LYNAS - Faktenthread, Analysen, Querverweise u. Meldungen zum Unternehmen (Seite 228)

eröffnet am 25.04.07 13:15:18 von

neuester Beitrag 31.03.24 09:13:03 von

neuester Beitrag 31.03.24 09:13:03 von

Beiträge: 3.527

ID: 1.126.458

ID: 1.126.458

Aufrufe heute: 2

Gesamt: 784.560

Gesamt: 784.560

Aktive User: 0

ISIN: AU000000LYC6 · WKN: 871899

3,9020

EUR

+5,20 %

+0,1930 EUR

Letzter Kurs 17.04.24 Tradegate

Neuigkeiten

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

21.12.23 · . . |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7000 | +11,11 | |

| 1,4000 | +10,24 | |

| 37,18 | +10,00 | |

| 17,930 | +10,00 | |

| 6,7700 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5900 | -8,09 | |

| 2,1800 | -9,17 | |

| 69,05 | -9,48 | |

| 154,95 | -9,76 | |

| 47,99 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 40.987.907 von JoJo49 am 05.02.11 10:54:08Das ist sehr interessant! Habe ich mich schon gewundert was mit den neuen steuern für cer La nd und pr ist! Ab nä. Wo gelten sie!  das macht eine Steigerung des Baskets um ca. 20 Prozent aus!!! Cer u La plus 25 Prozent Steuer sowie bei nd u pr statt 15 ebenfalls 25 Prozent - damit kratzt der Preis knapp an der 100!!! Kann's Moin auch noch mal genau ausrechnen aber lieg schon im Bett u tipple noch auf meinem iPhone... Gn8 allen!!!

das macht eine Steigerung des Baskets um ca. 20 Prozent aus!!! Cer u La plus 25 Prozent Steuer sowie bei nd u pr statt 15 ebenfalls 25 Prozent - damit kratzt der Preis knapp an der 100!!! Kann's Moin auch noch mal genau ausrechnen aber lieg schon im Bett u tipple noch auf meinem iPhone... Gn8 allen!!!

das macht eine Steigerung des Baskets um ca. 20 Prozent aus!!! Cer u La plus 25 Prozent Steuer sowie bei nd u pr statt 15 ebenfalls 25 Prozent - damit kratzt der Preis knapp an der 100!!! Kann's Moin auch noch mal genau ausrechnen aber lieg schon im Bett u tipple noch auf meinem iPhone... Gn8 allen!!!

das macht eine Steigerung des Baskets um ca. 20 Prozent aus!!! Cer u La plus 25 Prozent Steuer sowie bei nd u pr statt 15 ebenfalls 25 Prozent - damit kratzt der Preis knapp an der 100!!! Kann's Moin auch noch mal genau ausrechnen aber lieg schon im Bett u tipple noch auf meinem iPhone... Gn8 allen!!!

Antwort auf Beitrag Nr.: 40.988.351 von VirtualNormann am 05.02.11 13:39:03Ohhh...stimmt. Ich dachte erstens:

1. Diese Nachrichten sind aktuell vom 5.2.

2. doppelt hält besser ( , nein, hatte deinen Beitrag nicht mehr im Sinn)

, nein, hatte deinen Beitrag nicht mehr im Sinn)

...es braucht mich ja gar nicht mehr .

.

Weiter so!

1. Diese Nachrichten sind aktuell vom 5.2.

2. doppelt hält besser (

, nein, hatte deinen Beitrag nicht mehr im Sinn)

, nein, hatte deinen Beitrag nicht mehr im Sinn)...es braucht mich ja gar nicht mehr

.

.Weiter so!

Shortzertifikate

Spekulation auf einen Absturz bei Seltenen Erden

Ebenfalls neu emittiert hat die Schweizer Großbank UBS das erste Short-Zertifikat auf einen Basket mit Aktien von Unternehmen, die sich auf den Abbau sogenannter Seltener Erden fokussieren. Die oft kleinen Werte hatten nach einer massiven Exportkürzung des weltgrößten Lieferanten China in den vergangenen Monaten exorbitante Kurssprünge vollzogen, waren zuletzt aber wieder sichtlich zurückgefallen. Mit dem neuen Zertifikat können Anleger nun nach dem Höhenflug der exotischen Rohstoffe auf eine Fortsetzung der Korrektur spekulieren (WKN: UB5RES). raf

Spekulation auf einen Absturz bei Seltenen Erden

Ebenfalls neu emittiert hat die Schweizer Großbank UBS das erste Short-Zertifikat auf einen Basket mit Aktien von Unternehmen, die sich auf den Abbau sogenannter Seltener Erden fokussieren. Die oft kleinen Werte hatten nach einer massiven Exportkürzung des weltgrößten Lieferanten China in den vergangenen Monaten exorbitante Kurssprünge vollzogen, waren zuletzt aber wieder sichtlich zurückgefallen. Mit dem neuen Zertifikat können Anleger nun nach dem Höhenflug der exotischen Rohstoffe auf eine Fortsetzung der Korrektur spekulieren (WKN: UB5RES). raf

Antwort auf Beitrag Nr.: 40.988.240 von Optimist_ am 05.02.11 12:57:39Hast du mich auf Ignore? Genau das Gleiche habe ich in dem Posting vor dem von JoJo schon geschrieben. Sogar in der gleichen Reihenfolge  Blätter mal eine Seite zurück

Blätter mal eine Seite zurück

Gruß Normann

Blätter mal eine Seite zurück

Blätter mal eine Seite zurück

Gruß Normann

Danke JoJo, dass du hier so viel Engagement zeigst und Zeit nimmst um uns mit Hintergrundwissen, Meinungen und kritischen Berichten zu versorgen.

Mein Beitrag ist dafür etwas kürzer heute. Aber es untermauert die Erfolgsgeschichte der Seltenen Erden. Also für alle die noch nicht eingestiegen sind, zeigt es, dass es dafür noch (lange) nicht zu spät ist.

http://www.theaustralian.com.au/business/china-biggest-produ…

China, biggest produce of rare earths, expects to import more

* Matt Chambers* From: The Australian* February 05, 2011 12:00AM

CHINA'S chief rare earths research body says it expects the nation to become a net importer, even though it is the world's biggest producer.

The news is bound to fuel supply concerns from big consumers like Japan and the US.

In a presentation in Vancouver, Chinese Society of Rare Earths director Chen Zhanheng said Chinese consumption of the substances was growing rapidly.

"(There are) early signals that China is moving from sell-side to buy-side. China becomes a new market opportunity for producers outside China," he said. Chinese exports of rare earths peaked at nearly 60,000 tonnes, but slipped to about 39,000 tonnes in 2009.

That level was still more than Chinese quotas, which have been designed to slash exports.

The concern over rare earths supply has led Japan's Sojitz to form a partnership with Lynas Corp, which gives it import rights for 9000 tonnes of Australian rare-earth metals a year.

In return, Sojitz will seek up to $US250 million in Japanese funding to develop the project.

It had been expected that China would eventually become a net importer of rare earths, but the government has said little.

Lynas chairman Nick Curtis, who sparked a 9 per cent slip in the company's share price on Wednesday when he sold most of his shares, has said he believes China will be a net importer within five years.

Mr Chen said the quota from 2011 to 2015 should be between 32,000 and 35,000 tonnes.

The CSRE expects the rest of the world's production to grow from about 47,000 tonnes, or 35 per cent of global supply, in 2013 to 178,000 tonnes, or 64 per cent of estimated supply, in 2015.

Dazu über Nick Curtis Grossverkauf, der diese Woche Mittwoch gemeldet wurde.

http://www.smh.com.au/business/lynas-boss-tops-the-table-aga…

Lynas boss tops the table again

Christopher Webb

February 5, 2011

NICHOLAS Curtis, the executive chairman of Lynas Corporation, has for the second time in two months made it to the head of the directors' selling table.

