Simba Energy -- die rennt und rennt nach Norden - 500 Beiträge pro Seite

eröffnet am 18.01.11 20:13:23 von

neuester Beitrag 30.08.15 18:08:42 von

neuester Beitrag 30.08.15 18:08:42 von

Beiträge: 154

ID: 1.162.901

ID: 1.162.901

Aufrufe heute: 0

Gesamt: 20.473

Gesamt: 20.473

Aktive User: 0

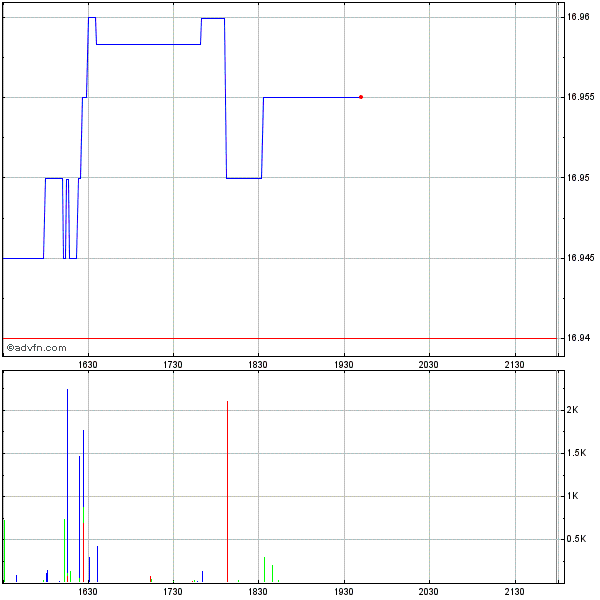

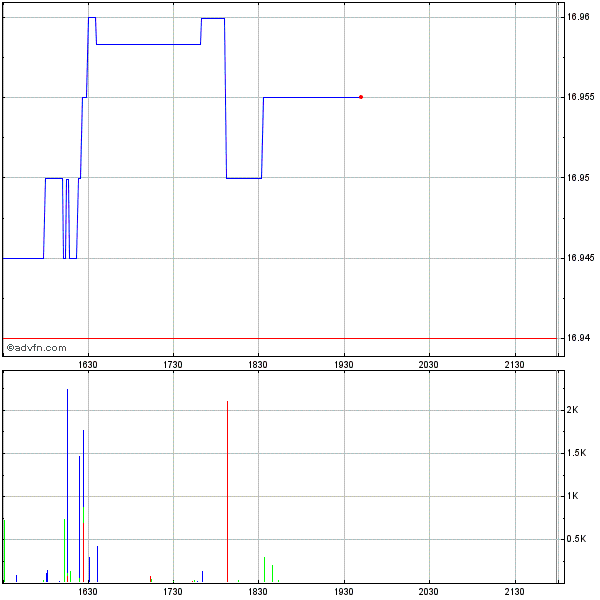

ISIN: CA82857V1031 · WKN: A2DQQM · Symbol: SMBZF

0,0000

USD

0,00 %

0,0000 USD

Letzter Kurs 17.04.24 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,5500 | +14,61 | |

| 0,8200 | +11,56 | |

| 1,0100 | +10,99 | |

| 4,9300 | +10,04 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 190,05 | -7,07 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

kein halten ??

Entlich jetzt geht es ab und ich bin dabei......................

Antwort auf Beitrag Nr.: 40.884.243 von heisseanleihe am 18.01.11 22:04:37

Schließt Privatplatzierung

Jan. 25, 2011 (Market News Publishing) -- 25 Januar 2011 (Market News Publishing) -

SIMBA ENERGY INC. ("SMB-T") - Closes Private Placement SIMBA Energy Inc. ("SMB-T") - schließt Privatplatzierung

Simba Energy Inc. (the "Company") announces that it has closed its private placement first announced on December 30, 2010, The Company issue 42,322,500 units at $0.08 per unit for total gross proceeds of $3,385,800. Simba Energy Inc. (das "Unternehmen") gibt bekannt, dass sie geschlossen sein Privatplatzierung zum ersten Mal angekündigt am 30. Dezember 2010, Die Gesellschaft Problem 42.322.500 Einheiten zu $ 0,08 pro Einheit für einen Bruttoerlös von insgesamt $ 3.385.800. Each unit consists of one common share and one-half of one transferable share purchase warrant, each whole warrant exercisable into one additional common share until January 20, 2012, a price of $0.16 per share. Jede Einheit besteht aus einer Stammaktie und einer Hälfte eines übertragbaren Warrant, wobei jeder ganze Warrant in eine weitere Stammaktie bis 20. Januar 2012, zu einem Preis von $ 0,16 pro Aktie. All securities issued under the placement are subject to hold periods expiring on May 21, 2011. Alle Wertpapiere im Rahmen der Platzierung ausgegebenen Wertpapiere unterliegen Perioden bis zum 21. Mai 2011 zu halten.

The Company paid $93,540 in finder's fees in respect of the placement. Das Unternehmen zahlte $ 93.540 in Finder's Fees in Bezug auf die Platzierung.

The majority of the proceeds will be used for the payment of government fees, preliminary ground work expenses and office setup fees in Mali, as well as licensing and survey costs and general overhead costs in Liberia for the next several months. Die Mehrheit der Erlös wird für die Zahlung von staatlichen Gebühren, vorläufige Bodenarbeit Aufwendungen und Office-Setup-Gebühren in Mali, sowie Lizenz-und Erhebungskosten und Gemeinkosten in Liberia für die nächsten Monate genutzt werden. The Company will also use general working capital funds to continue its pursuit of Production Sharing Agreements In pay down outstanding payables and other liabilities as required. Die Gesellschaft wird auch allgemeines Betriebskapital Mittel, um ihre Verfolgung von Production Sharing Agreements Im zahlen ab herausragende Leistungen und sonstige Verbindlichkeiten Bedarf fortsetzen.

The Company also announces that Casey Forward has resigned as director and Chief Financial Officer of the Company. Das Unternehmen gibt außerdem bekannt, dass Casey Sturm hat als Direktor und Chief Financial Officer des Unternehmens zurückgetreten. The Company thanks Mr, Forward for his years of service, Mr, Keith Margetson CA, has been appointed Chief Financial Officer of the Company effective immediately, Margetson qualified as a Chartered Accountant in 1975 and has operated his own accounting firm since 1992. Die Gesellschaft dankt Herrn, Forward für seine Dienstjahre, Herr, Keith Margetson CA, wurde Chief Financial Officer des Unternehmens mit sofortiger Wirkung bestellt, qualifizierte Margetson als Wirtschaftsprüfer im Jahre 1975 und betreibt seine eigene Wirtschaftsprüfungsgesellschaft seit 1992. He has 15 years experience with public companies both as an auditor and in providing other professional services. Er hat 15 Jahre Erfahrung mit öffentlichen Unternehmen sowohl als Wirtschaftsprüfer und bei der Bereitstellung in anderen Fachbereichen.

On Behalf of the Board, Im Auftrag des Vorstands,

Robert Dinning Robert Dinning

President and CEO Präsident und CEO

Jan. 25, 2011 (Market News Publishing) -- 25 Januar 2011 (Market News Publishing) -

SIMBA ENERGY INC. ("SMB-T") - Closes Private Placement SIMBA Energy Inc. ("SMB-T") - schließt Privatplatzierung

Simba Energy Inc. (the "Company") announces that it has closed its private placement first announced on December 30, 2010, The Company issue 42,322,500 units at $0.08 per unit for total gross proceeds of $3,385,800. Simba Energy Inc. (das "Unternehmen") gibt bekannt, dass sie geschlossen sein Privatplatzierung zum ersten Mal angekündigt am 30. Dezember 2010, Die Gesellschaft Problem 42.322.500 Einheiten zu $ 0,08 pro Einheit für einen Bruttoerlös von insgesamt $ 3.385.800. Each unit consists of one common share and one-half of one transferable share purchase warrant, each whole warrant exercisable into one additional common share until January 20, 2012, a price of $0.16 per share. Jede Einheit besteht aus einer Stammaktie und einer Hälfte eines übertragbaren Warrant, wobei jeder ganze Warrant in eine weitere Stammaktie bis 20. Januar 2012, zu einem Preis von $ 0,16 pro Aktie. All securities issued under the placement are subject to hold periods expiring on May 21, 2011. Alle Wertpapiere im Rahmen der Platzierung ausgegebenen Wertpapiere unterliegen Perioden bis zum 21. Mai 2011 zu halten.

The Company paid $93,540 in finder's fees in respect of the placement. Das Unternehmen zahlte $ 93.540 in Finder's Fees in Bezug auf die Platzierung.

