ZGNX nächster Turnaroundwert mit großem Potential - 500 Beiträge pro Seite

eröffnet am 30.11.11 23:50:09 von

neuester Beitrag 21.04.15 10:53:47 von

neuester Beitrag 21.04.15 10:53:47 von

Beiträge: 172

ID: 1.170.742

ID: 1.170.742

Aufrufe heute: 0

Gesamt: 23.798

Gesamt: 23.798

Aktive User: 0

ISIN: US98978L2043 · WKN: A14V7E

26,67

USD

+1,56 %

+0,41 USD

Letzter Kurs 05.03.22 NYSE

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5800 | +922,86 | |

| 0,8800 | +95,56 | |

| 384,00 | +20,00 | |

| 3,0980 | +19,34 | |

| 3,0650 | +18,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5000 | -24,62 | |

| 14,510 | -32,32 | |

| 71,33 | -33,92 | |

| 3,6400 | -38,62 | |

| 0,7000 | -61,85 |

TICKER: ZGNX

Kurs: $1.80

Börse: Nasdaq

Mein Kursziel: $ 5.00

52-Week High: $ 6.90

Mkt Cap (Mil) 117.33

Shares Out (Mil) 65.18

Float (Mil) 11.24

Insider buys: http://www.insidercow.com/history/company.jsp?company=zgnx&B…

Kurs: $1.80

Börse: Nasdaq

Mein Kursziel: $ 5.00

52-Week High: $ 6.90

Mkt Cap (Mil) 117.33

Shares Out (Mil) 65.18

Float (Mil) 11.24

Insider buys: http://www.insidercow.com/history/company.jsp?company=zgnx&B…

DD on ZGNX 100 Mill $$$ Mkt Cap 71 Mill in Cash & approved Migraine drug doing 40 mill in sales 2011 & projected to do 80 mill in 2012 BUT their big dollar drug has phase 3 trials completed & positive on their ( First to Market ) Extended release Hydrocodone drug & also ( First to Market ) APAP free or Acetaminophen free ( causes Liver Toxicity) & FDA cracking down on it. ZGNX according to last CC has already been approached by Pharmas looking to partner up on drug & will make a decision in early 2012 whether to partner or go alone. Why go alone ??? Huge market for Hydrocodone ( Over 6 Billion Dollars a Year ) & Oppenhiemer has opined that ZGNX drug will do around 500 Million a year in sales. Insiders know the potential & have bought over 56% of the total outstanding shares 36.4 Million shares including the 7.1 Million shares purchased in September. Coupled with the 18 Million shares just purchased in the last 3 months by Institutions which now totals over 25 million shares & growing . BTW 18 million shares bought 11 thousand shares sold ???? FLOAT is around 4 Million shares 4 MILLION ...This is a sure shot double/triple/??? easily could be another INHX $2 to $10 quickly on FDA or Partner news or a straight buyout..INSANE Valuation here

ZGNX webcast von gestern

http://ir.zogenix.com/phoenix.zhtml?c=220862&p=irol-IRHome

http://ir.zogenix.com/phoenix.zhtml?c=220862&p=irol-IRHome

From S.E.C. filing of latest 10Q

As of September 30, 2011, we had cash and cash equivalents of $70.8 million. We believe that our cash and cash equivalents as of September 30, 2011, together with future revenue and borrowings available under our $10.0 million revolving credit facility, will be sufficient to fund our operations into the second quarter of 2013.

As of September 30, 2011, we had cash and cash equivalents of $70.8 million. We believe that our cash and cash equivalents as of September 30, 2011, together with future revenue and borrowings available under our $10.0 million revolving credit facility, will be sufficient to fund our operations into the second quarter of 2013.

Ich habe noch nie einen Wert gesehen bei dem die Insiderkäufe im Vergleich zu den außenstehenden Aktien zu extrem sind.

Hier kommt was auf jeden Fall.

ZGNX ist keine Tradingaktie, sondern ein Investment.

Im ersten Quartal 2012 wird das Migränemedikamet von ZGNX entweder von FDA zugelassen oder nicht.

Aktuell sind ca. 900.000 short.

Hier kommt was auf jeden Fall.

ZGNX ist keine Tradingaktie, sondern ein Investment.

Im ersten Quartal 2012 wird das Migränemedikamet von ZGNX entweder von FDA zugelassen oder nicht.

Aktuell sind ca. 900.000 short.

ZGNX ist aktuell mit dem 1.65 fachen des Cashbestands bewertet.

LÄCHERLICH!

LÄCHERLICH!

Antwort auf Beitrag Nr.: 42.424.648 von Kursziel1000 am 01.12.11 11:59:53Alleinunterhalter??? Naja, nicht viel zu finden, aber seit einigen Tagen gehts langsam hoch....es sieht zumindest mal nicht schlecht aus

!

Dieser Beitrag wurde von MODernist moderiert. Grund: auf eigenen Wunsch des Users

Antwort auf Beitrag Nr.: 42.456.491 von sebirem am 08.12.11 18:18:26wobei ein Reverse nicht schlimm ist, sofern er nur alle paar "Jubeljahre"

geschieht!

Der Wert wird erst wieder um die 1-1,25 USD heiß und dann wäre ich dabei

also abwarten...

geschieht!

Der Wert wird erst wieder um die 1-1,25 USD heiß und dann wäre ich dabei

also abwarten...

Antwort auf Beitrag Nr.: 42.463.336 von sebirem am 10.12.11 09:13:07Dann sag mir bitte mal wie die Insider buys bei $2 erklärst, wenn die Aktie auf $1 fallen wird lol

Ich bin gespannt...

Ich bin gespannt...

Antwort auf Beitrag Nr.: 42.456.491 von sebirem am 08.12.11 18:18:26GENTA ist ne Bruchbude und kurz vor dem Bankkrott im Vergleich zu ZGNX.

Des weiteren ist ZGNX an der Nasdaq gelistet und nicht wie GENTA am Bulletin Board OTC.

Des weiteren ist ZGNX an der Nasdaq gelistet und nicht wie GENTA am Bulletin Board OTC.

Antwort auf Beitrag Nr.: 42.464.097 von Kursziel1000 am 10.12.11 15:56:48(wollte hier kein Vergleich ziehen...

Genta ist natürlich ne Bruchbude und =0 Wert!!)

Ja das mit den Insiderkäufen ist schon interessant!

Kann sicherlich nur noch interessanter werden, momentan bleibe

ich noch an der Seitenlinie.

Tja so ist das,sehr spekulativ, aber denke die Range die ich mir hier gesetzt habe,ist in Ordnung. Ansonsten habe ich leider pech gehabt, wenn

der Wert explodieren sollte

Wir werden sehen!

Genta ist natürlich ne Bruchbude und =0 Wert!!)

Ja das mit den Insiderkäufen ist schon interessant!

Kann sicherlich nur noch interessanter werden, momentan bleibe

ich noch an der Seitenlinie.

Tja so ist das,sehr spekulativ, aber denke die Range die ich mir hier gesetzt habe,ist in Ordnung. Ansonsten habe ich leider pech gehabt, wenn

der Wert explodieren sollte

Wir werden sehen!

Antwort auf Beitrag Nr.: 42.464.184 von sebirem am 10.12.11 16:48:50Die extremen Isiderkäufe machen für mich den Wert konservativ.

Hast jemals so heftige Insiderkäufe bei einem Wert gesehen?

Bei mir ist das schon sehr lange her...

Hast jemals so heftige Insiderkäufe bei einem Wert gesehen?

Bei mir ist das schon sehr lange her...

ZGNX news - Zogenix Completes Zohydro(TM) Pre-NDA Meetings With FDA

Zohydro NDA Submission on Track

SAN DIEGO, Dec. 20, 2011 (GLOBE NEWSWIRE) -- Zogenix, Inc. (Nasdaq:ZGNX - News), a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain, today announced that it has concluded its pre-New Drug Application (NDA) meetings with the U.S. Food & Drug Administration (FDA) related to its lead investigational product candidate, Zohydro(TM) (hydrocodone bitartrate extended-release capsules). The purpose of the meetings was to discuss the non-clinical, clinical and Chemistry, Manufacturing and Controls (CMC) development of Zohydro, and to agree on the submission requirements for the NDA submission under 505(b)(2) of the Federal Food, Drug, and Cosmetic Act. After a detailed review of the submission timeline, Zogenix plans to submit the NDA for Zohydro early in the second quarter of 2012.

Stephen Farr, PhD, president and chief operating officer of Zogenix, said, "The completion of our pre-NDA meetings with the FDA brings us one more important step closer to potentially gaining approval for Zohydro. We appreciate the informative interactions, timeliness, and clarity provided by the FDA, as well as the full support of Alkermes, our CMC partner, in the pre-NDA meeting process."

