TSODILO RESOURCES - Rekordmarktkapitalisierung seid Börsengang - 500 Beiträge pro Seite (Seite 2)

eröffnet am 15.02.10 00:10:42 von

neuester Beitrag 16.07.18 16:25:45 von

neuester Beitrag 16.07.18 16:25:45 von

Beiträge: 508

ID: 1.155.971

ID: 1.155.971

Aufrufe heute: 0

Gesamt: 24.734

Gesamt: 24.734

Aktive User: 0

ISIN: CA8985301008 · WKN: A0B880

0,1820

EUR

0,00 %

0,0000 EUR

Letzter Kurs 07:24:16 L&S Exchange

Neuigkeiten

21.03.24 · Accesswire |

15.03.24 · Accesswire |

05.03.24 · Accesswire |

20.02.24 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0100 | +10,99 | |

| 0,8150 | +10,88 | |

| 76,28 | +10,47 | |

| 17.600,00 | +10,00 | |

| 204,50 | +9,98 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9220 | -6,49 | |

| 0,5300 | -7,02 | |

| 2,1800 | -9,17 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Antwort auf Beitrag Nr.: 47.092.718 von Popeye82 am 03.06.14 12:37:18

Initial Resource Estimate for Block 1 of the Xaudum Iron Project, Botswana: 441.000.000 tonnes @29,4% Fe I - Sep 2, 2014

www.tsodiloresources.com/s/NewsReleases.asp?ReportID=672088&…

"TORONTO, CANADA - Tsodilo Resources Limited (TSX-V:TSD) ("Tsodilo" or the "Company") is pleased to announce the release of its maiden NI43-101 Technical Report including CIM compliant Inferred Mineral Resource Estimate of 441 million tonnes (Mt) with an average grade of 29.4% Fe for Block 1 of its flagship Xaudum Iron Project, North West Botswana.

James M. Bruchs Chairman and CEO of Tsodilo Resources Ltd commented on this announced resource saying, "We are delighted to say that we have defined large mineral resource tonnage in the Block 1 area of 441 Mt. This is a major step for the project and confirms that the Xaudum Iron Project can be a major iron ore project for Botswana. The project has the potential to supply iron ore and iron products to not only the whole southern African region but to the world. This resource is also only the 'Tip of the Iceberg' given the previously reported Exploration Target of between 5 and 7 billion of tonnes."

The Xaudum Iron Formation (XIF) NI 43-101 Mineral Resource Estimate (MRE) report (entitled; Mineral Resource Estimate for the Xaudum Iron Project (Block 1), Republic of Botswana) was completed by SRK Consulting (UK) Ltd and is the report referred to in this press release. This report has been uploaded to the System for Electronic Document Analysis and Retrieval (SEDAR) website www.sedar.com. SEDAR is the System for the electronic filing system for the disclosure documents of public companies and investment funds across Canada. A copy of this document along with this press release is available on the Company's web site, www.TsodiloResources.com.

Highlights

+ Inferred Mineral Resource of 441 million tonnes at average grades of 29.4% Fe, 41.0% SiO2, 6.1% Al2O3 and 0.3% P for Block 1 of the Xaudum Iron Formation (XIF).

+ Davis Tube Recovery (DTR) magnetic concentrate mass recoveries of 33.2% at P80 grind size of 80 microns.

+ Iron ore grade DTR magnetic concentrate at 67.2% Fe, 4.2% SiO2, 0.5% Al2O3, 0.07% P at P80 grind size of 80 microns, although higher grades are possible at finer P80's see the press release from December 17, 2013 available on the Company's website at www.TsodiloResources.com.

+ Significant potential to increase the Mineral Resource though ongoing exploration. The reported Mineral Resource represents only a fraction of the potential XIF mineralization delimited by the ground magnetics. Tsodilo has previously reported an Exploration Target* for the XIF of 5 to 7 billion tonnes with grades ranging between 15-40% Fe, see the press release from January 22, 2014 available on the Company's website at www.TsodiloResources.com.

+ Tsodilo is currently drilling the next exploration area referred to as Block 2a, where the company expects to define a significant Inferred Mineral Resource in due course which will significantly increase the Xaudum Iron Project total Mineral Resource.

* The XIF exploration target was generated using inversion modelling of the ground magnetic signal which was compared to a local drill-hole model to create inversion model volume conversion factors. For a more detailed description of the process used to create this exploration target please see the press release of January 22, 2014 available on the Company's website at www.TsodiloResources.com. It is important to note that the tonnages and grade quoted in this exploration target is conceptual in nature, there has been insufficient exploration to define this fully as a mineral resource and that it is uncertain if further exploration will result in the full target being delineated as a mineral resource.

XIF Resource Summary

The Inferred Mineral Resource for Block 1 (Table 1) presented in this press release comprising 441 Mt grading 29.4% Fe, 41.0% SiO2, 6.1% Al2O3 and 0.3% P (see Table 1 for breakdown), was prepared under the direction of Howard Baker (of SRK Consulting (UK) Ltd) the Qualified Person (QP) as such term is defined by National Instrument 43-101 and the companion policy 43-101 CP. The definitions of Inferred Resources in this Mineral Resource statement conform to the definitions and guidelines of the CIM Definition Standards for Mineral Resource and Mineral Reserves, May 2014. For more details please see the XIF NI 43-101 Mineral Resource Estimate (MRE) report that can be downloaded from www.TsodiloResources.com and also from the SEDAR website www.sedar.com.

Table 1. Mineral Resource Statement for XIF Block 1.

