Seltene Erden Quest Rar Minerals - 500 Beiträge pro Seite

eröffnet am 09.01.11 16:17:06 von

neuester Beitrag 08.05.17 21:07:27 von

neuester Beitrag 08.05.17 21:07:27 von

Beiträge: 142

ID: 1.162.641

ID: 1.162.641

Aufrufe heute: 0

Gesamt: 18.574

Gesamt: 18.574

Aktive User: 0

ISIN: CA74836T1012 · WKN: A1CXP0

0,0150

CAD

0,00 %

0,0000 CAD

Letzter Kurs 11.08.17 Toronto

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,8000 | +17,65 | |

| 0,5500 | +14,61 | |

| 0,8200 | +12,33 | |

| 11,420 | +11,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,1600 | -8,67 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 0,7997 | -12,16 | |

| 4,2300 | -17,86 |

Die die seltenen Erden, gar nicht so selten sind, sollte man diese Werte nicht vernachlässigen.

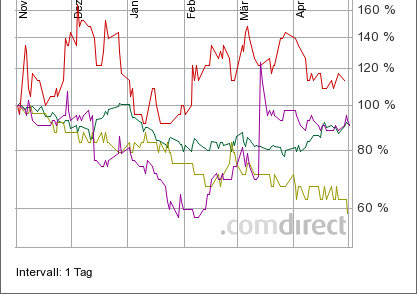

Die letzten drei Monate geht es kontinuierlich bergauf.

Die letzten drei Monate geht es kontinuierlich bergauf.

The Bloomberg Rare Earth Mineral Resources Index

The primary criterion for inclusion in the Index is that a company has a rare-earth project with a defined 43-101- or JORC-compliant mineral resource. The Index will be updated and re-weighted on a quarterly basis, so that companies with new mineral-resource definitions will be eligible for inclusion.

In the first iteration of the Index, Bloomberg chose the following companies and weightings:

Company Ticker Symbols Weighting (%)

Molycorp Inc. NYSE:MCP 16.4

Lynas Corporation Ltd. ASX:LYC, PK:LYSCF 15.0

Avalon Rare Metals Inc. TSX:AVL, AMEX:AVL 11.4

Rare Element Resources Ltd. TSX.V:RES, AMEX:REE 11.2

Arafura Resources Ltd. ASX:ARU, PK:ARAFF 10.0

Greenland Minerals and Energy Ltd. ASX:GGG, PK:GDLNF 6.7

Quest Rare Minerals Ltd. TSX.V:QRM, PK:QSURD 6.3

Frontier Rare Earths Ltd. TSX:FRO 5.9

Alkane Resources Ltd. ASX:ALK, PK:ALKEF 5.0

Tasman Metals Ltd. TSX.V:TSM, PK:TASXF, F:T61 4.6

Great Western Minerals Group Ltd. TSX.V:GWG, OTCBB:GWMGF 4.2

Navigator Resources Limited ASX:NAV 2.1

Matamec Explorations Inc. TSX.V:MAT, PK:MTCEF 1.2

Hier die News:

http://www.techmetalsresearch.com/2011/01/the-bloomberg-rare…

Hier der Chart:

http://www.bloomberg.com/apps/quote?ticker=BNREMRS:IND

MfG, FaxenClown

PS: Danke an RMIN aus dem ARU-Thread!

The primary criterion for inclusion in the Index is that a company has a rare-earth project with a defined 43-101- or JORC-compliant mineral resource. The Index will be updated and re-weighted on a quarterly basis, so that companies with new mineral-resource definitions will be eligible for inclusion.

In the first iteration of the Index, Bloomberg chose the following companies and weightings:

Company Ticker Symbols Weighting (%)

Molycorp Inc. NYSE:MCP 16.4

Lynas Corporation Ltd. ASX:LYC, PK:LYSCF 15.0

Avalon Rare Metals Inc. TSX:AVL, AMEX:AVL 11.4

Rare Element Resources Ltd. TSX.V:RES, AMEX:REE 11.2

Arafura Resources Ltd. ASX:ARU, PK:ARAFF 10.0

Greenland Minerals and Energy Ltd. ASX:GGG, PK:GDLNF 6.7

Quest Rare Minerals Ltd. TSX.V:QRM, PK:QSURD 6.3

Frontier Rare Earths Ltd. TSX:FRO 5.9

Alkane Resources Ltd. ASX:ALK, PK:ALKEF 5.0

Tasman Metals Ltd. TSX.V:TSM, PK:TASXF, F:T61 4.6

Great Western Minerals Group Ltd. TSX.V:GWG, OTCBB:GWMGF 4.2

Navigator Resources Limited ASX:NAV 2.1

Matamec Explorations Inc. TSX.V:MAT, PK:MTCEF 1.2

Hier die News:

http://www.techmetalsresearch.com/2011/01/the-bloomberg-rare…

Hier der Chart:

http://www.bloomberg.com/apps/quote?ticker=BNREMRS:IND

MfG, FaxenClown

PS: Danke an RMIN aus dem ARU-Thread!

Na da beschäftigt sich ja endlich wieder jemand mit Quest Rare Minerals (Ehem. Quest Uranium).

Schön das hier dann mal wieder ein bisschen Leben rein kommt.

gehtwas

Schön das hier dann mal wieder ein bisschen Leben rein kommt.

gehtwas

Quest Expands Its Prefeasibility Technical Team, Strange Lake B-Zone Deposit, Quebec

http://www.digitaljournal.com/pr/199608

gehtwas

http://www.digitaljournal.com/pr/199608

gehtwas

Antwort auf Beitrag Nr.: 40.857.185 von gehtwas am 13.01.11 17:51:18Ich betreibe mal etwas Vergangenheitsbewältigung:

... Link zum alten Thread: Kein Titel für Thread 1150081101110 Quest Uranium Corp. (QUC.V) erwacht zum Leben

... letzte Firmenpräsentation:

Reports and Presentations - New Orleans Investment Conference - October 25-31, 2010

http://questrareminerals.com/pdfs/Quest%20RM%20New%20Orleans…

... PEA von Strange Lake als PDF:

http://www.questrareminerals.com/pdfs/1055110200-REP-R0002-0…

... alle Firmennews seit dem letzten Eintrag im UCore-Uranium Thread (=12.10.2010):

January 13, 2011 Quest Expands Its Prefeasibility Technical Team, Strange Lake B-Zone Deposit, Quebec

January 11, 2011 Quest B-Zone Pegmatite Zone Drilling Returns Up to 105.3 Metres at 1.34% TREO With Sections Grading Up to 20.36% TREO, Strange Lake, Quebec

January 6, 2011 Quest Rare Minerals Appoints John Panneton to Its Board of Directors and Grants Stock Options

December 16, 2010 Quest Rare Minerals Appoints Ernst & Young LLP as Auditors

December 9, 2010 Quest Drilling Discovers New Deep REE Zone Northwest of the B-Zone Pegmatite Deposit, Returns Up to 14.3 Metres at 2.65% TREO, Strange Lake, Quebec

November 25, 2010 Quest Rare Minerals Ltd. Named 2010 Prospector of the Year

November 23, 2010 Quest Rare Minerals Hires Reno Pressacco as Vice-President, Operations

November 5, 2010 Quest Announces Conversion by SIDEX of $1.5 Million Loan Into Quest Shares

November 2, 2010 Quest Rare Minerals Grants Stock Options

October 28, 2010 Quest Drilling Expands High Grade B-Zone Pegmatite Mineralization, Returns Up to 51.9 Metres at 1.66% TREO, Strange Lake, Quebec

October 21, 2010 Quest Completes $51.75 Million New Issue

October 18, 2010 Quest Rare Minerals Grants Stock Options

... können alle hier nachgelesen werden:

http://questrareminerals.com/news.php

... da ich erstmal keine aufgeschlüsselten REO-Werte gefunden habe (um einen Basket zu berechnen), bin ich auf folgenden (gegenüber Quest krittisch eingestellten) Report von Byron Capital gestoßen:

Press Release or PEA?

http://www.byroncapitalmarkets.com/reports/Quest%20Rare%20Mi…

... die Zusammensetzung von Strange Lake habe ich in meine REO-Excel (mit vielen anderen REO-Lagerstätten) eingeklimpert ... mit folgendem Ergebnis:

Lagerstätte; HREO+MREO+Y HREO+Y; Y; HREO-Y;

