Potash Ridge T.PRK Sprott & Pinetree sind schon on Board! - 500 Beiträge pro Seite

eröffnet am 12.12.12 08:54:22 von

neuester Beitrag 11.06.18 00:07:54 von

neuester Beitrag 11.06.18 00:07:54 von

Beiträge: 244

ID: 1.178.289

ID: 1.178.289

Aufrufe heute: 0

Gesamt: 13.445

Gesamt: 13.445

Aktive User: 0

ISIN: CA83577W1086 · WKN: A2JR6N · Symbol: SOP.H

0,0150

CAD

-25,00 %

-0,0050 CAD

Letzter Kurs 22.04.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 13,170 | +15,32 | |

| 46,82 | +12,12 | |

| 41,11 | +9,98 | |

| 3.640,50 | +8,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 103,80 | -9,50 | |

| 0,6800 | -15,00 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 | |

| 46,80 | -98,06 |

Servus Gemeinde,

Potash Ridge T.PRK is a Canadian based mining Company with a unique opportunity to develop a premium quality sulphate of potash (SOP) deposit into long-term mining production.

http://www.potashridge.com/corporate/overview/default.aspx

Seit dem 5.12. gelistet an der TSX

http://www.potashridge.com/news/news-details/2012/Potash-Rid…

PRK hat ein vielversprechendes Projekt in Utah-USA.NI-Studie und PEA sind schon vorhanden!

http://www.potashridge.com/files/doc_presentations/Presentat…

Sprott hält 19,9% und Pinetree 11,7% !

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

INVESTMENT HIGHLIGHTS

1.Lower risk surface mining deposit; expected low-cost producer!

2. 30 year mine life, with upside potential !

3. PEA completed: $1.3 billion NPV at 10%; 21.3% after tax IRR !

Annual Production Rates:

SOP 680,000 tonnes

Sulphuric Acid 1.6 million tonnes

Initial Mine Plan 30 years

Capital Cost$1.075 billion

Cash Cost of Production (before acid credits) $101 per tonne

FINANCIAL HIGHLIGHTS

NPV @ 10% (after tax)4 $1,331 million

Unlevered IRR (after tax)4 21.3%

Potash Ridge T.PRK is a Canadian based mining Company with a unique opportunity to develop a premium quality sulphate of potash (SOP) deposit into long-term mining production.

http://www.potashridge.com/corporate/overview/default.aspx

Seit dem 5.12. gelistet an der TSX

http://www.potashridge.com/news/news-details/2012/Potash-Rid…

PRK hat ein vielversprechendes Projekt in Utah-USA.NI-Studie und PEA sind schon vorhanden!

http://www.potashridge.com/files/doc_presentations/Presentat…

Sprott hält 19,9% und Pinetree 11,7% !

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

INVESTMENT HIGHLIGHTS

1.Lower risk surface mining deposit; expected low-cost producer!

2. 30 year mine life, with upside potential !

3. PEA completed: $1.3 billion NPV at 10%; 21.3% after tax IRR !

Annual Production Rates:

SOP 680,000 tonnes

Sulphuric Acid 1.6 million tonnes

Initial Mine Plan 30 years

Capital Cost$1.075 billion

Cash Cost of Production (before acid credits) $101 per tonne

FINANCIAL HIGHLIGHTS

NPV @ 10% (after tax)4 $1,331 million

Unlevered IRR (after tax)4 21.3%

Antwort auf Beitrag Nr.: 43.918.066 von SEPP_EIXLBERGER am 12.12.12 08:54:22mon moin, werden die auch in Deutschland gehandelt?

Gruß P50

Gruß P50

Antwort auf Beitrag Nr.: 43.918.674 von Privatier50 am 12.12.12 10:45:59Servus,

ich habe keine verlässliche Informationen ob und wann die Aktie in Deutschland handelbar ist-wird,zur Zeit nur in Canada mit sehr wenig Volumen!

ich habe keine verlässliche Informationen ob und wann die Aktie in Deutschland handelbar ist-wird,zur Zeit nur in Canada mit sehr wenig Volumen!

Antwort auf Beitrag Nr.: 43.920.485 von SEPP_EIXLBERGER am 12.12.12 16:29:34ok danke, ich warte lieber darauf bis sie hier handelbar sind.

Gruß P50

Gruß P50

Potash Ridge Commences Next Phase Pre-Feasibility Test Work and Drilling

http://www.stockhouse.com/companies/stories/t.prk/8712310

Potash Ridge Corporation ("Potash Ridge" or the "Corporation") (TSX:PRK) today announced that it has commenced its phase three drilling program and phase two metallurgical test work on its Blawn Mountain Project.

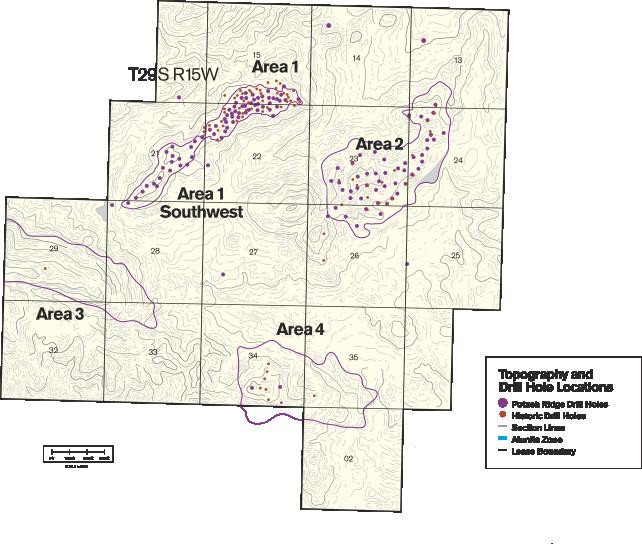

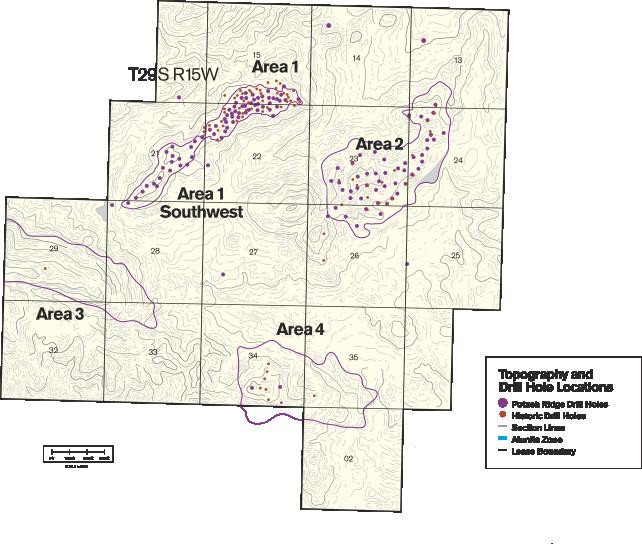

The third phase drilling program comprises of 18 infill drill holes within the mine areas defined in the preliminary economic assessment using reverse circulation. The focus is on Area 2 with, 16 drill holes, with the remaining two holes in Area 1. The objective of this drilling program is to convert certain inferred resources into measured and indicated resources for the pre-feasibility study, anticipated to be completed in the second quarter of this year.

The second phase metallurgical test program is focused on further confirmation of historical testing and pilot plant studies previously performed on the property, which will be used for the pre-feasibility study. Following completion of this test work for the pre-feasibility study, the Corporation plans to commence pilot plant and additional test work in order to optimize the production process for the feasibility study, scheduled for completion around the end of the first quarter of 2014.

....interessant....

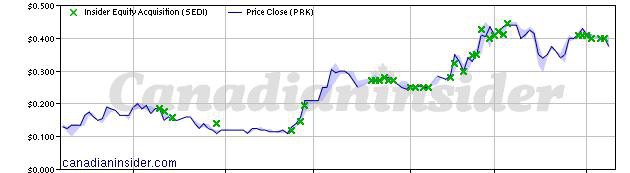

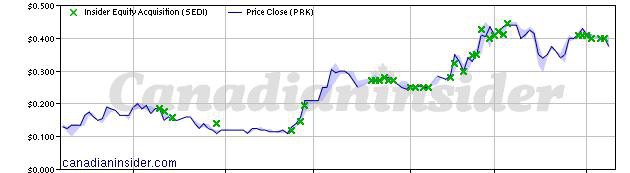

http://www.canadianinsider.com/node/7?ticker=PRK

Feb 6/13 Feb 5/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 57,000 $0.741

Feb 6/13 Feb 5/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 57,000 $0.741

Feb 5/13 Feb 4/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 75,000 $0.750

Feb 5/13 Feb 4/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 75,000 $0.750

Feb 4/13 Feb 1/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.750

Feb 4/13 Feb 1/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 50,000 $0.750

Jan 16/13 Jan 15/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 25,000 $0.790

Jan 16/13 Jan 15/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 25,000 $0.790

Jan 14/13 Jan 11/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.770

Jan 14/13 Jan 11/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 100,000 $0.770

http://www.canadianinsider.com/node/7?ticker=PRK

Feb 6/13 Feb 5/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 57,000 $0.741

Feb 6/13 Feb 5/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 57,000 $0.741

Feb 5/13 Feb 4/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 75,000 $0.750

Feb 5/13 Feb 4/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 75,000 $0.750

Feb 4/13 Feb 1/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 50,000 $0.750

Feb 4/13 Feb 1/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 50,000 $0.750

Jan 16/13 Jan 15/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 25,000 $0.790

Jan 16/13 Jan 15/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 25,000 $0.790

Jan 14/13 Jan 11/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 100,000 $0.770

Jan 14/13 Jan 11/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 100,000 $0.770

Antwort auf Beitrag Nr.: 44.116.338 von SEPP_EIXLBERGER am 07.02.13 20:13:53durch die hohen Insiderkäufe ist mir PRK auch aufgefallen.

Was mir nicht gefällt ist die enormen CAPEX von fast 1,1 Mrd.$!

Des Weiteren will ich zuerst die PFS Mitte 2013 sehen, ob diese die PEA-Zahlen bestätigt oder ob diese gar steigen!

Was mir nicht gefällt ist die enormen CAPEX von fast 1,1 Mrd.$!

Des Weiteren will ich zuerst die PFS Mitte 2013 sehen, ob diese die PEA-Zahlen bestätigt oder ob diese gar steigen!

Antwort auf Beitrag Nr.: 44.123.862 von Kongo-Otto am 10.02.13 13:29:25Servus Otto

lebst du noch oder....?

Wie du schon weißt im Potashsektor hast eine Handvoll Explorer mit CAPEX unter 1 Mrd.$.Bei der PRK ist mMn der SOP-Preis sehr wichtiger Faktor,20%-30% höherer Preis als MOP !

Interessanter Vergleich unter den Potashexplorern;

Capex Comparison

Seite7

http://www.elementalminerals.com.au/upload/documents/2012110…

Die Insiderkäufe verlaufen änlich wie bei der CAL lätztes Jahr!

Pinetree und Inwentash

P&L

SEPPi

lebst du noch oder....?

Wie du schon weißt im Potashsektor hast eine Handvoll Explorer mit CAPEX unter 1 Mrd.$.Bei der PRK ist mMn der SOP-Preis sehr wichtiger Faktor,20%-30% höherer Preis als MOP !

Interessanter Vergleich unter den Potashexplorern;

Capex Comparison

Seite7

http://www.elementalminerals.com.au/upload/documents/2012110…

Die Insiderkäufe verlaufen änlich wie bei der CAL lätztes Jahr!

