faktenthread - eisen - hierro - peru - 500 Beiträge pro Seite

eröffnet am 05.06.09 09:22:22 von

neuester Beitrag 28.09.12 08:14:11 von

neuester Beitrag 28.09.12 08:14:11 von

Beiträge: 236

ID: 1.150.876

ID: 1.150.876

Aufrufe heute: 0

Gesamt: 33.432

Gesamt: 33.432

Aktive User: 0

ISIN: CA14140U2048 · WKN: A142XA

0,1600

CAD

0,00 %

0,0000 CAD

Letzter Kurs 26.01.22 TSX Venture

Japanese and Korean investors will finance the private initiative

submitted by Minera de los Andes y el Pacifico (MAPS)

for the concession of the port of San Juan de Marcona in Ica,

which has a total investment of $ 2.2bn, Peru's APN has reported.

http://www.portstrategy.com/archive101/2009/june/news_americ…

submitted by Minera de los Andes y el Pacifico (MAPS)

for the concession of the port of San Juan de Marcona in Ica,

which has a total investment of $ 2.2bn, Peru's APN has reported.

http://www.portstrategy.com/archive101/2009/june/news_americ…

producción hierro

rueckgang zu jahresbegin um ca. 20 %

El hierro cayó 19,76 %

con una producción de 1.375.603 toneladas, mientras la cifra d

el año pasado fue de 1.714.326 toneladas en el primer cuatrimestre.

einer der groessten produzenten von eisen (shougang) in peru

meldete einen rueckgang von 12,5 % der produktion im april

Una de las mayores productoras de hierro en Perú,

la china Shougang, tuvo una disminución de 12,5 %

en su unidad de Marcona en abril pasado.

http://www.adn.es/economia/20090601/NWS-1882-Peru-principale…

...hier auch peruanische gold kupfer silber u.a. produktions zahlen

rueckgang zu jahresbegin um ca. 20 %

El hierro cayó 19,76 %

con una producción de 1.375.603 toneladas, mientras la cifra d

el año pasado fue de 1.714.326 toneladas en el primer cuatrimestre.

einer der groessten produzenten von eisen (shougang) in peru

meldete einen rueckgang von 12,5 % der produktion im april

Una de las mayores productoras de hierro en Perú,

la china Shougang, tuvo una disminución de 12,5 %

en su unidad de Marcona en abril pasado.

http://www.adn.es/economia/20090601/NWS-1882-Peru-principale…

...hier auch peruanische gold kupfer silber u.a. produktions zahlen

Hola bon.

Vielen Dank für die Infos.

Shakes

Vielen Dank für die Infos.

Shakes

bon dia Shakes - denada

Technip (Paris:TEC) (ISIN:FR0000131708) has been awarded by CF Industries

a lump sum contract for the front-end engineering design (FEED) of a proposed

grassroots nitrogen complex to be built in Peru, near the city of San Juan de Marcona.

http://online.wsj.com/article/BT-CO-20090604-700980.html

Technip (Paris:TEC) (ISIN:FR0000131708) has been awarded by CF Industries

a lump sum contract for the front-end engineering design (FEED) of a proposed

grassroots nitrogen complex to be built in Peru, near the city of San Juan de Marcona.

http://online.wsj.com/article/BT-CO-20090604-700980.html

Hay 4,317 kilómetros de carretera (strassen) concesionada

y compromisos de inversión por más de US$ 2,000 millones

Asimismo, la IIRSA Sur, que es un proyecto bastante ambicioso pues implica la construcción de 2,500 kilómetros de distancia y que permitirá conectar los puertos de Marcona (Ica), Matarani e Ilo (Moquegua) con Inambari (Madre de Dios), aumentando así el flujo comercial entre Perú y Brasil.

http://www.andina.com.pe/Espanol/Noticia.aspx?Id=kRNT8LgMra0…

y compromisos de inversión por más de US$ 2,000 millones

Asimismo, la IIRSA Sur, que es un proyecto bastante ambicioso pues implica la construcción de 2,500 kilómetros de distancia y que permitirá conectar los puertos de Marcona (Ica), Matarani e Ilo (Moquegua) con Inambari (Madre de Dios), aumentando así el flujo comercial entre Perú y Brasil.

http://www.andina.com.pe/Espanol/Noticia.aspx?Id=kRNT8LgMra0…

Megapuerto para Mollendo

http://www.correoperu.com.pe/correo/nota.php?txtEdi_id=5&txt…

Mollendo http://en.wikipedia.org/wiki/Mollendo

http://www.correoperu.com.pe/correo/nota.php?txtEdi_id=5&txt…

Mollendo http://en.wikipedia.org/wiki/Mollendo

Spot prices for ore delivered to China jumped 11 percent to $76.50

a metric ton in the week ended June 5, according to

Metal Bulletin prices, the highest since Feb. 20.

That’s the biggest weekly gain in 20 months.

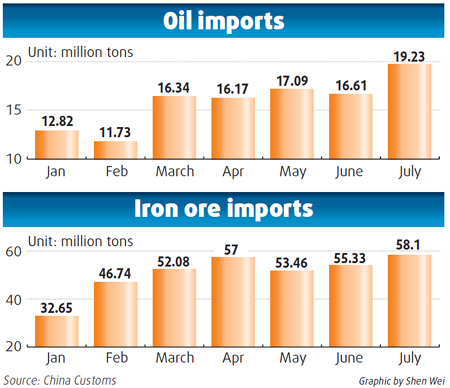

China’s iron ore imports jumped 33 percent to 57 million

metric ton in April from a year ago, according to customs data.

A surge in lending and investment and rising retail sales have

spurred confidence that Premier Wen Jiabao’s 4 trillion yuan

($585 billion) stimulus package is reviving growth

in the world’s third-biggest economy.

http://www.bloomberg.com/apps/news?pid=20601081&sid=ac.kuhew…

---

Vale Reaches Iron Ore Price Deal With Posco, Nippon Steel

Prices for iron ore fines will decline 28.2% from the 2008 reference price,

with lump iron ore prices sliding 44.47%, Vale said.

Iron pellet prices, much prized for their efficient use in blast

furnaces, will decrease 48.3% from the 2008 contract price.

http://www.tradingmarkets.com/.site/news/Stock%20News/236844…

---

India's iron ore rises to $60/T FOB, three-month high

http://in.reuters.com/article/domesticNews/idINBOM4380322009…

---

a metric ton in the week ended June 5, according to

Metal Bulletin prices, the highest since Feb. 20.

That’s the biggest weekly gain in 20 months.

China’s iron ore imports jumped 33 percent to 57 million

metric ton in April from a year ago, according to customs data.

A surge in lending and investment and rising retail sales have

spurred confidence that Premier Wen Jiabao’s 4 trillion yuan

($585 billion) stimulus package is reviving growth

in the world’s third-biggest economy.

http://www.bloomberg.com/apps/news?pid=20601081&sid=ac.kuhew…

---

Vale Reaches Iron Ore Price Deal With Posco, Nippon Steel

Prices for iron ore fines will decline 28.2% from the 2008 reference price,

with lump iron ore prices sliding 44.47%, Vale said.

Iron pellet prices, much prized for their efficient use in blast

furnaces, will decrease 48.3% from the 2008 contract price.

http://www.tradingmarkets.com/.site/news/Stock%20News/236844…

---

India's iron ore rises to $60/T FOB, three-month high

http://in.reuters.com/article/domesticNews/idINBOM4380322009…

---

!

Dieser Beitrag wurde moderiert. Grund: Provokation!

Dieser Beitrag wurde moderiert.

Vielen Dank für die Info´s und links bon!

Ist ja unglaublich was sich in und um Marcona herum alles tut...

Ist ja unglaublich was sich in und um Marcona herum alles tut...

Danke bon, sehr interessant!

merçie

---

India's Sesa Goa buys rival iron ore mines for $368 mln

http://www.reuters.com/article/rbssIndustryMaterialsUtilitie…

---

China’s Commodity Buying Spree

http://www.nytimes.com/2009/06/11/business/economy/11commodi…

---

Wisco to buy 19.99% stake in Canada's Consolidated Thompson

http://www.chinaknowledge.com/Newswires/News_Detail.aspx?typ…

OZ Minerals shareholders vote in favor of $1.4 billion deal with ChinaMinmetals.

http://www.forbes.com/2009/06/11/china-minmetals-Ozminerals-…

---

Kloppers Needs to Beat Rio Deal to Satisfy Demands for Growth

http://www.bloomberg.com/apps/news?pid=20601081&sid=aPCMJ4Bs…

Brazil’s Vale lands Manjung deal

http://biz.thestar.com.my/news/story.asp?file=/2009/6/12/bus…

---

India's Sesa Goa buys rival iron ore mines for $368 mln

http://www.reuters.com/article/rbssIndustryMaterialsUtilitie…

---

China’s Commodity Buying Spree

http://www.nytimes.com/2009/06/11/business/economy/11commodi…

---

Wisco to buy 19.99% stake in Canada's Consolidated Thompson

http://www.chinaknowledge.com/Newswires/News_Detail.aspx?typ…

OZ Minerals shareholders vote in favor of $1.4 billion deal with ChinaMinmetals.

http://www.forbes.com/2009/06/11/china-minmetals-Ozminerals-…

---

Kloppers Needs to Beat Rio Deal to Satisfy Demands for Growth

http://www.bloomberg.com/apps/news?pid=20601081&sid=aPCMJ4Bs…

Brazil’s Vale lands Manjung deal

http://biz.thestar.com.my/news/story.asp?file=/2009/6/12/bus…

no-go areas for the Chinese are:

• Russia

• Canada (only second-tier acquisitions will be allowed and only then in metals where there is an abundance

• Brazil (unlikely to be allowed any access to iron ore)

• Australia (unlikely to be allowed any more Tier One assets in any metal...unlikely to be allowed any more position with iron ore)

• Indonesia (anti-Chinese sentiment in the country)

Chinese interest in certain metals :

Gold: "there has been zero interest from China ...

