Altona Energy - ... hat wirklich sehr viel Kohle :-) - 500 Beiträge pro Seite (Seite 2)

eröffnet am 20.11.07 14:26:48 von

neuester Beitrag 03.02.15 20:46:24 von

neuester Beitrag 03.02.15 20:46:24 von

Beiträge: 848

ID: 1.135.476

ID: 1.135.476

Aufrufe heute: 1

Gesamt: 142.790

Gesamt: 142.790

Aktive User: 0

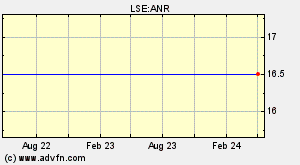

ISIN: GB00BFZNKV91 · WKN: A2N6NH · Symbol: REE

0,0163

GBP

0,00 %

0,0000 GBP

Letzter Kurs 18:39:38 London

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,5500 | +14,61 | |

| 1,0100 | +10,99 | |

| 4,9300 | +10,04 | |

| 17.600,00 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 190,05 | -7,07 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Antwort auf Beitrag Nr.: 37.850.523 von Ikar am 25.08.09 21:53:51gaaanz ruhig

Ist aber gar nicht so einfach, wenn dieser "Makler" in Frankfurt ständig umsatzlos Kurse von 3 Cent stellt.

Erst der Blick nach London beruhigt: aktuell 5,58p + 2,29%

Freundliche Grüße

supernova

Ist aber gar nicht so einfach, wenn dieser "Makler" in Frankfurt ständig umsatzlos Kurse von 3 Cent stellt.

Erst der Blick nach London beruhigt: aktuell 5,58p + 2,29%

Freundliche Grüße

supernova

Las doch Deine Aktien umbuchen damit Du sie in London verkaufen kannst, wenn Du sie in Deutschland gekauft hast. Und es sich mengenmäßig lohnt.

Mancher Broker, macht das sicherlich noch kostenfrei. Meiner leider nicht mehr.

Da kann dieses Pickelgesicht von Makler in Ffm. taxen was er will.

Ich kaufe und verkaufe an der LME.

Mancher Broker, macht das sicherlich noch kostenfrei. Meiner leider nicht mehr.

Da kann dieses Pickelgesicht von Makler in Ffm. taxen was er will.

Ich kaufe und verkaufe an der LME.

Antwort auf Beitrag Nr.: 37.854.363 von timezone am 26.08.09 12:23:06Denkst Du etwa, ich kaufe ANR in Deutschland?

Die habe ich bisher nur in London gekauft, die Umsätze in D sind absolut lächerlich.

Nur bei der Kursabfrage sehe ich halt zuerst den Kurs in Frankfurt!

Freundliche Grüße

supernova

P.S.: Aktuell 5,63p in London!

Die habe ich bisher nur in London gekauft, die Umsätze in D sind absolut lächerlich.

Nur bei der Kursabfrage sehe ich halt zuerst den Kurs in Frankfurt!

Freundliche Grüße

supernova

P.S.: Aktuell 5,63p in London!

War es ein strohfeuer oder eine Gewinnmitnahme?

News ?

Mfg schweigi

News ?

Mfg schweigi

Antwort auf Beitrag Nr.: 37.861.616 von Schweigi am 27.08.09 09:30:46Strohfeuer!!!!!!!!!

noch immer kein News über die hohe Stückanzahl

mfg Schweigi

noch immer kein News über die hohe Stückanzahl

mfg Schweigi

Altona Energy Plc / Index: AIM / Epic: ANR / Sector: Exploration & Production

27th August 2009

Altona Energy Plc ('Altona' or 'the Company')

Holdings in Company

Altona Energy Plc, the AIM listed Australian based energy company, was informed today that Invesco Limited ('Invesco'), acquired 37,000,000 ordinary shares in Altona on 24th August 2009. As a result of this acquisition Invesco are now interested in 50,945,122 ordinary shares in Altona, representing 13.75% of the total issued share capital.

27th August 2009

Altona Energy Plc ('Altona' or 'the Company')

Holdings in Company

Altona Energy Plc, the AIM listed Australian based energy company, was informed today that Invesco Limited ('Invesco'), acquired 37,000,000 ordinary shares in Altona on 24th August 2009. As a result of this acquisition Invesco are now interested in 50,945,122 ordinary shares in Altona, representing 13.75% of the total issued share capital.

Altona Energy Plc / Index: AIM / Epic: ANR / Sector: Exploration & Production

28 August 2009

Altona Energy Plc ('Altona Energy' or 'the Company')

Total Voting Rights

In accordance with the FSA's Disclosure and Transparency Rules, Altona Energy, the AIM listed Australian based energy company, would like to notify the market of the following:

*

The total number of ordinary shares of 0.1p each in the capital of the Company in issue as at the date of this notice is 370,360,906 with each share carrying the right to one vote;

*

the Company holds no shares in treasury; and

*

therefore, the total number of voting rights in the Company is 370,360,906.

The above figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in Altona Energy under the FSA's Disclosure and Transparency Rules.

http://www.londonstockexchange.com/exchange/prices-and-news/…

28 August 2009

Altona Energy Plc ('Altona Energy' or 'the Company')

Total Voting Rights

In accordance with the FSA's Disclosure and Transparency Rules, Altona Energy, the AIM listed Australian based energy company, would like to notify the market of the following:

*

The total number of ordinary shares of 0.1p each in the capital of the Company in issue as at the date of this notice is 370,360,906 with each share carrying the right to one vote;

*

the Company holds no shares in treasury; and

*

therefore, the total number of voting rights in the Company is 370,360,906.

The above figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in Altona Energy under the FSA's Disclosure and Transparency Rules.

http://www.londonstockexchange.com/exchange/prices-and-news/…

Also wenn invesco an weitere 50 Mio. Aktien interesse hat, ist das nicht schlecht.

Bin gespannt bei welchen Kurs sie die Aktien bekommen.

Mfg Schweigi

Bin gespannt bei welchen Kurs sie die Aktien bekommen.

Mfg Schweigi

Antwort auf Beitrag Nr.: 37.871.720 von Schweigi am 28.08.09 12:03:00apropos-

interested bedeutet soviel wie die halten jetzt zusammen 50mio, nicht, dass sie an weiteren 50 mio Interesse haben. Das mag ja evtl. sogar der Fall sein, aber das sagt die Meldung nicht aus.

interested bedeutet soviel wie die halten jetzt zusammen 50mio, nicht, dass sie an weiteren 50 mio Interesse haben. Das mag ja evtl. sogar der Fall sein, aber das sagt die Meldung nicht aus.

Altona Energy Plc, the AIM listed Australian based energy company, is pleased to

announce that it has become a Foundation Member of the Global Carbon Capture and

Storage Institute ('the Global CCS Institute'), a worldwide organisation

focussed on accelerating the commercial deployment of carbon capture and storage

('CCS') projects and the promotion of the global reduction of carbon dioxide

emissions. Amongst others, 23 national governments including all the G8 are

Foundation Members.

announce that it has become a Foundation Member of the Global Carbon Capture and

Storage Institute ('the Global CCS Institute'), a worldwide organisation

focussed on accelerating the commercial deployment of carbon capture and storage

('CCS') projects and the promotion of the global reduction of carbon dioxide

emissions. Amongst others, 23 national governments including all the G8 are

Foundation Members.

Wie kann der Kurs so nachgeben?

Oder will hier jemand billigst rein ?

Schweigi

Oder will hier jemand billigst rein ?

Schweigi

Bervor der Thread ganz einschläft:

03 November 2009

Holdings in Company

Altona Energy Plc, the AIM listed Australian based energy company, was informed on 2 November that Invesco Limited ('Invesco'), acquired 942,000 ordinary shares in Altona. As a result of this acquisition Invesco are now interested in 51,887,122 ordinary shares in Altona, representing 14.00% of the total issued share capital.

+++

Freundliche Grüße

supernova

03 November 2009

Holdings in Company

Altona Energy Plc, the AIM listed Australian based energy company, was informed on 2 November that Invesco Limited ('Invesco'), acquired 942,000 ordinary shares in Altona. As a result of this acquisition Invesco are now interested in 51,887,122 ordinary shares in Altona, representing 14.00% of the total issued share capital.

+++

Freundliche Grüße

supernova

lesezeichen !

Hallo an alle Investierten, habe vor langer Zeit einige Stücke in Frankfurt gekauft. Hier zeigte sich der Kurs allerdings als völlig wirr.

Wer hat einen Tip wie ich online in london handeln kann

Besten dank

Wer hat einen Tip wie ich online in london handeln kann

Besten dank

Antwort auf Beitrag Nr.: 38.362.893 von henka23 am 11.11.09 09:37:15das geht eigentlich nicht

in d-land gekaufte aktien wirst du auch nur in d-land wieder verkaufen können, wenn du bei einem deutschen broker bist.

theoretisch ist es möglich, die shares auch auf einen anderen Transaktionsbereich umzubuchen...aber das kostet und ist für Kleinanleger eine unübliche Verfahrensweise

deswegen kauft man lieber an der Heimatbörse... auch wenn es evtl mehr Gebühren kostet

in d-land gekaufte aktien wirst du auch nur in d-land wieder verkaufen können, wenn du bei einem deutschen broker bist.

theoretisch ist es möglich, die shares auch auf einen anderen Transaktionsbereich umzubuchen...aber das kostet und ist für Kleinanleger eine unübliche Verfahrensweise

deswegen kauft man lieber an der Heimatbörse... auch wenn es evtl mehr Gebühren kostet

Antwort auf Beitrag Nr.: 38.365.834 von XIO am 11.11.09 15:16:28Hallo Xio,

das hatte ich mir gedacht. Meine Frage ging eher in die Richtung wenn ich mir neue Aktien von Altona hinlegen möchte.

das hatte ich mir gedacht. Meine Frage ging eher in die Richtung wenn ich mir neue Aktien von Altona hinlegen möchte.