Lynas, the booming rare earths producer, has seen its scrip soar from 50¢ to as high as $2.35 in less than a year and Mr Curtis has cleaned up handsomely.

In December, he sold 5 million shares at around $1.50 apiece following the exercise of 5 million options at 11¢ an option.

Advertisement: Story continues below

He has just peeled off a further 7 million shares and sold them into the market at around $1.93 each.

In December, the scrip moved considerably higher following his sale, but this time the shares beat a hasty retreat. The day following his disposals were reported, the shares fell from $1.90 to $1.70. But they have now recovered somewhat, closing yesterday at $1.77.

Mr Curtis retains $28 million of stock, not to mention 31 million employee incentive options.

...

Mein Beitrag ist dafür etwas kürzer heute. Aber es untermauert die Erfolgsgeschichte der Seltenen Erden. Also für alle die noch nicht eingestiegen sind, zeigt es, dass es dafür noch (lange) nicht zu spät ist.

http://www.theaustralian.com.au/business/china-biggest-produ…

China, biggest produce of rare earths, expects to import more

* Matt Chambers* From: The Australian* February 05, 2011 12:00AM

CHINA'S chief rare earths research body says it expects the nation to become a net importer, even though it is the world's biggest producer.

The news is bound to fuel supply concerns from big consumers like Japan and the US.

In a presentation in Vancouver, Chinese Society of Rare Earths director Chen Zhanheng said Chinese consumption of the substances was growing rapidly.

"(There are) early signals that China is moving from sell-side to buy-side. China becomes a new market opportunity for producers outside China," he said. Chinese exports of rare earths peaked at nearly 60,000 tonnes, but slipped to about 39,000 tonnes in 2009.

That level was still more than Chinese quotas, which have been designed to slash exports.

The concern over rare earths supply has led Japan's Sojitz to form a partnership with Lynas Corp, which gives it import rights for 9000 tonnes of Australian rare-earth metals a year.

In return, Sojitz will seek up to $US250 million in Japanese funding to develop the project.

It had been expected that China would eventually become a net importer of rare earths, but the government has said little.

Lynas chairman Nick Curtis, who sparked a 9 per cent slip in the company's share price on Wednesday when he sold most of his shares, has said he believes China will be a net importer within five years.

Mr Chen said the quota from 2011 to 2015 should be between 32,000 and 35,000 tonnes.

The CSRE expects the rest of the world's production to grow from about 47,000 tonnes, or 35 per cent of global supply, in 2013 to 178,000 tonnes, or 64 per cent of estimated supply, in 2015.

Dazu über Nick Curtis Grossverkauf, der diese Woche Mittwoch gemeldet wurde.

http://www.smh.com.au/business/lynas-boss-tops-the-table-aga…

Lynas boss tops the table again

Christopher Webb

February 5, 2011

NICHOLAS Curtis, the executive chairman of Lynas Corporation, has for the second time in two months made it to the head of the directors' selling table.

Lynas, the booming rare earths producer, has seen its scrip soar from 50¢ to as high as $2.35 in less than a year and Mr Curtis has cleaned up handsomely.

In December, he sold 5 million shares at around $1.50 apiece following the exercise of 5 million options at 11¢ an option.

Advertisement: Story continues below

He has just peeled off a further 7 million shares and sold them into the market at around $1.93 each.

In December, the scrip moved considerably higher following his sale, but this time the shares beat a hasty retreat. The day following his disposals were reported, the shares fell from $1.90 to $1.70. But they have now recovered somewhat, closing yesterday at $1.77.

Mr Curtis retains $28 million of stock, not to mention 31 million employee incentive options.

...

Antwort auf Beitrag Nr.: 40.987.907 von JoJo49 am 05.02.11 10:54:08Eim IMHO gutes Beispiel wie die sogenannten Experten/Analysten rechnen und dabei u.a. auch auf Lynas Bezug nehmen.

http://seekingalpha.com/article/250978-molycorp-a-fundamenta…

Molycorp: A Fundamental, Psychological and Quantitative Response to Rare Earth Bears

15 comments | by: The Strategist February 04, 2011 | about: MCP

...

