Rare Earth Elements - Seltene Erden : Infos, Fakten, Unternehmen - 500 Beiträge pro Seite (Seite 2)

eröffnet am 23.04.07 15:20:36 von

neuester Beitrag 05.01.15 19:48:35 von

neuester Beitrag 05.01.15 19:48:35 von

Beiträge: 691

ID: 1.126.354

ID: 1.126.354

Aufrufe heute: 31

Gesamt: 84.822

Gesamt: 84.822

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 49 Minuten | 4381 | |

| vor 33 Minuten | 3258 | |

| vor 1 Stunde | 2384 | |

| vor 30 Minuten | 2359 | |

| vor 1 Stunde | 1792 | |

| vor 39 Minuten | 1566 | |

| heute 13:33 | 1201 | |

| heute 13:38 | 1145 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.752,10 | -0,01 | 201 | |||

| 2. | 2. | 150,10 | +0,11 | 96 | |||

| 3. | 7. | 6,7000 | -0,42 | 78 | |||

| 4. | 5. | 0,1735 | -5,96 | 70 | |||

| 5. | 8. | 3,7850 | +1,20 | 65 | |||

| 6. | 4. | 2.394,73 | +0,65 | 53 | |||

| 7. | 17. | 7,3550 | +0,68 | 42 | |||

| 8. | 3. | 7,2500 | +3,57 | 34 |

http://www.criticalmetals.de/midasresearch/pdf/seltene_metal…

... Seite 24

Lynas Corporation

Der nächste Seltene-Erden-

Produzent

Unternehmen und Strategie

Das australische Rohstoff-Unternehmen Lynas

Corporation besitzt das am weitesten

fortgeschrittene Seltene Erden-Projekt

außerhalb Chinas. Das im australischen Sydney

ansässige Unternehmen baut aktuell an einer

Mine auf seinem westaustralischen Mount Weld-

Projekt. Trotzdem die Produktion noch nicht

gestartet wurde, gehört Lynas Corporation mit

einer Marktkapitalisierung von mehr als drei

Milliarden AUD schon jetzt zu den 100 größten

an der australischen ASX notierten

Unternehmen.

Das Mount Weld-Projekt inWestaustralien

Das Mount Weld-Projekt besitzt aktuell bekannte

Vorkommen von etwa 1,4 Millionen Tonnen an

Seltene Erden-Oxid. Der durchschnittliche

Seltene Erden-Gehalt am gesamten Gestein

beträgt dabei rund 8%, die Cut-Off-Rate liegt

bei 2,5%. Die Anlage zur Herstellung eines

Seltene-Erden-Konzentrats befindet sich noch im

Bau und soll Ende März 2011 fertiggestellt sein.

Ab diesem Zeitpunkt soll auch eine erste

Produktionsphase gestartet werden. Das auf

Mount Weld produzierte Konzentrat wird dann zum etwa 1.000 Kilometer entfernten Hafen

Fremantle transportiert und von dort zur unternehmenseigenen Endverarbeitungsanlage ins

malaysische Gebeng verschifft. Die Transportkosten machen dabei etwa 9% der gesamten

Produktionskosten aus.

Seite 25

Eigene Anlage zur Endverarbeitung garantiert hohe Marge

In Gebeng/Malaysia entsteht aktuell die so genannte „Advanced Materials Plant“. Diese soll

spätestens im dritten Quartal 2011 die Produktion aufnehmen und in einer ersten Phase etwa

11.000 Tonnen Seltene Erden jährlich produzieren. In einer zweiten Phase soll diese

Produktionsrate auf bis zu 22.000 Tonnen jährlich erhöht werden. Die recht hohen Grade machen

es Lynas Corporation bereits im Vorfeld möglich, die Infrastruktur der gesamten Anlage auf die

doppelte Verarbeitungskapazität auszulegen. Das Ziel soll bis zum Jahr 2014 erreicht werden. Die

Anlage in Gebeng kommt Lynas gleich doppelt zugute: Erstens lässt sich das in Westaustralien

hergestellte Konzentrat so effektiv in einem Niedriglohnland weiterverarbeiten; zweitens kann

durch die Trennung in die einzelnen Elemente den Kunden ein hochwertiges Einzelprodukt

angeboten und verkauft werden kann. Denn die Preise für die einzelnen Elemente liegen

verständlicherweise weit höher als für ein Konzentrat aus mehreren Seltene Erden–Elementen.

Abnahmeverträge und strategische Allianz garantieren hohe Renditen

Parallel zum Bau der Mine und der Konzentrationsanlage auf Mount Weld sowie der

Weiterverarbeitungsanlage in Malaysia hat sich die Lynas Corporation im Vorfeld auch lukrative

Abnahmeverträge gesichert. Lynas konnte dabei bereits sechs feste Abnahmeverträge sowie zwei

Absichtserklärungen zur Abnahme von Seltenen Erden abschließen. Diese sind zum Großteil

langfristig ausgelegt und besitzen ein Volumen von mehr als einer Milliarde USD. Zudem

konnte die Lynas Corporation eine strategische Allianz mit der Sojitz Corporation, einem

japanischen Großhandelsunternehmen, eingehen. Die Sojitz Corporation zählt zu den 100 größten

Unternehmen Japans und wird innerhalb von 10 Jahren zwischen 80.000 und 90.000 Tonnen an

Seltenen Erden von Lynas abnehmen und auf dem japanischen Markt weiterverkaufen. Die

strategische Allianz bedeutet dabei für beide Seiten eine Win-Win-Situation. Das stark vom

ehemaligen Erzfeind China abhängige Japan erhält somit einen direkten Zugang zu den

wichtigen Seltenen Erden. Die Lynas Corporation sichert sich die Abnahme von mindestens 40%

der Gesamtproduktion (bei Erreichung der vollen Produktionskapazität von 22.000 Tonnen

jährlich) und könnte damit innerhalb von nur 10 Jahren bei den aktuellen Seltene Erden-Preisen

einen Umsatz von knapp 10 Milliarden USD generieren - und das allein durch den Deal mit der

Sojitz Corporation.

Fazit und Ausblick

Die Lynas Corporation ist lediglich einen Schritt vom Produktionsstart auf seinem Mount Weld-

Projekt entfernt. Dieses besitzt sehr gute Grade und eine exzellente Verarbeitungsstrategie. Sofern

die aktuelle Planung bis 2014 eins-zu-eins umgesetzt werden kann, sollte es mit einer

Produktionskapazität von 22.000 Tonnen Seltene Erden pro Jahr zum drittgrößten Seltene Erden

Projekt weltweit und zum größten außerhalb Chinas ausgebaut werden. Damit dürften auf Mount

Weld ab 2014 rund 11% aller Seltenen Erden weltweit gefördert werden. Das Mount Weld-Projekt

ist schon jetzt zu einem Projekt von nationaler und internationaler Wichtigkeit geworden,

Australien bezeichnet es als „strategische Ressource“. Beide Produktionsphasen sind bereits voll

durch finanziert, Abnahmeverträge über mehrere Jahre im Milliarden-USD-Bereich konnten

gesichert werden. Ein hoher Cashflow ist von Anfang an garantiert. Das führende australische

Brokerhaus Patersons Securities sieht den Wert von Lynas Corporation bei den aktuellen

Preisen für Seltene Erden bei bis zu 11 AUD je Aktie. Trotz der aktuellen Krisensituation in

Japan, Heimatland des strategischen Kooperationspartners Sojitz, gehört die Lynas Corporation

angesichts der langfristigen Planungen des Unternehmens u.E. in jedes Rohstoff-Portfolio.

...

http://www.lynascorp.com/page.asp?category_id=1&page_id=25

What are their prices?The first point to note about Rare Earths prices is that there is significant variance in the relative market value for selected Rare Earths oxides. Secondly, the price of Rare Earths depends on the purity level, which is largely set by the specifications for each application.

The table below shows the average annual price for a 'standard' 99% purity of individual elements and for the generic composite of Rare Earths equivalent to the Rare Earths distribution at Mt Weld. Prices are quoted in US$/kg on an FOB China basis. Note that higher purity oxides and other value added properties will attract higher prices than those shown.

http://www.metal-pages.com/metalprices/rareearths/

http://www.asianmetal.com/price/initPriceListEn.am?priceFlag…

@ eine erfolgreiche Woche

Grüsse JoJo

... Seite 24

Lynas Corporation

Der nächste Seltene-Erden-

Produzent

Unternehmen und Strategie

Das australische Rohstoff-Unternehmen Lynas

Corporation besitzt das am weitesten

fortgeschrittene Seltene Erden-Projekt

außerhalb Chinas. Das im australischen Sydney

ansässige Unternehmen baut aktuell an einer

Mine auf seinem westaustralischen Mount Weld-

Projekt. Trotzdem die Produktion noch nicht

gestartet wurde, gehört Lynas Corporation mit

einer Marktkapitalisierung von mehr als drei

Milliarden AUD schon jetzt zu den 100 größten

an der australischen ASX notierten

Unternehmen.

