TFS Corporation - Sandelholzproduzent - 500 Beiträge pro Seite

eröffnet am 24.05.10 21:26:42 von

neuester Beitrag 12.09.18 11:24:03 von

neuester Beitrag 12.09.18 11:24:03 von

Beiträge: 179

ID: 1.157.992

ID: 1.157.992

Aufrufe heute: 0

Gesamt: 21.458

Gesamt: 21.458

Aktive User: 0

ISIN: AU000000QIN5 · WKN: A2DN0R

0,2200

EUR

+4,27 %

+0,0090 EUR

Letzter Kurs 16.05.17 Tradegate

Werte aus der Branche Holzindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 628,50 | +9,99 | |

| 13,240 | +9,97 | |

| 118,60 | +9,81 | |

| 79,63 | +7,83 | |

| 3,4420 | +7,03 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 19,510 | -5,61 | |

| 36,75 | -6,96 | |

| 7,4100 | -9,52 | |

| 18,300 | -9,85 | |

| 67,00 | -22,09 |

Tue, 4 May 2010 08:28:00 +1000 2 weeks, 6 days ago

ASX RELEASE MARKET UPDATE: PLANTATION SALES ON TRACK TO EXCEED FORECAST 4th May, 2010 TFS would like to update the market on the current state of its plantation sales program and revenue model for FY10 and beyond. Key Points: 2010 Wholesale Sales Update • Global Institutional Forestry Investment By June 30, TFS will have completed sales of at least 300 ha under its 2010 Beyond Carbon investment project. The client base involved is distinctly European institutional and ultra high net worth individuals.

Emirates Joint Venture In May TFS Emirates joint venture partner EIG is launching a forestry fund as part of its commitment to assist in raising at least 200 ha per annum of new plantation investment for TFS from middle eastern sources- closing date for this fund is 30 June 2010. Global Sales confirms revenue shift International sale of hectares confirms a significant shift in the sustainability of TFS’s revenue model for FY10 and future years to come. • • 2009 Wholesale Sales 350 ha Update Part funds received on 350ha from 2009 wholesale investor with balance expected in FY10.

1. Global Institutional Forestry Investment Over the last year TFS has delivered non-MIS sales to diversify its MIS retail sales to include a wholesale institutional investor base. This has entailed restructuring our Indian Sandalwood Investment project for a different client base and marketing the project on a global basis.

Institutional investment in this sector over the last two decades has averaged investment flows in the vicinity of US$2.5b per annum. Throughout this process TFS has discovered significant global interest for the TFS offering which will serve to de-risk TFS’ revenue base over the medium to longterm, as TFS attracts institutional customers willing to consider longer term investment horizons. Through the course of FY10 TFS embarked on a marketing campaign for its 2010 wholesale project which has seen a number of distribution relationships develop.

One such relationship TFS has developed is with a European investment firm who demonstrated a desire and a capability of sourcing wholesale investors on a repetitive basis for the TFS Indian Sandalwood Project. Due diligence on this counterparty has provided TFS confidence that it has secured a valuable means of product distribution to achieve ongoing sales, with greater certainty within the wholesale non MIS investment program. This European distribution partner has committed to sourcing over 300 ha in cash sales in FY10, with a commitment to ....

ASX RELEASE MARKET UPDATE: PLANTATION SALES ON TRACK TO EXCEED FORECAST 4th May, 2010 TFS would like to update the market on the current state of its plantation sales program and revenue model for FY10 and beyond. Key Points: 2010 Wholesale Sales Update • Global Institutional Forestry Investment By June 30, TFS will have completed sales of at least 300 ha under its 2010 Beyond Carbon investment project. The client base involved is distinctly European institutional and ultra high net worth individuals.

Emirates Joint Venture In May TFS Emirates joint venture partner EIG is launching a forestry fund as part of its commitment to assist in raising at least 200 ha per annum of new plantation investment for TFS from middle eastern sources- closing date for this fund is 30 June 2010. Global Sales confirms revenue shift International sale of hectares confirms a significant shift in the sustainability of TFS’s revenue model for FY10 and future years to come. • • 2009 Wholesale Sales 350 ha Update Part funds received on 350ha from 2009 wholesale investor with balance expected in FY10.

1. Global Institutional Forestry Investment Over the last year TFS has delivered non-MIS sales to diversify its MIS retail sales to include a wholesale institutional investor base. This has entailed restructuring our Indian Sandalwood Investment project for a different client base and marketing the project on a global basis.

Institutional investment in this sector over the last two decades has averaged investment flows in the vicinity of US$2.5b per annum. Throughout this process TFS has discovered significant global interest for the TFS offering which will serve to de-risk TFS’ revenue base over the medium to longterm, as TFS attracts institutional customers willing to consider longer term investment horizons. Through the course of FY10 TFS embarked on a marketing campaign for its 2010 wholesale project which has seen a number of distribution relationships develop.

One such relationship TFS has developed is with a European investment firm who demonstrated a desire and a capability of sourcing wholesale investors on a repetitive basis for the TFS Indian Sandalwood Project. Due diligence on this counterparty has provided TFS confidence that it has secured a valuable means of product distribution to achieve ongoing sales, with greater certainty within the wholesale non MIS investment program. This European distribution partner has committed to sourcing over 300 ha in cash sales in FY10, with a commitment to ....

Antwort auf Beitrag Nr.: 39.575.747 von R-BgO am 24.05.10 21:26:42Haste mal den Link zur Homepage?

TFS Corporation - AAA RATED US BASED INSTITUTION COMMITS TO TFS SANDALWOOD Wed, 26 May 2010 09:57:00 +1000 10 hours, 23 minutes ago

ASX RELEASE AAA RATED US BASED INSTITUTION COMMITS TO TFS SANDALWOOD PLANTATIONS 26 May 2010 Highlights • • • AAA rated US based Institution enters into an Investment Management Agreement pursuant to which TFS will manage a 180 hectare Indian sandalwood plantation to be planted in FY10 . Investment by the Institution over the life of the plantation excluding performance bonuses to TFS anticipated to be circa $20m. Secures option to plant an additional 180ha per annum for next 5 years to 2015 with this investment anticipated to be, approximately, $100m if all options are exercised.

Australian agribusiness TFS Corporation (ASX: TFC) has signed a confidential Investment Management Agreement (IMA) with a US based institutional investor potentially worth $120 million over six years. The IMA is subject to and conditional upon the settlement of a related land acquisition agreement with TFS. The land acquisition agreement is conditional on, amongst other things, the Investor obtaining Foreign Investment Board approval.

Under the IMA TFS is paid an upfront payment for the purchase of land and establishment of the plantation, annual payments for plantation management, and a performance bonus upon a hurdle rate of return being achieved by the investor. This investment is in addition to the recently announced (May 4) forecast of 500 hectares of NonMIS sales, and puts TFS on track to sell over 500 hectares of Non-MIS in FY10 up over 40% on FY09 Non-MIS sales. “This institutional investment continues the rapid and fundamental transformation of TFS from a company heavily reliant on yearly MIS sales and its associated income to one that will receive its investment and income from predominantly more stable institutional and private sector sources,” TFS Executive Chairman Frank Wilson said.

“Even in a tumultuous economic environment, TFS’s forestry products continue to attract the support of leading global institutions and private investors by entering longer term investment agreements. This gives TFS the revenue stability to deliver on its strategy of becoming the world’s leading integrated Sandalwood supplier.” “Our strategy to restructure our products to attract institutional investors has proven to be the right one in the wake of the MIS market fallout. Together with the continuing increase in profitability of our sandalwood processing arm Mt Romance, TFS is well positioned as our first Indian Sandalwood plantations are harvested in the next three years,” Mr Wilson said.

Indian Sandalwood sits in the high return category compared to traditional ....

Price at Announcement

Code: TFC Price: $0.810

Current Price

Code: TFC Price: $0.880

Chart Share Price last 60 days

Company Profile

About TFS Corporation

Phone: 08 9221 9466

Fax: 08 9221 9477

GIGS : Materials

Shares on Issue : 189310000

Profile: TFS Corporation Ltd (TFS) is engaged in management and operation of forestry plantations, and the provision of finance. Its principal activities include promotion of sandalwood-managed investment schemes; management and maintenance of sandalwood plantations; ownership and leasing of land; provision of finance; ownership of sandalwood plantations, and undertaking the production and ...

Activities: Managed Investment Schemes company in Indian Sandalwood Industry

ASX RELEASE AAA RATED US BASED INSTITUTION COMMITS TO TFS SANDALWOOD PLANTATIONS 26 May 2010 Highlights • • • AAA rated US based Institution enters into an Investment Management Agreement pursuant to which TFS will manage a 180 hectare Indian sandalwood plantation to be planted in FY10 . Investment by the Institution over the life of the plantation excluding performance bonuses to TFS anticipated to be circa $20m. Secures option to plant an additional 180ha per annum for next 5 years to 2015 with this investment anticipated to be, approximately, $100m if all options are exercised.

Australian agribusiness TFS Corporation (ASX: TFC) has signed a confidential Investment Management Agreement (IMA) with a US based institutional investor potentially worth $120 million over six years. The IMA is subject to and conditional upon the settlement of a related land acquisition agreement with TFS. The land acquisition agreement is conditional on, amongst other things, the Investor obtaining Foreign Investment Board approval.

Under the IMA TFS is paid an upfront payment for the purchase of land and establishment of the plantation, annual payments for plantation management, and a performance bonus upon a hurdle rate of return being achieved by the investor. This investment is in addition to the recently announced (May 4) forecast of 500 hectares of NonMIS sales, and puts TFS on track to sell over 500 hectares of Non-MIS in FY10 up over 40% on FY09 Non-MIS sales. “This institutional investment continues the rapid and fundamental transformation of TFS from a company heavily reliant on yearly MIS sales and its associated income to one that will receive its investment and income from predominantly more stable institutional and private sector sources,” TFS Executive Chairman Frank Wilson said.

