Anerkannter Rohstoffguru aus Kanada: " Die besten Goldaktien 2011" - 500 Beiträge pro Seite

eröffnet am 02.10.10 23:46:50 von

neuester Beitrag 22.08.11 18:00:00 von

neuester Beitrag 22.08.11 18:00:00 von

Beiträge: 33

ID: 1.160.255

ID: 1.160.255

Aufrufe heute: 0

Gesamt: 4.110

Gesamt: 4.110

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 35 Minuten | 2211 | |

| vor 1 Stunde | 1818 | |

| vor 38 Minuten | 1222 | |

| gestern 21:02 | 917 | |

| vor 40 Minuten | 909 | |

| vor 1 Stunde | 842 | |

| gestern 12:46 | 837 | |

| vor 32 Minuten | 835 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.717,34 | -0,20 | 189 | |||

| 2. | 2. | 138,62 | -1,51 | 112 | |||

| 3. | 7. | 6,5940 | -1,99 | 86 | |||

| 4. | 5. | 0,1835 | -0,54 | 67 | |||

| 5. | 3. | 7,3700 | +5,29 | 66 | |||

| 6. | 8. | 3,8000 | +1,60 | 65 | |||

| 7. | 4. | 2.381,45 | +0,09 | 62 | |||

| 8. | 9. | 12,350 | +0,16 | 44 |

Aufwachen, Freunde! Die Goldaktien 2011 gibts jetzt schon!!! :-)

Craig Stanley, anerkannter Börsenguru aus Kanada und Fondverwalter (von sagenhaften 1,1 Billionen Dollar) von Pinetree Capital, der die Liegenschaften von Continental Gold bald selbst besichtigen wird, ist fest davon überzeugt, dass das Unternehmen zu den Goldaktien 2011 gehören wird. Er sagte: Das Management ( u.a. mit Ari Sussmann und Victor Wall ) ist großartig, die gr. Liegenschaften in Kolumbien sind einzigartig und die Partnerschaften erstklassig. Continental Gold wird extrem schnell wachsen und extrem hohe Resourcen nachweisen. Bald soll es Meganews geben ( ca. 12.500m von 25.000m sind nämlich fertig gebohrt!), die allen Zweiflern zeigen wird, dass Ari Sussmann und sein ausgezeichnetes Team Taten sprechen lassen.

Craig Stanley ist wirklich lange genug im Geschäft, um festzustellen, wenn es sich um eine spektakuläre Entdeckung handelt.

Hier könnt Ihr alles nachlessen (kam gestern kurz nach Börsenschluß!):

http://www.stockhouse.com/Community-News/2010/Oct/1/Movers--…

Pinetree Capital's Craig Stanley - Part 1

"What to look for in a gold stock investment"

Craig Stanley is Vice President of Research for Pinetree Capital (TSX: T.PNP, Stock Forum), a merchant banking firm focused on investing in early stage micro and small cap resource companies. Although Pinetree became well known for uranium back when there was a boom in that commodity in 2006, the company is focused on small-cap mining in general. Its biggest positions currently are in gold and other precious metal related equities and that’s what they’re focused on for the longer term. They still have uranium companies in their portfolio, though, and Pinetree CEO Sheldon Inwentash also runs Mega Uranium (TSX: T.MGA, Stock Forum).

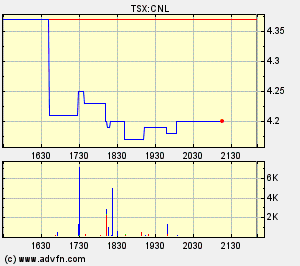

“Some of our big wins we’ve had recently that still have a lot of potential – one is Colossus Minerals (TSX: T.CSI, Stock Forum),” said Stanley. He calls the company’s drill results “ridiculously high grade, the highest grades in the world I’ve ever seen for gold, silver, platinum and palladium.” Another one of Pinetree’s big winners Stanley mentioned is Continental Gold (TSX: T.CNL, Stock Forum) in Colombia.

For Stanley, these companies are examples of great management, with great assets that were open to Pinetree getting in at a very early stage. For Pinetree, however, it’s also about getting the right people in to hold the stock – ones that will be long-term holders.

“It’s a mixture of management and assets. We’ll invest in a company even if it has bad management with good assets if maybe there’s something we can do there,” Stanley added.

As far as the asset goes, Stanley asserts that his company looks for both open ‘pittable’ and underground mining potential. As well, he is not particular in regards to geography either – Pinetree will invest in riskier countries throughout the world.

“Sheldon (Pinetree’s CEO) just wants leverage to gold, that’s his big thing. Sometimes he’ll invest (in a company) even if it doesn’t work at this gold price, will it work at $2000 gold? And if he can get it for cheap then that will make sense,” Stanley stated.

As far as how to value a gold producer, Stanley believes investors should look to a company’s net asset value (NAV) as opposed to price multiples such as P/E, P/CF and P/B. A company’s NAV is calculated by summing up the discounted cash flows (DCF) produced from its mine(s), adding cash and subtracting any debt.

NAV calculations take into consideration a company’s debt position, as well as the cash flows over an entire mine’s life (and thus the size of a mine’s reserves/resources along with the metallurgical recoveries), and the initial and sustaining capital required to build and operate a mine.

Shares of senior gold producers trade well above NAV, even up to 2.5 times. The reason being is due to the non mean-reverting price performance of gold, where the supply-demand factors that affect base metals are different than that for gold (base metals are consumed as opposed to gold, which is stored).

Mehr Infos zu Continental Gold in meinem Thread:

http://www.wallstreet-online.de/diskussion/1159639-1-10/disk…

Mehr Infos zu Colossus Minerals:

http://www.wallstreet-online.de/diskussion/1139614-1-10/colo…

Craig Stanley, anerkannter Börsenguru aus Kanada und Fondverwalter (von sagenhaften 1,1 Billionen Dollar) von Pinetree Capital, der die Liegenschaften von Continental Gold bald selbst besichtigen wird, ist fest davon überzeugt, dass das Unternehmen zu den Goldaktien 2011 gehören wird. Er sagte: Das Management ( u.a. mit Ari Sussmann und Victor Wall ) ist großartig, die gr. Liegenschaften in Kolumbien sind einzigartig und die Partnerschaften erstklassig. Continental Gold wird extrem schnell wachsen und extrem hohe Resourcen nachweisen. Bald soll es Meganews geben ( ca. 12.500m von 25.000m sind nämlich fertig gebohrt!), die allen Zweiflern zeigen wird, dass Ari Sussmann und sein ausgezeichnetes Team Taten sprechen lassen.

Craig Stanley ist wirklich lange genug im Geschäft, um festzustellen, wenn es sich um eine spektakuläre Entdeckung handelt.

Hier könnt Ihr alles nachlessen (kam gestern kurz nach Börsenschluß!):

http://www.stockhouse.com/Community-News/2010/Oct/1/Movers--…

Pinetree Capital's Craig Stanley - Part 1

"What to look for in a gold stock investment"

Craig Stanley is Vice President of Research for Pinetree Capital (TSX: T.PNP, Stock Forum), a merchant banking firm focused on investing in early stage micro and small cap resource companies. Although Pinetree became well known for uranium back when there was a boom in that commodity in 2006, the company is focused on small-cap mining in general. Its biggest positions currently are in gold and other precious metal related equities and that’s what they’re focused on for the longer term. They still have uranium companies in their portfolio, though, and Pinetree CEO Sheldon Inwentash also runs Mega Uranium (TSX: T.MGA, Stock Forum).

“Some of our big wins we’ve had recently that still have a lot of potential – one is Colossus Minerals (TSX: T.CSI, Stock Forum),” said Stanley. He calls the company’s drill results “ridiculously high grade, the highest grades in the world I’ve ever seen for gold, silver, platinum and palladium.” Another one of Pinetree’s big winners Stanley mentioned is Continental Gold (TSX: T.CNL, Stock Forum) in Colombia.

For Stanley, these companies are examples of great management, with great assets that were open to Pinetree getting in at a very early stage. For Pinetree, however, it’s also about getting the right people in to hold the stock – ones that will be long-term holders.

“It’s a mixture of management and assets. We’ll invest in a company even if it has bad management with good assets if maybe there’s something we can do there,” Stanley added.

As far as the asset goes, Stanley asserts that his company looks for both open ‘pittable’ and underground mining potential. As well, he is not particular in regards to geography either – Pinetree will invest in riskier countries throughout the world.

“Sheldon (Pinetree’s CEO) just wants leverage to gold, that’s his big thing. Sometimes he’ll invest (in a company) even if it doesn’t work at this gold price, will it work at $2000 gold? And if he can get it for cheap then that will make sense,” Stanley stated.

As far as how to value a gold producer, Stanley believes investors should look to a company’s net asset value (NAV) as opposed to price multiples such as P/E, P/CF and P/B. A company’s NAV is calculated by summing up the discounted cash flows (DCF) produced from its mine(s), adding cash and subtracting any debt.

NAV calculations take into consideration a company’s debt position, as well as the cash flows over an entire mine’s life (and thus the size of a mine’s reserves/resources along with the metallurgical recoveries), and the initial and sustaining capital required to build and operate a mine.