Douglas River (GWG) ; 99,87% 99,58% 80,37% 19,21%

Kishkek Kutessay II (Stans Energy; RUU) ; 54,17% 45,16% 26,69% 18,47%

Longnan / Jiangxi Ionic Clay (China) 78,40% 70,97% 56,20% 14,77%

Strange Lake (QRM) 49,70% 44,19% 31,01% 13,18%

Benjamin River (GWG) ; 30,79% 23,31% 16,34% 6,97%

Nechalacho (AVA); 26,11% 18,00% 11,69% 6,31%

Deep Sands (GWG) ; 19,35% 14,55% 8,90% 5,65%

Dubbo (ALK) ; 25,50% 21,10% 15,83% 5,27%

Lofdal Dykes (Namibia) 17,30% 12,80% 9,00% 3,80%

Motzfeld (RMR) 18,10% 13,40% 9,60% 3,80%

Mouambe (GBE) 18,10% 13,40% 9,60% 3,80%

Kvanefjeld (GGG) ; 13,40% 10,60% 7,70% 2,90%

Mt Weld (Duncan Deposit; LYC) ; 13,72% 7,93% 5,36% 2,57%

Sichuan (China); 11,90% 6,93% 4,51% 2,42%

Charley Creek (CUX) 11,02% 7,05% 4,97% 2,08%

Zandkopsdrift (FRO) 10,15% 5,81% 4,12% 1,69%

Emanya Carbonatite (Namibia) 9,60% 5,30% 4,10% 1,20%

Eldor (EC10-027-47 Report; CCE); 7,29% 3,38% 2,32% 1,06%

Steenkampskraal (GWG) ; 10,16% 6,03% 5,00% 1,03%

Hoidas (GWG) ; 6,40% 1,91% 1,17% 0,74%

Mt Weld (Central Lanthanide Deposit; LYC) ; 5,74% 1,63% 0,95% 0,68%

Nolans (ARU) ; 5,71% 1,94% 1,32% 0,62%

Bayan Obo (China) ; 2,49% 0,75% 0,20% 0,55%

Mountain Pass (MCP) ; 1,30% 0,26% 0,00% 0,26%

Kangankunde, Malawi (LYC); 1,80% 0,20% 0,00% 0,20%

Xunwu / Jiangxi Ionic Clay (China) 15,50% 8,09% 8,00% 0,09%

Definition:

HREO+MREO+Y = alle Seltenen Erden Elemente + Yttrium, außer den LREOs (=La, Ce, Pr und Nd)

HREO+Y = alle seltenen Erden Elemente + Yttrium, außer den LREOs (s.o.) und MREOs (=Sm, Eu, Gd)

Y = selbsterklärend, Yttrium

HREO-Y = Heavy Rahre Earth (=Tb, Dy, Ho, Er, Tm, Yb, Lu) ohne Yttrium

Anmerkung: Gegenüber früheren Versionen dieser Liste, habe ich Sm jetzt als MREO eingeordnet. War früher als eine LREO definiert.

Platz 4 in meiner REE-Liste (nach HREO-Y sortiert) ... nicht schlecht!

... konservative Basketschätzung auf Basis der FOB-Preise von La; Ce; Pr; Nd; Sm; Dy; Eu; Tb; Gd; Y:

Strange Lake (QRM) +8,14%

10.01.2011 : $86,14

17.01.2011 : $93,15

Preis als "Hydrometallurgical Concentrate" (=20% des BP): $18,63

Der Basket ist die Summe aller o.g. Elemente und entspricht 91,99% des TREO-Gehaltes. Da die HREOs (außer Tb und Dy) selten gehandet werden ist eine Preisfindung schwierig. Ich nehme aber an, dass der Durchschnittspreis höher liegt als um Durchschnitt von La bis Dy incl. Y und extrapoliere deshalb von 91,99% auf 100%

Beispiel:

91,99% = 85,69USD/kg --> 100% = 85,69USd/kg / 91,99% = 93,15USD/kg (siehe 17.01.2011)

Vererzung: 1,16% TREO --> In-Situ-Wert = 1.080,51 USD/t Gestein

Preisquelle La-Tb: http://www.lynascorp.com/page.asp?category_id=1&page_id=25

Preisquelle Gd+Y: http://www.metal-pages.com/metalprices/rareearths/

... weiterer Indikator für Preisentwicklungen (FOB):

http://www.asianmetal.com/partner/peleMountain.html

Randbemerkungen: Neben REE sollen auch Nb2O5 und ZrO2 abgebaut werden, Strange Lake weist aber bei diesen Elementen aber nur geringe Gehalte auf. Des weiteren sollen die REs nur als "Hydrometallurgical Concentrates" verkauft werden. Deren Preis liegt nach Byron Capital etwa bei 20% des erreichbaren Basketpreises (beide Infos aus dem Byron Capital Report).

MfG, FaxenClown

PS: Jetzt haben wir die wichtigsten Grundlagen zu Quest auf der ersten Seite des neuen Threads!

... Link zum alten Thread: Kein Titel für Thread 1150081101110 Quest Uranium Corp. (QUC.V) erwacht zum Leben

... letzte Firmenpräsentation:

Reports and Presentations - New Orleans Investment Conference - October 25-31, 2010

http://questrareminerals.com/pdfs/Quest%20RM%20New%20Orleans…

... PEA von Strange Lake als PDF:

http://www.questrareminerals.com/pdfs/1055110200-REP-R0002-0…

... alle Firmennews seit dem letzten Eintrag im UCore-Uranium Thread (=12.10.2010):

January 13, 2011 Quest Expands Its Prefeasibility Technical Team, Strange Lake B-Zone Deposit, Quebec

January 11, 2011 Quest B-Zone Pegmatite Zone Drilling Returns Up to 105.3 Metres at 1.34% TREO With Sections Grading Up to 20.36% TREO, Strange Lake, Quebec

January 6, 2011 Quest Rare Minerals Appoints John Panneton to Its Board of Directors and Grants Stock Options

December 16, 2010 Quest Rare Minerals Appoints Ernst & Young LLP as Auditors

December 9, 2010 Quest Drilling Discovers New Deep REE Zone Northwest of the B-Zone Pegmatite Deposit, Returns Up to 14.3 Metres at 2.65% TREO, Strange Lake, Quebec

November 25, 2010 Quest Rare Minerals Ltd. Named 2010 Prospector of the Year

November 23, 2010 Quest Rare Minerals Hires Reno Pressacco as Vice-President, Operations

November 5, 2010 Quest Announces Conversion by SIDEX of $1.5 Million Loan Into Quest Shares

November 2, 2010 Quest Rare Minerals Grants Stock Options

October 28, 2010 Quest Drilling Expands High Grade B-Zone Pegmatite Mineralization, Returns Up to 51.9 Metres at 1.66% TREO, Strange Lake, Quebec

October 21, 2010 Quest Completes $51.75 Million New Issue

October 18, 2010 Quest Rare Minerals Grants Stock Options

... können alle hier nachgelesen werden:

http://questrareminerals.com/news.php

... da ich erstmal keine aufgeschlüsselten REO-Werte gefunden habe (um einen Basket zu berechnen), bin ich auf folgenden (gegenüber Quest krittisch eingestellten) Report von Byron Capital gestoßen:

Press Release or PEA?

http://www.byroncapitalmarkets.com/reports/Quest%20Rare%20Mi…

... die Zusammensetzung von Strange Lake habe ich in meine REO-Excel (mit vielen anderen REO-Lagerstätten) eingeklimpert ... mit folgendem Ergebnis:

Lagerstätte; HREO+MREO+Y HREO+Y; Y; HREO-Y;

Douglas River (GWG) ; 99,87% 99,58% 80,37% 19,21%

Kishkek Kutessay II (Stans Energy; RUU) ; 54,17% 45,16% 26,69% 18,47%

Longnan / Jiangxi Ionic Clay (China) 78,40% 70,97% 56,20% 14,77%

Strange Lake (QRM) 49,70% 44,19% 31,01% 13,18%

Benjamin River (GWG) ; 30,79% 23,31% 16,34% 6,97%

Nechalacho (AVA); 26,11% 18,00% 11,69% 6,31%

Deep Sands (GWG) ; 19,35% 14,55% 8,90% 5,65%

Dubbo (ALK) ; 25,50% 21,10% 15,83% 5,27%

Lofdal Dykes (Namibia) 17,30% 12,80% 9,00% 3,80%

Motzfeld (RMR) 18,10% 13,40% 9,60% 3,80%

Mouambe (GBE) 18,10% 13,40% 9,60% 3,80%

Kvanefjeld (GGG) ; 13,40% 10,60% 7,70% 2,90%

Mt Weld (Duncan Deposit; LYC) ; 13,72% 7,93% 5,36% 2,57%

Sichuan (China); 11,90% 6,93% 4,51% 2,42%

Charley Creek (CUX) 11,02% 7,05% 4,97% 2,08%

Zandkopsdrift (FRO) 10,15% 5,81% 4,12% 1,69%

Emanya Carbonatite (Namibia) 9,60% 5,30% 4,10% 1,20%

Eldor (EC10-027-47 Report; CCE); 7,29% 3,38% 2,32% 1,06%

Steenkampskraal (GWG) ; 10,16% 6,03% 5,00% 1,03%

Hoidas (GWG) ; 6,40% 1,91% 1,17% 0,74%

Mt Weld (Central Lanthanide Deposit; LYC) ; 5,74% 1,63% 0,95% 0,68%

Nolans (ARU) ; 5,71% 1,94% 1,32% 0,62%

Bayan Obo (China) ; 2,49% 0,75% 0,20% 0,55%

Mountain Pass (MCP) ; 1,30% 0,26% 0,00% 0,26%

Kangankunde, Malawi (LYC); 1,80% 0,20% 0,00% 0,20%

Xunwu / Jiangxi Ionic Clay (China) 15,50% 8,09% 8,00% 0,09%

Definition:

HREO+MREO+Y = alle Seltenen Erden Elemente + Yttrium, außer den LREOs (=La, Ce, Pr und Nd)

HREO+Y = alle seltenen Erden Elemente + Yttrium, außer den LREOs (s.o.) und MREOs (=Sm, Eu, Gd)

Y = selbsterklärend, Yttrium

HREO-Y = Heavy Rahre Earth (=Tb, Dy, Ho, Er, Tm, Yb, Lu) ohne Yttrium

Anmerkung: Gegenüber früheren Versionen dieser Liste, habe ich Sm jetzt als MREO eingeordnet. War früher als eine LREO definiert.

Platz 4 in meiner REE-Liste (nach HREO-Y sortiert) ... nicht schlecht!