Antwort auf Beitrag Nr.: 38.365.976 von henka23 am 11.11.09 15:31:06dann kauf in London

z.B. bei consors geht das

z.B. bei consors geht das

Antwort auf Beitrag Nr.: 38.365.834 von XIO am 11.11.09 15:16:28Guten Abend.

Ein Lagerstellenübertag ist ohne weiteres möglich. Habe dafür 35,00 Euro bezahlt bei meiner Sparkasse in Ösiland.(Verhandlungssache aus meiner Sicht)

Aber es rentiert sich auf jeden Fall. Vorallem bei der derzeitigen Kursstellung.

Für Neuinvestments natürlich nur London.....

Ich wünsche viel Erfolg und hoffentliche bald gute News.

Ein Lagerstellenübertag ist ohne weiteres möglich. Habe dafür 35,00 Euro bezahlt bei meiner Sparkasse in Ösiland.(Verhandlungssache aus meiner Sicht)

Aber es rentiert sich auf jeden Fall. Vorallem bei der derzeitigen Kursstellung.

Für Neuinvestments natürlich nur London.....

Ich wünsche viel Erfolg und hoffentliche bald gute News.

Korrektur:

ein "r" vergessen. Sollte natürlich Lagerstellen-Übertrag heißen - nicht Übertag.

ein "r" vergessen. Sollte natürlich Lagerstellen-Übertrag heißen - nicht Übertag.

Antwort auf Beitrag Nr.: 38.368.057 von Rohstoffinvestor am 11.11.09 18:31:16oha, daß es nur 35€ kostet, hab ich auch nicht gewusst.. es kommt evtl auch auf den Broker an

Danke für die Info!!!

Danke für die Info!!!

Bin gerade dabei zu Lynx Broker zu wechseln,werde dann meine Depots bei Consors und SBroker dorthin übertragen,allein schon wegen der Abgeltungssteuer in D.

Günstige Gebühren und alle Börsen, vorallem London und Canada wegen der Rohstoffwerte-da in D kaum Umsätze.

Günstige Gebühren und alle Börsen, vorallem London und Canada wegen der Rohstoffwerte-da in D kaum Umsätze.

Guten Morgen

Vor noch nicht allzulanger Zeit, hatte eine Lagerstellenumbuchung bei Consors überhaupt nichts gekostet. Da wurde nur kurz darauf hingewiesen und dann konnte man an einer anderen Börse verkaufen.

Das wars. Heute kostet es 35 Euro. Was machen die da, die machen einen Haken aus einen Kästchen in ein anderes und das wars.

Ist jemanden schon aufgefallen, das seit über zwei Wochen täglich 250k und 500k Pakete in London zu Preisen von 4,15 und 4,20 Pence verkauft werden. Also es gibt einen großen Käufer bei 4,20.

Vor noch nicht allzulanger Zeit, hatte eine Lagerstellenumbuchung bei Consors überhaupt nichts gekostet. Da wurde nur kurz darauf hingewiesen und dann konnte man an einer anderen Börse verkaufen.

Das wars. Heute kostet es 35 Euro. Was machen die da, die machen einen Haken aus einen Kästchen in ein anderes und das wars.

Ist jemanden schon aufgefallen, das seit über zwei Wochen täglich 250k und 500k Pakete in London zu Preisen von 4,15 und 4,20 Pence verkauft werden. Also es gibt einen großen Käufer bei 4,20.

18 November 2009

Altona Energy Plc ('Altona' or 'the Company')

Binding Agreement signs with CNOOC-NEI for the Joint Venture Terms to develop the Arckaringa Project

Altona Energy Plc, the AIM listed Australian based energy company, through its wholly owned Australian subsidiary Arckaringa Energy Pty Ltd ('Arckaringa Energy'), has signed a binding agreement with CNOOC New Energy Investment Ltd ('CNOOC-NEI') that agrees the terms of the Unincorporated Evaluation Joint Venture Agreement ('the UEJV' or 'the Agreement'). Through the UEJV, the parties will evaluate the maximum development and commercial potential of the Company's estimated 7.8 billion tonne coal resource (based on non-JORC standards) in South Australia ('the Arckaringa Project') and will carry out detailed studies covering resource extraction and optimisation, project development options and chemicals and other coal conversion studies. CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation, one of the three largest state owned oil companies in the Peoples Republic of China, specialises in and is dedicated to developing alternative energy sources, renewable energy, energy-efficient products and innovative technologies. The UEJV will be executed by an Australian subsidiary of CNOOC-NEI, upon its incorporation.

Overview

Terms of the UEJV finalised and agreed with CNOOC-NEI to evaluate the Company's estimated 7.8 billion tonne coal resource (based on non-JORC standards) in South Australia

Under the terms of the UEJV, a subsidiary of CNOOC-NEI will fund the bankable feasibility study ('BFS') for the Arckaringa Project and will act as the operator, not only to carry out the staged evaluation work under the BFS, but also to take responsibility for assessing the full potential of the coal resource and bringing projects to development, in return for a 51% interest in Arckaringa Energy's exploration licences

CNOOC-NEI's expertise, resources, and stature will be instrumental in moving the Arckaringa Project forward. CNOOC-NEI's role as the operator in the study, management and operation of the Arckaringa Project, in particular, will accelerate its commercialisation

Strategic partnership has been established between CNOOC-NEI and Altona by signing the UEJV

Under the terms of the Agreement, the subsidiary of CNOOC-NEI ('CNOOC-NEI-Sub) will fund a BFS for a coal mine and an integrated value-added project. The BFS will determine the optimum way to maximise the value in the Company's coal energy bank, of which 1.287 billion tonnes at the Wintinna Deposit has been brought up to current JORC standards. It is noted that in late 2008 the Company completed a tender process for the role of Study Engineer to complete a BFS for the 'Base Case' Arckaringa Project of an integrated mine at Wintinna and 10 million barrel per year Coal to Liquids ('CTL') plant with a 560 MW co-generation power facility. CNOOC-NEI-Sub will complete the BFS in accordance with the UEJV and will, in step with international and local market demand and the need to adapt to climate change, proceed selectively and progressively with coal development, CTL and/or Synthetic Natural Gas ('Syngas' or 'SNG'), power co-generation and a range of other clean energy projects. The scope of the BFS under the UEJV may redefine the 'Base Case'.

In the event that CNOOC-NEI-Sub and Altona decide to proceed with the commercial development of any project, the parties will negotiate and enter into a development agreement for each project, under which CNOOC-NEI-Sub's interest would increase from 51% to 70%. CNOOC-NEI-Sub and Altona will work together to obtain funding for the development of any project. In the event that CNOOC-NEI-Sub wish to proceed to the development phase of a project prior to the finalisation of the BFS, CNOOC-NEI-Sub will procure the provision of debt funding for both parties to develop the project.

Altona Chairman Chris Lambert said, "The UEJV is a major milestone for Altona as it secures the funding of the BFS and the pathway for the development and financing of what we believe to be one of the world's largest undeveloped energy banks. We are delighted to have secured a partner of CNOOC-NEI's major stature and it has been a pleasure to work with its technical and commercial teams over the past year, to advance our joint understanding in unlocking the vast potential and value of the Arckaringa Project. Its valuable expertise, managerial skills and resources will be instrumental in bringing a CTL project to fruition, and also in adding further value through the development of ancillary products derived from the large scale production of Syngas and the potential for developing additional projects utilising the Syngas. With financing for the BFS and professional management from CNOOC-NEI, the Board believes the potential for a re-rating in the value of the Company is highly evident.

"We have always understood that this project may play a significant role in solving the energy requirements of South Australia and as a result we will be working closely with our colleagues at CNOOC-NEI to assist in the application to the Australian Foreign Investment Review Board. Our goal is to ensure that CNOOC-NEI's investment and professional management will benefit all stakeholders and assist in crystallising the value of the Arckaringa Project."

Further Details of the Agreement

Arckaringa Energy holds 100% of three exploration licences (EL3360, EL3361 and EL3362) in the Arckaringa Basin region of South Australia and has undertaken extensive pre-feasibility studies into the commercialisation of the coal deposits contained within those licences. Under the terms of the Agreement, the two parties will establish an unincorporated joint venture in order to undertake certain joint works in respect of the exploration licences held by Arckaringa Energy ('Arckaringa Licences'), which will be carried out in two stages:

Stage 1: complete a BFS in relation to a project to develop a mine to extract coal from the Arckaringa Leases ('Mining Development Project') and a further pre-feasibility study in relation to at least one other value added project, such as a CTL, SNG and integrated power generation project ('Nominated Project').

Stage 2: complete a BFS in respect of the Nominated Project(s) identified in Stage 1 to enable both parties to secure debt funding for the costs of the Nominated Project(s).

Interests in the UEJV

In consideration of CNOOC-NEI-Sub undertaking, subject to mutually agreed budgets and certain other limitations in the Agreement, to meet the full costs of the Stage 1 and 2 works (as described above), Arckaringa Energy will transfer to CNOOC-NEI-Sub a 51% beneficial interest in the Arckaringa Licences. Further detail on this funding commitment is outlined below.