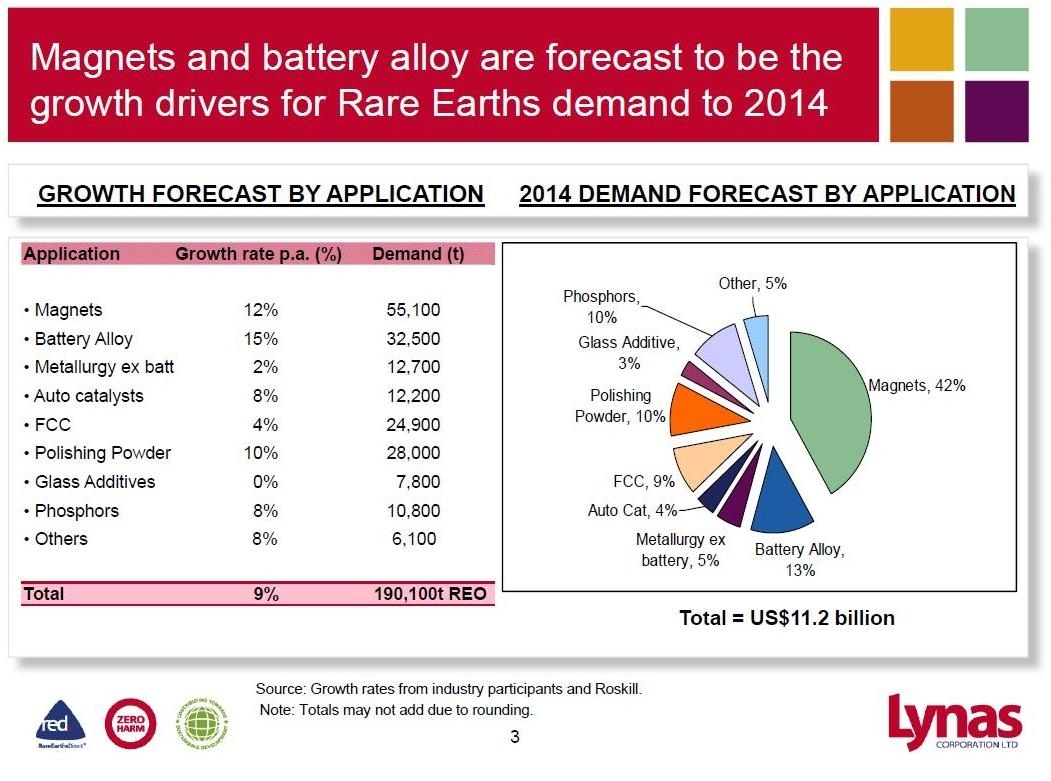

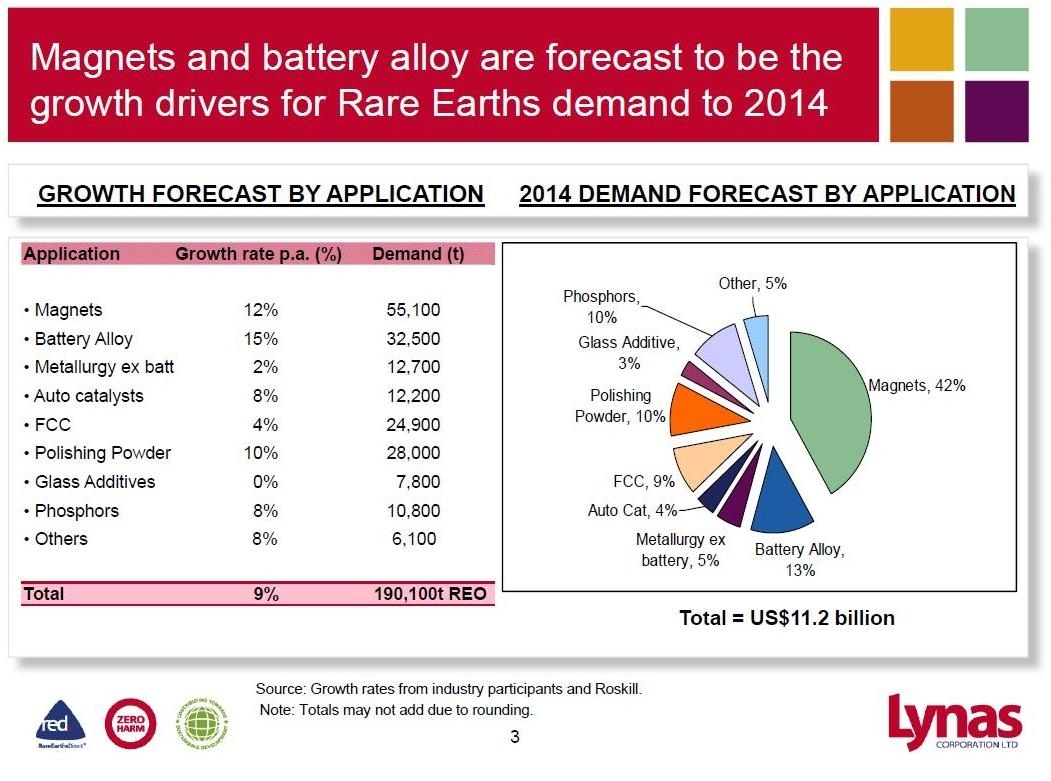

We know some people think we are lunatics for suggesting such a higher earnings per share for Molycorp, but we would point out that the research on Wall Street suggests that the potential is there. While that may make us look like lemmings for listening to the sell side, we are believers in the rare earth growth story. Lynas forecasts the rare earth market in 2014 will be $11 billion, and the 2014 market size is the major factor in the rare earth story - not the current or 2010 market size.

...

...

übersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

http://seekingalpha.com/article/250978-molycorp-a-fundamenta…

Molycorp: A Fundamental, Psychological and Quantitative Response to Rare Earth Bears

15 comments | by: The Strategist February 04, 2011 | about: MCP

...

We know some people think we are lunatics for suggesting such a higher earnings per share for Molycorp, but we would point out that the research on Wall Street suggests that the potential is there. While that may make us look like lemmings for listening to the sell side, we are believers in the rare earth growth story. Lynas forecasts the rare earth market in 2014 will be $11 billion, and the 2014 market size is the major factor in the rare earth story - not the current or 2010 market size.

...

...

übersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Antwort auf Beitrag Nr.: 40.984.094 von VirtualNormann am 04.02.11 15:21:50Danke!

Zum WE ein Paar in Detail nicht ganz erst zu nehmende, dafür IMHO aber nette, Meinungen/Geschichten aus dem HC-Forum zu Lynas von Heute.

@ noch ein schönes Rest-WE

Grüsse JoJo

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=137419…

re: pr (oneforthe)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $1.77 | Price Chart | Announcements | Google LYC)

Post: 6286384

Reply to: #6286205 from chihawk Views: 88

Posted: 05/02/11 17:37 Stock Price (at time of posting): $1.77 Sentiment: LT Buy Disclosure: Stock Held From: 119.11.xxx.xxx

------------------------------------------------------------------------------------------------------------------------

I put my Linas (actually have one with Peanuts)..I mean my Lynas doll (small boy sucking thumb but with much smaller,lighter,stronger,more compact,longer wearing blanket near the lap top and said lets go educate the world on Lynas.

near the lap top and said lets go educate the world on Lynas.

On Yahoo Finance I got bogged down on the Avalon (AVL)site.

Prior to that I had a good check of AVL,s site...closed at $6.50 NYSE.(-21c)

AVL is Canada,s flagship.

Well if you want a good laugh..check out their site..starting with Thor Lake...yes you read right..a lake.

Where Lynas photo gallary shows c plant..LAMP..actual stuff.They show picks of a few Geologist looking at some drilling pipes in the snow..figuring out which one to use (all looked the same to me..thus their dilemma..lol.

Then a pic of a dog ..their mascot..running over some more snow..then more guys looking around their territory..snow covered..not a shovel in sight..actually no site to store the shovel.The final pic really broke me up..their Relations mngr..all you can see is his eyes..snow and dressed to survive.Bit like pics you,d exspect from Greenland.

Nothing..they have absolutely nothing to show except $6.50.

Sorry,not correct..they have started to build an Ice road across the lake..so trucks can go to and fro.!!! carting ore..at least with LREE,S...but with HREE,S must cause a strain on the ole ice..lol.

Lots of feasability studies,permit gathering,community work,etc but no shovel talk.

add all the hype with MCP..and then add the rest with shovel holes,no wonder most are calling it a bubble.

But a final note on the AVL thing and how the holders were all looking at long term..excited.

It struck home to me how the same term can be light years apart.

Long term for LYC holders is like till end of this year.

For the good luck with the lake and ice roads AVL Long term is like about 4-6 yrs.(where do they store their ice roads in Summer

I re read Nicks presentation from the last AGM.

His figures and thoughts indicate that LYC ..then MCP will have a 5 yr window..not exact words.

Due to the supply demand estimates and others coming on line eventually.

The Basket price during this 5 yr period is going to be very difficult to lower..because noone requiring the stuff will have any bargaining power..as there will always be a list waiting to pay whatever to get ahead of their competitors.

The Vancouver conference...China...each meeting has the same message since their quota drop bombshell...we need it badly..so badly we will use all of ours,and become the buyer..so they move further out of the picture for satisfying world demand,or lowering the basket price...actually just the opposite for all the reasons we know the transfomation REE,S are going through..taxes/enviro/green/manuf/employment etc.

Anyway I flew the LYC blanket far and wide..I mean flag.

Get that smug look off your face Linus.

I guess like most there will be milestones along the way,new car,tinnie or yaucht,penthouse,2 mistress,s,that sales will go through,bit like Nick,at the moment I like the look off at least a 5 year affair...but first milestone..the $4 club..so we can have a beer with Duncan.

------------------------------------------------------------------------------------------------------------------------

Kalenn wrote: "...So how about an indepth look at Lynas?

On my figures, profits based on current basket prices ( which may go up substantially this week when the chinese FOB tariffs kick in) should be 74c per share 18 months forward, so a PE of 15 would suggest a share price in 12-18 mths north of $10, currently south of $2. Lynas will also have first mover advantage, perhaps several years before Molycorp. What are your thoughts? ..."

Ya know the thing is Kalenn, some would say that is best case scenario and express caution. At the same time, they would take far more speculative and less verifiable information from an early stage exploration stock years away from producing and accept those same facts as a base case. I will admit I am a pound the table buyer of Lynas Corporation. It is my largest holding and I am still adding. And I am no pumper. Ive had it for a while and have a lot of my position in my 401K-retirement (long term holdings).

Wall St. and paid consultants have tried to rumor on this stock for as long as Ive held it. Maybe its because Goldman did the MCP IPO. Maybe its because Lynas has an expert team and did not pay a bunch of blogger consultants. But Ive heard about delays and metallurgical problems for years and ignored the noise. Now, it is Feb 2011 and the concentration plant is on time and on budget and being tested this month for first ore on March 7th. In other words, Lynas is now where all the other rare earth high fliers hope to be in 2-5 years according to their own company websites.

And at some point I will do an article calling out the liars that have rumored and disappeared. Perhaps March 7th would be the right time.

I guess what Im saying is if people did their own research you and I would not have to wait a year. But the only thing more powerful than the street is fundamentals. Thats what matters. The rest will come along in due time. Meanwhile Ill continue to load and wait. Lynas is still outperforming my Apple position. No one mentions that either.

SA Lynas pr plan.

