Tencent - größtes chinesisches Internetportal, 73% EK-Rendite, aber TEUER - 500 Beiträge pro Seite

eröffnet am 08.04.10 16:33:48 von

neuester Beitrag 17.06.16 14:00:14 von

neuester Beitrag 17.06.16 14:00:14 von

Beiträge: 187

ID: 1.157.021

ID: 1.157.021

Aufrufe heute: 0

Gesamt: 24.031

Gesamt: 24.031

Aktive User: 0

ISIN: KYG875721634 · WKN: A1138D

32,26

EUR

-1,00 %

-0,33 EUR

Letzter Kurs 23.06.17 Xetra

Neuigkeiten

08.04.24 · BNP Paribas Anzeige |

20.03.24 · wallstreetONLINE Redaktion |

17.03.24 · HSBC Zertifikate Anzeige |

12.03.24 · wallstreetONLINE Redaktion |

27.02.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 26,40 | +15,59 | |

| 4,2200 | +14,99 | |

| 0,5090 | +11,14 | |

| 0,8080 | +10,84 | |

| 3,6550 | +8,78 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,0600 | -5,94 | |

| 7,5700 | -9,12 | |

| 9,7700 | -9,62 | |

| 6,1000 | -14,69 | |

| 3,0900 | -20,57 |

Habe einen Artikel in der FTD gelesen, wonach die fast 500 Mio. Kunden haben.

Gorillaliga also.

Gorillaliga also.

Naspers aus Südafrika hat ungefähr einen Anteil von einem Drittel an Tencent; im Naspers-Thread wird fast nur über Tencent gesprochen...:

Thread: naspers hat tradus gekauft...und nun?

Thread: naspers hat tradus gekauft...und nun?

Hallo RGBO,

das ist eine gute Idee mit dem neuen Tencent Thread!

Hier ein erster Beitrag von mir aus der FTD:

Unternehmen der Superlative

Chinas Netzwerk-Guru

Tencent hat mehr Kunden als Deutschland, Frankreich, England und die USA Einwohner. Mit dieser Klientel erzielt die chinesische Webfirma eine Rendite, von der Facebook, Myspace und Twitter nur träumen.

Deng Qianting hat QQ laufen, sobald ihr Laptop eingeschaltet ist. Die Mittzwanzigerin, die an der Southern China Agriculture University in Guangzhou arbeitet, ist oft auf Recherchetrips in ländlichen Gegenden unterwegs. Sie schwört auf den Kurznachrichtendienst, der wie der bekannte Messenger von Microsoft übers Web zu nutzen ist. "So halte ich Kontakt zu Kollegen und Schulfreunden; es ist extrem praktisch, weil einfach jeder QQ nutzt."

Tencent-Gründer, -Großaktionär und -Chef Ma Huateng Tencent-Gründer, -Großaktionär und -Chef Ma Huateng

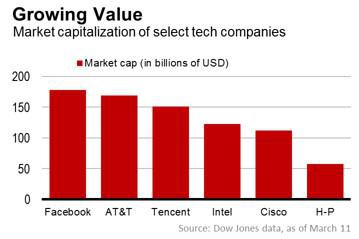

Ma Huateng wird das gefallen. Der 38-Jährige muss sich um die Popularität des von ihm gegründeten Unternehmens Tencent, zu dem die Marke QQ gehört, keine Sorgen machen. 523 Millionen Chinesen hatten Ende 2009 ein QQ-Konto - das sind mehr als die Bevölkerung der USA, Deutschlands, Frankreichs und Großbritanniens zusammen. Schätzungen sprechen von über 100 Millionen, die den Dienst tagtäglich aktiv nutzen. Laut dem Brokerhaus CLSA rangiert die Marke als beliebteste der Volksrepublik, noch vor China Mobile und dem Fertiggerichtehersteller Master Kong. Die Aktie von Tencent hat 2009 um 215 Prozent zugelegt. Unter den Internetfirmen übertreffen global nur Google und Amazon die Marktkapitalisierung von Tencent.

"Tencent ist der Riese, der aus dem Nichts zu Chinas beherrschendem Internetunternehmen wurde, sowohl nach der Zahl der Nutzer als auch dem Geschick, daraus Profit zu schlagen", urteilt David Murphy, Analyst bei CLSA. Vorstandschef Ma ist der Architekt dieses Erfolges. 1998 hatte der Absolvent der Informatikfakultät an der Universität im südchinesischen Shenzhen Tencent gegründet, so die englische Version des chinesischen Namens Tengxun. Ursprüngliches Geschäft war ein Paging-Dienst. Ein Jahr danach entstand QQ als Kopie des später von AOL übernommenen Webnachrichtendienstes ICQ, wie Ma in einem Interview einmal eingeräumt hat. Wenig originell nannten die Gründer ihren chinesischen Klon QICQ, wenig überraschend klagte AOL im Frühjahr 2000 gegen die Verletzung der Eigentumsrechte - und bekam Recht. Seither nutzt Tencent die Marke QQ und hat sich auch im Design von der Vorlage ICQ entfernt.

Als sie noch ein kleines Unternehmen waren, hätten sie auf den Schultern eines Riesen stehen müssen, so der Milliardär. "Aber andere zu kopieren kann dich nicht wirklich groß machen. Der Schlüssel zum Erfolg ist es, eine gute Idee zu lokalisieren und sie in deiner Region zu entwickeln." Das sei gelungen, attestiert Analyst Murphy. Neben QQ gehören ein Nachrichtenportal, Blogs, Videos, ein mit Myspace vergleichbares Netzwerk, Auktionen, E-Mail und Online-Spiele zum Angebot. Ma arbeitet daran, Online-Games anzubieten, die Hunderttausende Spieler gleichzeitig spielen können und vermarktet Werbeflächen. Er hat es geschafft, die Firma höchst profitabel zu machen - im Unterschied zu Webdiensten wie Twitter oder Facebook. 2009 erwirtschafte Tencent aus 12,4 Mrd. Yuan (1,3 Mrd. Euro) Erlös 5,2 Mrd. Yuan Reingewinn, ein Plus von 85 Prozent gegenüber dem Vorjahr.

Ma profitiert davon; laut "Forbes" belegt er mit einem Vermögen von rund 1,4 Mrd. $ Platz 522 im Ranking der Reichsten weltweit. Der Unternehmer pflegt Zurückhaltung in der Öffentlichkeit. Dennoch hat das Magazin "Barron's" Ma unter die Top-30 der CEOs weltweit gewählt, "Asiamoney" kürte ihn im Dezember zum besten Vorstandschef Asiens. Von Tencents Ruhm profitiert neben Ma, der einen großen Anteil hält, das südafrikanische Medienunternehmen Naspers. Die Südafrikaner, die 2001 einstiegen, besitzen ein gutes Drittel von Tencent. Naspers dürfte damit der erfolgreichste ausländische Investor im chinesischen Mediensektor sein.

Microsofts Messenger hat es schwer in diesem Umfeld, in dem Tencent rund 80 Prozent des Marktes beherrscht. Ma gibt sich nonchalant. "Ich habe keine Angst vor Microsoft. Deren Kunden sind Großunternehmen, unsere sind junge Leute." Mitarbeit: Huang Peiy

das ist eine gute Idee mit dem neuen Tencent Thread!

Hier ein erster Beitrag von mir aus der FTD:

Unternehmen der Superlative

Chinas Netzwerk-Guru

Tencent hat mehr Kunden als Deutschland, Frankreich, England und die USA Einwohner. Mit dieser Klientel erzielt die chinesische Webfirma eine Rendite, von der Facebook, Myspace und Twitter nur träumen.

Deng Qianting hat QQ laufen, sobald ihr Laptop eingeschaltet ist. Die Mittzwanzigerin, die an der Southern China Agriculture University in Guangzhou arbeitet, ist oft auf Recherchetrips in ländlichen Gegenden unterwegs. Sie schwört auf den Kurznachrichtendienst, der wie der bekannte Messenger von Microsoft übers Web zu nutzen ist. "So halte ich Kontakt zu Kollegen und Schulfreunden; es ist extrem praktisch, weil einfach jeder QQ nutzt."

Tencent-Gründer, -Großaktionär und -Chef Ma Huateng Tencent-Gründer, -Großaktionär und -Chef Ma Huateng

Ma Huateng wird das gefallen. Der 38-Jährige muss sich um die Popularität des von ihm gegründeten Unternehmens Tencent, zu dem die Marke QQ gehört, keine Sorgen machen. 523 Millionen Chinesen hatten Ende 2009 ein QQ-Konto - das sind mehr als die Bevölkerung der USA, Deutschlands, Frankreichs und Großbritanniens zusammen. Schätzungen sprechen von über 100 Millionen, die den Dienst tagtäglich aktiv nutzen. Laut dem Brokerhaus CLSA rangiert die Marke als beliebteste der Volksrepublik, noch vor China Mobile und dem Fertiggerichtehersteller Master Kong. Die Aktie von Tencent hat 2009 um 215 Prozent zugelegt. Unter den Internetfirmen übertreffen global nur Google und Amazon die Marktkapitalisierung von Tencent.