The majority of the proceeds will be used for the payment of government fees, preliminary ground work expenses and office setup fees in Mali, as well as licensing and survey costs and general overhead costs in Liberia for the next several months. Die Mehrheit der Erlös wird für die Zahlung von staatlichen Gebühren, vorläufige Bodenarbeit Aufwendungen und Office-Setup-Gebühren in Mali, sowie Lizenz-und Erhebungskosten und Gemeinkosten in Liberia für die nächsten Monate genutzt werden. The Company will also use general working capital funds to continue its pursuit of Production Sharing Agreements In pay down outstanding payables and other liabilities as required. Die Gesellschaft wird auch allgemeines Betriebskapital Mittel, um ihre Verfolgung von Production Sharing Agreements Im zahlen ab herausragende Leistungen und sonstige Verbindlichkeiten Bedarf fortsetzen.

The Company also announces that Casey Forward has resigned as director and Chief Financial Officer of the Company. Das Unternehmen gibt außerdem bekannt, dass Casey Sturm hat als Direktor und Chief Financial Officer des Unternehmens zurückgetreten. The Company thanks Mr, Forward for his years of service, Mr, Keith Margetson CA, has been appointed Chief Financial Officer of the Company effective immediately, Margetson qualified as a Chartered Accountant in 1975 and has operated his own accounting firm since 1992. Die Gesellschaft dankt Herrn, Forward für seine Dienstjahre, Herr, Keith Margetson CA, wurde Chief Financial Officer des Unternehmens mit sofortiger Wirkung bestellt, qualifizierte Margetson als Wirtschaftsprüfer im Jahre 1975 und betreibt seine eigene Wirtschaftsprüfungsgesellschaft seit 1992. He has 15 years experience with public companies both as an auditor and in providing other professional services. Er hat 15 Jahre Erfahrung mit öffentlichen Unternehmen sowohl als Wirtschaftsprüfer und bei der Bereitstellung in anderen Fachbereichen.

On Behalf of the Board, Im Auftrag des Vorstands,

Robert Dinning Robert Dinning

President and CEO Präsident und CEO

Antwort auf Beitrag Nr.: 40.884.243 von heisseanleihe am 18.01.11 22:04:37Nettes Unternehmen gefällt mir Simba Energy, mit guten

Aussichten auf Erfolg, Öl wird immer gebraucht auf der Welt.

Beobachte das Unternehmen auch schon eine Weile.

Ein Longinvest für alle Fälle.

Bin gespannt wie es hier weiter geht.

..........

Aussichten auf Erfolg, Öl wird immer gebraucht auf der Welt.

Beobachte das Unternehmen auch schon eine Weile.

Ein Longinvest für alle Fälle.

Bin gespannt wie es hier weiter geht.

..........

also ich muss sagen unsere simba hält sich sehr sehr gut.

Antwort auf Beitrag Nr.: 40.978.884 von kreminalkomissar am 03.02.11 20:23:24Das Ding wird spitze ich finde diese ganze Region echt cool,

überall Öl. Das quillt da nur so raus aus allen Löchern überall.

Ich komm da gleich selber runter und bau ein Öl Förderturm.

überall Öl. Das quillt da nur so raus aus allen Löchern überall.

Ich komm da gleich selber runter und bau ein Öl Förderturm.

Antwort auf Beitrag Nr.: 40.978.884 von kreminalkomissar am 03.02.11 20:23:24

Also die Liegenschaft ist auch schön gross und grenzt auch an reichhaltige Öl Lagerstätten anderer Unternehmen an.

Gefällt mir !!!

Also die Liegenschaft ist auch schön gross und grenzt auch an reichhaltige Öl Lagerstätten anderer Unternehmen an.

Gefällt mir !!!

moin jungs,

als bei diesem schönen Firmenlogo kann das ja nur gut ausgehen! Wäre aber schön wenn mal wieder news kommen würden, zB. ob das Gebiet in Mali ergattert wurde.

Wann setzen die eigentlich endlich mal den Bohrer an, scheinbar muss man ja nicht mal suchen. Angeblich quillt das ja überall daraus. Ich glaub ich muss mal ne Afrikasafari machen und mich selbst überzeugen.

Weiß irgendwer mehr?

PS: Kennt ihr eigentlich noch aussichtsreiche Öl und Gas Player in Afrika? Oder ist Simba derzeit die interessanteste Firma?

als bei diesem schönen Firmenlogo kann das ja nur gut ausgehen! Wäre aber schön wenn mal wieder news kommen würden, zB. ob das Gebiet in Mali ergattert wurde.

Wann setzen die eigentlich endlich mal den Bohrer an, scheinbar muss man ja nicht mal suchen. Angeblich quillt das ja überall daraus. Ich glaub ich muss mal ne Afrikasafari machen und mich selbst überzeugen.

Weiß irgendwer mehr?

PS: Kennt ihr eigentlich noch aussichtsreiche Öl und Gas Player in Afrika? Oder ist Simba derzeit die interessanteste Firma?

Antwort auf Beitrag Nr.: 41.103.698 von pearlhunter am 25.02.11 00:06:39Morgen pearlhunter,

also so wie ich das mitbekommen habe,

geht es da um die Lizenz und Produktionsvereinbarung die abgeklärt werden muss mit der Liberianischen Regierung.

Der Antrag dafür ist in Bearbeitung. Danach soll wohl eine Seismische Bodenprobung/Erkundung vorgenommen werden um Öl nachzuweisen was förderbar wäre, in tieferen Schichten.

Bzw. mit einem möglichen Partner danach, weil Simba dafür zu klein ist, dass ganze Ölfeld allein zu erschliessen.

Sollte Öl nachgewiesen werden was ich auch denke, da auch bereits die Nachbarn auf Öl gestoßen sind. Ist die ganze Region sehr vielversprechend.

Ich gehe davon aus das im Frühjahr/Sommer da was kommt.

Die Chancen stehen gut für Simba Energy daher.

Andere Firmen sind da auch auf dem Gelände aktiv und Chinesen wohl auch da irgendwo.

Aber eine Safari würde ich auch gern da

machen wollen.

also so wie ich das mitbekommen habe,

geht es da um die Lizenz und Produktionsvereinbarung die abgeklärt werden muss mit der Liberianischen Regierung.

Der Antrag dafür ist in Bearbeitung. Danach soll wohl eine Seismische Bodenprobung/Erkundung vorgenommen werden um Öl nachzuweisen was förderbar wäre, in tieferen Schichten.

Bzw. mit einem möglichen Partner danach, weil Simba dafür zu klein ist, dass ganze Ölfeld allein zu erschliessen.

Sollte Öl nachgewiesen werden was ich auch denke, da auch bereits die Nachbarn auf Öl gestoßen sind. Ist die ganze Region sehr vielversprechend.

Ich gehe davon aus das im Frühjahr/Sommer da was kommt.

Die Chancen stehen gut für Simba Energy daher.

Andere Firmen sind da auch auf dem Gelände aktiv und Chinesen wohl auch da irgendwo.

Aber eine Safari würde ich auch gern da

machen wollen.

moin snoggles,

danke für die Info. Chienesen sind ja mittlerweile überall, nicht loszuwerden diese Pest. Am meisten ärgert mich, dass die sich überall groß einkaufen und dann den Rohstoffabnahmepreis bestimmen wollen. So kann man überhaupt nicht mehr von Preissteigerungen profitieren.Meinst du mit Nachbarn die Förderfimen die offshore sind oder gibt es noch welche, die auf dem Land suchen. Ich dachte Simba wären die einzigen auf dem Land. Sofern es noch weitere auf dem Land gibt, kennst du da Ergebnisse? Frage ich deshalb um mögliche Förderbedingungen zu ergründen. Kann ja sein dass es schwierig ist. Weißt was zu deren Reserevn (viel kleine oder große Ölagerstätten)

Weißt du wann Ergebisse zu den Entscheidungen bezüglich Mali und Seismische Erkundung in Liberia anstehen?

danke für die Info. Chienesen sind ja mittlerweile überall, nicht loszuwerden diese Pest. Am meisten ärgert mich, dass die sich überall groß einkaufen und dann den Rohstoffabnahmepreis bestimmen wollen. So kann man überhaupt nicht mehr von Preissteigerungen profitieren.Meinst du mit Nachbarn die Förderfimen die offshore sind oder gibt es noch welche, die auf dem Land suchen. Ich dachte Simba wären die einzigen auf dem Land. Sofern es noch weitere auf dem Land gibt, kennst du da Ergebnisse? Frage ich deshalb um mögliche Förderbedingungen zu ergründen. Kann ja sein dass es schwierig ist. Weißt was zu deren Reserevn (viel kleine oder große Ölagerstätten)

Weißt du wann Ergebisse zu den Entscheidungen bezüglich Mali und Seismische Erkundung in Liberia anstehen?

Antwort auf Beitrag Nr.: 41.110.290 von pearlhunter am 25.02.11 22:14:43Hallo pearlhunter,

viele Fragen, jedoch ist aus den Presse Mitteilungen nicht viel mehr

herauszulesen. Jedoch sind einige große Firmen dort unten aktiv am fördern.

Als Nachbar der Westgrenze hat ein französischer Ölkonzern Total zuletzt eine Entdeckung gemacht. Und ENI, China National Petroleum und andere sind da auch aktiv und suchen nach Öl. Zu weiteren kleineren Explorern liegen mir keine News vor.