Das Mount Weld-Projekt inWestaustralien

Das Mount Weld-Projekt besitzt aktuell bekannte

Vorkommen von etwa 1,4 Millionen Tonnen an

Seltene Erden-Oxid. Der durchschnittliche

Seltene Erden-Gehalt am gesamten Gestein

beträgt dabei rund 8%, die Cut-Off-Rate liegt

bei 2,5%. Die Anlage zur Herstellung eines

Seltene-Erden-Konzentrats befindet sich noch im

Bau und soll Ende März 2011 fertiggestellt sein.

Ab diesem Zeitpunkt soll auch eine erste

Produktionsphase gestartet werden. Das auf

Mount Weld produzierte Konzentrat wird dann zum etwa 1.000 Kilometer entfernten Hafen

Fremantle transportiert und von dort zur unternehmenseigenen Endverarbeitungsanlage ins

malaysische Gebeng verschifft. Die Transportkosten machen dabei etwa 9% der gesamten

Produktionskosten aus.

Seite 25

Eigene Anlage zur Endverarbeitung garantiert hohe Marge

In Gebeng/Malaysia entsteht aktuell die so genannte „Advanced Materials Plant“. Diese soll

spätestens im dritten Quartal 2011 die Produktion aufnehmen und in einer ersten Phase etwa

11.000 Tonnen Seltene Erden jährlich produzieren. In einer zweiten Phase soll diese

Produktionsrate auf bis zu 22.000 Tonnen jährlich erhöht werden. Die recht hohen Grade machen

es Lynas Corporation bereits im Vorfeld möglich, die Infrastruktur der gesamten Anlage auf die

doppelte Verarbeitungskapazität auszulegen. Das Ziel soll bis zum Jahr 2014 erreicht werden. Die

Anlage in Gebeng kommt Lynas gleich doppelt zugute: Erstens lässt sich das in Westaustralien

hergestellte Konzentrat so effektiv in einem Niedriglohnland weiterverarbeiten; zweitens kann

durch die Trennung in die einzelnen Elemente den Kunden ein hochwertiges Einzelprodukt

angeboten und verkauft werden kann. Denn die Preise für die einzelnen Elemente liegen

verständlicherweise weit höher als für ein Konzentrat aus mehreren Seltene Erden–Elementen.

Abnahmeverträge und strategische Allianz garantieren hohe Renditen

Parallel zum Bau der Mine und der Konzentrationsanlage auf Mount Weld sowie der

Weiterverarbeitungsanlage in Malaysia hat sich die Lynas Corporation im Vorfeld auch lukrative

Abnahmeverträge gesichert. Lynas konnte dabei bereits sechs feste Abnahmeverträge sowie zwei

Absichtserklärungen zur Abnahme von Seltenen Erden abschließen. Diese sind zum Großteil

langfristig ausgelegt und besitzen ein Volumen von mehr als einer Milliarde USD. Zudem

konnte die Lynas Corporation eine strategische Allianz mit der Sojitz Corporation, einem

japanischen Großhandelsunternehmen, eingehen. Die Sojitz Corporation zählt zu den 100 größten

Unternehmen Japans und wird innerhalb von 10 Jahren zwischen 80.000 und 90.000 Tonnen an

Seltenen Erden von Lynas abnehmen und auf dem japanischen Markt weiterverkaufen. Die

strategische Allianz bedeutet dabei für beide Seiten eine Win-Win-Situation. Das stark vom

ehemaligen Erzfeind China abhängige Japan erhält somit einen direkten Zugang zu den

wichtigen Seltenen Erden. Die Lynas Corporation sichert sich die Abnahme von mindestens 40%

der Gesamtproduktion (bei Erreichung der vollen Produktionskapazität von 22.000 Tonnen

jährlich) und könnte damit innerhalb von nur 10 Jahren bei den aktuellen Seltene Erden-Preisen

einen Umsatz von knapp 10 Milliarden USD generieren - und das allein durch den Deal mit der

Sojitz Corporation.

Fazit und Ausblick

Die Lynas Corporation ist lediglich einen Schritt vom Produktionsstart auf seinem Mount Weld-

Projekt entfernt. Dieses besitzt sehr gute Grade und eine exzellente Verarbeitungsstrategie. Sofern

die aktuelle Planung bis 2014 eins-zu-eins umgesetzt werden kann, sollte es mit einer

Produktionskapazität von 22.000 Tonnen Seltene Erden pro Jahr zum drittgrößten Seltene Erden

Projekt weltweit und zum größten außerhalb Chinas ausgebaut werden. Damit dürften auf Mount

Weld ab 2014 rund 11% aller Seltenen Erden weltweit gefördert werden. Das Mount Weld-Projekt

ist schon jetzt zu einem Projekt von nationaler und internationaler Wichtigkeit geworden,

Australien bezeichnet es als „strategische Ressource“. Beide Produktionsphasen sind bereits voll

durch finanziert, Abnahmeverträge über mehrere Jahre im Milliarden-USD-Bereich konnten

gesichert werden. Ein hoher Cashflow ist von Anfang an garantiert. Das führende australische

Brokerhaus Patersons Securities sieht den Wert von Lynas Corporation bei den aktuellen

Preisen für Seltene Erden bei bis zu 11 AUD je Aktie. Trotz der aktuellen Krisensituation in

Japan, Heimatland des strategischen Kooperationspartners Sojitz, gehört die Lynas Corporation

angesichts der langfristigen Planungen des Unternehmens u.E. in jedes Rohstoff-Portfolio.

...

http://www.lynascorp.com/page.asp?category_id=1&page_id=25

What are their prices?The first point to note about Rare Earths prices is that there is significant variance in the relative market value for selected Rare Earths oxides. Secondly, the price of Rare Earths depends on the purity level, which is largely set by the specifications for each application.

The table below shows the average annual price for a 'standard' 99% purity of individual elements and for the generic composite of Rare Earths equivalent to the Rare Earths distribution at Mt Weld. Prices are quoted in US$/kg on an FOB China basis. Note that higher purity oxides and other value added properties will attract higher prices than those shown.

http://www.metal-pages.com/metalprices/rareearths/

http://www.asianmetal.com/price/initPriceListEn.am?priceFlag…

@ eine erfolgreiche Woche

Grüsse JoJo

http://www.thetradercentral.com/featuredstocks" target="_blank" rel="nofollow ugc noopener">http://www.thetradercentral.com/featuredstocks

...

Lynas Corporation

Lynas are a rare earth resource company based in Western Australia. Lynas’ most advanced operation is the Mount Weld Rare Earths project. Mount weld involves the development of a mine, concentration plant, and an advanced materials plant. Mount Weld currently has a REO of 1.4 million tonnes. Lynas plan to truck ore produced from Mount weld to the Fremantle Port where it will then be shipped to their Malaysian processing hub. Lynas aim to produce 11,000 tones of rare earth resource in 2011 and double that figure to 22,000 in 2012. Mount Weld is a world-class project, the size and quality of the resource can be compared against most rare earth metal mines in the world.

The current status of the project is the following:

• Concentration plant completed, awaiting government approval to start plant

• Advanced materials plant under construction with first feed scheduled for late 2011

• 8 buyers have signed an agreement to purchase RER from lynas

Back in 2010 the Foreign Investment Review board rejected an offer by Chinese Non-ferrous Metals Mining Company to acquire more than 50% of Lyans. As a result Lynas’ share price languished for some time with investors unsure where the required capital to fund their projects would come from, however The Foreign Investment Review Board has now approved of significant investment by Japanese Oil Gas and Metals National Corporation. Under the deal JOGMEC will invest $325 million into lynas in the form of a loan and the placement of shares.

Last Month, Lynas agreed to sub-lease several areas within Mount Weld (Crown) to Forge Resources. The transaction involved Lynas receiving $20.7 million in cash and the option to purchase 7 million shares in Forge as well as the right to purchase resource produced in the leases. Lynas will also receive royalties as part of the transaction. The deal looks likely to be met by strong opposition from shareholders who argue the value of the leases are being significantly undervalued. An independent expert backed the transaction citing the deal was “fair and reasonable”. Shareholders will vote on may 18th.

Analysing the deal we see the following:

Investor presentation in March 2010 states that the crown polymetallic deposit is “ a world class niobium asset and contains 475,000t REO”. To put it simply, world class assets are not sold for 20 million and a couple of options. Calculations of the resource have put it well in to the tens of billions, the decision to sell these “world class assets” so cheaply is interesting to say the least. The following image is a slide taken from a lynas presentation in 2007:

Lynas say the Crown resource has “over $50 billion metal content”. Prices have increased since 2007 which would value the resource significantly higher today. So a resource that the company itself has valued at over $50 billion is now being sold for $20.7 million plus options? Investors are very interested in what has changed for Crown to be considered a non-core asset and to be valued at so little when the company previously valued the resource at tens of billions more than it is being sold for. Either the company over-valued Crown by 49.8 billion dollars or there is another reason unknown to everyone.

Despite the controversy surrounding the deal with Forge, Lynas have one of, if not the largest rare earth resources project in the world. With the restricted supply from China, the demand for their resource will be significant; this is already shown by a total of 8 customers entering into agreements with Lynas. The ever increasing demand for rare metals and the limited supply is most likely to drive the price of rare earths in the long term resulting in greater Margins for Lynas.

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

...

