Sunridge Gold - Chancenreicher Explorer in Eritrea - 500 Beiträge pro Seite

eröffnet am 10.01.13 16:00:01 von

neuester Beitrag 29.04.16 01:40:03 von

neuester Beitrag 29.04.16 01:40:03 von

Beiträge: 104

ID: 1.178.765

ID: 1.178.765

Aufrufe heute: 0

Gesamt: 6.851

Gesamt: 6.851

Aktive User: 0

ISIN: CA86769Q1028 · WKN: 120742

0,0272

USD

-6,21 %

-0,0018 USD

Letzter Kurs 09.12.16 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,5500 | +14,61 | |

| 1,0100 | +10,99 | |

| 4,9300 | +10,04 | |

| 17.600,00 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 190,05 | -7,07 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Sunridge Gold Corp.(SGC/TSX.V) ist ein junges Entwicklungs-und-Explorationsunternehmen, dass sich auf unedle Metalle und Edelmetalle konzentriert. Das Unternehmen möchte vier NI 43-101 Lagerstätten fördern, und die Ressourcen auf mehrere Prioritäts-Ziele auf dem Asmara Projekt (Eritrea) erhöhen. Nach einer kürzlichen Privatplatzierung und Explorationsabkommen mit Antofagasta Minerals SA, ist Sunridge gut finanziert, um ihre 100%igen Lagerstätten zu entwickeln. Gleichzeitig, arbeiten Antofagasta und Sunridge zusammen, um andere Ziele mit dem Potenzial für grosse Entdeckungen zu bohren. Mit erheblichen Liegenschaften und dem Potenzial für mehr ist Sunridge ein junges Unternehmen, welches zu beobachten wert ist.

http://www.proactiveinvestors.de/companies/news/2647/sunridg…

Sunridge Gold

Company Overview

Sunridge Gold has been exploring for VMS base and precious metal deposits in Eritrea since 2003 and has successfully defined 4 deposits on the Asmara Project located outside of Asmara which contain significant amounts of copper, zinc, gold, and silver. A Feasibility study is currently examining an integrated mining operation on all 4 deposits and is on schedule for completion in Q2 2013.

The Feasibility Study is a continuation of a prefeasibility study (PFS) completed in May 2012 which considered an integrated mining operation for all 4 deposits with a central mill located at the large Emba Derho Deposit. The Prefeasibility Study demonstrates very robust economics, with the Net Present Value (NPV) of the project was shown to be $555 million dollars with a 10% discount applied ($1.642 Billion NPV with zero discount) and the Internal rate of return (IRR) is 27%.

The integrated mining operation outlined in the PFS details a processing facility at Emba Derho that processes ore from open pit mines at Emba Derho, Debarwa, and Gupo and an underground mine at Adi Nefas.

The current Feasibly Study will differ from PFS as it is considering a staged start up beginning with the mining and direct shipping of 116,000 tonnes of high-grade copper material averaging 16% copper, 3.0 g/t gold, and 77 g/t silver from the DSO Zone at Debarwa. This will enable the project to be in production earlier and will generate early cash flow and reduce initial capital costs.

Also in the staged start up mining plan, a heap leach operation will process the gold from the gold caps early in the mine life and a floatation plant will begin by processing the supergene copper material.

Full production will begin in the 3rd year of operation and will process 4 million tonnes of material per annum. Annual production will average 57.3 million lbs. (26,000 tonnes) copper, 143.2 million lbs. (65,000 tonnes) zinc, 24,000 oz gold, 787,000 oz silver over 13 years of full production.

Total metal production over the life of the mine is 804 million pounds (365,000 tonnes) of copper, 1.789 million pounds (812,000 tonnes) of zinc, 415,000 ounces of gold, and 11 million ounces of silver. Sunridge has now begun a Feasibility Study and is expected to complete in Q1 2013.

Sunridge also continues to explore new targets. Encouraging results from recent drilling at Adi Rassi support Sunridge management's belief that Adi Rassi is a new large copper-gold discovery that has the potential to become Sunridge's fifth deposit on the Asmara Project.

