partnerschaft mit paramount gold - 500 Beiträge pro Seite

eröffnet am 22.07.09 10:53:47 von

neuester Beitrag 23.09.16 21:20:12 von

neuester Beitrag 23.09.16 21:20:12 von

Beiträge: 59

ID: 1.151.899

ID: 1.151.899

Aufrufe heute: 0

Gesamt: 6.434

Gesamt: 6.434

Aktive User: 0

ISIN: CA4986961031 · WKN: 727231

1,8800

EUR

-1,05 %

-0,0200 EUR

Letzter Kurs 21.07.18 Tradegate

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +30,77 | |

| 0,5998 | +22,41 | |

| 575,00 | +21,05 | |

| 10,500 | +16,67 | |

| 48.400,00 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,100 | -10,76 | |

| 1,6000 | -13,53 | |

| 0,5100 | -13,56 | |

| 9,0900 | -17,36 | |

| 2,1400 | -45,41 |

was haltet ihr davon von den deal mit paramount gold

Beobachtet noch jemand diesen Wert. P/E 2013 4,3 ; 2014 0,8

Ja! Ein sehr interessanter Wert!

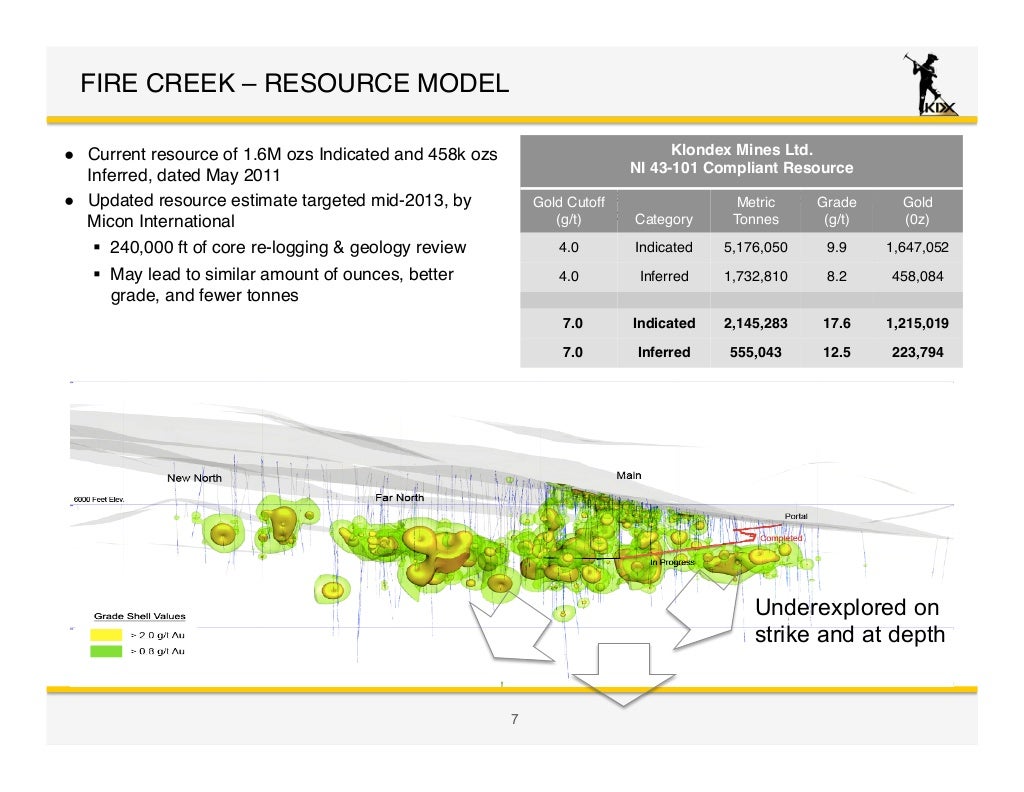

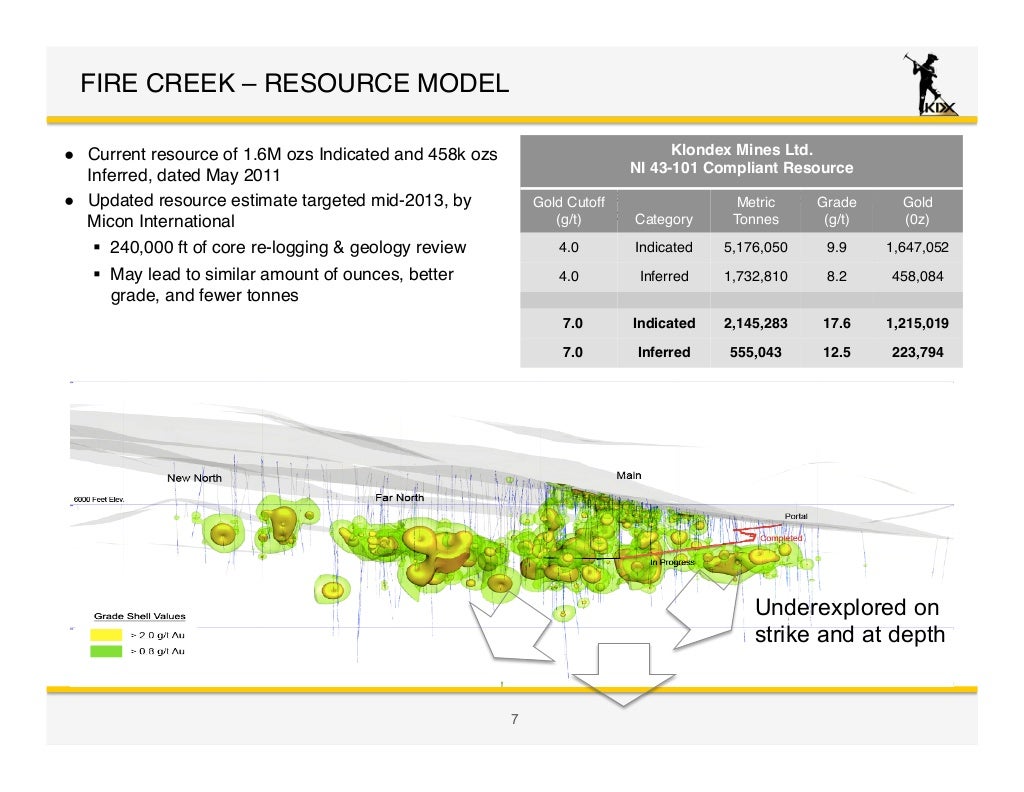

- Ressource ca. 3,5 Mio. Oz Au mit großem Erweiterungspotential!

- hohe Grade 8,2 - 17,6 g/t (Durchschnitt ca. 13-14 g/t)

- Marktkapitalisierung ca. 80 Mio. EUR (46,4 Mio. Aktien á 1,75 EUR)

- 11208 Acre Fläche (ca. 45 km²) in Nevada

- Potential for cash generation starting mid 2012

Neue Präsentation vom Febr. 2012

http://184.173.221.26/~klondex/images/pdf/KDX%20Merriman%202…

- Ressource ca. 3,5 Mio. Oz Au mit großem Erweiterungspotential!

- hohe Grade 8,2 - 17,6 g/t (Durchschnitt ca. 13-14 g/t)

- Marktkapitalisierung ca. 80 Mio. EUR (46,4 Mio. Aktien á 1,75 EUR)

- 11208 Acre Fläche (ca. 45 km²) in Nevada

- Potential for cash generation starting mid 2012

Neue Präsentation vom Febr. 2012

http://184.173.221.26/~klondex/images/pdf/KDX%20Merriman%202…

--bookmark---

http://www.stockhouse.com/financialtools/sn_newsreleases.asp…

Glenn Pountney announces acquisition of common shares of Klondex Mines Ltd.

AURORA,ON, July 31, 2012 /CNW/ - Glenn Pountney announced today that he has purchased 322,200 common shares ("Common Shares") of Klondex Mines Ltd. ("Klondex"). The Common Shares acquired and now held by Mr. Pountney will represent 10.6% of the outstanding Common Shares upon closing of the offering.

The Common Shares are being acquired, without any joint actors, for investment purposes and Mr. Pountney may increase or decrease his investment in Klondex depending on market conditions or any other relevant factors

Jul 31/12 Jul 31/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 44,700 $1.16

Jul 30/12 Jul 30/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 322,200 $1.16

http://canadianinsider.com/node/7?ticker=KDX

Glenn Pountney announces acquisition of common shares of Klondex Mines Ltd.

AURORA,ON, July 31, 2012 /CNW/ - Glenn Pountney announced today that he has purchased 322,200 common shares ("Common Shares") of Klondex Mines Ltd. ("Klondex"). The Common Shares acquired and now held by Mr. Pountney will represent 10.6% of the outstanding Common Shares upon closing of the offering.

The Common Shares are being acquired, without any joint actors, for investment purposes and Mr. Pountney may increase or decrease his investment in Klondex depending on market conditions or any other relevant factors

Jul 31/12 Jul 31/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 44,700 $1.16

Jul 30/12 Jul 30/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 322,200 $1.16

http://canadianinsider.com/node/7?ticker=KDX

Top Institutional Holders

K2 & Associates ... 6.8M $11,921,315 +27% 14.4% Low

Pountney (Glenn) 5.0M $5,837,166 +20% 10.6% --

I.G. Investment ... 4.1M $7,974,987 +16% 8.7% Low

Solloway (William J) 3.6M $6,298,608 +14% 7.6% Low

U.S. Global ... 3.1M $6,762,484 +12% 6.5% Moderate

Sprott Asset ... 1.3M $2,885,696 +5% 2.8% Low

Lawrence Decter ... 400.0K $886,883 +2% 0.9% Moderate

Morgan Meighen & ... 350.0K $1,132,342 +1% 0.7% Low

BMO Asset ... 300.0K $586,626 +1% 0.6% Moderate

British Columbia ... 157.6K $562,161 +1% 0.3% Low

Die top 10 halten 53%

As of July 16, 2012, Klondex had approximately 47.0 million shares issued and outstanding and 59.1 million shares on a diluted basis.