"Tencent ist der Riese, der aus dem Nichts zu Chinas beherrschendem Internetunternehmen wurde, sowohl nach der Zahl der Nutzer als auch dem Geschick, daraus Profit zu schlagen", urteilt David Murphy, Analyst bei CLSA. Vorstandschef Ma ist der Architekt dieses Erfolges. 1998 hatte der Absolvent der Informatikfakultät an der Universität im südchinesischen Shenzhen Tencent gegründet, so die englische Version des chinesischen Namens Tengxun. Ursprüngliches Geschäft war ein Paging-Dienst. Ein Jahr danach entstand QQ als Kopie des später von AOL übernommenen Webnachrichtendienstes ICQ, wie Ma in einem Interview einmal eingeräumt hat. Wenig originell nannten die Gründer ihren chinesischen Klon QICQ, wenig überraschend klagte AOL im Frühjahr 2000 gegen die Verletzung der Eigentumsrechte - und bekam Recht. Seither nutzt Tencent die Marke QQ und hat sich auch im Design von der Vorlage ICQ entfernt.

Als sie noch ein kleines Unternehmen waren, hätten sie auf den Schultern eines Riesen stehen müssen, so der Milliardär. "Aber andere zu kopieren kann dich nicht wirklich groß machen. Der Schlüssel zum Erfolg ist es, eine gute Idee zu lokalisieren und sie in deiner Region zu entwickeln." Das sei gelungen, attestiert Analyst Murphy. Neben QQ gehören ein Nachrichtenportal, Blogs, Videos, ein mit Myspace vergleichbares Netzwerk, Auktionen, E-Mail und Online-Spiele zum Angebot. Ma arbeitet daran, Online-Games anzubieten, die Hunderttausende Spieler gleichzeitig spielen können und vermarktet Werbeflächen. Er hat es geschafft, die Firma höchst profitabel zu machen - im Unterschied zu Webdiensten wie Twitter oder Facebook. 2009 erwirtschafte Tencent aus 12,4 Mrd. Yuan (1,3 Mrd. Euro) Erlös 5,2 Mrd. Yuan Reingewinn, ein Plus von 85 Prozent gegenüber dem Vorjahr.

Ma profitiert davon; laut "Forbes" belegt er mit einem Vermögen von rund 1,4 Mrd. $ Platz 522 im Ranking der Reichsten weltweit. Der Unternehmer pflegt Zurückhaltung in der Öffentlichkeit. Dennoch hat das Magazin "Barron's" Ma unter die Top-30 der CEOs weltweit gewählt, "Asiamoney" kürte ihn im Dezember zum besten Vorstandschef Asiens. Von Tencents Ruhm profitiert neben Ma, der einen großen Anteil hält, das südafrikanische Medienunternehmen Naspers. Die Südafrikaner, die 2001 einstiegen, besitzen ein gutes Drittel von Tencent. Naspers dürfte damit der erfolgreichste ausländische Investor im chinesischen Mediensektor sein.

Microsofts Messenger hat es schwer in diesem Umfeld, in dem Tencent rund 80 Prozent des Marktes beherrscht. Ma gibt sich nonchalant. "Ich habe keine Angst vor Microsoft. Deren Kunden sind Großunternehmen, unsere sind junge Leute." Mitarbeit: Huang Peiy

Ein kurzer Nachtrag von mir,

warum mich Tencent als Aktie eigentlich gar nicht so interessiert,

sondern die Firma vielmehr im Zusammenhang mit Naspers betrachte.

Wie die Überschrift bereits sagt, halte ich Tencent auch für "teuer".

Die Bewertung hat ein KGV von zurzeit 60. Das ist natürlich ambitioniert. Da sind weitere Gewinnsteigerungen bereits eingepreist.

Dagegen ist Naspers völlig anders bewertet.

Das sieht man insbesondere dann, wenn man Naspers' 35%-Anteil von Tencent betrachtet. So deckt alleine dieser Anteil, rein rechnerisch, die aktuelle Marktkapitalisierung von Naspers (10 Mrd €)

ab. Das heißt, das Multichoice, QXL, Buscape, Mail.ru und weitere Beteiligungen von Naspers "nichts wert" sind. Wie gesagt, rein rechnerisch betrachtet.

Dabei trägt alleine Multichoice, der Pay-TV Anbieter, zurzeit mehr als 2/3 zum Gewinn bei. Und Multichoice hat Wachstumsraten von etwa 15%.

Ich denke, dass Tencent bei einem Gewinnwachstum in den nächsten Jahren von durchschnittlich 40% im Jahre 2013 Multichoice als "Nr.1" der Gewinnbringer abgelöst haben wird.

Und deshalb liegt auf Tencent eben mein Hauptaugenmerk wenn ich Naspers betrachte.

Der Bereich Pay-TV ist relativ gut vorher zu sehen für die nächsten Jahre (Wachstum zwischen 0-20%), während Tencent eine unglaublich dynamische Geschichte darstellt.

Die Wachstumsraten der letzten Jahre sind hoch beeindruckend (um 90%) und keiner kann abschätzen, wie sich das weiter entwickeln wird. Schon jetzt trägt Tencent für 2009 185 M€ zum Gewinn bei Naspers bei. 2008 waren es noch 100 M€, 2007 55 M€.

Sollten meine konservativen Wachstumsschätzungen von jährlich 40%

erreicht werden, würde Tencent für 2013 rund 700 M€ an Naspers "Überweisen".

Wie gesagt, keiner weiss, wie sich Tencent entwickeln wird und wer die Berichterstattung verfolgt, liest einiges über aufziehende Risiken im Geschäftsfeld.

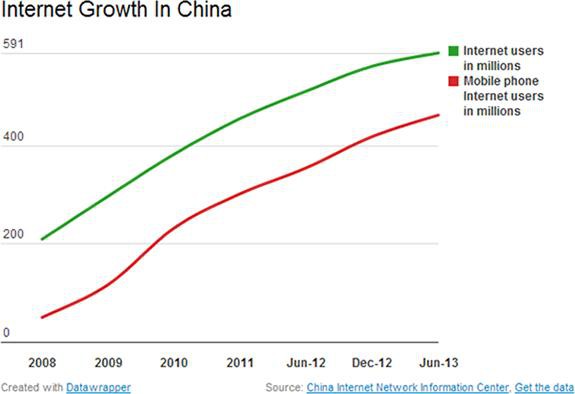

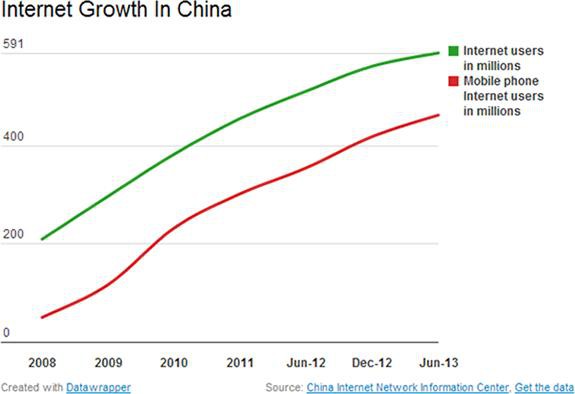

Aber, Tencent hat ein excellentes Management, welchem die Innovationskraft zuzutrauen ist, diesen Tanker immer wieder neu zu manövrieren. Der Markt in China ist nicht nur groß, sondern wächst auch enorm. Dabei hat Tencent jetzt schon ein Branding wie nur wenige Marken weltweit. So gesehen, kann man Tencent durchaus "Google-Potential" beimessen.

Diese Melange aus excellentem Management, Internetphantasie und dem riesen Markt China verspricht Aussergewöhnliches.

Aber es ist nur ein Versprechen.

Taten und Ergebnisse müssen folgen!

Denkt mal darüber nach

Brain

warum mich Tencent als Aktie eigentlich gar nicht so interessiert,

sondern die Firma vielmehr im Zusammenhang mit Naspers betrachte.

Wie die Überschrift bereits sagt, halte ich Tencent auch für "teuer".

Die Bewertung hat ein KGV von zurzeit 60. Das ist natürlich ambitioniert. Da sind weitere Gewinnsteigerungen bereits eingepreist.

Dagegen ist Naspers völlig anders bewertet.

Das sieht man insbesondere dann, wenn man Naspers' 35%-Anteil von Tencent betrachtet. So deckt alleine dieser Anteil, rein rechnerisch, die aktuelle Marktkapitalisierung von Naspers (10 Mrd €)

ab. Das heißt, das Multichoice, QXL, Buscape, Mail.ru und weitere Beteiligungen von Naspers "nichts wert" sind. Wie gesagt, rein rechnerisch betrachtet.

Dabei trägt alleine Multichoice, der Pay-TV Anbieter, zurzeit mehr als 2/3 zum Gewinn bei. Und Multichoice hat Wachstumsraten von etwa 15%.

Ich denke, dass Tencent bei einem Gewinnwachstum in den nächsten Jahren von durchschnittlich 40% im Jahre 2013 Multichoice als "Nr.1" der Gewinnbringer abgelöst haben wird.

Und deshalb liegt auf Tencent eben mein Hauptaugenmerk wenn ich Naspers betrachte.

Der Bereich Pay-TV ist relativ gut vorher zu sehen für die nächsten Jahre (Wachstum zwischen 0-20%), während Tencent eine unglaublich dynamische Geschichte darstellt.

Die Wachstumsraten der letzten Jahre sind hoch beeindruckend (um 90%) und keiner kann abschätzen, wie sich das weiter entwickeln wird. Schon jetzt trägt Tencent für 2009 185 M€ zum Gewinn bei Naspers bei. 2008 waren es noch 100 M€, 2007 55 M€.