If the parties decide to adopt and implement the Mining Development Project or a Nominated Project, they will then negotiate and enter into a development agreement in relation to each project (a 'Development Agreement'), under which CNOOC-NEI-Sub's interest in the relevant project can increase to 70%.

Management of the UEJV

The UEJV will be governed by a management committee ('Management Committee') which will be constituted by four representatives of CNOOC-NEI-Sub and three representatives of Altona.

While general business decisions may be determined by a majority of the Management Committee, certain key decisions must be taken unanimously by the Management Committee, including: any expenditure or contract in excess of AUD5m, and entry into material related party contracts.

The Operating Team of the CNOOC-NEI-Sub will be in charge of the overall process of the Arckaringa Project, including the BFS and future construction work, production management and product sales.

Funding Commitment by CNOOC-NEI-Sub

If, following completion of the Stage 1 and 2 works, the parties enter into a Development Agreement in relation to a Nominated Project, any CNOOC-NEI-Sub expenditure in respect of the Stage 2 budget that is relevant to that Nominated Project will be credited as a contribution to CNOOC-NEI-Sub's share of the costs of that Nominated Project.

The funding obligations of CNOOC-NEI-Sub will cease on the earlier of:

completion of both the Stage 1 and Stage 2 Works;

in respect of the Stage 1 Work, when the funds expended by CNOOC-NEI-Sub exceed the total of the funds agreed in the Stage 1 budget;

in respect of the Stage 2 Work, when the funds expended by CNOOC-NEI-Sub exceed the total of the funds agreed in the Stage 2 budget;

if during the Stage 2 Period and prior to completion of the BFS, CNOOC-NEI-Sub procures the funding from third parties (in the form of debt or otherwise) to enable both parties to complete the development of a Nominated Project and the relevant financing documents have become unconditional; or

if the Joint Venture terminates upon a withdrawal of CNOOC-NEI-Sub.

Conditions and Regulatory Consents

The Agreement is conditional upon the receipt by the parties of the relevant third party consents, including from the Chinese government and the Australian Foreign Investment Review Board. These consents are to be obtained within 180 days of signing the Agreement; however this may be extended by mutual agreement of the parties.

Termination of UEJV

The Agreement is capable of termination by written agreement of the parties or if either party fails to pay an amount owing under the Agreement, commits a material breach or is in default or becomes insolvent.

CNOOC-NEI-Sub also has the right to withdraw during Stage 1 or Stage 2 on 30 days notice. Following termination CNOOC-NEI-Sub will have no further obligation to provide funds, except in respect of liabilities and obligations that have already arisen or been incurred and which cannot be avoided and are directly attributable to the termination.

If termination occurs during Stage 1 and CNOOC-NEI-Sub has committed less than 30% of the budgeted expenditure, CNOOC-NEI-Sub must at its own cost transfer back to Arckaringa Energy, free of all consideration, its 51% interest in the UEJV.

If termination occurs after CNOOC-NEI-Sub has committed all of the Stage 1 budgeted expenditure, CNOOC-NEI-Sub will be entitled to retain its 51% interest in the Joint Venture Property. If termination occurs after CNOOC-NEI-Sub has committed between 30% and 100% of the Stage 1 budgeted expenditure, CNOOC-NEI-Sub will be entitled to a pro-rata interest in the Joint Venture Property.

If termination occurs during Stage 2 then both parties must use reasonable endeavours to find a mutually acceptable replacement for CNOOC-NEI-Sub. If no replacement can be agreed, Arckaringa Energy may opt to purchase CNOOC-NEI-Sub's interest at a fair market value determined in accordance with the Agreement.

For further information visit www.altonaenergy.com or please contact:

Christopher Lambert

Altona Chairman

Tel: +44 (0) 20 7024 8391

Christopher Schrape

Altona Managing Director

Tel: +44 (0) 20 7024 8391

Samantha Harrison

Ambrian Partners Limited

Tel: +44 (0) 20 7634 4705

Alexandra Carse

Ambrian Partners Limited

Tel: +44 (0) 20 7634 4705

Paul Youens

St Brides Media & Finance Ltd

Tel: +44 (0) 20 7236 1177

Hugo de Salis

St Brides Media & Finance Ltd

Tel: +44 (0) 20 7236 1177

About Altona

Altona Energy Plc is an Australian based energy company that was admitted to trading on AIM in March 2005. Its primary focus to date has been the completion of a bankable feasibility study for its wholly owned Arckaringa Project for an integrated 10 million barrel per year coal to liquid ('CTL') plant with a 560 MW co-generation power facility.

The Company holds, through its wholly owned subsidiary Arckaringa Energy Pty Ltd, a 100% interest in three exploration licences covering 2,500 sq. kms in the northern portion of the Permian Arckaringa Basin in South Australia. These include three coal deposits, Westfield (EL3360), Wintinna (EL3361) and Murloocoppie (EL3362). All three lie close to the Adelaide to Darwin railway and the Stuart Highway. Containing more than 7.8 billion tonnes of coal (based on non-JORC standards), these coal deposits are effectively one of the world's largest undeveloped energy banks, capable of conversion into clean liquid fuels, low cost power and high value industrial feedstocks.

This information is provided by RNS

The company news service from the London Stock Exchange

http://www.investegate.co.uk/Article.aspx?id=200911180700036…

+++

UPDATE 1-Altona signs JV with China's CNOOC; shares up

* JV to develop Arckaringa project in South Australia

* To evaluate 7.8 bln tonne coal resource

* Shares rise as much as 42 pct

Nov 18 (Reuters) - Energy firm Altona Energy Plc (ALRE.L) said it signed a joint venture deal with a unit of state-owned China National Offshore Oil Corp to develop its project at Arckaringa in South Australia, sending its shares up as much as 42 percent.

The Australia-based Altona said the joint venture with China National Offshore Oil Corporation New Energy Investment (CNOOC-NEI) would help evaluate the development and commercial potential of the 7.8 billion tonne coal resource.

Under the terms, a unit of CNOOC-NEI will fund a bankable feasibility study for a coal mine and will also act as an operator to carry out the evaluation work in return for a 51 percent stake in Altona's Australian unit's exploration licences.

Altona's shares rose 1.35 pence to 5.75 pence by 0909 GMT on the London Stock Exchange. (Reporting by Purwa Naveen Raman in Bangalore; Editing by Aradhana Aravindan)

http://www.reuters.com/article/rbssEnergyNews/idUSBNG4520712…

Warum schreibt hier keiner?

Habt Ihr alle schon den Schampus offen?

Freundliche Grüße

supernova

Altona Energy Plc ('Altona' or 'the Company')

Binding Agreement signs with CNOOC-NEI for the Joint Venture Terms to develop the Arckaringa Project

Altona Energy Plc, the AIM listed Australian based energy company, through its wholly owned Australian subsidiary Arckaringa Energy Pty Ltd ('Arckaringa Energy'), has signed a binding agreement with CNOOC New Energy Investment Ltd ('CNOOC-NEI') that agrees the terms of the Unincorporated Evaluation Joint Venture Agreement ('the UEJV' or 'the Agreement'). Through the UEJV, the parties will evaluate the maximum development and commercial potential of the Company's estimated 7.8 billion tonne coal resource (based on non-JORC standards) in South Australia ('the Arckaringa Project') and will carry out detailed studies covering resource extraction and optimisation, project development options and chemicals and other coal conversion studies. CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation, one of the three largest state owned oil companies in the Peoples Republic of China, specialises in and is dedicated to developing alternative energy sources, renewable energy, energy-efficient products and innovative technologies. The UEJV will be executed by an Australian subsidiary of CNOOC-NEI, upon its incorporation.

Overview

Terms of the UEJV finalised and agreed with CNOOC-NEI to evaluate the Company's estimated 7.8 billion tonne coal resource (based on non-JORC standards) in South Australia

Under the terms of the UEJV, a subsidiary of CNOOC-NEI will fund the bankable feasibility study ('BFS') for the Arckaringa Project and will act as the operator, not only to carry out the staged evaluation work under the BFS, but also to take responsibility for assessing the full potential of the coal resource and bringing projects to development, in return for a 51% interest in Arckaringa Energy's exploration licences

CNOOC-NEI's expertise, resources, and stature will be instrumental in moving the Arckaringa Project forward. CNOOC-NEI's role as the operator in the study, management and operation of the Arckaringa Project, in particular, will accelerate its commercialisation

Strategic partnership has been established between CNOOC-NEI and Altona by signing the UEJV

Under the terms of the Agreement, the subsidiary of CNOOC-NEI ('CNOOC-NEI-Sub) will fund a BFS for a coal mine and an integrated value-added project. The BFS will determine the optimum way to maximise the value in the Company's coal energy bank, of which 1.287 billion tonnes at the Wintinna Deposit has been brought up to current JORC standards. It is noted that in late 2008 the Company completed a tender process for the role of Study Engineer to complete a BFS for the 'Base Case' Arckaringa Project of an integrated mine at Wintinna and 10 million barrel per year Coal to Liquids ('CTL') plant with a 560 MW co-generation power facility. CNOOC-NEI-Sub will complete the BFS in accordance with the UEJV and will, in step with international and local market demand and the need to adapt to climate change, proceed selectively and progressively with coal development, CTL and/or Synthetic Natural Gas ('Syngas' or 'SNG'), power co-generation and a range of other clean energy projects. The scope of the BFS under the UEJV may redefine the 'Base Case'.