Pinetree und Inwentash

P&L

SEPPi

Antwort auf Beitrag Nr.: 44.124.028 von SEPP_EIXLBERGER am 10.02.13 15:07:53PRK liest sich schon sehr interessant und die Insiderkaeufe sprechen auch fuer PRK.

Und auch das trifft meine Meinung ganz gut:

https://www.stockhouse.com/bullboards/messagedetail.aspx?p=…

Dennoch, 1 Mrd. CAPEX ist 1 Mrd. CAPEX. Es muss jemand finanzieren, da fuehrt kein Weg daran vorbei.

Bist du hier schon investiert?

Und auch das trifft meine Meinung ganz gut:

https://www.stockhouse.com/bullboards/messagedetail.aspx?p=…

Dennoch, 1 Mrd. CAPEX ist 1 Mrd. CAPEX. Es muss jemand finanzieren, da fuehrt kein Weg daran vorbei.

Bist du hier schon investiert?

PRK ist nur auf meiner STRONG-WL,...kann mir nicht jede gönnen...

APROPOS Insider;

Insider Trade Summaries - Toronto Stock Exchange

Last Updated: February 8, 2013

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Symbol Company Name Insider Buys Volume Insider Sells Volume Net Buys Volume

PRK Potash Ridge Corporation 86,500 0 86,500

...irgedetwas ist im Busch!!

APROPOS Insider;

Insider Trade Summaries - Toronto Stock Exchange

Last Updated: February 8, 2013

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Symbol Company Name Insider Buys Volume Insider Sells Volume Net Buys Volume

PRK Potash Ridge Corporation 86,500 0 86,500

...irgedetwas ist im Busch!!

Antwort auf Beitrag Nr.: 44.116.338 von SEPP_EIXLBERGER am 07.02.13 20:13:53

Feb 11/13 Feb 8/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 81,500 $0.750

Feb 11/13 Feb 8/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 81,500 $0.750

Feb 11/13 Feb 8/13 Sharan, Rahoul Direct Ownership Common Shares 15 - Acquisition under a prospectus 5,000 $0.730

Feb 11/13 Feb 8/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 81,500 $0.750

Feb 11/13 Feb 8/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 81,500 $0.750

Feb 11/13 Feb 8/13 Sharan, Rahoul Direct Ownership Common Shares 15 - Acquisition under a prospectus 5,000 $0.730

Antwort auf Beitrag Nr.: 44.143.871 von SEPP_EIXLBERGER am 15.02.13 09:06:26Trading Date Ticker Insider Volume Average

Buy Price AverageSell Price Buy Sell Net

Feb 14/13 PRK 54,000 54,000 $0.710

Buy Price AverageSell Price Buy Sell Net

Feb 14/13 PRK 54,000 54,000 $0.710

Antwort auf Beitrag Nr.: 44.147.834 von SEPP_EIXLBERGER am 15.02.13 20:55:31Feb 15/13 Feb 14/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 54,000 $0.710

Feb 15/13 Feb 14/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 54,000 $0.710

Nur gucken (noch)nicht anfassen !

Feb 15/13 Feb 14/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 54,000 $0.710

Nur gucken (noch)nicht anfassen !

Front Street Capital ist auch dabei,zwar "nur" mit 733k aber immerhin....

Sprott- 16,1Mil.sh.= 19,9%/OS

Pinetree-9,5 Mil.sh = 11,7%/OS

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Sprott- 16,1Mil.sh.= 19,9%/OS

Pinetree-9,5 Mil.sh = 11,7%/OS

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Antwort auf Beitrag Nr.: 44.148.931 von SEPP_EIXLBERGER am 16.02.13 10:30:25Feb 19/13 Feb 15/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 27,500 $0.700

Feb 19/13 Feb 15/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 27,500 $0.700

Feb 19/13 Feb 15/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 27,500 $0.700

Antwort auf Beitrag Nr.: 44.170.312 von SEPP_EIXLBERGER am 21.02.13 17:12:42...schon wieder...seltsam..

Feb 21/13 Feb 20/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 30,000 $0.700

Feb 21/13 Feb 20/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.700

Feb 21/13 Feb 20/13 Inwentash, Sheldon Control or Direction Common Shares 10 - Acquisition in the public market 30,000 $0.700

Feb 21/13 Feb 20/13 Pinetree Capital Ltd. Indirect Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.700

TORONTO, ONTARIO--(Marketwire - March 27, 2013) - Potash Ridge Corporation ("Potash Ridge" or the "Corporation") (TSX:PRK) today released its fourth quarter and full year results for 2012 and provided a status update on its flagship Blawn Mountain Project (the "Project") in Utah.

2012 Financial Results

The Corporation reported a net loss for the fourth quarter 2012 of $2.1 million ($0.03 per share) compared with a net loss of $1.1 million ($0.02 per share) for the fourth quarter 2011. For the full year 2012, the net loss was $4.8 million ($0.07 per share) compared with a net loss of $1.1 million ($0.04 per share) for the period February 16 to December 31, 2011.

A total of $8 million was incurred on project activities during 2012; $1.9 million for the fourth quarter 2012 compared with $2.3 million on project activities during 2011; $1.7 million for the fourth quarter 2011.

The Corporation closed 2012 with cash and short-term investments of $23 million.

The 2012 Audited Financial Statements and Management's Discussion & Analysis are available at www.sedar.com.

Key Project Highlights

Confirmation Drilling Programs Completed

The Corporation has now undertaken three phases of drilling comprising a total of 140 core and reverse circulation holes. Phases 1 and 2 drilling took place during 2012 and the results from these campaigns were incorporated into the Preliminary Economic Assessment ("PEA"). The PEA included a mine life of 30 years based on measured and indicated resources. This excludes significant historic resources reported where the Corporation has not performed confirmation drilling. The objective of the Phase 3 drilling program was to convert certain inferred resources into measured and indicated resources for purposes of the Prefeasibility Study. This third campaign was completed in February 2013 and the data is currently being analyzed for inclusion in the latest mine plan.

Recommendations from Norwest following analysis of the latest drilling program will determine whether additional drilling is necessary for purposes of the Feasibility Study.

Metallurgical Testing Underway

The Corporation commenced its second phase metallurgical test program in January 2013. The objective of the program is to optimize the process flowsheet and to develop process design parameters, including optimal particle size, flotation, calcining and leaching conditions, as well as the selection of process equipment types and sizes.

The initial focus of this program has been on confirming historic flotation test work and evaluating alternative calcination temperatures to optimize recoveries of SOP and bauxite-type material, both for the purpose of the Prefeasibility Study.

In April, the focus of the test work will move towards additional process optimization testing, pilot plant scale testing and the production of SOP and bauxite-type material for testing by potential offtakers. The pilot plant scale testing will initially use a bulk sample extracted from the property and will run at a rate of approximately 1 tonne per day.

It is anticipated that the metallurgical test program will be completed by the end of 2013.

Prefeasibility Study Work Ongoing

In November 2012, the Corporation published a PEA for the Project in compliance with NI 43-101 standards. At production rates of 680,000 tonnes per annum of SOP and 1.6 million tonnes per annum of sulphuric acid, the PEA showed a net present value of $1.3 billion and an after-tax, unlevered internal rate of return of 21.3%.

Following completion of the PEA, work began on the Prefeasibility Study, with completion anticipated in the second quarter 2013. Part of this Prefeasibility Study includes evaluating a number of strategies designed to lower capital and operating costs and reduce execution risk.

The PEA did not include revenue associated with the 3.3 million tonnes per annum of bauxite-type material that is produced as a residue from the SOP leaching process.

