WESDOME Gold Mines -- unentdeckte kanadische Goldperle!? - Die letzten 30 Beiträge

eröffnet am 17.06.09 09:13:44 von

neuester Beitrag 08.11.23 23:10:05 von

neuester Beitrag 08.11.23 23:10:05 von

Beiträge: 229

ID: 1.151.166

ID: 1.151.166

Aufrufe heute: 0

Gesamt: 20.303

Gesamt: 20.303

Aktive User: 0

ISIN: CA95083R1001 · WKN: A0JC4E · Symbol: WDO

10,660

CAD

+0,38 %

+0,040 CAD

Letzter Kurs 24.04.24 Toronto

Neuigkeiten

22.04.24 · globenewswire |

15.04.24 · globenewswire |

08.04.24 · globenewswire |

12.03.24 · globenewswire |

21.02.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 15,880 | +16,17 | |

| 29,49 | +15,74 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8800 | -7,37 | |

| 30,90 | -7,49 | |

| 7,2100 | -7,80 | |

| 2,1800 | -9,17 | |

| 46,59 | -98,01 |

Beitrag zu dieser Diskussion schreiben

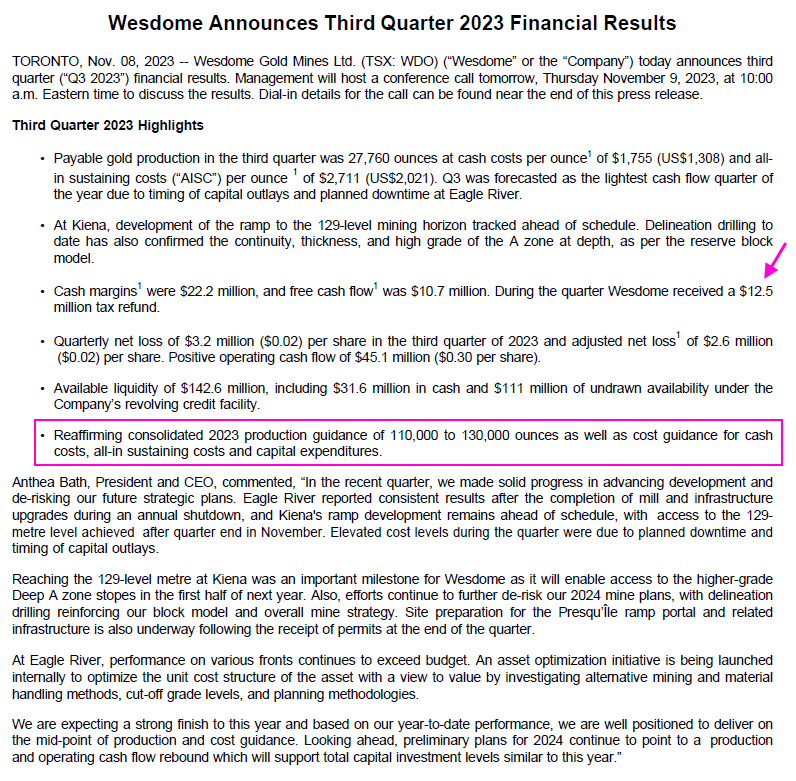

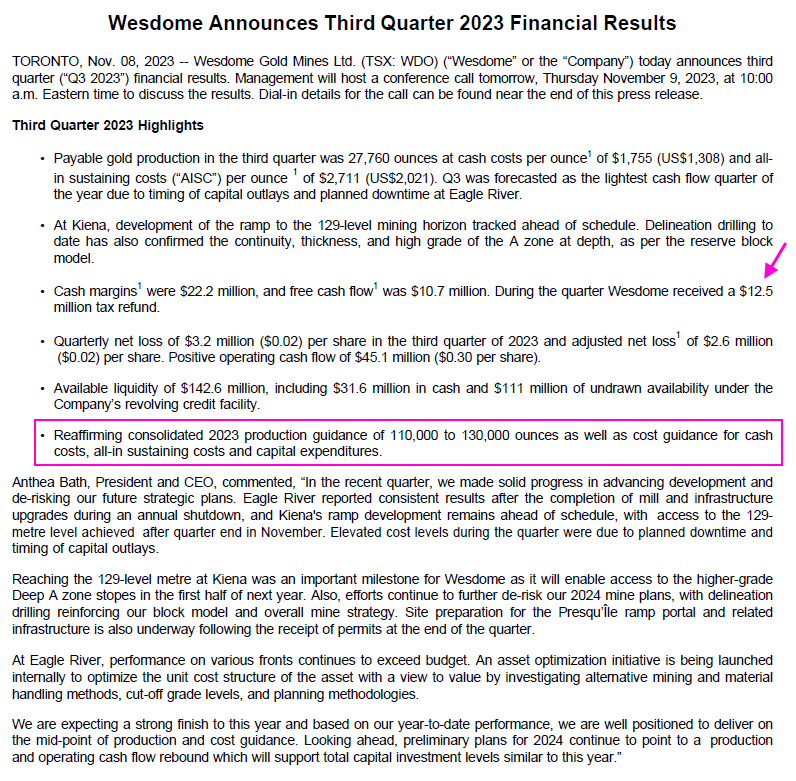

Q3: https://www.wesdome.com/English/investors/latest-news/news-d…

...

...

mit einem C$12,508,000 Mining and income tax refund

Daneben:

Elevated cost levels during the quarter were due to planned downtime and timing of capital outlays.

...

At Eagle River, performance on various fronts continues to exceed budget. An asset optimization initiative is being launched internally to optimize the unit cost structure of the asset with a view to value by investigating alternative mining and material handling methods, cut-off grade levels, and planning methodologies.

...

...

mit einem C$12,508,000 Mining and income tax refund

Daneben:

Elevated cost levels during the quarter were due to planned downtime and timing of capital outlays.

...

At Eagle River, performance on various fronts continues to exceed budget. An asset optimization initiative is being launched internally to optimize the unit cost structure of the asset with a view to value by investigating alternative mining and material handling methods, cut-off grade levels, and planning methodologies.

https://www.wallstreet-online.de/nachricht/17433299-wesdome-…

16.10., Q3:

...

