Alternet Systems - mobile banking and security - 500 Beiträge pro Seite

eröffnet am 30.01.12 11:14:00 von

neuester Beitrag 10.03.15 13:24:19 von

neuester Beitrag 10.03.15 13:24:19 von

Beiträge: 298

ID: 1.172.036

ID: 1.172.036

Aufrufe heute: 1

Gesamt: 58.685

Gesamt: 58.685

Aktive User: 0

ISIN: US02146M2017 · WKN: A0NBWD · Symbol: ALYI

0,0005

USD

+25,00 %

+0,0001 USD

Letzter Kurs 21:46:05 Nasdaq OTC

Werte aus der Branche Telekommunikation

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 87.000,00 | +33,85 | |

| 48,84 | +13,58 | |

| 65,10 | +11,86 | |

| 14,200 | +9,23 | |

| 1,7900 | +8,48 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 23,78 | -8,76 | |

| 22,600 | -8,87 | |

| 145,18 | -10,88 | |

| 2,0100 | -11,06 | |

| 19,500 | -32,10 |

Hallo !

Ich verfolge diese Aktie seit mehreren Monaten.

Aus Zeitmangel habe ich bisher keinen Thread hierzu eröffnet.

In einem meiner bestehenden Threads, INT, habe ich das getan, was ich eigentlich selbst nicht leiden kann, nämlich auf eine andere Aktie hingewiesen - ALYI.

Da umgehend ein feedback kam, und ich im bestehenden Thread nicht über eine andere Aktie diskutieren wollte, nun doch diese Neueröffnung.

Allzuviele Infos werde ich hier nicht einstellen können, da der Zeitmangel natürlich dennoch vorhanden ist ...

Ich stelle im Folgenden meinen Beitrag im INT-Thraed und die Antwort darauf hier ein.

Gruß, praesens

Ich verfolge diese Aktie seit mehreren Monaten.

Aus Zeitmangel habe ich bisher keinen Thread hierzu eröffnet.

In einem meiner bestehenden Threads, INT, habe ich das getan, was ich eigentlich selbst nicht leiden kann, nämlich auf eine andere Aktie hingewiesen - ALYI.

Da umgehend ein feedback kam, und ich im bestehenden Thread nicht über eine andere Aktie diskutieren wollte, nun doch diese Neueröffnung.

Allzuviele Infos werde ich hier nicht einstellen können, da der Zeitmangel natürlich dennoch vorhanden ist ...

Ich stelle im Folgenden meinen Beitrag im INT-Thraed und die Antwort darauf hier ein.

Gruß, praesens

Hallo,

ich mache jetzt etwas, das ich eigentlich selbst überhaupt nicht ausstehen kann - ich verweise in einem Thread auf eine andere Aktie ...

Ich würde schon seit Wochen gerne zu ALYI einen eigenen Thrad hier auf w:o eröffnen, aber mir fehlt ganz einfach die Zeit dazu.

Aufgrund dessen dieses Ausnahme-posting ...

Im stockhouse bullboard, und speziell im jimrockford blog, erfahrt Ihr Alles wesentliche.

January 2012 jimrockford blog

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=1243…

A few points re the jimrockford blog

* I write my blog in the style of an aggregator – and one who is trying to bring up things which might not be covered otherwise.

* This is a blog that covers a few microcap / juniors – ie. companies in which I do extensive DD, or have information trap-lines set to follow when and where nobody else will/can.

* I may own the first set of companies mentioned in the title. The rest, referred to as “Others” in the title heading, I absolutely would not have in my portfolio.

ALYI

The mobile commerce and mobile security spaces are growing in North and South America very, very quickly. All my DD tells me that Alternet has the head start and the chops to do extremely well.

I believe that the next month and a half will be stellar for ALYI, leading into one fantastic year. IMHO – MAKE SURE YOU HAVE YOUR POSITION RIGHT NOW.

- The DD being put on the ALYI bullboard is excellent. Read it. Then read it again.

- My jimrockford blog has done extensive DD work. So, use it. Here is a link:

http://www.stockhouse.com/Blogs/ViewBlog.aspx?b=1435

- The market movement is excellent. I myself have tested the strength of the bids – and they are strong.

The technicals show ALYI to be a STRONG BUY. Here’s a link:

http://barchart.com/quotes/stocks/ALYI

IMHO, ALYI is making a move right now and is going well north of today’s SP. I think this will be very exciting and rewarding.

Wenn es jemanden interessiert - viel Spaß !

Gruß, praesens

ich mache jetzt etwas, das ich eigentlich selbst überhaupt nicht ausstehen kann - ich verweise in einem Thread auf eine andere Aktie ...

Ich würde schon seit Wochen gerne zu ALYI einen eigenen Thrad hier auf w:o eröffnen, aber mir fehlt ganz einfach die Zeit dazu.

Aufgrund dessen dieses Ausnahme-posting ...

Im stockhouse bullboard, und speziell im jimrockford blog, erfahrt Ihr Alles wesentliche.

January 2012 jimrockford blog

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=1243…

A few points re the jimrockford blog

* I write my blog in the style of an aggregator – and one who is trying to bring up things which might not be covered otherwise.

* This is a blog that covers a few microcap / juniors – ie. companies in which I do extensive DD, or have information trap-lines set to follow when and where nobody else will/can.

* I may own the first set of companies mentioned in the title. The rest, referred to as “Others” in the title heading, I absolutely would not have in my portfolio.

ALYI

The mobile commerce and mobile security spaces are growing in North and South America very, very quickly. All my DD tells me that Alternet has the head start and the chops to do extremely well.

I believe that the next month and a half will be stellar for ALYI, leading into one fantastic year. IMHO – MAKE SURE YOU HAVE YOUR POSITION RIGHT NOW.

- The DD being put on the ALYI bullboard is excellent. Read it. Then read it again.

- My jimrockford blog has done extensive DD work. So, use it. Here is a link:

http://www.stockhouse.com/Blogs/ViewBlog.aspx?b=1435

- The market movement is excellent. I myself have tested the strength of the bids – and they are strong.

The technicals show ALYI to be a STRONG BUY. Here’s a link:

http://barchart.com/quotes/stocks/ALYI

IMHO, ALYI is making a move right now and is going well north of today’s SP. I think this will be very exciting and rewarding.

Wenn es jemanden interessiert - viel Spaß !

Gruß, praesens

Hi praesens

Hast Du deine DD gemacht?

Die Umsatzrückgang auf Jahresbasis beträgt 90%!!!! (Vergleich 3 Monate September gegenüber Vorjahr)

http://www.easyir.com/easyir/edgr.do?easyirid=26A2B632BF19C9…

http://yahoo.brand.edgar-online.com/default.aspx?cik=1126003

http://yahoo.brand.edgar-online.com/DisplayFiling.aspx?TabIn…

http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?F…

Three months ended Nine months ended

September 30, September 30,

2011 2010 2011 2010

REVENUE

Sales $ 60,606 $ 665,634 $ 137,450 $ 763,238

Sales discounts - (145,500 ) (8,656 ) (145,500 )

TOTAL REVENUE 60,606 520,134 128,794 617,738

COST OF SALES

Direct cost of sales 48,138 316,486 98,786 349,850

GROSS PROFIT 12,468 203,648 30,008 267,888

Hast Du deine DD gemacht?

Die Umsatzrückgang auf Jahresbasis beträgt 90%!!!! (Vergleich 3 Monate September gegenüber Vorjahr)

http://www.easyir.com/easyir/edgr.do?easyirid=26A2B632BF19C9…

http://yahoo.brand.edgar-online.com/default.aspx?cik=1126003

http://yahoo.brand.edgar-online.com/DisplayFiling.aspx?TabIn…

http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?F…

Three months ended Nine months ended

September 30, September 30,

2011 2010 2011 2010

REVENUE

Sales $ 60,606 $ 665,634 $ 137,450 $ 763,238

Sales discounts - (145,500 ) (8,656 ) (145,500 )

TOTAL REVENUE 60,606 520,134 128,794 617,738

COST OF SALES

Direct cost of sales 48,138 316,486 98,786 349,850

GROSS PROFIT 12,468 203,648 30,008 267,888

Antwort auf Beitrag Nr.: 42.667.168 von praesens am 30.01.12 11:18:31Ja, simonalex, habe ich !

Der Umsatzrückgang beträgt m.E. 55 %, von 137.450 auf 60.606 für den 3-Monats-Zeitraum. Aber das nur am Rande.

Es verhält sich hier wie bei INT - der Umsatz ist momentan egal, da quasi sowieso nicht vorhanden.

Ob 60.000 oder 137.000 - relativ lachhaft ist Beides, um anhand dessen eine Investitionsentscheidung treffen zu wollen.

Somit für mich nicht gegeneinander abwägbar.

Auch hier geht es um die zukünftigen Chancen, und nicht um den marginalen Umsatz eines start-ups !

Wie gesagt, lest Euch in die story ein, nicht in die Zahlen.

Die kommen bei guter story automatisch - hoffentlich ...

Gruß, praesens

Der Umsatzrückgang beträgt m.E. 55 %, von 137.450 auf 60.606 für den 3-Monats-Zeitraum. Aber das nur am Rande.

Es verhält sich hier wie bei INT - der Umsatz ist momentan egal, da quasi sowieso nicht vorhanden.

Ob 60.000 oder 137.000 - relativ lachhaft ist Beides, um anhand dessen eine Investitionsentscheidung treffen zu wollen.

Somit für mich nicht gegeneinander abwägbar.

Auch hier geht es um die zukünftigen Chancen, und nicht um den marginalen Umsatz eines start-ups !

Wie gesagt, lest Euch in die story ein, nicht in die Zahlen.

Die kommen bei guter story automatisch - hoffentlich ...

Gruß, praesens

http://finance.yahoo.com/q/hp?s=ALYI.PK&a=11&b=12&c=2005&d=0…

Jan 24, 2008 1: 10 Stock Split (??????)

Es gibt überhaupt keine Insiderkäufe auf die angeblich vervorstehenden Neuigkeiten.

Nach meiner kurze Recherche ist das ein ewiges Talent, dass seit Jahren dahintümpelt. Zudem schreibt der Author, dass er denkt, dass es sich bei diesem Deal um ALYI handeln könnte.

Warum hätten sie dazu kein news herausbringen sollen.

Selbst auf Gerüchte reagiert der Aktienpreis gewöhnlich. Hier aber tut sich nichts?

Jan 24, 2008 1: 10 Stock Split (??????)

Es gibt überhaupt keine Insiderkäufe auf die angeblich vervorstehenden Neuigkeiten.

Nach meiner kurze Recherche ist das ein ewiges Talent, dass seit Jahren dahintümpelt. Zudem schreibt der Author, dass er denkt, dass es sich bei diesem Deal um ALYI handeln könnte.

