MMT...........was geht hier UPPPPPPPP !?!?!!? - 500 Beiträge pro Seite

eröffnet am 04.03.09 23:56:15 von

neuester Beitrag 01.04.15 22:55:24 von

neuester Beitrag 01.04.15 22:55:24 von

Beiträge: 120

ID: 1.148.789

ID: 1.148.789

Aufrufe heute: 0

Gesamt: 14.211

Gesamt: 14.211

Aktive User: 0

ISIN: CA5729031024 · WKN: A0CAKJ

0,1680

EUR

+0,60 %

+0,0010 EUR

Letzter Kurs 30.03.16 Tradegate

......mit nachfolg. news kam wieder schwung in diesen kleinen

oelwert rein.........

CALGARY, ALBERTA--(Marketwire - Feb. 11, 2009)

- Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") announces that it has received an unsolicited expression of interest from a third party with respect to a proposal for a corporate purchase transaction. In response thereto, the Board of Directors of the Company has appointed a special committee of the board of directors to review and evaluate this expression of interest as well as to evaluate all other possible strategic alternatives that may be available to the Company with the intent of maximizing shareholder value. In furtherance of the foregoing, Mart is also seeking to retain a financial advisor to assist in this strategic review process.

About Mart Resources:

Mart Resources Inc. is an independent, international petroleum company focused on drilling, developing and producing oil and gas from low-risk proven petroleum properties in Africa. The Company owns two drilling rigs, has strong local relationships and has formed joint venture partnerships with indigenous operators in Nigeria. Mart has acquired interests in and begun development of three onshore Nigerian oil fields. Mart's first oil production commenced in April 2008 from the Umusadege field.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mart Resources, Inc. - London

David Parker

President

+44 207 953 4090

Email: David.Parker@martresources.com

Mart Resources, Inc. - Calgary

David Halpin

CFO

(403) 270-1841

Email: David.Halpin@martresources.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE RELEASE.

Source: CCN Matthews (February 11, 2009 - 8:31 AM EST)

News by QuoteMedia

...HEUTE sahen wir noch nie da gewesene vols von

17 mio. shares in TOR mit SK von cad 0,06 !!!!

17 mio. shares in TOR mit SK von cad 0,06 !!!!

...welch unheimliche chance in MMT schlummert zeigt der

blick auf den jahres- chart.....im HOCH bei cad 0,79

blick auf den jahres- chart.....im HOCH bei cad 0,79

Antwort auf Beitrag Nr.: 36.702.910 von hbg55 am 05.03.09 00:04:02

....darin sehe ICH auch den hintergrund des neuerlichen AUSBRUCHS,

der indiz dafür sein dürfte, daß ein BIG PLAYER sich angesichts des akt. schnäppchen- niv. ein schönen strake geschnappt haben dürfte !!!

....darin sehe ICH auch den hintergrund des neuerlichen AUSBRUCHS,

der indiz dafür sein dürfte, daß ein BIG PLAYER sich angesichts des akt. schnäppchen- niv. ein schönen strake geschnappt haben dürfte !!!

Antwort auf Beitrag Nr.: 36.702.916 von hbg55 am 05.03.09 00:08:27

....könnten gestern den start einer bevorstehenden

übernahmeschlacht gesehen haben, bei der akt. in den

boards schon kurse von cad 0,20 und meeeeehr gehandelt

werden !!!

....könnten gestern den start einer bevorstehenden

übernahmeschlacht gesehen haben, bei der akt. in den

boards schon kurse von cad 0,20 und meeeeehr gehandelt

werden !!!

Mart Resources, Inc. Announces Third Quarter Results, Adoption of Shareholder Rights Plan and Evaluation of Strategic and Funding Alternatives

.........zahlen zum 3q.2008 sowie forecast für 2009 sind

unter nachfolg. link zu finden......

http://finance.yahoo.com/news/Mart-Resources-Inc-Announces-c…

.........zahlen zum 3q.2008 sowie forecast für 2009 sind

unter nachfolg. link zu finden......

http://finance.yahoo.com/news/Mart-Resources-Inc-Announces-c…

Mart receives mysterious expression of interest

Die stockwatch-Überschrift ist auch recht treffend...

könnte auch nur ein Fake gewesen sein, um ein Paketchen loszuwerden...

Die stockwatch-Überschrift ist auch recht treffend...

könnte auch nur ein Fake gewesen sein, um ein Paketchen loszuwerden...

.....kleines, aber nicht gaaaaanz unbedeutendes ´schmankerl´

sind die letzten INSIDER- trades.......

Mart Resources, Inc. (MMT)

As of March 3rd, 2009

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Dec 12/08 Dec 11/08 Wakula, Walter Direct Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.050

Dec 12/08 Dec 03/08 Wakula, Walter Direct Ownership Common Shares 10 - Acquisition in the public market 55,000 $0.055

Nov 18/08 Nov 18/08 Halpin, David John Direct Ownership Common Shares 10 - Acquisition in the public market 20,000 $0.055

Nov 11/08 Oct 02/08 Wolbaum, Leroy Direct Ownership Common Shares 10 - Acquisition in the public market 68,000 $0.120

Nov 11/08 Sep 24/08 Wolbaum, Leroy Direct Ownership Common Shares 10 - Acquisition in the public market 39,000 $0.125

Oct 31/08 Oct 31/08 Wakula, Walter Direct Ownership Common Shares 10 - Acquisition in the public market 61,000 $0.082

Oct 31/08 Oct 31/08 Woitas, Mark H. Direct Ownership Common Shares 10 - Acquisition in the public market 80,000 $0.085

Oct 27/08 Oct 24/08 Cherwayko, William Direct Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.060

Oct 24/08 Oct 24/08 Wakula, Walter Direct Ownership Common Shares 10 - Acquisition in the public market 24,000 $0.060

Oct 23/08 Oct 23/08 Halpin, David John Direct Ownership Common Shares 10 - Acquisition in the public market 70,000 $0.060

Antwort auf Beitrag Nr.: 36.702.975 von blash5 am 05.03.09 00:43:26

moin BLASH,

richtig, wenn man sich letzten monat anschaut

könnte man auf diesen gedanken kommen..........aaaaaaber

das gestrige FINALE wirft nun doch paaaaar rätsel auf, wie

auch ein blick ins SH- board zeigt !!!!

moin BLASH,

richtig, wenn man sich letzten monat anschaut

könnte man auf diesen gedanken kommen..........aaaaaaber

das gestrige FINALE wirft nun doch paaaaar rätsel auf, wie

auch ein blick ins SH- board zeigt !!!!

Antwort auf Beitrag Nr.: 36.702.994 von hbg55 am 05.03.09 00:51:05moin ist gut, eher gute nacht...brauch mal ein paar stunden schlaf...

RAB Capital ist hier massiv auf der Verkäuferseite über Tristone gewesen...mag RABs finanzieller Situation geschuldet sein. I don't know. Wäre indes nix Neues, wenn Fonds Gerüchte streuen, um von Positionen herunterzukommen.

Ölfeld in Nigeria? - da ist mir das politische Risiko zu hoch und keine Lust auf Trading/Zocken

- da ist mir das politische Risiko zu hoch und keine Lust auf Trading/Zocken

@hbg - schau dir mal bei Gelegenheit Ascot Mining an, dann schaue ich hier auch wieder mal rein. merci.

RAB Capital ist hier massiv auf der Verkäuferseite über Tristone gewesen...mag RABs finanzieller Situation geschuldet sein. I don't know. Wäre indes nix Neues, wenn Fonds Gerüchte streuen, um von Positionen herunterzukommen.

Ölfeld in Nigeria?

- da ist mir das politische Risiko zu hoch und keine Lust auf Trading/Zocken

- da ist mir das politische Risiko zu hoch und keine Lust auf Trading/Zocken@hbg - schau dir mal bei Gelegenheit Ascot Mining an, dann schaue ich hier auch wieder mal rein. merci.

Antwort auf Beitrag Nr.: 36.702.901 von hbg55 am 05.03.09 00:00:55

.....und so sahen die gestrigen 10 last trades von insgesamt

292 aus..........gaaaanz schöne pakete dabei !!!

Time Ex Price Change Volume Buyer Seller Markers

15:59:51 V 0.06 +0.015 50,000 1 Anonymous 54 Global K

15:59:50 V 0.06 +0.015 200,000 1 Anonymous 68 Leede K

15:59:05 V 0.06 +0.015 8,000 7 TD Sec 7 TD Sec K

15:59:05 V 0.06 +0.015 75,000 7 TD Sec 68 Leede K

15:59:05 V 0.06 +0.015 17,000 7 TD Sec 124 Questrade K

15:58:06 V 0.06 +0.015 150,000 2 RBC 124 Questrade K

15:56:16 V 0.06 +0.015 30,000 79 CIBC 124 Questrade K

15:55:12 V 0.055 +0.01 5,000 7 TD Sec 7 TD Sec K

15:54:56 V 0.06 +0.015 3,000 2 RBC 124 Questrade K

15:51:49 V 0.06 +0.015 200,000 7 TD Sec 7 TD Sec K

.....und so sahen die gestrigen 10 last trades von insgesamt

292 aus..........gaaaanz schöne pakete dabei !!!