Sunridge is operated by an entrepreneurial team with a proven record of discovery, exploration and development success with companies such as Nevsun Resources Ltd. and Bema Gold Corp.

http://www.sunridgegold.com/s/Home.asp

Stefan Ioannou (Haywood Securities) über Sunridge Gold:

(aus einem Interview mit "The Gold Report" vom 2.Januar 2013)

Stefan Ioannou: People are not familiar with Eritrea, and red flags typically go up when anything related to Northeast Africa is mentioned. Nevsun was basically the first publicly traded company to get into Eritrea. It made the Bisha discovery and over 10 years, took it through exploration, permitting, development, construction and into production. Along the way skeptics pointed to the risk of the government taking more than its fair share of the project.

I give the Eritrean government a lot of credit. It has been very pragmatic. The government recognized early on that it had to work with foreign investment to make a mining industry a reality, and not just with Nevsun. The last time I checked there were about 15 exploration companies active in Eritrea. I have been to Eritrea twice now and had very good experiences both times. The common sentiment among visitors is that it was safer than they expected.

Sunridge Gold Corp. (SGC:TSX.V) is also active in Eritrea, as is Chalice Gold Mines Ltd. (CXN:TSX; CHN:ASX). The latter is exploring for VMS deposits along the same belt that hosts Bisha, and recently announced a discovery.

The Gold Report: Sunridge just published a resource estimate for its Adi Rassi discovery. Given the size and scope of the deposit and Sunridge's lack of cash, could this be a takeover target?

Stefan Ioannou: I think the Eritrean government would like to see more than one foreign player developing the mining industry in Eritrea.

With respect to takeover potential, I think the completion of a feasibility study, expected in Q2/13, on the company's Asmara project will be key. The feasibility study will not include Adi Rassi. It is based on four other projects, the Emba Derho, Debarwa and Adi Nefas copper-zinc-gold and silver deposits and the Gupo gold deposit. That said, Adi Rassi is located near Debarwa and could ultimately develop into the Asmara project's fifth deposit.

Also important for Sunridge is the Eritrean government's intention to buy upwards of a 30% interest in the project, similar to what it did with Nevsun at Bisha. The price still needs to be determined. That may happen before the feasibility comes out or the government may use the feasibility study as the basis of the valuation.

The government paid fair value to Nevsun and we expect the same to happen with Sunridge. Once the government does that, it will signal a vote of confidence to the investment community that things are moving in the right direction.

The feasibility study, of course, will give us a better handle on the project's economics and what it should be worth. The big questions include what it will cost to build it, how much money Sunridge will have to raise, and what that means from a dilution point of view.

http://www.theaureport.com/pub/na/14898

(aus einem Interview mit "The Gold Report" vom 2.Januar 2013)

Stefan Ioannou: People are not familiar with Eritrea, and red flags typically go up when anything related to Northeast Africa is mentioned. Nevsun was basically the first publicly traded company to get into Eritrea. It made the Bisha discovery and over 10 years, took it through exploration, permitting, development, construction and into production. Along the way skeptics pointed to the risk of the government taking more than its fair share of the project.

I give the Eritrean government a lot of credit. It has been very pragmatic. The government recognized early on that it had to work with foreign investment to make a mining industry a reality, and not just with Nevsun. The last time I checked there were about 15 exploration companies active in Eritrea. I have been to Eritrea twice now and had very good experiences both times. The common sentiment among visitors is that it was safer than they expected.

Sunridge Gold Corp. (SGC:TSX.V) is also active in Eritrea, as is Chalice Gold Mines Ltd. (CXN:TSX; CHN:ASX). The latter is exploring for VMS deposits along the same belt that hosts Bisha, and recently announced a discovery.

The Gold Report: Sunridge just published a resource estimate for its Adi Rassi discovery. Given the size and scope of the deposit and Sunridge's lack of cash, could this be a takeover target?

Stefan Ioannou: I think the Eritrean government would like to see more than one foreign player developing the mining industry in Eritrea.

With respect to takeover potential, I think the completion of a feasibility study, expected in Q2/13, on the company's Asmara project will be key. The feasibility study will not include Adi Rassi. It is based on four other projects, the Emba Derho, Debarwa and Adi Nefas copper-zinc-gold and silver deposits and the Gupo gold deposit. That said, Adi Rassi is located near Debarwa and could ultimately develop into the Asmara project's fifth deposit.