Sollten meine konservativen Wachstumsschätzungen von jährlich 40%

erreicht werden, würde Tencent für 2013 rund 700 M€ an Naspers "Überweisen".

Wie gesagt, keiner weiss, wie sich Tencent entwickeln wird und wer die Berichterstattung verfolgt, liest einiges über aufziehende Risiken im Geschäftsfeld.

Aber, Tencent hat ein excellentes Management, welchem die Innovationskraft zuzutrauen ist, diesen Tanker immer wieder neu zu manövrieren. Der Markt in China ist nicht nur groß, sondern wächst auch enorm. Dabei hat Tencent jetzt schon ein Branding wie nur wenige Marken weltweit. So gesehen, kann man Tencent durchaus "Google-Potential" beimessen.

Diese Melange aus excellentem Management, Internetphantasie und dem riesen Markt China verspricht Aussergewöhnliches.

Aber es ist nur ein Versprechen.

Taten und Ergebnisse müssen folgen!

Denkt mal darüber nach

Brain

12.04.2010 16:43

Tencent Invests $300m in DST and Establishes Strategic Partnership / Transaction seals partnership between two leading Internet companies

HONG KONG and MOSCOW, April 12 /PRNewswire-Asia/ -- Tencent Holdings Limited ("Tencent" or the "Company", SEHK 00700), a leading provider of Internet and mobile&telecommunications value-added services in China, and Digital Sky Technologies Limited ("DST"), one of the largest Internet companies in the Russian-speaking and Eastern European markets, today jointly announced that Tencent will invest approximately US$300 million in DST, thereby establishing a long-term strategic partnership between the two companies.

The aggregate consideration of approximately US$300 million, which will be paid in cash, gives Tencent approximately a 10.26% economic interest in DST upon completion of the transaction. Tencent will hold approximately 0.51% of the total voting power of DST and have the right to nominate one observer to the DST Board.

DST and Tencent will embark on a long-term partnership and co-operation as they seek to benefit from each other's insights gained from their respective markets. DST's deep understanding of the Russian Internet market, together with its leading brands such as Mail.ru, Odnoklassniki and VKontakte, will enable Tencent to benefit from the high growth of the Russian-speaking Internet market. At the same time, Tencent's leading position in China will provide DST and its companies with unique and valuable operational insights and access to its regional network that can help DST further accelerate its growth path.

Chief Executive Officer of DST, Mr. Yuri Milner, said, "We are extremely pleased to welcome Tencent as a shareholder in DST. This investment is a vote of confidence in DST from the market leader in China and one of the world's most successful and dynamic Internet companies overall. Our teams share many common views and beliefs and a clear vision about the significant opportunities that lay ahead. We look forward to working together with Tencent and benefiting from their expertise as we both push forward with our plans to capitalize on this immense growth in our markets."

President of Tencent, Mr. Martin Lau, said, "We are excited to enter into a long-term strategic partnership with DST, a key global Internet player and a leader in Russian-speaking Internet markets. The investment allows us to benefit from the fast-growing Internet market in Russia, as well as to leverage our technical and operational know-how to strengthen the leadership position of DST and explore new business opportunities in the Russian-speaking Internet markets."

Details of the transaction can also be obtained from the statutory disclosure documents available on http://www.hkexnews.hk/ website and http://www.tencent.com/ir .

About Digital Sky Technologies

DST was founded in 2005 and is one of the largest Internet companies in the Russian-speaking and Eastern European markets and one of the leading investment groups globally to exclusively focus on internet related companies. DST, together with its affiliate DST Global, also hold stakes in Internet world leaders such as Facebook and Zynga. DST is a privately held company backed by leading Russian and Western financial institutions. For more information please visit http://www.dst-global.com/ .

Tencent Invests $300m in DST and Establishes Strategic Partnership / Transaction seals partnership between two leading Internet companies

HONG KONG and MOSCOW, April 12 /PRNewswire-Asia/ -- Tencent Holdings Limited ("Tencent" or the "Company", SEHK 00700), a leading provider of Internet and mobile&telecommunications value-added services in China, and Digital Sky Technologies Limited ("DST"), one of the largest Internet companies in the Russian-speaking and Eastern European markets, today jointly announced that Tencent will invest approximately US$300 million in DST, thereby establishing a long-term strategic partnership between the two companies.

The aggregate consideration of approximately US$300 million, which will be paid in cash, gives Tencent approximately a 10.26% economic interest in DST upon completion of the transaction. Tencent will hold approximately 0.51% of the total voting power of DST and have the right to nominate one observer to the DST Board.

DST and Tencent will embark on a long-term partnership and co-operation as they seek to benefit from each other's insights gained from their respective markets. DST's deep understanding of the Russian Internet market, together with its leading brands such as Mail.ru, Odnoklassniki and VKontakte, will enable Tencent to benefit from the high growth of the Russian-speaking Internet market. At the same time, Tencent's leading position in China will provide DST and its companies with unique and valuable operational insights and access to its regional network that can help DST further accelerate its growth path.

Chief Executive Officer of DST, Mr. Yuri Milner, said, "We are extremely pleased to welcome Tencent as a shareholder in DST. This investment is a vote of confidence in DST from the market leader in China and one of the world's most successful and dynamic Internet companies overall. Our teams share many common views and beliefs and a clear vision about the significant opportunities that lay ahead. We look forward to working together with Tencent and benefiting from their expertise as we both push forward with our plans to capitalize on this immense growth in our markets."

President of Tencent, Mr. Martin Lau, said, "We are excited to enter into a long-term strategic partnership with DST, a key global Internet player and a leader in Russian-speaking Internet markets. The investment allows us to benefit from the fast-growing Internet market in Russia, as well as to leverage our technical and operational know-how to strengthen the leadership position of DST and explore new business opportunities in the Russian-speaking Internet markets."

Details of the transaction can also be obtained from the statutory disclosure documents available on http://www.hkexnews.hk/ website and http://www.tencent.com/ir .

About Digital Sky Technologies

DST was founded in 2005 and is one of the largest Internet companies in the Russian-speaking and Eastern European markets and one of the leading investment groups globally to exclusively focus on internet related companies. DST, together with its affiliate DST Global, also hold stakes in Internet world leaders such as Facebook and Zynga. DST is a privately held company backed by leading Russian and Western financial institutions. For more information please visit http://www.dst-global.com/ .

Antwort auf Beitrag Nr.: 39.301.387 von Brain67 am 09.04.10 12:00:44Deine Einschätzung zu Naspers teile ich; interessanter Wert.

Bin aber oft schlechter gefahren, wenn ich indirekt in eine Story investiert habe; deswegen will ich zumindest in der Watchlist auch Tencent als stand-alone drinhaben.

Bin aber oft schlechter gefahren, wenn ich indirekt in eine Story investiert habe; deswegen will ich zumindest in der Watchlist auch Tencent als stand-alone drinhaben.

Der Einstieg von Tencent in DST ist ein weiterer Meilenstein in der Story "Google2", die ich seit einem Jahr über Tencent propagiere.

Die haben jetzt so viel Cash liegen, dass sie jetzt Partnerschaften in "Übersee" angehen.

Mit Intel haben sie jetzt auch eine Kooperation in Punkto mobile Services abgeschlossen.

Es bleibt spannend.

Brain

Die haben jetzt so viel Cash liegen, dass sie jetzt Partnerschaften in "Übersee" angehen.

Mit Intel haben sie jetzt auch eine Kooperation in Punkto mobile Services abgeschlossen.

Es bleibt spannend.

Brain

Tencent invests in DST

Networked networks

A big Chinese internet firm makes tentative steps abroad

Apr 15th 2010 | HONG KONG | From The Economist print edition

CRITICS of China’s internet firms argue that they have simply copied the business models of Western rivals, in some cases adding a few twists to accord with local tastes. But it is hard to make that criticism of Tencent, which runs the country’s biggest social network, instant-messaging service and online gaming business. Unlike many Western rivals, it has not only come up with desirable products, but also with reliable means to make money from them. The comparison is all the more pertinent since Tencent is expanding abroad, and will soon own an indirect stake in the biggest social network of all, Facebook.

On April 12th Tencent said it would pay $300m for a 10% stake (but almost no voting rights) in Digital Sky Technologies (DST), a Russian internet firm with investments in social networks, portals and web-mail. DST, in turn, owns stakes in Facebook and Zynga, which makes games that are played on the social network. Naspers, a South African media firm that is Tencent’s biggest shareholder, also owns a stake in mail.ru, DST’s most popular site.

Quite how all these ties will play out is not clear. Many of the firms involved are in similar businesses, and so have skills to share, but they also risk competing with one another. DST’s boss, Yuri Milner, has said that the link-up with Tencent will help his own firm catch up in social networking, which has lagged in Russia.

Tencent is certainly good at exploiting opportunities. A decade ago it struck a deal with China Mobile to transfer short messages from computers to mobile phones. The charge to users was 10 yuan a month ($1.50), of which Tencent received 85%. The text-messaging business that has emerged from this is nothing short of staggering: the firm claims the service had 500m active accounts in December.

Even greater success has come from gaming. Explicit import barriers and fear of counterfeiting stymied Japanese and American firms’ attempts to introduce gaming consoles in China. Tencent filled the vacuum by allowing customers to play PC-based games online free of charge, and then selling them digital accoutrements, such as weapons or clothes. This model proved piracy-proof and wildly popular. Tencent also sells add-ons (such as wallpaper images) for its social network, Qzone. Its revenues and profits, which come mainly from sales of virtual items, have been growing by over 60% a year. With a market capitalisation of more than $37 billion, it is the world’s third-biggest internet firm.

