unzen PGM (Platin Gruppen Metall) angestrebt. 2009 sollen es schon 230.000 Unzen sein.

Sollte der Palladium Preis wie es Experten vermuten noch über 500 $ gehen, bildet Platinum einen schönen Hebel auf Palladium.

Dies ist keine Kaufempfehlung, lediglich meine Meinung.

Beste Grüße

schulle01

Sollte der Palladium Preis wie es Experten vermuten noch über 500 $ gehen, bildet Platinum einen schönen Hebel auf Palladium.

Dies ist keine Kaufempfehlung, lediglich meine Meinung.

Beste Grüße

schulle01

Antwort auf Beitrag Nr.: 28.973.661 von schulle01 am 24.04.07 16:45:03Hurra,ich bin nicht mehr der alleinige "Vorbeter".

Bei einem Verhältnis von ca.1:1 Pt/Pd ist Platinum ein hervorragender Hebel für beide Metalle.

Und nebenbei fallen ja auch noch ein paar andere Sachen an bei den Projekten von PLA.Die haben wohl bis zu 6PGE .

Das bedeutet dann:

Rh

Ir

Ru

Au

kommen auch noch vor.

Wen es interessiert hier die aktuellste Präsentation von Platinum.

Aber nur für DSL-Flat zu empfehlen,da 18,5 MB.

http://www.gtp.com.au/platinumaus/inews_files/PLA%20april%20…

PS:

Bist du ein Schulle aus Sachsen??

Antwort auch per BM.

Bei einem Verhältnis von ca.1:1 Pt/Pd ist Platinum ein hervorragender Hebel für beide Metalle.

Und nebenbei fallen ja auch noch ein paar andere Sachen an bei den Projekten von PLA.Die haben wohl bis zu 6PGE .

Das bedeutet dann:

Rh

Ir

Ru

Au

kommen auch noch vor.

Wen es interessiert hier die aktuellste Präsentation von Platinum.

Aber nur für DSL-Flat zu empfehlen,da 18,5 MB.

http://www.gtp.com.au/platinumaus/inews_files/PLA%20april%20…

PS:

Bist du ein Schulle aus Sachsen??

Antwort auch per BM.

Antwort auf Beitrag Nr.: 28.980.850 von odin1603 am 25.04.07 00:17:52Und weiter geht es im Aufwärtstrend.

SK Australien

4:10pm PLA 1.97 +0.11 +5.9% Vol.604,258

SK Australien

4:10pm PLA 1.97 +0.11 +5.9% Vol.604,258

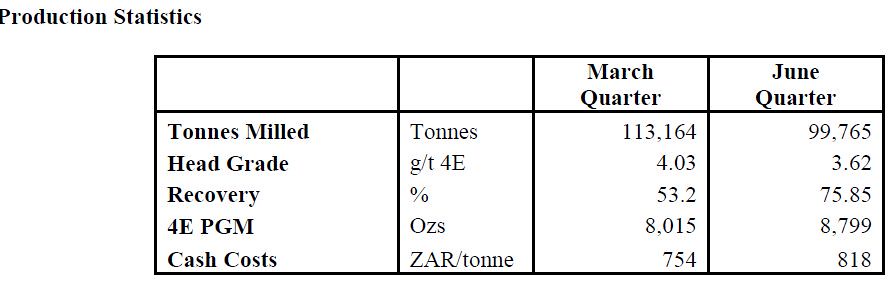

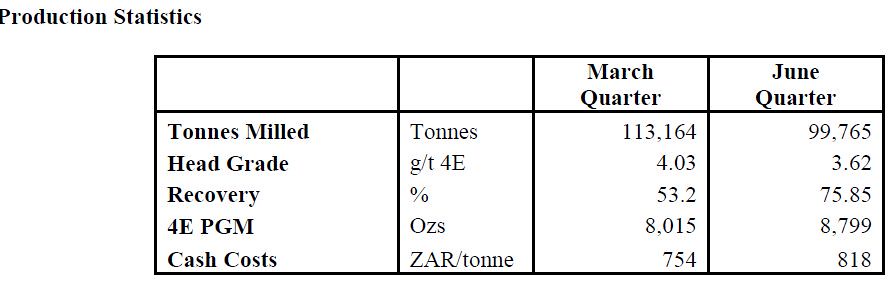

QUARTERLY REPORT FOR THE PERIOD

ENDED 31st MARCH 2007

HIGHLIGHTS

PLA Issues 15 million Shares to Complete the Acquisition of 80% of the Smokey Hills PGM Project

On January 25th PLA announced that following the successful completion of the Bankable Feasibility Study

and the Cession of the New Order Prospecting Right, it had issued 15 million shares as the final payment for

the acquisition of the 80% interest in the Smokey Hills Project.