Kalenn also wrote: Chihawk, if we are the author creator of a comment, we own copyright on our contribution, we can place it in more than one forum. Any forum that tried any games with this fundamental right of ownership would loose my support and in fact probably raise my ire

OK Hon. Kalenn. I accept your ruling. Besides, I cant leave a Lynashead on the battlefield alone :-). But a quick word about SA strategy. Click write a post on the profile page. And always submit as an article first and cut paste and save the doc in Microsoft Word before you submit. Then if the article is rejected you can transfer the article/post back to SA as an instablog. Instablogs reach very few readers and search engines. Articles get a much larger reach but are subject to a stronger factual standard. And as you build followers, be sociable, and tell the new friends about this favorite pub/ ice house we call Hot Copper Lynas-LYC.

------------------------------------------------------------------------------------------------------------------------

Phantom8 reprinted a Smith SA article:

I think the article was good on the Lynas part. But look how the Moly portion is written. Smith (the author not the MCP CEO) calls Moly the 800pound gorilla based on a billion dollar project that just broke ground last month that will take a full three years to complete. It also carries with it a number of unproven technologies on a commercial level. Moly is innovative and this will be great if it all works. But Molyheads treat the project as completed because it is funded. No other North American company is viewed this way. Throw in the fact that Moly is in the most taxed and regulated state in the US (my now scorned native state of California), and the attitude becomes even more bizarre. I mean Moly has had environmental problems before and Sacramento ate their lunch over it in the past. I think if Obama is a one term president and a turtle dies near Mountain Pass, Ill be buying MCP put options. I mean the greens are very powerful and rather wacky in Sacramento. And they have a lengthy track record of success as well.

Also note Molys pricing comes after Lynas production. So if you believe Duetche, Citi and JPM about Weld prices falling back to $35 long term, you must dispute the Dundee Securities conclusions (particularly as they apply to Moly). Now as a practical matter I think Lynas will get $80 per kilo for the first ten years of production. And I even think Moly will achieve much of their plans.

Bottom line is that I am in and out of Moly these days and will end up investing in them long term. But Lynas guys know something Molyheads have never known: Multiyear, billion dollar projects take a lot of time and patience and the road can get rocky. When Lynas is producing and cash flow positive, and the rare earth story is maturing, fundamentals will set in and eventually Lynas will trade at a large premium to MCP. That day is near because MCP is running out of near term catalysts and Lynas has them on its doorstep. Thats just how the trading has set itself up at this point. We shall see. But this is my strategy for these two companies. Because long term, I like them both.

------------------------------------------------------------------------------------------------------------------------

With the recent gains in rare earths pushing gains up into the five bagger territory, we were forced to revisit some of our past write-ups and look at the industry as a whole. It is at times such as these that taking a step back and reevaluating the playing field does wonders for one, and one�s portfolio. In volatile, quickly changing sectors of the market, this is a practice one must continually do.

As we looked around at the landscape it was hard to disagree with the thesis we have been using for over the past year. Lynas (LYSCF.PK) and Molycorp (MCP) will be first to production and our first to production strategy has paid off pretty nicely for readers and subscribers. Lynas and Molycorp will be the first Western suppliers of rare earth elements to come online in the next 2-3 years. Light Rare Earth Elements (LREEs), will dominate the market. The Heavy Rare Earth Elements (HREE) market is up for grabs, but our readers know where we stand on the HREEs. Stans Energy (STZYF.PK) and Quest Rare Minerals are our favorites, with both returning over 500% since we profiled them.

What we found interesting during our reevaluation of the industry is that although many feel that these stocks are overvalued, going forward they could be quite cheap. Based on the expected output of the companies� mines along with the current prices of REEs, both Lynas and Molycorp continue to appear to us as long-term buys.

We have analyzed the deposits of both Molycorp and Lynas and, feeling that in-situ value is a horrible way to value a company, decided that projected revenues would be the best measure of these companies� potential fair value. We had to double check the numbers, as we were pretty blown away by the spreadsheet compiled for our database via information available from the companies themselves and other reputable sources. When more than one source was used, we defaulted to the individual company�s data and used the other reference material to confirm the numbers.

Let us first go over the data within the tables below. The production numbers are those which have been publicly announced by the companies, in both cases they have two production levels which represent the two phases they have planned. The REO prices are those supplied via asianmetal.com prices (as of this past weekend). If one wanted to confirm these prices simply go to pelemountain.com and click on the �Asian Metal Prices� link on their page (located at the bottom right of the page).

The revenues are broken down according to total revenue per element at the mine, and the total revenue figure is yearly as it is based on the annual production (per the companies). Now both have contracts, and in some cases firm sales prices via floors and ceilings, on forward production but this would be their �base case� bringing production online today at current prices and with only selling the oxides (not further �refining� the product as MCP will do). Due to the lack of information on breakdown of the �Other REEs� we have simply used a sales price of zero for these materials.

Here are the current prices we used in our analysis:

Product Current Price

Cerium Oxide (USD/kg) 67.10

Lanthanum Oxide (USD/kg) 64.10

Neodymium Oxide (USD/kg) 110.00

Praseodymium Oxide (USD/kg) 103.50

Samarium Oxide (USD/kg) 61.10

Dysprosium Oxide (USD/kg) 375.00

Europium Oxide (USD/kg) 646.00

Terbium Oxide (USD/kg) 640.00

Gadolinium Oxide (USD/kg) 83.00

Prices Courtesy of asianmetal.com

Looking at Lynas Corp.�s Mt. Weld Deposit we find the deposit is composed of the following elements, and we have assumed here that production will mirror the composition of the deposit as a whole. A fair assumption over the life of the deposit, but production numbers will vary from time to time as various parts of the deposit are mined.

Element Estimated % in Production Mining

Mt. Weld Ore Phase 1 Revenues (1)

Cerium Oxide 46.74% 5,141 344,987,940.00

Lanthanum Oxide 26% 2,805 179,800,500.00

Neodymium Oxide 18.50% 2,035 223,850,000.00

Praseodymium Oxide 5.32% 585 60,568,200.00

Samarium Oxide 2.27% 250 15,256,670.00

Dysprosium Oxide 0.12% 14 5,115,000.00

Europium Oxide 0.44% 49 31,479,580.00

Terbium Oxide 0.05% 6 3,520,000.00

Other REEs (Incl. Gandolinium) 1.05% 116 0.00

100.00% 11,000 864,577,890.00

Courtesy of theinvestar.com

For Phase 2, production will be doubled. Our number is off by 1 metric tonne due to rounding, so it actually comes in under the official Lynas projections. For Phase 2 production, revenues should look something like this:

Element Estimated % in Production Mining

Mt. Weld Ore Phase 2 Revenues (2)

Cerium Oxide 46.74% 10,283 689,975,880.00

Lanthanum Oxide 26% 5,610 359,601,000.00

Neodymium Oxide 18.50% 4,070 447,700,000.00

Praseodymium Oxide 5.32% 1,170 121,136,400.00

Samarium Oxide 2.27% 499 30,513,340.00

Dysprosium Oxide 0.12% 27 10,230,000.00

Europium Oxide 0.44% 97 62,959,160.00

Terbium Oxide 0.05% 11 7,040,000.00

Other REEs (Incl. Gandolinium) 1.05% 231 0.00

100.00% 21,999 * 1,729,155,780.00

Courtesy of theinvestar.com

Lynas will be first to production outside of China, and we believe that they will be sold out of material moving forward. It is our understanding that they have favorable supply contracts that do not hamper them in the way many juniors get bogged down when they first bring production online.

Molycorp has been a controversial stock here in the States. Our viewpoint has been that it is going to be the 800-pound gorilla in the industry moving forward, and will be a hybrid mining, manufacturing, and technology concern. Below are the numbers for the Mountain Pass deposit, once again using the REO prices specified above, and specifying that this is the production from Phase 1.