Geodomain Zone Resource Category Tonnes (Mt) Fe % SiO2 % Al2O3 % P %

MBA Inferred 236 35.6 34.0 4.0 0.3

DIM Inferred 148 20.9 51.0 9.1 0.2

MBW Inferred 21 34.3 35.4 4.4 0.2

DMW Inferred 29 20.5 49.5 8.2 0.2

MGS Inferred 7 22.1 50.8 8.9 0.2

TOTAL Inferred 441 29.4 41.0 6.1 0.3

Notes:

(1) Geodomains MBA = Magnetite Banded (BIF), DIM = Magnetic Diamictite, MBW = Weathered Banded Magnetite (oxidized MBA), DMW = Weathered Magnetic Diamictite (oxidised DIM), and MGS = Magnetic Garnet Schist.

(2) The Mineral Resource is not a Mineral Reserve and has no demonstrated economic viability.

(3) The effective date of the Mineral Resource is August 29, 2014.

(4) The Mineral Resource estimate for Xaudum was constrained within lithological and grade based solids and within a Lerchs-Grossman optimized pit shell defined by the following assumptions; metal price of USD 1.5 / dmtu; slope angles of 26°, 45° and 50° in the sand, calcrete / oxide and fresh material; a mining recovery of 95.0%; a mining dilution of 5.0%; a base case mining cost of USD 2.20 / t ore and an incremental mine operating costs of USD 0.05 / t / 10 m; process operating costs of USD 5.00 / t ore; iron processing recoveries of 78.1% (MBA); 54.0% (DIM); 46.3% (MBW); 53.6% (DMW); 23.7% (MGS); G&A costs of USD 5.00 / t / ore; transport costs of USD 5 / t concentrate.

(5) The Mineral Resource is reported using a 12% Fe cut-off grade.

(6) Mineral Resources at Xaudum have been classified according to the "CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines (May 2014)" by Howard Baker (FAusIMM(CP)), an independent Qualified Person as defined in NI 43-101.

(7) The quantity and grade of reported Inferred Mineral Resource is uncertain in nature and there has been insufficient exploration to report this as an Indicated or Measured Mineral Resource; and it is uncertain if further exploration will result in upgrading it, or a portion of it, to an Indicated or Measured Mineral Resource category.

Metallurgical testwork carried out on drill core composites indicates that it is possible that a high grade magnetite concentrate could be produced from a combination of all of the mineralized Geodomains shown in Table 1 with an average magnetite concentrate grade of between 67.2% and 68.5% Fe and with a silica content of between 4.2% and 3.0% SiO2 dependent upon grind size. This work has also shown that the high P levels within the XIF are substantially reduced to during concentration to between 0.07% and 0.05% P. The grade ranges expressed here reflect P80 grind sizes of 80 and 60 microns respectively. All other deleterious elements within the concentrate are very low and well below acceptable levels for premium grade iron ore. All DTR sizer concentrate testwork was completed independently by ALS Minerals Division, Iron Ore Technical Centre (Wangara, Perth, Western Australia).

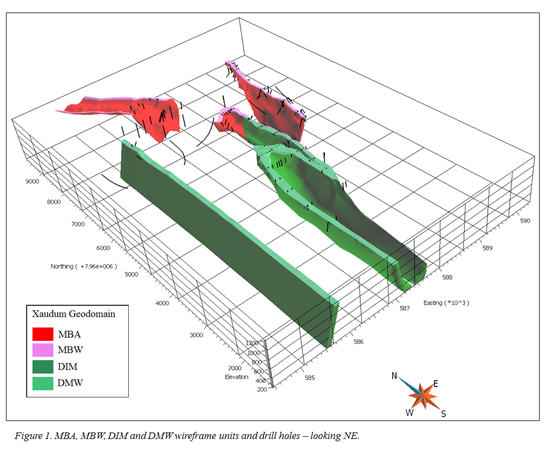

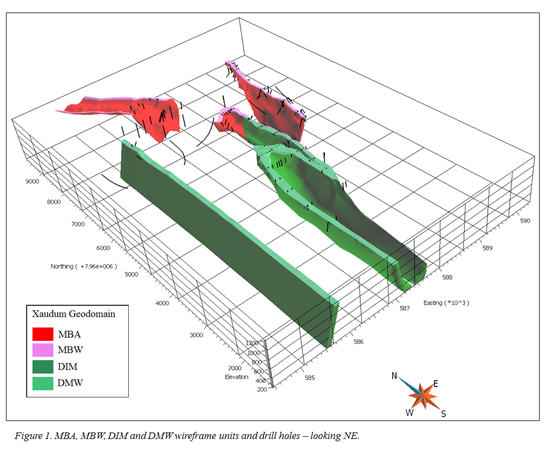

The Block 1 Mineral Resource estimate quoted in this press release is based on the in-house XIF geological wireframe modelling of Block 1 which was verified by SRK. A block model was then coded using the geological wireframes, block grades interpolated, and Mineral Resources defined and reported using a pit shell optimization in conjunction with a 12% Fe cut-off grade. The XIF geological (wireframe) model can be seen in Figure 1 but can also be seen as an animation video on our website by following this link, http://player.vimeo.com/video/104426385. For more details on the process of modelling, resource estimation and resource reporting using pit shell optimization techniques by SRK please see the XIF NI 43-101 MRE report.