“Even in a tumultuous economic environment, TFS’s forestry products continue to attract the support of leading global institutions and private investors by entering longer term investment agreements. This gives TFS the revenue stability to deliver on its strategy of becoming the world’s leading integrated Sandalwood supplier.” “Our strategy to restructure our products to attract institutional investors has proven to be the right one in the wake of the MIS market fallout. Together with the continuing increase in profitability of our sandalwood processing arm Mt Romance, TFS is well positioned as our first Indian Sandalwood plantations are harvested in the next three years,” Mr Wilson said.

Indian Sandalwood sits in the high return category compared to traditional ....

Price at Announcement

Code: TFC Price: $0.810

Current Price

Code: TFC Price: $0.880

Chart Share Price last 60 days

Company Profile

About TFS Corporation

Phone: 08 9221 9466

Fax: 08 9221 9477

GIGS : Materials

Shares on Issue : 189310000

Profile: TFS Corporation Ltd (TFS) is engaged in management and operation of forestry plantations, and the provision of finance. Its principal activities include promotion of sandalwood-managed investment schemes; management and maintenance of sandalwood plantations; ownership and leasing of land; provision of finance; ownership of sandalwood plantations, and undertaking the production and ...

Activities: Managed Investment Schemes company in Indian Sandalwood Industry

Antwort auf Beitrag Nr.: 39.584.331 von 81HAMC am 26.05.10 11:30:57http://www.tfsltd.com.au/

TFS launches inaugural native Australian Sandalwood Project (Spicatum)

02 June 2010

Key Points

• ATO Product ruling 2010/12

• Project capacity is 1,000 ha with subscriptions being available in 0.25 ha woodlots

• Establishment fee is $3,900 per woodlot (ex GST)

• Minimum subscription of 250 ha is required for the Project to proceed

• Plantations to be established in the Wheatbelt region of Western Australia

• No allowance for earnings from the Project has been made in TFS’ FY 10 earnings guidance

Following the release of ATO Product Ruling 2010/12, TFS is pleased to announce the launch of its inaugural native Australian Sandalwood Project for retail investors. TFS is a specialist Indian sandalwood (Album) plantation owner and manager, and the establishment of a plantation project for the native species of Australian sandalwood (Spicatum) is a natural extension of TFS’ core business and operations as a vertically integrated sandalwood products company.

TFS is already a producer of native Australian sandalwood oil through the processing business of Mt. Romance (MRA) which sells oil and related products to the European fragrance industry, India, China and Taiwan. TFS’ established production capacity and end market customer base enable TFS to process raw material into finished products and distribute these to global customers.

Australian sandalwood is complimentary to Indian sandalwood as they serve distinct product segments. Indian sandalwood is used in high-end cosmetics and luxury fragrances, as well as having widespread religious and cultural applications in India and Asia. Australian sandalwood has typically been used for incense in China, Taiwan and south east Asia and also has usage in fragrances and cosmetics. Australian sandalwood sells at a significant discount to the premium Indian sandalwood.

TFS notes that no allowance has been made in its FY 10 earnings guidance for earnings from this new project.

TFS would also like to clarify a report made in today’s West Australian newspaper. TFS has executed an agreement with WA Sandalwood Plantations Pty Ltd (WASP) to be the plantation contractor for the Project, under the supervision of TFS. TFS is not making any investment in WASP, nor in any of WASP’s Australian sandalwood plantations. TFS is simply engaging WASP as a plantation contractor.

02 June 2010

Key Points

• ATO Product ruling 2010/12

• Project capacity is 1,000 ha with subscriptions being available in 0.25 ha woodlots

• Establishment fee is $3,900 per woodlot (ex GST)

• Minimum subscription of 250 ha is required for the Project to proceed

• Plantations to be established in the Wheatbelt region of Western Australia

• No allowance for earnings from the Project has been made in TFS’ FY 10 earnings guidance

Following the release of ATO Product Ruling 2010/12, TFS is pleased to announce the launch of its inaugural native Australian Sandalwood Project for retail investors. TFS is a specialist Indian sandalwood (Album) plantation owner and manager, and the establishment of a plantation project for the native species of Australian sandalwood (Spicatum) is a natural extension of TFS’ core business and operations as a vertically integrated sandalwood products company.

TFS is already a producer of native Australian sandalwood oil through the processing business of Mt. Romance (MRA) which sells oil and related products to the European fragrance industry, India, China and Taiwan. TFS’ established production capacity and end market customer base enable TFS to process raw material into finished products and distribute these to global customers.

Australian sandalwood is complimentary to Indian sandalwood as they serve distinct product segments. Indian sandalwood is used in high-end cosmetics and luxury fragrances, as well as having widespread religious and cultural applications in India and Asia. Australian sandalwood has typically been used for incense in China, Taiwan and south east Asia and also has usage in fragrances and cosmetics. Australian sandalwood sells at a significant discount to the premium Indian sandalwood.

TFS notes that no allowance has been made in its FY 10 earnings guidance for earnings from this new project.

TFS would also like to clarify a report made in today’s West Australian newspaper. TFS has executed an agreement with WA Sandalwood Plantations Pty Ltd (WASP) to be the plantation contractor for the Project, under the supervision of TFS. TFS is not making any investment in WASP, nor in any of WASP’s Australian sandalwood plantations. TFS is simply engaging WASP as a plantation contractor.

TFS EXCEEDS SALES FORECAST

02 July 2010

Sandalwood grower and processor, TFS Corporation (TFS), has today announced total sales of approximately 1,088 hectares of Indian Sandalwood an increase of 6% on FY09.

Non MIS Sales

TFS has achieved sales from non-MIS institutional investors of 782 hectares, representing an increase of 120% on FY09.

MIS Sales

TFS has closed its retail MIS for FY10 having accepted applications for approximately 306 hectares of the Indian Sandalwood project for the FY10 financial year, down 54% on FY09.

FY10 Earnings Guidance

Following this sales result, TFS advises that it maintains its FY10 earnings guidance.

“We are extremely pleased with this sales result which is in line with the forecast we made at the outset of the financial year, and which is testimony to the appeal of our Indian Sandalwood product,” said Frank Wilson, Executive Chairman. “Given the dramatic decline in overall MIS sales in Australia in FY10, we believe this outcome vindicates our strategy to move away from reliance on MIS and reflects the strong long term market outlook for Indian sandalwood products and the growing recognition of our company’s future position as a leading industrial company supplying sandalwood oil and sandalwood by-products to a robust and growing global market.”

TFS expects to release its full year results during the week commencing 23 August 2010.

02 July 2010

Sandalwood grower and processor, TFS Corporation (TFS), has today announced total sales of approximately 1,088 hectares of Indian Sandalwood an increase of 6% on FY09.

Non MIS Sales

TFS has achieved sales from non-MIS institutional investors of 782 hectares, representing an increase of 120% on FY09.

MIS Sales

TFS has closed its retail MIS for FY10 having accepted applications for approximately 306 hectares of the Indian Sandalwood project for the FY10 financial year, down 54% on FY09.

FY10 Earnings Guidance

Following this sales result, TFS advises that it maintains its FY10 earnings guidance.

“We are extremely pleased with this sales result which is in line with the forecast we made at the outset of the financial year, and which is testimony to the appeal of our Indian Sandalwood product,” said Frank Wilson, Executive Chairman. “Given the dramatic decline in overall MIS sales in Australia in FY10, we believe this outcome vindicates our strategy to move away from reliance on MIS and reflects the strong long term market outlook for Indian sandalwood products and the growing recognition of our company’s future position as a leading industrial company supplying sandalwood oil and sandalwood by-products to a robust and growing global market.”

TFS expects to release its full year results during the week commencing 23 August 2010.

Tue, 31 Aug 2010 09:48:00 +1000 1 day, 6 hours ago

31st August 2010 ASX Release TFS Beats Earnings Guidance as it Transforms Business Model Highlights • • • • • • • Cash NPAT of $26.7m achieved growth of 14.7% ahead of guidance of 10%+ 2H Dividend of 3.5 cps declared amounting to full year dividend of 4.75 cps, up 11.8% Successfully transformed business model from solely MIS with revenue from Non-MIS sales accounting for 73% of cash operating revenue MRA rebounded strongly with EBITDA of $5.4m, growth of 58% v guidance of 20%, achieving a record result Balance sheet remains strong with low gearing at 19% and interest cover @10.5x Outlook is positive with wholesale deal flow to settle in FY11 following completion of land subdivision at Kingston Rest End market opportunities continue to develop in positive direction TFS Executive Chairman Frank Wilson said TFS had delivered a strong result in difficult trading conditions. “The business model has been successfully transitioned away from solely MIS, and evolved into one with a diverse mix of plantation and processing related sales.” “We are seeing increased demand from wholesale investors from a variety of regions, including the USA, Europe and Asia and we expect their prominence in the TFS revenue profile to continue to grow”, Mr Wilson said. “The performance of our processing division at Mount Romance was particularly pleasing as it demonstrates the resilience and underlying demand for sandalwood products in global markets”.

FY10 Results TFS Corporation Ltd (TFS) (ASX: TFC) today announced a rise in Comprehensive Income after Tax of $41.4m for the year to June 30, 2010. This result is an increase of 18.8% reported in the previous corresponding period (pcp). In addition to the core operating performance, this result reflects the inclusion of both non-cash items such as deferred fees, tree revaluations, as well as the new accounting standard (AASB101) that encompasses the treatment of land that is either sold for cash or held for re-sale.