Zohydro is being evaluated for the management of moderate to severe chronic pain in patients requiring continuous around-the-clock opioid therapy for an extended period of time. If approved, Zohydro could be the first extended-release hydrocodone therapy available without acetaminophen, which is associated with an increased risk of liver toxicity when used in high doses over time.

Hydrocodone pain products represent the largest prescription drug category in the United States, with over 128 million prescriptions filled in 2010. The Company believes Zohydro's ability to provide consistent 12-hour pain relief, without exposure to acetaminophen, will position the product well in this large market.

About Zohydro

Zohydro is a novel, oral, single entity (without acetaminophen) extended-release capsule formulation of hydrocodone bitartrate. When used in high dosages over time, acetaminophen can cause liver toxicity. If approved, Zohydro could be the first single-entity hydrocodone therapy available. Zohydro uses Alkermes' patented Spheriodal Oral Drug Absorption System (SODAS(R)) drug delivery technology which serves to enhance the release profile of hydrocodone to provide consistent 12-hour pain relief relative to existing immediate release combination products. Capsule strengths utilized in the Phase 3 studies included 10, 20, 30, 40 and 50 mg capsules.

About Chronic Pain

The American Pain Society estimated in 1999 that 9% of the U.S. adult population suffers from moderate to severe non-cancer related chronic pain. Chronic pain can be treated with both immediate-release and extended-release opioids. Marketed hydrocodone products are the most commonly prescribed pharmaceuticals in the U.S., generating $3.2 billion in sales during the 12 months ended December 2010 (Wolters Kluwer Pharma Solutions, Source Pharmaceutical Audit Suite Retail, January 2010 -- December 2010). All of these hydrocodone products contain an analgesic combination ingredient, primarily acetaminophen. Acetaminophen may cause liver toxicity when used in high dosages over time.

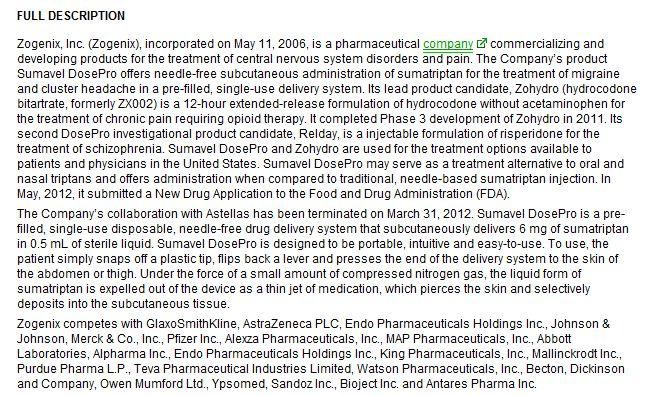

About Zogenix

Zogenix, Inc. (Nasdaq:ZGNX - News), with offices in San Diego and Emeryville, California, is a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain. Zogenix's first commercial product, SUMAVEL(R) DosePro(R) (sumatriptan injection) Needle-free Delivery System, was launched in January 2010 for the acute treatment of migraine and cluster headache. Zogenix's lead investigational product candidate, Zohydro(TM) (hydrocodone bitartrate), is a novel, oral, single-entity (without acetaminophen) extended-release capsule formulation currently in Phase 3 clinical trials for the management of moderate to severe chronic pain in patients requiring around-the-clock opioid therapy. Zogenix's second investigational DosePro product candidate, Relday(TM), is a proprietary, long-acting injectable formulation of risperidone for the treatment of schizophrenia.

Forward Looking Statements

Zogenix cautions you that statements included in this press release that are not a description of historical facts are forward-looking statements. Words such as "believes," "anticipates," "plans," "expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended to identify forward-looking statements. These statements are based on the company's current beliefs and expectations. These forward-looking statements include statements regarding: the potential for, and timing of, an NDA submission for Zohydro; the potential for Zohydro to be the first approved oral, single-entity extended-release formulation of hydrocodone; and the size of the opioid pain market and the potential of Zohydro to be well positioned in that market. The inclusion of forward-looking statements should not be regarded as a representation by Zogenix that any of its plans will be achieved. Actual results may differ from those set forth in this release due to the risk and uncertainties inherent in Zogenix's business, including, without limitation: the top-line data Zogenix has reported for Zohydro is based on preliminary analysis of key efficacy and safety data, and such data may change following a more comprehensive review of the data related to the clinical trial, and may also change in connection with the continued review of such data as part of Zogenix's planned submission and the FDA's review of the NDA for Zohydro; the progress, timing and results of the planned bioequivalence study for Zohydro; the potential that earlier clinical trials may not be predictive of future results; the potential for Zohydro to receive regulatory approval on a timely basis or at all; the potential for adverse safety findings relating to Zohydro to delay or prevent regulatory approval or commercialization; the impact of any inability to raise sufficient capital to fund ongoing operations; the ability of Zogenix and its licensors to obtain, maintain and successfully enforce adequate patent and other intellectual property protection of its products and product candidates and the ability to operate its business without infringing the intellectual property rights of others; and other risks described in Zogenix's filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Zogenix undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SODAS(R) is a trademark of Alkermes plc.

SUMAVEL(R), DosePro(R), ReldayTM and ZohydroTM are trademarks of Zogenix, Inc.

Contact:

INVESTORS:Zack Kubow | The Ruth Group646.536.7020 | zkubow@theruthgroup.comMEDIA:Victoria Aguiar | The Ruth Group646.536.7013 | vaguiar@theruthgroup.com

Zohydro NDA Submission on Track

SAN DIEGO, Dec. 20, 2011 (GLOBE NEWSWIRE) -- Zogenix, Inc. (Nasdaq:ZGNX - News), a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain, today announced that it has concluded its pre-New Drug Application (NDA) meetings with the U.S. Food & Drug Administration (FDA) related to its lead investigational product candidate, Zohydro(TM) (hydrocodone bitartrate extended-release capsules). The purpose of the meetings was to discuss the non-clinical, clinical and Chemistry, Manufacturing and Controls (CMC) development of Zohydro, and to agree on the submission requirements for the NDA submission under 505(b)(2) of the Federal Food, Drug, and Cosmetic Act. After a detailed review of the submission timeline, Zogenix plans to submit the NDA for Zohydro early in the second quarter of 2012.

Stephen Farr, PhD, president and chief operating officer of Zogenix, said, "The completion of our pre-NDA meetings with the FDA brings us one more important step closer to potentially gaining approval for Zohydro. We appreciate the informative interactions, timeliness, and clarity provided by the FDA, as well as the full support of Alkermes, our CMC partner, in the pre-NDA meeting process."

Zohydro is being evaluated for the management of moderate to severe chronic pain in patients requiring continuous around-the-clock opioid therapy for an extended period of time. If approved, Zohydro could be the first extended-release hydrocodone therapy available without acetaminophen, which is associated with an increased risk of liver toxicity when used in high doses over time.

Hydrocodone pain products represent the largest prescription drug category in the United States, with over 128 million prescriptions filled in 2010. The Company believes Zohydro's ability to provide consistent 12-hour pain relief, without exposure to acetaminophen, will position the product well in this large market.

About Zohydro

Zohydro is a novel, oral, single entity (without acetaminophen) extended-release capsule formulation of hydrocodone bitartrate. When used in high dosages over time, acetaminophen can cause liver toxicity. If approved, Zohydro could be the first single-entity hydrocodone therapy available. Zohydro uses Alkermes' patented Spheriodal Oral Drug Absorption System (SODAS(R)) drug delivery technology which serves to enhance the release profile of hydrocodone to provide consistent 12-hour pain relief relative to existing immediate release combination products. Capsule strengths utilized in the Phase 3 studies included 10, 20, 30, 40 and 50 mg capsules.

About Chronic Pain

The American Pain Society estimated in 1999 that 9% of the U.S. adult population suffers from moderate to severe non-cancer related chronic pain. Chronic pain can be treated with both immediate-release and extended-release opioids. Marketed hydrocodone products are the most commonly prescribed pharmaceuticals in the U.S., generating $3.2 billion in sales during the 12 months ended December 2010 (Wolters Kluwer Pharma Solutions, Source Pharmaceutical Audit Suite Retail, January 2010 -- December 2010). All of these hydrocodone products contain an analgesic combination ingredient, primarily acetaminophen. Acetaminophen may cause liver toxicity when used in high dosages over time.