Time Ex Price Change Volume Buyer Seller Markers

15:59:51 V 0.06 +0.015 50,000 1 Anonymous 54 Global K

15:59:50 V 0.06 +0.015 200,000 1 Anonymous 68 Leede K

15:59:05 V 0.06 +0.015 8,000 7 TD Sec 7 TD Sec K

15:59:05 V 0.06 +0.015 75,000 7 TD Sec 68 Leede K

15:59:05 V 0.06 +0.015 17,000 7 TD Sec 124 Questrade K

15:58:06 V 0.06 +0.015 150,000 2 RBC 124 Questrade K

15:56:16 V 0.06 +0.015 30,000 79 CIBC 124 Questrade K

15:55:12 V 0.055 +0.01 5,000 7 TD Sec 7 TD Sec K

15:54:56 V 0.06 +0.015 3,000 2 RBC 124 Questrade K

15:51:49 V 0.06 +0.015 200,000 7 TD Sec 7 TD Sec K

Antwort auf Beitrag Nr.: 36.703.007 von blash5 am 05.03.09 00:58:36

.........Ascot Mining........

...thx, geht in ordnung und lass mich geeeern überraschen

dann mal goooooooooood night.......and CU

.........Ascot Mining........

...thx, geht in ordnung und lass mich geeeern überraschen

dann mal goooooooooood night.......and CU

CALGARY, ALBERTA--(Marketwire - March 5, 2009)

- Mart Resources, Inc. (TSX VENTURE:MMT - News; "Mart" or the "Company") is pleased to announce that further to its press release of February 11, 2009, it has retained Research Capital Corporation to act as exclusive financial advisor to review, evaluate and assist the Company in respect of possible strategic alternatives to maximize shareholder value in the near term. These strategic alternatives may include the sale of the Company or its assets (including its oil and natural gas property interests, drilling rigs and equipment), an amalgamation or reorganization with a company having a strong capital position, or such other transaction with the intent of maximizing shareholder value.

Mart's working capital deficiency has increased significantly since it reported its third quarter financial results. Mart, together with its financial advisor, is therefore currently endeavoring to raise additional funds to bridge the Company through to completion of a strategic alternative transaction.

Research Capital is a full service investment dealer with an energy and mining focus and has been actively working with a wide range of emerging international oil and gas companies, including a number that are similar in profile and size to Mart. Parties interested in pursuing a strategic transaction with Mart are requested to contact P. Gage Jull, Managing Director, Energy Investment Banking at Research Capital Corporation - Telephone: (416) 860-7614; Cell: (416) 562-7525 or by email: Gage.Jull@Researchcapital.com.

About Mart Resources:

Mart Resources Inc. is an independent, international petroleum company focused on drilling, developing and producing oil and natural gas from low-risk proven petroleum properties in Africa. The Company owns two drilling rigs, has strong local relationships and has formed joint venture partnerships with indigenous operators in Nigeria. Mart has acquired interests in and begun development of three onshore Nigerian oil fields. Mart's first oil production commenced in April 2008 from the Umusadege field. The Company currently has production of approximately 1950 BOPD from its Umusadege Field and testing of the Company's most recently completed UMU-5 well also located on the Umusadege Field is expected to occur in the upcoming week.

Certain statements in this Press Release constitute forward-looking statements under applicable securities legislation. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Forward-looking statements in this press release include but are not limited to references, whether express or implied, of the ability of the Company to raise additional bridge funds or to complete a strategic alternative transaction. This forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels and timing of activity and achievements to differ materially from those expressed or implied by such information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE RELEASE.

Contact:

David Parker

Mart Resources, Inc. - London

President

+44 207 953 4090

Email: David.Parker@martresources.com

David Halpin

Mart Resources, Inc. - Calgary

CFO

(403) 270-1841

Email: David.Halpin@martresources.com

Website: www.martresources.com

- Mart Resources, Inc. (TSX VENTURE:MMT - News; "Mart" or the "Company") is pleased to announce that further to its press release of February 11, 2009, it has retained Research Capital Corporation to act as exclusive financial advisor to review, evaluate and assist the Company in respect of possible strategic alternatives to maximize shareholder value in the near term. These strategic alternatives may include the sale of the Company or its assets (including its oil and natural gas property interests, drilling rigs and equipment), an amalgamation or reorganization with a company having a strong capital position, or such other transaction with the intent of maximizing shareholder value.

Mart's working capital deficiency has increased significantly since it reported its third quarter financial results. Mart, together with its financial advisor, is therefore currently endeavoring to raise additional funds to bridge the Company through to completion of a strategic alternative transaction.

Research Capital is a full service investment dealer with an energy and mining focus and has been actively working with a wide range of emerging international oil and gas companies, including a number that are similar in profile and size to Mart. Parties interested in pursuing a strategic transaction with Mart are requested to contact P. Gage Jull, Managing Director, Energy Investment Banking at Research Capital Corporation - Telephone: (416) 860-7614; Cell: (416) 562-7525 or by email: Gage.Jull@Researchcapital.com.

About Mart Resources:

Mart Resources Inc. is an independent, international petroleum company focused on drilling, developing and producing oil and natural gas from low-risk proven petroleum properties in Africa. The Company owns two drilling rigs, has strong local relationships and has formed joint venture partnerships with indigenous operators in Nigeria. Mart has acquired interests in and begun development of three onshore Nigerian oil fields. Mart's first oil production commenced in April 2008 from the Umusadege field. The Company currently has production of approximately 1950 BOPD from its Umusadege Field and testing of the Company's most recently completed UMU-5 well also located on the Umusadege Field is expected to occur in the upcoming week.

Certain statements in this Press Release constitute forward-looking statements under applicable securities legislation. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Forward-looking statements in this press release include but are not limited to references, whether express or implied, of the ability of the Company to raise additional bridge funds or to complete a strategic alternative transaction. This forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels and timing of activity and achievements to differ materially from those expressed or implied by such information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE RELEASE.

Contact:

David Parker

Mart Resources, Inc. - London

President

+44 207 953 4090

Email: David.Parker@martresources.com

David Halpin

Mart Resources, Inc. - Calgary

CFO

(403) 270-1841

Email: David.Halpin@martresources.com

Website: www.martresources.com

Antwort auf Beitrag Nr.: 36.706.241 von hbg55 am 05.03.09 15:00:25to raise additional funds to bridge the Company

Antwort auf Beitrag Nr.: 36.706.284 von blash5 am 05.03.09 15:04:09

........its just a ´verrrry speculative thing´ !!!

........its just a ´verrrry speculative thing´ !!!

Antwort auf Beitrag Nr.: 36.706.324 von hbg55 am 05.03.09 15:08:08Da die Firma in finanziellen Problemen ist, könnte es auch einen Firesale geben...take care...

Antwort auf Beitrag Nr.: 36.706.601 von blash5 am 05.03.09 15:34:55Detailed Quote for Mart Resources Inc (MMT:CA)

$ 0.05 RT

-0.01 (-16.67%)

Volume: 1.72 m

$ 0.05 RT

-0.01 (-16.67%)

Volume: 1.72 m

Antwort auf Beitrag Nr.: 36.706.601 von blash5 am 05.03.09 15:34:55

...denke die akt. klemme ist ausdruck des gesehenen kursverlaufs

der last 3 month.

wie bei angestrebten mergers üblich wird mit ALLL tricks

gearbeitet, um kurs in den keller zu prügeln. bei akt. MK

von cad mio 20,- sehe ICH angesichts der dahinter stehenden

rec. ein nur noch seeeehr begrenztes risiko

think over........WARUM gingen gestern MASSSSSSEN zu cad 0,05

übern tisch !?!?!

...denke die akt. klemme ist ausdruck des gesehenen kursverlaufs

der last 3 month.

wie bei angestrebten mergers üblich wird mit ALLL tricks

gearbeitet, um kurs in den keller zu prügeln. bei akt. MK

von cad mio 20,- sehe ICH angesichts der dahinter stehenden

rec. ein nur noch seeeehr begrenztes risiko

think over........WARUM gingen gestern MASSSSSSEN zu cad 0,05

übern tisch !?!?!

Antwort auf Beitrag Nr.: 36.706.714 von hbg55 am 05.03.09 15:46:03Weil RAB Capital Geld brauchte?

Antwort auf Beitrag Nr.: 36.706.714 von hbg55 am 05.03.09 15:46:03Weil schon Stücke für ein Placement in den markt verkauft wurde?

Antwort auf Beitrag Nr.: 36.706.774 von blash5 am 05.03.09 15:51:00

...ALLLINALLL......für MICH nen zockkkk wert

...ALLLINALLL......für MICH nen zockkkk wert

Antwort auf Beitrag Nr.: 36.706.853 von hbg55 am 05.03.09 15:57:28........uuuuund für DIESEN kollegen auch....

Times & Sales in FRA

Uhrzeit Kurs Volumen

letztes kumuliert

14:57:00 0,056 850 850

09:00:32 0,027 0 0

Times & Sales in FRA

Uhrzeit Kurs Volumen

letztes kumuliert

14:57:00 0,056 850 850

09:00:32 0,027 0 0

Antwort auf Beitrag Nr.: 36.706.774 von blash5 am 05.03.09 15:51:00

.........guck mal......ausm SH.........

Reading between the lines.