Also gute Chancen auf Öl zu stoßen hat somit Simba Energy, ohne weitere Konkurenz zu befürchten.

Zu den Chinesen, ja klar mischen die gerne mit und versuchen durch billige Rohstoff Liegenschaftsaufkäufe in Afrika so das Monopol wie bei

Seltenen Erden zu sichern.

Würde mich nicht wundern, wenn die Chinesen da bei Simba Energy auch noch anklopfen werden.

Werden aber bald News kommen ich bin optimistisch.

Das Land Liberia muss sich auch erst erholen nach den ganzen Kriegen.

Durch die liberianische Regierung und den Rebellengruppen.

Also wirtschaftlich und demokratisch kommt da auch der Aufschwung in Gang.

Alles gute Anzeichen für Stabilität auch für Simba dadurch.

viele Fragen, jedoch ist aus den Presse Mitteilungen nicht viel mehr

herauszulesen. Jedoch sind einige große Firmen dort unten aktiv am fördern.

Als Nachbar der Westgrenze hat ein französischer Ölkonzern Total zuletzt eine Entdeckung gemacht. Und ENI, China National Petroleum und andere sind da auch aktiv und suchen nach Öl. Zu weiteren kleineren Explorern liegen mir keine News vor.

Also gute Chancen auf Öl zu stoßen hat somit Simba Energy, ohne weitere Konkurenz zu befürchten.

Zu den Chinesen, ja klar mischen die gerne mit und versuchen durch billige Rohstoff Liegenschaftsaufkäufe in Afrika so das Monopol wie bei

Seltenen Erden zu sichern.

Würde mich nicht wundern, wenn die Chinesen da bei Simba Energy auch noch anklopfen werden.

Werden aber bald News kommen ich bin optimistisch.

Das Land Liberia muss sich auch erst erholen nach den ganzen Kriegen.

Durch die liberianische Regierung und den Rebellengruppen.

Also wirtschaftlich und demokratisch kommt da auch der Aufschwung in Gang.

Alles gute Anzeichen für Stabilität auch für Simba dadurch.

Hallo liebe Simba Energy Fans !

Laut dem Unternehmens-Update vom 17. März 2011

soll ja nun bald die Produktionsvereinbarung PSA folgen abschliessend.

Für die Liegenbschaften in Liberia, Mali und Ghana ich hoffe das damit endlich der Weg frei gemacht wird für das seismische Bodenerkundungsprogramm um Öl oder Gas auf den Liegenschaften nachzuweisen.

Die Chancen stehen weiterhin gut und gehe auch davon aus das die was finden.

Schon allein wegen Ölfunde anderer Unternehmen in der Region ist das schon sehr vielversprechend und interesant.

Bin gespannt auf die nächsten News.

Euch allen eine schönen Tag.

Laut dem Unternehmens-Update vom 17. März 2011

soll ja nun bald die Produktionsvereinbarung PSA folgen abschliessend.

Für die Liegenbschaften in Liberia, Mali und Ghana ich hoffe das damit endlich der Weg frei gemacht wird für das seismische Bodenerkundungsprogramm um Öl oder Gas auf den Liegenschaften nachzuweisen.

Die Chancen stehen weiterhin gut und gehe auch davon aus das die was finden.

Schon allein wegen Ölfunde anderer Unternehmen in der Region ist das schon sehr vielversprechend und interesant.

Bin gespannt auf die nächsten News.

Euch allen eine schönen Tag.

moin SMB- lers,

wert scheint ein etwas ´anderer´ zu sein - statt SELL IN MAY wird

grad kräftig GEKAUFT...........schaut euch mal die trades der insider

an............schon recht ordtl. vol.....IMO

Simba Energy Inc. (SMB)

As of May 11th, 2011

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

May 04/11 May 02/11 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 250,000 $0.185

May 03/11 May 02/11 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 250,000 $0.185

May 02/11 Apr 29/11 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 250,000 $0.185

May 02/11 Apr 29/11 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 250,000 $0.185

Apr 29/11 Apr 27/11 Inwentash, Sheldon Indirect Ownership Common Shares 10 - Acquisition in the public market 184,000 $0.160

Apr 29/11 Apr 28/11 Inwentash, Sheldon Indirect Ownership Common Shares 10 - Acquisition in the public market 116,000 $0.160

http://www.canadianinsider.com/coReport/allTransactions.php?…

denke, da sollte man selbst nicht nur zugucken

wert scheint ein etwas ´anderer´ zu sein - statt SELL IN MAY wird

grad kräftig GEKAUFT...........schaut euch mal die trades der insider

an............schon recht ordtl. vol.....IMO

Simba Energy Inc. (SMB)

As of May 11th, 2011

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

May 04/11 May 02/11 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 250,000 $0.185

May 03/11 May 02/11 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 250,000 $0.185

May 02/11 Apr 29/11 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 250,000 $0.185

May 02/11 Apr 29/11 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 250,000 $0.185

Apr 29/11 Apr 27/11 Inwentash, Sheldon Indirect Ownership Common Shares 10 - Acquisition in the public market 184,000 $0.160

Apr 29/11 Apr 28/11 Inwentash, Sheldon Indirect Ownership Common Shares 10 - Acquisition in the public market 116,000 $0.160

http://www.canadianinsider.com/coReport/allTransactions.php?…

denke, da sollte man selbst nicht nur zugucken

Antwort auf Beitrag Nr.: 41.493.161 von hbg55 am 12.05.11 17:07:16...uuuuund wenn ICH mir so die charts anschau, kanns schon recht

bald sein, daß SIE weiter gen norden ´rennt´

RT....cad 0,155

bald sein, daß SIE weiter gen norden ´rennt´

RT....cad 0,155

Antwort auf Beitrag Nr.: 41.493.161 von hbg55 am 12.05.11 17:07:16Kurschwankung um paar Cents sind hier immer drin schon wegen Neuzukäufe.

Und dahin ziehen der PSA Produktionsvereinbarung,

wenn die PSA durch ist, wird der Kurs bestimmt neu belebt werden.

Kann ja nun wirklich nicht mehr lange dauern.

Ich bin gespannt was da noch kömmt...

falls nicht komm ich persönlich runter und Bohr selber das S...loch.

Und dahin ziehen der PSA Produktionsvereinbarung,

wenn die PSA durch ist, wird der Kurs bestimmt neu belebt werden.

Kann ja nun wirklich nicht mehr lange dauern.

Ich bin gespannt was da noch kömmt...

falls nicht komm ich persönlich runter und Bohr selber das S...loch.

Antwort auf Beitrag Nr.: 41.493.161 von hbg55 am 12.05.11 17:07:16...hier mal die NEWS dazu........

Simba Energy shareholder Pinetree Capital buys more shares

Wednesday, May 04, 2011 by Andre Lamberti

Simba Energy (CVE:SMB) shareholder Pinetree Capital Ltd (LON:PNP) has increased its stake in the oil explorer by acquiring a further 500,000 shares.

The venture capital group said it acquired the shares through a series of transactions ending on May 2 2011, and they represent around 0.4 percent of Simba’s issued and outstanding shares.

Pinetree and jointly acting parties now control an aggregate of 11.8 million common shares of Simba, including the newly acquired shares and rights to acquire an additional 5 million shares of Simba upon exercise of certain convertible securities.

In the event that the convertible securities are fully exercised, the holdings of Pinetree and its joint actors represent a total of 16.8 million Simba shares, or approximately 11.6 percent of the capital. Pinetree alone would hold 16 million shares, or an 11.1 percent stake.

This transaction was made for investment purposes, Pinetree said.

Pinetree is focused on the small cap market, and its investments are primarily in the resources sector: precious metals, uranium and coal, base metals, oil and gas, and potash, lithium and rare earths.

In March, Simba reported it was making solid progress with production sharing agreements in Liberia, Ghana and Mali.

In Mali the group is awaiting final approval for its hydrocarbon PSA on Block 3. It follows a visit by a delegation of senior company officials which met the government agencies and officials handling its application.

In Liberia, meanwhile, it has submitted an application to turn its hydrocarbon reconnaissance permit into a production sharing agreement. In March it completed negotiations with the national oil company NOCAL and is now just waiting for a meeting with the technical committee to formalise an agreement.

Finally in Ghana, the company hopes to soon get to the final decision phase of its PSA application, which was made at the end of 2010.

Simba Energy shareholder Pinetree Capital buys more shares

Wednesday, May 04, 2011 by Andre Lamberti

Simba Energy (CVE:SMB) shareholder Pinetree Capital Ltd (LON:PNP) has increased its stake in the oil explorer by acquiring a further 500,000 shares.

The venture capital group said it acquired the shares through a series of transactions ending on May 2 2011, and they represent around 0.4 percent of Simba’s issued and outstanding shares.

Pinetree and jointly acting parties now control an aggregate of 11.8 million common shares of Simba, including the newly acquired shares and rights to acquire an additional 5 million shares of Simba upon exercise of certain convertible securities.