Shares of senior gold producers trade well above NAV, even up to 2.5 times. The reason being is due to the non mean-reverting price performance of gold, where the supply-demand factors that affect base metals are different than that for gold (base metals are consumed as opposed to gold, which is stored).

Mehr Infos zu Continental Gold in meinem Thread:

http://www.wallstreet-online.de/diskussion/1159639-1-10/disk…

Mehr Infos zu Colossus Minerals:

http://www.wallstreet-online.de/diskussion/1139614-1-10/colo…

Antwort auf Beitrag Nr.: 40.254.727 von visas am 02.10.10 23:46:50Kommentar:

one billion (engl.) = eine Milliarde

(Eine Billion Fondsvolumen = 1.000 Milliarden wären ja wohl auch unglaublich)

Inhaltlich sag ich nix dazu, nur dass es mir viel zu reisserisch klingt.

one billion (engl.) = eine Milliarde

(Eine Billion Fondsvolumen = 1.000 Milliarden wären ja wohl auch unglaublich)

Inhaltlich sag ich nix dazu, nur dass es mir viel zu reisserisch klingt.

"The Gold Report" hat vorab ein ausführliches Interview mit Craig Stanley durchgeführt!

Von Favorit Continental Gold scheint er besonders begeistert zu sein

http://www.theaureport.com/pub/na/7513

Craig Stanley Bets on Management, Good Assets

Source: Brian Sylvester of The Gold Report 10/01/2010

Pinetree Capital VP of Research Craig Stanley believes that, above all else, junior mining companies need solid management and good assets. And he believes management, in particular, trumps good assets. "We have been known to back management teams even before they have a project, based solely on their history," he says. Pinetree has positions in more than 400 companies and, in this exclusive interview with The Gold Report, Craig offers up some of his favorite gold and base metals plays in the lot.

The Gold Report: Craig, in more specific terms, what do you do for Pinetree?

Craig Stanley: My job here is to aid in managing the existing portfolio. I am also involved in seeking out and researching new opportunities.

....

TGR: All right, let's get into some of the companies you have positions in. You mentioned Colossus Minerals, which has the high-grade gold/PGMs Serra Pelada Project in Brazil. That stock went from about $0.50 to a high of over $9. The CEO of Colossus, Ari Sussman, has since launched Continental Gold Ltd. (TSX:CNL), and Pinetree has a position in Continental. Is that a bet on management? Tell us about Continental.

CS: Well, here's an example of using Sheldon's contacts. When I joined Pinetree in 2009, Continental was based here in our office; I mean it started off as a concept of Sheldon backing Ari. Sheldon gave him office space to get the company moving and helped with sponsoring the shareholders. Continental was a concept Ari had, and he was able to use his contacts to acquire ground in Colombia. We were able to leverage our relationship with Ari to get in early on Continental; so, we were there before it even went public.

Ari is a great guy; and he has Victor Wall, a very well-known and -respected geologist, as his special advisor. I just visited Continental's Buritica gold project . It's in Colombia on a very large land package; it's the same belt of rocks that host Medoro Resources Ltd.'s (TSX.V:MRS) Marmato Project or AngloGold Ashanti Ltd.'s (NYSE:AU; JSE:ANG; ASX:AGG; LSE:AGD) La Colosa Project. There are some small, artisanal gold mines already on this huge land package, wherein locals are going in and high-grading some veins. But, yes, it's a bet on great management and amazing exploration potential—and, in this case, there's a great corporate structure, as well.

TGR: What do you mean by a "great corporate structure?"

CS: There aren't many shares outstanding; as I talked about earlier, we want folks that have good management and good assets, but I didn't mention good corporate structure. You don't want to have these companies that constantly issue hundreds of millions of shares. I know that's sort of a model in Australia, but here we want to focus on companies that have tighter share float. For example, if you have good drill results and you've got a tighter float, you get more leverage in the share price. I also find that, in a rising share price environment, if you have too many shares, it's like trying to herd cats to get the stock to move. Ideally, we want companies that have a nice, tight share structure. That also means management knows how to finance properly. It's a lot easier to create shareholder value with a tighter float. Now, that's not a hard and fast rule; companies sometimes come in with a great management team and great assets, but have a poor corporate structure. However, that can be fixed by, perhaps, rolling back the stock. It all depends.

TGR: Does Continental have some drill results coming out soon that could move the share price?

CS: Yes. They are in the midst of a 25,000-meter drill program, though that will be just the beginning. I expect continuous results from these guys.

TGR: Is this strictly a gold project, or are there other metals in the mineralization?

CS: There might be some byproduct silver, but it's primarily a gold project.

TGR: What about Colombia as a jurisdiction?

CS: Colombia has really turned the corner from a political-risk standpoint, and the geology is amazing there. It's relatively under-explored. We have seen a lot of companies list up here on the TSX that have done very well in the oil and gas (O&G) sector, and now we're also seeing that in the mining space. There are still pockets that you probably want to stay away from, but there are a lot riskier places in the world than Colombia right now.

Von Favorit Continental Gold scheint er besonders begeistert zu sein

http://www.theaureport.com/pub/na/7513

Craig Stanley Bets on Management, Good Assets

Source: Brian Sylvester of The Gold Report 10/01/2010

Pinetree Capital VP of Research Craig Stanley believes that, above all else, junior mining companies need solid management and good assets. And he believes management, in particular, trumps good assets. "We have been known to back management teams even before they have a project, based solely on their history," he says. Pinetree has positions in more than 400 companies and, in this exclusive interview with The Gold Report, Craig offers up some of his favorite gold and base metals plays in the lot.

The Gold Report: Craig, in more specific terms, what do you do for Pinetree?

Craig Stanley: My job here is to aid in managing the existing portfolio. I am also involved in seeking out and researching new opportunities.

....

TGR: All right, let's get into some of the companies you have positions in. You mentioned Colossus Minerals, which has the high-grade gold/PGMs Serra Pelada Project in Brazil. That stock went from about $0.50 to a high of over $9. The CEO of Colossus, Ari Sussman, has since launched Continental Gold Ltd. (TSX:CNL), and Pinetree has a position in Continental. Is that a bet on management? Tell us about Continental.

CS: Well, here's an example of using Sheldon's contacts. When I joined Pinetree in 2009, Continental was based here in our office; I mean it started off as a concept of Sheldon backing Ari. Sheldon gave him office space to get the company moving and helped with sponsoring the shareholders. Continental was a concept Ari had, and he was able to use his contacts to acquire ground in Colombia. We were able to leverage our relationship with Ari to get in early on Continental; so, we were there before it even went public.

Ari is a great guy; and he has Victor Wall, a very well-known and -respected geologist, as his special advisor. I just visited Continental's Buritica gold project . It's in Colombia on a very large land package; it's the same belt of rocks that host Medoro Resources Ltd.'s (TSX.V:MRS) Marmato Project or AngloGold Ashanti Ltd.'s (NYSE:AU; JSE:ANG; ASX:AGG; LSE:AGD) La Colosa Project. There are some small, artisanal gold mines already on this huge land package, wherein locals are going in and high-grading some veins. But, yes, it's a bet on great management and amazing exploration potential—and, in this case, there's a great corporate structure, as well.

TGR: What do you mean by a "great corporate structure?"

CS: There aren't many shares outstanding; as I talked about earlier, we want folks that have good management and good assets, but I didn't mention good corporate structure. You don't want to have these companies that constantly issue hundreds of millions of shares. I know that's sort of a model in Australia, but here we want to focus on companies that have tighter share float. For example, if you have good drill results and you've got a tighter float, you get more leverage in the share price. I also find that, in a rising share price environment, if you have too many shares, it's like trying to herd cats to get the stock to move. Ideally, we want companies that have a nice, tight share structure. That also means management knows how to finance properly. It's a lot easier to create shareholder value with a tighter float. Now, that's not a hard and fast rule; companies sometimes come in with a great management team and great assets, but have a poor corporate structure. However, that can be fixed by, perhaps, rolling back the stock. It all depends.

TGR: Does Continental have some drill results coming out soon that could move the share price?

CS: Yes. They are in the midst of a 25,000-meter drill program, though that will be just the beginning. I expect continuous results from these guys.

TGR: Is this strictly a gold project, or are there other metals in the mineralization?

CS: There might be some byproduct silver, but it's primarily a gold project.

TGR: What about Colombia as a jurisdiction?

CS: Colombia has really turned the corner from a political-risk standpoint, and the geology is amazing there. It's relatively under-explored. We have seen a lot of companies list up here on the TSX that have done very well in the oil and gas (O&G) sector, and now we're also seeing that in the mining space. There are still pockets that you probably want to stay away from, but there are a lot riskier places in the world than Colombia right now.

Antwort auf Beitrag Nr.: 40.254.734 von traumstrand am 02.10.10 23:54:33Craig Stanley, vice president of research, joined Pinetree Capital (PNP:TSX) in January 2009 as resources analyst. Pinetree is a diversified investment, financial advisory and merchant banking firm focused on the small-cap market. Pinetree's investments are primarily in the resources sector: uranium, oil and gas, precious metals, base metals, potash, lithium and rare earths. Stanley is responsible for aiding the management of Pinetree's existing portfolio as well as researching and analyzing new investment opportunities. Prior to joining Pinetree, Craig worked both as a buy-side and sell-side analyst, the former at a firm with over $1 billion in mining investments in actively managed mutual funds, exchange-traded closed-end funds and flow-through limited partnerships. Craig holds a master of science in geology from The University of Western Ontario and is a member of the Society of Economic Geologists, the Society for Geology Applied to Mineral Deposits and the Prospectors and Developers Association of Canada.