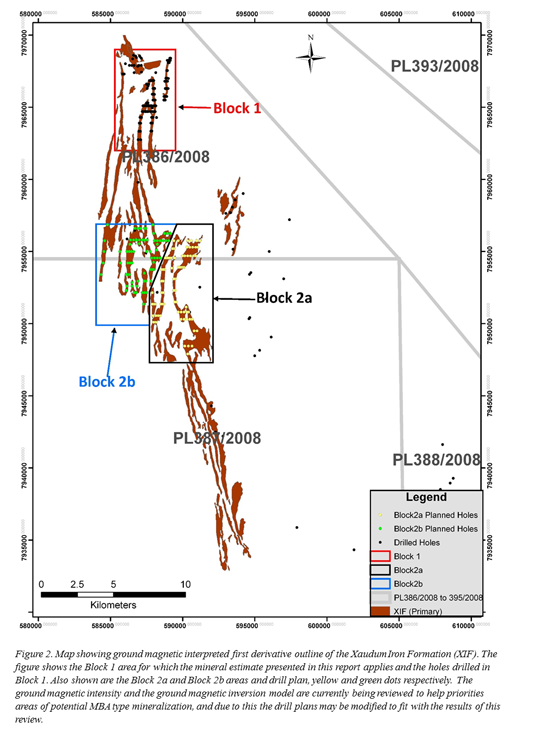

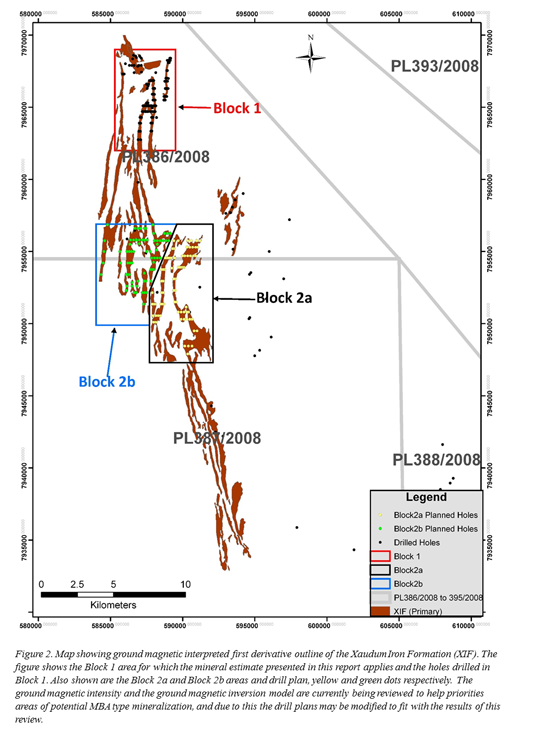

Next Phase

The company is now moving into its next phase of exploration and is targeting a significant increase in the Mineral Resource by drilling out the Block 2 area which is split into Block 2a and Block 2b areas, see Figure 2. Significant tonnages of material are expected from these areas based on our exploration target mentioned above. We are anticipating a NI 43-101 MRE report following exploration at both Block 2a and Block 2b. The exploration priority is targeting MBA type material which is the higher grade material over 25% Fe and in Block 1 averaged 35.6% Fe. We are currently reviewing the ground magnetic signature intensity and inversion model to locate areas of higher grade potential MBA type material. We will use this to priorities the drilling order in Block 2a and Block 2b drill plans, and could modify the drill plans around the outcomes of this review. The drill holes in Block 2 is on a general spacing of around 800 meters along strike (North-South) and 100 meters across strike (East-West). This drill spacing aims to delineate an Inferred Mineral Resource, providing the mineralization is simple and continuous along strike and down-dip. If there are areas in Block 2 which are more geologically complex, in a similar manner to some complicated areas in Block 1, then extra holes may have to be drilled at a closer spacing.

The company will maintain its on-going metallurgical testwork program and will also look to invite structural expertise to enhance our knowledge of the XIF. Ground magnetics work is on-going and is focusing on a more detailed spacing of 20 meters (normally 50 meters) along drill lines to give us higher resolution data on drill hole section/fence lines and help with refining drill hole locations to maximize the drill plan efficiency.

Mineral Resource Estimate

The company began exploring in the XIF region for metals in 2008. A major program of ground magnetic surveying was conducted, and this greatly refined the XIF regional airborne magnetic anomaly and defined a very strong striped magnetic north-south orientation anomaly in the region that has a strike length up to 40 kilometers. Some initial holes drilled into the anomaly indicated the presence of XIF material which was identified as banded iron formation (BIF). Exploration drilling for the XIF began in more detail in 2011, however only ramped up into resource definition drilling in 2012 culminating in the completion of Block 1 in June 2014. The MRE is based on 157 holes totaling 31,149 meters drilled by Tsodilo within the Block 1 area, containing 9,221 assays from 13,824 meters of samples.

The geological modelling of Block 1 was carried out in-house by the company using Paradigm GOCAD geological modelling software, which was completed by geo-referencing interpreted cross sections into GOCAD and digitizing these sectional interpretations. These formed the basis of further interpretation and detailed geological modelling of wireframe surfaces of both mineralization and waste zones (geodomains).

The geodomains delineated in the model comprise: three separate magnetite-banded (MBA) zones (along with associated weathered MBW), three separate magnetic diamictite (DIM) zones (along with associated weathered DMW), seven MBA pods, one DIM pod, three magnetite schist (MGS) pods, eight garnet schist (GST) waste pods, one diamictite (DIA) waste pod, along with other waste lithology units. Mineralization has been delineated over a strike length of 8.5 kilometers within Block 1 which is based on diamond drilling and geophysical magnetic interpretation.

Using the geological wireframes, a single block model was created using block sizes 100 mY by 25 mX and 10 mZ. Grades of Fe, Al2O3, SiO2, Mn, P, S, CaO, LOI, MgO, K2O, and TiO2, were interpolated into the model using Ordinary Kriging (OK) for major geodomains and Inverse Distance Weighting to the power of 3 (IDW3) for minor geodomains using assay data from the diamond drilling completed by Tsodilo. This interpolated block model was run through a pit optimization process using reasonable operating and processing cost parameters along with a long-term commodity price to ensure the reported Mineral Resource comprises only material with reasonable potential for eventual economic extraction. The resulting reported Mineral Resource is therefore restricted to material falling within the optimized pit shell, and above a cut-off grade of 12% Fe. Details of these pit optimization parameters can be found in the XIF MRE resource report. Table 1 shows the resulting Mineral Resource statement for the Block 1.