Element Estimated % in Production Mining

Mtn Pass Ore Phase 1* Revenues (1)

Cerium 48.80% 9,760 653,920,000.00

Lanthanum 34% 6,800 435,200,000.00

Neodymium 11.70% 2,340 256,230,000.00

Praseodymium 4.20% 840 86,520,000.00

Samarium 0.79% 158 9,638,000.00

Gadolinium 0.21% 42 3,486,000.00

Europium 0.13% 26 19,370,000.00

Dysprosium 0.05% 10 3,730,000.00

Other REEs (Including Terbium) 0.12% 24 0.00

20,000 1,468,094,000.00

Courtesy of theinvestar.com

Phase 2 production will set the company apart from the rest of the industry as it will ramp up to 40,000 metric tonnes.

Element Estimated % in Production Mining

Mtn Pass Ore Phase 2* Revenues (2)

Cerium Oxide 48.80% 19,520 1,307,840,000.00

Lanthanum Oxide 34% 13,600 870,400,000.00

Neodymium Oxide 11.70% 4,680 512,460,000.00

Praseodymium Oxide 4.20% 1,680 173,040,000.00

Samarium Oxide 0.79% 316 19,276,000.00

Gadolinium Oxide 0.21% 84 6,972,000.00

Europium Oxide 0.13% 52 38,740,000.00

Dysprosium Oxide 0.05% 20 7,460,000.00

Other REEs (Including Terbium) 0.12% 48 0.00

40,000 2,936,188,000.00

Courtesy of theinvestar.com

Molycorp�s numbers appear to indicate that if REE prices can at least maintain their current levels the revenues would be significant, however we stress that this is the �base case� for production. That is, if Molycorp simply mined the REEs and sold the REOs on the market.

The business plan MCP will use is to sell the highly desirable products into the open market and to take the cerium and others which could have a supply overhang going forward and actually manufacture them into products to sell, thus actually providing for a higher revenue total than our mining only numbers indicate. Cerium for instance is the main component of the patented water filter they will market. Our analysis indicates that Molycorp could be a net purchaser of Cerium in the years ahead. Although we will not delve into the earnings potential at this time, it is believed that MCP will have a mining cost of about US$2.77/kg TREO according to Dundee Securities estimates.

MCP, using the latest technology, will become the world�s low cost producer of REEs as the Chinese continue to raise the cost of the REE industry through their new compliance requirements and environmental laws. It is our belief that MCP will have the highest margins in the industry due to this business plan based on the estimated mining costs and current business plan.

Lynas, according to Dundee Securities, will have mining costs of roughly US$7.00/kg TREO, which should still provide for ample profits. Lynas is also trying to develop a brand known as �RED� (Rare Earths Direct) to differentiate its product from that of others. They hope to develop RED into a brand that customers know stands for quality.

Investors are free to place their own multiple on these numbers to �guesstimate� a fair value for the shares, and in all honesty the figures vary wildly. The revenue multiple is a whole new argument for another day, but one could look at the diversified miners and use a multiplier of somewhere in the neighborhood of 5ish or use the uranium stocks which we think are a little bit more of a fair comp. Using Cameco (CCJ), the revenue multiplier would have to be 15 to get the value of shares based on that theory.

It takes conviction in one�s own thesis and the assumption that REO pricing remains strong going forward, but based on the above numbers it is apparent that the REE sector could still power higher based not on rumors anymore but actual fundamentals as these companies near production.

Zum WE ein Paar in Detail nicht ganz erst zu nehmende, dafür IMHO aber nette, Meinungen/Geschichten aus dem HC-Forum zu Lynas von Heute.

@ noch ein schönes Rest-WE

Grüsse JoJo

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=137419…

re: pr (oneforthe)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $1.77 | Price Chart | Announcements | Google LYC)

Post: 6286384

Reply to: #6286205 from chihawk Views: 88

Posted: 05/02/11 17:37 Stock Price (at time of posting): $1.77 Sentiment: LT Buy Disclosure: Stock Held From: 119.11.xxx.xxx

------------------------------------------------------------------------------------------------------------------------

I put my Linas (actually have one with Peanuts)..I mean my Lynas doll (small boy sucking thumb but with much smaller,lighter,stronger,more compact,longer wearing blanket

near the lap top and said lets go educate the world on Lynas.

near the lap top and said lets go educate the world on Lynas.On Yahoo Finance I got bogged down on the Avalon (AVL)site.

Prior to that I had a good check of AVL,s site...closed at $6.50 NYSE.(-21c)

AVL is Canada,s flagship.

Well if you want a good laugh..check out their site..starting with Thor Lake...yes you read right..a lake.

Where Lynas photo gallary shows c plant..LAMP..actual stuff.They show picks of a few Geologist looking at some drilling pipes in the snow..figuring out which one to use (all looked the same to me..thus their dilemma..lol.

Then a pic of a dog ..their mascot..running over some more snow..then more guys looking around their territory..snow covered..not a shovel in sight..actually no site to store the shovel.The final pic really broke me up..their Relations mngr..all you can see is his eyes..snow and dressed to survive.Bit like pics you,d exspect from Greenland.

Nothing..they have absolutely nothing to show except $6.50.

Sorry,not correct..they have started to build an Ice road across the lake..so trucks can go to and fro.!!! carting ore..at least with LREE,S...but with HREE,S must cause a strain on the ole ice..lol.

Lots of feasability studies,permit gathering,community work,etc but no shovel talk.

add all the hype with MCP..and then add the rest with shovel holes,no wonder most are calling it a bubble.

But a final note on the AVL thing and how the holders were all looking at long term..excited.

It struck home to me how the same term can be light years apart.

Long term for LYC holders is like till end of this year.

For the good luck with the lake and ice roads AVL Long term is like about 4-6 yrs.(where do they store their ice roads in Summer

I re read Nicks presentation from the last AGM.

His figures and thoughts indicate that LYC ..then MCP will have a 5 yr window..not exact words.

Due to the supply demand estimates and others coming on line eventually.

The Basket price during this 5 yr period is going to be very difficult to lower..because noone requiring the stuff will have any bargaining power..as there will always be a list waiting to pay whatever to get ahead of their competitors.

The Vancouver conference...China...each meeting has the same message since their quota drop bombshell...we need it badly..so badly we will use all of ours,and become the buyer..so they move further out of the picture for satisfying world demand,or lowering the basket price...actually just the opposite for all the reasons we know the transfomation REE,S are going through..taxes/enviro/green/manuf/employment etc.

Anyway I flew the LYC blanket far and wide..I mean flag.

Get that smug look off your face Linus.

I guess like most there will be milestones along the way,new car,tinnie or yaucht,penthouse,2 mistress,s,that sales will go through,bit like Nick,at the moment I like the look off at least a 5 year affair...but first milestone..the $4 club..so we can have a beer with Duncan.

------------------------------------------------------------------------------------------------------------------------

Kalenn wrote: "...So how about an indepth look at Lynas?

On my figures, profits based on current basket prices ( which may go up substantially this week when the chinese FOB tariffs kick in) should be 74c per share 18 months forward, so a PE of 15 would suggest a share price in 12-18 mths north of $10, currently south of $2. Lynas will also have first mover advantage, perhaps several years before Molycorp. What are your thoughts? ..."

Ya know the thing is Kalenn, some would say that is best case scenario and express caution. At the same time, they would take far more speculative and less verifiable information from an early stage exploration stock years away from producing and accept those same facts as a base case. I will admit I am a pound the table buyer of Lynas Corporation. It is my largest holding and I am still adding. And I am no pumper. Ive had it for a while and have a lot of my position in my 401K-retirement (long term holdings).

Wall St. and paid consultants have tried to rumor on this stock for as long as Ive held it. Maybe its because Goldman did the MCP IPO. Maybe its because Lynas has an expert team and did not pay a bunch of blogger consultants. But Ive heard about delays and metallurgical problems for years and ignored the noise. Now, it is Feb 2011 and the concentration plant is on time and on budget and being tested this month for first ore on March 7th. In other words, Lynas is now where all the other rare earth high fliers hope to be in 2-5 years according to their own company websites.

