Goldene Zeiten für Goldfüchse in 2009 - 500 Beiträge pro Seite

eröffnet am 11.06.09 15:58:57 von

neuester Beitrag 17.12.18 16:18:17 von

neuester Beitrag 17.12.18 16:18:17 von

Beiträge: 73

ID: 1.151.043

ID: 1.151.043

Aufrufe heute: 0

Gesamt: 10.546

Gesamt: 10.546

Aktive User: 0

ISIN: CA38119T8077 · WKN: A2N8FY

3,8900

USD

+0,26 %

+0,0100 USD

Letzter Kurs 27.01.22 NYSE Arca

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,5501 | +14,63 | |

| 1,0100 | +10,99 | |

| 4,9300 | +10,04 | |

| 17.600,00 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 190,05 | -7,07 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Damit die Diskussion in Gang kommt, Neueröffnung Thread.

Wie seht Ihr die Aussichten bis 2015 ?

http://www.gsr.com

http://www.stjudegold.com

Explorer gut, erfolgreiche Produzenten sehr gut.

Nur meine Meinung

Wie seht Ihr die Aussichten bis 2015 ?

http://www.gsr.com

http://www.stjudegold.com

Explorer gut, erfolgreiche Produzenten sehr gut.

Nur meine Meinung

Antwort auf Beitrag Nr.: 37.373.009 von Kohlenzieher am 11.06.09 15:58:57der 2. Link tut nich funzen!

Toll, seit Eröffnung Thread schon 100%.

Das Ding hier nimmt wohl keiner für voll.

Seit Treaderöffnung-Ach, rechnet selber nach, wieviel Prozent.

Zeit zum nachkaufen.

Seit Treaderöffnung-Ach, rechnet selber nach, wieviel Prozent.

Zeit zum nachkaufen.

So,

langsam Zeit, wieder auszusteigen und die über 100% mitzunehmen.

Danach Kohle sofort (weg mit dem Euro) in Kinebarren umtauschen.

Gibts bei mir zu kaufen. Info per BM.

langsam Zeit, wieder auszusteigen und die über 100% mitzunehmen.

Danach Kohle sofort (weg mit dem Euro) in Kinebarren umtauschen.

Gibts bei mir zu kaufen. Info per BM.

Weiter gehts.

Kauf i jetzt noch mal nach?

Gebt mir doch mal nen Tipp.

Hat hier bisher keiner verdient? Nur ich?

Bis später.

Gebt mir doch mal nen Tipp.

Hat hier bisher keiner verdient? Nur ich?

Bis später.

Nachkaufen.

Hey Leute

Habe gesehen das man auf der Webseite von Golden Star Recources auch von denen deren Gold und Silber Münzen kaufen kann hat das jemand von euch schonmal gemacht??hat jemand Erfahrung?

Habe gesehen das man auf der Webseite von Golden Star Recources auch von denen deren Gold und Silber Münzen kaufen kann hat das jemand von euch schonmal gemacht??hat jemand Erfahrung?

http://www.gsr.com/News_Releases/Index.asp

Golden Star Resources Restarts Its Oxide Plant at Bogoso/Prestea Mine

DENVER, CO, Feb 01, 2012 (MARKETWIRE via COMTEX) --Golden Star Resources Ltd. (NYSE Amex: GSS) (TSX: GSC) (GHANA: GSR) ("Golden Star" or the "Company") today announced the re-commissioning of its oxide (non refractory) plant at Bogoso/Prestea Mine. The plant is expected to generate up to 70,000 ounces of gold in 2012............. usw.

Golden Star Resources Restarts Its Oxide Plant at Bogoso/Prestea Mine

DENVER, CO, Feb 01, 2012 (MARKETWIRE via COMTEX) --Golden Star Resources Ltd. (NYSE Amex: GSS) (TSX: GSC) (GHANA: GSR) ("Golden Star" or the "Company") today announced the re-commissioning of its oxide (non refractory) plant at Bogoso/Prestea Mine. The plant is expected to generate up to 70,000 ounces of gold in 2012............. usw.

http://www.gsr.com/News_Releases/Index.asp

Golden Star Resources Announces Drilling Results From Wassa Mine in Ghana

Intersects 21.2 Meters Grading 15.8 g/t of Gold and 5.6 Meters Grading 11.9 g/t Beneath the Current Operating "B Shoot" Pit; Intersects 36.3 Meters Grading 5.4 g/t Beneath the Current Operating "SE" Pit

Golden Star Resources Announces Drilling Results From Wassa Mine in Ghana

Intersects 21.2 Meters Grading 15.8 g/t of Gold and 5.6 Meters Grading 11.9 g/t Beneath the Current Operating "B Shoot" Pit; Intersects 36.3 Meters Grading 5.4 g/t Beneath the Current Operating "SE" Pit

http://www.gsr.com/News_Releases/Index.asp

Golden Star Resources Announces Mineral Reserves and Resources Estimates as of December 31, 2011

Auszug daraus:

PROVEN & PROBABLE

MINERAL RESERVES As at December 31, 2011 As at December 31, 2010

------------------------------------------------------

Gold Gold

Property Mineral Tonnes Grade Ounces Tonnes Grade Ounces

Reserve Category (millions) (g/t) (millions)(millions) (g/t) (millions)

------------------------------------------------------

Bogoso/Prestea

Total Proven and

Probable

Non-refractory 8.2 2.21 0.58 8.3 2.20 0.59

Refractory 32.6 2.63 2.75 38.9 2.56 3.20

------------------------------------------------------

Total Bogoso/Prestea

Proven and Probable 40.8 2.55 3.34 47.2 2.49 3.78

------------------------------------------------------

Wassa/HBB

------------------------------------------------------

Total Wassa/HBB Proven

and Probable 18.1 1.38 0.80 18.1 1.43 0.83

------------------------------------------------------

Totals

Total Proven and

Probable

Non-refractory 26.3 1.64 1.38 26.4 1.67 1.42

Refractory 32.6 2.63 2.75 38.9 2.56 3.20

------------------------------------------------------

Total Proven and

Probable 58.8 2.19 4.14 65.3 2.20 4.62

Notes to the Mineral Reserve Statement:

(1) The stated Mineral Reserve for Bogoso/Prestea includes Prestea South,

Pampe and Mampon.

(2) The stated Mineral Reserve for Wassa/HBB includes the Hwini-Butre and

Benso properties.

(3) The stated Mineral Reserves have been prepared in accordance with

Canada's National Instrument 43-101 Standards of Disclosure for Mineral

Projects and are classified in accordance with the Canadian Institute of

Mining, Metallurgy and Petroleum's "CIM Definition Standards -- For

Mineral Resources and Mineral Reserves". Mineral Reserves are equivalent

to Proven and Probable Reserves as defined by the SEC Industry Guide 7.

Mineral Reserve estimates reflect the Company's reasonable expectation

that all necessary permits and approvals will be obtained and

maintained. Mining dilution and mining recovery vary by deposit and have

been applied in estimating the Mineral Reserves.

(4) The 2010 Mineral Reserves were prepared under the supervision of Mr.

Karl Smith, Vice President Technical Services for the Company. Mr. Smith

is a "Qualified Person" as defined by Canada's National Instrument 43-

101. The 2011 Mineral Reserves were prepared under the supervision of

Dr. Martin Raffield, Senior Vice President Technical Services for the

Company. Dr. Raffield is a "Qualified Person" as defined by Canada's

National Instrument 43-101.

(5) The Mineral Reserves at December 31, 2011 were estimated using a gold

price of $1,250 per ounce, which is approximately equal to the three-

year average gold price. At December 31, 2010, Mineral Reserves were

estimated using a gold price of $1,025 per ounce.

(6) The terms "non-refractory" and "refractory" refer to the metallurgical

characteristics of the ore and are defined in the Glossary of Terms. We

plan to process the refractory ore in our sulfide bio-oxidation plant at

Bogoso and to process the non-refractory ore using our more traditional

gravity, flotation and/or cyanidation techniques.

(7) The slope angles of all pit designs are based on geo-technical criteria

as established by external consultants. The size and shape of the pit

designs are guided by consideration of the results from a pit

optimization program. The parameters for the pit optimization program

are based on a gold price of $1,250 per ounce, historical and projected

operating costs at Bogoso/Prestea, Wassa and Hwini-Butre and Benso.

Metallurgical recoveries are based on historical performance or

estimated from test work and typically range from 80% to 95% for non-

refractory ores and from 70% to 85% for refractory ores. A government

royalty of 5% is allowed as are other applicable royalties.

(8) Numbers may not add due to rounding.

RECONCILIATION OF MINERAL RESERVES:

Contained Tonnes Ounces

Tonnes Ounces (% of (% of

(millions) (millions) Opening) Opening)

Mineral Reserves at December 31,

2010 65.3 4.62 100% 100%

Gold price increase (1 & 6) 4.5 0.09 7% 2%

Exploration changes (2 & 7) 4.3 0.27 7% 6%

Mining depletion (3) (5.3) (0.38) -8% -8%

Engineering (4) (9.9) (0.46) -15% -10%

---------- ---------- ---------- ----------

Mineral Reserves at December 31,

2011 (5) 58.8 4.14 90% 90%

Golden Star Resources Announces Mineral Reserves and Resources Estimates as of December 31, 2011

Auszug daraus:

PROVEN & PROBABLE

MINERAL RESERVES As at December 31, 2011 As at December 31, 2010

------------------------------------------------------

Gold Gold

Property Mineral Tonnes Grade Ounces Tonnes Grade Ounces

Reserve Category (millions) (g/t) (millions)(millions) (g/t) (millions)

------------------------------------------------------

Bogoso/Prestea

Total Proven and

Probable

Non-refractory 8.2 2.21 0.58 8.3 2.20 0.59

Refractory 32.6 2.63 2.75 38.9 2.56 3.20

------------------------------------------------------

Total Bogoso/Prestea

Proven and Probable 40.8 2.55 3.34 47.2 2.49 3.78

------------------------------------------------------

Wassa/HBB

------------------------------------------------------

Total Wassa/HBB Proven

and Probable 18.1 1.38 0.80 18.1 1.43 0.83

------------------------------------------------------

Totals

Total Proven and

Probable

Non-refractory 26.3 1.64 1.38 26.4 1.67 1.42

Refractory 32.6 2.63 2.75 38.9 2.56 3.20

------------------------------------------------------

Total Proven and

Probable 58.8 2.19 4.14 65.3 2.20 4.62

Notes to the Mineral Reserve Statement:

(1) The stated Mineral Reserve for Bogoso/Prestea includes Prestea South,

Pampe and Mampon.