Warum hätten sie dazu kein news herausbringen sollen.

Selbst auf Gerüchte reagiert der Aktienpreis gewöhnlich. Hier aber tut sich nichts?

http://www.easyir.com/easyir/customrel.do?easyirid=26A2B632B…

Alternet Systems, Inc. (ALYI) Arranges First Tranche of Private Placement

MIAMI, FL -- (Marketwire) -- 07/20/2011 -- Alternet Systems, Inc. (OTCQB: ALYI) (PINKSHEETS: ALYI) today announced that it has arranged a non-brokered private placement. The proceeds of the private placement will be used to finance Alternet's growth plan in the high growth segments of the mobile value added services markets, mobile commerce and digital and mobile security. Mobile value added services are growing explosively fueled by the near ubiquity of the mobile phone, which has achieved over 80% penetration of the global population.

In the transaction concluded June 15th, a new investor purchased 3,333,333 common shares for $500,000. As part of the transaction the investor received warrants for an additional 2,000,000 shares at an Exercise Price of $0.25 per share. The warrants have an 18 month term and carry a call option, should the Company's share trade at $0.40 or higher for any 60 day period. This placement adds to funds raised earlier in the second quarter, as disclosed in the company's filings.

Alternet CEO Henryk Dabrowski expressed great optimism at the news of the capital raise, saying, "This new investor clearly sees the potential in Alternet and its mobile industry investments. We appreciate their support and investment at a time where we are fulfilling key contracts and projects with Mobile Network Operators and Banks in the Americas. This private placement, in this and future tranches, allows Alternet to fund its high growth subsidiaries."

Alternet's mobile commerce subsidiary, Utiba Americas, is rapidly expanding its presence throughout Latin America and deploying customer contracts. Utiba Americas is a joint venture with Singapore based software developer, Utiba, a leading provider of mobile financial service platforms worldwide. Alternet's digital and mobile security subsidiary, International Mobile Security (IMS), is marketing mobile security products to the global law enforcement community and preparing to launch mobile security products for the enterprise and consumer markets. IMS's product portfolio was recently augmented with the acquisition of intellectual property concluded in the first quarter of 2011.

On Thursday, July 28th, Alternet's management will issue a letter to update current and prospective shareholders on the status of business in the first half of 2011.

http://finance.yahoo.com/q/pr?s=ALYI.PK+Profile

Bei Lohnbezügen von 400K jährlich alleine für die beiden Top Manager, reichen die 500K nicht allzuweit.

Alternet Systems, Inc. (ALYI) Arranges First Tranche of Private Placement

MIAMI, FL -- (Marketwire) -- 07/20/2011 -- Alternet Systems, Inc. (OTCQB: ALYI) (PINKSHEETS: ALYI) today announced that it has arranged a non-brokered private placement. The proceeds of the private placement will be used to finance Alternet's growth plan in the high growth segments of the mobile value added services markets, mobile commerce and digital and mobile security. Mobile value added services are growing explosively fueled by the near ubiquity of the mobile phone, which has achieved over 80% penetration of the global population.

In the transaction concluded June 15th, a new investor purchased 3,333,333 common shares for $500,000. As part of the transaction the investor received warrants for an additional 2,000,000 shares at an Exercise Price of $0.25 per share. The warrants have an 18 month term and carry a call option, should the Company's share trade at $0.40 or higher for any 60 day period. This placement adds to funds raised earlier in the second quarter, as disclosed in the company's filings.

Alternet CEO Henryk Dabrowski expressed great optimism at the news of the capital raise, saying, "This new investor clearly sees the potential in Alternet and its mobile industry investments. We appreciate their support and investment at a time where we are fulfilling key contracts and projects with Mobile Network Operators and Banks in the Americas. This private placement, in this and future tranches, allows Alternet to fund its high growth subsidiaries."

Alternet's mobile commerce subsidiary, Utiba Americas, is rapidly expanding its presence throughout Latin America and deploying customer contracts. Utiba Americas is a joint venture with Singapore based software developer, Utiba, a leading provider of mobile financial service platforms worldwide. Alternet's digital and mobile security subsidiary, International Mobile Security (IMS), is marketing mobile security products to the global law enforcement community and preparing to launch mobile security products for the enterprise and consumer markets. IMS's product portfolio was recently augmented with the acquisition of intellectual property concluded in the first quarter of 2011.

On Thursday, July 28th, Alternet's management will issue a letter to update current and prospective shareholders on the status of business in the first half of 2011.

http://finance.yahoo.com/q/pr?s=ALYI.PK+Profile

Bei Lohnbezügen von 400K jährlich alleine für die beiden Top Manager, reichen die 500K nicht allzuweit.

Antwort auf Beitrag Nr.: 42.667.286 von Simonalex am 30.01.12 11:37:27"Es gibt überhaupt keine Insiderkäufe auf die angeblich vervorstehenden Neuigkeiten."

Dazu kann ich Dir mindestens 2 weitere Beispiele nennen, bei denen ich auch investiert bin , und die in den letzten Wochen jeweils um grob 50 % zugelegt haben.

, und die in den letzten Wochen jeweils um grob 50 % zugelegt haben.

Und ein split von vor 4 Jahren ...?

Überdies hatte der Kurs reagiert - von 12 Cent auf 20 Cent.

Kam wieder zurück - sitzt jetzt bei 15 Cent.

Der Umsatz ist allerdings allgemein recht lächerlich.

Aber auch das interessiert mich nicht wirklich.

Also, wer den Wert nicht mag, bitte !

Ich zwinge ja niemand.

Gruß, praesens

Dazu kann ich Dir mindestens 2 weitere Beispiele nennen, bei denen ich auch investiert bin

, und die in den letzten Wochen jeweils um grob 50 % zugelegt haben.

, und die in den letzten Wochen jeweils um grob 50 % zugelegt haben.Und ein split von vor 4 Jahren ...?

Überdies hatte der Kurs reagiert - von 12 Cent auf 20 Cent.

Kam wieder zurück - sitzt jetzt bei 15 Cent.

Der Umsatz ist allerdings allgemein recht lächerlich.

Aber auch das interessiert mich nicht wirklich.

Also, wer den Wert nicht mag, bitte !

Ich zwinge ja niemand.

Gruß, praesens

Antwort auf Beitrag Nr.: 42.667.286 von Simonalex am 30.01.12 11:37:27

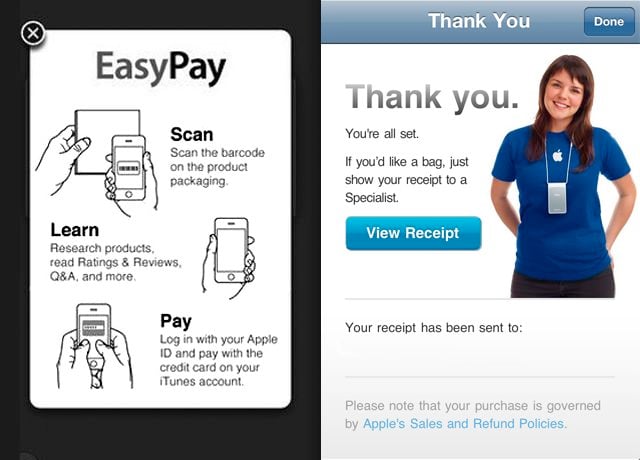

Hier ganz einfach ausgedrückt die Geschäftsidee:

Mobile banking per Handy für die "ärmere" Bevölkerung dieser Welt, die keinen Zugang zu Bankkonten haben.

Hier ganz einfach ausgedrückt die Geschäftsidee:

Mobile banking per Handy für die "ärmere" Bevölkerung dieser Welt, die keinen Zugang zu Bankkonten haben.

Antwort auf Beitrag Nr.: 42.667.286 von Simonalex am 30.01.12 11:37:27Wer den Wert interesant findet, hier 2 homepages:

Alternet und Utiba Americas:

http://alternetsystems.com/joomla/

http://www.utiba.com/

Alternet und Utiba Americas:

http://alternetsystems.com/joomla/

http://www.utiba.com/

Antwort auf Beitrag Nr.: 42.667.198 von praesens am 30.01.12 11:23:31Zitat "Der Umsatzrückgang beträgt m.E. 55 %, von 137.450 auf 60.606 für den 3-Monats-Zeitraum. Aber das nur am Rande."

http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?F…

Verkäufe September Quartal 2011 60K

Verkäufe September Quartal 2010 665K

Verkäufe Januar bis September 2011 137K

Verkäufe Januar bis September 2010 763 K

http://finance.yahoo.com/q/pr?s=ALYI.PK+Profile

Alternet Systems, Inc. provides long-distance telecommunications services, mobile transaction services, and Internet content management solutions for the North and South American markets. The company also offers mobile value added services for mobile commerce and mobile security. It provides mobile financial and mobile commerce suite of services as a software license, or as software-as-a-service. In addition, the company offers voice over Internet protocol services primarily in Latin America. Alternet Systems, Inc. was founded in 2002 and is headquartered in Miami, Florida.

Existiert seit zehn Jahren (ewiges Talent)

http://www.alternetsystems.com/joomla/index.php?option=com_c…

Mobile Commerce and Transaction Solutions

Utiba Americas is the result of a joint venture between Alternet and Utiba Pte Ltd, a Singapore company, and leader in mobile financial transactions. Alternet is a majority shareholder in the venture.

Utiba Americas has the exclusive rights to market all Utiba products, offered as Software as a Service (SaS), in North, South, and Central America, and the Caribbean. The company targets mobile operators, financial institutions, money remitters, governments and utilities, and retailers, to name a few.

M-Commerce Services Include:

Mobile Commerce

Mobile Banking

Top Up (recharge)

Person to Person Value Transfer

Loyalty and Retention (points)

International & Domestic Money Remittance

Microfinance and Microloans

Mobile Merchant (bill payment/ credit card processing)

Mobile Collection Logistics (Mass Consumer Companies)

Mobile Recharge of Prepaid Services (Cable TV, Urban Transportation, Municipal Services)

Verstehe nicht, dass all das nur einen Umsatz von 60 K im letzten Quartal gebracht hat. Verlust war 585 K im letzten Quartal per Ende September 2011.

Die MK beträgt 10 Millionen USD. Selbst wenn die 10 jährige Firma 2 Million Umsatz machen würde im Jahr, wär das Unternehmen stolz bewertet.