Further Positive Results from the Drilling Program at the Kalahari Platinum Project

PLA announced that the latest results from the resource definition drilling program on the Kalahari Platinum

(“Kalplats”) Project (PLA earning 49% from ARMplatinum) extended

the known mineralisation at both the

Serpens North and Serpens South Deposits.

New Order Prospecting Right Issued for the Kalplats “Extended” Platinum Project

PLA announced that a New Order Prospecting Right has been issued to ARMplatinum for the Kalahari

“Extended” Platinum Project (the “Extended Project”) (PLA 50%: ARMplatinum 50%). The Extended

Project covers an area approximately 20 kilometres to the north and 18 kilometres to the south of the

Kalplats area (Figure 1).

The issue of the Prospecting Right allows the immediate commencement of exploration work including a

detailed aeromagnetic survey and geochemical sampling program on the project area.

OPERATIONS

PLA operations were focused on the resource definition drilling program at Kalplats with four drill rigs

operating and almost 20,000 metres drilled since work commenced in September 2006. In addition at the

Smokey Hills PGM Project work focused on progressing the approvals process for the commencement of

operations with the community consultation process and the Environmental Management Plan completed.

PLATINUM AUSTRALIA LIMITED

ACN 093 417 942

2

Smokey Hills Platinum Project

The Smokey Hills PGM Project is located on the eastern limb of the Bushveld Complex in the Limpopo

Province, 300 kilometres north of Johannesburg.

PLA commenced a resource definition drilling program on the project in July 2005 and a Bankable

Feasibility Study with GRD Minproc as the Lead Engineer in October 2005. The results of the BFS showed

the project to be extremely attractive and very robust and able to generate returns of over 70% on the Base

Case assumptions and in excess of 600% using July 2006 metal prices and exchange rate.

The Company envisages commencing operations at Smokey Hills initially as an open cut and then

progressing to a shallow underground mine. During the initial phase while the plant is under construction

PLA proposes to mine ore for toll treatment through a nearby plant to generate early cash flow. This phase

would last for approximately 9 to 12 months after which ore would be treated through the on-site plant at a

rate of 720,000 tonnes per annum and producing approximately 95,000 ozs 4E PGM in a flotation

concentrate. This would be toll treated or sold to any one of a number of smelters in South Africa, the nearest

of which is less than 100 kilometres distant.

Dependent on the timing of the issuing of the necessary permits PLA proposes to commence construction

and mining operations in mid 2007 with plant commissioning occurring some 9 to 12 months later.

PLA signed a formal Sale Agreement with Smokey Hills Platinum (Pty) Ltd (“SHP”) to acquire up to 80%

of the Project through the staged acquisition of 100% of SHP in May 2004. With this staged acquisition now

completed PLA has an 80% interest in the Project with the balance of the Project held 5% by the local

community and 15% by Corridor Mining Resources, a company owned by the Limpopo Provincial

Government.

Kalahari Platinum Project

The Kalplats Project is located 330km west of Johannesburg and has an established (Indicated and Inferred)

resource of 3.4 million ounces 3E PGM including a high grade resource of 1.4 million ounces 3E PGM at a

grade of 3.6 g/t 3E PGM. PLA believes that there is significant potential to increase the size of the resource

as all deposits appear to be open at depth and along strike. PLA has also identified numerous targets from

geochemical survey work and a high resolution aeromagnetic survey completed by PLA in early 2005.

Under the Kalplats Joint Venture Agreement, PLA is earning up to 49% of the Kalplats Project from African

Rainbow Minerals Platinum (Pty) Ltd (“ARMplatinum”) by completing a Bankable Feasibility Study

including further drilling and providing the right for the project to use the Panton metallurgical process

(“Panton Process”).