Das komplette Interview könnt Ihr hier nachlesen:

http://www.theaureport.com/pub/na/7513

unter anderem:

TGR: Yes, but how do you determine which companies you take an equity interest in and which companies you don't?

CS: It's sort of the same factors that you hear bandied about, but it usually comes down to good management and good assets. And, ideally, it would have a good corporate structure, though that can always be fixed. By good management, I mean guys that have either experience finding deposits or a good, new concept. We like to invest in exploration stage companies, and good assets are those that have big exploration potential. I mean we're swinging for home runs. We're not worried about singles or doubles; we're looking for the big multimillion-ounce type deposits.

http://www.theaureport.com/pub/na/7513

unter anderem:

TGR: Yes, but how do you determine which companies you take an equity interest in and which companies you don't?

CS: It's sort of the same factors that you hear bandied about, but it usually comes down to good management and good assets. And, ideally, it would have a good corporate structure, though that can always be fixed. By good management, I mean guys that have either experience finding deposits or a good, new concept. We like to invest in exploration stage companies, and good assets are those that have big exploration potential. I mean we're swinging for home runs. We're not worried about singles or doubles; we're looking for the big multimillion-ounce type deposits.

Hier ne Zusammenstellung von Bohrergebnissen von Continental Gold (CNL.TO):

http://www.continentalgold.com/news/index.php?&content_id=68

Continental Gold Drills 14.3 metres at 446g/t Gold and 166g/t Silver in the Veta Sur System, Buriticá Gold Project, Colombia

14.3 metres at 446g/t Gold and 166g/t Silver

19.2 meteres at 79.09 g/t Gold

9.30 metres at 6.37g/t gold and 44g/t silver

8.85 metres at 10.28g/t gold and 11g/t Silver

8,80 meteres at 71,10g/t gold

8.50 metres at 23.67g/t gold and 149g/t silver

7.0 meteres at 91.99 g/t gold

5.9 metres at 21.34g/t gold and 49g/t silver

5.5 metres at 100.2g/t gold and 88.3g/t silver

4.70 metres at 85.44g/t gold and 71g/t silver

3.90 metres at 31.98g/t gold and 40g/t silver

3.0 metres at 2106.1g/t Gold and 738.7g/t Silver

2.1 metres at 258g/t gold

1.5 metres at 64.82g/t gold

1.2 metres at 61.43g/t gold

2.7 metres at 5.87g/t gold

0,6 meteres at 634,5g/t gold

1,0 meteres at 4046g/t gold

http://www.continentalgold.com/news/index.php?&content_id=68

Continental Gold Drills 14.3 metres at 446g/t Gold and 166g/t Silver in the Veta Sur System, Buriticá Gold Project, Colombia

14.3 metres at 446g/t Gold and 166g/t Silver

19.2 meteres at 79.09 g/t Gold

9.30 metres at 6.37g/t gold and 44g/t silver

8.85 metres at 10.28g/t gold and 11g/t Silver

8,80 meteres at 71,10g/t gold

8.50 metres at 23.67g/t gold and 149g/t silver

7.0 meteres at 91.99 g/t gold

5.9 metres at 21.34g/t gold and 49g/t silver

5.5 metres at 100.2g/t gold and 88.3g/t silver

4.70 metres at 85.44g/t gold and 71g/t silver

3.90 metres at 31.98g/t gold and 40g/t silver

3.0 metres at 2106.1g/t Gold and 738.7g/t Silver

2.1 metres at 258g/t gold

1.5 metres at 64.82g/t gold

1.2 metres at 61.43g/t gold

2.7 metres at 5.87g/t gold

0,6 meteres at 634,5g/t gold

1,0 meteres at 4046g/t gold

Antwort auf Beitrag Nr.: 40.254.754 von visas am 03.10.10 00:09:44Hier die Unternehmenspräsentation von Continental Gold aus Kanada:

http://www.continentalgold.com/_resources/presentations/Cont…

Insgesamt 86 Mio Aktien, Cashbestand aktuell 87 MIO C$ (!!!) - Gr. Investoren sind vor 4 Wochen mit ca. 68 Mio C$ eingestiegen!

http://www.continentalgold.com/_resources/presentations/Cont…

Insgesamt 86 Mio Aktien, Cashbestand aktuell 87 MIO C$ (!!!) - Gr. Investoren sind vor 4 Wochen mit ca. 68 Mio C$ eingestiegen!

Expertenmeinungen zu Continental Gold ( Quelle: http://www.theaureport.com/pub/co/2406?cover=1 ):

Canaccord Capital, Morning Coffee (09/27/10) "The Colombia gold explorer (Continental Gold) continued its upward trek on Friday, extending its two months of gains to over 100% and hitting an all-time high. . .on gold prices? The company has enjoyed a double whammy of late—impressive drill results and gold M&A euphoria. . .Highlights from the first results of its 2010 drill campaign at Veta Sur included: Hole 79, which intersected 14.3 m at 446g/t Au and 166g/t Ag, including 3.0 m at 2106.1g/t Au and 738.7g/t Ag; and separately 5.5 m at 100.2g/t Au and 88.3g/t Ag. . .Additionally, drilling at Hole 63. . .intersected 1.5 m at 64.82g/t Au and 2.7 m at 5.87g/t Au. These results unveiled a newly discovered vein system under a soil geochemical anomaly to the north of the Yaragua vein system and showed potential for further discoveries at Buritica outside of the Yaragua and Veta Sur systems. This first set of drill holes should be followed by the release of consistent drill results over the next six months. While the company is not going to see a resource estimate for the project until H2/11, it will likely start to attract a lot more attention from the drill bit in the interim."

---------------------------------------------

Laurie Curtis, Clarus Securities Inc. (09/24/10) "Exploration thus far has revealed that the approximately nine veins (likely more once the veins can confidently be connected) occur in the Yaragua system and appear to comprise a braided vein network 250m–300m vertical and 120m wide over a strike length of 500m. . .Clearly, the regional geochemistry and historic workings are indicative of a much larger system but management has not yet speculated as to the ultimate size potential, suffice to say the geochemical footprint extends far beyond known veins systems to date. CNL believes [it has] a tiger, but one that needs to be tamed with a focused effort. The expensive adit [sic] program will provide not only exploration intelligence but will essentially comprise development access and relieve likely long-term bottleneck in future mining. This serious approach, as with the current mining program, which generates annual cash flow of about US$7M) is not about proving up quick ounces for the market. The CNL management team assembled by Ari Sussman is engaged to mine and step-by-step and millimeter-by-millimeter, they are pushing to understand the ore body they are defining. While we anticipate that Buritica will, ultimately, be a high-grade producer (from selective mining), it will be underpinned by a significant +3 Moz. global resource, which we estimate will be of quality grade and ensure long-life production."

--------------------------------------------

Thom Calandra, Stockhouse (09/14/10) "Colombia is heads-away the leader for grassroots metals exploration. The nation wants to replicate the rapid success of Continental Gold and its Buriticá Gold Project in Antioquia. Continental Gold is the junior prospector that has outpaced nearly every other since I started going to the beloved Paris of South America quite frequently two years ago. The company has the beauty and vast potential of its Buriticá Gold Project, which is a producer and which I have seen. CNL enjoys plentiful capital ($57M just reported in its most-recent equity placement) thanks to eager institutional investors. Just as importantly, its main geologist and VP of exploration, Stuart Moller, is a workaholic. Buriticá's latest headline number—14m of 446 g/t gold. I asked CEO Ari Sussman. . .whether any of the amazing Buriticá gold and silver assays from several weeks ago regarding drill results neglected to mention holes that were duds. He said there were none."

--------------------------------------------

James West, Midas Letter (09/07/10)"

I really hope you bought a little Continental Gold when we first mentioned it back in April when it started trading. Now trading at 140% higher than that price of $2.60 a share, the company has had what can only be described as a 'best-case-scenario' existence from day one. On August 31st, the company announced drill intercepts that put to rest decisively the question as to whether or not there would be golddiscovered at their flagship Buritica project. A 14.3-meter intercept grading 446 g/t of gold (13 troy ounces per ton!) and 166 g/t of silver is nothing short of a jaw-dropper. Within tht intercept was a 3-meter section grading 2,106 g/t of gold. (65 ounces of g/t!!!) Wow! The company did what every smart company does when they hit something spectacular and the share price reacts dramatically—they announced a bought-deal private placement: $57 million at $5.70 a unit. Now you're going to see some action!"