Given the protectionism it has benefited from in China, Tencent may suspect that straightforward expansion into a place like Russia may not be feasible. Instead, both Tencent and DST seem to be considering further acquisitions as a means to move abroad. Both are said to be interested in buying ICQ, an instant-messaging business owned by AOL, an American web portal. DST is also reported to have its eye on Bebo, a social network owned by AOL. There are rumours, too, that Tencent may now help Facebook get into China, where it is currently blocked. The only certainty is that linkages between such firms are growing almost as quickly as the social networks they run—especially among those looking for virtual means to cut holes through protected borders.

Networked networks

A big Chinese internet firm makes tentative steps abroad

Apr 15th 2010 | HONG KONG | From The Economist print edition

CRITICS of China’s internet firms argue that they have simply copied the business models of Western rivals, in some cases adding a few twists to accord with local tastes. But it is hard to make that criticism of Tencent, which runs the country’s biggest social network, instant-messaging service and online gaming business. Unlike many Western rivals, it has not only come up with desirable products, but also with reliable means to make money from them. The comparison is all the more pertinent since Tencent is expanding abroad, and will soon own an indirect stake in the biggest social network of all, Facebook.

On April 12th Tencent said it would pay $300m for a 10% stake (but almost no voting rights) in Digital Sky Technologies (DST), a Russian internet firm with investments in social networks, portals and web-mail. DST, in turn, owns stakes in Facebook and Zynga, which makes games that are played on the social network. Naspers, a South African media firm that is Tencent’s biggest shareholder, also owns a stake in mail.ru, DST’s most popular site.

Quite how all these ties will play out is not clear. Many of the firms involved are in similar businesses, and so have skills to share, but they also risk competing with one another. DST’s boss, Yuri Milner, has said that the link-up with Tencent will help his own firm catch up in social networking, which has lagged in Russia.

Tencent is certainly good at exploiting opportunities. A decade ago it struck a deal with China Mobile to transfer short messages from computers to mobile phones. The charge to users was 10 yuan a month ($1.50), of which Tencent received 85%. The text-messaging business that has emerged from this is nothing short of staggering: the firm claims the service had 500m active accounts in December.

Even greater success has come from gaming. Explicit import barriers and fear of counterfeiting stymied Japanese and American firms’ attempts to introduce gaming consoles in China. Tencent filled the vacuum by allowing customers to play PC-based games online free of charge, and then selling them digital accoutrements, such as weapons or clothes. This model proved piracy-proof and wildly popular. Tencent also sells add-ons (such as wallpaper images) for its social network, Qzone. Its revenues and profits, which come mainly from sales of virtual items, have been growing by over 60% a year. With a market capitalisation of more than $37 billion, it is the world’s third-biggest internet firm.

Given the protectionism it has benefited from in China, Tencent may suspect that straightforward expansion into a place like Russia may not be feasible. Instead, both Tencent and DST seem to be considering further acquisitions as a means to move abroad. Both are said to be interested in buying ICQ, an instant-messaging business owned by AOL, an American web portal. DST is also reported to have its eye on Bebo, a social network owned by AOL. There are rumours, too, that Tencent may now help Facebook get into China, where it is currently blocked. The only certainty is that linkages between such firms are growing almost as quickly as the social networks they run—especially among those looking for virtual means to cut holes through protected borders.

Tencent, China Merchants Bank Sign Strategic Agreement

April 19, 2010 | Print | Email Email | Comments | Category: Business, Internet

Chinese Internet company Tencent and China Merchants Bank have signed a strategic cooperating agreement to realize overall cooperation for the construction of a financial service platform.

The signing of the agreement marks the first overall cross-industry cooperation between a financial organization and an Internet portal in China. The cooperation will reportedly cover various sectors, including branding, services, and industry development. The two parties will promote each other's products and services, implement mutual marketing of customers, jointly organize charity activities, jointly initiate marketing activities, and jointly hold financial brand forums.

Tencent and China Merchants Bank have maintained a close partnership and the two parties have extensive cooperation in various areas. The comprehensive agreement signed this time is expected to promote the partnership of the two companies to the next stage.

No financial details or projections for this deal have been released.

April 19, 2010 | Print | Email Email | Comments | Category: Business, Internet

Chinese Internet company Tencent and China Merchants Bank have signed a strategic cooperating agreement to realize overall cooperation for the construction of a financial service platform.

The signing of the agreement marks the first overall cross-industry cooperation between a financial organization and an Internet portal in China. The cooperation will reportedly cover various sectors, including branding, services, and industry development. The two parties will promote each other's products and services, implement mutual marketing of customers, jointly organize charity activities, jointly initiate marketing activities, and jointly hold financial brand forums.

Tencent and China Merchants Bank have maintained a close partnership and the two parties have extensive cooperation in various areas. The comprehensive agreement signed this time is expected to promote the partnership of the two companies to the next stage.

No financial details or projections for this deal have been released.

Tencent (HKG:0700) to add 40% SZ Domain at RMB162.5M

[Date:04-19-2010] Source: Infocast News RSS Feed

Tencent Holdings (HKG:0700) has agreed to acquire a total of 40% equity interest in Shenzhen Domain Computer Network Company Limited (SZ Domain) at a total consideration of RMB162.5 million to increase its equity interest in SZ Domain to 100%.

SZ Domain is engaged in the development and provision of online games, in particular MMOGs (massively multiplayer online games). QQ Huaxia and Hero Island are two of the MMOGs developed and introduced by SZ Domain and are well received by the online game community.

[Date:04-19-2010] Source: Infocast News RSS Feed

Tencent Holdings (HKG:0700) has agreed to acquire a total of 40% equity interest in Shenzhen Domain Computer Network Company Limited (SZ Domain) at a total consideration of RMB162.5 million to increase its equity interest in SZ Domain to 100%.

SZ Domain is engaged in the development and provision of online games, in particular MMOGs (massively multiplayer online games). QQ Huaxia and Hero Island are two of the MMOGs developed and introduced by SZ Domain and are well received by the online game community.

Tencent To Acquire Remaining Stake In SZdomain For CNY150 Million

April 21, 2010 | Print | Email Email | Comments | Category: Business, Internet

The Chinese Internet company Tencent Holdings Limited has published an announcement, stating that it will acquire the remaining 40% stake in SZdomain, a Shenzhen-based online game developer and operator, for a consideration of over CNY150 million.

On the completion of this transaction, Tencent will own the complete stake in SZdomain.

Tencent said that it will invest CNY141.8 million to acquire a 29% stake in SZdomain from its founder and executive president, Zhang Yan. In addition, Tencent will gain the remaining 11% options of the company.

In November 2005, Tencent acquired a 19.9% stake in SZdomain for CNY29.9 million and then Tencent made another investment of CNY106.3 million in the acquisition of a 40.1% stake in SZdomain, gaining a total of 60% stake in the online game company in the two transactions. The new acquisition is expected to be completed before June 19, 2010.

Tencent's board of directors said that the completion of the acquisition can ensure the smooth integration of Tencent and SZdomain. At the same time, Tencent will provide more resources and supports to SZdomain to promote the continuous development of the latter.

Founded in 1997, SZdomain is a high-tech software company specialized in the development and operation of online games and the research of network applications. It claims to be one of the few Chinese companies that have proprietary 2D and 3D game engine technologies and intellectual property rights.

April 21, 2010 | Print | Email Email | Comments | Category: Business, Internet

The Chinese Internet company Tencent Holdings Limited has published an announcement, stating that it will acquire the remaining 40% stake in SZdomain, a Shenzhen-based online game developer and operator, for a consideration of over CNY150 million.

On the completion of this transaction, Tencent will own the complete stake in SZdomain.

Tencent said that it will invest CNY141.8 million to acquire a 29% stake in SZdomain from its founder and executive president, Zhang Yan. In addition, Tencent will gain the remaining 11% options of the company.

In November 2005, Tencent acquired a 19.9% stake in SZdomain for CNY29.9 million and then Tencent made another investment of CNY106.3 million in the acquisition of a 40.1% stake in SZdomain, gaining a total of 60% stake in the online game company in the two transactions. The new acquisition is expected to be completed before June 19, 2010.

Tencent's board of directors said that the completion of the acquisition can ensure the smooth integration of Tencent and SZdomain. At the same time, Tencent will provide more resources and supports to SZdomain to promote the continuous development of the latter.

Founded in 1997, SZdomain is a high-tech software company specialized in the development and operation of online games and the research of network applications. It claims to be one of the few Chinese companies that have proprietary 2D and 3D game engine technologies and intellectual property rights.

Kaum zu glauben, dass hier fast keiner bei einer solchen Perle postet. schaut mal in den aktuellen Aktionär Seite 26/27

First Ship Lease Trust kaufen

22.04.2010

HSH Nordbank AG

Hamburg (aktiencheck.de AG) - Der Analyst Stefan Gäde von der HSH Nordbank AG stuft die Aktie von First Ship Lease Trust (FSL Trust) (ISIN SG1U66934613 / WKN A0MM8X) unverändert mit "kaufen" ein.