K2 & Associates ... 6.8M $11,921,315 +27% 14.4% Low

Pountney (Glenn) 5.0M $5,837,166 +20% 10.6% --

I.G. Investment ... 4.1M $7,974,987 +16% 8.7% Low

Solloway (William J) 3.6M $6,298,608 +14% 7.6% Low

U.S. Global ... 3.1M $6,762,484 +12% 6.5% Moderate

Sprott Asset ... 1.3M $2,885,696 +5% 2.8% Low

Lawrence Decter ... 400.0K $886,883 +2% 0.9% Moderate

Morgan Meighen & ... 350.0K $1,132,342 +1% 0.7% Low

BMO Asset ... 300.0K $586,626 +1% 0.6% Moderate

British Columbia ... 157.6K $562,161 +1% 0.3% Low

Die top 10 halten 53%

As of July 16, 2012, Klondex had approximately 47.0 million shares issued and outstanding and 59.1 million shares on a diluted basis.

http://canadianinsider.com/node/7?ticker=KDX

Aug 8/12 Aug 8/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 10,000 $1.18

Aug 8/12 Aug 8/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 60,000 $1.20

Aug 7/12 Aug 7/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 5,000 $1.20

Aug 7/12 Aug 7/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 5,000 $1.22

Aug 3/12 Aug 3/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 10,000 $1.25

Aug 3/12 Aug 3/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 100 $1.23

Aug 3/12 Aug 2/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 75,000 $1.23

Aug 1/12 Aug 1/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 3,700 $1.20

KK

Aug 16/12 Aug 16/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 200,000 $1.19

Aug 16/12 Aug 16/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 25,000 $1.20

Aug 16/12 Aug 16/12 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $1.19

Aug 16/12 Aug 15/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 20,000 $1.20

Aug 16/12 Aug 15/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 5,000 $1.18

Aug 16/12 Aug 15/12 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 27,000 $1.20

Aug 14/12 Aug 14/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 83,000 $1.16

Aug 14/12 Aug 14/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 1,000 $1.15

Zitat von SEPP_EIXLBERGER:

Aug 16/12 Aug 16/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 200,000 $1.19

Aug 16/12 Aug 16/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 25,000 $1.20

Aug 16/12 Aug 16/12 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $1.19

Aug 16/12 Aug 15/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 20,000 $1.20

Aug 16/12 Aug 15/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 5,000 $1.18

Aug 16/12 Aug 15/12 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 27,000 $1.20

Aug 14/12 Aug 14/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 83,000 $1.16

Aug 14/12 Aug 14/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 1,000 $1.15

Aug 20/12 Aug 20/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 2,000 $1.18

Aug 19/12 Aug 17/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 27,800 $1.19

Aug 19/12 Aug 17/12 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 15,000 $1.20

Eigentlich müsste der Q 2 Bericht inzwischen vorliegen??

Klondex Drills 2,910 g/t (85 oz/ton) Gold over 1.5 Meters at the Fire Creek, Nevada Project

http://finance.yahoo.com/news/klondex-drills-2-910-g-1332007…

http://finance.yahoo.com/news/klondex-drills-2-910-g-1332007…

Mar 21/13 Mar 21/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 50,000 $1.10

Mar 21/13 Mar 21/13 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 25,000 $1.10

Mar 21/13 Mar 21/13 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 42,600 $1.11

Mar 21/13 Mar 21/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 15,000 $1.11

Mar 21/13 Mar 20/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 35,000 $1.11

Mar 21/13 Mar 20/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 2,000 $1.10

Mar 17/13 Mar 15/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 117,500 $1.12

http://canadianinsider.com/node/7?ticker=KDX

Mar 21/13 Mar 21/13 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 25,000 $1.10

Mar 21/13 Mar 21/13 Pountney, Glenn Direct Ownership Common Shares 10 - Acquisition in the public market 42,600 $1.11

Mar 21/13 Mar 21/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 15,000 $1.11

Mar 21/13 Mar 20/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 35,000 $1.11

Mar 21/13 Mar 20/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 2,000 $1.10

Mar 17/13 Mar 15/13 Pountney, Glenn Indirect Ownership Common Shares 10 - Acquisition in the public market 117,500 $1.12

http://canadianinsider.com/node/7?ticker=KDX

Wichtige Nachricht von gestern:

Angesichts der hohen Grade ist der Preis für Transport und Milling in Höhe von 148 $ / Tonne ok:

KLONDEX MINES IS SUCCESSFUL IN ACHIEVING MAJOR MILESTONE FOR 2013

Finalizes Toll Milling Agreement with Veris Gold for Fire Creek Project

Vancouver, BC & Elko, NV– April 2, 2013– Klondex Mines Ltd. (TSX: KDX or OTCQX: KLNDF) (“Klondex”) today announces that it has entered into a toll milling agreement with Veris Gold Corp. ("Veris Gold") to process Klondex material from its Fire Creek project near Elko, Nevada.

Under the terms of the agreement, Veris Gold will accept for processing, delivery of the Fire Creek material to the Jerritt Canyon Mill, approximately 120 miles northeast of Fire Creek. Klondex will pay to Veris Gold the costs to mill and transport the mineralized material and a toll-milling fee with quarterly adjustments reflecting the change in contributing costs associated with processing of mineralized material. All precious metals milled pursuant to the agreement will be the property of Klondex. The total costs for shipping (transportation) and milling will be $148.50 per ton. Klondex will receive the recoveries achieved by Veris Gold’s circuit.

Mike Doolin, General Manager of the Fire Creek project stated, “I’m happy to report we continue to gain momentum in the development of the Fire Creek gold project towards a production decision via our bulk sampling program. Finalizing this milling agreement is another major step forward for us, and we are extremely pleased to be working with the team at Veris Gold.”

Paul Huet, Klondex Mines CEO commented, “The Nevada team delivers another important milestone for Klondex; the group has a reputation of consistently delivering and this is another great example. 2013 is a pivotal year for us as we continue to de-risk the Fire Creek asset. The excavation of the secondary egress, necessary to begin our bulk sampling, is now 20% complete and is on-track to be commissioned mid-June, 2013. Now, through this milling agreement with Veris Gold, we have a place to process mineralized material from Fire Creek. I have had the opportunity to work with this group at Veris Gold in the past and look forward to a continued relationship with such a professional team.”

Randy Reichert, Co-CEO and COO of Veris stated, “This second toll milling agreement adds to our third party ore processing revenue stream and provides an excellent additional source of ore as the Klondex team ramps up their mining operations into 2014. This agreement will further reduce our costs by making use of the excess capacity at the Jerritt Canyon Mill when we begin processing the Fire Creek ore in the third quarter of 2013. We look forward to working with yet another gold producing neighbour in Nevada.”

http://www.klondexmines.com/index.php/klondexnews/current/25…

Angesichts der hohen Grade ist der Preis für Transport und Milling in Höhe von 148 $ / Tonne ok:

KLONDEX MINES IS SUCCESSFUL IN ACHIEVING MAJOR MILESTONE FOR 2013

Finalizes Toll Milling Agreement with Veris Gold for Fire Creek Project

Vancouver, BC & Elko, NV– April 2, 2013– Klondex Mines Ltd. (TSX: KDX or OTCQX: KLNDF) (“Klondex”) today announces that it has entered into a toll milling agreement with Veris Gold Corp. ("Veris Gold") to process Klondex material from its Fire Creek project near Elko, Nevada.

Under the terms of the agreement, Veris Gold will accept for processing, delivery of the Fire Creek material to the Jerritt Canyon Mill, approximately 120 miles northeast of Fire Creek. Klondex will pay to Veris Gold the costs to mill and transport the mineralized material and a toll-milling fee with quarterly adjustments reflecting the change in contributing costs associated with processing of mineralized material. All precious metals milled pursuant to the agreement will be the property of Klondex. The total costs for shipping (transportation) and milling will be $148.50 per ton. Klondex will receive the recoveries achieved by Veris Gold’s circuit.

Mike Doolin, General Manager of the Fire Creek project stated, “I’m happy to report we continue to gain momentum in the development of the Fire Creek gold project towards a production decision via our bulk sampling program. Finalizing this milling agreement is another major step forward for us, and we are extremely pleased to be working with the team at Veris Gold.”

Paul Huet, Klondex Mines CEO commented, “The Nevada team delivers another important milestone for Klondex; the group has a reputation of consistently delivering and this is another great example. 2013 is a pivotal year for us as we continue to de-risk the Fire Creek asset. The excavation of the secondary egress, necessary to begin our bulk sampling, is now 20% complete and is on-track to be commissioned mid-June, 2013. Now, through this milling agreement with Veris Gold, we have a place to process mineralized material from Fire Creek. I have had the opportunity to work with this group at Veris Gold in the past and look forward to a continued relationship with such a professional team.”

Randy Reichert, Co-CEO and COO of Veris stated, “This second toll milling agreement adds to our third party ore processing revenue stream and provides an excellent additional source of ore as the Klondex team ramps up their mining operations into 2014. This agreement will further reduce our costs by making use of the excess capacity at the Jerritt Canyon Mill when we begin processing the Fire Creek ore in the third quarter of 2013. We look forward to working with yet another gold producing neighbour in Nevada.”

http://www.klondexmines.com/index.php/klondexnews/current/25…

Neue Bohrergebnisse - für Samples-Sammeln nicht schlecht:

Hole No. From(m) To(m) Length(m) From(m) To(m) Length(m) Grade(Au g/t) Grade

(Au opt)

FC-12-029U 157.7 170.7 13.0 517.4 560.2 42.8 16.6 0.48

Including 159.1 161.1 2.0 522.0 528.7 6.7 33.8 0.99

Including 162.2 163.2 1.1 532.0 535.5 3.5 17.3 0.50

Including 163.2 164.2 1.0 535.5 538.8 3.3 17.9 0.52

Including 168.6 169.8 1.1 553.3 557.0 3.7 11.8 0.34

Including 169.8 170.7 1.0 557.0 560.2 3.2 41.0 1.20

http://www.klondexmines.com/index.php/klondexnews/current/25…

Hole No. From(m) To(m) Length(m) From(m) To(m) Length(m) Grade(Au g/t) Grade

(Au opt)

FC-12-029U 157.7 170.7 13.0 517.4 560.2 42.8 16.6 0.48

Including 159.1 161.1 2.0 522.0 528.7 6.7 33.8 0.99

Including 162.2 163.2 1.1 532.0 535.5 3.5 17.3 0.50

Including 163.2 164.2 1.0 535.5 538.8 3.3 17.9 0.52

Including 168.6 169.8 1.1 553.3 557.0 3.7 11.8 0.34

Including 169.8 170.7 1.0 557.0 560.2 3.2 41.0 1.20

http://www.klondexmines.com/index.php/klondexnews/current/25…

News Releases

Facebook Tweet LinkedIn Google + Email

May 13, 2013

Klondex Discovers Visible Gold Mineralization

Vancouver & Elko, NV --May 13, 2013 -- Through additional exploration and metallurgical sampling, Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) is pleased to announce significant visible gold mineralization on the Joyce structure (Figures 1, 2 and 3) at the 5370 cross cut. As a result of the sampling, Klondex expects to have a better understanding of the structure character, widths, grades and metallurgy that will prepare the company to begin bulk sampling in Q3 2013. Assays from the south segment returned a fully-diluted grade of 137.1 g/t (4 opt) gold over 2.4 m (8 ft). Assays from the north segment are pending. Samples will be displayed at the Las Vegas MoneyShow May 14-16 at Booth #714.