With the latest news from Mart it looks like the main intial concern is too bridge some financing for the short term . It makes sense to me that Rearch Cap with do a P.P. at .5 cents to firm up cash flow short term. This will alow Mart to release flow results from UMU5 which are anticipated to be very good.

Time to get new production on stream and also time for a potential takeover to further develop. This is why Mart has released News as such to keep the price down and let research get in at nickle with the upside for them being having hands on control of the Company Take over.

Cheers Billy.

..........kommt mir irgendwie bekannt vor

.........guck mal......ausm SH.........

Reading between the lines.

With the latest news from Mart it looks like the main intial concern is too bridge some financing for the short term . It makes sense to me that Rearch Cap with do a P.P. at .5 cents to firm up cash flow short term. This will alow Mart to release flow results from UMU5 which are anticipated to be very good.

Time to get new production on stream and also time for a potential takeover to further develop. This is why Mart has released News as such to keep the price down and let research get in at nickle with the upside for them being having hands on control of the Company Take over.

Cheers Billy.

..........kommt mir irgendwie bekannt vor

Antwort auf Beitrag Nr.: 36.709.455 von hbg55 am 05.03.09 20:27:30Detailed Quote for Mart Resources Inc (MMT:CA)

$ 0.045 RT

-0.015 (-25.00%)

Volume: 4.42 m

0,045 CAD Brief...

$ 0.045 RT

-0.015 (-25.00%)

Volume: 4.42 m

0,045 CAD Brief...

Antwort auf Beitrag Nr.: 36.709.455 von hbg55 am 05.03.09 20:27:30

...und ein nicht minder int. beitrag ist nachfolg......

RE: I still hold my position...

This is what happened.....

Mart took a loan out to fund future explorations...then the downturn happened. They have the money to survive the crisis and pay the loan bill. Anyway they realized that they were gonna have to raise some funds to continue exploration in their three properties for they are some what dead in the water until oil bounces back. In the process of trying to fish for potential companies to initiate a joint venture and raise capital and continue exploration, a certain company (which remains unknown because there is no LOI) said well hell you guys need a good chunk of doe......it would probably might just be as good to buy you out!!

Mart says hmmm hold on a minute....do we want to sell ????? Lets get our S#*t together and figure out the best option here.

There are still some other things to consider and here they are................... the Umusadege Field is said to have the capability to facilitate a possible 6-7 operating wells. The Qua-Ibo Field is known to have oil in it because in the 60's shell drilled in it....the only reason they got water was because they thought the oil pocket was one giant reserve but they actually drilled right between the TWO reserves and between the two reserves lies a fault and in that fault was, well, plenty of water.......so don't count that field out either. There is also known oil in the Ke Field but it brings me back to my point. They need doe to continue exploration today!

There are huge decisions that are going to have to be made here.

They were asked to sell when they weren't thinking of selling...they have flow results coming and I applause the management for not being hasty because there are many factors at play in front of them.

So I say whatever, They can survive through the downturn and when oil rises so will Marts S/P and that will be cool. If they sell at a good turn then thats cool too. The good thing is that they aren't in between a rock and a hard place.......they have some cards to play so don't count em out!

GLTA LONGS MMT

Peace

DMAC

...und ein nicht minder int. beitrag ist nachfolg......

RE: I still hold my position...

This is what happened.....

Mart took a loan out to fund future explorations...then the downturn happened. They have the money to survive the crisis and pay the loan bill. Anyway they realized that they were gonna have to raise some funds to continue exploration in their three properties for they are some what dead in the water until oil bounces back. In the process of trying to fish for potential companies to initiate a joint venture and raise capital and continue exploration, a certain company (which remains unknown because there is no LOI) said well hell you guys need a good chunk of doe......it would probably might just be as good to buy you out!!

Mart says hmmm hold on a minute....do we want to sell ????? Lets get our S#*t together and figure out the best option here.

There are still some other things to consider and here they are................... the Umusadege Field is said to have the capability to facilitate a possible 6-7 operating wells. The Qua-Ibo Field is known to have oil in it because in the 60's shell drilled in it....the only reason they got water was because they thought the oil pocket was one giant reserve but they actually drilled right between the TWO reserves and between the two reserves lies a fault and in that fault was, well, plenty of water.......so don't count that field out either. There is also known oil in the Ke Field but it brings me back to my point. They need doe to continue exploration today!

There are huge decisions that are going to have to be made here.

They were asked to sell when they weren't thinking of selling...they have flow results coming and I applause the management for not being hasty because there are many factors at play in front of them.

So I say whatever, They can survive through the downturn and when oil rises so will Marts S/P and that will be cool. If they sell at a good turn then thats cool too. The good thing is that they aren't in between a rock and a hard place.......they have some cards to play so don't count em out!

GLTA LONGS MMT

Peace

DMAC

...nach zögerlichem start kam zum ende der gestrigen

sitzung noch richtig musik auf....wie die last trades

mit SK auf TH von cad 0,06 dokumentieren..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:58:25 V 0.06 +0.015 40,000 80 National Bank 19 Desjardins K

15:58:25 V 0.06 +0.015 50,000 80 National Bank 7 TD Sec K

15:58:25 V 0.06 +0.015 10,000 80 National Bank 85 Scotia K

15:58:20 V 0.06 +0.015 190,000 6 Union 85 Scotia K

15:58:20 V 0.06 +0.015 200,000 6 Union 7 TD Sec K

15:58:20 V 0.06 +0.015 10,000 6 Union 7 TD Sec K

15:58:20 V 0.06 +0.015 100,000 6 Union 145 Woodstone K

15:57:29 V 0.06 +0.015 50,000 6 Union 1 Anonymous K

15:57:29 V 0.06 +0.015 50,000 6 Union 54 Global K

15:56:51 V 0.055 +0.01 31,000 1 Anonymous 7 TD Sec K

sitzung noch richtig musik auf....wie die last trades

mit SK auf TH von cad 0,06 dokumentieren..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:58:25 V 0.06 +0.015 40,000 80 National Bank 19 Desjardins K

15:58:25 V 0.06 +0.015 50,000 80 National Bank 7 TD Sec K

15:58:25 V 0.06 +0.015 10,000 80 National Bank 85 Scotia K

15:58:20 V 0.06 +0.015 190,000 6 Union 85 Scotia K

15:58:20 V 0.06 +0.015 200,000 6 Union 7 TD Sec K

15:58:20 V 0.06 +0.015 10,000 6 Union 7 TD Sec K

15:58:20 V 0.06 +0.015 100,000 6 Union 145 Woodstone K

15:57:29 V 0.06 +0.015 50,000 6 Union 1 Anonymous K

15:57:29 V 0.06 +0.015 50,000 6 Union 54 Global K

15:56:51 V 0.055 +0.01 31,000 1 Anonymous 7 TD Sec K

SK....cad 0,06

....uuuuund die vorzeichen für eine weitere kurs- erholung sehen

für MICH gar nicht so übel aus

....und unter nachfolg. link gibts ab seite 117 reichlich

infos zu MMT........

http://www.columbuscapitaladvisor.com/pressReleases/Africa_O…

infos zu MMT........

http://www.columbuscapitaladvisor.com/pressReleases/Africa_O…

Antwort auf Beitrag Nr.: 36.725.527 von hbg55 am 08.03.09 19:52:05

......da scheint MIR akt. MK von cad-mios 20,- doch

erheblich potential gen norden aufzuweisen

......da scheint MIR akt. MK von cad-mios 20,- doch

erheblich potential gen norden aufzuweisen

Antwort auf Beitrag Nr.: 36.725.568 von hbg55 am 08.03.09 19:58:57

....uuuund ´etwas plakativer´ komm. ein SH- user........

Mart is Screaming Buy

Thanks for sharing this useful document. According to this article, Mart is way underalued and it is value at 0.36 cents per share. It is nice to see that there is significant potetial for probable reserves.

so sit tight on your shares and wait for excellent return.

Any comments about SP on monday give 2mil shares traded in last few minutes on friday,

Good luck to all longs.

....uuuund ´etwas plakativer´ komm. ein SH- user........

Mart is Screaming Buy

Thanks for sharing this useful document. According to this article, Mart is way underalued and it is value at 0.36 cents per share. It is nice to see that there is significant potetial for probable reserves.

so sit tight on your shares and wait for excellent return.

Any comments about SP on monday give 2mil shares traded in last few minutes on friday,

Good luck to all longs.

....woooow........da gehts zur börsen- eröffnung gleich

mit schönen trades gen norden.......

