.........Rebound bei FEC Resources......oder kommen die Chinesen !?!? - 500 Beiträge pro Seite (Seite 2)

eröffnet am 11.05.07 18:39:49 von

neuester Beitrag 20.11.18 13:30:30 von

neuester Beitrag 20.11.18 13:30:30 von

Beiträge: 704

ID: 1.127.255

ID: 1.127.255

Aufrufe heute: 0

Gesamt: 97.432

Gesamt: 97.432

Aktive User: 0

ISIN: CA30246X1087 · WKN: A0ERXT · Symbol: FECOF

0,0017

USD

0,00 %

0,0000 USD

Letzter Kurs 22.04.24 Nasdaq OTC

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,0800 | +43,06 | |

| 12,990 | +38,93 | |

| 0,5070 | +31,52 | |

| 1,0200 | +24,39 | |

| 15,640 | +15,77 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,7000 | -10,07 | |

| 0,6500 | -12,16 | |

| 1,2100 | -13,57 | |

| 11,820 | -16,41 | |

| 20,000 | -33,33 |

Antwort auf Beitrag Nr.: 40.583.368 von hainholz am 24.11.10 16:30:19500

Antwort auf Beitrag Nr.: 40.583.471 von hainholz am 24.11.10 16:39:31vielleicht werden wir ja mal belohnt, wird auch mal langsam zeit

Antwort auf Beitrag Nr.: 40.583.881 von schneebe am 24.11.10 17:15:26aber,ehrlich

in london 25 % auffi

in london 25 % auffi

Antwort auf Beitrag Nr.: 40.583.881 von schneebe am 24.11.10 17:15:26Der Startschuss ist gefallen! Das wird hier was!

Antwort auf Beitrag Nr.: 40.584.100 von xxtsc am 24.11.10 17:35:53das ist schon nicht schlecht,erst in amiland und jetzt schon wieder hier

Antwort auf Beitrag Nr.: 40.584.243 von hainholz am 24.11.10 17:49:05I agree!

Forum Energy seeking partners

By Amy R. Remo

Philippine Daily Inquirer

First Posted 22:08:00 11/28/2010

Filed Under: Oil & Gas - Upstream activities, Joint Ventures, business, Investments

MANILA, Philippines—UK-based Forum Energy Plc is seeking prospective partners for its plan to further explore and develop the oil- and gas-rich Reed Bank basin in offshore Palawan, which is covered by Service Contract 72.

“The company continues to have discussions with potential strategic partners for the purpose of accelerating the development of SC72. However, no firm proposal is currently being considered,” Forum said.

Months after it was granted a service contract, Forum Energy is finally set to start the implementation of its approved work program. The company recently secured a $10-million facility from Philex Mining Corp.

The lending facility, which would make available the $10 million for three years at an interest rate of US Libor plus 4.5 percent, will allow the local subsidiary, Forum Philippines Holdings Ltd., to fund its 70-percent share (or $7.4 million) in the first sub-phase work program for SC 72.

SC72, which covers 880,000 hectares within the Reed Bank basin, contains the Sampaguita oil and gas field discovery, which is estimated to contain as much as 3.4 trillion cubic feet of gas.

The planned work program was designed to provide a more comprehensive valuation of these areas and identify potential sites for appraisal wells within the Reed Bank basin.

The work program also includes 3D seismic work in an area of up to 550 square kilometers around the Sampaguita gas discovery and 2,200 line-kilometers of high resolution 2D over existing leads within the 8,800-square-kilometer contract area.

The acquisition of the seismic data is scheduled for completion in the first half of 2011 and will then be subject to technical analysis.

Aside from Sampaguita gas discovery, the SC 72 field was also reported to contain at least eight other potential leads.

Given the resources covered by SC 72, Forum said it was enough to form the foundation of a liquefied natural gas (LNG) project, similar to the Malampaya deepwater-to-gas power project.

By Amy R. Remo

Philippine Daily Inquirer

First Posted 22:08:00 11/28/2010

Filed Under: Oil & Gas - Upstream activities, Joint Ventures, business, Investments

MANILA, Philippines—UK-based Forum Energy Plc is seeking prospective partners for its plan to further explore and develop the oil- and gas-rich Reed Bank basin in offshore Palawan, which is covered by Service Contract 72.

“The company continues to have discussions with potential strategic partners for the purpose of accelerating the development of SC72. However, no firm proposal is currently being considered,” Forum said.

Months after it was granted a service contract, Forum Energy is finally set to start the implementation of its approved work program. The company recently secured a $10-million facility from Philex Mining Corp.

The lending facility, which would make available the $10 million for three years at an interest rate of US Libor plus 4.5 percent, will allow the local subsidiary, Forum Philippines Holdings Ltd., to fund its 70-percent share (or $7.4 million) in the first sub-phase work program for SC 72.

SC72, which covers 880,000 hectares within the Reed Bank basin, contains the Sampaguita oil and gas field discovery, which is estimated to contain as much as 3.4 trillion cubic feet of gas.

The planned work program was designed to provide a more comprehensive valuation of these areas and identify potential sites for appraisal wells within the Reed Bank basin.

The work program also includes 3D seismic work in an area of up to 550 square kilometers around the Sampaguita gas discovery and 2,200 line-kilometers of high resolution 2D over existing leads within the 8,800-square-kilometer contract area.

The acquisition of the seismic data is scheduled for completion in the first half of 2011 and will then be subject to technical analysis.

Aside from Sampaguita gas discovery, the SC 72 field was also reported to contain at least eight other potential leads.

Given the resources covered by SC 72, Forum said it was enough to form the foundation of a liquefied natural gas (LNG) project, similar to the Malampaya deepwater-to-gas power project.

FEC Resources, Inc. Announces Management Changes

Fec Resources (OTCBB:FECOF)

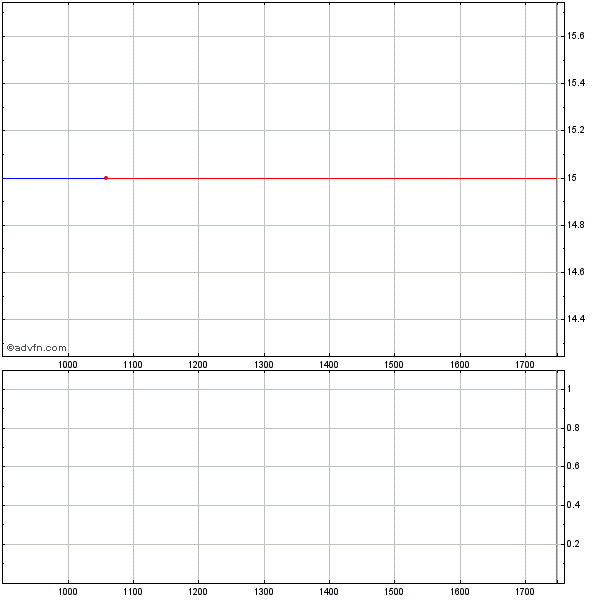

Intraday Stock Chart

Today : Wednesday 15 December 2010

Click Here for more Fec Resources Charts.

FEC Resources, Inc. Announces Management Changes

PR Newswire

CALGARY, Canada, Dec. 15, 2010

CALGARY, Canada, Dec. 15, 2010 /PRNewswire-FirstCall/ -- FEC Resources, Inc. (OTC Bulletin Board: FECOF) wishes to announce the following management appointments:

Barry Stansfield has retired as Chairman of the Company and will remain a Director of the Company. Carlo Pablo, currently Director of FEC, will assume the role of Chairman effective immediately.

Carlo Pablo (age 47) is currently Chief Operating Officer of Philex Petroleum Corporation, Philippines, which is the wholly-owned oil and gas subsidiary of Philex Mining Corporation. Previously Mr. Pablo was a Commercial Adviser at Shell, where he worked for 24 years in various upstream and downstream projects in the Philippines, Indonesia and Malaysia. Mr. Pablo was a Director of PT Kridapetra Graha between October 2001 and September 2005 and is also a director of Petroenergy Resources Corporation and an Executive Director of Forum Energy Plc.

In addition, the following have been appointed as officers of the Company:

Jose Ernesto Villaluna - President and CEO

Riaz Sumar – Chief Financial Officer and Corporate Secretary

Renato Migrino – Treasurer

All above management were elected as Directors at the Company's last Annual General Meeting along with Edward Tortorici and Andrew Mullins.

For and on behalf of the Board of FEC Resources, Inc.

FEC Resources, Inc.

"Carlo S. Pablo"

Carlo S. Pablo

Chairman

This release contains "forward looking statements" as per Section 21E of the US Securities and Exchange Act of 1934, as amended. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Management is currently reviewing many options and there is no assurance that they will not make decisions other than those now contemplated. The Company is subject to political risks and operational risks identified in documents filed with the Securities and Exchange Commission, including changing and depressed oil prices, unsuccessful drilling results, change of government and political unrest in its main area of operations

For more information please contact Riaz Sumar at (403) 290-1676 e-mail info@fecresources.com or visit the FEC Resources website at www.fecresources.com

SOURCE FEC Resources, Inc.