Following the construction of the vent-raise egress, Klondex is targeting to extract approximately 10,000 tons of material in 2013 as part of to its bulk sampling program. Klondex's targets for 2014 and 2015under the bulk sampling permit will be provided upon completion of the updated mineral resource estimate, anticipated in June 2013.

The initial bulk sampling program is expected to begin between the 5370 and 5400 crosscuts in the Joyce and Vonnie structures where, in addition to the sampling results announced today substantial gold mineralization has been encountered by the two crosscuts, including (See press release of Klondex dated October 31, 2012):

• 496.6 g/t gold (14.5 oz/ton) over 1.8m (5.9 ft) in the 5370 cross cut

• 95.5 g/t gold (2.2 oz/ton) over 0.9m (2.9 ft) at the 5400 cross cut

• 43.5 g/t gold (1.3 oz/ton) over 1.5m (4.9 ft) at the 5400 cross cut

Paul Huet, Klondex President and CEO stated, "We're excited to be encountering visible gold mineralization from further exploration, especially as we're preparing to begin the bulk sample program in Q3. Fire Creek's gold mineralization will allow us to be flexible and reactive in today's volatile gold environment. This is an extremely important year for Klondex, as we finalize the resource model and mine plan, complete the vent-raise egress, construct the rapid infiltration basin and initiate bulk sampling from Fire Creek. Encountering this type of visible gold mineralization only adds to the excitement surrounding the Fire Creek project."

Assays were determined by ALS Minerals of Reno, Nevada and Inspectorate America Corporation of Sparks, Nevada, both independent analytical laboratories.

The content of this press release has been reviewed by Steven L. McMillin, CPG-11031 (American Inst. of Prof. Geol.), Chief Geologist for Klondex Mines Ltd., as a non-independent Qualified Person for the purposes of National Instrument 43-101.

About Klondex Mines Ltd. (www.klondexmines.com)

Klondex Mines is focused on the exploration and development of its Fire Creek gold deposit in North Central Nevada. Fire Creek is a compelling gold mining prospect located in a region of prolific gold production, near power, transportation, mining infrastructure and several milling facilities. As of April 29, 2013 Klondex had 64.4 million shares issued and outstanding and 85.7 million shares on a fully diluted basis.

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=584179#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=584179#sthas…

Facebook Tweet LinkedIn Google + Email

May 13, 2013

Klondex Discovers Visible Gold Mineralization

Vancouver & Elko, NV --May 13, 2013 -- Through additional exploration and metallurgical sampling, Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) is pleased to announce significant visible gold mineralization on the Joyce structure (Figures 1, 2 and 3) at the 5370 cross cut. As a result of the sampling, Klondex expects to have a better understanding of the structure character, widths, grades and metallurgy that will prepare the company to begin bulk sampling in Q3 2013. Assays from the south segment returned a fully-diluted grade of 137.1 g/t (4 opt) gold over 2.4 m (8 ft). Assays from the north segment are pending. Samples will be displayed at the Las Vegas MoneyShow May 14-16 at Booth #714.

Following the construction of the vent-raise egress, Klondex is targeting to extract approximately 10,000 tons of material in 2013 as part of to its bulk sampling program. Klondex's targets for 2014 and 2015under the bulk sampling permit will be provided upon completion of the updated mineral resource estimate, anticipated in June 2013.

The initial bulk sampling program is expected to begin between the 5370 and 5400 crosscuts in the Joyce and Vonnie structures where, in addition to the sampling results announced today substantial gold mineralization has been encountered by the two crosscuts, including (See press release of Klondex dated October 31, 2012):

• 496.6 g/t gold (14.5 oz/ton) over 1.8m (5.9 ft) in the 5370 cross cut

• 95.5 g/t gold (2.2 oz/ton) over 0.9m (2.9 ft) at the 5400 cross cut

• 43.5 g/t gold (1.3 oz/ton) over 1.5m (4.9 ft) at the 5400 cross cut

Paul Huet, Klondex President and CEO stated, "We're excited to be encountering visible gold mineralization from further exploration, especially as we're preparing to begin the bulk sample program in Q3. Fire Creek's gold mineralization will allow us to be flexible and reactive in today's volatile gold environment. This is an extremely important year for Klondex, as we finalize the resource model and mine plan, complete the vent-raise egress, construct the rapid infiltration basin and initiate bulk sampling from Fire Creek. Encountering this type of visible gold mineralization only adds to the excitement surrounding the Fire Creek project."

Assays were determined by ALS Minerals of Reno, Nevada and Inspectorate America Corporation of Sparks, Nevada, both independent analytical laboratories.

The content of this press release has been reviewed by Steven L. McMillin, CPG-11031 (American Inst. of Prof. Geol.), Chief Geologist for Klondex Mines Ltd., as a non-independent Qualified Person for the purposes of National Instrument 43-101.

About Klondex Mines Ltd. (www.klondexmines.com)

Klondex Mines is focused on the exploration and development of its Fire Creek gold deposit in North Central Nevada. Fire Creek is a compelling gold mining prospect located in a region of prolific gold production, near power, transportation, mining infrastructure and several milling facilities. As of April 29, 2013 Klondex had 64.4 million shares issued and outstanding and 85.7 million shares on a fully diluted basis.

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=584179#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=584179#sthas…

hab mir eben mal das MD&A vom 10. Mai angesehen.

-> http://www.sedar.com

Einige Auszüge bzw. einige Fakten zusammengefasst (für Details bitte selbst ins MD&A schauen). (Markierung von mir):

[...]

The Company’s objective is to advance

the Fire Creek Project through to production in the first quarter of 2015.

[...]

6. On April 2, 2013, the Company announced that it entered into a toll milling agreement with Veris Gold Corp. to process the Company’s material from its Fire Creek project.

7. On May 1, 2013, the Company announced the completion of the drill core re-logging program, approximately 5 weeks ahead of schedule.

[...]

1. The completion of the core re-logging program, in connection with the resource estimate will be used to develop a comprehensive mine plan followed by a Preliminary Economic Assessment (PEA) that the Company proposes to complete in 2013 for the Fire Creek Project.

2. In April 2013, the Company engaged Micon International Ltd. to provide independent evaluation for mineral resource estimate for the Fire Creek Project. An updated resource model is expected in the second quarter of 2013. The resource estimate will include 36,939 meters (120,175 feet) of

infill core drilling from both surface and underground [...]

5. Archaeological surveys and studies were undertaken by the Company on the proposed power line route at the Fire Creek Project. A decision on the final route is expected in the second quarter of 2013, immediately followed by construction.

[...]

7. The Fire Creek 2013 underground drill program is underway primarily focusing on the Main Zone mineralization between the 5370 and 5400 crosscuts.

[...]

Construction of the vent raise is expected to be complete in time for the Fire Creek project to mine, process and recover 8,000 Au ounces in 2013

[...]

During the three months ended March 31, 2013, the Company reported Fire Creek expenditures of $4,963,937 (total current expenditures less borrowing costs and depreciation)[...]

Management salaries and fees increased by $34,042. The Company incurred salaries, bonuses and directors fees of $303,208 to current directors and officers and $269,166 to former directors and officers for the three months ended March 31, 2012.

[...]

As at March 31, 2013, the Company had working capital of $2,274,928 (December 31, 2012 – working capital of $2,808,806).

Shares (fully diluted): 85.7M

MK (fully diluted, bei einem Kurs von 1.09CAD): 93.4M$

Täuscht es, oder lassen es sich die Direktoren gut gehen?

Denn wenn ich es richtig überflogen habe, dann wurden auch einige Insentive Stocks ausgegeben.

Für 1,65MOz (bei einem Cut-Off von 4g/t) indicated und 0.46MOz inferred finde ich die MK relativ hoch.

D.h. ich möchte hier erstmal das Ressourcen Update sehen und am Besten auch die PEA...

Oder wie seht ihr das?

-> http://www.sedar.com

Einige Auszüge bzw. einige Fakten zusammengefasst (für Details bitte selbst ins MD&A schauen). (Markierung von mir):

[...]

The Company’s objective is to advance

the Fire Creek Project through to production in the first quarter of 2015.

[...]

6. On April 2, 2013, the Company announced that it entered into a toll milling agreement with Veris Gold Corp. to process the Company’s material from its Fire Creek project.

7. On May 1, 2013, the Company announced the completion of the drill core re-logging program, approximately 5 weeks ahead of schedule.

[...]

1. The completion of the core re-logging program, in connection with the resource estimate will be used to develop a comprehensive mine plan followed by a Preliminary Economic Assessment (PEA) that the Company proposes to complete in 2013 for the Fire Creek Project.

2. In April 2013, the Company engaged Micon International Ltd. to provide independent evaluation for mineral resource estimate for the Fire Creek Project. An updated resource model is expected in the second quarter of 2013. The resource estimate will include 36,939 meters (120,175 feet) of

infill core drilling from both surface and underground [...]

5. Archaeological surveys and studies were undertaken by the Company on the proposed power line route at the Fire Creek Project. A decision on the final route is expected in the second quarter of 2013, immediately followed by construction.

[...]

7. The Fire Creek 2013 underground drill program is underway primarily focusing on the Main Zone mineralization between the 5370 and 5400 crosscuts.

[...]

Construction of the vent raise is expected to be complete in time for the Fire Creek project to mine, process and recover 8,000 Au ounces in 2013

[...]

During the three months ended March 31, 2013, the Company reported Fire Creek expenditures of $4,963,937 (total current expenditures less borrowing costs and depreciation)[...]

Management salaries and fees increased by $34,042. The Company incurred salaries, bonuses and directors fees of $303,208 to current directors and officers and $269,166 to former directors and officers for the three months ended March 31, 2012.

[...]

As at March 31, 2013, the Company had working capital of $2,274,928 (December 31, 2012 – working capital of $2,808,806).

Shares (fully diluted): 85.7M

MK (fully diluted, bei einem Kurs von 1.09CAD): 93.4M$

Täuscht es, oder lassen es sich die Direktoren gut gehen?