Lynas Corporation

Lynas are a rare earth resource company based in Western Australia. Lynas’ most advanced operation is the Mount Weld Rare Earths project. Mount weld involves the development of a mine, concentration plant, and an advanced materials plant. Mount Weld currently has a REO of 1.4 million tonnes. Lynas plan to truck ore produced from Mount weld to the Fremantle Port where it will then be shipped to their Malaysian processing hub. Lynas aim to produce 11,000 tones of rare earth resource in 2011 and double that figure to 22,000 in 2012. Mount Weld is a world-class project, the size and quality of the resource can be compared against most rare earth metal mines in the world.

The current status of the project is the following:

• Concentration plant completed, awaiting government approval to start plant

• Advanced materials plant under construction with first feed scheduled for late 2011

• 8 buyers have signed an agreement to purchase RER from lynas

Back in 2010 the Foreign Investment Review board rejected an offer by Chinese Non-ferrous Metals Mining Company to acquire more than 50% of Lyans. As a result Lynas’ share price languished for some time with investors unsure where the required capital to fund their projects would come from, however The Foreign Investment Review Board has now approved of significant investment by Japanese Oil Gas and Metals National Corporation. Under the deal JOGMEC will invest $325 million into lynas in the form of a loan and the placement of shares.

Last Month, Lynas agreed to sub-lease several areas within Mount Weld (Crown) to Forge Resources. The transaction involved Lynas receiving $20.7 million in cash and the option to purchase 7 million shares in Forge as well as the right to purchase resource produced in the leases. Lynas will also receive royalties as part of the transaction. The deal looks likely to be met by strong opposition from shareholders who argue the value of the leases are being significantly undervalued. An independent expert backed the transaction citing the deal was “fair and reasonable”. Shareholders will vote on may 18th.

Analysing the deal we see the following:

Investor presentation in March 2010 states that the crown polymetallic deposit is “ a world class niobium asset and contains 475,000t REO”. To put it simply, world class assets are not sold for 20 million and a couple of options. Calculations of the resource have put it well in to the tens of billions, the decision to sell these “world class assets” so cheaply is interesting to say the least. The following image is a slide taken from a lynas presentation in 2007:

Lynas say the Crown resource has “over $50 billion metal content”. Prices have increased since 2007 which would value the resource significantly higher today. So a resource that the company itself has valued at over $50 billion is now being sold for $20.7 million plus options? Investors are very interested in what has changed for Crown to be considered a non-core asset and to be valued at so little when the company previously valued the resource at tens of billions more than it is being sold for. Either the company over-valued Crown by 49.8 billion dollars or there is another reason unknown to everyone.

Despite the controversy surrounding the deal with Forge, Lynas have one of, if not the largest rare earth resources project in the world. With the restricted supply from China, the demand for their resource will be significant; this is already shown by a total of 8 customers entering into agreements with Lynas. The ever increasing demand for rare metals and the limited supply is most likely to drive the price of rare earths in the long term resulting in greater Margins for Lynas.

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

http://www.themalaysianinsider.com/malaysia/article/rare-ear…

Rare earths refinery benefits Kuantan, says Lynas

By Shannon TeohApril 12, 2011

A Geiger counter and rare earth samples displayed outside a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack Ooi

A Geiger counter and rare earth samples displayed outside a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack Ooi

KUALA LUMPUR, April 12 — Lynas Corp has told residents living near its rare earth plant in Kuantan that its RM1 billion investment into the Gebeng industrial zone will be a boon, not bane, for their future despite fears of its radioactive effects.

The Australian miner says its RM700 million refinery and other investments will be “the foundation industry for other high-technology industries that use rare earth.”

“This will be of benefit to the next generation of Malaysians,” executive chairman Nicholas Curtis told The Malaysian Insider in an interview yesterday, adding that the multiplier effect could result in double or triple the money flow from its initial investment.

“The whole momentum, the workshops we use, the equipment that needs to be built, maintenance contracts. The economic impact is far in excess of our own investment,” he said.

Curtis also insisted that the amount of thorium - the radioactive element found in virtually all rare earth deposits - that will be released from the factory would result in “zero public exposure” due to specialised storage dams it is constructing onsite. Studies say radiation is linked to diseases such as to cancer and congenital birth defects, fears of which has led environmentalists and local residents to protest against the project.

Kuantan residents examine the government's point of view before a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack Ooi

Kuantan residents examine the government's point of view before a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack Ooi

They have compared the plant being built by Lynas to the Asian Rare Earth (ARE) plant in Bukit Merah that eventually closed down in 1992 after sustained public protests.

Nearly two decades later, the plant is still undergoing a RM303 million cleanup exercise and has been linked to at least eight cases of leukemia, with seven resulting in death.

Although reports say that the plant may generate revenues amounting up to one per cent of the Malaysian GDP, critics have questioned the real economic benefit of the project, pointing to the 12-year tax holiday Lynas will receive after being accorded pioneer status.

However, the government has estimated RM2.3 billion in investments spinning off from the plant that will be ready for operations in September after over two years of construction.

Science, Technology and Innovation Minister Datuk Seri Maximus Johnity Ongkili told Parliament last month that RM300 million has already been poured in for two factories in Gebeng that will produce the hydrochloric and sulphuric acid needed to extract the rare earth metals.

Curtis said yesterday that the plant would position Malaysia as a prime hub for high-technology industry as rare earth metals are crucial in applications ranging from the automotive, energy and electronics sectors.

Lynas plans for its Gebeng plant to supply one-third of global rare earth demand outside of China by 2013, with California being the only other site outside of the Asian giant with a similar kind of deposit the company says has low enough thorium levels to be processed safely.

curtis reassuring Gebeng residents about the benefits of the plant. — Picture by Jack Ooi

curtis reassuring Gebeng residents about the benefits of the plant. — Picture by Jack Ooi

“Electronics is a big end user but Malaysia is principally an assembler. But this is an opportunity to move from assembler to manufacturer.

“When the full value chain is here, that’s 2020, that’s knowledge society,” Curtis said, referencing Malaysia’s plan to be a developed, high-income nation in nine years.

He said that the Gebeng industrial zone could grow into a hub for research and development (R&D), resulting in “distinctive Malaysian intellectual property” as rare earth metals was making cutting-edge products like smartphones, hybrid cars and laptops possible.

Curtis said that of the 350 skilled workers the plant would hire, only a handful of R&D staff would be non-Malaysian, who will be given “the best knowledge in the world on the processing of rare earths and the potential to modify those processes to meet special application needs.”

Asked if there was the right skills in Malaysia to fill those positions, he replied, “We advertised for 30 positions last week and received 10 Malaysian applicants per position.”

“I firmly believe that the best people to run a plant in Malaysia are Malaysians. It’s their home, they will look after it as though it is their home and they will actually be proud of it,” Curtis said.

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

Rare earths refinery benefits Kuantan, says Lynas

By Shannon TeohApril 12, 2011

A Geiger counter and rare earth samples displayed outside a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack Ooi

A Geiger counter and rare earth samples displayed outside a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack OoiKUALA LUMPUR, April 12 — Lynas Corp has told residents living near its rare earth plant in Kuantan that its RM1 billion investment into the Gebeng industrial zone will be a boon, not bane, for their future despite fears of its radioactive effects.

The Australian miner says its RM700 million refinery and other investments will be “the foundation industry for other high-technology industries that use rare earth.”

“This will be of benefit to the next generation of Malaysians,” executive chairman Nicholas Curtis told The Malaysian Insider in an interview yesterday, adding that the multiplier effect could result in double or triple the money flow from its initial investment.

“The whole momentum, the workshops we use, the equipment that needs to be built, maintenance contracts. The economic impact is far in excess of our own investment,” he said.

Curtis also insisted that the amount of thorium - the radioactive element found in virtually all rare earth deposits - that will be released from the factory would result in “zero public exposure” due to specialised storage dams it is constructing onsite. Studies say radiation is linked to diseases such as to cancer and congenital birth defects, fears of which has led environmentalists and local residents to protest against the project.

Kuantan residents examine the government's point of view before a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack Ooi

Kuantan residents examine the government's point of view before a town hall meeting to discuss the Lynas plant in Kuantan, April 5, 2011. — Picture by Jack OoiThey have compared the plant being built by Lynas to the Asian Rare Earth (ARE) plant in Bukit Merah that eventually closed down in 1992 after sustained public protests.

Nearly two decades later, the plant is still undergoing a RM303 million cleanup exercise and has been linked to at least eight cases of leukemia, with seven resulting in death.

Although reports say that the plant may generate revenues amounting up to one per cent of the Malaysian GDP, critics have questioned the real economic benefit of the project, pointing to the 12-year tax holiday Lynas will receive after being accorded pioneer status.

However, the government has estimated RM2.3 billion in investments spinning off from the plant that will be ready for operations in September after over two years of construction.

Science, Technology and Innovation Minister Datuk Seri Maximus Johnity Ongkili told Parliament last month that RM300 million has already been poured in for two factories in Gebeng that will produce the hydrochloric and sulphuric acid needed to extract the rare earth metals.

Curtis said yesterday that the plant would position Malaysia as a prime hub for high-technology industry as rare earth metals are crucial in applications ranging from the automotive, energy and electronics sectors.