... konservative Basketschätzung auf Basis der FOB-Preise von La; Ce; Pr; Nd; Sm; Dy; Eu; Tb; Gd; Y:

Strange Lake (QRM) +8,14%

10.01.2011 : $86,14

17.01.2011 : $93,15

Preis als "Hydrometallurgical Concentrate" (=20% des BP): $18,63

Der Basket ist die Summe aller o.g. Elemente und entspricht 91,99% des TREO-Gehaltes. Da die HREOs (außer Tb und Dy) selten gehandet werden ist eine Preisfindung schwierig. Ich nehme aber an, dass der Durchschnittspreis höher liegt als um Durchschnitt von La bis Dy incl. Y und extrapoliere deshalb von 91,99% auf 100%

Beispiel:

91,99% = 85,69USD/kg --> 100% = 85,69USd/kg / 91,99% = 93,15USD/kg (siehe 17.01.2011)

Vererzung: 1,16% TREO --> In-Situ-Wert = 1.080,51 USD/t Gestein

Preisquelle La-Tb: http://www.lynascorp.com/page.asp?category_id=1&page_id=25

Preisquelle Gd+Y: http://www.metal-pages.com/metalprices/rareearths/

... weiterer Indikator für Preisentwicklungen (FOB):

http://www.asianmetal.com/partner/peleMountain.html

Randbemerkungen: Neben REE sollen auch Nb2O5 und ZrO2 abgebaut werden, Strange Lake weist aber bei diesen Elementen aber nur geringe Gehalte auf. Des weiteren sollen die REs nur als "Hydrometallurgical Concentrates" verkauft werden. Deren Preis liegt nach Byron Capital etwa bei 20% des erreichbaren Basketpreises (beide Infos aus dem Byron Capital Report).

MfG, FaxenClown

PS: Jetzt haben wir die wichtigsten Grundlagen zu Quest auf der ersten Seite des neuen Threads!

Bei dem Anstieg in den letzten Tage hätte ruhig mal einer was schreiben können.

gehtwas

gehtwas

kommt noch besser

kommt noch besser

Antwort auf Beitrag Nr.: 40.995.153 von Schnueferl am 07.02.11 15:29:2207.02.2011 14:48

BRIEF-RESEARCH ALERT-Dundee starts Quest Rare Minerals with buy

Feb 7 (Reuters) - Quest Rare Minerals Ltd:

* Dundee starts Quest Rare Minerals Ltd with buy rating and target

price of C$8.88

For a summary of rating and price target changes on S&P 500 companies: Reuters 3000Xtra users, double-click Reuters Station users, click .1568 Reuters Plus users search on RCH/US

For a summary of rating and price target changes on non-S&P 500 companies: Reuters 3000Xtra users, double-click Reuters Station users, click .2102 Reuters Plus users search on RCH/US2

For a summary of rating and price target changes on Canadian companies: Reuters 3000Xtra users, double-click Reuters Station users, click .4899 Reuters Plus users search on RCH/CA

((Bangalore Equities Newsroom; +91 80 4135 5800; within U.S. +1 646 223 8780))

(For more news, please click here)

COPYRIGHT

Copyright Thomson Reuters 2011. All rights reserved.

The copying, republication or redistribution of Reuters News Content, including by framing or similar means, is expressly prohibited without the prior written consent of Thomson Reuters.

© 2011 AFX News

http://www.finanznachrichten.de/nachrichten-2011-02/19291131…

MfG, FaxenClown

BRIEF-RESEARCH ALERT-Dundee starts Quest Rare Minerals with buy

Feb 7 (Reuters) - Quest Rare Minerals Ltd:

* Dundee starts Quest Rare Minerals Ltd with buy rating and target

price of C$8.88

For a summary of rating and price target changes on S&P 500 companies: Reuters 3000Xtra users, double-click Reuters Station users, click .1568 Reuters Plus users search on RCH/US

For a summary of rating and price target changes on non-S&P 500 companies: Reuters 3000Xtra users, double-click Reuters Station users, click .2102 Reuters Plus users search on RCH/US2

For a summary of rating and price target changes on Canadian companies: Reuters 3000Xtra users, double-click Reuters Station users, click .4899 Reuters Plus users search on RCH/CA

((Bangalore Equities Newsroom; +91 80 4135 5800; within U.S. +1 646 223 8780))

(For more news, please click here)

COPYRIGHT

Copyright Thomson Reuters 2011. All rights reserved.

The copying, republication or redistribution of Reuters News Content, including by framing or similar means, is expressly prohibited without the prior written consent of Thomson Reuters.

© 2011 AFX News

http://www.finanznachrichten.de/nachrichten-2011-02/19291131…

MfG, FaxenClown

aktueller Basketpreis:

Strange Lake (QRM) +21,10%

21.02.2011 : $109,10

28.02.2011 : $132,12

In-Situ Value: 1.532,62 USD/t @ 1,16% TREO

Quellen: Lynas, MP, AM und eigene Berechnungen

MfG, FaxenClown

Strange Lake (QRM) +21,10%

21.02.2011 : $109,10

28.02.2011 : $132,12

In-Situ Value: 1.532,62 USD/t @ 1,16% TREO

Quellen: Lynas, MP, AM und eigene Berechnungen

MfG, FaxenClown

Antwort auf Beitrag Nr.: 41.119.252 von gehtwas am 28.02.11 17:12:28... wenn du "was gescheites" fragst, bekommst du auch eine "gescheite Antwort". Smileys sind da nicht zielführend!

MfG, FaxenClown

MfG, FaxenClown

Quest Rare Minerals Files Form 40-F With U.S. Securities and Exchange Commission

TORONTO, ONTARIO--(Marketwire - March 7, 2011) - Quest Rare Minerals Ltd. (TSX VENTURE:QRM) is pleased to announce that it has filed a registration statement on Form 40-F with the United States Securities and Exchange Commission, pursuant to section 12 of the United States Securities Exchange Act of 1934. Quest has filed the Form 40-F in light of Quest's intention to seek a listing on a stock exchange in the United States.

This action follows Quest's recent filing with the securities commissions of each province of Canada of Quest's annual report as at October 31, 2010, and audited financial statements, management's discussion and analysis (MD&A) and annual information form (AIF) for the fiscal year ended October 31, 2010, all of which are available under Quest's profile at www.SEDAR.com. These documents may also be viewed on Quest's website at www.questrareminerals.com.

http://www.marketwire.com/press-release/Quest-Rare-Minerals-…

gehtwas

TORONTO, ONTARIO--(Marketwire - March 7, 2011) - Quest Rare Minerals Ltd. (TSX VENTURE:QRM) is pleased to announce that it has filed a registration statement on Form 40-F with the United States Securities and Exchange Commission, pursuant to section 12 of the United States Securities Exchange Act of 1934. Quest has filed the Form 40-F in light of Quest's intention to seek a listing on a stock exchange in the United States.

This action follows Quest's recent filing with the securities commissions of each province of Canada of Quest's annual report as at October 31, 2010, and audited financial statements, management's discussion and analysis (MD&A) and annual information form (AIF) for the fiscal year ended October 31, 2010, all of which are available under Quest's profile at www.SEDAR.com. These documents may also be viewed on Quest's website at www.questrareminerals.com.

http://www.marketwire.com/press-release/Quest-Rare-Minerals-…

gehtwas

Wieder auf dem Weg zu aklten Höchtständen

gehtwas

gehtwas

Nichts neues, nur ne weitere Zusammenfassung:

http://www.theenergyreport.com/pub/co/711

DESCRIPTION: Quest Rare Minerals Ltd. is a Canadian-based, exploration company focused on identifying discovering new world-class rare earth element deposit opportunities. The company is led by highly respected management and technical teams with proven mine-finding track records. Quest is currently advancing several high-potential REE projects in Canada's premier rare earth exploration areas—Strange Lake in NE Québec, Kenora in NW Ontario and Plaster Rock in NW New Brunswick. Quest continues to pursue high-value REE project opportunities throughout North America.

WEBSITE: http://www.questrareminerals.com

Corporate Presentation (1/31/11)

The information provided below is based on the most recent information we have received from analysts, newsletters and other contributors to Streetwise Reports' The Gold Report or The Energy Report. We encourage you to visit the company's web site and call the company for more specifics on this company before you decide to invest.

--------------------------------------------------------------------------------

Related Quotes

The Gold Report Interview with Mickey Fulp (03/21/11) "Quest released final drill results from 2011 drilling at Strange Lake in mid-January. Geologists have outlined a thick, high-grade zone called the Pegmatite Spine both within and extending the currently known resource to the north. A new resource estimate is expected within the next month and the company will proceed to a prefeasibility study. I expect an AMEX listing in Q2; if performance mimics recent AMEX listings. . .we will see increased interest from American investors, better liquidity and a higher share price. I am a committed long-term investor in this company."

View Entire Article: Mickey Fulp: Double or Nothing

Rodney Cooper, Dundee Capital Markets (01/26/11) "Quest has a compelling in-situ value exceeding CAD$18B, representing a CAD$274B in-situ value per share, the highest of any Canadian rare earth project. With a market capitalization of only CAD$0.021 per dollar of contained TREO value, Quest is truly undervalued compared to an average of CAD$0.14 per dollar contained TREO for 15 peer projects."

http://www.theenergyreport.com/pub/co/711

DESCRIPTION: Quest Rare Minerals Ltd. is a Canadian-based, exploration company focused on identifying discovering new world-class rare earth element deposit opportunities. The company is led by highly respected management and technical teams with proven mine-finding track records. Quest is currently advancing several high-potential REE projects in Canada's premier rare earth exploration areas—Strange Lake in NE Québec, Kenora in NW Ontario and Plaster Rock in NW New Brunswick. Quest continues to pursue high-value REE project opportunities throughout North America.