Denn wenn ich es richtig überflogen habe, dann wurden auch einige Insentive Stocks ausgegeben.

Für 1,65MOz (bei einem Cut-Off von 4g/t) indicated und 0.46MOz inferred finde ich die MK relativ hoch.

D.h. ich möchte hier erstmal das Ressourcen Update sehen und am Besten auch die PEA...

Oder wie seht ihr das?

Für 1,65MOz (bei einem Cut-Off von 4g/t) indicated und 0.46MOz inferred finde ich die MK relativ hoch.

Hallo,

ich bin der Meinung, dass sie im Schnitt deutlich mehr als die Cutoff von 4g/t fördern werden.

Ich hoffe, 8-10 g/t sind drin, denn es werden Samples gebuddelt.

4 g/t braucht man, um die Kosten zu decken.

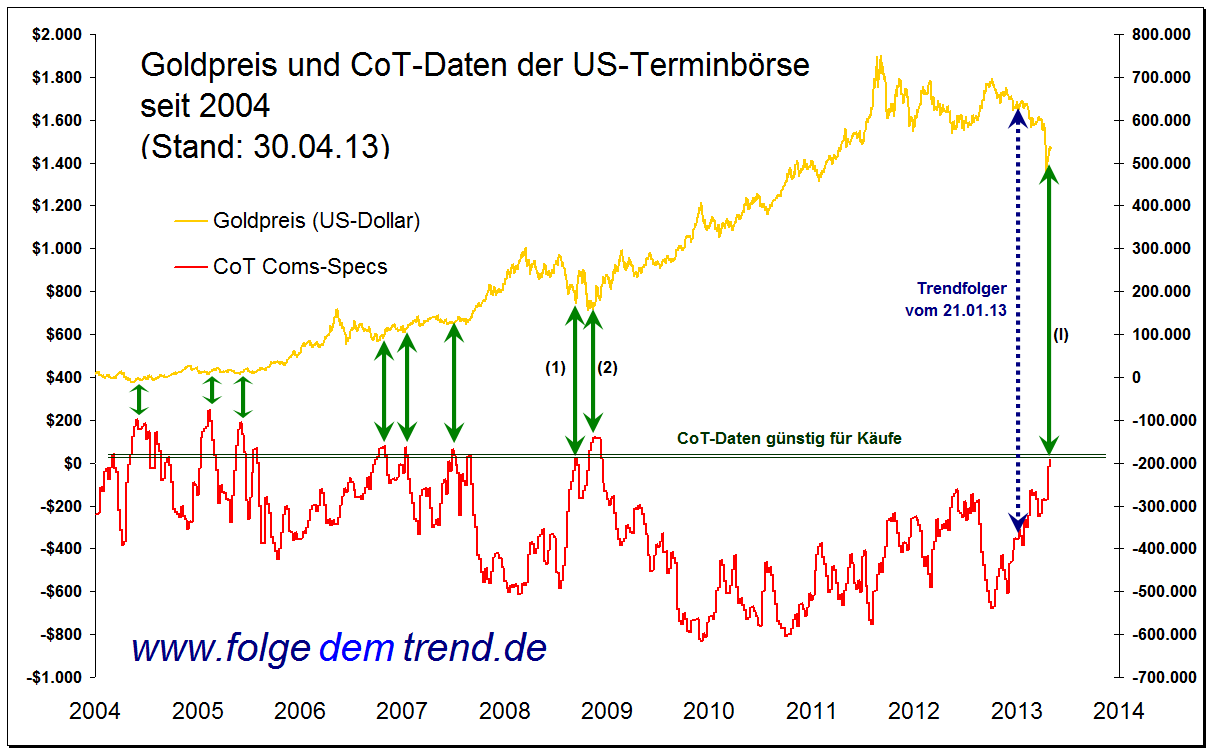

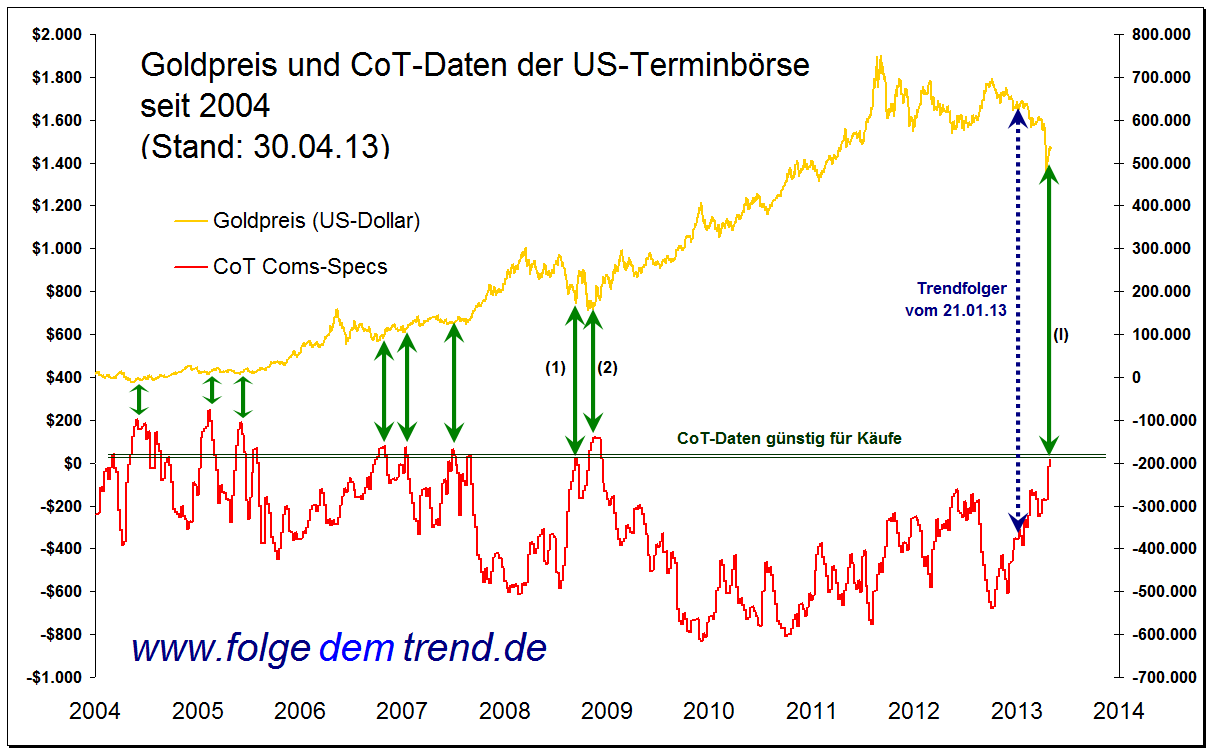

Bei the way, hier noch ein Interessanter Chart:

http://www.goldseitenblog.com/daniel_haase/index.php/2013/05…

Hallo,

ich bin der Meinung, dass sie im Schnitt deutlich mehr als die Cutoff von 4g/t fördern werden.

Ich hoffe, 8-10 g/t sind drin, denn es werden Samples gebuddelt.

4 g/t braucht man, um die Kosten zu decken.

Bei the way, hier noch ein Interessanter Chart:

http://www.goldseitenblog.com/daniel_haase/index.php/2013/05…

News

June 12, 2013

Klondex Mines Reports on May Metallurgical Sampling

Elko, NV & Vancouver, BC -- June 12, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) a Nevada gold exploration and development company, today reported the metallurgical sampling program yielded 682 tons of mineralized material at an average grade of 73.8 g/t (2.15 opt) Au during the month of May (see May 13, 2013 news release). Metallurgical sampling is expected to continue monthly through the remainder of 2013 to gain a better understanding of the mineralogy and metallurgy of the Type II mineralization that hosts the Joyce and Vonnie structures. Assays were performed by SGS of Elko, Nevada, under the supervision of Klondex staff.

Current sampling is within a high-grade zone of the Joyce structure, and as a result, Klondex will ship the material collected in May for direct smelting rather than processing it through a conventional milling facility. The company will begin shipping to Jerritt Canyon later this year, as planned.

Klondex is in the process of finalizing terms with a third party for the direct smelting of the high-grade material from the Joyce Structure. Shipment of the first lot is expected before the end of June.

Paul Huet, President and CEO stated, "This is a pivotal year for Klondex as we transition from an exploration and development company into initial production via bulk sampling. Any cash flow received from metallurgical and bulk sampling will be used for future development and core drilling as we continue to expand our understanding of the deposit. With excellent dilution management and geological controls, the grades from exploration sampling in the 5370 crosscut are exceeding our expectations.

Mr. Huet added, "The vent raise access is progressing well. The top access is complete and the bottom drift is in place. We are putting in a grout curtain to complete the secondary egress and the hoist has been received onsite. The raise is expected to be completed in the third quarter of 2013, after which, we intend to move into our bulk sample program."

The technical information contained in this press release has been approved by Steven L. McMillin, CPG-11031 (American Inst. of Prof. Geol.), Chief Geologist for Klondex Mines Ltd., as a non-independent Qualified Person for the purposes of National Instrument 43-101.

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=588193#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=588193#sthas…

Neue Präsentation vom 01.06.2013

http://www.klondexmines.com/i/pdf/ppt/KDX%200613.pdf

June 12, 2013

Klondex Mines Reports on May Metallurgical Sampling

Elko, NV & Vancouver, BC -- June 12, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) a Nevada gold exploration and development company, today reported the metallurgical sampling program yielded 682 tons of mineralized material at an average grade of 73.8 g/t (2.15 opt) Au during the month of May (see May 13, 2013 news release). Metallurgical sampling is expected to continue monthly through the remainder of 2013 to gain a better understanding of the mineralogy and metallurgy of the Type II mineralization that hosts the Joyce and Vonnie structures. Assays were performed by SGS of Elko, Nevada, under the supervision of Klondex staff.

Current sampling is within a high-grade zone of the Joyce structure, and as a result, Klondex will ship the material collected in May for direct smelting rather than processing it through a conventional milling facility. The company will begin shipping to Jerritt Canyon later this year, as planned.

Klondex is in the process of finalizing terms with a third party for the direct smelting of the high-grade material from the Joyce Structure. Shipment of the first lot is expected before the end of June.

Paul Huet, President and CEO stated, "This is a pivotal year for Klondex as we transition from an exploration and development company into initial production via bulk sampling. Any cash flow received from metallurgical and bulk sampling will be used for future development and core drilling as we continue to expand our understanding of the deposit. With excellent dilution management and geological controls, the grades from exploration sampling in the 5370 crosscut are exceeding our expectations.

