Taipan Resources - Exploring and developing Africa's hydrocarbon potential - 500 Beiträge pro Seite

eröffnet am 21.10.12 18:19:01 von

neuester Beitrag 26.02.15 17:14:24 von

neuester Beitrag 26.02.15 17:14:24 von

Beiträge: 124

ID: 1.177.378

ID: 1.177.378

Aufrufe heute: 0

Gesamt: 27.449

Gesamt: 27.449

Aktive User: 0

ISIN: CA87320M2004 · WKN: A3EWCR · Symbol: 2TP0

0,1710

EUR

-5,26 %

-0,0095 EUR

Letzter Kurs 11:09:27 Tradegate

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0400 | +48,57 | |

| 12,810 | +39,69 | |

| 0,5400 | +38,46 | |

| 27,80 | +32,38 | |

| 31,00 | +24,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6610 | -24,02 | |

| 0,7350 | -31,31 | |

| 28,18 | -32,62 | |

| 0,5660 | -40,42 | |

| 2,8100 | -48,72 |

Taipan Resources

TSX.V: TPN >>> Info-Site der TMX: http://tmx.quotemedia.com/quote.php?qm_symbol=tpn

WKN: A1JT69

ISIN: CA87402T1075

Unternehmensprofil laut website:

Taipan Resources is the fourth largest acreage holder onshore Kenya (9.7 million acres/ 39,588 km2) with multiple exploration plays in multiple basins and estimated total net prospective resources of 530 million barrels of oil equivalent. Management has a track record of repeated exploration success, having discovered over 1.75 billion barrels of oil equivalent in frontier regions.

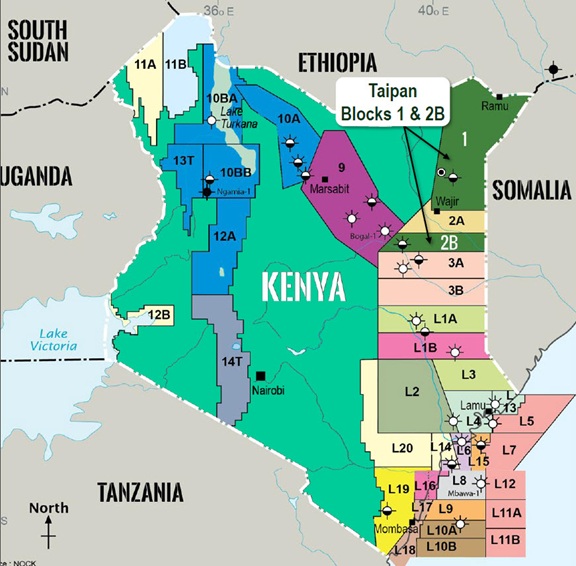

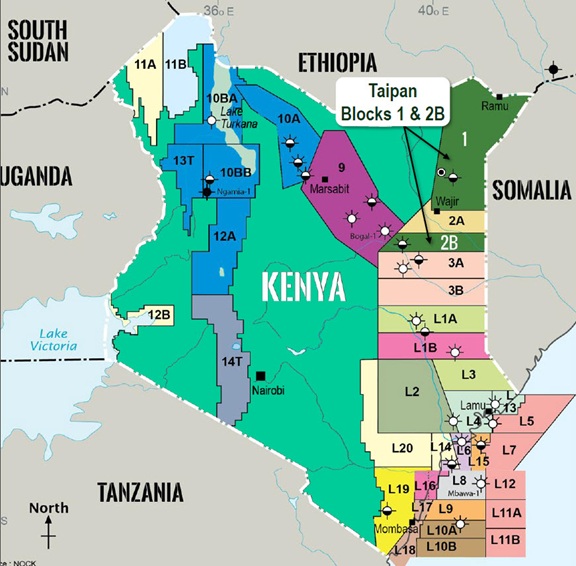

Through its wholly owned subsidiary Lion Petroleum, Taipan currently holds a 100% working interest in Block 2B and a 20% interest in Block 1 which is operated by Afren plc (LON:AFR). Afren is carrying Taipan through 1,200 km of the 2D seismic acquisition on Block 1. Taipan expects to drill its first well on Block 2B in 2013.

http://www.taipanresources.com/index.php

Aktuelle Unternehmenspräsentation:

http://www.taipanresources.com/pdf/2012-10-09%20TPN%20presen…

Aktien und MC (Per 17.07.2012, http://www.taipanresources.com/investors.html):

Anzahl Aktien (fully dilluted):

- 118,496,531 St.

Davon:

- 74,662,991 St. ausgegeben

- 43,833,540 St. Warrants (20 Mio bei 0,12 CAD bis 03/2015 und 23,8 Mio bei 0,60 CAD bis 07/2017)

Marktkapitalisierung (in CAD bei SK von 0,38 vom 19.10.2012): ~28,4 Mio CAD (bezogen auf Shares Outstanding)

Operations/Assets:

Taipan ist in Kenya aktiv. Man ist zu 20% an Block 1 (größte vergebene Onshore-Lizenz Kenyas) beteiligt, an Block 2B hält man 100%.

http://www.taipanresources.com/operations-overview.html

Highlights zu Block 1:

•Taipan 20%, Afren 80% (the operator)

•Covers an area of 31, 781 km2

•Extension of productive Ogaden basin

•Oil seep on south west basin flank

•Oil discovery (1972) made in nearby Ethiopia

•1,200km 2D seismic started in November 2011

Details: http://www.taipanresources.com/operations-kenya1.html

Highlights zu Block 2B:

•Taipan 100%

•7,807 km2 (1.9 million acres) - equivalent to 43 North Sea Blocks

•Prospective resources of 387 mmboe based on Sproule and Associates NI 51-101 report with 17 leads in total and individual leads of up to 128 mmboe

•Thick Tertiary section and structures similar to the Tullow / Africa Oil Ngamia-1 discovery (March 2012, net pay > 100 metres) based on existing seismic

•Oil and gas shows proven on Block 2B with the Hothori-1 well drilled by Amoco in 1989

•Western boundary fully contiguous to Africa Oil’s Block 9 where Marathon Oil farmed-in July 2012 for $78.5mm – tertiary play extends through Block 9 into Block 2B

•Multiple potential play-types – Block 2B also on trend with the cretaceous discoveries of the Melut and Muglad Basins of Sudan

•Expect to drill at least one well in 2013

Details: http://www.taipanresources.com/operations-kenya2.html

Sproule-CPR für beide Blöcke:

Ist zwar auf der neuen TPN-Homepage nicht mehr verlinkt, ist unter dem Lion Petroleum Link aber noch abrufbar: http://www.lionpetroleumcorp.com/fileadmin/user_upload/Lion_…

Schulden:

Keine (s. Unternehmenspräsentation)

Cash:

Derzeit keine aktuelle Info. Mein letzter Stand nach den Corporate-Transaktionen war um die 10 Mio. USD.

Upward Potential:

- bzgl. Region: East Afrika bzw. Kenya als hot-spot schlechthin http://www.taipanresources.com/operations-east.html

- bzgl. Liegenschaften: Unternehmenspräsentation S. 4, 10, 12)

Management und BoD:

- Maxwell Birley (CEO); früher u.a. Marathon.

- Andi Bell (CFO); früher u.a. Centric Energy.

- Charles Watson (BoD); früher u.a. Shell.

- u.a.

Unternehmensstrategie und Vison:

Strategy

•Fully-explore existing acreage, farming down as appropriate to manage risk.

•Grow the company at pace through corporate deals.

•Licence new areas in under-explored basins with attractive geological characteristics.

Vison

•Uncovering corporate deals and new acreage licences

•Initially focusing on eastern sub-Saharan Africa for growth

•Looking at prospective under-explored basins for new licences

•Driving corporate and asset acquisition opportunities

http://www.taipanresources.com/about-overview.html

Aktuell/Gedanken:

- News-Releases: http://www.taipanresources.com/news.html oder TMX (s.oben)

- Nach Berufung des neuen CEO Birley kehrte spürbar Ruhe ein. M.E. war er es, der den Farmout-Deal mit New Age stoppte.

- Das Farmout für Block 2B soll bis Jahresende abgeschlossen sein. Inwiefern die bestehenden Kontakte z.B. zu verganegenen Arbeitgebern genutzt werden können ist noch offen. Jedenfalls lässt sich -auch durch das in Kürze anstehende Twiga-Ergebnis von Tullow/Africa Oil- ein ordentlicher Preis für die Teilhabe von Block 2B erhoffen.

- Eine erste Bohrung für beide Blöcke ist für das zweite Halbjahr 2013 angestrebt (s. Unternehmenspräsentation slide 14)

------------------------------------------------------------------------------------------------------------

Sinn und Zweck:

Hier soll vornehmlich zu Taipan Resources Informationen ausgetauscht und diskutiert werden.

Entsprechnend dem Thread-Titel "Exploring and developing Africa's hydrocarbon potential" sind aber ausdrücklich auch Infos und Gedanken zu anderen (kleinen, bisher nicht diskutierten) Explorern willkommen.

TSX.V: TPN >>> Info-Site der TMX: http://tmx.quotemedia.com/quote.php?qm_symbol=tpn

WKN: A1JT69

ISIN: CA87402T1075

Unternehmensprofil laut website:

Taipan Resources is the fourth largest acreage holder onshore Kenya (9.7 million acres/ 39,588 km2) with multiple exploration plays in multiple basins and estimated total net prospective resources of 530 million barrels of oil equivalent. Management has a track record of repeated exploration success, having discovered over 1.75 billion barrels of oil equivalent in frontier regions.

