Carsales.com - australischer Marktführer - 500 Beiträge pro Seite

eröffnet am 17.12.10 10:30:14 von

neuester Beitrag 19.07.19 10:05:52 von

neuester Beitrag 19.07.19 10:05:52 von

Beiträge: 16

ID: 1.162.056

ID: 1.162.056

Aufrufe heute: 0

Gesamt: 2.320

Gesamt: 2.320

Aktive User: 0

ISIN: AU000000CAR3 · WKN: A14PN8

20,200

EUR

-0,25 %

-0,050 EUR

Letzter Kurs 18.04.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 33,49 | +26,86 | |

| 9,5900 | +26,68 | |

| 4,0200 | +9,99 | |

| 3,3700 | +9,06 | |

| 6,3800 | +8,69 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,0100 | -4,87 | |

| 5,3400 | -9,95 | |

| 0,6000 | -10,45 | |

| 3,7700 | -10,66 | |

| 3,3700 | -12,24 |

...mit typischen e-commerce Merkmalen:

KBV 13

KGV 26

EK-Rendite 95%

Div-Rendite 3,1%

Leider realistisch nur in OZ handelbar...

KBV 13

KGV 26

EK-Rendite 95%

Div-Rendite 3,1%

Leider realistisch nur in OZ handelbar...

Antwort auf Beitrag Nr.: 40.726.678 von R-BgO am 17.12.10 10:30:14Habe mal in den sauren Apfel gebissen und in Sydney geordert...

MELBOURNE, March 7 (Reuters) - Private equity-owned Nine Entertainment has sold its stake in carsales.com for $565 million to cut debt, taking advantage of a recent rally in the shares of Australia's top online car classifieds business.

The move by Nine Entertainment's private equity owner CVC Asia Pacific will not affect any decision on the timing of a float of Nine, which would be worth around $4.5 billion, a person close to CVC said.

'It was an opportunity and a strong price, but it has no impact at all on the timing of a possible float,' said the person, who declined to be named because the IPO plan has not been made public.

Nine Entertainment sold its 49.1 percent stake in carsales through UBS to institutional investors at A$4.92 a share, a 6 percent discount to carsales.com's Friday close .

In the ten days leading up to the sale, carsales shares had climbed 9 percent to a 10-month high after the company reported a 45 percent jump in first-half profit.

CVC has been considering floating Nine Entertainment, which owns TV broadcaster Nine Network and Australia's largest magazine group ACP, following a pick-up in advertising and a revival in the fortunes of free-to-air TV broadcasters with new digital channels.

Those factors have spurred a string of deals, including West Australian Newspapers' agreement to buy Nine's rival Seven Media Group for $2 billion from Seven Group Holdings and private equity firm Kohlberg Kravis Roberts .

CVC appointed Credit Suisse, Goldman Sachs and UBS to advise on an IPO, but is under no pressure to sell as its debt of between A$3 billion and A$4 billion is not due to be refinanced until 2013.

Carsales.com Chief Executive Greg Roebuck said the sale would have little impact on the company as operational ties with ACP Magazines and Nine Entertainment had been minimal.

'We expect it to be business as usual,' Roebuck said in a statement.

Carsales shares fell 4.4 percent to one-week low of A$5.01. The broader market was down 1.4 percent.

The move by Nine Entertainment's private equity owner CVC Asia Pacific will not affect any decision on the timing of a float of Nine, which would be worth around $4.5 billion, a person close to CVC said.

'It was an opportunity and a strong price, but it has no impact at all on the timing of a possible float,' said the person, who declined to be named because the IPO plan has not been made public.

Nine Entertainment sold its 49.1 percent stake in carsales through UBS to institutional investors at A$4.92 a share, a 6 percent discount to carsales.com's Friday close .

In the ten days leading up to the sale, carsales shares had climbed 9 percent to a 10-month high after the company reported a 45 percent jump in first-half profit.