Also important for Sunridge is the Eritrean government's intention to buy upwards of a 30% interest in the project, similar to what it did with Nevsun at Bisha. The price still needs to be determined. That may happen before the feasibility comes out or the government may use the feasibility study as the basis of the valuation.

The government paid fair value to Nevsun and we expect the same to happen with Sunridge. Once the government does that, it will signal a vote of confidence to the investment community that things are moving in the right direction.

The feasibility study, of course, will give us a better handle on the project's economics and what it should be worth. The big questions include what it will cost to build it, how much money Sunridge will have to raise, and what that means from a dilution point of view.

http://www.theaureport.com/pub/na/14898

Institutional Shareholders

Top Holders

US Global Investors, Inc. (Asset Management) 6.60m 3,77%

Enso Capital Management LLC 6.26m 3,57%

BlackRock Advisors LLC 5.55m 3,17%

BlackRock Investment Management (UK) Ltd. 4.44m 2,54%

Vertex One Asset Management, Inc. 4.04m 2,31%

http://markets.ft.com/research/Markets/Tearsheets/Business-p…

Top Holders

US Global Investors, Inc. (Asset Management) 6.60m 3,77%

Enso Capital Management LLC 6.26m 3,57%

BlackRock Advisors LLC 5.55m 3,17%

BlackRock Investment Management (UK) Ltd. 4.44m 2,54%

Vertex One Asset Management, Inc. 4.04m 2,31%

http://markets.ft.com/research/Markets/Tearsheets/Business-p…

Erst Mitte Oktober 2012 kauften US Global Investors, Inc. (Asset Management) 4,6 Millionen Shares nach.

Das war die grösste Aktienbewegung bei Sunridge Gold Corp. in den letzten zwei Jahren :

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

Das war die grösste Aktienbewegung bei Sunridge Gold Corp. in den letzten zwei Jahren :

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

SUNRIDGE GOLD HIGHLIGHTS

Asmara Project Hosts $8.5bn of in-situ Gold, Copper, Zinc, and Silver – Sunridge Gold has successfully defined four independently estimated 43-101 mineral deposits on the Asmara Project in Eritrea, Africa, with indicated resources of 1.28b Cu lbs, 2.5b zinc lbs, 1.05m gold oz, and 31.2m silver oz.

Advancing 100%-owned Emba Derho and Derbarwa Gold-Copper-Zinc VMS Deposits, the company’s two largest deposits. Emba Derho contains Indicated Resources of 62.5 m/t containing 990m lbs Cu, 1.9 billion lbs Zn, 580,000oz. gold and 20.8m oz Ag. Derbarwa is a Supergene copper zone with 1.3m tonnes of 5.36% Cu, 1.54 g/t Au, and 33.87 g/t Ag – containing 158m pounds of Cu in the Indicated category.

Excellent Infrastructure: Grid Power, Water, Roads and Rail – Emba Derho and Debarwa are located 15 and 25km, respectively, from Asmara, the capital city of Eritrea, where the infrastructure is excellent.

Largest Shareholders: Strategic Partner, Antofagasta Minerals, Lundin Mining – Sunridge has a strategic partnership with London-based mining conglomerate Antofagasta Minerals in which Antofagasta has agreed to fund $10 million in exploration work and has become Sunridge’s largest shareholder.

http://www.goldalert.com/sunridge-gold/

Sunridge Gold moves as “Rapidly” as it can towards Production

December 7th, 2012 TesfaNews

By Stock Tube

Michael Hopley, President and CEO of Sunridge Gold (CVE:SGC) explains that the company, with money in the bank for the feasibility study, has a lot of copper and precious metals on the project and now hopes to be in production earlier than initially indicated. Michael also says that investors should look to exploration results next year.

http://www.tesfanews.net/archives/10407

December 7th, 2012 TesfaNews

By Stock Tube

Michael Hopley, President and CEO of Sunridge Gold (CVE:SGC) explains that the company, with money in the bank for the feasibility study, has a lot of copper and precious metals on the project and now hopes to be in production earlier than initially indicated. Michael also says that investors should look to exploration results next year.