Lynas plans for its Gebeng plant to supply one-third of global rare earth demand outside of China by 2013, with California being the only other site outside of the Asian giant with a similar kind of deposit the company says has low enough thorium levels to be processed safely.

curtis reassuring Gebeng residents about the benefits of the plant. — Picture by Jack Ooi

curtis reassuring Gebeng residents about the benefits of the plant. — Picture by Jack Ooi“Electronics is a big end user but Malaysia is principally an assembler. But this is an opportunity to move from assembler to manufacturer.

“When the full value chain is here, that’s 2020, that’s knowledge society,” Curtis said, referencing Malaysia’s plan to be a developed, high-income nation in nine years.

He said that the Gebeng industrial zone could grow into a hub for research and development (R&D), resulting in “distinctive Malaysian intellectual property” as rare earth metals was making cutting-edge products like smartphones, hybrid cars and laptops possible.

Curtis said that of the 350 skilled workers the plant would hire, only a handful of R&D staff would be non-Malaysian, who will be given “the best knowledge in the world on the processing of rare earths and the potential to modify those processes to meet special application needs.”

Asked if there was the right skills in Malaysia to fill those positions, he replied, “We advertised for 30 positions last week and received 10 Malaysian applicants per position.”

“I firmly believe that the best people to run a plant in Malaysia are Malaysians. It’s their home, they will look after it as though it is their home and they will actually be proud of it,” Curtis said.

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

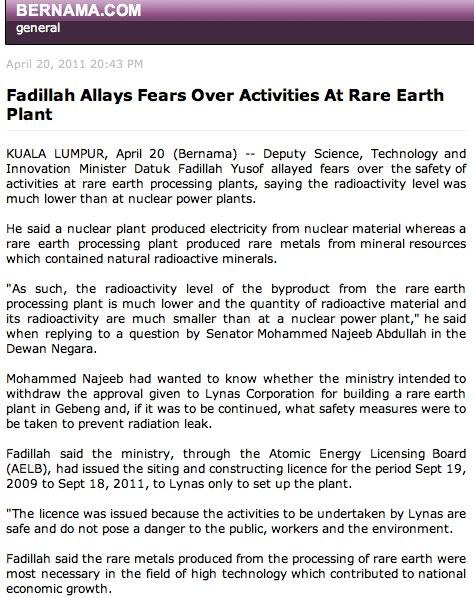

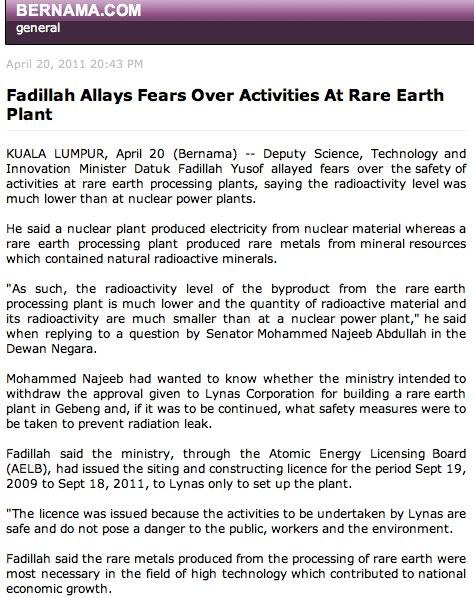

Diese, auf Grund der aktuelle Ereignissen in Japan sowie durch negative Vorfälle aus der Vergangenheit, entstandene Verunsicherung bei der kritischen Bevölkerung vor Ort wird nicht nur ernst genommen sondern u.a. durch die unterschiedlichen Medien/Behörden öffentlich unter Einbezug aller mit NC-Lynas zur Diskussion gestellt um alle Verunsicherungen in Bezug auf den gerinden Thoriumanteil im Deposit von Lynas und deren Gefahrenpotential auszuräumen.

Grüsse JoJo

http://www.themalaysianinsider.com/malaysia/article/lynas-wi…

Lynas will start Kuantan plant, radioactive waste onsite

By Shannon TeohApril 12, 2011

...

...

“The waste is a sitting time bomb,” Environmental Protection Society of Malaysia (EPSM) president Nithi Nesadurai had said.

Curtis however, said that special storage dams that can hold six years of waste have been built that will cause “zero exposure” to the public.

“Two thirds or more is gypsum. There is no issue with respect to it being used as plasterboard and other markets. Malaysia is a net importer of gypsum so we will use it in commercial quantities for sure. This increases our storage (for the radioactie waste) to 24 years,” he explained.

Lynas plans to process the iron-bound thorium into a concrete with a thorium concentration of less than 500 parts per million (ppm) for further industrial use but admitted to not having a commercial application yet.

“It’s not that Lynas does not have the solution. The solution (storage dams) has been agreed. Now Lynas is going beyond the standards,” he said in the interview, where he stressed repeatedly that Malaysia’s last rare earth project, in Bukit Merah, should never have gone ahead.

The Asian Rare Earth plant has been linked to at least eight leukemia cases with seven deaths after being shut down in 1992.

Alarm in Japan over potential radiation leaks from nuclear plant explosions caused by the recent earthquake and tsunami, coupled with a recent New York Times report highlighting the radioactive waste produced in the rare earth refining process, has revived fears and debate on the issue.

Environmentalists and residents living near the factory site in the Gebeng industrial zone have raised questions over the potential environmental hazards arising from radioactive waste being produced and stored at the plant.

But Curtis said today that the radioactive levels were now enough that “to get the equivalent exposure to one x-ray, you need to be buried in our material for 70 hours.”

He also said that workers at the RM700 million plant will receive added radiation per year of less than one x-ray scan and nearly five times less than people who worked on commercial planes.

“You don’t want them misled into fear,” he said of residents in Kuantan.

Curtis also said that the ratio of thorium to rare earth metals found in its concentrated raw material was 55 to 10,000 while the Bukit Merah operation had 12,000 parts thorium to every 10,000 parts of rare earth.

As it plans to ramp up production to 22,000 tonnes per year of the material that is crucial to high-technology applications such as smartphones, hybrid cars and even bombs, it will mean producing about 120 tonnes of thorium per year.

He said that the Mount Weld ore, along with the Mountain Pass site in California and deposits in China, was one of only three known places where rare earth ore was found with such low levels of thorium.

“Our material is of a different nature, a completely different geological genesis from the material in tin slag (used ib Bukit Merah). That comment that rare earths occur in monazite with high levels of thorium is correct. The comment that is not correct is that that’s the only place that rare earths could occur.

“By law in Australia, you’re not allowed to use that monazite and Bukit Merah should never have been allowed on the same basis,” he said.

Curtis added that the concentrated material shipped to Malaysia had 1,600 ppm of thorium and was not considered by Australia “under is transportation guidelines to require even notification as being radioactive. It is not considered radioactive material.” He also dismissed fears of a similar mishap as Japan’s nuclear plants the Gebeng plant’s material had too low a level of radiation.

“The levels are so absolutely different with Japan, there is no comparison. Even after 70 hours, all you get is an x-ray,” he said of a potential leak of its waste product.

Lynas expects to receive a preliminary operating licence from the Atomic Energy Licensing Board (AELB) before September which will be renewed as a full license after three years should the plant comply to agreed standards.

The company hopes RM8 billion annual revenues from 2013 based on the refined metals’ current prices, when it will produce one-third of the world’s demand outside of China.

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

http://www.themalaysianinsider.com/malaysia/article/lynas-wi…

Lynas will start Kuantan plant, radioactive waste onsite

By Shannon TeohApril 12, 2011

...

...

“The waste is a sitting time bomb,” Environmental Protection Society of Malaysia (EPSM) president Nithi Nesadurai had said.

Curtis however, said that special storage dams that can hold six years of waste have been built that will cause “zero exposure” to the public.

“Two thirds or more is gypsum. There is no issue with respect to it being used as plasterboard and other markets. Malaysia is a net importer of gypsum so we will use it in commercial quantities for sure. This increases our storage (for the radioactie waste) to 24 years,” he explained.

Lynas plans to process the iron-bound thorium into a concrete with a thorium concentration of less than 500 parts per million (ppm) for further industrial use but admitted to not having a commercial application yet.

“It’s not that Lynas does not have the solution. The solution (storage dams) has been agreed. Now Lynas is going beyond the standards,” he said in the interview, where he stressed repeatedly that Malaysia’s last rare earth project, in Bukit Merah, should never have gone ahead.

The Asian Rare Earth plant has been linked to at least eight leukemia cases with seven deaths after being shut down in 1992.

Alarm in Japan over potential radiation leaks from nuclear plant explosions caused by the recent earthquake and tsunami, coupled with a recent New York Times report highlighting the radioactive waste produced in the rare earth refining process, has revived fears and debate on the issue.

Environmentalists and residents living near the factory site in the Gebeng industrial zone have raised questions over the potential environmental hazards arising from radioactive waste being produced and stored at the plant.

But Curtis said today that the radioactive levels were now enough that “to get the equivalent exposure to one x-ray, you need to be buried in our material for 70 hours.”

He also said that workers at the RM700 million plant will receive added radiation per year of less than one x-ray scan and nearly five times less than people who worked on commercial planes.

“You don’t want them misled into fear,” he said of residents in Kuantan.