In the event that the convertible securities are fully exercised, the holdings of Pinetree and its joint actors represent a total of 16.8 million Simba shares, or approximately 11.6 percent of the capital. Pinetree alone would hold 16 million shares, or an 11.1 percent stake.

This transaction was made for investment purposes, Pinetree said.

Pinetree is focused on the small cap market, and its investments are primarily in the resources sector: precious metals, uranium and coal, base metals, oil and gas, and potash, lithium and rare earths.

In March, Simba reported it was making solid progress with production sharing agreements in Liberia, Ghana and Mali.

In Mali the group is awaiting final approval for its hydrocarbon PSA on Block 3. It follows a visit by a delegation of senior company officials which met the government agencies and officials handling its application.

In Liberia, meanwhile, it has submitted an application to turn its hydrocarbon reconnaissance permit into a production sharing agreement. In March it completed negotiations with the national oil company NOCAL and is now just waiting for a meeting with the technical committee to formalise an agreement.

Finally in Ghana, the company hopes to soon get to the final decision phase of its PSA application, which was made at the end of 2010.

Antwort auf Beitrag Nr.: 41.493.773 von hbg55 am 12.05.11 18:41:26klingt doch gut.

Nun noch die PSA durch und die Seismische

Bodenerkundung kann endlich beginnen.

Mögliche Joint Venture Partner sollten wohl schon angeklopft haben oder mit denen

man zusammen arbeiten möchte, da Simba Energy ja zu klein ist.

Aber eins steht fest, wenn die da unten Gas, Öl Felder finden, werden

hier andere Kurswinde wehen.

Nun noch die PSA durch und die Seismische

Bodenerkundung kann endlich beginnen.

Mögliche Joint Venture Partner sollten wohl schon angeklopft haben oder mit denen

man zusammen arbeiten möchte, da Simba Energy ja zu klein ist.

Aber eins steht fest, wenn die da unten Gas, Öl Felder finden, werden

hier andere Kurswinde wehen.

Antwort auf Beitrag Nr.: 41.493.891 von Snoggles am 12.05.11 19:00:48

....Mögliche Joint Venture Partner sollten wohl schon angeklopft haben....

DAS dürfte wohl EIN grund für PINETREE gewesen sein, hier noch mal

schööööön zuzulegen !!!

....Mögliche Joint Venture Partner sollten wohl schon angeklopft haben....

DAS dürfte wohl EIN grund für PINETREE gewesen sein, hier noch mal

schööööön zuzulegen !!!

Antwort auf Beitrag Nr.: 41.494.082 von hbg55 am 12.05.11 19:26:49jep, die Zukäufe sind ein guter Beweis.

Und ich schätze mal die wissen schon ganz genau, was da in den Feldern drín

schlummert bei Simba.

Und ich schätze mal die wissen schon ganz genau, was da in den Feldern drín

schlummert bei Simba.

...hab im SH-Forum gefunden. zur Info

http://www.stockhouse.com/bullboards/MessageDetail.aspx?s=SM…

Simba Presentation Dates in UK

Simba-Admin

6/2/2011 5:25:02 PM | | 47 reads | Post #29804671

Rate this

clarity 4

overall quality 4

credibility 5

usefulness 5

Simba Energy will be making a presentation on June 8th at the Proactive One2One investment Forum at the Chesterfield, Mayfair in London. http://www.proactiveinvestors.co.uk/register/event_details/1…" target="_blank" rel="nofollow ugc noopener">http://www.proactiveinvestors.co.uk/register/event_details/1…

The company will also be making a presentation on June 15th at Drapers Hall for the UK - Liberia Investment Forum put on by DMA (Developing Markets Association). The Government of Liberia will be in attendance including the President, Ellen Johnson Sirlearf, as well as the President and CEO of NOCAL (National Oil Company of Liberia), Christopher Nyeor.

Simba's website has a new look as of today. www.simbaenergy.ca

You can also stay connected through facebook and twitter for regular updates

Simba Energy Inc.

1-855-777-4622

info@simbaenergy.ca

http://www.stockhouse.com/bullboards/MessageDetail.aspx?s=SM…

Simba Presentation Dates in UK

Simba-Admin

6/2/2011 5:25:02 PM | | 47 reads | Post #29804671

Rate this

clarity 4

overall quality 4

credibility 5

usefulness 5

Simba Energy will be making a presentation on June 8th at the Proactive One2One investment Forum at the Chesterfield, Mayfair in London. http://www.proactiveinvestors.co.uk/register/event_details/1…" target="_blank" rel="nofollow ugc noopener">http://www.proactiveinvestors.co.uk/register/event_details/1…

The company will also be making a presentation on June 15th at Drapers Hall for the UK - Liberia Investment Forum put on by DMA (Developing Markets Association). The Government of Liberia will be in attendance including the President, Ellen Johnson Sirlearf, as well as the President and CEO of NOCAL (National Oil Company of Liberia), Christopher Nyeor.

Simba's website has a new look as of today. www.simbaenergy.ca

You can also stay connected through facebook and twitter for regular updates

Simba Energy Inc.

1-855-777-4622

info@simbaenergy.ca

Antwort auf Beitrag Nr.: 41.597.048 von SteirerMan am 03.06.11 00:41:49hallo alle!

ich denke die Presi May 2011 hatten wir noch niergends:

http://www.simbaenergy.ca/images/SimbaEnergy_May2011_CorpPre…

ich denke die Presi May 2011 hatten wir noch niergends:

http://www.simbaenergy.ca/images/SimbaEnergy_May2011_CorpPre…

nur noch wenige augenblicke bis zum endgültigen PSC!!

Simba Energy Inc, Finalizing Onshore Liberian PSC Application

July 06, 2011, Vancouver, B.C., Canada. Simba Energy Inc. (the “Company”) (TSX-V: SMB, Frankfurt: GDA, OTCBB: SMBZF), has received an official invitation from the National Oil Company of Liberia (NOCAL) to meet in Monrovia, Liberia during the week of July 18, 2011 to commence the final negotiation process for Simba Energy Inc.’s formal Production Sharing Contract (PSC) application. A Draft Production Sharing Contract (PSC) has been received from NOCAL and Simba Energy is currently reviewing this draft PSC and will be in attendance the week of July 18, 2011 to finalize discussions which it anticipates will lead to the issuance of the onshore PSC.

Pursuant to our previous announcement in October 2010, Simba Energy submitted its application to the National Oil Company of Liberia (NOCAL) to convert its current Hydrocarbon Reconnaissance Permit (NR-001) into a Production Sharing Contract (PSC). Since then, the Company has had extensive meetings with NOCAL to review, advance, and finalize this PSC application. During this period there have been changes to management and the board of directors of NOCAL, as well as a moratorium imposed by the Government on new (offshore) PSC applications. The Company is pleased to confirm it has successfully completed all required negotiations and discussions with NOCAL and will be in attendance the week of July 18, 2011 to finalize discussions which it anticipates will lead to the issuance of the onshore PSC.

The formal letter received by Simba Energy from NOCAL also stated that the delay in reaching the final negotiation process was due mainly to the lack of a “Model Production Sharing Contract for onshore oil” along with the reorganization within NOCAL`s offices.

Mr Robert Dinning, President and CEO is quoted "This invitation and meeting represents the final step in the process for the Company’s application to convert its current exploration license into a PSC. We look forward to finalizing this application process so we can begin our planned activities and continue to contribute socially to the communities within our area of work.”

Antwort auf Beitrag Nr.: 41.752.571 von SteirerMan am 06.07.11 21:47:58

...gut zu sehen, wie damit neuer schwung in die aktie reinkam - trotz

neg. gesamtmarktes !!!!

SK gestern....cad 0,17

...gut zu sehen, wie damit neuer schwung in die aktie reinkam - trotz

neg. gesamtmarktes !!!!

SK gestern....cad 0,17

Simba Energy Acquires Controlling Interest of PSC for Blocks 1 & 2, Onshore Guinea

VANCOUVER, BRITISH COLUMBIA -- (MARKET WIRE) -- 07/27/11 -- Simba Energy Inc. ("Simba" or the "Company") (TSX VENTURE: SMB) (FRANKFURT: GDA) (OTCBB: SMBZF), announces it has signed an Agreement to acquire a 60% interest in the PSC (Production Sharing Contract) for Blocks 1 & 2 comprising 12,000 square kilometres onshore in the Republic of Guinea's Bove basin.

Under terms of the agreement, Summa Energy is transferring to Simba Energy a 60% interest in the PSC covering Blocks 1 & 2. Simba will provide 100% funding of all program costs in the first year, and 60% of all program costs thereafter.

The finalization of this agreement is subject to receipt of approval from the Republic of Guinea's Minister of Mines and Geology (Le Ministere des Mines et de la Geologie). A work program, including planning for commencement of a seismic program, will proceed immediately after receipt of final approval from the Minister of Mines. Simba recently conducted a detailed review of technical data on Blocks 1 & 2 and concluded a significant potential for oil and gas exists.