http://www.tesfanews.net/archives/10407

Press Release

Wednesday Jan 16, 2013

Sunridge Gold Provides 2013 Outlook On The Asmara Project, Eritrea And Corporate Activity

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) is pleased to provide an outlook on the Company's planned activities for 2013. The Company's primary focus for early 2013 is to complete the feasibility study (the "Study") and apply for a mining license on the four mineral deposits that make up the Asmara Project in Eritrea. The Company also plans to continue exploration work on its fifth deposit the Adi Rassi copper-gold deposit where initial resources were announced on December 4, 2012 as well as to conduct exploration work on additional targets on the Asmara Project.

...

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=565…

Wednesday Jan 16, 2013

Sunridge Gold Provides 2013 Outlook On The Asmara Project, Eritrea And Corporate Activity

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) is pleased to provide an outlook on the Company's planned activities for 2013. The Company's primary focus for early 2013 is to complete the feasibility study (the "Study") and apply for a mining license on the four mineral deposits that make up the Asmara Project in Eritrea. The Company also plans to continue exploration work on its fifth deposit the Adi Rassi copper-gold deposit where initial resources were announced on December 4, 2012 as well as to conduct exploration work on additional targets on the Asmara Project.

...

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=565…

Friday Jan 18, 2013

Sunridge Gold Files Technical Report For Adi Rassi Resource

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) ) has filed a National Instrument 43-101 compliant technical report regarding the initial resource estimate for the Adi Rassi copper-gold deposit located on the Asmara Project, Eritrea.

As announced on December 4, 2012, the highlights of the estimate were:

- Inferred Mineral Resource of 15.77 million tonnes with an average grade of 0.54% copper and 0.33 g/t gold

- Contained metal = 189,060,000 pounds of copper and 167,000 ounces of gold

- The resources area is open for expansion in most directions

- Less than 10 km from Debarwa deposit and paved road access

- Positive initial metallurgical results

- Further expansion drilling planned in 2013

Adi Rassi is the fifth mineral resource defined by Sunridge on the Asmara Project. A feasibility study is scheduled for completion in April 2013 on the other four deposits (Adi Nefas, Emba Derho, Gupo and Debarwa).

The report is titled "Adi Rassi Deposit" prepared by Fladgate Exploration Consulting Corporation with an effective date of January 18, 2013.

Mr. Michael J. Hopley is the Qualified Person who approved the technical information contained in this news release.

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=566…

Sunridge Gold Files Technical Report For Adi Rassi Resource

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) ) has filed a National Instrument 43-101 compliant technical report regarding the initial resource estimate for the Adi Rassi copper-gold deposit located on the Asmara Project, Eritrea.

As announced on December 4, 2012, the highlights of the estimate were:

- Inferred Mineral Resource of 15.77 million tonnes with an average grade of 0.54% copper and 0.33 g/t gold

- Contained metal = 189,060,000 pounds of copper and 167,000 ounces of gold

- The resources area is open for expansion in most directions

- Less than 10 km from Debarwa deposit and paved road access

- Positive initial metallurgical results

- Further expansion drilling planned in 2013

Adi Rassi is the fifth mineral resource defined by Sunridge on the Asmara Project. A feasibility study is scheduled for completion in April 2013 on the other four deposits (Adi Nefas, Emba Derho, Gupo and Debarwa).

The report is titled "Adi Rassi Deposit" prepared by Fladgate Exploration Consulting Corporation with an effective date of January 18, 2013.

Mr. Michael J. Hopley is the Qualified Person who approved the technical information contained in this news release.

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=566…

Das Länderrisiko ist leider nicht zu vernachlässigen...

http://www.reuters.com/article/2013/01/21/us-eritrea-siege-i…

http://www.reuters.com/article/2013/01/21/us-eritrea-siege-i…

@videomart

Danke erstmal für's Reinstellen,interressanter Wert..Die Vorfälle in Asmara gestern sind schwer zu bewerten als Ausländer,schaut wohl aber so aus als ob in Asmara derz. Ruhe ist..