Silver: "Zero interest...

Zinc: "this is the metal where...

Uranium: "Central Asian states might be a playground and possible Latin America

Copper: Chinese are likely to have to focus on Africa and LatAm

Iron Ore: "oops...blocked on all fronts. ...

The most prospective place that we see for Chinese in iron ore

is Peru where Cardero Resources has massive magnetite dunes

that have been the subject of on-again/off-again Chinese interest."

http://www.mineweb.co.za/mineweb/view/mineweb/en/page67?oid=…

---

Annual contract prices for iron ore, down for the first time in seven years,

may rebound 10 percent next year on rising imports by China,

according to Goldman Sachs JBWere Pty analysts.

http://www.bloomberg.com/apps/news?pid=20601091&sid=aGmnClvV…

“Growth in Chinese imports should be sufficient to offset weaker demand from the rest of the world,”

Goldman said. Global seaborne trade of iron may rise 11 percent in 2010 to 905 million tons, it said.

---

La cartera de proyectos de inversión está aumentando en Perú y

sumará 27,216 millones de dólares entre los años 2009 y 2011 ...

señaló hoy el presidente del Banco Central de Reserva (BCR), Julio Velarde.

http://www.andina.com.pe/Espanol/Noticia.aspx?id=yRn4EoqL8KQ…

• Russia

• Canada (only second-tier acquisitions will be allowed and only then in metals where there is an abundance

• Brazil (unlikely to be allowed any access to iron ore)

• Australia (unlikely to be allowed any more Tier One assets in any metal...unlikely to be allowed any more position with iron ore)

• Indonesia (anti-Chinese sentiment in the country)

Chinese interest in certain metals :

Gold: "there has been zero interest from China ...

Silver: "Zero interest...

Zinc: "this is the metal where...

Uranium: "Central Asian states might be a playground and possible Latin America

Copper: Chinese are likely to have to focus on Africa and LatAm

Iron Ore: "oops...blocked on all fronts. ...

The most prospective place that we see for Chinese in iron ore

is Peru where Cardero Resources has massive magnetite dunes

that have been the subject of on-again/off-again Chinese interest."

http://www.mineweb.co.za/mineweb/view/mineweb/en/page67?oid=…

---

Annual contract prices for iron ore, down for the first time in seven years,

may rebound 10 percent next year on rising imports by China,

according to Goldman Sachs JBWere Pty analysts.

http://www.bloomberg.com/apps/news?pid=20601091&sid=aGmnClvV…

“Growth in Chinese imports should be sufficient to offset weaker demand from the rest of the world,”

Goldman said. Global seaborne trade of iron may rise 11 percent in 2010 to 905 million tons, it said.

---

La cartera de proyectos de inversión está aumentando en Perú y

sumará 27,216 millones de dólares entre los años 2009 y 2011 ...

señaló hoy el presidente del Banco Central de Reserva (BCR), Julio Velarde.

http://www.andina.com.pe/Espanol/Noticia.aspx?id=yRn4EoqL8KQ…

Antwort auf Beitrag Nr.: 37.386.012 von bonDiacomova am 13.06.09 07:19:24Mal sehen ob diese magnetite dunes demnächst öfter namentlich erwähnt werden.

Jun 15 2009 - MD&A - English

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

aus Management Discussion & Analysis

Peru - Pampa El Toro Iron Sands Project

Phase III

The goal for the pilot-scale smelting test is

to demonstrate consistent melter operation,

uniform hot metal quality and slag quality

over an extended period of operation time.

The Phase III pilot-scale melting test will be designed

to run with the optimum briquette formulation along

with operating control parameters gleaned from

the bench-scale smelting test. The pilot-scale melting test

program is undergoing a permitting process that is targeted

to be completed by the end of Q2 2009,

with the actual pilot plant operation and final report to follow.

Peru - Pampa El Toro Iron Sands Project

Phase III

The goal for the pilot-scale smelting test is

to demonstrate consistent melter operation,

uniform hot metal quality and slag quality

over an extended period of operation time.

The Phase III pilot-scale melting test will be designed

to run with the optimum briquette formulation along

with operating control parameters gleaned from

the bench-scale smelting test. The pilot-scale melting test

program is undergoing a permitting process that is targeted

to be completed by the end of Q2 2009,

with the actual pilot plant operation and final report to follow.

aus Management Discussion & Analysis

Peru - Pampa de Pongo Iron Property

Cardero terminates the Sale Agreement or (ii)

Rio Tinto exercises its right of first offer

(due to the new lower purchase price, pursuant to

its right of first offer Rio Tinto has another 45- day period

(expires on July 9, 2009) to match the revised terms).

Hongda has agreed to provide, on or before August 19, 2009, (i) an irrevocable

letter of guarantee from a senior Chinese bank guaranteeing the payment of the balance of the purchase

price and (ii) a formal commitment letter to guarantee that the total purchase price of USD 100 million,

and the terms and conditions for the payment of the purchase price, is final and cannot be changed by Hongda.

Peru - Pampa de Pongo Iron Property

Cardero terminates the Sale Agreement or (ii)

Rio Tinto exercises its right of first offer

(due to the new lower purchase price, pursuant to

its right of first offer Rio Tinto has another 45- day period

(expires on July 9, 2009) to match the revised terms).

Hongda has agreed to provide, on or before August 19, 2009, (i) an irrevocable

letter of guarantee from a senior Chinese bank guaranteeing the payment of the balance of the purchase

price and (ii) a formal commitment letter to guarantee that the total purchase price of USD 100 million,

and the terms and conditions for the payment of the purchase price, is final and cannot be changed by Hongda.

Antwort auf Beitrag Nr.: 37.402.317 von bonDiacomova am 16.06.09 14:55:11Sprich bis 30. Juni, was von heute aus noch 14 Tage sind. Hoffentlich ein Termin der eingehalten wird.

!

Dieser Beitrag wurde moderiert. Grund: themenfremder Inhalt!

Dieser Beitrag wurde moderiert. Grund: Provokation

Antwort auf Beitrag Nr.: 37.402.317 von bonDiacomova am 16.06.09 14:55:11aus

Press Release Cardero Resource Corp.

http://finance.yahoo.com/news/Cardero-Announces-2009-ccn-155…

Cardero Announces 2009 Project Development Strategy

Pampa el Toro Iron Sands, Peru

- targeting a large bulk-tonnage low-OPEX iron-titanium-vanadium deposit.

An initial independent resource estimate is anticipated imminently

with full-scale pilot plant melt tests scheduled to commence in July 2009.

Metallurgical test-work, being undertaken at the National Testing Laboratory's 'state-of-the-art' laboratory and testing facilities in Oregon, USA, is progressing successfully and according to design. To date, high-quality Pig Iron has been produced at a bench-scale level. Based on these favourable results the Company is progressing to a full-scale melt test of approximately 40 tonnes of 'run-of mine' iron concentrates produced from the central portion of the Iron Sands deposit. The full-scale melt test is scheduled to commence in early July and will take approximately 4 to 6 weeks to complete.

---

Cardero is planning an aggressive 2009 field program :

- Iron-Titanium Deposits, Minnesota -

The Company has scheduled an independent N.I. 43-101 compliant resource estimate

at the Longnose Deposit, Minnesota, USA

The resource estimate is anticipated in late 2009.

- Organullo Gold Project, Argentina -

Initial drill testing of the Organullo gold project is planned for Q3/Q4-2009

- Baja Iron Oxide Copper Gold Belt -

Drilling is scheduled to commence in Q3/Q4 2009

Press Release Cardero Resource Corp.

http://finance.yahoo.com/news/Cardero-Announces-2009-ccn-155…

Cardero Announces 2009 Project Development Strategy

Pampa el Toro Iron Sands, Peru

- targeting a large bulk-tonnage low-OPEX iron-titanium-vanadium deposit.

An initial independent resource estimate is anticipated imminently

with full-scale pilot plant melt tests scheduled to commence in July 2009.

Metallurgical test-work, being undertaken at the National Testing Laboratory's 'state-of-the-art' laboratory and testing facilities in Oregon, USA, is progressing successfully and according to design. To date, high-quality Pig Iron has been produced at a bench-scale level. Based on these favourable results the Company is progressing to a full-scale melt test of approximately 40 tonnes of 'run-of mine' iron concentrates produced from the central portion of the Iron Sands deposit. The full-scale melt test is scheduled to commence in early July and will take approximately 4 to 6 weeks to complete.