About Zogenix

Zogenix, Inc. (Nasdaq:ZGNX - News), with offices in San Diego and Emeryville, California, is a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain. Zogenix's first commercial product, SUMAVEL(R) DosePro(R) (sumatriptan injection) Needle-free Delivery System, was launched in January 2010 for the acute treatment of migraine and cluster headache. Zogenix's lead investigational product candidate, Zohydro(TM) (hydrocodone bitartrate), is a novel, oral, single-entity (without acetaminophen) extended-release capsule formulation currently in Phase 3 clinical trials for the management of moderate to severe chronic pain in patients requiring around-the-clock opioid therapy. Zogenix's second investigational DosePro product candidate, Relday(TM), is a proprietary, long-acting injectable formulation of risperidone for the treatment of schizophrenia.

Forward Looking Statements

Zogenix cautions you that statements included in this press release that are not a description of historical facts are forward-looking statements. Words such as "believes," "anticipates," "plans," "expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended to identify forward-looking statements. These statements are based on the company's current beliefs and expectations. These forward-looking statements include statements regarding: the potential for, and timing of, an NDA submission for Zohydro; the potential for Zohydro to be the first approved oral, single-entity extended-release formulation of hydrocodone; and the size of the opioid pain market and the potential of Zohydro to be well positioned in that market. The inclusion of forward-looking statements should not be regarded as a representation by Zogenix that any of its plans will be achieved. Actual results may differ from those set forth in this release due to the risk and uncertainties inherent in Zogenix's business, including, without limitation: the top-line data Zogenix has reported for Zohydro is based on preliminary analysis of key efficacy and safety data, and such data may change following a more comprehensive review of the data related to the clinical trial, and may also change in connection with the continued review of such data as part of Zogenix's planned submission and the FDA's review of the NDA for Zohydro; the progress, timing and results of the planned bioequivalence study for Zohydro; the potential that earlier clinical trials may not be predictive of future results; the potential for Zohydro to receive regulatory approval on a timely basis or at all; the potential for adverse safety findings relating to Zohydro to delay or prevent regulatory approval or commercialization; the impact of any inability to raise sufficient capital to fund ongoing operations; the ability of Zogenix and its licensors to obtain, maintain and successfully enforce adequate patent and other intellectual property protection of its products and product candidates and the ability to operate its business without infringing the intellectual property rights of others; and other risks described in Zogenix's filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Zogenix undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SODAS(R) is a trademark of Alkermes plc.

SUMAVEL(R), DosePro(R), ReldayTM and ZohydroTM are trademarks of Zogenix, Inc.

Contact:

INVESTORS:Zack Kubow | The Ruth Group646.536.7020 | zkubow@theruthgroup.comMEDIA:Victoria Aguiar | The Ruth Group646.536.7013 | vaguiar@theruthgroup.com

Zogenix, Astellas To End Co-Promotion Agreement For Sumavel Drug

Pharmaceutical company Zogenix Inc. (ZGNX) said it agreed to end its co-promotion of the Sumavel DosePro needle-free delivery system with Astellas Pharma U.S. Inc., a U.S. subsidiary of Astellas Pharma Inc. (4503.TO), on March 31 next year.

Sumavel DosePro is Zogenix's first commercial product and was launched with Astellas in January of last year to treat migraines and cluster headaches. Zogenix develops drugs for the treatment of nervous system disorders and pain.

Beginning in the second quarter of 2012, Zogenix will assume full responsibility for the commercialization of Sumavel, focusing on headache specialists, neurologists and primary care physicians who treat a lot of migraine patients.

Zogenix Chief Executive Roger Hawley said ending the co-promotion will lower its expenses, since Zogenix will no longer pay a service fee to Astellas beginning in the second quarter of 2012. He said the company is exploring the potential of modestly expanding its sales force and considering other Sumavel promotion partners.

Neither company will incur a penalty payment for terminating the agreement, which was originally slated to expire in June 2013. The companies plan to agree on a detailed customer transition plan by February next year, with the goal of uninterrupted access and service to physicians receiving the drug from Astellas.

Last month, Zogenix said its third-quarter loss edged lower on higher sales of Sumavel.

Shares closed Tuesday at $1.60 and were inactive premarket. The stock is down 72% year to date.

-By Ben Fox Rubin, Dow Jones Newswires; 212-416-3108; ben.rubin@dowjones.com;

Pharmaceutical company Zogenix Inc. (ZGNX) said it agreed to end its co-promotion of the Sumavel DosePro needle-free delivery system with Astellas Pharma U.S. Inc., a U.S. subsidiary of Astellas Pharma Inc. (4503.TO), on March 31 next year.

Sumavel DosePro is Zogenix's first commercial product and was launched with Astellas in January of last year to treat migraines and cluster headaches. Zogenix develops drugs for the treatment of nervous system disorders and pain.

Beginning in the second quarter of 2012, Zogenix will assume full responsibility for the commercialization of Sumavel, focusing on headache specialists, neurologists and primary care physicians who treat a lot of migraine patients.

Zogenix Chief Executive Roger Hawley said ending the co-promotion will lower its expenses, since Zogenix will no longer pay a service fee to Astellas beginning in the second quarter of 2012. He said the company is exploring the potential of modestly expanding its sales force and considering other Sumavel promotion partners.

Neither company will incur a penalty payment for terminating the agreement, which was originally slated to expire in June 2013. The companies plan to agree on a detailed customer transition plan by February next year, with the goal of uninterrupted access and service to physicians receiving the drug from Astellas.

Last month, Zogenix said its third-quarter loss edged lower on higher sales of Sumavel.

Shares closed Tuesday at $1.60 and were inactive premarket. The stock is down 72% year to date.

-By Ben Fox Rubin, Dow Jones Newswires; 212-416-3108; ben.rubin@dowjones.com;

ZGNX on ABC " 'Zo-Hydro' Contains Pure Hydrocodone"

http://abcnews.go.com/WNT/video/zohydro-pure-hydrocodone-152…

http://abcnews.go.com/WNT/video/zohydro-pure-hydrocodone-152…

Top Biotech Pick For 2012: Zogenix ( ZGNX )

http://seekingalpha.com/article/317105-top-biotech-pick-for-…

http://seekingalpha.com/article/317105-top-biotech-pick-for-…

sehr interessant... mehr sag i net..

mehr sag i net..

mehr sag i net..

mehr sag i net..

Zogenix (NASDAQ: ZGNX) is now covered by analysts at William Blair. The analysts set an “outperform” rating and a $6.00 price target on the stock.

Sie ist mit Sicherheit auf dem Besten Weg dorthin :

wenn das so wäre.....???

Antwort auf Beitrag Nr.: 42.572.014 von ElGordo am 10.01.12 09:41:01Lies mal Dicker...

Bloomberg

Super Painkiller Needs Extra Scrutiny From FDA, NY Senator Says

January 09, 2012, 5:07 PM EST

By Anna Edney

Jan. 9 (Bloomberg) -- Powerful painkillers being researched by Zogenix Inc., a specialty pharmaceutical company, should be severely restricted if U.S. regulators decide to approve them, a New York senator said today.

Senator Charles Schumer, a Democrat, wrote Food and Drug Administration Commissioner Margaret Hamburg urging her to proceed with caution before allowing what he called “super” drugs that are 10 times more powerful than Vicodin on the market. Zogenix and at least three other companies are researching pure-form hydrocodone pain relievers, according to a statement from Schumer.

The products have never been sold in the U.S. and would be the most powerful prescription painkillers available, Schumer said. The senator urged FDA to closely track any approved hydrocodone products and take precautions to deter abuse as well as closely monitor advertising and sales.

“It’s tremendously concerning that at the same time policy makers and law enforcement professionals are waging a war on the growing prescription drug crisis, new and more powerful super- drugs could well be on their way, flooding the market,” Schumer said.

Zogenix’s product, Zohydro, began final phases of testing in March 2010, according to the company’s website. Zogenix plans to submit an application to the FDA for approval in the second quarter of 2012, Victoria Aguiar, a spokeswoman for Zogenix, said in an e-mail.

The company is attempting to develop a safer pain treatment than Vicodin, which contains acetaminophen and can cause liver toxicity, Aguiar said. Zogenix also plans to implement a risk mitigation strategy that recognizes the abuse potential of its product.

Zogenix rose less than 1 percent to $2.84 at the close in New York. The shares have declined 53 percent in the past 12 months.

--Editor: Andrew Pollack, Adriel Bettelheim

Bloomberg

Super Painkiller Needs Extra Scrutiny From FDA, NY Senator Says

January 09, 2012, 5:07 PM EST

By Anna Edney

Jan. 9 (Bloomberg) -- Powerful painkillers being researched by Zogenix Inc., a specialty pharmaceutical company, should be severely restricted if U.S. regulators decide to approve them, a New York senator said today.