Hier ein update von Grandich:

http://www.grandich.com/2013/01/grandich-client-sunridge-gol…

Gruß

wz

Danke erstmal für's Reinstellen,interressanter Wert..Die Vorfälle in Asmara gestern sind schwer zu bewerten als Ausländer,schaut wohl aber so aus als ob in Asmara derz. Ruhe ist..

Hier ein update von Grandich:

http://www.grandich.com/2013/01/grandich-client-sunridge-gol…

Gruß

wz

Antwort auf Beitrag Nr.: 44.048.024 von Wasserzeichen am 22.01.13 11:24:48Tja, war eine tolle Nachkaufchance gestern!

Leider ist mein Auftrag zu 0,16 Euro nicht ausgeführt worden...

Hier eine aktuelle Stellungnahme von Michael Hopley zur gestrigen Reuters-Meldung:

Mon Jan 21, 2013

Sunridge Gold Provides Update on Eritrea

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) ) is aware of reports by Reuters and other international news agencies of dissident soldiers taking-over the ministry of information building in the capital city of Asmara, Eritrea. Information from the Company's in-country staff is that Asmara is calm and these events have had no effect on Sunridge's ongoing engineering studies and drilling operations in the country.

SUNRIDGE GOLD CORP.

"Michael Hopley"

Michael Hopley, President and Chief Executive Officer

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=566…

Leider ist mein Auftrag zu 0,16 Euro nicht ausgeführt worden...

Hier eine aktuelle Stellungnahme von Michael Hopley zur gestrigen Reuters-Meldung:

Mon Jan 21, 2013

Sunridge Gold Provides Update on Eritrea

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) ) is aware of reports by Reuters and other international news agencies of dissident soldiers taking-over the ministry of information building in the capital city of Asmara, Eritrea. Information from the Company's in-country staff is that Asmara is calm and these events have had no effect on Sunridge's ongoing engineering studies and drilling operations in the country.

SUNRIDGE GOLD CORP.

"Michael Hopley"

Michael Hopley, President and Chief Executive Officer

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=566…

Sunridge Gold Begins Drilling Gold Cap at Kodadu, Asmara Project, Eritrea

Wed Jan 23, 2013

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) is pleased to announce that a reverse-circulation drill program has commenced on the Kodadu volcanogenic-massive sulphide (VMS) target located on the Company's Asmara Project in Eritrea, East Africa.

The program consisting of approximately 20 drill holes is specifically targeting the oxide gold cap within the upper oxidized zones (known as gossans) of the Kodadu VMS mineral occurrence. The goal of the program is to rapidly define a resource that could be mined as feed to a central gold plant near the large Emba Derho deposit.

"Although Sunridge's main focus has recently been completing the Asmara Project feasibility study and moving the four established deposits on the Asmara Project toward production, it is important to realize that the area remains highly prospective for new gold and base metal deposits" states Michael Hopley, Sunridge's President and CEO.

The Kodadu VMS target is located approximately 25 kilometres south of the Emba Derho copper-zinc-gold-silver deposit. Several gossans trend north-northeast for over a 1.2 kilometre strike length with an average width of 10 metres and about 35 metres deep. A recent (2009) Sunridge trenching program in which 87 samples were taken, returned 28 gold values of over 0.2g/t and the best values were 10.67g/t over 14.7m, 2.3g/t over 8m and 1.79 g/t over 13.3m.

Gold mineralization that has been identified in a one kilometre shear zone running parallel and about 100 metres west of the Kodadu gossans will also be drill tested. Geological mapping has shown the zone to be approximately 30 metres wide and historic gold values from trenches sampled by a previous operator are reported as 3.85g/t over 50m; 2.05g/t over 50m; and 11.87g/t over 8m.

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=567…

Wed Jan 23, 2013

Sunridge Gold Corp. (the "Company" or "Sunridge") (SGC:TSX.V/SGCNF.OTCQX) is pleased to announce that a reverse-circulation drill program has commenced on the Kodadu volcanogenic-massive sulphide (VMS) target located on the Company's Asmara Project in Eritrea, East Africa.

The program consisting of approximately 20 drill holes is specifically targeting the oxide gold cap within the upper oxidized zones (known as gossans) of the Kodadu VMS mineral occurrence. The goal of the program is to rapidly define a resource that could be mined as feed to a central gold plant near the large Emba Derho deposit.