@praesens: Warum sollte es jetzt plötzlich soviel Wachstum geben?

http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?F…

Verkäufe September Quartal 2011 60K

Verkäufe September Quartal 2010 665K

Verkäufe Januar bis September 2011 137K

Verkäufe Januar bis September 2010 763 K

http://finance.yahoo.com/q/pr?s=ALYI.PK+Profile

Alternet Systems, Inc. provides long-distance telecommunications services, mobile transaction services, and Internet content management solutions for the North and South American markets. The company also offers mobile value added services for mobile commerce and mobile security. It provides mobile financial and mobile commerce suite of services as a software license, or as software-as-a-service. In addition, the company offers voice over Internet protocol services primarily in Latin America. Alternet Systems, Inc. was founded in 2002 and is headquartered in Miami, Florida.

Existiert seit zehn Jahren (ewiges Talent)

http://www.alternetsystems.com/joomla/index.php?option=com_c…

Mobile Commerce and Transaction Solutions

Utiba Americas is the result of a joint venture between Alternet and Utiba Pte Ltd, a Singapore company, and leader in mobile financial transactions. Alternet is a majority shareholder in the venture.

Utiba Americas has the exclusive rights to market all Utiba products, offered as Software as a Service (SaS), in North, South, and Central America, and the Caribbean. The company targets mobile operators, financial institutions, money remitters, governments and utilities, and retailers, to name a few.

M-Commerce Services Include:

Mobile Commerce

Mobile Banking

Top Up (recharge)

Person to Person Value Transfer

Loyalty and Retention (points)

International & Domestic Money Remittance

Microfinance and Microloans

Mobile Merchant (bill payment/ credit card processing)

Mobile Collection Logistics (Mass Consumer Companies)

Mobile Recharge of Prepaid Services (Cable TV, Urban Transportation, Municipal Services)

Verstehe nicht, dass all das nur einen Umsatz von 60 K im letzten Quartal gebracht hat. Verlust war 585 K im letzten Quartal per Ende September 2011.

Die MK beträgt 10 Millionen USD. Selbst wenn die 10 jährige Firma 2 Million Umsatz machen würde im Jahr, wär das Unternehmen stolz bewertet.

@praesens: Warum sollte es jetzt plötzlich soviel Wachstum geben?

2 Utiba-news:

http://www.utiba.com/archives/531

"Utiba Executive Commends Nigerian Central Bank on Mobile Payment Guidelines ..."

http://www.utiba.com/archives/310

"Utiba Americas wins mobile wallet project from Central Bank of Ecuador ..."

1 Alternet-news:

http://finance.yahoo.com/news/Alternet-Systems-Inc-ALYI-iw-2…

"MIAMI, FL--(Marketwire -11/29/11)- Alternet Systems, Inc. (OTCQB: ALYI.PK - News) (Pinksheets: ALYI.PK - News) today announced the conclusion of an exclusive master distribution agreement between Alternet's subsidiary, International Mobile Security (IMS) and UK-based technology and systems integration company, Delma MSS, for the re-sale of Delma's mobile security solutions in the Western hemisphere.

Under this agreement IMS will be the exclusive master distributor of Delma's products and services in the Americas. Delma's technology provides mobile security solutions to global law enforcement agencies and mobile network operators, focusing on the following areas:

* Asset location and recovery

* Security and forensics

* GSM network surveying

IMS will offer these solutions to its existing clientele and contacts within the international law enforcement community, in conjunction with its existing portfolio of proprietary mobile security services.

Delma will also offer IMS' services to its global customer base, and the two companies have already identified a series of joint research and development projects to pursue.

IMS CEO Juan Cubides explained, "The inclusion of Delma's services into our mobile security portfolio further reinforces our offering to international law enforcement agencies. It is a perfect complement to our existing technologies and sales in this vertical market segment."

"Our agreement with IMS will bring us wider geographical coverage and result in a more comprehensive solutions portfolio for our partners and customers. We are excited by the opportunities that we have already begun to explore," said Gordon McKay, CEO of Delma MMS.

..."

http://www.utiba.com/archives/531

"Utiba Executive Commends Nigerian Central Bank on Mobile Payment Guidelines ..."

http://www.utiba.com/archives/310

"Utiba Americas wins mobile wallet project from Central Bank of Ecuador ..."

1 Alternet-news:

http://finance.yahoo.com/news/Alternet-Systems-Inc-ALYI-iw-2…

"MIAMI, FL--(Marketwire -11/29/11)- Alternet Systems, Inc. (OTCQB: ALYI.PK - News) (Pinksheets: ALYI.PK - News) today announced the conclusion of an exclusive master distribution agreement between Alternet's subsidiary, International Mobile Security (IMS) and UK-based technology and systems integration company, Delma MSS, for the re-sale of Delma's mobile security solutions in the Western hemisphere.

Under this agreement IMS will be the exclusive master distributor of Delma's products and services in the Americas. Delma's technology provides mobile security solutions to global law enforcement agencies and mobile network operators, focusing on the following areas:

* Asset location and recovery

* Security and forensics

* GSM network surveying

IMS will offer these solutions to its existing clientele and contacts within the international law enforcement community, in conjunction with its existing portfolio of proprietary mobile security services.

Delma will also offer IMS' services to its global customer base, and the two companies have already identified a series of joint research and development projects to pursue.

IMS CEO Juan Cubides explained, "The inclusion of Delma's services into our mobile security portfolio further reinforces our offering to international law enforcement agencies. It is a perfect complement to our existing technologies and sales in this vertical market segment."

"Our agreement with IMS will bring us wider geographical coverage and result in a more comprehensive solutions portfolio for our partners and customers. We are excited by the opportunities that we have already begun to explore," said Gordon McKay, CEO of Delma MMS.

..."

Okay, Simonalex, ich hab´s jetzt kapiert ...!

Es sind, laut comdirect, knapp 70 mio Aktien ausgegeben.

Und dann stellst Du mir hier eine news rein über die Neuasgabe von 3,3 mio neuen Stücken ...!

Hallo, wie finanzieren wir uns denn hier an OTC und TSXC-V - mit 2,9 % von der Deutschen Bank ...?!

Und klar, 500.000 $ in der Kasse, 400.000 $ gehen an die Jungs vom Vorstand, geben wir im Februar nochmal 3,3 mio Aktien aus, oder ...?!

(Achtung: Ironie ...)

Gruß, praesens

Es sind, laut comdirect, knapp 70 mio Aktien ausgegeben.

Und dann stellst Du mir hier eine news rein über die Neuasgabe von 3,3 mio neuen Stücken ...!

Hallo, wie finanzieren wir uns denn hier an OTC und TSXC-V - mit 2,9 % von der Deutschen Bank ...?!

Und klar, 500.000 $ in der Kasse, 400.000 $ gehen an die Jungs vom Vorstand, geben wir im Februar nochmal 3,3 mio Aktien aus, oder ...?!

(Achtung: Ironie ...)