Senator Charles Schumer, a Democrat, wrote Food and Drug Administration Commissioner Margaret Hamburg urging her to proceed with caution before allowing what he called “super” drugs that are 10 times more powerful than Vicodin on the market. Zogenix and at least three other companies are researching pure-form hydrocodone pain relievers, according to a statement from Schumer.

The products have never been sold in the U.S. and would be the most powerful prescription painkillers available, Schumer said. The senator urged FDA to closely track any approved hydrocodone products and take precautions to deter abuse as well as closely monitor advertising and sales.

“It’s tremendously concerning that at the same time policy makers and law enforcement professionals are waging a war on the growing prescription drug crisis, new and more powerful super- drugs could well be on their way, flooding the market,” Schumer said.

Zogenix’s product, Zohydro, began final phases of testing in March 2010, according to the company’s website. Zogenix plans to submit an application to the FDA for approval in the second quarter of 2012, Victoria Aguiar, a spokeswoman for Zogenix, said in an e-mail.

The company is attempting to develop a safer pain treatment than Vicodin, which contains acetaminophen and can cause liver toxicity, Aguiar said. Zogenix also plans to implement a risk mitigation strategy that recognizes the abuse potential of its product.

Zogenix rose less than 1 percent to $2.84 at the close in New York. The shares have declined 53 percent in the past 12 months.

--Editor: Andrew Pollack, Adriel Bettelheim

Zogenix, Inc Traded with a strange Volume - NASDAQ:ZGNX

Jan 10th, 2012

Zogenix, Inc (NASDAQ:ZGNX) is a specialty pharmaceutical company with two product candidates in late-stage development for the treatment of central nervous system (CNS) disorders and pain. Zogenix, Inc witnessed volume of 1.74 million shares during last trade however it holds an average trading capacity of 454,700 shares. ZGNX last trade opened at $2.90 reached intraday low of $2.32 and went +0.71% up to close at $2.84.

ZGNX has intra-day market capitalization $185.12 million and an enterprise value at $168.99 million. Trailing twelve months price to sales ratio of the stock was 4.81 while price to book ratio in most recent quarter was 6.07. In profitability ratios, net profit margin in past twelve months appeared at -162.00% whereas operating profit margin for the same period at -193.42%.

The company made a return on asset of -54.11% in past twelve months and return on equity of -779.22% for similar period. In the period of trailing 12 months it generated revenue amounted to $38.48 million gaining $1.30 revenue per share. Its year over year, quarterly growth of revenue was 47.30%.

According to preceding quarter balance sheet results, the company had $70.85 million cash in hand making cash per share at 1.09. The total of $56.01 million debt was there putting a total debt to equity ratio 185.68. Moreover its current ratio according to same quarter results was 2.70 and book value per share was 0.47.

Looking at the trading information, the stock price history displayed that its S&P500 52 Week Change illustrated 0.49% where the stock current price exhibited up beat from its 50 day moving average price of $1.86 and remained below from its 200 Day Moving Average price of $2.85.

ZGNX holds 65.18 million outstanding shares with 39.09 million floating shares where insider possessed 38.97% and institutions kept 39.10%.

THIS IS NOT A RECOMMENDATION TO BUY OR SELL ANY SECURITY!

Jan 10th, 2012

Zogenix, Inc (NASDAQ:ZGNX) is a specialty pharmaceutical company with two product candidates in late-stage development for the treatment of central nervous system (CNS) disorders and pain. Zogenix, Inc witnessed volume of 1.74 million shares during last trade however it holds an average trading capacity of 454,700 shares. ZGNX last trade opened at $2.90 reached intraday low of $2.32 and went +0.71% up to close at $2.84.

ZGNX has intra-day market capitalization $185.12 million and an enterprise value at $168.99 million. Trailing twelve months price to sales ratio of the stock was 4.81 while price to book ratio in most recent quarter was 6.07. In profitability ratios, net profit margin in past twelve months appeared at -162.00% whereas operating profit margin for the same period at -193.42%.

The company made a return on asset of -54.11% in past twelve months and return on equity of -779.22% for similar period. In the period of trailing 12 months it generated revenue amounted to $38.48 million gaining $1.30 revenue per share. Its year over year, quarterly growth of revenue was 47.30%.

According to preceding quarter balance sheet results, the company had $70.85 million cash in hand making cash per share at 1.09. The total of $56.01 million debt was there putting a total debt to equity ratio 185.68. Moreover its current ratio according to same quarter results was 2.70 and book value per share was 0.47.

Looking at the trading information, the stock price history displayed that its S&P500 52 Week Change illustrated 0.49% where the stock current price exhibited up beat from its 50 day moving average price of $1.86 and remained below from its 200 Day Moving Average price of $2.85.

ZGNX holds 65.18 million outstanding shares with 39.09 million floating shares where insider possessed 38.97% and institutions kept 39.10%.

THIS IS NOT A RECOMMENDATION TO BUY OR SELL ANY SECURITY!

will hier nur n kurzen Comment zum Chart geben...

(glaube Zogenix wird zwischen der 100- und 200 Tage Linie seitwärts pendeln 2,2-3,3USD ca. oder dann wieder nach oben ausbrechen, mal schauen...)

was mich nachdenklich macht, wie kommt so etwas zu stande?

Computer Programm?Technische Gegegnreaktion?Menschliches Handeln?Ist mir schon öfter aufgefallen auch nach sukzessiven Anstieg und dann schon direkt nach 50% folgen Gewinnmitnahmen...echt arm!So ist die Börse!

(glaube Zogenix wird zwischen der 100- und 200 Tage Linie seitwärts pendeln 2,2-3,3USD ca. oder dann wieder nach oben ausbrechen, mal schauen...)

was mich nachdenklich macht, wie kommt so etwas zu stande?

Computer Programm?Technische Gegegnreaktion?Menschliches Handeln?Ist mir schon öfter aufgefallen auch nach sukzessiven Anstieg und dann schon direkt nach 50% folgen Gewinnmitnahmen...echt arm!So ist die Börse!

Gestern nachbörsliche Ankündigung...

http://www.bloomberg.com/news/2012-02-03/aeropostale-micron-…

Nächste Woche sollte turbulent werden, hohes Volumen wird für ordentlichen Umsatz sorgen.

http://www.bloomberg.com/news/2012-02-03/aeropostale-micron-…

Nächste Woche sollte turbulent werden, hohes Volumen wird für ordentlichen Umsatz sorgen.

Wie soll man diese News sehen ?

Negativ ?

Negativ ?

Antwort auf Beitrag Nr.: 42.702.348 von Wohnwunsch am 05.02.12 18:32:50Mal sehen was hier kommt in den nächsten 3 Monaten

Antwort auf Beitrag Nr.: 42.715.481 von Wohnwunsch am 07.02.12 21:34:32Hier wird es bald einen Newsflow geben.

Höre das dies innerhalb der nächsten 30-45Tage geschehen soll.

Also wer noch nicht investiert ist sollte sich die Aktie mal genauer anschauen!

Höre das dies innerhalb der nächsten 30-45Tage geschehen soll.

Also wer noch nicht investiert ist sollte sich die Aktie mal genauer anschauen!

Antwort auf Beitrag Nr.: 42.567.819 von Kursziel1000 am 09.01.12 12:00:43Hiervscheint heute auch in grossem Stil gedeckelt zu werden

Größere Blaue Balken und der Kurs bewegt sich 0,0

Oh man heute könnte einem schlecht werden bei meinen Werten

Größere Blaue Balken und der Kurs bewegt sich 0,0

Oh man heute könnte einem schlecht werden bei meinen Werten

Und ab in den Keller, am besten geh ich mit in den Keller denn lachen kann ich nur noch dort wenn das so weiter geht

Antwort auf Beitrag Nr.: 42.567.819 von Kursziel1000 am 09.01.12 12:00:43Und ab in den Keller, heute grosser Ausverkauf

Oh wie ist das zum kotzen

Wer will nochmal wer hat noch nicht ?

Oh wie ist das zum kotzen

Wer will nochmal wer hat noch nicht ?

Höre auf mit rumheulen, Kleiner!

Wenn du die Schwankungen nicht verträgst, lege dir ein Sparbuch bei der Sparkasse zu!

Wenn du die Schwankungen nicht verträgst, lege dir ein Sparbuch bei der Sparkasse zu!

