LED - ein kommender Riesenmarkt? - 500 Beiträge pro Seite

eröffnet am 21.07.11 12:59:16 von

neuester Beitrag 18.07.18 13:41:31 von

neuester Beitrag 18.07.18 13:41:31 von

Beiträge: 226

ID: 1.167.743

ID: 1.167.743

Aufrufe heute: 0

Gesamt: 13.928

Gesamt: 13.928

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 01:29 | 375 | |

| heute 00:17 | 262 | |

| gestern 13:40 | 247 | |

| gestern 21:33 | 159 | |

| gestern 23:24 | 137 | |

| heute 01:34 | 125 | |

| gestern 21:02 | 124 | |

| gestern 22:40 | 114 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.179,00 | +1,33 | 218 | |||

| 2. | 2. | 160,89 | +13,26 | 156 | |||

| 3. | 3. | 0,1910 | +4,95 | 77 | |||

| 4. | 4. | 2.319,26 | -0,13 | 59 | |||

| 5. | 5. | 0,0313 | +95,63 | 49 | |||

| 6. | 6. | 43,75 | -3,42 | 45 | |||

| 7. | 7. | 4,7480 | +3,15 | 43 | |||

| 8. | 8. | 14,475 | +5,46 | 41 |

Hallo zusammen,

nachdem ich mich einige Jahre primär mit dem PV-Markt beschäftigt habe, bin ich zuletzt sehr interessiert an der Entwicklung des LED-Markts.

LED's können Licht energetisch günstiger und deutlich langlebiger erzeugen als herkömmliche Leuchtmittel.

Bisher waren sie schlicht zu teuer und auch oft nicht leistungsfähig genug, so dass es nur Nischenanwendungen gab.

Seit einiger Zeit gibt es aber dramatische Fortschritte in Sachen Qualität, Preis und Marktvolumen so dass mein Bauchgefühl jetzt sagt, dass es hier in (naher?) Zukunft so richtig abgehen wird.

Ich bin schlicht an allem interessiert, was mit der Branche zu tun hat: Struktur der Wertschöpfungskette, einzelne Player, Technologie- und Markttrends, etc., etc.

Da es zwar eine Reihe börsennotierter Werte gibt, von denen aber sehr viele in Taiwan notiert sind und es m.E. interessant ist ein Branchenverständnis zu entwickeln, möchte ich ab jetzt lieber primär in diesem Meta-Thread posten und hoffe, dass sich wenigstens ein bisschen Diskussion entwickelt.

Wenn man mit mehreren Leuten an etwas arbeitet, kommt einfach meistens auch mehr raus.

In diesem Sinne fange ich in den nächsten Postings mal damit an, einen Überblick über das zu geben, was ich schon weiss und/oder gepostet habe...

nachdem ich mich einige Jahre primär mit dem PV-Markt beschäftigt habe, bin ich zuletzt sehr interessiert an der Entwicklung des LED-Markts.

LED's können Licht energetisch günstiger und deutlich langlebiger erzeugen als herkömmliche Leuchtmittel.

Bisher waren sie schlicht zu teuer und auch oft nicht leistungsfähig genug, so dass es nur Nischenanwendungen gab.

Seit einiger Zeit gibt es aber dramatische Fortschritte in Sachen Qualität, Preis und Marktvolumen so dass mein Bauchgefühl jetzt sagt, dass es hier in (naher?) Zukunft so richtig abgehen wird.

Ich bin schlicht an allem interessiert, was mit der Branche zu tun hat: Struktur der Wertschöpfungskette, einzelne Player, Technologie- und Markttrends, etc., etc.

Da es zwar eine Reihe börsennotierter Werte gibt, von denen aber sehr viele in Taiwan notiert sind und es m.E. interessant ist ein Branchenverständnis zu entwickeln, möchte ich ab jetzt lieber primär in diesem Meta-Thread posten und hoffe, dass sich wenigstens ein bisschen Diskussion entwickelt.

Wenn man mit mehreren Leuten an etwas arbeitet, kommt einfach meistens auch mehr raus.

In diesem Sinne fange ich in den nächsten Postings mal damit an, einen Überblick über das zu geben, was ich schon weiss und/oder gepostet habe...

Folgende Wertschöpfungsstufen und darin tätige Player (mit Threads) habe ich bisher ausgegraben:

Equipment (hauptsächlich MOCVD):

Aixtron Thread: Aixtron - Die Perle im Technologiebereich

Veeco Thread: VEECO - Solar- und LED-Zulieferer

GT Solar Thread: GT Solar - Weltmarktführer (?) für Ingot-Öfen

Taiyo Nippon Sanso Thread: Taiyo Nippon Sanso - macht auch MOCVD-Equipment

Ingot-/Waferhersteller (da gibt es Saphir und Siliconcarbid):

Rubicon Technologies Thread: Rubicon Technologies - LED-Zulieferer

Crystalwise Thread: Crystalwise - taiwanesischer Saphir-Ingot-Produzent

Formosa Epitaxy Thread: Formosa Epitaxy - taiwanesischer LED-Player

Tekcore Thread: Tekcore - taiwanesischer LED-Player

Crystal Applied Thread: Crystal Applied - taiwanesischer Saphir-Ingot-Maker

LED-Chips

Epistar Thread: Epistar - LED-Chips aus Taiwan

SemiLEDs Thread: Nach Bearisher Bodenlandung gute Einstiegschance

BLUGlass Thread: BLUGLASS - Neue LED Technologie Semiconductors - Chance zum Einstieg vor der Kommerzialisierung

Changelight Thread: Xiamen Changelight - einer der größten chinesischen LED-Player

Genesis Photonics Thread: Genesis Photonics - taiwanesischer LED-Player

Edison Opto

LED-Komponenten/Systeme (Packager)

Neo-Neon Thread: Neo-Neon - chinesischer LED-Hersteller

Everlight Thread: Everlight Electronics - taiwanesischer LED-Player

Unity Opto Thread: Unity Opto - LED Packager aus Taiwan

LED-Anwendungen

Zumtobel Thread: Zumtobel - LED-Sparte wächst schnell

Nexxus Lighting Thread: Nexxus Lighting - LED-Anbieter

integrierte Player

Osram Thread: OSRAM - Siemens plant IPO

Philips Thread: Royal Philips Electronics

Cree Thread: CREE: LED-Geschäft kommt in Schwung

Nichia

Equipment (hauptsächlich MOCVD):

Aixtron Thread: Aixtron - Die Perle im Technologiebereich

Veeco Thread: VEECO - Solar- und LED-Zulieferer

GT Solar Thread: GT Solar - Weltmarktführer (?) für Ingot-Öfen

Taiyo Nippon Sanso Thread: Taiyo Nippon Sanso - macht auch MOCVD-Equipment

Ingot-/Waferhersteller (da gibt es Saphir und Siliconcarbid):

Rubicon Technologies Thread: Rubicon Technologies - LED-Zulieferer

Crystalwise Thread: Crystalwise - taiwanesischer Saphir-Ingot-Produzent

Formosa Epitaxy Thread: Formosa Epitaxy - taiwanesischer LED-Player

Tekcore Thread: Tekcore - taiwanesischer LED-Player

Crystal Applied Thread: Crystal Applied - taiwanesischer Saphir-Ingot-Maker

LED-Chips

Epistar Thread: Epistar - LED-Chips aus Taiwan

SemiLEDs Thread: Nach Bearisher Bodenlandung gute Einstiegschance

BLUGlass Thread: BLUGLASS - Neue LED Technologie Semiconductors - Chance zum Einstieg vor der Kommerzialisierung

Changelight Thread: Xiamen Changelight - einer der größten chinesischen LED-Player

Genesis Photonics Thread: Genesis Photonics - taiwanesischer LED-Player

Edison Opto

LED-Komponenten/Systeme (Packager)

Neo-Neon Thread: Neo-Neon - chinesischer LED-Hersteller

Everlight Thread: Everlight Electronics - taiwanesischer LED-Player

Unity Opto Thread: Unity Opto - LED Packager aus Taiwan

LED-Anwendungen

Zumtobel Thread: Zumtobel - LED-Sparte wächst schnell

Nexxus Lighting Thread: Nexxus Lighting - LED-Anbieter

integrierte Player

Osram Thread: OSRAM - Siemens plant IPO

Philips Thread: Royal Philips Electronics

Cree Thread: CREE: LED-Geschäft kommt in Schwung

Nichia

Für neue Player mache ich erstmal keine eigenen Threads mehr, sondern stelle sie hier rein:

BLU maker Global Lighting Technologies sets IPO price

Rebecca Kuo, Taipei; Steve Shen, DIGITIMES [Thursday 21 July 2011]

LED backlight unit and light guide plate maker Global Lighting Technologies (GLT) will debut on the Taiwan Stock Exchange (TSE) with an initial price of NT$50 (US$1.73) on July 28. The IPO will total 15.35 million shares.

GLT is expected to post revenues of NT$4 billion in 2011 with an EPS of NT$6, according to an estimate by industry sources.