Gruß, praesens

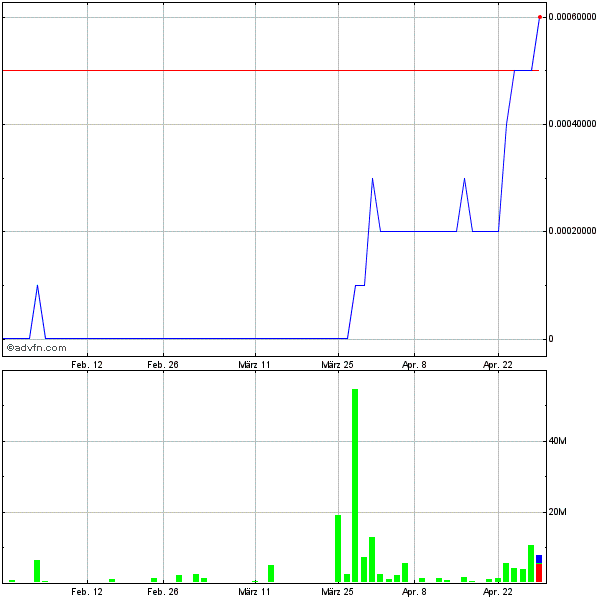

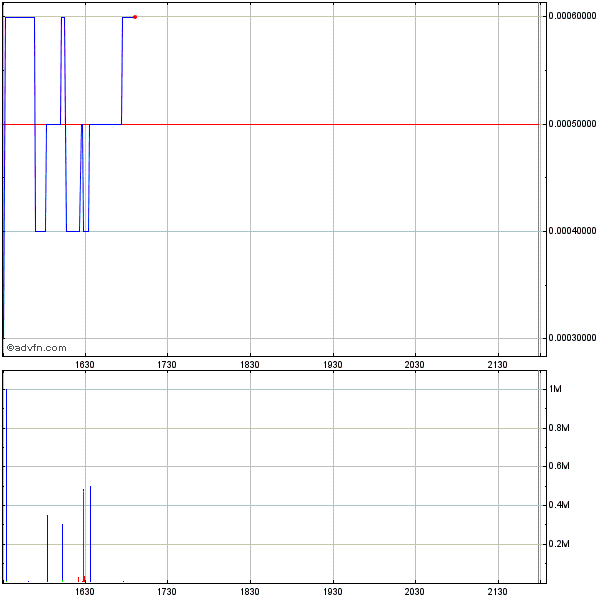

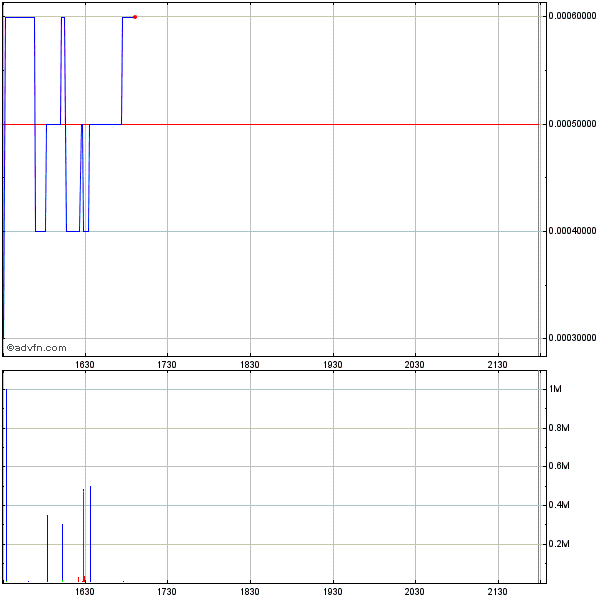

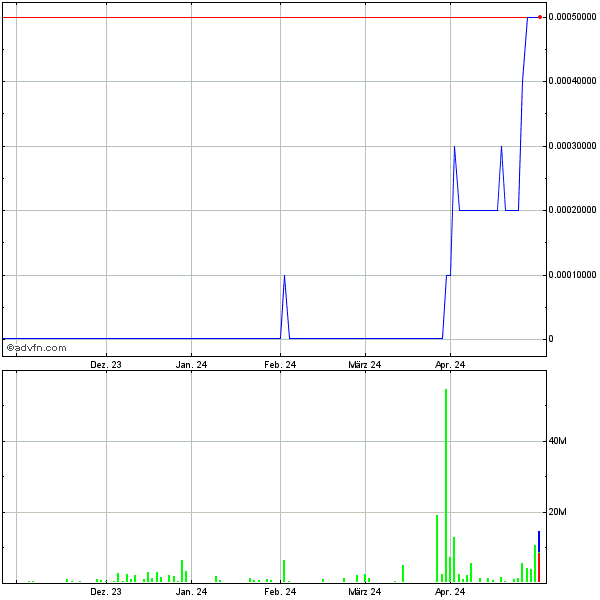

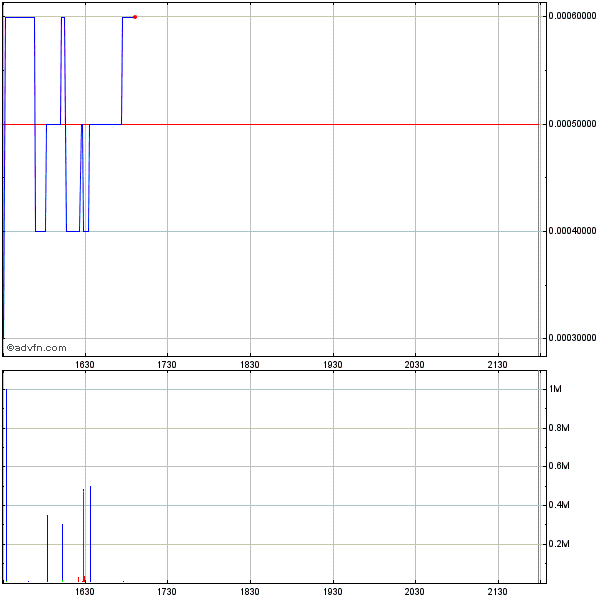

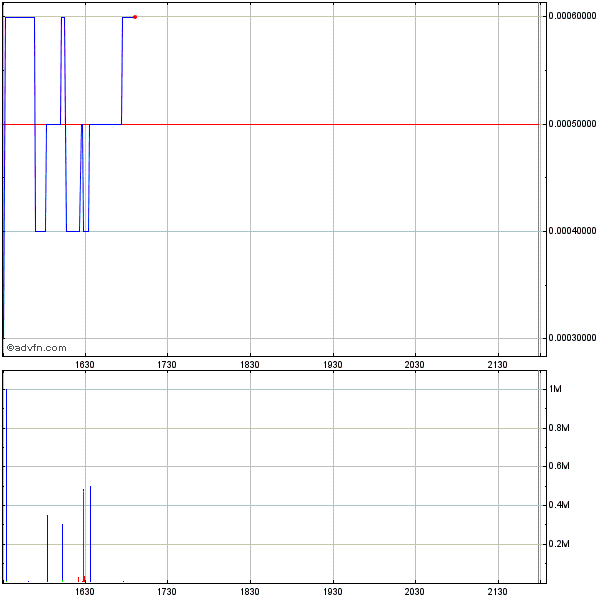

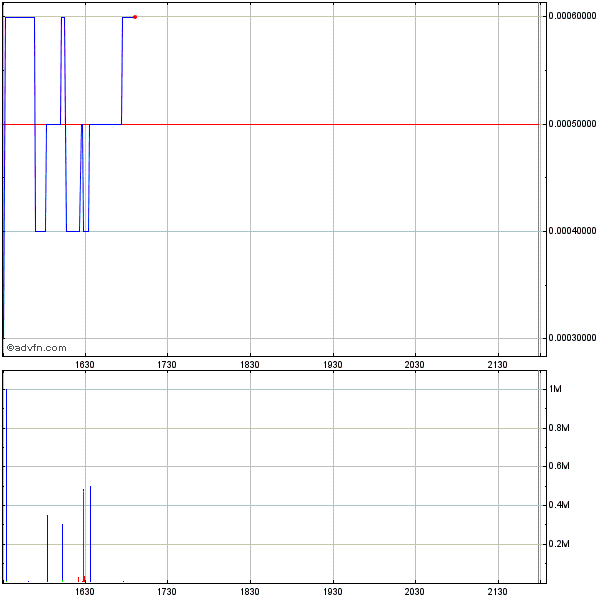

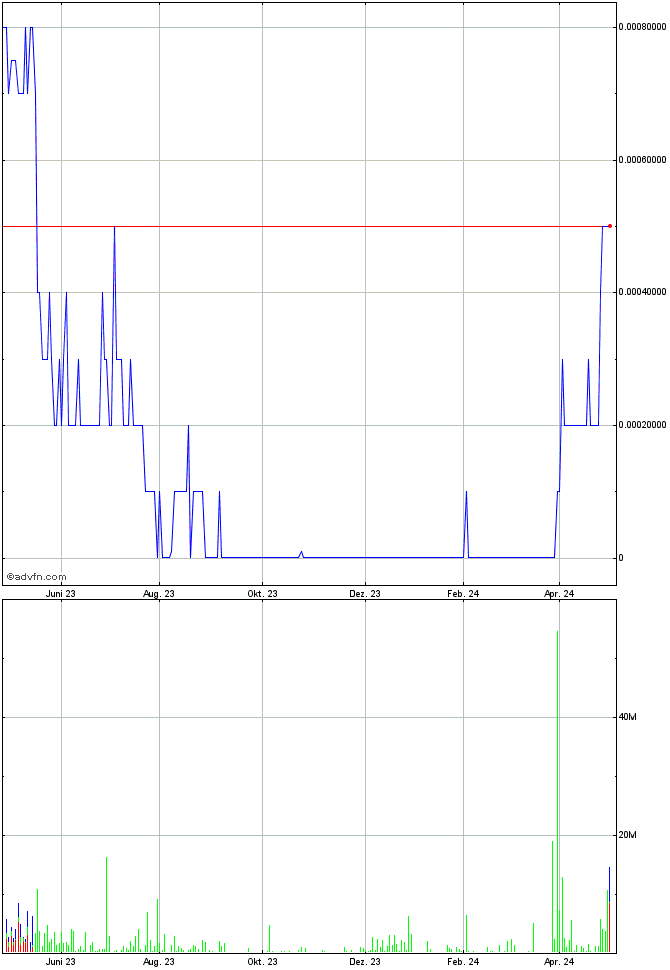

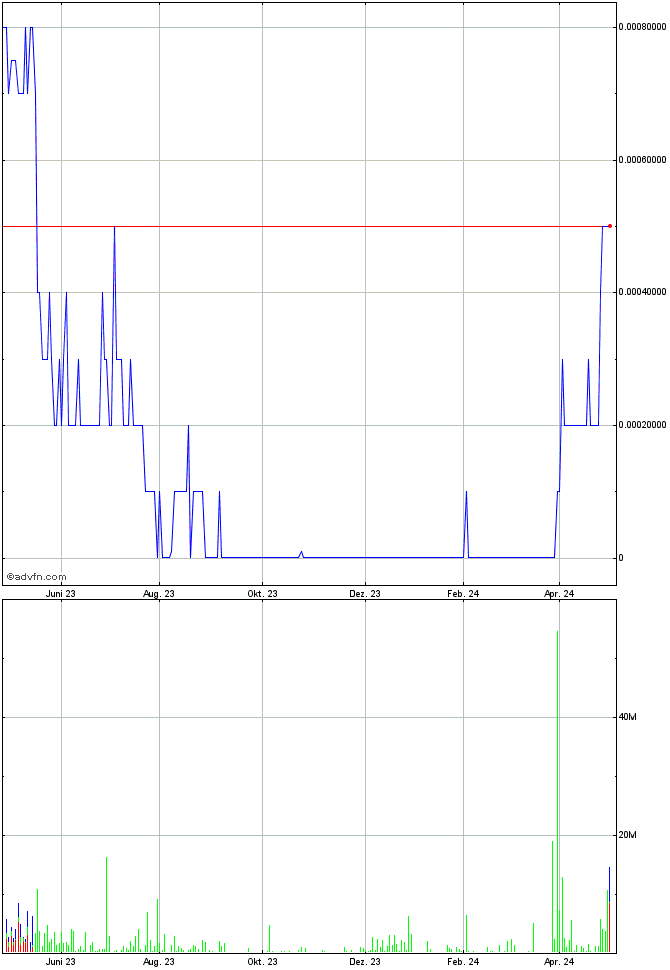

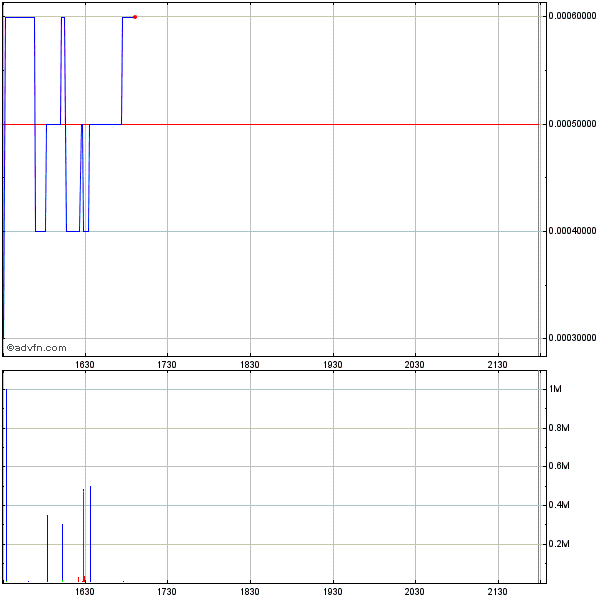

5-Jahres-Chart:

1-Jahres-Chart:

1-Jahres-Chart:

Ein stockhouse-posting mit dem Titel "connect the dots ...", man muß es aufmerksam lesen, es ist recht lang, aber es connected ...

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&…

Connect the dots ............

On Dec. 6th I mentioned that I had some unanswered questions. One of the questions came up when reading Jim Rockford's blog relating to the private placement.

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=1187…

The terms of the pp seemed unusual for the ALYI share price at the time.

Excerpts from ALYI News release about Private Placement

...............In the transaction concluded June 15th, a new investor purchased 3,333,333 common shares for $500,000. As part of the transaction the investor received warrants for an additional 2,000,000 shares at an Exercise Price of

.25 per share. The warrants have an 18 month term and carry a call option, should the Company's share trade at

.40 or higher for any 60 day period. This placement adds to funds raised earlier in the second quarter, as disclosed in the company's filings.