Antwort auf Beitrag Nr.: 42.752.416 von mr.krabs am 15.02.12 09:55:38Hier läuft auch nicht mehr viel ausser Richtung Süde

Zogenix, Inc. Earnings Conference Call (Q4 2011)

Scheduled to start Thu, Mar 8, 2012, 4:30 pm Eastern

Scheduled to start Thu, Mar 8, 2012, 4:30 pm Eastern

Antwort auf Beitrag Nr.: 42.792.231 von Wohnwunsch am 22.02.12 22:12:33Also heute sieht es sehr sehr gut aus, Volumen stimmt auch

Auf jedenfall bis jetzt

Auf jedenfall bis jetzt

Antwort auf Beitrag Nr.: 42.852.407 von Wohnwunsch am 05.03.12 16:34:59Sieht sehr sehr gut aus

Go Zogenix go go go

Go Zogenix go go go

Antwort auf Beitrag Nr.: 42.567.819 von Kursziel1000 am 09.01.12 12:00:43Sehr gut gestartet und dann wieder ins Minus

SCHADE

SCHADE

GAP bei $1.95 sollte hier morgen geschlossen werden.

Die Umsatzschätzungen von den Analysten wurden leicht verfehlt.

Die Umsatzschätzungen von den Analysten wurden leicht verfehlt.

Antwort auf Beitrag Nr.: 42.567.819 von Kursziel1000 am 09.01.12 12:00:43Was ist denn hier los, aus welchem Grund so stark im Minus ?

Warum dieser Kursrutsch, wascläuft hier jetzt ?

Antwort auf Beitrag Nr.: 42.874.515 von Kursziel1000 am 08.03.12 23:54:07Also ist auch diese Aktie ein Flopp und hier werden wir wohl nie die 5$ sehen

Wohl eher der $ wird hier bald kommen??????

Wohl eher der $ wird hier bald kommen??????

ZGNX 2.03 NDA filing 04/30/2012

Wohin geht jetzt wohl die Reise

Und sehen wir hier demnächst nochmal die 2,80-3,00$ ?

:

:

Was ist deine Meinung Kursziel1000 ?

Und sehen wir hier demnächst nochmal die 2,80-3,00$ ?

:

:Was ist deine Meinung Kursziel1000 ?

Antwort auf Beitrag Nr.: 42.881.977 von Wohnwunsch am 10.03.12 13:35:175$ bis spätestens Mitte des Jahres! In der Zwischenzeit höre ich mir Dein Geheule an!

Oh man oh man, was ist mit dieser Ktie jetzt los

Antwort auf Beitrag Nr.: 42.702.348 von Wohnwunsch am 05.02.12 18:32:50Also das nenne ich mal einen massiven Kursverlust innerhalb ein paar Tagen

Mir wird schon ganz schlecht bei dem Kursverlauf

Mir wird schon ganz schlecht bei dem Kursverlauf

Antwort auf Beitrag Nr.: 42.567.819 von Kursziel1000 am 09.01.12 12:00:43Kursverfall scheint auch weiterhin bei Zogenix voll in Takt zu sein

LEIDER

LEIDER

Kleiner Tipp an "Wünsch-dir-was".

Wenn man keine Ahnung hat, einfach mal die Fresse halten.

Danke

Wenn man keine Ahnung hat, einfach mal die Fresse halten.

Danke

ZGNX $1.96 ready for gap fill @$2.48 next week!

NDA filing 04/30/2012

Neues Tageshoch $2.18

Zogenix and Battelle Ink Marketing Agreement for DosePro(R) Drug Delivery Technology

Zogenix, Inc. (Nasdaq:ZGNX), a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain, and Battelle, the world's largest independent research and development organization, today finalized their previously announced collaborative agreement to advance out-licensing opportunities and development of Zogenix's DosePro® drug delivery technology. Battelle and Zogenix will co-market DosePro technology to potential pharmaceutical and government clients with the objective of licensing the system for use with innovative therapeutics that would be enabled or enhanced by DosePro's unique needle-free delivery system.

DosePro offers increased safety and convenience compared to needle-based injection via syringes or auto-injectors by providing a pre-filled, single-use, disposable, needle-free drug delivery system that is easy to use and preferred by patients. Compared to other delivery technologies, DosePro has the potential to solve the significant challenges of delivering viscous drug formulations, such as high concentration biologics, which cannot be delivered with traditional needle-based injection.

The DosePro drug delivery technology is covered by more than 46 internationally issued patents extending through 2026. Zogenix has produced in excess of 1.5 million units of the company's migraine therapy, SUMAVEL® DosePro®, which has received approval in the United States and Europe using the DosePro technology. Patient experience has demonstrated that patients will switch from oral to injectable formulations when provided the option of using SUMAVEL DosePro, despite the availability of a needle-based product for over a decade.

John Turanin, Vice President and General Manager, DosePro Technology, at Zogenix, states, "Battelle has a strong reputation for product development that has earned them a 'who's who' client list in the pharmaceutical industry. Collaborating on DosePro provides additional support of our technology and the backing of a significant technical business partner. We expect the out-licensing effort to accelerate now that we are working with Battelle. We have already trained their business development team and are expanding laboratory capabilities to begin working on DosePro product candidates."

Barbara Kunz, President of Battelle Health and Life Sciences Global Business, said, "This collaboration enables Battelle to expand our platform of innovative drug delivery solutions to our pharmaceutical customers. We believe DosePro will be able to assist our clients with addressing many of the challenges they face today, in particular, the delivery of highly viscous drug formulations."

Battelle's business development professionals responsible for life and health sciences will market DosePro to their customers in strategic product planning meetings, at conferences, in trade publications, and through other marketing communications. The technical teams from both Battelle and Zogenix are working together to create a center of excellence for DosePro technology development and testing within Battelle's laboratories. Battelle has the option to enter into an agreement with Zogenix to jointly develop and commercialize an iteration of the DosePro technology which delivers a larger dose (1.2mL) than the current dose size of 0.5mL.

For more information on licensing opportunities using the DosePro platform contact Michael Chansler from Battelle at (206) 588-9827 or chanslerm@battelle.org.

About DosePro®

The DosePro system is a first-in-class, easy-to-use drug delivery system designed for self-administration of a pre-filled, single dose of liquid drug, subcutaneously, without a needle. The platform is currently used by Zogenix's first commercial product, SUMAVEL DosePro®, and its investigational candidate, Relday. The Company believes that DosePro offers several benefits to patients compared to other subcutaneous delivery methods, and that it has the potential to become a preferred delivery option for patients and physicians. These benefits include less anxiety or fear due to the lack of a needle, easier disposal without the need for a sharps container, no risk of needle stick injury or contamination, an easy-to-use three step process, no need to fill or manipulate the device, reliable performance, discreet use and portability. In several clinical trials and market research studies, DosePro has been shown to be preferred by patients over conventional needle-based systems.

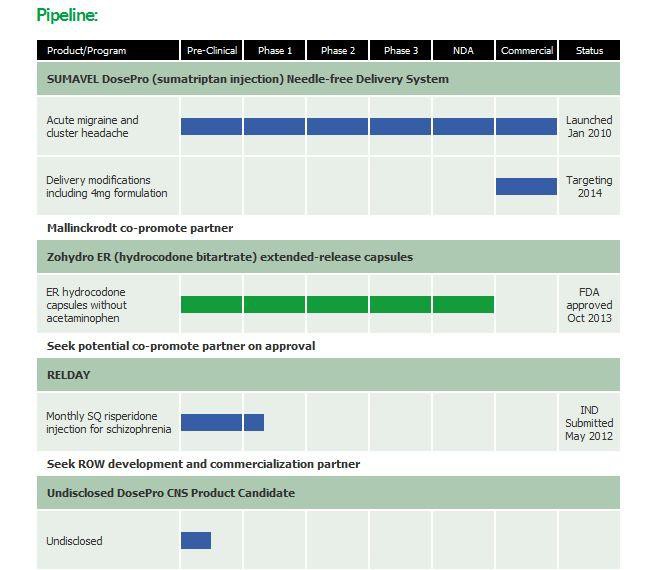

About Zogenix

Zogenix, Inc. (Nasdaq:ZGNX), with offices in San Diego and Emeryville, California, is a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain. Zogenix's first commercial product, SUMAVEL® DosePro® (sumatriptan injection) Needle-free Delivery System, was launched in January 2010 for the acute treatment of migraine and cluster headache. Zogenix's lead investigational product candidate, Zohydro™ (hydrocodone bitartrate), is a novel, oral, 12-hour extended-release formulation of hydrocodone without acetaminophen for the treatment of moderate to severe chronic pain requiring around the clock opioid therapy which has recently completed Phase 3 clinical trials. Zogenix's second DosePro investigational product candidate, Relday™, is a proprietary, long-acting injectable formulation of risperidone for the treatment of schizophrenia.