GLT's light guide plates, built using micro lens technology, target a number of applications, including LED indoor lighting, LED TVs, notebook keyboards, LED notebooks and smartphones.

GLT posted a gross margin of 28.6% in the first quarter and aims to raise the margin to 30% for all of 2011, according the company.

BLU maker Global Lighting Technologies sets IPO price

Rebecca Kuo, Taipei; Steve Shen, DIGITIMES [Thursday 21 July 2011]

LED backlight unit and light guide plate maker Global Lighting Technologies (GLT) will debut on the Taiwan Stock Exchange (TSE) with an initial price of NT$50 (US$1.73) on July 28. The IPO will total 15.35 million shares.

GLT is expected to post revenues of NT$4 billion in 2011 with an EPS of NT$6, according to an estimate by industry sources.

GLT's light guide plates, built using micro lens technology, target a number of applications, including LED indoor lighting, LED TVs, notebook keyboards, LED notebooks and smartphones.

GLT posted a gross margin of 28.6% in the first quarter and aims to raise the margin to 30% for all of 2011, according the company.

LED chipmaker Lextar swings back to profitability in 2Q11

Siu Han, Taipei; Steve Shen, DIGITIMES [Thursday 21 July 2011]

LED epitaxial wafer and chip maker Lextar Electronics has managed to swing back to profitability in the second quarter of 2011 generating a net profit of NT$112 million (US$3.87 million) for the quarter. For the first half of 2011, net profits totaled NT$38.06 million, translating into an EPS of NT$0.10.

Lextar also said that its gross margin rebounded to 18% in the second quarter compared to 7.96% in the first quarter, during which time the company posted a net loss of NT$74 million due to off-season effects and non-operating losses.

Revenues will continue to move upward in the third quarter, buoyed by increasing shipments of LED lighting products, said the company, noting that sales of lighting products will account for 40% of total revenues by year-end compared to 30% in the first half.

Lextar is expected to debut on the Taiwan Stock Exchange (TSE) in the third quarter with an IPO issue of 22.5 million shares priced tentatively at NT$30 per unit.

Siu Han, Taipei; Steve Shen, DIGITIMES [Thursday 21 July 2011]

LED epitaxial wafer and chip maker Lextar Electronics has managed to swing back to profitability in the second quarter of 2011 generating a net profit of NT$112 million (US$3.87 million) for the quarter. For the first half of 2011, net profits totaled NT$38.06 million, translating into an EPS of NT$0.10.

Lextar also said that its gross margin rebounded to 18% in the second quarter compared to 7.96% in the first quarter, during which time the company posted a net loss of NT$74 million due to off-season effects and non-operating losses.

Revenues will continue to move upward in the third quarter, buoyed by increasing shipments of LED lighting products, said the company, noting that sales of lighting products will account for 40% of total revenues by year-end compared to 30% in the first half.

Lextar is expected to debut on the Taiwan Stock Exchange (TSE) in the third quarter with an IPO issue of 22.5 million shares priced tentatively at NT$30 per unit.

Antwort auf Beitrag Nr.: 41.823.333 von R-BgO am 21.07.11 13:21:50Von den genannten Werten habe ich in absteigender Gewichtung im Depot:

Aixtron

Veeco

Cree

Zumtobel

Epistar

Rubicon

Neo-Neon

GT Solar

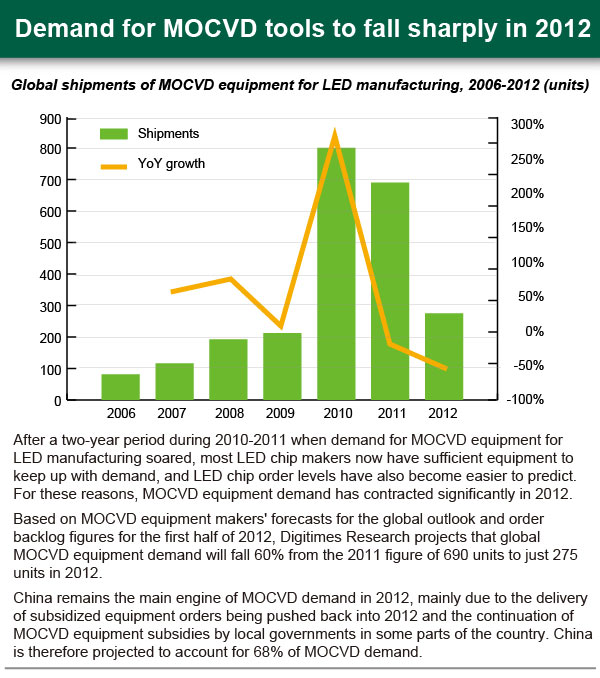

Zuletzt sind fast alle LED-Aktien nach Süder gerauscht; zum einen weil ein bisheriger Hauptabsatzmarkt: Hintergrundbeleuchtung für LED-Fernseher (BLU = back-light units) schwächelt, zum anderen, weil China einen riesigen Boom für die Herstellung von LED-Chips ausgelöst hat, indem es 50% Subvention auf den Kauf von MOCVD-Tools gewährt hat (deswegen auch die raketengleichen Aufstiege von Aixtron und Veeco) und die Fortführung dieses Programms (mir) nicht klar ist...

Könnte aber ein guter Einstiegszeitpunkt sein, wenn man daran glaubt, dass es erst der Beginn des Massenmarkts ist.

Andererseits stehen zu so einem frühen Zeitpunkt die Sieger noch lange nicht fest und sehr viele werden auf der Strecke bleiben (wie z.B. auch bei PV).

Umso spannender ist die Marktbeobachtung...

Aixtron

Veeco

Cree

Zumtobel

Epistar

Rubicon

Neo-Neon

GT Solar

Zuletzt sind fast alle LED-Aktien nach Süder gerauscht; zum einen weil ein bisheriger Hauptabsatzmarkt: Hintergrundbeleuchtung für LED-Fernseher (BLU = back-light units) schwächelt, zum anderen, weil China einen riesigen Boom für die Herstellung von LED-Chips ausgelöst hat, indem es 50% Subvention auf den Kauf von MOCVD-Tools gewährt hat (deswegen auch die raketengleichen Aufstiege von Aixtron und Veeco) und die Fortführung dieses Programms (mir) nicht klar ist...

Könnte aber ein guter Einstiegszeitpunkt sein, wenn man daran glaubt, dass es erst der Beginn des Massenmarkts ist.

Andererseits stehen zu so einem frühen Zeitpunkt die Sieger noch lange nicht fest und sehr viele werden auf der Strecke bleiben (wie z.B. auch bei PV).

Umso spannender ist die Marktbeobachtung...

Antwort auf Beitrag Nr.: 41.823.415 von R-BgO am 21.07.11 13:31:26Orders for large-size LED BLUs declining in July

Siu Han, Taipei; Jackie Chang, DIGITIMES [Thursday 21 July 2011]

Orders for large-size LED backlight units (BLUs) from downstream TV makers so far this month have been lower than those received in June, according to sources at LED chipmakers. Since there are no signs pinpointing to a pick-up in demand momentum, most LED makers are likely to post negative growth in the third quarter.

In previous years, July has been the month for orders to increase in the LED industry. However, demand from Europe and US markets continues to be flat causing conservative inventory control at the downstream end and downward pressure on prices in the third quarter.

According to LED chipmakers, demand for LED lighting and outdoor billboards has been good, with capacity utilization rates close to full and order visibility clear to August and September. In contrast, demand for backlight modules has been weak. Although there are customers requesting quotations, most customers are demanding lower prices.

Taiwan-based LED chipmaker Epistar indicated production of blue LEDs was at full capacity in June, but the capacity utilization rate in July has been shrinking to 70% due to a sudden decrease in demand. Industry watchers estimate the demand for backlight modules in the third quarter is likely to show an on-quarter decrease.

Formosa Epitaxy confirmed orders from TV firms have been lower compared with the second quarter.

LED packaging house Everlight believes there will be slight growth in the third quarter for the LED industry. Unity Opto optimistically estimates quarterly revenues to increase by 20-30% due to increased orders of LED lighting and the market for backlight modules will climb out of the bottom.

Demand for LED TVs will be more apparent in 2012 as the price lowers to the level of CCFL-backlit TVs, added industry sources, at that time the penetration of LED TVs should finally go over 50%.

Siu Han, Taipei; Jackie Chang, DIGITIMES [Thursday 21 July 2011]

Orders for large-size LED backlight units (BLUs) from downstream TV makers so far this month have been lower than those received in June, according to sources at LED chipmakers. Since there are no signs pinpointing to a pick-up in demand momentum, most LED makers are likely to post negative growth in the third quarter.

In previous years, July has been the month for orders to increase in the LED industry. However, demand from Europe and US markets continues to be flat causing conservative inventory control at the downstream end and downward pressure on prices in the third quarter.

According to LED chipmakers, demand for LED lighting and outdoor billboards has been good, with capacity utilization rates close to full and order visibility clear to August and September. In contrast, demand for backlight modules has been weak. Although there are customers requesting quotations, most customers are demanding lower prices.