---

Cardero is planning an aggressive 2009 field program :

- Iron-Titanium Deposits, Minnesota -

The Company has scheduled an independent N.I. 43-101 compliant resource estimate

at the Longnose Deposit, Minnesota, USA

The resource estimate is anticipated in late 2009.

- Organullo Gold Project, Argentina -

Initial drill testing of the Organullo gold project is planned for Q3/Q4-2009

- Baja Iron Oxide Copper Gold Belt -

Drilling is scheduled to commence in Q3/Q4 2009

Spot option looms large on steel industry's radar

http://www.chinadaily.com.cn/bizchina/2009-06/18/content_829…

Iron ore price negotiations - Analysts forecasting rise now

http://www.steelprices-china.com/news/index/2009/06/17/ODk4O…

Weltbank sieht chinesische Wirtschaft auf gutem Weg

Die Weltbank hat die Wachstumsprognose 2009 für China von 6,5 auf 7,2 Prozent angehoben. Die milliardenschweren Konjunkturanreize der Regierung stützten das Wachstum, erklärte die Weltbank am Donnerstag in ihrem Quartalsbericht. Es sei aber noch zu früh um zu sagen, ob eine anhaltende Erholung zu erwarten sei.

http://de.biz.yahoo.com/18062009/12/weltbank-sieht-chinesisc…

Standard & Poor's: Investment in Peru to grow faster in second half 2009

http://www.andina.com.pe/Espanol/Noticia.aspx?id=XvIPF5ashl8…

http://www.andina.com.pe/ingles/Noticia.aspx?id=A4PZKtgnHn8=

http://www.lloydslist.com/ll/news/chinas-iron-ore-mines-face…" target="_blank" rel="nofollow ugc noopener">http://www.lloydslist.com/ll/news/chinas-iron-ore-mines-face…

China's iron ore mines face massive shakeout

Michelle Wiese Bockmann - Freitag 19 Juni 2009

CHINA’s iron ore mines face a massive shakeout, with a “severe fall” in domestic production set to boost shipments from Brazil and Australia, according to the United Nations Conference on Trade and Development.

The agency’s annual report on the 2008 iron ore industry forecasts what it called a “great Chinese shakeout” resulting in widespread mine closures and even greater reliance on imported iron ore — a key driver of demand for the bulk carrier freight market.

“It is probable that between one third and one half of Chinese iron ore capacity will close over the next three years, with 40%, or 130-150m tonnes, being the most likely reduction figure,” the report said.

This would “catapult” the world’s top three iron ore miners to record levels of control of the global trade in seaborne iron ore.

Chinese substitution of imported iron ore over its own more expensive and poorer quality product, has emerged as the sole driver of rocketing freight rates in the last two months.

Capesize spot rates on the major trading route from Brazil to China have tripled since mid-April to exceed nearly $117,000 per day because of substitution.

Forecasts that this trend is set to accelerate is of major significance for the global capesize fleet, which now relies almost wholly on Chinese demand to set the market rate.

Brazil’s Vale and Australia’s BHP Billiton and Rio Tinto control 69% of iron ore shipments, which rose 7% to a record 845m tonnes in 2008.

The shakeout was forecast in “the next few years”, Unctad said.

China is currently the world’s largest iron ore producer, at 366m tonnes, or just over 20% of the world’s total production of 1.7bn tonnes.

But Unctad says that small and medium-sized Chinese producers will be “forced to substantially reduce their output, particularly since they are no longer protected by high freight costs for imported iron ore”.

Last month, Rio Tinto said half of domestic mines were already closed.

Unctad says lower freight rates and high costs have meant half of China’s 8,000 mines were operating at a loss, and reliant on government assistance.

Contract prices for iron ore were likely to remain at same level as spot prices of $70 per tonne for landed iron ore in China in the medium term.

“A consequence of this price shift is shakeout of Chinese iron ore mining,” the Unctad report said.

“The effect of the price fall will be reinforced, as far as Chinese mines are concerned by rising costs for health and safety measures, environmental management and rising energy prices.”

Chinese iron ore has average grade of about 27.5%, much lower than imported iron ore at about 60%.

The industry is highly fragmented, with only 49 mines classified as “major” and producing 188.3m tonnes, while “medium and small mines” produce 636m tonnes.

Lundin refreshes Cardero buy

Cardero Resource Corp (C:CDU)

Shares Issued 58,543,477

Last Close6/29/2009 $1.14

Monday June 29 2009 - In the News

Brien Lundin, in the June, 2009, edition of the GoldNewsletter, refreshes his buy of Cardero Resource Corp., recently $1.17. Mr.Lundin said buy Cardero four times between December, 2004, and March, 2009, atprices ranging from $1.15 to $4. Assuming a $1,000 investment for each of thefour buys, the $4,000 investment is now worth $2,368. The newsletter editor saysCardero shareholders have endured a roller coaster ride recently. First,Nanjinzhao delayed paying a $10-million instalment for the Pampa de Pongo ironore deposit so it could delve deeper into the economics of the project. Afterreviewing the economics of the project, Nanjinzhao said it required a "reductionin the overall purchase price of $200-million," which sent Cardero shares to 90cents from $1.50. Two days later, Cardero renegotiated a price of $100-millionand it received a $10-million deposit. This bit of news sent the share price to$1.20. According to Mr. Lundin, Rio Tinto PLC still has the right to match therevised terms of the agreement over the next 45 days. The cash infusion givesCardero plenty of money to put toward its suite of properties and the stockmarket guru says Cardero is a great deal

China's iron ore mines face massive shakeout

Michelle Wiese Bockmann - Freitag 19 Juni 2009

CHINA’s iron ore mines face a massive shakeout, with a “severe fall” in domestic production set to boost shipments from Brazil and Australia, according to the United Nations Conference on Trade and Development.

The agency’s annual report on the 2008 iron ore industry forecasts what it called a “great Chinese shakeout” resulting in widespread mine closures and even greater reliance on imported iron ore — a key driver of demand for the bulk carrier freight market.

“It is probable that between one third and one half of Chinese iron ore capacity will close over the next three years, with 40%, or 130-150m tonnes, being the most likely reduction figure,” the report said.

This would “catapult” the world’s top three iron ore miners to record levels of control of the global trade in seaborne iron ore.

Chinese substitution of imported iron ore over its own more expensive and poorer quality product, has emerged as the sole driver of rocketing freight rates in the last two months.

Capesize spot rates on the major trading route from Brazil to China have tripled since mid-April to exceed nearly $117,000 per day because of substitution.

Forecasts that this trend is set to accelerate is of major significance for the global capesize fleet, which now relies almost wholly on Chinese demand to set the market rate.

Brazil’s Vale and Australia’s BHP Billiton and Rio Tinto control 69% of iron ore shipments, which rose 7% to a record 845m tonnes in 2008.

The shakeout was forecast in “the next few years”, Unctad said.

China is currently the world’s largest iron ore producer, at 366m tonnes, or just over 20% of the world’s total production of 1.7bn tonnes.

But Unctad says that small and medium-sized Chinese producers will be “forced to substantially reduce their output, particularly since they are no longer protected by high freight costs for imported iron ore”.

Last month, Rio Tinto said half of domestic mines were already closed.

Unctad says lower freight rates and high costs have meant half of China’s 8,000 mines were operating at a loss, and reliant on government assistance.

Contract prices for iron ore were likely to remain at same level as spot prices of $70 per tonne for landed iron ore in China in the medium term.

“A consequence of this price shift is shakeout of Chinese iron ore mining,” the Unctad report said.

“The effect of the price fall will be reinforced, as far as Chinese mines are concerned by rising costs for health and safety measures, environmental management and rising energy prices.”

Chinese iron ore has average grade of about 27.5%, much lower than imported iron ore at about 60%.

The industry is highly fragmented, with only 49 mines classified as “major” and producing 188.3m tonnes, while “medium and small mines” produce 636m tonnes.

Lundin refreshes Cardero buy

Cardero Resource Corp (C:CDU)

Shares Issued 58,543,477

Last Close6/29/2009 $1.14

Monday June 29 2009 - In the News

Brien Lundin, in the June, 2009, edition of the GoldNewsletter, refreshes his buy of Cardero Resource Corp., recently $1.17. Mr.Lundin said buy Cardero four times between December, 2004, and March, 2009, atprices ranging from $1.15 to $4. Assuming a $1,000 investment for each of thefour buys, the $4,000 investment is now worth $2,368. The newsletter editor saysCardero shareholders have endured a roller coaster ride recently. First,Nanjinzhao delayed paying a $10-million instalment for the Pampa de Pongo ironore deposit so it could delve deeper into the economics of the project. Afterreviewing the economics of the project, Nanjinzhao said it required a "reductionin the overall purchase price of $200-million," which sent Cardero shares to 90cents from $1.50. Two days later, Cardero renegotiated a price of $100-millionand it received a $10-million deposit. This bit of news sent the share price to$1.20. According to Mr. Lundin, Rio Tinto PLC still has the right to match therevised terms of the agreement over the next 45 days. The cash infusion givesCardero plenty of money to put toward its suite of properties and the stockmarket guru says Cardero is a great deal

July 6 (Bloomberg)

China, the world’s biggest buyer of iron ore, faces the risk

of higher cash prices as annual contract talks stall with producers.