Mr. Huet added, "The vent raise access is progressing well. The top access is complete and the bottom drift is in place. We are putting in a grout curtain to complete the secondary egress and the hoist has been received onsite. The raise is expected to be completed in the third quarter of 2013, after which, we intend to move into our bulk sample program."

The technical information contained in this press release has been approved by Steven L. McMillin, CPG-11031 (American Inst. of Prof. Geol.), Chief Geologist for Klondex Mines Ltd., as a non-independent Qualified Person for the purposes of National Instrument 43-101.

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=588193#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=588193#sthas…

Neue Präsentation vom 01.06.2013

http://www.klondexmines.com/i/pdf/ppt/KDX%200613.pdf

Klondex Intercepts 767.0 g/t (22.4 opt) Gold Over 0.6m (1.9ft) in Joyce Vein and Encounters a New Mineralized Structure

http://finance.yahoo.com/news/klondex-intercepts-767-0-g-122…

Hallo,

gute Bohrergebnisse. Zwar sind die Adern nicht besonders dick aber für Samples hervorragend.

Bei dem Bohrloch FC12-029U jedoch kann man sich über die Dicke der Adern überhaupt nicht beklagen:

Drill station 1 (Figure 3): Seven east-directed holes have been completed, and logging is in progress with assays pending. Drilling from station 1 east of the ramp is testing the extension and continuity of mineralization of the Vonnie and Joyce veins in the 5400 cross cut to the north, and in drill hole FC12-029U, 16.6 g/t (0.48 opt) Au over 13.0m (42.8ft) to the southwest (see April 9, 2013 news release).

gute Bohrergebnisse. Zwar sind die Adern nicht besonders dick aber für Samples hervorragend.

Bei dem Bohrloch FC12-029U jedoch kann man sich über die Dicke der Adern überhaupt nicht beklagen:

Drill station 1 (Figure 3): Seven east-directed holes have been completed, and logging is in progress with assays pending. Drilling from station 1 east of the ramp is testing the extension and continuity of mineralization of the Vonnie and Joyce veins in the 5400 cross cut to the north, and in drill hole FC12-029U, 16.6 g/t (0.48 opt) Au over 13.0m (42.8ft) to the southwest (see April 9, 2013 news release).

June 27, 2013

Klondex Samples 22,396 gpt (653 opt)

Gold over 0.15m (0.5ft) on the Vonnie Structure at Fire Creek in Nevada

Gold over 0.15m (0.5ft) on the Vonnie Structure at Fire Creek in Nevada

Elko, NV & Vancouver, BC -- June 27, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) ("Klondex" or the "Company") is pleased to announce the results of additional exploration drifting and metallurgical sampling on the Vonnie vein at its Fire Creek gold project in Nevada. Highlights of the channel sampling results (Figures 1 and 2 ) include assays of 20,231 g/t (590 opt) Au, 15,891 g/t (463 opt) Au at 69ft and 22,396g/t (653 opt) Au, 63ft, 69ft and 74ft north of the 5400 cross cut, respectively. The complete set of results of channel sample assays is set out in Table 1 below.

The high-grade gold mineralization was encountered while following-up on a surface drill intercept from FC-12-11S that returned 2,910 g/t Au (85 opt Au) over 1.5m (4.8ft) as announced on September 24, 2012. As a part of the exploration and sampling program, Klondex is assaying the Vonnie vein after each exploration round.

Vollständige Tabelle mit diesen für Samples hervorragenden Resultaten unter:

http://www.klondexmines.com/s/news.asp?ReportID=590202#sthas…

Klondex Samples 22,396 gpt (653 opt)

Gold over 0.15m (0.5ft) on the Vonnie Structure at Fire Creek in Nevada

Gold over 0.15m (0.5ft) on the Vonnie Structure at Fire Creek in NevadaElko, NV & Vancouver, BC -- June 27, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) ("Klondex" or the "Company") is pleased to announce the results of additional exploration drifting and metallurgical sampling on the Vonnie vein at its Fire Creek gold project in Nevada. Highlights of the channel sampling results (Figures 1 and 2 ) include assays of 20,231 g/t (590 opt) Au, 15,891 g/t (463 opt) Au at 69ft and 22,396g/t (653 opt) Au, 63ft, 69ft and 74ft north of the 5400 cross cut, respectively. The complete set of results of channel sample assays is set out in Table 1 below.

The high-grade gold mineralization was encountered while following-up on a surface drill intercept from FC-12-11S that returned 2,910 g/t Au (85 opt Au) over 1.5m (4.8ft) as announced on September 24, 2012. As a part of the exploration and sampling program, Klondex is assaying the Vonnie vein after each exploration round.

Vollständige Tabelle mit diesen für Samples hervorragenden Resultaten unter:

http://www.klondexmines.com/s/news.asp?ReportID=590202#sthas…

July 10, 2013

Klondex Sampling Averages 132.8 g/t (3.87 opt) Au over Strike Length of 144.2m (473ft); Demonstrates Joyce Structure Continuity by Exploration Development

Sampling Highlights:

30,228.7 g/t (881.7 opt) Au over 0.2m (0.7ft) 106' South of 5400 crosscut

632.8 g/t (18.5 opt) Au over 0.5m (1.6ft) 135' North of 5370 cross cut

Elko, NV & Vancouver, BC - July 10, 2013 -Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) is pleased to announce results from its ongoing 2013 exploration and development program on the Joyce (A1) structure at its Fire Creek project, located in Nevada. The weighted average grade of samples from the Joyce structure is 132.8 g/t (3.87 opt) Au along 144.2 m (473 ft) strike, with an average width of 0.6m (2.0ft). This information was derived from 94 face samples ranging from 1.4 g/t (0.04 opt) Au to 30,228.7 g/t (881.6 opt) Au. Joyce channel samples taken from north and south of the 5370 and the 5400 crosscuts are summarized and detailed in tables 1 and 2, respectively.

To date, 144.2m (473 ft) of exploration development is now complete on the Joyce Structure. Previous drilling near the 5400 and 5370 cross cuts demonstrate that the mineralization extends beyond the current boundaries, both along strike and at depth.

Mike Doolin, Fire Creek General Manager commented, "We are obviously very pleased with the results and the valuable perspective the data provides. Not only do these results confirm the continuity of the mineralization along strike, but they also demonstrate the overall grade consistency within the Joyce Structure."

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=591565#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=591565#sthas…

Klondex Sampling Averages 132.8 g/t (3.87 opt) Au over Strike Length of 144.2m (473ft); Demonstrates Joyce Structure Continuity by Exploration Development

Sampling Highlights:

30,228.7 g/t (881.7 opt) Au over 0.2m (0.7ft) 106' South of 5400 crosscut

632.8 g/t (18.5 opt) Au over 0.5m (1.6ft) 135' North of 5370 cross cut

Elko, NV & Vancouver, BC - July 10, 2013 -Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF) is pleased to announce results from its ongoing 2013 exploration and development program on the Joyce (A1) structure at its Fire Creek project, located in Nevada. The weighted average grade of samples from the Joyce structure is 132.8 g/t (3.87 opt) Au along 144.2 m (473 ft) strike, with an average width of 0.6m (2.0ft). This information was derived from 94 face samples ranging from 1.4 g/t (0.04 opt) Au to 30,228.7 g/t (881.6 opt) Au. Joyce channel samples taken from north and south of the 5370 and the 5400 crosscuts are summarized and detailed in tables 1 and 2, respectively.

To date, 144.2m (473 ft) of exploration development is now complete on the Joyce Structure. Previous drilling near the 5400 and 5370 cross cuts demonstrate that the mineralization extends beyond the current boundaries, both along strike and at depth.

Mike Doolin, Fire Creek General Manager commented, "We are obviously very pleased with the results and the valuable perspective the data provides. Not only do these results confirm the continuity of the mineralization along strike, but they also demonstrate the overall grade consistency within the Joyce Structure."

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=591565#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=591565#sthas…

Klondex Mines Yields 1,435 Tons of 119.8 g/t (3.49 opt) Gold in June Underground Development Program

http://finance.yahoo.com/news/klondex-mines-yields-1-435-100…

[...]June's 1,435 tons are in addition to 682 tons in May, for a total of 2,117 tons that will be shipped to Newmont for processing; initial payments are expected in August (see July 25, 2013 press release). July activities are expected to be more in line with May's development, resulting from the areas of the project being developed.[...]

Hallo,

es geht mal nicht um Bohrergebnisse.

SONDERN

am 29.Nov. werden

5.894.784 Warrents fällig

Allerdings Preis 2.50 und 3.50

kriegt man die Aktie noch so hoch?

oder werden die Warrents im Preis verwässert.?

es geht mal nicht um Bohrergebnisse.

SONDERN

am 29.Nov. werden

5.894.784 Warrents fällig

Allerdings Preis 2.50 und 3.50

kriegt man die Aktie noch so hoch?

oder werden die Warrents im Preis verwässert.?

Aber natürlich geht es in erster Linie darum, was (wieviel, wo etc) da im Boden steckt! Das ist essenziell!

Und jetzt: Was bringen die 2100 t wirklich, wieviel Au-Gehalt kommt tatsächlich raus

Bin vorsichtig optimistisch ...

Und jetzt: Was bringen die 2100 t wirklich, wieviel Au-Gehalt kommt tatsächlich raus

Bin vorsichtig optimistisch ...

Klondex Mines Underground Development Yields 1,465 Tons of 32.7 g/t (0.95 opt) Gold in July

http://finance.yahoo.com/news/klondex-mines-underground-deve…

ELKO, NV and VANCOUVER, BC--(Marketwired - Sep 12, 2013) - Klondex Mines Ltd. (TSX: KDX) (OTCQX: KLNDF), a Nevada gold exploration and development company, today reported that its underground development program, targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project, yielded 1,329 tonnes (1,465 tons) of mineralized material in July at an average grade of 32.7 g/t (0.95 opt) gold. Underground development at the Fire Creek project over the last three months has yielded 3,249 tonnes (3,582 tons) of mineralized material averaging 75.4 g/t (2.20 opt) Au.

Klondex continued to develop on the Joyce (5370N and 5400S) structure and on the Vonnie (5370N and 5400S) structure during July. A total of 240 samples were taken from these work areas and submitted for assay during July. Gold grades ranged from 0.2 g/t Au to 400 g/t Au (0.005 opt Au to 11.690 opt Au) over a vein width ranging from of 0.1 m to 0.7 m (0.2 ft to 2.4 ft).[...]