In the event that CNOOC-NEI-Sub and Altona decide to proceed with the commercial development of any project, the parties will negotiate and enter into a development agreement for each project, under which CNOOC-NEI-Sub's interest would increase from 51% to 70%. CNOOC-NEI-Sub and Altona will work together to obtain funding for the development of any project. In the event that CNOOC-NEI-Sub wish to proceed to the development phase of a project prior to the finalisation of the BFS, CNOOC-NEI-Sub will procure the provision of debt funding for both parties to develop the project.

Altona Chairman Chris Lambert said, "The UEJV is a major milestone for Altona as it secures the funding of the BFS and the pathway for the development and financing of what we believe to be one of the world's largest undeveloped energy banks. We are delighted to have secured a partner of CNOOC-NEI's major stature and it has been a pleasure to work with its technical and commercial teams over the past year, to advance our joint understanding in unlocking the vast potential and value of the Arckaringa Project. Its valuable expertise, managerial skills and resources will be instrumental in bringing a CTL project to fruition, and also in adding further value through the development of ancillary products derived from the large scale production of Syngas and the potential for developing additional projects utilising the Syngas. With financing for the BFS and professional management from CNOOC-NEI, the Board believes the potential for a re-rating in the value of the Company is highly evident.

"We have always understood that this project may play a significant role in solving the energy requirements of South Australia and as a result we will be working closely with our colleagues at CNOOC-NEI to assist in the application to the Australian Foreign Investment Review Board. Our goal is to ensure that CNOOC-NEI's investment and professional management will benefit all stakeholders and assist in crystallising the value of the Arckaringa Project."

Further Details of the Agreement

Arckaringa Energy holds 100% of three exploration licences (EL3360, EL3361 and EL3362) in the Arckaringa Basin region of South Australia and has undertaken extensive pre-feasibility studies into the commercialisation of the coal deposits contained within those licences. Under the terms of the Agreement, the two parties will establish an unincorporated joint venture in order to undertake certain joint works in respect of the exploration licences held by Arckaringa Energy ('Arckaringa Licences'), which will be carried out in two stages:

Stage 1: complete a BFS in relation to a project to develop a mine to extract coal from the Arckaringa Leases ('Mining Development Project') and a further pre-feasibility study in relation to at least one other value added project, such as a CTL, SNG and integrated power generation project ('Nominated Project').

Stage 2: complete a BFS in respect of the Nominated Project(s) identified in Stage 1 to enable both parties to secure debt funding for the costs of the Nominated Project(s).

Interests in the UEJV

In consideration of CNOOC-NEI-Sub undertaking, subject to mutually agreed budgets and certain other limitations in the Agreement, to meet the full costs of the Stage 1 and 2 works (as described above), Arckaringa Energy will transfer to CNOOC-NEI-Sub a 51% beneficial interest in the Arckaringa Licences. Further detail on this funding commitment is outlined below.

If the parties decide to adopt and implement the Mining Development Project or a Nominated Project, they will then negotiate and enter into a development agreement in relation to each project (a 'Development Agreement'), under which CNOOC-NEI-Sub's interest in the relevant project can increase to 70%.

Management of the UEJV

The UEJV will be governed by a management committee ('Management Committee') which will be constituted by four representatives of CNOOC-NEI-Sub and three representatives of Altona.

While general business decisions may be determined by a majority of the Management Committee, certain key decisions must be taken unanimously by the Management Committee, including: any expenditure or contract in excess of AUD5m, and entry into material related party contracts.

The Operating Team of the CNOOC-NEI-Sub will be in charge of the overall process of the Arckaringa Project, including the BFS and future construction work, production management and product sales.

Funding Commitment by CNOOC-NEI-Sub

If, following completion of the Stage 1 and 2 works, the parties enter into a Development Agreement in relation to a Nominated Project, any CNOOC-NEI-Sub expenditure in respect of the Stage 2 budget that is relevant to that Nominated Project will be credited as a contribution to CNOOC-NEI-Sub's share of the costs of that Nominated Project.

The funding obligations of CNOOC-NEI-Sub will cease on the earlier of:

completion of both the Stage 1 and Stage 2 Works;

in respect of the Stage 1 Work, when the funds expended by CNOOC-NEI-Sub exceed the total of the funds agreed in the Stage 1 budget;

in respect of the Stage 2 Work, when the funds expended by CNOOC-NEI-Sub exceed the total of the funds agreed in the Stage 2 budget;

if during the Stage 2 Period and prior to completion of the BFS, CNOOC-NEI-Sub procures the funding from third parties (in the form of debt or otherwise) to enable both parties to complete the development of a Nominated Project and the relevant financing documents have become unconditional; or

if the Joint Venture terminates upon a withdrawal of CNOOC-NEI-Sub.

Conditions and Regulatory Consents

The Agreement is conditional upon the receipt by the parties of the relevant third party consents, including from the Chinese government and the Australian Foreign Investment Review Board. These consents are to be obtained within 180 days of signing the Agreement; however this may be extended by mutual agreement of the parties.

Termination of UEJV

The Agreement is capable of termination by written agreement of the parties or if either party fails to pay an amount owing under the Agreement, commits a material breach or is in default or becomes insolvent.

CNOOC-NEI-Sub also has the right to withdraw during Stage 1 or Stage 2 on 30 days notice. Following termination CNOOC-NEI-Sub will have no further obligation to provide funds, except in respect of liabilities and obligations that have already arisen or been incurred and which cannot be avoided and are directly attributable to the termination.

If termination occurs during Stage 1 and CNOOC-NEI-Sub has committed less than 30% of the budgeted expenditure, CNOOC-NEI-Sub must at its own cost transfer back to Arckaringa Energy, free of all consideration, its 51% interest in the UEJV.

If termination occurs after CNOOC-NEI-Sub has committed all of the Stage 1 budgeted expenditure, CNOOC-NEI-Sub will be entitled to retain its 51% interest in the Joint Venture Property. If termination occurs after CNOOC-NEI-Sub has committed between 30% and 100% of the Stage 1 budgeted expenditure, CNOOC-NEI-Sub will be entitled to a pro-rata interest in the Joint Venture Property.

If termination occurs during Stage 2 then both parties must use reasonable endeavours to find a mutually acceptable replacement for CNOOC-NEI-Sub. If no replacement can be agreed, Arckaringa Energy may opt to purchase CNOOC-NEI-Sub's interest at a fair market value determined in accordance with the Agreement.

For further information visit www.altonaenergy.com or please contact:

Christopher Lambert

Altona Chairman

Tel: +44 (0) 20 7024 8391

Christopher Schrape

Altona Managing Director

Tel: +44 (0) 20 7024 8391

Samantha Harrison

Ambrian Partners Limited

Tel: +44 (0) 20 7634 4705

Alexandra Carse

Ambrian Partners Limited

Tel: +44 (0) 20 7634 4705

Paul Youens

St Brides Media & Finance Ltd

Tel: +44 (0) 20 7236 1177

Hugo de Salis

St Brides Media & Finance Ltd

Tel: +44 (0) 20 7236 1177

About Altona

Altona Energy Plc is an Australian based energy company that was admitted to trading on AIM in March 2005. Its primary focus to date has been the completion of a bankable feasibility study for its wholly owned Arckaringa Project for an integrated 10 million barrel per year coal to liquid ('CTL') plant with a 560 MW co-generation power facility.

The Company holds, through its wholly owned subsidiary Arckaringa Energy Pty Ltd, a 100% interest in three exploration licences covering 2,500 sq. kms in the northern portion of the Permian Arckaringa Basin in South Australia. These include three coal deposits, Westfield (EL3360), Wintinna (EL3361) and Murloocoppie (EL3362). All three lie close to the Adelaide to Darwin railway and the Stuart Highway. Containing more than 7.8 billion tonnes of coal (based on non-JORC standards), these coal deposits are effectively one of the world's largest undeveloped energy banks, capable of conversion into clean liquid fuels, low cost power and high value industrial feedstocks.

This information is provided by RNS

The company news service from the London Stock Exchange

http://www.investegate.co.uk/Article.aspx?id=200911180700036…

+++

UPDATE 1-Altona signs JV with China's CNOOC; shares up

* JV to develop Arckaringa project in South Australia

* To evaluate 7.8 bln tonne coal resource

* Shares rise as much as 42 pct

Nov 18 (Reuters) - Energy firm Altona Energy Plc (ALRE.L) said it signed a joint venture deal with a unit of state-owned China National Offshore Oil Corp to develop its project at Arckaringa in South Australia, sending its shares up as much as 42 percent.

The Australia-based Altona said the joint venture with China National Offshore Oil Corporation New Energy Investment (CNOOC-NEI) would help evaluate the development and commercial potential of the 7.8 billion tonne coal resource.

Under the terms, a unit of CNOOC-NEI will fund a bankable feasibility study for a coal mine and will also act as an operator to carry out the evaluation work in return for a 51 percent stake in Altona's Australian unit's exploration licences.

Altona's shares rose 1.35 pence to 5.75 pence by 0909 GMT on the London Stock Exchange. (Reporting by Purwa Naveen Raman in Bangalore; Editing by Aradhana Aravindan)

http://www.reuters.com/article/rbssEnergyNews/idUSBNG4520712…

Warum schreibt hier keiner?

Habt Ihr alle schon den Schampus offen?

Freundliche Grüße

supernova

Habt Ihr alle schon den Schampus offen?

Nööö - nach DIESEN news schon längst auf EX geleert!

Nööö - nach DIESEN news schon längst auf EX geleert!

Abwarten kann sich lohnen, wie bei einem endlen Tropfen, den man im Kelle vergisst, war Altona auch eher eine Depot-Leiche bei mir.

Obwohl +25% ja noch eine verhaltene Reaktion sind...

Da muss doch eine Neubewertung anstehen...