Time Ex Price Change Volume Buyer Seller Markers

09:39:16 V 0.075 +0.015 10,000 1 Anonymous 7 TD Sec K

09:39:16 V 0.075 +0.015 35,000 1 Anonymous 88 E-TRADE K

09:35:38 V 0.075 +0.015 25,000 2 RBC 88 E-TRADE K

09:33:17 V 0.075 +0.015 4,000 7 TD Sec 54 Global K

09:33:16 V 0.075 +0.015 1,000 85 Scotia 54 Global K

09:33:16 V 0.075 +0.015 20,000 85 Scotia 7 TD Sec K

09:32:25 V 0.07 +0.01 10,000 1 Anonymous 124 Questrade K

09:32:25 V 0.07 +0.01 101,000 1 Anonymous 85 Scotia K

09:32:25 V 0.07 +0.01 100,000 1 Anonymous 7 TD Sec K

09:32:25 V 0.07 +0.01 4,000 1 Anonymous 85 Scotia K

ein bemerkenswerter tag geht mit nem kurssprung von

über 30 % prozent auf TH zu ende - kaum zu toppen

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:50 V 0.08 +0.02 10,000 85 Scotia 7 TD Sec K

15:56:21 V 0.08 +0.02 2,000 9 BMO Nesbitt 9 BMO Nesbitt K

15:49:00 V 0.07 +0.01 154,000 85 Scotia 85 Scotia K

15:49:00 V 0.075 +0.015 5,000 85 Scotia 85 Scotia K

15:49:00 V 0.075 +0.015 41,000 7 TD Sec 85 Scotia K

15:39:45 V 0.075 +0.015 59,000 7 TD Sec 1 Anonymous K

15:39:45 V 0.075 +0.015 10,000 19 Desjardins 1 Anonymous K

15:38:51 V 0.075 +0.015 20,000 80 National Bank 1 Anonymous K

15:38:51 V 0.075 +0.015 5,000 85 Scotia 1 Anonymous K

15:38:51 V 0.075 +0.015 5,000 7 TD Sec 1 Anonymous K

über 30 % prozent auf TH zu ende - kaum zu toppen

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:50 V 0.08 +0.02 10,000 85 Scotia 7 TD Sec K

15:56:21 V 0.08 +0.02 2,000 9 BMO Nesbitt 9 BMO Nesbitt K

15:49:00 V 0.07 +0.01 154,000 85 Scotia 85 Scotia K

15:49:00 V 0.075 +0.015 5,000 85 Scotia 85 Scotia K

15:49:00 V 0.075 +0.015 41,000 7 TD Sec 85 Scotia K

15:39:45 V 0.075 +0.015 59,000 7 TD Sec 1 Anonymous K

15:39:45 V 0.075 +0.015 10,000 19 Desjardins 1 Anonymous K

15:38:51 V 0.075 +0.015 20,000 80 National Bank 1 Anonymous K

15:38:51 V 0.075 +0.015 5,000 85 Scotia 1 Anonymous K

15:38:51 V 0.075 +0.015 5,000 7 TD Sec 1 Anonymous K

...charttechnisch siehts nach fortsetzung der erholung aus

Mart Resources halted at 6:10 a.m. PT

2009-03-10 09:12 EST - Halt Trading

Antwort auf Beitrag Nr.: 36.737.145 von hbg55 am 10.03.09 14:27:44

Antwort auf Beitrag Nr.: 36.737.254 von blash5 am 10.03.09 14:39:09

moin blash......ist bei dir schon hintergrund für HALT

durchgesickert

moin blash......ist bei dir schon hintergrund für HALT

durchgesickert

Antwort auf Beitrag Nr.: 36.737.145 von hbg55 am 10.03.09 14:27:44

....wär natürlich schööööön, wenn dieser SH- user recht behielte.......wenn der preis stimmt

I dont think this is a takeover but some good results and then the next halt will be the takeover.

....wär natürlich schööööön, wenn dieser SH- user recht behielte.......wenn der preis stimmt

I dont think this is a takeover but some good results and then the next halt will be the takeover.

Antwort auf Beitrag Nr.: 36.737.341 von hbg55 am 10.03.09 14:48:28nein, noch nicht

......hier ist die news - und beim ersten überfliegen kann man

von ner GOOOOOOD news sprechen........

CALGARY, ALBERTA--(Marketwire - March 10, 2009) - Mart Resources, Inc. (TSX VENTURE:MMT) and its partners, Midwestern Oil and Gas Company PLC (Operator) and Suntrust Oil Company Nigeria Limited, are pleased to report encouraging initial test results from the first production test on the UMU-5 well located at the Umusadege field in the Niger Delta of Nigeria.

The first test on the UMU-5 well was conducted on the IX oil zone for a duration of 17 hours. During the test, the well flowed at rates up to 3,200 barrels per day of 48 API gravity oil through 2 7/8 inch tubing on a 32/64" choke at a flowing tubing pressure of 625 PSI. Water production was less than 0.2% and the gas/oil ratio was approximately 80 standard cubic feet per barrel. Mart and its partners are currently undertaking an additional production test in the VII oil zone, located uphole of the IX oil zone.

In addition to the current production test in the IX zone, the UMU-5 well confirmed oil in six other zones based upon wireline fluid samples. These samples bring the total number of oil zones in the Umusadege field confirmed by fluid samples to thirteen. Logs from the UMU-5 well indicate a total net oil pay of 175 feet, including 27 feet in the IX zone and 47 feet in the VII zone.

The UMU-5 well was drilled as a "twin well" to the currently producing UMU-1 well in order to enable production from additional oil zones. Production from the UMU-1 well, which was drilled by Elf in 1974, commenced on April 21, 2008 and the well is currently producing approximately 2,000 barrels of 42 API oil per day from the XIIb zone. This zone has 20 feet of net oil pay and has produced more than 490,000 barrels of oil to date.

All interconnecting pipelines to tie the UMU-5 well into the Umusadege field production and export facilities have been completed and the partners plan to commence commercial production from the UMU-5 well immediately following analysis of the crude oil samples and receipt of all requisite approvals, which are currently anticipated by the end of March 2009.

Certain statements in this News Release constitute forward-looking statements under applicable securities legislation. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements in this new release include but are not limited to references, whether actual or implied, to future production levels from the Umu-5 well and the ability of the Company to commercially produce the well. By its very nature, such forward-looking information requires the Company to make assumptions that may not materialize or that may not be accurate. This forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. In particular, there is no assurance that UMU-5 well will be commercially producible or that the future production levels therefrom will be at the tested production rates. If commercial production is achieved, there is no assurance it will be achieved within the express or implied timeframes set forth herein. All references to production levels contained in this press release are to total field production rates at the wellhead and are before the deduction of interests to third parties.

Furthermore, the forward-looking information contained in this news release is made as of the date of this news release and, except as required by applicable law, Mart Resources, Inc. does not undertake any obligation to update publicly or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mart Resources, Inc. - London

David Parker

+44 20 7953 4090 or Mobile: +44 7887 635 117

Email: David.Parker@martresources.com

Mart Resources, Inc. - Calgary

David Halpin

(403) 270-1841

Email: David.Halpin@martresources.com

Website: www.martresources.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE RELEASE.

Source: CCN Matthews (March 10, 2009 - 2:50 PM EDT)

News by QuoteMedia

von ner GOOOOOOD news sprechen........

CALGARY, ALBERTA--(Marketwire - March 10, 2009) - Mart Resources, Inc. (TSX VENTURE:MMT) and its partners, Midwestern Oil and Gas Company PLC (Operator) and Suntrust Oil Company Nigeria Limited, are pleased to report encouraging initial test results from the first production test on the UMU-5 well located at the Umusadege field in the Niger Delta of Nigeria.

The first test on the UMU-5 well was conducted on the IX oil zone for a duration of 17 hours. During the test, the well flowed at rates up to 3,200 barrels per day of 48 API gravity oil through 2 7/8 inch tubing on a 32/64" choke at a flowing tubing pressure of 625 PSI. Water production was less than 0.2% and the gas/oil ratio was approximately 80 standard cubic feet per barrel. Mart and its partners are currently undertaking an additional production test in the VII oil zone, located uphole of the IX oil zone.

In addition to the current production test in the IX zone, the UMU-5 well confirmed oil in six other zones based upon wireline fluid samples. These samples bring the total number of oil zones in the Umusadege field confirmed by fluid samples to thirteen. Logs from the UMU-5 well indicate a total net oil pay of 175 feet, including 27 feet in the IX zone and 47 feet in the VII zone.

The UMU-5 well was drilled as a "twin well" to the currently producing UMU-1 well in order to enable production from additional oil zones. Production from the UMU-1 well, which was drilled by Elf in 1974, commenced on April 21, 2008 and the well is currently producing approximately 2,000 barrels of 42 API oil per day from the XIIb zone. This zone has 20 feet of net oil pay and has produced more than 490,000 barrels of oil to date.

All interconnecting pipelines to tie the UMU-5 well into the Umusadege field production and export facilities have been completed and the partners plan to commence commercial production from the UMU-5 well immediately following analysis of the crude oil samples and receipt of all requisite approvals, which are currently anticipated by the end of March 2009.

Certain statements in this News Release constitute forward-looking statements under applicable securities legislation. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements in this new release include but are not limited to references, whether actual or implied, to future production levels from the Umu-5 well and the ability of the Company to commercially produce the well. By its very nature, such forward-looking information requires the Company to make assumptions that may not materialize or that may not be accurate. This forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. In particular, there is no assurance that UMU-5 well will be commercially producible or that the future production levels therefrom will be at the tested production rates. If commercial production is achieved, there is no assurance it will be achieved within the express or implied timeframes set forth herein. All references to production levels contained in this press release are to total field production rates at the wellhead and are before the deduction of interests to third parties.

Furthermore, the forward-looking information contained in this news release is made as of the date of this news release and, except as required by applicable law, Mart Resources, Inc. does not undertake any obligation to update publicly or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mart Resources, Inc. - London

David Parker

+44 20 7953 4090 or Mobile: +44 7887 635 117

Email: David.Parker@martresources.com

Mart Resources, Inc. - Calgary

David Halpin

(403) 270-1841

Email: David.Halpin@martresources.com

Website: www.martresources.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE RELEASE.