(2) The stated Mineral Reserve for Wassa/HBB includes the Hwini-Butre and

Benso properties.

(3) The stated Mineral Reserves have been prepared in accordance with

Canada's National Instrument 43-101 Standards of Disclosure for Mineral

Projects and are classified in accordance with the Canadian Institute of

Mining, Metallurgy and Petroleum's "CIM Definition Standards -- For

Mineral Resources and Mineral Reserves". Mineral Reserves are equivalent

to Proven and Probable Reserves as defined by the SEC Industry Guide 7.

Mineral Reserve estimates reflect the Company's reasonable expectation

that all necessary permits and approvals will be obtained and

maintained. Mining dilution and mining recovery vary by deposit and have

been applied in estimating the Mineral Reserves.

(4) The 2010 Mineral Reserves were prepared under the supervision of Mr.

Karl Smith, Vice President Technical Services for the Company. Mr. Smith

is a "Qualified Person" as defined by Canada's National Instrument 43-

101. The 2011 Mineral Reserves were prepared under the supervision of

Dr. Martin Raffield, Senior Vice President Technical Services for the

Company. Dr. Raffield is a "Qualified Person" as defined by Canada's

National Instrument 43-101.

(5) The Mineral Reserves at December 31, 2011 were estimated using a gold

price of $1,250 per ounce, which is approximately equal to the three-

year average gold price. At December 31, 2010, Mineral Reserves were

estimated using a gold price of $1,025 per ounce.

(6) The terms "non-refractory" and "refractory" refer to the metallurgical

characteristics of the ore and are defined in the Glossary of Terms. We

plan to process the refractory ore in our sulfide bio-oxidation plant at

Bogoso and to process the non-refractory ore using our more traditional

gravity, flotation and/or cyanidation techniques.

(7) The slope angles of all pit designs are based on geo-technical criteria

as established by external consultants. The size and shape of the pit

designs are guided by consideration of the results from a pit

optimization program. The parameters for the pit optimization program

are based on a gold price of $1,250 per ounce, historical and projected

operating costs at Bogoso/Prestea, Wassa and Hwini-Butre and Benso.

Metallurgical recoveries are based on historical performance or

estimated from test work and typically range from 80% to 95% for non-

refractory ores and from 70% to 85% for refractory ores. A government

royalty of 5% is allowed as are other applicable royalties.

(8) Numbers may not add due to rounding.

RECONCILIATION OF MINERAL RESERVES:

Contained Tonnes Ounces

Tonnes Ounces (% of (% of

(millions) (millions) Opening) Opening)

Mineral Reserves at December 31,

2010 65.3 4.62 100% 100%

Gold price increase (1 & 6) 4.5 0.09 7% 2%

Exploration changes (2 & 7) 4.3 0.27 7% 6%

Mining depletion (3) (5.3) (0.38) -8% -8%

Engineering (4) (9.9) (0.46) -15% -10%

---------- ---------- ---------- ----------

Mineral Reserves at December 31,

2011 (5) 58.8 4.14 90% 90%

gibt es meinungen zu den gestrigen quartalszahlen?

was wissen wir über die derzeitigen kosten pro unze?

und.....wann kommen wir aus diesem tief (ich hab noch die erinnerung an den dreifachen wert unserer shares, ohne auf den anstieg des goldpreises warten zu müssen?

fragen über fragen...

regnerische grüße aus niedersachsen

was wissen wir über die derzeitigen kosten pro unze?

und.....wann kommen wir aus diesem tief (ich hab noch die erinnerung an den dreifachen wert unserer shares, ohne auf den anstieg des goldpreises warten zu müssen?

fragen über fragen...

regnerische grüße aus niedersachsen

Diem Pappnasen im Puscherboard übersehen mal wieder, welch excellente Chancen sich hier auftun.Fast nur Ignoranten und Political Correctness-Neurotiker unterwegs, die den Eisberg wie Anno 1912 wieder nicht sehen, und sich danach fragen, warum sie keiner gewarnt hat.

Wer die Augen nicht zum Sehen benutzt, wird sie zum Weinen gebrauchen.Der Arabische Frühling hat nix mit Sommer,Sonne und Blütenmeer zu tun.

Genausowenig kapieren hier die meisten gar nicht, was sich am Gold und Silbersektor abspielen wird. Neuer Markt Reloaded sag ich nur

Wer die Augen nicht zum Sehen benutzt, wird sie zum Weinen gebrauchen.Der Arabische Frühling hat nix mit Sommer,Sonne und Blütenmeer zu tun.

Genausowenig kapieren hier die meisten gar nicht, was sich am Gold und Silbersektor abspielen wird. Neuer Markt Reloaded sag ich nur

Baby steht kurz vor Explosion, Wetten

SchäubleGmbh hat nun beschlossen, die Rettungsaktionen nicht mehr einzeln, sondern als unübersichtliches Paket durch den Bundestag zu schleusen. ESM nun nicht mehr 190 Mrd. sondern auf 2 Bio gehebelt-Hyper Hyper.

Die Drecksbande sorgt wenigstens dafür, das den EM,s nicht das Pulver ausgeht und Minenaktien zu einem Must Have werden.

KZ Golden Star bis Jahresende mind. 8 Euro- Bei Timmins bin ich noch positiver, 12-14 Ruro. Und dann wird umgeschichtet in Klopapier,Reis,Alkohol und Silber

Die Drecksbande sorgt wenigstens dafür, das den EM,s nicht das Pulver ausgeht und Minenaktien zu einem Must Have werden.

KZ Golden Star bis Jahresende mind. 8 Euro- Bei Timmins bin ich noch positiver, 12-14 Ruro. Und dann wird umgeschichtet in Klopapier,Reis,Alkohol und Silber

Die 2 Dollar-Marke stellt scheinbar einen starken Widerstand dar. Allerdings unter 1,95 ebenso massive Aufkäufe.Je länger wir uns in dieser Tradingrange befinden, desto massiver wird der Ausbruch nach oben.

sehe das nur ich so oder ist dieses unternehmen ganz schön hart unterbewertet?

Antwort auf Beitrag Nr.: 43.878.658 von Lukass84 am 30.11.12 10:27:25Jaja, gesehen wird dies von vielen, aber in unsicheren Börsenzeiten fehlt eben manchmal der Mut...

Antwort auf Beitrag Nr.: 43.971.930 von kussie am 01.01.13 16:17:31Hier nun die neusten Produktionszahlen des abgelaufenen Quartals und des Gesamtjahres.

09.01.2013 10:03 Uhr | minenportal.de

Golden Star Resources Ltd. meldet Produktionszahlen

Golden Star Resources Limited veröffentlichte gestern die vorläufigen Produktionsergebnisse des vierten Quartals und des Gesamtjahres 2012. Während der drei Monate bis 31. Dezember belief sich die Produktion auf 92.614 Unzen Gold. Damit wurde der Ausstoß im Vergleich zum Vorjahreszeitraum um 31% gesteigert. Die Verkäufe beliefen sich auf 87.544 Unzen.

Im Gesamtjahr verzeichnete Golden Star eine Produktion von insgesamt 336.348 oz Gold, im Vergleich zum Vorjahr bedeutet dies einen Anstieg um 12%. Die Verkäufe beliefen sich im Gesamtjahr auf 331.278 oz.

Die Produktionsplanung für das Jahr 2013 liegt bei 320.000 - 350.000 Unzen Gold zu Cash-Betriebskosten von 1.050 - 1.150 $/oz.

09.01.2013 10:03 Uhr | minenportal.de

Golden Star Resources Ltd. meldet Produktionszahlen

Golden Star Resources Limited veröffentlichte gestern die vorläufigen Produktionsergebnisse des vierten Quartals und des Gesamtjahres 2012. Während der drei Monate bis 31. Dezember belief sich die Produktion auf 92.614 Unzen Gold. Damit wurde der Ausstoß im Vergleich zum Vorjahreszeitraum um 31% gesteigert. Die Verkäufe beliefen sich auf 87.544 Unzen.

Im Gesamtjahr verzeichnete Golden Star eine Produktion von insgesamt 336.348 oz Gold, im Vergleich zum Vorjahr bedeutet dies einen Anstieg um 12%. Die Verkäufe beliefen sich im Gesamtjahr auf 331.278 oz.

Die Produktionsplanung für das Jahr 2013 liegt bei 320.000 - 350.000 Unzen Gold zu Cash-Betriebskosten von 1.050 - 1.150 $/oz.

So, seit dem letzten Hoch gezehntelt. Und das als Produzent! Das ist mal ein Crash.

Ich könnt auch ko...

Habe aber trotzdem vorgestern 1000 Stck. für 352 € nachgekauft.

Hoffentlich war das jetzt wirklich der billigste Kauf (EK jetzt 1,48€).

Im Moment braucht man wirklich bei allen "Goldies" Nerven wie Drahtseile.

