Tripadvisor - spin-off von Expedia (Seite 4)

eröffnet am 24.12.11 17:59:53 von

neuester Beitrag 05.08.22 19:39:43 von

neuester Beitrag 05.08.22 19:39:43 von

Beiträge: 71

ID: 1.171.253

ID: 1.171.253

Aufrufe heute: 0

Gesamt: 12.196

Gesamt: 12.196

Aktive User: 0

ISIN: US8969452015 · WKN: A1JRLK · Symbol: TRIP

26,12

USD

+2,19 %

+0,56 USD

Letzter Kurs 23:20:00 Nasdaq

Neuigkeiten

29.02.24 · dpa-AFX |

19.02.24 · Der Aktionär TV |

13.02.24 · dpa-AFX |

13.02.24 · dpa-AFX |

13.02.24 · dpa-AFX |

Werte aus der Branche Hotels/Tourismus

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,4300 | +9,35 | |

| 18,240 | +5,00 | |

| 5,3700 | +4,68 | |

| 60,84 | +4,50 | |

| 13,420 | +3,71 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 40,20 | -2,19 | |

| 2,8600 | -2,40 | |

| 7,2300 | -3,46 | |

| 5,3500 | -4,46 | |

| 3,3800 | -9,14 |

Beitrag zu dieser Diskussion schreiben

Didi and TripAdvisor China talk the full service ecosystem talk

Oct 21.2016

In the wider scheme of things, TripAdvisor doing something with 100 hotels wouldn’t blip the radar.

Unless those hotels are in China, and TripAdvisor is doing something with Didi, China’s biggest taxi app, and the partnership is positioned as “building a full service ecosystem of services for travelers not only to research, plan and manage what they want to do but also to easily incorporate mobility solutions into their travel plans.”

The actuality is a bit more prosaic than the PR.

TripAdvisor (China) will build dedicated Didi “stations” at 100 hotels where there is a demand from guests to get to local tourist attractions.

Whether these stations are a branded kiosks in reception or an employee dressed up as the TripAdvisor owl to orchestrate traffic outside the hotels remains to be seen.

But the partnership, however vague or tenuous at this nascent stage, could, in theory, develop into something significant. Particularly as Uber China, which Didi took over in August, launched “Uber + Travel”, an initiative which aimed to “connect travellers with the travel services they need before, during and after their journey.”

Currently we have nothing more than an interesting offline tie-up between two massive brands, and a lot needs to happen before a “full-service ecosystem of services for travellers” starring Didi and TripAdvisor becomes a reality.

Still, every paradigm shift and game-changer has to start somewhere.

Oct 21.2016

In the wider scheme of things, TripAdvisor doing something with 100 hotels wouldn’t blip the radar.

Unless those hotels are in China, and TripAdvisor is doing something with Didi, China’s biggest taxi app, and the partnership is positioned as “building a full service ecosystem of services for travelers not only to research, plan and manage what they want to do but also to easily incorporate mobility solutions into their travel plans.”

The actuality is a bit more prosaic than the PR.

TripAdvisor (China) will build dedicated Didi “stations” at 100 hotels where there is a demand from guests to get to local tourist attractions.

Whether these stations are a branded kiosks in reception or an employee dressed up as the TripAdvisor owl to orchestrate traffic outside the hotels remains to be seen.

But the partnership, however vague or tenuous at this nascent stage, could, in theory, develop into something significant. Particularly as Uber China, which Didi took over in August, launched “Uber + Travel”, an initiative which aimed to “connect travellers with the travel services they need before, during and after their journey.”

Currently we have nothing more than an interesting offline tie-up between two massive brands, and a lot needs to happen before a “full-service ecosystem of services for travellers” starring Didi and TripAdvisor becomes a reality.

Still, every paradigm shift and game-changer has to start somewhere.

TripAdvisor Acquires Citymaps in Quest to Offer Best-In-Class Tourism Mapping Features for Travelers

NEEDHAM, Mass., Aug. 24, 2016 (GLOBE NEWSWIRE) --

Travel planning and booking site TripAdvisor® (www.tripadvisor.com) today announced that it has acquired New York-based Citymaps (https://citymaps.com/), a social mapping platform that enables tourists to discover countless hidden gems and hot spots, near and far, all around the world. The website and app make it easy for consumers to find points of interest, navigate urban destinations and share favorite locations with friends.

"The Citymaps team understands how people experience their day through a maps lens," said Adam Medros, senior vice president, global product, TripAdvisor. "We are excited to welcome the team to the TripAdvisor family of brands to help TripAdvisor ensure its mapping features best address the needs of its users who are increasingly accessing the site on mobile devices."