Through its wholly owned subsidiary Lion Petroleum, Taipan currently holds a 100% working interest in Block 2B and a 20% interest in Block 1 which is operated by Afren plc (LON:AFR). Afren is carrying Taipan through 1,200 km of the 2D seismic acquisition on Block 1. Taipan expects to drill its first well on Block 2B in 2013.

http://www.taipanresources.com/index.php

Aktuelle Unternehmenspräsentation:

http://www.taipanresources.com/pdf/2012-10-09%20TPN%20presen…

Aktien und MC (Per 17.07.2012, http://www.taipanresources.com/investors.html):

Anzahl Aktien (fully dilluted):

- 118,496,531 St.

Davon:

- 74,662,991 St. ausgegeben

- 43,833,540 St. Warrants (20 Mio bei 0,12 CAD bis 03/2015 und 23,8 Mio bei 0,60 CAD bis 07/2017)

Marktkapitalisierung (in CAD bei SK von 0,38 vom 19.10.2012): ~28,4 Mio CAD (bezogen auf Shares Outstanding)

Operations/Assets:

Taipan ist in Kenya aktiv. Man ist zu 20% an Block 1 (größte vergebene Onshore-Lizenz Kenyas) beteiligt, an Block 2B hält man 100%.

http://www.taipanresources.com/operations-overview.html

Highlights zu Block 1:

•Taipan 20%, Afren 80% (the operator)

•Covers an area of 31, 781 km2

•Extension of productive Ogaden basin

•Oil seep on south west basin flank

•Oil discovery (1972) made in nearby Ethiopia

•1,200km 2D seismic started in November 2011

Details: http://www.taipanresources.com/operations-kenya1.html

Highlights zu Block 2B:

•Taipan 100%

•7,807 km2 (1.9 million acres) - equivalent to 43 North Sea Blocks

•Prospective resources of 387 mmboe based on Sproule and Associates NI 51-101 report with 17 leads in total and individual leads of up to 128 mmboe

•Thick Tertiary section and structures similar to the Tullow / Africa Oil Ngamia-1 discovery (March 2012, net pay > 100 metres) based on existing seismic

•Oil and gas shows proven on Block 2B with the Hothori-1 well drilled by Amoco in 1989

•Western boundary fully contiguous to Africa Oil’s Block 9 where Marathon Oil farmed-in July 2012 for $78.5mm – tertiary play extends through Block 9 into Block 2B

•Multiple potential play-types – Block 2B also on trend with the cretaceous discoveries of the Melut and Muglad Basins of Sudan

•Expect to drill at least one well in 2013

Details: http://www.taipanresources.com/operations-kenya2.html

Sproule-CPR für beide Blöcke:

Ist zwar auf der neuen TPN-Homepage nicht mehr verlinkt, ist unter dem Lion Petroleum Link aber noch abrufbar: http://www.lionpetroleumcorp.com/fileadmin/user_upload/Lion_…

Schulden:

Keine (s. Unternehmenspräsentation)

Cash:

Derzeit keine aktuelle Info. Mein letzter Stand nach den Corporate-Transaktionen war um die 10 Mio. USD.

Upward Potential:

- bzgl. Region: East Afrika bzw. Kenya als hot-spot schlechthin http://www.taipanresources.com/operations-east.html

- bzgl. Liegenschaften: Unternehmenspräsentation S. 4, 10, 12)

Management und BoD:

- Maxwell Birley (CEO); früher u.a. Marathon.

- Andi Bell (CFO); früher u.a. Centric Energy.

- Charles Watson (BoD); früher u.a. Shell.

- u.a.

Unternehmensstrategie und Vison:

Strategy

•Fully-explore existing acreage, farming down as appropriate to manage risk.

•Grow the company at pace through corporate deals.

•Licence new areas in under-explored basins with attractive geological characteristics.

Vison

•Uncovering corporate deals and new acreage licences

•Initially focusing on eastern sub-Saharan Africa for growth

•Looking at prospective under-explored basins for new licences

•Driving corporate and asset acquisition opportunities

http://www.taipanresources.com/about-overview.html

Aktuell/Gedanken:

- News-Releases: http://www.taipanresources.com/news.html oder TMX (s.oben)

- Nach Berufung des neuen CEO Birley kehrte spürbar Ruhe ein. M.E. war er es, der den Farmout-Deal mit New Age stoppte.

- Das Farmout für Block 2B soll bis Jahresende abgeschlossen sein. Inwiefern die bestehenden Kontakte z.B. zu verganegenen Arbeitgebern genutzt werden können ist noch offen. Jedenfalls lässt sich -auch durch das in Kürze anstehende Twiga-Ergebnis von Tullow/Africa Oil- ein ordentlicher Preis für die Teilhabe von Block 2B erhoffen.

- Eine erste Bohrung für beide Blöcke ist für das zweite Halbjahr 2013 angestrebt (s. Unternehmenspräsentation slide 14)

------------------------------------------------------------------------------------------------------------

Sinn und Zweck:

Hier soll vornehmlich zu Taipan Resources Informationen ausgetauscht und diskutiert werden.

Entsprechnend dem Thread-Titel "Exploring and developing Africa's hydrocarbon potential" sind aber ausdrücklich auch Infos und Gedanken zu anderen (kleinen, bisher nicht diskutierten) Explorern willkommen.

Hallo motz1,

will mich gleich mal in Dein Gästebuch eintragen. Ich hatte auch schon mal daran gedacht einen Taipan-Thread einzurichten, habe aber nie die Zeit dafür gefunden. Wie ich sehe haben sie endlich ihre neue Homepage fertig gestellt, optisch ansprechend und gut gegliedert. Apropos Zeit, muß schon wieder für 3 Tage auf Reisen, 10 Daumen von mir !!!

Gruß Resources

will mich gleich mal in Dein Gästebuch eintragen. Ich hatte auch schon mal daran gedacht einen Taipan-Thread einzurichten, habe aber nie die Zeit dafür gefunden. Wie ich sehe haben sie endlich ihre neue Homepage fertig gestellt, optisch ansprechend und gut gegliedert. Apropos Zeit, muß schon wieder für 3 Tage auf Reisen, 10 Daumen von mir !!!

Gruß Resources

Ein etwa 3 Wochen alter Beitrag, der einen Überblick über TPN verschafft. Der abschließende Größenvergleich, wonach AOI eine etwa 100 mal so große Marktkapitalisierung aufweist, verdeutlicht anschaulich die Verhältnisse.

Auch wenn hier gleich der erste Artikel einen Vergleich zu AOI sucht, bei TPN sollte man meiner Meinung nach keine zweite Africa Oil erwarten. Luft für einen Kursanstieg ist IMHO aber allemal und reichlich vorhanden.

------------------

Oct. 4, 2012, 6:06 a.m. EDT

Taipan Resources Joins East African ''Big Oil'' Bonanza

Oct 04, 2012 (ACCESSWIRE-TNW via COMTEX) -- SOURCE: [Commodity Dispatch] - On March 26, 2012 Tullow Oil (TLW-LSE) and Africa Oil (AOI-TSX) announced that the jointly drilled Ngamia-1 well in Kenya hit 100 meters of net play. Africa Oil's market cap went from $450 million to $2.5 billion. The Ngamia-1 discovery is similar in size to the Lake Albert Rift basin in Uganda which Tullow predicts may hold 2.5 billion proven barrels of oil, with another 10 billion barrels in Kenya.

Recently big Energy giants like Exxon Mobile (XOM-NYSE), BG Group (BG-LSE), Marathon (MRO-NYSE) and Apache (APA-NYSE) have flooded into East Africa.

A Morgan Stanley research report noted that the Ngamia-1 well had "significantly de-risked the basin's wider potential".

Taipan Resources (TPN-TSX.V) is the third largest acreage holder onshore Kenya after Tullow and Africa Oil with a 9.7 million acres land package in the heart of the East African Rift System. Taipan currently holds a 100% working interest in Block 2B (1.9 million acres) and a 20% working interest in Block 1 (7.8 million acres) which is operated by Afren plc (AFR-LSE).

Taipan's total mean net un-risked prospective resources on the Blocks are estimated to be 530 million barrels of oil equivalent.

"East Africa is easier to operate in than West Africa," states Taipan Director Adam Zive, "There are fewer above ground issues. And Kenya is a largely unexplored region. In fact since 1992, there have only been two wells drilled. One of them was Ngamia-1."

The East African Rift System extends from the Red Sea in the north through Sudan, Ethiopia, Kenya, Tanzania and Mozambique. Dozens of new targets are currently being identified, but only a hand full of juniors operate in the region.

Taipan Overview:

Operational team responsible for discovering 1.75 billion boe in previous venturesLargest acreage holding of the small cap independents in KenyaInitial company assets are 20% WI in Block 1 and 100% of Block 2B, onshore Kenya:Total net un-risked prospective resources of 530 mmboeNewly identified Tertiary plays, similar to the recent Tullow/Africa Oil discoveryMarathon Oil $78.5 million farm-in on Block 9 contiguous to Taipan's Block 2B

East Africa is one of the last regions in the world where junior explorers can pursue world-class oil and gas deposits onshore with relatively low drilling costs. "Most of the big exploration targets remaining are off-shore," confirms Zive, "where it can cost $100 million to drill a single well targeting similar resources. In Kenya we expect to be able to drill a well for about $15 million. The risk/reward ratio is very attractive."