Alternet CEO Henryk Dabrowski expressed great optimism at the news of the capital raise, saying, "This new investor clearly sees the potential in Alternet and its mobile industry investments. We appreciate their support and investment at a time where we are fulfilling key contracts and projects with Mobile Network Operators and Banks in the Americas. This private placement, in this and future tranches, allows Alternet to fund its high growth subsidiaries." ........

http://app.quotemedia.com/quotetools/newsStoryPopup.go?story…

I was curious about who the new investor is and why they would put up $500,000. Although I believe in ALYI, I would have to be convinced a lot more before putting up $500,000 (if I had it). I assumed that the new investor was likely close to ALYI and that they had been provided a great deal more detail than what is available to retail investors! I decided to try to follow the money and connect some dots!! All the following information is available to the public and IMHO the connected dots draw a very interesting picture!

Excerpts from: ALTERNET SYSTEMS INC - SC 13G (Filed: 23-06-2011)

Name of Reporting Person

Flow Capital, LLC

Aggregate Amount Beneficially Owned by Each Reporting Person 5,902,777*

*Includes 2,569,444 shares of common stock of Alternate Systems Inc. that are subject to currently exercisable rights to purchase and that are therefore deemed beneficially owned by Flow Capital, LLC under Rule 13d-3.

Item 1.(a) Name of Issuer: Alternet Systems Inc.

(b) Address of Issuer’s Principal Executive Office

2665 S. Bayshore Drive

Miami, FL 33133

Item 2.(a) Name of Person(s) Filing: Flow Capital, LLC

(b) Address of Principal Business Office or, if none, Residence:

c/o Arazoza & Fernandez-Fraga, PA

2100 Salzedo Street, Suite 300

Coral Gables, FL 33134

(c) Citizenship: Florida

(d) Title of Class of Securities: Common Stock

.00001 par value per share

(e) CUSIP Number: 02146M 20

11. Percent of Class Represented by Amount in Row (9) 9.9%

(Why 9.9 %, someone wanting to stay under 10% ?)

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

June 22, 2011

Date

/s/ Fernando Cisneros

Signature

Fernando Cisneros

Manager, Flow Capital, LLC

Name/Title

http://app.quotemedia.com/quotetools/showFiling.go?webmaster…

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&…

Connect the dots ............

On Dec. 6th I mentioned that I had some unanswered questions. One of the questions came up when reading Jim Rockford's blog relating to the private placement.

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=1187…

The terms of the pp seemed unusual for the ALYI share price at the time.

Excerpts from ALYI News release about Private Placement

...............In the transaction concluded June 15th, a new investor purchased 3,333,333 common shares for $500,000. As part of the transaction the investor received warrants for an additional 2,000,000 shares at an Exercise Price of

.25 per share. The warrants have an 18 month term and carry a call option, should the Company's share trade at

.40 or higher for any 60 day period. This placement adds to funds raised earlier in the second quarter, as disclosed in the company's filings.

Alternet CEO Henryk Dabrowski expressed great optimism at the news of the capital raise, saying, "This new investor clearly sees the potential in Alternet and its mobile industry investments. We appreciate their support and investment at a time where we are fulfilling key contracts and projects with Mobile Network Operators and Banks in the Americas. This private placement, in this and future tranches, allows Alternet to fund its high growth subsidiaries." ........

http://app.quotemedia.com/quotetools/newsStoryPopup.go?story…

I was curious about who the new investor is and why they would put up $500,000. Although I believe in ALYI, I would have to be convinced a lot more before putting up $500,000 (if I had it). I assumed that the new investor was likely close to ALYI and that they had been provided a great deal more detail than what is available to retail investors! I decided to try to follow the money and connect some dots!! All the following information is available to the public and IMHO the connected dots draw a very interesting picture!

Excerpts from: ALTERNET SYSTEMS INC - SC 13G (Filed: 23-06-2011)

Name of Reporting Person

Flow Capital, LLC

Aggregate Amount Beneficially Owned by Each Reporting Person 5,902,777*

*Includes 2,569,444 shares of common stock of Alternate Systems Inc. that are subject to currently exercisable rights to purchase and that are therefore deemed beneficially owned by Flow Capital, LLC under Rule 13d-3.

Item 1.(a) Name of Issuer: Alternet Systems Inc.

(b) Address of Issuer’s Principal Executive Office

2665 S. Bayshore Drive

Miami, FL 33133

Item 2.(a) Name of Person(s) Filing: Flow Capital, LLC

(b) Address of Principal Business Office or, if none, Residence:

c/o Arazoza & Fernandez-Fraga, PA

2100 Salzedo Street, Suite 300

Coral Gables, FL 33134

(c) Citizenship: Florida

(d) Title of Class of Securities: Common Stock

.00001 par value per share

(e) CUSIP Number: 02146M 20

11. Percent of Class Represented by Amount in Row (9) 9.9%

(Why 9.9 %, someone wanting to stay under 10% ?)

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

June 22, 2011

Date

/s/ Fernando Cisneros

Signature

Fernando Cisneros

Manager, Flow Capital, LLC

Name/Title

http://app.quotemedia.com/quotetools/showFiling.go?webmaster…

Fortsetzung:

Flow Capital, LLC.

http://www.corporationwiki.com/Florida/Coral-Gables/flow-cap…

Flow Capital, LLC. has a location in Coral Gables, FL. Active officers include Fernando Cisneros and Ana Maria Bitar. Flow Capital, LLC. filed as a Florida Limited Liability on Wednesday, July 16, 2008 in the state of Florida and is currently active. Arazoza & Fernandez-Fraga, P.A. serves as the registered agent for this organization.

Filings: Florida Limited Liability (FL - Active)

State of Record: FL

State Reference ID: L08000068904

Registered Agent: Arazoza & Fernandez-Fraga, P.A.

File Date: Wednesday, July 16, 2008

Active: True

Filing Type: Florida Limited Liability

Source: Florida Department of State last refreshed Saturday, October 22, 2011

http://www.corporationwiki.com/Florida/Coral-Gables/flow-cap…

Fernando Cisneros and Ana Maria Bitar are shown as the active officers and appear to be co-managers of Flow Capital, LLC. So far I have not determined who owns Flow Capital, LLC. Fernando Cisneros and Ana Maria Bitar also appear to be co-owners of a property in Key Biscayne.

Blockshopper

Sep. 17, 2008 Single Family331 Beachwood Drive Key Biscayne $X,XXX,XXX Fernando Cisneros and Ana M Bitar

http://southflorida.blockshopper.com/sales/cities/key_biscay…

Fernando Cisneros appears to have moved to Florida from Venezuela a couple of years ago based on the details in the following Bill of Lading.

Fernando J. Cisneros R. C/o imports products from Fernando J. Cisneros R. C/o in Caracas via Port Everglades, Florida. Container #SUDU5497178

Company Name Fernando J Cisneros R C o

Address CLOVER SYSTEMS INC 331 BEECHWOOD DRILE,KEY BISCAYNE 331 BEECHWOOD DRILE,KEY FL 33172 US

Total shipments in our database 1 record(s)

Latest Shipment Jul 16, 2010

known suppliers 1 known suppliers

FERNANDO J. CISNEROS R. C/O (Venezuela)

Bill of Lading No.SUDU202622349004

Arrival Date 2010-07-16

Voyage No.022N

Vessel Name 9377690

Shipper FERNANDO J. CISNEROS R. C/O

CLOVER INTERNACIONAL C.A. CLOVER PISO 3 TLF 9031245 AYMARA MENDEZ. VE

Consignee FERNANDO J. CISNEROS R. C/O

CLOVER SYSTEMS INC 331 BEECHWOOD DRILE,KEY BISCAYNE 331 BEECHWOOD DRILE,KEY FL 33172 US

Notify Party CLOVER SYSTEMS INC / ALIIED

Port of Loading Caracas

Port of Discharge

Port Everglades, Florida

Declaration of Goods

PERSONAL EFFECTS EFECTOS PERSONALES FERNANDO J CISNEROSR DATE OF BIRTH SEP 24 197 ASSPORT NUMBER 00153662 REIGHT PREPAID

http://www.importgenius.com/importers/fernando-j-cisneros-r-…

Flow Capital, LLC.

http://www.corporationwiki.com/Florida/Coral-Gables/flow-cap…

Flow Capital, LLC. has a location in Coral Gables, FL. Active officers include Fernando Cisneros and Ana Maria Bitar. Flow Capital, LLC. filed as a Florida Limited Liability on Wednesday, July 16, 2008 in the state of Florida and is currently active. Arazoza & Fernandez-Fraga, P.A. serves as the registered agent for this organization.

Filings: Florida Limited Liability (FL - Active)

State of Record: FL

State Reference ID: L08000068904

Registered Agent: Arazoza & Fernandez-Fraga, P.A.

File Date: Wednesday, July 16, 2008

Active: True

Filing Type: Florida Limited Liability

Source: Florida Department of State last refreshed Saturday, October 22, 2011

http://www.corporationwiki.com/Florida/Coral-Gables/flow-cap…

Fernando Cisneros and Ana Maria Bitar are shown as the active officers and appear to be co-managers of Flow Capital, LLC. So far I have not determined who owns Flow Capital, LLC. Fernando Cisneros and Ana Maria Bitar also appear to be co-owners of a property in Key Biscayne.

Blockshopper

Sep. 17, 2008 Single Family331 Beachwood Drive Key Biscayne $X,XXX,XXX Fernando Cisneros and Ana M Bitar

http://southflorida.blockshopper.com/sales/cities/key_biscay…

Fernando Cisneros appears to have moved to Florida from Venezuela a couple of years ago based on the details in the following Bill of Lading.

Fernando J. Cisneros R. C/o imports products from Fernando J. Cisneros R. C/o in Caracas via Port Everglades, Florida. Container #SUDU5497178

Company Name Fernando J Cisneros R C o

Address CLOVER SYSTEMS INC 331 BEECHWOOD DRILE,KEY BISCAYNE 331 BEECHWOOD DRILE,KEY FL 33172 US

Total shipments in our database 1 record(s)

Latest Shipment Jul 16, 2010

known suppliers 1 known suppliers

FERNANDO J. CISNEROS R. C/O (Venezuela)

Bill of Lading No.SUDU202622349004

Arrival Date 2010-07-16

Voyage No.022N

Vessel Name 9377690

Shipper FERNANDO J. CISNEROS R. C/O

CLOVER INTERNACIONAL C.A. CLOVER PISO 3 TLF 9031245 AYMARA MENDEZ. VE

Consignee FERNANDO J. CISNEROS R. C/O

CLOVER SYSTEMS INC 331 BEECHWOOD DRILE,KEY BISCAYNE 331 BEECHWOOD DRILE,KEY FL 33172 US

Notify Party CLOVER SYSTEMS INC / ALIIED

Port of Loading Caracas

Port of Discharge

Port Everglades, Florida

Declaration of Goods

PERSONAL EFFECTS EFECTOS PERSONALES FERNANDO J CISNEROSR DATE OF BIRTH SEP 24 197 ASSPORT NUMBER 00153662 REIGHT PREPAID

http://www.importgenius.com/importers/fernando-j-cisneros-r-…

Fortsetzung:

If we once again revisit Alternet's July 28th, 2011, Letter to the Shareholders, Update on YTD Business it states:

................Since Utiba Americas' launch in early 2010 we have grown the company's regional footprint, and created a position of leadership in mobile commerce in the hemisphere, which can be seen in the following achievements:

* Launch of four commercial mobile financial service platforms in 2011, to be announced in the third quarter, subject to client approval.