Fec Resources (OTCBB:FECOF)

Intraday Stock Chart

Today : Wednesday 15 December 2010

Click Here for more Fec Resources Charts.

FEC Resources, Inc. Announces Management Changes

PR Newswire

CALGARY, Canada, Dec. 15, 2010

CALGARY, Canada, Dec. 15, 2010 /PRNewswire-FirstCall/ -- FEC Resources, Inc. (OTC Bulletin Board: FECOF) wishes to announce the following management appointments:

Barry Stansfield has retired as Chairman of the Company and will remain a Director of the Company. Carlo Pablo, currently Director of FEC, will assume the role of Chairman effective immediately.

Carlo Pablo (age 47) is currently Chief Operating Officer of Philex Petroleum Corporation, Philippines, which is the wholly-owned oil and gas subsidiary of Philex Mining Corporation. Previously Mr. Pablo was a Commercial Adviser at Shell, where he worked for 24 years in various upstream and downstream projects in the Philippines, Indonesia and Malaysia. Mr. Pablo was a Director of PT Kridapetra Graha between October 2001 and September 2005 and is also a director of Petroenergy Resources Corporation and an Executive Director of Forum Energy Plc.

In addition, the following have been appointed as officers of the Company:

Jose Ernesto Villaluna - President and CEO

Riaz Sumar – Chief Financial Officer and Corporate Secretary

Renato Migrino – Treasurer

All above management were elected as Directors at the Company's last Annual General Meeting along with Edward Tortorici and Andrew Mullins.

For and on behalf of the Board of FEC Resources, Inc.

FEC Resources, Inc.

"Carlo S. Pablo"

Carlo S. Pablo

Chairman

This release contains "forward looking statements" as per Section 21E of the US Securities and Exchange Act of 1934, as amended. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Management is currently reviewing many options and there is no assurance that they will not make decisions other than those now contemplated. The Company is subject to political risks and operational risks identified in documents filed with the Securities and Exchange Commission, including changing and depressed oil prices, unsuccessful drilling results, change of government and political unrest in its main area of operations

For more information please contact Riaz Sumar at (403) 290-1676 e-mail info@fecresources.com or visit the FEC Resources website at www.fecresources.com

SOURCE FEC Resources, Inc.

Ganz schön was los in Amerika, 0,042$ zur Zeit, mal sehen, ob der Anstieg hält und es nicht ne Bullenfalle ist. News gabs keine und FEP dümpelt nachwievor vor sich hin, wenig Volumen.

Die Amis sind auf FEC aufmerksam geworden, viele neue Schreiberlinge bei IHUB.

Die Amis sind auf FEC aufmerksam geworden, viele neue Schreiberlinge bei IHUB.

Antwort auf Beitrag Nr.: 40.865.923 von xxtsc am 14.01.11 20:14:50jau ich auch

aber sehr schön so nach langer Nichtbeachtung

aber sehr schön so nach langer Nichtbeachtung

Antwort auf Beitrag Nr.: 40.866.387 von hainholz am 14.01.11 21:43:080,035$ = 400 % Plus für mich!

Mit guten FEP News könnte FEC zum Jahresende 2011 ein 5 - 10 Bagger werden! Bin sehr optimistisch!

Schönes WE!

Mit guten FEP News könnte FEC zum Jahresende 2011 ein 5 - 10 Bagger werden! Bin sehr optimistisch!

Schönes WE!

Antwort auf Beitrag Nr.: 40.866.685 von xxtsc am 14.01.11 22:24:22im US Board sehen welche Fecof bei o,16 bis Ende Februar,was bei dem aufkommenden Interesse auch gut möglich ist.

My prediction is that we reach .16 by the end of february

Everything is in the works and its all going to happen in the first part of 2011

Glad to be onboard for the ride

My prediction is that we reach .16 by the end of february

Everything is in the works and its all going to happen in the first part of 2011

Glad to be onboard for the ride

Antwort auf Beitrag Nr.: 40.867.282 von hainholz am 15.01.11 08:20:47ist von euch keiner mehr dabei, geht seit tagen nach oben.

Antwort auf Beitrag Nr.: 40.923.108 von schneebe am 25.01.11 19:35:56

Antwort auf Beitrag Nr.: 40.923.116 von schneebe am 25.01.11 19:36:47türlich

ist schwer was los im US Board

nur hier interessiert´s kein Mensch

ist schwer was los im US Board

nur hier interessiert´s kein Mensch

0,020

1.900,00 %

0,0190

es wurde ja wnigstens mal der preis angepasst

1.900,00 %

0,0190

es wurde ja wnigstens mal der preis angepasst

Antwort auf Beitrag Nr.: 40.923.818 von hainholz am 25.01.11 21:05:16ja da war ich schuld, habe meine paar st in frankfurt verkauf

konzentriere mich nur noch auf die drüben hehehe

konzentriere mich nur noch auf die drüben hehehe

Antwort auf Beitrag Nr.: 40.923.857 von hainholz am 25.01.11 21:11:04wenn jetzt dann noch endlich die erwarteten news kommen,

geht es schnell auf die 0,10 hin.

die im army board schreiben das der kurz in februar auf 0,16 sein

könnte, dass wäre mal was

geht es schnell auf die 0,10 hin.

die im army board schreiben das der kurz in februar auf 0,16 sein

könnte, dass wäre mal was

vielleicht schließen wir auf tages hoch.

der umsatz ist ja für fec auch nicht so schlecht.

die meisten aktien sind ja in festen händen

der umsatz ist ja für fec auch nicht so schlecht.

die meisten aktien sind ja in festen händen

Antwort auf Beitrag Nr.: 40.924.194 von schneebe am 25.01.11 21:57:24das sind mal die, die jeweils über 10 % der aktien besitzen

Philex Mining Corporation 225.000.000 st

Asian Coast International 65.740.000 st

CDS & Co 44.464.231 st

Philex Mining Corporation 225.000.000 st

Asian Coast International 65.740.000 st

CDS & Co 44.464.231 st

Antwort auf Beitrag Nr.: 40.925.100 von schneebe am 26.01.11 07:18:47FEC steigt nur aufgrund der Ihub-Euphorie. Verfolge das US-Board nun schon einige Jahre, es gab noch nie so viele Posts wie in den letzten Wochen. Das zieht neue Käufer ein, viele sind aus dem HDY (sehr gut gelaufen im vergang. Jahr) Board zu FEC gewechselt.

Ein news-begründeter Anstieg wäre mir lieber. FEP verzeichnet kaum Umsätze und steigt nicht. Ganz anders FEC: Mit Pump sind 0,10 jederzeit möglich, mit Dump kann es auch schnell wieder zu 0,02$ zurücklaufen. Halt OTC!

Ich warte auf gute Palavan-News. Denke, dass Philex irgendwann alle Shares aufkaufen wird. Das haben Sie auch bei Philex Gold getan. Die Frage ist zu welchen Preis?

Gruß

Ein news-begründeter Anstieg wäre mir lieber. FEP verzeichnet kaum Umsätze und steigt nicht. Ganz anders FEC: Mit Pump sind 0,10 jederzeit möglich, mit Dump kann es auch schnell wieder zu 0,02$ zurücklaufen. Halt OTC!

Ich warte auf gute Palavan-News. Denke, dass Philex irgendwann alle Shares aufkaufen wird. Das haben Sie auch bei Philex Gold getan. Die Frage ist zu welchen Preis?

Gruß

Antwort auf Beitrag Nr.: 40.925.302 von xxtsc am 26.01.11 08:29:10ja sehe ich auch so, war noch nie soviel postings im us board wie die letzten wochen.

jetzt wären gute news vom vorteil, wenn die euphorie vorbei ist, dann geht es schneller

wieder auf die 0.01 runter wie wir schauen können.

aber ich denke bis 0,16 geht es noch.

jetzt wären gute news vom vorteil, wenn die euphorie vorbei ist, dann geht es schneller

wieder auf die 0.01 runter wie wir schauen können.

aber ich denke bis 0,16 geht es noch.