--------------------------------------------------------

Ron Stewart, Dundee Securities (08/31/10)"Awesome drill results—CNL today released the results of seven new drill holes at Veta Sur, four new holes at Yaragua and the first hole drilled into the Yaragua North prospect from the 100%-owned Buriticá project in Colombia. All of the holes cut substantial gold mineralization. Highlights include Veta Sur holes BUSY-79 that returned 14.3m grading 446 g/t gold (including a 3m interval at 2106.1 g/t gold), along with BUSY-66 that cut 8.5m at 23.67 g/t and BUSY-68 that cut 4.7m at 85.44 g/t gold. As we have previously stated, based on the number and areal extent of the vein set, we believe Buriticá has excellent potential to evolve into a multimillion-ounce gold deposit. We continue to recommend CNL as a BUY, Venture Risk opportunity for investors specifically interested in exposure to a high-quality exploration play."

-----------------------------

The Gold Report Interview with James West (08/13/10)"I follow guys like Colossus CEO Ari Sussman. He's also got a project in Colombia called Continental Gold. We wrote that one up at $2-something and it's already trading well over $3. There's another one that's going to go. They bought the choice assets from Grupo de Bullet S.A. in Colombia. Grupo de Bullet was the largest private landholder of gold claims in Colombia. . .Ari's got the cream of that crop."

------------------------------------

Ron Stewart, Dundee Securities (08/09/10)

"When we visited Continental Gold's Colombia-based Buriticá gold project in June, our initial impression was that they're onto something good leading us to recommend that risk tolerant investors looking for exploration exposure consider CNL as a worthy investment choice. Since that time, the company has been actively drilling with three surface and one underground drill rig and has completed a surface geochemical survey on the property. We expect that news of this drilling is headed for the headlines and wish to remind our readers of some of our thoughts about Buriticá.

Chemistry is the Key to Size and Grade

Buriticá is classified as a carbonate base metal (CBM) gold deposit. Geologically, this class of deposit is believed to form the link between the better-known, high-temperature porphyry and low-temperature epithermal end members. Some of attributes that make this class of deposit particularly appealing are. . .the vein array of a CBM deposit can be vertically extensive [and] the zonation of both the carbonates and base metals provide useful indicators, which point to portions of the vein array that may host better gold grades (bonanza grades are not uncommon). . .Given that economic-grade mineralization has already been established over a vertical distance of up to 450m and remains open at depth, we are of the view that Buriticá could host a 3–5 Moz. gold resource."

---------------------------------------------

Nana Sangmuah, Clarus Securities Inc. (06/18/10)"Our site trip highlighted the potential to build ounces from new discoveries on Continental's flagship Buriticá asset. . .multiple high-grade veins discovered so far hold the potential to support a high-margin operation that could be sustainable in different gold price environments. Our interaction with some of the board members and management confirmed the depth of knowledge and breadth of experience required to unlock value on the portfolio of assets.

Based on the prospective grade profile, we highlight the potential for Continental to build ounces rapidly if it can generate success with further high-grade discoveries. With four rigs onsite and a fifth, larger rig en route, we expect Continental to generate news flow over 2010 from its 25,000m program at Buriticá and its 5,000m reconnaissance program at Berlin. We also note the number of derisking catalysts over the latter half of 2010 and early 2011 with completion of a scoping study in H210, environmental baseline studies by Q410 and completion of an initial resource estimate by H111."

-----------------------------------

Ron Stewart, Dundee Securities (06/18/10)

"We attended Continental Gold's inaugural analyst tour of their flagship Buriticá gold project June 16–17, 2010. Our initial impression is that the current exploration campaign is not only well justified but offers much promise to deliver a steady stream of impressive results.

CNL has established itself as a serious contender in the race to unlock the precious metal riches of Colombia. We recommend risk tolerant investors, keen on exposure to exploration upside consider CNL as a candidate worth a much closer look."

----------------------------------------

Goldletter I N T E R N A T I O N A L über Continental Gold

http://www.goldletterint.com/documents/pdf/CONTGOLD_GLSP_Jun…

u.a.

During the first quarter of 2010, gold sales resulting from exploration work and drifting in ore at the Buritica Project amounted to Cdn$ 1.93 million.[/b]

An exploration budget of Cdn$ 4.55 million has been allocated to the Buritica Project for the remainder of 2010. Approximately Cdn$ 3.5 million will be spent on a 22,000 metre drill program of which two thirds will be for infill drilling and a third for new target exploration

-------------------

Canaccord Capital, Morning Coffee (09/27/10) "The Colombia gold explorer (Continental Gold) continued its upward trek on Friday, extending its two months of gains to over 100% and hitting an all-time high. . .on gold prices? The company has enjoyed a double whammy of late—impressive drill results and gold M&A euphoria. . .Highlights from the first results of its 2010 drill campaign at Veta Sur included: Hole 79, which intersected 14.3 m at 446g/t Au and 166g/t Ag, including 3.0 m at 2106.1g/t Au and 738.7g/t Ag; and separately 5.5 m at 100.2g/t Au and 88.3g/t Ag. . .Additionally, drilling at Hole 63. . .intersected 1.5 m at 64.82g/t Au and 2.7 m at 5.87g/t Au. These results unveiled a newly discovered vein system under a soil geochemical anomaly to the north of the Yaragua vein system and showed potential for further discoveries at Buritica outside of the Yaragua and Veta Sur systems. This first set of drill holes should be followed by the release of consistent drill results over the next six months. While the company is not going to see a resource estimate for the project until H2/11, it will likely start to attract a lot more attention from the drill bit in the interim."

---------------------------------------------

Laurie Curtis, Clarus Securities Inc. (09/24/10) "Exploration thus far has revealed that the approximately nine veins (likely more once the veins can confidently be connected) occur in the Yaragua system and appear to comprise a braided vein network 250m–300m vertical and 120m wide over a strike length of 500m. . .Clearly, the regional geochemistry and historic workings are indicative of a much larger system but management has not yet speculated as to the ultimate size potential, suffice to say the geochemical footprint extends far beyond known veins systems to date. CNL believes [it has] a tiger, but one that needs to be tamed with a focused effort. The expensive adit [sic] program will provide not only exploration intelligence but will essentially comprise development access and relieve likely long-term bottleneck in future mining. This serious approach, as with the current mining program, which generates annual cash flow of about US$7M) is not about proving up quick ounces for the market. The CNL management team assembled by Ari Sussman is engaged to mine and step-by-step and millimeter-by-millimeter, they are pushing to understand the ore body they are defining. While we anticipate that Buritica will, ultimately, be a high-grade producer (from selective mining), it will be underpinned by a significant +3 Moz. global resource, which we estimate will be of quality grade and ensure long-life production."

--------------------------------------------

Thom Calandra, Stockhouse (09/14/10) "Colombia is heads-away the leader for grassroots metals exploration. The nation wants to replicate the rapid success of Continental Gold and its Buriticá Gold Project in Antioquia. Continental Gold is the junior prospector that has outpaced nearly every other since I started going to the beloved Paris of South America quite frequently two years ago. The company has the beauty and vast potential of its Buriticá Gold Project, which is a producer and which I have seen. CNL enjoys plentiful capital ($57M just reported in its most-recent equity placement) thanks to eager institutional investors. Just as importantly, its main geologist and VP of exploration, Stuart Moller, is a workaholic. Buriticá's latest headline number—14m of 446 g/t gold. I asked CEO Ari Sussman. . .whether any of the amazing Buriticá gold and silver assays from several weeks ago regarding drill results neglected to mention holes that were duds. He said there were none."

--------------------------------------------

James West, Midas Letter (09/07/10)"

I really hope you bought a little Continental Gold when we first mentioned it back in April when it started trading. Now trading at 140% higher than that price of $2.60 a share, the company has had what can only be described as a 'best-case-scenario' existence from day one. On August 31st, the company announced drill intercepts that put to rest decisively the question as to whether or not there would be golddiscovered at their flagship Buritica project. A 14.3-meter intercept grading 446 g/t of gold (13 troy ounces per ton!) and 166 g/t of silver is nothing short of a jaw-dropper. Within tht intercept was a 3-meter section grading 2,106 g/t of gold. (65 ounces of g/t!!!) Wow! The company did what every smart company does when they hit something spectacular and the share price reacts dramatically—they announced a bought-deal private placement: $57 million at $5.70 a unit. Now you're going to see some action!"

--------------------------------------------------------

Ron Stewart, Dundee Securities (08/31/10)"Awesome drill results—CNL today released the results of seven new drill holes at Veta Sur, four new holes at Yaragua and the first hole drilled into the Yaragua North prospect from the 100%-owned Buriticá project in Colombia. All of the holes cut substantial gold mineralization. Highlights include Veta Sur holes BUSY-79 that returned 14.3m grading 446 g/t gold (including a 3m interval at 2106.1 g/t gold), along with BUSY-66 that cut 8.5m at 23.67 g/t and BUSY-68 that cut 4.7m at 85.44 g/t gold. As we have previously stated, based on the number and areal extent of the vein set, we believe Buriticá has excellent potential to evolve into a multimillion-ounce gold deposit. We continue to recommend CNL as a BUY, Venture Risk opportunity for investors specifically interested in exposure to a high-quality exploration play."

-----------------------------

The Gold Report Interview with James West (08/13/10)"I follow guys like Colossus CEO Ari Sussman. He's also got a project in Colombia called Continental Gold. We wrote that one up at $2-something and it's already trading well over $3. There's another one that's going to go. They bought the choice assets from Grupo de Bullet S.A. in Colombia. Grupo de Bullet was the largest private landholder of gold claims in Colombia. . .Ari's got the cream of that crop."