Taiwan-based LED chipmaker Epistar indicated production of blue LEDs was at full capacity in June, but the capacity utilization rate in July has been shrinking to 70% due to a sudden decrease in demand. Industry watchers estimate the demand for backlight modules in the third quarter is likely to show an on-quarter decrease.

Formosa Epitaxy confirmed orders from TV firms have been lower compared with the second quarter.

LED packaging house Everlight believes there will be slight growth in the third quarter for the LED industry. Unity Opto optimistically estimates quarterly revenues to increase by 20-30% due to increased orders of LED lighting and the market for backlight modules will climb out of the bottom.

Demand for LED TVs will be more apparent in 2012 as the price lowers to the level of CCFL-backlit TVs, added industry sources, at that time the penetration of LED TVs should finally go over 50%.

Sapphire ingots, substrates face large price drops

Siu Han, Taipei; Jackie Chang, DIGITIMES [Wednesday 20 July 2011]

Supply shortages caused the price of sapphire ingots and substrates to increase rapidly in 2010 resulting in high gross margins and revenues for related firms. However, the tide has been turning in 2011 as prices have dropped at an amazing rate due to lack of demand for LED products.

Alpha Xtal, a Taiwan-based sapphire crystal growing firm, announced recently a merger with sapphire substrate maker Tera Xtal. The integration combined the upstream sapphire crystal growing business with downstream substrate production into one with Tera Xtal as the surviving company.

The price of sapphire ingots was once US$25/1mm at the end of 2010 pushing the price of substrates to US$30-35/unit. The market estimated the price drop to be 5-10% on quarter and 30% on year in 2011 when the price of sapphire ingots remained high in first quarter.

As the supply of sapphire ingots started to increase, the price began to lose rigidity and reached US$20/1mm in the second quarter amid weakening demand.

Industry sources pointed out international sapphire ingot suppliers have been leading the price drops and coupled with the low demand, prices have dropped 50% recently.

The merger of Tera Xtal and Alpha Xtal has some risks. In 2010, 90% of the capacity of Alpha Xtal was to supply materials to Tera Xtal when the market was short of sapphire ingots. If the merger had occurred then, it would have been beneficial as Tera Xtal would have had no concerns over lack of supply. However, the market is now uncertain and the price of sapphire ingots has been falling, the risk of recognizing impairment losses has increased and will likely harm the gross margin.

The capacity of Alpha Xtal is about 100,000mm and is expected to increase to one million mm when installation of 150 units of equipment completes in the first quarter of 2012 to become the largest sapphire crystal growing firm in Asia. The merger means that Tera Xtal may have to expand its capacity to absorb the large quantity of sapphire ingots. The capacity expansion might cause oversupply concerns in the market.

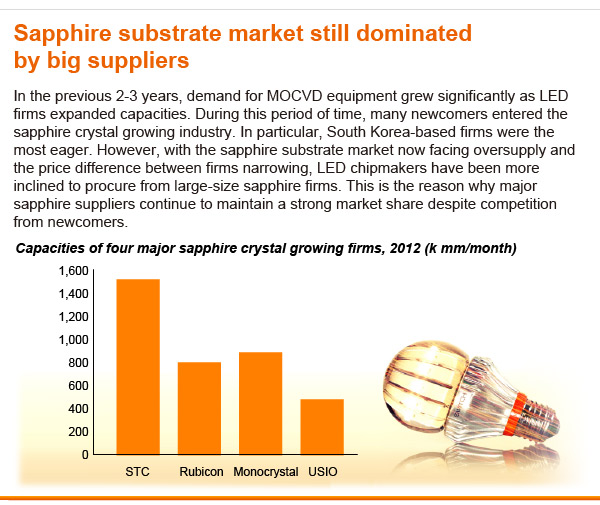

Nevertheless, vertical integration of the sapphire industry seems inevitable. The entry barriers to growing crystals have been high, hence the market has been dominated by international firms such as US-based Rubicon, Russia-based MonoCrystal and South Korea-based Sapphire Technology Company (STC). Sapphire substrate makers have been caught between LED epitaxy customers demanding lower price and international sapphire ingot supplier with rigid quotations.

Taiwan-based sapphire substrate makers have been trying to increase the self-sufficient rate of sapphire ingots this year.

Siu Han, Taipei; Jackie Chang, DIGITIMES [Wednesday 20 July 2011]

Supply shortages caused the price of sapphire ingots and substrates to increase rapidly in 2010 resulting in high gross margins and revenues for related firms. However, the tide has been turning in 2011 as prices have dropped at an amazing rate due to lack of demand for LED products.

Alpha Xtal, a Taiwan-based sapphire crystal growing firm, announced recently a merger with sapphire substrate maker Tera Xtal. The integration combined the upstream sapphire crystal growing business with downstream substrate production into one with Tera Xtal as the surviving company.

The price of sapphire ingots was once US$25/1mm at the end of 2010 pushing the price of substrates to US$30-35/unit. The market estimated the price drop to be 5-10% on quarter and 30% on year in 2011 when the price of sapphire ingots remained high in first quarter.

As the supply of sapphire ingots started to increase, the price began to lose rigidity and reached US$20/1mm in the second quarter amid weakening demand.

Industry sources pointed out international sapphire ingot suppliers have been leading the price drops and coupled with the low demand, prices have dropped 50% recently.

The merger of Tera Xtal and Alpha Xtal has some risks. In 2010, 90% of the capacity of Alpha Xtal was to supply materials to Tera Xtal when the market was short of sapphire ingots. If the merger had occurred then, it would have been beneficial as Tera Xtal would have had no concerns over lack of supply. However, the market is now uncertain and the price of sapphire ingots has been falling, the risk of recognizing impairment losses has increased and will likely harm the gross margin.

The capacity of Alpha Xtal is about 100,000mm and is expected to increase to one million mm when installation of 150 units of equipment completes in the first quarter of 2012 to become the largest sapphire crystal growing firm in Asia. The merger means that Tera Xtal may have to expand its capacity to absorb the large quantity of sapphire ingots. The capacity expansion might cause oversupply concerns in the market.

Nevertheless, vertical integration of the sapphire industry seems inevitable. The entry barriers to growing crystals have been high, hence the market has been dominated by international firms such as US-based Rubicon, Russia-based MonoCrystal and South Korea-based Sapphire Technology Company (STC). Sapphire substrate makers have been caught between LED epitaxy customers demanding lower price and international sapphire ingot supplier with rigid quotations.

Taiwan-based sapphire substrate makers have been trying to increase the self-sufficient rate of sapphire ingots this year.

der led markt wird boomen

Antwort auf Beitrag Nr.: 41.825.219 von fraufinanz am 21.07.11 17:20:15Über welche Werte würdest Du darauf setzen?

Antwort auf Beitrag Nr.: 41.823.415 von R-BgO am 21.07.11 13:31:26Ciao R-BgO

Interessante Idee, NUR folgende Ueberlegungen meinerseits:

Habe schon seit Mai 2010 eine "Led-Watchlist" angelegt, mit ählichen Titeln wie Du. Zualleroberst stand Aixtron, habe jedoch den ersten Hype verpasst.

Wenn ich mir nun aber die zurzeit grauenerregenden Charts (bin jedoch kein wirklicher Chartanalyst) der einzelnen Titel, vor allem auch von Aixtron, anschaue, dann werde ich den Verdacht nicht los, dass hier das Gleiche abläuft wie mit den ( vor allem Deutschen) Solartiteln, die schlichtweg nicht mehr mit der asiatischen Konkurrenz mithalten konnten.

Ich kenne jedoch (noch) keine asiatischen Led-Hersteller und halte mich vorläufig auch mit asiatischen (chinesischen) Titeln noch etwas zurück, befürchte jedoch, dass ich wieder zu lange warte, wie damals bei "Renesola".

Ich hatte sogar schon geliebäugelt, bei Aixtron mit einem Knock-out-Zerti short zu gehen, habe es aber bisher bleiben lassen.

Viele liebe Grüsse

boheme

Interessante Idee, NUR folgende Ueberlegungen meinerseits:

Habe schon seit Mai 2010 eine "Led-Watchlist" angelegt, mit ählichen Titeln wie Du. Zualleroberst stand Aixtron, habe jedoch den ersten Hype verpasst.

Wenn ich mir nun aber die zurzeit grauenerregenden Charts (bin jedoch kein wirklicher Chartanalyst) der einzelnen Titel, vor allem auch von Aixtron, anschaue, dann werde ich den Verdacht nicht los, dass hier das Gleiche abläuft wie mit den ( vor allem Deutschen) Solartiteln, die schlichtweg nicht mehr mit der asiatischen Konkurrenz mithalten konnten.

Ich kenne jedoch (noch) keine asiatischen Led-Hersteller und halte mich vorläufig auch mit asiatischen (chinesischen) Titeln noch etwas zurück, befürchte jedoch, dass ich wieder zu lange warte, wie damals bei "Renesola".

Ich hatte sogar schon geliebäugelt, bei Aixtron mit einem Knock-out-Zerti short zu gehen, habe es aber bisher bleiben lassen.