Im ersten Quartal 2010 habe FSL Trust ein deutlich geringeres Ergebnis als im Vorjahresquartal und im vierten Quartal 2009 erzielt. Bei einem Umsatz von 24,43 USD (Vorjahr: 24,82 Mio. USD) sei das Quartalsergebnis von 1,54 auf 0,69 Mio. USD gesunken. Hauptgrund dafür sei der höhere Zinsaufwand. Im dritten Quartal habe FSL Trust wegen der Nichterfüllung von Loan-to-value-covenants einen 2-Jahres-Waiver abschließen müssen. Die zusätzliche Belastung sei mit 0,7 Mio. USD pro Quartal angegeben worden. Hinzu kämen nicht realisierte Währungsverluste von 0,20 Mio. USD, die im Finanzergebnis zum Tragen kämen.

Die leichten Schwankungen im Umsatz würden von zwei Schiffen stammen, deren Charterrate und Refinanzierung an den LIBOR gekoppelt sei, was sich im Nettoergebnis wieder aufhebe. Der operative Cashflow (vor Zinsen) habe geringfügig von 23,01 auf 22,57 Mio. USD abgenommen. Neben der Zahlung von Zinsen seien die Bankverbindlichkeiten vertragsgemäß um 8 Mio. USD zurückgeführt worden. Weitere 9 Mio. USD seien ausgeschüttet worden. Die Quartalsdividende werde wieder 1,50 US-Cent pro Anteilsschein betragen. Das Management gehe von diesem Betrag auch für das zweite Quartal 2010 aus.

Der Wert des Schiffsportfolios ohne Berücksichtigung der langfristigen Charterverträge sei Ende März 2010 mit 623,0 Mio. USD angegeben worden. Das entspreche 129% der Bankverbindlichkeiten von 484,3 Mio. USD. Insgesamt bestehe die FSL-Flotte aus 23 Schiffen. Ende März hätten die vertraglich gesicherten Umsätze noch 731,4 USD ohne Berücksichtigung von Verlängerungsoder Ausstiegsoptionen umfasst.

Anzeige

Das erste Quartal 2010 habe im Zeichen einer höheren Zinsbelastung gestanden und ein entsprechend niedrigeres Ergebnis mit sich gebracht. Der Cashflow erlaube aber weiterhin neben der Tilgung der Verbindlichkeiten die Zahlung einer Quartalsdividende von 1,5 US-Cent pro Anteilsschein. Dieses Ergebnis- bzw. Ausschüttungsniveau könne nach Meinung der Analysten auch für die folgenden Quartale des laufenden Geschäftsjahres als gesichert angesehen werden.

Mit der sich erholenden Konjunktur würden sich auch die Perspektiven für die Schifffahrt verbessern. So untermauere der überraschend kräftige Zuwachs des Containerumschlags im ersten Quartal 2010 den einsetzenden Aufwärtstrend. Gleichwohl rechne man damit, dass das Überangebot an Tonnage die Erholung der Charterraten bis mindestens Ende 2011 noch beeinträchtigen werde.

Weil viele Banken beim Neugeschäft Zurückhaltung üben würden, dürfte es FSL Trust nicht schwer fallen, die Schiffsflotte aufzustocken. Dafür stünden die Mittel aus der Kapitalerhöhung (28,3 Mio. USD) zur Verfügung. Allerdings seien die Analysten davon ausgegangen, dass es schon im ersten Quartal zu einem Vertragsabschluss kommen würde. Das FSL-Management halte einen Abschluss im zweiten Quartal für wahrscheinlich. Das würde sich entsprechend im Ergebnis widerspiegeln.

Da der Ausbau der Flotte langsamer vorangehe als erwartet, hätten die Analysten ihre Umsatz- und Ergebnisprognose für dieses Jahr reduziert. Außerdem würden sie von etwas ungünstigeren Investitionsbedingungen für FSL ausgehen.

Die Analysten der HSH Nordbank AG bestätigen das "kaufen"-Rating für die FSL Trust-Aktie. Das Kursziel auf Sicht von zwölf Monaten hätten die Analysten von 0,57 auf 0,55 USD reduziert. Dies entspreche 0,75 SGD (Singapur-Dollar) (Umrechnungskurs: 1,000 SGD = 0,7250 USD). Das Anlagerisiko schätze man als mittel ein. (Analyse vom 22.04.2010) (22.04.2010/ac/a/a)

22.04.2010

HSH Nordbank AG

Hamburg (aktiencheck.de AG) - Der Analyst Stefan Gäde von der HSH Nordbank AG stuft die Aktie von First Ship Lease Trust (FSL Trust) (ISIN SG1U66934613 / WKN A0MM8X) unverändert mit "kaufen" ein.

Im ersten Quartal 2010 habe FSL Trust ein deutlich geringeres Ergebnis als im Vorjahresquartal und im vierten Quartal 2009 erzielt. Bei einem Umsatz von 24,43 USD (Vorjahr: 24,82 Mio. USD) sei das Quartalsergebnis von 1,54 auf 0,69 Mio. USD gesunken. Hauptgrund dafür sei der höhere Zinsaufwand. Im dritten Quartal habe FSL Trust wegen der Nichterfüllung von Loan-to-value-covenants einen 2-Jahres-Waiver abschließen müssen. Die zusätzliche Belastung sei mit 0,7 Mio. USD pro Quartal angegeben worden. Hinzu kämen nicht realisierte Währungsverluste von 0,20 Mio. USD, die im Finanzergebnis zum Tragen kämen.

Die leichten Schwankungen im Umsatz würden von zwei Schiffen stammen, deren Charterrate und Refinanzierung an den LIBOR gekoppelt sei, was sich im Nettoergebnis wieder aufhebe. Der operative Cashflow (vor Zinsen) habe geringfügig von 23,01 auf 22,57 Mio. USD abgenommen. Neben der Zahlung von Zinsen seien die Bankverbindlichkeiten vertragsgemäß um 8 Mio. USD zurückgeführt worden. Weitere 9 Mio. USD seien ausgeschüttet worden. Die Quartalsdividende werde wieder 1,50 US-Cent pro Anteilsschein betragen. Das Management gehe von diesem Betrag auch für das zweite Quartal 2010 aus.

Der Wert des Schiffsportfolios ohne Berücksichtigung der langfristigen Charterverträge sei Ende März 2010 mit 623,0 Mio. USD angegeben worden. Das entspreche 129% der Bankverbindlichkeiten von 484,3 Mio. USD. Insgesamt bestehe die FSL-Flotte aus 23 Schiffen. Ende März hätten die vertraglich gesicherten Umsätze noch 731,4 USD ohne Berücksichtigung von Verlängerungsoder Ausstiegsoptionen umfasst.

Anzeige

Das erste Quartal 2010 habe im Zeichen einer höheren Zinsbelastung gestanden und ein entsprechend niedrigeres Ergebnis mit sich gebracht. Der Cashflow erlaube aber weiterhin neben der Tilgung der Verbindlichkeiten die Zahlung einer Quartalsdividende von 1,5 US-Cent pro Anteilsschein. Dieses Ergebnis- bzw. Ausschüttungsniveau könne nach Meinung der Analysten auch für die folgenden Quartale des laufenden Geschäftsjahres als gesichert angesehen werden.

Mit der sich erholenden Konjunktur würden sich auch die Perspektiven für die Schifffahrt verbessern. So untermauere der überraschend kräftige Zuwachs des Containerumschlags im ersten Quartal 2010 den einsetzenden Aufwärtstrend. Gleichwohl rechne man damit, dass das Überangebot an Tonnage die Erholung der Charterraten bis mindestens Ende 2011 noch beeinträchtigen werde.

Weil viele Banken beim Neugeschäft Zurückhaltung üben würden, dürfte es FSL Trust nicht schwer fallen, die Schiffsflotte aufzustocken. Dafür stünden die Mittel aus der Kapitalerhöhung (28,3 Mio. USD) zur Verfügung. Allerdings seien die Analysten davon ausgegangen, dass es schon im ersten Quartal zu einem Vertragsabschluss kommen würde. Das FSL-Management halte einen Abschluss im zweiten Quartal für wahrscheinlich. Das würde sich entsprechend im Ergebnis widerspiegeln.

Da der Ausbau der Flotte langsamer vorangehe als erwartet, hätten die Analysten ihre Umsatz- und Ergebnisprognose für dieses Jahr reduziert. Außerdem würden sie von etwas ungünstigeren Investitionsbedingungen für FSL ausgehen.

Die Analysten der HSH Nordbank AG bestätigen das "kaufen"-Rating für die FSL Trust-Aktie. Das Kursziel auf Sicht von zwölf Monaten hätten die Analysten von 0,57 auf 0,55 USD reduziert. Dies entspreche 0,75 SGD (Singapur-Dollar) (Umrechnungskurs: 1,000 SGD = 0,7250 USD). Das Anlagerisiko schätze man als mittel ein. (Analyse vom 22.04.2010) (22.04.2010/ac/a/a)

Börsenkalenderfür TENCENT HOLDINGS LTD.

12.05.2010 Hauptversammlung

12.05.2010 Ergebnisse erstes Quartal

12.05.2010 Hauptversammlung

12.05.2010 Ergebnisse erstes Quartal

Antwort auf Beitrag Nr.: 39.506.599 von zinn123 am 12.05.10 12:22:37For Immediate Release

TENCENT ANNOUNCES 2010 FIRST QUARTER RESULTS

Hong Kong, May 12, 2010 – Tencent Holdings Limited (“Tencent” or the “Company”, SEHK 00700), a

leading provider of Internet and mobile & telecommunications value-added services in China, today

announced the unaudited consolidated results for the first quarter of 2010 ended March 31, 2010.