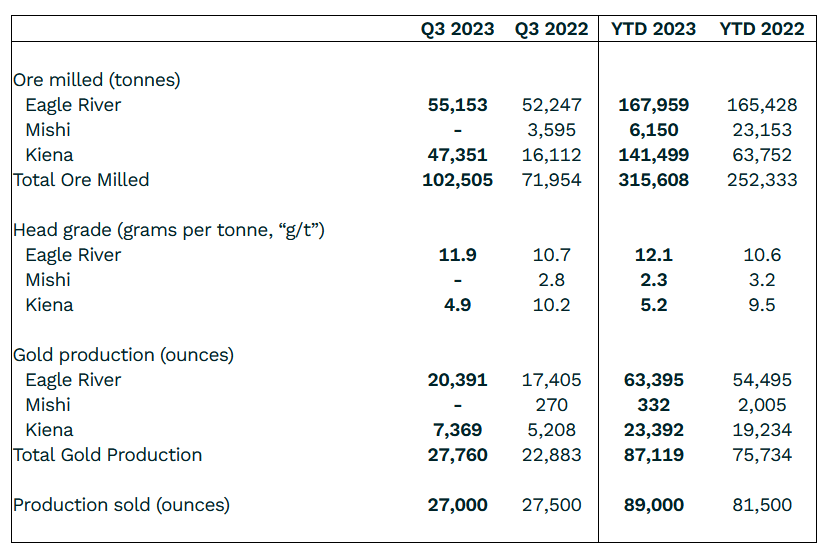

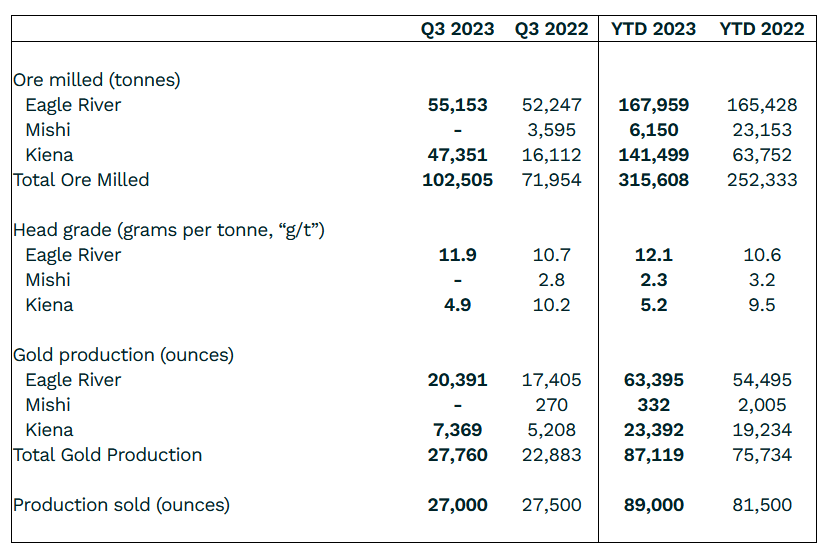

Anthea Bath, President and CEO commented, “As expected, combined production in Q3 was slightly lower than Q2 (30,992 ounces) as a result of planned mill maintenance at Eagle River. At Kiena, ramp development continues to track ahead of schedule, positioning us well to develop and access higher grade reserves in H1 2024.

We are also pleased to announce that towards the end of the quarter, we received the necessary permit required to drive an exploration ramp at Presqu’île. This authorization allows us to assess the continuity of the mineralization and test the down plunge extension of the deposit.

With an uptick in production expected in the fourth quarter, our year to date performance of 87,119 ounces has us tracking to the mid-point of our 110,000 - 130,000 ounce guidance range.

...

16.10., Q3:

...

Anthea Bath, President and CEO commented, “As expected, combined production in Q3 was slightly lower than Q2 (30,992 ounces) as a result of planned mill maintenance at Eagle River. At Kiena, ramp development continues to track ahead of schedule, positioning us well to develop and access higher grade reserves in H1 2024.

We are also pleased to announce that towards the end of the quarter, we received the necessary permit required to drive an exploration ramp at Presqu’île. This authorization allows us to assess the continuity of the mineralization and test the down plunge extension of the deposit.

With an uptick in production expected in the fourth quarter, our year to date performance of 87,119 ounces has us tracking to the mid-point of our 110,000 - 130,000 ounce guidance range.

...

https://www.wallstreet-online.de/nachricht/17347602-wesdome-…

Wesdome Drilling Confirms Continuity of Presqu’île Zone and Prepares for Exploration Ramp Development at Kiena Mine

...

Wesdome Drilling Confirms Continuity of Presqu’île Zone and Prepares for Exploration Ramp Development at Kiena Mine

...

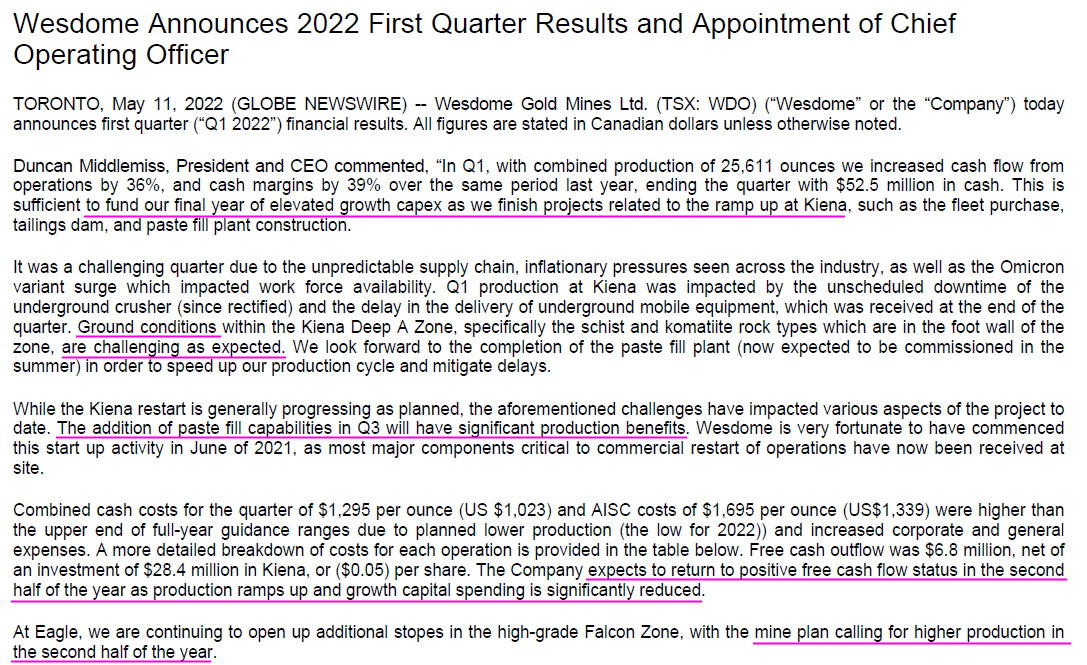

Q1: https://www.wallstreet-online.de/nachricht/16916878-wesdome-…

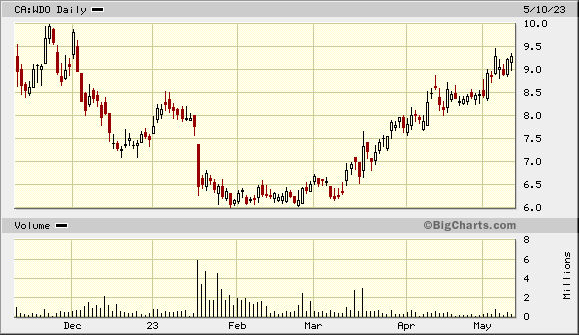

=> die Erholung geht weiter:

...

Warwick Morley-Jepson, Board Chair and Interim CEO commented, “The year is off to a solid start with combined production results of 28,368 ounces coming in ahead of budget.

We continued to make excellent progress on the Kiena production ramp, currently at the 123 level. Once the ramp reaches the 129 level late this year and we can develop 129L station, we will be able to take advantage of the significant ounces per vertical metre increase which is expected to result in materially better unit economics in 2024. At Eagle River, production exceeded our internal targets. Grade reconciliation in the Falcon Zone has significantly improved now that additional drilling and ore development is in place.