Sieht gut aus, mir fehlen noch 20% dann bin ich im Gewinn..

hobiewaters

Obwohl +25% ja noch eine verhaltene Reaktion sind...

Da muss doch eine Neubewertung anstehen...

Sieht gut aus, mir fehlen noch 20% dann bin ich im Gewinn..

hobiewaters

wonderbar

wonderbar

Hallo zusammen,

bin eher zufällig auf die Firma gestossen.

Kann mir jemand bitte mitteilen wie viel Cash die Aktuell habe sowie die Anzahl der Aktien?

Gruß,

Starwars

bin eher zufällig auf die Firma gestossen.

Kann mir jemand bitte mitteilen wie viel Cash die Aktuell habe sowie die Anzahl der Aktien?

Gruß,

Starwars

Antwort auf Beitrag Nr.: 38.410.942 von Starwars1969 am 18.11.09 15:18:59Letzter Geschäftsbericht von der HP:

http://www.altonaenergy.com/AnnualReport2008.pdf

358 Mio Aktien

Cash 2,8 Min GBP

Freundliche Grüße

supernova

http://www.altonaenergy.com/AnnualReport2008.pdf

358 Mio Aktien

Cash 2,8 Min GBP

Freundliche Grüße

supernova

Final Results - Nov 23, 2009

Overview:

+ Transformational period following agreement of the joint venture terms with CNOOC-NEI to evaluate the Company's estimated 7.8 billion tonne coal resource (non-JORC standard) in South Australia, one of the world's largest untapped energy banks, of which 1.287 billion tonnes at the Wintinna Deposit has been brought up to current JORC standards

+ Strategic partnership established with CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation, one of the three largest state owned oil companies in the Peoples Republic of China, whose expertise, resources and stature will be instrumental in moving the Arckaringa Project forward and accelerating its commercialisation

+ CNOOC-NEI to fund and manage the BFS, with responsibility for assessing the full potential of the coal resource and bringing projects to development, in return for a 51% interest in Arckaringa Energy's exploration licences

+ Parties to evaluate proceeding progressively with coal development, Coal-to-Liquids and/or Synthetic Natural Gas, power co-generation and a range of other potential clean energy projects that will benefit South Australia

+ Tender process completed with leading international engineering companies for the role of Study Engineer to complete a BFS for the 'Base Case' Arckaringa Project, with the outcome of this process to be released in due course

+ Key technical studies for BFS commenced

+ Actively working with the South Australian Government and the Department of Primary Industry and Resources of South Australia to advance the Arckaringa Project

+ Became a Foundation Member of the Global Carbon Capture and Storage Institute

+ Welcomed new major strategic institutional investor in Invesco Perpetual, who now hold a 15% interest

www.londonstockexchange.com/exchange/prices-and-news/news/ma…

Overview:

+ Transformational period following agreement of the joint venture terms with CNOOC-NEI to evaluate the Company's estimated 7.8 billion tonne coal resource (non-JORC standard) in South Australia, one of the world's largest untapped energy banks, of which 1.287 billion tonnes at the Wintinna Deposit has been brought up to current JORC standards

+ Strategic partnership established with CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation, one of the three largest state owned oil companies in the Peoples Republic of China, whose expertise, resources and stature will be instrumental in moving the Arckaringa Project forward and accelerating its commercialisation

+ CNOOC-NEI to fund and manage the BFS, with responsibility for assessing the full potential of the coal resource and bringing projects to development, in return for a 51% interest in Arckaringa Energy's exploration licences

+ Parties to evaluate proceeding progressively with coal development, Coal-to-Liquids and/or Synthetic Natural Gas, power co-generation and a range of other potential clean energy projects that will benefit South Australia

+ Tender process completed with leading international engineering companies for the role of Study Engineer to complete a BFS for the 'Base Case' Arckaringa Project, with the outcome of this process to be released in due course

+ Key technical studies for BFS commenced

+ Actively working with the South Australian Government and the Department of Primary Industry and Resources of South Australia to advance the Arckaringa Project

+ Became a Foundation Member of the Global Carbon Capture and Storage Institute

+ Welcomed new major strategic institutional investor in Invesco Perpetual, who now hold a 15% interest

www.londonstockexchange.com/exchange/prices-and-news/news/ma…

Antwort auf Beitrag Nr.: 38.437.411 von Popeye82 am 23.11.09 14:04:57Du schon wieder, Popeye?

Gerade noch bei Freewest, jetzt schon bei Altona.

Hast Du wenigstend von ANR ein paar Stück?

Zum nachstehenden Artikel: Nicht nur die Titelzeile lesen!

Altona Energy losses rise

Posted 23 November 2009 @ 08:50 am BST

Altona Energy posts full year losses of £1.1m - up from £766,000 last time.

The pre-tax loss increases to £1.27m compared with £766,000 a year ago.

The firm said the year to the end of June had been transformational period following agreement of the joint venture terms with CNOOC-NEI to evaluate the company's estimated 7.8 billion tonne coal resource (non-JORC standard) in South Australia.

It said this was one of the world's largest untapped energy banks, of which 1.287 billion tonnes at the Wintinna Deposit had been brought up to current JORC standards.

Strategic partnership established with CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation, one of the three largest state owned oil companies in China, whose expertise, resources and stature will be instrumental in moving the Arckaringa Project forward and accelerating its commercialisation.

Chairman Chris Lambert said: "We now have a clear path through to bankable feasibility and then the potential resultant multiple projects.

"We will be working with our strategic partner, CNOOC-NEI, on evaluating the optimal development of our 7.8 billion tonne coal resource, which may play a significant role in solving the energy requirements of South Australia.

"We look forward to working closely with all parties, including government and CNOOC-NEI, to maximise the Arckaringa Project's exciting and vast potential.

"With this in mind, we expect a positive re-rating in the value of your company as more investors come to better understand this potential and our strategic partnership with a company of the stature and immense resources of CNOOC-NEI."

Story provided by Business Financial Newswire

Read the full article of:

http://www.ibtimes.co.uk/articles/20091123/altona-energy-los…

Freundliche Grüße

supernova

Gerade noch bei Freewest, jetzt schon bei Altona.

Hast Du wenigstend von ANR ein paar Stück?

Zum nachstehenden Artikel: Nicht nur die Titelzeile lesen!

Altona Energy losses rise

Posted 23 November 2009 @ 08:50 am BST

Altona Energy posts full year losses of £1.1m - up from £766,000 last time.

The pre-tax loss increases to £1.27m compared with £766,000 a year ago.

The firm said the year to the end of June had been transformational period following agreement of the joint venture terms with CNOOC-NEI to evaluate the company's estimated 7.8 billion tonne coal resource (non-JORC standard) in South Australia.

It said this was one of the world's largest untapped energy banks, of which 1.287 billion tonnes at the Wintinna Deposit had been brought up to current JORC standards.

Strategic partnership established with CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation, one of the three largest state owned oil companies in China, whose expertise, resources and stature will be instrumental in moving the Arckaringa Project forward and accelerating its commercialisation.

Chairman Chris Lambert said: "We now have a clear path through to bankable feasibility and then the potential resultant multiple projects.

"We will be working with our strategic partner, CNOOC-NEI, on evaluating the optimal development of our 7.8 billion tonne coal resource, which may play a significant role in solving the energy requirements of South Australia.

"We look forward to working closely with all parties, including government and CNOOC-NEI, to maximise the Arckaringa Project's exciting and vast potential.

"With this in mind, we expect a positive re-rating in the value of your company as more investors come to better understand this potential and our strategic partnership with a company of the stature and immense resources of CNOOC-NEI."

Story provided by Business Financial Newswire

Read the full article of:

http://www.ibtimes.co.uk/articles/20091123/altona-energy-los…

Freundliche Grüße

supernova

Antwort auf Beitrag Nr.: 38.438.236 von supernova1712 am 23.11.09 15:42:06wenigstens

Ich dachte meine Legasthenie sei geheilt.

Ich dachte meine Legasthenie sei geheilt.

Noch einer. Steht zwar nichts neues drin, aber die Weltpresse macht vielleicht den einen oder anderen auf unsere Perle aufmerksam.

+

China backs Altona project

Sarah-Jane Tasker From: The Australian November 20, 2009 9:45AM

ALTONA Energy has secured a Chinese partner to help it develop a $3 billion coal project in South Australia.

The London-listed company said yesterday that its Australian subsidiary, Arckaringa Energy, had signed a deal with CNOOC New Energy Investment to develop the estimated 7.8 billion tonne coal resource.

CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation -- one of the three largest state-owned oil companies in China -- will receive a 51 per cent interest in Arckaringa Energy's exploration licences.

Altona said China's interest would speed up development.

Managing director Chris Schrape said the deal was a major milestone for a small company with a "grand vision".

CNOOC-NEI will establish an Australian subsidiary to fund and research a bankable feasibility study for a coalmine and an integrated value-added project, which is expected to be a coal to liquids plant and power facility.

+

Klingt doch schön, oder? major milestone

Freundliche Grüße

supernova

+

China backs Altona project

Sarah-Jane Tasker From: The Australian November 20, 2009 9:45AM

ALTONA Energy has secured a Chinese partner to help it develop a $3 billion coal project in South Australia.

The London-listed company said yesterday that its Australian subsidiary, Arckaringa Energy, had signed a deal with CNOOC New Energy Investment to develop the estimated 7.8 billion tonne coal resource.

CNOOC-NEI, a subsidiary of China National Offshore Oil Corporation -- one of the three largest state-owned oil companies in China -- will receive a 51 per cent interest in Arckaringa Energy's exploration licences.