* Execution of five contracts, with more than twenty opportunities in negotiation and more than twenty qualified prospects throughout the region

* Utiba Americas and its partner, Utiba Pte, Ltd., are in advance negotiations, with announcements expected soon, to enter into global strategic partnerships with industry giants, enhancing the company's presence and market participation

We are on track to play a leading role in this expanding multi-billion dollar industry and reap double digit sales growth over the next 5 years.

http://www.easyir.com/easyir/customrel.do?easyirid=26A2B632B…

I found the above highlighted wording very interesting as it was not just Utiba Americas but Utiba Pte. as well that is involved in the negotiations and the words "global" and "industry giants" are very specific and suggestive!

Revisiting part of Henryk's (der CEO, praesens) statement about his past work experience we see one "industry giant" in his past, having spent a great deal of time in Caracas, Venezuela.

....................Prior to my work with NewMarket, I held the position of CEO at Vox2Vox Communications, Inc., a Cisneros Group venture in VoIP Telecommunications, with operations in Turkey, Italy, Spain, Portugal, Brazil, Venezuela and the United States. I have extensive experience in Latin America in the technology and telecommunications industry and have executed engineering and telecommunications projects for many major companies in the region. I have an MBA from Universidad Metropolitana in Caracas, Venezuela. I am married with twin daughters and currently reside in Miami, Florida.

Source: http://www.allbusiness.com/company-activities-management/com…

IMHO the dots are connected, however, it all could just be wishful thinking/speculation on my part.

Always DYODD.

If we once again revisit Alternet's July 28th, 2011, Letter to the Shareholders, Update on YTD Business it states:

................Since Utiba Americas' launch in early 2010 we have grown the company's regional footprint, and created a position of leadership in mobile commerce in the hemisphere, which can be seen in the following achievements:

* Launch of four commercial mobile financial service platforms in 2011, to be announced in the third quarter, subject to client approval.

* Execution of five contracts, with more than twenty opportunities in negotiation and more than twenty qualified prospects throughout the region

* Utiba Americas and its partner, Utiba Pte, Ltd., are in advance negotiations, with announcements expected soon, to enter into global strategic partnerships with industry giants, enhancing the company's presence and market participation

We are on track to play a leading role in this expanding multi-billion dollar industry and reap double digit sales growth over the next 5 years.

http://www.easyir.com/easyir/customrel.do?easyirid=26A2B632B…

I found the above highlighted wording very interesting as it was not just Utiba Americas but Utiba Pte. as well that is involved in the negotiations and the words "global" and "industry giants" are very specific and suggestive!

Revisiting part of Henryk's (der CEO, praesens) statement about his past work experience we see one "industry giant" in his past, having spent a great deal of time in Caracas, Venezuela.

....................Prior to my work with NewMarket, I held the position of CEO at Vox2Vox Communications, Inc., a Cisneros Group venture in VoIP Telecommunications, with operations in Turkey, Italy, Spain, Portugal, Brazil, Venezuela and the United States. I have extensive experience in Latin America in the technology and telecommunications industry and have executed engineering and telecommunications projects for many major companies in the region. I have an MBA from Universidad Metropolitana in Caracas, Venezuela. I am married with twin daughters and currently reside in Miami, Florida.

Source: http://www.allbusiness.com/company-activities-management/com…

IMHO the dots are connected, however, it all could just be wishful thinking/speculation on my part.

Always DYODD.

Spekulation, klar !

Schlüssig ...?!

Kann jeder für sich selbst entscheiden ...

Gruß, praesens

Schlüssig ...?!

Kann jeder für sich selbst entscheiden ...

Gruß, praesens

Alternet nimmt teil am mbileworldongress von 27.2. bis 1.3. in Barcelona

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=AL…

Here is something I wasn’t aware of until today………………

Mobile World Congress Barcelona, Feb 27 – Mar 1, 2012

http://www.mobileworldcongress.com/about/

I was looking to see if ALYI would be represented/participating , I couldn’t find anything under Alternet, however, if you look under Exhibitors you will see that Utiba Pte Ltd. is listed as an exhibitor with the contact being Alternets’ Vice President of Marketing, Erin Clancy!

Utiba Pte Ltd.

contact: eclancy@utiba.com

http://www.mobileworldcongress.com/exhibitor-list/utiba-pte-…

Alternet web site,

Erin Clancy, Vice President Marketing

http://alternetsystems.com/joomla/index.php?option=com_conte…

Good to see the co-owners of Utiba Americas working together on this! A quick look at who attended last year and it is apparent if you are involved with “mobile” this is the place to be at the end of February!

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=AL…

Here is something I wasn’t aware of until today………………

Mobile World Congress Barcelona, Feb 27 – Mar 1, 2012

http://www.mobileworldcongress.com/about/

I was looking to see if ALYI would be represented/participating , I couldn’t find anything under Alternet, however, if you look under Exhibitors you will see that Utiba Pte Ltd. is listed as an exhibitor with the contact being Alternets’ Vice President of Marketing, Erin Clancy!

Utiba Pte Ltd.

contact: eclancy@utiba.com

http://www.mobileworldcongress.com/exhibitor-list/utiba-pte-…

Alternet web site,

Erin Clancy, Vice President Marketing

http://alternetsystems.com/joomla/index.php?option=com_conte…

Good to see the co-owners of Utiba Americas working together on this! A quick look at who attended last year and it is apparent if you are involved with “mobile” this is the place to be at the end of February!

Vom gleichen poster:

Previously I posted that Utiba Americas provides customers with the Utiba platform on a per transaction or revenue share basis. It is esimated that the revenue to be shared could be 7- 15 cents US per transaction.

This post is about just ONE customer of Utiba Americas - look at the growth in the last 15 months ...... the more revenue Movilway earns the more Utiba Americas earns of which ALYI owns 51%. GO MOVILWAY!!

...

Movilway

MIAMI, SEPTEMBER 2nd, 2010- Movilway, technological company specialized in the market of electronic recharge in Latin America, has achieved a financing of 30 million dollars from private investors for the development of its project in Latin America.

http://www.movilway.com/mwprensa/web_files/notas_prensa/1287…

PAYMENTS MARKET >>Submitted by Jeremy Drzal on Tue, OCTOBER 19th,/2010 - 9:09pm

MIAMI, (AllPayNews) - Movilway, technological company specialized in the market of Latin America, has chosen Utiba Americas as strategic supplier to promote recharging and mobile banking services in Latin America.In order to this agreement Utiba Americas will provide Movilway with the technology that enables refills, transfers and payments via cell phone. This solution is the most complete in the market, because it allows transfers via cellphone, from the simplest to the most complex. The software which will be implemented already has been tested successfully in over 20 countries worldwide, supporting more than 30% of traffic from mobile commerce worldwide.

This operation will allow Movilway promote the deployment of innovative mobile banking services to the non bancarized sector of population in Latin America, and develop other mobile services in trade and finance.

http://paymentsmarket.com/news/movilway-chooses-utiba-deploy…

FEBRUARY 11, 2011 Movilway SL Introduces Electronic Recharging Services for Mobile Users in Mexico

Movilway SL has launched electronic recharging services for mobile devices in Mexico. Through the company's service, recharging can be done at the point of sale or online, for users of Mexico's main mobile operators. Movilway expects users to have access to more than 8,000 points of sales this year, and more than 30,000 by 2012. Through the electronic system, operators will see an increase in revenues and offer new services to their clients, eventually being able to provide access to Movilway's financial services such as mobile wallet.

http://investing.businessweek.com/research/stocks/private/sn…

TECHCRUNCH Jay Donovan FEBRUARY 20th, 2011

It looks like a mobile phone inside of a calculator (and that may be just about what it actually is). Regardless, Movilway, a payments platform serving the underbanked mostly in South and Central America, are further developing their self contained cellular POS system. It works mano-a-mano with their pre-paid system for money transfer in order to facilitate payments sans bank account or credit card. Think of it as being like a combination of paypal and western union, in that you go to physical merchant locations to deposit cash into the system, but then can carry that credit indefinitely inside the system and debit it anytime you want at select Movilway merchants. Their goal is to further deploy and make non-cash payments possible in developing markets where having a bank account or credit card may not be an option due to lack of infrastructure.

http://techcrunch.com/2011/02/20/video-movilway-mobile-point…

WorldCity APRIL 6th, 2011 Moving from veteran Telefonica to startup Celistics, executive explores ways to build a brand from scratch

After years at an established multinational, Maxim Weitzman took on the challenge to create a marketing strategy for a fast-growing startup, and questions abounded:............................

Weitzman switched jobs just three months ago, leaving the post of vice president of marketing at Telefonica USA, the Americas unit of Spain’s telecommunications giant, to head up marketing and communications for Spain-based startup Celistics and its subsidiary Movilway, both run from South Florida.

Celistics distributes cell phones in Spain and Latin America, mostly for Telefonica, and now is expanding to serve other clients. Its Movilway division lets consumers, even those without banking accounts, pre-pay into cellphone-based accounts to pay other bills from electricity to government fees. Started in 2008, Celistics posted $1.4 billion in revenues last year and expects solid growth again this year. ............

..Business took off easily with a ready client in Telefonica, which sought a logistics partner in Latin America.

http://www.worldcityweb.com/marketing-connections-listing/80…

PRLog (Press Release) - MAY 26th, 2011 -

Movilway invests over 6 millions of dollars in mobile service in Chile

The company has a high-level technological platform, already successful in several continents.