WEBSITE: http://www.questrareminerals.com

Corporate Presentation (1/31/11)

The information provided below is based on the most recent information we have received from analysts, newsletters and other contributors to Streetwise Reports' The Gold Report or The Energy Report. We encourage you to visit the company's web site and call the company for more specifics on this company before you decide to invest.

--------------------------------------------------------------------------------

Related Quotes

The Gold Report Interview with Mickey Fulp (03/21/11) "Quest released final drill results from 2011 drilling at Strange Lake in mid-January. Geologists have outlined a thick, high-grade zone called the Pegmatite Spine both within and extending the currently known resource to the north. A new resource estimate is expected within the next month and the company will proceed to a prefeasibility study. I expect an AMEX listing in Q2; if performance mimics recent AMEX listings. . .we will see increased interest from American investors, better liquidity and a higher share price. I am a committed long-term investor in this company."

View Entire Article: Mickey Fulp: Double or Nothing

Rodney Cooper, Dundee Capital Markets (01/26/11) "Quest has a compelling in-situ value exceeding CAD$18B, representing a CAD$274B in-situ value per share, the highest of any Canadian rare earth project. With a market capitalization of only CAD$0.021 per dollar of contained TREO value, Quest is truly undervalued compared to an average of CAD$0.14 per dollar contained TREO for 15 peer projects."

Rising demand for rare earths bodes well for Quest’s landmark Strange Lake project

Quest Rare Minerals’ (TSXV: QRM) discovery of one of the world’s most significant rare earth deposits in 2009 has put the spotlight on this three-year-old Quebec-based company. Backed by an award-winning operations and technical team and rapidly growing awareness and demand for rare earths, Quest Rare Minerals’ outlook is rosy, to say the least. President and CEO Peter Cashin shares his enthusiasm for this young kid on the block and why going to production as early as 2014 is not out of the question.

Resource Intelligence: Congratulations. Quest was awarded the Prospector of the Year award. How did that come to be?

Peter Cashin: We accepted the award not just on the fact that it was a large and significant discovery, but also on the basis of all the associated activity following the discovery’s announcement. Our discovery generated quite a bit of exploration activity by a number of companies around our Strange Lake property and that is one of the provisos for the award. I am very proud of Quest and the Quest team for what they have accomplished. We’ve done that in short order. We launched only in January 2008 and now we’re developing probably one of the world’s most significant rare earth deposits.

RI: How much of the global demand for rare earths could Strange Lake satisfy?

PC: Strange Lake would feed out about 6% to 10% of the world demand, which is not enough to flood the market and depress the prices, but certainly enough to feed into a very important aspect of the rare earth element sector that the Chinese don’t deliver out to.

RI: What does your PEA suggest as an annual output in rare earths?

PC: The PEA is based on a portion of what we believe is there and we are looking at a production of about 4,000 tonnes of open-pitable material a day and we would deliver out from our assumptions about 12,500 tonnes of rare element oxides per year.

RI: American demand according to USGS is about 10,000 tonnes per year. Your mine, when built, could satisfy the entire US need for rare earths.

PC: That is correct. But the 10,000 tonnes is for the full spectrum of rare earths. Because of the high proportion of heavies at Strange Lake it obviously feeds into a specific sector within that 10,000 tonnes. A lot of the new technology that is being developed now, especially for military applications and some of the new high-tech electronics are showing a preference for the use of heavies. But up to this point there has not been a primary source of the heavy rare earths. Strange Lake will be able to deliver on that to the markets.

RI: For somebody who doesn’t understand the importance of rare earths and possibly more importantly heavy rare earths, explain what is going on.

PC: Rare earths are feeding into what I would consider to be the technological economy, in other words, those sectors of the economy that are fairly recent developments. I would say that for the past 20 to 25 years these things have come to be: wind turbines and hybrid automotive, cells phones and flat screens. Rare earths are a small percentage contribution in terms of the cost of the item but they are critically important and they can’t be replaced. There are no substitutes for their contribution to the miniaturization of today’s electronics or use in industrial applications. Without them those applications just won’t work. I think the big issue related to the nature of these metals is the fact that they are very heat-tolerant. Heavies of course are atomically heavier but they are much rarer. What they impart is even further heat tolerance to those same applications.

RI: When did your PEA come out and why did you focus on the B zone specifically?

PC: We delivered the PEA in September of 2010. What we liked about the B zone is that it was fully in Quebec and, so far, the only known deposit is the historical IOC or what we called the Main zone, which straddles a provincial boundary that has not been surveyed yet. So there will potentially be issues related to the true position of the boundary and not really knowing what percentage of the deposit would be available to us. The B Zone on the other hand is well away from the border; it is in a positive jurisdiction, is open-pitable and sufficiently large to give us an indication of the commercial viability of Strange Lake as a whole. We’ve done metallurgy on that and we can apply conventional acid leach to the ore with very good recovery. It’s a much better deposit.

RI: How many mineral phases are there?

PC: The elemental suite is gadolinite, gerenite and kainosite. Those are calcium bearing heavy rare earth element silicate and carbonate minerals. They have been re-crystallized so they are very amenable to acid leach. It’s almost like Mother Nature did a lot of the pre-cracking to this deposit, thereby facilitating recovery of the valuable rare earth components.

RI: That led you to a very low operating cost. About $100 per tonne; you’re estimating?

PC: Yes. $102 to $105. That is due to the fact that the resource can be a mine via open-pit methods so our cost is $5 a tonne vs. mining costs related to a typical underground operation which is in the order of $50-$60 a tonne.

Mining analysts visit the Strange Lake Project, Québec, July 2010

RI: The ore value you’re looking at is great as well. Last year when I spoke to John Kaiser he had done an evaluation on each of the elements and came up with a value of $304 per tonne. What is that now?

PC: It’s gone up in leaps and bounds with the Chinese cutbacks on their export quotas. I can’t even estimate what it is. I think it is in the order of about $700 per tonne. It’s just gone through the roof.

RI: What is your NPV and what are your revenues expected to be?

PC: The IRR on the 115 million tonnes used in the PEA is a very robust 36%. The NPV is a 12% discount rate because it is still high risk and it still came out to be over $1.4 billion over a minimum 25-year production period.

RI: You say that you have a mine life of about 25 years but actually you’ve got enough tonnage for 65 years. Why the discrepancy?

PC: The thing is once you go past the 25-year window the rest is all gravy. To be honest with you we just wanted to show and establish the economic model in a reasonable operating time frame. That was based on last year’s resource estimate. We’ve done subsequent work now and we know that we are going to be well past that time line once we deliver our revised resource estimate of the deposit.

RI: What prices did you use then? You say a payback of three to four years, which is incredible. Are those recent prices?

PC: We used as the base case a trailing three-year average from 2007 to 2010, and then grew that number over the life of the project. Since the price scenario was set in September, the prices have moved up materially due to the China quotas and export tariffs. So it is actually a fairly discounted price. The price assumption we used on Strange Lake is conservative: about a half to a third of the current market prices.

RI: Geographically, you don’t have any First Nations issues, and Quebec is mining-friendly. What about infrastructure? Have you had issues there?

PC: I’ve had to answer a lot of shareholders about the concern for lack of infrastructure. If Strange Lake were a small deposit I would be very concerned. If infrastructure difficulties would have been an issue for such mines as Voisey’s Bay copper/nickel deposit or the Raglan nickel deposit or the Echo Bay gold deposit or Red Dog lead/zinc deposit they would never have happened. What made those projects work is that fact that they were very large and very rich, which, for investors, mitigates the potential risk of opening an operation. So I don’t think from an infrastructure standpoint that it’s unattainable.

RI: When do you foresee going into production by?

PC: I’ve got a model of a startup about 2015/16, which is much in keeping with my philosophy of under-promising and over-performing in what we deliver out. What is nice about an open-pit opportunity is that it’s more easily scalable if you want to fast track it and it’s looking very good. The economics also continue to be very positive and you’ve got indications from end users for wanting the material you can deliver out then you can probably accelerate that in the order of 2014.

RI: Is it important for you to beat competitors to

the market?

PC: We are really talking to a different sector of the rare elements base because of the heavies. Strange Lake stands alone with that fact of the extreme enrichment, the size of the deposit, the amenability to open-pit mining and conventional metallurgy.

RI: Based on all of these green lights you seem to be getting is this a fait du compli?

PC: No. There could be bumps in the road all the way through development. But I think the project and the deposit is such that a lot of our concerns and risks have been mitigated by the nature of the deposit itself.

RI: I think the market speaks a great deal as well. When you look at how you’re trading and how quickly your price has escalated and has managed to hold the course so far.

PC: I think that the deposit speaks and I think that the last time you and I spoke I did say that the true success of a junior exploration company is to first and foremost ensure the technical integrity of the program and bring those along and develop your resources first before you go out and promote them. We’ve done that and the proof is in the pudding.

RI: You’ve had a lot happen in the last year. What will happen between now and next year when we next speak?