Altona said China's interest would speed up development.

Managing director Chris Schrape said the deal was a major milestone for a small company with a "grand vision".

CNOOC-NEI will establish an Australian subsidiary to fund and research a bankable feasibility study for a coalmine and an integrated value-added project, which is expected to be a coal to liquids plant and power facility.

+

Klingt doch schön, oder? major milestone

Freundliche Grüße

supernova

Antwort auf Beitrag Nr.: 38.438.236 von supernova1712 am 23.11.09 15:42:06

Nee, auch nicht(anfänglich eine kurze Zeit). Das hindert einen ja nicht daran verschiedene Unternehmen/Projekte zu verfolgen, um mal zu schauen, ob sich eventl. mal ein guter Augenblick ergibt(worauf meine Ausrichtung inzwischen ganz wesentlich basiert).

Das hindert einen ja nicht daran verschiedene Unternehmen/Projekte zu verfolgen, um mal zu schauen, ob sich eventl. mal ein guter Augenblick ergibt(worauf meine Ausrichtung inzwischen ganz wesentlich basiert).

Möchte mir aber eigentlich noch ein weiteres CTL Unternehmen ins Depot legen &versuche mir gerade aus verschiedenen Kandidaten einen vielversprechenden auszufiltern, wird aber wohl noch etwas dauern.

Gruß,

Popeye

Nee, auch nicht(anfänglich eine kurze Zeit).

Das hindert einen ja nicht daran verschiedene Unternehmen/Projekte zu verfolgen, um mal zu schauen, ob sich eventl. mal ein guter Augenblick ergibt(worauf meine Ausrichtung inzwischen ganz wesentlich basiert).

Das hindert einen ja nicht daran verschiedene Unternehmen/Projekte zu verfolgen, um mal zu schauen, ob sich eventl. mal ein guter Augenblick ergibt(worauf meine Ausrichtung inzwischen ganz wesentlich basiert).

Möchte mir aber eigentlich noch ein weiteres CTL Unternehmen ins Depot legen &versuche mir gerade aus verschiedenen Kandidaten einen vielversprechenden auszufiltern, wird aber wohl noch etwas dauern.

Gruß,

Popeye

Antwort auf Beitrag Nr.: 38.439.227 von Popeye82 am 23.11.09 17:11:23ein weiteres CTL Unternehmen

Wenn Du eines entdeckt hast, dann sach Bescheid.

Schönen Abend noch

supernova

Wenn Du eines entdeckt hast, dann sach Bescheid.

Schönen Abend noch

supernova

Antwort auf Beitrag Nr.: 38.439.227 von Popeye82 am 23.11.09 17:11:23Für deine Suche:

http://www.dyor.de/ctl-gtl.html

ich würde auch gerne erweitern...

http://www.dyor.de/ctl-gtl.html

ich würde auch gerne erweitern...

Antwort auf Beitrag Nr.: 38.440.545 von XIO am 23.11.09 19:38:27ich würde auch gerne erweitern

Ich auch.

Gruß Looe

Ich auch.

Gruß Looe

Antwort auf Beitrag Nr.: 38.441.792 von Looe am 23.11.09 22:56:17

Hallo,

Zum Thema CTL hab ich mir seit längerem immer mal Unternehmen vermerkt, das ist die Aufstellung –eine reine Auflistung von potentiellen Kandidaten(Auswahl schaffen, vergleichen, einkreisen etc. ...&irgendwann zuschlagen, so in der Art). Vor allem inklusive CBM dürften sich die Kandidaten wahrs. weitaus erhöhen, bei einigen ist es auch nur eine von mehreren Optionen:

- Central Petroleum

- Carbon Energy

- Metgasco

- Linc Energy

- Liberty Resources

- Blackham Resources

- Syngas

- Strike Oil

- Icon Energy

- Liqufied Natural Gas

- Molopo Energy

- Gulf Resources

- CBM Asia Development

- Victoria Petroleum

- East Coast Minerals

- Cougar Energy

- Metro Coal, Pre IPO

- Blue Energy

- Comet Ridge

- L &M Petroleum

- Exoma Energy

- Rey Resources

- Spitfire Oil

- European Gas

- Ignite Energy Resources, Pre IPO

- Coalworks

- Orion Petroleum

- Red Sky Energy

- Wildhorse Energy

- Clean Global Energy

- NuCoal Energy, Pre IPO

Neben CTP, von Denen ich für meine Verhälnisse ´ne dicke Position hab, scheinen mir auf jeden Fall noch Spitfire Oil, Linc Energy, Ignite Energy Resources &Blackham Resources interessant, IMO insgesamt recht kompliziertes Thema(v.a. Technologie(entwicklung) &rechtliche/Umwelt Ramenbedingungen).

Hier ist noch ein würd´ ich sagen ganz guter Bericht zu UCG:

www.lincenergy.com.au/pdf/ucgreport-01.pdf

Gruß,

Popeye

Hallo,

Zum Thema CTL hab ich mir seit längerem immer mal Unternehmen vermerkt, das ist die Aufstellung –eine reine Auflistung von potentiellen Kandidaten(Auswahl schaffen, vergleichen, einkreisen etc. ...&irgendwann zuschlagen, so in der Art). Vor allem inklusive CBM dürften sich die Kandidaten wahrs. weitaus erhöhen, bei einigen ist es auch nur eine von mehreren Optionen:

- Central Petroleum

- Carbon Energy

- Metgasco

- Linc Energy

- Liberty Resources

- Blackham Resources

- Syngas

- Strike Oil

- Icon Energy

- Liqufied Natural Gas

- Molopo Energy

- Gulf Resources

- CBM Asia Development

- Victoria Petroleum

- East Coast Minerals

- Cougar Energy

- Metro Coal, Pre IPO

- Blue Energy

- Comet Ridge

- L &M Petroleum

- Exoma Energy

- Rey Resources

- Spitfire Oil

- European Gas

- Ignite Energy Resources, Pre IPO

- Coalworks

- Orion Petroleum

- Red Sky Energy

- Wildhorse Energy

- Clean Global Energy

- NuCoal Energy, Pre IPO

Neben CTP, von Denen ich für meine Verhälnisse ´ne dicke Position hab, scheinen mir auf jeden Fall noch Spitfire Oil, Linc Energy, Ignite Energy Resources &Blackham Resources interessant, IMO insgesamt recht kompliziertes Thema(v.a. Technologie(entwicklung) &rechtliche/Umwelt Ramenbedingungen).

Hier ist noch ein würd´ ich sagen ganz guter Bericht zu UCG:

www.lincenergy.com.au/pdf/ucgreport-01.pdf

Gruß,

Popeye

Antwort auf Beitrag Nr.: 38.442.101 von Popeye82 am 24.11.09 02:47:45Super Liste.. die muss ich mir einfach mal kopieren

thx

thx

November 23, 2009

Little Altona Energy Now Has A JV With China’s 3rd Biggest Oil Company On A Huge Coal Resource In South Australia

By Charles Wyatt

A jump of 30 per cent in the share price greeted the news that AIM listed Altona Energy has at last signed up to a joint venture with CNOOC New Energy Investment on its Arckaringa coal project in South Australia. The reaction in the shares is not surprising as Arckaringa is a huge coal project in South Australia with a resource estimincluding gas and synthetic fuelsated at around 7.8 million tonnes yet Altona is still capitalised at less than £ 20 million. It therefore needed a big partner with the reputation, expertise and funding to get some real impetus behind what chairman Chris Lambert believes is one of the world’s biggest undeveloped energy banks. It has certainly found just such a partner in CNOOC as it is one of the three largest state owned oil companies in the Peoples Republic of China. More than that, it has proven expertise in Coal- to- Liquid technology which converts coal into more environmentally clean and manageable energy sources .The process involves two major stages, gasification to produce synthetic gas rich in hydrogen and carbon, and a liquefication stage where the synthetic gas is reacted over a catalyst to produce high quality, ultraclean synthetic fuels and chemical feedstocks. CNOOC-NEI already has plenty of experience in synthetic gas so there is no great learning curve to climb. In fact C-to-L is a prime example of clean coal technology - the associated combined cycle units produce negligible sulphur oxides,...

+++

Man liest es einfach immer wieder gerne:

"Little Altona!" - süüüüüß!

Freundliche Grüße

supernova

Little Altona Energy Now Has A JV With China’s 3rd Biggest Oil Company On A Huge Coal Resource In South Australia

By Charles Wyatt

A jump of 30 per cent in the share price greeted the news that AIM listed Altona Energy has at last signed up to a joint venture with CNOOC New Energy Investment on its Arckaringa coal project in South Australia. The reaction in the shares is not surprising as Arckaringa is a huge coal project in South Australia with a resource estimincluding gas and synthetic fuelsated at around 7.8 million tonnes yet Altona is still capitalised at less than £ 20 million. It therefore needed a big partner with the reputation, expertise and funding to get some real impetus behind what chairman Chris Lambert believes is one of the world’s biggest undeveloped energy banks. It has certainly found just such a partner in CNOOC as it is one of the three largest state owned oil companies in the Peoples Republic of China. More than that, it has proven expertise in Coal- to- Liquid technology which converts coal into more environmentally clean and manageable energy sources .The process involves two major stages, gasification to produce synthetic gas rich in hydrogen and carbon, and a liquefication stage where the synthetic gas is reacted over a catalyst to produce high quality, ultraclean synthetic fuels and chemical feedstocks. CNOOC-NEI already has plenty of experience in synthetic gas so there is no great learning curve to climb. In fact C-to-L is a prime example of clean coal technology - the associated combined cycle units produce negligible sulphur oxides,...