Our balance sheet is also continuing to benefit from higher production and gold prices, as well as disciplined use of our ATM financing. During the quarter, we paid down $8 million of debt, $12 million in Accounts Payables and expect to continue aggressively paying down our credit facility throughout the rest of the year.”...

=> die Erholung geht weiter:

...

Warwick Morley-Jepson, Board Chair and Interim CEO commented, “The year is off to a solid start with combined production results of 28,368 ounces coming in ahead of budget.

We continued to make excellent progress on the Kiena production ramp, currently at the 123 level. Once the ramp reaches the 129 level late this year and we can develop 129L station, we will be able to take advantage of the significant ounces per vertical metre increase which is expected to result in materially better unit economics in 2024. At Eagle River, production exceeded our internal targets. Grade reconciliation in the Falcon Zone has significantly improved now that additional drilling and ore development is in place.

Our balance sheet is also continuing to benefit from higher production and gold prices, as well as disciplined use of our ATM financing. During the quarter, we paid down $8 million of debt, $12 million in Accounts Payables and expect to continue aggressively paying down our credit facility throughout the rest of the year.”...

...

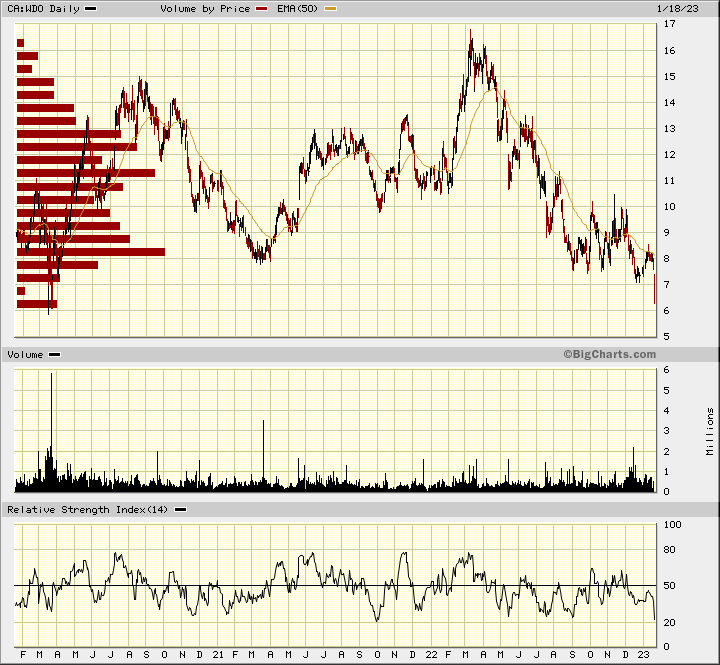

"we have leveraged our experiences" heißt das nun.

Kann man nur hoffen mMn, daß es auch tatsächlich so ist

24.1.

Wesdome Announces Executive Changes

https://www.wesdome.com/English/investors/latest-news/news-d…

...

Warwick Morley-Jepson, the Chair of the Board, will act as Interim President and Chief Executive Officer to manage the Company as the Board works with an executive search firm to select a permanent successor.

...

Wesdome Announces Executive Changes

https://www.wesdome.com/English/investors/latest-news/news-d…

...

Warwick Morley-Jepson, the Chair of the Board, will act as Interim President and Chief Executive Officer to manage the Company as the Board works with an executive search firm to select a permanent successor.

...

der ceo ist gegangen worden.

das werden mit sicherheit furchtbare zahlen und updates für q4 und das jahr 22

das werden mit sicherheit furchtbare zahlen und updates für q4 und das jahr 22

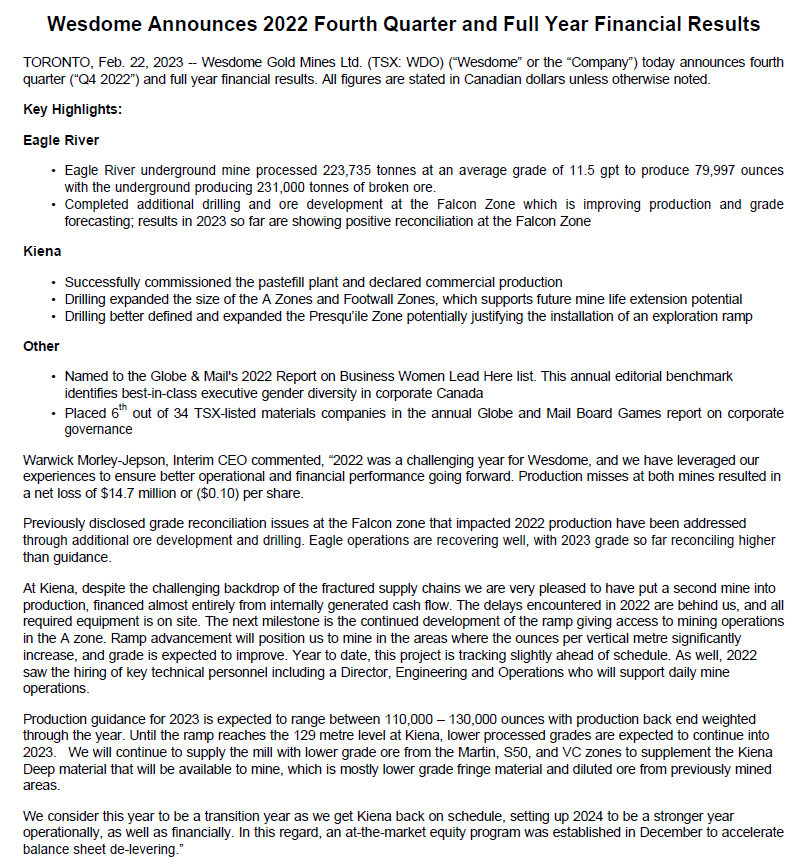

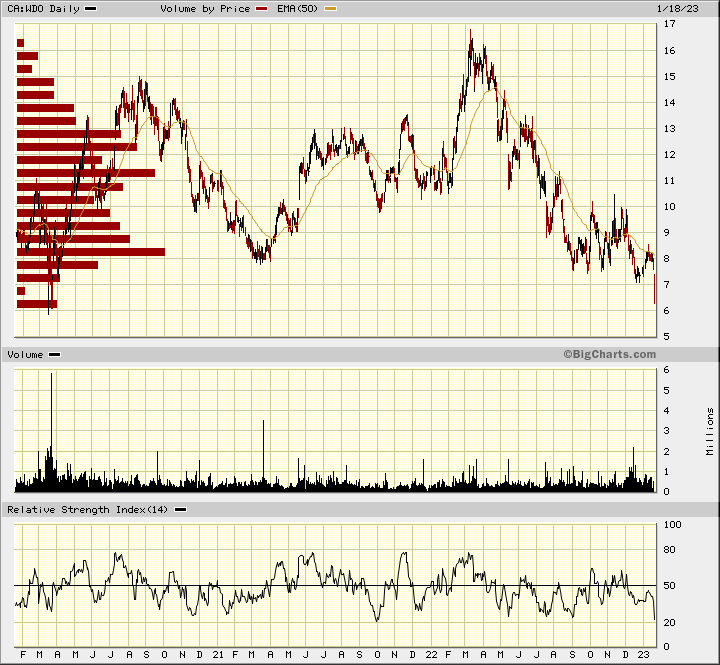

Antwort auf Beitrag Nr.: 73.114.050 von faultcode am 18.01.23 12:22:31damit fast schon wieder auf "Corona"-Kursniveau:

https://iknnews.com/wesdome-4q22-production-and-2023-guidanc…

01 / 17 / 23

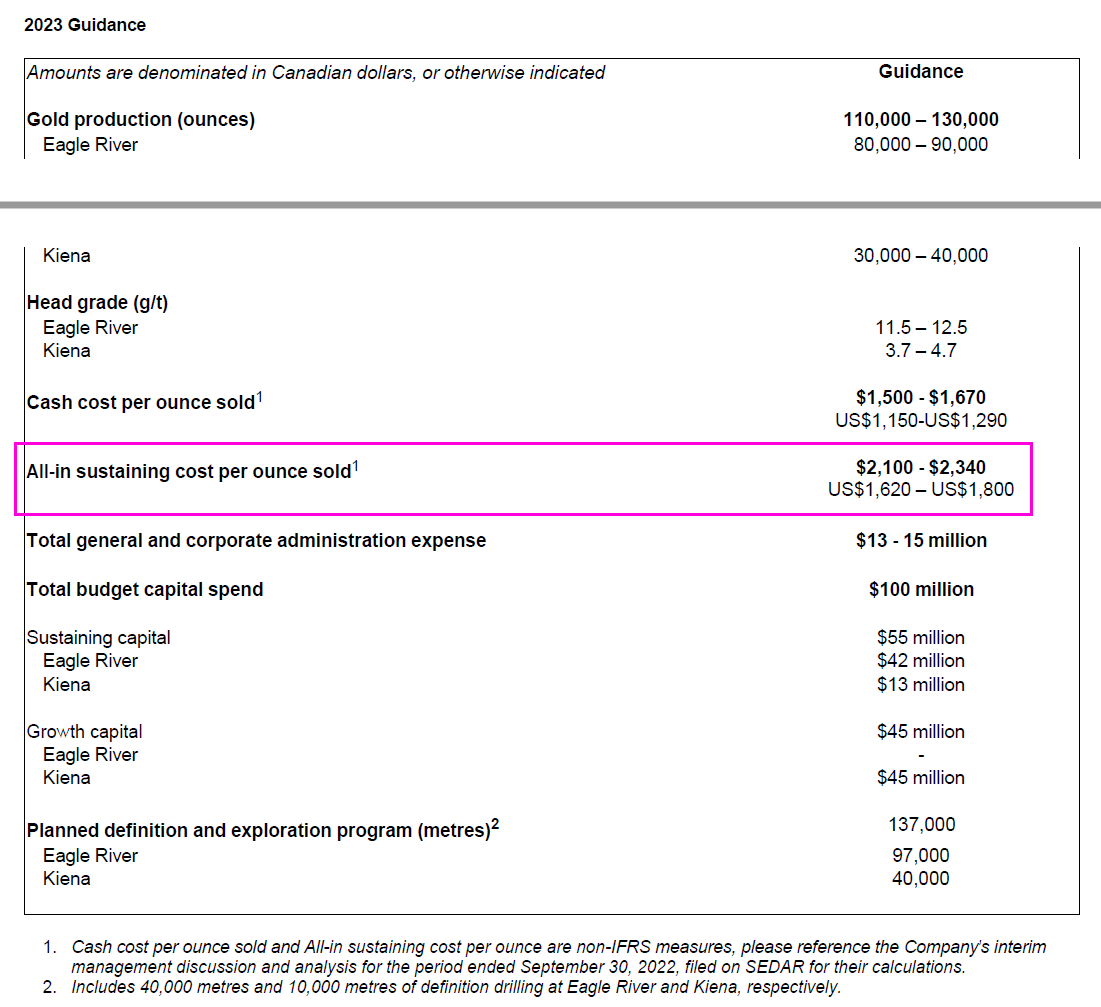

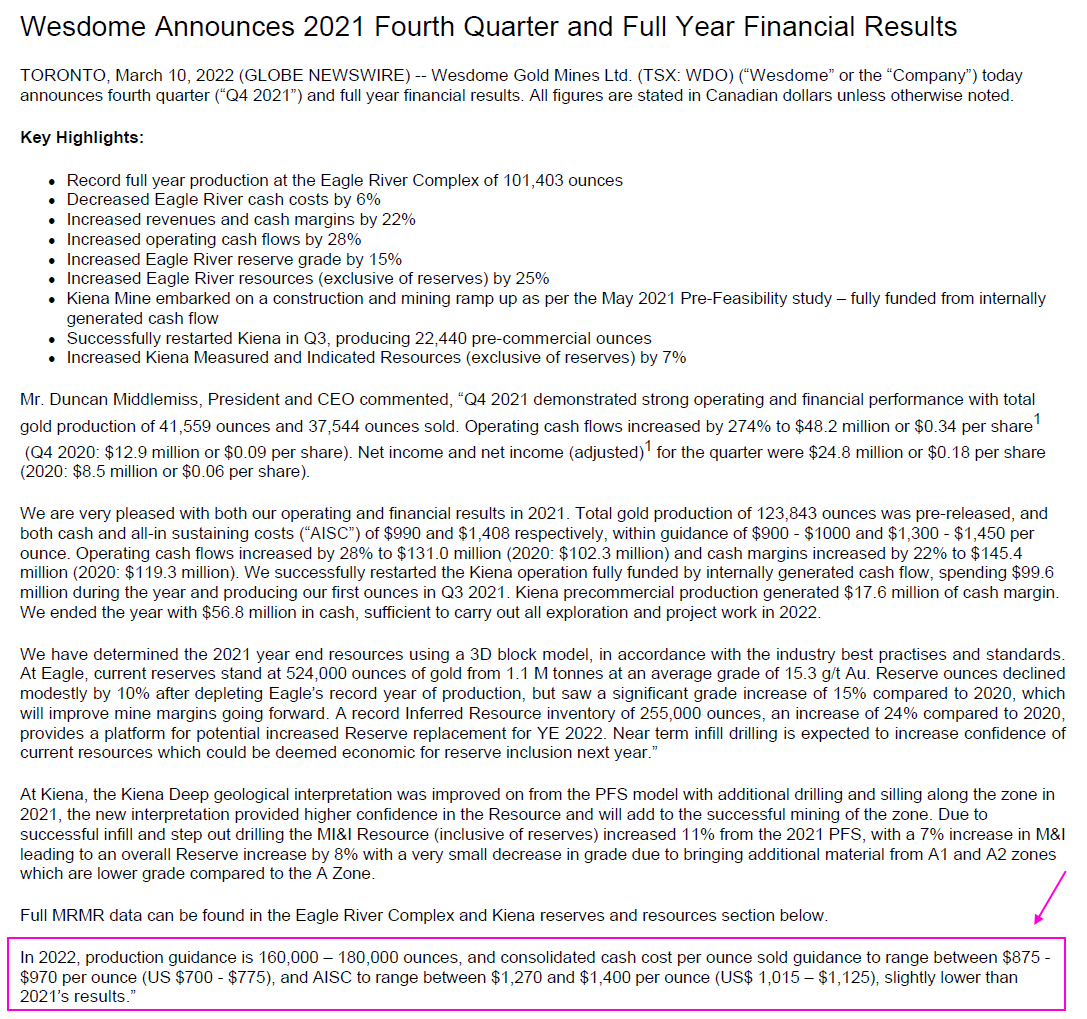

Wesdome 4q22 production and 2023 guidance

We can do this in one word: Sucks

For more words: 4q22 production was light compared to guidance, sales even lighter and as a result, the operations aren’t going to be much over breakeven. As for 2023, guidance at Eagle seems to be pitched to the conservative side in order to kitchen-sink the message and allow some potential room for upside, because the news out of Kiena is not good. WDO now won’t access the high-grading deep levels until late 2023 at the very earliest, which means guided grade is much lower than expected and the while on-site operations should be modestly profitable, the combo capex budget and guided consolidated costs suggest a significant cash shortfall. No wonder WDO took out those lines of credit, it looks as though it will remain in negative working cap territory for at least three more quarters. We’re also supposed to believe that Kiena Deep will come online January 1st 2024 and run on rails when it does, apparently.

...

01 / 17 / 23

Wesdome 4q22 production and 2023 guidance

We can do this in one word: Sucks

For more words: 4q22 production was light compared to guidance, sales even lighter and as a result, the operations aren’t going to be much over breakeven. As for 2023, guidance at Eagle seems to be pitched to the conservative side in order to kitchen-sink the message and allow some potential room for upside, because the news out of Kiena is not good. WDO now won’t access the high-grading deep levels until late 2023 at the very earliest, which means guided grade is much lower than expected and the while on-site operations should be modestly profitable, the combo capex budget and guided consolidated costs suggest a significant cash shortfall. No wonder WDO took out those lines of credit, it looks as though it will remain in negative working cap territory for at least three more quarters. We’re also supposed to believe that Kiena Deep will come online January 1st 2024 and run on rails when it does, apparently.

...

17.1.

Wesdome Announces Fourth Quarter and Full Year 2022 Production Results; Provides 2023 Guidance

https://www.wesdome.com/English/investors/latest-news/news-d…

...

Duncan Middlemiss, President and CEO of Wesdome, commented:

...

Looking ahead, 2023 will be a consolidation year for the Company as we leverage the experience from 2022 to better forecast production at Eagle River (particularly the Falcon Zone), and advance development at Kiena to increase our developed reserves by year end.

While total capital spending in 2023 is expected to be lower relative to last year, some growth capex at Kiena remains to be spent as we catch-up on delayed ramp development, gaining access to the area of the A Zone where gold production approaches the Pre-Feasibility Study (PFS) levels forecast for 2024.

Capital outlays are then expected to decline in 2024 as the majority of growth spending comes to an end. As such, operational and financial performance overall is expected to significantly improve in 2024.

Despite recent headwinds, on the exploration front we remain excited about what the future holds at both assets. With approximately 137,000 metres of drilling budgeted for 2023, exploration activities will prioritize opportunities to extend mineralization near existing mine infrastructure. At Eagle River, we see strong potential in the targets adjacent to the mine diorite and the up-plunge extension of the Falcon Zone (see press release dated October 5, 2022). At Kiena, we plan to better define and extend recently discovered zones (see press release dated June 1, 2022) and prepare the Presqu’ile zone for future development.”

Wesdome Announces Fourth Quarter and Full Year 2022 Production Results; Provides 2023 Guidance

https://www.wesdome.com/English/investors/latest-news/news-d…

...

Duncan Middlemiss, President and CEO of Wesdome, commented:

...

Looking ahead, 2023 will be a consolidation year for the Company as we leverage the experience from 2022 to better forecast production at Eagle River (particularly the Falcon Zone), and advance development at Kiena to increase our developed reserves by year end.