Deferred fees were up 31% to $11.1m reflecting the rise in the size of the plantation estate over recent years. Cash flow from these fees will be realised as the harvest program commences in 2013. Revenue from tree revaluation was flat v pcp principally due to exchange rate movement.

The after tax contribution from land to the Comprehensive Income result was $4.3m. TFS has declared a 2H10 dividend 3.5 cps, up 16.7% on pcp, payable on 22 December 2010 and the record ....

31st August 2010 ASX Release TFS Beats Earnings Guidance as it Transforms Business Model Highlights • • • • • • • Cash NPAT of $26.7m achieved growth of 14.7% ahead of guidance of 10%+ 2H Dividend of 3.5 cps declared amounting to full year dividend of 4.75 cps, up 11.8% Successfully transformed business model from solely MIS with revenue from Non-MIS sales accounting for 73% of cash operating revenue MRA rebounded strongly with EBITDA of $5.4m, growth of 58% v guidance of 20%, achieving a record result Balance sheet remains strong with low gearing at 19% and interest cover @10.5x Outlook is positive with wholesale deal flow to settle in FY11 following completion of land subdivision at Kingston Rest End market opportunities continue to develop in positive direction TFS Executive Chairman Frank Wilson said TFS had delivered a strong result in difficult trading conditions. “The business model has been successfully transitioned away from solely MIS, and evolved into one with a diverse mix of plantation and processing related sales.” “We are seeing increased demand from wholesale investors from a variety of regions, including the USA, Europe and Asia and we expect their prominence in the TFS revenue profile to continue to grow”, Mr Wilson said. “The performance of our processing division at Mount Romance was particularly pleasing as it demonstrates the resilience and underlying demand for sandalwood products in global markets”.

FY10 Results TFS Corporation Ltd (TFS) (ASX: TFC) today announced a rise in Comprehensive Income after Tax of $41.4m for the year to June 30, 2010. This result is an increase of 18.8% reported in the previous corresponding period (pcp). In addition to the core operating performance, this result reflects the inclusion of both non-cash items such as deferred fees, tree revaluations, as well as the new accounting standard (AASB101) that encompasses the treatment of land that is either sold for cash or held for re-sale.

Deferred fees were up 31% to $11.1m reflecting the rise in the size of the plantation estate over recent years. Cash flow from these fees will be realised as the harvest program commences in 2013. Revenue from tree revaluation was flat v pcp principally due to exchange rate movement.

The after tax contribution from land to the Comprehensive Income result was $4.3m. TFS has declared a 2H10 dividend 3.5 cps, up 16.7% on pcp, payable on 22 December 2010 and the record ....

nachgekauft;

5% Div.Rendite, KGV von 5, >20% EK-Rendite, unter Buchwert

5% Div.Rendite, KGV von 5, >20% EK-Rendite, unter Buchwert

Lesezeichen.

19 January 2011

TFS is pleased to advise that a $47m plantation investment by a middle eastern sovereign wealth fund, referred to in ASX release 23 December 2010 has settled with initial proceeds of approximately $27m (inclusive of GST) received. A further $13m in annual management and investment service fees will be received by TFS over the life of the investment, plus an additional $9.6m has been allocated to the purchase of MIS grower woodlots in the secondary market.

The settlement occurred post the receipt of formal approval from the Foreign Investment Review Board (FIRB) as referred to in the December update.

The settlement of this transaction concludes a key transaction for TFS and reinforces the success of TFS’ initiative to develop an institutional investment product for the wholesale market. It is worth noting that arrangements with this investor also include a 5 year option and, if all options are exercised the total investment by the sovereign wealth fund over the life of the project, excluding performance fees and the direct investment into secondary market purchases of MIS Indian Sandalwood grower woodlots will be approximately $240m.

The settlement of this transaction along with two rounds of investment from a AAA rated US investor, provide a strong foundation for the continued success of this new business segment and global recognition of the sound fundamentals underpinning TFS’ Indian Sandalwood business.

The settlement of this transaction also reflects the conclusion of all structural issues enabling ease of foreign investment into plantations managed and owned by TFS. Subsequently, the timing of the receipt of funds should in general now be aligned with the sales and planting cycle, such that the strong underlying cash flows of TFS will become transparent for the investment community.

TFS has a very strong pipeline of institutional investor interest which forms the back drop to TFS’ recent FY11 forecast of circa $70m at the operating cash flow line.

As referred to in the December update, part of the proceeds from this settlement will be applied to paying down bank debt to circa $33m.

As the MIS market continues to be subdued, the wisdom of the TFS board and management to diversify its sources of investment flows to a more reliable and stable customer base becomes even clearer. In FY11, investment flows from the institutional market should again increase their prominence. TFS is exceptionally pleased that it has been able to grow its earnings through the GFC and the decline in the MIS sector. As noted in the AGM, TFS expects to increase its FY11 cash earnings again by at least 10%.

TFS is pleased to advise that a $47m plantation investment by a middle eastern sovereign wealth fund, referred to in ASX release 23 December 2010 has settled with initial proceeds of approximately $27m (inclusive of GST) received. A further $13m in annual management and investment service fees will be received by TFS over the life of the investment, plus an additional $9.6m has been allocated to the purchase of MIS grower woodlots in the secondary market.

The settlement occurred post the receipt of formal approval from the Foreign Investment Review Board (FIRB) as referred to in the December update.

The settlement of this transaction concludes a key transaction for TFS and reinforces the success of TFS’ initiative to develop an institutional investment product for the wholesale market. It is worth noting that arrangements with this investor also include a 5 year option and, if all options are exercised the total investment by the sovereign wealth fund over the life of the project, excluding performance fees and the direct investment into secondary market purchases of MIS Indian Sandalwood grower woodlots will be approximately $240m.

The settlement of this transaction along with two rounds of investment from a AAA rated US investor, provide a strong foundation for the continued success of this new business segment and global recognition of the sound fundamentals underpinning TFS’ Indian Sandalwood business.

The settlement of this transaction also reflects the conclusion of all structural issues enabling ease of foreign investment into plantations managed and owned by TFS. Subsequently, the timing of the receipt of funds should in general now be aligned with the sales and planting cycle, such that the strong underlying cash flows of TFS will become transparent for the investment community.

TFS has a very strong pipeline of institutional investor interest which forms the back drop to TFS’ recent FY11 forecast of circa $70m at the operating cash flow line.

As referred to in the December update, part of the proceeds from this settlement will be applied to paying down bank debt to circa $33m.

As the MIS market continues to be subdued, the wisdom of the TFS board and management to diversify its sources of investment flows to a more reliable and stable customer base becomes even clearer. In FY11, investment flows from the institutional market should again increase their prominence. TFS is exceptionally pleased that it has been able to grow its earnings through the GFC and the decline in the MIS sector. As noted in the AGM, TFS expects to increase its FY11 cash earnings again by at least 10%.

TFS CORPORATION TO RAISE $37.9 MILLION VIA PLACEMENT AND RIGHTS ISSUE

09 March 2011

TFS Corporation (ASX: TFC) today announced it has successfully placed 34.3 million shares to institutional investors at 80 cents to raise $27.4 million dollars.

The placement, which was oversubscribed, was managed by Bell Potter Securities.

Another $10.5 million will be raised via a rights issue, with 13.1 million shares being offered on a one-for-20 basis, at 80 cents per share, to give existing retail shareholders a chance to participate in the capital raising.

Eligible shareholders registered at 5pm on Friday 18th March 2010 can apply in the rights issue, with the offer closing on 5 April, 2011

The rights issue is fully underwritten by Bell Potter Securities. All TFS directors have committed to accepting their rights entitlement and, in addition, the Executive Chairman has taken a significant sub-underwriting position.

TFS Executive Chairman Frank Wilson said there was excess demand for the placement from international and domestic investors.

Funds will be used to pay out TFS’ $20 million bank debt, which is repayable by April 30, 2011, and $10 million of shareholder’s loans, leaving the company debt free.

“We are now in a very strong financial position. The equity raising can be seen in the context of a wider funding package, currently under negotiation, which will assist with our long term requirements,” Mr Wilson said.

“As we outlined in our [first half] results, we believe the outlook for FY11 is extremely positive. We have strong cash flows, an excellent institutional investor pipeline and the global price of Indian Sandalwood Oil has hit an all-time high of $2000 per kg.”

An offer document and formal Entitlement and Acceptance form will be mailed to all shareholders on 22 March 2010.

09 March 2011

TFS Corporation (ASX: TFC) today announced it has successfully placed 34.3 million shares to institutional investors at 80 cents to raise $27.4 million dollars.

The placement, which was oversubscribed, was managed by Bell Potter Securities.

Another $10.5 million will be raised via a rights issue, with 13.1 million shares being offered on a one-for-20 basis, at 80 cents per share, to give existing retail shareholders a chance to participate in the capital raising.

Eligible shareholders registered at 5pm on Friday 18th March 2010 can apply in the rights issue, with the offer closing on 5 April, 2011

The rights issue is fully underwritten by Bell Potter Securities. All TFS directors have committed to accepting their rights entitlement and, in addition, the Executive Chairman has taken a significant sub-underwriting position.

TFS Executive Chairman Frank Wilson said there was excess demand for the placement from international and domestic investors.

Funds will be used to pay out TFS’ $20 million bank debt, which is repayable by April 30, 2011, and $10 million of shareholder’s loans, leaving the company debt free.

“We are now in a very strong financial position. The equity raising can be seen in the context of a wider funding package, currently under negotiation, which will assist with our long term requirements,” Mr Wilson said.

“As we outlined in our [first half] results, we believe the outlook for FY11 is extremely positive. We have strong cash flows, an excellent institutional investor pipeline and the global price of Indian Sandalwood Oil has hit an all-time high of $2000 per kg.”