Habe aber trotzdem vorgestern 1000 Stck. für 352 € nachgekauft.

Hoffentlich war das jetzt wirklich der billigste Kauf (EK jetzt 1,48€).

Im Moment braucht man wirklich bei allen "Goldies" Nerven wie Drahtseile.

Ja glaube hier sind die Produktionskosten ein gewaltiges Problem. Produzieren zwar super viel Gold nur leider zu hohen kosten.Wenn der Goldpreis noch weiter fällt wirkt sich das extrem schlecht aus.#

Oder wie seht ihr das hier? Meint ihr Golden Star recources kommt bald wieder auf den richtigen Weg zurück hab gesehen standen mal bei 4 Eurp wäre jetzt echt eine Chance zum einstieg da braucht man aber nerven.

Die Produktionsplanung für das Jahr 2013 liegt bei 320.000 - 350.000 Unzen Gold zu Cash-Betriebskosten von 1.050 - 1.150 $/oz

Oder wie seht ihr das hier? Meint ihr Golden Star recources kommt bald wieder auf den richtigen Weg zurück hab gesehen standen mal bei 4 Eurp wäre jetzt echt eine Chance zum einstieg da braucht man aber nerven.

Die Produktionsplanung für das Jahr 2013 liegt bei 320.000 - 350.000 Unzen Gold zu Cash-Betriebskosten von 1.050 - 1.150 $/oz

nach dem heutigen Tag könnte man mehr denn je Zweifel bekommen....Goldpreis im Minus...um über 3 %, bei ungefähr 1.289 USD.

Dennoch halte ich Golden Star Resources für eine der billigsten Goldaktien, die es derzeit zu kaufen gibt.

Schlußkurs: 0,41 USD in New York...lächerlich

http://www.denvergoldforum.org/dgf13/webcast-dgf13/dgf13-day…

Der link funzt nur bedingt, keine Ahnung, warum. Der Vortrag war am 25.09. um 11.15 Uhr.

Meinungen ?...Ach ja, übrigens ist Ghana eines der politisch stabilsten Länder Afrikas.

pmodds

Dennoch halte ich Golden Star Resources für eine der billigsten Goldaktien, die es derzeit zu kaufen gibt.

Schlußkurs: 0,41 USD in New York...lächerlich

http://www.denvergoldforum.org/dgf13/webcast-dgf13/dgf13-day…

Der link funzt nur bedingt, keine Ahnung, warum. Der Vortrag war am 25.09. um 11.15 Uhr.

Meinungen ?...Ach ja, übrigens ist Ghana eines der politisch stabilsten Länder Afrikas.

pmodds

Bei den Minen ist im Moment absolute Schnäppchenzeit, bin jetzt auch hier dabei, killing of a lifetime......

Marketcap. ca. 103 Mio. $, cash auf dem Konto 67 Mio. $

in 9 Monaten 250 k oz Gold produziert!

herrlich, diese Sonderangebote gibt nicht mehr lange!

Golden Star Announces Preliminary Third Quarter 2013 Production Results

TORONTO, ON -- (Marketwired) -- 10/03/13 -- Golden Star Resources Ltd. (NYSE MKT: GSS) (TSX: GSC) (GHANA: GSR) ("Golden Star" or the "Company") today announced its preliminary production results for its Bogoso/Prestea and Wassa/HBB operations for the three month period ended September 30, 2013.

In the third quarter of 2013, the Company sold a total of 88,915 ounces of gold at an average realized price of USD$1,329 per ounce. Third quarter production marks three consecutive quarters of consolidated production growth for Golden Star.

Bogoso/Prestea operations sold 44,085 ounces of gold for the third quarter.

Wassa/HBB operations sold 44,830 ounces of gold for the third quarter.

Year-to-date, the Company has sold 255,366 ounces of gold.

As of September 30, 2013, the Company had a cash balance of $67 million and additional available cash resources of $40 million from the undrawn portion of the Ecobank term loan facility.

Sam Coetzer, President and CEO of Golden Star, commented: "I am very encouraged with our mines' performance during the third quarter of 2013. Production from the Bogoso Mine has increased quarter over quarter since the first quarter of 2013 due to increased processing throughput. Low cost gold production from the tailings reclaim facility, which we commissioned in July, partially replaced production from the now suspended Pampe pit and this facility is expected to continue to contribute positively to Bogoso's production results. Progress on the betterment stripping at Chujah and Bogoso North has been solid and from the fourth quarter of 2013 onwards, the stripping ratios of these pits are expected to decline, resulting in a decrease of costs going forward. The Wassa operations performed to plan. With the investments the Company has made into drilling the Wassa main pit, the Father Brown pit and the processing plant, the Wassa operations are demonstrating good results. Consolidated annual production is trending to the high end of guidance and we are confident that the fourth quarter of 2013 will underscore the operational transformation of the Company."

The Company plans to release its third quarter 2013 financial results on Monday November 4, 2013, before market open. Management will be hosting a call on that date at 10:00 AM EST.

Company profile

Golden Star holds a 90% equity interest in Golden Star (Bogoso/Prestea) Limited and Golden Star (Wassa) Limited, which respectively own the Bogoso/Prestea and Wassa/HBB open-pit gold mines in Ghana. In addition, Golden Star has a 90% interest in the Prestea Underground mine in Ghana. Golden Star also holds gold exploration interests elsewhere in Ghana, in other parts of West Africa and in Brazil in South America. Golden Star has approximately 259 million shares outstanding.

Statements regarding forward-looking information:

Some statements contained in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and under Canadian securities laws. Such statements include comments regarding: the Company's expectations regarding it achievement of 2013 gold production guidance; the impact of the tailings reclaim facility on our Bogoso production and expected declines in stripping ratios and costs at Bogoso. Factors that could cause actual results to differ materially include timing of and unexpected events at the Wassa and Bogoso processing plants; variations in ore grade, tonnes mined, crushed or milled; variations in relative amounts of refractory, non-refractory and transition ores; the availability and cost of electrical power; timing and availability of external financing on acceptable terms; technical, mining or processing issues; changes in U.S. and Canadian securities markets; and fluctuations in gold price and costs and general economic conditions. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual facts to differ materially. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in our Form 10-K for 2012. The forecasts contained in this press release constitute management's current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received. While we may elect to update these estimates at any time, we do not undertake any estimate at any particular time or in response to any particular event.

For further information, please contact:

Golden Star Resources Ltd.

Jeff Swinoga

Executive Vice President and Chief Financial Officer

+1 416-583-3803

Angela Parr

Director, Investor Relations and Corporate Affairs

+1 416-583-3815

The Capital Lab, Inc.

Belinda Labatte

+1 647-427-0208

Marketcap. ca. 103 Mio. $, cash auf dem Konto 67 Mio. $

in 9 Monaten 250 k oz Gold produziert!

herrlich, diese Sonderangebote gibt nicht mehr lange!

Golden Star Announces Preliminary Third Quarter 2013 Production Results

TORONTO, ON -- (Marketwired) -- 10/03/13 -- Golden Star Resources Ltd. (NYSE MKT: GSS) (TSX: GSC) (GHANA: GSR) ("Golden Star" or the "Company") today announced its preliminary production results for its Bogoso/Prestea and Wassa/HBB operations for the three month period ended September 30, 2013.

In the third quarter of 2013, the Company sold a total of 88,915 ounces of gold at an average realized price of USD$1,329 per ounce. Third quarter production marks three consecutive quarters of consolidated production growth for Golden Star.

Bogoso/Prestea operations sold 44,085 ounces of gold for the third quarter.

Wassa/HBB operations sold 44,830 ounces of gold for the third quarter.

Year-to-date, the Company has sold 255,366 ounces of gold.

As of September 30, 2013, the Company had a cash balance of $67 million and additional available cash resources of $40 million from the undrawn portion of the Ecobank term loan facility.

Sam Coetzer, President and CEO of Golden Star, commented: "I am very encouraged with our mines' performance during the third quarter of 2013. Production from the Bogoso Mine has increased quarter over quarter since the first quarter of 2013 due to increased processing throughput. Low cost gold production from the tailings reclaim facility, which we commissioned in July, partially replaced production from the now suspended Pampe pit and this facility is expected to continue to contribute positively to Bogoso's production results. Progress on the betterment stripping at Chujah and Bogoso North has been solid and from the fourth quarter of 2013 onwards, the stripping ratios of these pits are expected to decline, resulting in a decrease of costs going forward. The Wassa operations performed to plan. With the investments the Company has made into drilling the Wassa main pit, the Father Brown pit and the processing plant, the Wassa operations are demonstrating good results. Consolidated annual production is trending to the high end of guidance and we are confident that the fourth quarter of 2013 will underscore the operational transformation of the Company."

The Company plans to release its third quarter 2013 financial results on Monday November 4, 2013, before market open. Management will be hosting a call on that date at 10:00 AM EST.

Company profile

Golden Star holds a 90% equity interest in Golden Star (Bogoso/Prestea) Limited and Golden Star (Wassa) Limited, which respectively own the Bogoso/Prestea and Wassa/HBB open-pit gold mines in Ghana. In addition, Golden Star has a 90% interest in the Prestea Underground mine in Ghana. Golden Star also holds gold exploration interests elsewhere in Ghana, in other parts of West Africa and in Brazil in South America. Golden Star has approximately 259 million shares outstanding.