Viele liebe Grüsse

boheme

Antwort auf Beitrag Nr.: 41.825.573 von boheme am 21.07.11 18:13:30siehe Posting #2 unten; die Mehrheit der Werte, die ich bisher gefunden habe, kommt aus Asien

Austriamicrosystems auch noch ein Titel in dem Bereich

müsste mal die bewertungen und auftragseingänge zerpflücken um sich ein bild zu machen.

der erste LED boom ist bereits in der konsolidierung. wird aber bald wieder anlaufen. dann bestimmt richtig

müsste mal die bewertungen und auftragseingänge zerpflücken um sich ein bild zu machen.

der erste LED boom ist bereits in der konsolidierung. wird aber bald wieder anlaufen. dann bestimmt richtig

neues Listing:

Global Lighting Technologies to list on TSE

Rebecca Kuo, Tainan; Adam Hwang, DIGITIMES [Monday 25 July 2011]

Global Lighting Technologies (GLT), a Taiwan-based maker of light guide plates used in LED backlight units (BLU), LED illuminated keyboards and indoor lighting products, will begin listing on the Taiwan Stock Exchange on July 28, according to the company.

GLT expects orders for light guide plates used in LED indoor lighting products from Toshiba as well as for those used in LED backlit illuminated keyboards from vendors of notebooks to increase in the third quarter of 2011, the company indicated.

In addition, GLT has been capable of making light guide plates based on micro-lens technology for use in LCD TVs of over 55-inch.

GLT has set up three production lines with total monthly capacity of 400,000 light guide plates for large-size LCD TVs at its factory in northern Taiwan. In addition, GLT will start establishment of five more production lines at its factory in Zhoushan, southern China, in August, with completion scheduled for the fourth quarter.

GLT recently issued 15.35 million new shares for sale at NT$50 (US$1.73) per share to raise additional paid-in capital.

Global Lighting Technologies to list on TSE

Rebecca Kuo, Tainan; Adam Hwang, DIGITIMES [Monday 25 July 2011]

Global Lighting Technologies (GLT), a Taiwan-based maker of light guide plates used in LED backlight units (BLU), LED illuminated keyboards and indoor lighting products, will begin listing on the Taiwan Stock Exchange on July 28, according to the company.

GLT expects orders for light guide plates used in LED indoor lighting products from Toshiba as well as for those used in LED backlit illuminated keyboards from vendors of notebooks to increase in the third quarter of 2011, the company indicated.

In addition, GLT has been capable of making light guide plates based on micro-lens technology for use in LCD TVs of over 55-inch.

GLT has set up three production lines with total monthly capacity of 400,000 light guide plates for large-size LCD TVs at its factory in northern Taiwan. In addition, GLT will start establishment of five more production lines at its factory in Zhoushan, southern China, in August, with completion scheduled for the fourth quarter.

GLT recently issued 15.35 million new shares for sale at NT$50 (US$1.73) per share to raise additional paid-in capital.

Quereinsteiger:

XINYU CITY, China and SUNNYVALE, Calif., April 8, 2011 /PRNewswire via COMTEX/ -- LDK Solar Co., Ltd. ("LDK Solar") (NYSE: LDK), a leading manufacturer of multicrystalline solar wafers and PV products, today announced a business investment of approximately $40 million to establish a new manufacturing plant in Nanchang City, Jiangxi Province. This new manufacturing facility will have capacity to supply two million two-inch equivalent pieces of sapphire wafers per year and be positioned to capture the growing opportunities in the LED industry.

"We are very pleased to expand our wafer manufacturing to Nanchang City, Jiangxi Province," stated Xiaofeng Peng, Chairman and CEO of LDK Solar.

"We believe this new investment in manufacturing sapphire wafers has a great synergy with LDK Solar's crystallization and wafer engineering and manufacturing expertise, and will enhance LDK Solar's product offerings.

"We also would like to express our sincere appreciation to Nanchang City and Jiangxi Province for the support they have shown us during the planning and construction of our wafer and module plants over the past two years."

XINYU CITY, China and SUNNYVALE, Calif., April 8, 2011 /PRNewswire via COMTEX/ -- LDK Solar Co., Ltd. ("LDK Solar") (NYSE: LDK), a leading manufacturer of multicrystalline solar wafers and PV products, today announced a business investment of approximately $40 million to establish a new manufacturing plant in Nanchang City, Jiangxi Province. This new manufacturing facility will have capacity to supply two million two-inch equivalent pieces of sapphire wafers per year and be positioned to capture the growing opportunities in the LED industry.

"We are very pleased to expand our wafer manufacturing to Nanchang City, Jiangxi Province," stated Xiaofeng Peng, Chairman and CEO of LDK Solar.

"We believe this new investment in manufacturing sapphire wafers has a great synergy with LDK Solar's crystallization and wafer engineering and manufacturing expertise, and will enhance LDK Solar's product offerings.

"We also would like to express our sincere appreciation to Nanchang City and Jiangxi Province for the support they have shown us during the planning and construction of our wafer and module plants over the past two years."

GLT expects 2H11 revenues to exceed 1H11

Rebecca Kuo, Taipei; Jackie Chang, DIGITIMES [Wednesday 27 July 2011]

Light guide plate maker Global Lighting Technologies (GLT) will list on the TSE on July 28. According to GLT, the traditional boom season will enhance performance in the third quarter. Furthermore, shipments of large-size light guide plates have been growing continuously. Revenues in the second half of 2011 will be better than in the first half, added GLT.

GLT estimates 2011 revenues to reach NT$4 billion (US$139 million) with gross margin reaching 35%.

GLT reported after-tax profits of NT$257 million in 2010. The after-tax profits from first half of 2011 reached NT$269 million with EPS of NT$2.20. GLT expects increased capacity in the third and fourth quarters, hence EPS for 2011 is likely to reach NT$6.00.

According to GLT, light guide plates can be applied to products such as LED indoor lighting, TVs, and keypads for notebooks and smartphones. GLT noted that there are currently three production lines for large-size light guide plates for LED TVs in Taiwan with monthly capacity of 400,000 units. The plant in Suzhou, China will begin production in July.

With the additional capacity, total revenues for 2011 are expected to show a 30% on-year growth.

GLT plants to adopt micro-lens light guide plate technology of LED lighting to increase even brightness and decrease the number of LED chips used. GLT's main LED lighting clients are Unity Opto and Toshiba.

Rebecca Kuo, Taipei; Jackie Chang, DIGITIMES [Wednesday 27 July 2011]

Light guide plate maker Global Lighting Technologies (GLT) will list on the TSE on July 28. According to GLT, the traditional boom season will enhance performance in the third quarter. Furthermore, shipments of large-size light guide plates have been growing continuously. Revenues in the second half of 2011 will be better than in the first half, added GLT.

GLT estimates 2011 revenues to reach NT$4 billion (US$139 million) with gross margin reaching 35%.

GLT reported after-tax profits of NT$257 million in 2010. The after-tax profits from first half of 2011 reached NT$269 million with EPS of NT$2.20. GLT expects increased capacity in the third and fourth quarters, hence EPS for 2011 is likely to reach NT$6.00.

According to GLT, light guide plates can be applied to products such as LED indoor lighting, TVs, and keypads for notebooks and smartphones. GLT noted that there are currently three production lines for large-size light guide plates for LED TVs in Taiwan with monthly capacity of 400,000 units. The plant in Suzhou, China will begin production in July.

With the additional capacity, total revenues for 2011 are expected to show a 30% on-year growth.

GLT plants to adopt micro-lens light guide plate technology of LED lighting to increase even brightness and decrease the number of LED chips used. GLT's main LED lighting clients are Unity Opto and Toshiba.

Antwort auf Beitrag Nr.: 41.834.303 von R-BgO am 23.07.11 12:26:10ziemlich interessant der ganze Bereich und ganz interessante Artikel denke das koennte was werden...finde Aixtron und Rubicon ganz interessant...naja muss man mal gucken...gruesse CW

Antwort auf Beitrag Nr.: 41.852.655 von dicki31785 am 27.07.11 15:24:33lange nicht gelesen; schön Dich hier zu haben...

Aixtron (siehe auch #5) ist bisher meine größte LED-Posi

Aixtron (siehe auch #5) ist bisher meine größte LED-Posi

Taiwan Bureau of Energy responds to criticism from Everlight chairman

Bryan Chuang, Taipei; Jackie Chang, DIGITIMES [Thursday 28 July 2011]

Weak demand for LED TVs has been causing stress to LED firms. Robert Yeh, chairman of Everlight, recently pointed out the lack of supporting policies from Taiwan's government for the LED industry, despite the fact Taiwan produces the largest quantity of LED products in the world. Taiwan's Bureau of Energy from Ministry of Economic Affairs visited Yeh to explain government policies and indicated a further NT$120 million (US$4 million) subsidy to the LED industry in 2011.

Yeh recently criticized the government's green energy policies that passed in October 2009, which allocated NT$16,687 million to the solar industry and NT$3,975 million to the LED industry. Yeh pointed out that it is more expensive to provide subsidies for the solar industry to generate 1 KWh of electricity a day. For much less, the government can invest into the LED industry that conserves up to 24KWh of energy a day.