While total capital spending in 2023 is expected to be lower relative to last year, some growth capex at Kiena remains to be spent as we catch-up on delayed ramp development, gaining access to the area of the A Zone where gold production approaches the Pre-Feasibility Study (PFS) levels forecast for 2024.

Capital outlays are then expected to decline in 2024 as the majority of growth spending comes to an end. As such, operational and financial performance overall is expected to significantly improve in 2024.

Despite recent headwinds, on the exploration front we remain excited about what the future holds at both assets. With approximately 137,000 metres of drilling budgeted for 2023, exploration activities will prioritize opportunities to extend mineralization near existing mine infrastructure. At Eagle River, we see strong potential in the targets adjacent to the mine diorite and the up-plunge extension of the Falcon Zone (see press release dated October 5, 2022). At Kiena, we plan to better define and extend recently discovered zones (see press release dated June 1, 2022) and prepare the Presqu’ile zone for future development.”

Autsch!

Wesdome Establishes At-The-Market Equity Program

https://www.globenewswire.com/news-release/2022/12/02/256669…

...

TORONTO, Dec. 02, 2022 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces it has established an at-the-market equity program (the “ATM Program”) allowing Wesdome to issue and sell up to $100 million common shares from treasury (the “Common Shares”) to the public from time to time at the Company’s sole discretion and at the prevailing market price.

Sales of the Common Shares under the ATM Program will be made pursuant to the terms of an equity distribution agreement (the “Distribution Agreement”) dated December 2, 2022 entered into among the Company and a syndicate of agents including National Bank Financial, BMO Capital Markets and Desjardins Capital Markets (collectively, the “Agents”). The volume and timing of distributions under the ATM Program, if any, will be determined at the Company’s sole discretion, subject to applicable regulatory limitations.

The Company currently intends to use the net proceeds, if any, from the ATM Program to repay indebtedness, for working capital, and general corporate purposes. In addition to its cash on hand and its recently upsized $150 million revolving credit facility, the ATM Program will provide Wesdome with a flexible tool to efficiently access the capital markets, opportunistically as needed, in order to continue executing on its growth strategy. Management of the Company will have discretion with respect to the actual use of the net proceeds of the ATM Program.

...

Wesdome Establishes At-The-Market Equity Program

https://www.globenewswire.com/news-release/2022/12/02/256669…

...

TORONTO, Dec. 02, 2022 (GLOBE NEWSWIRE) -- Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces it has established an at-the-market equity program (the “ATM Program”) allowing Wesdome to issue and sell up to $100 million common shares from treasury (the “Common Shares”) to the public from time to time at the Company’s sole discretion and at the prevailing market price.

Sales of the Common Shares under the ATM Program will be made pursuant to the terms of an equity distribution agreement (the “Distribution Agreement”) dated December 2, 2022 entered into among the Company and a syndicate of agents including National Bank Financial, BMO Capital Markets and Desjardins Capital Markets (collectively, the “Agents”). The volume and timing of distributions under the ATM Program, if any, will be determined at the Company’s sole discretion, subject to applicable regulatory limitations.

The Company currently intends to use the net proceeds, if any, from the ATM Program to repay indebtedness, for working capital, and general corporate purposes. In addition to its cash on hand and its recently upsized $150 million revolving credit facility, the ATM Program will provide Wesdome with a flexible tool to efficiently access the capital markets, opportunistically as needed, in order to continue executing on its growth strategy. Management of the Company will have discretion with respect to the actual use of the net proceeds of the ATM Program.