Highlights of the potential of the Bove basin include:

-- Migration and communication are demonstrated by the presence of seeps,

large accumulations of bio-degraded heavy oil at surface, along with

light oil staining in earlier (historical) core and samples

-- A detailed laboratory analysis of samples from two wells carried out in

1989 by Beicip (France) indicated a level of maturity as mature to over

mature and a source that is likely oil prone

-- Silurian shales, which are the major source rock in all North African

basins, are present

-- The basin has three known reservoir systems with fair to good reservoir

parameters in both clastic sediments and carbonates

-- A gravity and magnetometer survey carried out over the entire basin in

1972 by Texas Geophysical Company indicates sediments were present up to

a depth of 4,000 metres and identified numerous anomalies, the magnitude

of which remain of great interest

-- Most of the basin's wells to date were drilled prior to the 1960's and

were too shallow to fully evaluate the section

-- The tectonic style of the Bove basin is such that structures are formed

that produce traps capable of pooling large reserves

In an area 100 to 200 kilometres offshore from Blocks 1 & 2 Hyperdynamics Corporation (Houston, TX, NYSE Amex: HDY) recently carried out extensive 2D & 3D seismic surveys and now plans to drill the first of a two well program later this year.

Robert Dinning, President & CEO of Simba said, "This agreement is a major milestone for the Company, and further supports our strategy of pursuing underexplored onshore basins in Africa. The Company also advises it has completed PSC applications with other jurisdictions in the region, and expects to close these very shortly. When completed the Company will possess an exciting portfolio of exploration properties in addition to the PSC for Blocks 1 & 2 just acquired in Guinea".

To view a map detailing the geographic scope of this acquisition, please visit our website or select the following link: http://www.simbaenergy.ca/images/simba_blocks1and2_guinea.pd…

James Dick, P.Geol., P.Eng., Director of the company and Qualified Person in accordance with National Instrument 51-101, has reviewed and approves the technical disclosure in this news release.

Finder's Fees on this acquisition will be paid in accordance with TSX Venture Exchange policy.

About Simba Energy Inc.

Simba Energy is a Vancouver, B.C. based oil and gas exploration company strategically focusing on underexplored overlooked basins in its pursuit of hydrocarbon opportunities in Africa (currently Liberia, Mali, Ghana, Guinea and others). This region has shown increased promise for development of new hydrocarbon deposits. On behalf of its shareholders the Company's Senior Management Team have endeavoured to leverage their expertise and affiliations to pursue, secure and develop strategic assets that demonstrate high potential for drilling and or production operations; and to do so in a manner of best practices and to the betterment of those communities where we work.

ON BEHALF OF THE BOARD

Robert Dinning, President & CEO

We seek safe harbour.

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements relating to the exploration merits of the property and other future plans, objectives or expectations of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating commodity prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable securities legislation.

Contacts:

Simba Energy Inc.Mark Sommer

604-641-4450 or Toll Free: 1-855-777-4622

info@simbaenergy.cawww.simbaenergy.caSource: Simba Energy Inc.

Read more: http://www.nasdaq.com/aspx/company-news-story.aspx?storyid=2…

VANCOUVER, BRITISH COLUMBIA -- (MARKET WIRE) -- 07/27/11 -- Simba Energy Inc. ("Simba" or the "Company") (TSX VENTURE: SMB) (FRANKFURT: GDA) (OTCBB: SMBZF), announces it has signed an Agreement to acquire a 60% interest in the PSC (Production Sharing Contract) for Blocks 1 & 2 comprising 12,000 square kilometres onshore in the Republic of Guinea's Bove basin.

Under terms of the agreement, Summa Energy is transferring to Simba Energy a 60% interest in the PSC covering Blocks 1 & 2. Simba will provide 100% funding of all program costs in the first year, and 60% of all program costs thereafter.

The finalization of this agreement is subject to receipt of approval from the Republic of Guinea's Minister of Mines and Geology (Le Ministere des Mines et de la Geologie). A work program, including planning for commencement of a seismic program, will proceed immediately after receipt of final approval from the Minister of Mines. Simba recently conducted a detailed review of technical data on Blocks 1 & 2 and concluded a significant potential for oil and gas exists.

Highlights of the potential of the Bove basin include:

-- Migration and communication are demonstrated by the presence of seeps,

large accumulations of bio-degraded heavy oil at surface, along with

light oil staining in earlier (historical) core and samples

-- A detailed laboratory analysis of samples from two wells carried out in

1989 by Beicip (France) indicated a level of maturity as mature to over

mature and a source that is likely oil prone

-- Silurian shales, which are the major source rock in all North African

basins, are present

-- The basin has three known reservoir systems with fair to good reservoir

parameters in both clastic sediments and carbonates

-- A gravity and magnetometer survey carried out over the entire basin in

1972 by Texas Geophysical Company indicates sediments were present up to

a depth of 4,000 metres and identified numerous anomalies, the magnitude

of which remain of great interest

-- Most of the basin's wells to date were drilled prior to the 1960's and

were too shallow to fully evaluate the section

-- The tectonic style of the Bove basin is such that structures are formed

that produce traps capable of pooling large reserves

In an area 100 to 200 kilometres offshore from Blocks 1 & 2 Hyperdynamics Corporation (Houston, TX, NYSE Amex: HDY) recently carried out extensive 2D & 3D seismic surveys and now plans to drill the first of a two well program later this year.

Robert Dinning, President & CEO of Simba said, "This agreement is a major milestone for the Company, and further supports our strategy of pursuing underexplored onshore basins in Africa. The Company also advises it has completed PSC applications with other jurisdictions in the region, and expects to close these very shortly. When completed the Company will possess an exciting portfolio of exploration properties in addition to the PSC for Blocks 1 & 2 just acquired in Guinea".

To view a map detailing the geographic scope of this acquisition, please visit our website or select the following link: http://www.simbaenergy.ca/images/simba_blocks1and2_guinea.pd…

James Dick, P.Geol., P.Eng., Director of the company and Qualified Person in accordance with National Instrument 51-101, has reviewed and approves the technical disclosure in this news release.

Finder's Fees on this acquisition will be paid in accordance with TSX Venture Exchange policy.

About Simba Energy Inc.

Simba Energy is a Vancouver, B.C. based oil and gas exploration company strategically focusing on underexplored overlooked basins in its pursuit of hydrocarbon opportunities in Africa (currently Liberia, Mali, Ghana, Guinea and others). This region has shown increased promise for development of new hydrocarbon deposits. On behalf of its shareholders the Company's Senior Management Team have endeavoured to leverage their expertise and affiliations to pursue, secure and develop strategic assets that demonstrate high potential for drilling and or production operations; and to do so in a manner of best practices and to the betterment of those communities where we work.

ON BEHALF OF THE BOARD

Robert Dinning, President & CEO

We seek safe harbour.

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements relating to the exploration merits of the property and other future plans, objectives or expectations of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating commodity prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable securities legislation.

Contacts:

Simba Energy Inc.Mark Sommer

604-641-4450 or Toll Free: 1-855-777-4622

info@simbaenergy.cawww.simbaenergy.caSource: Simba Energy Inc.

Read more: http://www.nasdaq.com/aspx/company-news-story.aspx?storyid=2…

watchlist

Antwort auf Beitrag Nr.: 41.858.802 von Nissie am 28.07.11 13:58:05

damit nicht genug - nun hat man auch in KENIA zuschlagen können..........

Simba Energy Granted Block 2A in Kenya

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Aug. 3, 2011) - Simba Energy Inc. (the "Company") (TSX VENTURE:SMB)(FRANKFURT:GDA)(OTCBB:SMBZF), is pleased to announce the Company has been granted a Production Sharing Contract (PSC) by the Ministry of Energy, Republic of Kenya for Block 2A, comprising 7,801.72 square kilometres in northeast Kenya.

"We are delighted in having been awarded this PSC from the Republic of Kenya's Energy Ministry. This is a major achievement for the Company and further supports our strategy to pursue underexplored and overlooked onshore basins in Africa. While we remain very close to finalizing other PSC applications elsewhere, Block 2A's PSC provides our shareholders a very significant boost in near term upside exploration potential for the Company. It has been a lot of work to get to this point so we are extremely pleased," remarks Robert Dinning, President CEO..........

http://tmx.quotemedia.com/article.php?newsid=43534999&qm_sym…

damit nicht genug - nun hat man auch in KENIA zuschlagen können..........

Simba Energy Granted Block 2A in Kenya

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Aug. 3, 2011) - Simba Energy Inc. (the "Company") (TSX VENTURE:SMB)(FRANKFURT:GDA)(OTCBB:SMBZF), is pleased to announce the Company has been granted a Production Sharing Contract (PSC) by the Ministry of Energy, Republic of Kenya for Block 2A, comprising 7,801.72 square kilometres in northeast Kenya.