According to Bureau of Energy, the limited budget currently provides subsidies of NT$2.5 million, maximum of 100 LED street lamps, for every city and township. Even the procurement volume is not great, the government hopes citizens can also participate to conserve energy by using LED lights.

As for the large difference between the subsidies for solar and LED industries, the Bureau of Energy indicated that to compare the two is like comparing apples with oranges as the developments of the two industries require very different strategies.

The Bureau of Energy noted the two directions to increase domestic demand for LEDs. The first is outdoor lightings. There are several policies such as replacing street signal lights and street lamps with LED products. The second direction is to promote the usage of LED products for indoor lightings. The policies promote government institutions to procure energy-saving products with government certifications. The additional NT$120 million of subsidies will be used to promote the adoption of highly-efficient LED street lamps in hope to increase the overall quality of Taiwan's LED street lamps in order to compete in the global market.

The Bureau of Energy will also promote the standardization of street lamps and unification of power supply specifications.

Bryan Chuang, Taipei; Jackie Chang, DIGITIMES [Thursday 28 July 2011]

Weak demand for LED TVs has been causing stress to LED firms. Robert Yeh, chairman of Everlight, recently pointed out the lack of supporting policies from Taiwan's government for the LED industry, despite the fact Taiwan produces the largest quantity of LED products in the world. Taiwan's Bureau of Energy from Ministry of Economic Affairs visited Yeh to explain government policies and indicated a further NT$120 million (US$4 million) subsidy to the LED industry in 2011.

Yeh recently criticized the government's green energy policies that passed in October 2009, which allocated NT$16,687 million to the solar industry and NT$3,975 million to the LED industry. Yeh pointed out that it is more expensive to provide subsidies for the solar industry to generate 1 KWh of electricity a day. For much less, the government can invest into the LED industry that conserves up to 24KWh of energy a day.

According to Bureau of Energy, the limited budget currently provides subsidies of NT$2.5 million, maximum of 100 LED street lamps, for every city and township. Even the procurement volume is not great, the government hopes citizens can also participate to conserve energy by using LED lights.

As for the large difference between the subsidies for solar and LED industries, the Bureau of Energy indicated that to compare the two is like comparing apples with oranges as the developments of the two industries require very different strategies.

The Bureau of Energy noted the two directions to increase domestic demand for LEDs. The first is outdoor lightings. There are several policies such as replacing street signal lights and street lamps with LED products. The second direction is to promote the usage of LED products for indoor lightings. The policies promote government institutions to procure energy-saving products with government certifications. The additional NT$120 million of subsidies will be used to promote the adoption of highly-efficient LED street lamps in hope to increase the overall quality of Taiwan's LED street lamps in order to compete in the global market.

The Bureau of Energy will also promote the standardization of street lamps and unification of power supply specifications.

GlacialLight's LED panel lights have lowered customer's lighting bill by sixty-one percent

Press release [Monday 1 August 2011]

July 26, 2011, Taipei, Taiwan – GlacialLight, a sub-division of the experienced technology manufacturer GlacialTech Inc., is pleased to announce that their well-designed, environmentally-friendly lines of LED lighting products are being used in numerous applications around the world and providing users with energy-saving light of the highest quality. In the Taiwanese city of Kaohsiung, Marrons Cake Factory has greatly benefited by replacing their traditional T8 tube lights with GlacialLight's 595 x 595mm LED Panel Lights. Since the switch, Marrons has seen a 61% reduction in energy used for lighting, as well as better light quality. Like Marrons, consumers around the world, using GlacialLight's products, are reporting energy savings and increases in lighting quality.

With no perceptible flickering, GlacialLight's excellently designed LED Panel Lights have allowed Marrons Cake Factory to save money because of their exceptional lifespans and low power-consumption levels. The factory has replaced 720 traditional T8 tube lights (180 sets of four tubes) with a much lower number of GlacialLight LED Panel Lights. 120 GlacialLight Panel Lights now provide Marrons employees with better light quality while saving the company money. With employees enjoying better light quality and management enjoying bottom-line savings, everyone at Marrons has benefited.

GlacialLight is excited to see their product lines being used to make other businesses more successful and at the same time benefiting society as a whole by offering lighting products that have longer lifetimes and higher energy-saving levels, as compared to traditional lighting products, and that emit no harmful UV or IR radiation and contain no hazardous materials such as mercury.

Click here for more information on how consumers are using GlacialLight's products.

Excellent LED lighting products you can trust

Design of LED lighting products is based on three core technologies including electrical design (LED drivers), mechanical design (cooling devices), and optical design (lamp holders), respectively performed by GlacialPower, GlacialTech, and GlacialLight in the GlacialTech family. With the three core technologies in hand, GlacialTech has integrated all the resources required for exceptional designs and manufactures excellent LED lighting products you can trust.

Advantages and benefits of LED lighting compared to traditional lighting

1) Directional lighting: Ideal for flashlights/torches and spotlights

2) No warm-up time in cold environments: LEDs don't require warm-up time like conventional CFLs

3) No harmful radiation and no hazardous metals: LEDs don't emit harmful radiation such as Ultraviolet or Infrared emitting halogen lamps and don't contain hazardous metals such as mercury contained in mercury lamps

4) Extremely long lifetimes free users from frequent bulb replacement

5) Extremely small carbon footprints: An environmentally-friendly technology

Press release [Monday 1 August 2011]

July 26, 2011, Taipei, Taiwan – GlacialLight, a sub-division of the experienced technology manufacturer GlacialTech Inc., is pleased to announce that their well-designed, environmentally-friendly lines of LED lighting products are being used in numerous applications around the world and providing users with energy-saving light of the highest quality. In the Taiwanese city of Kaohsiung, Marrons Cake Factory has greatly benefited by replacing their traditional T8 tube lights with GlacialLight's 595 x 595mm LED Panel Lights. Since the switch, Marrons has seen a 61% reduction in energy used for lighting, as well as better light quality. Like Marrons, consumers around the world, using GlacialLight's products, are reporting energy savings and increases in lighting quality.

With no perceptible flickering, GlacialLight's excellently designed LED Panel Lights have allowed Marrons Cake Factory to save money because of their exceptional lifespans and low power-consumption levels. The factory has replaced 720 traditional T8 tube lights (180 sets of four tubes) with a much lower number of GlacialLight LED Panel Lights. 120 GlacialLight Panel Lights now provide Marrons employees with better light quality while saving the company money. With employees enjoying better light quality and management enjoying bottom-line savings, everyone at Marrons has benefited.

GlacialLight is excited to see their product lines being used to make other businesses more successful and at the same time benefiting society as a whole by offering lighting products that have longer lifetimes and higher energy-saving levels, as compared to traditional lighting products, and that emit no harmful UV or IR radiation and contain no hazardous materials such as mercury.

Click here for more information on how consumers are using GlacialLight's products.

Excellent LED lighting products you can trust

Design of LED lighting products is based on three core technologies including electrical design (LED drivers), mechanical design (cooling devices), and optical design (lamp holders), respectively performed by GlacialPower, GlacialTech, and GlacialLight in the GlacialTech family. With the three core technologies in hand, GlacialTech has integrated all the resources required for exceptional designs and manufactures excellent LED lighting products you can trust.

Advantages and benefits of LED lighting compared to traditional lighting

1) Directional lighting: Ideal for flashlights/torches and spotlights

2) No warm-up time in cold environments: LEDs don't require warm-up time like conventional CFLs

3) No harmful radiation and no hazardous metals: LEDs don't emit harmful radiation such as Ultraviolet or Infrared emitting halogen lamps and don't contain hazardous metals such as mercury contained in mercury lamps

4) Extremely long lifetimes free users from frequent bulb replacement

5) Extremely small carbon footprints: An environmentally-friendly technology

neuer Player:

MPI expanding production capacity of LED-packaging machines

Ingrid Lee, Taipei; Steve Shen, DIGITIMES [Wednesday 3 August 2011]

Probe card maker MJC Probe (MPI) is constructing a new factory aiming to ramp up its production capacity of LED-packaging machines, according to the company.

The new factory is to be completed in the fourth quarter of 2011 and will initially roll out 100-150 LED-packaging machines a month, in addition to current monthly production of 300 units, according to the company.

However, MPI expects its sales of probe cards to go up or down in a range of 5% sequentially in the third quarter of 2011 compared to a 10-15% growth enjoyed previously in the third quarter. The company shipped 800,000 probe cards in the second quarter, down from 880,000 units shipped in the first.

For the third quarter, MPI looks to a growth of 5-10% in revenues as shipments of LED sorting, probing and packaging machines will make up the slow sale in the probe card line, the company noted.

MPI expanding production capacity of LED-packaging machines

Ingrid Lee, Taipei; Steve Shen, DIGITIMES [Wednesday 3 August 2011]

Probe card maker MJC Probe (MPI) is constructing a new factory aiming to ramp up its production capacity of LED-packaging machines, according to the company.

The new factory is to be completed in the fourth quarter of 2011 and will initially roll out 100-150 LED-packaging machines a month, in addition to current monthly production of 300 units, according to the company.

