BHP Billiton - ein Basisinvestment im Rohstoffsektor (Seite 13)

eröffnet am 11.06.07 15:37:48 von

neuester Beitrag 08.04.24 14:31:55 von

neuester Beitrag 08.04.24 14:31:55 von

Beiträge: 726

ID: 1.128.624

ID: 1.128.624

Aufrufe heute: 18

Gesamt: 123.589

Gesamt: 123.589

Aktive User: 0

ISIN: AU000000BHP4 · WKN: 850524

27,42

EUR

-0,27 %

-0,08 EUR

Letzter Kurs 22:49:06 Lang & Schwarz

Neuigkeiten

17.04.24 · BörsenNEWS.de |

19.03.24 · globenewswire |

19.03.24 · GOLDINVEST.de Anzeige |

19.03.24 · Gold-Silber-Rohstofftrends |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 13,170 | +15,32 | |

| 1,2030 | +14,68 | |

| 3,6400 | +14,11 | |

| 11,180 | +14,08 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14.400,00 | -9,43 | |

| 0,7250 | -14,71 | |

| 0,6800 | -15,00 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 |

Beitrag zu dieser Diskussion schreiben

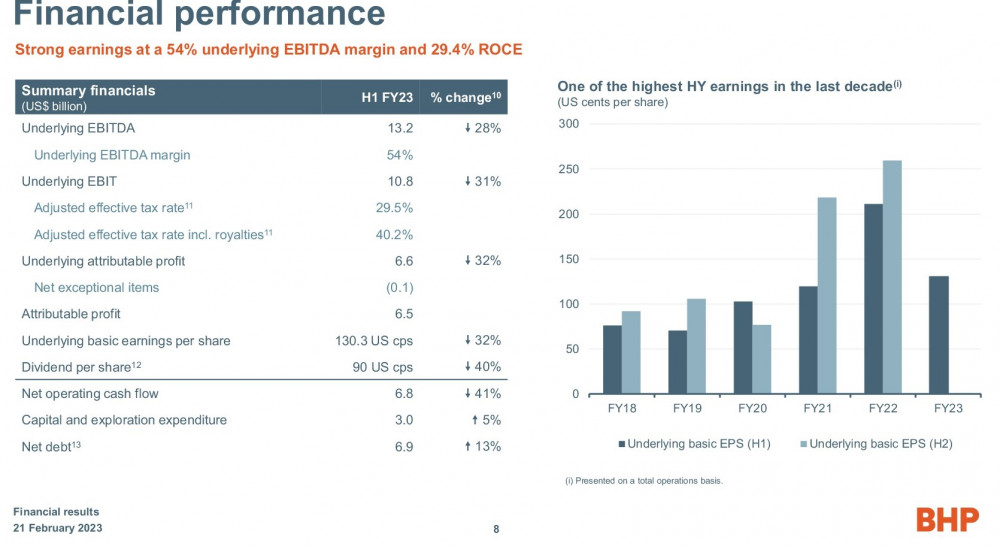

Div. 0,90 U$/Aktie

Australia's Magnis in deal with Tesla to supply graphite for electric vehicle batteries

Zitat von Oginvest: Feb 21 (Reuters) - Australia's graphite developer Magnis Energy (MNS.AX) on Tuesday said it has signed a binding offtake deal with Tesla Inc (TSLA.O) to supply battery anode materials for a minimum three-year term beginning February 2025.

The deal comes while automakers race to secure the supply of critical minerals as the world shifts to decarbonise and diversify global supply chains away from China, the world's biggest producer of electric vehicle batteries.

Australia is beefing up its supply of critical minerals to the global auto industry, with BHP group (BHP.AX), Syrah Resources (SYR.AX), Liontown Resources(LTR.AX) and Piedmont Lithium having agreed to supply these minerals to Tesla.

The company said it will supply to Tesla a minimum of 17,500 terapascal of anode active material (AAM), used in the making of lithium ion batteries, going to up to 35,000 terapascal, from a facility in the U.S. yet to be built.

Magnis aims to secure a final location for its commercial AAM facility in the U.S. by June 30, and commence production by February 2025.

https://www.reuters.com/business/autos-transportation/austra…

BHP upbeat on demand outlook on China reopening, first-half profit drops 32%

Feb 21 (Reuters) - BHP Group Ltd (BHP.AX) on Tuesday reported a steeper than estimated 32% drop in profit for the first half, citing weak iron ore prices, but forecast a positive demand outlook on strengthening activity in China.

However, its interim dividend of 90 U.S. cents per share, while lower than last year's 150 cents per share, beat Vuma Financial's estimate of 88 cents.

"We are positive about the demand outlook in the second half of fiscal 2023 and into fiscal 2024, with strengthening activity in China on the back of recent policy decisions the major driver," Chief Executive Officer Mike Henry said.

"We expect domestic demand in China and India to provide stabilising counterweights to the ongoing slowdown in global trade and in the economies of the US, Japan and Europe," he said in a statement.

...

"The long-term outlook for our commodities remains strong given population growth, rising living standards and the metals intensity of the energy transition, including for steelmaking raw materials," Henry added, apparently referring to the need for metals for products like electric vehicles and windmills.

...

https://www.kitco.com/news/2023-02-20/BHP-upbeat-on-demand-o…

Feb 21 (Reuters) - BHP Group Ltd (BHP.AX) on Tuesday reported a steeper than estimated 32% drop in profit for the first half, citing weak iron ore prices, but forecast a positive demand outlook on strengthening activity in China.