Antwort auf Beitrag Nr.: 40.925.891 von schneebe am 26.01.11 09:53:52moin FEC- lers,

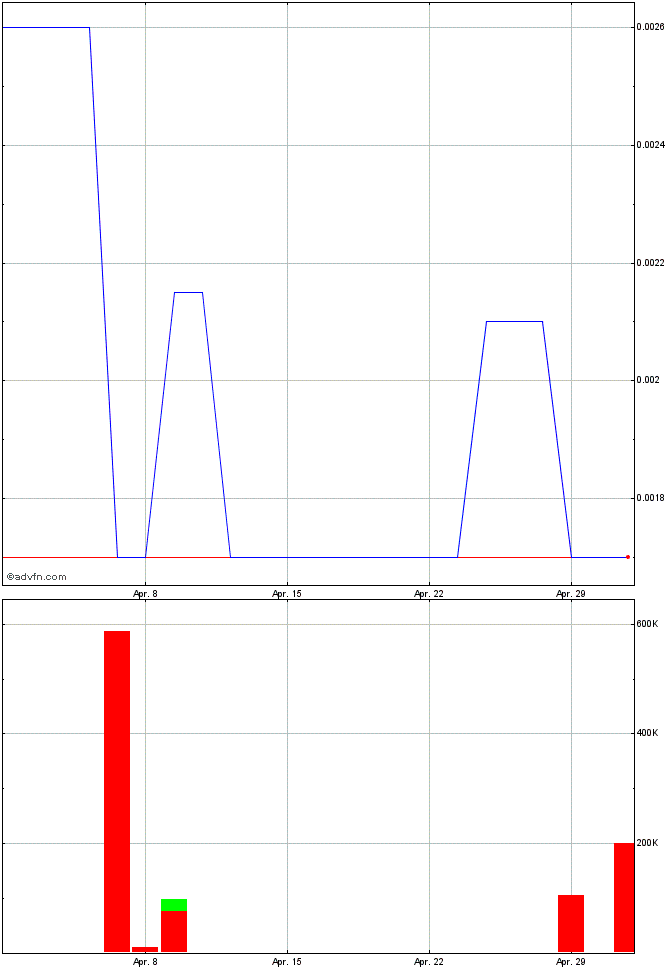

zur verdeutlichung des gewaltigen ansprungs in den letzten monaten mal

zwei chartbilder.

schön erkennbar, mit welcher dynamik es hier zuletzt UPPPP- ging bzw.

phantasie weckend, wohin es NOCH gehen kann......

....wird 2011 DAS jahr für unser flügge werdendes baby

zur verdeutlichung des gewaltigen ansprungs in den letzten monaten mal

zwei chartbilder.

schön erkennbar, mit welcher dynamik es hier zuletzt UPPPP- ging bzw.

phantasie weckend, wohin es NOCH gehen kann......

....wird 2011 DAS jahr für unser flügge werdendes baby

Antwort auf Beitrag Nr.: 40.926.277 von hbg55 am 26.01.11 10:37:21hoffen wir es mal

mit meinem ersten kauf bei 0,40 wird es noch dauern bis ich da im plus bin ,

,

aber mit meinen nachkauf positionen bei durchschnitt 0,01 schaut es eh schon gut aus

mit meinem ersten kauf bei 0,40 wird es noch dauern bis ich da im plus bin

,

,aber mit meinen nachkauf positionen bei durchschnitt 0,01 schaut es eh schon gut aus

heute sehen wir die 0,05

ask ist schon auf 0,054 ist aber nicht aktuell 15 min verzögert

Antwort auf Beitrag Nr.: 40.928.478 von schneebe am 26.01.11 15:21:16

....sieht gaaaaanz so aus, als könnten wir HEUTE die usd 0,05- hürde

nehmen.........

....sieht gaaaaanz so aus, als könnten wir HEUTE die usd 0,05- hürde

nehmen.........

ist aktuell bei 0,062

Antwort auf Beitrag Nr.: 40.929.818 von schneebe am 26.01.11 17:26:15wirklich der hammer

, wie das teil heute aufgepumpt wird, so wie es aussieht dürfte es weiterlaufen

, wie das teil heute aufgepumpt wird, so wie es aussieht dürfte es weiterlaufen

, wie das teil heute aufgepumpt wird, so wie es aussieht dürfte es weiterlaufen

, wie das teil heute aufgepumpt wird, so wie es aussieht dürfte es weiterlaufen

Antwort auf Beitrag Nr.: 40.929.919 von xxtsc am 26.01.11 17:36:10schaut so aus, wird ja auch endlich mal zeit das wir belohnt werden.

Antwort auf Beitrag Nr.: 40.929.952 von schneebe am 26.01.11 17:38:43Hoffentlich kommen bald FEP News. Wenn sich das upside potential bis 20 TCF bestätigt sitzen wir hier auf einen Goldesel! Die jetzigen Kursturbulenzen sind nur ein Vorspiel.

Antwort auf Beitrag Nr.: 40.930.080 von xxtsc am 26.01.11 17:52:22wenn diese jetzt noch nach geschossen werden würden,

dann ist die 0,0 geschichte, 0,1? willkommen.

dann ist die 0,0 geschichte, 0,1? willkommen.

Antwort auf Beitrag Nr.: 40.930.125 von schneebe am 26.01.11 17:58:43Edison hat für FEP ( zur Zeit 64 Pence ) 9 Pfund pro Share veranschlagt. Sobald das 10 Mill.$ Erkundungsprogramm erledigt ist (irgendwann im Laufe des Jahres) und positiv ausfällt wird FEP rasch in den Pfundbereich aufrücken. Für FEC könnte das 0,20 - 0,30 $ bedeuten.

hi Jungs

das sieht ja riesig aus da drüben

lasst uns mal ein wenig mit posten

das sieht ja riesig aus da drüben

lasst uns mal ein wenig mit posten

auch hier zu Lande wird man mutig

Das wird die Ihub - Euphorie weiter anheizen!

Anschnallen bitte, die Startposition ist erreicht!

Anschnallen bitte, die Startposition ist erreicht!

Aquino bares 2 oil exploration projectsJanuary 26, 2011, 8:45pmMANILA, Philippines – President Aquino is excited about two oil exploration projects in the country, including a probable oil reserve in Palawan that may be as big as Iraq’s stock.

The President mentioned the two prospective oil finds that could help meet the country’s oil requirements during a tribute to his mother, the late President Corazon Aquino, in Malacañang last Tuesday.

“A military official has told me about the start of a seismic study in an area of Palawan which allegedly is as big as Iraq’s proven reserves. Iraq, by the way, has the second biggest proven reserve next to Saudi Arabia,” he said in his speech.

The President also cited that local officials of Mindoro Occidental have also informed him about the “sizeable natural gas field” that is being verified in their province.

“Those are the natural resources that are found in the country but there are also those secured by our hard work,” he said.

Apart from oil exploration projects, the President highlighted the flow of investments in the country coming from Japan and other countries. (Genalyn Kabiling)

.http://www.mb.com.ph/articles/300844/aquino-bares-2-oil-expl…" target="_blank" rel="nofollow ugc noopener">

http://www.mb.com.ph/articles/300844/aquino-bares-2-oil-expl…

Anschnallen bitte, die Startposition ist erreicht!

Anschnallen bitte, die Startposition ist erreicht!

Aquino bares 2 oil exploration projectsJanuary 26, 2011, 8:45pmMANILA, Philippines – President Aquino is excited about two oil exploration projects in the country, including a probable oil reserve in Palawan that may be as big as Iraq’s stock.

The President mentioned the two prospective oil finds that could help meet the country’s oil requirements during a tribute to his mother, the late President Corazon Aquino, in Malacañang last Tuesday.

“A military official has told me about the start of a seismic study in an area of Palawan which allegedly is as big as Iraq’s proven reserves. Iraq, by the way, has the second biggest proven reserve next to Saudi Arabia,” he said in his speech.

The President also cited that local officials of Mindoro Occidental have also informed him about the “sizeable natural gas field” that is being verified in their province.

“Those are the natural resources that are found in the country but there are also those secured by our hard work,” he said.

Apart from oil exploration projects, the President highlighted the flow of investments in the country coming from Japan and other countries. (Genalyn Kabiling)

.http://www.mb.com.ph/articles/300844/aquino-bares-2-oil-expl…" target="_blank" rel="nofollow ugc noopener">

http://www.mb.com.ph/articles/300844/aquino-bares-2-oil-expl…

Antwort auf Beitrag Nr.: 40.932.897 von xxtsc am 27.01.11 06:13:31Die IHub - Euphorie hält an. Das Ganze könnte sich als Pump and Dump erweisen, wenn nicht bald FEP News kommen. Keiner kauft FEP Shares, FEC ist mehr wert als FEP. Also aufgepasst, falls der Kurs wieder in sich zusammenfällt.

Gruß

Gruß

Antwort auf Beitrag Nr.: 40.932.897 von xxtsc am 27.01.11 06:13:31volumen steigt immer mehr.

0,067 geschlossen

0,067 geschlossen

Antwort auf Beitrag Nr.: 40.939.794 von schneebe am 27.01.11 22:00:26ich korrigiere 0,065

Antwort auf Beitrag Nr.: 40.939.825 von schneebe am 27.01.11 22:03:53Schon der Wahnsinn, alles ohne News, nur aufgrund IHub Posts...könnte noch weiterlaufen, bevor es abwärts geht.

Antwort auf Beitrag Nr.: 40.939.913 von xxtsc am 27.01.11 22:15:50ist echt der wahnsinn wie die hochgetrieben wird, vielleicht kommen ja noch

super news, wir werden es aber bald wissen wo es hingeht.

super news, wir werden es aber bald wissen wo es hingeht.

Antwort auf Beitrag Nr.: 40.940.861 von schneebe am 28.01.11 08:27:40moin s.,

für MICH verdichten sich die anzeichen, daß hier ´etwas´ gewaltiges

in der luft liegt - ansonsten wären wir gestern in USA nicht mit TOP- vol.

bzw. nahe TH ausm handel gegangen

für MICH verdichten sich die anzeichen, daß hier ´etwas´ gewaltiges

in der luft liegt - ansonsten wären wir gestern in USA nicht mit TOP- vol.

bzw. nahe TH ausm handel gegangen

Antwort auf Beitrag Nr.: 40.942.398 von hbg55 am 28.01.11 11:53:12und die ganze woche waren wir im plus,

bin schon gespannt wie es heute weitergeht.

kann mir auch nur vorstellen das was in der luft liegt,

der umsatz (zumindestens für fec) ist ja enorm.

bin schon gespannt wie es heute weitergeht.

kann mir auch nur vorstellen das was in der luft liegt,

der umsatz (zumindestens für fec) ist ja enorm.