Highlights of the first quarter of 2010:

§ Total revenues were RMB4,226.1 million (USD619.1 million1), an increase of 14.6% over the

fourth quarter of 2009 (“QoQ”) or an increase of 68.7% over the first quarter of 2009 (“YoY”)

§ Revenues from Internet value-added services (“IVAS”) were RMB3,387.4 million (USD496.2

million), an increase of 19.0% QoQ or an increase of 77.9% YoY

§ Revenues from mobile & telecommunications value-added services (“MVAS”) were RMB618.2

million (USD90.6 million), an increase of 12.4% QoQ or an increase of 40.7% YoY

§ Revenues from online advertising were RMB204.3 million (USD29.9 million), a decrease of

26.8% QoQ or an increase of 39.4% YoY

§ Gross profit was RMB2,897.7 million (USD424.5 million), an increase of 13.9% QoQ or an

increase of 68.6% YoY. Gross margin decreased to 68.6% from 69.0% last quarter

§ Operating profit was RMB2,148.4 million (USD314.7 million), an increase of 20.9% QoQ or an

increase of 84.5% YoY. Operating margin increased to 50.8% from 48.2% last quarter

§ Profit for the period was RMB1,802.4 million (USD264.0 million), an increase of 17.6% QoQ or an

increase of 71.1% YoY. Net margin increased to 42.7% from 41.6% last quarter

§ Profit attributable to equity holders of the Company was RMB1,783.2 million (USD261.2 million),

an increase of 18.3% QoQ or an increase of 72.2% YoY

§ Key platform statistics:

- Active Instant Messaging (“IM”) user accounts increased 8.7% QoQ to 568.6 million

- Peak simultaneous online user accounts for IM services increased 13.2% QoQ to 105.3

million

- Active user accounts of Qzone increased 10.4% QoQ to 428.0 million

- Peak simultaneous online user accounts of QQ Game portal (for mini casual games only)

increased 9.7% QoQ to 6.8 million

- IVAS paying subscriptions increased 16.1% QoQ to 59.9 million

- MVAS paying subscriptions increased 14.8% QoQ to 23.3 million

Mr. Ma Huateng, Chairman and CEO of Tencent, said, “During the first quarter of 2010, our various

online platforms continued to grow and our IVAS business, particularly our online gaming business,

benefited from the strong holiday season. The second quarter will be a weaker season for our IVAS

business, but it will present stronger seasonality for our online advertising business. We are also

looking forward to leveraging the Shanghai World Expo and World Cup events to further build our

brand and media influence. While we are cognizant of the fact that as our scale grows, the growth

rate of our business will inevitably slow down; we are committed to continuously investing into the

future as we believe in the long-term potential of the China Internet market.”

1 Figures stated in USD are based on USD1 to RMB6.8263

Page 2 of 8

Financial Review for the First Quarter of 2010

IVAS revenues increased 19.0% QoQ to RMB3,387.4 million and represented 80.2% of our total

revenues for the first quarter of 2010. Revenues from our online games increased by 30.1% to

RMB2,023.6 million. This primarily reflected the positive seasonal impact of the Chinese New Year

holidays and winter break for students, which resulted in the increased monetisation of our major

advanced casual games and MMOGs, namely Cross Fire, Dungeon and Fighter (“DNF”), QQ Dancer

and QQ Speed. The growth of QQ Game also contributed to the increase in online gaming revenues.

For our community value-added services, revenues increased by 5.6% to RMB1,363.8 million.

Subscriber of QQ Membership increased as we focused on enhancing user value and stickiness by

enriching the online and offline privileges of the product. Growth in Qzone was mainly due to

increased user activeness driven by our SNS applications. Revenues from QQ Show also increased

as we launched programmes to attract new subscribers and continued to improve user loyalty with

enhanced features as well as annual subscription package.

MVAS revenues increased 12.4% QoQ to RMB618.2 million and represented 14.6% of our total

revenues. This was primarily driven by the growth in the user base of our bundled SMS packages

resulting from enhanced privileges and features. Revenues from mobile SNS applications and mobile

games also increased. The increase in revenues was partly offset by the reduction in revenues from

our WAP business due to the suspension of billing for WAP services by China Mobile since 30

November 2009. Revenues from legacy mobile voice value-added services also declined.

Online advertising revenues decreased 26.8% QoQ to RMB204.3 million and represented 4.8% of

our total revenues. This primarily reflected weaker seasonality in the first quarter as advertising

activities reduced around the Chinese New Year holidays.

Other Key Financial Information for the First Quarter of 2010

Share-based compensation was RMB101.0 million for the first quarter of 2010 as compared with

RMB100.3 million for the previous quarter.

Foreign exchange loss was RMB1.6 million for the first quarter of 2010 as compared with RMB0.4

million for the previous quarter.

Capital expenditure was RMB366.6 million for the first quarter of 2010 as compared with RMB369.2

million for the previous quarter.

Basic earnings per share for the quarter were RMB0.984, and diluted earnings per share were

RMB0.959.

As at March 31, 2010, cash and cash equivalents, term deposits with initial term of over three months

and held-to-maturity investments totaled RMB13,810.3 million. The total number of shares of the

Company in issue was 1.824 billion.

Page 3 of 8

Business Review and Outlook

We delivered solid financial and operating performance in the first quarter of 2010 on the back of

strong seasonality and the continued growth of our platforms. Our IVAS, especially for online games,

benefited from the Chinese New Year holidays and winter break for students, when users’ propensity

to spend increased. Our MVAS registered growth during the quarter, primarily driven by the increase

in subscription to our bundled SMS packages as we enriched the privileges and features. For our

online advertising business, revenues decreased on a quarter-on-quarter basis as the first quarter

was traditionally a weak season. Looking into the second quarter of 2010, we expect weaker

seasonality for our IVAS due to fewer school holidays during the quarter and school examinations

towards the end of the quarter. Visibility of our MVAS business would remain low as the industry

continues to face significant regulatory uncertainties. On the other hand, our online advertising

business should benefit from stronger seasonality in the second quarter.

In April 2010, we announced a USD300 million investment in Digital Sky Technologies Limited

(“DST”), one of the largest Internet companies in the Russian-speaking and Eastern European

markets, and the establishment of a long-term strategic partnership between DST and Tencent. This

transaction represents a step for us to tap into the potential of the fast-growing Internet market in

Russia. It also aligns with our long-term strategy of cooperating with top local Internet companies in

emerging markets through strategic investment and partnership, and leveraging our technical and

operational know-how to deliver quality Internet products and services to users in these markets.

IM Platform

Our IM platform continued to expand during the quarter, with active users and peak concurrent users

(“PCU”) increasing to 568.6 million and 105.3 million respectively. This was primarily driven by

positive seasonality and the popularity of SNS applications, which enhanced user activity and

engagement through cross-platform integration. The increasing usage of our IM services on mobile

devices also contributed to the growth. To extend our leadership in the market, we are broadening

and deepening the integration of our IM services with other platforms of Tencent. We are also

enhancing our services for different user segments with tailored functionalities and features.

QQ.com

The traffic on QQ.com increased during the quarter as we enriched the content of our key vertical

channels and fostered stronger cross-platform integration. We also continued to execute our brand

TV advertising campaign to further improve our brand image and awareness. In the second quarter

and third quarter of 2010, we will increase our investments in content as well as advertising and

promotion activities to leverage the 2010 World Exposition in Shanghai and the World Cup to

enhance our media influence and standing in the industry. As part of this strategy, we have just

acquired the right from China Network Television to provide World Cup video clips to our users.

Internet value-added services

For community value-added services, QQ Membership registered healthy growth in user base on the

back of enhanced user loyalty and stickiness mainly driven by the bundling of more value-added

functions as well as online and offline lifestyle privileges. Benefiting from the popularity of SNS

Page 4 of 8

applications, Qzone’s active user accounts increased by 10.4% on a quarter-on-quarter basis to

reach 428.0 million at the end of the first quarter. As we saw the growth of our most popular SNS

game, QQ Farm, approaching saturation because of its high penetration, we increased the promotion

of QQ Ranch, a social game closely related and integrated with QQ Farm, to provide more content to

our users. We are also launching new self-developed and third-party applications on Qzone and

Xiaoyou on trial basis during the first quarter as we recognise the life cycle of individual social game

tends to be short. Going forward, we will continue to enhance the user value of our SNS platforms by

improving the basic social networking functionalities as well as introducing different SNS applications

that cater to the varying needs of our user base. We are also increasing our effort to extend Qzone to

our wireless platforms to further enhance its reach and usage. For QQ Show, monthly subscription

grew during the quarter as we introduced free trial and enhanced free items to attract new users and

converted some of these users into paid subscribers. User stickiness also improved, with enhanced

features as well as introduction of annual subscription package.

Our online game business benefited from positive seasonality as well as the launch of expansion

packs and holiday promotions for our major advanced casual games and MMOGs. QQ Game also

benefited from in-game promotions, with its PCU reaching 6.8 million. During the quarter, we

launched Dragon Power, a hardcore 2D MMOG, and A.V.A., a niche market First Person Shooting

game, to further enrich our diversified game portfolio. We are also working on the launch of additional

MMOGs for the rest of 2010. We believe that as the online game industry begins to mature, the

operating environment for online game companies would become more challenging going forward.