About Tsodilo Resources Limited:

Tsodilo Resources Limited is an international diamond and metals exploration company engaged in the search for economic diamond and metal deposits at its Newdico (Pty) Limited ("Newdico") and Gcwihaba Resources (Pty) Limited ("Gcwihaba") projects in northwest Botswana. The Company has a 98% stake in Newdico (851 km2 under Precious Stone - diamond licenses). The Gcwihaba project area: 494 km2 under Precious Stone - diamond licenses; 11,158 km2 Metal (base, precious, platinum group, and rare earth) licenses; and, 6,925 km2 under Radioactive Minerals licenses is 100% held by the Company. Tsodilo manages the exploration of both the Newdico and Gcwihaba license areas. Overall supervision of the Company's exploration program is the responsibility of Dr. Mike de Wit, President and COO of the Company and a "qualified person" as such term is defined in National Instrument 43-101. Dr. de Wit has reviewed the information contained herein and approved the contents of this Press Release. Further to this, the supervision of the Xaudum Iron Ore project is the responsibility of Dr. Alistair Jeffcoate, Chief Geologist and Project Manager for the Company and a "qualified person" as such term is defined in National Instrument 43-101. Dr. Jeffcoate has also reviewed the information contained herein and approved the contents of this press release.

The Company has offices in Toronto, Canada and Gaborone and Maun, Botswana. Please visit the Company's website, www.TsodiloResources.com, for additional information and background on our projects. "

Initial Resource Estimate for Block 1 of the Xaudum Iron Project, Botswana: 441.000.000 tonnes @29,4% Fe I - Sep 2, 2014

www.tsodiloresources.com/s/NewsReleases.asp?ReportID=672088&…

"TORONTO, CANADA - Tsodilo Resources Limited (TSX-V:TSD) ("Tsodilo" or the "Company") is pleased to announce the release of its maiden NI43-101 Technical Report including CIM compliant Inferred Mineral Resource Estimate of 441 million tonnes (Mt) with an average grade of 29.4% Fe for Block 1 of its flagship Xaudum Iron Project, North West Botswana.

James M. Bruchs Chairman and CEO of Tsodilo Resources Ltd commented on this announced resource saying, "We are delighted to say that we have defined large mineral resource tonnage in the Block 1 area of 441 Mt. This is a major step for the project and confirms that the Xaudum Iron Project can be a major iron ore project for Botswana. The project has the potential to supply iron ore and iron products to not only the whole southern African region but to the world. This resource is also only the 'Tip of the Iceberg' given the previously reported Exploration Target of between 5 and 7 billion of tonnes."

The Xaudum Iron Formation (XIF) NI 43-101 Mineral Resource Estimate (MRE) report (entitled; Mineral Resource Estimate for the Xaudum Iron Project (Block 1), Republic of Botswana) was completed by SRK Consulting (UK) Ltd and is the report referred to in this press release. This report has been uploaded to the System for Electronic Document Analysis and Retrieval (SEDAR) website www.sedar.com. SEDAR is the System for the electronic filing system for the disclosure documents of public companies and investment funds across Canada. A copy of this document along with this press release is available on the Company's web site, www.TsodiloResources.com.

Highlights

+ Inferred Mineral Resource of 441 million tonnes at average grades of 29.4% Fe, 41.0% SiO2, 6.1% Al2O3 and 0.3% P for Block 1 of the Xaudum Iron Formation (XIF).

+ Davis Tube Recovery (DTR) magnetic concentrate mass recoveries of 33.2% at P80 grind size of 80 microns.

+ Iron ore grade DTR magnetic concentrate at 67.2% Fe, 4.2% SiO2, 0.5% Al2O3, 0.07% P at P80 grind size of 80 microns, although higher grades are possible at finer P80's see the press release from December 17, 2013 available on the Company's website at www.TsodiloResources.com.

+ Significant potential to increase the Mineral Resource though ongoing exploration. The reported Mineral Resource represents only a fraction of the potential XIF mineralization delimited by the ground magnetics. Tsodilo has previously reported an Exploration Target* for the XIF of 5 to 7 billion tonnes with grades ranging between 15-40% Fe, see the press release from January 22, 2014 available on the Company's website at www.TsodiloResources.com.

+ Tsodilo is currently drilling the next exploration area referred to as Block 2a, where the company expects to define a significant Inferred Mineral Resource in due course which will significantly increase the Xaudum Iron Project total Mineral Resource.

* The XIF exploration target was generated using inversion modelling of the ground magnetic signal which was compared to a local drill-hole model to create inversion model volume conversion factors. For a more detailed description of the process used to create this exploration target please see the press release of January 22, 2014 available on the Company's website at www.TsodiloResources.com. It is important to note that the tonnages and grade quoted in this exploration target is conceptual in nature, there has been insufficient exploration to define this fully as a mineral resource and that it is uncertain if further exploration will result in the full target being delineated as a mineral resource.

XIF Resource Summary

The Inferred Mineral Resource for Block 1 (Table 1) presented in this press release comprising 441 Mt grading 29.4% Fe, 41.0% SiO2, 6.1% Al2O3 and 0.3% P (see Table 1 for breakdown), was prepared under the direction of Howard Baker (of SRK Consulting (UK) Ltd) the Qualified Person (QP) as such term is defined by National Instrument 43-101 and the companion policy 43-101 CP. The definitions of Inferred Resources in this Mineral Resource statement conform to the definitions and guidelines of the CIM Definition Standards for Mineral Resource and Mineral Reserves, May 2014. For more details please see the XIF NI 43-101 Mineral Resource Estimate (MRE) report that can be downloaded from www.TsodiloResources.com and also from the SEDAR website www.sedar.com.

Table 1. Mineral Resource Statement for XIF Block 1.