Antwort auf Beitrag Nr.: 40.942.398 von hbg55 am 28.01.11 11:53:12Mag sein, wenn es sich um SC 72 handelt, müsste zuerst FEP profitieren. Aber FEP kauft niemand, wenig Umsatz. Könnte es sich um die anderen Vermögenswerte handeln? Allerdings liegt die Kursfantasie eindeutig auf Palavan! Oder einfach Pump and Dump?

Es sieht weiterhin gut aus. Eine mögliche Erklärung könnte auch sein, dass Philex FEC voll aufkauft, wie sie es bei Philex Gold gemacht haben. Vielleicht wissen Insider mehr und beeilen sich die Aktien aufzukaufen und hoffen auf einen guten Preis. Philex hat letztes Jahr für FEC Shares 0,50$ hingelegt!

Antwort auf Beitrag Nr.: 40.946.887 von xxtsc am 28.01.11 21:58:52

durchaus ein denkbares szenario bzw. ein nachvollziehbarer gedanke

´gegen´ PUMP & DUMP....IMO

durchaus ein denkbares szenario bzw. ein nachvollziehbarer gedanke

´gegen´ PUMP & DUMP....IMO

China vows to continue buying overseas businesses

January 29, 2011, 12:27am

DAVOS, Switzerland, Jan. 28 (AFP) – China pledged Thursday to play its part in lifting global consumption, with Commerce Minister Chen Deming saying the Asian giant planned to double its imports over the next five years.

''Our development needs to be shared, so in future we will be even more open. We will focus on Chinese companies investing overseas, buying even more from overseas,'' Chen told political and economic elites gathered at the annual World Economic Forum meeting in Davos. ''We want to help boost consumption,'' he declared.

Major industrialized nations such as the United States have been urging China to help rebalance the global economy by boosting domestic consumption and cutting its reliance on exports.

On Thursday, Chen outlined Beijing's plan to ''focus even more on joint development'' with the world in the next 10 years and noted that its internal market of 1.3 billion people was a massive opportunity for foreign firms.

China is latching on to the occasion of its 10th year anniversary as a member of the World Trade Organization as a ''new start.'' ''We plan to be even more open. China is planning to double import trade in the next five years,'' he told reporters.

''We are encouraging Chinese companies to head out all over the world and expand. We are also building up our domestic market to increase consumption,'' he added.

China has been posting 15-16 percent annual growth in domestic consumption in recent years, Chen noted. ''In the next 10 years, such robust growth will continue,'' he added.

Chen last week voiced hopes that US exports to China would more than double to 200 billion dollars by 2015 as part of 500 billion dollars in overall trade.

Nevertheless, the latest US data showed that the US trade deficit with China in 2010 was likely to top the 2008 record of 268 billion dollars, even though the overall US trade gap shrank in November.

Chen said that Chinese trade surplus makes up a ''very small part'' of the country's output.

''Ninety-nine percent of our trade surplus is really against one country. This year, we will try our best to change this situation very quickly,'' he said, referring to the United States.

January 29, 2011, 12:27am

DAVOS, Switzerland, Jan. 28 (AFP) – China pledged Thursday to play its part in lifting global consumption, with Commerce Minister Chen Deming saying the Asian giant planned to double its imports over the next five years.

''Our development needs to be shared, so in future we will be even more open. We will focus on Chinese companies investing overseas, buying even more from overseas,'' Chen told political and economic elites gathered at the annual World Economic Forum meeting in Davos. ''We want to help boost consumption,'' he declared.

Major industrialized nations such as the United States have been urging China to help rebalance the global economy by boosting domestic consumption and cutting its reliance on exports.

On Thursday, Chen outlined Beijing's plan to ''focus even more on joint development'' with the world in the next 10 years and noted that its internal market of 1.3 billion people was a massive opportunity for foreign firms.

China is latching on to the occasion of its 10th year anniversary as a member of the World Trade Organization as a ''new start.'' ''We plan to be even more open. China is planning to double import trade in the next five years,'' he told reporters.

''We are encouraging Chinese companies to head out all over the world and expand. We are also building up our domestic market to increase consumption,'' he added.

China has been posting 15-16 percent annual growth in domestic consumption in recent years, Chen noted. ''In the next 10 years, such robust growth will continue,'' he added.

Chen last week voiced hopes that US exports to China would more than double to 200 billion dollars by 2015 as part of 500 billion dollars in overall trade.

Nevertheless, the latest US data showed that the US trade deficit with China in 2010 was likely to top the 2008 record of 268 billion dollars, even though the overall US trade gap shrank in November.

Chen said that Chinese trade surplus makes up a ''very small part'' of the country's output.

''Ninety-nine percent of our trade surplus is really against one country. This year, we will try our best to change this situation very quickly,'' he said, referring to the United States.

0,031

3.000,00 %

0,030

macht was her

3.000,00 %

0,030

macht was her

moin ALLLL,

sehen zwar vereinzelt gewinnmitnahmen, OHNE allerdings neu- gefundenes

kursniv. zu verlassen.......sieht gut aus....IMO

sehen zwar vereinzelt gewinnmitnahmen, OHNE allerdings neu- gefundenes

kursniv. zu verlassen.......sieht gut aus....IMO

gewaltig unter Pari hier !!

Antwort auf Beitrag Nr.: 40.970.237 von hainholz am 02.02.11 18:09:23Forum Energy obtains nod to explore Reed Bank gas prospect

by Alena Mae S. Flores

The Energy Department gave the go-signal to Forum Energy Plc of UK to proceed with the exploration of the Reed Bank basin near the disputed Kalayaan Islands off South China Sea.

Energy Secretary Jose Rene Almendras said Forum Energy’s work program for service contract 72 located offshore West Palawan complied with the requirements of the department.

“Forum is okay,” Almendras said when asked if Forum passed the review of the petroleum service contracts. “Their work program is in order.”

The work program includes 3D seismic work over an area of up to 550 square kilometers over and around the Sampaguita gas discovery, and 2,200 line-km of high resolution 2D over existing leads within the 8,800 sq. km. contract area.

Forum Energy is expected to complete acquisition of the seismic data in the first half for technical analysis.

Almendras said “discussions are ongoing” regarding Forum’s planned exploration activities.

Almendras has threatened to cancel the service contracts of non-performing oil and gas companies.

Forum Philippines Holdings Ltd., a wholly-owned subsidiary of Forum, earlier signed a $10-million facility agreement with Philex Mining Corp. to partly finance the work program in SC 72.

Earlier results from a 248-sq. km 3D seismic survey over the SC 72 contract area in 2006 indicated 3.4 trillion cubic feet of gas at the Reed Bank basin.

“The company continues to have discussions with potential strategic partners for the purpose of accelerating the development of SC 72. However, no firm proposal is currently being considered,” Forum said.

http://www.manilastandardtoday.com/insideBusiness.htm?f=2011…

by Alena Mae S. Flores

The Energy Department gave the go-signal to Forum Energy Plc of UK to proceed with the exploration of the Reed Bank basin near the disputed Kalayaan Islands off South China Sea.

Energy Secretary Jose Rene Almendras said Forum Energy’s work program for service contract 72 located offshore West Palawan complied with the requirements of the department.

“Forum is okay,” Almendras said when asked if Forum passed the review of the petroleum service contracts. “Their work program is in order.”

The work program includes 3D seismic work over an area of up to 550 square kilometers over and around the Sampaguita gas discovery, and 2,200 line-km of high resolution 2D over existing leads within the 8,800 sq. km. contract area.

Forum Energy is expected to complete acquisition of the seismic data in the first half for technical analysis.

Almendras said “discussions are ongoing” regarding Forum’s planned exploration activities.

Almendras has threatened to cancel the service contracts of non-performing oil and gas companies.

Forum Philippines Holdings Ltd., a wholly-owned subsidiary of Forum, earlier signed a $10-million facility agreement with Philex Mining Corp. to partly finance the work program in SC 72.

Earlier results from a 248-sq. km 3D seismic survey over the SC 72 contract area in 2006 indicated 3.4 trillion cubic feet of gas at the Reed Bank basin.

“The company continues to have discussions with potential strategic partners for the purpose of accelerating the development of SC 72. However, no firm proposal is currently being considered,” Forum said.

http://www.manilastandardtoday.com/insideBusiness.htm?f=2011…

Antwort auf Beitrag Nr.: 41.004.474 von schneebe am 08.02.11 18:43:33Was für Mondkurse in Deutschland!