PC: We’re going to get our revised resource estimate that gives us the measured and indicated grade that we need for commencing a pre-feasibility study. We’re pretty confident because of the nature of the PEA that we will make that decision to go into pre-feasibility soon after receipt of the resource estimate. We’ll be continuing our exploration and definition program throughout 2011. There are indications of further resources on the property that we have yet to drill define. My hope is that we can deliver out a pre-feasibility before the end of the calendar year.

Investor Highlights:

■Stage: Preliminary resource estimate, awaiting a revised resource estimate at the indicated/measured category, likely to launch pre-feasibility study by end of q1 2011

■Market cap: $363 million as of February 11, 2011

■Share price: 187% in 12 months; 11,660% in 24 months

■Share price: $6.24 as of February 11, 2011

■Commodity: Rare earth metals

■Production planned: Late 2015

■Mine life: 25 years, minimum

■Cash: $50 million as of January 31, 2011

Highlights:

■Strange Lake is a world-class resource and one of only two known primary heavy REE resources in the world

■Rare earths are critical and irreplaceable components in military applications and high-tech electronics. Quest’s Strange Lake property would deliver the highly heat-tolerant heavy rare earth minerals much-needed in such applications

■Misery Lake and newly discovered targets south of the property add further upside

■Experienced and respected management and technical team

http://www.resourceintelligence.net/rising-demand-for-rare-e…

gehtwas

Quest Rare Minerals’ (TSXV: QRM) discovery of one of the world’s most significant rare earth deposits in 2009 has put the spotlight on this three-year-old Quebec-based company. Backed by an award-winning operations and technical team and rapidly growing awareness and demand for rare earths, Quest Rare Minerals’ outlook is rosy, to say the least. President and CEO Peter Cashin shares his enthusiasm for this young kid on the block and why going to production as early as 2014 is not out of the question.

Resource Intelligence: Congratulations. Quest was awarded the Prospector of the Year award. How did that come to be?

Peter Cashin: We accepted the award not just on the fact that it was a large and significant discovery, but also on the basis of all the associated activity following the discovery’s announcement. Our discovery generated quite a bit of exploration activity by a number of companies around our Strange Lake property and that is one of the provisos for the award. I am very proud of Quest and the Quest team for what they have accomplished. We’ve done that in short order. We launched only in January 2008 and now we’re developing probably one of the world’s most significant rare earth deposits.

RI: How much of the global demand for rare earths could Strange Lake satisfy?

PC: Strange Lake would feed out about 6% to 10% of the world demand, which is not enough to flood the market and depress the prices, but certainly enough to feed into a very important aspect of the rare earth element sector that the Chinese don’t deliver out to.

RI: What does your PEA suggest as an annual output in rare earths?

PC: The PEA is based on a portion of what we believe is there and we are looking at a production of about 4,000 tonnes of open-pitable material a day and we would deliver out from our assumptions about 12,500 tonnes of rare element oxides per year.

RI: American demand according to USGS is about 10,000 tonnes per year. Your mine, when built, could satisfy the entire US need for rare earths.

PC: That is correct. But the 10,000 tonnes is for the full spectrum of rare earths. Because of the high proportion of heavies at Strange Lake it obviously feeds into a specific sector within that 10,000 tonnes. A lot of the new technology that is being developed now, especially for military applications and some of the new high-tech electronics are showing a preference for the use of heavies. But up to this point there has not been a primary source of the heavy rare earths. Strange Lake will be able to deliver on that to the markets.

RI: For somebody who doesn’t understand the importance of rare earths and possibly more importantly heavy rare earths, explain what is going on.

PC: Rare earths are feeding into what I would consider to be the technological economy, in other words, those sectors of the economy that are fairly recent developments. I would say that for the past 20 to 25 years these things have come to be: wind turbines and hybrid automotive, cells phones and flat screens. Rare earths are a small percentage contribution in terms of the cost of the item but they are critically important and they can’t be replaced. There are no substitutes for their contribution to the miniaturization of today’s electronics or use in industrial applications. Without them those applications just won’t work. I think the big issue related to the nature of these metals is the fact that they are very heat-tolerant. Heavies of course are atomically heavier but they are much rarer. What they impart is even further heat tolerance to those same applications.

RI: When did your PEA come out and why did you focus on the B zone specifically?

PC: We delivered the PEA in September of 2010. What we liked about the B zone is that it was fully in Quebec and, so far, the only known deposit is the historical IOC or what we called the Main zone, which straddles a provincial boundary that has not been surveyed yet. So there will potentially be issues related to the true position of the boundary and not really knowing what percentage of the deposit would be available to us. The B Zone on the other hand is well away from the border; it is in a positive jurisdiction, is open-pitable and sufficiently large to give us an indication of the commercial viability of Strange Lake as a whole. We’ve done metallurgy on that and we can apply conventional acid leach to the ore with very good recovery. It’s a much better deposit.

RI: How many mineral phases are there?

PC: The elemental suite is gadolinite, gerenite and kainosite. Those are calcium bearing heavy rare earth element silicate and carbonate minerals. They have been re-crystallized so they are very amenable to acid leach. It’s almost like Mother Nature did a lot of the pre-cracking to this deposit, thereby facilitating recovery of the valuable rare earth components.

RI: That led you to a very low operating cost. About $100 per tonne; you’re estimating?

PC: Yes. $102 to $105. That is due to the fact that the resource can be a mine via open-pit methods so our cost is $5 a tonne vs. mining costs related to a typical underground operation which is in the order of $50-$60 a tonne.

Mining analysts visit the Strange Lake Project, Québec, July 2010

RI: The ore value you’re looking at is great as well. Last year when I spoke to John Kaiser he had done an evaluation on each of the elements and came up with a value of $304 per tonne. What is that now?

PC: It’s gone up in leaps and bounds with the Chinese cutbacks on their export quotas. I can’t even estimate what it is. I think it is in the order of about $700 per tonne. It’s just gone through the roof.

RI: What is your NPV and what are your revenues expected to be?

PC: The IRR on the 115 million tonnes used in the PEA is a very robust 36%. The NPV is a 12% discount rate because it is still high risk and it still came out to be over $1.4 billion over a minimum 25-year production period.

RI: You say that you have a mine life of about 25 years but actually you’ve got enough tonnage for 65 years. Why the discrepancy?

PC: The thing is once you go past the 25-year window the rest is all gravy. To be honest with you we just wanted to show and establish the economic model in a reasonable operating time frame. That was based on last year’s resource estimate. We’ve done subsequent work now and we know that we are going to be well past that time line once we deliver our revised resource estimate of the deposit.

RI: What prices did you use then? You say a payback of three to four years, which is incredible. Are those recent prices?

PC: We used as the base case a trailing three-year average from 2007 to 2010, and then grew that number over the life of the project. Since the price scenario was set in September, the prices have moved up materially due to the China quotas and export tariffs. So it is actually a fairly discounted price. The price assumption we used on Strange Lake is conservative: about a half to a third of the current market prices.

RI: Geographically, you don’t have any First Nations issues, and Quebec is mining-friendly. What about infrastructure? Have you had issues there?

PC: I’ve had to answer a lot of shareholders about the concern for lack of infrastructure. If Strange Lake were a small deposit I would be very concerned. If infrastructure difficulties would have been an issue for such mines as Voisey’s Bay copper/nickel deposit or the Raglan nickel deposit or the Echo Bay gold deposit or Red Dog lead/zinc deposit they would never have happened. What made those projects work is that fact that they were very large and very rich, which, for investors, mitigates the potential risk of opening an operation. So I don’t think from an infrastructure standpoint that it’s unattainable.

RI: When do you foresee going into production by?

PC: I’ve got a model of a startup about 2015/16, which is much in keeping with my philosophy of under-promising and over-performing in what we deliver out. What is nice about an open-pit opportunity is that it’s more easily scalable if you want to fast track it and it’s looking very good. The economics also continue to be very positive and you’ve got indications from end users for wanting the material you can deliver out then you can probably accelerate that in the order of 2014.

RI: Is it important for you to beat competitors to

the market?

PC: We are really talking to a different sector of the rare elements base because of the heavies. Strange Lake stands alone with that fact of the extreme enrichment, the size of the deposit, the amenability to open-pit mining and conventional metallurgy.

RI: Based on all of these green lights you seem to be getting is this a fait du compli?

PC: No. There could be bumps in the road all the way through development. But I think the project and the deposit is such that a lot of our concerns and risks have been mitigated by the nature of the deposit itself.

RI: I think the market speaks a great deal as well. When you look at how you’re trading and how quickly your price has escalated and has managed to hold the course so far.

PC: I think that the deposit speaks and I think that the last time you and I spoke I did say that the true success of a junior exploration company is to first and foremost ensure the technical integrity of the program and bring those along and develop your resources first before you go out and promote them. We’ve done that and the proof is in the pudding.

RI: You’ve had a lot happen in the last year. What will happen between now and next year when we next speak?

PC: We’re going to get our revised resource estimate that gives us the measured and indicated grade that we need for commencing a pre-feasibility study. We’re pretty confident because of the nature of the PEA that we will make that decision to go into pre-feasibility soon after receipt of the resource estimate. We’ll be continuing our exploration and definition program throughout 2011. There are indications of further resources on the property that we have yet to drill define. My hope is that we can deliver out a pre-feasibility before the end of the calendar year.