"Over the past several years, we have built a popular mapping app that delivers socially-powered inspiration and exploration for travelers," said Elliot Cohen, CEO and co-founder of Citymaps. "Given our shared focus on helping travelers plan and experience a great trip, we look forward to working with the TripAdvisor team."

The importance of online mapping technology is increasingly significant in consumer usage for everyday situations, including tourism. In 2015, TripAdvisor's "TripBarometer Connected Traveler Report" revealed that 81 percent of U.S. travelers use maps on their smartphones to find their way around¹.

TripAdvisor's existing mapping features currently help consumers find, book and experience the best things destinations have to offer and receive millions of views per day.

Citymaps will continue to be run as a standalone business. Terms of the acquisition will not be disclosed.

NEEDHAM, Mass., Aug. 24, 2016 (GLOBE NEWSWIRE) --

Travel planning and booking site TripAdvisor® (www.tripadvisor.com) today announced that it has acquired New York-based Citymaps (https://citymaps.com/), a social mapping platform that enables tourists to discover countless hidden gems and hot spots, near and far, all around the world. The website and app make it easy for consumers to find points of interest, navigate urban destinations and share favorite locations with friends.

"The Citymaps team understands how people experience their day through a maps lens," said Adam Medros, senior vice president, global product, TripAdvisor. "We are excited to welcome the team to the TripAdvisor family of brands to help TripAdvisor ensure its mapping features best address the needs of its users who are increasingly accessing the site on mobile devices."

"Over the past several years, we have built a popular mapping app that delivers socially-powered inspiration and exploration for travelers," said Elliot Cohen, CEO and co-founder of Citymaps. "Given our shared focus on helping travelers plan and experience a great trip, we look forward to working with the TripAdvisor team."

The importance of online mapping technology is increasingly significant in consumer usage for everyday situations, including tourism. In 2015, TripAdvisor's "TripBarometer Connected Traveler Report" revealed that 81 percent of U.S. travelers use maps on their smartphones to find their way around¹.

TripAdvisor's existing mapping features currently help consumers find, book and experience the best things destinations have to offer and receive millions of views per day.

Citymaps will continue to be run as a standalone business. Terms of the acquisition will not be disclosed.

Antwort auf Beitrag Nr.: 52.559.426 von R-BgO am 07.06.16 13:55:28https://skift.com/2016/06/16/tripadvisor-is-a-smart-acquisit…

fände ich interessant:

Is a Priceline Acquisition of TripAdvisor Becoming More Feasible?

Rani Molla and Tara Lachapelle, Bloomberg - Jun 06, 2016 6:00 pm

https://skift.com/2016/06/06/is-a-priceline-acquisition-of-t…

Priceline Group is a huge internet company that continues to grow, is immensely profitable and usually over-delivers on its forecasts. Yet cutthroat competition in the online travel industry has left its stock looking dull lately.

The $64 billion behemoth and its fiercest rival, $16 billion Expedia, have been going head to head for the best assets, as newer vacation-rental entrants like HomeAway and Airbnb — valued at almost $26 billion in its latest funding round — take some market share. Most of the big takeover candidates have already been bought up: Kayak and Booking.com are owned by Priceline, which has also been investing in businesses abroad such as China’s Ctrip.com, while Travelocity, Orbitz and HomeAway have all sold to Expedia. In fact, the September completion of the Orbitz deal allowed Expedia to reclaim the No. 1 position in online bookings.

Priceline sought to broaden its reach in 2014 by acquiring OpenTable, a restaurant-booking service rather than a travel site. But as you can see in the chart below, that pricey $2.4 billion acquisition has had little impact on Priceline shares. They’ve risen about 7 percent since the deal closed, compared with a 36 percent surge in Expedia’s stock over the span.

It hasn’t helped that France, a major travel destination, was the target of terrorist attacks in November, and that China’s smog is turning off tourists. But to boot, Priceline’s CEO resigned in April after the company learned that he had an inappropriate relationship with an employee. And last week, the head of the Priceline.com unit also quit for a job outside of the travel industry. Jeffrey Boyd, Priceline’s chairman who was previously CEO from 2002 to 2013, is running the company while the board searches for a permanent CEO replacement.

On the one hand, Boyd may not want to make any big changes ahead of new management coming in. However, no one knows the company better than he does and there’s a deal opportunity he might not want to miss — or let Expedia get a hold of. That would be TripAdvisor.