Antwort auf Beitrag Nr.: 41.005.101 von xxtsc am 08.02.11 19:57:48xxtsc

Re: styl post# 2863

I bought FECOF in 2008 and last year because of the substance. This is not a typical penny. No dilution. Philex last year paid 0.50 cents per share. FECOF is a long play and this year will be the year of good news.

hoffen wir´s mal, dass es ein gutes jahr wird.

Re: styl post# 2863

I bought FECOF in 2008 and last year because of the substance. This is not a typical penny. No dilution. Philex last year paid 0.50 cents per share. FECOF is a long play and this year will be the year of good news.

hoffen wir´s mal, dass es ein gutes jahr wird.

endlich habe die mal die homepage aktualisiert

Antwort auf Beitrag Nr.: 41.007.619 von schneebe am 09.02.11 10:10:26ach,sag blos

da muß ich gleich mal nachsehen

da muß ich gleich mal nachsehen

Antwort auf Beitrag Nr.: 41.011.553 von hainholz am 09.02.11 17:46:36Update:

FEC Provides Update on SC72 and Lascogon Mining Corporation

Mar 4, 2011 1:16:00 PM

Lascogon Mining Corporation

FEC has recently appointed two directors to the Board of Lascogon. It is anticipated that the Board of Lascogon will convene in the coming weeks to examine available results and make recommendations to the joint venture partners. The Company will provide a further update once it receives the results and recommendations from the Board of Lascogon.

Forum Energy Plc

FEP approved a work program for the first sub-phase of the Service Contract 72, designed to provide a more comprehensive valuation of the contract area and identify potential sites for appraisal wells. FEP's 70% share of the first sub-phase work program will be funded by a US$10 million Facility Agreement with Philex Mining Corporation.

FEC's President commented, "We are pleased that FEP was able to source the funds for the work program in order to maintain FEC's shareholding in FEP at 25.63%. We are looking forward to the results of the work program and are pleased to see that the project is moving ahead."

For and on behalf of the Company:

FEC Resources, Inc.

"J.E. Villaluna"

Jose Ernesto C. Villaluna, Jr.

President & CEO

This release contains "forward looking statements" as per Section 21E of the US Securities and Exchange Act of 1934, as amended. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Management is currently reviewing many options and there is no assurance that they will not make decisions other than those now contemplated. The Company is subject to political risks and operational risks identified in documents filed with the Securities and Exchange Commission, including changing and depressed oil prices, unsuccessful drilling results, change of government and political unrest in its main area of operations

For more information please call (403) 290-1676 e-mail info@FECResources.com or visit the FEC Resources website at www.FECResources.com

SOURCE FEC Resources Inc.

----------------------------------------------

FEC Resources Inc

+1-403-290-1676

fax

+1-403-398-1382

info@FECResources.com

FEC Provides Update on SC72 and Lascogon Mining Corporation

Mar 4, 2011 1:16:00 PM

Lascogon Mining Corporation

FEC has recently appointed two directors to the Board of Lascogon. It is anticipated that the Board of Lascogon will convene in the coming weeks to examine available results and make recommendations to the joint venture partners. The Company will provide a further update once it receives the results and recommendations from the Board of Lascogon.

Forum Energy Plc

FEP approved a work program for the first sub-phase of the Service Contract 72, designed to provide a more comprehensive valuation of the contract area and identify potential sites for appraisal wells. FEP's 70% share of the first sub-phase work program will be funded by a US$10 million Facility Agreement with Philex Mining Corporation.

FEC's President commented, "We are pleased that FEP was able to source the funds for the work program in order to maintain FEC's shareholding in FEP at 25.63%. We are looking forward to the results of the work program and are pleased to see that the project is moving ahead."

For and on behalf of the Company:

FEC Resources, Inc.

"J.E. Villaluna"

Jose Ernesto C. Villaluna, Jr.

President & CEO

This release contains "forward looking statements" as per Section 21E of the US Securities and Exchange Act of 1934, as amended. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Management is currently reviewing many options and there is no assurance that they will not make decisions other than those now contemplated. The Company is subject to political risks and operational risks identified in documents filed with the Securities and Exchange Commission, including changing and depressed oil prices, unsuccessful drilling results, change of government and political unrest in its main area of operations

For more information please call (403) 290-1676 e-mail info@FECResources.com or visit the FEC Resources website at www.FECResources.com

SOURCE FEC Resources Inc.

----------------------------------------------

FEC Resources Inc

+1-403-290-1676

fax

+1-403-398-1382

info@FECResources.com

Antwort auf Beitrag Nr.: 41.150.675 von xxtsc am 04.03.11 19:44:46geht alles seinen gang

Antwort auf Beitrag Nr.: 41.151.205 von hainholz am 04.03.11 21:33:25Hi Hain, bin gespannt auf das Goldupdate. Was ich bisher über Lascogon weiss stimmt mich positiv, zumal das Gold, was bisher nachgewiesen ist, oberflächennah liegt. Was mag wohl in der Tiefe vorhanden sein? Gold, Öl und Gas, das wird eine explosive Mischung. Obwohl FEC seit seinem Tiefs mehr als 1000 % gemacht hat, stehen wir immer noch am Anfang. Meine Shares sind alle Freeshares, meinen Einsatz habe ich raus. Was soll hier noch schief gehen mit Philex als starken Partner?

Antwort auf Beitrag Nr.: 41.152.385 von xxtsc am 05.03.11 12:23:38 Was soll hier noch schief gehen mit Philex als starken Partner?

na nix mehr

na nix mehr

Antwort auf Beitrag Nr.: 41.153.182 von hainholz am 05.03.11 18:11:17was meinst du denn mit Freeshares ?

Antwort auf Beitrag Nr.: 41.153.794 von hainholz am 06.03.11 01:02:08Habe einen kleinen Teil mit 1000 % Gewinn verkauft und damit die Anschaffungskosten für den Gesamtbestand reingeholt. Die verbleibenden Shares haben somit nix gekostet und immer, wenn ich so verfahre, bezeichne ich sie als "Freeshares".

0,048

45,45 %

0,0150

gewaltiger Umsatz

45,45 %

0,0150

gewaltiger Umsatz

Antwort auf Beitrag Nr.: 41.160.394 von hainholz am 07.03.11 19:01:22Wer hat sich denn in Frankfurt 50 Stück gegönnt?

Antwort auf Beitrag Nr.: 41.160.471 von xxtsc am 07.03.11 19:14:07

...HEUTE schon 30k zu € 0,049

weiß da EINER schon meeeeeehr

...HEUTE schon 30k zu € 0,049

weiß da EINER schon meeeeeehr

in USA das ASK hoch auf o,o6

Last Price

0.047

Change $

0.006

Change %

14.63%

vielleicht doch was los

Last Price

0.047

Change $

0.006

Change %

14.63%

vielleicht doch was los

FEP Results

Final Results

TIDMFEP

RNS Number : 5465C

Forum Energy Plc

08 March 2011

8 March 2011

FORUM ENERGY PLC

("Forum Energy" or the "Company")

Audited results for the year ended 31 December 2010

Forum Energy, the UK incorporated oil and gas exploration and production company with a focus on the Philippines, today announces its audited results for the year ended 31 December 2010.

OPERATIONAL HIGHLIGHTS

-- Conversion of the GSEC101 licence to Service Contract 72 in February 2010

-- First sub-phase work programme ongoing and 2D and 3D seismic surveys on track for completion within Q1 2011

-- Galoc production of 61,000 barrels in 2010 (net to Forum) and expected 40,000 barrels (net to Forum) in 2011. Forum has a 2.27% interest in the Galoc field

FINANCIAL AND CORPORATE HIGHLIGHTS

-- Revenues of US$6.1 million in 2010 (US$1.8 million - 2009)

-- Gross Profit of US$2.1 million in 2010 (US$0.2 million - 2009)

-- Fixed overhead costs US$2.4 million in 2010 (US$2.6 million - 2009)

-- Working capital of US$1.7 million as of 31 December 2010 (US$4.1 million - 2009)

-- Facility Agreement with Philex Mining Corporation for US$10 million to be utilized within 3 years

-- Shareholders' equity of US$44 million as of 31 December 2010 (US$44 million - 2009)

Robin Nicholson, Executive Chairman, commented:

"The main development in 2010 was the final conversion of the GSEC101 licence area to a Service Contract in February 2010 and the implementation of the first sub-phase work programme which includes a further 550 Km(2) of 3D seismic and 2,200 line Km of 2D seismic, expected to be completed within Q1 2011. In addition, the Company progressed discussions with potential strategic partners. A facility agreement with Philex Mining for US$10 million has enabled Forum to progress the development of its principal asset and we look forward to further developments at a critical point in the Company's development."

Final Results

TIDMFEP

RNS Number : 5465C

Forum Energy Plc

08 March 2011

8 March 2011

FORUM ENERGY PLC

("Forum Energy" or the "Company")

Audited results for the year ended 31 December 2010

Forum Energy, the UK incorporated oil and gas exploration and production company with a focus on the Philippines, today announces its audited results for the year ended 31 December 2010.