Taipan is a leading acreage holder in Kenya with 9.7 million acres. The potential of the Interior rift basins in Kenya is being re-ranked from millions to billions of barrels. Significant corporate activity & farm-outs are expected. Taipan's assets include multiple exploration plays in different basins - spreading exploration risks & increasing the chance of success.

On Oct 1, 2012 Africa Oil announced that it is drilling a 3rd well in Kenya with its partner Tullow. AOI stock price is up 5% on the news. The Paipai-1 well is being be drilled to total depth of 4,112 metres. "A discovery at Paipai would extend the producing plays of Sudan into Kenya and open a potentially significant and new petroleum province within Kenya," stated Keith Hill, Africa Oil's chief executive.

Taipan's Block 1 Operator Afren plc has exercised its option to increase its interest in Block 1 from 50% to 80% in exchange for carrying Taipan through 1,200 km of the 2D seismic acquisition.

Taipan has commenced a farm-out process for Block 2B. This process is expected to be concluded during Q4, 2012.

"There is a significant amount of industry interest regarding farming-in to Block 2B," states Maxwell Birley, Taipan CEO, "based on gravity, magnetic, and seismic data we can see that the Tertiary trend on Block 9 extends into our Block 2B."

Occupying senior positions with Marathon, Premier and Oil Search, Max Birley has played a key role in the discovery over 1.75 BBO. A frontier market expert, Birley has in-country operating experience in Equatorial Guinea, India, Pakistan and Yemen. Mr. Birley is now living full time in Kenya.

Kenya, East Africa's largest economy, is also placing a big bet on East African Oil, beginning construction on a $25 billion pipeline leading to a deep sea port. This will open up export routes from South Sudan, Ethiopia, Uganda - and Northern Kenya where Taipan is operating.

TPN is currently trading at .31, with 75 million shares outstanding and a market cap of $23 million. Africa Oil with its Ngamia-1 discovery in the same rift basin is worth 100 times that.

Copyright 2012 ACCESSWIRE-TNW

http://www.marketwatch.com/story/taipan-resources-joins-east…

Auch wenn hier gleich der erste Artikel einen Vergleich zu AOI sucht, bei TPN sollte man meiner Meinung nach keine zweite Africa Oil erwarten. Luft für einen Kursanstieg ist IMHO aber allemal und reichlich vorhanden.

------------------

Oct. 4, 2012, 6:06 a.m. EDT

Taipan Resources Joins East African ''Big Oil'' Bonanza

Oct 04, 2012 (ACCESSWIRE-TNW via COMTEX) -- SOURCE: [Commodity Dispatch] - On March 26, 2012 Tullow Oil (TLW-LSE) and Africa Oil (AOI-TSX) announced that the jointly drilled Ngamia-1 well in Kenya hit 100 meters of net play. Africa Oil's market cap went from $450 million to $2.5 billion. The Ngamia-1 discovery is similar in size to the Lake Albert Rift basin in Uganda which Tullow predicts may hold 2.5 billion proven barrels of oil, with another 10 billion barrels in Kenya.

Recently big Energy giants like Exxon Mobile (XOM-NYSE), BG Group (BG-LSE), Marathon (MRO-NYSE) and Apache (APA-NYSE) have flooded into East Africa.

A Morgan Stanley research report noted that the Ngamia-1 well had "significantly de-risked the basin's wider potential".

Taipan Resources (TPN-TSX.V) is the third largest acreage holder onshore Kenya after Tullow and Africa Oil with a 9.7 million acres land package in the heart of the East African Rift System. Taipan currently holds a 100% working interest in Block 2B (1.9 million acres) and a 20% working interest in Block 1 (7.8 million acres) which is operated by Afren plc (AFR-LSE).

Taipan's total mean net un-risked prospective resources on the Blocks are estimated to be 530 million barrels of oil equivalent.

"East Africa is easier to operate in than West Africa," states Taipan Director Adam Zive, "There are fewer above ground issues. And Kenya is a largely unexplored region. In fact since 1992, there have only been two wells drilled. One of them was Ngamia-1."

The East African Rift System extends from the Red Sea in the north through Sudan, Ethiopia, Kenya, Tanzania and Mozambique. Dozens of new targets are currently being identified, but only a hand full of juniors operate in the region.

Taipan Overview:

Operational team responsible for discovering 1.75 billion boe in previous venturesLargest acreage holding of the small cap independents in KenyaInitial company assets are 20% WI in Block 1 and 100% of Block 2B, onshore Kenya:Total net un-risked prospective resources of 530 mmboeNewly identified Tertiary plays, similar to the recent Tullow/Africa Oil discoveryMarathon Oil $78.5 million farm-in on Block 9 contiguous to Taipan's Block 2B

East Africa is one of the last regions in the world where junior explorers can pursue world-class oil and gas deposits onshore with relatively low drilling costs. "Most of the big exploration targets remaining are off-shore," confirms Zive, "where it can cost $100 million to drill a single well targeting similar resources. In Kenya we expect to be able to drill a well for about $15 million. The risk/reward ratio is very attractive."

Taipan is a leading acreage holder in Kenya with 9.7 million acres. The potential of the Interior rift basins in Kenya is being re-ranked from millions to billions of barrels. Significant corporate activity & farm-outs are expected. Taipan's assets include multiple exploration plays in different basins - spreading exploration risks & increasing the chance of success.

On Oct 1, 2012 Africa Oil announced that it is drilling a 3rd well in Kenya with its partner Tullow. AOI stock price is up 5% on the news. The Paipai-1 well is being be drilled to total depth of 4,112 metres. "A discovery at Paipai would extend the producing plays of Sudan into Kenya and open a potentially significant and new petroleum province within Kenya," stated Keith Hill, Africa Oil's chief executive.

Taipan's Block 1 Operator Afren plc has exercised its option to increase its interest in Block 1 from 50% to 80% in exchange for carrying Taipan through 1,200 km of the 2D seismic acquisition.

Taipan has commenced a farm-out process for Block 2B. This process is expected to be concluded during Q4, 2012.

"There is a significant amount of industry interest regarding farming-in to Block 2B," states Maxwell Birley, Taipan CEO, "based on gravity, magnetic, and seismic data we can see that the Tertiary trend on Block 9 extends into our Block 2B."

Occupying senior positions with Marathon, Premier and Oil Search, Max Birley has played a key role in the discovery over 1.75 BBO. A frontier market expert, Birley has in-country operating experience in Equatorial Guinea, India, Pakistan and Yemen. Mr. Birley is now living full time in Kenya.

Kenya, East Africa's largest economy, is also placing a big bet on East African Oil, beginning construction on a $25 billion pipeline leading to a deep sea port. This will open up export routes from South Sudan, Ethiopia, Uganda - and Northern Kenya where Taipan is operating.

TPN is currently trading at .31, with 75 million shares outstanding and a market cap of $23 million. Africa Oil with its Ngamia-1 discovery in the same rift basin is worth 100 times that.

Copyright 2012 ACCESSWIRE-TNW

http://www.marketwatch.com/story/taipan-resources-joins-east…

Antwort auf Beitrag Nr.: 43.736.597 von Resources am 22.10.12 10:56:58Ein sehr schöner Thread-Auftakt, freut mich wenn du dich hier blicken lässt. Ob von unterwegs oder wie/wo auch immer  .

.

Die Homepage ist richtig schick geworden. Nur dass sie den Sproule-CPR nicht verlinkt haben ist schade, der ist interessant. Kommt aber vielleicht noch oder ich finde ihn nur nicht.

Die company selbst hat imho mit Birley sehr gewonnen, es ist -zumindest nach außen- Ruhe eingekehrt. Ich bin gespannt wen er als Partner präsentiert...

.

.Die Homepage ist richtig schick geworden. Nur dass sie den Sproule-CPR nicht verlinkt haben ist schade, der ist interessant. Kommt aber vielleicht noch oder ich finde ihn nur nicht.

Die company selbst hat imho mit Birley sehr gewonnen, es ist -zumindest nach außen- Ruhe eingekehrt. Ich bin gespannt wen er als Partner präsentiert...

Ui. Gestern über 23% hoch in Kanda. Mal sehen ob was dahinter steckt, ggf. kommt das Farmout?

Die im September engagierte PR-Agentur hat sich geich ordentlich eingeführt. Sie verweist die Newsletter-Abonnenten auf die Twiga-Meldung:

...............

October 31, 2012

kin communications thought you might enjoy this industry related article in regards to Taipan Resources (TSXV: TPN)

If you have any questions regarding the opportunities in Kenya or Taipan in particular, do not hesitate to contact us.

Tullow strikes oil in second Northern Kenya operationBy Business Daily

British petroleum company Tullow has discovered additional oil deposits in northern Kenya, moving the country closer to having commercially exploitable reserves.

Sources with knowledge of Tullow Kenya's operations said the Twiga 1 South well, where exploration began mid this year, has yielded more than 30 metres of net pay' deposits, 10 metres more than the initial discovery at the pioneer Ngamia well.

To view the rest of the article, please follow this link.

http://www.businessdailyafrica.com/Corporate+News/Tullow+str…

...............