On the one hand, gamers are now more sophisticated in choosing online games, raising the bar on

the quality of successful games. On the other hand, competition for licensed games and talent has

increased as there are many well-funded gaming companies in the market. These factors would

decrease the success rate and extent of success for new games, as well as increase investment

requirements. Against this backdrop, we will have to work even harder on leveraging our platforms

and operational experience to introduce high quality games to different market segments via

self-development, licensing and investments. Our recent acquisition of the remaining 40% stake in

Shenzhen Domain Computer Network Company Limited, which will allow us to better integrate and

leverage the development resources of the company, is in line with this strategy.

Mobile and telecommunications value-added services

Our MVAS business grew during the quarter primarily driven by the expansion in the user base of our

bundled SMS packages as we added more privileges and features to the packages. Traffic on our

WAP portal continued to increase, reinforcing our leading position in the freeWAP portal industry. The

growth of our MVAS business was dampened by the suspension of billing for WAP services by China

Mobile since 30 November 2009 and the decline in legacy mobile voice value-added services.

Visibility of the industry would remain low as the sector is still subject to significant regulatory

uncertainties.

Online advertising

Our online advertising business was affected by weaker seasonality in the first quarter of 2010 as

advertising activities generally reduced around the Chinese New Year holidays. During the quarter,

we continued to develop cross-platform and user-targeted advertising solutions to deepen our

differentiation in the market. Looking ahead, we are positioning ourselves for long-term growth by

Page 5 of 8

enhancing our image as a mainstream and influential media, strengthening our sales organisation

and further improving our advertising products to capitalise on the strengths of our platforms.

# # #

Page 6 of 8

About Tencent

Tencent aims to enrich the interactive online experience of Internet users in China by providing a

comprehensive range of Internet and wireless value-added services. Through its various online

platforms, including Instant Messaging QQ, web portal QQ.com, QQ Game portal, multi-media social

networking service Qzone and wireless portal, Tencent services the largest online community in

China and fulfills the user’s needs for communication, information, entertainment and e-Commerce

on the Internet.

Tencent has three main streams of revenues: Internet value-added services, mobile and

telecommunications value-added services and online advertising.

Shares of Tencent Holdings Limited are traded on the Main Board of the Stock Exchange of Hong

Kong Limited, under stock code 00700. The Company became one of the 43 constituents of the Hang

Seng Index (HSI) on June 10, 2008. For more information, please visit www.tencent.com/ir.

For enquiries, please contact:

Catherine Chan Tel: (86) 755 86013388 ext 88369 or (852) 21795122 Email: cchan#tencent.com

Jane Yip Tel: (86) 755 86013388 ext 81374 or (852) 21795122 Email: janeyip#tencent.com

Forward-Looking Statements

This press release contains forward-looking statements relating to the business outlook, forecast

business plans and growth strategies of the Company. These forward-looking statements are based

on information currently available to the Group and are stated herein on the basis of the outlook at the

time of this announcement. They are based on certain expectations, assumptions and premises,

some of which are subjective or beyond our control. These forward-looking statements may prove to

be incorrect and may not be realized in future. Underlying the forward-looking statements is a large

number of risks and uncertainties. Further information regarding these risks and uncertainties is

included in our other public disclosure documents on our corporate website.

Page 7 of 8

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

In RMB ‘000 (unless otherwise stated)

Unaudited Unaudited

1Q2010 4Q2009 1Q2010 1Q2009

Revenues 4,226,060 3,688,264 4,226,060 2,504,365

Internet VAS 3,387,377 2,847,055 3,387,377 1,904,563

Mobile & Telecom VAS 618,238 549,899 618,238 439,545

Online Advertising 204,334 279,006 204,334 146,563

Others 16,111 12,304 16,111 13,694

Cost of revenues (1,328,355) (1,144,855) (1,328,355) (785,914)

Gross profit 2,897,705 2,543,409 2,897,705 1,718,451

Gross margin 68.6% 69.0% 68.6% 68.6%

Interest income 57,191 41,116 57,191 34,049

Other losses, net (35,275) (26,886) (35,275) (34,820)

S&M expenses (185,417) (208,105) (185,417) (98,105)

G&A expenses (585,766) (572,882) (585,766) (455,018)

Operating profit 2,148,438 1,776,652 2,148,438 1,164,557

Operating margin 50.8% 48.2% 50.8% 46.5%

Finance (costs)/income (1,558) (369) (1,558) 248

Share of profit of associates 12,913 9,542 12,913 5,372

Profit before income tax 2,159,793 1,785,825 2,159,793 1,170,177

Income tax expense (357,375) (252,772) (357,375) (116,567)

Profit for the period /Total

comprehensive income for the period

1,802,418 1,533,053 1,802,418 1,053,610

Net margin 42.7% 41.6% 42.7% 42.1%

Attributable to:

Equity holders of the Company 1,783,194 1,507,945 1,783,194 1,035,440

Minority interests 19,224 25,108 19,224 18,170

Earnings per share

- basic (RMB) 0.984 0.835 0.984 0.577

- diluted (RMB) 0.959 0.812 0.959 0.566

Page 8 of 8

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

In RMB ‘000 (unless otherwise stated) Unaudited Audited

31 March

2010

31 December

2009

ASSETS

Non-current assets

Fixed assets 2,688,833 2,517,202

Construction in progress 123,824 105,771

Investment properties 67,703 68,025

Land use rights 35,109 35,296

Intangible assets 277,620 268,713

Investment in associates 612,856 477,622

Deferred income tax assets 286,862 301,016

Held-to-maturity investments 341,315 341,410

Available-for-sale financial assets 174,031 153,462

Prepayments, deposits and other receivables 12,799 80,306

4,620,952 4,348,823

Current assets

Accounts receivable 1,610,069 1,229,436

Prepayments, deposits and other receivables 431,937 373,642

Term deposits with initial term of over three months 6,673,010 5,310,168

Restricted cash 1,008,175 200,000

Cash and cash equivalents 6,795,966 6,043,696

16,519,157 13,156,942

Total Assets 21,140,109 17,505,765

EQUITY

Equity attributable to the Company’s equity holders

Share capital 197 197

Share premium 1,283,509 1,244,425

Shares held for share award scheme (155,664) (123,767)

Share-based compensation reserve 804,623 703,563

Other reserves (66,030) (166,364)

Retained earnings 12,297,564 10,520,453

14,164,199 12,178,507

Minority interests in equity 112,672 120,146

Total Equity 14,276,871 12,298,653

LIABILITIES

Non-current liabilities

Deferred income tax liabilities 403,229 369,983

Long-term payables 12,799 274,050

416,028 644,033

Current liabilities

Accounts payable 937,360 696,511

Other payables and accruals 1,793,618 1,626,051

Short-term bank borrowings 988,448 202,322

Current income tax liabilities 288,728 85,216

Other tax liabilities 272,939 216,978

Deferred revenue 2,166,117 1,736,001

6,447,210 4,563,079

Total Liabilities 6,863,238 5,207,112

Total Equity and Liabilities 21,140,109 17,505,765

TENCENT ANNOUNCES 2010 FIRST QUARTER RESULTS

Hong Kong, May 12, 2010 – Tencent Holdings Limited (“Tencent” or the “Company”, SEHK 00700), a

leading provider of Internet and mobile & telecommunications value-added services in China, today

announced the unaudited consolidated results for the first quarter of 2010 ended March 31, 2010.

Highlights of the first quarter of 2010:

§ Total revenues were RMB4,226.1 million (USD619.1 million1), an increase of 14.6% over the

fourth quarter of 2009 (“QoQ”) or an increase of 68.7% over the first quarter of 2009 (“YoY”)

§ Revenues from Internet value-added services (“IVAS”) were RMB3,387.4 million (USD496.2

million), an increase of 19.0% QoQ or an increase of 77.9% YoY

§ Revenues from mobile & telecommunications value-added services (“MVAS”) were RMB618.2

million (USD90.6 million), an increase of 12.4% QoQ or an increase of 40.7% YoY

§ Revenues from online advertising were RMB204.3 million (USD29.9 million), a decrease of

26.8% QoQ or an increase of 39.4% YoY

§ Gross profit was RMB2,897.7 million (USD424.5 million), an increase of 13.9% QoQ or an

increase of 68.6% YoY. Gross margin decreased to 68.6% from 69.0% last quarter

§ Operating profit was RMB2,148.4 million (USD314.7 million), an increase of 20.9% QoQ or an

increase of 84.5% YoY. Operating margin increased to 50.8% from 48.2% last quarter

§ Profit for the period was RMB1,802.4 million (USD264.0 million), an increase of 17.6% QoQ or an

increase of 71.1% YoY. Net margin increased to 42.7% from 41.6% last quarter

§ Profit attributable to equity holders of the Company was RMB1,783.2 million (USD261.2 million),

an increase of 18.3% QoQ or an increase of 72.2% YoY

§ Key platform statistics:

- Active Instant Messaging (“IM”) user accounts increased 8.7% QoQ to 568.6 million

- Peak simultaneous online user accounts for IM services increased 13.2% QoQ to 105.3

million

- Active user accounts of Qzone increased 10.4% QoQ to 428.0 million

- Peak simultaneous online user accounts of QQ Game portal (for mini casual games only)

increased 9.7% QoQ to 6.8 million

- IVAS paying subscriptions increased 16.1% QoQ to 59.9 million

- MVAS paying subscriptions increased 14.8% QoQ to 23.3 million

Mr. Ma Huateng, Chairman and CEO of Tencent, said, “During the first quarter of 2010, our various

online platforms continued to grow and our IVAS business, particularly our online gaming business,

benefited from the strong holiday season. The second quarter will be a weaker season for our IVAS

business, but it will present stronger seasonality for our online advertising business. We are also

looking forward to leveraging the Shanghai World Expo and World Cup events to further build our

brand and media influence. While we are cognizant of the fact that as our scale grows, the growth

rate of our business will inevitably slow down; we are committed to continuously investing into the

future as we believe in the long-term potential of the China Internet market.”