"We are delighted in having been awarded this PSC from the Republic of Kenya's Energy Ministry. This is a major achievement for the Company and further supports our strategy to pursue underexplored and overlooked onshore basins in Africa. While we remain very close to finalizing other PSC applications elsewhere, Block 2A's PSC provides our shareholders a very significant boost in near term upside exploration potential for the Company. It has been a lot of work to get to this point so we are extremely pleased," remarks Robert Dinning, President CEO..........

http://tmx.quotemedia.com/article.php?newsid=43534999&qm_sym…

Antwort auf Beitrag Nr.: 41.890.213 von hbg55 am 04.08.11 10:39:17...dazu mal ein beitrag eines SH- users............

From the research I have been doing, Kenya is potentially the next major region in Africa for multi-billion barrel discoveries. The geology is good enough to host large reserves of oil and gas, but has been hardly explored compared to other basins around the world. The Basins in Kenya are approximately 1/3 the area of the basin under Alberta. Alberta has had tens of thousands of wells drilled, Kenya has had just a handful.

Kenya was largely ignored until the Billion barrel discoveries in neighboring Uganda by Tullow Oil. Now Tullow has aggressively moved into Kenya and are about to start a very aggressive drilling program. Exploration in Kenya was dominated by CNOOC of China and African OIL another Vancouver based company who is a member of the Lundin group of companies. Tullow and African Oil will be spending tens of millions in the next year drilling.

Simba`s Block 2A is next to Block 9 which is Africa Oil. North of Simba`s block is Afren, UK based company which produces 40k barrels a day and has just made a major move into Kenya. They are expected to conduct a major seismic and drilling program in the next year also.

Anadarko has just acquired 5 offshore blocks and will also be drilling in the next year.

Simba is the smallest company which has a block in Kenya. Simba is surrounded by majors who will collectively spend over a $100 million in the next year drilling for oil.

It seems obvious the one of the majors in Kenya or another major looking to participate in Kenya will most likely farm into to Simba`s block or try to acquire Simba if oil is discovered in an adjacent block.

Simba`s entry into Kenya seems to be a very strategic move by management which the market did not realize this week. It is only a matter of time before a major farms into Simba or tries to acquire it, Either way we shareholders WIN

......seh ICH ähnlich und rechne mit baldiger reaktion des marktes - bis dahin heißts

schnäppchen sammeln

From the research I have been doing, Kenya is potentially the next major region in Africa for multi-billion barrel discoveries. The geology is good enough to host large reserves of oil and gas, but has been hardly explored compared to other basins around the world. The Basins in Kenya are approximately 1/3 the area of the basin under Alberta. Alberta has had tens of thousands of wells drilled, Kenya has had just a handful.

Kenya was largely ignored until the Billion barrel discoveries in neighboring Uganda by Tullow Oil. Now Tullow has aggressively moved into Kenya and are about to start a very aggressive drilling program. Exploration in Kenya was dominated by CNOOC of China and African OIL another Vancouver based company who is a member of the Lundin group of companies. Tullow and African Oil will be spending tens of millions in the next year drilling.

Simba`s Block 2A is next to Block 9 which is Africa Oil. North of Simba`s block is Afren, UK based company which produces 40k barrels a day and has just made a major move into Kenya. They are expected to conduct a major seismic and drilling program in the next year also.

Anadarko has just acquired 5 offshore blocks and will also be drilling in the next year.

Simba is the smallest company which has a block in Kenya. Simba is surrounded by majors who will collectively spend over a $100 million in the next year drilling for oil.

It seems obvious the one of the majors in Kenya or another major looking to participate in Kenya will most likely farm into to Simba`s block or try to acquire Simba if oil is discovered in an adjacent block.

Simba`s entry into Kenya seems to be a very strategic move by management which the market did not realize this week. It is only a matter of time before a major farms into Simba or tries to acquire it, Either way we shareholders WIN

......seh ICH ähnlich und rechne mit baldiger reaktion des marktes - bis dahin heißts

schnäppchen sammeln

Ich werde warum der Kurs fällt und fällt, trotz guter News. Deckt sich jemand günstig ein oder verkauft jemand seine Aktien die letzten Tage? Hoffe es wird bald die Liberia PSA News vermeldet. Als UNX vor 3-4 sich an Namibia Blöcken beteiligt hat beteiligt hat, fiel die Aktie bis 10-15 Cent. UNX wurde ich glaube letztes oder dieses Jahr von den Brasilianern übernommen, die Aktie kletterte bis über 5 Euro an. Ich habe mich dann geärgert, als ich meine Aktien bei 15 Cents verkauft habe und danach der Kurs stetig gestiegen ist.

Ich weiss nicht, ob ich Simba bei den jetzigen Kursen aufstocken soll oder nicht.

Was meint ihr? Bitte um eure Meinung, hier ist es sehr ruhig.

Gruss

seanpaul

Ich weiss nicht, ob ich Simba bei den jetzigen Kursen aufstocken soll oder nicht.

Was meint ihr? Bitte um eure Meinung, hier ist es sehr ruhig.

Gruss

seanpaul

Hallo, liebe Simbanesen und -innen

...mit dem heutigen Tag können IMO die Spiele beginnen.

die Aussichten sind erfreulich, und ich hoffe die umsetzung wird noch erfreulicher

Simba Energy receives PSC approval for block 3

2011-10-27 10:23 ET - News Release

Mr. Robert Dinning reports

SIMBA ENERGY PROVIDES CORPORATE UPDATE

Simba Energy Inc. has provided the following corporate update on its current activities, as well as the status on a number of applications for production sharing contracts (PSCs) currently in the final stages of their review and negotiation process.

Simba president and chief executive officer Robert Dinning said: "In spite of very difficult market conditions, the company has been able to remain focused on the task of pursuing and securing the assets we have targeted. As a result, management anticipates finalizing a number of strategic PSC applications in the near future. By this time, the Company expects to be holding 100% interests in a number of Production Sharing Contracts in some very strategic and prospective blocks in Africa for its technical team to advance through the early exploration and development stages of work.

1. Republic of Mali - PSC for Block 3

The Company has received a formal notification that the Republic of Mali's Council of Ministers has adopted a Decree granting Simba Energy a PSC for Block 3. This notification has been approved by the Republic of Mali's Ministry of Mines, Energy, and Water with the support of the government agency AUREP (L'Autorite pour la Promotion de la Recherche Petroliere au Mali or The Authority for the Promotion of Oil Research in Mali).

Management anticipates traveling to Bamako in the very near future for the formal signing ceremony and looks forward to providing further information about the block and its development plans in a more detailed news release.

2. Liberia - Application to convert Hydrocarbon Reconnaissance Licence NR-001 into PSC status

Efforts to finalize and close this negotiation have been delayed by the current national election in Liberia. A run-off election is scheduled for November 8th 2011. Officials at NOCAL (National Oil Company of Liberia) have informed that negotiations with the Company will re-commence immediately after the elections are over. Management believes that while negotiations have taken on a protracted nature, it is very close to a finalizing this agreement and anticipates a conclusion swiftly after this process resumes.

3. Republic of Kenya - Block 2A

The Company is now a holder of a 100% interest in the PSC for a very prospective oil block in northeastern Kenya. Since signing the PSC with the government of Kenya in August, the Company has established an office in Nairobi and commenced the process of procuring the project's next phases of work, primarily, the reprocessing of existing historical seismic data and the acquisition of further seismic data in conjunction with initiating base line environmental studies. The tender and selection process to procure these services is expected to take six to eight weeks with work due to commence in the first quarter of 2012. The technical team continues to compile and review all currently available data.

4. Republic of Guinea – Blocks 1 & 2 (onshore)

The Company successfully acquired a 60% interest in a PSC for onshore Blocks 1 & 2 in the Republic of Guinea this past July. Earlier this month, in Vancouver, the Company hosted a delegation of officials from Guinea as part of their review and approval of the Company's technical and financial capabilities. The Company is confident that it has met or exceeded all the requirements set forth and anticipates formal approval before the end of this year. At this point, the Company intends to begin an aggressive assessment of basin characteristics where during its due diligence site visit the technical team observed very similar seep characteristics with those encountered at the Company's concession in Liberia. Hyperdynamics Corporation (Texas) is currently drilling its first of two exploration wells 100 to 200 kilometres offshore from Blocks 1&2.

In addition to the above, the Company's management and technical staff remain active pursuing a number of other assets in the region. Finally, in these coming weeks, those already familiar with Simba Energy can expect to see a new look and branding for our company.

Simba Energy’s Hassan sees exciting times ahead as industry interest builds

Thursday, November 10, 2011 by Jamie Ashcroft

There are exciting times ahead for Simba Energy (CVE:SMB) as some of the larger industry players size up the group’s highly prospective assets in Africa, managing director Hassan Hassan told Proactive Investors.

From a standing start Simba has built a considerable portfolio in just one year.

The firm now has four onshore licence blocks on the continent – one each in Kenya and Mali and two in the Republic of Guinea. Applications are also being processed for assets in Liberia and Ghana.

Hassan’s comments today followed a productive visit to the Africa Oil Week 2011 event in Cape Town last week.

“We went to the conference to build industry awareness,” Hassan told Proactive Investors.

“The show was a resounding success for us. We expected to get some passing interest from other junior companies.

“But what actually happened was a lot of larger companies came to visit us literally every day at our booth.