However, MPI expects its sales of probe cards to go up or down in a range of 5% sequentially in the third quarter of 2011 compared to a 10-15% growth enjoyed previously in the third quarter. The company shipped 800,000 probe cards in the second quarter, down from 880,000 units shipped in the first.

For the third quarter, MPI looks to a growth of 5-10% in revenues as shipments of LED sorting, probing and packaging machines will make up the slow sale in the probe card line, the company noted.

Craton Equity Partners leads $60 million investment in Bridgelux

Date Announced: 03 Aug 2011

-- New Equity Financing to Accelerate Meeting Global Demand for LED Lighting

LOS ANGELES -- Craton Equity Partners, Southern California's leading clean tech private equity fund, today announced it has led a $60 million round in Series E financing for Bridgelux Inc., a leading developer and manufacturer of LED lighting technologies.

Existing financial and strategic investors also participated in the round, including VantagePoint Capital Partners, DCM, El Dorado Ventures, Novus Energy Partners, Invus Group, VTS, Harris & Harris Group and Passport Capital among others.

Bridgelux will use the new funding to extend its leadership position in the solid state lighting market by accelerating research and development in key areas of strategic focus for the company, including GaN-on-silicon development and LED chip-on-board architecture.

"We are thrilled to partner with Bridgelux at this important point in the company's growth trajectory as it advances new lighting technologies that are more efficient yet lower-cost," said Kevin Wall, managing partner, Craton Equity Partners.

"At Craton we continually strive to support standout sector leaders, like Bridgelux, that are positioned to address today's global clean energy challenges through the application of new technologies to massive markets."

"Craton Equity Partners is a top growth stage investor in clean tech, and we welcome their support as we work to expand the market for solid state solutions for general lighting - which we expect to triple this year to over $3 billion," said Bill Watkins, Bridgelux's Chief Executive Officer.

"This additional capital will accelerate our breakthrough development efforts in producing commercial grade LEDs on silicon and in creating new packaging solutions for our LED chips. We think our proprietary innovation in both of these areas is critical to driving market adoption."

David Asarnow, principal, Craton Equity Partners, will join the Bridgelux board as an observer.

About Craton Equity Partners

Craton is Southern California's largest exclusive clean tech private equity fund. Craton was recently announced as one of the top ten California clean technology funds by PE Hub. Craton focuses its investment strategies on a diverse set of subsectors from retail alternative fuels, to wastewater treatment technology, recycling and solid state lighting to a series of smart grid and energy efficiency technologies. Craton is located in Los Angeles, California. For more information visit www.cratonep.com.

About Bridgelux

Bridgelux is a leading developer and manufacturer of technologies and solutions transforming the $40 billion global lighting industry into a $100 billion market opportunity. Based in Livermore, California, Bridgelux is a pioneer in solid-state lighting (SSL), expanding the market for light-emitting diode (LED) technologies by driving down the cost of LED lighting systems. Bridgelux's patented light source technology replaces traditional technologies (such as incandescent, halogen, fluorescent and high intensity discharge lighting) with integrated, solid-state lighting solutions that enable lamp and luminaire manufacturers to provide high performance and energy-efficient white light for the rapidly growing interior and exterior lighting markets, including street lights, commercial lighting and consumer applications. With more than 500 patent applications filed or granted worldwide, Bridgelux is the only vertically integrated LED manufacturer and developer of solid-state light sources that designs its solutions specifically for the lighting industry. For more information about the company, please visit www.bridgelux.com.

Date Announced: 03 Aug 2011

-- New Equity Financing to Accelerate Meeting Global Demand for LED Lighting

LOS ANGELES -- Craton Equity Partners, Southern California's leading clean tech private equity fund, today announced it has led a $60 million round in Series E financing for Bridgelux Inc., a leading developer and manufacturer of LED lighting technologies.

Existing financial and strategic investors also participated in the round, including VantagePoint Capital Partners, DCM, El Dorado Ventures, Novus Energy Partners, Invus Group, VTS, Harris & Harris Group and Passport Capital among others.

Bridgelux will use the new funding to extend its leadership position in the solid state lighting market by accelerating research and development in key areas of strategic focus for the company, including GaN-on-silicon development and LED chip-on-board architecture.

"We are thrilled to partner with Bridgelux at this important point in the company's growth trajectory as it advances new lighting technologies that are more efficient yet lower-cost," said Kevin Wall, managing partner, Craton Equity Partners.

"At Craton we continually strive to support standout sector leaders, like Bridgelux, that are positioned to address today's global clean energy challenges through the application of new technologies to massive markets."

"Craton Equity Partners is a top growth stage investor in clean tech, and we welcome their support as we work to expand the market for solid state solutions for general lighting - which we expect to triple this year to over $3 billion," said Bill Watkins, Bridgelux's Chief Executive Officer.

"This additional capital will accelerate our breakthrough development efforts in producing commercial grade LEDs on silicon and in creating new packaging solutions for our LED chips. We think our proprietary innovation in both of these areas is critical to driving market adoption."

David Asarnow, principal, Craton Equity Partners, will join the Bridgelux board as an observer.

About Craton Equity Partners

Craton is Southern California's largest exclusive clean tech private equity fund. Craton was recently announced as one of the top ten California clean technology funds by PE Hub. Craton focuses its investment strategies on a diverse set of subsectors from retail alternative fuels, to wastewater treatment technology, recycling and solid state lighting to a series of smart grid and energy efficiency technologies. Craton is located in Los Angeles, California. For more information visit www.cratonep.com.

About Bridgelux

Bridgelux is a leading developer and manufacturer of technologies and solutions transforming the $40 billion global lighting industry into a $100 billion market opportunity. Based in Livermore, California, Bridgelux is a pioneer in solid-state lighting (SSL), expanding the market for light-emitting diode (LED) technologies by driving down the cost of LED lighting systems. Bridgelux's patented light source technology replaces traditional technologies (such as incandescent, halogen, fluorescent and high intensity discharge lighting) with integrated, solid-state lighting solutions that enable lamp and luminaire manufacturers to provide high performance and energy-efficient white light for the rapidly growing interior and exterior lighting markets, including street lights, commercial lighting and consumer applications. With more than 500 patent applications filed or granted worldwide, Bridgelux is the only vertically integrated LED manufacturer and developer of solid-state light sources that designs its solutions specifically for the lighting industry. For more information about the company, please visit www.bridgelux.com.

habe mir mal ein paar Aixtron zugelegt...heute ist auch RBCN mit earnings dran...die Aktien sind sowas von ausgebombt...naja schaun wir mal...mfg CW

Antwort auf Beitrag Nr.: 41.891.351 von dicki31785 am 04.08.11 13:22:02habe mir heute ein paar Rubicon geholt; sie scheinen weniger vom Preisrückgang betroffen, weil sie mehr große Wafer machen.

weiß leider nicht genau, inwiefern die möglicherweise in andere Zielmärkte als die kleinen gehen...

weiß leider nicht genau, inwiefern die möglicherweise in andere Zielmärkte als die kleinen gehen...

Antwort auf Beitrag Nr.: 41.900.741 von R-BgO am 05.08.11 14:20:02aber der Outlook war schon recht bitter habe mir noch nicht den CC angehoert...weisst du warum Rev guidance so "light" war...gruesse CW

China-based Tsinghua Tongfang plans to expand MOCVD capacity

Jessie Lin, Nantong; Jackie Chang, DIGITIMES [Tuesday 9 August 2011]

China-based Tsinghua Tongfang held a ceremony for the beginning of production at its semiconductor and LED base in Nantong, China on August 8. The completion of the base, which includes organizing the property, building the plant, and beginning production of LEDs took only one year. It shows the determination of China-based firms to develop the LED industry mapped out by China's 12th five-year plan.

There are currently six MOCVD sets in Beijing, according to Tsinghua Tongfang, and its plans to add another 100 units at the Nantong plant in two phases. Tsinghua Tongfang indicated the MOCVD machines are mainly from Veeco and Aixtron.

The production of LED wafers will begin with 2-inch units, and the company plans to kick-off 4-inch production in the second quarter of 2012, according to Tsinghua Tongfang. The first phase of investment in Nantong will reach CNY3 billion (US$466 million) with CNY1 billion for MOCVD crystal growing furnaces and CNY2 billion for LED wafer production.

According to Tsinghua Tongfang, the LED department will bring in revenues of CNY2.1-2.3 billion in 2011 with LED chips contributing CNY300-400 million in revenues. The Nantong base will contribute around CNY100 million and applications will bring in close to CNY2 billion. LED TV backlight modules account for 65% of applications, added Tsinghua Tongfang.

Tsinghua Tongfang hopes to increase annual capacity of LED TV backlight modules to five million units from the current 3.5-4 million units by the second quarter of 2012.

As for the LED lighting market, Tsinghua Tongfang pointed out the importance of cost. For the market for LED light bulbs to grow effectively, cost needs to be lower to stimulate demand.

Indoor lighting will likely to grow in places that use lights for a long period of time. Which means the total cost of using LED lights in such areas will be lower than the cost of using traditional lighting, said Tsinghua Tongfang.