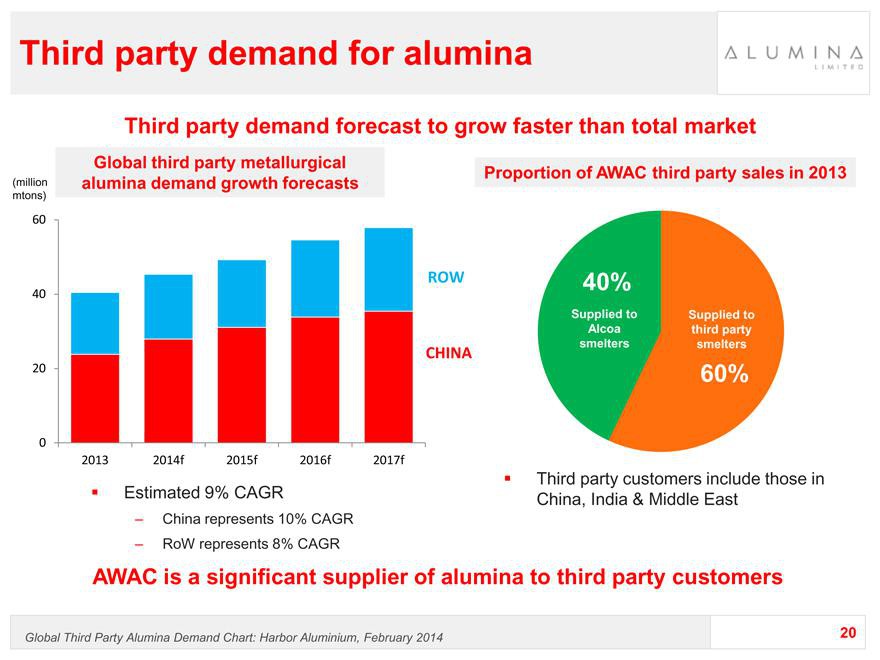

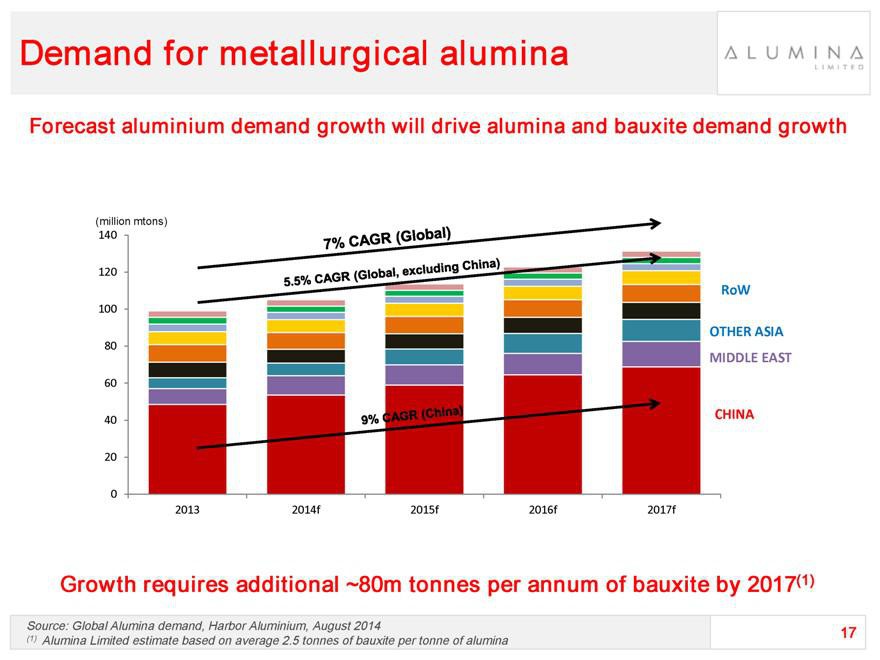

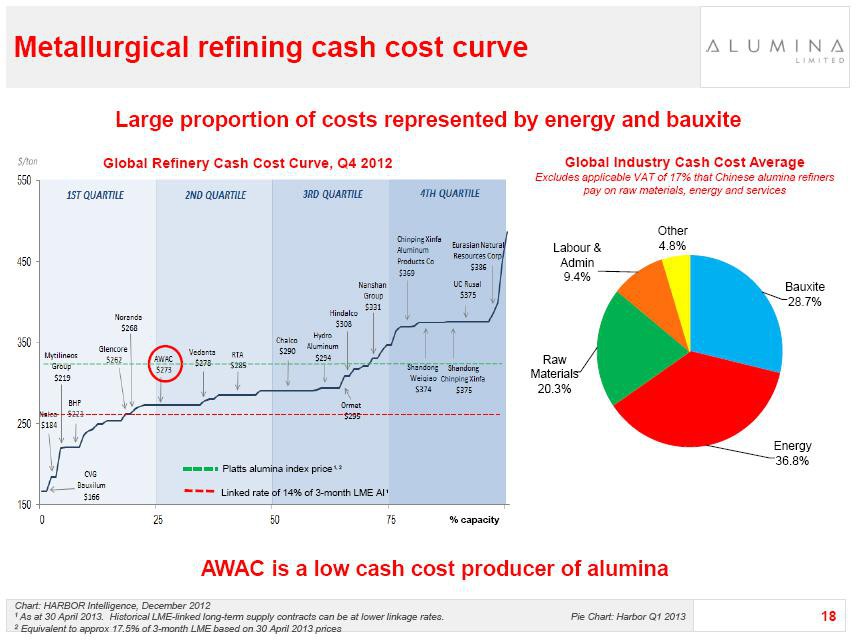

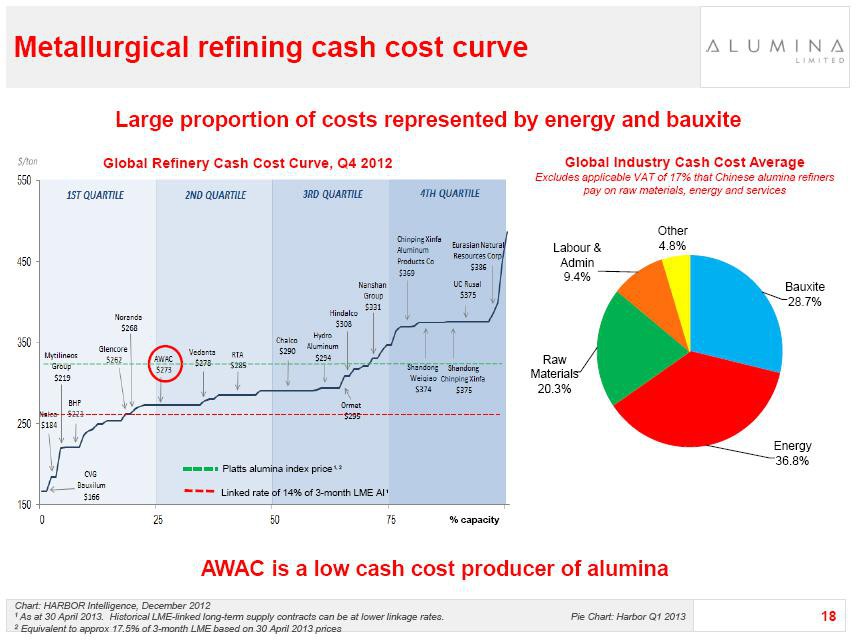

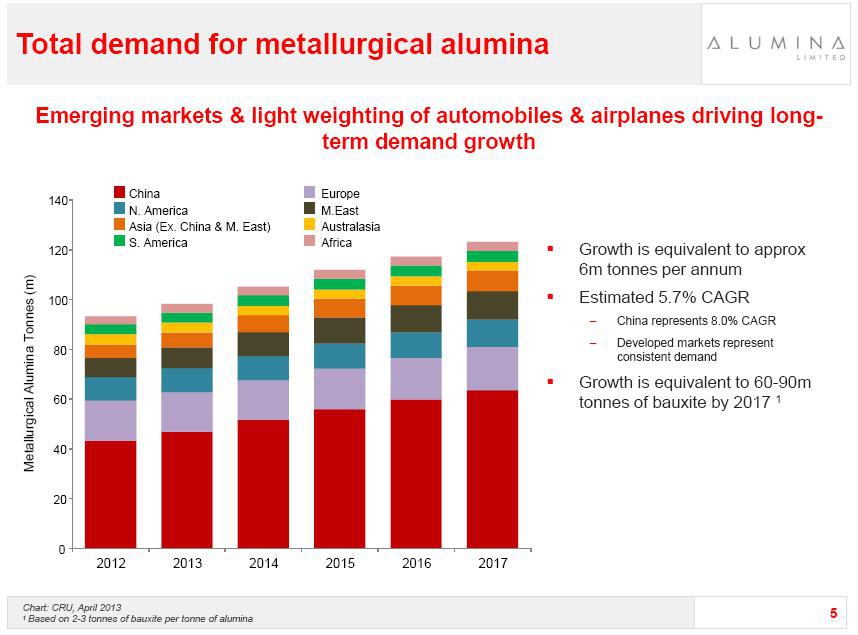

The PEA did not include revenue associated with the 3.3 million tonnes per annum of bauxite-type material that is produced as a residue from the SOP leaching process. During 2013, an independent firm of consultants completed a study with respect to the potential market and price for the bauxite-type material that will be produced by the Project. Given its high alumina content and other characteristics, it is likely that this bauxite-type material will be attractive to alumina producers. It is envisioned that the Prefeasibility Study will incorporate economics associated with selling this bauxite-type material based on this independent study.

During 2013, an independent firm of consultants completed a study with respect to the potential market and price for the bauxite-type material that will be produced by the Project. Given its high alumina content and other characteristics, it is likely that this bauxite-type material will be attractive to alumina producers. It is envisioned that the Prefeasibility Study will incorporate economics associated with selling this bauxite-type material based on this independent study.

Permitting Process on Track

The Corporation has made several advances in permitting the Project over the last few months.

First stage analyses to validate water availability in the area of operations has been completed and groundwater monitoring wells have been installed on site, with expected data collection starting spring 2013 to confirm baseline water quality.

In late-2012, the Corporation and the landowner, the Utah State School and Institutional Trust Lands Association, jointly submitted a water rights application. This application is currently under review by the Utah Division of Water Rights, with approval anticipated during the second half of 2013.

Air-monitoring systems have been in place close to site for several months with the aim of completing the baseline study during the fall of 2013, after which the Corporation will submit the air permit application.

Baseline field assessments for the large mining permit are expected to commence in spring 2013, with the expectation of filing the large mining permit application by the fourth quarter of 2013. Additional baseline surveys including soil, vegetation, surface water, species and wildlife are required for other permit applications, all of which are planned to be filed during the fourth quarter 2013.

The target date for receipt of all construction and operating permits is mid-2014.

Execution Team Continues to Expand

The Potash Ridge team continues to grow as momentum on the Project builds.

In recent months, the Corporation has recruited two individuals experienced in permitting hard rock mines in Utah. Other recent hires include a Senior Metallurgist, a Project Controls Manager and a Commercial Manager. Currently, approximately 50 employees and consultants are engaged on the Project.

It is expected that the execution team will continue to grow during 2013, primarily in the areas of engineering and construction.

Off-take Discussions Initiated

The Corporation has initiated discussion with potential off-takers for its production of SOP, bauxite-type material and sulphuric acid.

2013 Outlook

A number of key milestones are anticipated during 2013. These include:

Commencement of pilot plant scale testing in April

Completion of the Prefeasibility Study during the second quarter

Approval of the water rights application during the second half of the year

Submission of various permits, including the large mining permit and air emissions permit during the fourth quarter

Signing of offtake and other strategic agreements

About Potash Ridge

Potash Ridge is a Canadian based exploration and development company with a unique opportunity to develop a SOP and bauxite-type material project into long-term mining production.

The Company's Blawn Mountain Project consists of four areas of surface mineable alunite mineralization in the State of Utah. Alunite is a sulfate mineral ore rich in both SOP and alumina.

Located in a mining friendly jurisdiction with established infrastructure nearby, the project covers approximately 11,550 acres of state-owned land and has a known permitting process. Extensive development was completed in the 1970s including a mine plan, feasibility study and 3-year pilot plant operation.

Potash Ridge has a highly qualified and proven management team in place with significant financial, project management and operational experience and the ability to take projects into production.

2012 Financial Results

The Corporation reported a net loss for the fourth quarter 2012 of $2.1 million ($0.03 per share) compared with a net loss of $1.1 million ($0.02 per share) for the fourth quarter 2011. For the full year 2012, the net loss was $4.8 million ($0.07 per share) compared with a net loss of $1.1 million ($0.04 per share) for the period February 16 to December 31, 2011.

A total of $8 million was incurred on project activities during 2012; $1.9 million for the fourth quarter 2012 compared with $2.3 million on project activities during 2011; $1.7 million for the fourth quarter 2011.

The Corporation closed 2012 with cash and short-term investments of $23 million.

The 2012 Audited Financial Statements and Management's Discussion & Analysis are available at www.sedar.com.

Key Project Highlights

Confirmation Drilling Programs Completed

The Corporation has now undertaken three phases of drilling comprising a total of 140 core and reverse circulation holes. Phases 1 and 2 drilling took place during 2012 and the results from these campaigns were incorporated into the Preliminary Economic Assessment ("PEA"). The PEA included a mine life of 30 years based on measured and indicated resources. This excludes significant historic resources reported where the Corporation has not performed confirmation drilling. The objective of the Phase 3 drilling program was to convert certain inferred resources into measured and indicated resources for purposes of the Prefeasibility Study. This third campaign was completed in February 2013 and the data is currently being analyzed for inclusion in the latest mine plan.

Recommendations from Norwest following analysis of the latest drilling program will determine whether additional drilling is necessary for purposes of the Feasibility Study.

Metallurgical Testing Underway

The Corporation commenced its second phase metallurgical test program in January 2013. The objective of the program is to optimize the process flowsheet and to develop process design parameters, including optimal particle size, flotation, calcining and leaching conditions, as well as the selection of process equipment types and sizes.

The initial focus of this program has been on confirming historic flotation test work and evaluating alternative calcination temperatures to optimize recoveries of SOP and bauxite-type material, both for the purpose of the Prefeasibility Study.

In April, the focus of the test work will move towards additional process optimization testing, pilot plant scale testing and the production of SOP and bauxite-type material for testing by potential offtakers. The pilot plant scale testing will initially use a bulk sample extracted from the property and will run at a rate of approximately 1 tonne per day.

It is anticipated that the metallurgical test program will be completed by the end of 2013.

Prefeasibility Study Work Ongoing

In November 2012, the Corporation published a PEA for the Project in compliance with NI 43-101 standards. At production rates of 680,000 tonnes per annum of SOP and 1.6 million tonnes per annum of sulphuric acid, the PEA showed a net present value of $1.3 billion and an after-tax, unlevered internal rate of return of 21.3%.

Following completion of the PEA, work began on the Prefeasibility Study, with completion anticipated in the second quarter 2013. Part of this Prefeasibility Study includes evaluating a number of strategies designed to lower capital and operating costs and reduce execution risk.

The PEA did not include revenue associated with the 3.3 million tonnes per annum of bauxite-type material that is produced as a residue from the SOP leaching process.