Ore for immediate delivery rose to a four-month high of $ 82.50

a metric ton in the week ended July 3, according to Metal Bulletin.

http://www.bloomberg.com/apps/news?pid=20601081&sid=ambiBnFp…

---

MOT ( Ministry of Transport ) figures show ports handled 55.5 million tons

of imported iron ore in May, a 24.6 percent increase year-on-year.

http://www.chinadaily.com.cn/bizchina/2009-07/06/content_838…

China, the world’s biggest buyer of iron ore, faces the risk

of higher cash prices as annual contract talks stall with producers.

Ore for immediate delivery rose to a four-month high of $ 82.50

a metric ton in the week ended July 3, according to Metal Bulletin.

http://www.bloomberg.com/apps/news?pid=20601081&sid=ambiBnFp…

---

MOT ( Ministry of Transport ) figures show ports handled 55.5 million tons

of imported iron ore in May, a 24.6 percent increase year-on-year.

http://www.chinadaily.com.cn/bizchina/2009-07/06/content_838…

...was in diesem Artikel zudem nicht erwähnt wird.

Der Fund befindet sich im "Niemandsland" ohne jegliche Infrastruktur.

http://mobil.welt.de/article.do?id=finanzen%2Farticle3994777…

ROHSTOFFE

China verkündet rekordverdächtigen Eisenerzfund

Foto: dpa

Erstaunliche Entdeckung: Die Chinesen haben die womöglich größte Eisenerzmine der Welt entdeckt. Die Rohstoffmärkte reagieren prompt: Die Papiere des am Fund beteiligten Unternehmens schießt in die Höhe. Auch Stahlaktien steigen kräftig. Kritiker vermuten dahinter jedoch den Versuch des Preisdumpings.

Ohnehin wurden in der Branche schnell Zweifel am Wahrheitsgehalt der Meldung laut. Denn die Ankündigung fällt zeitlich genau mit den entscheidenden Verhandlungen der chinesischen Stahlhersteller mit deren internationalen Eisenerzlieferanten zusammen. "Möglicherweise handelt es sich nur um eine Finte, damit niedrigere Erzpreise verlangt werden können", erklärt ein Kenner der Branche, der jedoch nicht namentlich zitiert werden möchte. Außerdem hätten in China noch einige Akteure Rechnungen mit den großen australischen Bergbaufirmen offen. China ist der größte Käufer von Eisenerz auf dem Weltmarkt und will die Abhängigkeit von Bergbaukonzernen wie Vale, Rio Tinto und BHP Billiton durch eine höhere Eigenproduktion schrittweise verringern.

Kein Land importiert derzeit mehr Eisenerz als China - das Riesenreich muss fast die Hälfte seines Verbrauchs im Ausland decken. Allein im vergangenen Jahr kaufte China in anderen Ländern 444 Mio. Tonnen. Branchenexperten zufolge dürfte es China jedoch kaum gelingen, mit der Bekanntgabe des Fundes schon in der jetzigen Runde die Preise zu drücken.

Zumal sich das Vorkommen in einer Tiefe zwischen 1,2 und zwei Kilometern befindet. Damit liegt das Erz tiefer als in allen anderen derzeit produzierenden chinesischen Eisenerz-Minen, sagte der Branchenexperte Zou Zian, Berater der Industrievereinigung China Metallurgical Mining Enterprise Association. Das erschwere die Ausbeutung des Vorkommens und verteuere den Prozess. Typischerweise komme Eisenerz in China in einer Tiefe zwischen 500 und 600 Metern vor. Durch die höheren Erschließungskosten könne das Erz aus der neu entdeckten Lagerstätte preislich nicht mit Importen aus Australien mithalten, sagte Analyst Hu Kai vom Umetal Research Institute.

Damit dürfte die Entdeckung kurzfristig wenig an Chinas Verhandlungsposition im Ringen um billigere Eisenerz-Importe ändern. Bis Dienstag kommender Woche will Rio Tinto einen Festpreis für ein Jahr vereinbaren. Während China angesichts des Abschwungs auf eine Senkung um 45 Prozent pocht, will der Konzern nur 33 Prozent zugestehen und damit genau so viel wie seinen europäischen oder japanischen Kunden. Die Alternative zum Festpreis ist ein Einkauf an den Rohstoffbörsen. Hier verteuert sich Eisenerz allerdings bereits wieder wegen der ersten Anzeichen für eine bessere Konjunktur und nähert sich den von Rio angebotenen Festpreisen an.

Der Fund befindet sich im "Niemandsland" ohne jegliche Infrastruktur.

http://mobil.welt.de/article.do?id=finanzen%2Farticle3994777…

ROHSTOFFE

China verkündet rekordverdächtigen Eisenerzfund

Foto: dpa

Erstaunliche Entdeckung: Die Chinesen haben die womöglich größte Eisenerzmine der Welt entdeckt. Die Rohstoffmärkte reagieren prompt: Die Papiere des am Fund beteiligten Unternehmens schießt in die Höhe. Auch Stahlaktien steigen kräftig. Kritiker vermuten dahinter jedoch den Versuch des Preisdumpings.

Ohnehin wurden in der Branche schnell Zweifel am Wahrheitsgehalt der Meldung laut. Denn die Ankündigung fällt zeitlich genau mit den entscheidenden Verhandlungen der chinesischen Stahlhersteller mit deren internationalen Eisenerzlieferanten zusammen. "Möglicherweise handelt es sich nur um eine Finte, damit niedrigere Erzpreise verlangt werden können", erklärt ein Kenner der Branche, der jedoch nicht namentlich zitiert werden möchte. Außerdem hätten in China noch einige Akteure Rechnungen mit den großen australischen Bergbaufirmen offen. China ist der größte Käufer von Eisenerz auf dem Weltmarkt und will die Abhängigkeit von Bergbaukonzernen wie Vale, Rio Tinto und BHP Billiton durch eine höhere Eigenproduktion schrittweise verringern.

Kein Land importiert derzeit mehr Eisenerz als China - das Riesenreich muss fast die Hälfte seines Verbrauchs im Ausland decken. Allein im vergangenen Jahr kaufte China in anderen Ländern 444 Mio. Tonnen. Branchenexperten zufolge dürfte es China jedoch kaum gelingen, mit der Bekanntgabe des Fundes schon in der jetzigen Runde die Preise zu drücken.

Zumal sich das Vorkommen in einer Tiefe zwischen 1,2 und zwei Kilometern befindet. Damit liegt das Erz tiefer als in allen anderen derzeit produzierenden chinesischen Eisenerz-Minen, sagte der Branchenexperte Zou Zian, Berater der Industrievereinigung China Metallurgical Mining Enterprise Association. Das erschwere die Ausbeutung des Vorkommens und verteuere den Prozess. Typischerweise komme Eisenerz in China in einer Tiefe zwischen 500 und 600 Metern vor. Durch die höheren Erschließungskosten könne das Erz aus der neu entdeckten Lagerstätte preislich nicht mit Importen aus Australien mithalten, sagte Analyst Hu Kai vom Umetal Research Institute.

Damit dürfte die Entdeckung kurzfristig wenig an Chinas Verhandlungsposition im Ringen um billigere Eisenerz-Importe ändern. Bis Dienstag kommender Woche will Rio Tinto einen Festpreis für ein Jahr vereinbaren. Während China angesichts des Abschwungs auf eine Senkung um 45 Prozent pocht, will der Konzern nur 33 Prozent zugestehen und damit genau so viel wie seinen europäischen oder japanischen Kunden. Die Alternative zum Festpreis ist ein Einkauf an den Rohstoffbörsen. Hier verteuert sich Eisenerz allerdings bereits wieder wegen der ersten Anzeichen für eine bessere Konjunktur und nähert sich den von Rio angebotenen Festpreisen an.

http://www.hallgartenco.com/file.php?path=Mining&filename=Ri…

Hallgarten & Company

Portfolio Strategy

Christopher Ecclestone

cecclestone@hallgartenco.com

Rio Tinto & Chinalco

Check …. and Checkmate

Iron ore: oops.. blocked on all fronts. Vedanta has El Mutun in Bolivia. As we noted it is unlikely that

anything in Brazil will be allowed to fall into Chinese hands and they have pretty much grabbed as much

of their quota of goodwill that Australia will allow them. Ironically the Chinese have gained a toehold in

Canadian iron ore production via the recent capital injection into Consolidated Thompson (CLM.to) which

gave them 19% of the capital and eventually 25% of the equity in CLM’s Bloom Lake project. The most

prospective place that we see for the Chinese in iron ore is Peru where Cardero Resources (CDY) has

massive magnetite dunes that have been the subject of on-again/off-again Chinese interest.