OPERATIONAL HIGHLIGHTS

-- Conversion of the GSEC101 licence to Service Contract 72 in February 2010

-- First sub-phase work programme ongoing and 2D and 3D seismic surveys on track for completion within Q1 2011

-- Galoc production of 61,000 barrels in 2010 (net to Forum) and expected 40,000 barrels (net to Forum) in 2011. Forum has a 2.27% interest in the Galoc field

FINANCIAL AND CORPORATE HIGHLIGHTS

-- Revenues of US$6.1 million in 2010 (US$1.8 million - 2009)

-- Gross Profit of US$2.1 million in 2010 (US$0.2 million - 2009)

-- Fixed overhead costs US$2.4 million in 2010 (US$2.6 million - 2009)

-- Working capital of US$1.7 million as of 31 December 2010 (US$4.1 million - 2009)

-- Facility Agreement with Philex Mining Corporation for US$10 million to be utilized within 3 years

-- Shareholders' equity of US$44 million as of 31 December 2010 (US$44 million - 2009)

Robin Nicholson, Executive Chairman, commented:

"The main development in 2010 was the final conversion of the GSEC101 licence area to a Service Contract in February 2010 and the implementation of the first sub-phase work programme which includes a further 550 Km(2) of 3D seismic and 2,200 line Km of 2D seismic, expected to be completed within Q1 2011. In addition, the Company progressed discussions with potential strategic partners. A facility agreement with Philex Mining for US$10 million has enabled Forum to progress the development of its principal asset and we look forward to further developments at a critical point in the Company's development."

Antwort auf Beitrag Nr.: 41.165.692 von hainholz am 08.03.11 16:38:12The main development in 2010 was the final conversion of the GSEC101 licence area to a Service Contract in February 2010 and the implementation of the first sub-phase work programme which includes a further 550 Km(2) of 3D seismic and 2,200 line Km of 2D seismic, expected to be completed within Q1 2011.

Das wäre in spät. drei Wochen, es sei denn, die Aussetzung der Exploration nach dem Zwischenfall mit dem chinesischen Militärboot verzögert das Ganze.

Heute war der Umsatz in Frankfurt höher als bis jetzt im Amiland. Aber das kann sich ja noch ändern!

Das wäre in spät. drei Wochen, es sei denn, die Aussetzung der Exploration nach dem Zwischenfall mit dem chinesischen Militärboot verzögert das Ganze.

Heute war der Umsatz in Frankfurt höher als bis jetzt im Amiland. Aber das kann sich ja noch ändern!

Antwort auf Beitrag Nr.: 41.166.922 von xxtsc am 08.03.11 19:23:26die sind auf dem richtigen Weg!

ein strategischer Partner wird bestimmt demnächst auch benannt,es sei denn,sie stemmen es mit philex allein.

ein strategischer Partner wird bestimmt demnächst auch benannt,es sei denn,sie stemmen es mit philex allein.

Antwort auf Beitrag Nr.: 41.168.386 von hainholz am 09.03.11 08:09:092011 wird unser Jahr. Noch dümmpelt FEP bei 60 Pence, könnte sein, dass sie bald bei 9 Pfund stehen ( ein Kursziel von Edison-Research ). FEC wird entsprechend profitieren!

Antwort auf Beitrag Nr.: 41.172.264 von xxtsc am 09.03.11 17:08:20was ist denn heut in USA los?

ausgesetzt oder einfach

ausgesetzt oder einfach

Antwort auf Beitrag Nr.: 41.172.684 von hainholz am 09.03.11 17:59:47war doch gestern auch so...handel kam erst kurz vorm börsenschluss auf

Antwort auf Beitrag Nr.: 41.173.053 von xxtsc am 09.03.11 18:51:41hast ja nen dollen Bericht in USA reingesetzt

Forum Energy im Ranking verbessert!!

außerdem fortgeschrittene Gespräche mit potentiellen partnern

Forum Energy Annual Revenue Up

By Staff Writer

Wednesday, 09 March 2011

UK-based oil and gas exploration firm Forum Energy has reported a revenue of $6.07m for the full year ended December 31, 2010, compared to $1.79m for the same period in 2009.

The company posted a gross profit of $2.06m for the full year of 2010, compared to $0.2m for the same period in 2009.

Total administrative expenses were $2.4m, compared to $2.58m for the same period in 2009.

Loss from operations was $0.34m, compared to $2.38m for the same period in 2009.

Loss for the year was $0.56m, compared to $3.73m for the same period in 2009.

The group's working capital decreased from $4.1m to $1.7m, primarily due to capital spending during the year on service contract 72 (SC72) first sub-phase.

Financial income and expenses recorded a net loss of $0.22m compared to a net loss of $0.12m in the previous year primarily due to unrealised losses on a Philippines peso-based long term creditor.

Robin Nicholson, executive chairman of the company, said: “The main development in 2010 was the final conversion of the GSEC101 licence area to a service contract in February 2010 and the implementation of the first sub-phase work programme which includes a further 550 Km2of 3D seismic and 2,200 line Km of 2D seismic, expected to be completed within Q1 2011.

In addition, the company progressed discussions with potential strategic partners.

“A facility agreement with Philex Mining for $10m has enabled Forum to progress the development of its principal asset and we look forward to further developments at a critical point in the company’s development.”

Will the firm further improve revenue in 2011?

Have your say and discuss with your peers on the InfoGrok community.

Participate by posting your comments now.

Forum Energy plc's Index Rating

Current Index Score Historical Index Score

Forum Energy plc is currently ranked 12 out of 12061 companies.

This is in the top 0.01 percent of companies ranked in the index.

Forum Energy plc is currently ranked 21 out of 35419 included in the InfoGrok Company Index.

This is the top 0.06 percent of companies.

User perception of the company stands at 50 percent.

This differs 0 percent over the score attributed to the company by other scoring factors.

außerdem fortgeschrittene Gespräche mit potentiellen partnern

Forum Energy Annual Revenue Up

By Staff Writer

Wednesday, 09 March 2011

UK-based oil and gas exploration firm Forum Energy has reported a revenue of $6.07m for the full year ended December 31, 2010, compared to $1.79m for the same period in 2009.

The company posted a gross profit of $2.06m for the full year of 2010, compared to $0.2m for the same period in 2009.

Total administrative expenses were $2.4m, compared to $2.58m for the same period in 2009.

Loss from operations was $0.34m, compared to $2.38m for the same period in 2009.

Loss for the year was $0.56m, compared to $3.73m for the same period in 2009.

The group's working capital decreased from $4.1m to $1.7m, primarily due to capital spending during the year on service contract 72 (SC72) first sub-phase.

Financial income and expenses recorded a net loss of $0.22m compared to a net loss of $0.12m in the previous year primarily due to unrealised losses on a Philippines peso-based long term creditor.

Robin Nicholson, executive chairman of the company, said: “The main development in 2010 was the final conversion of the GSEC101 licence area to a service contract in February 2010 and the implementation of the first sub-phase work programme which includes a further 550 Km2of 3D seismic and 2,200 line Km of 2D seismic, expected to be completed within Q1 2011.

In addition, the company progressed discussions with potential strategic partners.

“A facility agreement with Philex Mining for $10m has enabled Forum to progress the development of its principal asset and we look forward to further developments at a critical point in the company’s development.”

Will the firm further improve revenue in 2011?

Have your say and discuss with your peers on the InfoGrok community.

Participate by posting your comments now.

Forum Energy plc's Index Rating

Current Index Score Historical Index Score

Forum Energy plc is currently ranked 12 out of 12061 companies.

This is in the top 0.01 percent of companies ranked in the index.

Forum Energy plc is currently ranked 21 out of 35419 included in the InfoGrok Company Index.

This is the top 0.06 percent of companies.

User perception of the company stands at 50 percent.

This differs 0 percent over the score attributed to the company by other scoring factors.

Antwort auf Beitrag Nr.: 41.174.913 von hainholz am 10.03.11 07:32:28Spradly Islands und Reed Bank sind nun mal verschiedene Schuhe...im AmiBoard scheint die Luft erstmal raus zu sein...wenn FEP lange mit News auf sich warten lässt wird wohl der Kurs langsam nach Süden gehen

RNS Number : 9724C

Forum Energy Plc

15 March 2011

FORUM ENERGY plc

("Forum Energy" or the "Company")

2D and 3D seismic surveys completed

Forum Energy is pleased to announce that it has completed its seismic acquisition over SC72.

As part of the work program, 564.887 Km2 of 3D seismic data was acquired over the Sampaguita Gas Field and 2,202.38 Line-Km of 2D seismic data was also acquired over the block in order to further define additional leads identified within the SC72 acreage.

The Company will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next sub-phase of the SC72 licence.

The survey was carried out by CGG Veritas, using the M/V Veritas Voyager.

Robin Nicholson, Executive Chairman, commented:

"We are delighted to have completed our work programme so efficiently and ahead of our anticipated schedule. We have now met our contractual commitments with the Philippine Department of Energy under Service Contract 72 and look forward to making further investments into the project."