Curtis also said that the ratio of thorium to rare earth metals found in its concentrated raw material was 55 to 10,000 while the Bukit Merah operation had 12,000 parts thorium to every 10,000 parts of rare earth.

As it plans to ramp up production to 22,000 tonnes per year of the material that is crucial to high-technology applications such as smartphones, hybrid cars and even bombs, it will mean producing about 120 tonnes of thorium per year.

He said that the Mount Weld ore, along with the Mountain Pass site in California and deposits in China, was one of only three known places where rare earth ore was found with such low levels of thorium.

“Our material is of a different nature, a completely different geological genesis from the material in tin slag (used ib Bukit Merah). That comment that rare earths occur in monazite with high levels of thorium is correct. The comment that is not correct is that that’s the only place that rare earths could occur.

“By law in Australia, you’re not allowed to use that monazite and Bukit Merah should never have been allowed on the same basis,” he said.

Curtis added that the concentrated material shipped to Malaysia had 1,600 ppm of thorium and was not considered by Australia “under is transportation guidelines to require even notification as being radioactive. It is not considered radioactive material.” He also dismissed fears of a similar mishap as Japan’s nuclear plants the Gebeng plant’s material had too low a level of radiation.

“The levels are so absolutely different with Japan, there is no comparison. Even after 70 hours, all you get is an x-ray,” he said of a potential leak of its waste product.

Lynas expects to receive a preliminary operating licence from the Atomic Energy Licensing Board (AELB) before September which will be renewed as a full license after three years should the plant comply to agreed standards.

The company hopes RM8 billion annual revenues from 2013 based on the refined metals’ current prices, when it will produce one-third of the world’s demand outside of China.

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

!

Dieser Beitrag wurde moderiert. Grund: Spammposting

Den Originalartikel und weitere Infos im Faktenthread: http://www.wallstreet-online.de/diskussion/1126458-1421-1430…

Wünsche @ erholsame, schöne und besinnliche Feiertage

Grüsse JoJo

Wünsche @ erholsame, schöne und besinnliche Feiertage

Grüsse JoJo

http://www.nytimes.com/2011/05/03/business/03rare.html

Supplies Squeezed, Rare Earth Prices Surge

By KEITH BRADSHER

Published: May 2, 2011

HONG KONG — Rare earth prices are reaching rarefied heights.

World prices have doubled in the last four months for rare earths — metallic elements needed for many of the most sophisticated civilian and military technologies, whether smartphones or smart bombs.

And this year’s increases come atop price gains of as much as fourfold during 2010.

The reason is basic economics: demand continues to outstrip efforts to expand supplies and break China’s chokehold on the market.

Neodymium, a rare earth necessary for a range of products including headphones and hybrid electric cars, now fetches more than $283 a kilogram ($129 a pound) on the spot market. A year ago it sold for about $42 a kilogram ($19 a pound).

Samarium, crucial to the manufacture of missiles, has climbed to more than $146 a kilogram, up from $18.50 a year earlier.

While the price inflation is a concern to manufacturers, consumers in many cases will barely notice the soaring cost of rare earths. Even though the materials are crucial to the performance of everyday equipment like automotive catalytic converters and laptop computer display screens, rare earths are typically are used only in trace quantities.

One exception is the Toyota Prius hybrid car, whose manufacture uses a kilogram of neodymium.

Toyota has been raising prices for the Prius, but has cited demand for the car and economic conditions. While acknowledging that rising prices for raw materials in general have affected the company’s overall financial results, Toyota has declined to provide a breakdown of the role of rare earths. (Production problems stemming from the Japanese earthquake and tsunami have also crimped supplies of Prius cars, which are made only in Japan.)

The high prices for rare earths reflect turmoil in the global industry that mines and refines them. China, which controls more than 95 percent of the market, has further restricted exports so as to conserve supplies for its own high-tech and green energy industries. That is despite the World Trade Organization’s ban on most export restrictions.

Meanwhile, an ambitious effort to open the world’s largest rare earth refinery in Malaysia, which had seemed certain to begin operating by this autumn, is tied up over regulatory reviews of the disposal plans for thousands of tons of low-level radioactive waste the plant would produce annually. Public opposition to the refinery is evident in the weekly protest demonstrations now being held.

At the same time, Japanese companies are finding it harder than originally hoped to recycle rare earths from electronics and to begin rare earth mining and refining in Vietnam.

Although rare earths are crucial to the supply chains of some of the world’s biggest manufacturers, the industry that mines and refines them has long been characterized by small, entrepreneurial companies. Lately, though, soaring prices have contributed to industry consolidation.

Last month, for example, Solvay, a big Belgian chemical-industrial corporation announced that it would pay $4.8 billion to acquire Rhodia of France, a technological leader in making complex chemicals based on rare earths.

That same day, April 4, Molycorp, the only American company currently producing rare earths, said it had paid $89 million for a more than 90 percent stake in Silmet of Estonia, a much smaller company that is Rhodia’s only European rival in rare earth processing.

In Malaysia, where the giant rare earth refinery is under construction near the eastern port of Kuantan, regulators are delaying approval for an operating permit amid public concern about naturally occurring low-level radioactive contamination of the rare earth ore, which will be mined in Australia.

Raja Dato Abdul Aziz bin Raja Adnan, the director general of the Malaysian Atomic Energy Licensing Board, said the board had asked the Lynas Corporation of Australia, which is building the refinery, to provide additional documentation before accepting its application for an initial operating permit. It will take up to six months to review the application, Raja Adnan said, and Lynas will not be allowed to bring any raw material to the plant until a permit is issued.

But Nicholas Curtis, Lynas’s executive chairman, said that he believed the company could obtain the necessary approvals before September and that his company was sticking to its plan to begin feeding Australian ore into the Malaysian refinery’s kilns by the end of that month.

The Malaysian government also announced last week that it would appoint a panel of international experts to review the safety of Lynas’s plans. The company said it welcomed the move.

But Fuziah Salleh, an opposition legislator who represents downtown Kuantan and has been leading weekly protests, is mistrustful.

“The people’s concerns are that the independent panel will be formed by the government to prove that they are right,” she wrote in an e-mail message.

Toyota Tsusho, a materials purchasing unit of the Toyota Group, has separately encountered complex local regulations as it seeks to open rare earth mining and processing operations in Vietnam. The project was announced last October during a Chinese embargo on rare earth shipments to Japan. Takeshi Mutsuura, a spokesman, said that Toyota Tsusho now hoped to reach a contract in Vietnam this summer and start production in early 2013.

1 2 Next Page »

Grüsse JoJo

Supplies Squeezed, Rare Earth Prices Surge

By KEITH BRADSHER

Published: May 2, 2011

HONG KONG — Rare earth prices are reaching rarefied heights.

World prices have doubled in the last four months for rare earths — metallic elements needed for many of the most sophisticated civilian and military technologies, whether smartphones or smart bombs.

And this year’s increases come atop price gains of as much as fourfold during 2010.

The reason is basic economics: demand continues to outstrip efforts to expand supplies and break China’s chokehold on the market.

Neodymium, a rare earth necessary for a range of products including headphones and hybrid electric cars, now fetches more than $283 a kilogram ($129 a pound) on the spot market. A year ago it sold for about $42 a kilogram ($19 a pound).

Samarium, crucial to the manufacture of missiles, has climbed to more than $146 a kilogram, up from $18.50 a year earlier.

While the price inflation is a concern to manufacturers, consumers in many cases will barely notice the soaring cost of rare earths. Even though the materials are crucial to the performance of everyday equipment like automotive catalytic converters and laptop computer display screens, rare earths are typically are used only in trace quantities.

One exception is the Toyota Prius hybrid car, whose manufacture uses a kilogram of neodymium.

Toyota has been raising prices for the Prius, but has cited demand for the car and economic conditions. While acknowledging that rising prices for raw materials in general have affected the company’s overall financial results, Toyota has declined to provide a breakdown of the role of rare earths. (Production problems stemming from the Japanese earthquake and tsunami have also crimped supplies of Prius cars, which are made only in Japan.)

The high prices for rare earths reflect turmoil in the global industry that mines and refines them. China, which controls more than 95 percent of the market, has further restricted exports so as to conserve supplies for its own high-tech and green energy industries. That is despite the World Trade Organization’s ban on most export restrictions.

Meanwhile, an ambitious effort to open the world’s largest rare earth refinery in Malaysia, which had seemed certain to begin operating by this autumn, is tied up over regulatory reviews of the disposal plans for thousands of tons of low-level radioactive waste the plant would produce annually. Public opposition to the refinery is evident in the weekly protest demonstrations now being held.

At the same time, Japanese companies are finding it harder than originally hoped to recycle rare earths from electronics and to begin rare earth mining and refining in Vietnam.

Although rare earths are crucial to the supply chains of some of the world’s biggest manufacturers, the industry that mines and refines them has long been characterized by small, entrepreneurial companies. Lately, though, soaring prices have contributed to industry consolidation.

Last month, for example, Solvay, a big Belgian chemical-industrial corporation announced that it would pay $4.8 billion to acquire Rhodia of France, a technological leader in making complex chemicals based on rare earths.

That same day, April 4, Molycorp, the only American company currently producing rare earths, said it had paid $89 million for a more than 90 percent stake in Silmet of Estonia, a much smaller company that is Rhodia’s only European rival in rare earth processing.