Following the issue of a New Order Prospecting Right over the Kalplats Project area in September 2006,

PLA commenced the resource definition drilling program of approximately 45,000 metres. By early

October, three drill rigs were working on the site. PLA anticipates completing this initial drilling in late

2007, allowing a Bankable Feasibility Study to be completed by the end of 2007.

An initial program of metallurgical testwork has already been undertaken with results indicating that a

recovery of 80% can be achieved to produce a saleable PGM concentrate.

PLA believes that the existing resource will support the development of an open pit operation producing

200,000 oz 3E per annum. Further success from the drilling program could increase this to 300,000 oz 3E

per annum.

ARMplatinum has also recently been issued a prospecting right over the Kalplats “Extended” Platinum

Project, covering an area approximately 20 kilometres to the north and 18 kilometres to the south of the

Kalplats area, increasing the total strike length in the joint venture to almost 50 kilometres.

PLA and ARMplatinum each has a 50% contributing interest in the new area and PLA will manage the

exploration program, which will target extensions of the known Kalplats style of PGM mineralisation. Work

on this will commence in the coming quarter.

3

Panton Platinum Palladium Project

The Panton Project is located in the Kimberley region of Western Australia, 60 km north of Halls Creek and

60 km south of the Sally Malay site. The Project has a (Measured + Indicated + Inferred) resource of 14.3

Mt at 5.2 g/t 7E PGM containing 2.4 million ounces 7E PGM, including a high grade resource of 10.1 Mt at

6.1 g/t 7E PGM containing 2 million oz 7E PGM.

Sally Malay Mining Limited (“SMY”) are earning a 50% interest in an initial parcel of 1.5 Mt of high grade

ore by spending $750,000 to complete a Bankable Feasibility Study to evaluate the mining of high grade ore

from Panton and processing it through the Sally Malay Plant to produce a high grade PGM concentrate. The

agreement may be extended to cover further parcels of ore.

SMY have been undertaking laboratory scale metallurgical testwork on the 10-15t bulk ore sample

commenced at AMMTEC during the quarter. The assay results from this work has shown a lower than

expected average ore grade of 3.5 g/t 7E PGM, compared to initial results of 6.5 g/t 7E PGM due to higher

than estimated mining dilution and ore loss. Further testwork and analysis is planned prior to undertaking

pilot plant testwork.

CORPORATE

A total of 700,000 unlisted PLA options were exercised at an average price of 37 cents during the quarter

raising $258000.

Following the resignation of an employee 120,000 incentive options with an exercise price of 37 cents and

80,000 incentive options with an exercise price of 22.5 cents were cancelled during the quarter

Qualification Statement

We confirm that exploration results contained in this report are based on information compiled by Chris

Meyer, Senior Project Geologist who is a member of the South African Council for Natural Scientific

Professions.

Chris Meyer has more than 5 years experience which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is undertaking, to qualify as a competent person as

defined in the 2004 edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources

and Ore Reserves’. Chris Meyer consents to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

JOHN LEWINS

Managing Director

Glossary

3E PGM platinum + palladium + gold

4E PGM platinum + palladium + rhodium + gold

6E PGM platinum + palladium + rhodium + iridium + ruthenium + gold

7E PGM platinum + palladium + rhodium + iridium + osmium + ruthenium + gold

* The six Platinum Group Metals (PGM’s) are Platinum (Pt), Palladium, (Pd), Rhodium, (Rh), Iridium (Ir), Osmium

ENDED 31st MARCH 2007

HIGHLIGHTS

PLA Issues 15 million Shares to Complete the Acquisition of 80% of the Smokey Hills PGM Project

On January 25th PLA announced that following the successful completion of the Bankable Feasibility Study

and the Cession of the New Order Prospecting Right, it had issued 15 million shares as the final payment for

the acquisition of the 80% interest in the Smokey Hills Project.

Further Positive Results from the Drilling Program at the Kalahari Platinum Project

PLA announced that the latest results from the resource definition drilling program on the Kalahari Platinum

(“Kalplats”) Project (PLA earning 49% from ARMplatinum) extended

the known mineralisation at both the

Serpens North and Serpens South Deposits.