October 31, 2012

kin communications thought you might enjoy this industry related article in regards to Taipan Resources (TSXV: TPN)

If you have any questions regarding the opportunities in Kenya or Taipan in particular, do not hesitate to contact us.

Tullow strikes oil in second Northern Kenya operationBy Business Daily

British petroleum company Tullow has discovered additional oil deposits in northern Kenya, moving the country closer to having commercially exploitable reserves.

Sources with knowledge of Tullow Kenya's operations said the Twiga 1 South well, where exploration began mid this year, has yielded more than 30 metres of net pay' deposits, 10 metres more than the initial discovery at the pioneer Ngamia well.

To view the rest of the article, please follow this link.

http://www.businessdailyafrica.com/Corporate+News/Tullow+str…

Ein Update - und was für eines. Ich hatte mir die Richtung erhofft, aber nicht dass so vieles so schnell in Schwung kommt. Im ersten "Birley-Update" deuten weiterhin viele Dinge darauf hin, dass TPN seinen Weg gehen wird. Und das alles bei 24 Mio CAD Market Cap. Nice  .

.

Hier die NR:

--------------------------------------

November 7, 2012 - President's Letter - An Operational Update from CEO, Max Birley

An Operational Update from CEO, Max Birley

Dear Shareholder,

Since closing Taipan’s first major round of financing ($11.5 million) and the amalgamation with Lion Petroleum in July, we have worked steadily to move the company and its assets in Kenya forward. As the fourth largest gross acreage holder in Kenya we have been quite busy. Below, I enclose a brief summary of what has been happening in the Kenyan oil industry and an update of our operational activities in the country.

In order to facilitate the exploration and development of our two Blocks in Kenya, I have moved my home and family to Nairobi. Relative to other frontier markets in which I have lived, worked and discovered hydrocarbons, Kenya is an easy and friendly place to conduct business. It is also a very exciting time in the Kenyan oil business with very high levels of both commercial and drilling activity post the first major oil discovery in Kenya in March. Kenya is now widely regarded in the industry as the “hottest” place for onshore oil exploration.

Taipan Resources has also engaged two key senior Kenyan nationals to provide the essential local experience and input to operational decisions. This includes Mr Daniel Ngenoh, a geophysicist who was previously the head of the Kenyan National Oil Company and Mr. Hari Ndugu, who is now overseeing Community Relations for the upcoming seismic survey on Block 2B. Both individuals are highly experienced in Kenya and have previous experience with our Blocks. Mr. Daniel Ngenoh has undertaken a significant amount of technical work on Block 1 and Block 2B, while Mr Hari Ndugu worked for many years with the Ministry of Environment and has undertaken many site visits to the Block 2B area.

As you are likely aware, in March Tullow Oil and Africa Oil announced that they had discovered oil in the Tertiary sandstones in the Ngamia-1 well. This well has created tremendous interest in Kenya since the announcement. As a follow on, Tullow are currently drilling a similar Tertiary exploration target to the north of the Ngamia well named Twiga South-1. Although the well is not expected to reach its total depth until later this month, Tullow distributed a press release on the 31st October 2012 declaring that oil has been encountered in the well. Clearly this will continue to generate much interest and excitement as Tullow and its partner Africa Oil share further results later this month on this promising new discovery.

The Tertiary oil discoveries that have been made by Tullow and Africa Oil are highly relevant to the exploration efforts of Taipan, as we have more than 3,150 metres of the same age and type of rocks occurring on Block 2B where we hold a 100% interest.

Tullow also recently commenced the drilling of the Pai Pai exploration well. The well will be drilled to reach total depth at around 4,112 meters and is expected to test Cretaceous and Jurassic objectives.

While our primary objective on Block 2B is oil in the Tertiary, the Pai Pai well is on-trend with additional Cretaceous and Jurassic plays that also exist on Taipan’s Block 2B. The results of the Pai Pai well are expected towards the end of the year.

Contiguous to Taipan’s Block 2B, on Block 9 Africa Oil and Marathon Oil plan to drill the Kinyonga Prospect, with Tertiary and Cretaceous targets, in the second half of 2013. This is a large prospect with a Gross Oil Prospective Resources (unrisked) Best Estimate of 320 mmbbls. Based on gravity, magnetic, and seismic data we can see that the Tertiary trend on Block 9 extends into Block 2B and we believe that the “sweet spot” of the basin is located on our block.

Figure 1: Location of discoveries and wells drilling or to be drilled in Kenya in the next 18 months

Operational Update

Block 2B is currently 100% owned by Taipan’s wholly owned subsidiary Lion Petroleum. Block 2B is 7,800 km2, which is equivalent to 1.9 million acres. We are currently in the Initial Exploration Period of the Production Sharing Contract (PSC) which ends on the 1st June 2013. We have the option to extend the exploration term of the PSC for a further 2 periods of 2 years (total of 4 years). The work program and expenditure up until the 1st June 2013 includes the acquisition of 400 kilometers of seismic data and the acquisition of a block wide Full Tensor Gradiometry survey (FTG).

We expect to begin the acquisition of 400 kilometers of seismic data for Block 2B in December of this year and early in 2013 we will also acquire the FTG survey. The total expenditure for the work program up to the 1st June 2103 will be $6.5 million. Concurrent with the interpretation of the seismic and FTG data, we expect to begin our well planning and design work and expect to drill an exploration well on Block 2B in the second half of 2013.

We have also now completed an in-depth technical review of Block 2B which has exceeded our original expectations. Management believes that the resource estimates previously prepared by independent petroleum consultants Sproule for Block 2B are conservative. We expect to provide an update to our resource estimates in the first half of next year after the seismic and gravity work has been integrated. It should also be noted that the current resource estimates for Block 2B were prepared prior to the oil discoveries that have occurred this year in Kenya.

During the month of October we arranged a 20 day site visit to Block 2B to meet senior government officials and tribal elders to begin the process of pre-survey community awareness. Two public meetings were held to explain the work that will be undertaken and to take onboard the concerns of the local community. Further sensitization meetings will take place before the seismic survey commences.

Figure 2. Left: Part of the crowd attending the sensitization Baraza at Sericho area

Right: Taipan’s Community relations team having their photos taken on Block 2B

On Block 1 where Taipan holds a 20% interest in a 40,000 km2 block (7.8 million acres), BGP the Chinese Bureau of Geophysical Prospecting, have acquired 1,300 kilometers of the planned 1,800 kilometer seismic survey. The survey is expected to be completed in January 2013.

Commercial Update

In September we commenced a farmout process for Taipan’s wholly-owned Block 2B. The aim is to bring in a partner that will be expected to add technical input to the work on the block in addition to carrying our costs through the exploration work program. We are currently engaged in various levels of discussion with a number of potential farm-in partners. We plan to farm out up to 50% of our interest in the block and expect the farm-out process to be concluded by the end of this year.

We have also been encouraged by the high level of recent commercial activity in both Kenya and the surrounding region, and in particular by the farm-in on Block 9 which is contiguous to Taipan’s Block 2B. Commercial activity has included the Marathon farm-in into Africa Oil’s interests in Blocks 9 (50%) and 12A (15%) for $57 million that closed in October, and the purchase from Agriterra also by Marathon of its 20% interest in the South Omo Block in Ethiopia for a total of $50 million also in October. In addition, in September Bowleven farmed into Adamantines’ Block 11B to acquire a 50% interest for funding the next $10 million of seismic work. All of this activity demonstrates the sizable interest in the Kenyan hydrocarbon arena.

Investor communication is very important to the Taipan Board and Management Team. In order to educate investors of the attractiveness of Taipan’s acreage position and to clarify the upcoming work program and expected farm-out, throughout October we held more than 50 investor and analyst meetings across the UK, Ireland, Canada and the USA.

We will continue to keep you updated on our progress and also suggest you visit Taipan’s recently refurbished website (www.taipanresources.com) for news on developments with the Company and throughout east Africa.

Finally, we wish to thank you for the confidence you have entrusted in the Taipan Board and Management Team, and assure you of our commitment to building sustainable shareholder value.

Warm regards,

Maxwell Birley

Chief Executive Officer

http://www.taipanresources.com/news.html#nov7

.

.Hier die NR:

--------------------------------------

November 7, 2012 - President's Letter - An Operational Update from CEO, Max Birley

An Operational Update from CEO, Max Birley

Dear Shareholder,

Since closing Taipan’s first major round of financing ($11.5 million) and the amalgamation with Lion Petroleum in July, we have worked steadily to move the company and its assets in Kenya forward. As the fourth largest gross acreage holder in Kenya we have been quite busy. Below, I enclose a brief summary of what has been happening in the Kenyan oil industry and an update of our operational activities in the country.

In order to facilitate the exploration and development of our two Blocks in Kenya, I have moved my home and family to Nairobi. Relative to other frontier markets in which I have lived, worked and discovered hydrocarbons, Kenya is an easy and friendly place to conduct business. It is also a very exciting time in the Kenyan oil business with very high levels of both commercial and drilling activity post the first major oil discovery in Kenya in March. Kenya is now widely regarded in the industry as the “hottest” place for onshore oil exploration.