Investor Highlights:

■Stage: Preliminary resource estimate, awaiting a revised resource estimate at the indicated/measured category, likely to launch pre-feasibility study by end of q1 2011

■Market cap: $363 million as of February 11, 2011

■Share price: 187% in 12 months; 11,660% in 24 months

■Share price: $6.24 as of February 11, 2011

■Commodity: Rare earth metals

■Production planned: Late 2015

■Mine life: 25 years, minimum

■Cash: $50 million as of January 31, 2011

Highlights:

■Strange Lake is a world-class resource and one of only two known primary heavy REE resources in the world

■Rare earths are critical and irreplaceable components in military applications and high-tech electronics. Quest’s Strange Lake property would deliver the highly heat-tolerant heavy rare earth minerals much-needed in such applications

■Misery Lake and newly discovered targets south of the property add further upside

■Experienced and respected management and technical team

http://www.resourceintelligence.net/rising-demand-for-rare-e…

gehtwas

QUEST RARE MINERALS LTD

Daily Commentary

Our system posted a HOLD today. The previous BUY recommendation was issued on 04.04.2011 (1) day ago, when the stock price was 6.1000. Since then QRM has gained 2.46% .

Our advice today is simple and clear. Hold your stocks and wait for a new signal.

http://americanbulls.com/StockPage.asp?CompanyTicker=QRM&Mar…

Weg nach oben jetzt weiter offen??

Daily Commentary

Our system posted a HOLD today. The previous BUY recommendation was issued on 04.04.2011 (1) day ago, when the stock price was 6.1000. Since then QRM has gained 2.46% .

Our advice today is simple and clear. Hold your stocks and wait for a new signal.

http://americanbulls.com/StockPage.asp?CompanyTicker=QRM&Mar…

Weg nach oben jetzt weiter offen??

Quest's Revised Resource Estimate for the B-Zone REE Deposit Shows Important Improvements in Tonnage and Grade at Strange Lake, Quebec

TORONTO, ONTARIO--(Marketwire - April 11, 2011) - Quest Rare Minerals Ltd. (TSX VENTURE:QRM) -

/T/

Highlights:

- A NI43-101 compliant Resource Estimate for the B-Zone deposit was

determined using cut-off grades of 0.7%, 0.8%, 0.85%, 0.9%, 0.95%, 1.0%,

1.1% and 1.2% Total Rare Earth Oxides (TREO) and an average specific

gravity of 2.72 g/cm(3)

- An economic cut-off grade determined from Whittle pit shell optimization

methods of 0.579% TREO was calculated for the B-Zone deposit

- A cut-off grade of 0.95% TREO was selected to represent that portion of

the total B-Zone deposit resource that would be used in the anticipated

Pre-Feasibility Study for a 25-year Open-Pit production model

established by an earlier Preliminary Economic Assessment report

(September 2010)

- At a base-case cut-off grade of 0.95% TREO, the B-Zone contains an

Indicated Resource of 36.4 million tonnes grading 1.16% TREO, 2.17%

zirconium oxide, 0.24% niobium pentoxide, 0.05% hafnium oxide and 0.12%

beryllium oxide and a further Inferred Resource of 14.4 million tonnes

grading 1.11% TREO, 2.02% zirconium oxide, 0.21% niobium pentoxide,

0.05% hafnium oxide and 0.09% beryllium oxide

/T/

Quest Rare Minerals Ltd. (TSX VENTURE:QRM) (the "Company") is pleased to announce a revised National Instrument 43-101 compliant Indicated and Inferred category resource estimate for its B-Zone rare earth deposit within the Strange Lake Project, Quebec. The estimate was prepared by Wardrop, a Tetra-Tech Company ("Wardrop"). The Strange Lake Project is located 225 km northeast of Schefferville, Quebec and 125 km west of the giant Voisey's Bay nickel-copper-cobalt deposit, eastern Labrador. Quest also reports that exploration drilling on winter ice commenced in mid-March to probe the northern extension of the deposit over Lac Brisson, Quebec.

The base-case resource was estimated using a TREO cut-off grade of 0.95% TREO (Tables 1a, 2a) and represents sufficient Indicated Resource to satisfy a minimum 25-year open-pit production model for the B-Zone established for the Company's Preliminary Economic Assessment (PEA, see Press Release : September 9, 2010) study. At this cut-off, the B-Zone hosts an Indicated Resource of 36.4 million tonnes grading 1.16% TREO, 2.17% zirconium oxide (ZrO2), 0.24% niobium pentoxide (Nb2O5), 0.05% hafnium oxide (HfO2) and 0.12% beryllium oxide (BeO). A further Inferred Resource (Tables 1b, 2b) of 14.4 million tonnes grading 1.11% TREO, 2.02% ZrO2, 0.21% Nb2O5, 0.05% HfO2 and 0.09% BeO is calculated. It is estimated that Heavy Rare Earth Oxides (HREO) represent between 40% and 51% of the TREO in the deposit. Contained within the Indicated Resource is an outcropping and higher grade "Pegmatite Spine" (see Figure 1) containing 8.1 million tonnes at 1.66% TREO, 2.77% ZrO2, 0.37% Nb2O5, 0.06% HfO2 and 0.19% BeO. A further Inferred "Pegmatite Spine" resource of 2.57 million tonnes grading 1.53% TREO, 2.57% ZrO2, 0.30% Nb2O5, 0.06% HfO2 and 0.15% BeO is calculated.

Mineralisation within the deposit is currently open along strike, to the north and south, and down-dip to the northwest. In addition, a program of Phase 2 metallurgical testing studies for the deposit is currently being undertaken by Hazen Research, Inc. of Golden, Colorado. It is intended that the data from these studies will form the basis for a future Preliminary Feasibility Study (PFS) of the deposit.

/T/

Table 1a - Indicated Category Resources, B-Zone Deposit, Strange Lake

Project, Quebec

----------------------------------------------------------------------------

TREO Density Tonnage ZrO2 Nb2O5 HfO2 BeO TREO HREO LREO HREO/

% % % % % % % % TREO

----------------------------------------------------------------------------

Cut-off t per t x Ratio

m3 1000

----------------------------------------------------------------------------

1.20% 2.72 8,095 2.77 0.37 0.06 0.19 1.655 0.849 0.806 51

----------------------------------------------------------------------------

1.10% 2.72 12,044 2.59 0.33 0.06 0.17 1.487 0.733 0.754 49

----------------------------------------------------------------------------

1.00% 2.72 23,052 2.32 0.27 0.05 0.13 1.274 0.586 0.688 46

----------------------------------------------------------------------------

0.95% 2.72 36,359 2.17 0.24 0.05 0.12 1.164 0.511 0.653 44

----------------------------------------------------------------------------

0.90% 2.72 60,529 2.06 0.21 0.05 0.10 1.068 0.449 0.619 42

----------------------------------------------------------------------------

0.85% 2.72 93,139 2.00 0.20 0.05 0.09 1.000 0.408 0.592 41

----------------------------------------------------------------------------

0.80% 2.72 120,526 1.96 0.19 0.05 0.08 0.961 0.385 0.575 40

----------------------------------------------------------------------------

0.75% 2.72 135,033 1.94 0.18 0.05 0.08 0.941 0.375 0.566 40

----------------------------------------------------------------------------

0.70% 2.72 138,967 1.94 0.18 0.05 0.08 0.935 0.372 0.563 40

----------------------------------------------------------------------------

0.579% 2.72 140,259 1.93 0.18 0.05 0.08 0.933 0.371 0.562 40

----------------------------------------------------------------------------

Where: HfO2 - hafnium oxide; ZrO2 - zirconium oxide; Nb2O5 - niobium

pentoxide; BeO - beryllium oxide

Notes:

1. Total Rare Earth Oxides (TREO) include: La2O3, Ce2O3, Pr2O3, Nd2O3,

Sm2O3, Eu2O3, Gd2O3, Tb2O3, Tb2O3, Dy2O3, Ho2O3, Er2O3, Tm2O3,

Yb2O3, Lu2O3 and Y2O3

2. Heavy Rare Earth Oxides (HREO) include: Eu2O3, Gd2O3, Tb2O3, Tb2O3,

Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3 and Y2O3

3. Light Rare Earth Oxides (LREO) include: La2O3, Ce2O3, Pr2O3, Nd2O3

and Sm2O3

4. Effective date of the resource estimate is 8 April 2011

5. Resource estimate based on drill core assays from Quest's 2009 and

2010 assay database.

6. Wardrop considers a cut-off grade of 0.579 TREO% to be reasonable

based on a Whittle pit optimization on the current block model.

7. Average specific gravity is 2.72 g/cc for the subsolvus rocks and

2.74 g/cc for pegmatite rocks.

8. The resource estimate has been classified as Indicated and Inferred

Resource based on the following criteria:

- any block estimated on the first pass, using a minimum of 3

drill holes, at an average distance of less than or equal to

80m and where the closest point is less than 60 m is classified

as Indicated Resources.

- any block estimated using a minimum of 2 drill holes at an

average distance greater than 80 m is classified as Inferred

Resources.

9. Resource Estimate is based on:

- A database of 97 drill holes, totalling approximately 17,474 m

of diamond drilling, using 8,297 composite samples on 2m

composite lengths.

- A geological model for pegmatite rocks used an Indicator Kriged

(IK) wireframe, defining a 45% probability of achieving

pegmatite was generated on a block size of 5 m x 5 m x 5 m.

- A geological model encompassing the host subsolvus granite

rocks was bounded to within 50 m area of influence beyond the

outer drill holes.

- Block model was estimated by Ordinary Kriging (OK)

interpolation method on block size 5 m x 5 m x 5 m. The OK

estimation was generated on the two separate domains, the

subsolvus granites and the pegmatites.

- Resource Estimate assumes 100% recovery.