+++

Man liest es einfach immer wieder gerne:

"Little Altona!" - süüüüüß!

Freundliche Grüße

supernova

Frankfurt + 97 %

Den bringen sie sicher bald weg...

Den bringen sie sicher bald weg...

Antwort auf Beitrag Nr.: 38.471.711 von listening am 27.11.09 19:39:13Den bringen sie sicher bald weg...

Meinst Du den Makler ? Ist der besoffen ?

Ist der besoffen ?

Schaue eben in mein Depot und sehe + 97,9 %.

Meinst Du den Makler ?

Ist der besoffen ?

Ist der besoffen ?Schaue eben in mein Depot und sehe + 97,9 %.

Antwort auf Beitrag Nr.: 38.472.393 von Looe am 27.11.09 21:36:27Keine Ahnung was der für ein Zeug nimmt,

aber er hat das schon öfter konsumiert...

oder ist die Hyperinflation schon da?

aber er hat das schon öfter konsumiert...

oder ist die Hyperinflation schon da?

Antwort auf Beitrag Nr.: 38.473.308 von listening am 28.11.09 11:36:37

Der schwankt von einen Extrem ins andere

Ich möchte nicht wissen, wie viele von den Typen da in Frankfurt rumrennen, die abends nicht mehr wissen was sie den Tag über gemacht haben.

Der schwankt von einen Extrem ins andere

Ich möchte nicht wissen, wie viele von den Typen da in Frankfurt rumrennen, die abends nicht mehr wissen was sie den Tag über gemacht haben.

Antwort auf Beitrag Nr.: 38.473.308 von listening am 28.11.09 11:36:37aber er hat das schon öfter konsumiert...

Möchte mir den Stoff auch mal reinziehen, muß ja rattenscharf sein. Da sieht das Depot doch schon gleich ganz anders aus.

Möchte mir den Stoff auch mal reinziehen, muß ja rattenscharf sein. Da sieht das Depot doch schon gleich ganz anders aus.

Antwort auf Beitrag Nr.: 38.474.230 von timezone am 28.11.09 20:04:37Der schwankt von einen Extrem ins andere

Er scheint wieder nüchtern zu sein.

Er scheint wieder nüchtern zu sein.

Euroclear Nominees 11,689,800 3.2%

Securities Services 13,000,000 3.5%

Forest Nominees 10,733,789 2.9%

Invesco Perpetual 60,807,892 16.4%

Pershing Nominees 20,437,259 5.5%

Teawood Nominees 14,400,000 3.9%

T Hoare Nominees 15,131,153 4.1%

Homeland Energy 2,750,000 0.7%

Rebecca Holland-Kennedy 8,856,347 2.4%

Norman Kennedy 8,856,346 2.4%

RC Greig Nominees 8,502,520 2.3%

Tongjiang 76,500,000 20.6%

Perivest 7,600,000 2.1%

Morgan Stanley 7,257,113 2.0%

Christopher Lambert 6,000,000 1.6%

Anthony Samaha 1,500,000 0.4%

CIM 14,900,000 4.0%

Chris Schrape 500,000 0.1%

Mr JF Scott 18,700,000

Others 62,000,000 16.7%

Total 370,122,219 99.9

Total number of shares in issue 370,468,894

keine Garantie, grad in anderem Forum gefunden, scheint zu passen

Securities Services 13,000,000 3.5%

Forest Nominees 10,733,789 2.9%

Invesco Perpetual 60,807,892 16.4%

Pershing Nominees 20,437,259 5.5%

Teawood Nominees 14,400,000 3.9%

T Hoare Nominees 15,131,153 4.1%

Homeland Energy 2,750,000 0.7%

Rebecca Holland-Kennedy 8,856,347 2.4%

Norman Kennedy 8,856,346 2.4%

RC Greig Nominees 8,502,520 2.3%

Tongjiang 76,500,000 20.6%

Perivest 7,600,000 2.1%

Morgan Stanley 7,257,113 2.0%

Christopher Lambert 6,000,000 1.6%

Anthony Samaha 1,500,000 0.4%

CIM 14,900,000 4.0%

Chris Schrape 500,000 0.1%

Mr JF Scott 18,700,000

Others 62,000,000 16.7%

Total 370,122,219 99.9

Total number of shares in issue 370,468,894

keine Garantie, grad in anderem Forum gefunden, scheint zu passen

Zu diesem Thema:

Altona Energy Plc / Index: AIM / Epic: ANR / Sector: Exploration & Production

3rd August 2009

Altona Energy Plc ('Altona Energy' or 'the Company')

Placement to Invesco Perpetual

Altona Energy Plc, the AIM listed Australian based energy company, is pleased to announce it has completed a conditional placing with leading institutional investor, Invesco Perpetual (‘Invesco’), for 12,195,122 ordinary shares (‘the Placing Shares’) at 4.10 pence per share to raise £500,000 before costs (‘the Placing’), to provide additional working capital for the Company.

Following the Placing, Invesco will have an interest in 12,195,122 ordinary shares of the Company, representing 3.29 % of Altona's issued share capital.

The Placing is conditional on the admission of the Placing Shares to trading on AIM. Application will be made to the London Stock Exchange for the Placing Shares to be admitted to trading on AIM and it is expected this admission will become effective and that trading in the new ordinary shares will commence on 7 August 2009.

The total number of ordinary shares in issue following the Placing will be 370,360,906.

Altona Chairman Chris Lambert said, "We are delighted to welcome an institutional investor of the stature of Invesco as a new significant shareholder, and to have completed this share placement to raise additional working capital at a premium to the current share price."

Altona Energy Plc / Index: AIM / Epic: ANR / Sector: Exploration & Production

3rd August 2009

Altona Energy Plc ('Altona Energy' or 'the Company')

Placement to Invesco Perpetual

Altona Energy Plc, the AIM listed Australian based energy company, is pleased to announce it has completed a conditional placing with leading institutional investor, Invesco Perpetual (‘Invesco’), for 12,195,122 ordinary shares (‘the Placing Shares’) at 4.10 pence per share to raise £500,000 before costs (‘the Placing’), to provide additional working capital for the Company.

Following the Placing, Invesco will have an interest in 12,195,122 ordinary shares of the Company, representing 3.29 % of Altona's issued share capital.

The Placing is conditional on the admission of the Placing Shares to trading on AIM. Application will be made to the London Stock Exchange for the Placing Shares to be admitted to trading on AIM and it is expected this admission will become effective and that trading in the new ordinary shares will commence on 7 August 2009.

The total number of ordinary shares in issue following the Placing will be 370,360,906.

Altona Chairman Chris Lambert said, "We are delighted to welcome an institutional investor of the stature of Invesco as a new significant shareholder, and to have completed this share placement to raise additional working capital at a premium to the current share price."

Antwort auf Beitrag Nr.: 38.481.344 von MONSIEURCB am 30.11.09 19:04:26

bissel her ,oder?

danach haben Invesco schon zwei mal nachgelegt.

hab ich was übersehen?

bissel her ,oder?

danach haben Invesco schon zwei mal nachgelegt.

hab ich was übersehen?

Njet - sorry, mea culpa ...

Antwort auf Beitrag Nr.: 38.481.493 von MONSIEURCB am 30.11.09 19:23:11auf jeden Fall ist die Tendenz erkennbar, es wird enger

Antwort auf Beitrag Nr.: 38.442.101 von Popeye82 am 24.11.09 02:47:45

Lodestone Energy, Apollo Gas(führen gerade ein IPO durch)&Epsilon Energy wären noch weitere potentielle Kandidaten.

Gruß,

Popeye

Lodestone Energy, Apollo Gas(führen gerade ein IPO durch)&Epsilon Energy wären noch weitere potentielle Kandidaten.

Gruß,

Popeye

http://www.independent.co.uk/news/business/sharewatch/small-…...

Invesco buys into tiddler with coal mine bonanza

Another Aim-listed group from Australia had reason to raise a toast last week. Altona Energy, a real Aim market tiddler, which has three exploration licences, said the giant fund management group Invesco has increased its holding, taking its overall stake in the group to 17.19 per cent.

The punters clearly see something in Altona which, to the untrained eye, looks very much like a plethora of Aim-listed energy companies that struggle to produce very much at all. Altona says that its, "primary focus to date has been the completion of a bankable feasibility study for its wholly owned 'Arckaringa' Project for an integrated 10m barrel per year coal-to-liquid plant with a 560 MW co-generation power facility." The group's three sites are all lie close to the Adelaide-to-Darwin railway line, making transportation of the coal that much easier when Altona eventually gets it out of the ground.

"Containing more than 7.5 billion tonnes of coal, these deposits are effectively one of the world's largest undeveloped energy banks, capable of conversion into clean liquid fuels, low cost power and high value industrial feedstocks," the company said last week.

Invesco is buying into what has been a winning stock. Altona's shares have put on more than 16 per cent in the past month, the market encouraged by Invesco's. The jump is part of an outstanding 471 per cent increase in the past 12 months.

+++

http://www.fz-juelich.de/ief/ief-ste/datapool/pdferg/STE-Res…

STE Research Report 01/2009

Kohleverflüssigung

Thomas Frederik Linke

Institut für Energieforschung Systemforschung und Technologische Entwicklung (IEF-STE)

...