Taipan Resources has also engaged two key senior Kenyan nationals to provide the essential local experience and input to operational decisions. This includes Mr Daniel Ngenoh, a geophysicist who was previously the head of the Kenyan National Oil Company and Mr. Hari Ndugu, who is now overseeing Community Relations for the upcoming seismic survey on Block 2B. Both individuals are highly experienced in Kenya and have previous experience with our Blocks. Mr. Daniel Ngenoh has undertaken a significant amount of technical work on Block 1 and Block 2B, while Mr Hari Ndugu worked for many years with the Ministry of Environment and has undertaken many site visits to the Block 2B area.

As you are likely aware, in March Tullow Oil and Africa Oil announced that they had discovered oil in the Tertiary sandstones in the Ngamia-1 well. This well has created tremendous interest in Kenya since the announcement. As a follow on, Tullow are currently drilling a similar Tertiary exploration target to the north of the Ngamia well named Twiga South-1. Although the well is not expected to reach its total depth until later this month, Tullow distributed a press release on the 31st October 2012 declaring that oil has been encountered in the well. Clearly this will continue to generate much interest and excitement as Tullow and its partner Africa Oil share further results later this month on this promising new discovery.

The Tertiary oil discoveries that have been made by Tullow and Africa Oil are highly relevant to the exploration efforts of Taipan, as we have more than 3,150 metres of the same age and type of rocks occurring on Block 2B where we hold a 100% interest.

Tullow also recently commenced the drilling of the Pai Pai exploration well. The well will be drilled to reach total depth at around 4,112 meters and is expected to test Cretaceous and Jurassic objectives.

While our primary objective on Block 2B is oil in the Tertiary, the Pai Pai well is on-trend with additional Cretaceous and Jurassic plays that also exist on Taipan’s Block 2B. The results of the Pai Pai well are expected towards the end of the year.

Contiguous to Taipan’s Block 2B, on Block 9 Africa Oil and Marathon Oil plan to drill the Kinyonga Prospect, with Tertiary and Cretaceous targets, in the second half of 2013. This is a large prospect with a Gross Oil Prospective Resources (unrisked) Best Estimate of 320 mmbbls. Based on gravity, magnetic, and seismic data we can see that the Tertiary trend on Block 9 extends into Block 2B and we believe that the “sweet spot” of the basin is located on our block.

Figure 1: Location of discoveries and wells drilling or to be drilled in Kenya in the next 18 months

Operational Update

Block 2B is currently 100% owned by Taipan’s wholly owned subsidiary Lion Petroleum. Block 2B is 7,800 km2, which is equivalent to 1.9 million acres. We are currently in the Initial Exploration Period of the Production Sharing Contract (PSC) which ends on the 1st June 2013. We have the option to extend the exploration term of the PSC for a further 2 periods of 2 years (total of 4 years). The work program and expenditure up until the 1st June 2013 includes the acquisition of 400 kilometers of seismic data and the acquisition of a block wide Full Tensor Gradiometry survey (FTG).

We expect to begin the acquisition of 400 kilometers of seismic data for Block 2B in December of this year and early in 2013 we will also acquire the FTG survey. The total expenditure for the work program up to the 1st June 2103 will be $6.5 million. Concurrent with the interpretation of the seismic and FTG data, we expect to begin our well planning and design work and expect to drill an exploration well on Block 2B in the second half of 2013.

We have also now completed an in-depth technical review of Block 2B which has exceeded our original expectations. Management believes that the resource estimates previously prepared by independent petroleum consultants Sproule for Block 2B are conservative. We expect to provide an update to our resource estimates in the first half of next year after the seismic and gravity work has been integrated. It should also be noted that the current resource estimates for Block 2B were prepared prior to the oil discoveries that have occurred this year in Kenya.

During the month of October we arranged a 20 day site visit to Block 2B to meet senior government officials and tribal elders to begin the process of pre-survey community awareness. Two public meetings were held to explain the work that will be undertaken and to take onboard the concerns of the local community. Further sensitization meetings will take place before the seismic survey commences.

Figure 2. Left: Part of the crowd attending the sensitization Baraza at Sericho area

Right: Taipan’s Community relations team having their photos taken on Block 2B

On Block 1 where Taipan holds a 20% interest in a 40,000 km2 block (7.8 million acres), BGP the Chinese Bureau of Geophysical Prospecting, have acquired 1,300 kilometers of the planned 1,800 kilometer seismic survey. The survey is expected to be completed in January 2013.

Commercial Update

In September we commenced a farmout process for Taipan’s wholly-owned Block 2B. The aim is to bring in a partner that will be expected to add technical input to the work on the block in addition to carrying our costs through the exploration work program. We are currently engaged in various levels of discussion with a number of potential farm-in partners. We plan to farm out up to 50% of our interest in the block and expect the farm-out process to be concluded by the end of this year.

We have also been encouraged by the high level of recent commercial activity in both Kenya and the surrounding region, and in particular by the farm-in on Block 9 which is contiguous to Taipan’s Block 2B. Commercial activity has included the Marathon farm-in into Africa Oil’s interests in Blocks 9 (50%) and 12A (15%) for $57 million that closed in October, and the purchase from Agriterra also by Marathon of its 20% interest in the South Omo Block in Ethiopia for a total of $50 million also in October. In addition, in September Bowleven farmed into Adamantines’ Block 11B to acquire a 50% interest for funding the next $10 million of seismic work. All of this activity demonstrates the sizable interest in the Kenyan hydrocarbon arena.

Investor communication is very important to the Taipan Board and Management Team. In order to educate investors of the attractiveness of Taipan’s acreage position and to clarify the upcoming work program and expected farm-out, throughout October we held more than 50 investor and analyst meetings across the UK, Ireland, Canada and the USA.

We will continue to keep you updated on our progress and also suggest you visit Taipan’s recently refurbished website (www.taipanresources.com) for news on developments with the Company and throughout east Africa.

Finally, we wish to thank you for the confidence you have entrusted in the Taipan Board and Management Team, and assure you of our commitment to building sustainable shareholder value.

Warm regards,

Maxwell Birley

Chief Executive Officer

http://www.taipanresources.com/news.html#nov7

Zitat von motz1: In order to facilitate the exploration and development of our two Blocks in Kenya, I have moved my home and family to Nairobi. Relative to other frontier markets in which I have lived, worked and discovered hydrocarbons, Kenya is an easy and friendly place to conduct business.

Gutes Zeichen. Ggf. Wohngemeinschaft mit den Hills?

Zitat von motz1: Taipan Resources has also engaged two key senior Kenyan nationals to provide the essential local experience and input to operational decisions. This includes Mr Daniel Ngenoh, a geophysicist who was previously the head of the Kenyan National Oil Company and Mr. Hari Ndugu, who is now overseeing Community Relations for the upcoming seismic survey on Block 2B. Both individuals are highly experienced in Kenya and have previous experience with our Blocks. Mr. Daniel Ngenoh has undertaken a significant amount of technical work on Block 1 and Block 2B, while Mr Hari Ndugu worked for many years with the Ministry of Environment and has undertaken many site visits to the Block 2B area.

Wichtig.

Zitat von motz1: The Tertiary oil discoveries that have been made by Tullow and Africa Oil are highly relevant to the exploration efforts of Taipan, as we have more than 3,150 metres of the same age and type of rocks occurring on Block 2B where we hold a 100% interest.

Gleiches Rift aber weit weg.

Zitat von motz1: Based on gravity, magnetic, and seismic data we can see that the Tertiary trend on Block 9 extends into Block 2B and we believe that the “sweet spot” of the basin is located on our block.

Nice.

Zitat von motz1: We expect to begin the acquisition of 400 kilometers of seismic data for Block 2B in December of this year and early in 2013 we will also acquire the FTG survey. The total expenditure for the work program up to the 1st June 2103 will be $6.5 million. Concurrent with the interpretation of the seismic and FTG data, we expect to begin our well planning and design work and expect to drill an exploration well on Block 2B in the second half of 2013.

Sie fackeln nicht lange...

Zitat von motz1: We have also now completed an in-depth technical review of Block 2B which has exceeded our original expectations. Management believes that the resource estimates previously prepared by independent petroleum consultants Sproule for Block 2B are conservative. We expect to provide an update to our resource estimates in the first half of next year after the seismic and gravity work has been integrated. It should also be noted that the current resource estimates for Block 2B were prepared prior to the oil discoveries that have occurred this year in Kenya.

Diese (hier als veraltet/konservativ dargestellte) estimate beinhaltet bereits 17 Leads.

Zitat von motz1: On Block 1 where Taipan holds a 20% interest in a 40,000 km2 block (7.8 million acres), BGP the Chinese Bureau of Geophysical Prospecting, have acquired 1,300 kilometers of the planned 1,800 kilometer seismic survey. The survey is expected to be completed in January 2013.

In September we commenced a farmout process for Taipan’s wholly-owned Block 2B. The aim is to bring in a partner that will be expected to add technical input to the work on the block in addition to carrying our costs through the exploration work program. We are currently engaged in various levels of discussion with a number of potential farm-in partners. We plan to farm out up to 50% of our interest in the block and expect the farm-out process to be concluded by the end of this year.

Wie wäre es mit MRO?

------------------

Wie ich finde eine schöne Entwicklung bis dahin. Ich hoffe auf eine optimale Ausgestaltung des Farmouts und einen entsprechenden Partner. Sehr schön, aber wie immer alles imho.

NR: Birley sitzt nun auch im BoD:

....................