An offer document and formal Entitlement and Acceptance form will be mailed to all shareholders on 22 March 2010.

8 April 2011 TFS Corporation Ltd (ASX Code TFC) Pro rata Non-Renounceable Rights Issue – Under-subscription notification

TFS Corporation Ltd (“TFS”) announces that on 5 April 2011, it closed its offer pursuant to an offer document for the pro rata non-renounceable rights issue (“Entitlement Issue”) to TFS shareholders. The Entitlement Issue was for a total of 13,132,833 shares to raise approximately $10,506,266 (before expenses) on the basis of one (1) new share for every twenty (20) shares held on the record date at an issue price of 80 cents each.

The number of shares taken up by shareholders was 7,930,564 or 60.39% to the total offered to the shareholders raising approximately $6,344,451.20.

The Entitlement Issue was underwritten and the shortfall of 5,202,269 new shares not taken up by the shareholders will be dealt with by the Underwriter to the Entitlement Issue, Bell Potter Securities Limited, in accordance with the terms of the underwriting agreement.

The new shares are expected to commence normal trading on the ASX on the 14 April 2011 and the holding statements to be dispatched to shareholders on 13 April 2011.

TFS Corporation Ltd (“TFS”) announces that on 5 April 2011, it closed its offer pursuant to an offer document for the pro rata non-renounceable rights issue (“Entitlement Issue”) to TFS shareholders. The Entitlement Issue was for a total of 13,132,833 shares to raise approximately $10,506,266 (before expenses) on the basis of one (1) new share for every twenty (20) shares held on the record date at an issue price of 80 cents each.

The number of shares taken up by shareholders was 7,930,564 or 60.39% to the total offered to the shareholders raising approximately $6,344,451.20.

The Entitlement Issue was underwritten and the shortfall of 5,202,269 new shares not taken up by the shareholders will be dealt with by the Underwriter to the Entitlement Issue, Bell Potter Securities Limited, in accordance with the terms of the underwriting agreement.

The new shares are expected to commence normal trading on the ASX on the 14 April 2011 and the holding statements to be dispatched to shareholders on 13 April 2011.

Antwort auf Beitrag Nr.: 41.469.179 von wotuzu17 am 07.05.11 15:13:52na ja; relative Kaufempfehlung...

10th October 2011

TFS ANNOUNCES DIVIDEND

The board of TFS Corporation (TFS) (ASX: TFC) has declared a final dividend for its FY11 result at 3.5cps, in line with the previous year’s final dividend.

The record date of the dividend is 21st October 2011, with the payment date to be

4th November 2011.

This brings the full year dividend for FY11 to 4.75 cps and is in line with the previous year.

TFS ANNOUNCES DIVIDEND

The board of TFS Corporation (TFS) (ASX: TFC) has declared a final dividend for its FY11 result at 3.5cps, in line with the previous year’s final dividend.

The record date of the dividend is 21st October 2011, with the payment date to be

4th November 2011.

This brings the full year dividend for FY11 to 4.75 cps and is in line with the previous year.

Thu, 13 Oct 2011 09:20:00 +1000 7 hours, 32 minutes ago

ASX RELEASE 13th October 2011 LAND ACQUISITIONS SUPPORT SALES GROWTH TFS Corporation Ltd (TFS) today announced the settlement of two land acquisitions in Northern Queensland which support TFS’ institutional plantation investment program. These acquisitions represent the first application of funds from the recent US$150m in Senior Secured Notes. TFS has settled on two properties in Dalbeg in Northern Queensland totalling 685 ha (plantable 610 ha).

The two properties have been acquired after extensive due diligence which has deemed both properties suitable for growing Indian Sandalwood. These properties have been allocated to meet the commitment to the 610 ha institutional sale referred to in the recent TFS full year results ASX announcements. The Queensland land acquisitions represent the beginning of a move by TFS to diversify its land base outside of the traditional Ord River Irrigation Area around Kununurra, Western Australia.

TFS has targeted a significant area to source within Northern Queensland, although the precise quantum is subject to the ability to secure land deals in the short to medium term. The decision to move beyond TFS’ traditional land base has been driven by institutional investor demand for TFS’ plantation investment product given the fundamental drivers around Sandalwood as a commodity, and the pursuit of investment alternatives such as forestry that act as hedges against equity markets. Frank Wilson Executive Chairman Ph: 08 9386 3299 Quentin Megson Chief Financial Officer Ian Thompson Director - Communications For further investor and analyst queries, please contact Martyn Jacobs General Manager – Corporate Strategy Ph: 0412 785 180 ABOUT TFS TFS Corporation Ltd (ASX: TFC) is an owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia.

As part of its vision to be a vertically integrated producer of finished sandalwood products, TFS owns a significant proportion of the plantations in its own right and in 2008 acquired Mount Romance Australia (Mount Romance), the Albany-based sandalwood processor and oil distributor. TFS was founded in 1997 to exploit the success of government trials into the plantation growth of Indian sandalwood in the Ord River Irrigation Area (ORIA) of north-east Western Australia. TFS’s first planting was in 1999 and it now manages the largest area of Indian sandalwood plantation in the world, with approximately 5,000 hectares planted.

ASX RELEASE 13th October 2011 LAND ACQUISITIONS SUPPORT SALES GROWTH TFS Corporation Ltd (TFS) today announced the settlement of two land acquisitions in Northern Queensland which support TFS’ institutional plantation investment program. These acquisitions represent the first application of funds from the recent US$150m in Senior Secured Notes. TFS has settled on two properties in Dalbeg in Northern Queensland totalling 685 ha (plantable 610 ha).

The two properties have been acquired after extensive due diligence which has deemed both properties suitable for growing Indian Sandalwood. These properties have been allocated to meet the commitment to the 610 ha institutional sale referred to in the recent TFS full year results ASX announcements. The Queensland land acquisitions represent the beginning of a move by TFS to diversify its land base outside of the traditional Ord River Irrigation Area around Kununurra, Western Australia.

TFS has targeted a significant area to source within Northern Queensland, although the precise quantum is subject to the ability to secure land deals in the short to medium term. The decision to move beyond TFS’ traditional land base has been driven by institutional investor demand for TFS’ plantation investment product given the fundamental drivers around Sandalwood as a commodity, and the pursuit of investment alternatives such as forestry that act as hedges against equity markets. Frank Wilson Executive Chairman Ph: 08 9386 3299 Quentin Megson Chief Financial Officer Ian Thompson Director - Communications For further investor and analyst queries, please contact Martyn Jacobs General Manager – Corporate Strategy Ph: 0412 785 180 ABOUT TFS TFS Corporation Ltd (ASX: TFC) is an owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia.

As part of its vision to be a vertically integrated producer of finished sandalwood products, TFS owns a significant proportion of the plantations in its own right and in 2008 acquired Mount Romance Australia (Mount Romance), the Albany-based sandalwood processor and oil distributor. TFS was founded in 1997 to exploit the success of government trials into the plantation growth of Indian sandalwood in the Ord River Irrigation Area (ORIA) of north-east Western Australia. TFS’s first planting was in 1999 and it now manages the largest area of Indian sandalwood plantation in the world, with approximately 5,000 hectares planted.

Habe mir gerade eben ein paar Tausend Aktien ins Depot gelegt. Meiner Meinung steht eine Kursexplosion bevor. Recherchiert doch mal, dann wisst Ihr warum - ein Unternehmen mit einer Wahnsinnsstory, verdient aber bereits jetzt richtig Geld und zahlt eine stattliche Dividende. Bin gespannt, was passiert, wenn die breite Masse merkt, dass sie statt in eine Fondskonstruktion (Sandelwood 2) mit Agio und allem drum und dran ihr Geld zu stecken auch direkt in die Aktie investieren kann...

...habe echt kein gutes Gefühl mit dem working capital management bei TFS; so ist die 11%er Anleihe überhaupt kein gutes Zeichen und das hier auch nicht(war auch schon vom Prüfer angemoppert worden):

21th March 2012

MARKET UPDATE

Outstanding Debtor

TFS Corporation (TFS) ASX Code (TFC) wishes to update the market relating to recent ASX

disclosures about an outstanding debtor.

In the reporting of TFS’ half year accounts note 3 related to further detail on current receivables

and in particular an outstanding receivable of $26.16m from a wholesale investor being for 380

hectares (ha) of land and plantations located in Kununurra, Western Australia.

TFS advised the ASX that this debtor had until 17th March 2012 to either settle in full or provide

funds for a pro-rata allocation for this transaction.

TFS advises that full payment has not been received and therefore approximately 300 ha will be

reverting back to TFS. TFS notes that the investor will be retaining approximately 80 ha.

TFS further advises that there are interested parties seeking to take up the 300 ha.

However, TFS is still evaluating each of these alternatives including the option to retain the plantation

asset itself and therefore is not in the position to provide any further details at this time.

TFS will advise the ASX of the final outcome on this subject in due course.

21th March 2012

MARKET UPDATE

Outstanding Debtor

TFS Corporation (TFS) ASX Code (TFC) wishes to update the market relating to recent ASX

disclosures about an outstanding debtor.

In the reporting of TFS’ half year accounts note 3 related to further detail on current receivables

and in particular an outstanding receivable of $26.16m from a wholesale investor being for 380

hectares (ha) of land and plantations located in Kununurra, Western Australia.

TFS advised the ASX that this debtor had until 17th March 2012 to either settle in full or provide

funds for a pro-rata allocation for this transaction.

TFS advises that full payment has not been received and therefore approximately 300 ha will be

reverting back to TFS. TFS notes that the investor will be retaining approximately 80 ha.