2013-09-16 08:04 ET - Halt Trading

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:KDX-2105788…

Gruß

reini81

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:KDX-2105788…

Gruß

reini81

Es werden wahrscheinlich Ergebnisse (Au-Grade) aus den ersten 2100 t gemeldet.

Bis sehr gespannt - und zuversichtlich

- und zuversichtlich .... verhaltend optimistisch

.... verhaltend optimistisch

Bis sehr gespannt

- und zuversichtlich

- und zuversichtlich .... verhaltend optimistisch

.... verhaltend optimistisch

Antwort auf Beitrag Nr.: 45.460.877 von Modus-Berlin am 16.09.13 21:47:25Klondex Mines' Updated Mineral Resource Estimate Verifies Continuity and High Grades at Fire Creek

http://finance.yahoo.com/news/klondex-mines-updated-mineral-…

[...]The new resource estimate consists of Measured and Indicated resources totaling 295,900 ounces of gold at 44.7 g/t (1.304 opt) Au and Inferred resources of 421,400 ounces of gold at 19.2 g/t (0.560 opt) Au at Fire Creek, applying a 7 g/t Au cut off (see Table 1 below). [...]

___________________________________

langsam mache ich mir Sorgen, dass das Gap bei 0.97CAD nicht mehr geschlossen wird. Wäre evtl. ein netter Einstiegszeitpunkt gewesen...

http://finance.yahoo.com/news/klondex-mines-updated-mineral-…

[...]The new resource estimate consists of Measured and Indicated resources totaling 295,900 ounces of gold at 44.7 g/t (1.304 opt) Au and Inferred resources of 421,400 ounces of gold at 19.2 g/t (0.560 opt) Au at Fire Creek, applying a 7 g/t Au cut off (see Table 1 below). [...]

___________________________________

langsam mache ich mir Sorgen, dass das Gap bei 0.97CAD nicht mehr geschlossen wird. Wäre evtl. ein netter Einstiegszeitpunkt gewesen...

Zitat von Kongo-Otto:

langsam mache ich mir Sorgen, dass das Gap bei 0.97CAD nicht mehr geschlossen wird. Wäre evtl. ein netter Einstiegszeitpunkt gewesen...

Da müssten schon extrem schlechte Meldungen kommen - sowohl bei Klondex, als auch bei Gold.

Bei Klondex bin ich vorsichtig optimistisch, dass die Grade aus den gelieferten 2100 t den Vorgaben ungefähr entsprechen.

Beim Gold spricht nun einiges dafür, dass die Aufwärtsbewegung bevorsteht - siehe hier den angeschlagenen US-Dollar-Chart und den GDX-Index:

News Releases

Facebook Tweet LinkedIn Google + Email

September 30, 2013

Klondex Mines Provides August Update on Fire Creek Project; Ships Lot #2 to Newmont

Reno, NV & Vancouver, BC -- September 30, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF), a Nevada gold exploration and development company, today provides an update on its toll milling and underground development programs, as well as the results of the metallurgical test-work from its Fire Creek Project in Lander County, Nevada.

Toll Milling

Toll milling of Fire Creek's Lot #1 is complete (see press release dated September 23, 2013). Final receivables for Lot #1 totaled $1,967,176, sold at an average gold spot price of US $1,332/oz. Processing of Lot #1 included 1,055 dry tonnes (1,165 dry tons) at an average head grade of 50.7 g/t (1.48 opt) Au.

Toll milling of Lot #2, comprised of 1,812 tonnes (2,000 tons), started on September 18, 2013.

Paul Huet, Klondex President and CEO stated, "Continuing to toll mill and treat our second lot of material from the Fire Creek project is an important step moving forward. We are very fortunate to have multiple options (Newmont and Veris agreements) in place to treat the Fire Creek material. Through toll milling, we are able to better understand the metallurgical characteristics of the Fire Creek material, and the proceeds can be applied towards future exploration and development."

Underground Development

Over the past four months, Klondex's underground development program targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project has yielded 4,375 tonnes (4,824 tons) of mineralized material averaging 63.7 g/t (1.86 opt) Au. Development on the Joyce (5370N and 5400S) structure in August consisted of 192 samples taken and submitted for assay. Gold grades ranged from 0.2 g/t Au to 486 g/t Au (0.005 opt Au to 14.172 opt Au) over a vein width ranging from of 0.1 m to 1.3 m (0.2 ft to 3.5 ft). For May -- July development results please see press releases dated June 13, 2013, July 29, 2013 and September 12, 2013.

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=605844#sthas…

Underground Development

Over the past four months, Klondex's underground development program targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project has yielded 4,375 tonnes (4,824 tons) of mineralized material averaging 63.7 g/t (1.86 opt) Au. Development on the Joyce (5370N and 5400S) structure in August consisted of 192 samples taken and submitted for assay. Gold grades ranged from 0.2 g/t Au to 486 g/t Au (0.005 opt Au to 14.172 opt Au) over a vein width ranging from of 0.1 m to 1.3 m (0.2 ft to 3.5 ft). For May -- July development results please see press releases dated June 13, 2013, July 29, 2013 and September 12, 2013.

http://www.klondexmines.com/s/news.asp?ReportID=605844#sthas…" target="_blank" rel="nofollow ugc noopener">News Releases

Facebook Tweet LinkedIn Google + Email

September 30, 2013

Klondex Mines Provides August Update on Fire Creek Project; Ships Lot #2 to Newmont

Reno, NV & Vancouver, BC -- September 30, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF), a Nevada gold exploration and development company, today provides an update on its toll milling and underground development programs, as well as the results of the metallurgical test-work from its Fire Creek Project in Lander County, Nevada.

Toll Milling

Toll milling of Fire Creek's Lot #1 is complete (see press release dated September 23, 2013). Final receivables for Lot #1 totaled $1,967,176, sold at an average gold spot price of US $1,332/oz. Processing of Lot #1 included 1,055 dry tonnes (1,165 dry tons) at an average head grade of 50.7 g/t (1.48 opt) Au.

Toll milling of Lot #2, comprised of 1,812 tonnes (2,000 tons), started on September 18, 2013.

Paul Huet, Klondex President and CEO stated, "Continuing to toll mill and treat our second lot of material from the Fire Creek project is an important step moving forward. We are very fortunate to have multiple options (Newmont and Veris agreements) in place to treat the Fire Creek material. Through toll milling, we are able to better understand the metallurgical characteristics of the Fire Creek material, and the proceeds can be applied towards future exploration and development."

Underground Development

Over the past four months, Klondex's underground development program targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project has yielded 4,375 tonnes (4,824 tons) of mineralized material averaging 63.7 g/t (1.86 opt) Au. Development on the Joyce (5370N and 5400S) structure in August consisted of 192 samples taken and submitted for assay. Gold grades ranged from 0.2 g/t Au to 486 g/t Au (0.005 opt Au to 14.172 opt Au) over a vein width ranging from of 0.1 m to 1.3 m (0.2 ft to 3.5 ft). For May -- July development results please see press releases dated June 13, 2013, July 29, 2013 and September 12, 2013.

http://www.klondexmines.com/s/news.asp?ReportID=605844#sthas…

Facebook Tweet LinkedIn Google + Email

September 30, 2013

Klondex Mines Provides August Update on Fire Creek Project; Ships Lot #2 to Newmont

Reno, NV & Vancouver, BC -- September 30, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF), a Nevada gold exploration and development company, today provides an update on its toll milling and underground development programs, as well as the results of the metallurgical test-work from its Fire Creek Project in Lander County, Nevada.

Toll Milling

Toll milling of Fire Creek's Lot #1 is complete (see press release dated September 23, 2013). Final receivables for Lot #1 totaled $1,967,176, sold at an average gold spot price of US $1,332/oz. Processing of Lot #1 included 1,055 dry tonnes (1,165 dry tons) at an average head grade of 50.7 g/t (1.48 opt) Au.

Toll milling of Lot #2, comprised of 1,812 tonnes (2,000 tons), started on September 18, 2013.

Paul Huet, Klondex President and CEO stated, "Continuing to toll mill and treat our second lot of material from the Fire Creek project is an important step moving forward. We are very fortunate to have multiple options (Newmont and Veris agreements) in place to treat the Fire Creek material. Through toll milling, we are able to better understand the metallurgical characteristics of the Fire Creek material, and the proceeds can be applied towards future exploration and development."

Underground Development

Over the past four months, Klondex's underground development program targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project has yielded 4,375 tonnes (4,824 tons) of mineralized material averaging 63.7 g/t (1.86 opt) Au. Development on the Joyce (5370N and 5400S) structure in August consisted of 192 samples taken and submitted for assay. Gold grades ranged from 0.2 g/t Au to 486 g/t Au (0.005 opt Au to 14.172 opt Au) over a vein width ranging from of 0.1 m to 1.3 m (0.2 ft to 3.5 ft). For May -- July development results please see press releases dated June 13, 2013, July 29, 2013 and September 12, 2013.

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=605844#sthas…

Underground Development

Over the past four months, Klondex's underground development program targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project has yielded 4,375 tonnes (4,824 tons) of mineralized material averaging 63.7 g/t (1.86 opt) Au. Development on the Joyce (5370N and 5400S) structure in August consisted of 192 samples taken and submitted for assay. Gold grades ranged from 0.2 g/t Au to 486 g/t Au (0.005 opt Au to 14.172 opt Au) over a vein width ranging from of 0.1 m to 1.3 m (0.2 ft to 3.5 ft). For May -- July development results please see press releases dated June 13, 2013, July 29, 2013 and September 12, 2013.

http://www.klondexmines.com/s/news.asp?ReportID=605844#sthas…" target="_blank" rel="nofollow ugc noopener">News Releases

Facebook Tweet LinkedIn Google + Email

September 30, 2013

Klondex Mines Provides August Update on Fire Creek Project; Ships Lot #2 to Newmont

Reno, NV & Vancouver, BC -- September 30, 2013 -- Klondex Mines Ltd. (TSX: KDX; OTCQX: KLNDF), a Nevada gold exploration and development company, today provides an update on its toll milling and underground development programs, as well as the results of the metallurgical test-work from its Fire Creek Project in Lander County, Nevada.

Toll Milling

Toll milling of Fire Creek's Lot #1 is complete (see press release dated September 23, 2013). Final receivables for Lot #1 totaled $1,967,176, sold at an average gold spot price of US $1,332/oz. Processing of Lot #1 included 1,055 dry tonnes (1,165 dry tons) at an average head grade of 50.7 g/t (1.48 opt) Au.