In Malaysia, where the giant rare earth refinery is under construction near the eastern port of Kuantan, regulators are delaying approval for an operating permit amid public concern about naturally occurring low-level radioactive contamination of the rare earth ore, which will be mined in Australia.

Raja Dato Abdul Aziz bin Raja Adnan, the director general of the Malaysian Atomic Energy Licensing Board, said the board had asked the Lynas Corporation of Australia, which is building the refinery, to provide additional documentation before accepting its application for an initial operating permit. It will take up to six months to review the application, Raja Adnan said, and Lynas will not be allowed to bring any raw material to the plant until a permit is issued.

But Nicholas Curtis, Lynas’s executive chairman, said that he believed the company could obtain the necessary approvals before September and that his company was sticking to its plan to begin feeding Australian ore into the Malaysian refinery’s kilns by the end of that month.

The Malaysian government also announced last week that it would appoint a panel of international experts to review the safety of Lynas’s plans. The company said it welcomed the move.

But Fuziah Salleh, an opposition legislator who represents downtown Kuantan and has been leading weekly protests, is mistrustful.

“The people’s concerns are that the independent panel will be formed by the government to prove that they are right,” she wrote in an e-mail message.

Toyota Tsusho, a materials purchasing unit of the Toyota Group, has separately encountered complex local regulations as it seeks to open rare earth mining and processing operations in Vietnam. The project was announced last October during a Chinese embargo on rare earth shipments to Japan. Takeshi Mutsuura, a spokesman, said that Toyota Tsusho now hoped to reach a contract in Vietnam this summer and start production in early 2013.

1 2 Next Page »

Grüsse JoJo

Für @ die immer aktuell über Lynas und die LAMP in Malysia informiert sein möchten: http://www.themalaysianinsider.com/search/tag/lynas

Daraus der neuste Bericht: http://www.themalaysianinsider.com/bahasa/article/isu-lynas-…

Isu Lynas: IAEA tubuh panel pakar nasihat Malaysia

May 04, 2011

VIENNA, 4 Mei — Agensi nuklear Pertubuhan Bangsa-Bangsa Bersatu (PBB) akan membentuk panel bebas bagi menasihat kerajaan Malaysia berhubung potensi risiko yang akan diterima kesan daripada projek loji pemprosesan nadir bumi oleh syarikat perlombongan Australia, Lynas Corporation, kata agensi itu.

Pendirian itu dibuat selepas Malaysia meminta Agensi Tenaga Atom Antarabangsa (IAEA) di Vienna untuk membantu mengesan kesan yang akan diterima penduduk setempat terutamanya membentuk panel bebas bagi mengkaji tahap kesihatan dan keselamatan sekiranya projek itu diteruskan.

Ekoran projek loji pemprosesan nadir bumi itu, ia mendapat bantahan keras daripada aktivis yang mengatakan Malaysia akan menjadi lokasi pembuangan sisa radioaktif selain akan menyebabkan tahap kesihatan terjejas.

“Melalui program kerjasama teknikal IAEA, agensi akan menyokong usaha misi pakar antabangsa untuk mengkaji projek Lynas agar ia mematuhi piawaian keselamatan antarabangsa dan keperluan yang baik akan memberikan faedah terhadap aspek keselamatan projek Lynas,” katanya dalam satu kenyataan.

“Misi itu dijadualkan bermula pada 29 Mei 2011,” katanya.

Bulan lalu, Lynas berkata Malaysia hanya memerlukan kajian selama satu bulan berhubung kesan radioaktif dan tidak akan menangguhkan pembinaan loji pemprosesan itu.

Bernama sebelum ini melaporkan Menteri Perdagangan Antarabangsa dan Industri Datuk Seri Mustapa Mohamed berkata satu panel bebas akan ditubuhkan secepat yang mungkin bagi menjalankan kajian terhadap aspek kesihatan dan keselamatan loji itu bagi menolak kebimbangan bahawa ia menimbulkan ancaman radioaktif, yang berpotensi menyekat bekalan dari China.

Kajian itu dijangka siap dalam tempoh sebulan.

Lynas Malaysia berkata loji pemprosesan itu menerima bahan mentah dari firma Mount Weld di Barat Australia.

Pemprosesan nadir bumi digunakan untuk mencipta alat berteknologi tinggi termasuk telefon pinta dan kenderaan hidbrid.

Pembeli termasuk dari China, Amerika Syarikat dan negara-negara Eropah bergantung kepada bahan mentah yang mana kini mereka bergantung sehingga 95 peratus bekalan dari China.

Cadangan pembinaan loji pemprosesan nadir bumi di Gebeng dekat Kuantan akan mejadikan ia sebagai pengeluar terbesar selepas China.

Pegawai syarikat berkenaan berkata keuntungan yang akan diperoleh dari projek loji pemprosesan nadir bumi Malaysia akan mencecah sehingga 22,000 tan, dan ia akan memenuhi keperluan selain China menjelang 2013.

Googleübersetzt: http://translate.google.de/translate?hl=de&sl=ms&tl=de&u=htt…

Goldman Sachs rechnet mit weiteren Exportbeschränkungen von REO durch China auf Grund des stark steigenden Bedarfs im eigenen Land was für uns eigendlich nichts neues darstellt.

http://www.bloomberg.com/news/2011-05-05/china-may-further-r…

China May Further Reduce Rare Earth Quotas, Goldman Sachs Says

By Rebecca Keenan - May 5, 2011 2:22 AM GMT+0200

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Wohl auch aus diesen Gründen hat Goldman Sachs ein neues kursfristiges Kursziel auf 3,75 $ hochgeschraubt.

Wer den kpl. Bericht einsehen möchte kann sich auf dem folgenden Link anmelden: http://afr.com/p/markets/market_wrap/lynas_corporation_07nkt…

Lynas Corporation

PUBLISHED : -1 hours -54 minutes ago | UPDATED: -7 hours -25 minutes ago PUBLISHED: 05 May 2011

Goldman Sachs has initiated coverage of rare earths company Lynas Corporation with a “buy” recommendation and a price target of $3.75, but says the stock represents “above-average” risk.

Grüsse JoJo

Daraus der neuste Bericht: http://www.themalaysianinsider.com/bahasa/article/isu-lynas-…

Isu Lynas: IAEA tubuh panel pakar nasihat Malaysia

May 04, 2011

VIENNA, 4 Mei — Agensi nuklear Pertubuhan Bangsa-Bangsa Bersatu (PBB) akan membentuk panel bebas bagi menasihat kerajaan Malaysia berhubung potensi risiko yang akan diterima kesan daripada projek loji pemprosesan nadir bumi oleh syarikat perlombongan Australia, Lynas Corporation, kata agensi itu.

Pendirian itu dibuat selepas Malaysia meminta Agensi Tenaga Atom Antarabangsa (IAEA) di Vienna untuk membantu mengesan kesan yang akan diterima penduduk setempat terutamanya membentuk panel bebas bagi mengkaji tahap kesihatan dan keselamatan sekiranya projek itu diteruskan.

Ekoran projek loji pemprosesan nadir bumi itu, ia mendapat bantahan keras daripada aktivis yang mengatakan Malaysia akan menjadi lokasi pembuangan sisa radioaktif selain akan menyebabkan tahap kesihatan terjejas.

“Melalui program kerjasama teknikal IAEA, agensi akan menyokong usaha misi pakar antabangsa untuk mengkaji projek Lynas agar ia mematuhi piawaian keselamatan antarabangsa dan keperluan yang baik akan memberikan faedah terhadap aspek keselamatan projek Lynas,” katanya dalam satu kenyataan.

“Misi itu dijadualkan bermula pada 29 Mei 2011,” katanya.

Bulan lalu, Lynas berkata Malaysia hanya memerlukan kajian selama satu bulan berhubung kesan radioaktif dan tidak akan menangguhkan pembinaan loji pemprosesan itu.

Bernama sebelum ini melaporkan Menteri Perdagangan Antarabangsa dan Industri Datuk Seri Mustapa Mohamed berkata satu panel bebas akan ditubuhkan secepat yang mungkin bagi menjalankan kajian terhadap aspek kesihatan dan keselamatan loji itu bagi menolak kebimbangan bahawa ia menimbulkan ancaman radioaktif, yang berpotensi menyekat bekalan dari China.

Kajian itu dijangka siap dalam tempoh sebulan.

Lynas Malaysia berkata loji pemprosesan itu menerima bahan mentah dari firma Mount Weld di Barat Australia.

Pemprosesan nadir bumi digunakan untuk mencipta alat berteknologi tinggi termasuk telefon pinta dan kenderaan hidbrid.

Pembeli termasuk dari China, Amerika Syarikat dan negara-negara Eropah bergantung kepada bahan mentah yang mana kini mereka bergantung sehingga 95 peratus bekalan dari China.

Cadangan pembinaan loji pemprosesan nadir bumi di Gebeng dekat Kuantan akan mejadikan ia sebagai pengeluar terbesar selepas China.

Pegawai syarikat berkenaan berkata keuntungan yang akan diperoleh dari projek loji pemprosesan nadir bumi Malaysia akan mencecah sehingga 22,000 tan, dan ia akan memenuhi keperluan selain China menjelang 2013.