Statements regarding forward-looking information:

Some statements contained in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and under Canadian securities laws. Such statements include comments regarding: the Company's expectations regarding it achievement of 2013 gold production guidance; the impact of the tailings reclaim facility on our Bogoso production and expected declines in stripping ratios and costs at Bogoso. Factors that could cause actual results to differ materially include timing of and unexpected events at the Wassa and Bogoso processing plants; variations in ore grade, tonnes mined, crushed or milled; variations in relative amounts of refractory, non-refractory and transition ores; the availability and cost of electrical power; timing and availability of external financing on acceptable terms; technical, mining or processing issues; changes in U.S. and Canadian securities markets; and fluctuations in gold price and costs and general economic conditions. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual facts to differ materially. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in our Form 10-K for 2012. The forecasts contained in this press release constitute management's current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received. While we may elect to update these estimates at any time, we do not undertake any estimate at any particular time or in response to any particular event.

For further information, please contact:

Golden Star Resources Ltd.

Jeff Swinoga

Executive Vice President and Chief Financial Officer

+1 416-583-3803

Angela Parr

Director, Investor Relations and Corporate Affairs

+1 416-583-3815

The Capital Lab, Inc.

Belinda Labatte

+1 647-427-0208

"herrlich, diese Sonderangebote"

Warte nur ab !

Bis die Goldman -Prognose, Gold in den kommenden Jahren bei 1000 US Dollar, eingetroffen ist zu welchen Preisen du dann Gold-Minen kaufen kannst !

Warte nur ab !

Bis die Goldman -Prognose, Gold in den kommenden Jahren bei 1000 US Dollar, eingetroffen ist zu welchen Preisen du dann Gold-Minen kaufen kannst !

GSC wurde kürzlich von einem Chartisten runtergeputzt.

So skeptisch bin ich gar nicht , sollte Gold nicht ganz so tief fallen wie manche meinen oder sich sogar in den nächsten Jahren wieder nach oben arbeiten sehe ich gute Chancen für GSC !

So skeptisch bin ich gar nicht , sollte Gold nicht ganz so tief fallen wie manche meinen oder sich sogar in den nächsten Jahren wieder nach oben arbeiten sehe ich gute Chancen für GSC !

Und am Börsenende in Canada ging es wieder kräftig nach unten !

Nutzt da jemand die Gunst der Stunde zum aussteigen ?

Oder drückt da jemand gezielt den Kurs nach unten ?

Ich meine eher letzteres, was denkt ihr ?

Nutzt da jemand die Gunst der Stunde zum aussteigen ?

Oder drückt da jemand gezielt den Kurs nach unten ?

Ich meine eher letzteres, was denkt ihr ?

Antwort auf Beitrag Nr.: 45.953.174 von ernestokg am 30.11.13 13:56:46seit 17.6.2013 keine neuen Tiefs

Ausbruch über Trendlinie seit 1.8.2013

Trendlinie seit 1.11.2010 gebrochen!!!!

über GD 50!

Ich denke, es gibt hier noch einen kleinen Rücksetzer und dann uuuppp

ein Stop Buy bei 0,54 $ ist hier angebracht, wer noch nicht dabei ist!

Cheers!

Ausbruch über Trendlinie seit 1.8.2013

Trendlinie seit 1.11.2010 gebrochen!!!!

über GD 50!

Ich denke, es gibt hier noch einen kleinen Rücksetzer und dann uuuppp

ein Stop Buy bei 0,54 $ ist hier angebracht, wer noch nicht dabei ist!

Cheers!

Antwort auf Beitrag Nr.: 46.158.101 von N.Y. am 05.01.14 10:07:15Wenn man GSS heute kaufen wollte, wäre der Preis 137 Mio $, man könnte sich dann gleich 66 Mio. $ vom Festgeldkonto nehmen, bleiben noch 71 Mio $ übrig.

ca. 3 Mio. oz. Gold im Boden, haben heute einen Wert von 3,6 Mrd. $,

was für ein Schnäppchen, schade, dass ich gerade nicht flüssig bin :-))

Golden Star Achieves 2013 Production Guidance, Provides 2014 Guidance and Announces Appointment of COO

TORONTO, ONTARIO -- (Marketwired) -- 01/09/14 -- Golden Star Resources Ltd. (TSX:GSC) (NYSE MKT:GSS) (GHANA:GSR) ("Golden Star" or the "Company") today announces 2013 fourth quarter and full year production results for its Bogoso and Wassa mines as well as operational and financial guidance for 2014. The Company also announces the appointment of Daniel Owiredu to the position of Chief Operating Officer.

The Company sold 330,805 ounces of gold in 2013, in line with ounces sold in 2012 and the Company's revised guidance for 2013. In the fourth quarter of 2013, Golden Star produced and sold 75,429 ounces of gold. Of this, 44,337 ounces of gold were from Wassa and 31,093 ounces were from Bogoso. For the full year 2013, Wassa's gold sales were 185,807 ounces and Bogoso's were 144,999 ounces.

Cash operating costs per ounce are estimated to be at the low end of the guidance range of US$1,050 to US$1,150.

The Company closed 2013 with an estimated cash and cash equivalents balance of approximately US$66 million. This was after the drawdown of US$20 million in cash from the Ecobank loan and the payment of US$10.4 million in income taxes to the Government of Ghana in the fourth quarter of 2013.

2014 full year production and financial guidance is as follows:

http://www.gsr.com/News_Releases/Archived/Index.asp

ca. 3 Mio. oz. Gold im Boden, haben heute einen Wert von 3,6 Mrd. $,

was für ein Schnäppchen, schade, dass ich gerade nicht flüssig bin :-))

Golden Star Achieves 2013 Production Guidance, Provides 2014 Guidance and Announces Appointment of COO

TORONTO, ONTARIO -- (Marketwired) -- 01/09/14 -- Golden Star Resources Ltd. (TSX:GSC) (NYSE MKT:GSS) (GHANA:GSR) ("Golden Star" or the "Company") today announces 2013 fourth quarter and full year production results for its Bogoso and Wassa mines as well as operational and financial guidance for 2014. The Company also announces the appointment of Daniel Owiredu to the position of Chief Operating Officer.

The Company sold 330,805 ounces of gold in 2013, in line with ounces sold in 2012 and the Company's revised guidance for 2013. In the fourth quarter of 2013, Golden Star produced and sold 75,429 ounces of gold. Of this, 44,337 ounces of gold were from Wassa and 31,093 ounces were from Bogoso. For the full year 2013, Wassa's gold sales were 185,807 ounces and Bogoso's were 144,999 ounces.

Cash operating costs per ounce are estimated to be at the low end of the guidance range of US$1,050 to US$1,150.

The Company closed 2013 with an estimated cash and cash equivalents balance of approximately US$66 million. This was after the drawdown of US$20 million in cash from the Ecobank loan and the payment of US$10.4 million in income taxes to the Government of Ghana in the fourth quarter of 2013.

2014 full year production and financial guidance is as follows:

http://www.gsr.com/News_Releases/Archived/Index.asp

Goldpreis hat zum Wochenende auf Tageshöchststand (1.248$) geschlossen.

Chartanalysten auf und ab in den Foren halten das Erreichen der 1.270-Grenze in der nächsten Woche für machbar.

Als der Goldpreis das letzte Mal die 1270$ streifte, stand Golden Star Res. bei 0,55€ in Frankfurt.

Wenn sich tendenzielle Entwicklungen im Minensektor wie in der Vergangenheit wiederholen, hieße dies nichts anderes, als dass unser Schätzchen charttechnisch in kürzester Zeit fast 40% zulegen könnte.

Na, was sagt der ein -oder andere Mitstreiter zu diesem konstuierten Wunschverlauf?

Chartanalysten auf und ab in den Foren halten das Erreichen der 1.270-Grenze in der nächsten Woche für machbar.

Als der Goldpreis das letzte Mal die 1270$ streifte, stand Golden Star Res. bei 0,55€ in Frankfurt.

Wenn sich tendenzielle Entwicklungen im Minensektor wie in der Vergangenheit wiederholen, hieße dies nichts anderes, als dass unser Schätzchen charttechnisch in kürzester Zeit fast 40% zulegen könnte.

Na, was sagt der ein -oder andere Mitstreiter zu diesem konstuierten Wunschverlauf?

Antwort auf Beitrag Nr.: 46.212.903 von iwanowski am 12.01.14 12:04:11sorry, habe mich verschaut...

in der 33.Woche 2013 war Gold bei 1.370$ und nicht bei 1.270$.

Somit ist die aufgestelle These hinfällig, oder traut Golden Star trotzdem jemand kurzfristig eine immense Bewegung nach oben zu?

in der 33.Woche 2013 war Gold bei 1.370$ und nicht bei 1.270$.

Somit ist die aufgestelle These hinfällig, oder traut Golden Star trotzdem jemand kurzfristig eine immense Bewegung nach oben zu?

bei den immensen produktionskosten wohl eer nicht...

+ 80 % vom tief, nett anzuschauen ;-)))

DER NEUE GSC -Crash kommt allmählich in Fahrt,

wo wird GSC bei Gold 1000 Dollar je Unze stehen ?

wo wird GSC bei Gold 1000 Dollar je Unze stehen ?