Taipan Resources Inc. Announces Board Appointment of Mr. Maxwell Birley

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 13, 2012) - Taipan Resources Inc. ("Taipan" or the "Company") (TSX VENTURE:TPN) is pleased to announce the addition of Maxwell Birley to the Board of Directors of Taipan Resources Inc.

Mr. Charles Watson commented, "We are pleased to welcome Mr. Birley to the board of Taipan Resources. Since his appointment as CEO in July, Mr. Birley has delivered several key milestones for Taipan and has shown a strong commitment to the Company including relocating to Nairobi."

Maxwell Birley has over 30 years experience in the oil and gas industry including senior roles with Marathon Oil, Premier Oil, and Oil Search Limited and in-country operating experience in Equatorial Guinea, Pakistan, Yemen, and India. Mr. Birley has a geological geophysical degree and is an Explorationist by training. Throughout his career, Mr. Birley has been directly involved in the discovery of over 1.75 billion barrels of oil equivalent. He has also been responsible for negotiating numerous farm-out and farm-in agreements and acquisitions, and for managing and developing multi-billion dollar oil and gas assets in Africa.

Mr. Mike Devji has accordingly stepped down as a Director of the Company.

[...]

http://tmx.quotemedia.com/article.php?newsid=55835257&qm_sym…

....................

Taipan Resources Inc. Announces Board Appointment of Mr. Maxwell Birley

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 13, 2012) - Taipan Resources Inc. ("Taipan" or the "Company") (TSX VENTURE:TPN) is pleased to announce the addition of Maxwell Birley to the Board of Directors of Taipan Resources Inc.

Mr. Charles Watson commented, "We are pleased to welcome Mr. Birley to the board of Taipan Resources. Since his appointment as CEO in July, Mr. Birley has delivered several key milestones for Taipan and has shown a strong commitment to the Company including relocating to Nairobi."

Maxwell Birley has over 30 years experience in the oil and gas industry including senior roles with Marathon Oil, Premier Oil, and Oil Search Limited and in-country operating experience in Equatorial Guinea, Pakistan, Yemen, and India. Mr. Birley has a geological geophysical degree and is an Explorationist by training. Throughout his career, Mr. Birley has been directly involved in the discovery of over 1.75 billion barrels of oil equivalent. He has also been responsible for negotiating numerous farm-out and farm-in agreements and acquisitions, and for managing and developing multi-billion dollar oil and gas assets in Africa.

Mr. Mike Devji has accordingly stepped down as a Director of the Company.

[...]

http://tmx.quotemedia.com/article.php?newsid=55835257&qm_sym…

Taipan hat zu einer technischen Präsentation geladen. Mal sehen, an welche Infos man kommt:

November 15, 2012

Taipan Resources Technical Presentation Invite - A Review of Kenya

Taipan Resources warmly invites you to a technical analyst meeting at 11:00AM (London UK time) on November 16th, 2012 at IOD London Pall Mall - 116 Pall Mall, London, SW1 5ED, to introduce you to our portfolio of assets which currently comprise onshore Block 1 and Block 2B, Kenya.

The technical briefing will summarize the status and technical work programs currently being undertaken on both Block 1 and Block2B and their resource potential.

Special attention will be given to explaining Taipan's evolving technical understanding of Block 2B in the Anza Graben. This block is currently being farmed-out and is creating significant excitement in the industry. Taipan's recent proprietary technical work is demonstrating that the Anza Graben is likely to be the largest Tertiary-age rift-rift basin of the whole East Africa Rift system, bigger than the petroleum bearing Lake Alberta and Lokichar (containing the recent Ngamia - 1 oil discovery) basins.

The Anza Garben contains Tertiary plays directly analogous to those proven to be oil bearing in the Lake Alberta and Lokichar basins and it also contains additional Cretaceous plays concomitant to the proven, oil producing-plays in the Mugladn and Melut basins in souther Sudan. Given the proven reserves of the Sudanese and Lake Albert basins alone likely exceed 8 billion barrels of crude oil, the potential of the Anza Graben is undeniable.

Please RSVP if able to attend the presentation in person to ir@kincommunications.com

Interested parties unable to attend in person are welcome to join in via Conference Call requesting the dial in information and presentation material to ir@kincommunications.com

In addition, a playback of the technical presentation will be available by request by the following week.

November 15, 2012

Taipan Resources Technical Presentation Invite - A Review of Kenya

Taipan Resources warmly invites you to a technical analyst meeting at 11:00AM (London UK time) on November 16th, 2012 at IOD London Pall Mall - 116 Pall Mall, London, SW1 5ED, to introduce you to our portfolio of assets which currently comprise onshore Block 1 and Block 2B, Kenya.

The technical briefing will summarize the status and technical work programs currently being undertaken on both Block 1 and Block2B and their resource potential.

Special attention will be given to explaining Taipan's evolving technical understanding of Block 2B in the Anza Graben. This block is currently being farmed-out and is creating significant excitement in the industry. Taipan's recent proprietary technical work is demonstrating that the Anza Graben is likely to be the largest Tertiary-age rift-rift basin of the whole East Africa Rift system, bigger than the petroleum bearing Lake Alberta and Lokichar (containing the recent Ngamia - 1 oil discovery) basins.

The Anza Garben contains Tertiary plays directly analogous to those proven to be oil bearing in the Lake Alberta and Lokichar basins and it also contains additional Cretaceous plays concomitant to the proven, oil producing-plays in the Mugladn and Melut basins in souther Sudan. Given the proven reserves of the Sudanese and Lake Albert basins alone likely exceed 8 billion barrels of crude oil, the potential of the Anza Graben is undeniable.

Please RSVP if able to attend the presentation in person to ir@kincommunications.com

Interested parties unable to attend in person are welcome to join in via Conference Call requesting the dial in information and presentation material to ir@kincommunications.com

In addition, a playback of the technical presentation will be available by request by the following week.

Antwort auf Beitrag Nr.: 43.833.249 von motz1 am 16.11.12 16:14:24Hier die erste Info:

Taipan Resources Inc. Announces 2D Seismic Acquisition to Commence in January on Block 2B Onshore Kenya

NAIROBI, KENYA--(Marketwire - Nov 22, 2012) - Taipan Resources Inc. ("Taipan" or the "Company") (TSX VENTURE:TPN) is pleased to provide the following update regarding the 2D seismic acquisition program on Block 2B onshore Kenya.

Taipan has a contract with BGP (Bureau of Geophysical Prospecting of China) to acquire up to 800 kilometers of seismic data over Block 2B in North Eastern Kenya. BGP has begun mobilizing their seismic crew and plans to commence recording in January 2013. Taipan expects the 2D seismic acquisition to be completed by the end of Q1 2013.

BGP is one of the world''s leading geophysical service companies. BGP currently has five seismic crews working in Kenya and has completed a number of other seismic surveys surrounding Block 2B earlier this year. BGP is also currently shooting seismic on Block 1 in Kenya where Taipan owns a 20% interest.

Mr. Maxwell Birley CEO commented, "Taipan''s recent proprietary technical work is demonstrating that the Anza Basin is likely to be one of the largest Tertiary-age rift-basins of the East African Rift system which contains multi-billion barrel oil discoveries. Based on gravity, magnetic and seismic data we believe that the ''sweet spot'' of the Anza Basin is located on Block 2B."

Taipan Resources Inc. Announces 2D Seismic Acquisition to Commence in January on Block 2B Onshore Kenya

NAIROBI, KENYA--(Marketwire - Nov 22, 2012) - Taipan Resources Inc. ("Taipan" or the "Company") (TSX VENTURE:TPN) is pleased to provide the following update regarding the 2D seismic acquisition program on Block 2B onshore Kenya.

Taipan has a contract with BGP (Bureau of Geophysical Prospecting of China) to acquire up to 800 kilometers of seismic data over Block 2B in North Eastern Kenya. BGP has begun mobilizing their seismic crew and plans to commence recording in January 2013. Taipan expects the 2D seismic acquisition to be completed by the end of Q1 2013.

BGP is one of the world''s leading geophysical service companies. BGP currently has five seismic crews working in Kenya and has completed a number of other seismic surveys surrounding Block 2B earlier this year. BGP is also currently shooting seismic on Block 1 in Kenya where Taipan owns a 20% interest.

Mr. Maxwell Birley CEO commented, "Taipan''s recent proprietary technical work is demonstrating that the Anza Basin is likely to be one of the largest Tertiary-age rift-basins of the East African Rift system which contains multi-billion barrel oil discoveries. Based on gravity, magnetic and seismic data we believe that the ''sweet spot'' of the Anza Basin is located on Block 2B."

Antwort auf Beitrag Nr.: 43.851.655 von Resources am 22.11.12 13:05:24Hat der das echt gesagt

"Mr. Maxwell Birley CEO commented, "Taipan''s recent proprietary technical work is demonstrating that the Anza Basin is likely to be one of the largest Tertiary-age rift-basins of the East African Rift system which contains multi-billion barrel oil discoveries. Based on gravity, magnetic and seismic data we believe that the ''sweet spot'' of the Anza Basin is located on Block 2B."

---------------------

Thx! Ich habe die 2. gefunden - die Präse zum London-event:

http://taipanresources.com/pdf/2012-11-16_Taipan_TechnicalAn…

Gut gemacht, wie ich finde. Slide 28 gefällt mir sehr...