And at some point I will do an article calling out the liars that have rumored and disappeared. Perhaps March 7th would be the right time.

I guess what Im saying is if people did their own research you and I would not have to wait a year. But the only thing more powerful than the street is fundamentals. Thats what matters. The rest will come along in due time. Meanwhile Ill continue to load and wait. Lynas is still outperforming my Apple position. No one mentions that either.

SA Lynas pr plan.

Kalenn also wrote: Chihawk, if we are the author creator of a comment, we own copyright on our contribution, we can place it in more than one forum. Any forum that tried any games with this fundamental right of ownership would loose my support and in fact probably raise my ire

OK Hon. Kalenn. I accept your ruling. Besides, I cant leave a Lynashead on the battlefield alone :-). But a quick word about SA strategy. Click write a post on the profile page. And always submit as an article first and cut paste and save the doc in Microsoft Word before you submit. Then if the article is rejected you can transfer the article/post back to SA as an instablog. Instablogs reach very few readers and search engines. Articles get a much larger reach but are subject to a stronger factual standard. And as you build followers, be sociable, and tell the new friends about this favorite pub/ ice house we call Hot Copper Lynas-LYC.

------------------------------------------------------------------------------------------------------------------------

Phantom8 reprinted a Smith SA article:

I think the article was good on the Lynas part. But look how the Moly portion is written. Smith (the author not the MCP CEO) calls Moly the 800pound gorilla based on a billion dollar project that just broke ground last month that will take a full three years to complete. It also carries with it a number of unproven technologies on a commercial level. Moly is innovative and this will be great if it all works. But Molyheads treat the project as completed because it is funded. No other North American company is viewed this way. Throw in the fact that Moly is in the most taxed and regulated state in the US (my now scorned native state of California), and the attitude becomes even more bizarre. I mean Moly has had environmental problems before and Sacramento ate their lunch over it in the past. I think if Obama is a one term president and a turtle dies near Mountain Pass, Ill be buying MCP put options. I mean the greens are very powerful and rather wacky in Sacramento. And they have a lengthy track record of success as well.

Also note Molys pricing comes after Lynas production. So if you believe Duetche, Citi and JPM about Weld prices falling back to $35 long term, you must dispute the Dundee Securities conclusions (particularly as they apply to Moly). Now as a practical matter I think Lynas will get $80 per kilo for the first ten years of production. And I even think Moly will achieve much of their plans.

Bottom line is that I am in and out of Moly these days and will end up investing in them long term. But Lynas guys know something Molyheads have never known: Multiyear, billion dollar projects take a lot of time and patience and the road can get rocky. When Lynas is producing and cash flow positive, and the rare earth story is maturing, fundamentals will set in and eventually Lynas will trade at a large premium to MCP. That day is near because MCP is running out of near term catalysts and Lynas has them on its doorstep. Thats just how the trading has set itself up at this point. We shall see. But this is my strategy for these two companies. Because long term, I like them both.

------------------------------------------------------------------------------------------------------------------------

With the recent gains in rare earths pushing gains up into the five bagger territory, we were forced to revisit some of our past write-ups and look at the industry as a whole. It is at times such as these that taking a step back and reevaluating the playing field does wonders for one, and one�s portfolio. In volatile, quickly changing sectors of the market, this is a practice one must continually do.

As we looked around at the landscape it was hard to disagree with the thesis we have been using for over the past year. Lynas (LYSCF.PK) and Molycorp (MCP) will be first to production and our first to production strategy has paid off pretty nicely for readers and subscribers. Lynas and Molycorp will be the first Western suppliers of rare earth elements to come online in the next 2-3 years. Light Rare Earth Elements (LREEs), will dominate the market. The Heavy Rare Earth Elements (HREE) market is up for grabs, but our readers know where we stand on the HREEs. Stans Energy (STZYF.PK) and Quest Rare Minerals are our favorites, with both returning over 500% since we profiled them.

What we found interesting during our reevaluation of the industry is that although many feel that these stocks are overvalued, going forward they could be quite cheap. Based on the expected output of the companies� mines along with the current prices of REEs, both Lynas and Molycorp continue to appear to us as long-term buys.

We have analyzed the deposits of both Molycorp and Lynas and, feeling that in-situ value is a horrible way to value a company, decided that projected revenues would be the best measure of these companies� potential fair value. We had to double check the numbers, as we were pretty blown away by the spreadsheet compiled for our database via information available from the companies themselves and other reputable sources. When more than one source was used, we defaulted to the individual company�s data and used the other reference material to confirm the numbers.

Let us first go over the data within the tables below. The production numbers are those which have been publicly announced by the companies, in both cases they have two production levels which represent the two phases they have planned. The REO prices are those supplied via asianmetal.com prices (as of this past weekend). If one wanted to confirm these prices simply go to pelemountain.com and click on the �Asian Metal Prices� link on their page (located at the bottom right of the page).

The revenues are broken down according to total revenue per element at the mine, and the total revenue figure is yearly as it is based on the annual production (per the companies). Now both have contracts, and in some cases firm sales prices via floors and ceilings, on forward production but this would be their �base case� bringing production online today at current prices and with only selling the oxides (not further �refining� the product as MCP will do). Due to the lack of information on breakdown of the �Other REEs� we have simply used a sales price of zero for these materials.

Here are the current prices we used in our analysis:

Product Current Price

Cerium Oxide (USD/kg) 67.10

Lanthanum Oxide (USD/kg) 64.10

Neodymium Oxide (USD/kg) 110.00

Praseodymium Oxide (USD/kg) 103.50

Samarium Oxide (USD/kg) 61.10

Dysprosium Oxide (USD/kg) 375.00

Europium Oxide (USD/kg) 646.00

Terbium Oxide (USD/kg) 640.00

Gadolinium Oxide (USD/kg) 83.00

Prices Courtesy of asianmetal.com

Looking at Lynas Corp.�s Mt. Weld Deposit we find the deposit is composed of the following elements, and we have assumed here that production will mirror the composition of the deposit as a whole. A fair assumption over the life of the deposit, but production numbers will vary from time to time as various parts of the deposit are mined.

Element Estimated % in Production Mining

Mt. Weld Ore Phase 1 Revenues (1)

Cerium Oxide 46.74% 5,141 344,987,940.00

Lanthanum Oxide 26% 2,805 179,800,500.00

Neodymium Oxide 18.50% 2,035 223,850,000.00

Praseodymium Oxide 5.32% 585 60,568,200.00

Samarium Oxide 2.27% 250 15,256,670.00

Dysprosium Oxide 0.12% 14 5,115,000.00

Europium Oxide 0.44% 49 31,479,580.00

Terbium Oxide 0.05% 6 3,520,000.00

Other REEs (Incl. Gandolinium) 1.05% 116 0.00

100.00% 11,000 864,577,890.00

Courtesy of theinvestar.com

For Phase 2, production will be doubled. Our number is off by 1 metric tonne due to rounding, so it actually comes in under the official Lynas projections. For Phase 2 production, revenues should look something like this:

Element Estimated % in Production Mining

Mt. Weld Ore Phase 2 Revenues (2)

Cerium Oxide 46.74% 10,283 689,975,880.00

Lanthanum Oxide 26% 5,610 359,601,000.00

Neodymium Oxide 18.50% 4,070 447,700,000.00

Praseodymium Oxide 5.32% 1,170 121,136,400.00

Samarium Oxide 2.27% 499 30,513,340.00

Dysprosium Oxide 0.12% 27 10,230,000.00

Europium Oxide 0.44% 97 62,959,160.00

Terbium Oxide 0.05% 11 7,040,000.00

Other REEs (Incl. Gandolinium) 1.05% 231 0.00

100.00% 21,999 * 1,729,155,780.00

Courtesy of theinvestar.com

Lynas will be first to production outside of China, and we believe that they will be sold out of material moving forward. It is our understanding that they have favorable supply contracts that do not hamper them in the way many juniors get bogged down when they first bring production online.

