LYNAS - auf dem Weg zu einem Rohstoffproduzent von Hightech-Rohstoffen (Seite 4799)

eröffnet am 09.02.07 13:14:18 von

neuester Beitrag 25.04.24 13:05:01 von

neuester Beitrag 25.04.24 13:05:01 von

Beiträge: 57.635

ID: 1.110.967

ID: 1.110.967

Aufrufe heute: 2

Gesamt: 9.810.194

Gesamt: 9.810.194

Aktive User: 1

ISIN: AU000000LYC6 · WKN: 871899

3,8020

EUR

-1,02 %

-0,0390 EUR

Letzter Kurs 25.04.24 Tradegate

Neuigkeiten

18.04.24 · Der Aktionär TV |

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,050 | +17,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,59 | -98,01 |

Beitrag zu dieser Diskussion schreiben

.. ja er hat recht.

trotzdem haben heute viele mal Gewinne mitgenommen.

sell on good news

Pirat

trotzdem haben heute viele mal Gewinne mitgenommen.

sell on good news

Pirat

Rare earth will not be used as bargaining chip: Wen

By Su Qiang (China Daily)

BRUSSELS - China has not, and will not block exports of rare earth, Premier Wen Jiabao told European political and business leaders in a keynote speech at the Sixth China-EU Business Summit on Wednesday.

"China is not using rare earth as a bargaining chip," Wen said. "We aim for the world's sustainable development."

Related readings:

Ensuring sustainability of rare earth

Large rare earths deposit found in C China

China's Chinalco to invest 10b yuan in rare earth sector

'No ban' on exports of rare earths to Japan

Wen called for proper controls and regulations for the precious minerals and metals that can be used for electronic devices, but said that China will not close the market.

"It is necessary to exercise management and control over the rare earth industry, but there won't be any embargo," he said.

"What we pursue is to satisfy not only domestic demand but also the global demand for rare earth. We should not only stand from the present, but should also look forward to the future," he added.

"If the rare earth minerals were used up, how would the world and China deal with the problem?"

Wen, a geology major in college, said he studied rare earth for years.

In the 1980s and 1990s, rare earth metals from China were exported at low prices due to a lack of proper management and extraction technology, as well as chaos in supervision, Wen said.

Some countries accumulated so much rare earth that they are still using those reserves today, he said.

He also assured European investors that China would maintain a good investment environment for foreign businesses.

"Foreign businesses operating in China enjoy the same national treatment as Chinese enterprises do," Wen said.

"The only changes that have taken place are that foreign investment is now under better and more orderly regulation."

China will stick fast to its reform and opening-up policies, which will not be changed, he said. Only through reform and opening-up can China maintain its development, he stressed.

Wen acknowledged that foreign businesses are mostly concerned with issues related to intellectual property, independent innovation, and government procurement.

"All products made in foreign businesses are 'made-in-China' products," Wen said. "We will not only protect your intellectual property rights but also your legitimate rights and interests."

On the issue of yuan appreciation, he urged Europe not to press China too much.

Many Chinese export enterprises have slim profit margins and "should the yuan rise by 20 to 40 percent, as demanded by some people, a large number of Chinese export enterprises will go bankrupt, workers will lose their jobs making it hard for society to remain stable", he said. "The world will by no means benefit from a crisis in the Chinese economy."

Also on Wednesday, the premier called on the European Union (EU) to end the arms embargo against China and recognize China's market economy status to pave the way for further bilateral ties.

Wen made the remarks while co-chairing the 13th China-EU Summit with European Council President Herman Van Rompuy and European Commission President Jose Manuel Barroso in Brussels.

The summit should play a role of strategic guidance in promoting China-EU ties and pushing for the recognition of China's market economy status and an end to the arms embargo, Wen said.

China will work with the EU to achieve balanced and sustainable development of bilateral trade, improve the investment environment and enhance cooperation in financial and fiscal policy-making processes, he said.

Wen said China had expressed its support for, and confidence in, the 27-member European bloc, and believed that a strong and stable EU is conducive to the world as well as to China.

Barroso said the EU-China commercial relationship, worth 327 billion euros ($453 billion) in 2009, was one of the most important in the world and vital for the global economy.

Van Rompuy noted that the EU and China have differences of approach, but "this should not impede our joint will to bring the relationship to a higher level. We should be ambitious and make sincere efforts to achieve progress", he added.