Valued at $10 billion, TripAdvisor (ticker symbol TRIP) is the industry’s last major publicly traded target in the U.S. The business was actually spun off from Expedia in 2011 because it had been growing far faster than Expedia’s main operations. But now, the trend is moving back toward consolidation and scale — and no doubt both Priceline and Expedia have had their eye on TripAdvisor. Investors in this space need something to get excited about, and recent weakness in TripAdvisor’s shares (mostly due to the aforementioned industry headwinds) means it may be a good time to pounce.

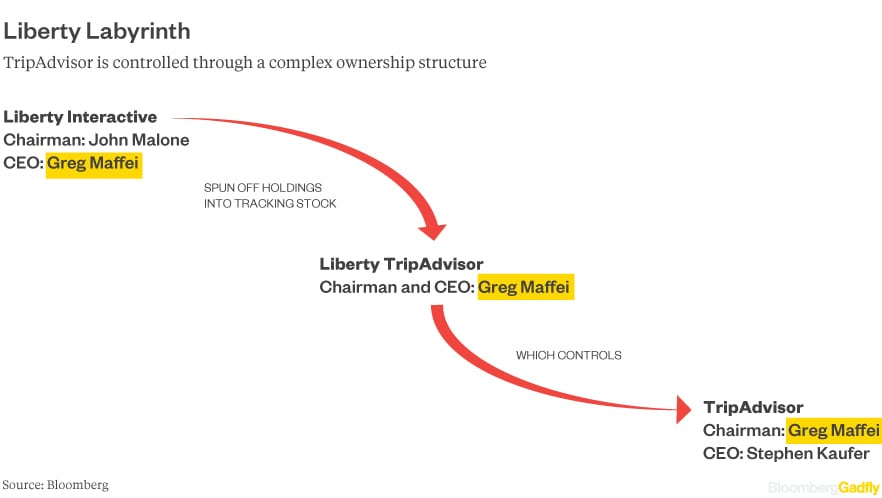

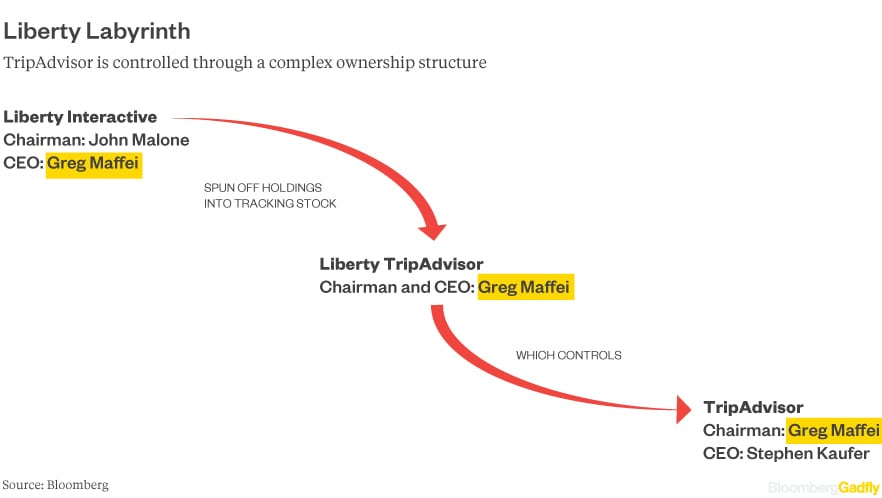

Expedia and TripAdvisor are still somewhat connected. Billionaires John Malone and Barry Diller control Expedia, while Malone’s business partner Greg Maffei effectively controls TripAdvisor through the Liberty TripAdvisor tracking stock, which was created in 2014 — a move that some thought signaled Malone and Maffei were opening the door to some sort of deal. That said, the ownership structure does make an acquisition of TripAdvisor a bit more complex than a typical M&A transaction.

Furthermore, even though TripAdvisor’s shares (and the tracking stock) have dropped 20 percent this year, a takeover still wouldn’t be cheap. The company is valued at 34 times its trailing 12-month Ebitda, a slightly higher multiple than Kayak fetched in its sale to Priceline. And with a takeover premium, a TripAdvisor acquisition would be nearing the steep 45 times Ebitda that Priceline paid for OpenTable. But in return, a buyer — be it Priceline or Expedia — could gain precious market share and expand its global footprint:

Whether Malone, Maffei and Boyd would work out a deal is just speculation at this point. But Priceline could use some excitement, perhaps in the form of a TRIP.

Is a Priceline Acquisition of TripAdvisor Becoming More Feasible?