Googleübersetzt: http://translate.google.de/translate?hl=de&sl=ms&tl=de&u=htt…

Goldman Sachs rechnet mit weiteren Exportbeschränkungen von REO durch China auf Grund des stark steigenden Bedarfs im eigenen Land was für uns eigendlich nichts neues darstellt.

http://www.bloomberg.com/news/2011-05-05/china-may-further-r…

China May Further Reduce Rare Earth Quotas, Goldman Sachs Says

By Rebecca Keenan - May 5, 2011 2:22 AM GMT+0200

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Wohl auch aus diesen Gründen hat Goldman Sachs ein neues kursfristiges Kursziel auf 3,75 $ hochgeschraubt.

Wer den kpl. Bericht einsehen möchte kann sich auf dem folgenden Link anmelden: http://afr.com/p/markets/market_wrap/lynas_corporation_07nkt…

Lynas Corporation

PUBLISHED : -1 hours -54 minutes ago | UPDATED: -7 hours -25 minutes ago PUBLISHED: 05 May 2011

Goldman Sachs has initiated coverage of rare earths company Lynas Corporation with a “buy” recommendation and a price target of $3.75, but says the stock represents “above-average” risk.

Grüsse JoJo

Der erste Artikel beschreibt ein IMHO interssantes Thema (Recycling) und zeichnet damit auf wie brisant die Versorgungslage weltweit mit REO imzwischen ist und sich wohl die nächsten Jahre weiterhin noch steigern wird, nur wenn man zum Ende kommt zeigt sich auch wiederum wie weit viele der sogenannten Experten sich immer noch nicht von der aktuellen Lage von Lynas überzeugt haben.

@ ein schönes WE

Grüsse JoJo

http://www.resourceinvestor.com/News/2011/4/Pages/Recycling-…

Recycling of Rare Earth Minerals Picks Up

Roman Baudzus

Published 4/27/2011

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

http://online.wsj.com/article/SB1000142405274870399270457630…

ASIA TECHNOLOGY* MAY 5, 2011, 12:55 P.M. ET

A Warning on Rare Earth Elements

By DAVID FICKLING

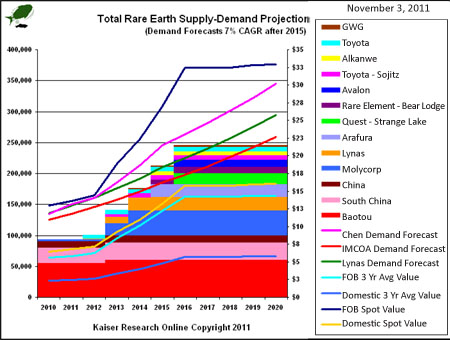

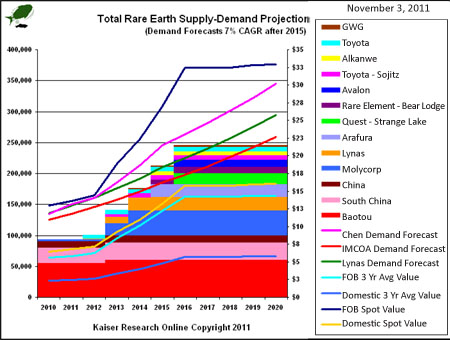

SYDNEY—Demand for rare earth elements that has driven up prices more than tenfold since 2009 is likely to be met by a surplus of supply by 2013, as Western companies start up new mines to compete with the Chinese firms that now dominate the market, Goldman Sachs analysts predicted Thursday.

...

Prices of rare earths hovered between $5 a kilogram and $20 a kilo from the early 1990s until 2010. But a 40% cut in export quotas by China, which accounts for 90% of global rare earth production, sent prices soaring. The basket price of rare earths held in Lynas Corp. Ltd.'s Mount Weld deposit in western Australia—the largest non-Chinese mine, due to come to production in the next few years—has jumped to an average of $162.66 kilos from just $10.32 kilos in 2009.

Goldman's view differs from that of miners. In a presentation last month, Lynas forecast that global demand for rare earths, which include neodymium, cerium and lanthanum, will outstrip supply this year by 35,000 tons this year and in 2012. Annual supply shortfalls of around 20,000 tons are expected in 2013 and 2014, it added. It predicted long-term prices in the $120/kg-to-$180/kg range.

Lynas Chief Executive Nicholas Curtis says China is on the verge of becoming a net importer of the elements, a transformation that would be similar to those that drove major shifts in global markets for coal in 2009 and oil in the mid-1990s, and could accentuate the current price spike.

"China will become a net importer because its consumption for its own domestic value-added industry is going to drive very high [demand] growth for these resources. They've explored every inch of China for what's available and if they had more rare earths deposits of any size, it would be being developed now," he said in a recent interview.

Lynas shares have risen fourfold since China announced the quota cuts in July 2010.

Goldman Sachs analyst Malcolm Southwood, however, said the price boom is nearing its peak. The supply deficit will peak at 18,734 tons this year, equivalent to 13.2% of a forecast 141,524 tons of demand, before the market slips into a slight surplus in 2013, he said in the report published Thursday. The surplus will rise to 5,860 tons or 3.2% of projected demand in the following year, the report said.

Initially, at least, prices will likely continue to rise, he said. The basket price for the Mount Weld rare earths should climb to $227 a kilogram next year, a gain of about 40%. Prices may eventually moderate to an average of $82 a kilogram, but that will happen only in 2015, the third consecutive year of a global surplus, the report said.

....

"Lynas has said their production costs are $10 per kilogram. If they think they can sell their material at $150 a kilogram, a markup of 15 times, I don't know customers are going to be prepared to pay for it," said Dudley Kingsnorth, executive director of Industrial Minerals Company of Australia, a rare earths analysis house.

"Once these new mines come onstream, there will be a fall in price, and if miners insist on multiples of 15-20, they're going to face more competitors. They're going to have to face a little bit of reality."

@ ein schönes WE

Grüsse JoJo

http://www.resourceinvestor.com/News/2011/4/Pages/Recycling-…

Recycling of Rare Earth Minerals Picks Up

Roman Baudzus

Published 4/27/2011

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

http://online.wsj.com/article/SB1000142405274870399270457630…

ASIA TECHNOLOGY* MAY 5, 2011, 12:55 P.M. ET

A Warning on Rare Earth Elements

By DAVID FICKLING

SYDNEY—Demand for rare earth elements that has driven up prices more than tenfold since 2009 is likely to be met by a surplus of supply by 2013, as Western companies start up new mines to compete with the Chinese firms that now dominate the market, Goldman Sachs analysts predicted Thursday.

...

Prices of rare earths hovered between $5 a kilogram and $20 a kilo from the early 1990s until 2010. But a 40% cut in export quotas by China, which accounts for 90% of global rare earth production, sent prices soaring. The basket price of rare earths held in Lynas Corp. Ltd.'s Mount Weld deposit in western Australia—the largest non-Chinese mine, due to come to production in the next few years—has jumped to an average of $162.66 kilos from just $10.32 kilos in 2009.

Goldman's view differs from that of miners. In a presentation last month, Lynas forecast that global demand for rare earths, which include neodymium, cerium and lanthanum, will outstrip supply this year by 35,000 tons this year and in 2012. Annual supply shortfalls of around 20,000 tons are expected in 2013 and 2014, it added. It predicted long-term prices in the $120/kg-to-$180/kg range.

Lynas Chief Executive Nicholas Curtis says China is on the verge of becoming a net importer of the elements, a transformation that would be similar to those that drove major shifts in global markets for coal in 2009 and oil in the mid-1990s, and could accentuate the current price spike.

"China will become a net importer because its consumption for its own domestic value-added industry is going to drive very high [demand] growth for these resources. They've explored every inch of China for what's available and if they had more rare earths deposits of any size, it would be being developed now," he said in a recent interview.

Lynas shares have risen fourfold since China announced the quota cuts in July 2010.

Goldman Sachs analyst Malcolm Southwood, however, said the price boom is nearing its peak. The supply deficit will peak at 18,734 tons this year, equivalent to 13.2% of a forecast 141,524 tons of demand, before the market slips into a slight surplus in 2013, he said in the report published Thursday. The surplus will rise to 5,860 tons or 3.2% of projected demand in the following year, the report said.

Initially, at least, prices will likely continue to rise, he said. The basket price for the Mount Weld rare earths should climb to $227 a kilogram next year, a gain of about 40%. Prices may eventually moderate to an average of $82 a kilogram, but that will happen only in 2015, the third consecutive year of a global surplus, the report said.

....

"Lynas has said their production costs are $10 per kilogram. If they think they can sell their material at $150 a kilogram, a markup of 15 times, I don't know customers are going to be prepared to pay for it," said Dudley Kingsnorth, executive director of Industrial Minerals Company of Australia, a rare earths analysis house.

"Once these new mines come onstream, there will be a fall in price, and if miners insist on multiples of 15-20, they're going to face more competitors. They're going to have to face a little bit of reality."

http://www.theaustralian.com.au/business/news/lynas-shares-s…

Lynas shares soar as rare earths continue to shine

Michael Bennet From: The Australian May 06, 2011 12:00AM

RARE earths prices are expected to continue their extraordinary rise in the next 18 months before "some softening" from 2013, sending shares in leading producer Lynas Corporation soaring.