------------------------------------

Ron Stewart, Dundee Securities (08/09/10)

"When we visited Continental Gold's Colombia-based Buriticá gold project in June, our initial impression was that they're onto something good leading us to recommend that risk tolerant investors looking for exploration exposure consider CNL as a worthy investment choice. Since that time, the company has been actively drilling with three surface and one underground drill rig and has completed a surface geochemical survey on the property. We expect that news of this drilling is headed for the headlines and wish to remind our readers of some of our thoughts about Buriticá.

Chemistry is the Key to Size and Grade

Buriticá is classified as a carbonate base metal (CBM) gold deposit. Geologically, this class of deposit is believed to form the link between the better-known, high-temperature porphyry and low-temperature epithermal end members. Some of attributes that make this class of deposit particularly appealing are. . .the vein array of a CBM deposit can be vertically extensive [and] the zonation of both the carbonates and base metals provide useful indicators, which point to portions of the vein array that may host better gold grades (bonanza grades are not uncommon). . .Given that economic-grade mineralization has already been established over a vertical distance of up to 450m and remains open at depth, we are of the view that Buriticá could host a 3–5 Moz. gold resource."

---------------------------------------------

Nana Sangmuah, Clarus Securities Inc. (06/18/10)"Our site trip highlighted the potential to build ounces from new discoveries on Continental's flagship Buriticá asset. . .multiple high-grade veins discovered so far hold the potential to support a high-margin operation that could be sustainable in different gold price environments. Our interaction with some of the board members and management confirmed the depth of knowledge and breadth of experience required to unlock value on the portfolio of assets.

Based on the prospective grade profile, we highlight the potential for Continental to build ounces rapidly if it can generate success with further high-grade discoveries. With four rigs onsite and a fifth, larger rig en route, we expect Continental to generate news flow over 2010 from its 25,000m program at Buriticá and its 5,000m reconnaissance program at Berlin. We also note the number of derisking catalysts over the latter half of 2010 and early 2011 with completion of a scoping study in H210, environmental baseline studies by Q410 and completion of an initial resource estimate by H111."

-----------------------------------

Ron Stewart, Dundee Securities (06/18/10)

"We attended Continental Gold's inaugural analyst tour of their flagship Buriticá gold project June 16–17, 2010. Our initial impression is that the current exploration campaign is not only well justified but offers much promise to deliver a steady stream of impressive results.

CNL has established itself as a serious contender in the race to unlock the precious metal riches of Colombia. We recommend risk tolerant investors, keen on exposure to exploration upside consider CNL as a candidate worth a much closer look."

----------------------------------------

Goldletter I N T E R N A T I O N A L über Continental Gold

http://www.goldletterint.com/documents/pdf/CONTGOLD_GLSP_Jun…

u.a.

During the first quarter of 2010, gold sales resulting from exploration work and drifting in ore at the Buritica Project amounted to Cdn$ 1.93 million.[/b]

An exploration budget of Cdn$ 4.55 million has been allocated to the Buritica Project for the remainder of 2010. Approximately Cdn$ 3.5 million will be spent on a 22,000 metre drill program of which two thirds will be for infill drilling and a third for new target exploration

-------------------

Antwort auf Beitrag Nr.: 40.254.758 von visas am 03.10.10 00:14:47Hallo!

Wer denn?

Stand 1.10.2010

da steht nix..... http://www.canadianinsider.com/coReport/allTransactions.php?…

Die Bohrergebnisse, Hammer!!!!!!

Den wert würde ich eher mal umtaufen auf "Goldplayer July 2010"!

Hätteste da mal was gesagt.......

Gruß

TimLuca

Wer denn?

Stand 1.10.2010

da steht nix..... http://www.canadianinsider.com/coReport/allTransactions.php?…

Die Bohrergebnisse, Hammer!!!!!!

Den wert würde ich eher mal umtaufen auf "Goldplayer July 2010"!

Hätteste da mal was gesagt.......

Gruß

TimLuca

Antwort auf Beitrag Nr.: 40.254.790 von TimLuca am 03.10.10 00:45:56Hallo TimLuca :-)

Bzgl. Investorennews kannst du hier nachlesen ( Die Investoren sind mir auch nicht bekannt!) --->>> http://www.continentalgold.com/news/index.php?&content_id=71

Ja die Bohrergebnisse sprechen für sich! Da wird noch viel mehr kommen.

Ich hatte Ende August 2010 bereits ein Thread hier zu Continental Gold eröffnet! Trotzdem ist der Wert immer noch unterbewertet. Craig Stanley und die andere Analysten wissen es auch. Bin mal gepannt - der Wert wird leider kaum hier in DE gehandelt ( nur in Berlin gelistet) - Kauf in Kanada ist angebracht!

Bzgl. Investorennews kannst du hier nachlesen ( Die Investoren sind mir auch nicht bekannt!) --->>> http://www.continentalgold.com/news/index.php?&content_id=71

Ja die Bohrergebnisse sprechen für sich! Da wird noch viel mehr kommen.

Ich hatte Ende August 2010 bereits ein Thread hier zu Continental Gold eröffnet! Trotzdem ist der Wert immer noch unterbewertet. Craig Stanley und die andere Analysten wissen es auch. Bin mal gepannt - der Wert wird leider kaum hier in DE gehandelt ( nur in Berlin gelistet) - Kauf in Kanada ist angebracht!

Schaut Euch auch mal die anderen Projekte von CNL (100Prozent im Besitz!!! - es muss nichts mehr bezahlt werden od. Aktien ausgegeben werden!!!) an:

Berlin:

The original Berlin Mine was operated from 1930-1946 by Canadian company Timmins Ochali. It produced 413,000 oz gold from a 20 m thick quartz lens with a production grade of 16 g/t Au. Gold recoveries averaged 94% in a standard gravity, flotation and cyanide circuit

Dojura:

Dojura is subject to a joint venture with AngloGold Ashanti Limited. Although the joint venture was concluded in October 2006, AngloGold has just recently been able to start exploration on the property due to security concerns. It is not clear when security conditions will permit ongoing exploration work. To date AngloGold has conducted airborne geophysical studies over the project area.

Dominical:

Dominical is a 100%-owned 6500 hectare project located 50 km. southwest of Popayan in Cauca Department in southwestern Colombia. Some of the better chip sampled widths include:◦12 m @ 1.15 g/t Au, ◦24 m @ 1.00 g/t Au ◦30 m @ 0.86 g/t Au

Santander

The project area is underlain by a complex assemblage of Precambrian and Palaeozoic metamorphic rocks and Cretaceous felsic-intermediate intrusions. The three blocks border the California and Vetas mining districts on the west, east, and southeast. Known mineralization in the district includes the gold deposit at Angostura (10.2 Moz measured and indicated resource, Greystar Resources Ltd.), the significant new high-grade gold discoveries recently reported by Ventana Gold Corp. and Galway Resources, and numerous precious metal vein occurrences in the Vetas District.

Berlin:

The original Berlin Mine was operated from 1930-1946 by Canadian company Timmins Ochali. It produced 413,000 oz gold from a 20 m thick quartz lens with a production grade of 16 g/t Au. Gold recoveries averaged 94% in a standard gravity, flotation and cyanide circuit

Dojura:

Dojura is subject to a joint venture with AngloGold Ashanti Limited. Although the joint venture was concluded in October 2006, AngloGold has just recently been able to start exploration on the property due to security concerns. It is not clear when security conditions will permit ongoing exploration work. To date AngloGold has conducted airborne geophysical studies over the project area.

Dominical:

Dominical is a 100%-owned 6500 hectare project located 50 km. southwest of Popayan in Cauca Department in southwestern Colombia. Some of the better chip sampled widths include:◦12 m @ 1.15 g/t Au, ◦24 m @ 1.00 g/t Au ◦30 m @ 0.86 g/t Au

Santander

The project area is underlain by a complex assemblage of Precambrian and Palaeozoic metamorphic rocks and Cretaceous felsic-intermediate intrusions. The three blocks border the California and Vetas mining districts on the west, east, and southeast. Known mineralization in the district includes the gold deposit at Angostura (10.2 Moz measured and indicated resource, Greystar Resources Ltd.), the significant new high-grade gold discoveries recently reported by Ventana Gold Corp. and Galway Resources, and numerous precious metal vein occurrences in the Vetas District.

Frank Holmes is CEO and CIO at U.S. Global Investors Inc. (NASDAQ:GROW), a registered investment adviser with approximately $2.56 billion in assets under management. Frank coauthored The Goldwatcher: Demystifying Gold Investing, which was published in 2008.

http://www.goodmorningcolombia.com/?p=1638

FH: I think the best country right now for value with government policies-and I’ve met with the ministers and the new president-is Colombia.

The best performing stock last year on the Toronto Stock Exchange was Pacific Rubiales Energy Corp., which has oil in Colombia. Government polices attracted capital. This was spectacular. It was up 600%. Even year-to-date it’s had great performance.

The Colombian government has made a real push to improve the gold mining industry too.