By the end of the year will expand prepaid-services up to150.000 strategic points of sale

Madrid, 26th of May 2011. Movilway, technological company specialized in the market of Latin America, is now present in Chile to offer Electronic top-up for prepaid users and introducing the Movilway e-Wallet. Users will be able to recharge their phones in a secure and easy way.Topping -up can be done at any time and as often as the client whishes, since there are no additional costs for maintenance involved. Users can top-up through the mobile phone at the point of sale device (POS) or directly through Movilway´s online interface.

http://www.prlog.org/11512630-movilway-arrives-in-chile-with…

GUATEMALA CITY, SEPTEMBER 9th, 2011 /PRNewswire/ -- Movilway, one of the leading platforms of prepaid mobile top-up in Latin America, announces its presence in Guatemala to provide their electronic recharge services.

http://www.prnewswire.com/news-releases/movilway-arrives-in-…

Published: Thursday, NOVEMBER 10th, 2011 11:10 (GMT -0400)More news from Venezuela

By Business News Americas staff reporters

Spanish prepaid mobile top-up platform provider Movilway has launched operations in Venezuela, local press reported. The company will offer e-wallet...

http://www.bnamericas.com/news/telecommunications/movilway-l…

The above are only a few of the links that I looked at, another very graphical look at Movilway's growth can be seen on their website map showing where located and "coming soon" countries

http://movilway.com/donde_eng.php

The growth of Movilway since their first launch in Mexico in February 2011 IMHO is phenomenal, however, it will take a bit of time for the actual revenues to churn through to ALYI but like I posted previously it is only a matter of time IMHO.

Always DYODD

Previously I posted that Utiba Americas provides customers with the Utiba platform on a per transaction or revenue share basis. It is esimated that the revenue to be shared could be 7- 15 cents US per transaction.

This post is about just ONE customer of Utiba Americas - look at the growth in the last 15 months ...... the more revenue Movilway earns the more Utiba Americas earns of which ALYI owns 51%. GO MOVILWAY!!

...

Movilway

MIAMI, SEPTEMBER 2nd, 2010- Movilway, technological company specialized in the market of electronic recharge in Latin America, has achieved a financing of 30 million dollars from private investors for the development of its project in Latin America.

http://www.movilway.com/mwprensa/web_files/notas_prensa/1287…

PAYMENTS MARKET >>Submitted by Jeremy Drzal on Tue, OCTOBER 19th,/2010 - 9:09pm

MIAMI, (AllPayNews) - Movilway, technological company specialized in the market of Latin America, has chosen Utiba Americas as strategic supplier to promote recharging and mobile banking services in Latin America.In order to this agreement Utiba Americas will provide Movilway with the technology that enables refills, transfers and payments via cell phone. This solution is the most complete in the market, because it allows transfers via cellphone, from the simplest to the most complex. The software which will be implemented already has been tested successfully in over 20 countries worldwide, supporting more than 30% of traffic from mobile commerce worldwide.

This operation will allow Movilway promote the deployment of innovative mobile banking services to the non bancarized sector of population in Latin America, and develop other mobile services in trade and finance.

http://paymentsmarket.com/news/movilway-chooses-utiba-deploy…

FEBRUARY 11, 2011 Movilway SL Introduces Electronic Recharging Services for Mobile Users in Mexico

Movilway SL has launched electronic recharging services for mobile devices in Mexico. Through the company's service, recharging can be done at the point of sale or online, for users of Mexico's main mobile operators. Movilway expects users to have access to more than 8,000 points of sales this year, and more than 30,000 by 2012. Through the electronic system, operators will see an increase in revenues and offer new services to their clients, eventually being able to provide access to Movilway's financial services such as mobile wallet.

http://investing.businessweek.com/research/stocks/private/sn…

TECHCRUNCH Jay Donovan FEBRUARY 20th, 2011

It looks like a mobile phone inside of a calculator (and that may be just about what it actually is). Regardless, Movilway, a payments platform serving the underbanked mostly in South and Central America, are further developing their self contained cellular POS system. It works mano-a-mano with their pre-paid system for money transfer in order to facilitate payments sans bank account or credit card. Think of it as being like a combination of paypal and western union, in that you go to physical merchant locations to deposit cash into the system, but then can carry that credit indefinitely inside the system and debit it anytime you want at select Movilway merchants. Their goal is to further deploy and make non-cash payments possible in developing markets where having a bank account or credit card may not be an option due to lack of infrastructure.

http://techcrunch.com/2011/02/20/video-movilway-mobile-point…

WorldCity APRIL 6th, 2011 Moving from veteran Telefonica to startup Celistics, executive explores ways to build a brand from scratch

After years at an established multinational, Maxim Weitzman took on the challenge to create a marketing strategy for a fast-growing startup, and questions abounded:............................

Weitzman switched jobs just three months ago, leaving the post of vice president of marketing at Telefonica USA, the Americas unit of Spain’s telecommunications giant, to head up marketing and communications for Spain-based startup Celistics and its subsidiary Movilway, both run from South Florida.

Celistics distributes cell phones in Spain and Latin America, mostly for Telefonica, and now is expanding to serve other clients. Its Movilway division lets consumers, even those without banking accounts, pre-pay into cellphone-based accounts to pay other bills from electricity to government fees. Started in 2008, Celistics posted $1.4 billion in revenues last year and expects solid growth again this year. ............

..Business took off easily with a ready client in Telefonica, which sought a logistics partner in Latin America.

http://www.worldcityweb.com/marketing-connections-listing/80…

PRLog (Press Release) - MAY 26th, 2011 -

Movilway invests over 6 millions of dollars in mobile service in Chile

The company has a high-level technological platform, already successful in several continents.

By the end of the year will expand prepaid-services up to150.000 strategic points of sale

Madrid, 26th of May 2011. Movilway, technological company specialized in the market of Latin America, is now present in Chile to offer Electronic top-up for prepaid users and introducing the Movilway e-Wallet. Users will be able to recharge their phones in a secure and easy way.Topping -up can be done at any time and as often as the client whishes, since there are no additional costs for maintenance involved. Users can top-up through the mobile phone at the point of sale device (POS) or directly through Movilway´s online interface.

http://www.prlog.org/11512630-movilway-arrives-in-chile-with…

GUATEMALA CITY, SEPTEMBER 9th, 2011 /PRNewswire/ -- Movilway, one of the leading platforms of prepaid mobile top-up in Latin America, announces its presence in Guatemala to provide their electronic recharge services.

http://www.prnewswire.com/news-releases/movilway-arrives-in-…

Published: Thursday, NOVEMBER 10th, 2011 11:10 (GMT -0400)More news from Venezuela

By Business News Americas staff reporters

Spanish prepaid mobile top-up platform provider Movilway has launched operations in Venezuela, local press reported. The company will offer e-wallet...

http://www.bnamericas.com/news/telecommunications/movilway-l…

The above are only a few of the links that I looked at, another very graphical look at Movilway's growth can be seen on their website map showing where located and "coming soon" countries

http://movilway.com/donde_eng.php

The growth of Movilway since their first launch in Mexico in February 2011 IMHO is phenomenal, however, it will take a bit of time for the actual revenues to churn through to ALYI but like I posted previously it is only a matter of time IMHO.

Always DYODD

Das war´s fürs Erste von mir.

Bin gespannt, ob, und wenn dann was, sich tut bis Ende Februar ..

Gruß, praesens

Bin gespannt, ob, und wenn dann was, sich tut bis Ende Februar ..

Gruß, praesens

http://alternetsystems.com/joomla/index.php?option=com_conte…

Company Overview

History

Alternet Systems, Inc. was incorporated in 2002, initially for the deployment of an educational content delivery system, known as SchoolWeb. In 2008, the company acquired TekVoice Communications, Inc. and began a restructuring of its vision and objectives toward the offering of hosted electronic ticketing and transaction solutions, and third party billing of Internet Protocol (IP) based services.

Since 2008, the company has developed strategic relationships (hyperlink to partners) and operational strengths which today provide key advantages in the pursuit of its vision - to enable secure mobile commerce and transaction services, on a hosted platform.

The Opportunity – Enabling Secure Mobile Commerce and Transactions

Two driving forces underlie the opportunity in the Mobile Commerce and Transaction Market

• Cellular Phone Penetration

• “Unbanked” Population Worldwide

Cellular Phone Penetration

The cellular phone has rapidly surpassed all other technologies in its speed of adoption- in 2010, more than 70% of the world’s adult population owns a cell phone. Alternet, through its subsidiary Utiba Americas, targets the region of the Americas and Caribbean for the deployment of mobile commerce services. The Americas and the Caribbean show remarkable potential, with a dozen countries in Latin America reporting greater than 100% cellular penetration, according to the International Telecommunications Union data for the year 2008.

The “Unbanked”

While cellular phone adoption continues unabated, the spread of financial services has stagnated, with negative consequences on economic growth in less developed countries. Access to traditional banking services has long been viewed as a precursor to economic development*. A bank account allows an individual to save and invest, and with time achieve financial stability and growth.

According to a recent study conducted by the Financial Access Initiative (“Half the World is Unbanked,” 2009), less than one half of the adult population of the world has a bank account. This is known as the “unbanked” population. As cell phones become ever more common, the number of “unbanked” with mobile phones is growing rapidly. In fact, the number is expected to grow from 1 billion to 1.7 billion, worldwide, from 2010 to 2012.

Mobile commerce and transactions promise to positively change the lives of the “Unbanked, Mobile,” and Alternet considers this social benefit an important dividend to its work.

Company Overview

History

Alternet Systems, Inc. was incorporated in 2002, initially for the deployment of an educational content delivery system, known as SchoolWeb. In 2008, the company acquired TekVoice Communications, Inc. and began a restructuring of its vision and objectives toward the offering of hosted electronic ticketing and transaction solutions, and third party billing of Internet Protocol (IP) based services.

Since 2008, the company has developed strategic relationships (hyperlink to partners) and operational strengths which today provide key advantages in the pursuit of its vision - to enable secure mobile commerce and transaction services, on a hosted platform.

The Opportunity – Enabling Secure Mobile Commerce and Transactions

Two driving forces underlie the opportunity in the Mobile Commerce and Transaction Market

• Cellular Phone Penetration

• “Unbanked” Population Worldwide

Cellular Phone Penetration

The cellular phone has rapidly surpassed all other technologies in its speed of adoption- in 2010, more than 70% of the world’s adult population owns a cell phone. Alternet, through its subsidiary Utiba Americas, targets the region of the Americas and Caribbean for the deployment of mobile commerce services. The Americas and the Caribbean show remarkable potential, with a dozen countries in Latin America reporting greater than 100% cellular penetration, according to the International Telecommunications Union data for the year 2008.

The “Unbanked”

While cellular phone adoption continues unabated, the spread of financial services has stagnated, with negative consequences on economic growth in less developed countries. Access to traditional banking services has long been viewed as a precursor to economic development*. A bank account allows an individual to save and invest, and with time achieve financial stability and growth.

According to a recent study conducted by the Financial Access Initiative (“Half the World is Unbanked,” 2009), less than one half of the adult population of the world has a bank account. This is known as the “unbanked” population. As cell phones become ever more common, the number of “unbanked” with mobile phones is growing rapidly. In fact, the number is expected to grow from 1 billion to 1.7 billion, worldwide, from 2010 to 2012.