Van Rompuy and Barroso also expressed to Wen "the need for a level playing field in China for our businesses", including the "opening up of public procurement".

Wen arrived in Italy late on Wednesday, and met with Italian leaders on Thursday before traveling to Turkey.

By Su Qiang (China Daily)

BRUSSELS - China has not, and will not block exports of rare earth, Premier Wen Jiabao told European political and business leaders in a keynote speech at the Sixth China-EU Business Summit on Wednesday.

"China is not using rare earth as a bargaining chip," Wen said. "We aim for the world's sustainable development."

Related readings:

Ensuring sustainability of rare earth

Large rare earths deposit found in C China

China's Chinalco to invest 10b yuan in rare earth sector

'No ban' on exports of rare earths to Japan

Wen called for proper controls and regulations for the precious minerals and metals that can be used for electronic devices, but said that China will not close the market.

"It is necessary to exercise management and control over the rare earth industry, but there won't be any embargo," he said.

"What we pursue is to satisfy not only domestic demand but also the global demand for rare earth. We should not only stand from the present, but should also look forward to the future," he added.

"If the rare earth minerals were used up, how would the world and China deal with the problem?"

Wen, a geology major in college, said he studied rare earth for years.

In the 1980s and 1990s, rare earth metals from China were exported at low prices due to a lack of proper management and extraction technology, as well as chaos in supervision, Wen said.

Some countries accumulated so much rare earth that they are still using those reserves today, he said.

He also assured European investors that China would maintain a good investment environment for foreign businesses.

"Foreign businesses operating in China enjoy the same national treatment as Chinese enterprises do," Wen said.

"The only changes that have taken place are that foreign investment is now under better and more orderly regulation."

China will stick fast to its reform and opening-up policies, which will not be changed, he said. Only through reform and opening-up can China maintain its development, he stressed.

Wen acknowledged that foreign businesses are mostly concerned with issues related to intellectual property, independent innovation, and government procurement.

"All products made in foreign businesses are 'made-in-China' products," Wen said. "We will not only protect your intellectual property rights but also your legitimate rights and interests."

On the issue of yuan appreciation, he urged Europe not to press China too much.

Many Chinese export enterprises have slim profit margins and "should the yuan rise by 20 to 40 percent, as demanded by some people, a large number of Chinese export enterprises will go bankrupt, workers will lose their jobs making it hard for society to remain stable", he said. "The world will by no means benefit from a crisis in the Chinese economy."

Also on Wednesday, the premier called on the European Union (EU) to end the arms embargo against China and recognize China's market economy status to pave the way for further bilateral ties.

Wen made the remarks while co-chairing the 13th China-EU Summit with European Council President Herman Van Rompuy and European Commission President Jose Manuel Barroso in Brussels.

The summit should play a role of strategic guidance in promoting China-EU ties and pushing for the recognition of China's market economy status and an end to the arms embargo, Wen said.

China will work with the EU to achieve balanced and sustainable development of bilateral trade, improve the investment environment and enhance cooperation in financial and fiscal policy-making processes, he said.

Wen said China had expressed its support for, and confidence in, the 27-member European bloc, and believed that a strong and stable EU is conducive to the world as well as to China.

Barroso said the EU-China commercial relationship, worth 327 billion euros ($453 billion) in 2009, was one of the most important in the world and vital for the global economy.

Van Rompuy noted that the EU and China have differences of approach, but "this should not impede our joint will to bring the relationship to a higher level. We should be ambitious and make sincere efforts to achieve progress", he added.

Van Rompuy and Barroso also expressed to Wen "the need for a level playing field in China for our businesses", including the "opening up of public procurement".

Wen arrived in Italy late on Wednesday, and met with Italian leaders on Thursday before traveling to Turkey.

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

Moin,

ein sehr lesenswerter Beitrag aus Hotcopper (bekam schon 23 + Ratings):

What an extraordinary situation with china playing the re card as extortion against japan and the panic this has now created as evidenced by the us senate committee hearings going on.

IMHO this has moved the game on to a new level as the us and japan now panic and scramble to ensure future supplies. The re industry is now on the map and is gaining more followers by the day.

Lyc has gone from having no major analysts on the stock to now having jp Morgan and now deutsche in their corner with buys on the stock.