Hassan said that he now plans to start talking with some of these companies about them potentially partnering Simba on some of its blocks.

“A lot of representatives of these large oil companies made a point to sit down with us, either publically or in private, to talk about our business,” Hassan added.

“They asked us how we’ve managed to do what we’ve done, for such a small company. They want to know how we can work together and what we would you like from them.”

Tying up with a larger explorer is in keeping with Simba’s plan to develop its early stage assets.

According to Old Park Lane Capital’s Barney Gray Simba’s business model is straightforward.

“(Simba’s) management works exceptionally hard in a competitive environment to secure highly prospective acreage in underexplored regions,” Gray said in a note to clients today.

“Following early stage work programmes to highlight the upside potential of the acreage, Simba will look to farm down its interests to larger partners in return for carried interests over longer term exploration programmes.”

In his note Gray said Simba’s initial emphasis will be on Kenya. Here he believes Hassan and his team will significantly boost the prospectivity of the acreage in the next 12 months.

That will be due in part to the group’s own desktop work. Simba will shortly re-process a catalogue of existing seismic data that was captured by previous operators.

After that it will submit a proposal to the Kenyan government, outlining the next phase of exploration plans.

However by that time the potential of Simba’s acreage is likely to have been underlined by exploration programmes on nearby properties, Grey said.

According to the analyst seismic work being carried out on either side of the group’s Kenyan acreage could allow enable Simba to draw positive inferences regarding its own acreage.

Toronto listed explorer African Oil has recently completed a seismic programme to the west. Afren is set to begin a programme in the adjacent block to the north while Lion Petroleum is preparing a survey to the immediate south.

Meanwhile in Guinea Simba has a 60 per cent stake in Blocks 1 and 2. Gray said that while there has been little history of exploration activity in the area Simba has recorded extensive surface oil seeps.

This indicates a working hydrocarbon system, he explained.

“The company intends to embark on a modest expenditure programme over the next twelve months including the reprocessing of existing seismic data and the submission of a new work programme to the government ministry,” Gray added.

The analyst reckons Simba will receive the formal signing of a production sharing contract in Mali imminently.

Meanwhile negotiations are ongoing in Liberia and Ghana.

“We believe that Liberia could be particularly promising given the recent escalation of exploration activity in the offshore region immediately adjacent to Simba’s onshore area of interest,” Gray said.

Indeed the first wave of exploration here is now gathering pace.

Tullow Oil today revealed the results of its Montserrado-1 exploration well. It was drilled in an offshore licence to the west of Simba’s onshore property – which is the subject of the current PSC negotiations.

The well encountered eight metres of hydrocarbon pay and a light oil sample was recovered from the well. However it is being considered as a non-commercial discovery.

The well result, which came alongside a more detailed trading statement, disappointed Tullow investors as the stock fell around 6 per cent today. But there were also some positives.

“We now know Simba is in an oil bearing region. That has been confirmed (by the Tullow result),” Hassan said.

Hassan said that Simba is “very close” to finalising the PSC in Liberia and the contracts are “basically done”.

However talks have been temporarily sidelined while the country’s elections take place.

He hopes to sit down with the authorities in the coming weeks, once the elections are complete, to finish the PSC talks.

Thursday, November 10, 2011 by Jamie Ashcroft

There are exciting times ahead for Simba Energy (CVE:SMB) as some of the larger industry players size up the group’s highly prospective assets in Africa, managing director Hassan Hassan told Proactive Investors.

From a standing start Simba has built a considerable portfolio in just one year.

The firm now has four onshore licence blocks on the continent – one each in Kenya and Mali and two in the Republic of Guinea. Applications are also being processed for assets in Liberia and Ghana.

Hassan’s comments today followed a productive visit to the Africa Oil Week 2011 event in Cape Town last week.

“We went to the conference to build industry awareness,” Hassan told Proactive Investors.

“The show was a resounding success for us. We expected to get some passing interest from other junior companies.

“But what actually happened was a lot of larger companies came to visit us literally every day at our booth.

Hassan said that he now plans to start talking with some of these companies about them potentially partnering Simba on some of its blocks.

“A lot of representatives of these large oil companies made a point to sit down with us, either publically or in private, to talk about our business,” Hassan added.

“They asked us how we’ve managed to do what we’ve done, for such a small company. They want to know how we can work together and what we would you like from them.”

Tying up with a larger explorer is in keeping with Simba’s plan to develop its early stage assets.

According to Old Park Lane Capital’s Barney Gray Simba’s business model is straightforward.

“(Simba’s) management works exceptionally hard in a competitive environment to secure highly prospective acreage in underexplored regions,” Gray said in a note to clients today.

“Following early stage work programmes to highlight the upside potential of the acreage, Simba will look to farm down its interests to larger partners in return for carried interests over longer term exploration programmes.”

In his note Gray said Simba’s initial emphasis will be on Kenya. Here he believes Hassan and his team will significantly boost the prospectivity of the acreage in the next 12 months.

That will be due in part to the group’s own desktop work. Simba will shortly re-process a catalogue of existing seismic data that was captured by previous operators.

After that it will submit a proposal to the Kenyan government, outlining the next phase of exploration plans.

However by that time the potential of Simba’s acreage is likely to have been underlined by exploration programmes on nearby properties, Grey said.

According to the analyst seismic work being carried out on either side of the group’s Kenyan acreage could allow enable Simba to draw positive inferences regarding its own acreage.

Toronto listed explorer African Oil has recently completed a seismic programme to the west. Afren is set to begin a programme in the adjacent block to the north while Lion Petroleum is preparing a survey to the immediate south.

Meanwhile in Guinea Simba has a 60 per cent stake in Blocks 1 and 2. Gray said that while there has been little history of exploration activity in the area Simba has recorded extensive surface oil seeps.

This indicates a working hydrocarbon system, he explained.

“The company intends to embark on a modest expenditure programme over the next twelve months including the reprocessing of existing seismic data and the submission of a new work programme to the government ministry,” Gray added.

The analyst reckons Simba will receive the formal signing of a production sharing contract in Mali imminently.

Meanwhile negotiations are ongoing in Liberia and Ghana.

“We believe that Liberia could be particularly promising given the recent escalation of exploration activity in the offshore region immediately adjacent to Simba’s onshore area of interest,” Gray said.

Indeed the first wave of exploration here is now gathering pace.

Tullow Oil today revealed the results of its Montserrado-1 exploration well. It was drilled in an offshore licence to the west of Simba’s onshore property – which is the subject of the current PSC negotiations.

The well encountered eight metres of hydrocarbon pay and a light oil sample was recovered from the well. However it is being considered as a non-commercial discovery.

The well result, which came alongside a more detailed trading statement, disappointed Tullow investors as the stock fell around 6 per cent today. But there were also some positives.

“We now know Simba is in an oil bearing region. That has been confirmed (by the Tullow result),” Hassan said.

Hassan said that Simba is “very close” to finalising the PSC in Liberia and the contracts are “basically done”.

However talks have been temporarily sidelined while the country’s elections take place.

He hopes to sit down with the authorities in the coming weeks, once the elections are complete, to finish the PSC talks.

...viele interessante Infos inkl. Timetable!

hier gibts die neue NOV 2011 - Presi:

http://www.simbaenergy.ca/images/stories/Files/Simba_Energy_…

hier gibts die neue NOV 2011 - Presi:

http://www.simbaenergy.ca/images/stories/Files/Simba_Energy_…

Simba Energy secures government approval for work programme for Block 2A in Kenya

Thursday, December 15, 2011 by Sergei Balashov

Vancouver-based oil explorer Simba Energy (CVE:SMB) said the one year work programme for its wholly owned Block 2A onshore Kenya has been submitted and approved by the government.

The Africa focused firm has now started environmental baseline and survey work on its Kenyan acreage, which is expected to complete in mid-January 2012, while interpreting existing gravity and magnetic data from the license block.

In addition, the company has started reprocessing select 2D seismic data after obtaining copies of all existing 2D seismic survey lines spanning 800 kilometres carried out by previous operators Chevron and Amoco.

“We are very pleased with the progress the team has made on the ground in Kenya,” said president and chief executive of Simba Energy Robert Dinning.

“During our initial assessment of available data during the application process we became very confident in the exploration potential for Block 2A and are therefore now very keen to evaluate the re-interpretations in these coming months.”

In addition to Block 2A in Kenya, Simba owns one block in Mali and two in the Republic of Guinea. Applications are also being processed for assets in Liberia and Ghana.

According to Old Park Lane Capital’s Barney Gray, Simba’s initial focus will be on Kenya, expecting the company to significantly boost the prospectivity of the acreage in the next 12 months.

Managing director of Simba Energy Hassan Hassan has recently told Proactive Investors that he plans to start talking with larger players interested in exploration assets in Africa about them potentially partnering Simba on some of its blocks.

The company also announced the resignation of director and vice president for exploration Karim Akrawi today.

Thursday, December 15, 2011 by Sergei Balashov

Vancouver-based oil explorer Simba Energy (CVE:SMB) said the one year work programme for its wholly owned Block 2A onshore Kenya has been submitted and approved by the government.