New Order Prospecting Right Issued for the Kalplats “Extended” Platinum Project

PLA announced that a New Order Prospecting Right has been issued to ARMplatinum for the Kalahari

“Extended” Platinum Project (the “Extended Project”) (PLA 50%: ARMplatinum 50%). The Extended

Project covers an area approximately 20 kilometres to the north and 18 kilometres to the south of the

Kalplats area (Figure 1).

The issue of the Prospecting Right allows the immediate commencement of exploration work including a

detailed aeromagnetic survey and geochemical sampling program on the project area.

OPERATIONS

PLA operations were focused on the resource definition drilling program at Kalplats with four drill rigs

operating and almost 20,000 metres drilled since work commenced in September 2006. In addition at the

Smokey Hills PGM Project work focused on progressing the approvals process for the commencement of

operations with the community consultation process and the Environmental Management Plan completed.

PLATINUM AUSTRALIA LIMITED

ACN 093 417 942

2

Smokey Hills Platinum Project

The Smokey Hills PGM Project is located on the eastern limb of the Bushveld Complex in the Limpopo

Province, 300 kilometres north of Johannesburg.

PLA commenced a resource definition drilling program on the project in July 2005 and a Bankable

Feasibility Study with GRD Minproc as the Lead Engineer in October 2005. The results of the BFS showed

the project to be extremely attractive and very robust and able to generate returns of over 70% on the Base

Case assumptions and in excess of 600% using July 2006 metal prices and exchange rate.

The Company envisages commencing operations at Smokey Hills initially as an open cut and then

progressing to a shallow underground mine. During the initial phase while the plant is under construction

PLA proposes to mine ore for toll treatment through a nearby plant to generate early cash flow. This phase

would last for approximately 9 to 12 months after which ore would be treated through the on-site plant at a

rate of 720,000 tonnes per annum and producing approximately 95,000 ozs 4E PGM in a flotation

concentrate. This would be toll treated or sold to any one of a number of smelters in South Africa, the nearest

of which is less than 100 kilometres distant.

Dependent on the timing of the issuing of the necessary permits PLA proposes to commence construction

and mining operations in mid 2007 with plant commissioning occurring some 9 to 12 months later.

PLA signed a formal Sale Agreement with Smokey Hills Platinum (Pty) Ltd (“SHP”) to acquire up to 80%

of the Project through the staged acquisition of 100% of SHP in May 2004. With this staged acquisition now

completed PLA has an 80% interest in the Project with the balance of the Project held 5% by the local

community and 15% by Corridor Mining Resources, a company owned by the Limpopo Provincial

Government.

Kalahari Platinum Project

The Kalplats Project is located 330km west of Johannesburg and has an established (Indicated and Inferred)

resource of 3.4 million ounces 3E PGM including a high grade resource of 1.4 million ounces 3E PGM at a

grade of 3.6 g/t 3E PGM. PLA believes that there is significant potential to increase the size of the resource

as all deposits appear to be open at depth and along strike. PLA has also identified numerous targets from

geochemical survey work and a high resolution aeromagnetic survey completed by PLA in early 2005.

Under the Kalplats Joint Venture Agreement, PLA is earning up to 49% of the Kalplats Project from African

Rainbow Minerals Platinum (Pty) Ltd (“ARMplatinum”) by completing a Bankable Feasibility Study

including further drilling and providing the right for the project to use the Panton metallurgical process

(“Panton Process”).

Following the issue of a New Order Prospecting Right over the Kalplats Project area in September 2006,

PLA commenced the resource definition drilling program of approximately 45,000 metres. By early

October, three drill rigs were working on the site. PLA anticipates completing this initial drilling in late

2007, allowing a Bankable Feasibility Study to be completed by the end of 2007.

An initial program of metallurgical testwork has already been undertaken with results indicating that a

recovery of 80% can be achieved to produce a saleable PGM concentrate.

PLA believes that the existing resource will support the development of an open pit operation producing

200,000 oz 3E per annum. Further success from the drilling program could increase this to 300,000 oz 3E

per annum.