Hallgarten & Company

Portfolio Strategy

Christopher Ecclestone

cecclestone@hallgartenco.com

Rio Tinto & Chinalco

Check …. and Checkmate

Iron ore: oops.. blocked on all fronts. Vedanta has El Mutun in Bolivia. As we noted it is unlikely that

anything in Brazil will be allowed to fall into Chinese hands and they have pretty much grabbed as much

of their quota of goodwill that Australia will allow them. Ironically the Chinese have gained a toehold in

Canadian iron ore production via the recent capital injection into Consolidated Thompson (CLM.to) which

gave them 19% of the capital and eventually 25% of the equity in CLM’s Bloom Lake project. The most

prospective place that we see for the Chinese in iron ore is Peru where Cardero Resources (CDY) has

massive magnetite dunes that have been the subject of on-again/off-again Chinese interest.

Antwort auf Beitrag Nr.: 37.521.573 von nugent am 06.07.09 06:56:00http://mineweb.net/mineweb/view/mineweb/en/page39?oid=85905&…

HIGHER COST THAN PROPOSED CONTRACT RATE

Record Rio Tinto iron ore sales to China at spot prices

Rio Tinto (RIO.L: Quote) (RIO.AX: Quote), the world's second largest iron ore miner, says Chinese buyers are choosing to pay spot market prices for iron ore and it is shipping material from its Western Australian mines at record rates.

Rio said demand for iron ore from Chinese buyers remained strong even though it had not yet struck a deal with the country's steel mills for shipments in the 2009-2010 contract year under the traditional benchmark pricing system.

"We're selling everything we make -- we've never been as busy," said Rio Tinto Iron Ore spokesman Gervase Greene.

Greene said Rio Tinto was selling iron ore to Chinese mills at spot prices after failing to agree annual contact prices.

"Instead of buying under contract, they just chose to buy at whatever the prevailing rate is on the day," he said. "At the moment that's about $82 so we're selling it at a higher price than if they had agreed (to the 33 percent cut) so that's where it's at."

"We believe in the benchmark system but if, at the end of the day, customers want to pay spot prices that's up to them," Greene said.

Ich würde mal sagen, seit Dezember hat der Wind schon ganz schön gedreht. Nicht zuletzt wegen dem halbierten Preis für PdP sollte RT nochmal genau nachrechnen...

Stefan

HIGHER COST THAN PROPOSED CONTRACT RATE

Record Rio Tinto iron ore sales to China at spot prices

Rio Tinto (RIO.L: Quote) (RIO.AX: Quote), the world's second largest iron ore miner, says Chinese buyers are choosing to pay spot market prices for iron ore and it is shipping material from its Western Australian mines at record rates.

Rio said demand for iron ore from Chinese buyers remained strong even though it had not yet struck a deal with the country's steel mills for shipments in the 2009-2010 contract year under the traditional benchmark pricing system.

"We're selling everything we make -- we've never been as busy," said Rio Tinto Iron Ore spokesman Gervase Greene.

Greene said Rio Tinto was selling iron ore to Chinese mills at spot prices after failing to agree annual contact prices.

"Instead of buying under contract, they just chose to buy at whatever the prevailing rate is on the day," he said. "At the moment that's about $82 so we're selling it at a higher price than if they had agreed (to the 33 percent cut) so that's where it's at."

"We believe in the benchmark system but if, at the end of the day, customers want to pay spot prices that's up to them," Greene said.

Ich würde mal sagen, seit Dezember hat der Wind schon ganz schön gedreht. Nicht zuletzt wegen dem halbierten Preis für PdP sollte RT nochmal genau nachrechnen...

Stefan

RT

Rio Tinto Set to Raise $1.2 Billion in Asset Sale

It will be financed with $1 billion in cash and $200 million in equity.

Rio Tinto acquired these packaging businesses as part of its 2007

purchase of Canadian aluminum giant Alcan for $38 billion in cash.

Rio Tinto, one of the world's largest producers of iron ore, copper, aluminum and other metals,

has sold several businesses in the last year in advance of several looming debt maturities,

including an $8.9 billion payment due next month.

It recently completed a $15.2 billion rights issue to raise money. It has nearly $39 billion in debt.

http://online.wsj.com/article/SB124684842229198797.html?mod=…

Rio Tinto Set to Raise $1.2 Billion in Asset Sale

It will be financed with $1 billion in cash and $200 million in equity.

Rio Tinto acquired these packaging businesses as part of its 2007

purchase of Canadian aluminum giant Alcan for $38 billion in cash.

Rio Tinto, one of the world's largest producers of iron ore, copper, aluminum and other metals,

has sold several businesses in the last year in advance of several looming debt maturities,

including an $8.9 billion payment due next month.

It recently completed a $15.2 billion rights issue to raise money. It has nearly $39 billion in debt.

http://online.wsj.com/article/SB124684842229198797.html?mod=…

http://www.unctad.org/en/docs/IronOreMarket_2008-2010.pdf

TRUST FUND ON IRON ORE INFORMATION

IRON ORE MARKET 2008-2010

Geneva, June 2009

SUMMARY 4

I. THE IRON ORE MARKET IN 2008 7

II. STEEL IN 2008 21

III. COUNTRY INFORMATION 25

IV. COMPANIES IN THE GLOBAL IRON ORE INDUSTRY 49

V. PROJECT REVIEW 62

VI. THE OUTLOOK FOR 2009 AND 2010 86

VII. SOME COMMENTS ON THE STATISTICS 91

Table 12. Ongoing and announced iron ore projects

Pampa de Pongo Iron Ore Deposit Peru Conceptual Cardero 3280

TRUST FUND ON IRON ORE INFORMATION

IRON ORE MARKET 2008-2010

Geneva, June 2009

SUMMARY 4

I. THE IRON ORE MARKET IN 2008 7

II. STEEL IN 2008 21

III. COUNTRY INFORMATION 25

IV. COMPANIES IN THE GLOBAL IRON ORE INDUSTRY 49

V. PROJECT REVIEW 62

VI. THE OUTLOOK FOR 2009 AND 2010 86

VII. SOME COMMENTS ON THE STATISTICS 91

Table 12. Ongoing and announced iron ore projects

Pampa de Pongo Iron Ore Deposit Peru Conceptual Cardero 3280

Antwort auf Beitrag Nr.: 37.528.387 von nugent am 07.07.09 19:30:30PERU

Peru’s only iron ore producer, Shougang Hierro Peru SA., fully owned by the Chinese state

controlled Shougang Group, which operates the Marcona open pit mine, produced 7.9 Mt

during 2008, the same amount as last year. In 2008, almost 91 % of the total production, or

7.2 Mt, was exported. This represents a decrease in exports of about 2.3 % from the 7.4 Mt

exported in 2007. China received 5.4 Mt or 75 % of total exports. Other important

destinations are Japan, Mexico and the Republic of Korea. Exports to all of these countries

decreased in 2008 while exports to China increased. Pellets production has been gaining in

importance in Peru but since 2007 production has decreased. In 2008 it fell by 16 %. Of the

total production roughly 30 % was pellets, a decline from the 35 % last year. Exports of

pellets have decreased over the last years and in 2008 they declined by 14 %. A couple of early stage iron ore projects in Peru are under way as well as an expansion of the Marcona

iron ore mine.

Peru’s only iron ore producer, Shougang Hierro Peru SA., fully owned by the Chinese state

controlled Shougang Group, which operates the Marcona open pit mine, produced 7.9 Mt

during 2008, the same amount as last year. In 2008, almost 91 % of the total production, or

7.2 Mt, was exported. This represents a decrease in exports of about 2.3 % from the 7.4 Mt

exported in 2007. China received 5.4 Mt or 75 % of total exports. Other important

destinations are Japan, Mexico and the Republic of Korea. Exports to all of these countries

decreased in 2008 while exports to China increased. Pellets production has been gaining in

importance in Peru but since 2007 production has decreased. In 2008 it fell by 16 %. Of the

total production roughly 30 % was pellets, a decline from the 35 % last year. Exports of

pellets have decreased over the last years and in 2008 they declined by 14 %. A couple of early stage iron ore projects in Peru are under way as well as an expansion of the Marcona

iron ore mine.

..Infos zu Longnose

Viel geplant in dieser Region.

http://www.laskinenergypark.com/the-energy-park

Laskin Energy Park: Powerful Sites for Growing Businesses

Welcome to Laskin Energy Park, a powerful location for growth-oriented manufacturers who want it all - robust, affordable industrial infrastructure, low capital costs, abundant skilled workers, and an unsurpassed quality of life.

The 220-acre park is located next to Minnesota Power's Laskin Energy Center in Hoyt Lakes, Minn., adjacent to Colby Lake and the Partridge River. This beautiful, wooded, park-like setting offers easy access to natural resources, a direct link to low-cost and reliable energy, convenient transportation routes, and the high-speed telecommunications access necessary to succeed in today's global economy.

http://www.laskinenergypark.com/the-energy-park/news

The Iron Range

The Iron Range is located in Northeast Minnesota. It is part of a seven-county area, known as the Arrowhead Region, which also includes land along the Canadian border, the North Shore of Lake Superior and Duluth. The total population of the Arrowhead Region is 322,073.