IV.1.2 Arckaringa Projekt

Das Arckaringa Projekt befindet sich auf der Stufe der Bewertungsphase und soll Kohleverflüssigung und Stromerzeugung verbinden. Der Standort in Südaustralien hält 7,8 Mrd. t unterbituminöse Kohle bereit und bietet sich auch durch seine geografische Lage und Anbindung für den Export an. In einer ersten Ausbaustufe sollen 15000 bpd an flüssigen Produkten und 280 MW elektrische Leistung installiert werden.

Mit dem zweiten und dritten Modul sollen sich diese eistungszahlen verdoppeln bzw. verdreifachen. Mit Abschluss der endgültigen Bewertungsphase wird Mitte 2010 gerechnet, so dass bei positiver Bewertung anschließend mit dem Bau der ersten Stufe, der sich über etwa vier Jahre streckt, begonnen werden soll. Die Versorgung mit Prozesswasser kann über die hohe Feuchtigkeit der Kohle erfolgen, so dass sogar ein Überschuss an sauberem Wasser anfallen soll. Die bisherige Planung sieht für die Vergasungstechnik ConocoPhilips und für die Fischer-Tropsch-Synthese Rentech als Hersteller vor (Schrape, 2008).

Freundliche Grüße

supernova

Invesco buys into tiddler with coal mine bonanza

Another Aim-listed group from Australia had reason to raise a toast last week. Altona Energy, a real Aim market tiddler, which has three exploration licences, said the giant fund management group Invesco has increased its holding, taking its overall stake in the group to 17.19 per cent.

The punters clearly see something in Altona which, to the untrained eye, looks very much like a plethora of Aim-listed energy companies that struggle to produce very much at all. Altona says that its, "primary focus to date has been the completion of a bankable feasibility study for its wholly owned 'Arckaringa' Project for an integrated 10m barrel per year coal-to-liquid plant with a 560 MW co-generation power facility." The group's three sites are all lie close to the Adelaide-to-Darwin railway line, making transportation of the coal that much easier when Altona eventually gets it out of the ground.

"Containing more than 7.5 billion tonnes of coal, these deposits are effectively one of the world's largest undeveloped energy banks, capable of conversion into clean liquid fuels, low cost power and high value industrial feedstocks," the company said last week.

Invesco is buying into what has been a winning stock. Altona's shares have put on more than 16 per cent in the past month, the market encouraged by Invesco's. The jump is part of an outstanding 471 per cent increase in the past 12 months.

+++

http://www.fz-juelich.de/ief/ief-ste/datapool/pdferg/STE-Res…

STE Research Report 01/2009

Kohleverflüssigung

Thomas Frederik Linke

Institut für Energieforschung Systemforschung und Technologische Entwicklung (IEF-STE)

...

IV.1.2 Arckaringa Projekt

Das Arckaringa Projekt befindet sich auf der Stufe der Bewertungsphase und soll Kohleverflüssigung und Stromerzeugung verbinden. Der Standort in Südaustralien hält 7,8 Mrd. t unterbituminöse Kohle bereit und bietet sich auch durch seine geografische Lage und Anbindung für den Export an. In einer ersten Ausbaustufe sollen 15000 bpd an flüssigen Produkten und 280 MW elektrische Leistung installiert werden.

Mit dem zweiten und dritten Modul sollen sich diese eistungszahlen verdoppeln bzw. verdreifachen. Mit Abschluss der endgültigen Bewertungsphase wird Mitte 2010 gerechnet, so dass bei positiver Bewertung anschließend mit dem Bau der ersten Stufe, der sich über etwa vier Jahre streckt, begonnen werden soll. Die Versorgung mit Prozesswasser kann über die hohe Feuchtigkeit der Kohle erfolgen, so dass sogar ein Überschuss an sauberem Wasser anfallen soll. Die bisherige Planung sieht für die Vergasungstechnik ConocoPhilips und für die Fischer-Tropsch-Synthese Rentech als Hersteller vor (Schrape, 2008).

Freundliche Grüße

supernova

Antwort auf Beitrag Nr.: 38.607.729 von Ikar am 21.12.09 11:14:03So, der Fahrplan zur BFS steht jetzt:

> bis März/ Mai 2010: FIRB-Genehmigung und Start an der BFS

Dann ist endlich für stetigen News-flows gesorgt im nächsten Jahr, mit signifikantem Projektfortschritt im Sinne einer Produktionsentscheidung ist dann wohl in 2011 zu rechnen.

Sobald die FIRB-Genehmigung vorliegt und mit der BFS angefangen wird,

ist aber mit deutlich mehr Aufmerksamkeit zu rechnen in den Medien

(und hoffentlich auch bei W

)

)

Entwickelt sich sehr gut Altona, das kann was Großes werden, ich bleibe dabei!

Grüße

-hobie

> bis März/ Mai 2010: FIRB-Genehmigung und Start an der BFS

Dann ist endlich für stetigen News-flows gesorgt im nächsten Jahr, mit signifikantem Projektfortschritt im Sinne einer Produktionsentscheidung ist dann wohl in 2011 zu rechnen.

Sobald die FIRB-Genehmigung vorliegt und mit der BFS angefangen wird,

ist aber mit deutlich mehr Aufmerksamkeit zu rechnen in den Medien

(und hoffentlich auch bei W

)

)Entwickelt sich sehr gut Altona, das kann was Großes werden, ich bleibe dabei!

Grüße

-hobie

Antwort auf Beitrag Nr.: 38.607.894 von hobiewaters am 21.12.09 11:36:39bitte,bitte,bitte,bitte,halte uns die Wichtigtuer fern danke.frohes Fest!

Antwort auf Beitrag Nr.: 38.607.941 von zuzi am 21.12.09 11:42:43bitte,bitte,bitte,bitte,halte uns die Wichtigtuer fern danke.frohes Fest!

hmm?

Na gut, keine Angst ich stelle keinen Hinweis oder Link in den CDU-Thread ein.

Auch frohes Fest!

hmm?

Na gut, keine Angst ich stelle keinen Hinweis oder Link in den CDU-Thread ein.

Auch frohes Fest!

Antwort auf Beitrag Nr.: 38.607.941 von zuzi am 21.12.09 11:42:43Entschuldigung

soll nicht mehr vorkommen

soll nicht mehr vorkommen

Antwort auf Beitrag Nr.: 38.607.941 von zuzi am 21.12.09 11:42:43

Für was brauchen wir dann diesen Thread Du Schlaumeier, Altona wird mit oder ohne Gerede hier steigen oder fallen.

Solche Typen wie Dich gibt es hier bei WO wie Sand am Meer, aller fünf Monate mal einen Spruch ablassen.

Für was brauchen wir dann diesen Thread Du Schlaumeier, Altona wird mit oder ohne Gerede hier steigen oder fallen.

Solche Typen wie Dich gibt es hier bei WO wie Sand am Meer, aller fünf Monate mal einen Spruch ablassen.

Antwort auf Beitrag Nr.: 38.607.894 von hobiewaters am 21.12.09 11:36:39Ja - die Präsentation ist wirklich interessant.

Hier braucht man einfach Geduld. Heute 4 Mio Umsatz in London.

Ich glaube 2010 bringt die Aktie Richtung 10 pence...

Hier braucht man einfach Geduld. Heute 4 Mio Umsatz in London.

Ich glaube 2010 bringt die Aktie Richtung 10 pence...

Antwort auf Beitrag Nr.: 38.611.846 von Rohstoffinvestor am 21.12.09 19:21:09Ich glaube 2010 bringt die Aktie Richtung 10 pence...

Das hoffe ich doch auch stark, und nicht nur an einem Freitag, weil der Makler "zu" ist.

Das hoffe ich doch auch stark, und nicht nur an einem Freitag, weil der Makler "zu" ist.

Antwort auf Beitrag Nr.: 38.657.425 von XIO am 03.01.10 20:12:52PS.. nur mal so, wen es interessiert

Allen hier ein erfolgreiches 2010,

Danke für die Karte Xio;

war schon vor knapp zwei Jahren bei ALTONA;

hoffentlich können die Investoren Carbon Capture umsetzen;

behaltet den chart im Auge, kann bald zappelig werden

bei der Fahrt die sie aufnimmt,

stay cool

UHU

UHU

Danke für die Karte Xio;

war schon vor knapp zwei Jahren bei ALTONA;

hoffentlich können die Investoren Carbon Capture umsetzen;

behaltet den chart im Auge, kann bald zappelig werden

bei der Fahrt die sie aufnimmt,

stay cool

UHU

UHU

Antwort auf Beitrag Nr.: 38.631.948 von Looe am 25.12.09 23:54:28Sobald die Umsätze steigen wird auch der Spread enger.

Heute schon wieder guter Umsatz - wird sind Richtung 10p...

Heute schon wieder guter Umsatz - wird sind Richtung 10p...

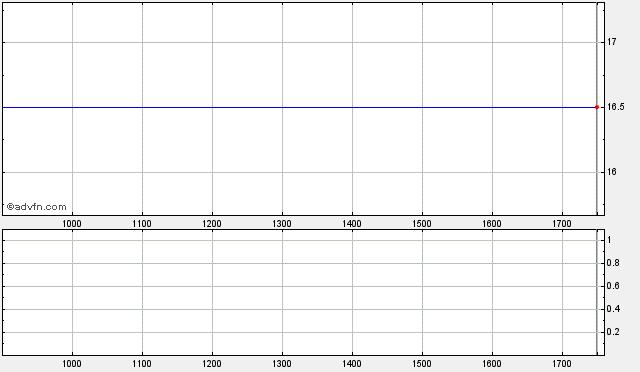

Altona heute:

Antwort auf Beitrag Nr.: 38.668.486 von uullii am 05.01.10 15:54:55he uullii.. sag mal, Dich gibts auch noch