"Although Sunridge's main focus has recently been completing the Asmara Project feasibility study and moving the four established deposits on the Asmara Project toward production, it is important to realize that the area remains highly prospective for new gold and base metal deposits" states Michael Hopley, Sunridge's President and CEO.

The Kodadu VMS target is located approximately 25 kilometres south of the Emba Derho copper-zinc-gold-silver deposit. Several gossans trend north-northeast for over a 1.2 kilometre strike length with an average width of 10 metres and about 35 metres deep. A recent (2009) Sunridge trenching program in which 87 samples were taken, returned 28 gold values of over 0.2g/t and the best values were 10.67g/t over 14.7m, 2.3g/t over 8m and 1.79 g/t over 13.3m.

Gold mineralization that has been identified in a one kilometre shear zone running parallel and about 100 metres west of the Kodadu gossans will also be drill tested. Geological mapping has shown the zone to be approximately 30 metres wide and historic gold values from trenches sampled by a previous operator are reported as 3.85g/t over 50m; 2.05g/t over 50m; and 11.87g/t over 8m.

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=567…

Hatte ausnahmsweise mal Dusel und bin vor dem rechner gewesen..Bin dann direkt zu 0,163zum Zug gekommen..(eigentlich hätte 0,16 locker ausgeführt werden müssen,Tiefstkurs waren ja 0,195CAD..naja,Frankfurt halt mal wieder

..und schonwieder ein Grandich-update:

http://www.grandich.com/2013/01/grandich-client-sunridge-gol…

..und schonwieder ein Grandich-update:

http://www.grandich.com/2013/01/grandich-client-sunridge-gol…

The directors of Sunridge Gold (TSX-V: SGC) and Tethys Petroleum (TSX: TPL) will be presenting:

Thursday the 31st January 2013,

Ivey ING Direct Leadership Centre - 130 King Street West

The presentations will start at 5:30pm and finish at 7:30pm. After the presentations are complete the directors will also be available to take questions during a complimentary canapé and wine reception. Details on the presenting companies can be found below.

This event is suitable for the following:

Sophisticated & private investors, private client brokers, fund managers, financial institutions, hedge funds, buy & sell side analysts and journalists.

The event is not suitable for people pursuing commercial opportunities.

Sunridge Gold (TSX-V:SGC)

Sunridge Gold Corp. is an exploration and development company that completed a positive feasibility study for the high grade Debarwa copper, gold and zinc deposit on May 14, 2012 and a positive pre-feasibility study on all four deposits of the Asmara Project, Emba Derho, Adi Nefas, Debarwa and Gupo Gold on May 2, 2012 showing a Base Case NPV of $555 million and IRR of 27%.

http://www.proactiveinvestors.com/register/event_details/90

Thursday the 31st January 2013,

Ivey ING Direct Leadership Centre - 130 King Street West

The presentations will start at 5:30pm and finish at 7:30pm. After the presentations are complete the directors will also be available to take questions during a complimentary canapé and wine reception. Details on the presenting companies can be found below.

This event is suitable for the following:

Sophisticated & private investors, private client brokers, fund managers, financial institutions, hedge funds, buy & sell side analysts and journalists.

The event is not suitable for people pursuing commercial opportunities.

Sunridge Gold (TSX-V:SGC)

Sunridge Gold Corp. is an exploration and development company that completed a positive feasibility study for the high grade Debarwa copper, gold and zinc deposit on May 14, 2012 and a positive pre-feasibility study on all four deposits of the Asmara Project, Emba Derho, Adi Nefas, Debarwa and Gupo Gold on May 2, 2012 showing a Base Case NPV of $555 million and IRR of 27%.

http://www.proactiveinvestors.com/register/event_details/90

Eritrea 2013: Year of Sunridge Gold

January 17th, 2013 TesfaNews

http://www.tesfanews.net/archives/11425

January 17th, 2013 TesfaNews

http://www.tesfanews.net/archives/11425

Mining Indaba South Africa:

Sunridge Gold & Nevsun Resources

By Editorial Team, capitaleritrea news, January 19, 2013

Title: Mining Indaba South Africa: Sunridge Gold & Nevsun Resources

Location: Cape Town, South Africa

Start Date: 2013-02-04

End Date: 2013-02-07

http://www.capitaleritrea.com/mining-indaba-south-africa-sun…

"Sunridge Gold Corp Invites You to Attend Mining Indaba in Cape Town"

Fri, 18 Jan 2013 13:59:25

http://www.dehai.org/archives/dehai_news_archive/2013/jan/00…

"Sunridge Gold Corp Invites You to Attend the Cambridge House - Vancouver Resource Investment Conference"

Tue, 15 Jan 2013 13:49:34

On: Sunday, January 20, 2013

At: Workshop #3

Time: 4:10pm

http://www.dehai.org/archives/dehai_news_archive/2013/jan/00…

Sunridge Gold & Nevsun Resources

By Editorial Team, capitaleritrea news, January 19, 2013

Title: Mining Indaba South Africa: Sunridge Gold & Nevsun Resources

Location: Cape Town, South Africa

Start Date: 2013-02-04

End Date: 2013-02-07

http://www.capitaleritrea.com/mining-indaba-south-africa-sun…

"Sunridge Gold Corp Invites You to Attend Mining Indaba in Cape Town"

Fri, 18 Jan 2013 13:59:25

http://www.dehai.org/archives/dehai_news_archive/2013/jan/00…

"Sunridge Gold Corp Invites You to Attend the Cambridge House - Vancouver Resource Investment Conference"

Tue, 15 Jan 2013 13:49:34

On: Sunday, January 20, 2013

At: Workshop #3

Time: 4:10pm

http://www.dehai.org/archives/dehai_news_archive/2013/jan/00…

Sunridge Gold Corp

Commencement of Drilling Gold Cap at Kodadu, Asmara Project, Eritrea

24rd January 2013

www.grandich.com/wp-content/uploads/2013/01/Sunridge-Gold-Co…

Commencement of Drilling Gold Cap at Kodadu, Asmara Project, Eritrea

24rd January 2013

www.grandich.com/wp-content/uploads/2013/01/Sunridge-Gold-Co…

29 Janury 2013

Grandich Client Sunridge Gold:

"The spat in Eritrea killed the recent rally but has given high-risk speculators a chance to become a shareholder on a situation that mirrors where Nevsun Resources was four years ago."

Sunridge Gold CEO has given two interviews:

http://rblcommunications.com/webcasts/SGC18jan2013/SGC18jan2…

http://rblcommunications.com/webcasts/SGC24jan2013/SGC24jan2…

http://www.grandich.com/2013/01/grandich-client-sunridge-gol…

Grandich Client Sunridge Gold:

"The spat in Eritrea killed the recent rally but has given high-risk speculators a chance to become a shareholder on a situation that mirrors where Nevsun Resources was four years ago."

Sunridge Gold CEO has given two interviews:

http://rblcommunications.com/webcasts/SGC18jan2013/SGC18jan2…

http://rblcommunications.com/webcasts/SGC24jan2013/SGC24jan2…

http://www.grandich.com/2013/01/grandich-client-sunridge-gol…

Sunridge Gold shares rally as investors sit tight for key feasibility study at Asmara

Jan 30, 2013 | 12:12 pm by Deborah Bacal

Sunridge is now working on finishing a final feasibility study, on track for April this year, after which the application for a mining license and permitting will follow, along with the social and environmental impact assessment. Sunridge Gold Corp. (CVE:SGC) (OTCQX:SGCNF) shares popped on Wednesday as investors await a key feasibility study report for its Asmara project in Eritrea next quarter, while the junior gold explorer also works to grow the resource through further drilling.

Shares of Sunridge were up by 3 cents, or more than 12%, to 27.5 cents today. Its stock is up almost 30% so far this year.

Last week, the company started a reverse-circulation drill program at its Kodadu target on Asmara, where the company is also focused on completing a feasibility study on the already four established deposits.

The aim of its work at Kodadu is to quickly define a resource that could potentially be mined as feed to a gold plant at Emba Derho - one of the four established deposits. Kodadu is located around 25 kilometres south of Emba.