Known locally as “The Range,” it contains multiple, distinct bands of iron ore, numbers lakes and thick woodlands. For much of the 20th Century, the region’s economic growth was tied to the steel, mining and forestry industries.

As the world economy expands and technology allows for greater process efficiencies, a number of mining firms are again looking to the Iron Range. More than $5 billion in new mining projects are proposed for the region, including no-ferrous metals mining projects.

The Iron Range is part of the Arrowhead Region of Minnesota.

Population 2000 322,073

Population 2010 projected 338,450

Population 2020 projected 347,780

http://www.laskinenergypark.com/the-energy-park/news/p/item/…

Januar 14, 2009

Cardero Acquires Longnose Titanium Deposit near Hoyt Lakes, MN

January 6, 2009 Cardero Acquires Longnose Titanium Deposit Near Hoyt Lakes, Minnesota Cardero Resource Corp. ("Cardero" or the "Company") - (TSX: CDU, NYSE-A: CDY, Frankfurt: CR5) announced that it has entered into (Read More)

Viel geplant in dieser Region.

http://www.laskinenergypark.com/the-energy-park

Laskin Energy Park: Powerful Sites for Growing Businesses

Welcome to Laskin Energy Park, a powerful location for growth-oriented manufacturers who want it all - robust, affordable industrial infrastructure, low capital costs, abundant skilled workers, and an unsurpassed quality of life.

The 220-acre park is located next to Minnesota Power's Laskin Energy Center in Hoyt Lakes, Minn., adjacent to Colby Lake and the Partridge River. This beautiful, wooded, park-like setting offers easy access to natural resources, a direct link to low-cost and reliable energy, convenient transportation routes, and the high-speed telecommunications access necessary to succeed in today's global economy.

http://www.laskinenergypark.com/the-energy-park/news

The Iron Range

The Iron Range is located in Northeast Minnesota. It is part of a seven-county area, known as the Arrowhead Region, which also includes land along the Canadian border, the North Shore of Lake Superior and Duluth. The total population of the Arrowhead Region is 322,073.

Known locally as “The Range,” it contains multiple, distinct bands of iron ore, numbers lakes and thick woodlands. For much of the 20th Century, the region’s economic growth was tied to the steel, mining and forestry industries.

As the world economy expands and technology allows for greater process efficiencies, a number of mining firms are again looking to the Iron Range. More than $5 billion in new mining projects are proposed for the region, including no-ferrous metals mining projects.

The Iron Range is part of the Arrowhead Region of Minnesota.

Population 2000 322,073

Population 2010 projected 338,450

Population 2020 projected 347,780

http://www.laskinenergypark.com/the-energy-park/news/p/item/…

Januar 14, 2009

Cardero Acquires Longnose Titanium Deposit near Hoyt Lakes, MN

January 6, 2009 Cardero Acquires Longnose Titanium Deposit Near Hoyt Lakes, Minnesota Cardero Resource Corp. ("Cardero" or the "Company") - (TSX: CDU, NYSE-A: CDY, Frankfurt: CR5) announced that it has entered into (Read More)

China Agrees to 33% Iron Ore Price Cut

http://www.bloomberg.com/apps/news?pid=20601081&sid=aLazHe1u…

http://business.watoday.com.au/business/china-accepts-33-iro…

INTERFAX-CHINA - Chinese steel mills are expected to accept the same price cuts that Japanese and South Korean steel mills settled with the world's top three iron ore miners soon, but for a limited half-year period ending on Sept. 30, 2009, an industry insider close to the situation, told Interfax on July 8

http://www.interfax.cn/news/10197/

http://www.bloomberg.com/apps/news?pid=20601081&sid=aLazHe1u…

http://business.watoday.com.au/business/china-accepts-33-iro…

INTERFAX-CHINA - Chinese steel mills are expected to accept the same price cuts that Japanese and South Korean steel mills settled with the world's top three iron ore miners soon, but for a limited half-year period ending on Sept. 30, 2009, an industry insider close to the situation, told Interfax on July 8

http://www.interfax.cn/news/10197/

Vom 24.06

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&fi…

Management’s Discussion and Analysis:

Material Mineral Properties

Material Mineral Properties

Peru - Pampa de Pongo Iron Property

On October 24, 2008, the Company and its Peruvian subsidiary, Cardero Hierro Del Peru, S.A.C. (“Cardero Peru”) entered into an agreement (the “Sale Agreement”) with Nanjinzhao Group Co., Ltd., (“Nanjinzhao”), a private Chinese enterprise located in Zibo City, Shandong Province, PRC, whereby the Company and Cardero Peru agreed to sell the Pampa de Pongo property (“Property”) to Nanjinzhao for USD 200 million, subject to the waiver by Rio Tinto Mining and Exploration, S.A.C. (“Rio Tinto”) of their right of first refusal in respect of the majority of the mining rights comprising the Property. The Sale Agreement required an initial deposit of USD 10 million, payable on or before March 17, 2009, with a final payment of USD 190 million due on or before September 17, 2009. During the initial three month period, Nanjinzhao was to obtain the appropriate Chinese governmental consents to the transaction. The Property will be transferred to a Peruvian subsidiary of Nanjinzhao once the USD 10 million deposit has been received. The Sale Agreement permits the Company to decline to proceed with the transaction at any time prior to the receipt of the final payment, provided that, if such decision is made at any time after the initial USD 10 million deposit has been paid, the Company is required to return the deposit and pay Nanjinzhao an additional USD 20 million as a break-up fee. Upon repayment of the deposit (and break fee, if required), the Property will be retransferred to Cardero Peru. Rio Tinto elected to waive its right of first refusal in respect of the sale of the Property to Nanjinzhao under the Sale Agreement on December 17, 2008.

The Company has agreed to pay a finder’s fee to an arm’s length private company in consideration of the finder introducing the Company to Nanjinzhao and providing ongoing advice in the negotiations.

On February 10, 2009, at the request of Nanjinzhao and in consideration of the payment by Nanjinzhao to Cardero Peru of the sum of USD 2.0 million (to be applied against the balance of the purchase price due on September 17, 2009 - which therefore reduced by that amount), the Company authorized Nanjinzhao to immediately commence engineering drilling on the Property under the existing drilling permit, in order to facilitate the timely collection of engineering and geotechnical data essential for the development permitting process. Payment of the USD 2 million advance did not trigger the “break fee” provisions of the Sale Agreement.

On April 3, 2009, Nanjinzhao, with the consent of Cardero and Cardero Peru, assigned its interest in the Sale Agreement, and its right to purchase the Property, to a subsidiary, Zibo Hongda Mining Co., Ltd.

On May 20, 2009, the Company, Cardero Peru and Hongda agreed to amend the provisions of the Sale Agreement. Hongda had requested a purchase price reduction due to difficult global economic conditions that have significantly adversely impacted iron ore prices. Following negotiations, Cardero and Cardero Peru agreed to revise the final sale price to USD 100 million (of which USD 2 million has already been paid). Accordingly, on May 21, 2009 Hongda paid the required USD 10 million deposit to Cardero Peru, which deposit is non-refundable unless either (i) Cardero terminates the Sale Agreement or (ii) Rio Tinto exercises its right of first offer (due to the new lower purchase price, pursuant to its right of first offer Rio Tinto has another 45- day period (expires on July 9, 2009) to match the revised terms). If Rio Tinto exercise its right of first offer, Cardero Peru will repay the USD 10 million deposit to Hongda.

The balance of the purchase price of USD 88 million is now due on the earlier of ten days after Hongda has received the necessary Chinese governmental approvals to proceed with the purchase and December 17, 2009. The break-up fee payable by the Company, should it determine not to proceed with the transaction (whether due to a better offer or otherwise), remains at USD 20 million (plus repayment of the USD 10 million deposit). Hongda has agreed to provide, on or before August 19, 2009, (i) an irrevocable letter of guarantee from a senior Chinese bank guaranteeing the payment of the balance of the purchase price and (ii) a formal commitment letter to guarantee that the total purchase price of USD 100 million, and the terms and conditions for the payment of the purchase price, is final and cannot be changed by Hongda.

Peru - Pampa El Toro Iron Sands Project

General

The Company’s Iron Sands project now comprises an aggregate of 21 concessions in two dune fields – Pampa el Toro and Carbonera. Of these concessions, 16 (12,100 hectares in four areas) are owned 100% by the Company and 5 concessions (3,600 hectares in 2 areas) are held under option from an arm’s length private Peruvian company. The Iron Sands project is located near the city of Nazca in the desert coastal region of southern Peru approximately 45 kilometres northeast of the port of San Juan and close to the large Marcona iron mine and the Company’s Pampa de Pongo iron deposit. The primary focus of the Company’s work during the first quarter and to date has been the Pampa el Toro dune field.

Work to Date

The Pampa El Toro Iron Sands project has been ongoing since 2005 and is now in the advanced stages of feasibility work. To date, the Company has completed processing and metallurgical work at various laboratories and scales, including SGS Lakefield (2005), Midrex (2005), Solumet/SGS (2006), Eriez (2006), Midrex (2006) and Bateman Engineering (2006). Percussion drilling of 122 drillholes has been completed. The drilling covers an area of approximately 2,600 hectares, less than 17% of the current Cardero iron sand land-holding. Surface sampling and subsequent percussion drillhole testing indicate that the overall magnetite content is relatively homogeneous (approximately 5% iron) particularly in the uppermost 30 metres.