This weeks senate hearings will also bring more investors to lyc as well as more potential contract signings and a quicker ramp up to stage 2 which has not been factored into the analysts price targets.

The deutsche valuation of 1.80 is based on a 25re price and a 2014 ramp up which in light of what's going on is very conservative by half.

The thing is it's all tangible

Real re resources

Real re prices in orbit

Real money in the bank

Real production next year

Real contracts for long term supply

Real doubling of production

Real us security and economic panic by senators

Real Chinese quotas

Real Japanese panic and contract signings

Real $$ for lyc shareholders

This is shaping up as one of the great investment stories of all time!

Habt einen guten Tag alle!

Matze

ein sehr lesenswerter Beitrag aus Hotcopper (bekam schon 23 + Ratings):

What an extraordinary situation with china playing the re card as extortion against japan and the panic this has now created as evidenced by the us senate committee hearings going on.

IMHO this has moved the game on to a new level as the us and japan now panic and scramble to ensure future supplies. The re industry is now on the map and is gaining more followers by the day.

Lyc has gone from having no major analysts on the stock to now having jp Morgan and now deutsche in their corner with buys on the stock.

This weeks senate hearings will also bring more investors to lyc as well as more potential contract signings and a quicker ramp up to stage 2 which has not been factored into the analysts price targets.

The deutsche valuation of 1.80 is based on a 25re price and a 2014 ramp up which in light of what's going on is very conservative by half.

The thing is it's all tangible

Real re resources

Real re prices in orbit

Real money in the bank

Real production next year

Real contracts for long term supply

Real doubling of production

Real us security and economic panic by senators

Real Chinese quotas

Real Japanese panic and contract signings

Real $$ for lyc shareholders

This is shaping up as one of the great investment stories of all time!

Habt einen guten Tag alle!

Matze

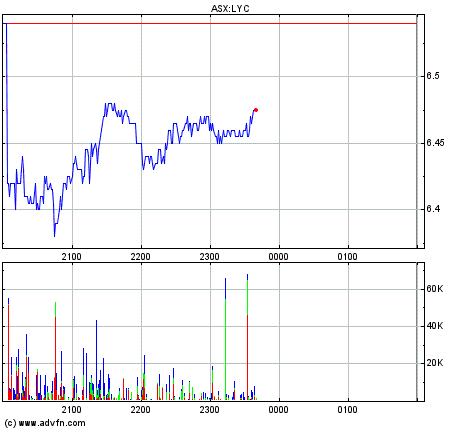

Zugabe: 1. Chart = LYNAS 2. Chart = ALKANE

Antwort auf Beitrag Nr.: 40.286.291 von sailor888 am 08.10.10 07:44:15Die Musik spielt zZ mehr bei China Rare Earth, im Moment + 15%, hat sich seit Anfang Juli mehr als verdoppelt (1,8 auf 4,5 HKD)..

Da scheint der Dirigent aber eingeschlafen zu sein, wenn ich mir diese charts ansehe:

Ende der Durchsage !

Da scheint der Dirigent aber eingeschlafen zu sein, wenn ich mir diese charts ansehe:

Ende der Durchsage !

Antwort auf Beitrag Nr.: 40.286.272 von suffkopf am 08.10.10 07:35:09Die Musik spielt zZ mehr bei China Rare Earth, im Moment + 15%, hat sich seit Anfang Juli mehr als verdoppelt (1,8 auf 4,5 HKD)..

sehr schön solange der stabiel ist ist alles gut man wird immer so nervös wenns sinkt ....

schönes we und ich freu mich schon euch eknnen zu lernen bei 3 €

schönes we und ich freu mich schon euch eknnen zu lernen bei 3 €

Antwort auf Beitrag Nr.: 40.286.243 von schlumpftrader am 08.10.10 07:17:22ups, sorry.

so muss es rein.

bye

schlumpftrader

so muss es rein.

bye

schlumpftrader

23.01.24 · kapitalerhoehungen.de · BASF |

22.01.24 · wallstreetONLINE Redaktion · Lynas Rare Earths |

08.08.23 · nebenwerte ONLINE · Lynas Rare Earths |

21.06.23 · Konstantin Oldenburger · Lynas Rare Earths |

09.05.23 · ESG Aktien · Lynas Rare Earths |