Rani Molla and Tara Lachapelle, Bloomberg - Jun 06, 2016 6:00 pm

https://skift.com/2016/06/06/is-a-priceline-acquisition-of-t…

Priceline Group is a huge internet company that continues to grow, is immensely profitable and usually over-delivers on its forecasts. Yet cutthroat competition in the online travel industry has left its stock looking dull lately.

The $64 billion behemoth and its fiercest rival, $16 billion Expedia, have been going head to head for the best assets, as newer vacation-rental entrants like HomeAway and Airbnb — valued at almost $26 billion in its latest funding round — take some market share. Most of the big takeover candidates have already been bought up: Kayak and Booking.com are owned by Priceline, which has also been investing in businesses abroad such as China’s Ctrip.com, while Travelocity, Orbitz and HomeAway have all sold to Expedia. In fact, the September completion of the Orbitz deal allowed Expedia to reclaim the No. 1 position in online bookings.

Priceline sought to broaden its reach in 2014 by acquiring OpenTable, a restaurant-booking service rather than a travel site. But as you can see in the chart below, that pricey $2.4 billion acquisition has had little impact on Priceline shares. They’ve risen about 7 percent since the deal closed, compared with a 36 percent surge in Expedia’s stock over the span.

It hasn’t helped that France, a major travel destination, was the target of terrorist attacks in November, and that China’s smog is turning off tourists. But to boot, Priceline’s CEO resigned in April after the company learned that he had an inappropriate relationship with an employee. And last week, the head of the Priceline.com unit also quit for a job outside of the travel industry. Jeffrey Boyd, Priceline’s chairman who was previously CEO from 2002 to 2013, is running the company while the board searches for a permanent CEO replacement.

On the one hand, Boyd may not want to make any big changes ahead of new management coming in. However, no one knows the company better than he does and there’s a deal opportunity he might not want to miss — or let Expedia get a hold of. That would be TripAdvisor.

Valued at $10 billion, TripAdvisor (ticker symbol TRIP) is the industry’s last major publicly traded target in the U.S. The business was actually spun off from Expedia in 2011 because it had been growing far faster than Expedia’s main operations. But now, the trend is moving back toward consolidation and scale — and no doubt both Priceline and Expedia have had their eye on TripAdvisor. Investors in this space need something to get excited about, and recent weakness in TripAdvisor’s shares (mostly due to the aforementioned industry headwinds) means it may be a good time to pounce.

Expedia and TripAdvisor are still somewhat connected. Billionaires John Malone and Barry Diller control Expedia, while Malone’s business partner Greg Maffei effectively controls TripAdvisor through the Liberty TripAdvisor tracking stock, which was created in 2014 — a move that some thought signaled Malone and Maffei were opening the door to some sort of deal. That said, the ownership structure does make an acquisition of TripAdvisor a bit more complex than a typical M&A transaction.

Furthermore, even though TripAdvisor’s shares (and the tracking stock) have dropped 20 percent this year, a takeover still wouldn’t be cheap. The company is valued at 34 times its trailing 12-month Ebitda, a slightly higher multiple than Kayak fetched in its sale to Priceline. And with a takeover premium, a TripAdvisor acquisition would be nearing the steep 45 times Ebitda that Priceline paid for OpenTable. But in return, a buyer — be it Priceline or Expedia — could gain precious market share and expand its global footprint:

Whether Malone, Maffei and Boyd would work out a deal is just speculation at this point. But Priceline could use some excitement, perhaps in the form of a TRIP.

Ja finde die Umstellung auf Instant Buchung auch gut, aber wie weit das bei der Profitabilität was ausmacht. Derzeit mir noch zu teuer aber ist auf der Watchliste: http://www.investresearch.net/tripadvisor-aktie/

...aber die Jahreszahlen haben der Börse gefallen: Kurs von 60 auf 72 euro

Ja Margen gehen runter und dafür eigentlich immer noch zu teuer, bei 40 USD würde ich wieder einsteigen. Hier noch eine Analyse zu Tripadvisor:

http://www.investresearch.net/tripadvisor-aktie/

http://www.investresearch.net/tripadvisor-aktie/

29.02.24 · dpa-AFX · TripAdvisor |

13.02.24 · dpa-AFX · Boeing |

13.02.24 · dpa-AFX · Boeing |

13.02.24 · dpa-AFX · Applied Materials |

13.02.24 · dpa-AFX · Coca-Cola |

13.02.24 · dpa-AFX · Applied Materials |

09.02.24 · dpa-AFX · IBM |

09.02.24 · dpa-AFX · Apple |