The Company has completed construction and optimization of a pilot-scale magnetic separation plant at Pampa el Toro. The plant consists of a primary separator drum, a secondary scavenger drum and a cleaner drum. Virtually all magnetite reports to the first-pass magnetic concentrate. The primary drum switches polarity during operation, which improves recovery of magnetic fraction. The resulting magnetic concentrate grades 55.54% iron. The final magnetic concentrate is classified by size-fraction (-80Mesh, +270 Mesh), resulting in a final grade of 65.1% iron.

The Company has commissioned SRK Consulting (Johannesburg) to prepare a resource estimate for Pampa el Toro, which it anticipates will be completed in the second quarter of calendar 2009. In August 2008, the Company signed a contract with SRK to prepare a Preliminary Economic Assessment for Pampa el Toro. However, given the advanced stage of testing at Pampa El Toro, SRK have agreed to skip this preliminary step and proceed directly to a Pre-Feasibility Study (PFS) and the Company is currently reviewing SRK’s proposal in this regard. The PFS will include a resource estimate and a determination of mining method, together with estimates for capital and operating costs. The design of the dry magnetic separation and size classification plant will be finalized and designed for full-scale construction. A comprehensive logistical operating plan and ore transportation plan will also be included.

A critical component of the feasibility work will be the results of the pilot-scale melting and slag recovery tests, which are currently in progress. Approximately 40mt from the nearly 60mt of iron ore concentrate produced during the Pampa el Toro pilot plant magnetic separation tests staged from April through June 2008 were shipped to a warehouse in Portland, Oregon for temporary storage. The majority of this concentrate material is earmarked for processing into liquid hot metal. The remainder of iron ore concentrate will be made available to equipment manufacturers (e.g., screen sizer manufacturers, mass flow & material handling system manufacturers, etc.) for the purpose of equipment design and performance guarantee tests.

The concentrate will be processed into liquid hot metal (molten iron) by means of a pilot-scale electric arc-based smelting furnace and cast into saleable iron ingots. The melting test program includes agglomeration studies and testing, bench-scale smelting tests to establish operating parameters, and a large-scale smelting test intended to produce a significant quantity of pig iron product, which demonstrates steady state smelting operation and provides samples for examination by end-users. The bench-scale testing was completed in January, 2009, and approximately 150 kilograms of high quality pig iron was successfully produced. The large scale melting test has been scheduled to take place early third quarter 2009. A research & development contract was entered into with Colorado School of Mines (“CSM”) in the second quarter of 2009 for the purpose of identifying and quantifying the operating parameters for the best technology route to be used in recovering vanadium and titanium contained in the melting test slag. Slag produced from the bench-scale melting tests has already been sent to CSM, and characterization work has commenced. The large scale smelting test will also produce a large sample of slag, which will also be sent to CSM for further testing and optimization for vanadium and titanium recovery for the commercial plant flow sheet.

In September 2008, a formal agreement was entered into with the U. S. Department of Energy (DOE)’s National Energy Technology Lab (NETL) located in Albany, Oregon (a U.S. government testing facility) to carry out extensive commercial-scale melting tests on PET concentrate. A three phase melting test program was initiated with an end goal to produce a premium-quality pig iron product (96-98% iron, 2-4% carbon and less than 0.05% deleterious elements), along with a vanadium and titanium enriched slag.

Phase I (Complete) - The first phase of testing was oriented towards agglomerating the defined mix of iron ore concentrate, pulverized reductant and modifiers to make a sufficiently strong cold briquette. Briquette strength was sufficient to resist breakage and abrasion expected during normal material handling in a commercial plant. Sufficient quality cold briquettes have been made with a bench-scale briquetter. A key result from this work will be identification of a low-cost yet effective binder.

Phase II (Complete) - Bench-scale smelting of the cold briquettes in 35kW melter was successfully undertaken during Phase II. Knowledge gained from the bench scale tests has been incorporated in the large scale smelting test plan.

Phase III - The pilot-scale smelting test will be designed to run with the optimum briquette formulation along with operating control parameters gleaned from the bench scale smelting test. The goal for the pilot-scale smelting test is to demonstrate consistent melter operation, uniform hot metal quality and slag quality over an extended period of operation time.

The Company has now completed both Phase I and Phase II of the program outlined above. A portion of the Pampa El Toro concentrate was agglomerated, processed into liquid hot metal (molten iron) and cast into pigs in a total of ten bench-scale electric arc-based melting furnace tests. A total of 128 kilograms of pig iron was produced. The pig iron product is currently undergoing chemical analysis. The knowledge gained from the bench scale tests will be incorporated in the large scale smelting test. The Phase III pilot-scale melting test will be designed to run with the optimum briquette formulation along with operating control parameters gleaned from the bench-scale smelting test. The pilot-scale melting test program is undergoing a permitting process that is targeted to be completed by the end of Q2 2009, with the actual pilot plant operation and final report to follow.

The ability of the Company to proceed with further work at its Iron Sands Project, including commissioning SRK to proceed with the PFS, is dependent upon the Company being able to raise the additional financing required to do so. At the present time, the Company does not have sufficient funding to proceed, and there can be no assurance that it will be able to do so. Failure to raise the required funding in a timely manner will result in the delay of further work and the commencement and completion of the PFS.

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&fi…

Management’s Discussion and Analysis:

Material Mineral Properties

Material Mineral Properties

Peru - Pampa de Pongo Iron Property

On October 24, 2008, the Company and its Peruvian subsidiary, Cardero Hierro Del Peru, S.A.C. (“Cardero Peru”) entered into an agreement (the “Sale Agreement”) with Nanjinzhao Group Co., Ltd., (“Nanjinzhao”), a private Chinese enterprise located in Zibo City, Shandong Province, PRC, whereby the Company and Cardero Peru agreed to sell the Pampa de Pongo property (“Property”) to Nanjinzhao for USD 200 million, subject to the waiver by Rio Tinto Mining and Exploration, S.A.C. (“Rio Tinto”) of their right of first refusal in respect of the majority of the mining rights comprising the Property. The Sale Agreement required an initial deposit of USD 10 million, payable on or before March 17, 2009, with a final payment of USD 190 million due on or before September 17, 2009. During the initial three month period, Nanjinzhao was to obtain the appropriate Chinese governmental consents to the transaction. The Property will be transferred to a Peruvian subsidiary of Nanjinzhao once the USD 10 million deposit has been received. The Sale Agreement permits the Company to decline to proceed with the transaction at any time prior to the receipt of the final payment, provided that, if such decision is made at any time after the initial USD 10 million deposit has been paid, the Company is required to return the deposit and pay Nanjinzhao an additional USD 20 million as a break-up fee. Upon repayment of the deposit (and break fee, if required), the Property will be retransferred to Cardero Peru. Rio Tinto elected to waive its right of first refusal in respect of the sale of the Property to Nanjinzhao under the Sale Agreement on December 17, 2008.

The Company has agreed to pay a finder’s fee to an arm’s length private company in consideration of the finder introducing the Company to Nanjinzhao and providing ongoing advice in the negotiations.

On February 10, 2009, at the request of Nanjinzhao and in consideration of the payment by Nanjinzhao to Cardero Peru of the sum of USD 2.0 million (to be applied against the balance of the purchase price due on September 17, 2009 - which therefore reduced by that amount), the Company authorized Nanjinzhao to immediately commence engineering drilling on the Property under the existing drilling permit, in order to facilitate the timely collection of engineering and geotechnical data essential for the development permitting process. Payment of the USD 2 million advance did not trigger the “break fee” provisions of the Sale Agreement.

On April 3, 2009, Nanjinzhao, with the consent of Cardero and Cardero Peru, assigned its interest in the Sale Agreement, and its right to purchase the Property, to a subsidiary, Zibo Hongda Mining Co., Ltd.

On May 20, 2009, the Company, Cardero Peru and Hongda agreed to amend the provisions of the Sale Agreement. Hongda had requested a purchase price reduction due to difficult global economic conditions that have significantly adversely impacted iron ore prices. Following negotiations, Cardero and Cardero Peru agreed to revise the final sale price to USD 100 million (of which USD 2 million has already been paid). Accordingly, on May 21, 2009 Hongda paid the required USD 10 million deposit to Cardero Peru, which deposit is non-refundable unless either (i) Cardero terminates the Sale Agreement or (ii) Rio Tinto exercises its right of first offer (due to the new lower purchase price, pursuant to its right of first offer Rio Tinto has another 45- day period (expires on July 9, 2009) to match the revised terms). If Rio Tinto exercise its right of first offer, Cardero Peru will repay the USD 10 million deposit to Hongda.