...

Wesdome Declares Commercial Production at the Kiena Mine

01/12/2022

https://www.wesdome.com/English/investors/latest-news/news-d…

01/12/2022

https://www.wesdome.com/English/investors/latest-news/news-d…

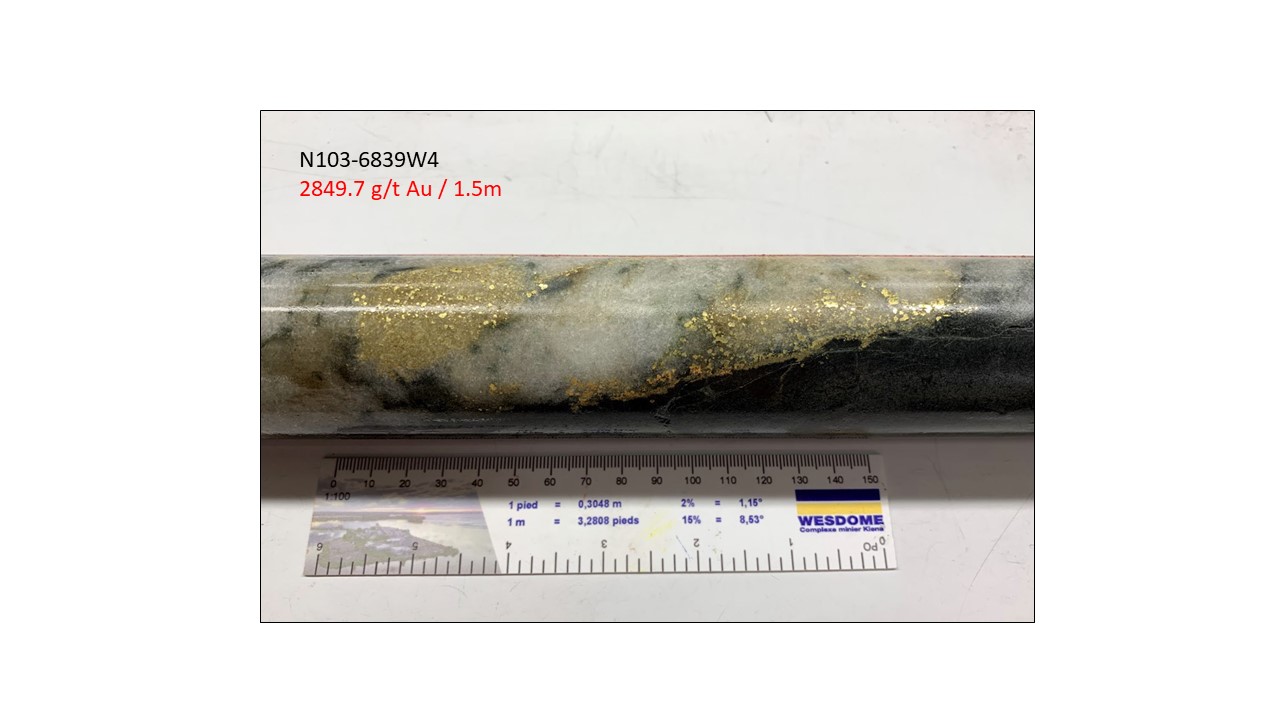

...und noch ein "goldiges" Bildchen:

Nochmals Otto. Gedanken zu einer möglichen Übernahmeo:

https://iknnews.com/thoughts-on-the-wesdome-gold-wdo-to-3q22…

Thoughts on the Wesdome Gold (WDO.to) 3q22 financials (from IKN704)

There may be a trade here. Still undecided, but the way WDO has continued to trade this week (currently C$8.62) means the window of opportunity is still open. Here’s how the note as seen in IKN704, out last Sunday, framed the potential and FWIW, personally I’m leaning toward waiting until the first weeks of 2023 when WDO announces its Q4 production results. Full disclosure: No position.

https://iknnews.com/thoughts-on-the-wesdome-gold-wdo-to-3q22…

Thoughts on the Wesdome Gold (WDO.to) 3q22 financials (from IKN704)

There may be a trade here. Still undecided, but the way WDO has continued to trade this week (currently C$8.62) means the window of opportunity is still open. Here’s how the note as seen in IKN704, out last Sunday, framed the potential and FWIW, personally I’m leaning toward waiting until the first weeks of 2023 when WDO announces its Q4 production results. Full disclosure: No position.

Das ist Otto auch aufgefallen:

https://iknnews.com/wesdome-gold-wdo-to-working-capital/

Interesting 3q22 data:

Der Aktienkurs hat bisher noch nicht allzu negativ reagiert.

Kritisch beobachten?

Freundliche Grüße

supernova

https://iknnews.com/wesdome-gold-wdo-to-working-capital/

Interesting 3q22 data:

Der Aktienkurs hat bisher noch nicht allzu negativ reagiert.

Kritisch beobachten?

Freundliche Grüße

supernova

was ist mit dem working capital (-$30m) passiert?

die brauchen doch dafür jetzt recht schnell frisches geld, oder?

die brauchen doch dafür jetzt recht schnell frisches geld, oder?

https://www.wesdome.com/English/investors/latest-news/news-d…

Wesdome Announces 2022 Third Quarter Financial Results

09/11/2022

Wesdome Announces 2022 Third Quarter Financial Results

09/11/2022

https://www.wesdome.com/English/investors/latest-news/news-d…

Wesdome Announces 2022 Third Quarter Production Results

13/10/2022

...

Duncan Middlemiss, President and CEO commented, “Eagle River production for the quarter was in line with revised guidance. During Q3, there was a planned shut down in July to complete mill upgrades and refurbishment work, which went according to plan and has already yielded operational gains such as reduced reagents consumption.

At Kiena, the mine also had a planned shutdown in July for necessary hoist upgrades. As well, the critical components of the paste fill plant were delivered and installed in Q3, with plant commissioning on track for later in Q4. Once the paste fill system is fully operational, we will have the ability to focus on mine development which will result in increased operational flexibility, and be better positioned to operate successfully in the challenging ground conditions encountered in Kiena Deep. We are currently tracking to produce towards the lower end of the 120,000 – 140,000 combined guidance range this year.”

...

Wesdome Announces 2022 Third Quarter Production Results

13/10/2022

...

Duncan Middlemiss, President and CEO commented, “Eagle River production for the quarter was in line with revised guidance. During Q3, there was a planned shut down in July to complete mill upgrades and refurbishment work, which went according to plan and has already yielded operational gains such as reduced reagents consumption.

At Kiena, the mine also had a planned shutdown in July for necessary hoist upgrades. As well, the critical components of the paste fill plant were delivered and installed in Q3, with plant commissioning on track for later in Q4. Once the paste fill system is fully operational, we will have the ability to focus on mine development which will result in increased operational flexibility, and be better positioned to operate successfully in the challenging ground conditions encountered in Kiena Deep. We are currently tracking to produce towards the lower end of the 120,000 – 140,000 combined guidance range this year.”

...

https://www.wesdome.com/English/investors/latest-news/news-d…

Wesdome Exploration Defines up Plunge Extension of Falcon 7 Zone and Identifies New Lens East of Mine 7 Zone at the Eagle River Mine

05/10/2022

...