Geodomain Zone Resource Category Tonnes (Mt) Fe % SiO2 % Al2O3 % P %

MBA Inferred 236 35.6 34.0 4.0 0.3

DIM Inferred 148 20.9 51.0 9.1 0.2

MBW Inferred 21 34.3 35.4 4.4 0.2

DMW Inferred 29 20.5 49.5 8.2 0.2

MGS Inferred 7 22.1 50.8 8.9 0.2

TOTAL Inferred 441 29.4 41.0 6.1 0.3

Notes:

(1) Geodomains MBA = Magnetite Banded (BIF), DIM = Magnetic Diamictite, MBW = Weathered Banded Magnetite (oxidized MBA), DMW = Weathered Magnetic Diamictite (oxidised DIM), and MGS = Magnetic Garnet Schist.

(2) The Mineral Resource is not a Mineral Reserve and has no demonstrated economic viability.

(3) The effective date of the Mineral Resource is August 29, 2014.

(4) The Mineral Resource estimate for Xaudum was constrained within lithological and grade based solids and within a Lerchs-Grossman optimized pit shell defined by the following assumptions; metal price of USD 1.5 / dmtu; slope angles of 26°, 45° and 50° in the sand, calcrete / oxide and fresh material; a mining recovery of 95.0%; a mining dilution of 5.0%; a base case mining cost of USD 2.20 / t ore and an incremental mine operating costs of USD 0.05 / t / 10 m; process operating costs of USD 5.00 / t ore; iron processing recoveries of 78.1% (MBA); 54.0% (DIM); 46.3% (MBW); 53.6% (DMW); 23.7% (MGS); G&A costs of USD 5.00 / t / ore; transport costs of USD 5 / t concentrate.

(5) The Mineral Resource is reported using a 12% Fe cut-off grade.

(6) Mineral Resources at Xaudum have been classified according to the "CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines (May 2014)" by Howard Baker (FAusIMM(CP)), an independent Qualified Person as defined in NI 43-101.

(7) The quantity and grade of reported Inferred Mineral Resource is uncertain in nature and there has been insufficient exploration to report this as an Indicated or Measured Mineral Resource; and it is uncertain if further exploration will result in upgrading it, or a portion of it, to an Indicated or Measured Mineral Resource category.

Metallurgical testwork carried out on drill core composites indicates that it is possible that a high grade magnetite concentrate could be produced from a combination of all of the mineralized Geodomains shown in Table 1 with an average magnetite concentrate grade of between 67.2% and 68.5% Fe and with a silica content of between 4.2% and 3.0% SiO2 dependent upon grind size. This work has also shown that the high P levels within the XIF are substantially reduced to during concentration to between 0.07% and 0.05% P. The grade ranges expressed here reflect P80 grind sizes of 80 and 60 microns respectively. All other deleterious elements within the concentrate are very low and well below acceptable levels for premium grade iron ore. All DTR sizer concentrate testwork was completed independently by ALS Minerals Division, Iron Ore Technical Centre (Wangara, Perth, Western Australia).

The Block 1 Mineral Resource estimate quoted in this press release is based on the in-house XIF geological wireframe modelling of Block 1 which was verified by SRK. A block model was then coded using the geological wireframes, block grades interpolated, and Mineral Resources defined and reported using a pit shell optimization in conjunction with a 12% Fe cut-off grade. The XIF geological (wireframe) model can be seen in Figure 1 but can also be seen as an animation video on our website by following this link, http://player.vimeo.com/video/104426385. For more details on the process of modelling, resource estimation and resource reporting using pit shell optimization techniques by SRK please see the XIF NI 43-101 MRE report.

Next Phase

The company is now moving into its next phase of exploration and is targeting a significant increase in the Mineral Resource by drilling out the Block 2 area which is split into Block 2a and Block 2b areas, see Figure 2. Significant tonnages of material are expected from these areas based on our exploration target mentioned above. We are anticipating a NI 43-101 MRE report following exploration at both Block 2a and Block 2b. The exploration priority is targeting MBA type material which is the higher grade material over 25% Fe and in Block 1 averaged 35.6% Fe. We are currently reviewing the ground magnetic signature intensity and inversion model to locate areas of higher grade potential MBA type material. We will use this to priorities the drilling order in Block 2a and Block 2b drill plans, and could modify the drill plans around the outcomes of this review. The drill holes in Block 2 is on a general spacing of around 800 meters along strike (North-South) and 100 meters across strike (East-West). This drill spacing aims to delineate an Inferred Mineral Resource, providing the mineralization is simple and continuous along strike and down-dip. If there are areas in Block 2 which are more geologically complex, in a similar manner to some complicated areas in Block 1, then extra holes may have to be drilled at a closer spacing.

The company will maintain its on-going metallurgical testwork program and will also look to invite structural expertise to enhance our knowledge of the XIF. Ground magnetics work is on-going and is focusing on a more detailed spacing of 20 meters (normally 50 meters) along drill lines to give us higher resolution data on drill hole section/fence lines and help with refining drill hole locations to maximize the drill plan efficiency.

Mineral Resource Estimate

The company began exploring in the XIF region for metals in 2008. A major program of ground magnetic surveying was conducted, and this greatly refined the XIF regional airborne magnetic anomaly and defined a very strong striped magnetic north-south orientation anomaly in the region that has a strike length up to 40 kilometers. Some initial holes drilled into the anomaly indicated the presence of XIF material which was identified as banded iron formation (BIF). Exploration drilling for the XIF began in more detail in 2011, however only ramped up into resource definition drilling in 2012 culminating in the completion of Block 1 in June 2014. The MRE is based on 157 holes totaling 31,149 meters drilled by Tsodilo within the Block 1 area, containing 9,221 assays from 13,824 meters of samples.

The geological modelling of Block 1 was carried out in-house by the company using Paradigm GOCAD geological modelling software, which was completed by geo-referencing interpreted cross sections into GOCAD and digitizing these sectional interpretations. These formed the basis of further interpretation and detailed geological modelling of wireframe surfaces of both mineralization and waste zones (geodomains).