CVC has been considering floating Nine Entertainment, which owns TV broadcaster Nine Network and Australia's largest magazine group ACP, following a pick-up in advertising and a revival in the fortunes of free-to-air TV broadcasters with new digital channels.

Those factors have spurred a string of deals, including West Australian Newspapers' agreement to buy Nine's rival Seven Media Group for $2 billion from Seven Group Holdings and private equity firm Kohlberg Kravis Roberts .

CVC appointed Credit Suisse, Goldman Sachs and UBS to advise on an IPO, but is under no pressure to sell as its debt of between A$3 billion and A$4 billion is not due to be refinanced until 2013.

Carsales.com Chief Executive Greg Roebuck said the sale would have little impact on the company as operational ties with ACP Magazines and Nine Entertainment had been minimal.

'We expect it to be business as usual,' Roebuck said in a statement.

Carsales shares fell 4.4 percent to one-week low of A$5.01. The broader market was down 1.4 percent.

HJ-Ergebnisse +30%plus

Zahlen kamen heute; Kurs inzwischen in stratosphärischen Höhen...

Gehen, wenn es am schönsten ist?

Dividendenrendite derzeit noch 3,4%

Gehen, wenn es am schönsten ist?

Dividendenrendite derzeit noch 3,4%

June 24, 2013

carsales.com Ltd (ASX: CRZ) and Banco Santander (Brasil) SA today announce that they have entered into final

unconditional binding agreements relating to carsales’ acquisition of 30 per cent interest in WebMotors SA

(www.webmotors.com.br), the number one automotive website in Brazil.

As announced on April 17, 2013, as part of the transaction, carsales.com Ltd, one of the world’s leading online automotive

businesses, will form a strategic partnership with Banco Santander to further grow WebMotors. Banco Santander, one of the

world’s largest and most successful financial institutions, will retain a 70 per cent stake in the business.

carsales.com Ltd’s CEO and Managing Director, Mr Greg Roebuck said the partnership with Santander represented a

significant opportunity for carsales. “We are both excited about working together to continue building on the strength of

Webmotors in the Brazilian market”

"Brazil is a highly attractive market with favourable demographics, rising disposable incomes and rapidly growing internet

penetration," Mr Roebuck stated.

"Brazil is the world's fourth largest car market with more than 4 million new vehicles expected to be sold in 2013,

approximately four times Australia's total. The investment in WebMotors provides carsales with an exciting opportunity to

leverage its expertise in online automotive classifieds through the market leading online automotive classifieds website in

Brazil."

As part of the investment, carsales will be entitled to appoint nominees to the WebMotors Board and a representative to the

WebMotors management team. carsales.com Limited CEO and Managing Director, Mr Greg Roebuck is expected to be

appointed to the WebMotors Board with further appointments by carsales to be finalised.

The key terms of the transaction are set out in the annexure to this announcement.

carsales’ investment will be funded by existing cash reserves and a new bank facility.

The transaction is expected to close over the coming days and to be EPS accretive in FY14.

carsales.com Ltd (ASX: CRZ) and Banco Santander (Brasil) SA today announce that they have entered into final

unconditional binding agreements relating to carsales’ acquisition of 30 per cent interest in WebMotors SA

(www.webmotors.com.br), the number one automotive website in Brazil.

As announced on April 17, 2013, as part of the transaction, carsales.com Ltd, one of the world’s leading online automotive

businesses, will form a strategic partnership with Banco Santander to further grow WebMotors. Banco Santander, one of the

world’s largest and most successful financial institutions, will retain a 70 per cent stake in the business.

carsales.com Ltd’s CEO and Managing Director, Mr Greg Roebuck said the partnership with Santander represented a

significant opportunity for carsales. “We are both excited about working together to continue building on the strength of

Webmotors in the Brazilian market”

"Brazil is a highly attractive market with favourable demographics, rising disposable incomes and rapidly growing internet

penetration," Mr Roebuck stated.