About Battelle

As the world's largest independent research and development organization, Battelle provides innovative solutions to the world's most pressing needs through its four global businesses: Laboratory Management; National Security; Health and Life Sciences; and Energy, Environment and Material Sciences. It advances scientific discovery and application by conducting $6.5 billion in global R&D annually through contract research, laboratory management and technology commercialization. Headquartered in Columbus, Ohio, Battelle oversees 22,000 employees in more than 130 locations worldwide, including seven national laboratories which Battelle manages or co-manages for the U.S. Department of Energy and the U.S. Department of Homeland Security and a nuclear energy lab in the United Kingdom.

Battelle also is one of the nation's leading charitable trusts focusing on societal and economic impact and actively supporting and promoting science, technology, engineering and mathematics (STEM) education.

Forward Looking Statements

Zogenix cautions you that statements included in this press release that are not a description of historical facts are forward-looking statements. Words such as "believes," "anticipates," "plans," "expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended to identify forward-looking statements. These statements are based on the company's current beliefs and expectations. These forward-looking statements include statements regarding the ability to successfully out-license the DosePro technology and the timing thereof, the ability of DosePro to solve the significant challenges of delivering viscous drug formulations, Battelle's exercise of the DosePro 1.2 mL option, the expected duration of patent protection for the DosePro technology and the likelihood that patients will switch from oral to injectable formulations when provided the option. The inclusion of forward-looking statements should not be regarded as a representation by Zogenix that any of its plans will be achieved. Actual results may differ from those set forth in this release due to the risk and uncertainties inherent in Zogenix's business, including, without limitation: difficulties in identifying, negotiating, executing and carrying out strategic transactions relating to DosePro and obtaining regulatory approval for other DosePro products; risks associated with the development of a larger volume, second generation version of the DosePro technology to accommodate drug formulation volumes greater than 0.5 mL; and the scope, validity and duration of patent protection and other intellectual property rights for DosePro; and other risks described in the company's prior press releases and filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Zogenix undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SUMAVEL®, DosePro®, ReldayTM and ZohydroTM are trademarks of Zogenix, Inc.

CONTACT: ZOGENIX MEDIA:

Victoria Aguiar | The Ruth Group

646.536.7013 | vaguiar@theruthgroup.com

BATTELLE:

Katy Delaney

614.424.7208 | delaneyk@battelle.org

T.R. Massey

614.424.5544 | masseytr@battelle.org

Zogenix, Inc. (Nasdaq:ZGNX), a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain, and Battelle, the world's largest independent research and development organization, today finalized their previously announced collaborative agreement to advance out-licensing opportunities and development of Zogenix's DosePro® drug delivery technology. Battelle and Zogenix will co-market DosePro technology to potential pharmaceutical and government clients with the objective of licensing the system for use with innovative therapeutics that would be enabled or enhanced by DosePro's unique needle-free delivery system.

DosePro offers increased safety and convenience compared to needle-based injection via syringes or auto-injectors by providing a pre-filled, single-use, disposable, needle-free drug delivery system that is easy to use and preferred by patients. Compared to other delivery technologies, DosePro has the potential to solve the significant challenges of delivering viscous drug formulations, such as high concentration biologics, which cannot be delivered with traditional needle-based injection.

The DosePro drug delivery technology is covered by more than 46 internationally issued patents extending through 2026. Zogenix has produced in excess of 1.5 million units of the company's migraine therapy, SUMAVEL® DosePro®, which has received approval in the United States and Europe using the DosePro technology. Patient experience has demonstrated that patients will switch from oral to injectable formulations when provided the option of using SUMAVEL DosePro, despite the availability of a needle-based product for over a decade.

John Turanin, Vice President and General Manager, DosePro Technology, at Zogenix, states, "Battelle has a strong reputation for product development that has earned them a 'who's who' client list in the pharmaceutical industry. Collaborating on DosePro provides additional support of our technology and the backing of a significant technical business partner. We expect the out-licensing effort to accelerate now that we are working with Battelle. We have already trained their business development team and are expanding laboratory capabilities to begin working on DosePro product candidates."

Barbara Kunz, President of Battelle Health and Life Sciences Global Business, said, "This collaboration enables Battelle to expand our platform of innovative drug delivery solutions to our pharmaceutical customers. We believe DosePro will be able to assist our clients with addressing many of the challenges they face today, in particular, the delivery of highly viscous drug formulations."

Battelle's business development professionals responsible for life and health sciences will market DosePro to their customers in strategic product planning meetings, at conferences, in trade publications, and through other marketing communications. The technical teams from both Battelle and Zogenix are working together to create a center of excellence for DosePro technology development and testing within Battelle's laboratories. Battelle has the option to enter into an agreement with Zogenix to jointly develop and commercialize an iteration of the DosePro technology which delivers a larger dose (1.2mL) than the current dose size of 0.5mL.

For more information on licensing opportunities using the DosePro platform contact Michael Chansler from Battelle at (206) 588-9827 or chanslerm@battelle.org.

About DosePro®

The DosePro system is a first-in-class, easy-to-use drug delivery system designed for self-administration of a pre-filled, single dose of liquid drug, subcutaneously, without a needle. The platform is currently used by Zogenix's first commercial product, SUMAVEL DosePro®, and its investigational candidate, Relday. The Company believes that DosePro offers several benefits to patients compared to other subcutaneous delivery methods, and that it has the potential to become a preferred delivery option for patients and physicians. These benefits include less anxiety or fear due to the lack of a needle, easier disposal without the need for a sharps container, no risk of needle stick injury or contamination, an easy-to-use three step process, no need to fill or manipulate the device, reliable performance, discreet use and portability. In several clinical trials and market research studies, DosePro has been shown to be preferred by patients over conventional needle-based systems.

About Zogenix

Zogenix, Inc. (Nasdaq:ZGNX), with offices in San Diego and Emeryville, California, is a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain. Zogenix's first commercial product, SUMAVEL® DosePro® (sumatriptan injection) Needle-free Delivery System, was launched in January 2010 for the acute treatment of migraine and cluster headache. Zogenix's lead investigational product candidate, Zohydro™ (hydrocodone bitartrate), is a novel, oral, 12-hour extended-release formulation of hydrocodone without acetaminophen for the treatment of moderate to severe chronic pain requiring around the clock opioid therapy which has recently completed Phase 3 clinical trials. Zogenix's second DosePro investigational product candidate, Relday™, is a proprietary, long-acting injectable formulation of risperidone for the treatment of schizophrenia.

About Battelle

As the world's largest independent research and development organization, Battelle provides innovative solutions to the world's most pressing needs through its four global businesses: Laboratory Management; National Security; Health and Life Sciences; and Energy, Environment and Material Sciences. It advances scientific discovery and application by conducting $6.5 billion in global R&D annually through contract research, laboratory management and technology commercialization. Headquartered in Columbus, Ohio, Battelle oversees 22,000 employees in more than 130 locations worldwide, including seven national laboratories which Battelle manages or co-manages for the U.S. Department of Energy and the U.S. Department of Homeland Security and a nuclear energy lab in the United Kingdom.

Battelle also is one of the nation's leading charitable trusts focusing on societal and economic impact and actively supporting and promoting science, technology, engineering and mathematics (STEM) education.

Forward Looking Statements

Zogenix cautions you that statements included in this press release that are not a description of historical facts are forward-looking statements. Words such as "believes," "anticipates," "plans," "expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended to identify forward-looking statements. These statements are based on the company's current beliefs and expectations. These forward-looking statements include statements regarding the ability to successfully out-license the DosePro technology and the timing thereof, the ability of DosePro to solve the significant challenges of delivering viscous drug formulations, Battelle's exercise of the DosePro 1.2 mL option, the expected duration of patent protection for the DosePro technology and the likelihood that patients will switch from oral to injectable formulations when provided the option. The inclusion of forward-looking statements should not be regarded as a representation by Zogenix that any of its plans will be achieved. Actual results may differ from those set forth in this release due to the risk and uncertainties inherent in Zogenix's business, including, without limitation: difficulties in identifying, negotiating, executing and carrying out strategic transactions relating to DosePro and obtaining regulatory approval for other DosePro products; risks associated with the development of a larger volume, second generation version of the DosePro technology to accommodate drug formulation volumes greater than 0.5 mL; and the scope, validity and duration of patent protection and other intellectual property rights for DosePro; and other risks described in the company's prior press releases and filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Zogenix undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SUMAVEL®, DosePro®, ReldayTM and ZohydroTM are trademarks of Zogenix, Inc.

CONTACT: ZOGENIX MEDIA:

Victoria Aguiar | The Ruth Group

646.536.7013 | vaguiar@theruthgroup.com

BATTELLE:

Katy Delaney

614.424.7208 | delaneyk@battelle.org

T.R. Massey

614.424.5544 | masseytr@battelle.org

Antwort auf Beitrag Nr.: 42.977.037 von Kursziel1000 am 30.03.12 01:40:00Und das ist fûr uns jetzt negativ oder positiv ?