TFS further advises that there are interested parties seeking to take up the 300 ha.

However, TFS is still evaluating each of these alternatives including the option to retain the plantation

asset itself and therefore is not in the position to provide any further details at this time.

TFS will advise the ASX of the final outcome on this subject in due course.

Bei einem Unternehmen mit dieser Marktstellung, das bereits Geld verdient und Dividenden zahlt sind das für mich Kauf- bzw- Nachkaufkurse!

Bei einem Unternehmen mit dieser Marktstellung, das bereits jetzt Geld verdient und Dividenden zahlt sind das für mich Kauf- bzw. Nachkaufkurse!

Antwort auf Beitrag Nr.: 43.173.582 von graublau am 16.05.12 16:17:20und was sagst Du zu meinen Anmerkungen?

ist Liquidität nur ein Thema für Weicheier und Heulsusen?

ist Liquidität nur ein Thema für Weicheier und Heulsusen?

Ich lass einfach nur Zahlen sprechen:

Fundamentale KennzahlenKennzahl 2011e 2012e

KGV: 4,82 4,73

KCV: 3,67 3,79

KUV: -- --

Dividendenrendite: 11,57% 11,57%

Es wird ja niemand gezwungen einzusteigen! ;-)

Fundamentale KennzahlenKennzahl 2011e 2012e

KGV: 4,82 4,73

KCV: 3,67 3,79

KUV: -- --

Dividendenrendite: 11,57% 11,57%

Es wird ja niemand gezwungen einzusteigen! ;-)

Hallo graublau,

wieso wird denn für das abgelaufene Geschäftsjahr keine Dividende ausgeschüttet?

Den Gedanken, statt über geschlossene Fondsbeteiligung in die Aktie zu investieren, finde ich sehr interessant.

Können wir mal Kontakt aufnehmen?

vesak

wieso wird denn für das abgelaufene Geschäftsjahr keine Dividende ausgeschüttet?

Den Gedanken, statt über geschlossene Fondsbeteiligung in die Aktie zu investieren, finde ich sehr interessant.

Können wir mal Kontakt aufnehmen?

vesak

Antwort auf Beitrag Nr.: 43.651.818 von vesak am 27.09.12 12:15:27Zitat aus dem Bericht vom 31.8., Seite5:

Dividend

TFS advises that after careful consideration, the Board of Directors has determined not to pay a dividend for the 2012 financial year. This determination has been made due to:

the timing of proceeds from certain wholesale plantation investments now expected to be received in FY2013 instead of FY2012; and

a more conservative accounting policy being adopted in FY2012.

The Directors advise that this decision is in relation to FY2012 only and will be reassessed by the Board at the FY2013 half year results.

Strategic Review

The Board of TFS also today announced it will initiate a comprehensive strategic review of the Company, its assets and businesses with the objective of reviewing all options that will enhance shareholder value. The review is expected to include an assessment of the Company’s operations, capital management initiatives including a share buy-back and potential privatisation or other corporate options.

Richard Alston, Chairman, said “Over the last 14 years, TFS has established a profitable and unique Australian business. The Board believes that the current trading price of TFS’ shares does not appropriately reflect the underlying value of its assets and businesses. We are committed to exploring all options on behalf of our shareholders to enhance the value of our Company.”

Dividend

TFS advises that after careful consideration, the Board of Directors has determined not to pay a dividend for the 2012 financial year. This determination has been made due to:

the timing of proceeds from certain wholesale plantation investments now expected to be received in FY2013 instead of FY2012; and

a more conservative accounting policy being adopted in FY2012.

The Directors advise that this decision is in relation to FY2012 only and will be reassessed by the Board at the FY2013 half year results.

Strategic Review

The Board of TFS also today announced it will initiate a comprehensive strategic review of the Company, its assets and businesses with the objective of reviewing all options that will enhance shareholder value. The review is expected to include an assessment of the Company’s operations, capital management initiatives including a share buy-back and potential privatisation or other corporate options.

Richard Alston, Chairman, said “Over the last 14 years, TFS has established a profitable and unique Australian business. The Board believes that the current trading price of TFS’ shares does not appropriately reflect the underlying value of its assets and businesses. We are committed to exploring all options on behalf of our shareholders to enhance the value of our Company.”

Gibt es eine Übersicht, wieviel TFS in den Jahren zuvor an Dividende ausgeschüttet hat?

Gibt es eine Erklärung, wieso der Kurs seit Jahren im Schnitt zurückgeht, und nur noch ein gutes Drittes des Höchststandes hat?

vesak

Gibt es eine Erklärung, wieso der Kurs seit Jahren im Schnitt zurückgeht, und nur noch ein gutes Drittes des Höchststandes hat?

vesak

Antwort auf Beitrag Nr.: 43.657.049 von vesak am 28.09.12 13:25:01ich habe erhalten:

1,25c/Aktie am 19.6.2010

3,50c/Aktie am 23.12.2010

1,25c/Aktie am 18.6.2011

3,50c/Aktie am 5.11.2011

dieses Jahr dann nix mehr;

"Gibt es eine Erklärung, wieso der Kurs seit Jahren im Schnitt zurückgeht, und nur noch ein gutes Drittes des Höchststandes hat?"

=> das ist nicht Dein Ernst, oder?

1,25c/Aktie am 19.6.2010

3,50c/Aktie am 23.12.2010

1,25c/Aktie am 18.6.2011

3,50c/Aktie am 5.11.2011

dieses Jahr dann nix mehr;

"Gibt es eine Erklärung, wieso der Kurs seit Jahren im Schnitt zurückgeht, und nur noch ein gutes Drittes des Höchststandes hat?"

=> das ist nicht Dein Ernst, oder?

Antwort auf Beitrag Nr.: 43.667.571 von R-BgO am 02.10.12 09:05:42Danke für die Info.

Zum Kurs: Seit dem Höchststand Ende Oktober 2010 ist der Kurs jetzt umd ca. 60% gefallen. O.k., ein Drittel war etwas übertrieben. Aber trotzdem ist eine stetige Abwärtsbewegung erkennbar, ober etwa nicht?

Meine Frage war, was es dafür für eine Erklärung gibt.

Vielen Dank

vesak

Zum Kurs: Seit dem Höchststand Ende Oktober 2010 ist der Kurs jetzt umd ca. 60% gefallen. O.k., ein Drittel war etwas übertrieben. Aber trotzdem ist eine stetige Abwärtsbewegung erkennbar, ober etwa nicht?

Meine Frage war, was es dafür für eine Erklärung gibt.

Vielen Dank

vesak

Antwort auf Beitrag Nr.: 43.669.750 von vesak am 02.10.12 16:00:01#16, #18, ...

Antwort auf Beitrag Nr.: 43.669.750 von vesak am 02.10.12 16:00:01Habe Deine Fragen zum Anlass genommen, noch einmal etwas mehr Zeit in die Bude reinzustecken und dabei meine Erkenntnisse etwas ausgebaut:

1) GB ist da http://www.asx.com.au/asx/statistics/displayAnnouncement.do?… und auch eine

2) Präsentation dazu http://www.asx.com.au/asx/statistics/displayAnnouncement.do?…

3) Chairman hat zum selben Datum niedergelegt

4) CEO Wilson hat einen erheblichen Anteil der Aktien: 45,3 Mio. Stück sind etwa 16,2%

5) TFS hat(te?) offenbar ein Finanzierungsproblem: langfristige assets nicht langfristig finanziert; das haben sie dann mit dem 11%er "gelöst" und obendrein noch dicke warrants rausrücken müssen

Damit haben wir jetzt die Lage, dass die akuten Probleme gelöst sind, rein optisch die Aktie substanzmäßig billig ist, aber mit sehr teurer Finanzierung und alles davon abhängt, ob die assets am Ende auch werthaltig sein werden;

wenn ich mir die Bilanz dann näher anschaue, mit Positionen wie

-67 Mio. Debitoren mit >120 Tagen Überfälligkeit,

-46 Mio. Darlehen an "Growers" (die eigentlich Lieferanten sein müssten)

-86 Mio. biological assets (nach nur 48 im VJ) und

-84 Mio. intangibles, wovon 64 Mio. "accrued income receivables"!!! sind

= zusammen 58% der Bilanzsumme

dann ist das zum jetzigen Zeitpunkt für mich nur schwer zu beantworten...

Zumindest habe ich den heute morgen beschlossenen Verkauf mit 50% Verlust ggü. Einstand noch einmal zurückgestellt und warte derzeit weiter ab

1) GB ist da http://www.asx.com.au/asx/statistics/displayAnnouncement.do?… und auch eine

2) Präsentation dazu http://www.asx.com.au/asx/statistics/displayAnnouncement.do?…

3) Chairman hat zum selben Datum niedergelegt

4) CEO Wilson hat einen erheblichen Anteil der Aktien: 45,3 Mio. Stück sind etwa 16,2%

5) TFS hat(te?) offenbar ein Finanzierungsproblem: langfristige assets nicht langfristig finanziert; das haben sie dann mit dem 11%er "gelöst" und obendrein noch dicke warrants rausrücken müssen

Damit haben wir jetzt die Lage, dass die akuten Probleme gelöst sind, rein optisch die Aktie substanzmäßig billig ist, aber mit sehr teurer Finanzierung und alles davon abhängt, ob die assets am Ende auch werthaltig sein werden;

wenn ich mir die Bilanz dann näher anschaue, mit Positionen wie

-67 Mio. Debitoren mit >120 Tagen Überfälligkeit,

-46 Mio. Darlehen an "Growers" (die eigentlich Lieferanten sein müssten)

-86 Mio. biological assets (nach nur 48 im VJ) und

-84 Mio. intangibles, wovon 64 Mio. "accrued income receivables"!!! sind

= zusammen 58% der Bilanzsumme

dann ist das zum jetzigen Zeitpunkt für mich nur schwer zu beantworten...