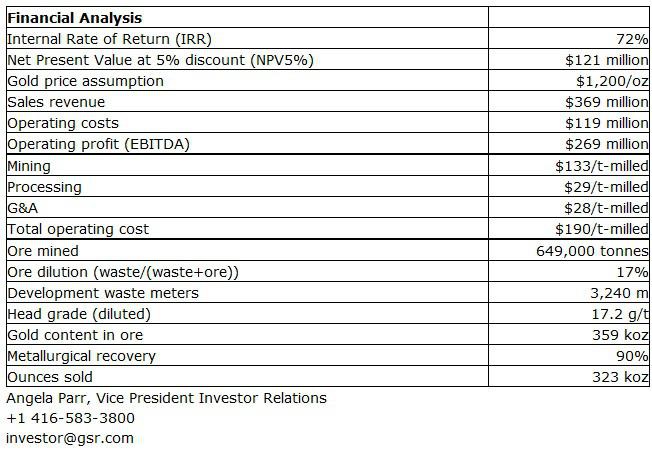

Golden Star's Prestea Mine PEA Indicates NPV of $121 M for Initial Capital Expenditure of $40 M

TORONTO, ONTARIO--(Marketwired - Nov. 13, 2014) - Golden Star (TSX:GSC)(NYSE MKT:GSS)(GHANA:GSR) is pleased to announce the results of its Preliminary Economic Assessment ("PEA") of the development of its Prestea Mine in Ghana.The Company released a feasibility study on the development of a mechanized mining operation at Prestea in June 2013. The PEA announced today is based on the development of a non-mechanized mining operation at Prestea. The capital expenditure associated with a non-mechanized mine is substantially lower and delivers a superior IRR

All references to currency are to United States dollars.

Highlights

Post-tax IRR of 72% at $1,200/oz gold price

NPV5% of $121 million at $1,200/oz gold price

Initial capital $40 million required to first production

Total project life of five years, after one year of development

LOM cash operating costs of $370/oz

LOM all-in sustaining costs of $518/oz

Payback period of 2.5 years from the start of development

Sam Coetzer, President and CEO of Golden Star commented:

"The high grade nature of the deposit at Prestea's West Reef is truly remarkable and offers us the opportunity to mine at exceptionally low cash costs per ounce. With the infrastructure of haul roads and a processing plant already in place, the capital requirements to bring Prestea into production are also relatively low. This makes the project ideally suited to our strategy to transform Golden Star into a low cost producer. Once production from the West Reef is attained, I am confident that we will be able to extend the life of mine materially. As such, I believe that this project offers us the opportunity to reduce the Company's cash operating costs over the long term to the benefit of enhanced returns to our shareholders."

Golden Star will be hosting a webcast today, November 13, 2014 to discuss the findings of this PEA. Details of this webcast can be found at the end of this release.

INTRODUCTION

Prestea is an underground mine which has been in existence for over 100 years and has produced an estimated 9 million ounces of gold to date. It was acquired by Golden Star in 2002 and placed on care and maintenance while evaluation and exploration activities continued. The mine, located 16 km south of the Bogoso Mine along a dedicated haul road and adjacent to the town of Prestea, is accessible by road from Accra as well as via the port city of Takoradi 150 kilometers away.

Subsequent to Golden Star's acquisition of Prestea, the Company has completed 284 holes of underground drilling for approximately 47,000 meters and has identified and defined a new mineral resource in the West Reef. This steeply dipping, high-grade, narrow vein deposit lies at a depth of 600 m to 950 m below surface approximately two kilometers to the south of the Prestea Central Shaft and is host to non-refractory free milling gold.

In June 2013, a feasibility study of the development of the West Reef at Prestea was released by Golden Star. This study showed positive economics for the development of an underground mechanized mine. Mineral Reserves were estimated at 1.4 million tonnes at a diluted mined grade of 9.6 g/t Au for 443,000 ounces. The initial capital outlay was estimated at $91 million with a development timeline of approximately three years.

In line with the Company's strategy to pursue growth from low cost ounces, the decision was taken to review the optimal mining method for Prestea. An internal concept study was concluded in early 2014 on the development of Prestea using shrinkage stoping. The concept study yielded favorable results which prompted the Company to embark on a PEA, the results of which are announced today.

MINERAL RESOURCES

As at December 31, 2013 Prestea had quantified Indicated Mineral Resources of 1,356 thousand tonnes at an average grade of 14.50 g/t Au for 632,000 ounces. This PEA has been based on these Indicated Mineral Resources and includes only a small proportion (<10%) of Inferred Mineral Resources.

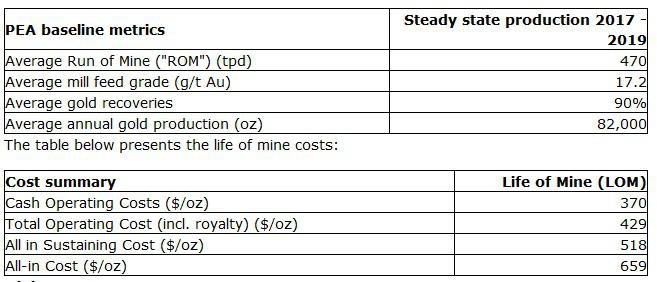

PRESTEA PEA FINDINGS

The PEA demonstrates positive economics for the extraction of the West Reef using shrinkage stoping. In conducting this assessment, a gold price of $1,200/oz was assumed. The results indicate an IRR of 72%, NPV at a 5% discount rate of $121 million and a payback period of 2.5 years from the start of development.

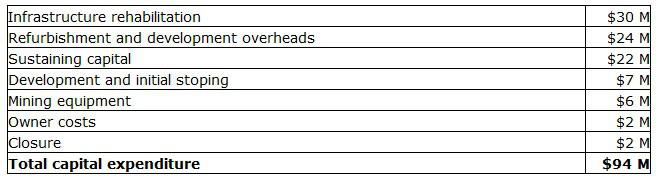

Capital Expenditure

Initial capital expenditure is estimated at $40 million with life of mine capital totaling $94 million. The table below presents the major capital items during the life of the project.

The infrastructure rehabilitation includes shaft and hoist upgrades, electrical infrastructure, process plant upgrade, ventilation, compressed air and pumping. This forms the bulk of the initial capital expenditure. The refurbishment and development overhead capital relates to manpower, power, consumables and refurbishment costs for items not directly related to the West Reef project during the pre-development and production ramp-up phase.

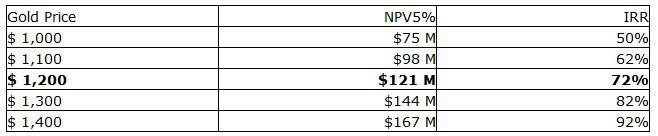

Economic Summary

The project is robust as the following sensitivities to gold price for post - tax NPV and IRR presented in the table below demonstrate:

Project Infrastructure

The plan to extract the West Reef at Prestea is an expansion of a previously operating underground mining operation, therefore most of the required services, infrastructure and community support are already in place:

Surface access to the mine is via the public road network that extends onto the minesite and mineralized material will be hauled to the Bogoso processing plant along an existing private haul road;

Labor with underground mining experience is plentiful and the care and maintenance activities at Prestea already employ 160 experienced staff and employees;

Utilities are available including electricity from the Ghana national grid which is currently used to power the existing Prestea mine surface and underground infrastructure;

Processing of the mineralized material is planned to be carried out at Golden Star's existing processing plant at Bogoso, 16 km to the northeast of the Prestea Mine; and

Tailings will be deposited in Golden Star's existing and permitted Bogoso Mine tailings storage facility.

At Prestea there is an extensive infrastructure of surface and underground vertical shafts, inclined shafts, horizontal development, raises and stopes developed along the 9km of strike length of the gold mineralization. The primary access shaft for the West Reef is the Central Shaft located in the town of Prestea and the secondary shaft is the Bondaye Shaft, 5 km to the south. The Central Shaft will be used for personnel access, materials transport, dewatering and hoisting. The Bondaye Shaft will act as the secondary means of egress as well as for dewatering.

Operating Metrics

A summary of the operating metrics for Prestea are presented in the table below:

Mining

The West Reef mineralization lies approximately 2 km south of Central Shaft and 2 km north of the Bondaye Shaft at a depth of between 570 m and 950 m below surface. The mineralization dips at approximately 60° to 85° to the west and varies in width from 0.5 m to 3.5 m with an average width of approximately 2.0 meters.

The PEA proposes shrinkage stoping, which was the mining method historically used at Prestea. The main haulage level will be established on the existing 24 level to move mineralized and waste rock to the Central Shaft for hoisting to surface. An incline/decline system will be developed in the footwall of the mineralization to access sublevels at a vertical spacing of approximately 40 m between existing levels 17 and 24. Shrinkage stopes will be developed between open raises spaced 60 m on strike. Drawcones will be developed out of the sublevels into the stopes and will be equipped with chutes for controlled shrinkage mucking into rail cars in the sublevels. The stopes will be advanced up dip with only the swell material (30% of total blasted) removed from the stopes during the mining phase. When the stope is mined up to the sill pillar below the upper sublevel, the remaining mineralized material in the stope can be drawn as required. Total mining operating costs are estimated to be an average of $133/tonne.

The PEA schedule assumes mining of 649,000 tonnes of mineralized material at an average grade of 17.2 g/t for 359,000 ounces of contained gold.

Metallurgy and Processing

The metallurgical testwork results indicate that the Prestea West Reef material is non-refractory with greater than 90% metallurgical recovery using Carbon-in-Leach ("CIL") processing. The proportion of gravity recoverable gold in the Prestea mineralization is high at approximately 80%. It is therefore suited to processing through the CIL section of the existing Bogoso Refractory Processing Plant which will be available to process this ore post the completion of mining at the Bogoso North and Chujah pits in late 2015. Modifications to the refractory plant to isolate the CIL circuit and to resize the crushing and grinding circuit are estimated to cost $8 million and are included in the initial capital expenditure of $40 million. Total haulage and processing costs are expected to average $29/tonne over the life of mine.

FUNDING

The Company is in discussions with a number of providers of capital to secure the funding necessary to develop Prestea. With the short payback period for the project identified, funding will ideally be raised at a project level. Consideration will be given to the cost of capital as well as the ability to repay this capital with no or limited penalties.

NI 43-101 TECHNICAL REPORT

The complete NI 43-101 Technical Report which will include the PEA will be filed on SEDAR (www.sedar.com) within 45 days and will also be available on the Company's website (www.gsr.com).