Source: CCN Matthews (March 10, 2009 - 2:50 PM EDT)

News by QuoteMedia

..handel jedoch immer noch ´halted´

...sooooo........UPPPP gehts - es darf wieder gehandelt werden !!!!

Mart Resources to resume effective at the open

2009-03-11 09:01 EST - Resume Trading

Mart Resources Inc. will resume trading effective at the open on March 11, 2009, an announcement having been made.

Mart Resources to resume effective at the open

2009-03-11 09:01 EST - Resume Trading

Mart Resources Inc. will resume trading effective at the open on March 11, 2009, an announcement having been made.

mit ner kl. schluß- rally beendeten wir den gestrigen

handelstag.........nur knapp unter TH von 0,085

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:57:11 V 0.08 +0.01 2,000 1 Anonymous 95 Wolverton K

15:57:06 V 0.08 +0.01 27,000 19 Desjardins 95 Wolverton K

15:56:31 V 0.08 +0.01 23,000 85 Scotia 95 Wolverton K

15:55:02 V 0.08 +0.01 48,000 1 Anonymous 95 Wolverton K

15:54:45 V 0.08 +0.01 2,000 1 Anonymous 1 Anonymous K

15:54:45 V 0.08 +0.01 10,000 7 TD Sec 1 Anonymous K

15:54:45 V 0.08 +0.01 8,000 1 Anonymous 1 Anonymous K

15:54:08 V 0.08 +0.01 10,000 7 TD Sec 7 TD Sec K

15:50:00 V 0.085 +0.015 2,000 85 Scotia 85 Scotia K

15:49:35 V 0.08 +0.01 21,000 1 Anonymous 2 RBC K

handelstag.........nur knapp unter TH von 0,085

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:57:11 V 0.08 +0.01 2,000 1 Anonymous 95 Wolverton K

15:57:06 V 0.08 +0.01 27,000 19 Desjardins 95 Wolverton K

15:56:31 V 0.08 +0.01 23,000 85 Scotia 95 Wolverton K

15:55:02 V 0.08 +0.01 48,000 1 Anonymous 95 Wolverton K

15:54:45 V 0.08 +0.01 2,000 1 Anonymous 1 Anonymous K

15:54:45 V 0.08 +0.01 10,000 7 TD Sec 1 Anonymous K

15:54:45 V 0.08 +0.01 8,000 1 Anonymous 1 Anonymous K

15:54:08 V 0.08 +0.01 10,000 7 TD Sec 7 TD Sec K

15:50:00 V 0.085 +0.015 2,000 85 Scotia 85 Scotia K

15:49:35 V 0.08 +0.01 21,000 1 Anonymous 2 RBC K

March 13, 2009 - 9:09 AM EDT

CALGARY, ALBERTA--(Marketwire - March 13, 2009) - Mart Resources, Inc. (TSX VENTURE:MMT) and its partners, Midwestern Oil and Gas Company PLC (Operator) and SunTrust Oil Company Nigeria Limited, are pleased to report positive initial results from the second production test on the UMU-5 well located at the Umusadege field in the Niger Delta of Nigeria.

A second test on the UMU-5 well was conducted on the VII oil zone, at a depth of 7,255 feet, for a duration of 18 hours. During the test, the well flowed at rates up to 725 barrels per day of 30 API gravity oil through 2 7/8 inch tubing on a 16/64" choke at a flowing tubing pressure of 388 PSI. Basic Sediment and Water production was 2.5% consisting of drilling mud and completion fluid. The test was curtailed due to concerns over sand production, which is a common feature of shallow reservoirs in the Niger Delta and routinely controlled by the installation of downhole gravel packs and sand screens that hold the sand back in the reservoir.

As previously announced, the first test on the UMU-5 well was conducted on the IX oil zone, at a depth of 7,595 feet, for a duration of 17 hours. During the test, the well flowed at stabilized rates up to 3,200 barrels per day of 48 API gravity oil through 2 7/8 inch tubing on a 32/64" choke at a flowing tubing pressure of 625 PSI. Water production was less than 0.2% and the gas/oil ratio was approximately 80 standard cubic feet per barrel. The combined flow rate for the UMU-5 from the VII and IX zones was 3925 barrels oil per day.

The UMU-5 well has been tied into the Umusadege production and export facilities and the partners plan to commence commercial production from the IX zone immediately following analysis of the crude oil samples and receipt of all requisite approvals, which are currently anticipated by the end of March 2009.

About Mart Resources:

Mart Resources Inc. is an independent, international petroleum company focused on drilling, developing and producing oil and gas from low-risk proven petroleum properties in Africa. The Company owns two drilling rigs, has strong local relationships and has formed joint venture partnerships with indigenous operators in Nigeria. Mart has acquired interests in and begun development of three onshore Nigerian oil fields. Mart's first oil production commenced in April 2008 from the Umusadege field.

Certain statements in this News Release constitute forward-looking statements under applicable securities legislation. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements in this new release include but are not limited to references, whether actual or implied, to future production levels from the Umu-5 well and the ability of the Company to commercially produce the well. By its very nature, such forward-looking information requires the Company to make assumptions that may not materialize or that may not be accurate. This forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. In particular, there is no assurance that UMU-5 well will be commercially producible or that the future production levels therefrom will be at the tested production rates. If commercial production is achieved, there is no assurance it will be achieved within the express or implied timeframes set forth herein. All references to production levels contained in this press release are to total field production rates at the wellhead and are before the deduction of interests to third parties.

Furthermore, the forward-looking information contained in this news release is made as of the date of this news release and, except as required by applicable law, Mart Resources, Inc. does not undertake any obligation to update publicly or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mart Resources, Inc. - London

David Parker

+44 20 7953 4090 or Mobile: +44 7887 635 117

Email: David.Parker@martresources.com

Mart Resources, Inc. - Calgary

David Halpin

(403) 270-1841

Email: David.Halpin@martresources.com

Website: www.martresources.com

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of the release.

Source: CCN Matthews (March 13, 2009 - 9:09 AM EDT)

News by QuoteMedia

CALGARY, ALBERTA--(Marketwire - March 13, 2009) - Mart Resources, Inc. (TSX VENTURE:MMT) and its partners, Midwestern Oil and Gas Company PLC (Operator) and SunTrust Oil Company Nigeria Limited, are pleased to report positive initial results from the second production test on the UMU-5 well located at the Umusadege field in the Niger Delta of Nigeria.

A second test on the UMU-5 well was conducted on the VII oil zone, at a depth of 7,255 feet, for a duration of 18 hours. During the test, the well flowed at rates up to 725 barrels per day of 30 API gravity oil through 2 7/8 inch tubing on a 16/64" choke at a flowing tubing pressure of 388 PSI. Basic Sediment and Water production was 2.5% consisting of drilling mud and completion fluid. The test was curtailed due to concerns over sand production, which is a common feature of shallow reservoirs in the Niger Delta and routinely controlled by the installation of downhole gravel packs and sand screens that hold the sand back in the reservoir.

As previously announced, the first test on the UMU-5 well was conducted on the IX oil zone, at a depth of 7,595 feet, for a duration of 17 hours. During the test, the well flowed at stabilized rates up to 3,200 barrels per day of 48 API gravity oil through 2 7/8 inch tubing on a 32/64" choke at a flowing tubing pressure of 625 PSI. Water production was less than 0.2% and the gas/oil ratio was approximately 80 standard cubic feet per barrel. The combined flow rate for the UMU-5 from the VII and IX zones was 3925 barrels oil per day.

The UMU-5 well has been tied into the Umusadege production and export facilities and the partners plan to commence commercial production from the IX zone immediately following analysis of the crude oil samples and receipt of all requisite approvals, which are currently anticipated by the end of March 2009.

About Mart Resources:

Mart Resources Inc. is an independent, international petroleum company focused on drilling, developing and producing oil and gas from low-risk proven petroleum properties in Africa. The Company owns two drilling rigs, has strong local relationships and has formed joint venture partnerships with indigenous operators in Nigeria. Mart has acquired interests in and begun development of three onshore Nigerian oil fields. Mart's first oil production commenced in April 2008 from the Umusadege field.

Certain statements in this News Release constitute forward-looking statements under applicable securities legislation. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements in this new release include but are not limited to references, whether actual or implied, to future production levels from the Umu-5 well and the ability of the Company to commercially produce the well. By its very nature, such forward-looking information requires the Company to make assumptions that may not materialize or that may not be accurate. This forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. In particular, there is no assurance that UMU-5 well will be commercially producible or that the future production levels therefrom will be at the tested production rates. If commercial production is achieved, there is no assurance it will be achieved within the express or implied timeframes set forth herein. All references to production levels contained in this press release are to total field production rates at the wellhead and are before the deduction of interests to third parties.

Furthermore, the forward-looking information contained in this news release is made as of the date of this news release and, except as required by applicable law, Mart Resources, Inc. does not undertake any obligation to update publicly or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mart Resources, Inc. - London

David Parker

+44 20 7953 4090 or Mobile: +44 7887 635 117

Email: David.Parker@martresources.com

Mart Resources, Inc. - Calgary

David Halpin

(403) 270-1841

Email: David.Halpin@martresources.com

Website: www.martresources.com

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of the release.