Der Kurs ging ja am Freitad wieder kräftig nach Süden

:

Der Kurs ging ja am Freitad wieder kräftig nach Süden

:

Aktuelle Kurse unter $2 sind klare Kaufkurse!

Also es ist schon traurig wenn man den Verlauf ansieht,

ich bleib jetzt erstmal dabei auch wenn ich hier gut im

Minus bin.

Mal sehen was kommt

ich bleib jetzt erstmal dabei auch wenn ich hier gut im

Minus bin.

Mal sehen was kommt

Antwort auf Beitrag Nr.: 43.039.196 von Wohnwunsch am 14.04.12 14:20:42Was ist denn Dein Durschschnittskurs hier?

Antwort auf Beitrag Nr.: 43.040.327 von Wohnwunsch am 15.04.12 09:21:56Na da würde ich am Montag deine BWOW in den ersten 15-30Min verkaufen und dann bei ZGNX verbilligen....

Antwort auf Beitrag Nr.: 43.040.475 von Kursziel1000 am 15.04.12 11:13:18Da bin ich mal gespannt was bei WOW am Montag geht

ZGNX $2.00 - gap to fill @$2.48

Also momentan sieht diese Aktie eher wie eine Geldverbrennungsmaschine aus

Schade, der Verlauf spricht für sich

Schade, der Verlauf spricht für sich

Antwort auf Beitrag Nr.: 43.104.775 von Wohnwunsch am 30.04.12 16:12:29Leider hat Zogenix wieder im Minus geschlossen, mittlerweile

Scheint das leider der Trend bei dieser Aktie zu sein.

Momentan bin ich von diesem Invest nicht mehr überzeugt

Scheint das leider der Trend bei dieser Aktie zu sein.

Momentan bin ich von diesem Invest nicht mehr überzeugt

Antwort auf Beitrag Nr.: 43.106.083 von Wohnwunsch am 30.04.12 22:15:24Na wenn Du anfängst bearisch zu ZGNX eingestellt zu sein, dann werte ich das als bullischen Indikator die Aktie zu kaufen bzw. aufzustocken!

Antwort auf Beitrag Nr.: 43.106.393 von Kursziel1000 am 01.05.12 00:41:06Na wenn es so sein sollte dann bleib ich erstmal bearish vielleicht gewinnen wir dann

beide Bit Zogenix

Ich muss aber ehrlich sagen, das ich damals zeitgleich ein Invest in Zogenix und Biodelivery getätigt

habe und bei Zogenix bin ich fett im Minus, bei Biodelivery gute 90% im Plus.

Aktuell ist die wahre Perle "noch" Biodelivery

beide Bit Zogenix

Ich muss aber ehrlich sagen, das ich damals zeitgleich ein Invest in Zogenix und Biodelivery getätigt

habe und bei Zogenix bin ich fett im Minus, bei Biodelivery gute 90% im Plus.

Aktuell ist die wahre Perle "noch" Biodelivery

Antwort auf Beitrag Nr.: 43.106.723 von Wohnwunsch am 01.05.12 09:48:34Du hast ja auch viel später gekauft als ich das getan habe.

Antwort auf Beitrag Nr.: 43.107.397 von Kursziel1000 am 01.05.12 14:55:07Ja leider und deshalb fett im Minus

Wenn man fett im minus bei einer Aktie ist bei der man fest davon überzeugt ist , dass sie auf jeden Fall kurzfristig bis mittelfristig steigen wird, dann sollte man mit einem Double Down seinen Einstandskurs verbilligen imo.

Aktueller Kurs $1.92

Aktueller Kurs $1.92

Antwort auf Beitrag Nr.: 43.108.011 von Kursziel1000 am 01.05.12 19:23:13Hoffen wir mal das der Anstieg von Zogenix mal wieder nachhaltig ist.

Zeit würde es jetzt werden, denn der Kurs hat in den letzten Monaten stark

nachgegeben, leider.

Ich hoff wir laufen jetzt mal nachhaltig über die 2,xx$

Zeit würde es jetzt werden, denn der Kurs hat in den letzten Monaten stark

nachgegeben, leider.

Ich hoff wir laufen jetzt mal nachhaltig über die 2,xx$

Sieht nach dem Motto aus wie gewonnen so geronnen aus ?

LEIDER WIEDER NICHT NACHHALTIG

LEIDER WIEDER NICHT NACHHALTIG

Nur die Harten kommen in den Garten ... Aktie wird heute schön steigen!

Zogenix Submits New Drug Application (NDA) to U.S. Food and Drug Administration (FDA) for Zohydro™ for Treatment of Chronic Pain

SAN DIEGO, May 2, 2012 /PRNewswire/ -- Zogenix, Inc. (ZGNX), a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain, announced today that the Company has submitted a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for Zohydro™ (hydrocodone bitartrate extended-release capsules), Zogenix's lead investigational product candidate for the treatment of chronic pain.

Zohydro is a novel, oral, single-entity (without acetaminophen) extended-release formulation of various strengths of hydrocodone intended for administration every 12 hours for around the clock management of moderate to severe chronic pain. If approved, Zohydro could be the first hydrocodone product to offer the benefit of less frequent dosing and the ability to treat patients with chronic pain without the risk of acetaminophen-related liver injury. Currently, hydrocodone is only available in immediate-release, combination products, most commonly with the analgesic acetaminophen, and requires dosing every 4 to 6 hours. Zohydro, classified as a Drug Enforcement Agency (DEA) Schedule II drug product, would carry more strict prescription and dispensing rules as compared to the currently available hydrocodone combination products. In addition, Zogenix has included in the NDA a comprehensive Risk Evaluation and Mitigation Strategy (REMS) that is consistent with current FDA and industry-wide guidelines for extended-release opioid products. The REMS is intended to control inappropriate prescribing, misuse and abuse of extended-release opioids while maintaining patient access to essential pain medications.

"The NDA submission for Zohydro is a significant milestone, bringing us another step closer to making this important acetaminophen-free hydrocodone treatment option available to patients in need of around the clock therapy for chronic pain," said Stephen Farr, Ph.D., president and chief operating officer of Zogenix. "Hydrocodone is often a physician's first opioid recommendation for treating acute, moderate or moderately severe pain. However, many patients are being treated with hydrocodone combination products that include acetaminophen and, when used in high dosages or over long periods of time, put themselves at risk for developing liver injury. Zohydro could provide a significant new treatment alternative that does not contribute to this health risk."

The NDA submission is based on data from over 1,100 patients with chronic pain participating in the pivotal Phase 3 efficacy study (Study 801), and an open-label Phase 3 safety study (Study 802) of Zohydro. Study 801 successfully met its primary efficacy endpoint, demonstrating that Zohydro resulted in significantly (p=0.008) improved chronic pain relief compared to placebo. The two key secondary endpoints in this study - the proportion of patients with at least 30% improvement in pain intensity and the improvement of overall satisfaction of medication - were also met. Additional study endpoints were supportive of the efficacy of Zohydro compared to placebo. The study demonstrated that Zohydro was generally safe and well tolerated. Overall, the most commonly reported adverse events (greater than or equal to 2%) in the placebo-controlled pivotal Phase 3 efficacy Study 801 in opioid-experienced patients were consistent with those typically seen with chronic opioid therapy and were constipation, nausea, somnolence, fatigue, headache, dizziness, dry mouth, vomiting and pruritus. Study 802, in which patients received Zohydro for up to 12 months, further demonstrated that Zohydro was generally safe and well tolerated, and the incidence of adverse events was consistent with that seen in the pivotal Phase 3 efficacy study.

In conjunction with Zohydro's NDA submission, Zogenix is required to make a milestone payment of $1.0 million to Alkermes Pharma Ireland Limited (APIL), a subsidiary of Alkermes, plc, under the Company's exclusive license agreement with APIL in the U.S. for Zohydro.

About Zohydro

Zohydro is a novel, oral, single-entity extended-release formulation of hydrocodone without acetaminophen for the management of moderate to severe chronic pain in patients requiring around the clock opioid therapy. If approved, Zohydro could be the first single-entity hydrocodone therapy, avoiding the potential for liver injury associated with the use of acetaminophen in high doses or over long periods of time.

Zohydro uses APIL's patented Spheroidal Oral Drug Absorption System (SODAS®) drug delivery technology which serves to enhance the release profile of hydrocodone to provide extended-release pain relief relative to existing immediate-release combination products.