The PEA did not include revenue associated with the 3.3 million tonnes per annum of bauxite-type material that is produced as a residue from the SOP leaching process. During 2013, an independent firm of consultants completed a study with respect to the potential market and price for the bauxite-type material that will be produced by the Project. Given its high alumina content and other characteristics, it is likely that this bauxite-type material will be attractive to alumina producers. It is envisioned that the Prefeasibility Study will incorporate economics associated with selling this bauxite-type material based on this independent study.

During 2013, an independent firm of consultants completed a study with respect to the potential market and price for the bauxite-type material that will be produced by the Project. Given its high alumina content and other characteristics, it is likely that this bauxite-type material will be attractive to alumina producers. It is envisioned that the Prefeasibility Study will incorporate economics associated with selling this bauxite-type material based on this independent study.Permitting Process on Track

The Corporation has made several advances in permitting the Project over the last few months.

First stage analyses to validate water availability in the area of operations has been completed and groundwater monitoring wells have been installed on site, with expected data collection starting spring 2013 to confirm baseline water quality.

In late-2012, the Corporation and the landowner, the Utah State School and Institutional Trust Lands Association, jointly submitted a water rights application. This application is currently under review by the Utah Division of Water Rights, with approval anticipated during the second half of 2013.

Air-monitoring systems have been in place close to site for several months with the aim of completing the baseline study during the fall of 2013, after which the Corporation will submit the air permit application.

Baseline field assessments for the large mining permit are expected to commence in spring 2013, with the expectation of filing the large mining permit application by the fourth quarter of 2013. Additional baseline surveys including soil, vegetation, surface water, species and wildlife are required for other permit applications, all of which are planned to be filed during the fourth quarter 2013.

The target date for receipt of all construction and operating permits is mid-2014.

Execution Team Continues to Expand

The Potash Ridge team continues to grow as momentum on the Project builds.

In recent months, the Corporation has recruited two individuals experienced in permitting hard rock mines in Utah. Other recent hires include a Senior Metallurgist, a Project Controls Manager and a Commercial Manager. Currently, approximately 50 employees and consultants are engaged on the Project.

It is expected that the execution team will continue to grow during 2013, primarily in the areas of engineering and construction.

Off-take Discussions Initiated

The Corporation has initiated discussion with potential off-takers for its production of SOP, bauxite-type material and sulphuric acid.

2013 Outlook

A number of key milestones are anticipated during 2013. These include:

Commencement of pilot plant scale testing in April

Completion of the Prefeasibility Study during the second quarter

Approval of the water rights application during the second half of the year

Submission of various permits, including the large mining permit and air emissions permit during the fourth quarter

Signing of offtake and other strategic agreements

About Potash Ridge

Potash Ridge is a Canadian based exploration and development company with a unique opportunity to develop a SOP and bauxite-type material project into long-term mining production.

The Company's Blawn Mountain Project consists of four areas of surface mineable alunite mineralization in the State of Utah. Alunite is a sulfate mineral ore rich in both SOP and alumina.

Located in a mining friendly jurisdiction with established infrastructure nearby, the project covers approximately 11,550 acres of state-owned land and has a known permitting process. Extensive development was completed in the 1970s including a mine plan, feasibility study and 3-year pilot plant operation.

Potash Ridge has a highly qualified and proven management team in place with significant financial, project management and operational experience and the ability to take projects into production.

Zitat von SEPP_EIXLBERGER: TORONTO, ONTARIO--(Marketwire - March 27, 2013) - Potash Ridge Corporation ("Potash Ridge" or the "Corporation") (TSX:PRK) today released its fourth quarter and full year results for 2012 and provided a status update on its flagship Blawn Mountain Project (the "Project") in Utah.

Prefeasibility Study Work Ongoing

In November 2012, the Corporation published a PEA for the Project in compliance with NI 43-101 standards. At production rates of 680,000 tonnes per annum of SOP and 1.6 million tonnes per annum of sulphuric acid, the PEA showed a net present value of $1.3 billion and an after-tax, unlevered internal rate of return of 21.3%.

Following completion of the PEA, work began on the Prefeasibility Study, with completion anticipated in the second quarter 2013. Part of this Prefeasibility Study includes evaluating a number of strategies designed to lower capital and operating costs and reduce execution risk.

The PEA did not include revenue associated with the 3.3 million tonnes per annum of bauxite-type material that is produced as a residue from the SOP leaching process.

During 2013, an independent firm of consultants completed a study with respect to the potential market and price for the bauxite-type material that will be produced by the Project. Given its high alumina content and other characteristics, it is likely that this bauxite-type material will be attractive to alumina producers. It is envisioned that the Prefeasibility Study will incorporate economics associated with selling this bauxite-type material based on this independent study.

3,3 Mil.T. x 2204 = 7,27 Mld.lbs of bauxite-type material

Frage ist;Wieviel Al kann (wird) man daraus gewinnen?

10% ...oder mehr...

Bei einem 10% Al Anteil wären das 727 Mil.lbs p.a. x 0,84 $/lbs = ca.610 Mil.$ p.a !!!!!!

Was ist falsch an meiner Calculation?

http://www.infomine.com/investment/metal-prices/aluminum/

Zitat von SEPP_EIXLBERGER: Front Street Capital ist auch dabei,zwar "nur" mit 733k aber immerhin....

Sprott- 16,1Mil.sh.= 19,9%/OS

Pinetree-9,5 Mil.sh = 11,7%/OS

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Neu dazugekommen;

SHARAN, RAHOUL-Chairman and Director

3.1M

$2,175,862 +10% 3.8% Owned of Shares Outstanding

$2,175,862 +10% 3.8% Owned of Shares OutstandingInwentash, Sheldon- Chairman and CEO of Pinetree Capital

1.5M

$1,013,003 +5% 1.8%

$1,013,003 +5% 1.8% Ich warte noch...0,20 oder noch tiefer...

Zitat von SEPP_EIXLBERGER:Zitat von SEPP_EIXLBERGER: TORONTO, ONTARIO--(Marketwire - March 27, 2013) - Potash Ridge Corporation ("Potash Ridge" or the "Corporation") (TSX:PRK) today released its fourth quarter and full year results for 2012 and provided a status update on its flagship Blawn Mountain Project (the "Project") in Utah.

Prefeasibility Study Work Ongoing

In November 2012, the Corporation published a PEA for the Project in compliance with NI 43-101 standards. At production rates of 680,000 tonnes per annum of SOP and 1.6 million tonnes per annum of sulphuric acid, the PEA showed a net present value of $1.3 billion and an after-tax, unlevered internal rate of return of 21.3%.

Following completion of the PEA, work began on the Prefeasibility Study, with completion anticipated in the second quarter 2013. Part of this Prefeasibility Study includes evaluating a number of strategies designed to lower capital and operating costs and reduce execution risk.

The PEA did not include revenue associated with the 3.3 million tonnes per annum of bauxite-type material that is produced as a residue from the SOP leaching process.

During 2013, an independent firm of consultants completed a study with respect to the potential market and price for the bauxite-type material that will be produced by the Project. Given its high alumina content and other characteristics, it is likely that this bauxite-type material will be attractive to alumina producers. It is envisioned that the Prefeasibility Study will incorporate economics associated with selling this bauxite-type material based on this independent study.

3,3 Mil.T. x 2204 = 7,27 Mld.lbs of bauxite-type material

Frage ist;Wieviel Al kann (wird) man daraus gewinnen?

10% ...oder mehr...

Bei einem 10% Al Anteil wären das 727 Mil.lbs p.a. x 0,84 $/lbs = ca.610 Mil.$ p.a !!!!!!

Was ist falsch an meiner Calculation?

http://www.infomine.com/investment/metal-prices/aluminum/

3.3 million tonnes per annum of 51% alumina content bauxite

http://www.potashridge.com/investors/presentation/default.as…

Zitat von SEPP_EIXLBERGER:Zitat von SEPP_EIXLBERGER: ...

3,3 Mil.T. x 2204 = 7,27 Mld.lbs of bauxite-type material

Frage ist;Wieviel Al kann (wird) man daraus gewinnen?

10% ...oder mehr...

Bei einem 10% Al Anteil wären das 727 Mil.lbs p.a. x 0,84 $/lbs = ca.610 Mil.$ p.a !!!!!!

Was ist falsch an meiner Calculation?

http://www.infomine.com/investment/metal-prices/aluminum/

3.3 million tonnes per annum of 51% alumina content bauxite

http://www.potashridge.com/investors/presentation/default.as…

Die Aluminiumherstellung ist sehr energieintensiv: Um 1t Al zu gewinnen, benötigt man 4t Bauxit, ½ t Elektrodenmaterial, 20 GJ(Gigajoule) Wärmeenergie zur Reinigung des Bauxits und 13,5 MWh elektrische Energie für die eigentliche Elektrolyse....

Guy Bentinck CEO

20.12.2012

Der nächste große Meilenstein im Projekt ist die Fertigstellung einer Machbarkeitsstudie und eine aktualisierte NI 43-101 konformen technischen Bericht - im zweiten Quartal des nächsten Jahres erwartet - was wird die neue Ressourcenschätzung enthalten.

Bentinck sagt, dass viel von der "relativ weit fortgeschritten" Arbeit bereits für die PEA getan für die Vor-Machbarkeitsstudie verwendet werden kann. Das Unternehmen unternimmt eine zweite Phase der metallurgischen Arbeiten für den Rest dieses Jahres und Anfang nächsten, und sagt, sie erwäge eine kleinere dritte Phase des Bohrens nach oben einige Ressourcen aus der der gemessenen und angezeigten Kategorie abgeleitet.

Die Blawn Mountain-Projekt besteht aus vier Bereichen der Oberflächentechnik abbaubare Alunit Mineralisierung einer Fläche von rund 11.550 Hektar staatliches Land zusammen. Alunit ein Sulfat Erz, reich an SOP und Aluminiumoxid.

Potash Ridge CEO stellt fest, dass SOP wünschenswerter als Dünger für die meisten Kulturen, insbesondere höheren Wert Kulturpflanzen wie Obst, Gemüse, Tabak und Tee, wie die Kali ist besser Qualität und verbessert die Erträge.

Tatsächlich befiehlt SOP einen höheren Preis. Es verkauft zu einem durchschnittlichen 47% igen Aufschlag auf MOP (salzsauren Kali), nach neueren Forschungen, was die meisten Kalibergwerke derzeit produzieren.

"Die SOP hat Kaliumsulfat - beide wichtige Nährstoffe für die meisten Kulturen und zeigt eine deutliche Verbesserung der Ausbeute und Menge im Vergleich zu MOP", sagt Bentinck fügte hinzu, dass MOP Kaliumchlorid, das ist eigentlich schädlich für Pflanzen enthält.

Das Unternehmen strebt Ausgabe von 680.000 Tonnen pro Jahr der SOP Mitte-2016.

"Der interessante Aspekt ist, dass der Markt heute für SOP nur etwa 10% der gesamten Kaliverbrauch ist. Aber wenn man Pflanzen, die besser für SOP geeignet sind aussehen, machen sie so etwas wie 25%. "

Sechs Millionen Tonnen SOP wurde im Jahr 2011 verkauft, aber Bentinck sagt, dass auf der Grundlage dieser Zahlen, die echten Marktes für SOP könnte so hoch sein wie 15 Millionen Tonnen oder mehr pro Jahr.