"Mr. Maxwell Birley CEO commented, "Taipan''s recent proprietary technical work is demonstrating that the Anza Basin is likely to be one of the largest Tertiary-age rift-basins of the East African Rift system which contains multi-billion barrel oil discoveries. Based on gravity, magnetic and seismic data we believe that the ''sweet spot'' of the Anza Basin is located on Block 2B."

---------------------

Thx! Ich habe die 2. gefunden - die Präse zum London-event:

http://taipanresources.com/pdf/2012-11-16_Taipan_TechnicalAn…

Gut gemacht, wie ich finde. Slide 28 gefällt mir sehr...

Hallo motz1,

ja, die Präsi ist wirklich gut gemacht und Dein Lieblingsslide gefällt mir auch. Ob er das wirklich gesagt hat sei mal dahingestellt, wichtig ist das es stimmt.

ja, die Präsi ist wirklich gut gemacht und Dein Lieblingsslide gefällt mir auch. Ob er das wirklich gesagt hat sei mal dahingestellt, wichtig ist das es stimmt.

Von Stockhouse:

-----------

MACKIE RESEARCH NOTE

RECOMMENDATION AND TARGET – SPEC. BUY / $1.00 PER SHARE TARGET

As one of largest landholders in Kenya, Taipan provides investors with exposure to one of the hottest high-impact exploration plays in onshore Africa.

Based upon the potential for a significant oil discovery from a carried exploration drilling program, we are initiating coverage on Taipan Resources Inc. with a SPECULATIVE BUY recommendation and a $1.00 per share 12-month target price equivalent to a 1.0x multiple of our risked prospective resource NAV/fd share.

On an un-risked basis, and indicative of the exploration potential, we calculate a NAV of $12.95/fd share

-----------

MACKIE RESEARCH NOTE

RECOMMENDATION AND TARGET – SPEC. BUY / $1.00 PER SHARE TARGET

As one of largest landholders in Kenya, Taipan provides investors with exposure to one of the hottest high-impact exploration plays in onshore Africa.

Based upon the potential for a significant oil discovery from a carried exploration drilling program, we are initiating coverage on Taipan Resources Inc. with a SPECULATIVE BUY recommendation and a $1.00 per share 12-month target price equivalent to a 1.0x multiple of our risked prospective resource NAV/fd share.

On an un-risked basis, and indicative of the exploration potential, we calculate a NAV of $12.95/fd share

So, die IR meldet, dass TPN in 'The Junior Report' beleuchtet wurde.

Frohe Weihnachten an alle TPN'ler, unser Präsent -das Farmout- wird sich wohl verspäten...

---------------------

Risk Capital Is In Abundance. Just Give It A Reason

By Junior Report – December 18, 2012

Posted in: Featured Articles

No one can deny this has been one of the most humbling and difficult markets investors have seen in a long time, if not their entire lives. Gone are the good old days of being able to throw a dart to pick a successful deal.

While some may say it’s a tough market, the abundance of risk capital on the side lines and the flow of money to new discoveries show that there are still a lot of opportunities out there.

I believe I found a company with huge potential, in a hot area, with the right team in place to make this story a huge success.

The company is Taipan Resources (TSXV: TPN)

Taipan’s operations are located onshore in Kenya which is home to the recent billion dollar discovery by Africa Oil Corp. AOI hit over 200m of pay and the market bought this stock up from $2 to over $12 at its peak. The most intriguing part is that they only own 50% of the play (London oil giant Tullow PLC has the other half), which means the overall market is valuing their discovery at over $3 Billion. When I say there is an abundance of risk capital on the sidelines, I am not lying. Africa Oil recently announced a financing which they recently increased to $232.5 million!

Again, there is always money for the next big thing.

Taipan is the 4th largest acreage holder in Kenya and currently holds a 100% working interest in Block 2B and a 20% interest in Block 1 which is operated by Afren plc (LON:AFR). They are the largest land holders outside of Tullow and Africa Oil.

Currently Taipan is in the process of completing a farm out agreement on their 100% owned Block 2B. Taipan has given guidance of completing a agreement farm out by year’s end. With this agreement Taipan hopes to receive compensation for back costs, funding for additional seismic, and a carry on the cost of drilling and testing future exploration wells. The plan is to retain a 50% interest in Block 2B.

Depending on what kind of deal Taipan can strike and with whom, this could be a huge potential catalyst for the story and can go a long way to further de risking Block 2B and the company’s financial position.

Don’t just take my word for it. Taipan Resources, not surprisingly, is the only junior company operating in Kenya to receive analyst coverage. Bill Newman, of Mackie Research Capital, recently initiated coverage on December 5, 2012 and came out with an aggressive 12 month target of $1 / share. The report was titled “Elephant Hunting in Kenya” which I couldn’t have said any better. Some highlights from that report highlight the significant opportunity with Taipan: “Taipan provides investors with exposure to high-impact conventional oil plays located onshore within Kenya’s hot rift basin play” “We believe the potential exists for significant share price appreciation once Taipan secures a farm-out partner and we see significant additional upside if a carried exploration campaign results in a new pool discovery” …with bullish comments like these, it’s no wonder why it was up over 20% on approx 1m shares, and now has an analyst target 300% higher than its current price.

Now that this coverage is in place, I expect the story to see more institutional buyers entering the market, which I believe was demonstrated yesterday when we saw Taipan traded just under 1M shares.

Anyone looking for huge leverage through a potential Africa Oil number two, Taipan Resources is a story that cannot be ignored.

Everything you need can be found at http://www.taipanresources.com/

As always, this is not an investment recommendation and everyone should do their due diligence and consult a competent financial advisor before making an investment decision.

No related posts.

http://juniorreport.com/featured_articles/2012-12-18-472/

Frohe Weihnachten an alle TPN'ler, unser Präsent -das Farmout- wird sich wohl verspäten...

---------------------

Risk Capital Is In Abundance. Just Give It A Reason

By Junior Report – December 18, 2012

Posted in: Featured Articles

No one can deny this has been one of the most humbling and difficult markets investors have seen in a long time, if not their entire lives. Gone are the good old days of being able to throw a dart to pick a successful deal.

While some may say it’s a tough market, the abundance of risk capital on the side lines and the flow of money to new discoveries show that there are still a lot of opportunities out there.

I believe I found a company with huge potential, in a hot area, with the right team in place to make this story a huge success.

The company is Taipan Resources (TSXV: TPN)

Taipan’s operations are located onshore in Kenya which is home to the recent billion dollar discovery by Africa Oil Corp. AOI hit over 200m of pay and the market bought this stock up from $2 to over $12 at its peak. The most intriguing part is that they only own 50% of the play (London oil giant Tullow PLC has the other half), which means the overall market is valuing their discovery at over $3 Billion. When I say there is an abundance of risk capital on the sidelines, I am not lying. Africa Oil recently announced a financing which they recently increased to $232.5 million!

Again, there is always money for the next big thing.

Taipan is the 4th largest acreage holder in Kenya and currently holds a 100% working interest in Block 2B and a 20% interest in Block 1 which is operated by Afren plc (LON:AFR). They are the largest land holders outside of Tullow and Africa Oil.

Currently Taipan is in the process of completing a farm out agreement on their 100% owned Block 2B. Taipan has given guidance of completing a agreement farm out by year’s end. With this agreement Taipan hopes to receive compensation for back costs, funding for additional seismic, and a carry on the cost of drilling and testing future exploration wells. The plan is to retain a 50% interest in Block 2B.

Depending on what kind of deal Taipan can strike and with whom, this could be a huge potential catalyst for the story and can go a long way to further de risking Block 2B and the company’s financial position.

Don’t just take my word for it. Taipan Resources, not surprisingly, is the only junior company operating in Kenya to receive analyst coverage. Bill Newman, of Mackie Research Capital, recently initiated coverage on December 5, 2012 and came out with an aggressive 12 month target of $1 / share. The report was titled “Elephant Hunting in Kenya” which I couldn’t have said any better. Some highlights from that report highlight the significant opportunity with Taipan: “Taipan provides investors with exposure to high-impact conventional oil plays located onshore within Kenya’s hot rift basin play” “We believe the potential exists for significant share price appreciation once Taipan secures a farm-out partner and we see significant additional upside if a carried exploration campaign results in a new pool discovery” …with bullish comments like these, it’s no wonder why it was up over 20% on approx 1m shares, and now has an analyst target 300% higher than its current price.

Now that this coverage is in place, I expect the story to see more institutional buyers entering the market, which I believe was demonstrated yesterday when we saw Taipan traded just under 1M shares.

Anyone looking for huge leverage through a potential Africa Oil number two, Taipan Resources is a story that cannot be ignored.

Everything you need can be found at http://www.taipanresources.com/

As always, this is not an investment recommendation and everyone should do their due diligence and consult a competent financial advisor before making an investment decision.

No related posts.

http://juniorreport.com/featured_articles/2012-12-18-472/

So, FTG-Survey startet noch Ende Januar und damit sind im Februar dann auch schon die Verpflichtungen aus der Initial Exploration Period erfüllt. Es läuft was  .

.