1 Figures stated in USD are based on USD1 to RMB6.8263

Page 2 of 8

Financial Review for the First Quarter of 2010

IVAS revenues increased 19.0% QoQ to RMB3,387.4 million and represented 80.2% of our total

revenues for the first quarter of 2010. Revenues from our online games increased by 30.1% to

RMB2,023.6 million. This primarily reflected the positive seasonal impact of the Chinese New Year

holidays and winter break for students, which resulted in the increased monetisation of our major

advanced casual games and MMOGs, namely Cross Fire, Dungeon and Fighter (“DNF”), QQ Dancer

and QQ Speed. The growth of QQ Game also contributed to the increase in online gaming revenues.

For our community value-added services, revenues increased by 5.6% to RMB1,363.8 million.

Subscriber of QQ Membership increased as we focused on enhancing user value and stickiness by

enriching the online and offline privileges of the product. Growth in Qzone was mainly due to

increased user activeness driven by our SNS applications. Revenues from QQ Show also increased

as we launched programmes to attract new subscribers and continued to improve user loyalty with

enhanced features as well as annual subscription package.

MVAS revenues increased 12.4% QoQ to RMB618.2 million and represented 14.6% of our total

revenues. This was primarily driven by the growth in the user base of our bundled SMS packages

resulting from enhanced privileges and features. Revenues from mobile SNS applications and mobile

games also increased. The increase in revenues was partly offset by the reduction in revenues from

our WAP business due to the suspension of billing for WAP services by China Mobile since 30

November 2009. Revenues from legacy mobile voice value-added services also declined.

Online advertising revenues decreased 26.8% QoQ to RMB204.3 million and represented 4.8% of

our total revenues. This primarily reflected weaker seasonality in the first quarter as advertising

activities reduced around the Chinese New Year holidays.

Other Key Financial Information for the First Quarter of 2010

Share-based compensation was RMB101.0 million for the first quarter of 2010 as compared with

RMB100.3 million for the previous quarter.

Foreign exchange loss was RMB1.6 million for the first quarter of 2010 as compared with RMB0.4

million for the previous quarter.

Capital expenditure was RMB366.6 million for the first quarter of 2010 as compared with RMB369.2

million for the previous quarter.

Basic earnings per share for the quarter were RMB0.984, and diluted earnings per share were

RMB0.959.

As at March 31, 2010, cash and cash equivalents, term deposits with initial term of over three months

and held-to-maturity investments totaled RMB13,810.3 million. The total number of shares of the

Company in issue was 1.824 billion.

Page 3 of 8

Business Review and Outlook

We delivered solid financial and operating performance in the first quarter of 2010 on the back of

strong seasonality and the continued growth of our platforms. Our IVAS, especially for online games,

benefited from the Chinese New Year holidays and winter break for students, when users’ propensity

to spend increased. Our MVAS registered growth during the quarter, primarily driven by the increase

in subscription to our bundled SMS packages as we enriched the privileges and features. For our

online advertising business, revenues decreased on a quarter-on-quarter basis as the first quarter

was traditionally a weak season. Looking into the second quarter of 2010, we expect weaker

seasonality for our IVAS due to fewer school holidays during the quarter and school examinations

towards the end of the quarter. Visibility of our MVAS business would remain low as the industry

continues to face significant regulatory uncertainties. On the other hand, our online advertising

business should benefit from stronger seasonality in the second quarter.

In April 2010, we announced a USD300 million investment in Digital Sky Technologies Limited

(“DST”), one of the largest Internet companies in the Russian-speaking and Eastern European

markets, and the establishment of a long-term strategic partnership between DST and Tencent. This

transaction represents a step for us to tap into the potential of the fast-growing Internet market in

Russia. It also aligns with our long-term strategy of cooperating with top local Internet companies in

emerging markets through strategic investment and partnership, and leveraging our technical and

operational know-how to deliver quality Internet products and services to users in these markets.

IM Platform

Our IM platform continued to expand during the quarter, with active users and peak concurrent users

(“PCU”) increasing to 568.6 million and 105.3 million respectively. This was primarily driven by

positive seasonality and the popularity of SNS applications, which enhanced user activity and

engagement through cross-platform integration. The increasing usage of our IM services on mobile

devices also contributed to the growth. To extend our leadership in the market, we are broadening

and deepening the integration of our IM services with other platforms of Tencent. We are also

enhancing our services for different user segments with tailored functionalities and features.

QQ.com

The traffic on QQ.com increased during the quarter as we enriched the content of our key vertical

channels and fostered stronger cross-platform integration. We also continued to execute our brand

TV advertising campaign to further improve our brand image and awareness. In the second quarter

and third quarter of 2010, we will increase our investments in content as well as advertising and

promotion activities to leverage the 2010 World Exposition in Shanghai and the World Cup to

enhance our media influence and standing in the industry. As part of this strategy, we have just

acquired the right from China Network Television to provide World Cup video clips to our users.

Internet value-added services

For community value-added services, QQ Membership registered healthy growth in user base on the

back of enhanced user loyalty and stickiness mainly driven by the bundling of more value-added

functions as well as online and offline lifestyle privileges. Benefiting from the popularity of SNS

Page 4 of 8

applications, Qzone’s active user accounts increased by 10.4% on a quarter-on-quarter basis to

reach 428.0 million at the end of the first quarter. As we saw the growth of our most popular SNS

game, QQ Farm, approaching saturation because of its high penetration, we increased the promotion

of QQ Ranch, a social game closely related and integrated with QQ Farm, to provide more content to

our users. We are also launching new self-developed and third-party applications on Qzone and

Xiaoyou on trial basis during the first quarter as we recognise the life cycle of individual social game

tends to be short. Going forward, we will continue to enhance the user value of our SNS platforms by

improving the basic social networking functionalities as well as introducing different SNS applications

that cater to the varying needs of our user base. We are also increasing our effort to extend Qzone to

our wireless platforms to further enhance its reach and usage. For QQ Show, monthly subscription

grew during the quarter as we introduced free trial and enhanced free items to attract new users and

converted some of these users into paid subscribers. User stickiness also improved, with enhanced

features as well as introduction of annual subscription package.

Our online game business benefited from positive seasonality as well as the launch of expansion

packs and holiday promotions for our major advanced casual games and MMOGs. QQ Game also

benefited from in-game promotions, with its PCU reaching 6.8 million. During the quarter, we

launched Dragon Power, a hardcore 2D MMOG, and A.V.A., a niche market First Person Shooting

game, to further enrich our diversified game portfolio. We are also working on the launch of additional

MMOGs for the rest of 2010. We believe that as the online game industry begins to mature, the

operating environment for online game companies would become more challenging going forward.

On the one hand, gamers are now more sophisticated in choosing online games, raising the bar on

the quality of successful games. On the other hand, competition for licensed games and talent has

increased as there are many well-funded gaming companies in the market. These factors would

decrease the success rate and extent of success for new games, as well as increase investment

requirements. Against this backdrop, we will have to work even harder on leveraging our platforms

and operational experience to introduce high quality games to different market segments via

self-development, licensing and investments. Our recent acquisition of the remaining 40% stake in

Shenzhen Domain Computer Network Company Limited, which will allow us to better integrate and

leverage the development resources of the company, is in line with this strategy.

Mobile and telecommunications value-added services

Our MVAS business grew during the quarter primarily driven by the expansion in the user base of our

bundled SMS packages as we added more privileges and features to the packages. Traffic on our

WAP portal continued to increase, reinforcing our leading position in the freeWAP portal industry. The

growth of our MVAS business was dampened by the suspension of billing for WAP services by China

Mobile since 30 November 2009 and the decline in legacy mobile voice value-added services.

Visibility of the industry would remain low as the sector is still subject to significant regulatory

uncertainties.

Online advertising

Our online advertising business was affected by weaker seasonality in the first quarter of 2010 as

advertising activities generally reduced around the Chinese New Year holidays. During the quarter,

we continued to develop cross-platform and user-targeted advertising solutions to deepen our

differentiation in the market. Looking ahead, we are positioning ourselves for long-term growth by

Page 5 of 8

enhancing our image as a mainstream and influential media, strengthening our sales organisation

and further improving our advertising products to capitalise on the strengths of our platforms.

# # #

Page 6 of 8

About Tencent

Tencent aims to enrich the interactive online experience of Internet users in China by providing a

comprehensive range of Internet and wireless value-added services. Through its various online

platforms, including Instant Messaging QQ, web portal QQ.com, QQ Game portal, multi-media social

networking service Qzone and wireless portal, Tencent services the largest online community in

China and fulfills the user’s needs for communication, information, entertainment and e-Commerce

on the Internet.

Tencent has three main streams of revenues: Internet value-added services, mobile and

telecommunications value-added services and online advertising.

Shares of Tencent Holdings Limited are traded on the Main Board of the Stock Exchange of Hong