"Der Grund ist es heute nicht hoch ist, weil es nicht genügend Produktion. Die beiden größten Produzenten von SOP - China und Europa - verbrauchen praktisch alle Kali erzeugen sie in ihren jeweiligen Regionen ".

Er fügt hinzu: "China verbraucht rund 2 Millionen Tonnen SOP pro Jahr und wir einfach keinen Zugang dazu."

Das Unternehmen Projekt-Infrastruktur in der Nähe, gegründet, wie es befindet sich etwa 20 Meilen westlich von Union Pacific Railroad Strecke, 12 Meilen südlich von Highway 21 und 62 Meilen westlich der Interstate 15, der wichtigsten Nord-Süd-Reise Korridor durch Utah. Darüber hinaus Staatsstraßen SR-21 und SR-130 Pass etwa 30 Meilen östlich von dem Projekt, mit zwei Energie-Korridore auch vorbei nach Osten des Grundstücks.

Das Unternehmen sagte, dass die staatlichen Grundstücken, für die sie Lizenzen, mehrere Vorteile, einschließlich einer mehr streamllined Genehmigungsverfahren, Pacht-und Royalty-Vereinbarungen in Kraft und ein günstigen Umweltbedingungen Einstellung für Entwicklung, bietet "keine sozialen oder Ureinwohner Probleme."

"Zulassen auf den Hektar aus Leasingverträgen wird weitgehend durch den Staat mit gut verstanden regulatroy Anforderung und organisierter Prozess gesteuert."

"Das letzte Hardrock Mine in Utah, von Red Leaf Ressourcen betrieben, erhielt Endanwendung Genehmigung für den Tagebau Aktivitäten und Prozesse innerhalb von 10 Monaten nach Einreichung, was die Effizienz des Prozesses", der CEO fügt hinzu, dass das Individuum in Höhe von Genehmigungsverfahren für diese Mine ist nun auf dem Weg bis regulatorischen und Regierungsangelegenheiten für Potash Ridge.

Damit das Projekt durch den Bau gehen, 20 Genehmigungen erforderlich sind, werden alle davon zwischen 6 bis 12 Monate in Anspruch nehmen, mit Ausnahme einer längeren Baseline-Studie für die Luftqualität. "Die Utah Regierung im Umgang mit Genehmigung Zugriffe proaktive und hat Erfahrung mit fast 100 Jahren der Kaliproduktion."

Das Projekt ist auch insofern einzigartig, als es an der Oberfläche ist und zwei Nebenprodukte produzieren - Schwefelsäure und Bauxit - das Ausgangsmaterial für die Herstellung von Aluminiumoxid.

Die Betriebskosten werden bei etwa 101 $ pro Tonne geschätzt, vor allen Nebenprodukt Credits. "Dies ist ein Spiel-Wechsler, wie die Nebenprodukte effektiv bezahlen konnte all die Betriebskosten der Mine, so dass wir SOP auf einem viel niedrigeren Betriebskosten als alle unsere Mitbewerber zu produzieren."

Credits. "Dies ist ein Spiel-Wechsler, wie die Nebenprodukte effektiv bezahlen konnte all die Betriebskosten der Mine, so dass wir SOP auf einem viel niedrigeren Betriebskosten als alle unsere Mitbewerber zu produzieren."

Die Wirtschaft in der PEA-Bericht nicht als eine Bauxit am Blawn Mountain, die schätzungsweise 3,3 Millionen Tonnen pro Jahr des Materials zu halten, dh es hat das Potenzial, zu einer erheblichen Verbesserung der Rendite.

Anders als die meisten Junioren, ist Potash Ridge bereits sein Augenmerk auf Off-Take-Vereinbarungen für verschiedene Produkte und arbeiten, um die Mine in Betrieb genommen, anstatt zu warten, für die bankfähige Machbarkeitsstudie für das Jahr 2014 angestrebt.

"Wir glauben, alle anderen Komponenten der Mine geliefert wird (es zulässt, PFS, BFS, Metallurgie) in Einklang mit den Erwartungen in den nächsten 12-18 Monaten, so-Management hart arbeiten, um mit der Vermarktung beginnen Produkt jetzt um das Projekt zu gewährleisten im Jahr 2016 vermarktet werden. "

Off-take Verhandlungen der Schwefelsäure sind bereits im Gange, mit SOP und Bauxit Gesprächen zu beginnen "in kürzester Zeit".

Bentinck, sagt seine Firma Bauxit höheren Besoldungsgruppe als die meisten, die auf dem internationalen Markt verkauft, mit 51% Aluminiumoxid-Anteil im Vergleich zu den typischen von rund 40%. "Es gibt weniger schädlichen Elementen. Es ist eine saubere Bauxit Material. "

Werttreiber für das Unternehmen im nächsten Jahr sind die geplanten Vor-Machbarkeitsstudie und aktualisierte NI 43-101 Bericht, ein Wasser erlauben, mögliche Off-take Vereinbarungen, und die vorläufigen Angebote für die Stromversorgung. Potash Ridge ist in Gesprächen mit Dritten, um ein Kraftwerk in der Region zu bauen, dh die Anlage wird nicht ein Teil der eigenen Investitionen Kosten.

Das Unternehmen, das $ 25 Mio. Cash hat nach ihrer Erstnotiz wird vollständig durch im nächsten Jahr finanziert. Potash Ridge wird nicht über die schwierigen Zustand der betreffenden Märkten.

"Wir glauben, wir haben ein robustes Projekt mit überlegene Wirtschaftlichkeit, die aufstehen wird in jedem Markt."

Das Projekt, das mehr als $ 1 Milliarde in der ländlichen Gegend von Utah investieren, schaffen auch 700 Arbeitsplätze in der Region, die Schaffung eines förderlichen Umfelds für Potash Ridge.

Die Kali-Explorer, die eine breite institutionelle Eigentum, einschließlich Sprott Resources and Front Street hat, hat gewährleistet, dass sie in zu bringen rund $ 12 Millionen in mehr Kapital in den nächsten zwei Jahren erwartet.

Der Börsengang der Potash Ridge war die zweite in diesem Jahr an der Toronto Stock Exchange in den Bergbau, kommen nur nach großen Bergbauunternehmen Unternehmer Robert Friedland ist Ivanplats - "ein Beleg für die Qualität unseres Projekts".

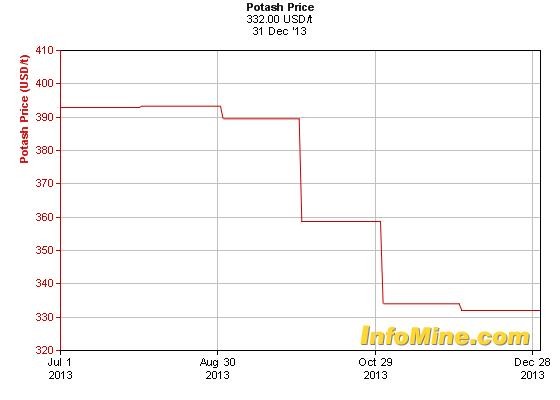

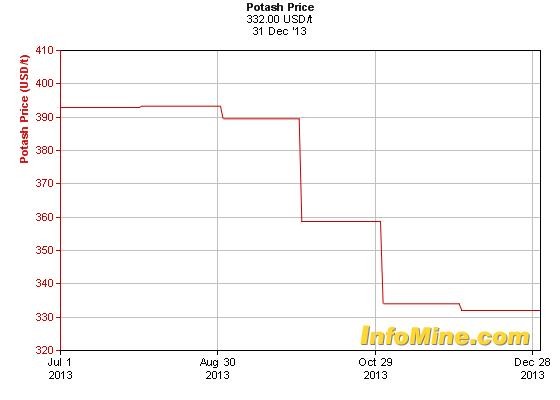

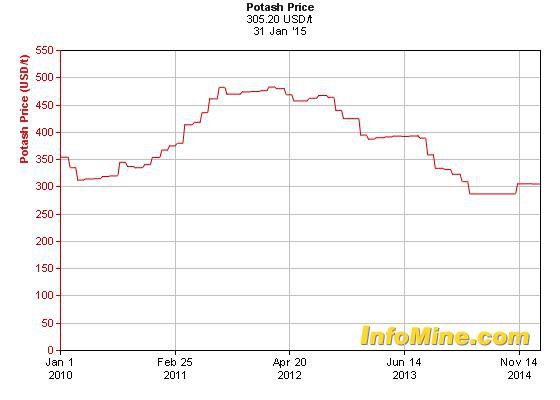

"Wir haben einige Schwächen in der Kali-Markt in den letzten Monaten gesehen, aber dies ist im Wesentlichen mit MOP tun, und wir sind ein anderes Produkt."

"SOP ist das, was wir eine unterversorgte Produkt nennen. Der größte Treiber für die SOP-Markt für die Zukunft wird sein, wie viel von einem Preisaufschlag kann über MOP auf der Grundlage der höheren Ertrag und bessere Qualität gerechtfertigt werden. "

http://www.proactiveinvestors.com/companies/news/38875/potas…

20.12.2012

Der nächste große Meilenstein im Projekt ist die Fertigstellung einer Machbarkeitsstudie und eine aktualisierte NI 43-101 konformen technischen Bericht - im zweiten Quartal des nächsten Jahres erwartet - was wird die neue Ressourcenschätzung enthalten.

Bentinck sagt, dass viel von der "relativ weit fortgeschritten" Arbeit bereits für die PEA getan für die Vor-Machbarkeitsstudie verwendet werden kann. Das Unternehmen unternimmt eine zweite Phase der metallurgischen Arbeiten für den Rest dieses Jahres und Anfang nächsten, und sagt, sie erwäge eine kleinere dritte Phase des Bohrens nach oben einige Ressourcen aus der der gemessenen und angezeigten Kategorie abgeleitet.

Die Blawn Mountain-Projekt besteht aus vier Bereichen der Oberflächentechnik abbaubare Alunit Mineralisierung einer Fläche von rund 11.550 Hektar staatliches Land zusammen. Alunit ein Sulfat Erz, reich an SOP und Aluminiumoxid.

Potash Ridge CEO stellt fest, dass SOP wünschenswerter als Dünger für die meisten Kulturen, insbesondere höheren Wert Kulturpflanzen wie Obst, Gemüse, Tabak und Tee, wie die Kali ist besser Qualität und verbessert die Erträge.

Tatsächlich befiehlt SOP einen höheren Preis. Es verkauft zu einem durchschnittlichen 47% igen Aufschlag auf MOP (salzsauren Kali), nach neueren Forschungen, was die meisten Kalibergwerke derzeit produzieren.

"Die SOP hat Kaliumsulfat - beide wichtige Nährstoffe für die meisten Kulturen und zeigt eine deutliche Verbesserung der Ausbeute und Menge im Vergleich zu MOP", sagt Bentinck fügte hinzu, dass MOP Kaliumchlorid, das ist eigentlich schädlich für Pflanzen enthält.

Das Unternehmen strebt Ausgabe von 680.000 Tonnen pro Jahr der SOP Mitte-2016.

"Der interessante Aspekt ist, dass der Markt heute für SOP nur etwa 10% der gesamten Kaliverbrauch ist. Aber wenn man Pflanzen, die besser für SOP geeignet sind aussehen, machen sie so etwas wie 25%. "

Sechs Millionen Tonnen SOP wurde im Jahr 2011 verkauft, aber Bentinck sagt, dass auf der Grundlage dieser Zahlen, die echten Marktes für SOP könnte so hoch sein wie 15 Millionen Tonnen oder mehr pro Jahr.