The technical contents of this press release have been reviewed and approved by Dr. Martin Raffield, P.Eng., a Qualified Person pursuant to National Instrument 43-101. Dr. Raffield is Senior Vice President Technical Services for Golden Star.

WEBCAST

The Company will conduct a conference call and webcast today to discuss the results of this PEA 2:00 pm EST.

The call can be accessed by telephone or by webcast as follows:

Participants - toll free: +1 888-428-9490

Participants - toll: +1 719-457-2689

Participant passcode (all numbers): 3869966

Webcast: www.gsr.com

Please call in at least five minutes prior to the conference call start time to ensure prompt access to the conference.

A recording of the conference call will be available until December 13, 2014 by dialing:

Toll free: +1 888-203-1112

Toll: +1 719-457-0820

Replay passcode: 3869966

The webcast will also be available after the call at www.gsr.com

COMPANY PROFILE

Golden Star Resources (TSX:GSC)(NYSE MKT:GSS)(GHANA:GSR) ("Golden Star" or the "Company") is an established gold mining company that holds a 90% interest in both the Bogoso and Wassa gold mines in Ghana. The Company also has a 90% interest in the Prestea mine in Ghana. Golden Star has Mineral Reserves of 3.9 million ounces and 6.0 million ounces in Measured and Indicated Mineral Resources. In 2013, Golden Star sold 331,000 ounces of gold and in 2014 the Company expects to produce 260,000 - 280,000 ounces. The Company offers investors leveraged exposure to the gold price in a stable African mining jurisdiction with exploration and development upside potential.

For further information regarding Golden Star's Mineral Reserves and Mineral Resources, see Golden Star's Annual Information Form for the year ended December 31, 2013, available on SEDAR at www.sedar.com. For further information on the Company, please visit www.gsr.com.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

Some statements contained in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual results to differ materially. Such statements include comments regarding: PEA operating metrics, including estimated gold production, tonnes processed, grade and gold recoveries; estimated pre-tax and post-tax internal rate of return and net present value of Prestea mine (including assumed discount rates) and sensitivities to gold price; the timing for first production from Prestea mine; the life of mine at Prestea and the ability to extend the life of mine; cash operating costs per ounce; all-in sustaining costs per ounce; the availability and quantum of funding to advance the development of Prestea mine; mining methods and estimated recovery at Prestea mine; capital costs, including pre-production capital costs, for Prestea mine; potential modifications to the Bogoso processing plant; required investments in mine infrastructure; production and operating metrics; the timing for ramping up production at Prestea mine; estimates of indicated mineral resources, including tonnage, grade and contained ounces of gold; and future work to be completed at Prestea mine. Factors that could cause actual results to differ materially include timing of and unexpected events at the Bogoso processing plant; variations in ore grade, tonnes mined, crushed or milled; variations in relative amounts of refractory, non-refractory and transition ores; delay or failure to receive board or government approvals and permits; the availability and cost of electrical power; timing and availability of external financing on acceptable terms; technical, permitting, mining or processing issues, including difficulties in establishing the infrastructure for Prestea mine; changes in U.S. and Canadian securities markets; and fluctuations in gold price and input costs and general economic conditions. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in our Annual Information Form for 2013. The forecasts contained in this press release constitute management's current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received and that actual results will vary from these estimates, possibly by material amounts. While we may elect to update these estimates at any time, we do not undertake to update any estimate at any particular time or in response to any particular event. Investors and others should not assume that any forecasts in this press release represent management's estimate as of any date other than the date of this press release.

CAUTIONARY NOTE TO US INVESTORS CONCERNING ESTIMATES OF MEASURED AND INDICATED MINERAL RESOURCES

This press release uses the terms "Measured Mineral Resources" and "Indicated Mineral Resources". The Company advises US investors that while these terms are recognized and required by National Instrument 43-101, the US Securities and Exchange Commission ("SEC") does not recognize them. Also, disclosure of contained ounces is permitted under Canadian regulations; however the SEC generally requires Mineral Resource information to be reported as in-place tonnage and grade. US Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into Mineral Reserves.

NON-GAAP FINANCIAL MEASURES

In this press release, we use the terms "cash operating cost per ounce" and "all-in sustaining costs per ounce". These terms should be considered as Non-GAAP Financial Measures as defined in applicable Canadian and United States securities laws and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. "Cash operating cost per ounce" for a period is equal to the cost of sales excluding depreciation and amortization for the period less royalties and production taxes, minus the cash component of metals inventory net realizable value adjustments divided by the number of ounces of gold sold during the period. "All-in sustaining costs per ounce" commences with cash operating costs and then adds sustaining capital expenditures, corporate general and administrative costs, mine site exploratory drilling and greenfield evaluation costs and environmental rehabilitation costs. This measure seeks to represent the total costs of producing gold from operations. These measures are not representative of all cash expenditures as they do not include income tax payments or interest costs. These measures are not necessarily indicative of operating profit or cash flow from operations as would be determined under International Financial Reporting Standards. Changes in numerous factors including, but not limited to, mining rates, milling rates, gold grade, gold recovery, and the costs of labor, consumables and mine site general and administrative activities can cause these measures to increase or decrease. We believe that these measures are the same or similar to the measures of other gold mining companies, but may not be comparable to similarly titled measures in every instance.

Source: Golden Star Resources Ltd.

http://www.wallstreet-online.de/nachricht/7170253-golden-sta…

Q3 2014 Golden Star Resources Ltd. Earnings Conference Call

http://www.gsr.com/files/doc_financials/Quarterly%202014/715…

and View Presentation:

http://www.gsr.com/files/doc_presentations/2014/2014-Novembe…

http://www.gsr.com/files/doc_financials/Quarterly%202014/715…

and View Presentation:

http://www.gsr.com/files/doc_presentations/2014/2014-Novembe…

test test test

Schauen wir mal wie sich das ganze jetzt entwickelt, wenn der Goldpreis weiter steigen sollte.

Sieht nicht schlecht aus, bei niedrigen Kursen einsteigen und wenn der Gold Preis weiterhin sich so entwickelt sind hier große Sprünge zu erwarten

Am 7.Mai sollen die Zahlen für das erste Quartal 2015 kommen.

Bin sehr gespannt - die horrend hohen Energiekosten sollten doch auf jeden Fall kein Thema mehr sein.

schauen wir mal

Bin sehr gespannt - die horrend hohen Energiekosten sollten doch auf jeden Fall kein Thema mehr sein.

schauen wir mal

150 Mio. $ Stream Vereinbarung mit Royal Gold:

http://www.gsr.com/investors/news/news-details/2015/Golden-S…

Q1-15 Zahlen:

Financial Statements:

http://www.gsr.com/files/doc_financials/Quarterly%202015/Fin…

MD&A:

http://www.gsr.com/files/doc_financials/Quarterly%202015/MDA…

GSS 0,22$

http://www.gsr.com/investors/news/news-details/2015/Golden-S…

Q1-15 Zahlen:

Financial Statements:

http://www.gsr.com/files/doc_financials/Quarterly%202015/Fin…

MD&A:

http://www.gsr.com/files/doc_financials/Quarterly%202015/MDA…

GSS 0,22$

Golden Star Resources Ltd.

Exchange: TSX Exchange | Sep 23, 2016, 1:49 AM EDT

GSC / $ 1.02 / 0.02 (+2.00%) / Volume: 747,730

Jepp, den einen Dollar in Canada haben wir schon mal wieder.

Jetzt kommt der eine US-Dollar unter das Messer...

Schöwo allen Langzeithelden im Gold - vor allem den Anhängern von Golden Star

Exchange: TSX Exchange | Sep 23, 2016, 1:49 AM EDT

GSC / $ 1.02 / 0.02 (+2.00%) / Volume: 747,730

Jepp, den einen Dollar in Canada haben wir schon mal wieder.

Jetzt kommt der eine US-Dollar unter das Messer...

Schöwo allen Langzeithelden im Gold - vor allem den Anhängern von Golden Star

Jetzt sollten wir ganz schnell den 1 USD sehen, Das GAP wird geschlossen.

Wenn der Goldpreis mitspielt, wird es noch deutlich höher gehen. Schließlich wollen die 2018 300 k Uncen produzieren. Damit können die ihre Schulden schön begleichen.

Wenn der Goldpreis mitspielt, wird es noch deutlich höher gehen. Schließlich wollen die 2018 300 k Uncen produzieren. Damit können die ihre Schulden schön begleichen.

Hatte in den seeligen Zeiten um 2010 Teilverkäufe zu 2.70€.

Anschließend mit dem Restbestand im Abwärtsstrudel Magenschmerzen und tapfere Nachkäufe bei Kursen um 0,60€ bis runter zu 0,25€.

Ick will mah Berlinern: Globe, dat wir hier alle balde ne dicke Scheibe Wurscht beschnuppern können, wa!!!

Zwee Jahre noch, wa und wir sehen den Heiermann wieder.....

Anschließend mit dem Restbestand im Abwärtsstrudel Magenschmerzen und tapfere Nachkäufe bei Kursen um 0,60€ bis runter zu 0,25€.

Ick will mah Berlinern: Globe, dat wir hier alle balde ne dicke Scheibe Wurscht beschnuppern können, wa!!!

Zwee Jahre noch, wa und wir sehen den Heiermann wieder.....

Antwort auf Beitrag Nr.: 53.373.657 von iwanowski am 29.09.16 12:43:04Sobald GSS über ein Dollar rauscht geht es erst richtig los da dann die Fonds Manager einsteigen dürfen!

Werend der Konso-Phase hat GSS sich absolut Top gehalten, daran kann man sehen was für ein Top Gold Wert GSS ist. Wir werden noch viel spass haben die nächsten Monate mit unserem Wert.