China's LED streetlights and tunnel lights will become the world's largest regional market for LED outdoor lights, Tsinghua Tongfang concluded.

Jessie Lin, Nantong; Jackie Chang, DIGITIMES [Tuesday 9 August 2011]

China-based Tsinghua Tongfang held a ceremony for the beginning of production at its semiconductor and LED base in Nantong, China on August 8. The completion of the base, which includes organizing the property, building the plant, and beginning production of LEDs took only one year. It shows the determination of China-based firms to develop the LED industry mapped out by China's 12th five-year plan.

There are currently six MOCVD sets in Beijing, according to Tsinghua Tongfang, and its plans to add another 100 units at the Nantong plant in two phases. Tsinghua Tongfang indicated the MOCVD machines are mainly from Veeco and Aixtron.

The production of LED wafers will begin with 2-inch units, and the company plans to kick-off 4-inch production in the second quarter of 2012, according to Tsinghua Tongfang. The first phase of investment in Nantong will reach CNY3 billion (US$466 million) with CNY1 billion for MOCVD crystal growing furnaces and CNY2 billion for LED wafer production.

According to Tsinghua Tongfang, the LED department will bring in revenues of CNY2.1-2.3 billion in 2011 with LED chips contributing CNY300-400 million in revenues. The Nantong base will contribute around CNY100 million and applications will bring in close to CNY2 billion. LED TV backlight modules account for 65% of applications, added Tsinghua Tongfang.

Tsinghua Tongfang hopes to increase annual capacity of LED TV backlight modules to five million units from the current 3.5-4 million units by the second quarter of 2012.

As for the LED lighting market, Tsinghua Tongfang pointed out the importance of cost. For the market for LED light bulbs to grow effectively, cost needs to be lower to stimulate demand.

Indoor lighting will likely to grow in places that use lights for a long period of time. Which means the total cost of using LED lights in such areas will be lower than the cost of using traditional lighting, said Tsinghua Tongfang.

China's LED streetlights and tunnel lights will become the world's largest regional market for LED outdoor lights, Tsinghua Tongfang concluded.

LED Manufacturers Navigate Near-Term Headwinds for Long-Term Profits

The Bedford Report Provides Equity Research on Cree and Rubicon Technology

NEW YORK, NY, Aug 11, 2011 (MARKETWIRE via COMTEX) -- The LED market is experiencing significant headwinds this year as reports from DIGITIMES argue that low orders in July and decreasing growth and prices are hindering the sector's recovery. Long term forecasts remain positive, however, as several countries continue to push for the energy efficiency LEDs offer. The Bedford Report examines the outlook for companies in the semiconductor industry and provides stock research on Cree, Inc. CREE +6.90% and Rubicon Technology, Inc. RBCN +7.98% . Access to the full company reports can be found at:

www.bedfordreport.com/CREE

www.bedfordreport.com/RBCN

The current downturn in the LED market is largely due to reduced prices for LED-based TV backlight and lighting systems. This is because of inventory adjustments, and increased competition from more backlight makers entering the LED lighting makers.

Rubicon Technology CEO Raja Parvez said in a statement that "prolonged weakness in the LED backlighting market is now having an impact" on demand. Parvez says that current pricing for two through four inch diameter cores is "down as much as 60 percent sequentially."

The Bedford Report releases investment research on the semiconductor equipment and materials industry so investors can stay ahead of the crowd and make the best investment decisions to maximize their returns. Take a few minutes to register with us free at www.bedfordreport.com and get exclusive access to our numerous analyst reports and industry newsletters.

In the long term, the industry's prospects remain bright. Reports from Frost & Sullivan claim that the light emitting diode (LED) market is primed to grow explosively in the next several years. The study estimated that the market, which earned revenues of almost half a billion in 2010, could reach as high as $2 billion in 2017.

Earlier this week Cree reported a fiscal fourth quarter profit of $19.8 million, or 18 cents a share, down from $52.8 million, or 48 cents a share, a year earlier. For the first-quarter the company forecast profit of 25 cents to 28 cents a share, excluding certain expenses, with revenue between $245 million and $255 million.

The Bedford Report provides Market Research focused on equities that offer growth opportunities, value, and strong potential return. We strive to provide the most up-to-date market activities. We constantly create research reports and newsletters for our members. The Bedford Report has not been compensated by any of the above-mentioned publicly traded companies. The Bedford Report is compensated by other third party organizations for advertising services. We act as an independent research portal and are aware that all investment entails inherent risks. Please view the full disclaimer at http://www.bedfordreport.com/disclaimer .

The Bedford Report Provides Equity Research on Cree and Rubicon Technology

NEW YORK, NY, Aug 11, 2011 (MARKETWIRE via COMTEX) -- The LED market is experiencing significant headwinds this year as reports from DIGITIMES argue that low orders in July and decreasing growth and prices are hindering the sector's recovery. Long term forecasts remain positive, however, as several countries continue to push for the energy efficiency LEDs offer. The Bedford Report examines the outlook for companies in the semiconductor industry and provides stock research on Cree, Inc. CREE +6.90% and Rubicon Technology, Inc. RBCN +7.98% . Access to the full company reports can be found at:

www.bedfordreport.com/CREE

www.bedfordreport.com/RBCN

The current downturn in the LED market is largely due to reduced prices for LED-based TV backlight and lighting systems. This is because of inventory adjustments, and increased competition from more backlight makers entering the LED lighting makers.

Rubicon Technology CEO Raja Parvez said in a statement that "prolonged weakness in the LED backlighting market is now having an impact" on demand. Parvez says that current pricing for two through four inch diameter cores is "down as much as 60 percent sequentially."

The Bedford Report releases investment research on the semiconductor equipment and materials industry so investors can stay ahead of the crowd and make the best investment decisions to maximize their returns. Take a few minutes to register with us free at www.bedfordreport.com and get exclusive access to our numerous analyst reports and industry newsletters.

In the long term, the industry's prospects remain bright. Reports from Frost & Sullivan claim that the light emitting diode (LED) market is primed to grow explosively in the next several years. The study estimated that the market, which earned revenues of almost half a billion in 2010, could reach as high as $2 billion in 2017.

Earlier this week Cree reported a fiscal fourth quarter profit of $19.8 million, or 18 cents a share, down from $52.8 million, or 48 cents a share, a year earlier. For the first-quarter the company forecast profit of 25 cents to 28 cents a share, excluding certain expenses, with revenue between $245 million and $255 million.

The Bedford Report provides Market Research focused on equities that offer growth opportunities, value, and strong potential return. We strive to provide the most up-to-date market activities. We constantly create research reports and newsletters for our members. The Bedford Report has not been compensated by any of the above-mentioned publicly traded companies. The Bedford Report is compensated by other third party organizations for advertising services. We act as an independent research portal and are aware that all investment entails inherent risks. Please view the full disclaimer at http://www.bedfordreport.com/disclaimer .

LEDs may have reached "tipping point" with electrical contractors

10 Aug 2011

A survey of 700 readers of Electrical Contractor magazine showed a majority of contractors believe LEDs are either now ready to replace incandescent and fluorescent lamps or will be ready by the Fall of 2012.

Electrical contractors may be reaching the point where specification and installation of LED lighting, where appropriate, is becoming the rule and not the exception.

Results of a survey of 700 readers of Electrical Contractor magazine indicate a majority of electrical contractors believe LED lamps are now ready or will be ready within a year to replace incandescent and fluorescent lamps.

The publisher of Electrical Contractor, John Maisel, said, “The more we educate [electrical contractors] on the technology and opportunities in the multibillion dollar LED market that’s growing more than 30 percent per year, the greater value they bring to their customers." Electrical Contractor, which reaches over 85,000 electrical contractors in the US, is published by the National Electrical Contractors Association (NECA) in Bethesda, MD.

Among those readers who responded to the survey, 33 percent of electrical contractors said LEDs are ready to replace incandescent lamps, compared with 23 percent saying LEDs are ready to replace CFLs and 19 percent claiming LEDs are ready to replace fluorescent lamps (see figure).

Market readiness for LED replacement

An additional 33 percent of electrical contractors believe LEDs will be ready to replace these traditional lamp sources within the next two years. The remaining respondents see LEDs becoming more viable later, or they “don’t know” when viability will occur. Of those who said LEDs were not ready or they didn’t know, 19 percent said that high cost was a factor, while 10 percent mentioned needed improvements in performance.

The survey was conducted by the firm Renaissance Research & Consulting (New York, NY) in the Fall of 2010. Participants included contractors working on residential projects, commercial/industrial/institutional (CII) projects and non-building projects (see figure).

All things to all people?

Lighting is an inherent part of the electrical contractor’s job. As such, it comes as little surprise that 97 percent of respondents indicated they work with indoor or outdoor fixtures (on a combined basis), while 95 percent perform work with lamps, 93 percent with ballasts and 85 percent with controls.

A substantial portion, between 45 and 60 percent of electrical contractors, perform all functions on the job including buying, specifying and installing lighting products. Ninety percent of contractors perform some lamp work, while about 60 percent work on all aspects, meaning they specify and install lamps.