Zumindest habe ich den heute morgen beschlossenen Verkauf mit 50% Verlust ggü. Einstand noch einmal zurückgestellt und warte derzeit weiter ab

Danke für die detailreiche Erklärung.

1. Da mein Englisch leider nicht so gut ist, kann ich GB (ist das Geschäftsbericht?) und

2. Präsentation dazu nicht mit der gebotenen Sorgfalt durchsehen

3. Wenn Chairman sein Amt niederlegt, was heißt das denn?

4. Das ist wohl ein gutes Zeichen, denn der Chef glaubt an seine Firma.

5. ja

Deinen Schlußfolgerungen stimme ich ganz zu.

Und lassen wir uns überraschen.

Gruß

vesak

1. Da mein Englisch leider nicht so gut ist, kann ich GB (ist das Geschäftsbericht?) und

2. Präsentation dazu nicht mit der gebotenen Sorgfalt durchsehen

3. Wenn Chairman sein Amt niederlegt, was heißt das denn?

4. Das ist wohl ein gutes Zeichen, denn der Chef glaubt an seine Firma.

5. ja

Deinen Schlußfolgerungen stimme ich ganz zu.

Und lassen wir uns überraschen.

Gruß

vesak

http://afr.com/tags;jsessionid=51058B7F809E18143E98F1902451D…

TFS bends in the wind of board change

08 OCTOBER 2012 | SARAH THOMPSON AND ANTHONY MACDONALD

PRINT: 08 OCTOBER 2012 | PAGE 14 | TFS BENDS IN THE WIND OF BOARD CHANGE

Western Australia-based TFS Corporation is one of the last timber growers still standing on the ASX, but the resignation of chairman Richard Alston has some investors wondering if it will be listed for much longer.

TFS bends in the wind of board change

08 OCTOBER 2012 | SARAH THOMPSON AND ANTHONY MACDONALD

PRINT: 08 OCTOBER 2012 | PAGE 14 | TFS BENDS IN THE WIND OF BOARD CHANGE

Western Australia-based TFS Corporation is one of the last timber growers still standing on the ASX, but the resignation of chairman Richard Alston has some investors wondering if it will be listed for much longer.

http://shares.intelligentinvestor.com.au/articles/comparativ…

Good oil on TFS

There is no shortage of companies selling managed investment schemes (MIS) to tax-deduction-hungry investors. But while Great Southern Plantations and Timbercorp, for example, have suffered from the government removing tax deductions for non-timber plantations, TFS Corporation hasn’t been affected because it only offers timber schemes.

There are other important differences, too. Whereas Great Southern and Timbercorp’s plantations will eventually be harvested for woodchips, TFS’s end product is of much higher value. Its plantations are of Indian sandalwood, a rare tree with highly specialised growing requirements that produces a sought-after oil used in upmarket perfumes and essential oils. And, as the tree only grows in tropical locations – in TFS’s case, northern Western Australia – there are no water issues.

With world supplies of sandalwood dwindling, the oil is becoming increasingly rare. When mature, each tree will produce about one kilogram of oil, which currently sells for about US$1,900, up from less than US$600 five years ago. The company has recently signed an agreement with a French company to help develop its skills for the eventual oil harvest, which will commence from 2012.

As with most of our other small growth stocks, TFS is also owner-managed – executive chairman Frank Wilson owns 22% – and he has consistently bought shares on market over the past year, including at prices above the current share price. Also, at a recent company presentation, the chief financial officer struck us as upfront and sensible.

There are a fair number of risks, though. Flooding and cyclones are real threats and, with the trees being fickle and difficult to grow, the survival rate could vary significantly. Also unknown is whether the mature trees will produce sufficiently high quality oil. And it’s possible synthetic oil could be developed now that the natural one is hard to come by.

Like most MIS companies, TFS has a complex and cash-consuming business model over the short term, so it’s not easy to value (don’t rely on its low PER). But with planting capacity having been recently increased, and its ownership stake in the valuable trees themselves amounting to about one-third of hectares under management, TFS could prove very cheap if sandalwood prices remain high.

That wraps up our six high quality growth stock picks. As we said in Part 1, they’re not screaming bargains, but nor do they look wildly overpriced. Of course, there’s nothing to prevent you from doing your own work but we’ll also keep an eye on them. If we see any obvious value down the track, we’ll be ready to pounce.

Disclosure: Staff members own shares in Great Southern Plantations and Timbercorp, but they don't include the author, James Greenhalgh.

Good oil on TFS

There is no shortage of companies selling managed investment schemes (MIS) to tax-deduction-hungry investors. But while Great Southern Plantations and Timbercorp, for example, have suffered from the government removing tax deductions for non-timber plantations, TFS Corporation hasn’t been affected because it only offers timber schemes.

There are other important differences, too. Whereas Great Southern and Timbercorp’s plantations will eventually be harvested for woodchips, TFS’s end product is of much higher value. Its plantations are of Indian sandalwood, a rare tree with highly specialised growing requirements that produces a sought-after oil used in upmarket perfumes and essential oils. And, as the tree only grows in tropical locations – in TFS’s case, northern Western Australia – there are no water issues.

With world supplies of sandalwood dwindling, the oil is becoming increasingly rare. When mature, each tree will produce about one kilogram of oil, which currently sells for about US$1,900, up from less than US$600 five years ago. The company has recently signed an agreement with a French company to help develop its skills for the eventual oil harvest, which will commence from 2012.

As with most of our other small growth stocks, TFS is also owner-managed – executive chairman Frank Wilson owns 22% – and he has consistently bought shares on market over the past year, including at prices above the current share price. Also, at a recent company presentation, the chief financial officer struck us as upfront and sensible.

There are a fair number of risks, though. Flooding and cyclones are real threats and, with the trees being fickle and difficult to grow, the survival rate could vary significantly. Also unknown is whether the mature trees will produce sufficiently high quality oil. And it’s possible synthetic oil could be developed now that the natural one is hard to come by.

Like most MIS companies, TFS has a complex and cash-consuming business model over the short term, so it’s not easy to value (don’t rely on its low PER). But with planting capacity having been recently increased, and its ownership stake in the valuable trees themselves amounting to about one-third of hectares under management, TFS could prove very cheap if sandalwood prices remain high.

That wraps up our six high quality growth stock picks. As we said in Part 1, they’re not screaming bargains, but nor do they look wildly overpriced. Of course, there’s nothing to prevent you from doing your own work but we’ll also keep an eye on them. If we see any obvious value down the track, we’ll be ready to pounce.

Disclosure: Staff members own shares in Great Southern Plantations and Timbercorp, but they don't include the author, James Greenhalgh.

Das hier bringt ein bisschen Licht ins Dunkel: http://www.tfsltd.com.au/library/file/AGM/AGM%20Chairmans%20…

Scheint für mich so, dass es da ein internes Scharmützel gab, das am Ende zu Alstons Demission beigetragen haben könnte...

Kurs hat sich zuletzt schön erholt.

Scheint für mich so, dass es da ein internes Scharmützel gab, das am Ende zu Alstons Demission beigetragen haben könnte...

Kurs hat sich zuletzt schön erholt.

12 December 2012

MIS Product Ruling for 2013

TFS Corporation Limited (TFS) is pleased to advise that the Product Ruling (PR 2012/29) for

its 2013 MIS Project has been issued by the Australian Taxation Office. TFS anticipates the

Product Disclosure Statement (PDS) will be available by the end of December 2012.

The 2013 MIS Project will be the 15th successive Indian sandalwood project that TFS has

launched. With a less competitive environment for MIS products and with TFS’ first harvest

set to deliver proof of concept for TFS growers, TFS is expecting significantly improved MIS

sales in 2013.

MIS Product Ruling for 2013

TFS Corporation Limited (TFS) is pleased to advise that the Product Ruling (PR 2012/29) for

its 2013 MIS Project has been issued by the Australian Taxation Office. TFS anticipates the

Product Disclosure Statement (PDS) will be available by the end of December 2012.

The 2013 MIS Project will be the 15th successive Indian sandalwood project that TFS has

launched. With a less competitive environment for MIS products and with TFS’ first harvest

set to deliver proof of concept for TFS growers, TFS is expecting significantly improved MIS

sales in 2013.

Hallo R-GbO,

danke für deine Infos. Leider ist mein Englisch nicht gut genug, und die Feinheiten zu verstehen. Was ist MIS?

Wäre dankbar sehr für eine Antwort.

vesak

danke für deine Infos. Leider ist mein Englisch nicht gut genug, und die Feinheiten zu verstehen. Was ist MIS?