The geodomains delineated in the model comprise: three separate magnetite-banded (MBA) zones (along with associated weathered MBW), three separate magnetic diamictite (DIM) zones (along with associated weathered DMW), seven MBA pods, one DIM pod, three magnetite schist (MGS) pods, eight garnet schist (GST) waste pods, one diamictite (DIA) waste pod, along with other waste lithology units. Mineralization has been delineated over a strike length of 8.5 kilometers within Block 1 which is based on diamond drilling and geophysical magnetic interpretation.

Using the geological wireframes, a single block model was created using block sizes 100 mY by 25 mX and 10 mZ. Grades of Fe, Al2O3, SiO2, Mn, P, S, CaO, LOI, MgO, K2O, and TiO2, were interpolated into the model using Ordinary Kriging (OK) for major geodomains and Inverse Distance Weighting to the power of 3 (IDW3) for minor geodomains using assay data from the diamond drilling completed by Tsodilo. This interpolated block model was run through a pit optimization process using reasonable operating and processing cost parameters along with a long-term commodity price to ensure the reported Mineral Resource comprises only material with reasonable potential for eventual economic extraction. The resulting reported Mineral Resource is therefore restricted to material falling within the optimized pit shell, and above a cut-off grade of 12% Fe. Details of these pit optimization parameters can be found in the XIF MRE resource report. Table 1 shows the resulting Mineral Resource statement for the Block 1.

About Tsodilo Resources Limited:

Tsodilo Resources Limited is an international diamond and metals exploration company engaged in the search for economic diamond and metal deposits at its Newdico (Pty) Limited ("Newdico") and Gcwihaba Resources (Pty) Limited ("Gcwihaba") projects in northwest Botswana. The Company has a 98% stake in Newdico (851 km2 under Precious Stone - diamond licenses). The Gcwihaba project area: 494 km2 under Precious Stone - diamond licenses; 11,158 km2 Metal (base, precious, platinum group, and rare earth) licenses; and, 6,925 km2 under Radioactive Minerals licenses is 100% held by the Company. Tsodilo manages the exploration of both the Newdico and Gcwihaba license areas. Overall supervision of the Company's exploration program is the responsibility of Dr. Mike de Wit, President and COO of the Company and a "qualified person" as such term is defined in National Instrument 43-101. Dr. de Wit has reviewed the information contained herein and approved the contents of this Press Release. Further to this, the supervision of the Xaudum Iron Ore project is the responsibility of Dr. Alistair Jeffcoate, Chief Geologist and Project Manager for the Company and a "qualified person" as such term is defined in National Instrument 43-101. Dr. Jeffcoate has also reviewed the information contained herein and approved the contents of this press release.

The Company has offices in Toronto, Canada and Gaborone and Maun, Botswana. Please visit the Company's website, www.TsodiloResources.com, for additional information and background on our projects. "

Antwort auf Beitrag Nr.: 46.667.819 von Popeye82 am 20.03.14 17:35:08

"Botswana overlooked, in hunt for copper"

www.miningweekly.com/article/botswana-overlooked-in-hunt-for…

" JOHANNESBURG (miningweekly.com) – Botswana was largely neglected in global mining majors' continued search for more copper, ASX-listed MOD Resources MD Julian Hanna said this week.

The landlocked Southern African country remained relatively unexplored, particularly the 700 km Kalahari copperbelt, which was a “well-endowed metal province” with significant sediment-hosted copper/silver deposits.

In a media statement, on Friday, Hanna noted that, as a result of recent developments in the copperbelt, MOD believed the potential of the well-mineralised region was only starting to be realised.

MOD Resources was the second-largest tenement holder in the Kalahari copperbelt, and its Botswana copper project comprised a “vast and strategically located” area in the centre of the province.

“MOD has 80% to 100% interests in more than 7 500 km2 of granted licences, so we are well positioned to make new discoveries,” he said, pointing to a recent raising of $2-million to embark on infill and extension drilling programmes and a conceptual mining study at its 100%-owned Mahumo copper/silver project, also in the Kalahari copperbelt.

“Our team has now identified high-grade copper and silver mineralisation at Mahumo, in addition to a number of other exciting targets, and now has funding and a well-defined strategy to test this potential,” he concluded.

Edited by: Creamer Media Reporter "

Zitat von Popeye82:Zitat von goldwiebloed: “The future of Botswana mining is going to be the coal and iron ore resources and of course diamonds,” he said.

Cupfa wird auch noch zukommen.

"Botswana overlooked, in hunt for copper"

www.miningweekly.com/article/botswana-overlooked-in-hunt-for…

" JOHANNESBURG (miningweekly.com) – Botswana was largely neglected in global mining majors' continued search for more copper, ASX-listed MOD Resources MD Julian Hanna said this week.

The landlocked Southern African country remained relatively unexplored, particularly the 700 km Kalahari copperbelt, which was a “well-endowed metal province” with significant sediment-hosted copper/silver deposits.

In a media statement, on Friday, Hanna noted that, as a result of recent developments in the copperbelt, MOD believed the potential of the well-mineralised region was only starting to be realised.

MOD Resources was the second-largest tenement holder in the Kalahari copperbelt, and its Botswana copper project comprised a “vast and strategically located” area in the centre of the province.

“MOD has 80% to 100% interests in more than 7 500 km2 of granted licences, so we are well positioned to make new discoveries,” he said, pointing to a recent raising of $2-million to embark on infill and extension drilling programmes and a conceptual mining study at its 100%-owned Mahumo copper/silver project, also in the Kalahari copperbelt.

“Our team has now identified high-grade copper and silver mineralisation at Mahumo, in addition to a number of other exciting targets, and now has funding and a well-defined strategy to test this potential,” he concluded.

Edited by: Creamer Media Reporter "

Noch jemand hier? Habe eine erste Position aufgebaut und kaufe eventuell noch einmal nach. Es gibt kaum Info im Netz, aber mit den ersten Ergebnissen der Kupfer-Testbohrungen von FQM wird wohl schon im Juli gerechnet. Wenn die finden, wonach sie suchen, dann gibt's hoffentlich ein ordentliches Übernahmeangebot an Tsodilo. Das Chancen-Risiko-Verhältnis auf diesem Niveau ist m.E. sehr gut.