There’s been a move away from artisanal miners (who basically use mercury, which is bad for the community and banditos) towards high-quality mechanized mining. It still employs thousands and thousands of people, but you won’t see the environmental disasters that have taken place previously with a bunch of those small miners that have no compliance for quality.

So I think Colombia is a country that is spectacular.

In Latin America, Colombia is great and Chile is a home run. Peru is improving dramatically. Argentina is a disaster, on a relative basis. Policies there are just very difficult. But the worst is Venezuela.

It’s a great case study of poor government policy, in contrast to very progressive and constructive government policy in neighboring Colombia.

TGR: Especially in South America, countries seem to change roles dramatically within a fairly short timeframe. For instance, a decade ago you couldn’t visit Colombia without armed guards.

FH: The change in Colombia started 20 years ago. Colombia really had a big, big change with President Clinton and what he did with the former President of Colombia, Andrés Pastrana. But it was Álvaro Uribe who was significant in developing and implementing a very structured model of security, basically peace and prosperity. Colombia is very aligned with America.

They have a huge trained military force to basically go after the Revolutionary Armed Forces of Colombia-FARC-which is a guerrilla mafia organization. He’s done a great job. Juan Manuel Santos, who is now Colombia’s president, was the minister for defense during that period.

His cabinet has the highest percentage of women of any Latin American country; he’s very, very cutting edge relative to other countries and very much pro-business.

http://www.goodmorningcolombia.com/?p=1638

FH: I think the best country right now for value with government policies-and I’ve met with the ministers and the new president-is Colombia.

The best performing stock last year on the Toronto Stock Exchange was Pacific Rubiales Energy Corp., which has oil in Colombia. Government polices attracted capital. This was spectacular. It was up 600%. Even year-to-date it’s had great performance.

The Colombian government has made a real push to improve the gold mining industry too.

There’s been a move away from artisanal miners (who basically use mercury, which is bad for the community and banditos) towards high-quality mechanized mining. It still employs thousands and thousands of people, but you won’t see the environmental disasters that have taken place previously with a bunch of those small miners that have no compliance for quality.

So I think Colombia is a country that is spectacular.

In Latin America, Colombia is great and Chile is a home run. Peru is improving dramatically. Argentina is a disaster, on a relative basis. Policies there are just very difficult. But the worst is Venezuela.

It’s a great case study of poor government policy, in contrast to very progressive and constructive government policy in neighboring Colombia.

TGR: Especially in South America, countries seem to change roles dramatically within a fairly short timeframe. For instance, a decade ago you couldn’t visit Colombia without armed guards.

FH: The change in Colombia started 20 years ago. Colombia really had a big, big change with President Clinton and what he did with the former President of Colombia, Andrés Pastrana. But it was Álvaro Uribe who was significant in developing and implementing a very structured model of security, basically peace and prosperity. Colombia is very aligned with America.

They have a huge trained military force to basically go after the Revolutionary Armed Forces of Colombia-FARC-which is a guerrilla mafia organization. He’s done a great job. Juan Manuel Santos, who is now Colombia’s president, was the minister for defense during that period.

His cabinet has the highest percentage of women of any Latin American country; he’s very, very cutting edge relative to other countries and very much pro-business.

Antwort auf Beitrag Nr.: 40.254.727 von visas am 02.10.10 23:46:50

Und was sind jetzt die anderen GoldRaketenStocks ´11??

Gruß

P.

Und was sind jetzt die anderen GoldRaketenStocks ´11??

Gruß

P.

Antwort auf Beitrag Nr.: 40.254.842 von Popeye82 am 03.10.10 01:54:01Nur Continental Gold (TSX:CNL) und Colossus Minerals Inc.(TSX:CSI) werden im Artikel erwähnt ! Im zweiten Artiel werden zusätzlich folg. Goldunternehmen aufgelistet:

Auryx Gold Corp. (TSX:AYX)

Gold Canyon Resources Inc. (TSX.V:GCU)

Evolving Gold Corp. (TSX.V:EVG)

Creso Exploration Inc. (TSX.V:CXT)

Temex Resources Corp. (TSX.V:TME)

Queenston Mining Inc. (TSX:QMI)

Viel Spaß :-)

Auryx Gold Corp. (TSX:AYX)

Gold Canyon Resources Inc. (TSX.V:GCU)

Evolving Gold Corp. (TSX.V:EVG)

Creso Exploration Inc. (TSX.V:CXT)

Temex Resources Corp. (TSX.V:TME)

Queenston Mining Inc. (TSX:QMI)

Viel Spaß :-)

Wer ist denn Craig Stanley?

Craig Stanley, Vice President, Research

Craig Stanley joined Pinetree in January 2009 as Resources Analyst. He is responsible for aiding the management of Pinetree’s existing portfolio as well as researching and analyzing new investment opportunities. Prior to joining Pinetree, Craig worked both as a buy-side and sell-side analyst, the former at a firm with over $1 billion in mining investments in actively managed mutual funds, exchange-traded closed-end funds and flow-through limited partnerships. Craig holds a Master of Science in Geology from The University of Western Ontario and is a member of the Society of Economic Geologists, the Society for Geology Applied to Mineral Deposits and the Prospectors and Developers Association of Canada.

Craig Stanley, Vice President, Research

Craig Stanley joined Pinetree in January 2009 as Resources Analyst. He is responsible for aiding the management of Pinetree’s existing portfolio as well as researching and analyzing new investment opportunities. Prior to joining Pinetree, Craig worked both as a buy-side and sell-side analyst, the former at a firm with over $1 billion in mining investments in actively managed mutual funds, exchange-traded closed-end funds and flow-through limited partnerships. Craig holds a Master of Science in Geology from The University of Western Ontario and is a member of the Society of Economic Geologists, the Society for Geology Applied to Mineral Deposits and the Prospectors and Developers Association of Canada.

http://www.stockwatch.com/News/...1766561&symbol=CSI®ion=…

Colossus drills 18.5 g/t Au over 52.4 m at Serra Pelada

2010-10-06 08:29 ET - News Release

Dr. Vic Wall reports

COLOSSUS MINERALS DISCOVERS NEW MINERALIZED ZONE, EXTENDS OTHER ZONES AND DRILLS 52.43 METRES AT 18.57 G/T GOLD, 8.34 G/T PLATINUM AND 11.33 G/T PALLADIUM

Colossus Minerals Inc. has released the results of further diamond drilling on the Serra Pelada gold-platinum-palladium project, the Colossus-COOMIGASP joint venture located in Para State, Brazil.

HIGHLIGHTS

Central Mineralized Zone ("CMZ")

-- SPD-055 intersected , in the CMZ, 52.43 metres at 18.57 g/t gold, 8.34 g/t platinum and 11.33 g/t palladium, including 11.87 metres at 42.34 g/t gold, 27.85 g/t platinum and 39.95 g/t palladium

-- Three step-out holes to test the potential for the continuation of the CMZ onto the newly acquired land package have been completed with assay results expected in the near term

GT Zone

-- SPD-056B intersected 8.25 metres at 12.27 g/t gold, 0.58 g/t platinum and 0.92 g/t palladium including 4.89 metres at 20.33 g/t gold, 0.96 g/t platinum and 1.53 g/t palladium

Ich erwarte nächste oder übernächste Woche neue Bohrergebnisse von Buritica. Schließlich werden jeden Monate 4000m gemacht (insgesamt 60.000m - die Bohrungen dauern bis zum 1. Quartal 2011) und seit dem 31.August sind keine Bohrergebnisse mehr berichtet worden. Mit Spannung erwarte ich die ersten Ergebnisse von dem anderen Projekt " Berlin", da diese, sofern positiv, das Potential von Continental Gold (T.CNL) sprunghaft steigen läßt.

Ahja allein am Freitag sind ca. 2,47 Millionen Aktien gehandelt worden. Gesamtvolumen ca. 16.7 Millionen DOLLAR!!! Am WE wurde ebenfalls bekannt, dass Insider nun auf diesem Niveau kräftig zugegriffen haben, und offenbar die Zukunft Ihres Unternehmens deutlich besser einschätzen, als dies der Markt zur Zeit tut. Hier die Quelle:

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Hier ein schöner Eintrag aus einem anderen Forum (Kanada) zum Thema ...

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&…

Gruß Visas

Ahja allein am Freitag sind ca. 2,47 Millionen Aktien gehandelt worden. Gesamtvolumen ca. 16.7 Millionen DOLLAR!!! Am WE wurde ebenfalls bekannt, dass Insider nun auf diesem Niveau kräftig zugegriffen haben, und offenbar die Zukunft Ihres Unternehmens deutlich besser einschätzen, als dies der Markt zur Zeit tut. Hier die Quelle:

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Hier ein schöner Eintrag aus einem anderen Forum (Kanada) zum Thema ...

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&…

Gruß Visas

Antwort auf Beitrag Nr.: 40.296.368 von visas am 10.10.10 21:32:43

Insider greifen weiter zu! Continental Gold steigt weiter ohne "NEWS" in Kanada!!!

Insider greifen weiter zu! Continental Gold steigt weiter ohne "NEWS" in Kanada!!!