"Brazil is the world's fourth largest car market with more than 4 million new vehicles expected to be sold in 2013,

approximately four times Australia's total. The investment in WebMotors provides carsales with an exciting opportunity to

leverage its expertise in online automotive classifieds through the market leading online automotive classifieds website in

Brazil."

As part of the investment, carsales will be entitled to appoint nominees to the WebMotors Board and a representative to the

WebMotors management team. carsales.com Limited CEO and Managing Director, Mr Greg Roebuck is expected to be

appointed to the WebMotors Board with further appointments by carsales to be finalised.

The key terms of the transaction are set out in the annexure to this announcement.

carsales’ investment will be funded by existing cash reserves and a new bank facility.

The transaction is expected to close over the coming days and to be EPS accretive in FY14.

Sie akquirieren den koreanischen Marktführer: http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9M…

Jahreszahlen gewohnt gut: von 84 auf 94 MUSD Gewinn, Divi rauf

Antwort auf Beitrag Nr.: 47.644.764 von R-BgO am 29.08.14 14:38:16

und jährlich grüßt das Murmeltier:

Gewinn auf 105 MAUD, Divi insgesamt 35,3c

Antwort auf Beitrag Nr.: 50.392.437 von R-BgO am 13.08.15 11:21:25

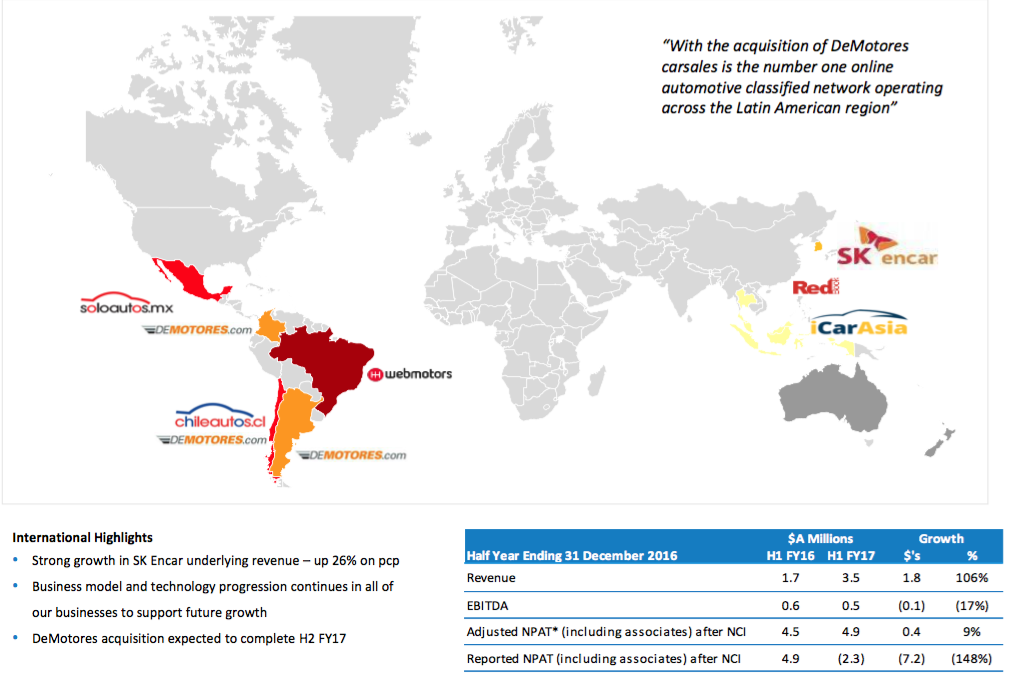

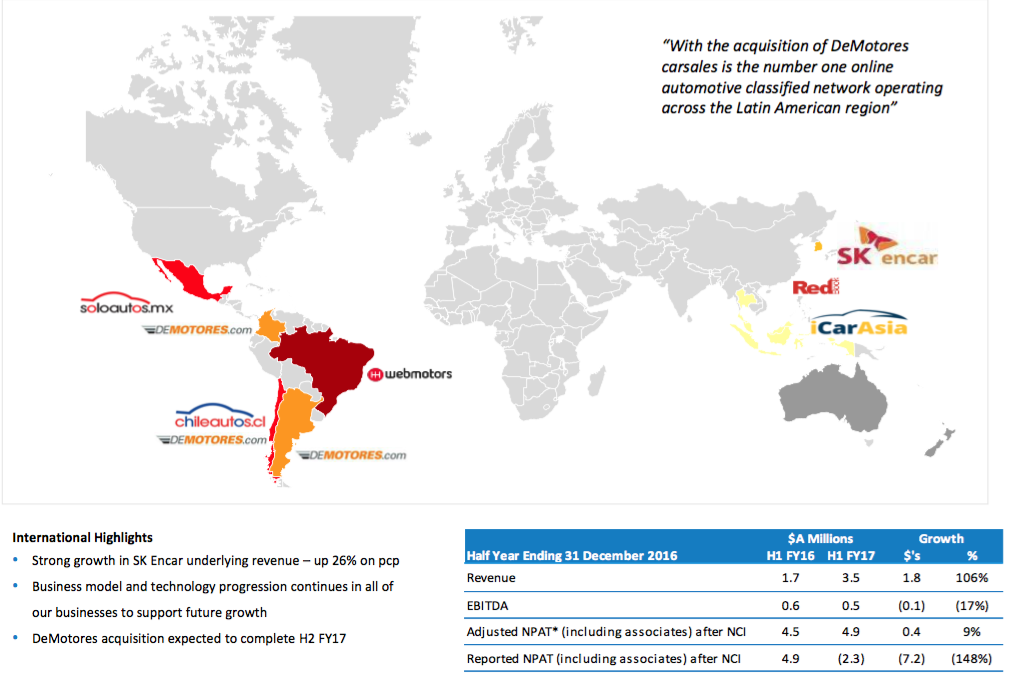