/T/

"Wardrop's Revised Resource Estimate for the B-Zone REE deposit reported today confirms that the B-Zone will likely become a very important rare earth oxide source, particularly for the high-value Heavy Rare Earths," said Peter J. Cashin, Quest's President and CEO. "The Indicated Resource base case will more than satisfy the notional 25-year production model established by our recent PEA at slightly higher REO grades than were used for the cash-flow model in the original study. We are particularly pleased with the important firming of the surface outcropping "Pegmatite Spine" Indicated resource, which show REO grades that are 43% higher than the grade used by the PEA and would support a minimum 6.6 years at the notional annual production rate of 1.46 million tonnes in our PEA. Drilling is also currently underway to expand the B-Zone resource outside of the limits of the deposit established for the Resource Estimate. This work will greatly expand the important mineral inventory that we have built on the property."

Quest intends to move the Strange Lake Project to the Pre-Feasibility Study stage of evaluation. Quest has received Proposals for the work required for the study and the work is anticipated to commence shortly.

/T/

Table 1b - Inferred Category Resource, B-Zone Deposit, Strange Lake Project,

Quebec

----------------------------------------------------------------------------

TREO Density Tonnage ZrO2 Nb2O5 HfO2 BeO TREO HREO LREO HREO/

% % % % % % % % TREO

----------------------------------------------------------------------------

Cut-off t per t x Ratio

m3 1000

----------------------------------------------------------------------------

1.20% 2.73 2,572 2.57 0.30 0.06 0.15 1.532 0.764 0.768 50%

----------------------------------------------------------------------------

1.10% 2.72 4,033 2.36 0.27 0.06 0.13 1.391 0.663 0.728 48%

----------------------------------------------------------------------------

1.00% 2.72 8,299 2.13 0.23 0.05 0.10 1.210 0.535 0.676 44%

----------------------------------------------------------------------------

0.95% 2.72 14,421 2.02 0.21 0.05 0.09 1.109 0.465 0.644 42%

----------------------------------------------------------------------------

0.90% 2.72 26,825 1.94 0.19 0.05 0.08 1.023 0.410 0.613 40%

----------------------------------------------------------------------------

0.85% 2.72 47,205 1.89 0.18 0.05 0.07 0.958 0.372 0.586 39%

----------------------------------------------------------------------------

0.80% 2.72 70,286 1.86 0.17 0.05 0.06 0.915 0.349 0.566 38%

----------------------------------------------------------------------------

0.75% 2.72 84,291 1.84 0.16 0.05 0.06 0.892 0.338 0.554 38%

----------------------------------------------------------------------------

0.70% 2.72 88,383 1.84 0.16 0.05 0.06 0.885 0.335 0.550 38%

----------------------------------------------------------------------------

0.579% 2.72 89,629 1.83 0.16 0.05 0.06 0.882 0.334 0.548 38%

----------------------------------------------------------------------------

/T/

Understanding the Rare Earth Metal Market

The discovery of significant quantities of rare earth metals in the Strange Lake area has driven Quest to focus on this new, highly valuable set of metallic commodities and to broaden its mineral asset base. Currently, 97% of the world's rare earth metals are produced in China, whose abundant resources and low production costs have made it a key source of these metals. China has placed strict controls on REE mining, production and export in order to maximize its own use of the resources. As a result, the past 4 years have brought fundamental change to the global industry, taking it from oversupply to demand shortages. Of the total rare earths produced by China, 98% of these are termed Light Rare Earth Elements (LREE), the more common members of the Lanthanide series on the Periodic Table of Elements. Most of the current applications which use rare earths are LREE because of greater Chinese availability of these metals. Alternatively, China produces only very small amounts of what are termed Heavy Rare Earth Elements (HREE). A lack of an abundant primary supply of the rarer, more valuable HREE has impeded the expansion of the R&D capacity for the industries that would prefer to use them. Quest's Strange Lake deposits are enriched in the HREE and present themselves as potentially important primary, non-Chinese sources of these metals. Recent declarations by the Chinese Government acknowledge that they may become net importers of HREE by 2014 or 2015 (Chen, Chinese Rare Earths Society, February 2011).

During the 1990s and early 2000s, significant production surpluses and coincident low REE prices led to most non-Chinese rare earth producers ceasing their operations and almost exclusive reliance on China supplies. With the curbing of exports from China and continued growth demand elsewhere, the supply-demand deficit is causing great concern to major REE consuming countries (Japan, Korea, Taiwan, Euro zone, United States), and they are anxious to identify new sources of rare earths. According to various media sources, excellent prospects for growth in the hybrid auto manufacturing, aerospace, defence and electronics industries are anticipated and will contribute to demand growth in REE of 8-11% per year. There is a pressing need for new non-Chinese production capacity in the next three to five years. This has focused attention on the re-opening of the Molycorp operation in Mountain Pass, California, on probable production increases from the Kola Peninsula, Russia and Lynas Corporation's plans to process Mount Weld ore in Australia, generally all Light Rare Earth enriched deposits. Other potential REE sources such as Nolans, Australia and Hoidas Lake and Nechalacho (Thor Lake) in northern Canada are also being considered for potential production.

On the basis that China will adhere to the announced production and export limits, there is a real prospect that by 2014 to 2015 the country will only produce sufficient material to satisfy its domestic consumption requirements. To meet the estimated global demand of 200,000t REO in 2012, approximately 60,000t of new capacity will be needed to meet the unfulfilled demand from outside China. In addition, it is estimated that world demand could reach 225,000 tonnes of REE per year by 2015, up from 135,000 tonnes in 2008 (IMCOA, February 2011). Primary production is unlikely to keep pace with the increasing demand.

2011 Winter Exploration Program

Quest is currently undertaking diamond drilling on Lac Brisson ice to test for the northern continuation of B-Zone Pegmatite mineralization. To date, 13 holes for 1839.1 m have been completed (see Figure 2, Table 3). All holes have intersected mineralized pegmatite and granite. Core samples have been sent to the lab and results are pending. This work continues and will be completed by the end of April.

Qualified Persons

Peter Cashin, P. Geo. is the Qualified Person on the Strange Lake Project. Mr. Cashin has read and approved the disclosure of the technical information in this news release.

Paul Daigle, P.Geo., Senior Geologist with Wardrop, is the Qualified Person responsible for the mineral resource estimate. The effective date of the resource is April 8, 2011.

The technical information contained in this press release has been reviewed and approved by John Smith, P.Geo., Senior Geologist for Wardrop, a qualified person as defined by NI 43-101.

About Quest Rare Minerals

Quest Rare Minerals Ltd. is a Canadian-based exploration company focused on the identification and discovery of new and significant Rare Earth deposit opportunities. The Corporation is publicly listed on the TSX Venture Exchange as "QRM" and is led by a highly respected management and technical team with a proven mine finding track record. Quest is currently advancing several high potential projects in Canada's premier exploration areas: the Strange Lake and Misery Lake areas of northeastern Quebec, the Kenora area of northwestern Ontario and the Plaster Rock area of northwestern New Brunswick. Quest's 2009 exploration led to the discovery of a significant new Rare Earth metal deposit, the B-Zone, on its Strange Lake property in northeastern Quebec. The Corporation recently filed a 43-101 Inferred Resource Estimate on the B-Zone deposit and has completed a Preliminary Economic Assessment for the deposit. In addition, Quest announced the discovery of an important new area of REE mineralization on its Misery Lake project, approximately 120 km south of the Strange Lake Project. Quest continues to pursue high-value project opportunities throughout North America. As a result of a recently-completed marketed equity financing, Quest has a strong working capital position in excess of $51.0 million. This will be sufficient to advance the Corporation's plans of completing a pre-feasibility study of the B-Zone REE deposit by 2011-2012 and to continue exploration on its other rare earth property interests.

Forward-Looking Statements

This news release contains statements that may constitute "forward-looking information" or "forward-looking statements" within the meaning of applicable securities legislation. More particularly, this news release may contain forward-looking information concerning the Strange Lake B-Zone Rare Earth Element (REE) deposit held by Quest Rare Minerals Ltd. ("Quest"). This forward-looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of Quest. Actual results or achievements may differ materially from those expressed in, or implied by, this forward-looking information. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits that Quest will derive. In particular, no assurance can be given with respect to the development by Quest of the Strange Lake B-Zone REE deposit. Forward-looking information is based on the estimates and opinions of Quest's management at the time the information is released and Quest does not undertake any obligation to update publicly or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

To view Figure 1, please visit the following link: http://media3.marketwire.com/docs/QRM-F1.pdf

To view Figure 2, please visit the following link: http://media3.marketwire.com/docs/QRM-F2.pdf

To view Table 2a and 2b, please visit the following link: http://media3.marketwire.com/docs/QRM-T2ab.pdf

To view Table 3, please visit the following link: http://media3.marketwire.com/docs/QRM-T3.pdf

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Read more: http://www.digitaljournal.com/pr/274662#ixzz1JJjo4yPG

http://www.digitaljournal.com/pr/274662

TORONTO, ONTARIO--(Marketwire - April 11, 2011) - Quest Rare Minerals Ltd. (TSX VENTURE:QRM) -

/T/

Highlights:

- A NI43-101 compliant Resource Estimate for the B-Zone deposit was

determined using cut-off grades of 0.7%, 0.8%, 0.85%, 0.9%, 0.95%, 1.0%,

1.1% and 1.2% Total Rare Earth Oxides (TREO) and an average specific

gravity of 2.72 g/cm(3)