Source: CCN Matthews (March 13, 2009 - 9:09 AM EDT)

News by QuoteMedia

Antwort auf Beitrag Nr.: 36.761.447 von hbg55 am 13.03.09 14:30:54

...mit hilfe dieser TOP- news sollten wir endlich den sprung

über cad 0,10 schaffen.........

Time Ex Price Change Volume Buyer Seller Markers

09:32:39 V 0.09 +0.01 20,000 88 Scotia iTRADE 1 Anonymous K

09:31:47 V 0.085 +0.005 48,000 1 Anonymous 2 RBC K

09:31:47 V 0.085 +0.005 20,000 1 Anonymous 9 BMO Nesbitt K

09:31:47 V 0.085 +0.005 60,000 1 Anonymous 7 TD Sec K

09:31:47 V 0.085 +0.005 16,000 1 Anonymous 124 Questrade K

09:31:30 V 0.085 +0.005 2,000 2 RBC 2 RBC K

09:30:28 V 0.085 +0.005 10,000 7 TD Sec 7 TD Sec K

09:30:17 V 0.085 +0.005 19,000 1 Anonymous 124 Questrade K

09:30:17 V 0.085 +0.005 8,000 1 Anonymous 9 BMO Nesbitt K

09:30:17 V 0.085 +0.005 20,000 1 Anonymous 79 CIBC K

...mit hilfe dieser TOP- news sollten wir endlich den sprung

über cad 0,10 schaffen.........

Time Ex Price Change Volume Buyer Seller Markers

09:32:39 V 0.09 +0.01 20,000 88 Scotia iTRADE 1 Anonymous K

09:31:47 V 0.085 +0.005 48,000 1 Anonymous 2 RBC K

09:31:47 V 0.085 +0.005 20,000 1 Anonymous 9 BMO Nesbitt K

09:31:47 V 0.085 +0.005 60,000 1 Anonymous 7 TD Sec K

09:31:47 V 0.085 +0.005 16,000 1 Anonymous 124 Questrade K

09:31:30 V 0.085 +0.005 2,000 2 RBC 2 RBC K

09:30:28 V 0.085 +0.005 10,000 7 TD Sec 7 TD Sec K

09:30:17 V 0.085 +0.005 19,000 1 Anonymous 124 Questrade K

09:30:17 V 0.085 +0.005 8,000 1 Anonymous 9 BMO Nesbitt K

09:30:17 V 0.085 +0.005 20,000 1 Anonymous 79 CIBC K

....moin MMT-lers,

HIER herrscht noch immer äußerste spannung ob, wer bzw. ob überhaupt

ein merger bevorsteht........wies ein SH- user schön aufn punkt

gebracht hat.......

I'll offer an opinion here instead of the analysis from the experts. If there is a buyout and you're in at < 0.15 you're a guaranteed winner. If your in at < 0.25 there is a good chance you're a winner or break even. The highs were last summer at 0.50 - 0.75 roughly. The higher OIL goes now, the more expensive it could the for the potential buyer as sp rises (do it now so to speak). Potential Buyer will split the difference or close to it (maybe even 0.30) ; HOWEVER,

MMT may now be resisting a friendly takeover or perhaps delaying the consideration given that in the last 2-3 weeks there are indications (TSX / OIL RISING STEADILY) the sp is going to rise slowly but surely even with no major news.

Last comment, given that MMT has actual production, it is well ahead of other O&G companies still in the development phase. Also, if we don't see a buyer in the next month, and OIL gets to $60.00 by April month end, I suspect management won't be selling anything.

HIER herrscht noch immer äußerste spannung ob, wer bzw. ob überhaupt

ein merger bevorsteht........wies ein SH- user schön aufn punkt

gebracht hat.......

I'll offer an opinion here instead of the analysis from the experts. If there is a buyout and you're in at < 0.15 you're a guaranteed winner. If your in at < 0.25 there is a good chance you're a winner or break even. The highs were last summer at 0.50 - 0.75 roughly. The higher OIL goes now, the more expensive it could the for the potential buyer as sp rises (do it now so to speak). Potential Buyer will split the difference or close to it (maybe even 0.30) ; HOWEVER,

MMT may now be resisting a friendly takeover or perhaps delaying the consideration given that in the last 2-3 weeks there are indications (TSX / OIL RISING STEADILY) the sp is going to rise slowly but surely even with no major news.

Last comment, given that MMT has actual production, it is well ahead of other O&G companies still in the development phase. Also, if we don't see a buyer in the next month, and OIL gets to $60.00 by April month end, I suspect management won't be selling anything.

Time Ex Price Change Volume Buyer Seller Markers

11:15:41 V 0.14 +0.05 19,000 85 Scotia 54 Global K ...akt. TH

11:15:41 V 0.135 +0.045 2,000 85 Scotia 19 Desjardins K

11:15:41 V 0.135 +0.045 11,000 85 Scotia 19 Desjardins K

11:15:31 V 0.12 +0.03 1,000 85 Scotia 79 CIBC K

11:15:14 V 0.12 +0.03 4,000 85 Scotia 2 RBC K

11:15:03 V 0.11 +0.02 20,000 85 Scotia 79 CIBC K

11:15:03 V 0.11 +0.02 20,000 85 Scotia 79 CIBC K

11:15:03 V 0.11 +0.02 23,000 85 Scotia 7 TD Sec K

11:12:26 V 0.09 +0.02 501 46 Blackmont 2 RBC E

11:11:30 V 0.11 +0.02 10,000 2 RBC 2 RBC K

....damit sollte widerstand bei 0,10 endgültig geknackt worden

sein

11:15:41 V 0.14 +0.05 19,000 85 Scotia 54 Global K ...akt. TH

11:15:41 V 0.135 +0.045 2,000 85 Scotia 19 Desjardins K

11:15:41 V 0.135 +0.045 11,000 85 Scotia 19 Desjardins K

11:15:31 V 0.12 +0.03 1,000 85 Scotia 79 CIBC K

11:15:14 V 0.12 +0.03 4,000 85 Scotia 2 RBC K

11:15:03 V 0.11 +0.02 20,000 85 Scotia 79 CIBC K

11:15:03 V 0.11 +0.02 20,000 85 Scotia 79 CIBC K

11:15:03 V 0.11 +0.02 23,000 85 Scotia 7 TD Sec K

11:12:26 V 0.09 +0.02 501 46 Blackmont 2 RBC E

11:11:30 V 0.11 +0.02 10,000 2 RBC 2 RBC K

....damit sollte widerstand bei 0,10 endgültig geknackt worden

sein

Antwort auf Beitrag Nr.: 36.881.515 von hbg55 am 30.03.09 17:36:56

......zum sitzungsende gabs zwar ein paaaaaar gewinnmitnahmen, doch

konnten wir uns mit SK 0,115 ü b e r der widerstandsmarke halten....

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:33 V 0.115 +0.025 70,000 10 FirstEnergy 27 Dundee K

15:59:30 V 0.115 +0.025 10,000 7 TD Sec 27 Dundee K

15:59:14 V 0.115 +0.025 1,000 79 CIBC 27 Dundee K

15:44:51 V 0.11 +0.02 15,000 10 FirstEnergy 79 CIBC K

15:27:55 V 0.115 +0.025 7,000 7 TD Sec 27 Dundee K

15:23:57 V 0.09 +0.02 242 46 Blackmont 79 CIBC E

15:11:37 V 0.11 +0.02 65,000 10 FirstEnergy 85 Scotia K

15:11:37 V 0.11 +0.02 30,000 7 TD Sec 85 Scotia K

15:11:37 V 0.11 +0.02 5,000 1 Anonymous 85 Scotia K

15:06:00 V 0.115 +0.025 15,000 1 Anonymous 27 Dundee K

......zum sitzungsende gabs zwar ein paaaaaar gewinnmitnahmen, doch

konnten wir uns mit SK 0,115 ü b e r der widerstandsmarke halten....

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:33 V 0.115 +0.025 70,000 10 FirstEnergy 27 Dundee K

15:59:30 V 0.115 +0.025 10,000 7 TD Sec 27 Dundee K

15:59:14 V 0.115 +0.025 1,000 79 CIBC 27 Dundee K

15:44:51 V 0.11 +0.02 15,000 10 FirstEnergy 79 CIBC K

15:27:55 V 0.115 +0.025 7,000 7 TD Sec 27 Dundee K

15:23:57 V 0.09 +0.02 242 46 Blackmont 79 CIBC E

15:11:37 V 0.11 +0.02 65,000 10 FirstEnergy 85 Scotia K

15:11:37 V 0.11 +0.02 30,000 7 TD Sec 85 Scotia K

15:11:37 V 0.11 +0.02 5,000 1 Anonymous 85 Scotia K

15:06:00 V 0.115 +0.025 15,000 1 Anonymous 27 Dundee K

...nach überwindung des widerstands bei 0,10 konsol. wir

bei mäßigem vol. weiter seitwärts........