"Der Grund ist es heute nicht hoch ist, weil es nicht genügend Produktion. Die beiden größten Produzenten von SOP - China und Europa - verbrauchen praktisch alle Kali erzeugen sie in ihren jeweiligen Regionen ".

Er fügt hinzu: "China verbraucht rund 2 Millionen Tonnen SOP pro Jahr und wir einfach keinen Zugang dazu."

Das Unternehmen Projekt-Infrastruktur in der Nähe, gegründet, wie es befindet sich etwa 20 Meilen westlich von Union Pacific Railroad Strecke, 12 Meilen südlich von Highway 21 und 62 Meilen westlich der Interstate 15, der wichtigsten Nord-Süd-Reise Korridor durch Utah. Darüber hinaus Staatsstraßen SR-21 und SR-130 Pass etwa 30 Meilen östlich von dem Projekt, mit zwei Energie-Korridore auch vorbei nach Osten des Grundstücks.

Das Unternehmen sagte, dass die staatlichen Grundstücken, für die sie Lizenzen, mehrere Vorteile, einschließlich einer mehr streamllined Genehmigungsverfahren, Pacht-und Royalty-Vereinbarungen in Kraft und ein günstigen Umweltbedingungen Einstellung für Entwicklung, bietet "keine sozialen oder Ureinwohner Probleme."

"Zulassen auf den Hektar aus Leasingverträgen wird weitgehend durch den Staat mit gut verstanden regulatroy Anforderung und organisierter Prozess gesteuert."

"Das letzte Hardrock Mine in Utah, von Red Leaf Ressourcen betrieben, erhielt Endanwendung Genehmigung für den Tagebau Aktivitäten und Prozesse innerhalb von 10 Monaten nach Einreichung, was die Effizienz des Prozesses", der CEO fügt hinzu, dass das Individuum in Höhe von Genehmigungsverfahren für diese Mine ist nun auf dem Weg bis regulatorischen und Regierungsangelegenheiten für Potash Ridge.

Damit das Projekt durch den Bau gehen, 20 Genehmigungen erforderlich sind, werden alle davon zwischen 6 bis 12 Monate in Anspruch nehmen, mit Ausnahme einer längeren Baseline-Studie für die Luftqualität. "Die Utah Regierung im Umgang mit Genehmigung Zugriffe proaktive und hat Erfahrung mit fast 100 Jahren der Kaliproduktion."

Das Projekt ist auch insofern einzigartig, als es an der Oberfläche ist und zwei Nebenprodukte produzieren - Schwefelsäure und Bauxit - das Ausgangsmaterial für die Herstellung von Aluminiumoxid.

Die Betriebskosten werden bei etwa 101 $ pro Tonne geschätzt, vor allen Nebenprodukt

Credits. "Dies ist ein Spiel-Wechsler, wie die Nebenprodukte effektiv bezahlen konnte all die Betriebskosten der Mine, so dass wir SOP auf einem viel niedrigeren Betriebskosten als alle unsere Mitbewerber zu produzieren."

Credits. "Dies ist ein Spiel-Wechsler, wie die Nebenprodukte effektiv bezahlen konnte all die Betriebskosten der Mine, so dass wir SOP auf einem viel niedrigeren Betriebskosten als alle unsere Mitbewerber zu produzieren."Die Wirtschaft in der PEA-Bericht nicht als eine Bauxit am Blawn Mountain, die schätzungsweise 3,3 Millionen Tonnen pro Jahr des Materials zu halten, dh es hat das Potenzial, zu einer erheblichen Verbesserung der Rendite.

Anders als die meisten Junioren, ist Potash Ridge bereits sein Augenmerk auf Off-Take-Vereinbarungen für verschiedene Produkte und arbeiten, um die Mine in Betrieb genommen, anstatt zu warten, für die bankfähige Machbarkeitsstudie für das Jahr 2014 angestrebt.

"Wir glauben, alle anderen Komponenten der Mine geliefert wird (es zulässt, PFS, BFS, Metallurgie) in Einklang mit den Erwartungen in den nächsten 12-18 Monaten, so-Management hart arbeiten, um mit der Vermarktung beginnen Produkt jetzt um das Projekt zu gewährleisten im Jahr 2016 vermarktet werden. "

Off-take Verhandlungen der Schwefelsäure sind bereits im Gange, mit SOP und Bauxit Gesprächen zu beginnen "in kürzester Zeit".

Bentinck, sagt seine Firma Bauxit höheren Besoldungsgruppe als die meisten, die auf dem internationalen Markt verkauft, mit 51% Aluminiumoxid-Anteil im Vergleich zu den typischen von rund 40%. "Es gibt weniger schädlichen Elementen. Es ist eine saubere Bauxit Material. "

Werttreiber für das Unternehmen im nächsten Jahr sind die geplanten Vor-Machbarkeitsstudie und aktualisierte NI 43-101 Bericht, ein Wasser erlauben, mögliche Off-take Vereinbarungen, und die vorläufigen Angebote für die Stromversorgung. Potash Ridge ist in Gesprächen mit Dritten, um ein Kraftwerk in der Region zu bauen, dh die Anlage wird nicht ein Teil der eigenen Investitionen Kosten.

Das Unternehmen, das $ 25 Mio. Cash hat nach ihrer Erstnotiz wird vollständig durch im nächsten Jahr finanziert. Potash Ridge wird nicht über die schwierigen Zustand der betreffenden Märkten.

"Wir glauben, wir haben ein robustes Projekt mit überlegene Wirtschaftlichkeit, die aufstehen wird in jedem Markt."

Das Projekt, das mehr als $ 1 Milliarde in der ländlichen Gegend von Utah investieren, schaffen auch 700 Arbeitsplätze in der Region, die Schaffung eines förderlichen Umfelds für Potash Ridge.

Die Kali-Explorer, die eine breite institutionelle Eigentum, einschließlich Sprott Resources and Front Street hat, hat gewährleistet, dass sie in zu bringen rund $ 12 Millionen in mehr Kapital in den nächsten zwei Jahren erwartet.

Der Börsengang der Potash Ridge war die zweite in diesem Jahr an der Toronto Stock Exchange in den Bergbau, kommen nur nach großen Bergbauunternehmen Unternehmer Robert Friedland ist Ivanplats - "ein Beleg für die Qualität unseres Projekts".

"Wir haben einige Schwächen in der Kali-Markt in den letzten Monaten gesehen, aber dies ist im Wesentlichen mit MOP tun, und wir sind ein anderes Produkt."

"SOP ist das, was wir eine unterversorgte Produkt nennen. Der größte Treiber für die SOP-Markt für die Zukunft wird sein, wie viel von einem Preisaufschlag kann über MOP auf der Grundlage der höheren Ertrag und bessere Qualität gerechtfertigt werden. "

http://www.proactiveinvestors.com/companies/news/38875/potas…

http://www.investorsguru.com/DetailedQuote.html?qm_page=5660…

SEDI Insider Trades

Last 3 Mo Last 12 Mo

Number of Insider Trades 135 319

Number of Buys 135 319

Number of Sells 0 0

Net Activity 8,263,000 17,726,000

"Nur gucken,nicht anfassen!"

P&L

SEPPi

Potash Ridge Presenting at the 4th World Aluminum Raw Materials Summit-May 16, 2013

http://www.marketwatch.com/story/potash-ridge-presenting-at-…

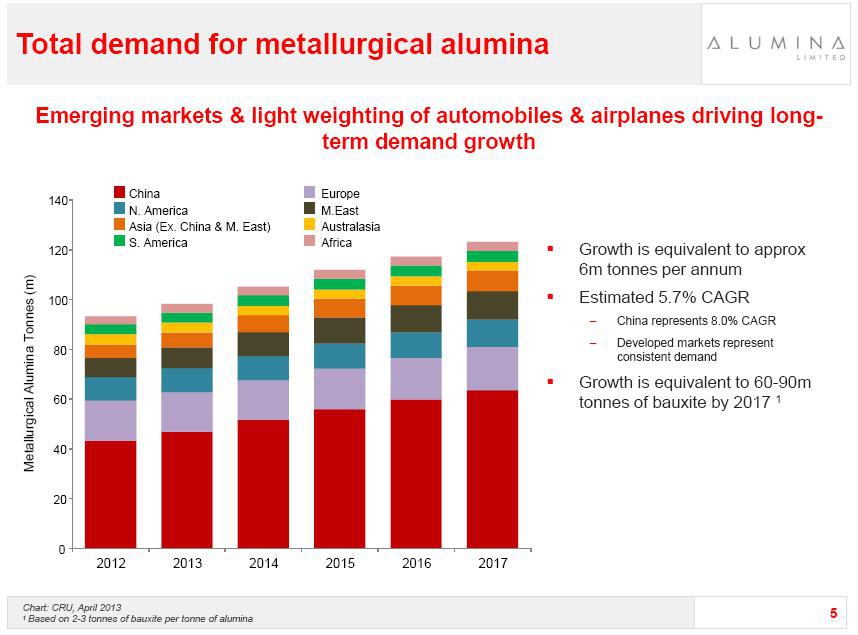

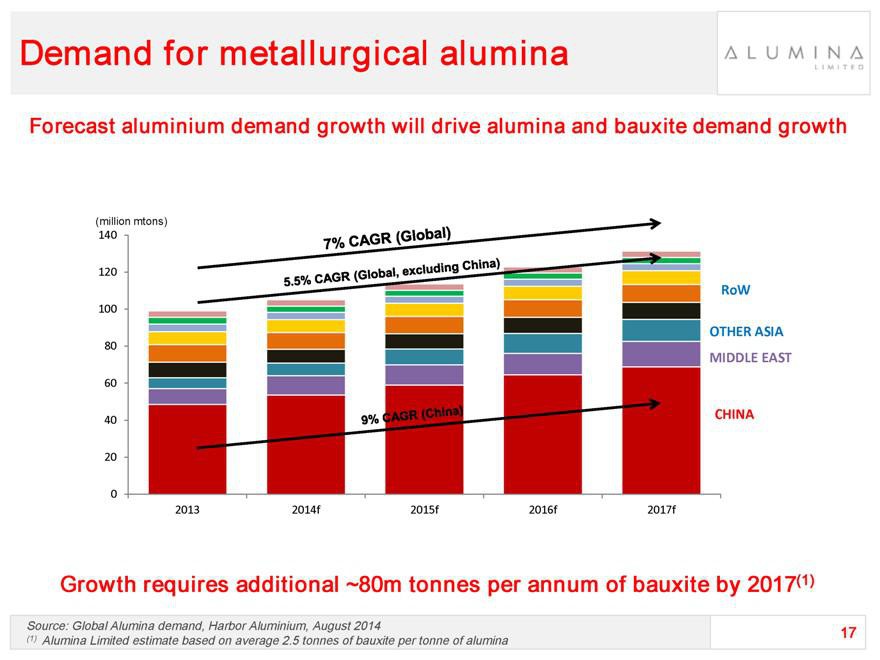

TORONTO, ONTARIO, Apr 23, 2013 (Marketwired via COMTEX) -- Potash Ridge Corporation ("Potash Ridge" or the "Corporation") CA:PRK -5.80% is pleased to announce that Chief Operating Officer (C.O.O.) Ross Phillips will be presenting at the 4th World Aluminum Raw Materials Summit in Xining, China.