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ eine erfolgreiche Woche

Grüsse JoJo

Lynas shares soar as rare earths continue to shine

Michael Bennet From: The Australian May 06, 2011 12:00AM

RARE earths prices are expected to continue their extraordinary rise in the next 18 months before "some softening" from 2013, sending shares in leading producer Lynas Corporation soaring.

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ eine erfolgreiche Woche

Grüsse JoJo

http://www.aktiencheck.de/analysen/Artikel-Lynas_steht_unmit…

Lynas steht unmittelbar vor dem Erreichen des Produzentenstatus

09.05.11 12:55

Hot Stocks Investor

Endingen (aktiencheck.de AG) - Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein.

Die Gesellschaft stehe unmittelbar vor dem Erreichen des Produzentenstatus und verfüge außerhalb Chinas über eines der am weitesten fortgeschrittensten Projekte.

Die Vorkommen des Mount Weld-Projekts würden auf rund 1,4 Mio. Tonnen geschätzt und ab dem dritten Quartal solle die Produktion aufgenommen werden. Diese solle sich zunächst auf rund 11.000 Tonnen pro Jahr belaufen und später auf 22.000 Tonnen p.a. ausgeweitet werden.

Schon in den letzten Monaten habe Lynas langfristige Abnahmeverträge im Volumen von über 1 Mrd. USD vereinbaren können und darüber hinaus sei eine strategische Zusammenarbeit mit dem japanischen Großkonzern Sojitz (ISIN JP3663900003 / WKN 255124) verkündet worden.

Einzelne Analysten seien von Lynas begeistert. So hätten zum Beispiel die Analysten von Goldman Sachs den Titel in ihrer Ersteinschätzung ein Kursziel von 3,75 Australische Dollar (AUD) zugesprochen. Auf Basis derer Gewinnschätzungen betrage das KGV 2012e nur 6,9 und das für 2013e lediglich 1,5.

Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein. (Ausgabe 09 vom 09.05.2011) (09.05.2011/ac/a/a)

Offenlegung von möglichen Interessenskonflikten:

Mögliche Interessenskonflikte können Sie auf der Site des Erstellers/ der Quelle der Analyse einsehen.

http://www.aktiencheck.de/871899-Lynas-Aktie-Profil

Grüsse JoJo

Lynas steht unmittelbar vor dem Erreichen des Produzentenstatus

09.05.11 12:55

Hot Stocks Investor

Endingen (aktiencheck.de AG) - Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein.

Die Gesellschaft stehe unmittelbar vor dem Erreichen des Produzentenstatus und verfüge außerhalb Chinas über eines der am weitesten fortgeschrittensten Projekte.

Die Vorkommen des Mount Weld-Projekts würden auf rund 1,4 Mio. Tonnen geschätzt und ab dem dritten Quartal solle die Produktion aufgenommen werden. Diese solle sich zunächst auf rund 11.000 Tonnen pro Jahr belaufen und später auf 22.000 Tonnen p.a. ausgeweitet werden.

Schon in den letzten Monaten habe Lynas langfristige Abnahmeverträge im Volumen von über 1 Mrd. USD vereinbaren können und darüber hinaus sei eine strategische Zusammenarbeit mit dem japanischen Großkonzern Sojitz (ISIN JP3663900003 / WKN 255124) verkündet worden.

Einzelne Analysten seien von Lynas begeistert. So hätten zum Beispiel die Analysten von Goldman Sachs den Titel in ihrer Ersteinschätzung ein Kursziel von 3,75 Australische Dollar (AUD) zugesprochen. Auf Basis derer Gewinnschätzungen betrage das KGV 2012e nur 6,9 und das für 2013e lediglich 1,5.

Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein. (Ausgabe 09 vom 09.05.2011) (09.05.2011/ac/a/a)

Offenlegung von möglichen Interessenskonflikten:

Mögliche Interessenskonflikte können Sie auf der Site des Erstellers/ der Quelle der Analyse einsehen.

http://www.aktiencheck.de/871899-Lynas-Aktie-Profil

Grüsse JoJo

http://www.spiegel.de/thema/seltene_erden/

Seltene Erden

Alle Artikel, Hintergründe und Fakten

Hightech-Metalle

Lanthan, Europium, Neodym und 14 weitere Metalle umfasst die Gruppe der Seltenen Erden. Zur Herstellung zahlreicher Elektro-Produkte sind sie unverzichtbar, darunter Akkus, Turbinen und Motoren. China, der wichtigste Lieferant, hortet die begehrten Bodenschätze. Bedrohen Versorgungsengpässe wichtige Zukunftsindustrien?

Seltene Erden

Die Seltenen Erden sind eine Gruppe von 17 Metallen, darunter Lanthan, Europium und Neodym. Meist kommen sie am selben Standort, im selben Gestein, vor. Sie werden in kleinen Mengen verwendet, sind aber unverzichtbar unter anderem für die Herstellung von Computern und Computer-Monitoren, DVD-Spielern, leistungsstarken Akkus, Hybrid-Autos, Halbleitern, Handys, Rüstungsgütern und Windturbinen. Autozulieferer nutzen Seltene Erden bei der Herstellung von Elektromotoren. Die größten Verbraucher Seltener Erden sind China, Japan und die USA, die eine starke Technologiebranche haben. Wegen der zunehmenden Bedeutung der Umwelttechnologien wird mit einem steigenden Bedarf gerechnet. Der mit Abstand größte Produzent ist China. Im Jahr 2008 wurden dort 120.000 Tonnen gefördert, das waren 97 Prozent der weltweiten Menge. China exportierte gut 30.000 Tonnen. Das Land senkt seine Exporte Seltener Erden seit 2005.

...

...

Grüsse JoJo

Seltene Erden

Alle Artikel, Hintergründe und Fakten

Hightech-Metalle

Lanthan, Europium, Neodym und 14 weitere Metalle umfasst die Gruppe der Seltenen Erden. Zur Herstellung zahlreicher Elektro-Produkte sind sie unverzichtbar, darunter Akkus, Turbinen und Motoren. China, der wichtigste Lieferant, hortet die begehrten Bodenschätze. Bedrohen Versorgungsengpässe wichtige Zukunftsindustrien?

Seltene Erden

Die Seltenen Erden sind eine Gruppe von 17 Metallen, darunter Lanthan, Europium und Neodym. Meist kommen sie am selben Standort, im selben Gestein, vor. Sie werden in kleinen Mengen verwendet, sind aber unverzichtbar unter anderem für die Herstellung von Computern und Computer-Monitoren, DVD-Spielern, leistungsstarken Akkus, Hybrid-Autos, Halbleitern, Handys, Rüstungsgütern und Windturbinen. Autozulieferer nutzen Seltene Erden bei der Herstellung von Elektromotoren. Die größten Verbraucher Seltener Erden sind China, Japan und die USA, die eine starke Technologiebranche haben. Wegen der zunehmenden Bedeutung der Umwelttechnologien wird mit einem steigenden Bedarf gerechnet. Der mit Abstand größte Produzent ist China. Im Jahr 2008 wurden dort 120.000 Tonnen gefördert, das waren 97 Prozent der weltweiten Menge. China exportierte gut 30.000 Tonnen. Das Land senkt seine Exporte Seltener Erden seit 2005.

...

...

Grüsse JoJo

Uns Hermann Kutzer und sein Bauchgefühl: http://www.finanznachrichten.de/nachrichten-2011-05/20217201…

12.05.2011 13:50

Marktstimmung: Anlagealternativen (II) - Seltene Erden sind die heimlichen Rohstoff-Stars (Kutzers Bauchgefühl)

Guten Tag, liebe Leserinnen und Leser,

"Rare Earth" hieß nicht nur eine Insidern wohlbekannte Rockgruppe in den späten 60er/frühen 70er Jahren. Seltene Erden und Sondermetalle sind seit einiger Zeit die geheimnisvollen und heimlichen Stars der Metallmärkte. Es gibt gute Gründe, dass dies noch lange so bleiben wird. Deshalb sollte sich der fortgeschrittene und an Rohstoffen interessierte Anleger auch damit auseinandersetzen. Internationale Banken haben in den vergangenen Monaten hierzulande diverse Zertifikate aufgelegt, die auf Aktien entsprechender Minengesellschaften basieren. Es gibt inzwischen aber auch die – wie ich finde – höchst attraktive Gelegenheit, diese Metalle (bzw. ihre Oxide) in physischer Form zu erwerben und beim Händler zu lagern.

Seltene Erden kommen zumeist nur jeweils in kleinen Mengen, in sehr vielen, weit verstreut lagernden Mineralien sowie als Beimischungen in anderen Mineralien vor. Ein Großteil der industriellen Gewinnung geschieht daher vorwiegend als Nebenprodukt durch die chemische Aufbereitung bei der Gewinnung anderer, stärker konzentriert vorliegender Metalle aus deren Erzen. Die großen Umweltprobleme, die dabei entstehen, wurden erst kürzlich in einer TV-Dokumentation gezeigt – das bedeutet enorme Kosten und lange Genehmigungsverfahren.