Toll milling of Lot #2, comprised of 1,812 tonnes (2,000 tons), started on September 18, 2013.

Paul Huet, Klondex President and CEO stated, "Continuing to toll mill and treat our second lot of material from the Fire Creek project is an important step moving forward. We are very fortunate to have multiple options (Newmont and Veris agreements) in place to treat the Fire Creek material. Through toll milling, we are able to better understand the metallurgical characteristics of the Fire Creek material, and the proceeds can be applied towards future exploration and development."

Underground Development

Over the past four months, Klondex's underground development program targeting the Joyce and Vonnie structures within the Main Zone of its Fire Creek project has yielded 4,375 tonnes (4,824 tons) of mineralized material averaging 63.7 g/t (1.86 opt) Au. Development on the Joyce (5370N and 5400S) structure in August consisted of 192 samples taken and submitted for assay. Gold grades ranged from 0.2 g/t Au to 486 g/t Au (0.005 opt Au to 14.172 opt Au) over a vein width ranging from of 0.1 m to 1.3 m (0.2 ft to 3.5 ft). For May -- July development results please see press releases dated June 13, 2013, July 29, 2013 and September 12, 2013.

http://www.klondexmines.com/s/news.asp?ReportID=605844#sthas…

Klondex Mines Infill Drilling Extends Continuity of Vein Structures to the North and South; Intercepts 286.8 g/t (8.4 opt) Gold Over 2.0m (6.5ft) in the North

http://finance.yahoo.com/news/klondex-mines-infill-drilling-…

[...]

Additional Intercepts:

•61.9 g/t (1.8 opt) gold over 0.9m (3.1ft) in FC-13-079U

•211.0 g/t (6.2 opt) gold over 0.2m (0.6ft) in FC-13-085U

•43.3 g/t (1.3 opt) gold over 1.1m (3.7ft) in FC-13-089U

•23.2 g/t (0.7 opt) gold over 1.5m (5.0ft) in FC-13-092U

[...]

http://finance.yahoo.com/news/klondex-mines-infill-drilling-…

[...]

Additional Intercepts:

•61.9 g/t (1.8 opt) gold over 0.9m (3.1ft) in FC-13-079U

•211.0 g/t (6.2 opt) gold over 0.2m (0.6ft) in FC-13-085U

•43.3 g/t (1.3 opt) gold over 1.1m (3.7ft) in FC-13-089U

•23.2 g/t (0.7 opt) gold over 1.5m (5.0ft) in FC-13-092U

[...]

Klondex Announces Closing of C$19 Million Financing

http://finance.yahoo.com/news/klondex-announces-closing-c-19…

Klondex Mines Ltd. (KDX.TO) (the "Company") is pleased to announce the closing of its previously announced private placement of 14,200,000 special warrants (the "Special Warrants") at a price of C$1.37 per Special Warrant for gross proceeds of C$19,454,000 (the "Offering"). [...]

http://finance.yahoo.com/news/klondex-announces-closing-c-19…

Klondex Mines Ltd. (KDX.TO) (the "Company") is pleased to announce the closing of its previously announced private placement of 14,200,000 special warrants (the "Special Warrants") at a price of C$1.37 per Special Warrant for gross proceeds of C$19,454,000 (the "Offering"). [...]

Na, diese Nachricht ist in meinen Augen alles andere als gut

Klondex Mines halted at 12:21 p.m. PT

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:KDX-2129848…" target="_blank" rel="nofollow ugc noopener">

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:KDX-2129848…

Gruß

reini81

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:KDX-2129848…" target="_blank" rel="nofollow ugc noopener">

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:KDX-2129848…

Gruß

reini81

Klondex Enters Into Definitive Agreement With Newmont to Acquire the Midas Mine and Mill Complex and Announces Acquisition Financing

http://www.klondexmines.com/s/news.asp?ReportID=614616#sthas…

Gruß

reini81

http://www.klondexmines.com/s/news.asp?ReportID=614616#sthas…

Gruß

reini81

December 9, 2013

Klondex Updates on Indicative Terms of the Proposed Financing With Franco-Nevada

http://www.klondexmines.com/s/news.asp?ReportID=615153#sthas…

December 19, 2013

Klondex Mines Intercepts New Areas of Gold Mineralization at its Fire Creek Project

http://www.klondexmines.com/s/news.asp?ReportID=616375#sthas…

Gruß

reini81

Klondex Updates on Indicative Terms of the Proposed Financing With Franco-Nevada

http://www.klondexmines.com/s/news.asp?ReportID=615153#sthas…

December 19, 2013

Klondex Mines Intercepts New Areas of Gold Mineralization at its Fire Creek Project

http://www.klondexmines.com/s/news.asp?ReportID=616375#sthas…

Gruß

reini81

bookmark

Gute Bohrergebnisse:

February 13, 2014

Klondex Mines Infill Drilling Extends Joyce and Vonnie Veins at Fire Creek

View PDF

166.0 g/t (4.8 opt) Au over 1.52 m (5.0 ft) - FC-13-99U

47.5 g/t (1.4 opt) Au over 2.50 m (8.2 ft) - FC-13-104U

146.2 g/t (4.3 opt) Au over 1.92 m (6.3 ft) - FC-13-106U

69.6 g/t (2.0 opt) Au over 1.52 m (5.0 ft) -- FC-13-107U

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=622917#sthas…

Neue Präsentation - February 2014:

http://www.klondexmines.com/i/pdf/ppt/2014/KDX%2002-14%20Cor…

February 13, 2014

Klondex Mines Infill Drilling Extends Joyce and Vonnie Veins at Fire Creek

View PDF

166.0 g/t (4.8 opt) Au over 1.52 m (5.0 ft) - FC-13-99U

47.5 g/t (1.4 opt) Au over 2.50 m (8.2 ft) - FC-13-104U

146.2 g/t (4.3 opt) Au over 1.92 m (6.3 ft) - FC-13-106U

69.6 g/t (2.0 opt) Au over 1.52 m (5.0 ft) -- FC-13-107U

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=622917#sthas…

Neue Präsentation - February 2014:

http://www.klondexmines.com/i/pdf/ppt/2014/KDX%2002-14%20Cor…

Auch die techn. Sit. ist vielversprechend:

Antwort auf Beitrag Nr.: 46.490.173 von Modus-Berlin am 19.02.14 20:30:20

was sagt ihr zu den ergebnissen der fire-creek pea?

Antwort auf Beitrag Nr.: 46.898.874 von Global-Player83 am 30.04.14 10:23:49Hier erst mal für alle zum Auffinden:

http://www.marketwired.com/press-release/klondex-announces-f…

Was meinst Du denn dazu ?

http://www.marketwired.com/press-release/klondex-announces-f…

Was meinst Du denn dazu ?

Für mich schaut es sehr robust aus:

durch high-grade relativ geringe Kostenstruktur pro Unze.

Mit CapEx von $ 50 Mio. sehr gut finanzierbar.

NPV mit 10% diskontiert von $128 Mio. bei realistischen Annahmen ($1250 Gold/ $18 Silber) und Rückzahlung in 0,5 Jahren klingt für mich sehr vielversprechend.

Auch hohe positive Korrelation zum Goldpreis sehr interessant: NPV 5% bei $1500 Gold wäre schon $200 Mio.

Habe bis jetzt noch kein Haar in der Suppe gefunden.

Andere vielleicht ?

durch high-grade relativ geringe Kostenstruktur pro Unze.

Mit CapEx von $ 50 Mio. sehr gut finanzierbar.

NPV mit 10% diskontiert von $128 Mio. bei realistischen Annahmen ($1250 Gold/ $18 Silber) und Rückzahlung in 0,5 Jahren klingt für mich sehr vielversprechend.

Auch hohe positive Korrelation zum Goldpreis sehr interessant: NPV 5% bei $1500 Gold wäre schon $200 Mio.

Habe bis jetzt noch kein Haar in der Suppe gefunden.

Andere vielleicht ?

http://elkodaily.com/mining/miner-dies-at-midas-mine-in-elko…

April 29, 2014 9:21 pm

ELKO — A miner died Monday at Klondex’s Midas Mine in Elko County, according to the Mine Safety and Health Administration.

Bin gerade zufällig über den Artikel gestolpert, weiß nicht, ob der hier schon bekannt war...

April 29, 2014 9:21 pm

ELKO — A miner died Monday at Klondex’s Midas Mine in Elko County, according to the Mine Safety and Health Administration.

Bin gerade zufällig über den Artikel gestolpert, weiß nicht, ob der hier schon bekannt war...

Neue Bohrergebnisse:

May 21, 2014

Klondex Exploration Program Extends Joyce Vein and Vonnie Vein at Fire Creek

40.0 g/t (1.17 opt) Au over 1.49 m (4.9 ft) - FCU-0004

12.8 g/t (0.37 opt) Au over 6.16 m (20.2 ft) - FCU-0008

30.4 g/t (0.90 opt) Au over 2.47 m (8.1 ft) - FCU-0029

158.7 g/t (4.63 opt) Au over 1.13 m (3.7 ft) -FCU-0049

350.0 g/t (10.21 opt) Au over 0.70 m (2.3 ft) - FCU-0050

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=654518#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=654518#sthas…

May 21, 2014

Klondex Exploration Program Extends Joyce Vein and Vonnie Vein at Fire Creek

40.0 g/t (1.17 opt) Au over 1.49 m (4.9 ft) - FCU-0004

12.8 g/t (0.37 opt) Au over 6.16 m (20.2 ft) - FCU-0008

30.4 g/t (0.90 opt) Au over 2.47 m (8.1 ft) - FCU-0029

158.7 g/t (4.63 opt) Au over 1.13 m (3.7 ft) -FCU-0049

350.0 g/t (10.21 opt) Au over 0.70 m (2.3 ft) - FCU-0050

- See more at: http://www.klondexmines.com/s/news.asp?ReportID=654518#sthas…

http://www.klondexmines.com/s/news.asp?ReportID=654518#sthas…

Klondex Reports Q3 Production Cost of US$439/Ounce Sold, with By-Product Credit - Nov 12, 2014

www.klondexmines.com/s/news.asp?ReportID=683154#sthash.d9XbI…

"VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 12, 2014) - Klondex Mines Ltd. (TSX:KDX) (OTCQX:KLNDF) ("Klondex" or the "Company") today announces that it has filed its Management Discussion and Analysis ("MD&A") and its unaudited condensed consolidated interim financial statements for the three and nine months ended September 30, 2014 which are available on the Company's web site at www.klondexmines.com and are posted on SEDAR, at www.sedar.com. The financial statements were prepared in accordance with International Financial Reporting Standards ("IFRS"). Unless otherwise stated, all currency amounts included in this release are expressed in Canadian dollars.