Potash Ridge continues the development of the its Blawn Mountain Project (the "Project") in Utah, U.S. The Corporation is pleased to participate in the summit and present further details regarding the Project. The two commodities to be produced are sulphate of potash ("SOP") and a bauxite-type material, both of which are in high demand in China.

The Project is expected to produce 680,000 tonnes of SOP and 3.3 million tonnes of a bauxite-type material by the second half of 2016. The Project is currently in the prefeasibility study ("PFS") stage. The completed PFS is expected by the end of June 2013.

For further information on the Project, Ross Phillips, C.O.O., will be presenting at 4:00 pm Beijing time on May 16, 2013.

http://www.marketwatch.com/story/potash-ridge-presenting-at-…

TORONTO, ONTARIO, Apr 23, 2013 (Marketwired via COMTEX) -- Potash Ridge Corporation ("Potash Ridge" or the "Corporation") CA:PRK -5.80% is pleased to announce that Chief Operating Officer (C.O.O.) Ross Phillips will be presenting at the 4th World Aluminum Raw Materials Summit in Xining, China.

Potash Ridge continues the development of the its Blawn Mountain Project (the "Project") in Utah, U.S. The Corporation is pleased to participate in the summit and present further details regarding the Project. The two commodities to be produced are sulphate of potash ("SOP") and a bauxite-type material, both of which are in high demand in China.

The Project is expected to produce 680,000 tonnes of SOP and 3.3 million tonnes of a bauxite-type material by the second half of 2016. The Project is currently in the prefeasibility study ("PFS") stage. The completed PFS is expected by the end of June 2013.

For further information on the Project, Ross Phillips, C.O.O., will be presenting at 4:00 pm Beijing time on May 16, 2013.

Interview mit Guy Bentinck,president and CEO of PRK !

Potash Ridge Aims to Capitalize on Underserved SOP Market

http://potashinvestingnews.com/7454-potash-ridge-mop-sop-mar…

Sulfate of potash (SOP) is an important nutrient used for growing high-value crops like vegetables, fruits and nuts. Farmers using fertilizers that contain SOP typically grow crops that are higher in yield than those using fertilizers that contain the more common muriate of potash (MOP). SOP is also known to improve food quality and shelf life.

Potash Investing News (PIN) sat down with Potash Ridge‘s (TSX:PRK) president and CEO, Guy Bentinck, to get a better understanding of both SOP and the company’s Blawn Mountain project in Utah, which hosts a unique geology containing both potash and bauxite.

PIN: Your Blawn Mountain project in Utah is in the prefeasibility stage. How does your project compare in terms of size to some of the other potash projects being developed in the US?

Guy Bentinck: We’re producing SOP, which is different from the MOP that you’ll see getting produced in Saskatchewan. There are a few projects in the Holbrook Basin as well, and they are all producing or plan to produce MOP as opposed to SOP. When you look at the other SOP projects in the United States, there are essentially two other projects. One is IC Potash (TSX:ICP) and the other is EPM Mining Ventures (TSXV:EPK). Both of those are smaller projects than ours and they’re extracting the potash from a different source than we are and are applying to produce at smaller volumes.

PIN: Your potash project is unique in that you’re producing not only SOP, but also bauxite. How does that affect the economics of the project?

GB: That’s right, it’s a very interesting ore that we’re mining. You essentially have three constituent parts. One is the SOP, which is by far the primary product. We’re also producing a bauxite-type material as we vent SO2, and we can convert that either into elemental sulfur or sulfuric acid. The sulfur will likely be sold into local markets.

The US is currently an underserved market for SOP. It is importing about 100,000 to 150,000 tonnes. The market potential in the US is quite a bit larger than what it currently is, around 300-plus thousand tonnes. Particularly California, Florida and some of the other southern states, where there is a big growth of high-volume crops like almonds and fruits and vegetables and grapes and so forth.

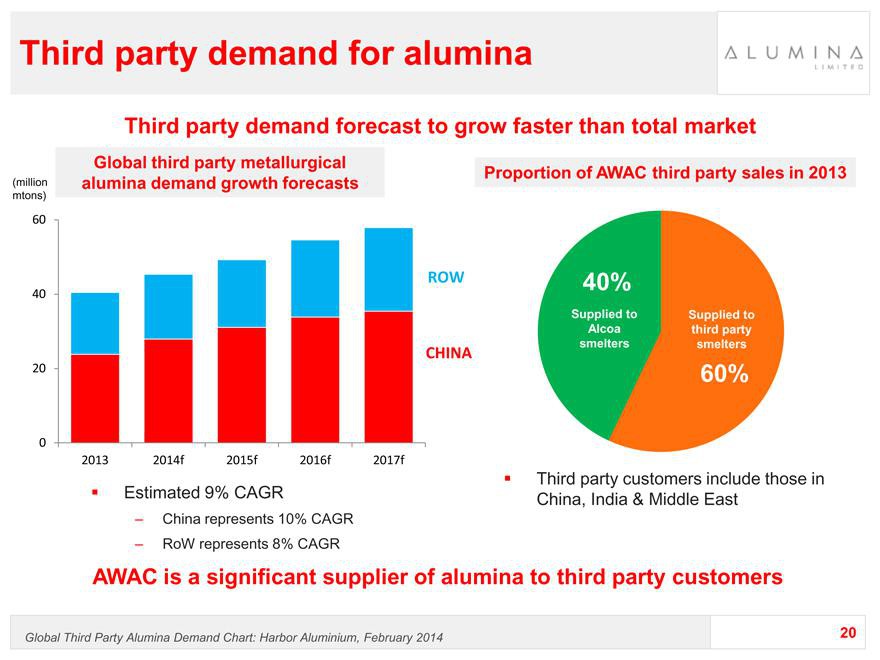

The bauxite is a very interesting angle for us. In China, there is a very big demand for bauxite right now. They’re building about 30 bauxite-processing plants. About 70 percent of the bauxite that they’re using today is coming from Indonesia. Indonesia has indicated recently that it intends to shut off exports of its bauxite material because it wants it processed on island. China is quite desperately looking for new sources of bauxite to offset that Indonesian supply as well as to generally diversify its source of bauxite.

In West Africa, places like Guinea, Mali, they have their own challenges in terms of infrastructure, political issues, as well as the logistics of shipping from West Africa to China. We’re in a much better jurisdiction where we don’t have the infrastructure-related issues to any great extent, and the shipping distance from the West Coast of the US to China is at least half of what it is from West Africa to China, so we have a shipping advantage as well.

We’re quite confident that the bauxite, while not a necessary part of our economics, will be an important contributor. The preliminary economic assessment that we published late last year did not assume any revenue with regards to the bauxite, so by the time we publish our prefeas study, we do anticipate having those economics included in the numbers.

PIN: Let’s talk a little more about SOP. How is it different from MOP?

GB: They key difference between MOP and SOP is that MOP contains chloride. For certain crops, particularly high-volume crops like fruits, vegetable, teas, tobaccos, nuts, any kind of leafy lettuce, alfalfa, the chloride ion is detrimental for a number of reasons. You can reduce the yield quite significantly, but also things like taste and shelf life can be impacted when MOP is applied to these crop types. The difference can be quite significant.

On the other hand, SOP actually contains two nutrients. It contains potassium, but it also contains sulfur. Sulfur is a key nutrient in the growth of crops, so you’re essentially getting two nutrients as opposed to one nutrient and one detrimental item. Because of that, SOP has traditionally traded at a fairly significant premium over MOP. It varies a little bit by geography and has varied a little bit over the years, but typically it’s averaging around a 50-percent price premium in North America over MOP.

The market for MOP today is about 55 million tonnes. For SOP, it’s around 6 million tonnes. It’s about a 90-10 split. Most of the production of SOP today is in China and Europe, and most of the consumption of SOP is in China and Europe. There is a huge untapped potential in the US for producing SOP for export. Brazil is the largest grower of citrus fruit in the world. China has a consumption of 2 million tonnes of SOP per year. Brazil is consuming something like 40,000 tonnes per year. India is another great example. They’re the second-largest tea-growing nation in the world, a big grower of tobacco; their population is about the same as China and their consumption of SOP is not too much different than Brazil’s because they can’t get it. There is a huge underserved market. If there was more SOP available, people would buy it. Particularly when they understand the yield benefits over MOP for these crops that I was referring to.

PIN: Compared to other mined commodities, do you think potash is a good space for investors to be in right now?

GB: There may be some short-term weaknesses in potash prices, but I still think the long-term fundamentals of potash are very sound, and I think SOP in particular is an underappreciated potash story. Over time, as people better understand the differences between SOP and MOP, they will appreciate that the benefits of SOP over MOP are there and will see the growth and demand potential of SOP. The fact that this is an organic fertilizer is another thing that people will see as an advantage.

PIN: By organic do you mean it doesn’t have the run-off effects that phosphate, for example, does?

GB: Yes. With MOP, potassium chloride is not organic because you’re adding chloride into the soil. SOP is organic because everything that is in the SOP gets absorbed by the plant.

PIN: In marketing your company and this product, do you feel that investors understand the difference between SOP and MOP?

GB: Some do, some don’t. It depends on who you’re talking to. Quite frankly, I think there may be a bit of market weariness on another MOP story because when potash prices spiked a few years back it created a new pipeline of potash development stories; the market is kind of weary of all these MOP development stories. Our story is different because it’s a different product and it has some unique characteristics. It’s the selling of high-grade potash, but we’re producing bauxite at the same time. It’s almost as though this is more of an industrial minerals-type business as opposed to a pure potash play.

PIN: That definitely makes it unique. What are your company’s upcoming milestones for this year?

GB: We’re undergoing our second phase of test work right now and the results of that will be included in the prefeas study. Our next major milestone will be towards beginning of May — we’re going to start some pilot plant test work and that will run throughout the balance of this year. The biggest milestone of this year will be the publication of of our prefeasibility study, which we are anticipating will happen by the end of this quarter.

We are doing some water drilling right now, confirmation drilling because obviously we need some water for the project. We have applied for the water rights already and based upon historical drilling, we do know that there is sufficient water nearby. We’re planning to file our large mine permit by the end of this year as well, which will start the clock on getting our permit approved. Those, I think are the major milestones.

PIN: Sounds like you have a lot on your plate. Thanks for speaking with me today.

GB: Thank you.

Potash Ridge Aims to Capitalize on Underserved SOP Market

http://potashinvestingnews.com/7454-potash-ridge-mop-sop-mar…

Sulfate of potash (SOP) is an important nutrient used for growing high-value crops like vegetables, fruits and nuts. Farmers using fertilizers that contain SOP typically grow crops that are higher in yield than those using fertilizers that contain the more common muriate of potash (MOP). SOP is also known to improve food quality and shelf life.

Potash Investing News (PIN) sat down with Potash Ridge‘s (TSX:PRK) president and CEO, Guy Bentinck, to get a better understanding of both SOP and the company’s Blawn Mountain project in Utah, which hosts a unique geology containing both potash and bauxite.

PIN: Your Blawn Mountain project in Utah is in the prefeasibility stage. How does your project compare in terms of size to some of the other potash projects being developed in the US?

Guy Bentinck: We’re producing SOP, which is different from the MOP that you’ll see getting produced in Saskatchewan. There are a few projects in the Holbrook Basin as well, and they are all producing or plan to produce MOP as opposed to SOP. When you look at the other SOP projects in the United States, there are essentially two other projects. One is IC Potash (TSX:ICP) and the other is EPM Mining Ventures (TSXV:EPK). Both of those are smaller projects than ours and they’re extracting the potash from a different source than we are and are applying to produce at smaller volumes.