Mobile commerce and transactions promise to positively change the lives of the “Unbanked, Mobile,” and Alternet considers this social benefit an important dividend to its work.

http://alternetsystems.com/joomla/index.php?option=com_conte…

Management Team

Experienced international executive and entrepreneur with over 20 years experience in information technology, data networking and the telecommunications industry.

RKM IT Solutions

* Co-founded RKM IT in 1986, which became one of the top five systems integration and outsourcing companies in Venezuela.

* Grew revenue from $3 MM Dollars in 2004 to $30 MM Dollars by 2006, and expanded local and regional operations in partnership with Chinese technology companies.

* Sold to New Market Technology, Inc. (OTC:NMKT) for $3.6 MM Dollars in 2004.

* CEO at NewMarket Latinamerica through 2006, responsible for consolidation of NewMarket acquisitions totaling sales in excess of $75 Million Dollars and more than 1500 employees.

* Named Chairman and CEO of RKM IT Solutions group of companies after the sale, and Advisor to the Board of Directors of NewMarket Technology, Inc.

Vox2Vox Communications

* COO/President 2000 – 2002. Miami based, multi-million dollar IP telecommunications and value added services company, with presence in eight countries throughout Europe and Latin America, and part of the Cisneros Holdings companies.

TekVoice Communications Inc.

* President, 2002 – 2007. Miami FL–based, Voice over IP telecommunications company, and successfully reverse merged the company into Alternet Systems, Inc. (OTC:ALYI) in December 2007.

Alternet Systems, Inc. (ALYI)

* Chairman and CEO since 2007. Leading the transformation of the company from a content management company to a secure mobile commerce and transaction platform provider.

Management Team

Experienced international executive and entrepreneur with over 20 years experience in information technology, data networking and the telecommunications industry.

RKM IT Solutions

* Co-founded RKM IT in 1986, which became one of the top five systems integration and outsourcing companies in Venezuela.

* Grew revenue from $3 MM Dollars in 2004 to $30 MM Dollars by 2006, and expanded local and regional operations in partnership with Chinese technology companies.

* Sold to New Market Technology, Inc. (OTC:NMKT) for $3.6 MM Dollars in 2004.

* CEO at NewMarket Latinamerica through 2006, responsible for consolidation of NewMarket acquisitions totaling sales in excess of $75 Million Dollars and more than 1500 employees.

* Named Chairman and CEO of RKM IT Solutions group of companies after the sale, and Advisor to the Board of Directors of NewMarket Technology, Inc.

Vox2Vox Communications

* COO/President 2000 – 2002. Miami based, multi-million dollar IP telecommunications and value added services company, with presence in eight countries throughout Europe and Latin America, and part of the Cisneros Holdings companies.

TekVoice Communications Inc.

* President, 2002 – 2007. Miami FL–based, Voice over IP telecommunications company, and successfully reverse merged the company into Alternet Systems, Inc. (OTC:ALYI) in December 2007.

Alternet Systems, Inc. (ALYI)

* Chairman and CEO since 2007. Leading the transformation of the company from a content management company to a secure mobile commerce and transaction platform provider.

Management Team (Forts.)

Michael T. Viadero, Chief Financial Officer

Executive with broad experience in multiple disciplines, diverse industries and markets throughout Latin America, including fifteen years of overseas assignments. Managed multi-functional organizations, regional departments and operations at MasterCard International, W.R. Grace and First Chicago.

MasterCard International Inc., Miami, Florida

* As Regional Financial Officer was responsible for financial operations, product and service pricing strategy, and transitioning MasterCard from privately-held to public company, including compliance with Sarbanes-Oxley Act

* Concurrently co-managed the company's Brazilian operation and lead the company's Member Business Agreement strategy, responsible for locking in approximately 40% of the region's annual revenue, 60% of business volume and increasing regional share

* Key member of project and negotiating team for the acquisition of a Brazilian debit brand and settlement with MasterCard's licensee in Argentina

* Served on the corporation's Global Member Risk Committee, Global Pricing Committee and Global Interchange Committee

W.R. Grace & Co.

* General Manager and Chief Financial Officer (Sao Paulo, Brazil), directly responsible for all corporate activities and manufacturing of two product lines

* Increased net sales from $63 million to $120 million, and decreased headcount by 20%, during two year assignment,

* Manager of International Treasury (Boca Raton, Florida), responsible for regional treasury functions for Latin America, Canada and Iberian Peninsula, covering multi-currency financing, structuring of optimal capital/ financing structure for each country, forex exposure management, cash management and banking relationships. Arranged financing in six countries for the acquisition of a large regional water treatment company.

The First National Bank of Chicago (First Chicago)

* Vice President and Country Manager (Sao Paulo, Brazil), chief executive responsible for defining and implementing bank's strategy, corporate objectives and managing exposure profile. Profit contribution exceeded plan by 123%, while headcount and expenses decreased 56% and 40% respectively.

* Vice President (Sao Paulo, Brazil), developed and implemented corporate finance initiative that included debt/ equity conversions, informal swaps and currency hedges. Formed and managed corporate finance team.

* Vice President (Sao Paulo, Brazil), managed divestment of real estate portfolio, collection of real estate related problem loans and divestiture of non-banking subsidiaries of local investment bank affiliate.

Michael T. Viadero, Chief Financial Officer

Executive with broad experience in multiple disciplines, diverse industries and markets throughout Latin America, including fifteen years of overseas assignments. Managed multi-functional organizations, regional departments and operations at MasterCard International, W.R. Grace and First Chicago.

MasterCard International Inc., Miami, Florida

* As Regional Financial Officer was responsible for financial operations, product and service pricing strategy, and transitioning MasterCard from privately-held to public company, including compliance with Sarbanes-Oxley Act

* Concurrently co-managed the company's Brazilian operation and lead the company's Member Business Agreement strategy, responsible for locking in approximately 40% of the region's annual revenue, 60% of business volume and increasing regional share

* Key member of project and negotiating team for the acquisition of a Brazilian debit brand and settlement with MasterCard's licensee in Argentina

* Served on the corporation's Global Member Risk Committee, Global Pricing Committee and Global Interchange Committee

W.R. Grace & Co.

* General Manager and Chief Financial Officer (Sao Paulo, Brazil), directly responsible for all corporate activities and manufacturing of two product lines

* Increased net sales from $63 million to $120 million, and decreased headcount by 20%, during two year assignment,

* Manager of International Treasury (Boca Raton, Florida), responsible for regional treasury functions for Latin America, Canada and Iberian Peninsula, covering multi-currency financing, structuring of optimal capital/ financing structure for each country, forex exposure management, cash management and banking relationships. Arranged financing in six countries for the acquisition of a large regional water treatment company.

The First National Bank of Chicago (First Chicago)

* Vice President and Country Manager (Sao Paulo, Brazil), chief executive responsible for defining and implementing bank's strategy, corporate objectives and managing exposure profile. Profit contribution exceeded plan by 123%, while headcount and expenses decreased 56% and 40% respectively.

* Vice President (Sao Paulo, Brazil), developed and implemented corporate finance initiative that included debt/ equity conversions, informal swaps and currency hedges. Formed and managed corporate finance team.

* Vice President (Sao Paulo, Brazil), managed divestment of real estate portfolio, collection of real estate related problem loans and divestiture of non-banking subsidiaries of local investment bank affiliate.

Saubere Leistung von mir ...

Der erste Beitrag zum Management Team zeigt ein Foto, ohne Namen ...

Der Herr ist Henryk Dabrowski, Chairman & CEO

Der erste Beitrag zum Management Team zeigt ein Foto, ohne Namen ...

Der Herr ist Henryk Dabrowski, Chairman & CEO

Management Team (Forts.)

Fabio Alvino, Director and VP of Business Development

Experienced international entrepreneur and executive with more than 20 years experience in the information technology, multimedia and business and information consulting industries.

Profile Multimedia

* Founder (1992-94) and CEO. Communication firm that developed avant-garde technology and multimedia tools oriented to the communication and advertising industry. Sold to an important local advertising group.

CyberMedia

* Founder (1995). Latin American leader in process design and business tools development based on web technology. With 120+ engineers, programmers, web designers and professionals from different fields, CyberMedia was the most important Internet technology consultant in Venezuela and provided the first e-commerce and OnLine banking solutions in the region.

* Sold in 2000 to CEMEX, which then merged the company into a new entity, Neoris.

Neoris

* Board Member and Partner (2000-04). Business and technology consulting group created through the merger of seven leading firms in Brazil, Argentina, Chile, Mexico, Spain, Portugal, USA, and Venezuela.

* Responsible for company operations in Miami, Central America, the Caribbean and Andean Region. Neoris operations currently span ten countries, with more than 3,000 professionals employed in twenty offices, reporting annual revenues in excess of $250MM in 2009. (www.neoris.com).

Fabio Alvino, Director and VP of Business Development

Experienced international entrepreneur and executive with more than 20 years experience in the information technology, multimedia and business and information consulting industries.

Profile Multimedia

* Founder (1992-94) and CEO. Communication firm that developed avant-garde technology and multimedia tools oriented to the communication and advertising industry. Sold to an important local advertising group.

CyberMedia

* Founder (1995). Latin American leader in process design and business tools development based on web technology. With 120+ engineers, programmers, web designers and professionals from different fields, CyberMedia was the most important Internet technology consultant in Venezuela and provided the first e-commerce and OnLine banking solutions in the region.

* Sold in 2000 to CEMEX, which then merged the company into a new entity, Neoris.

Neoris

* Board Member and Partner (2000-04). Business and technology consulting group created through the merger of seven leading firms in Brazil, Argentina, Chile, Mexico, Spain, Portugal, USA, and Venezuela.

* Responsible for company operations in Miami, Central America, the Caribbean and Andean Region. Neoris operations currently span ten countries, with more than 3,000 professionals employed in twenty offices, reporting annual revenues in excess of $250MM in 2009. (www.neoris.com).

Dann wären da noch

Angel Pacheco, Chief Technology Officer

Visionary technologist with more than 20 years experience in C level positions in the financial and mobile payment industries in the US, Europe and Latin America.

Juan Cubides, Chairman & CEO of IMS

Twenty five year veteran of the security industry, experienced in deploying and implementing of cutting edge security technologies.

Erin Clancy, Vice President Marketing

Experienced international executive with more than 15 years experience in start up and early stage growth companies in industries ranging from telecommunications, natural and organic foods, to sustainable building products.

Angel Pacheco, Chief Technology Officer

Visionary technologist with more than 20 years experience in C level positions in the financial and mobile payment industries in the US, Europe and Latin America.

Juan Cubides, Chairman & CEO of IMS