-------------

Taipan Resources

January 10, 2013

Taipan Resources Inc. Announces Award of Full Tensor Gravity Survey to ARKeX Ltd. on Block 2B Onshore Kenya

NAIROBI, KENYA--(Marketwire - Jan. 10, 2013) - Taipan Resources Inc. (TSX.V:TPN) ("Taipan" or the "Company") is pleased to announce that it has contracted ARKeX Ltd. to undertake an 11,750 km Full Tensor Gravity Gradiometry survey (FTG) over Block 2B onshore Kenya. The survey, which will also acquire magnetic data, is expected to commence in late January and to be completed in February 2013.

The award of the FTG survey to ARKeX Ltd. is the last contract required to complete the work program on Block 2B during the Initial Exploration Period. On completion of the Initial Exploration Period, Taipan expects to enter the First Additional Exploration Period and to drill an exploration well on Block 2B in late 2013 or early 2014. The First Additional Exploration Period has a term of two years.

Mr. Maxwell Birley, CEO commented, "The Anza Basin is one of the largest Tertiary-age rift-basins of the East African Rift system which contains multi-billion barrel oil discoveries. We continue to believe based on existing gravity, magnetic and seismic data that the 'sweet spot' of the Anza Basin is located on Block 2B. Recent proprietary geochemistry work completed by Taipan also demonstrates that there is excellent quality Tertiary oil-prone source rock present in the Anza Basin in the region of Block 2B."

About Taipan Resources Inc.

Taipan Resources Inc. (TSX VENTURE:TPN) is an independent African oil and gas exploration company with interests in 9.7 million gross oil and gas exploration acres (39,588 km2 ) in Block 1 and Block 2B onshore Kenya. Through its wholly owned subsidiary Lion Petroleum Corp., Taipan currently holds a 100% working interest in Block 2B (1.9 million acres / 7,807 km2) and a 20% working interest in Block 1 (7.8 million acres gross / 31,781 km 2) which is operated by Afren plc. Taipan is traded on the TSX Venture Exchange with the symbol TPN.

About ARKeX Ltd.

ARKeX is a provider of non-seismic geophysical imaging services for the oil & gas exploration industries. It specialises in the acquisition of multi-client and proprietary Full Tensor Gravity Gradiometry (FTG) data. FTG surveys measure minute variations in the earth's gravitational field to help image subsurface structures. FTG has a much higher bandwidth and delivers a higher resolution image than conventional gravity surveys. It can be used as a stand alone service or in conjunction with seismic data. ARKeX can also process and interpret conventional gravity and magnetic data as well as brokering multi-client non-seismic data. Based in Cambridge, UK, ARKeX has offices in Sherington, UK, and Houston, USA, and has global operational capabilities. www.arkex.com

Quelle: E-Mail-Newsletter von TPN.

.

.-------------

Taipan Resources

January 10, 2013

Taipan Resources Inc. Announces Award of Full Tensor Gravity Survey to ARKeX Ltd. on Block 2B Onshore Kenya

NAIROBI, KENYA--(Marketwire - Jan. 10, 2013) - Taipan Resources Inc. (TSX.V:TPN) ("Taipan" or the "Company") is pleased to announce that it has contracted ARKeX Ltd. to undertake an 11,750 km Full Tensor Gravity Gradiometry survey (FTG) over Block 2B onshore Kenya. The survey, which will also acquire magnetic data, is expected to commence in late January and to be completed in February 2013.

The award of the FTG survey to ARKeX Ltd. is the last contract required to complete the work program on Block 2B during the Initial Exploration Period. On completion of the Initial Exploration Period, Taipan expects to enter the First Additional Exploration Period and to drill an exploration well on Block 2B in late 2013 or early 2014. The First Additional Exploration Period has a term of two years.

Mr. Maxwell Birley, CEO commented, "The Anza Basin is one of the largest Tertiary-age rift-basins of the East African Rift system which contains multi-billion barrel oil discoveries. We continue to believe based on existing gravity, magnetic and seismic data that the 'sweet spot' of the Anza Basin is located on Block 2B. Recent proprietary geochemistry work completed by Taipan also demonstrates that there is excellent quality Tertiary oil-prone source rock present in the Anza Basin in the region of Block 2B."

About Taipan Resources Inc.

Taipan Resources Inc. (TSX VENTURE:TPN) is an independent African oil and gas exploration company with interests in 9.7 million gross oil and gas exploration acres (39,588 km2 ) in Block 1 and Block 2B onshore Kenya. Through its wholly owned subsidiary Lion Petroleum Corp., Taipan currently holds a 100% working interest in Block 2B (1.9 million acres / 7,807 km2) and a 20% working interest in Block 1 (7.8 million acres gross / 31,781 km 2) which is operated by Afren plc. Taipan is traded on the TSX Venture Exchange with the symbol TPN.

About ARKeX Ltd.

ARKeX is a provider of non-seismic geophysical imaging services for the oil & gas exploration industries. It specialises in the acquisition of multi-client and proprietary Full Tensor Gravity Gradiometry (FTG) data. FTG surveys measure minute variations in the earth's gravitational field to help image subsurface structures. FTG has a much higher bandwidth and delivers a higher resolution image than conventional gravity surveys. It can be used as a stand alone service or in conjunction with seismic data. ARKeX can also process and interpret conventional gravity and magnetic data as well as brokering multi-client non-seismic data. Based in Cambridge, UK, ARKeX has offices in Sherington, UK, and Houston, USA, and has global operational capabilities. www.arkex.com

Quelle: E-Mail-Newsletter von TPN.

Sehr ausführliches Interview mit Maxwell Birley mit einigen Highlights, u.a.:

- geschätzte 1,0 Mio barrels unrisked prospective resources im Resource Update

- Uganda-Pipeline wird in geschätzten 175km "Nähe" vorbeiführen

- The Anza Basin is the largest of these East African rift basins and 10 times the size of Uganda’s Albertine Basin and Kenya’s Lokichar Basin.

- Bohrungen in Block 1 und 2B jeweils Ende diesen/Anfang kommenden Jahres.

-----------------------------------------------

Kenyan Oil, Hot and Getting Hotter: Interview with Taipan’s Maxwell Birley

By James Stafford | Mon, 14 January 2013 23:21

Kenya has become the hottest oil and gas venue in East Africa since big discoveries were made in the country’s virgin oilfields last April. All eyes are on Kenya in 2013 to see how quickly--and economically they can develop those discoveries into production.

Nairobi based Taipan Resources Inc. (TPN-TSXV; TAIPF-PINK) is the 4th largest acreage owner in Kenya, and is getting ready to carry out seismic on Block 2B. They recently attracted Maxwell Birley as CEO. Mr. Birley has been instrumental in discovering more than 2 billion barrels of oil equivalent in his 30-year career—much of it in Africa and Asia.

In an exclusive interview with Oilprice.com, Taipan CEO Maxwell Birley discusses:

• Why Kenya is the hottest venue in East Africa

• Why 2013 will be a stellar year for Kenya

• Why the regulatory environment remains attractive

• Why Kenya outranks its neighbours

• Why infrastructure will be in place in time for commercial activity

• Why this venue is good for the juniors

• Why the Somalia security risk remains low

• What Taipan is really chasing

Oilprice.com: There were some major discoveries in Kenya last year. Could you give me some colour on these discoveries that has the market thinking Kenya is now one of the hottest exploration spots on earth?

Maxwell Birley: There are a couple—or 2 billion--reasons actually. First, two recent discoveries by Tullow in the Tertiary Lokichar basin of Kenya are in similar geological settings as the discoveries also made by Tullow in the Albertine Basin in Uganda, just to the west.

Uganda has over 2 billion barrels, and the discoveries are similar enough that one could assume the eventual size of the resources in the Lokichar basin could be in the billions of barrels range as well.

There are also other Tertiary basins in Kenya that are attractive. Based on geochemical work we recently did it’s possible that the eventual hydrocarbon resource size for the whole of Kenya could be much higher than this.

Being specific the unrisked prospective resources for Taipan’s acreage in Kenya is 530 million barrels. We also believe that this estimate will likely increase to approximately 1.0 billion on completion of our studies.

These estimates are for only 2 blocks in Kenya, if this is reasonably extrapolated to other blocks across the country one can easily forecast very significant hydrocarbon resource sizes indeed.

Oilprice.com: What’s the easiest and most challenging thing about working with the Kenyan government and in the Kenyan political climate?

Maxwell Birley: The Ministry of Energy is always ready for a meeting. They listen to our concerns and take the appropriate action. They quickly follow up and give us the support that we need with other Ministries. In the field the local administration is also very helpful. We have regular meetings to make sure our work continues without a hitch.

With regard to the political climate, there is an election coming up in March 2013. We’re making arrangements so that we do not have a slowdown in seismic operations during that period. The last elections in 2007 were associated with some “geographically limited” security issues, however these were located far from our areas of operation, so we are not expecting the elections to have much impact on our operations.

Oilprice.com: The Kenyan government is reviewing its oil and gas regulations. Among the suggested amendments is one that would see the National Oil Corporation (NOC) get a 25% interest in oil properties that foreign firms are operating in Kenya, but this would put the government in a precarious position vis-à-vis attracting investors. How do you see this playing out in the end?

Maxwell Birley: The government is reviewing the terms that shall apply for licences/contracts that will be granted in the future. Oil companies will review all the terms on offer at the time of bid submission and compare them to the attractiveness of the acreage.

Oilprice.com: In November last year, Kenya expelled Norwegian Statoil, after revoking its exploration license. Is Nairobi increasingly ‘policing’ exploration, and what will this mean for investors in the near/medium term?