The Africa focused firm has now started environmental baseline and survey work on its Kenyan acreage, which is expected to complete in mid-January 2012, while interpreting existing gravity and magnetic data from the license block.

In addition, the company has started reprocessing select 2D seismic data after obtaining copies of all existing 2D seismic survey lines spanning 800 kilometres carried out by previous operators Chevron and Amoco.

“We are very pleased with the progress the team has made on the ground in Kenya,” said president and chief executive of Simba Energy Robert Dinning.

“During our initial assessment of available data during the application process we became very confident in the exploration potential for Block 2A and are therefore now very keen to evaluate the re-interpretations in these coming months.”

In addition to Block 2A in Kenya, Simba owns one block in Mali and two in the Republic of Guinea. Applications are also being processed for assets in Liberia and Ghana.

According to Old Park Lane Capital’s Barney Gray, Simba’s initial focus will be on Kenya, expecting the company to significantly boost the prospectivity of the acreage in the next 12 months.

Managing director of Simba Energy Hassan Hassan has recently told Proactive Investors that he plans to start talking with larger players interested in exploration assets in Africa about them potentially partnering Simba on some of its blocks.

The company also announced the resignation of director and vice president for exploration Karim Akrawi today.

Simba Energy identifies two leads on Block 2A in Kenya

Saturday, March 03, 2012 by Sergei Balashov

Simba Energy (CVE:SMB, OTCQX:SMBZF) reported that work on its Block 2A project in Kenya is progressing ahead of schedule and raised C$3 million to fund its projects.

The Vancouver-based oil and gas explorer has now completed the reprocessing of select 2D lines along with existing gravity and magnetic data and has so far identified two exploration leads in these early stages of the study.

In addition to completing the Environmental Impact Assessment (EIA), which has already been submitted to the oil ministry, Simba has obtained all the past geophysical data from Block 2A.

This has allowed the company to accelerate the work programme that has already been approved by the ministry including a passive seismic survey, now anticipated to kick off in early April.

In the meantime, it is expected that a technical report – compliant with the NI51-101 standard – and a competent person’s report (CPR) for the project will be completed in the coming weeks.

“Having progressed this well early on sure helps the company gain some traction,” said president and chief executive of Simba Robert Dinning.

“It sure is encouraging to see such positive results come from this region in these past number of weeks.

“There's no question things are heating up in the area so we're looking forward to maintaining our aggressive pace on the ground in Kenya.”

The company also announced a private placement of up to 37.5 million units consisting of a share and a warrant at a price of 8 Canadian cents to raise a total C$3 million to advance its projects. The fundraising is subject to the approval of the TSX-Venture exchange.

In today’s report, Simba also drew investors' attention to the upcoming drilling campaigns in Kenya by Tullow Oil (LON:TLW) and Africa Oil, which will drill close to Block 2A.

Saturday, March 03, 2012 by Sergei Balashov

Simba Energy (CVE:SMB, OTCQX:SMBZF) reported that work on its Block 2A project in Kenya is progressing ahead of schedule and raised C$3 million to fund its projects.

The Vancouver-based oil and gas explorer has now completed the reprocessing of select 2D lines along with existing gravity and magnetic data and has so far identified two exploration leads in these early stages of the study.

In addition to completing the Environmental Impact Assessment (EIA), which has already been submitted to the oil ministry, Simba has obtained all the past geophysical data from Block 2A.

This has allowed the company to accelerate the work programme that has already been approved by the ministry including a passive seismic survey, now anticipated to kick off in early April.

In the meantime, it is expected that a technical report – compliant with the NI51-101 standard – and a competent person’s report (CPR) for the project will be completed in the coming weeks.

“Having progressed this well early on sure helps the company gain some traction,” said president and chief executive of Simba Robert Dinning.

“It sure is encouraging to see such positive results come from this region in these past number of weeks.

“There's no question things are heating up in the area so we're looking forward to maintaining our aggressive pace on the ground in Kenya.”

The company also announced a private placement of up to 37.5 million units consisting of a share and a warrant at a price of 8 Canadian cents to raise a total C$3 million to advance its projects. The fundraising is subject to the approval of the TSX-Venture exchange.

In today’s report, Simba also drew investors' attention to the upcoming drilling campaigns in Kenya by Tullow Oil (LON:TLW) and Africa Oil, which will drill close to Block 2A.

Antwort auf Beitrag Nr.: 42.268.388 von SteirerMan am 27.10.11 18:47:54

...hat sich doch noch abisl verzögert - abbbbba dafür ´krachts´ HEUTE

gaaaaanz ordtl........

RT...cad 0,135

...hat sich doch noch abisl verzögert - abbbbba dafür ´krachts´ HEUTE

gaaaaanz ordtl........

RT...cad 0,135

Antwort auf Beitrag Nr.: 42.848.989 von allida am 05.03.12 08:19:03

.....In today’s report, Simba also drew investors' attention to the upcoming drilling campaigns in Kenya by Tullow Oil (LON:TLW) and Africa Oil, which will drill close to Block 2A....

gestrige pos. PR nun von AOI hinterließ auch bei unsrem baby seine spuren

mit nem satten UPPPP- satz von über 37% bei TOP- jahresvol. von 3,7mios

.....In today’s report, Simba also drew investors' attention to the upcoming drilling campaigns in Kenya by Tullow Oil (LON:TLW) and Africa Oil, which will drill close to Block 2A....

gestrige pos. PR nun von AOI hinterließ auch bei unsrem baby seine spuren

mit nem satten UPPPP- satz von über 37% bei TOP- jahresvol. von 3,7mios

Antwort auf Beitrag Nr.: 42.959.770 von hbg55 am 27.03.12 11:35:04

...uuuuuund als hätten SIE nur darauf gewarten sehen wir folg. PR

heute.........

Simba Engages Sproule to Evaluate Block 2A - Kenya

Simba Energy Inc. (the “Company”) (TSXV: SMB, Frankfurt: GDA, OTCQX: SMBZF) is pleased to announce Sproule Associates Limited (Calgary) as having been engaged to carry out an evaluation on the Company’s 100% interest in Block 2A in Kenya and provide an evaluation report compliant to both NI 51-101, and a Competent Persons Report (‘CPR’ – for European investment standards).

Sproule has considerable evaluation experience in Kenya and especially in the area of Block 2A where they have previously provided similar reports for blocks adjacent to Block 2A. The Company expects the report to be completed in the next 60 days.

Robert Dinning, President & CEO remarks, “…we commissioned Sproule for this evaluation because they have done extensive in depth geological and geophysical studies in the immediate area. While Simba’s technical team is encouraged by its own evaluation and review of the available data, our shareholders can now look forward to seeing the results of an independent evaluation of this asset’s potential within these coming weeks.” ...........

http://tmx.quotemedia.com/article.php?newsid=49745918&qm_sym…

...uuuuuund als hätten SIE nur darauf gewarten sehen wir folg. PR

heute.........

Simba Engages Sproule to Evaluate Block 2A - Kenya

Simba Energy Inc. (the “Company”) (TSXV: SMB, Frankfurt: GDA, OTCQX: SMBZF) is pleased to announce Sproule Associates Limited (Calgary) as having been engaged to carry out an evaluation on the Company’s 100% interest in Block 2A in Kenya and provide an evaluation report compliant to both NI 51-101, and a Competent Persons Report (‘CPR’ – for European investment standards).

Sproule has considerable evaluation experience in Kenya and especially in the area of Block 2A where they have previously provided similar reports for blocks adjacent to Block 2A. The Company expects the report to be completed in the next 60 days.

Robert Dinning, President & CEO remarks, “…we commissioned Sproule for this evaluation because they have done extensive in depth geological and geophysical studies in the immediate area. While Simba’s technical team is encouraged by its own evaluation and review of the available data, our shareholders can now look forward to seeing the results of an independent evaluation of this asset’s potential within these coming weeks.” ...........

http://tmx.quotemedia.com/article.php?newsid=49745918&qm_sym…

Simba Energy eyes Kenya's tremendous oil potential

Thursday, March 29, 2012 by Jamie Ashcroft

Toronto-listed oil explorer Simba Energy (CVE:SMB) has an excellent chance of striking oil in Kenya, according to director Hassan Hassan.

Shares raced to a 12-month high of 14.2 Canadian cents yesterday, following the shrewdly-timed announcement that industry consultant Sproule Associates had been hired to assess the group’s onshore exploration licence in Kenya.

It follows Tullow Oil’s breakthrough discovery in the Kenyan rift basin on Monday. This is Kenya’s very first oil discovery. And its significance is underlined by the fact that it was formally announced by the country’s president Mwai Kibaki in Nairobi.

“In the past there have been around 36 dry holes in Kenya, so this new discovery is massive for the industry,” Hassan said.

“This first successful well shows there is tremendous potential going forward.

"The fact that we have an onshore block means we’re very well positioned to participate in that. It is very exciting for us as a company and we are incredibly privileged to be active in Kenya at this time.