Botswana Geoscience hat da m.Wissen.n. vor einiger zeit Diese Karten in Einem riesen Aufwand erstmal in so einer Qualität und Dieser (kartographischen)Reichweite geschaffen

New IGS Xplore prospectivity maps for Botswana; International Geoscience Services(IGS) have released a series of base metal prospectivity maps for the Ngamiland District of northwestern Botswana, using free geodata available on the recently-launched Botswana Geoscience Portal, hosted by Geosoft

www.earthexplorer.com/2016/New_IGS_Xplore_prospectivity_maps…

"International Geoscience Services (IGS) have released a series of base metal prospectivity maps for the Ngamiland District of northwestern Botswana using free geodata available on the recently-launched Botswana Geoscience Portal, hosted by Geosoft.

IGS, a spin-out of the British Geological Survey, used their proprietary IGS Xplore software to identify favorable areas for copper, zinc and lead mineralization using geological, geochemical and geophysical datasets downloaded directly from the portal.

“What’s key about these mineral prospectivity maps,” explains Dr Aoife Brady, Geodata Product Manager for IGS, “is that they give industry and government an indication of the mineral potential of a particular region or country. They show mineralization across a range of commodities, assist with prioritizing future mapping programs or data gathering, and can assist with delineating mineral tenements or cadastre licence areas.”

IGS recognises the vital strategic and investment link between geodata and mineral exploration, particularly for emerging and developing countries. The new prospectivity maps connect and interpret the datasets available on the Portal to bring out the potential and add value.

“The data we downloaded from the Botswana Geoscience Portal was extremely clean, well presented and easily downloadable and readable,” says Brady, “Our system is designed to work with basic geochemical, geological, and structural data, as long as it’s in good condition, is correctly georeferenced, consistent and well-attributed vectorized data. The data on the portal was all in this format.”

Fundamentally different to other geological software, IGS Xplore is a non-GIS semantically-driven knowledge-based mineral prospectivity software system. It uses robust, peer-reviewed geological knowledge to infer and visualise potentially prospective regions, quickly and cost-effectively identifying early-stage exploration targets for a range of commodities in a variety of regional geological environments.

“In essence, we’ve tried to mimic how a geologist thinks by imputing geological rules for up to 50

mineralization models into a computerized system,” says Brady, “We then test the geodata for a particular region against it.”

mineralization models into a computerized system,” says Brady, “We then test the geodata for a particular region against it.”

The IGS Xplore Prospectivity Maps are free to download from the Botswana Geoscience Portal. Each download includes a map in both geotiff and shape / layer formats and a mineral prospectivity report which provides details of the analyses and the prospectivity results.

- The IGS Xplore Prospectivity Map of Besshi Copper Deposits in North West Botswana.View this map. -

- The IGS Xplore Prospectivity Map for Carbonate-hosted Pb-Zn ±Cu deposits (Irish-type Sedex, Mississippi Valley-type and/or Kipushi type) in North West Botswana.View this map. - "

New IGS Xplore prospectivity maps for Botswana; International Geoscience Services(IGS) have released a series of base metal prospectivity maps for the Ngamiland District of northwestern Botswana, using free geodata available on the recently-launched Botswana Geoscience Portal, hosted by Geosoft

www.earthexplorer.com/2016/New_IGS_Xplore_prospectivity_maps…

"International Geoscience Services (IGS) have released a series of base metal prospectivity maps for the Ngamiland District of northwestern Botswana using free geodata available on the recently-launched Botswana Geoscience Portal, hosted by Geosoft.

IGS, a spin-out of the British Geological Survey, used their proprietary IGS Xplore software to identify favorable areas for copper, zinc and lead mineralization using geological, geochemical and geophysical datasets downloaded directly from the portal.

“What’s key about these mineral prospectivity maps,” explains Dr Aoife Brady, Geodata Product Manager for IGS, “is that they give industry and government an indication of the mineral potential of a particular region or country. They show mineralization across a range of commodities, assist with prioritizing future mapping programs or data gathering, and can assist with delineating mineral tenements or cadastre licence areas.”

IGS recognises the vital strategic and investment link between geodata and mineral exploration, particularly for emerging and developing countries. The new prospectivity maps connect and interpret the datasets available on the Portal to bring out the potential and add value.

“The data we downloaded from the Botswana Geoscience Portal was extremely clean, well presented and easily downloadable and readable,” says Brady, “Our system is designed to work with basic geochemical, geological, and structural data, as long as it’s in good condition, is correctly georeferenced, consistent and well-attributed vectorized data. The data on the portal was all in this format.”

Fundamentally different to other geological software, IGS Xplore is a non-GIS semantically-driven knowledge-based mineral prospectivity software system. It uses robust, peer-reviewed geological knowledge to infer and visualise potentially prospective regions, quickly and cost-effectively identifying early-stage exploration targets for a range of commodities in a variety of regional geological environments.

“In essence, we’ve tried to mimic how a geologist thinks by imputing geological rules for up to 50

mineralization models into a computerized system,” says Brady, “We then test the geodata for a particular region against it.”

mineralization models into a computerized system,” says Brady, “We then test the geodata for a particular region against it.”The IGS Xplore Prospectivity Maps are free to download from the Botswana Geoscience Portal. Each download includes a map in both geotiff and shape / layer formats and a mineral prospectivity report which provides details of the analyses and the prospectivity results.