Time Ex Price Change Volume Buyer Seller Markers

14:33:49 V 0.11 +0.01 27,000 7 TD Sec 85 Scotia K

14:25:14 V 0.11 +0.01 2,000 58 Qtrade 1 Anonymous K

14:24:11 V 0.11 +0.01 40,000 58 Qtrade 1 Anonymous K

14:24:11 V 0.11 +0.01 5,000 58 Qtrade 2 RBC K

14:24:11 V 0.11 +0.01 4,000 58 Qtrade 2 RBC K

14:24:11 V 0.11 +0.01 18,000 58 Qtrade 15 UBS K

14:21:28 V 0.105 +0.005 6,000 88 Scotia iTRADE 7 TD Sec K

14:21:28 V 0.105 +0.005 18,000 85 Scotia 7 TD Sec K

13:28:19 V 0.11 +0.01 30,000 7 TD Sec 15 UBS K

13:27:59 V 0.11 +0.01 40,000 19 Desjardins 15 UBS K

bei mäßigem vol. weiter seitwärts........

Time Ex Price Change Volume Buyer Seller Markers

14:33:49 V 0.11 +0.01 27,000 7 TD Sec 85 Scotia K

14:25:14 V 0.11 +0.01 2,000 58 Qtrade 1 Anonymous K

14:24:11 V 0.11 +0.01 40,000 58 Qtrade 1 Anonymous K

14:24:11 V 0.11 +0.01 5,000 58 Qtrade 2 RBC K

14:24:11 V 0.11 +0.01 4,000 58 Qtrade 2 RBC K

14:24:11 V 0.11 +0.01 18,000 58 Qtrade 15 UBS K

14:21:28 V 0.105 +0.005 6,000 88 Scotia iTRADE 7 TD Sec K

14:21:28 V 0.105 +0.005 18,000 85 Scotia 7 TD Sec K

13:28:19 V 0.11 +0.01 30,000 7 TD Sec 15 UBS K

13:27:59 V 0.11 +0.01 40,000 19 Desjardins 15 UBS K

Antwort auf Beitrag Nr.: 36.910.053 von hbg55 am 02.04.09 21:08:46

...SOOOO auch heute.........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:58:45 V 0.11 +0.01 2,000 79 CIBC 83 Research Cap K

15:58:42 V 0.11 +0.01 2,000 79 CIBC 83 Research Cap K

15:58:42 V 0.115 +0.015 1,000 88 Scotia iTRADE 19 Desjardins K

15:57:22 V 0.11 +0.01 95,000 79 CIBC 85 Scotia K

15:57:22 V 0.11 +0.01 3,000 79 CIBC 83 Research Cap K

15:57:03 V 0.11 +0.01 2,500 85 Scotia 85 Scotia K

15:54:45 V 0.105 +0.005 5,000 2 RBC 7 TD Sec K

15:53:53 V 0.11 +0.01 47,000 79 CIBC 83 Research Cap K

15:52:56 V 0.11 +0.01 50,000 79 CIBC 83 Research Cap K

15:52:56 V 0.11 +0.01 3,000 79 CIBC 83 Research Cap K

...SOOOO auch heute.........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:58:45 V 0.11 +0.01 2,000 79 CIBC 83 Research Cap K

15:58:42 V 0.11 +0.01 2,000 79 CIBC 83 Research Cap K

15:58:42 V 0.115 +0.015 1,000 88 Scotia iTRADE 19 Desjardins K

15:57:22 V 0.11 +0.01 95,000 79 CIBC 85 Scotia K

15:57:22 V 0.11 +0.01 3,000 79 CIBC 83 Research Cap K

15:57:03 V 0.11 +0.01 2,500 85 Scotia 85 Scotia K

15:54:45 V 0.105 +0.005 5,000 2 RBC 7 TD Sec K

15:53:53 V 0.11 +0.01 47,000 79 CIBC 83 Research Cap K

15:52:56 V 0.11 +0.01 50,000 79 CIBC 83 Research Cap K

15:52:56 V 0.11 +0.01 3,000 79 CIBC 83 Research Cap K

RT...cad 0,115

Mart's UMU-5 oil well onshore Nigeria starts production

2009-04-17 09:14 ET - News Release

Mr. David Parker reports

MART ANNOUNCES COMMENCEMENT OF PRODUCTION FROM THE UMU-5 WELL AT UMUSADEGE FIELD

Mart Resources Inc. and its partners, Midwestern Oil & Gas Company PLC (operator) and Suntrust Oil Company Nigeria Ltd., have commenced production from the UMU-5 well in the Umusadege field, onshore Nigeria.

Oil production has commenced at the Umu-5 well from the IX zone pursuant to an authorized phased production test. The well is flowing at an initial rate of 1,590 barrels of oil per day on a 20/64th choke. The well will be flowed through progressively increasing choke sizes as part of the test program in order to establish the maximum efficient rate for the well. As previously announced, the IX zone previously flowed at a rate of 3,200 barrels of oil per day on a 32/64th-inch choke during the initial test.

As a result of bringing the UMU-5 well on stream, total production from the Umusadege field, including the UMU-1 well, is currently 3,500 barrels of oil per day.

The UMU-5 well was drilled to a total depth of 7,770 feet and encountered eight oil-bearing sandstone reservoir zones between depths of 6,680 feet and 7,710 feet, with a combined net pay thickness of approximately 175 feet. The well has been completed for production from two zones using a single-string dual completion and tied back to the Umusadege production facilities located approximately 500 feet away.

Mart and its partners are also pleased to announce completion of the first phase of the program to reduce continuing operating costs at the Umusadege field. Produced water from the field is now being treated and disposed of on site rather than being trucked to an off-site treatment facility. In addition, the partners have acquired a dedicated oil-water-gas separator system that is now in the field and tie-in of this new facility is under way. This system is anticipated to replace the current rented system by the end of April and is expected to lead to a further reduction in operating costs.

langsam wird es hier interessant. ich hoffe die droppen den preis mal noch ne weile in der nächste woche das ich zu 5 us cent noch mal rein kann.

MMT ist auf der watchlist, öl zwischenrally startet ja mittlerweile auch. könnte nen heißer juni werden

MMT ist auf der watchlist, öl zwischenrally startet ja mittlerweile auch. könnte nen heißer juni werden

Antwort auf Beitrag Nr.: 37.112.181 von KMST am 06.05.09 19:48:58

....da wirste wohl mind. nen CENT drufflegen müssen

....da wirste wohl mind. nen CENT drufflegen müssen

denk ich auch...das wäre halt auch der extremfall.

Antwort auf Beitrag Nr.: 37.112.181 von KMST am 06.05.09 19:48:58

...uuuuuuund dann solltest du evtl. auch mal ein auge auf AZA richten......

http://www.wallstreet-online.de/diskussion/1149903-neustebei…

...uuuuuuund dann solltest du evtl. auch mal ein auge auf AZA richten......

http://www.wallstreet-online.de/diskussion/1149903-neustebei…

Hiermit ist der Thread wieder "beschreibbar".

Viele Grüße, Andrea Kummermehr

Viele Grüße, Andrea Kummermehr

Antwort auf Beitrag Nr.: 43.427.029 von akummermehr am 26.07.12 15:18:37..thx für schnelle erledigung !!!!

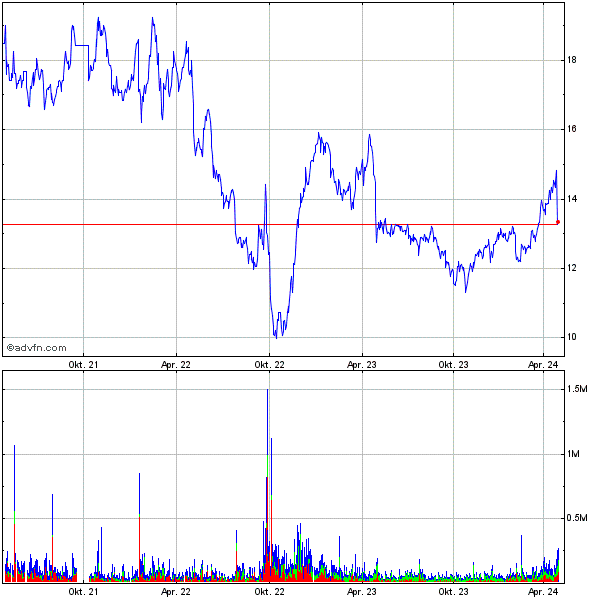

wie nachfolg. 3- jahrescharts zu entnehmen ist, hat sich seit

letztem beitrag in 05.09 doch EINIGES erfreuliche getan......

SK gestern.....cad 1,37

leider selbst nicht mehr dabei, abbbba wünsche ALLLLL noch investierten

viiiiiel erfolg !!!

grüssis hbg55

wie nachfolg. 3- jahrescharts zu entnehmen ist, hat sich seit

letztem beitrag in 05.09 doch EINIGES erfreuliche getan......

SK gestern.....cad 1,37

leider selbst nicht mehr dabei, abbbba wünsche ALLLLL noch investierten

viiiiiel erfolg !!!

grüssis hbg55

ich hab das teil seit 09.03.2009 für 0,02 €cent, weil da mal was bei wo über den ticker lief.......

aber leider nur auf der watchlist!!!!!

ich torfkopp!!!!!!!

watt für eine perle.

aber leider nur auf der watchlist!!!!!

ich torfkopp!!!!!!!

watt für eine perle.