- An economic cut-off grade determined from Whittle pit shell optimization

methods of 0.579% TREO was calculated for the B-Zone deposit

- A cut-off grade of 0.95% TREO was selected to represent that portion of

the total B-Zone deposit resource that would be used in the anticipated

Pre-Feasibility Study for a 25-year Open-Pit production model

established by an earlier Preliminary Economic Assessment report

(September 2010)

- At a base-case cut-off grade of 0.95% TREO, the B-Zone contains an

Indicated Resource of 36.4 million tonnes grading 1.16% TREO, 2.17%

zirconium oxide, 0.24% niobium pentoxide, 0.05% hafnium oxide and 0.12%

beryllium oxide and a further Inferred Resource of 14.4 million tonnes

grading 1.11% TREO, 2.02% zirconium oxide, 0.21% niobium pentoxide,

0.05% hafnium oxide and 0.09% beryllium oxide

/T/

Quest Rare Minerals Ltd. (TSX VENTURE:QRM) (the "Company") is pleased to announce a revised National Instrument 43-101 compliant Indicated and Inferred category resource estimate for its B-Zone rare earth deposit within the Strange Lake Project, Quebec. The estimate was prepared by Wardrop, a Tetra-Tech Company ("Wardrop"). The Strange Lake Project is located 225 km northeast of Schefferville, Quebec and 125 km west of the giant Voisey's Bay nickel-copper-cobalt deposit, eastern Labrador. Quest also reports that exploration drilling on winter ice commenced in mid-March to probe the northern extension of the deposit over Lac Brisson, Quebec.

The base-case resource was estimated using a TREO cut-off grade of 0.95% TREO (Tables 1a, 2a) and represents sufficient Indicated Resource to satisfy a minimum 25-year open-pit production model for the B-Zone established for the Company's Preliminary Economic Assessment (PEA, see Press Release : September 9, 2010) study. At this cut-off, the B-Zone hosts an Indicated Resource of 36.4 million tonnes grading 1.16% TREO, 2.17% zirconium oxide (ZrO2), 0.24% niobium pentoxide (Nb2O5), 0.05% hafnium oxide (HfO2) and 0.12% beryllium oxide (BeO). A further Inferred Resource (Tables 1b, 2b) of 14.4 million tonnes grading 1.11% TREO, 2.02% ZrO2, 0.21% Nb2O5, 0.05% HfO2 and 0.09% BeO is calculated. It is estimated that Heavy Rare Earth Oxides (HREO) represent between 40% and 51% of the TREO in the deposit. Contained within the Indicated Resource is an outcropping and higher grade "Pegmatite Spine" (see Figure 1) containing 8.1 million tonnes at 1.66% TREO, 2.77% ZrO2, 0.37% Nb2O5, 0.06% HfO2 and 0.19% BeO. A further Inferred "Pegmatite Spine" resource of 2.57 million tonnes grading 1.53% TREO, 2.57% ZrO2, 0.30% Nb2O5, 0.06% HfO2 and 0.15% BeO is calculated.

Mineralisation within the deposit is currently open along strike, to the north and south, and down-dip to the northwest. In addition, a program of Phase 2 metallurgical testing studies for the deposit is currently being undertaken by Hazen Research, Inc. of Golden, Colorado. It is intended that the data from these studies will form the basis for a future Preliminary Feasibility Study (PFS) of the deposit.

/T/

Table 1a - Indicated Category Resources, B-Zone Deposit, Strange Lake

Project, Quebec

----------------------------------------------------------------------------

TREO Density Tonnage ZrO2 Nb2O5 HfO2 BeO TREO HREO LREO HREO/

% % % % % % % % TREO

----------------------------------------------------------------------------

Cut-off t per t x Ratio

m3 1000

----------------------------------------------------------------------------

1.20% 2.72 8,095 2.77 0.37 0.06 0.19 1.655 0.849 0.806 51

----------------------------------------------------------------------------

1.10% 2.72 12,044 2.59 0.33 0.06 0.17 1.487 0.733 0.754 49

----------------------------------------------------------------------------

1.00% 2.72 23,052 2.32 0.27 0.05 0.13 1.274 0.586 0.688 46

----------------------------------------------------------------------------

0.95% 2.72 36,359 2.17 0.24 0.05 0.12 1.164 0.511 0.653 44

----------------------------------------------------------------------------

0.90% 2.72 60,529 2.06 0.21 0.05 0.10 1.068 0.449 0.619 42

----------------------------------------------------------------------------

0.85% 2.72 93,139 2.00 0.20 0.05 0.09 1.000 0.408 0.592 41

----------------------------------------------------------------------------

0.80% 2.72 120,526 1.96 0.19 0.05 0.08 0.961 0.385 0.575 40

----------------------------------------------------------------------------

0.75% 2.72 135,033 1.94 0.18 0.05 0.08 0.941 0.375 0.566 40

----------------------------------------------------------------------------

0.70% 2.72 138,967 1.94 0.18 0.05 0.08 0.935 0.372 0.563 40

----------------------------------------------------------------------------

0.579% 2.72 140,259 1.93 0.18 0.05 0.08 0.933 0.371 0.562 40

----------------------------------------------------------------------------

Where: HfO2 - hafnium oxide; ZrO2 - zirconium oxide; Nb2O5 - niobium

pentoxide; BeO - beryllium oxide

Notes:

1. Total Rare Earth Oxides (TREO) include: La2O3, Ce2O3, Pr2O3, Nd2O3,

Sm2O3, Eu2O3, Gd2O3, Tb2O3, Tb2O3, Dy2O3, Ho2O3, Er2O3, Tm2O3,

Yb2O3, Lu2O3 and Y2O3

2. Heavy Rare Earth Oxides (HREO) include: Eu2O3, Gd2O3, Tb2O3, Tb2O3,

Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3 and Y2O3

3. Light Rare Earth Oxides (LREO) include: La2O3, Ce2O3, Pr2O3, Nd2O3

and Sm2O3

4. Effective date of the resource estimate is 8 April 2011

5. Resource estimate based on drill core assays from Quest's 2009 and

2010 assay database.

6. Wardrop considers a cut-off grade of 0.579 TREO% to be reasonable

based on a Whittle pit optimization on the current block model.

7. Average specific gravity is 2.72 g/cc for the subsolvus rocks and

2.74 g/cc for pegmatite rocks.

8. The resource estimate has been classified as Indicated and Inferred

Resource based on the following criteria:

- any block estimated on the first pass, using a minimum of 3

drill holes, at an average distance of less than or equal to

80m and where the closest point is less than 60 m is classified

as Indicated Resources.

- any block estimated using a minimum of 2 drill holes at an

average distance greater than 80 m is classified as Inferred

Resources.

9. Resource Estimate is based on:

- A database of 97 drill holes, totalling approximately 17,474 m

of diamond drilling, using 8,297 composite samples on 2m

composite lengths.

- A geological model for pegmatite rocks used an Indicator Kriged

(IK) wireframe, defining a 45% probability of achieving

pegmatite was generated on a block size of 5 m x 5 m x 5 m.

- A geological model encompassing the host subsolvus granite

rocks was bounded to within 50 m area of influence beyond the

outer drill holes.

- Block model was estimated by Ordinary Kriging (OK)

interpolation method on block size 5 m x 5 m x 5 m. The OK

estimation was generated on the two separate domains, the

subsolvus granites and the pegmatites.

- Resource Estimate assumes 100% recovery.

/T/

"Wardrop's Revised Resource Estimate for the B-Zone REE deposit reported today confirms that the B-Zone will likely become a very important rare earth oxide source, particularly for the high-value Heavy Rare Earths," said Peter J. Cashin, Quest's President and CEO. "The Indicated Resource base case will more than satisfy the notional 25-year production model established by our recent PEA at slightly higher REO grades than were used for the cash-flow model in the original study. We are particularly pleased with the important firming of the surface outcropping "Pegmatite Spine" Indicated resource, which show REO grades that are 43% higher than the grade used by the PEA and would support a minimum 6.6 years at the notional annual production rate of 1.46 million tonnes in our PEA. Drilling is also currently underway to expand the B-Zone resource outside of the limits of the deposit established for the Resource Estimate. This work will greatly expand the important mineral inventory that we have built on the property."

Quest intends to move the Strange Lake Project to the Pre-Feasibility Study stage of evaluation. Quest has received Proposals for the work required for the study and the work is anticipated to commence shortly.

/T/

Table 1b - Inferred Category Resource, B-Zone Deposit, Strange Lake Project,

Quebec

----------------------------------------------------------------------------

TREO Density Tonnage ZrO2 Nb2O5 HfO2 BeO TREO HREO LREO HREO/

% % % % % % % % TREO

----------------------------------------------------------------------------

Cut-off t per t x Ratio

m3 1000

----------------------------------------------------------------------------

1.20% 2.73 2,572 2.57 0.30 0.06 0.15 1.532 0.764 0.768 50%

----------------------------------------------------------------------------

1.10% 2.72 4,033 2.36 0.27 0.06 0.13 1.391 0.663 0.728 48%

----------------------------------------------------------------------------

1.00% 2.72 8,299 2.13 0.23 0.05 0.10 1.210 0.535 0.676 44%

----------------------------------------------------------------------------

0.95% 2.72 14,421 2.02 0.21 0.05 0.09 1.109 0.465 0.644 42%

----------------------------------------------------------------------------

0.90% 2.72 26,825 1.94 0.19 0.05 0.08 1.023 0.410 0.613 40%

----------------------------------------------------------------------------