Brasilien

Chile

Mexico

SüdKorea

Thailand

Indonesien

Neuseeland

Gewinn diesmal nur auf 109 MAUD gestiegen,

dafür inzwischen tätig in:Brasilien

Chile

Mexico

SüdKorea

Thailand

Indonesien

Neuseeland

Antwort auf Beitrag Nr.: 53.183.676 von R-BgO am 01.09.16 14:21:41

globale peer group:

Thread: --- Quo Vadis Ebay? --- - Deutschland, mobile.de

Thread: Scout24 AG - Plattformanbieter geht an die Börse - Deutschland, Autoscout 24

Thread: iCar Asia - Internet start-up - Asien

Thread: Cars.com - USA

Thread: Auto Trader - UK

Thread: CarGurus - USA

Thread: Schibsted ASA (SCH) - Investor Seminar 2014 - Frankreich, Leboncoin

Thread: --- Quo Vadis Ebay? --- - Deutschland, mobile.de

Thread: Scout24 AG - Plattformanbieter geht an die Börse - Deutschland, Autoscout 24

Thread: iCar Asia - Internet start-up - Asien

Thread: Cars.com - USA

Thread: Auto Trader - UK

Thread: CarGurus - USA

Thread: Schibsted ASA (SCH) - Investor Seminar 2014 - Frankreich, Leboncoin

Zahlen sind für den 22.8. angekündigt

Antwort auf Beitrag Nr.: 58.390.221 von R-BgO am 07.08.18 12:02:08aktuelles KGV rund 21

zum Halbjahr dicke Goodwill-Abschreibung

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| +1,09 | |

| +0,32 | |

| +0,82 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 172 | ||

| 120 | ||

| 78 | ||

| 57 | ||

| 56 | ||

| 54 | ||

| 54 | ||

| 53 | ||

| 44 | ||

| 40 |