Third Quarter 2014 Financial Highlights

Production costs for the third quarter per gold equivalent ounce ("GEO") sold were $613 (US$563); year-to-date were $676 (US$617); third quarter production costs per gold ounce sold on a by-product basis were $478 (US$439); year-to-date were $510 (US$465) (See "Non-IFRS Measures").

Cash balance as of September 30, 2014 was $43.2 million.

Working capital (current assets minus current liabilities) as of September 30, 2014 was $48.2 million.

Revenue for the third quarter was $38.0 million from the sale of 28,162 GEOs which consisted of 23,166 gold ounces and 315,504 silver ounces, at an average realized price of $1,374 (US$1,262) and $19.62 (US$18.02), respectively.

Revenue year to date was $77.1 million from the sale of 58,174 GEOs which consisted of 46,828 gold ounces and 716,582 silver ounces, at an average realized price of $1,398 (US$1,276) and $20.97 (US$19.13), respectively.

Net income for the third quarter totaled $7.2 million or $0.06 per share, which is an improvement from Q2 net income of $4.4 million or $0.04 per share.

Cash flow for the third quarter provided by operating activities was $16.2 million; year-to-date was $27.8 million.

Capital expenditures for the third quarter were $8.9 million; year-to-date were $20.3 million, principally for the rapid infiltration basin and ramp expansion at Fire Creek, and exploration and development at both sites.

GEOs recovered in the third quarter were 39,109 which consisted of 33,339 gold ounces and 364,435 silver ounces; year-to-date GEOs recovered were 77,401 which consisted of 63,977 gold ounces and 847,825 silver ounces.

Updated Operational Targets

Based on operational results of the nine months ending September 30, 2014, Klondex is increasing its target to recover at least 95k GEOs and sell at least 85k GEOs in 2014 compared to our earlier production target of 70-85k GEOs.

Prepare and release an updated mineral resource estimate for Fire Creek in the fourth quarter.

File the Midas technical report in the fourth quarter for the updated mineral resource estimate released on September 30, 2014. Complete a pre-feasibility in 1Q2015.

Paul Huet, Klondex President and CEO commented:

"The third quarter operational results continue to transform Klondex from a development company into a profitable low-cost precious metals producer. The strength of our first three quarters of production allows us to increase our targeted production to 95k GEOs recovered. I am very grateful for the dedicated efforts of the Midas and Fire Creek teams as they continue to produce exceptional operational results. We anticipate that even within the current volatile gold price environment, Klondex will continue to generate positive cash flows from operations, further strengthening our balance sheet.

"In my opinion, the updated Midas mineral resource estimate is the most significant accomplishment for Klondex within the quarter. The updated resource includes measured and indicated gold equivalent ounces of 526k at a grade of 0.47 GEO per ton (858k tons), and inferred gold equivalent ounces of 286k at 0.33 GEO per ton (1,117k tons). This is game-changing for Klondex."

Unaudited Condensed Consolidated Interim Statements of Income (Loss)

Three months ended Nine months ended

September 30, September 30,

2014 2013 2014 2013

Revenues $ 38,012,787 $ - $ 77,083,745 $ -

Cost of sales

Production costs 17,254,621 - 37,652,263 -

Depreciation and depletion 7,974,402 - 14,900,176 -

Gross profit 12,783,764 - 24,531,306 -

General and administrative expenses 2,976,545 987,572 7,379,974 2,762,671

Income (loss) from operations 9,807,219 (987,572 ) 17,151,332 (2,762,671 )

Business acquisition costs - - (2,257,018 ) -

Gain on change in fair value of derivative 442,514 - 2,034,305 -

Finance charges (2,751,340 ) - (6,987,316 ) -

Foreign currency gain 4,243,667 - 5,255,983 -

Income (loss) before tax 11,742,060 (987,572 ) 15,197,286 (2,762,671 )

Income tax expense (4,517,000 ) - (5,943,000 ) -

Net income (loss) $ 7,225,060 $ (987,572 ) $ 9,254,286 $ (2,762,671 )

Net income (loss) per share

Basic $ 0.06 $ (0.02 ) $ 0.08 $ (0.04 )

Diluted $ 0.06 $ (0.02 ) $ 0.08 $ (0.04 )

Weighted average number of shares outstanding

Basic 118,717,882 64,512,225 112,498,115 64,449,572

Diluted 121,641,031 64,512,225 115,152,301 64,449,572

Revenue

During the three and nine months ended September 30, 2014, Klondex's revenue was $38.0 million and $77.1 million, respectively, from the sale of 23,166 gold ounces and 315,504 silver ounces and 46,828 gold ounces and 716,582 silver ounces, respectively. The revenue increased 4% during the third quarter from the second quarter due to a 9% increase in GEOs sold offset by a 5% decrease in the average price per GEO.

Cost of Sales

Production costs for the three and nine months ended September 30, 2014 were $17.3 million and $37.7 million, respectively. Production costs per GEO sold in the three and nine months ended September 30, 2014 were $613 (US $563) and $676 (US $617), respectively. Production costs per gold ounce sold on a by-product basis in the three and nine months ended September 30, 2014 were $478 (US $439) and $510 (US $465), respectively. See "Non-IFRS Measures". The production costs per GEO sold and the production costs per gold ounce sold on a by-product basis in the third quarter were lower by 16% and 13%, respectively, compared to the second quarter of 2014. Depreciation and depletion costs in the three and nine months ended September 30, 2014 were $8.0 million and $14.9 million, respectively.

Gross Profit

Gross profit in the three and nine months ended September 30, 2014 was $12.8 million and $24.5 million, respectively.

General and Administrative Expenses

General and administrative expenses for the three and nine months ended September 30, 2014 were $3.0 and $7.4 million, respectively (2013 - $1.0 million and $2.8 million, respectively). During the third quarter, G&A expenses increased by $0.8 million compared to the second quarter of 2014. The increase is principally related to non-cash share-based compensation expenses. The increase in G&A expenses over the prior year is due to the growth of the Company as it has transformed from an exploration stage company to a production stage company.

Business Acquisition Costs

Business acquisition costs for the nine months ended September 30, 2014 of $2.3 million were related to the acquisition of the Midas mine and mill. There was no recorded business acquisition cost for the three months ended September 30, 2014.

Gain on Change in Fair Value of Derivative

The Company recorded a gain on the valuation of the derivative associated with a gold supply agreement with a third party (the "Gold Supply Agreement") in the three and nine months ended September 30, 2014 of $0.4 million and $2.0 million, respectively. The derivative is valued at each quarter end. The reduction in the derivative value is principally related to gold ounces produced and offered under the Gold Supply Agreement and a decrease in the estimated forward gold spot price and in the estimated volatility of gold price over the remaining term of the Gold Supply Agreement.

Finance Charges

The finance charges for the three and nine months ended September 30, 2014 were $2.8 million and $7.0 million, respectively. The finance charges are mainly related to the obligations under a gold purchase agreement and a senior secured facility agreement, each of which was entered into in connection with the acquisition of the Midas mine and mill in February 2014. In 2013, the finance charges were capitalized into the Fire Creek evaluation and exploration assets.

Income Tax Expense

The income tax expense for the three and nine months ended September 30, 2014 was $4.5 million (38.5%) and $5.9 million (39.1%), respectively. Income tax expense includes the State of Nevada net proceeds tax. The income tax expense reflects unbenefited losses in Canada.

Net Income

Total net income for the three and nine months ended September 30, 2014 was $7.2 million and $9.3 million, respectively, (2013 - ($1.0 million) and ($2.8 million), respectively). The net income increase for the three and nine months ended September 30, 2014 over the previous year is due to the recognition of revenue and profit from the Fire Creek Project and Midas mine.

NON-IFRS MEASURES

The Company has included non-IFRS measure for "Production costs per gold equivalent ounce" and "Production costs per gold ounce sold on a by-product basis" herein and in the MD&A to supplement its financial statements which are presented in accordance with IFRS. Management believes that these measures provide investors with an improved ability to evaluate the performance of the Company. Non-IFRS measures do not have a standardized meaning prescribed under IFRS. Therefore, they may not be comparable to similar measures employed by other companies. The data are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The following tables provide a reconciliation of production per the financial statements to production costs per gold equivalent ounce sold and production costs per gold ounce sold on a by-product basis:

Three Months Ended

September 30, 2014 Nine Months Ended

September 30, 2014

Total

Production costs $ 17,254,621 $ 37,652,263

Gold equivalent ounces sold 28,162 55,735

Production costs per gold equivalent ounce sold $ 613 $ 676

Production costs per gold equivalent ounce sold US$ 563 US$ 617

The silver to gold ratio used is 63.1579:1

Three Months Ended

September 30, 2014 Nine Months Ended

September 30, 2014

Total

Production costs $ 17,254,621 $ 37,652,263

Less: silver credit (6,189,099 ) (15,024,995 )

Production costs after silver credit $ 11,065,522 $ 22,627,268

Gold ounces sold 23,166 44,389

Production costs per gold equivalent ounce sold on a by-product basis $ 478 $ 510

Production costs per gold equivalent ounce sold on a by-product basis US$ 439 US$ 465

Canadian dollars were converted to United States dollars using the average Bank of Canada rate for the three and nine months ended September 30, 2014 which were 1 CAD = 0.91829 USD and 1 CAD = 0.91249 USD, respectively.

Third Quarter 2014 Results Conference Call

Management will host a conference call on Thursday, November 13, 2014 at 10:00 am ET/7:00 am PT to discuss third quarter results. Presenting on the call will be Paul Huet, President and CEO, and Barry Dahl, Chief Financial Officer.

The call can be accessed by dialing: +1 800-319-4610 (North America, toll-free), +1 416-915-3227 (Toronto and International) and +1 604-638-5340 (Outside of Canada and the US).

Registration is required for the call. Please dial in at least ten minutes prior to the scheduled start time.

A replay will be available until 11:59 pm on Saturday, November 22, 2014. The replay can be accessed by dialing toll free from the US and Canada: +1 800-319-6413 or dialing international toll: +1 604-638-9010 and entering passcode: 3599, followed by the # sign.

About Klondex Mines Ltd. (www.klondexmines.com)