Wesdome Exploration Defines up Plunge Extension of Falcon 7 Zone and Identifies New Lens East of Mine 7 Zone at the Eagle River Mine

05/10/2022

...

https://www.wesdome.com/English/investors/latest-news/news-d…

Wesdome Drilling Confirms Continuity of Presqu’île Zone and Is Investigating Installation of Exploration Ramp From Surface Adjacent to the Kiena Mine

08/09/2022

...

Highlights of the recent drilling are listed below and are summarized in Table 1.

Hole PR-22-034: 24.3 g/t over 3.3 m core length (10.6 g/t Au capped*, 3.0 true width) PR-1 Zone

Hole PR-22-026: 30.0 g/t Au over 9.4 m core length (13.1 g/t Au capped*, 9.2 m true width) PR-2A Zone

Hole PR-22-024: 45.0 g/t Au over 3.8 m core length (18.5 g/t Au capped*, 3.7 m true width) PR-2A Zone

Hole PR-22-029: 27.6 g/t over 3.5 m core length (12.8 g/t Au capped*, 3.3 m true width) PR-2 Zone

* All assays capped at 35 g/t. Au. True widths are estimated based on 3D model construction.

...

Wesdome Drilling Confirms Continuity of Presqu’île Zone and Is Investigating Installation of Exploration Ramp From Surface Adjacent to the Kiena Mine

08/09/2022

...

Highlights of the recent drilling are listed below and are summarized in Table 1.

Hole PR-22-034: 24.3 g/t over 3.3 m core length (10.6 g/t Au capped*, 3.0 true width) PR-1 Zone

Hole PR-22-026: 30.0 g/t Au over 9.4 m core length (13.1 g/t Au capped*, 9.2 m true width) PR-2A Zone

Hole PR-22-024: 45.0 g/t Au over 3.8 m core length (18.5 g/t Au capped*, 3.7 m true width) PR-2A Zone

Hole PR-22-029: 27.6 g/t over 3.5 m core length (12.8 g/t Au capped*, 3.3 m true width) PR-2 Zone

* All assays capped at 35 g/t. Au. True widths are estimated based on 3D model construction.

...

https://www.wesdome.com/English/investors/latest-news/news-d…

Wesdome Announces 2022 Second Quarter Financial Results

10/08/2022

...

Key operating and financial highlights of the Q2 2022 results include:

Gold production of 27,240 ounces, including 8,914 Kiena pre-commercial ounces, is a 10% decrease over the same period of the previous year (Q2 2021: 30,375 ounces):

Eagle River Underground milled 59,964 tonnes at a head grade of 9.6 grams per tonne for 17,756 ounces produced, a 40% decrease over the same period in the previous year (Q2 2021: 29,836 ounces).

Mishi Open Pit milled 7,685 tonnes at a head grade of 2.8 grams per tonne for 570 ounces produced (Q2 2021: 539 ounces).

Kiena milled 26,478 tonnes at a head grade of 10.6 grams per tonne for 8,914 pre-commercial ounces produced.

Revenue of $61.9 million, a 3% decrease over the same period of the previous year (Q2 2021: $63.9 million).

Ounces sold were 26,000 at an average sales price of $2,380/oz (Q2 2021: 28,500 ounces at an average price of $2,239/oz).

Cash margin1 of $21.9 million, a 46% decrease over the same period of the previous year (Q2 2021: $40.6 million).

Operating cash flows decreased by 55% to $12.1 million or $0.08 per share1 as compared to $26.9 million or $0.19 per share for the same period in 2021.

Free cash outflow of $28.6 million, net of an investment of $31.2 million in Kiena, or ($0.20) per share1 (Q2 2021: free cash outflow of $9.1 million or ($0.07) per share1).

Net loss of $14.3 million or ($0.10) per share (Q2 2021: Net income - $84.9 million or $0.63 per share) and Net loss (adjusted)1 of $5.5 million or ($0.04) per share (Q2 2021: $20.6 million or $0.15 per share)

Cash position at the end of the quarter of $23.5 million.

Cash costs1 of $1,538/oz or US$1,205/oz, an 89% increase over the same period in 2021 (Q2 2021: $814/oz or US$663/oz);

AISC1 increased by 63% to $2,020/oz or US$1,582/oz (Q2 2021: $1,240 or US$1,009 per ounce) due to lower ounces sold and increased corporate and general expenses.

1. Refer to the Company’s 2021 Annual Management Discussion and Analysis section entitled “Non-IFRS Performance Measures” for the reconciliation of these non-IFRS measurements to the consolidated financial statements.

...

Wesdome Announces 2022 Second Quarter Financial Results

10/08/2022

...

Key operating and financial highlights of the Q2 2022 results include:

Gold production of 27,240 ounces, including 8,914 Kiena pre-commercial ounces, is a 10% decrease over the same period of the previous year (Q2 2021: 30,375 ounces):

Eagle River Underground milled 59,964 tonnes at a head grade of 9.6 grams per tonne for 17,756 ounces produced, a 40% decrease over the same period in the previous year (Q2 2021: 29,836 ounces).

Mishi Open Pit milled 7,685 tonnes at a head grade of 2.8 grams per tonne for 570 ounces produced (Q2 2021: 539 ounces).

Kiena milled 26,478 tonnes at a head grade of 10.6 grams per tonne for 8,914 pre-commercial ounces produced.

Revenue of $61.9 million, a 3% decrease over the same period of the previous year (Q2 2021: $63.9 million).

Ounces sold were 26,000 at an average sales price of $2,380/oz (Q2 2021: 28,500 ounces at an average price of $2,239/oz).

Cash margin1 of $21.9 million, a 46% decrease over the same period of the previous year (Q2 2021: $40.6 million).

Operating cash flows decreased by 55% to $12.1 million or $0.08 per share1 as compared to $26.9 million or $0.19 per share for the same period in 2021.

Free cash outflow of $28.6 million, net of an investment of $31.2 million in Kiena, or ($0.20) per share1 (Q2 2021: free cash outflow of $9.1 million or ($0.07) per share1).

Net loss of $14.3 million or ($0.10) per share (Q2 2021: Net income - $84.9 million or $0.63 per share) and Net loss (adjusted)1 of $5.5 million or ($0.04) per share (Q2 2021: $20.6 million or $0.15 per share)

Cash position at the end of the quarter of $23.5 million.

Cash costs1 of $1,538/oz or US$1,205/oz, an 89% increase over the same period in 2021 (Q2 2021: $814/oz or US$663/oz);

AISC1 increased by 63% to $2,020/oz or US$1,582/oz (Q2 2021: $1,240 or US$1,009 per ounce) due to lower ounces sold and increased corporate and general expenses.

1. Refer to the Company’s 2021 Annual Management Discussion and Analysis section entitled “Non-IFRS Performance Measures” for the reconciliation of these non-IFRS measurements to the consolidated financial statements.

...

https://www.wesdome.com/investors/latest-news/news-details/2…

Wesdome Expands Folded Kiena Deep A Zones Down Plunge and Confirms Mineralization in a Second Limb at Depth

01/06/2022

...

Freundliche Grüße

supernova

Wesdome Expands Folded Kiena Deep A Zones Down Plunge and Confirms Mineralization in a Second Limb at Depth

01/06/2022

...