About Chronic Pain

Chronic pain is defined as ongoing or recurrent pain that adversely affects an individual's well-being. An estimated 116 million people in the United States are burdened with chronic pain, at an estimated national economic cost of $560 to $635 billion annually.

Chronic pain can be treated with both immediate-release and extended-release opioids. Currently marketed hydrocodone products are only immediate-release and contain an analgesic combination ingredient, primarily acetaminophen. Acetaminophen may cause liver injury when used in high dosages, over long periods of time or in accidental overdoses due to multiple acetaminophen products being taken at once.

About Zogenix

Zogenix, Inc. (ZGNX), with offices in San Diego and Emeryville, California, is a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain. Zogenix's first commercial product, SUMAVEL® DosePro® (sumatriptan injection) Needle-free Delivery System, was launched in January 2010 for the acute treatment of migraine and cluster headache. Zogenix's lead investigational product candidate, Zohydro™ (hydrocodone bitartrate), is a novel, oral, single-entity (without acetaminophen) extended-release formulation of various strengths of hydrocodone intended for administration every 12 hours for around the clock management of moderate to severe chronic pain. Zogenix submitted an NDA to the FDA for Zohydro in May 2012. Zogenix's second DosePro investigational product candidate, Relday™, is a proprietary, long-acting injectable formulation of risperidone for the treatment of schizophrenia.

For additional information, please visit www.zogenix.com.

Forward Looking Statements

Zogenix cautions you that statements included in this press release that are not a description of historical facts are forward-looking statements. Words such as "believes," "anticipates," "plans," "expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed" and similar expressions are intended to identify forward-looking statements. These statements are based on the company's current beliefs and expectations. These forward-looking statements include statements regarding: the potential for Zohydro to be the first approved oral, single-entity extended-release formulation of hydrocodone; and the size of the chronic pain market and the potential of Zohydro to provide a significant new treatment alternative and be well positioned in that market. The inclusion of forward-looking statements should not be regarded as a representation by Zogenix that any of its plans will be achieved. Actual results may differ from those set forth in this release due to the risk and uncertainties inherent in Zogenix's business, including, without limitation: the top-line data Zogenix has reported for Zohydro is based on preliminary analysis of key efficacy and safety data, and such data may change following a more comprehensive review of the data related to the clinical trial, and may also change in connection with the continued review of such data as part of Zogenix's submission and the FDA's review of the NDA for Zohydro; the potential for delays associated with any additional data required to be submitted by Zogenix in support of the NDA; the potential for Zohydro to receive regulatory approval on a timely basis or at all; the potential for adverse safety findings relating to Zohydro to delay or prevent regulatory approval or commercialization; the impact of any inability to raise sufficient capital to fund ongoing operations; the ability of Zogenix and its licensors to obtain, maintain and successfully enforce adequate patent and other intellectual property protection of its products and product candidates and the ability to operate its business without infringing the intellectual property rights of others; and other risks described in Zogenix's filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Zogenix undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SODAS® is a trademark of Alkermes Pharma Ireland Limited.

SUMAVEL ®, DosePro ®, Relday™ and Zohydro™ are trademarks of Zogenix, Inc.

INVESTORS:

MEDIA:

Zack Kubow | The Ruth Group

Emily Poe | WCG

646.536.7020 | zkubow@theruthgroup.com

212.301.7183 | epoe@wcgworld.com

Zogenix Submits New Drug Application (NDA) to U.S. Food and Drug Administration (FDA) for Zohydro™ for Treatment of Chronic Pain

SAN DIEGO, May 2, 2012 /PRNewswire/ -- Zogenix, Inc. (ZGNX), a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain, announced today that the Company has submitted a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for Zohydro™ (hydrocodone bitartrate extended-release capsules), Zogenix's lead investigational product candidate for the treatment of chronic pain.

Zohydro is a novel, oral, single-entity (without acetaminophen) extended-release formulation of various strengths of hydrocodone intended for administration every 12 hours for around the clock management of moderate to severe chronic pain. If approved, Zohydro could be the first hydrocodone product to offer the benefit of less frequent dosing and the ability to treat patients with chronic pain without the risk of acetaminophen-related liver injury. Currently, hydrocodone is only available in immediate-release, combination products, most commonly with the analgesic acetaminophen, and requires dosing every 4 to 6 hours. Zohydro, classified as a Drug Enforcement Agency (DEA) Schedule II drug product, would carry more strict prescription and dispensing rules as compared to the currently available hydrocodone combination products. In addition, Zogenix has included in the NDA a comprehensive Risk Evaluation and Mitigation Strategy (REMS) that is consistent with current FDA and industry-wide guidelines for extended-release opioid products. The REMS is intended to control inappropriate prescribing, misuse and abuse of extended-release opioids while maintaining patient access to essential pain medications.

"The NDA submission for Zohydro is a significant milestone, bringing us another step closer to making this important acetaminophen-free hydrocodone treatment option available to patients in need of around the clock therapy for chronic pain," said Stephen Farr, Ph.D., president and chief operating officer of Zogenix. "Hydrocodone is often a physician's first opioid recommendation for treating acute, moderate or moderately severe pain. However, many patients are being treated with hydrocodone combination products that include acetaminophen and, when used in high dosages or over long periods of time, put themselves at risk for developing liver injury. Zohydro could provide a significant new treatment alternative that does not contribute to this health risk."

The NDA submission is based on data from over 1,100 patients with chronic pain participating in the pivotal Phase 3 efficacy study (Study 801), and an open-label Phase 3 safety study (Study 802) of Zohydro. Study 801 successfully met its primary efficacy endpoint, demonstrating that Zohydro resulted in significantly (p=0.008) improved chronic pain relief compared to placebo. The two key secondary endpoints in this study - the proportion of patients with at least 30% improvement in pain intensity and the improvement of overall satisfaction of medication - were also met. Additional study endpoints were supportive of the efficacy of Zohydro compared to placebo. The study demonstrated that Zohydro was generally safe and well tolerated. Overall, the most commonly reported adverse events (greater than or equal to 2%) in the placebo-controlled pivotal Phase 3 efficacy Study 801 in opioid-experienced patients were consistent with those typically seen with chronic opioid therapy and were constipation, nausea, somnolence, fatigue, headache, dizziness, dry mouth, vomiting and pruritus. Study 802, in which patients received Zohydro for up to 12 months, further demonstrated that Zohydro was generally safe and well tolerated, and the incidence of adverse events was consistent with that seen in the pivotal Phase 3 efficacy study.

In conjunction with Zohydro's NDA submission, Zogenix is required to make a milestone payment of $1.0 million to Alkermes Pharma Ireland Limited (APIL), a subsidiary of Alkermes, plc, under the Company's exclusive license agreement with APIL in the U.S. for Zohydro.

About Zohydro

Zohydro is a novel, oral, single-entity extended-release formulation of hydrocodone without acetaminophen for the management of moderate to severe chronic pain in patients requiring around the clock opioid therapy. If approved, Zohydro could be the first single-entity hydrocodone therapy, avoiding the potential for liver injury associated with the use of acetaminophen in high doses or over long periods of time.

Zohydro uses APIL's patented Spheroidal Oral Drug Absorption System (SODAS®) drug delivery technology which serves to enhance the release profile of hydrocodone to provide extended-release pain relief relative to existing immediate-release combination products.

About Chronic Pain

Chronic pain is defined as ongoing or recurrent pain that adversely affects an individual's well-being. An estimated 116 million people in the United States are burdened with chronic pain, at an estimated national economic cost of $560 to $635 billion annually.

Chronic pain can be treated with both immediate-release and extended-release opioids. Currently marketed hydrocodone products are only immediate-release and contain an analgesic combination ingredient, primarily acetaminophen. Acetaminophen may cause liver injury when used in high dosages, over long periods of time or in accidental overdoses due to multiple acetaminophen products being taken at once.

About Zogenix

Zogenix, Inc. (ZGNX), with offices in San Diego and Emeryville, California, is a pharmaceutical company commercializing and developing products for the treatment of central nervous system disorders and pain. Zogenix's first commercial product, SUMAVEL® DosePro® (sumatriptan injection) Needle-free Delivery System, was launched in January 2010 for the acute treatment of migraine and cluster headache. Zogenix's lead investigational product candidate, Zohydro™ (hydrocodone bitartrate), is a novel, oral, single-entity (without acetaminophen) extended-release formulation of various strengths of hydrocodone intended for administration every 12 hours for around the clock management of moderate to severe chronic pain. Zogenix submitted an NDA to the FDA for Zohydro in May 2012. Zogenix's second DosePro investigational product candidate, Relday™, is a proprietary, long-acting injectable formulation of risperidone for the treatment of schizophrenia.

For additional information, please visit www.zogenix.com.

Forward Looking Statements