For further information please contact:

Forum Energy Plc

Andrew Mullins, Tel: +44 (0) 1932 445 344

Executive Director

Company Secretary

Execution Noble & Company Ltd (Nominated Adviser & Broker)

Harry Stockdale Tel: +44 (0) 207 456 9191

Or visit the Company's website:

www.forumenergy.com

Notes to Editors:

1 Service Contract 72 (formerly GSEC101) is an 8,800 Km2 licence located approximately 100 Km offshore West Palawan, in the South China Sea. Forum Energy Plc (through its 100% interest in Forum Philippine Holdings Ltd and Forum (GSEC101) Ltd) holds a 70% equity interest in the SC72 licence.

2 In 2006, results from a 248-square kilometre 3D seismic survey over the SC72 licence area indicated mean 3.4 Trillion Cubic Feet (TCF) gas-in-place (GIP) at the Sampaguita Gas Discovery.

3 Philex Mining Corporation (through its interests in FEC Resources, Inc and Philex Petroleum Corporation) controls 64.45% of the share capital of Forum.

Forum Energy Plc

15 March 2011

FORUM ENERGY plc

("Forum Energy" or the "Company")

2D and 3D seismic surveys completed

Forum Energy is pleased to announce that it has completed its seismic acquisition over SC72.

As part of the work program, 564.887 Km2 of 3D seismic data was acquired over the Sampaguita Gas Field and 2,202.38 Line-Km of 2D seismic data was also acquired over the block in order to further define additional leads identified within the SC72 acreage.

The Company will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next sub-phase of the SC72 licence.

The survey was carried out by CGG Veritas, using the M/V Veritas Voyager.

Robin Nicholson, Executive Chairman, commented:

"We are delighted to have completed our work programme so efficiently and ahead of our anticipated schedule. We have now met our contractual commitments with the Philippine Department of Energy under Service Contract 72 and look forward to making further investments into the project."

For further information please contact:

Forum Energy Plc

Andrew Mullins, Tel: +44 (0) 1932 445 344

Executive Director

Company Secretary

Execution Noble & Company Ltd (Nominated Adviser & Broker)

Harry Stockdale Tel: +44 (0) 207 456 9191

Or visit the Company's website:

www.forumenergy.com

Notes to Editors:

1 Service Contract 72 (formerly GSEC101) is an 8,800 Km2 licence located approximately 100 Km offshore West Palawan, in the South China Sea. Forum Energy Plc (through its 100% interest in Forum Philippine Holdings Ltd and Forum (GSEC101) Ltd) holds a 70% equity interest in the SC72 licence.

2 In 2006, results from a 248-square kilometre 3D seismic survey over the SC72 licence area indicated mean 3.4 Trillion Cubic Feet (TCF) gas-in-place (GIP) at the Sampaguita Gas Discovery.

3 Philex Mining Corporation (through its interests in FEC Resources, Inc and Philex Petroleum Corporation) controls 64.45% of the share capital of Forum.

Antwort auf Beitrag Nr.: 41.207.710 von schneebe am 15.03.11 14:20:59Das sieht gut aus. Momentan ist es ein großer Vorteil, dass FEC als Wert kaum jemand kennt. Wenn ich mir die Panikverkäufe bei anderen Werten ansehe, steht FEC gut da.

Antwort auf Beitrag Nr.: 41.209.689 von xxtsc am 15.03.11 17:11:18ja ist der wahnsinnig, dax war heute schon über 5% im minus,

gott sei dank kennt noch kaum einer fec, aber das wird

noch kommen, bin auf die ausgewerteten daten gespannt.

gott sei dank kennt noch kaum einer fec, aber das wird

noch kommen, bin auf die ausgewerteten daten gespannt.

Forum Energy Plc Seismic Completed

Fec Resources (OTCBB:FECOF)

Intraday Stock Chart

Today : Wednesday 16 March 2011

Click Here for more Fec Resources Charts.

FEC Resources, Inc. (OTC Bulletin Board: FECOF) ("FEC" or the "Company") reports that Forum Energy Plc ("Forum") has announced the following:

"2D and 3D seismic surveys completed"

Forum Energy is pleased to announce that it has completed its seismic acquisition over SC72.

As part of the work program, 564.887 Km(2) of 3D seismic data was acquired over the Sampaguita Gas Field and 2,202.38 Line-Km of 2D seismic data was also acquired over the block in order to further define additional leads identified within the SC72 acreage.

The Company will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next sub-phase of the SC72 licence.

The survey was carried out by CGG Veritas, using the M/V Veritas Voyager.

Robin Nicholson, Executive Chairman, commented:

"We are delighted to have completed our work programme so efficiently and ahead of our anticipated schedule. We have now met our contractual commitments with the Philippine Department of Energy under Service Contract 72 and look forward to making further investments into the project."

For and on behalf of the Company:

FEC Resources, Inc.

"J.E. Villaluna"

Jose Ernesto C. Villaluna, Jr.

President & CEO

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any natural resources that may be located, variations in the market price of any natural resource products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce natural resources from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company's Annual Report on Form 20-F for the year ended December 31, 2009 and its most recent quarterly reports filed with the United States Securities Exchange Commission (the "SEC"), and other information released by the Company and filed with the appropriate regulatory agencies. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and its United States public disclosure filings may be accessed via www.sec.gov, and readers are urged to review these materials.

For more information please contact (403) 290-1676 e-mail info@FECResources.com or visit the FEC Resources website at www.FECResources.com

SOURCE FEC Resources, Inc.

Fec Resources (OTCBB:FECOF)

Intraday Stock Chart

Today : Wednesday 16 March 2011

Click Here for more Fec Resources Charts.

FEC Resources, Inc. (OTC Bulletin Board: FECOF) ("FEC" or the "Company") reports that Forum Energy Plc ("Forum") has announced the following:

"2D and 3D seismic surveys completed"

Forum Energy is pleased to announce that it has completed its seismic acquisition over SC72.

As part of the work program, 564.887 Km(2) of 3D seismic data was acquired over the Sampaguita Gas Field and 2,202.38 Line-Km of 2D seismic data was also acquired over the block in order to further define additional leads identified within the SC72 acreage.

The Company will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next sub-phase of the SC72 licence.

The survey was carried out by CGG Veritas, using the M/V Veritas Voyager.

Robin Nicholson, Executive Chairman, commented:

"We are delighted to have completed our work programme so efficiently and ahead of our anticipated schedule. We have now met our contractual commitments with the Philippine Department of Energy under Service Contract 72 and look forward to making further investments into the project."

For and on behalf of the Company:

FEC Resources, Inc.

"J.E. Villaluna"

Jose Ernesto C. Villaluna, Jr.

President & CEO

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any natural resources that may be located, variations in the market price of any natural resource products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce natural resources from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company's Annual Report on Form 20-F for the year ended December 31, 2009 and its most recent quarterly reports filed with the United States Securities Exchange Commission (the "SEC"), and other information released by the Company and filed with the appropriate regulatory agencies. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and its United States public disclosure filings may be accessed via www.sec.gov, and readers are urged to review these materials.

For more information please contact (403) 290-1676 e-mail info@FECResources.com or visit the FEC Resources website at www.FECResources.com

SOURCE FEC Resources, Inc.

bleiben wir bei diesem

Forum Energy eyes partners for Reed Bank

FORUM Energy Plc. is in talks with potential partners for the development of its exploration block in the Reed Bank Basin in offshore West Palawan.

Robin Nicholson, Forum Energy executive chairman, said in a report that the company has “progressed discussions with potential strategic partners” for Service Contract (SC) 72.

The company is completing a 550 square kilometer of 3D seismic and 2,200 line kilometer of 2D seismic exploration activity over the oil and gas block that is expected to be completed within the first quarter of the year.

SC 72 was awarded to Forum Energy in February 2010 after the Department of Energy approved the conversion of the Geophysical Survey and Exploration Contract (GSEC) 101 into a full SC, allowing the company to proceed with drilling activities.

GSEC 101 was earlier included in an area in the Spratly’s Islands covered by a marine seismic study under a tripartite agreement among the Philippines, China and Vietnam, leading to delays in the area’s conversion into a full SC.

The acquisition of seismic data over the 8,800 square kilometer exploration block is part of Forum Energy’s first sub-phase work program, which is estimated to cost approximately $7.4 million.

“The completion of our first sub-phase work program over SC 72 will be a milestone for the company since the last data acquisition which was concluded over five years ago.

We expect that this data will give us significant additional information that will enable the company to better assess the various development scenarios and potential partnership options for the SC 72 block at a critical time in the development of this important asset,” Nicholson said.

Forum Energy eyes partners for Reed Bank

FORUM Energy Plc. is in talks with potential partners for the development of its exploration block in the Reed Bank Basin in offshore West Palawan.

Robin Nicholson, Forum Energy executive chairman, said in a report that the company has “progressed discussions with potential strategic partners” for Service Contract (SC) 72.

The company is completing a 550 square kilometer of 3D seismic and 2,200 line kilometer of 2D seismic exploration activity over the oil and gas block that is expected to be completed within the first quarter of the year.

SC 72 was awarded to Forum Energy in February 2010 after the Department of Energy approved the conversion of the Geophysical Survey and Exploration Contract (GSEC) 101 into a full SC, allowing the company to proceed with drilling activities.

GSEC 101 was earlier included in an area in the Spratly’s Islands covered by a marine seismic study under a tripartite agreement among the Philippines, China and Vietnam, leading to delays in the area’s conversion into a full SC.