Molycorp has been a controversial stock here in the States. Our viewpoint has been that it is going to be the 800-pound gorilla in the industry moving forward, and will be a hybrid mining, manufacturing, and technology concern. Below are the numbers for the Mountain Pass deposit, once again using the REO prices specified above, and specifying that this is the production from Phase 1.

Element Estimated % in Production Mining

Mtn Pass Ore Phase 1* Revenues (1)

Cerium 48.80% 9,760 653,920,000.00

Lanthanum 34% 6,800 435,200,000.00

Neodymium 11.70% 2,340 256,230,000.00

Praseodymium 4.20% 840 86,520,000.00

Samarium 0.79% 158 9,638,000.00

Gadolinium 0.21% 42 3,486,000.00

Europium 0.13% 26 19,370,000.00

Dysprosium 0.05% 10 3,730,000.00

Other REEs (Including Terbium) 0.12% 24 0.00

20,000 1,468,094,000.00

Courtesy of theinvestar.com

Phase 2 production will set the company apart from the rest of the industry as it will ramp up to 40,000 metric tonnes.

Element Estimated % in Production Mining

Mtn Pass Ore Phase 2* Revenues (2)

Cerium Oxide 48.80% 19,520 1,307,840,000.00

Lanthanum Oxide 34% 13,600 870,400,000.00

Neodymium Oxide 11.70% 4,680 512,460,000.00

Praseodymium Oxide 4.20% 1,680 173,040,000.00

Samarium Oxide 0.79% 316 19,276,000.00

Gadolinium Oxide 0.21% 84 6,972,000.00

Europium Oxide 0.13% 52 38,740,000.00

Dysprosium Oxide 0.05% 20 7,460,000.00

Other REEs (Including Terbium) 0.12% 48 0.00

40,000 2,936,188,000.00

Courtesy of theinvestar.com

Molycorp�s numbers appear to indicate that if REE prices can at least maintain their current levels the revenues would be significant, however we stress that this is the �base case� for production. That is, if Molycorp simply mined the REEs and sold the REOs on the market.

The business plan MCP will use is to sell the highly desirable products into the open market and to take the cerium and others which could have a supply overhang going forward and actually manufacture them into products to sell, thus actually providing for a higher revenue total than our mining only numbers indicate. Cerium for instance is the main component of the patented water filter they will market. Our analysis indicates that Molycorp could be a net purchaser of Cerium in the years ahead. Although we will not delve into the earnings potential at this time, it is believed that MCP will have a mining cost of about US$2.77/kg TREO according to Dundee Securities estimates.

MCP, using the latest technology, will become the world�s low cost producer of REEs as the Chinese continue to raise the cost of the REE industry through their new compliance requirements and environmental laws. It is our belief that MCP will have the highest margins in the industry due to this business plan based on the estimated mining costs and current business plan.

Lynas, according to Dundee Securities, will have mining costs of roughly US$7.00/kg TREO, which should still provide for ample profits. Lynas is also trying to develop a brand known as �RED� (Rare Earths Direct) to differentiate its product from that of others. They hope to develop RED into a brand that customers know stands for quality.

Investors are free to place their own multiple on these numbers to �guesstimate� a fair value for the shares, and in all honesty the figures vary wildly. The revenue multiple is a whole new argument for another day, but one could look at the diversified miners and use a multiplier of somewhere in the neighborhood of 5ish or use the uranium stocks which we think are a little bit more of a fair comp. Using Cameco (CCJ), the revenue multiplier would have to be 15 to get the value of shares based on that theory.

It takes conviction in one�s own thesis and the assumption that REO pricing remains strong going forward, but based on the above numbers it is apparent that the REE sector could still power higher based not on rumors anymore but actual fundamentals as these companies near production.

China, biggest produce of rare earths, expects to import more

Kompletter Beitrag: http://www.theaustralian.com.au/business/china-biggest-produ…

Google-Übersetzung: http://translate.google.de/translate?u=http%3A%2F%2Fwww.thea…

Lynas boss tops the table again

Kompletter Beitrag: http://www.smh.com.au/business/lynas-boss-tops-the-table-aga…

Google-Übersetzung: http://translate.google.de/translate?u=http%3A%2F%2Fwww.smh.…

Schönes Wochenende

CHINA'S chief rare earths research body says it expects the nation to become a net importer, even though it is the world's biggest producer.

The news is bound to fuel supply concerns from big consumers like Japan and the US.

In a presentation in Vancouver, Chinese Society of Rare Earths director Chen Zhanheng said Chinese consumption of the substances was growing rapidly.

"(There are) early signals that China is moving from sell-side to buy-side. China becomes a new market opportunity for producers outside China," he said. Chinese exports of rare earths peaked at nearly 60,000 tonnes, but slipped to about 39,000 tonnes in 2009.

That level was still more than Chinese quotas, which have been designed to slash exports.

The concern over rare earths supply has led Japan's Sojitz to form a partnership with Lynas Corp, which gives it import rights for 9000 tonnes of Australian rare-earth metals a year...

Kompletter Beitrag: http://www.theaustralian.com.au/business/china-biggest-produ…

Google-Übersetzung: http://translate.google.de/translate?u=http%3A%2F%2Fwww.thea…

Lynas boss tops the table again

NICHOLAS Curtis, the executive chairman of Lynas Corporation, has for the second time in two months made it to the head of the directors' selling table.

Lynas, the booming rare earths producer, has seen its scrip soar from 50¢ to as high as $2.35 in less than a year and Mr Curtis has cleaned up handsomely.

In December, he sold 5 million shares at around $1.50 apiece following the exercise of 5 million options at 11¢ an option.

Advertisement: Story continues below

He has just peeled off a further 7 million shares and sold them into the market at around $1.93 each.

In December, the scrip moved considerably higher following his sale, but this time the shares beat a hasty retreat. The day following his disposals were reported, the shares fell from $1.90 to $1.70. But they have now recovered somewhat, closing yesterday at $1.77.

Mr Curtis retains $28 million of stock, not to mention 31 million employee incentive options.

Meanwhile, directors are now required to disclose details of transactions occurring in blackout periods and the ASX has been reminding directors of their obligations....

Kompletter Beitrag: http://www.smh.com.au/business/lynas-boss-tops-the-table-aga…

Google-Übersetzung: http://translate.google.de/translate?u=http%3A%2F%2Fwww.smh.…

Schönes Wochenende

http://www.npr.org/2011/01/31/133372641/california-challenge…

California Challenges China In Rare Earths Mining

by Ina Jaffe

January 31, 2011

...

...

"The gap in terms of the world demand outside of what China has said they'll export is about 100,000 tons," Richardson says.

He said that as China's industry grows, its exports of rare earths will continue to shrink.

"They're going to use all the rare earths they mine and then some," said Richardson. "So, many in the industry think that [China] will eventually not export at all, that they will eventually import rare earths."

Meaning that one day China might not be Molycorp's competitor, but one of its customers.

Übversetzt: http://translate.google.de/translate?hl=de&sl=en&tl=de&u=htt…

Grüsse JoJo

California Challenges China In Rare Earths Mining

by Ina Jaffe

January 31, 2011

...

...

"The gap in terms of the world demand outside of what China has said they'll export is about 100,000 tons," Richardson says.

He said that as China's industry grows, its exports of rare earths will continue to shrink.

"They're going to use all the rare earths they mine and then some," said Richardson. "So, many in the industry think that [China] will eventually not export at all, that they will eventually import rare earths."

Meaning that one day China might not be Molycorp's competitor, but one of its customers.