Gold, silver, coal: Grudging or all out

Respect for natural resources: It is grudging, growing or all-out.

http://www.stockhouse.com/Columnists/2010/Oct/15/Prophetic--…" target="_blank" rel="nofollow ugc noopener">

http://www.stockhouse.com/Columnists/2010/Oct/15/Prophetic--…

u.a

All out: Gold. Leaders on the gold front in this category include Quebec’s Osisko Mining (TSX: T.OSK, Stock Forum) and Colombia’s Continental Gold (TSX: T.CNL, Stock Forum).

Osisko Mining (MK 4,2 Mrd. EUR) und Continental Gold (NK 430 Mio EUR) werden in diesem Bericht zusammen „in einem Atemzug“ erwähnt...

Osisko Mining (MK 4,2 Mrd. EUR) und Continental Gold (NK 430 Mio EUR) werden in diesem Bericht zusammen „in einem Atemzug“ erwähnt...

Gruß Visas

Respect for natural resources: It is grudging, growing or all-out.

http://www.stockhouse.com/Columnists/2010/Oct/15/Prophetic--…" target="_blank" rel="nofollow ugc noopener">

http://www.stockhouse.com/Columnists/2010/Oct/15/Prophetic--…

u.a

All out: Gold. Leaders on the gold front in this category include Quebec’s Osisko Mining (TSX: T.OSK, Stock Forum) and Colombia’s Continental Gold (TSX: T.CNL, Stock Forum).

Osisko Mining (MK 4,2 Mrd. EUR) und Continental Gold (NK 430 Mio EUR) werden in diesem Bericht zusammen „in einem Atemzug“ erwähnt...

Osisko Mining (MK 4,2 Mrd. EUR) und Continental Gold (NK 430 Mio EUR) werden in diesem Bericht zusammen „in einem Atemzug“ erwähnt...

Gruß Visas

Sehr lesenswert!

http://www.stockhouse.com/Community-News/2010/Oct/15/Movers-…

"Interpreting drill results for junior resource speculating success"

For Part 1 of this interview please click here

Craig Stanley is Vice President of Research for Pinetree Capital (TSX: T.PNP, Stock Forum), a merchant banking firm focused on investing in early stage micro and small cap resource companies. Although Pinetree became well known for uranium back when there was a boom in that commodity in 2006, the company is focused on small-cap mining in general. Its biggest positions currently are in gold and other precious metal related equities and that’s what they’re focused on for the longer term. They still have uranium companies in their portfolio, though, and Pinetree CEO Sheldon Inwentash also runs Mega Uranium (TSX: T.MGA, Stock Forum).

With a Master of Science in Geology, Stockhouse asked Craig Stanley if he had any advice for investors/speculators in the junior resource space as to how to interpret drill results.

“There’s a number of things you can look at and it’s always best to ask someone with some geological experience,” said Stanley.

“I look for grams times (x) meters. Say a company puts out 10 metres at five grams (per tonne) – is that good? Well you first of all have to put it in context. Is it a new hole in a new area? Is it an infill hole, so they’re drilling between two existing holes that have similar mineralization? Or are they twinning an old hole? So, I first of all want to know all that – the location of the hole. Secondly, I want to look at what I call the grams/metres – so you take the grams per tonne and times (x) it by the width or metre. And roughly as a rule of thumb I look for 100 there. So 100 metres of one gram is awesome and 10 metres of 10 grams is great.”

Stanley added, “One of the things investors should always look for is grade smearing. So, a company might hit one metre of say 10 grams (per tonne) gold but might ‘smear’ it out and say it is 10 metres of one gram or something like that – they will try and report it over a lot bigger width and I’m thinking of Trelawney that has done that a lot.”

When asked how important depth is with drill results Stanley stated that it depends. “If it’s low grade and it’s too deep and you can’t open pit it then – an open pitted target (roughly) could have grades anywhere from one to three grams or even a bit below one gram per tonne. Anything below three hundred metres is not going to be open ‘pittable’ probably so anything below that I wouldn’t even count it,” he said.

Stanley asserted that open pit mining is the “cheapest” per tonne but the company will make it up in volume produced. “Open pits are low grade but (the company) will be moving and mining a lot of tonnes.” He stated that if the deposit is really deep the company will have to have the grades to make it worthwhile.

“Then again you have to look at whether there’s a bunch of waste rock on top. Say (the company) is reporting results that are 200 metres down but it STARTS at 200 metres; that is you have 200 metres of rock. That’s too much money to strip all that rock as an open pit.”

http://www.stockhouse.com/Community-News/2010/Oct/15/Movers-…

"Interpreting drill results for junior resource speculating success"

For Part 1 of this interview please click here

Craig Stanley is Vice President of Research for Pinetree Capital (TSX: T.PNP, Stock Forum), a merchant banking firm focused on investing in early stage micro and small cap resource companies. Although Pinetree became well known for uranium back when there was a boom in that commodity in 2006, the company is focused on small-cap mining in general. Its biggest positions currently are in gold and other precious metal related equities and that’s what they’re focused on for the longer term. They still have uranium companies in their portfolio, though, and Pinetree CEO Sheldon Inwentash also runs Mega Uranium (TSX: T.MGA, Stock Forum).

With a Master of Science in Geology, Stockhouse asked Craig Stanley if he had any advice for investors/speculators in the junior resource space as to how to interpret drill results.

“There’s a number of things you can look at and it’s always best to ask someone with some geological experience,” said Stanley.

“I look for grams times (x) meters. Say a company puts out 10 metres at five grams (per tonne) – is that good? Well you first of all have to put it in context. Is it a new hole in a new area? Is it an infill hole, so they’re drilling between two existing holes that have similar mineralization? Or are they twinning an old hole? So, I first of all want to know all that – the location of the hole. Secondly, I want to look at what I call the grams/metres – so you take the grams per tonne and times (x) it by the width or metre. And roughly as a rule of thumb I look for 100 there. So 100 metres of one gram is awesome and 10 metres of 10 grams is great.”

Stanley added, “One of the things investors should always look for is grade smearing. So, a company might hit one metre of say 10 grams (per tonne) gold but might ‘smear’ it out and say it is 10 metres of one gram or something like that – they will try and report it over a lot bigger width and I’m thinking of Trelawney that has done that a lot.”

When asked how important depth is with drill results Stanley stated that it depends. “If it’s low grade and it’s too deep and you can’t open pit it then – an open pitted target (roughly) could have grades anywhere from one to three grams or even a bit below one gram per tonne. Anything below three hundred metres is not going to be open ‘pittable’ probably so anything below that I wouldn’t even count it,” he said.

Stanley asserted that open pit mining is the “cheapest” per tonne but the company will make it up in volume produced. “Open pits are low grade but (the company) will be moving and mining a lot of tonnes.” He stated that if the deposit is really deep the company will have to have the grades to make it worthwhile.

“Then again you have to look at whether there’s a bunch of waste rock on top. Say (the company) is reporting results that are 200 metres down but it STARTS at 200 metres; that is you have 200 metres of rock. That’s too much money to strip all that rock as an open pit.”

Antwort auf Beitrag Nr.: 40.254.977 von visas am 03.10.10 09:28:49

Jo, die waren alle mal vor einem halben Jahr interessant. Früher aufwachen!

Jo, die waren alle mal vor einem halben Jahr interessant. Früher aufwachen!

Antwort auf Beitrag Nr.: 40.568.168 von iZock am 22.11.10 17:54:21Selten so ein Schwachsinn gelesen!

Der Thread bzw. die Empfehlung ist nun ca. 7 Wochen alt! Continental Gold wird unter anderem seit längerem (ca. 3 Monate - Kursstand 5,50CAD$) in diesem Thread diskutiert:

http://www.wallstreet-online.de/diskussion/1159639-1-10/disk…

Kursstand heute von Continental Gold in Kanada : 8,35CAD$!

Tip: Schau mal in vier Wochen wieder vorbei! Die CNL-Party geht erst grad los!

Die CNL-Party geht erst grad los!

Der Thread bzw. die Empfehlung ist nun ca. 7 Wochen alt! Continental Gold wird unter anderem seit längerem (ca. 3 Monate - Kursstand 5,50CAD$) in diesem Thread diskutiert:

http://www.wallstreet-online.de/diskussion/1159639-1-10/disk…

Kursstand heute von Continental Gold in Kanada : 8,35CAD$!

Tip: Schau mal in vier Wochen wieder vorbei!

Die CNL-Party geht erst grad los!

Die CNL-Party geht erst grad los!

Frisch reingekommen!

Continental Gold Drills 17.9 metres at113.82 g/t Gold and 112 g/t Silver in the Veta Sur System, Buritica GoldProject, Colombia

11/24/2010 6:31 AM - Market Wire

TORONTO, ONTARIO, Nov 24, 2010 (MARKETWIRE via COMTEX News Network) --

ContinentalGold Ltd. ("Continental" or the "Company") (TSX: CNL) is pleased to announce further diamond drilling results from the Veta Sur and Yaraguavein systems at its Buritica gold project in Antioquia, Colombia. Seven drills continue to turn as part of a 100,000 metres Phase II diamonddrilling program, with completion anticipated prior to the end of 2011.