PIN: Your potash project is unique in that you’re producing not only SOP, but also bauxite. How does that affect the economics of the project?

GB: That’s right, it’s a very interesting ore that we’re mining. You essentially have three constituent parts. One is the SOP, which is by far the primary product. We’re also producing a bauxite-type material as we vent SO2, and we can convert that either into elemental sulfur or sulfuric acid. The sulfur will likely be sold into local markets.

The US is currently an underserved market for SOP. It is importing about 100,000 to 150,000 tonnes. The market potential in the US is quite a bit larger than what it currently is, around 300-plus thousand tonnes. Particularly California, Florida and some of the other southern states, where there is a big growth of high-volume crops like almonds and fruits and vegetables and grapes and so forth.

The bauxite is a very interesting angle for us. In China, there is a very big demand for bauxite right now. They’re building about 30 bauxite-processing plants. About 70 percent of the bauxite that they’re using today is coming from Indonesia. Indonesia has indicated recently that it intends to shut off exports of its bauxite material because it wants it processed on island. China is quite desperately looking for new sources of bauxite to offset that Indonesian supply as well as to generally diversify its source of bauxite.

In West Africa, places like Guinea, Mali, they have their own challenges in terms of infrastructure, political issues, as well as the logistics of shipping from West Africa to China. We’re in a much better jurisdiction where we don’t have the infrastructure-related issues to any great extent, and the shipping distance from the West Coast of the US to China is at least half of what it is from West Africa to China, so we have a shipping advantage as well.

We’re quite confident that the bauxite, while not a necessary part of our economics, will be an important contributor. The preliminary economic assessment that we published late last year did not assume any revenue with regards to the bauxite, so by the time we publish our prefeas study, we do anticipate having those economics included in the numbers.

PIN: Let’s talk a little more about SOP. How is it different from MOP?

GB: They key difference between MOP and SOP is that MOP contains chloride. For certain crops, particularly high-volume crops like fruits, vegetable, teas, tobaccos, nuts, any kind of leafy lettuce, alfalfa, the chloride ion is detrimental for a number of reasons. You can reduce the yield quite significantly, but also things like taste and shelf life can be impacted when MOP is applied to these crop types. The difference can be quite significant.

On the other hand, SOP actually contains two nutrients. It contains potassium, but it also contains sulfur. Sulfur is a key nutrient in the growth of crops, so you’re essentially getting two nutrients as opposed to one nutrient and one detrimental item. Because of that, SOP has traditionally traded at a fairly significant premium over MOP. It varies a little bit by geography and has varied a little bit over the years, but typically it’s averaging around a 50-percent price premium in North America over MOP.

The market for MOP today is about 55 million tonnes. For SOP, it’s around 6 million tonnes. It’s about a 90-10 split. Most of the production of SOP today is in China and Europe, and most of the consumption of SOP is in China and Europe. There is a huge untapped potential in the US for producing SOP for export. Brazil is the largest grower of citrus fruit in the world. China has a consumption of 2 million tonnes of SOP per year. Brazil is consuming something like 40,000 tonnes per year. India is another great example. They’re the second-largest tea-growing nation in the world, a big grower of tobacco; their population is about the same as China and their consumption of SOP is not too much different than Brazil’s because they can’t get it. There is a huge underserved market. If there was more SOP available, people would buy it. Particularly when they understand the yield benefits over MOP for these crops that I was referring to.

PIN: Compared to other mined commodities, do you think potash is a good space for investors to be in right now?

GB: There may be some short-term weaknesses in potash prices, but I still think the long-term fundamentals of potash are very sound, and I think SOP in particular is an underappreciated potash story. Over time, as people better understand the differences between SOP and MOP, they will appreciate that the benefits of SOP over MOP are there and will see the growth and demand potential of SOP. The fact that this is an organic fertilizer is another thing that people will see as an advantage.

PIN: By organic do you mean it doesn’t have the run-off effects that phosphate, for example, does?

GB: Yes. With MOP, potassium chloride is not organic because you’re adding chloride into the soil. SOP is organic because everything that is in the SOP gets absorbed by the plant.

PIN: In marketing your company and this product, do you feel that investors understand the difference between SOP and MOP?

GB: Some do, some don’t. It depends on who you’re talking to. Quite frankly, I think there may be a bit of market weariness on another MOP story because when potash prices spiked a few years back it created a new pipeline of potash development stories; the market is kind of weary of all these MOP development stories. Our story is different because it’s a different product and it has some unique characteristics. It’s the selling of high-grade potash, but we’re producing bauxite at the same time. It’s almost as though this is more of an industrial minerals-type business as opposed to a pure potash play.

PIN: That definitely makes it unique. What are your company’s upcoming milestones for this year?

GB: We’re undergoing our second phase of test work right now and the results of that will be included in the prefeas study. Our next major milestone will be towards beginning of May — we’re going to start some pilot plant test work and that will run throughout the balance of this year. The biggest milestone of this year will be the publication of of our prefeasibility study, which we are anticipating will happen by the end of this quarter.

We are doing some water drilling right now, confirmation drilling because obviously we need some water for the project. We have applied for the water rights already and based upon historical drilling, we do know that there is sufficient water nearby. We’re planning to file our large mine permit by the end of this year as well, which will start the clock on getting our permit approved. Those, I think are the major milestones.

PIN: Sounds like you have a lot on your plate. Thanks for speaking with me today.

GB: Thank you.

Antwort auf Beitrag Nr.: 44.508.521 von SEPP_EIXLBERGER am 25.04.13 08:23:58http://www.asianmetal.cn/Events_2013/2013ARMS/Index_2013ARMS…

The agenda of the meeting

15 (Wednesday)

16:00 Delegate Registration

18:00-20:00 Buffet dinner

16 (Thursday)

08:45-08:55 Welcome speech

08:55-09:30 Under the leadership of the new government, China's economic policy interpretation and trend analysis

09:30-10:05 Northwest New aluminum project construction progress of its old industrial bases

10:05-10:40 2013 China's alumina industry challenges and opportunities and market trends

10:40-10:50 Coffee Break

10:50-11:25 Analysis of the competitiveness of manufacturers, Chinese aluminum fluoride and 2013 market trends to determine

11:25-12:00 Aluminum with carbon anode quality performance

12:00-14:00 Lunch

14:00-14:30 2013 global economic slight increase in global aluminum prices will gradually shift the center of gravity

The bauxite investment promotion at home and abroad special exchange

14:30-15:15 China and the world's bauxite resources condition and the next 20 years the demand outlook

15:10-15:45 The bauxite Trade inspection problems and countermeasures

15:45-16:00 Coffee Break

16:00-16:30 A Brief Analysis of India's bauxite exports

16:30-17:00 The Blawn Mountain, Utah, USA quarries

16:30-17:00 The Blawn Mountain, Utah, USA quarries

17:00-17:30 The Ghana the bauxite development of the status quo and Analysis

17:30-18:00 The Mongolian the bauxite development of the status quo and Analysis

18:30-20:00 Reception Dinner

17 (Friday)

09:30-14:00 Visit the Yellow River Xin Industry Co., Ltd.

16:00 Return to hotel

The agenda of the meeting

15 (Wednesday)

16:00 Delegate Registration

18:00-20:00 Buffet dinner

16 (Thursday)

08:45-08:55 Welcome speech

08:55-09:30 Under the leadership of the new government, China's economic policy interpretation and trend analysis

09:30-10:05 Northwest New aluminum project construction progress of its old industrial bases

10:05-10:40 2013 China's alumina industry challenges and opportunities and market trends

10:40-10:50 Coffee Break

10:50-11:25 Analysis of the competitiveness of manufacturers, Chinese aluminum fluoride and 2013 market trends to determine

11:25-12:00 Aluminum with carbon anode quality performance

12:00-14:00 Lunch

14:00-14:30 2013 global economic slight increase in global aluminum prices will gradually shift the center of gravity

The bauxite investment promotion at home and abroad special exchange

14:30-15:15 China and the world's bauxite resources condition and the next 20 years the demand outlook

15:10-15:45 The bauxite Trade inspection problems and countermeasures

15:45-16:00 Coffee Break

16:00-16:30 A Brief Analysis of India's bauxite exports

16:30-17:00 The Blawn Mountain, Utah, USA quarries

16:30-17:00 The Blawn Mountain, Utah, USA quarries

17:00-17:30 The Ghana the bauxite development of the status quo and Analysis

17:30-18:00 The Mongolian the bauxite development of the status quo and Analysis

18:30-20:00 Reception Dinner

17 (Friday)

09:30-14:00 Visit the Yellow River Xin Industry Co., Ltd.

16:00 Return to hotel

Potash Ridge Reports First Quarter 2013 Results and Blawn Mountain Project Update

http://www.stockhouse.com/companies/stories/t.prk/8843464

TORONTO, ONTARIO--(Marketwired - May 10, 2013) - Potash Ridge Corporation ("Potash Ridge" or the "Corporation") (TSX:PRK)(OTCQX:POTRF) today released its first quarter results and provided an update on its flagship 100%-owned Blawn Mountain Project ("The Project").

Q1-2013 Financial Results

The Corporation reported a net loss for the first quarter of 2013 of $1.0 million ($0.01 per share) compared with a net loss of $0.8 million ($0.01 per share) for the first quarter of 2012.

A total of $3.6 million was incurred on project activities during the first quarter compared with $2.5 million on project activities for the first quarter of 2012.

compared with $2.5 million on project activities for the first quarter of 2012.

The Corporation closed the first quarter of 2013 with cash and short-term investments of $18.6 million.

First quarter unaudited Financial Statements and Management's Discussion & Analysis are available at www.sedar.com.

Key Updates

The various aspects of developing the Project remain on track.

Completion of the prefeasibility study is still anticipated for the end of the second quarter 2013.

Pilot plant scale testing is planned to start by mid-May. The start-up was delayed slightly to allow for completion of some metallurgical test work, although this delay is not expected to impact completion of the metallurgical testing, scheduled for the end of 2013.

The start-up was delayed slightly to allow for completion of some metallurgical test work, although this delay is not expected to impact completion of the metallurgical testing, scheduled for the end of 2013.

A number of permitting milestones are expected throughout 2013, the most significant of which will be the filing of the large mining permit application, anticipated by the end of 2013.

Subsequent to the quarter end, the Corporation received confirmation from State of Utah School and Institutional Trust Land Administration ("SITLA") that it has been granted the unconditional right to convert its Exploration Lease on the Project into a Mining Lease. The Corporation has until March 31, 2014 to exercise its option, at which time it is required to pay SITLA US$1,020,000.

Also, on April 29, Potash Ridge commenced trading on the OTCQX International. This is a segment of the OTCQX marketplace reserved for high-quality non-U.S. companies listed on a qualified foreign stock exchange. The listing will provide U.S investors quick access to the stock and all shareholders will benefit from the Corporation's exposure to a larger base of investors.

Outlook

The Corporation plans to work towards completion of the prefeasibility study, metallurgical and pilot plant scale test work and filing of the large mining permit. Absent raising additional capital, the Corporation expects that it will have sufficient cash to continue operations through to the end of 2014. In the event sufficient capital is raised subsequent to filing of the prefeasibility study, the Corporation will immediately commence work on the bankable feasibility study.

About Potash Ridge

Potash Ridge is a Canadian based exploration and development company with a unique opportunity to develop a long-term mining project for the production of SOP and bauxite-type material.