Wäre dankbar sehr für eine Antwort.

vesak

Antwort auf Beitrag Nr.: 44.023.593 von vesak am 15.01.13 14:06:45

...klingt für mich so ein bisschen wie das, was hier als geschlossener Fonds durchgeht; wahrscheinlich kombiniert mit ein paar steuerlichen Besonderheiten

M-anaged

I-nvestment

S-cheme

...klingt für mich so ein bisschen wie das, was hier als geschlossener Fonds durchgeht; wahrscheinlich kombiniert mit ein paar steuerlichen Besonderheiten

16 January 2013

MARKET UPDATE

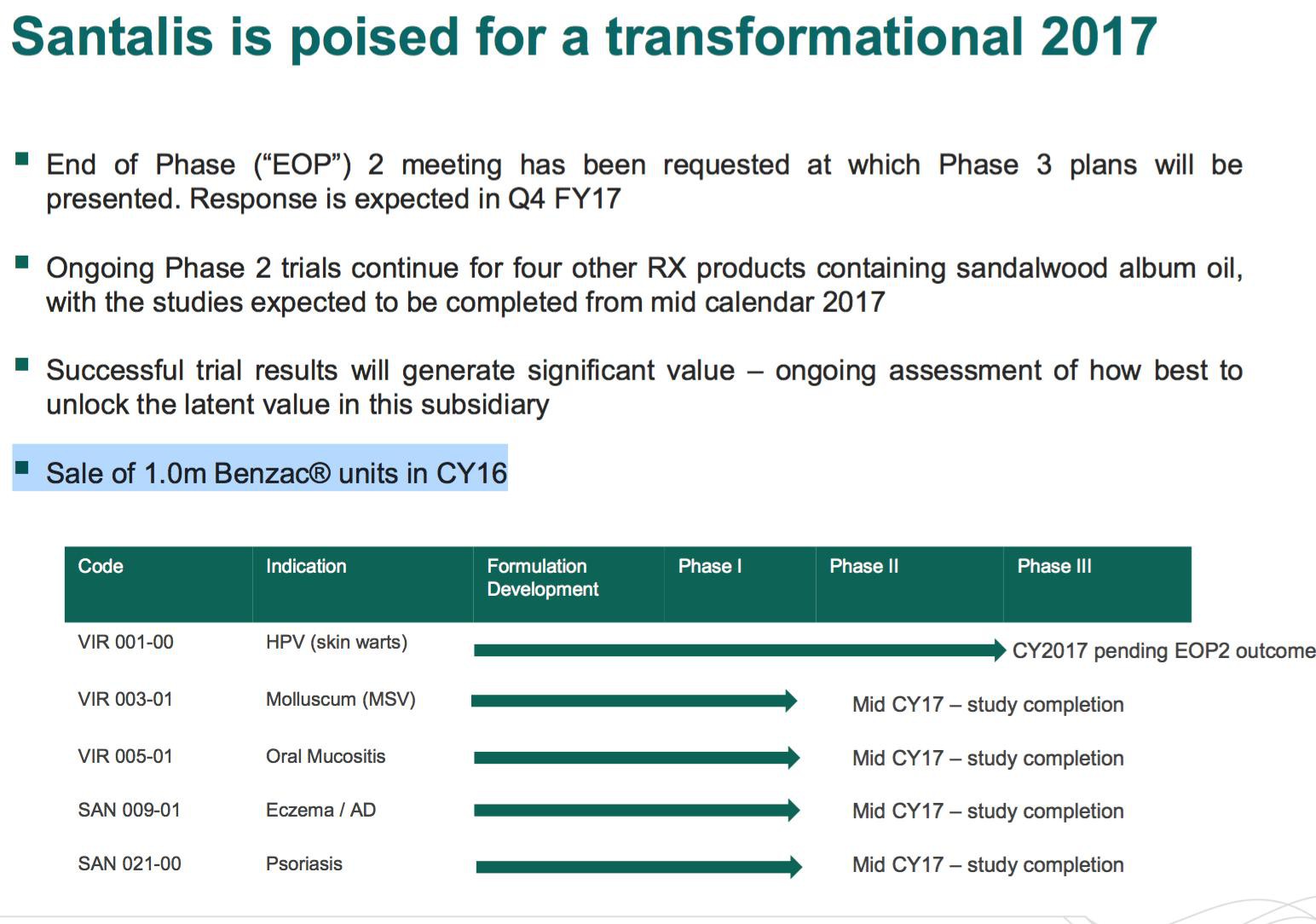

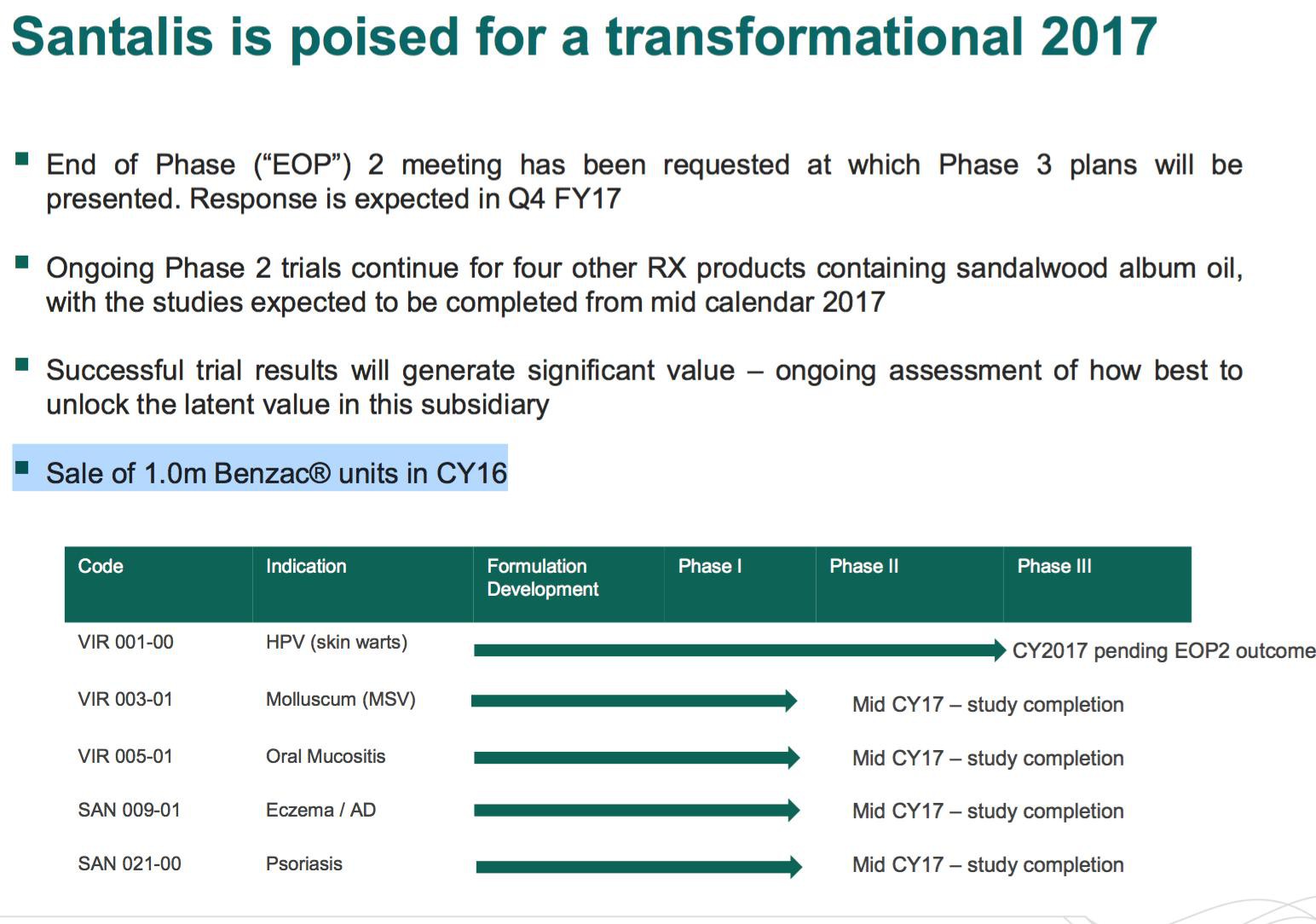

Successful Completion of Santalis Pharmaceuticals Initial Clinical Trials

TFS Corporation Limited (TFS) is pleased to confirm that its 50% owned joint venture entity,

Santalis Pharmaceuticals, Inc, has announced that its first commercial product the Santalia™

acne treatment kit, available over the counter (OTC), has successfully completed its initial

clinical evaluation and will be launched early in 2013. The completion of the clinical

evaluation trial is consistent with previous market disclosures made by TFS in May 2012.

The 50 patient, open label, phase 2 clinical study was conducted by Dr Ronald L. Moy and

the results were published in the December 2012 issue of the Journal of Drugs in

Dermatology (http://jddonline.com). The study demonstrated that the Santalia™ acne

treatment kit was highly effective in reducing patient lesion counts, with both minimal side

effects and a high compliance rate supporting the clinical benefits achieved.

The Santalia™ Acne Treatment kit is the only one of its kind formulated with sustainablygrown, pharmaceutical grade East Indian sandalwood oil (EISO) and was designed to provide

effective anti-bacterial and anti-inflammatory benefits without the drawbacks often

associated with benzoyl peroxide-containing products, such as dryness and irritation of the

skin. The Santalia™ acne treatment kit will initially be available through the company

website (www.santaliashop.com, http://www.facebook.com/santaliaskin) and later through

a number of private-label distribution partners.

Santalis was formed to develop a range of OTC and prescription drugs that can utilize EISO’s

unique anti-microbial, anti-inflammatory, and anti-proliferative properties. The Santalia™

acne treatment kit is the first of a range of proprietary, clinically-validated products that the

company intends to launch in the area of dermatology, with eczema and sensitive skin

formulations expected to reach the market in late 2013.

Santalis CEO, Dr. Paul Castella, stated that, “The clinical validation of our first OTC product is

the first step in an expansive program to commercialize a range of EISO-based products to

treat a number of widespread and significant disease conditions. We are fortunate that we

are working with a uniquely suited botanical drug candidate, which demonstrates not only a

wide range of unique pharmacological effects, but also a very beneficial safety profile

backed up by an extensive history of human use. All of our efforts are strictly science driven,

and our goal for the OTC product range is to provide a commercial foundation that will

enable us to tackle a number of significant prescription drug opportunities for EISO.”