Moin Moin

Die Nachricht ist schon eine Woche alt aber interessant

http://www.onvista.de/analysen/alle-analysen/artikel/23.07.2…

http://www.onvista.de/analysen/alle-analysen/artikel/23.07.2…

interessanter Wert habe leider nicht die Chance genutzt bei 1,11€ als ich diesen Wert entdeckt einzusteigen

S&P Dow Jones Indices Announces Changes to the S&P/TSX Canadian Indices

The Semi-Annual Review of the S&P/TSX Venture 30 Index

TORONTO, Aug. 10, 2012 /CNW/ - S&P Canadian Index Services announces the results of the semi-annual review of the S&P/TSX Venture 30 Index effective after the close of trading on Friday, August 17, 2012.......

http://tmx.quotemedia.com/article.php?newsid=53466011&qm_sym…

Antwort auf Beitrag Nr.: 43.547.084 von IIBI am 29.08.12 16:07:18Was ist hier los ????

Habe gerade ein paar Stücke per Abstauber ins Depot bekommen !!!

Gut oder schlecht ???

Habe gerade ein paar Stücke per Abstauber ins Depot bekommen !!!

Gut oder schlecht ???

Net income for the three months ended June 30, 2012, was $2.3-million (0.7 cent per share), compared with net income of $20.8-million (6.2 cents per share) for the three months ended June 30, 2011. The decrease in net income was due to several factors that occurred in the second quarter, including lower realized prices for oil sold in connection with the under-lift position on March 31, 2012 (see note 1 to the financial and operating results table herein regarding non-IFRS (international financial reporting standards) measures), greater pipeline losses in the second quarter of 2012, the decline in Mart's share of production in the second quarter to 52 per cent (from 82.5 per cent in the first quarter of 2012 and 68 per cent in the second quarter of 2011), primarily because drilling costs had been recovered, and lower prices on current period production. A more detailed discussion is set out herein.

weiter down, schließung des gaps bei 1 cad wahrscheinlich....ufpasse

und down again, super wieder

Antwort auf Beitrag Nr.: 43.567.856 von Frickhasserin am 04.09.12 18:10:29Gestern gab es noch welche für'n Euro !!

Nächster Abstauber liegt schon !!

Nächster Abstauber liegt schon !!

Zitat von Frickhasserin:Zitat von IIBI: und down again, super wieder

die Abstrafung für das miese Quartal war gerechtfertigt. Bin jetzt aber wieder rein. Hoffe mal das ich das Tief erwischt habe

würde vorsichtig sein, Analysten in Kanada haben Angst, dass Mart die Dividende nicht beibehalten kann. Wenn die wegfällt oder sinkt, wird es eng.

Was für ein Wert.

Habe heute Vormittag nochmal aufgestockt und jetzt

geht die post ab. alleine schon wegen der dividende

ein super unternehmen.

langfristig top.

Habe heute Vormittag nochmal aufgestockt und jetzt

geht die post ab. alleine schon wegen der dividende

ein super unternehmen.

langfristig top.

mal schauen wie lange es die Dividende noch gibt, schätze noch ein Quartal dann gibts nix mehr

Dividende hängt anscheint von der neuen Pipeline ab, genug mögliche Öl-Tagesproduktion ist z.Zt. auf jeden Fall da. Wenn die Pipeline läuft und die neue Quelle UMU10 produziert, dürfte es mit der Dividende schön weiter nach oben gehen.

Mittel/Langfristig ist die Frage, wie hoch die Decline-Rates der Quellen sind und ob Management mit dem ganzen Geld etwas Vernünftiges anfangen können. Über das hohe politische Risiko muss man glaub ich nicht reden.

Mittel/Langfristig ist die Frage, wie hoch die Decline-Rates der Quellen sind und ob Management mit dem ganzen Geld etwas Vernünftiges anfangen können. Über das hohe politische Risiko muss man glaub ich nicht reden.

meine dividende ist heute eingegangen und habe

nochmal aufgestockt. leichter kann man sein geld

nicht verdienen.

Risiko hin oder her das hat man bei jeder aktie.

wer nicht riskiert der nicht gewinnt.

absichern mit stoppkurs und gut ist.

dann auf weitere erfolgreiche monate für mart res.

nochmal aufgestockt. leichter kann man sein geld

nicht verdienen.

Risiko hin oder her das hat man bei jeder aktie.

wer nicht riskiert der nicht gewinnt.

absichern mit stoppkurs und gut ist.

dann auf weitere erfolgreiche monate für mart res.

Letzter Operational Update sieht doch ganz gut aus. Mehr Öl im September und weniger Downtime. UMU10 sieht wie UMU9 aus, und mit mit der Pipeline geht's voran. Beides ist wichtig damit die Wahrscheinlichkeit steigt, dass sich die Produktion in den nächsten 1-2 Jahren verdoppeln kann.

Antwort auf Beitrag Nr.: 43.715.863 von Sanoko am 16.10.12 08:41:29Beabsichtige auch meine MMT kontinuierlich aufzustocken. Die Abzüge auf der Dividende sind schon gewaltig. Trotzdem wird der "Rest" sofort wieder reinvestiert.

Auch die Umsätze gefallen mir.

Auch die Umsätze gefallen mir.

Ich liebe diese Aktie.

Weiß jemand warum die Aktie heute so ansteigt?

Weiß jemand warum die Aktie heute so ansteigt?

Hallo,

weiß jemand warum die Aktie momentan so abschmiert?? Irgendwelche schlechten news??

LG

weiß jemand warum die Aktie momentan so abschmiert?? Irgendwelche schlechten news??

LG

Was für ein Rebound !

wer hätte gedacht das nach den news und 10% minus die aktie

ein tag später wieder fast 10% im plus ist.

es soll ein leck in der pipline geben und muß

repariert werden. ansonsten bin ich für die zukunft

ganz entspannt.

wer hätte gedacht das nach den news und 10% minus die aktie

ein tag später wieder fast 10% im plus ist.

es soll ein leck in der pipline geben und muß

repariert werden. ansonsten bin ich für die zukunft

ganz entspannt.

schade das es hier keine regere diskussion gibt, eigentlich ein superding mit dieser aktie, hammerdividente, ...

wer ist alles investiert?

wer ist alles investiert?

Mart Resources, Inc.: November 2012 Operational Update and December Production Disruptions

Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production and drilling operations.

November 2012 Production Disruptions

Due to an ongoing shutdown of the export pipeline that started on October 30, 2012, there was no production from the Umusadege field in November and December 2012. At the beginning of November 2012 there was a shipment of crude oil produced in October 2012 of 320,000 barrels of oil ("bbls"). Nigerian Agip Oil Company ("AGIP"), the pipeline operator, has advised that while repairs to the export pipeline have commenced, the nature of the damage has prevented a temporary repair and that a partial replacement of the line is required. The damaged pipeline is located in a river crossing. AGIP advises that it is working diligently to repair the export pipeline to enable the restoration of normal pipeline operations at the earliest possible date.

The Brass River Export Terminal, where oil production from the Umusadege field is shipped, continues to experience loading delays and AGIP has extended its previous declaration of force majeure on loadings at the Brass River Export Terminal due to flooding.

As a consequence of the foregoing, all Umusadege field production shipped through the AGIP export pipeline continues to be shut-in pending AGIP's repair of the export pipeline and the reopening of the Brass River Export Terminal. Mart and its co-venturers will continue to monitor the situation.

Pipeline and export facility losses for October 2012 as reported by AGIP were 56,874 bbls or approximately 17.7% of total crude deliveries (losses for September 2012 as reported by the pipeline operator were 40,018 bbls or approximately 11.6% of total crude deliveries). Pipeline and export facility losses as reported by AGIP from the beginning of the year to end of October 2012 are approximately 13.6% of total crude deliveries for that period.

UMU-10 Well Update

As previously announced, the UMU-10 well encountered 479 foot gross hydrocarbon pay in 20 sands. Six of these sands, XVIIa & XVIIb (commingled), XVIIIa, XIX, XXb, and XXI have been perforated. Sands will be tested, and completed for production. Any two of these zones can be produced simultaneously using dual tubing string sliding sleeve completion technology. Operations to prepare to flow test the six targeted sands in the UMU-10 well have been progressing and is approximately 80% completed. The long string (3 1/2 inch) completion has been installed, and the short string (2 7/8 inch) installation is currently underway. The sands completed in UMU-10 will access 161 feet of the total 479 feet of gross pay in the well.

Shell Export Pipeline

Mart and its co-venturers are continuing their negotiations with an affiliate of Royal Dutch Shell plc. ("Shell") to complete a crude handling agreement that will enable plans to move forward to provide a second independent export pipeline for Umusadege field production. Mart and its co-venturers will then gain access to Shell's export facilities and a 50-kilometer pipeline will be constructed. The pipes have been manufactured and loaded on a ship heading for Nigeria and expected to arrive in the third week of December 2012.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production and drilling operations.

November 2012 Production Disruptions

Due to an ongoing shutdown of the export pipeline that started on October 30, 2012, there was no production from the Umusadege field in November and December 2012. At the beginning of November 2012 there was a shipment of crude oil produced in October 2012 of 320,000 barrels of oil ("bbls"). Nigerian Agip Oil Company ("AGIP"), the pipeline operator, has advised that while repairs to the export pipeline have commenced, the nature of the damage has prevented a temporary repair and that a partial replacement of the line is required. The damaged pipeline is located in a river crossing. AGIP advises that it is working diligently to repair the export pipeline to enable the restoration of normal pipeline operations at the earliest possible date.