Werend der Konso-Phase hat GSS sich absolut Top gehalten, daran kann man sehen was für ein Top Gold Wert GSS ist. Wir werden noch viel spass haben die nächsten Monate mit unserem Wert.

Hier eine Video Presentation auf dem Denver Goldforum falls nicht bekannt

http://www.denvergoldforum.org/dgf16/company-webcast/GSS:US/

http://www.denvergoldforum.org/dgf16/company-webcast/GSS:US/

Ich sage mal nur: läuft...

Den US-Dollar fast zum Greifen; sauberer, kontinuierlicher Anstieg die letzten Tage.

Ich will mal träumen und sehe schon ein bischen wieder die 2.-€ pro Share...oje, oje.

Besser: Ole, ole....

Den US-Dollar fast zum Greifen; sauberer, kontinuierlicher Anstieg die letzten Tage.

Ich will mal träumen und sehe schon ein bischen wieder die 2.-€ pro Share...oje, oje.

Besser: Ole, ole....

Antwort auf Beitrag Nr.: 53.592.945 von iwanowski am 01.11.16 07:57:36Wir scheinen wirklich stark am Goldpreis zu hängen.

Ist so ruhig geworden, bei meinem Highflyer-Schätzchen....

Ist so ruhig geworden, bei meinem Highflyer-Schätzchen....

Trotz derzeitiger "Gesamthaftung" aller Goldminen für die schlechtere Entwicklung des Goldpreises als von vielen erhofft, hält der Golden Star sich wacker am Aktienfirnament. Und was an News kommt, ist ja man nicht so schlecht und würde bei "normalem" Verlauf der Spotmärkte für Furore sorgen.....guckst du:

..."Golden Star Resources Ltd. meldete gestern, dass die kommerzielle Produktionsphase im Untertagebau der Goldmine Prestea in Ghana erreicht wurde. Der Ausstoß der Mine soll im Laufe des Jahres weiter gesteigert werden. Der Erzkörper West Reef, der in der Mine abgebaut wird, enthält nachgewiesene und wahrscheinliche Reserven im Umfang von 1,09 Mio. t mit einem durchschnittlichen Goldgehalt von 13,93 g/t. Das Unternehmen führt zudem weitere Explorationsbohrungen durch, um die Reserven zu erweitern und die Lebensdauer der Mine zu verlängern. Für das Jahr 2018 hat Golden Star für den gesamten Minenkomplex Prestea, einschließlich des Untertagebaus und der Tagebaue, ein Produktionsziel von 93.000-113.000 oz Gold zu Cashkosten von durchschnittlich 740-880 $/oz vorgegeben..."

© Redaktion MinenPortal.de / 02.02.2018

..."Golden Star Resources Ltd. meldete gestern, dass die kommerzielle Produktionsphase im Untertagebau der Goldmine Prestea in Ghana erreicht wurde. Der Ausstoß der Mine soll im Laufe des Jahres weiter gesteigert werden. Der Erzkörper West Reef, der in der Mine abgebaut wird, enthält nachgewiesene und wahrscheinliche Reserven im Umfang von 1,09 Mio. t mit einem durchschnittlichen Goldgehalt von 13,93 g/t. Das Unternehmen führt zudem weitere Explorationsbohrungen durch, um die Reserven zu erweitern und die Lebensdauer der Mine zu verlängern. Für das Jahr 2018 hat Golden Star für den gesamten Minenkomplex Prestea, einschließlich des Untertagebaus und der Tagebaue, ein Produktionsziel von 93.000-113.000 oz Gold zu Cashkosten von durchschnittlich 740-880 $/oz vorgegeben..."

© Redaktion MinenPortal.de / 02.02.2018

Das hört sich nicht schlecht an

93.000-113.000 oz Gold zu Cashkosten von durchschnittlich 740-880 $/oz vorgegeben..."

Irgendwie wird die Firma vom Markt nicht sehr viel beachtet....

Man muss sagen das die Kosten pro Unze wirklich nicht schecht sind da bleibt bei aktuellen Goldpreisen einiges an Gewinn hängen....

http://www.kitco.com/news/2018-01-11/Golden-Star-Meets-Guida…

93.000-113.000 oz Gold zu Cashkosten von durchschnittlich 740-880 $/oz vorgegeben..."

Irgendwie wird die Firma vom Markt nicht sehr viel beachtet....

Man muss sagen das die Kosten pro Unze wirklich nicht schecht sind da bleibt bei aktuellen Goldpreisen einiges an Gewinn hängen....

http://www.kitco.com/news/2018-01-11/Golden-Star-Meets-Guida…

Weitere, gute News:

"...Golden Star veröffentlicht hochgradige Bohrergebnisse von der Goldmine Wassa

Golden Star Resources Inc. meldete gestern neue Analyseergebnisse des Bohrprogramms, welches das Unternehmen in der untertägigen Goldmine Wassa in Ghana durchführt. Nach Angaben des CEOs bestätigen die Ergebnisse die Einschätzung, dass in der Mine zur Tiefe hin noch großes Potential besteht, und dass sich der Erzkörper deutlich über die bislang bekannten Mineralreserven hinaus erstreckt. Die Bohrungen sollen in diesem Jahr in verschiedenen Zielgebieten fortgesetzt werden.

Zu den Höhepunkten der zuletzt analysierten Bohrkerne zählen u. a. die folgenden Abschnitte:

• Bohrloch BS17DD385D3: 4,4 g/t Gold über 94,0 m, darin 8,3 g/t Gold über 18,4 m und 4,5 g/t Gold über 29,8 m

• Bohrloch BS17-720-29: 8,7 g/t Gold über 27,1 m, darin 22,2 g/t Gold über 8,3 m; sowie 7,3 g/t Gold über 11,4 m

• Bohrloch 242DD17006: 8,2 g/t Gold über 6,8 m..."

Quelle: Redaktion MinenPortal.de / 15.02.18

"...Golden Star veröffentlicht hochgradige Bohrergebnisse von der Goldmine Wassa

Golden Star Resources Inc. meldete gestern neue Analyseergebnisse des Bohrprogramms, welches das Unternehmen in der untertägigen Goldmine Wassa in Ghana durchführt. Nach Angaben des CEOs bestätigen die Ergebnisse die Einschätzung, dass in der Mine zur Tiefe hin noch großes Potential besteht, und dass sich der Erzkörper deutlich über die bislang bekannten Mineralreserven hinaus erstreckt. Die Bohrungen sollen in diesem Jahr in verschiedenen Zielgebieten fortgesetzt werden.

Zu den Höhepunkten der zuletzt analysierten Bohrkerne zählen u. a. die folgenden Abschnitte:

• Bohrloch BS17DD385D3: 4,4 g/t Gold über 94,0 m, darin 8,3 g/t Gold über 18,4 m und 4,5 g/t Gold über 29,8 m

• Bohrloch BS17-720-29: 8,7 g/t Gold über 27,1 m, darin 22,2 g/t Gold über 8,3 m; sowie 7,3 g/t Gold über 11,4 m

• Bohrloch 242DD17006: 8,2 g/t Gold über 6,8 m..."

Quelle: Redaktion MinenPortal.de / 15.02.18

Golden Star Resources Limited hat gestern die finanziellen und operativen Ergebnisse des Gesamtjahres 2017 veröffentlicht.

Während der zwölf Monate verzeichnete das Unternehmen einen operativen Cashflow vor Änderungen des Betriebskapitals in Höhe von 62,6 Mio. $ (2016: 75,5 Mio. $) und einen Umsatz in Höhe von 315,5 Mio. $ (2016: 221,3 Mio. $).

Im Gesamtjahr wurde zudem ein den Aktionären zurechenbarer Nettogewinn von 38,8 Mio. $ oder 0,10 $ je Aktie verzeichnet (2016: Verlust von 39,6 Mio. $ oder 0,13 $ je Aktie).

Die Goldproduktion erreichte indes 267.565 oz (2016: 194.054 oz).

Die All-In Sustaining Costs (AISC) beliefen sich auf 944 $ je Unze (2016: 1.093 $/oz).

http://www.gsr.com/investors/news/news-details/2018/Golden-S…

Es ist ein Fortschritt im Vergl. zu 2016

Während der zwölf Monate verzeichnete das Unternehmen einen operativen Cashflow vor Änderungen des Betriebskapitals in Höhe von 62,6 Mio. $ (2016: 75,5 Mio. $) und einen Umsatz in Höhe von 315,5 Mio. $ (2016: 221,3 Mio. $).

Im Gesamtjahr wurde zudem ein den Aktionären zurechenbarer Nettogewinn von 38,8 Mio. $ oder 0,10 $ je Aktie verzeichnet (2016: Verlust von 39,6 Mio. $ oder 0,13 $ je Aktie).

Die Goldproduktion erreichte indes 267.565 oz (2016: 194.054 oz).

Die All-In Sustaining Costs (AISC) beliefen sich auf 944 $ je Unze (2016: 1.093 $/oz).

http://www.gsr.com/investors/news/news-details/2018/Golden-S…

Es ist ein Fortschritt im Vergl. zu 2016

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Löschung auf Wunsch des Users

Gibt es ausstehende News in der nächsten Zeit? Weiß jemand was?

Golden Star Resources im Goldproduzentenvergleich mit 39 anderen Goldproduzenten

http://copesetic.de/goldproduzenten-q1-q4-2017/

Viel Spaß eim Studieren.

MfG

sinsala

http://copesetic.de/goldproduzenten-q1-q4-2017/

Viel Spaß eim Studieren.

MfG

sinsala

Das ist doch mal ein Wort...mehr als die Verdoppelung der abgeleiteten Ressourcenschätzung für Wassa. Hammer; da kommt aber sicher noch mehr. Aber liest selbst:

"....Golden Star doubles inferred mineral resources

Golden Star Resources has more than doubled its inferred mineral resource estimate for its Wassa underground gold mine in Ghana.