MARKET UPDATE

Successful Completion of Santalis Pharmaceuticals Initial Clinical Trials

TFS Corporation Limited (TFS) is pleased to confirm that its 50% owned joint venture entity,

Santalis Pharmaceuticals, Inc, has announced that its first commercial product the Santalia™

acne treatment kit, available over the counter (OTC), has successfully completed its initial

clinical evaluation and will be launched early in 2013. The completion of the clinical

evaluation trial is consistent with previous market disclosures made by TFS in May 2012.

The 50 patient, open label, phase 2 clinical study was conducted by Dr Ronald L. Moy and

the results were published in the December 2012 issue of the Journal of Drugs in

Dermatology (http://jddonline.com). The study demonstrated that the Santalia™ acne

treatment kit was highly effective in reducing patient lesion counts, with both minimal side

effects and a high compliance rate supporting the clinical benefits achieved.

The Santalia™ Acne Treatment kit is the only one of its kind formulated with sustainablygrown, pharmaceutical grade East Indian sandalwood oil (EISO) and was designed to provide

effective anti-bacterial and anti-inflammatory benefits without the drawbacks often

associated with benzoyl peroxide-containing products, such as dryness and irritation of the

skin. The Santalia™ acne treatment kit will initially be available through the company

website (www.santaliashop.com, http://www.facebook.com/santaliaskin) and later through

a number of private-label distribution partners.

Santalis was formed to develop a range of OTC and prescription drugs that can utilize EISO’s

unique anti-microbial, anti-inflammatory, and anti-proliferative properties. The Santalia™

acne treatment kit is the first of a range of proprietary, clinically-validated products that the

company intends to launch in the area of dermatology, with eczema and sensitive skin

formulations expected to reach the market in late 2013.

Santalis CEO, Dr. Paul Castella, stated that, “The clinical validation of our first OTC product is

the first step in an expansive program to commercialize a range of EISO-based products to

treat a number of widespread and significant disease conditions. We are fortunate that we

are working with a uniquely suited botanical drug candidate, which demonstrates not only a

wide range of unique pharmacological effects, but also a very beneficial safety profile

backed up by an extensive history of human use. All of our efforts are strictly science driven,

and our goal for the OTC product range is to provide a commercial foundation that will

enable us to tackle a number of significant prescription drug opportunities for EISO.”

Antwort auf Beitrag Nr.: 44.027.191 von R-BgO am 16.01.13 10:11:23Heißt das, dass TFS eine 50%Beteiligung an Santalis hält?

Danke.

Danke.

Dieses Jahr im Sommer ist ja die erste Ernte von indischem Sandelholz fällig und dann kommt Cash in die Kasse. Und so soll es dann jedes Jahr weitergehen, wenn jeweils wieder eine neue Ernte geerntet werden kann.

Eigentlich ziemlich gute Aussichten.

vesak

Eigentlich ziemlich gute Aussichten.

vesak

Dieses Jahr im Sommer wird ja die erste Ernte von indischem Sandelholz eingefahren. Und dann kommt Cash in die Kasse. Und so soll es dann jedes weitere Jahr weiter gehen, wenn dann immer die bis dahin herangewachsenen Bäume geerntet werden können. Sie wurden ja seit 1999 kontinuierlich jeder Jahr angebaut, und nach 14 Jahren ist immer Ernte.

Gute Aussichten.

vesal

Gute Aussichten.

vesal

gut?:

1 May 2013

ASX RELEASE

TFS RECEIVES $22.4 MILLIONFROM DIVESTMENTOF MIS LOANPORTFOLIO

The Board of TFS Corporation Ltd (TFS)is pleased to announce the divestment of a portfolio of MIS loansto a

large global creditfund for approximately $22.4million.

As previously announced,the Board determined thatthe MIS loan portfolio was not a core asset ofthe

Company and appointed Moelis&Company to assistitin undertaking a sales process.

The portfolio of loans divested comprisesmainly performing loans associated with MIS projects offered by

TFS between 2003 and 2012 (Sale Portfolio). The Sale Portfolio has a weighted average term to maturity of

approximately 6.7 years.

TFS hasreceived gross cash proceeds of approximately $22.4million forthe Sale Portfolio and is notsubject

to clawback provisions on any loans that default. In addition, as part ofthe transaction, TFS has agreed to

continue tomanage the Sale Portfolio on behalf ofthe acquirerfor an ongoing management fee. The

transaction was undertaken at a discountto the face value ofthe loan portfolio and will result in a reduction

to after‐tax, non‐cash earnings of approximately $2.5million.

The remaining MIS loans of approximately $17million are expected to be fully recoverable withmany due to

be repaid in the next 12months with harvest proceedsfromTFS’ first commercial harvestlaterthis year.

The Board believes that the monetisation of the Sale Portfolio reflectsthe Company’s ability to efficiently

recycle capital. Funds received fromthe Sale Portfolio will be reinvested into value enhancing activities

including TFS’ balance sheet plantation assets and leaves TFS in a strong cash position asit approachesthe

culmination ofthe MIS and Beyond Carbon salesseason in June and itsfirst harvest which is due to

commence laterthis calendar year.

1 May 2013

ASX RELEASE

TFS RECEIVES $22.4 MILLIONFROM DIVESTMENTOF MIS LOANPORTFOLIO

The Board of TFS Corporation Ltd (TFS)is pleased to announce the divestment of a portfolio of MIS loansto a

large global creditfund for approximately $22.4million.

As previously announced,the Board determined thatthe MIS loan portfolio was not a core asset ofthe

Company and appointed Moelis&Company to assistitin undertaking a sales process.

The portfolio of loans divested comprisesmainly performing loans associated with MIS projects offered by

TFS between 2003 and 2012 (Sale Portfolio). The Sale Portfolio has a weighted average term to maturity of

approximately 6.7 years.

TFS hasreceived gross cash proceeds of approximately $22.4million forthe Sale Portfolio and is notsubject

to clawback provisions on any loans that default. In addition, as part ofthe transaction, TFS has agreed to

continue tomanage the Sale Portfolio on behalf ofthe acquirerfor an ongoing management fee. The

transaction was undertaken at a discountto the face value ofthe loan portfolio and will result in a reduction

to after‐tax, non‐cash earnings of approximately $2.5million.

The remaining MIS loans of approximately $17million are expected to be fully recoverable withmany due to

be repaid in the next 12months with harvest proceedsfromTFS’ first commercial harvestlaterthis year.

The Board believes that the monetisation of the Sale Portfolio reflectsthe Company’s ability to efficiently

recycle capital. Funds received fromthe Sale Portfolio will be reinvested into value enhancing activities

including TFS’ balance sheet plantation assets and leaves TFS in a strong cash position asit approachesthe

culmination ofthe MIS and Beyond Carbon salesseason in June and itsfirst harvest which is due to

commence laterthis calendar year.

Habe den Beitrag von R-GbO vom 2.5.13 erst jetzt gelesen. Ich verstehe Englisch leider nicht so gut, und daraus schlau zu werden. Was ist denn die für uns Aktionäre interessante Quintessenz dieser ASX-Release?

Vielen Dank!

Vesak

Vielen Dank!

Vesak

Antwort auf Beitrag Nr.: 44.808.113 von vesak am 07.06.13 16:12:18Quintessenz ist das unterstrichene:

sie haben eine Forderung mit Abschlag zu Geld gemacht; also bessere Liquidität und schlechtere GuV

sie haben eine Forderung mit Abschlag zu Geld gemacht; also bessere Liquidität und schlechtere GuV

26 June 2013

TFS Corporation Ltd (TFS) is pleased to advise that a Middle Eastern Sovereign Wealth Fund has approved the exercise of its third option with TFS and will plant a further 595 ha of Indian Sandalwood in the 2013 planting season. The new plantation is located in the Northern Territory.

Pending approval of the Foreign Investment Review Board the transaction is expected to settle in the first quarter of FY2014.

TFS Corporation Ltd (TFS) is pleased to advise that a Middle Eastern Sovereign Wealth Fund has approved the exercise of its third option with TFS and will plant a further 595 ha of Indian Sandalwood in the 2013 planting season. The new plantation is located in the Northern Territory.

Pending approval of the Foreign Investment Review Board the transaction is expected to settle in the first quarter of FY2014.

US INSTITUTION EXERCISES SECOND OPTION

27 June 2013

TFS Corporation Ltd (TFS) is pleased to advise a US institutional investor has exercised its second option with TFS and will plant a further 238 ha of Indian Sandalwood. The new plantation is located in the Northern Territory and planting will be completed in the 2013 planting season.

Settlement of the transaction is conditional on the approval of the Foreign Investment Review Board (FIRB) and other conditions including the finalisation of the subdivision application for the Northern Territory land. Pending satisfaction of all conditions the transaction is expected to settle in the first quarter of FY2014.

27 June 2013

TFS Corporation Ltd (TFS) is pleased to advise a US institutional investor has exercised its second option with TFS and will plant a further 238 ha of Indian Sandalwood. The new plantation is located in the Northern Territory and planting will be completed in the 2013 planting season.

Settlement of the transaction is conditional on the approval of the Foreign Investment Review Board (FIRB) and other conditions including the finalisation of the subdivision application for the Northern Territory land. Pending satisfaction of all conditions the transaction is expected to settle in the first quarter of FY2014.

02 July 2013

Financial Product Sales

TFS is pleased to advise that total sales of 1,614 hectares (BC and MIS) were achieved for FY13 an increase of 132% on FY12 (693 hectares). The sales result was an excellent outcome given the business interruptions caused by some minority shareholders in the first half of FY13.

Earnings Outlook

As advised at the end of May 2013, the Company reported that it remained on track to achieve a full year cash EBITDA of at least $35m. The financial impact of the above sales ensures the Company will be in a position to achieve at least this result.

First Commercial Harvest