Regarding lamp types, contractors mentioned fluorescent and compact fluorescent lamps the most, while LEDs actually were mentioned the least. However, the report says “ECs are proportionately more involved in LED specification than with other lamp types.”

LEDs on building projects

Beyond this recent survey, Electrical Contractor featured a special supplement entitled The LED Revolution, with its July issue. With articles addressing initial cost and payback, dimming and required drivers, compatibility with controls and LED standards, the issue provides a useful overview to contractors and distributors.

Out of the readership survey came important tips for electrical contractors. For instance, contractors should specify LED luminaires with well-designed optics to ensure the light reaches the intended surfaces. Controls are considered the largest contributor to improved efficiency through sophisticated addressable ballasts along with daylight and motion sensors.

10 Aug 2011

A survey of 700 readers of Electrical Contractor magazine showed a majority of contractors believe LEDs are either now ready to replace incandescent and fluorescent lamps or will be ready by the Fall of 2012.

Electrical contractors may be reaching the point where specification and installation of LED lighting, where appropriate, is becoming the rule and not the exception.

Results of a survey of 700 readers of Electrical Contractor magazine indicate a majority of electrical contractors believe LED lamps are now ready or will be ready within a year to replace incandescent and fluorescent lamps.

The publisher of Electrical Contractor, John Maisel, said, “The more we educate [electrical contractors] on the technology and opportunities in the multibillion dollar LED market that’s growing more than 30 percent per year, the greater value they bring to their customers." Electrical Contractor, which reaches over 85,000 electrical contractors in the US, is published by the National Electrical Contractors Association (NECA) in Bethesda, MD.

Among those readers who responded to the survey, 33 percent of electrical contractors said LEDs are ready to replace incandescent lamps, compared with 23 percent saying LEDs are ready to replace CFLs and 19 percent claiming LEDs are ready to replace fluorescent lamps (see figure).

Market readiness for LED replacement

An additional 33 percent of electrical contractors believe LEDs will be ready to replace these traditional lamp sources within the next two years. The remaining respondents see LEDs becoming more viable later, or they “don’t know” when viability will occur. Of those who said LEDs were not ready or they didn’t know, 19 percent said that high cost was a factor, while 10 percent mentioned needed improvements in performance.

The survey was conducted by the firm Renaissance Research & Consulting (New York, NY) in the Fall of 2010. Participants included contractors working on residential projects, commercial/industrial/institutional (CII) projects and non-building projects (see figure).

All things to all people?

Lighting is an inherent part of the electrical contractor’s job. As such, it comes as little surprise that 97 percent of respondents indicated they work with indoor or outdoor fixtures (on a combined basis), while 95 percent perform work with lamps, 93 percent with ballasts and 85 percent with controls.

A substantial portion, between 45 and 60 percent of electrical contractors, perform all functions on the job including buying, specifying and installing lighting products. Ninety percent of contractors perform some lamp work, while about 60 percent work on all aspects, meaning they specify and install lamps.

Regarding lamp types, contractors mentioned fluorescent and compact fluorescent lamps the most, while LEDs actually were mentioned the least. However, the report says “ECs are proportionately more involved in LED specification than with other lamp types.”

LEDs on building projects

Beyond this recent survey, Electrical Contractor featured a special supplement entitled The LED Revolution, with its July issue. With articles addressing initial cost and payback, dimming and required drivers, compatibility with controls and LED standards, the issue provides a useful overview to contractors and distributors.

Out of the readership survey came important tips for electrical contractors. For instance, contractors should specify LED luminaires with well-designed optics to ensure the light reaches the intended surfaces. Controls are considered the largest contributor to improved efficiency through sophisticated addressable ballasts along with daylight and motion sensors.

...gefährlich für RBCN & Co.?:

Bridgelux hits 160 lm/W in lab with LEDs produced using GaN on Silicon

09 Aug 2011

Using Gallium Nitride on 8-in Silicon wafers, Bridgelux is achieving LED efficacy in the lab on par with LEDs produced on sapphire or silicon carbide wafers.

Bridgelux announced that it has fabricated LEDs in the lab using Gallium-on-Silicon (GaN-on-Si) technology that delivers 160 lm/W (cool white) and 125 lm/W (warm white) efficacy. The performance realized using 8-in wafers is similar to the best efficacy demonstrated in the lab by leading LED vendors using traditional sapphire or silicon carbide wafers, and Bridgelux believes the GaN-on-Si approach will ultimately yield a "75% inmrovement in cost" for LED components that will in turn reduce the cost of solid-state-lighting (SSL) lamps and luminaires.

The new LEDs deliver a cool-white CCT of 4350K and a warm white CCT of 2940K. The warm white devices have a CRI of 80. The company said that its 1.5-mm blue LEDs can deliver wall-plug efficiency as high as 59% at 350 mA – and says that exceeds any published values from other vendors. The company also claims waveform uniformity of sigma 6.8 nm with a median wavelength of 455 nm.

Getting from the lab to production

Of course the Bridgelux announcement is focused on lab prototypes and production is perhaps two years away. Still it shows progress. Back in March, the company announced the demonstration of 135 lm/W LEDs. Since, the company was able to both boost efficacy considerably and demonstrate that performance on 8-in substrates that are, in large part, a key to lower-cost components.

Bridgelux VP of global marketing Jason Posselt said, "It's important that we demonstrated this on an 8-in wafer." Posselt also believes that Bridgelux has largely closed the performance gap relative to sapphire-based LEDs. Bridgelux's silicon-based LEDs appeared to be 12 to 18 months behind state-of-the-art LEDs in terms of efficacy at the public launch of the company's GaN-on-Si program.

But Posselt acknowledged the challenge that remains in terms of commercializing the technology. The company is building wafers that yield as many as a thousand good die now and ultimately they need to produce 20,000 good die on an 8-in wafer.

Silicon cost advantages

The allure of silicon-based LEDs is purely cost and the savings come in two primary areas. First, the semiconductor industry has the proven ability to manufacture low-cost large silicon wafers. Silicon would both lower baseline wafer cost and pave a smoother transition to larger wafer sizes. Long Yang, vice president of chip technology at Bridgelux, noted that you can get the equivalent number of LEDs from 3 8-in silicon wafers that you get from 42 2-in sapphire wafers today.

The second set of savings come in the back-end of the manufacturing process where fully-depreciated, and fully-automated silicon fabs stand ready to fabricate LEDs. Posselt said "Typical LED fabs are very labor intensive, and not automated like silicon fabs." And those automated fabs are ready to handle 8-in wafers and the far greater number of die on those wafers.

Of course there are technical challenges that stand in the way of a silicon transition as well as skeptics of the economic story. In an informal poll of people at the recent Semicon trade show, many pointed out that a move to silicon doesn't impact the most-expensive part of an LED factory – the MOCVD reactor. Bridgelux's Yang said that the MOCVD reactor represents 40% of the capital expenditure in an LED fab line. He believes there is substantial savings to be had in utilizing automated semiconductor systems for the remainder of the manufacturing process.

Challenges to silicon wafers

Among the challenges to GaN-on-Si technology is the thermal mismatch between the silicon wafer and the GaN layers. That mismatch can lead to cracking in the GaN layers and bowed wafers either during the epitaxial growth process or later at room temperature. Bridgelux says it has solved that problem with a proprietary buffer layer that delivers crack-free "virtually flat" 8-in wafers.

When asked about the remaining challenges, Long mentioned two important milestones and a significant challenge. Yang said, "We need to convert our process to be fully 8-in compatible." He said that Bridgelux is well along in that effort and would complete it soon. The second milestone will be achieving better uniformity across the wafer in the MOCVD reactor, followed by large runs of wafers in pilot production."

Transferable recipe

Long sees the primary challenge as developing a transferable process or recipe. He noted that even the same model of MOCVD reactor have inherent differences. And Bridgelux must develop a recipe that first is usable across the same MOCVD model and subsequently to different reactor models from the same vendor and later to reactors from different vendors. But the company could go into production once it can reliably transfer the process across the same model MOCVD reactor from a single vendor. Bridgelux is working with a single unnamed MOCVD reactor vendor for now.

Assuming, Bridgelux overcomes the technical hurdles, Yang sees other advantages in the GaN-on-Si technology. He said "It's easier to control variations when you load wafers into equipment with robots." Basically he is saying that robotics will yield more consistent components and better yield. Certainly LED manufacturing on sapphire and silicon carbide is evolving toward more automated processes, but that takes time and money.

Meanwhile those silicon fabs stand ready and Bridgelux hopes to partner with a company that can bring expertise in silicon-manufacturing to the table. Posselt asked, "How to we bridge the gap between the opto LED and the semiconductor space?" Presumbaly the answer is a partner that for now is either unidentified or unnamed.

Bridgelux CTO Steve Lester is clearly confident in the progress. He said, "We are very pleased with the pace of our progress in this area, and we will continue to aggressively develop our GaN-on-Si processes in order to drive the migration of LED commercial production from sapphire to silicon substrates. Our first commercially available GaN-on-Si products remain on schedule for delivery to the market within the next two years."