- The IGS Xplore Prospectivity Map of Besshi Copper Deposits in North West Botswana.View this map. -

- The IGS Xplore Prospectivity Map for Carbonate-hosted Pb-Zn ±Cu deposits (Irish-type Sedex, Mississippi Valley-type and/or Kipushi type) in North West Botswana.View this map. - "

Antwort auf Beitrag Nr.: 53.112.300 von Popeye82 am 22.08.16 17:19:21

Hier gibts viel mehr Der Karten

http://geoscienceportal.geosoft.com/Botswana/Results?bookmar…

Hier gibts viel mehr Der Karten

http://geoscienceportal.geosoft.com/Botswana/Results?bookmar…

Commences 3,000 Meter Diamond Core Drill Program On BK16

News Release - Thursday, February 16, 2017

TORONTO, ONTARIO - Tsodilo Resources Limited ("Tsodilo" or the "Company") (TSX-Venture Exchange: (TSD)) is pleased to announce that it has commenced a drilling program utilizing its diamond core drill rigs on its wholly owned BK16 kimberlite project. The purpose of this drilling program is to drill pilot holes on the sites which have been earmarked for the Large Diameter Drill ("LDD") drilling program.

BK16

The BK16 kimberlite project is located within the Orapa Kimberlite Field ("OKF") in Botswana. The diamond mines in Botswana have produced an average of 27 million carats annually in the last 10 years and Botswana is the world's largest producer of diamonds by value. In 2016, the OKF area produced 8.85 million carats. Of the 83 known kimberlite bodies, nine have been or are currently being mined. These are AK1 (Orapa, Debswana), AK6 (Karowe, Lucara Diamond Corporation), BK1, BK9, BK12 and BK15 (Damtshaa, Debswana), DK1 and DK2 (Letlhakane, Debswana) and BK11 (Firestone Diamonds). The Karowe mine has produced such notable diamonds as the 1,109 carat 'Lesedi La Rona' and the 813 carat 'Constellation'.

The diamondiferous BK16 kimberlite pipe is approximately 6 hectares in size at surface, and is known to contain rare and valuable Type IIa diamonds (see press release dated May 31, 2016). The following phases of kimberlite were identified during the 2015 drilling program: Red volcaniclastic kimberlite VK1, Black VK2, Grey VK3 and VKxxx also referred to as the basalt breccia, and coherent kimberlite CK1. A geological model based on the 3,050 meters of core recover in 2015 was completed in 2016. Kimberlite phases VK2 and VK3 are volumetrically the most important and will be the focus of the LDD program. The placement of the initial 14 LDD holes was designed to provide grade estimates for the main kimberlite phases as well as initial grade distribution across the kimberlite. Z Star Mineral Resource Consultants (Cape Town, South Africa) was retained to optimize these objectives. The hole diameter of the LDD holes will be 24-inch and the planned 14 holes will provide some 2,000 tons of kimberlite.

In order to correlate the diamond recoveries directly to the geological model and to ensure that the intersection of the LDD holes are maximized it is necessary to probe all LDD sites with the above mentioned pilot core holes. The cumulative depth of the core holes for this program is 3,000 meters and it is anticipated that the pilot holes will take 6 to 7 weeks to complete.

News Release - Thursday, February 16, 2017

TORONTO, ONTARIO - Tsodilo Resources Limited ("Tsodilo" or the "Company") (TSX-Venture Exchange: (TSD)) is pleased to announce that it has commenced a drilling program utilizing its diamond core drill rigs on its wholly owned BK16 kimberlite project. The purpose of this drilling program is to drill pilot holes on the sites which have been earmarked for the Large Diameter Drill ("LDD") drilling program.

BK16

The BK16 kimberlite project is located within the Orapa Kimberlite Field ("OKF") in Botswana. The diamond mines in Botswana have produced an average of 27 million carats annually in the last 10 years and Botswana is the world's largest producer of diamonds by value. In 2016, the OKF area produced 8.85 million carats. Of the 83 known kimberlite bodies, nine have been or are currently being mined. These are AK1 (Orapa, Debswana), AK6 (Karowe, Lucara Diamond Corporation), BK1, BK9, BK12 and BK15 (Damtshaa, Debswana), DK1 and DK2 (Letlhakane, Debswana) and BK11 (Firestone Diamonds). The Karowe mine has produced such notable diamonds as the 1,109 carat 'Lesedi La Rona' and the 813 carat 'Constellation'.

The diamondiferous BK16 kimberlite pipe is approximately 6 hectares in size at surface, and is known to contain rare and valuable Type IIa diamonds (see press release dated May 31, 2016). The following phases of kimberlite were identified during the 2015 drilling program: Red volcaniclastic kimberlite VK1, Black VK2, Grey VK3 and VKxxx also referred to as the basalt breccia, and coherent kimberlite CK1. A geological model based on the 3,050 meters of core recover in 2015 was completed in 2016. Kimberlite phases VK2 and VK3 are volumetrically the most important and will be the focus of the LDD program. The placement of the initial 14 LDD holes was designed to provide grade estimates for the main kimberlite phases as well as initial grade distribution across the kimberlite. Z Star Mineral Resource Consultants (Cape Town, South Africa) was retained to optimize these objectives. The hole diameter of the LDD holes will be 24-inch and the planned 14 holes will provide some 2,000 tons of kimberlite.

In order to correlate the diamond recoveries directly to the geological model and to ensure that the intersection of the LDD holes are maximized it is necessary to probe all LDD sites with the above mentioned pilot core holes. The cumulative depth of the core holes for this program is 3,000 meters and it is anticipated that the pilot holes will take 6 to 7 weeks to complete.

Tsodilo Resources encouraged by initial results of diamond valuation

http://www.proactiveinvestors.co.uk/companies/stocktube/9859… Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -3,23 | |

| 0,00 | |

| 0,00 | |

| -3,14 | |

| 0,00 | |

| -0,27 | |

| +3,13 | |

| +5,26 | |

| -5,20 | |

| -4,65 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 179 | ||

| 120 | ||

| 77 | ||

| 58 | ||

| 57 | ||

| 57 | ||

| 55 | ||

| 51 | ||

| 44 | ||

| 40 |