"By more than doubling the inferred mineral resources at Wassa underground, we have begun to demonstrate the compelling potential of this asset in the longer term," comments President and CEO of Golden Star, Sam Coetzer.

"We had believed for some time that Wassa was a larger deposit than previous estimates suggested and as the deposit remains open to the south, we believe that further upside exists still.

Wassa underground has ramped up well and this operational success forms a solid foundation for the next stage of the mine's growth.

We have under-utilised capacity within Wassa's processing plant and the southern portion of the deposit represents the potential to 'fill the mill' and increase production.

"I am looking forward to commencing the PEA and to exploring further the viability of this strategy," he continues.

Inferred mineral resource estimate

Wassa underground's inferred mineral resources have increased by 147% to 5.2 million ounces, in the B Shoot South and F Shoot South areas.

The grade of the inferred mineral resources has increased by 9% to 3.6 g/t Au.

The updated inferred mineral resource estimate includes nine holes that have been released previously, one deepened historical hole and two new mother holes, the results of which are reported today.

Golden Star is drilling the Wassa South extensions currently and the company expects that Wassa underground's inferred mineral resources will continue to grow with further step out drilling.

Preliminary Economic Assessment

Golden Star is planning to undertake a PEA on the Inferred Mineral Resources of the Wassa Underground deposit.

The objective of the PEA is to demonstrate the viability of the Inferred Mineral Resources, potentially including a new access shaft and new ventilation infrastructure.

As Golden Star has significant under-utilized capacity in the Wassa processing plant, this additional material could be processed without the need to build any additional processing capacity.

If the results of the PEA are positive, it will demonstrate the potential to increase production from the Wassa complex and to fast track cash flow.

Golden Star expects to commence work on the PEA late in the second quarter of 2018 and the Company anticipates it will be completed in the third quarter of 2018...."

Quelle: Mining Review Africa / 15.04.2018

"....Golden Star doubles inferred mineral resources

Golden Star Resources has more than doubled its inferred mineral resource estimate for its Wassa underground gold mine in Ghana.

"By more than doubling the inferred mineral resources at Wassa underground, we have begun to demonstrate the compelling potential of this asset in the longer term," comments President and CEO of Golden Star, Sam Coetzer.

"We had believed for some time that Wassa was a larger deposit than previous estimates suggested and as the deposit remains open to the south, we believe that further upside exists still.

Wassa underground has ramped up well and this operational success forms a solid foundation for the next stage of the mine's growth.

We have under-utilised capacity within Wassa's processing plant and the southern portion of the deposit represents the potential to 'fill the mill' and increase production.

"I am looking forward to commencing the PEA and to exploring further the viability of this strategy," he continues.

Inferred mineral resource estimate

Wassa underground's inferred mineral resources have increased by 147% to 5.2 million ounces, in the B Shoot South and F Shoot South areas.

The grade of the inferred mineral resources has increased by 9% to 3.6 g/t Au.

The updated inferred mineral resource estimate includes nine holes that have been released previously, one deepened historical hole and two new mother holes, the results of which are reported today.

Golden Star is drilling the Wassa South extensions currently and the company expects that Wassa underground's inferred mineral resources will continue to grow with further step out drilling.

Preliminary Economic Assessment

Golden Star is planning to undertake a PEA on the Inferred Mineral Resources of the Wassa Underground deposit.

The objective of the PEA is to demonstrate the viability of the Inferred Mineral Resources, potentially including a new access shaft and new ventilation infrastructure.

As Golden Star has significant under-utilized capacity in the Wassa processing plant, this additional material could be processed without the need to build any additional processing capacity.

If the results of the PEA are positive, it will demonstrate the potential to increase production from the Wassa complex and to fast track cash flow.

Golden Star expects to commence work on the PEA late in the second quarter of 2018 and the Company anticipates it will be completed in the third quarter of 2018...."

Quelle: Mining Review Africa / 15.04.2018

Antwort auf Beitrag Nr.: 57.548.946 von iwanowski am 15.04.18 21:27:42www.miningreview.com

https://www.miningreview.com/golden-star-doubles-inferred-mi…

https://www.miningreview.com/golden-star-doubles-inferred-mi…

Antwort auf Beitrag Nr.: 57.687.849 von Lennypenny am 03.05.18 17:09:11Die Produktionskosten je Unze beliefen sich auf 909 Dollar, die All-In Sustaining Costs je Unze betrugen hingegen 1.171 Dollar.

Sind die all in cost nicht ein bisschen hoch? ich meine da bleibt nicht viel Gewinn

Sind die all in cost nicht ein bisschen hoch? ich meine da bleibt nicht viel Gewinn

Antwort auf Beitrag Nr.: 57.955.263 von freddy1989 am 11.06.18 09:15:23...gerade das sind die Minen, die bei steigendem Goldpreis den größten Hebel haben.

Als Beimischung im Depot ist solch eine Mine das "Salz in der Suppe".

Gruß

Lenny

Als Beimischung im Depot ist solch eine Mine das "Salz in der Suppe".

Gruß

Lenny

Antwort auf Beitrag Nr.: 57.959.748 von Lennypenny am 11.06.18 17:51:28Ja das stimmt aber warum schafft die Firma es nicht die Kosten auf 900 Dollar all In zu drücken dann wären selbst in diesem Marktumfeld ordentliche Gewinne möglich?

Welche Market cap ist angemessen?

Welche Market cap ist angemessen?

Antwort auf Beitrag Nr.: 57.959.748 von Lennypenny am 11.06.18 17:51:28Weiss jemand was aus der BIOX Anlage geworden ist die soll doch auf der Prestea Mine für das Sulfiderz genutzt werden?

Weiss jemand wie hoch die Kosten bei der BIOX Anlage sind und die Recovery Werte?

Weiss jemand wie hoch die Kosten bei der BIOX Anlage sind und die Recovery Werte?

Hier nochmals die Kursziele von vor 2 Monaten der kanadischen Analystenriege:

Dated April 13, Desjardins Capital raised to Buy,Target of C1.65 from C1.40

Dated April 12, National Bank of Canada raised to Outperform, Target of C1.50

Dated April 16, BMO Capital analyst Sanam Nourbakhsh upgraded Golden Star Resources to Outperform from Market Perform and raised his price target to $1.50 from $1.25

Quelle: http://www.stockhouse.com/companies/bullboard?symbol=t.gsc&p…

Dated April 13, Desjardins Capital raised to Buy,Target of C1.65 from C1.40

Dated April 12, National Bank of Canada raised to Outperform, Target of C1.50

Dated April 16, BMO Capital analyst Sanam Nourbakhsh upgraded Golden Star Resources to Outperform from Market Perform and raised his price target to $1.50 from $1.25

Quelle: http://www.stockhouse.com/companies/bullboard?symbol=t.gsc&p…

Bei den AISC die du genannt hast, Finger weg freddy!

Zur Info, die Heuschrecken kommen:

La Mancha announces the investment of US$125.7 million in Golden Star Resources and the creation of a strategic partnership

Acquisition of a 30% stake in Golden Star Resources

Strategic partnership to accelerate development of Wassa and Prestea underground mines

Investment will help create a strong platform for growth

LUXEMBOURG, Aug. 01, 2018 (GLOBE NEWSWIRE) -- La Mancha Holding S.à.r.l. (“La Mancha”), a Luxembourg-incorporated private gold investment company, is pleased to announce that today it has agreed an equity investment of US$125.7 million to acquire a 30% stake in Golden Star Resources (GSC: TSX) (“Golden Star”) which operates the Wassa and Prestea underground mines in Ghana.

This transaction builds on La Mancha’s already strong portfolio of gold mining investments with a track record of creating value through its stakes in Endeavour Mining (EDV: TSX) in Africa and Evolution Mining (EVN: ASX) in Australia. With both of these investments, La Mancha has actively supported meaningful organic and acquisition led growth which has driven substantial industrial synergies. We see significant opportunity to build on these achievements through our investment in Golden Star.

Following completion of the investment in Golden Star, La Mancha will be the major shareholder in a rapidly growing gold producer in Ghana, with 2018 forecast annual production of 230,000 – 255,000 ounces at an AISC of US$850-950 per ounce from its two underground operations. Recently, Golden Star announced the re-commencement of underground mining at the Prestea operation, and an increase of 147% to the Wassa Deeps Inferred underground resource to more than 5 million ounces of gold.

La Mancha’s investment will support Golden Star in accelerating exploration and resource definition drilling at both operations to determine the optimum mining plans to realise the most value for all shareholders. Over time we would expect to see significant organic production growth, the potential to substantially extend mine life and a resulting drop in unit costs. This will create a strong platform for the business to target further growth from its existing asset base as well as through potential acquisitions.

Naguib Sawiris, Chairman of the Advisory Board of La Mancha, commented:

“As the new reference shareholder in Golden Star, our intention is to build on the track record of value creation in the mining sector by helping to unlock their organic growth and supporting the expansion of the company which we believe will create significant value for all shareholders.

As a result, we will be strongly positioned to capture African growth opportunities through this new investment together with our core investment in Endeavour Mining, with its focus on delivering its strong internal growth pipeline.”

Andrew Wray, CEO of La Mancha, stated:

“We have worked closely with Golden Star to understand the potential of its asset base and to agree this transaction which will help to unlock the value of the world-class Wassa and Prestea ore bodies, through accelerated exploration and resource definition drilling and the injection of development capital to fast-track the expansion of high-margin production at both operations.

The current team at Golden Star has proven its ability to delineate, develop and bring into production high quality underground operations that have the potential to create significant value.