The balance of the purchase price of USD 88 million is now due on the earlier of ten days after Hongda has received the necessary Chinese governmental approvals to proceed with the purchase and December 17, 2009. The break-up fee payable by the Company, should it determine not to proceed with the transaction (whether due to a better offer or otherwise), remains at USD 20 million (plus repayment of the USD 10 million deposit). Hongda has agreed to provide, on or before August 19, 2009, (i) an irrevocable letter of guarantee from a senior Chinese bank guaranteeing the payment of the balance of the purchase price and (ii) a formal commitment letter to guarantee that the total purchase price of USD 100 million, and the terms and conditions for the payment of the purchase price, is final and cannot be changed by Hongda.

Peru - Pampa El Toro Iron Sands Project

General

The Company’s Iron Sands project now comprises an aggregate of 21 concessions in two dune fields – Pampa el Toro and Carbonera. Of these concessions, 16 (12,100 hectares in four areas) are owned 100% by the Company and 5 concessions (3,600 hectares in 2 areas) are held under option from an arm’s length private Peruvian company. The Iron Sands project is located near the city of Nazca in the desert coastal region of southern Peru approximately 45 kilometres northeast of the port of San Juan and close to the large Marcona iron mine and the Company’s Pampa de Pongo iron deposit. The primary focus of the Company’s work during the first quarter and to date has been the Pampa el Toro dune field.

Work to Date

The Pampa El Toro Iron Sands project has been ongoing since 2005 and is now in the advanced stages of feasibility work. To date, the Company has completed processing and metallurgical work at various laboratories and scales, including SGS Lakefield (2005), Midrex (2005), Solumet/SGS (2006), Eriez (2006), Midrex (2006) and Bateman Engineering (2006). Percussion drilling of 122 drillholes has been completed. The drilling covers an area of approximately 2,600 hectares, less than 17% of the current Cardero iron sand land-holding. Surface sampling and subsequent percussion drillhole testing indicate that the overall magnetite content is relatively homogeneous (approximately 5% iron) particularly in the uppermost 30 metres.

The Company has completed construction and optimization of a pilot-scale magnetic separation plant at Pampa el Toro. The plant consists of a primary separator drum, a secondary scavenger drum and a cleaner drum. Virtually all magnetite reports to the first-pass magnetic concentrate. The primary drum switches polarity during operation, which improves recovery of magnetic fraction. The resulting magnetic concentrate grades 55.54% iron. The final magnetic concentrate is classified by size-fraction (-80Mesh, +270 Mesh), resulting in a final grade of 65.1% iron.

The Company has commissioned SRK Consulting (Johannesburg) to prepare a resource estimate for Pampa el Toro, which it anticipates will be completed in the second quarter of calendar 2009. In August 2008, the Company signed a contract with SRK to prepare a Preliminary Economic Assessment for Pampa el Toro. However, given the advanced stage of testing at Pampa El Toro, SRK have agreed to skip this preliminary step and proceed directly to a Pre-Feasibility Study (PFS) and the Company is currently reviewing SRK’s proposal in this regard. The PFS will include a resource estimate and a determination of mining method, together with estimates for capital and operating costs. The design of the dry magnetic separation and size classification plant will be finalized and designed for full-scale construction. A comprehensive logistical operating plan and ore transportation plan will also be included.

A critical component of the feasibility work will be the results of the pilot-scale melting and slag recovery tests, which are currently in progress. Approximately 40mt from the nearly 60mt of iron ore concentrate produced during the Pampa el Toro pilot plant magnetic separation tests staged from April through June 2008 were shipped to a warehouse in Portland, Oregon for temporary storage. The majority of this concentrate material is earmarked for processing into liquid hot metal. The remainder of iron ore concentrate will be made available to equipment manufacturers (e.g., screen sizer manufacturers, mass flow & material handling system manufacturers, etc.) for the purpose of equipment design and performance guarantee tests.

The concentrate will be processed into liquid hot metal (molten iron) by means of a pilot-scale electric arc-based smelting furnace and cast into saleable iron ingots. The melting test program includes agglomeration studies and testing, bench-scale smelting tests to establish operating parameters, and a large-scale smelting test intended to produce a significant quantity of pig iron product, which demonstrates steady state smelting operation and provides samples for examination by end-users. The bench-scale testing was completed in January, 2009, and approximately 150 kilograms of high quality pig iron was successfully produced. The large scale melting test has been scheduled to take place early third quarter 2009. A research & development contract was entered into with Colorado School of Mines (“CSM”) in the second quarter of 2009 for the purpose of identifying and quantifying the operating parameters for the best technology route to be used in recovering vanadium and titanium contained in the melting test slag. Slag produced from the bench-scale melting tests has already been sent to CSM, and characterization work has commenced. The large scale smelting test will also produce a large sample of slag, which will also be sent to CSM for further testing and optimization for vanadium and titanium recovery for the commercial plant flow sheet.

In September 2008, a formal agreement was entered into with the U. S. Department of Energy (DOE)’s National Energy Technology Lab (NETL) located in Albany, Oregon (a U.S. government testing facility) to carry out extensive commercial-scale melting tests on PET concentrate. A three phase melting test program was initiated with an end goal to produce a premium-quality pig iron product (96-98% iron, 2-4% carbon and less than 0.05% deleterious elements), along with a vanadium and titanium enriched slag.

Phase I (Complete) - The first phase of testing was oriented towards agglomerating the defined mix of iron ore concentrate, pulverized reductant and modifiers to make a sufficiently strong cold briquette. Briquette strength was sufficient to resist breakage and abrasion expected during normal material handling in a commercial plant. Sufficient quality cold briquettes have been made with a bench-scale briquetter. A key result from this work will be identification of a low-cost yet effective binder.

Phase II (Complete) - Bench-scale smelting of the cold briquettes in 35kW melter was successfully undertaken during Phase II. Knowledge gained from the bench scale tests has been incorporated in the large scale smelting test plan.

Phase III - The pilot-scale smelting test will be designed to run with the optimum briquette formulation along with operating control parameters gleaned from the bench scale smelting test. The goal for the pilot-scale smelting test is to demonstrate consistent melter operation, uniform hot metal quality and slag quality over an extended period of operation time.

The Company has now completed both Phase I and Phase II of the program outlined above. A portion of the Pampa El Toro concentrate was agglomerated, processed into liquid hot metal (molten iron) and cast into pigs in a total of ten bench-scale electric arc-based melting furnace tests. A total of 128 kilograms of pig iron was produced. The pig iron product is currently undergoing chemical analysis. The knowledge gained from the bench scale tests will be incorporated in the large scale smelting test. The Phase III pilot-scale melting test will be designed to run with the optimum briquette formulation along with operating control parameters gleaned from the bench-scale smelting test. The pilot-scale melting test program is undergoing a permitting process that is targeted to be completed by the end of Q2 2009, with the actual pilot plant operation and final report to follow.

The ability of the Company to proceed with further work at its Iron Sands Project, including commissioning SRK to proceed with the PFS, is dependent upon the Company being able to raise the additional financing required to do so. At the present time, the Company does not have sufficient funding to proceed, and there can be no assurance that it will be able to do so. Failure to raise the required funding in a timely manner will result in the delay of further work and the commencement and completion of the PFS.

http://www.mcclatchydc.com/homepage/story/71510.html

July 8, 2009

China replacing U.S. as top trade partner in Latin America

Beijing's main interest in Latin America has been guaranteeing access to the region's raw materials — principally oil, iron ore, soybeans and copper — to fuel its continued rapid growth. For many countries, there's a downside in the China trade, through which cheap imports have displaced local textiles.

Peruvian President Alan Garcia is trying to position his country as a major commercial hub for China in South America. He's hoping to capitalize not only on Peru's ports in the center of South America but also on a shared history: Thousands of Chinese emigrated to Peru in the 19th and early 20th centuries to do manual labor. These immigrants have left a legacy of the so-called "chifa" restaurants, which offer Chinese food throughout Peru.

Today, China's biggest appetite is for Peru's plentiful minerals.

Two Chinese companies are moving forward with major mining projects in Peru while companies from other countries are suspending or canceling theirs, said John Youle, the executive president of ConsultAndes, a Lima-based firm.

July 8, 2009

China replacing U.S. as top trade partner in Latin America

Beijing's main interest in Latin America has been guaranteeing access to the region's raw materials — principally oil, iron ore, soybeans and copper — to fuel its continued rapid growth. For many countries, there's a downside in the China trade, through which cheap imports have displaced local textiles.

Peruvian President Alan Garcia is trying to position his country as a major commercial hub for China in South America. He's hoping to capitalize not only on Peru's ports in the center of South America but also on a shared history: Thousands of Chinese emigrated to Peru in the 19th and early 20th centuries to do manual labor. These immigrants have left a legacy of the so-called "chifa" restaurants, which offer Chinese food throughout Peru.

Today, China's biggest appetite is for Peru's plentiful minerals.

Two Chinese companies are moving forward with major mining projects in Peru while companies from other countries are suspending or canceling theirs, said John Youle, the executive president of ConsultAndes, a Lima-based firm.

http://www.steelguru.com/news/raw_material.html

Iron ore price negotiations - Chinks in Chinese armor

Friday, 10 Jul 2009

Reuters reported that China's hard headed handling of iron ore price talks may pave the way for more spot deals and fewer annual contracts next year as frustrated steel mills seek to break with the trade body that has led negotiations to deadlock.