Freundliche Grüße

supernova

https://www.wesdome.com/investors/latest-news/news-details/2…

Wesdome Announces Continued High Grade Drilling Results From the Falcon 7 Zone at the Eagle River Mine

05/05/2022

Freundliche Grüße

supernova

Wesdome Announces Continued High Grade Drilling Results From the Falcon 7 Zone at the Eagle River Mine

05/05/2022

Freundliche Grüße

supernova

https://www.wesdome.com/investors/latest-news/news-details/2…

Wesdome Announces 2022 First Quarter Production Results

14/04/2022

Wesdome Announces 2022 First Quarter Production Results

14/04/2022

https://www.wesdome.com/investors/latest-news/news-details/2…

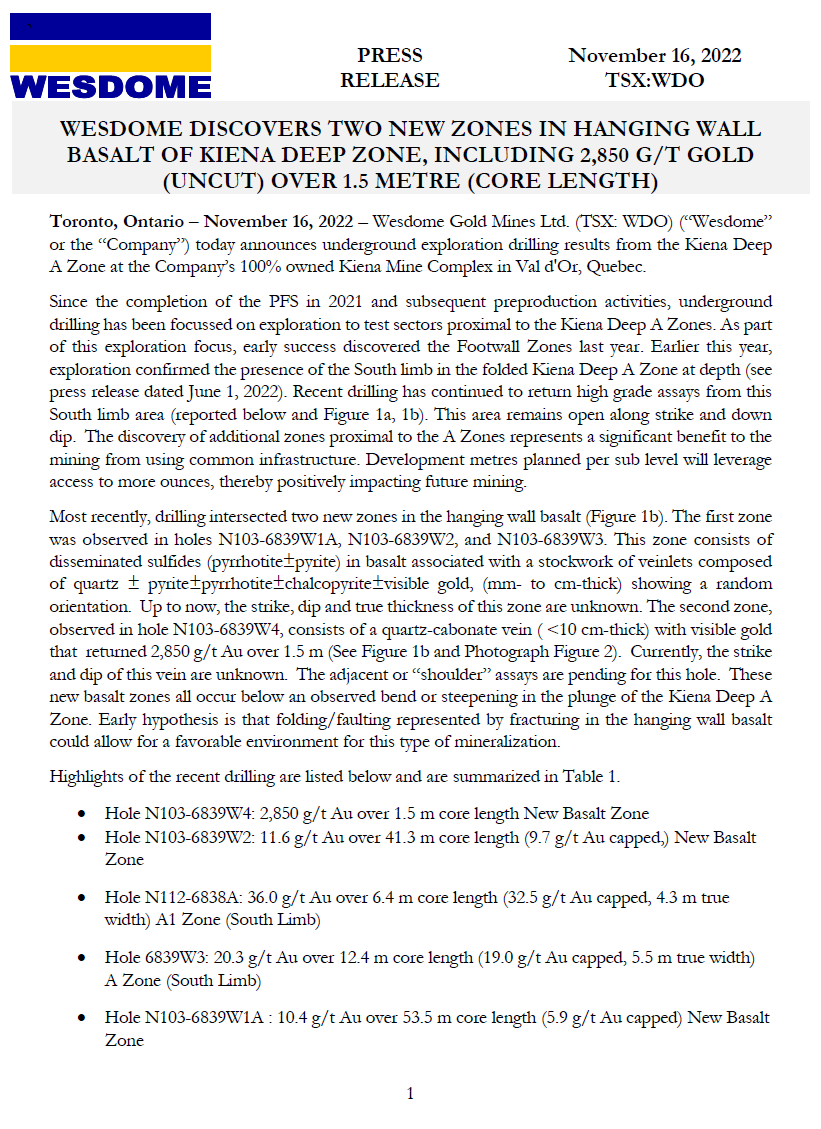

Wesdome Continues to Expand Kiena High Grade A Zones and Footwall Zones

08/02/2022

...

We are continuing to spend aggressively on exploration at Kiena with $17.7 million to be spent in 2022 that includes approximately 50,000 m of underground drilling and 30,000 m of surface drilling.

...

We are also pleased with the progress being made ramping up production at Kiena. As planned, production will ramp up throughout the year with higher production expected in H2 2022. While we continue to expect commercial production in Q2, production this year will be back end weighted in H2 2022 as we continue to ramp up, with total production this year forecasted at 64,000 – 75,000 ounces. As per the 2021 Pre-Feasibility Study, completed prior to the Footwall Zone discovery, the life of mine average yearly production is 83,574 ounces with costs declining materially in 2024 once higher output levels are realized. However, with the discover of the Footwall Zone, and most recently with the Hanging wall Basalt Zone, we expect these new zones could extend the LOM and have the potential to increase annual production given the increase reserve ounces per vertical metre.”

...

ABOUT WESDOME

Wesdome is Canadian focused with two producing underground gold mines. The Company’s goal is to build Canada’s next intermediate gold producer, producing over 200,000 ounces from two mines in Ontario and Québec. The Eagle River Underground Mine in Wawa, Ontario is currently producing gold at a rate of 92,000 – 105,000 ounces per year. The recently re-started Kiena Complex in Val d’or, Quebec is a fully permitted underground mine and milling operation. Wesdome is actively exploring both underground and on surface within the mine areas and more regionally at both the Eagle River and Kiena Complex. The Company also retains meaningful exposure to the Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario through its equity position in Goldshore Resources Inc. The Company has approximately 141.6 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO.”

...

Freundliche Grüße

supernova

Wesdome Continues to Expand Kiena High Grade A Zones and Footwall Zones

08/02/2022

...

We are continuing to spend aggressively on exploration at Kiena with $17.7 million to be spent in 2022 that includes approximately 50,000 m of underground drilling and 30,000 m of surface drilling.

...

We are also pleased with the progress being made ramping up production at Kiena. As planned, production will ramp up throughout the year with higher production expected in H2 2022. While we continue to expect commercial production in Q2, production this year will be back end weighted in H2 2022 as we continue to ramp up, with total production this year forecasted at 64,000 – 75,000 ounces. As per the 2021 Pre-Feasibility Study, completed prior to the Footwall Zone discovery, the life of mine average yearly production is 83,574 ounces with costs declining materially in 2024 once higher output levels are realized. However, with the discover of the Footwall Zone, and most recently with the Hanging wall Basalt Zone, we expect these new zones could extend the LOM and have the potential to increase annual production given the increase reserve ounces per vertical metre.”

...

ABOUT WESDOME

Wesdome is Canadian focused with two producing underground gold mines. The Company’s goal is to build Canada’s next intermediate gold producer, producing over 200,000 ounces from two mines in Ontario and Québec. The Eagle River Underground Mine in Wawa, Ontario is currently producing gold at a rate of 92,000 – 105,000 ounces per year. The recently re-started Kiena Complex in Val d’or, Quebec is a fully permitted underground mine and milling operation. Wesdome is actively exploring both underground and on surface within the mine areas and more regionally at both the Eagle River and Kiena Complex. The Company also retains meaningful exposure to the Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario through its equity position in Goldshore Resources Inc. The Company has approximately 141.6 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO.”

...

Freundliche Grüße

supernova