The acquisition of seismic data over the 8,800 square kilometer exploration block is part of Forum Energy’s first sub-phase work program, which is estimated to cost approximately $7.4 million.

“The completion of our first sub-phase work program over SC 72 will be a milestone for the company since the last data acquisition which was concluded over five years ago.

We expect that this data will give us significant additional information that will enable the company to better assess the various development scenarios and potential partnership options for the SC 72 block at a critical time in the development of this important asset,” Nicholson said.

65 11.00 (20.37%) up in London

NEWS in THE AIR

NEWS in THE AIR

Antwort auf Beitrag Nr.: 41.248.917 von hainholz am 22.03.11 17:40:44Hallo hainholz,

ist wirklich noch zu erwarten, dass diese Firma noch mal auf die Beine kommt? Wenn ja, was für Gründe wären das?

ist wirklich noch zu erwarten, dass diese Firma noch mal auf die Beine kommt? Wenn ja, was für Gründe wären das?

Antwort auf Beitrag Nr.: 41.250.530 von Bollodotz am 22.03.11 22:53:28z.B.

das hier

Forum Energy completes Reed Bank survey

By Donnabelle L. Gatdula, The Philippine Star

Posted at 03/23/2011 1:57 AM | Updated as of 03/23/2011 2:01 AM

MANILA, Philippines - Despite territorial disputes, UK-based Forum Energy Plc said it had completed its seismic survey at Service Contract (SC) 72 in the Reed Bank basin.

In a report, Forum executive chairman Robin Nicholson said as part of the work program, 564.887 square kilometers of 3D seismic data was acquired over the Sampaguita gas field and 2,202.38 line-kilometers of 2D seismic data was also acquired over the block in order to further define additional leads identified within the SC 72 acreage.

Nicholson said the company will continue to pour in capital for exploration in the area.

“We are delighted to have completed our work program so efficiently and ahead of our anticipated schedule.

We have now met our contractual commitments with the Department of Energy under Service Contract 72 and look forward to making further investments into the project,” he said.

Forum Energy had been stressing that SC 72 is not situated in the disputed Spratlys Group of Islands.

It said the contract is located in the Reed Bank basin which is at least 150 kilometers east of the disputed Spratlys Island and is closer to the island of Palawan.

It said SC 72 is within the 200-nautical mile exclusive economic zone (EEZ) based on Republic Act 9522 or the Philippine Archipelagic Baseline Law signed on March 10, 2009.

RA 9522 defines the archipelagic baselines of the Philippines, while affirming Philippine sovereignty and jurisdiction over these areas, which include SC 72.

Reed Bank has been subject of numerous exploration campaigns in the past.

The first petroleum contract in the area was awarded by the then Ministry of Energy in 1975.

Forum (through its 100% interest in Forum Philippine Holdings Ltd and Forum (GSEC101) Ltd). holds a 70% equity interest in the SC 72 license.

Philex Mining Corp. (through its interests in FEC Resources Inc. and Philex Petroleum Corp.) controls 64.45% of the share capital of Forum.

Philex provided a financing facility worth $10 million that enabled Forum to progress the development of SC 72.

In its report, Forum said it will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next sub-phase of the SC 72 license.

MANILA, Philippines - Forum Energy Plc. of the United Kingdom is ready to put up additional investments in its Sampaguita gas discovery off West Palawan after completing the seismic survey in the area ahead of schedule.

“We have now met our contractual commitments with the Energy Department under Service Contract [SC] 72 and we look forward to making further investments into the project,” Robin Nicholson, Forum executive chairman, said.

Nicholson said they have been going about the work program in SC 72 “efficiently and ahead of our anticipated schedule.”

The company initially projected to complete the survey at the end of the first quarter. It completed the survey in the middle of March.

Forum acquired 564.887 kilometer of 3D seismic data over the Sampaguita gas field and 2,202.38 line-kilometer of 2D seismic data as part of its work program in order to further define drilling areas within the SC 72 acreage.

“The company will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next subphase of the SC 72 license,” Nicholson said.

CGG Veritas, using the MV Veritas Voyager carried out the seismic survey.

A previous 248-square- kilometer 3D seismic survey over the SC 72 license area indicated a 3.4-trillion-cubic-feet gas-in-place at the Sampaguita gas discovery, an 8,800-km license area loca

das hier

Forum Energy completes Reed Bank survey

By Donnabelle L. Gatdula, The Philippine Star

Posted at 03/23/2011 1:57 AM | Updated as of 03/23/2011 2:01 AM

MANILA, Philippines - Despite territorial disputes, UK-based Forum Energy Plc said it had completed its seismic survey at Service Contract (SC) 72 in the Reed Bank basin.

In a report, Forum executive chairman Robin Nicholson said as part of the work program, 564.887 square kilometers of 3D seismic data was acquired over the Sampaguita gas field and 2,202.38 line-kilometers of 2D seismic data was also acquired over the block in order to further define additional leads identified within the SC 72 acreage.

Nicholson said the company will continue to pour in capital for exploration in the area.

“We are delighted to have completed our work program so efficiently and ahead of our anticipated schedule.

We have now met our contractual commitments with the Department of Energy under Service Contract 72 and look forward to making further investments into the project,” he said.

Forum Energy had been stressing that SC 72 is not situated in the disputed Spratlys Group of Islands.

It said the contract is located in the Reed Bank basin which is at least 150 kilometers east of the disputed Spratlys Island and is closer to the island of Palawan.

It said SC 72 is within the 200-nautical mile exclusive economic zone (EEZ) based on Republic Act 9522 or the Philippine Archipelagic Baseline Law signed on March 10, 2009.

RA 9522 defines the archipelagic baselines of the Philippines, while affirming Philippine sovereignty and jurisdiction over these areas, which include SC 72.

Reed Bank has been subject of numerous exploration campaigns in the past.

The first petroleum contract in the area was awarded by the then Ministry of Energy in 1975.

Forum (through its 100% interest in Forum Philippine Holdings Ltd and Forum (GSEC101) Ltd). holds a 70% equity interest in the SC 72 license.

Philex Mining Corp. (through its interests in FEC Resources Inc. and Philex Petroleum Corp.) controls 64.45% of the share capital of Forum.

Philex provided a financing facility worth $10 million that enabled Forum to progress the development of SC 72.

In its report, Forum said it will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next sub-phase of the SC 72 license.

MANILA, Philippines - Forum Energy Plc. of the United Kingdom is ready to put up additional investments in its Sampaguita gas discovery off West Palawan after completing the seismic survey in the area ahead of schedule.

“We have now met our contractual commitments with the Energy Department under Service Contract [SC] 72 and we look forward to making further investments into the project,” Robin Nicholson, Forum executive chairman, said.

Nicholson said they have been going about the work program in SC 72 “efficiently and ahead of our anticipated schedule.”

The company initially projected to complete the survey at the end of the first quarter. It completed the survey in the middle of March.

Forum acquired 564.887 kilometer of 3D seismic data over the Sampaguita gas field and 2,202.38 line-kilometer of 2D seismic data as part of its work program in order to further define drilling areas within the SC 72 acreage.

“The company will immediately begin processing the data with the aim of further evaluating the commercial potential of the block, and to help identify the best location for possible appraisal wells to be drilled in the next subphase of the SC 72 license,” Nicholson said.

CGG Veritas, using the MV Veritas Voyager carried out the seismic survey.

A previous 248-square- kilometer 3D seismic survey over the SC 72 license area indicated a 3.4-trillion-cubic-feet gas-in-place at the Sampaguita gas discovery, an 8,800-km license area loca

Antwort auf Beitrag Nr.: 41.250.530 von Bollodotz am 22.03.11 22:53:28Ich halte es für sicher, dass FECOF bald richtig durchstarten wird, natürlich nur meine Meinung!

Infos findet Du hier:

http://ih.advfn.com/p.php?pid=squote&symbol=fecof

http://www.iii.co.uk/investment/detail?code=cotn:FEP.L&it=le" target="_blank" rel="nofollow ugc noopener">

http://www.iii.co.uk/investment/detail?code=cotn:FEP.L&it=le

Infos findet Du hier:

http://ih.advfn.com/p.php?pid=squote&symbol=fecof

http://www.iii.co.uk/investment/detail?code=cotn:FEP.L&it=le" target="_blank" rel="nofollow ugc noopener">

http://www.iii.co.uk/investment/detail?code=cotn:FEP.L&it=le

China Aims to More Than Triple Its Oil & Gas Production in the South China Sea over the Next 10 years

Philex-led Forum Energy seeks partners for SC 72

By Donnabelle L. Gatdula (The Philippine Star) Updated June 11, 2011 12:00 AM

MANILA, Philippines - Forum Energy Plc is scouting for a partner for Service Contract (SC) 72 off Palawan to be able to continue exploration activities in the area. a top company official said.

“The company is also assessing potential partnerships in SC 72 to accelerate the development of the project, although there are no proposals currently in place,” Forum chairman Robert Nicholson said in a report.

But he stressed they are optimistic that SC 72 would continue to be one of the company’s major achievements.