Highlights

-- Drill hole BUSY-131 tested the central Veta Sur system and intersected

17.9 metres @ 113.82 g/t gold and 112 g/t silver including 1.2 metres @

1432.35 g/t gold and 625 g/t silver. This hole was an offset of the

previously announced BUSY-79 which intersected 14.3 m @ 446 g/t gold and

166 g/t silver.

-- Step-out drilling on the Veta Sur system indicates significant gold

mineralization in multiple sub-parallel veins in a 100-meter wide

corridor with more than 400 meters of lateral and 350 metres vertical

extents and is open to the west and at depth.

-- High grade Stage II-style gold mineralization has now been identified

overprinting phyllic alteration and base metal/carbonate gold (Stage I)

mineralization in the Yaragua and Veta Sur systems

-- Continuing drilling in the Yaragua area family of veins intersected 11.0

meters @ 17.16 g/t gold including 1.25 meters @ 128.40 g/t gold and 55

g/t silver in hole BUSY-129 in the western portion of the San Antonio

vein.

-- Step-out and infill drill intercepts on Yaragua Vein B includes 2.95

meters @ 24.37 g/t gold with 30 g/t silver in BUSY-92 and 13.4 meters @

6.54 g/t gold in BUUY-49.

Details

The 100%-owned, 18,000 hectare Buritica gold project, located in the Department of Antioquia, Colombia, is characterized by widespread,high-grade gold mineralization in multiple vein packages as well asextensive gold-in-soil anomalies. Drilling to date has focused on the Yaragua and Veta Sur vein systems. These systems exhibit twomineralogically and geochemically distinct phases of goldmineralization. Stage I, seen in veins and breccias, consists ofsemi-massive banded iron-zinc-lead (Fe-Zn-Pb) sulfides with acarbonate-quartz gangue. The recently identified Stage II style is lowerin sulfide and consists principally of carbonate, quartz and nativegold. Bonanza-grade drill intercepts in areas dominated by Stage II mineralization previously reported from the Veta Sur zone include 14.3metres at 446 g/t gold and 166 g/t silver in Busy-79.

Total surface and underground diamond drilling on the property since its discovery in 2008 is over 42,000 meters. Seven drills are currently working on infill and step-out on the Veta Sur and Yaragua families ofveins, new exploration in targets defined by soil anomalies, anddrilling along the trend of a planned one kilometer long tunnel whichwill access the ore bodies at depth. The 100,000-metre Phase II drillingprogram is to be completed before end 2011. This release summarizes theresults of recent drilling in the Veta Sur and Yaragua systems.

Veta Sur

Results from the eight new drill-holes reported in the Veta Sur system extendthe strike length of the 100-metre wide mineralized corridor to 400 meters (Figure 1), open to the southwest. Within this corridor all holesexhibit multiple vein intersections, which preliminary modelingindicates reflect a family of five main veins. The entire Veta Surcorridor is open below the 350 vertical meters currently drill tested.Significant intercepts are tabulated below:

Interval

Hole ID From (m) To (m) (m) Gold g/t Silver g/t Zinc ppm

---------------------------------------------------------------------------

BUSY-81 236.85 239.45 2.60 20.91 7.5 7133

249.35 261.50 12.15 4.81 120.1 3527

including 256.80 258.85 2.05 11.33 254.8 12597

268.40 269.70 1.30 14.22 80.0 2616

285.10 286.35 1.25 23.93 219.2 2421

BUSY-82 68.80 70.20 1.40 14.26 20.0 53800

81.00 83.00 2.00 6.46 30.2 38040

202.10 203.20 1.10 7.62 14.0 1083

313.30 316.50 3.20 4.55 14.8 4380

343.30 346.70 3.40 12.42 23.4 871

BUSY-83 171.00 173.00 2.00 23.33 216.0 13751

252.55 254.50 1.95 12.56 160.2 1369

BUSY-86 352.90 355.00 2.10 4.12 27.8 4445

359.00 362.20 3.20 3.49 23.5 3326

BUSY-89 325.80 328.50 2.70 12.16 19.0 2403

334.50 340.55 6.05 8.93 78.2 1587

BUSY-90 260.85 262.30 1.45 9.38 79.2 3286

333.15 333.80 0.65 18.47 28.0 2036

381.70 382.60 0.90 27.24 68.6 654

405.50 409.80 4.30 16.05 14.7 200

BUSY-91 245.60 249.30 3.70 4.22 18.4 333

283.00 288.10 5.10 4.34 24.2 589

317.70 318.75 1.05 8.64 28.0 2748

BUSY-131 104.00 106.50 2.50 9.63 27.4 1887

124.00 141.90 17.90 113.82 112.4 645

including 127.30 128.50 1.20 1432.35 625.4 625

and 132.00 133.80 1.80 127.02 161.8 796

(a) True widths not known but estimated at 50% or higher of the quoted

intercept

(b) Grades are uncut and an external grade cutoff of 1.0 g/t Au used to

determine intersection thickness and grade

(c) BUSY- sequence drilled from the surface, BUUY- sequence from underground

(d) Holes not reported in numerical sequence are in sample preparation or

assay lab

BUSY-131 was drilled from south to north and in scissor pattern with thenorth-to-south drilled Busy-79, which intersected 14.3 m @ 446 g/t Augold and 166 g/t Ag silver. Both holes contain two very high gradeportions which exhibit abundant visible gold and which define asteeply-dipping high grade sub-zone of more than 10 metres truethickness. The bonanza gold grades associated with low base metals andvuggy carbonate are typical of the Stage II style mineralization which is proving to be extensive in the Veta Sur system.

Yaragua Veins

Drillingin the Yaragua area focused on defining the western extension of Vein B. Eight of the nine new drill holes into Vein B intersected good goldgrades and/or vein-set thicknesses. Higher grades were encountered tothe west where the vein shows a distinct Stage II overprintcharacterized by carbonate-native gold-stibnite mineralization. The mainintercepts from these holes are tabulated below and are shown in Figure2.

A single drill hole completed on the San Antonio vein furtherdemonstrates good grades and continuity of the western part of this vein set. The intersection of 1.25 meters @ 128 g/t Au in BUSY-129 appears to be a Phase II overprint within the broader intersection of 11meters @ 17.16 g/t Au.

Interval Gold Silver Zinc

Drillhole ID From (m) To (m) (m) g/t g/t ppm Subzone

---------------------------------------------------------------------------

BUSY-80 127.50 129.00 1.50 3.37 6.2 5795 Vein B

BUSY-84 85.00 86.15 1.15 12.58 5.1 4863 Vein B

BUSY-85 85.40 89.90 4.50 6.24 4.0 3281 Vein B

98.90 100.40 1.50 7.10 7.9 3528

BUSY-88 40.95 47.30 6.35 5.07 18.2 13015 Vein B

82.30 84.80 2.50 9.25 6.3 11824

BUSY-92 143.50 144.50 1.00 7.97 18.6 47220

157.75 160.70 2.95 24.37 30.0 18227 Vein B

198.30 198.70 0.40 38.91 10.0 562

BUSY-129 108.70 110.20 1.50 7.13 7.2 2872

118.85 129.85 11.00 17.16 9.9 3038 San Antonio

including 122.40 123.65 1.25 128.40 55.0 3963

140.10 149.60 9.50 8.52 18.1 7551

BUUY-40 136.30 138.50 2.20 15.44 25.8 4470 Vein B

BUUY-41 231.35 237.60 6.25 5.69 6.6 4143 Vein B

240.60 256.90 16.30 3.47 5.2 2423

including 243.30 246.50 3.20 9.72 11.4 1254

BUUY-43 75.00 76.50 1.50 13.10 16.3 1136 Vein B

266.55 267.95 1.40 5.59 8.4 761

BUUY-49 11.00 15.60 4.60 3.86 4.5 1541

60.10 73.50 13.40 6.54 4.6 6646 Vein B

including 65.50 70.50 5.00 13.80 6.6 10918

85.00 86.00 1.00 13.75 4.9 247

(a) True widths not known but estimated to be 50% or higher of quoted

intercept

(b) Grades are uncut and an external grade cutoff of 1.0 g/t Au used to

determine intersection thickness and grade

(c) BUSY- sequence drilled from the surface, BUUY- sequence from underground

(d) Holes not reported in numerical sequence are in sample preparation or

assay lab

Technical Information

Theresults of the Company's drilling program have been reviewed, verifiedand compiled by Vice President Exploration, Stuart Moller P.Geol., aqualified person for the purpose of NI 43-101. Mr. Moller has over 30years of mineral exploration experience and is a Licensed ProfessionalGeologist in the Province of British Colombia and a Fellow of theSociety of Exploration Geologists.

The company utilizes anindustry-standard QA/QC program. HQ and NQ diamond drill-core is sawn inhalf with one half shipped to a sample preparation lab in Medellin runby SGS Colombia. Samples are then shipped for analysis to SGS certifiedassay laboratory in Lima, Peru. The remainder of the core is stored in asecured storage facility for future assay verification. Blanks,duplicates and certified reference standards are inserted into thesample stream to monitor laboratory performance and a portion of thesamples are periodically check assayed at ACME laboratories in Vancouverand/or Inspectorate Labs in Reno.

About Continental Gold Limited