Übversetzt: http://translate.google.de/translate?hl=de&sl=en&tl=de&u=htt…

Grüsse JoJo

Zum WE einige versöhnliche Postings aus dem HC-Forum zu Lynas von Heute:

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=137406…

major upside in 1st to produce outside china (Socrates44)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $1.77 | Price Chart | Announcements | Google LYC)

Post: 6284140 (Start of thread) Views: 139

Posted: 04/02/11 17:40 Stock Price (at time of posting): $1.77 Sentiment: Buy Disclosure: Stock Held From: 60.241.xxx.xxx

---------------------------------------------------------------------------------------------------------------------------------

This is a better thread - be positive.

Lynas has major upside in being first to produce outside of China.

Alkane and Arafura will follow, but not until 2013.

GGG and RMR in Greenland will not produce before 2015, assuming permission is given

As Nursury posted:

Add to that the fact that the plant is designed to follow known and proven technology and has the technical help necessary to follow through to production. This is not the result of an experimental plant being designed and built. No new inventions necessary that could cause failure if they didn't eventuate. They are not waiting for the hand to be dealt, they allready hold 4 aces.

1st Ace. Very rich deposit.

2nd Ace. Ahead of any new competition

3rd Ace. Improving basket price.

4th Ace. Firm orders.

The fifth card held is the joker. They can break the Chinese monopoly.

---------------------------------------------------------------------------------------------------------------------------------

"To assume the plant will procure perfectly and deliver all the rare earths concentrates without a hitch for a head start market cap of $2.9bn is a mighty big assumption."

Not really. The concentration plant is basically done and will be mostly tested throughout February. Then it will receive ore on 7 March. That is all according to the previous ASX Announcements not some slingshot website or penny stock presentation. And then realize that no one else is within two years of new ore production.

Please also note when a miner has been working on a project for years and is only months from conclusion, the risk of delays or additional expenses is much less than if the project has longer to go and a larger number of dollars to spend. When I did construction work during my college years, we had dollar and time multipliers that we added into larger project bids. It makes more sense to me than JPM's 15% discount because delays and price management is much easier after being on time and on budget part way through a project rather than when you first start out. This is because the planning and engineering becomes more apparent as a project progresses. With a billion dollar mine I can only imagine how this effect would apply.

---------------------------------------------------------------------------------------------------------------------------------

Saracen

How can you comment about valuation without reference to the projected cashflows and weighted average cost of capital that produce the valuation?

JP Morgan acknowledge the risks you mention and factor them into their $2.71 per share valuation by doing the following:

- Using a weighted average cost of capital of 15%; and

- Assuming the REE basket price is much lower than where it stands today.

Unfortuantely, until Lynas starts producing there's no exact science to valuing the business. Assumptions have to be made because the business clearly is valuable. Anybody who says it has no value until it starts producing has no idea what they're talking about; or has no understanding on how to value a start up operation.

---------------------------------------------------------------------------------------------------------------------------------

Not directed at you ken, just picked a Nick topic.

Over the years I have read some ordinary stuff on HC, but these last few days on LYC is up with the worst.

Back in the good old days all we did was check the paper for directors trades and I can tell you we did no better than if we had thrown a dart. I have been asked over the last 12 months is it still ok to pick up stock after this run, I have said the same to all, we have not seen the run yet, but it?s moved well and I am not so sure you will see any measured fall back so close to the many announcements due. And guess what I was wrong along comes a completely non core issue to the SP value which dumps it down a nice percentage.

But please stop all this hand wringing over the 7mil Nick sold, he is able to do this off the back of 31mil options and actually requires confidence IMHO. The money is needed for something who am I to object, he has followed all the rules and this is of course a concrete confirmation we will only see good news in the medium to short IMHO.

As always DYOR!!!

---------------------------------------------------------------------------------------------------------------------------------

@ ein schönes WE

Grüsse JoJo

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=137406…

major upside in 1st to produce outside china (Socrates44)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $1.77 | Price Chart | Announcements | Google LYC)

Post: 6284140 (Start of thread) Views: 139

Posted: 04/02/11 17:40 Stock Price (at time of posting): $1.77 Sentiment: Buy Disclosure: Stock Held From: 60.241.xxx.xxx

---------------------------------------------------------------------------------------------------------------------------------

This is a better thread - be positive.

Lynas has major upside in being first to produce outside of China.

Alkane and Arafura will follow, but not until 2013.

GGG and RMR in Greenland will not produce before 2015, assuming permission is given

As Nursury posted:

Add to that the fact that the plant is designed to follow known and proven technology and has the technical help necessary to follow through to production. This is not the result of an experimental plant being designed and built. No new inventions necessary that could cause failure if they didn't eventuate. They are not waiting for the hand to be dealt, they allready hold 4 aces.

1st Ace. Very rich deposit.

2nd Ace. Ahead of any new competition

3rd Ace. Improving basket price.

4th Ace. Firm orders.

The fifth card held is the joker. They can break the Chinese monopoly.

---------------------------------------------------------------------------------------------------------------------------------

"To assume the plant will procure perfectly and deliver all the rare earths concentrates without a hitch for a head start market cap of $2.9bn is a mighty big assumption."

Not really. The concentration plant is basically done and will be mostly tested throughout February. Then it will receive ore on 7 March. That is all according to the previous ASX Announcements not some slingshot website or penny stock presentation. And then realize that no one else is within two years of new ore production.

Please also note when a miner has been working on a project for years and is only months from conclusion, the risk of delays or additional expenses is much less than if the project has longer to go and a larger number of dollars to spend. When I did construction work during my college years, we had dollar and time multipliers that we added into larger project bids. It makes more sense to me than JPM's 15% discount because delays and price management is much easier after being on time and on budget part way through a project rather than when you first start out. This is because the planning and engineering becomes more apparent as a project progresses. With a billion dollar mine I can only imagine how this effect would apply.

---------------------------------------------------------------------------------------------------------------------------------

Saracen

How can you comment about valuation without reference to the projected cashflows and weighted average cost of capital that produce the valuation?

JP Morgan acknowledge the risks you mention and factor them into their $2.71 per share valuation by doing the following:

- Using a weighted average cost of capital of 15%; and

- Assuming the REE basket price is much lower than where it stands today.

Unfortuantely, until Lynas starts producing there's no exact science to valuing the business. Assumptions have to be made because the business clearly is valuable. Anybody who says it has no value until it starts producing has no idea what they're talking about; or has no understanding on how to value a start up operation.

---------------------------------------------------------------------------------------------------------------------------------

Not directed at you ken, just picked a Nick topic.

Over the years I have read some ordinary stuff on HC, but these last few days on LYC is up with the worst.

Back in the good old days all we did was check the paper for directors trades and I can tell you we did no better than if we had thrown a dart. I have been asked over the last 12 months is it still ok to pick up stock after this run, I have said the same to all, we have not seen the run yet, but it?s moved well and I am not so sure you will see any measured fall back so close to the many announcements due. And guess what I was wrong along comes a completely non core issue to the SP value which dumps it down a nice percentage.

But please stop all this hand wringing over the 7mil Nick sold, he is able to do this off the back of 31mil options and actually requires confidence IMHO. The money is needed for something who am I to object, he has followed all the rules and this is of course a concrete confirmation we will only see good news in the medium to short IMHO.

As always DYOR!!!

---------------------------------------------------------------------------------------------------------------------------------

@ ein schönes WE

Grüsse JoJo

23.01.24 · kapitalerhoehungen.de · BASF |

22.01.24 · wallstreetONLINE Redaktion · Lynas Rare Earths |

08.08.23 · nebenwerte ONLINE · Lynas Rare Earths |

21.06.23 · Konstantin Oldenburger · Lynas Rare Earths |

09.05.23 · ESG Aktien · Lynas Rare Earths |

| Zeit | Titel |

|---|---|

| 17.04.24 |