However, its interim dividend of 90 U.S. cents per share, while lower than last year's 150 cents per share, beat Vuma Financial's estimate of 88 cents.

"We are positive about the demand outlook in the second half of fiscal 2023 and into fiscal 2024, with strengthening activity in China on the back of recent policy decisions the major driver," Chief Executive Officer Mike Henry said.

"We expect domestic demand in China and India to provide stabilising counterweights to the ongoing slowdown in global trade and in the economies of the US, Japan and Europe," he said in a statement.

...

"The long-term outlook for our commodities remains strong given population growth, rising living standards and the metals intensity of the energy transition, including for steelmaking raw materials," Henry added, apparently referring to the need for metals for products like electric vehicles and windmills.

...

https://www.kitco.com/news/2023-02-20/BHP-upbeat-on-demand-o…

Australia's iron ore giants face earnings, dividend plunge

BENGALURU/MELBOURNE (Reuters) - Australia's iron ore giants BHP Group, Rio Tinto and Fortescue are set to report a steep drop in their earnings, which is set to compress their payouts to shareholders, after China's COVID lockdown drove down iron ore prices.Earnings at Rio Tinto and BHP Group are seen declining 48% and 28%, respectively, for the six months to December 2022, while Fortescue's half-year earnings are set to slide about 16%, based on estimates from Visible Alpha and Vuma Financial.

The miners are expected to offer a mixed outlook for 2023, amid uncertainty over the strength of China's recovery following the lifting of its strict COVID-19 curbs.

"We haven't seen too much hard data from China just yet, but I think there's enough for the miners to be more optimistic - cautiously so," said Adrian Prendergast, an analyst at Morgans Financial in Melbourne.

....

https://au.finance.yahoo.com/news/australias-iron-ore-giants…

OZ Minerals' $6.6 billion buyout by BHP gets Brazil's approval

Feb 6 (Reuters) - Australian copper and gold producer OZ Minerals (OZL.AX) on Monday said its A$9.6 billion ($6.61 billion) buyout by BHP Group (BHP.AX) received approval from Brazilian competition regulator the Administrative Council for Economic Defence.OZ Minerals on Dec. 22 entered a scheme implementation deed with the world's largest listed miner, BHP, to proceed formally with the takeover.

...

https://www.reuters.com/business/oz-minerals-66-bln-buyout-b…

BHP considers early closure of Mt Arthur coal mine

BHP (ASX: BHP) is reportedly considering the closure of its Mt Arthur coal mine in New South Wales ahead of its 2030 target.The potential closure is due to the state government’s coal reservation scheme and a coal price cap announced by the federal government last year.

The state government requires thermal coal miners to reserve up to 10% of their output for domestic coal-fired power stations.

In December, the state government imposed domestic coal reservation and price cap orders on NSW producers to offer at least 18.6 million tonnes into the domestic market.

The federal government introduced a 12-month price ceiling on domestic coal of $125 per tonne in NSW and Queensland.

...

>> https://smallcaps.com.au/bhp-early-closure-mt-arthur-coal-mi…

Brazil govt eyes compensation deal for 2015 Vale-BHP dam burst

BRASILIA, Jan 27 (Reuters) - Brazil's government will try to reach a deal "as soon as possible" on compensation for the 2015 burst of a tailings dam owned by Samarco, a joint venture between Vale (VALE3.SA) and BHP <BHP.AX>, Institutional Relations Minister Alexandre Padilha said on Friday....

https://www.reuters.com/world/americas/brazils-government-ey…

ich hab Rana Gruber jetzt verkauft. Einstieg war 4,14 Euro am 14.11.22 und Verkauf nun bei 5,53 Euro.

Toller Trade.

Trick17

Toller Trade.

Trick17

Ich denke intensiv über den Verkauf von Rana Gruber vor der Nächsten Dividendenzahlung nach.

Norwegen ist wirklich Mist bezüglich Dividenden. Doppelte Belastung, kann man sixh aber wiederholen.

Ja, klar wegen sub 100 Euro nen mega Aufwand. keine Lust drauf.

Rana ist verspätet hoch gelaufen, hat das aber jetzt wieder fast aufgeholt.

Derzeit würde ich beim Eisenerz am ehesten bei Kumba zuschlagen.

Gerade im Vergleich zu BHP schön zurück geblieben.

Trick17

Norwegen ist wirklich Mist bezüglich Dividenden. Doppelte Belastung, kann man sixh aber wiederholen.

Ja, klar wegen sub 100 Euro nen mega Aufwand. keine Lust drauf.

Rana ist verspätet hoch gelaufen, hat das aber jetzt wieder fast aufgeholt.

Derzeit würde ich beim Eisenerz am ehesten bei Kumba zuschlagen.

Gerade im Vergleich zu BHP schön zurück geblieben.

Trick17

17.04.24 · BörsenNEWS.de · ABB |

19.03.24 · Gold-Silber-Rohstofftrends · BHP Group |

19.03.24 · Gold-Silber-Rohstofftrends · BHP Group |

20.02.24 · dpa-AFX · BHP Group |

19.02.24 · BörsenNEWS.de · Air Liquide |

16.02.24 · BörsenNEWS.de · Air Liquide |