As of now, the Asmara project consists of the Emba Derho, Debarwa and Adi Nefas copper-zinc-gold and silver deposits and the Gupo gold deposit - all located within 40 kilometres of the capital city of Asmara.

The results of a preliminary feasibility study in May that considered all four deposits being processed at a central mill showed production of 365,000 tonnes of copper, 812,000 tonnes of zinc, 415,000 ounces of gold and 11 million ounces of silver over a 15.25 year mine life.

The report also estimated a pre-tax net present value of $555 million at a 10 per cent discount rate and an internal rate of return of 27 per cent, with an initial capital cost pegged at $489 million.

Sunridge is now working on finishing a final feasibility study, on track for April this year, after which the application for a mining license and permitting will follow, along with the social and environmental impact assessment.

Late last year, the company also unveiled a maiden resource for the Adi Rassi copper-gold deposit - the fifth deposit defined by the company at Asmara. The junior mineral explorer reported an inferred mineral resource of 15.77 million tonnes at Adi Rassi, with an average grade of 0.54% copper and 0.33 grams per tonne (g/t) gold.

"Although Sunridge's main focus has recently been completing the Asmara Project feasibility study and moving the four established deposits on the Asmara Project toward production, it is important to realize that the area remains highly prospective for new gold and base metal deposits" said president and CEO, Michael Hopley, in a statement earlier this month.

Indeed, the Kodadu volcanogenic-massive sulphide (VMS) target will see a program consisting of around 20 drill holes, specifically aiming for the oxide gold cap within the upper oxidized zones.

The junior explorer said that a 2009 trenching program by the company, in which 87 samples were taken, returned 28 gold values of over 0.2 grams per tonne (g/t), with the best values being 10.67 g/t over 14.7m, 2.3 g/t over 8m and 1.79 g/t over 13.3m.

It added that gold mineralization that has been found running parallel and about 100 metres west of Kodadu will also be drill tested.

Sunridge's upcoming feasibility study will now include early mining of the direct shipping ore (DSO) from Debarwa, and early heap-leaching of the surface gold material from the project, allowing more revenue to be generated earlier.

As a result, cash flow is expected a year earlier than presented in the prefeasibility study, now anticipated in 2015. Initial capital costs are also anticipated to be lower due to the new operating scenarios.

The company is targeting that full production at 4 million tonnes per year would be reached roughly 2 years after the start of mining activities.

http://www.proactiveinvestors.com/companies/news/40031/sunri…

Jan 30, 2013 | 12:12 pm by Deborah Bacal

Sunridge is now working on finishing a final feasibility study, on track for April this year, after which the application for a mining license and permitting will follow, along with the social and environmental impact assessment. Sunridge Gold Corp. (CVE:SGC) (OTCQX:SGCNF) shares popped on Wednesday as investors await a key feasibility study report for its Asmara project in Eritrea next quarter, while the junior gold explorer also works to grow the resource through further drilling.

Shares of Sunridge were up by 3 cents, or more than 12%, to 27.5 cents today. Its stock is up almost 30% so far this year.

Last week, the company started a reverse-circulation drill program at its Kodadu target on Asmara, where the company is also focused on completing a feasibility study on the already four established deposits.

The aim of its work at Kodadu is to quickly define a resource that could potentially be mined as feed to a gold plant at Emba Derho - one of the four established deposits. Kodadu is located around 25 kilometres south of Emba.

As of now, the Asmara project consists of the Emba Derho, Debarwa and Adi Nefas copper-zinc-gold and silver deposits and the Gupo gold deposit - all located within 40 kilometres of the capital city of Asmara.

The results of a preliminary feasibility study in May that considered all four deposits being processed at a central mill showed production of 365,000 tonnes of copper, 812,000 tonnes of zinc, 415,000 ounces of gold and 11 million ounces of silver over a 15.25 year mine life.

The report also estimated a pre-tax net present value of $555 million at a 10 per cent discount rate and an internal rate of return of 27 per cent, with an initial capital cost pegged at $489 million.

Sunridge is now working on finishing a final feasibility study, on track for April this year, after which the application for a mining license and permitting will follow, along with the social and environmental impact assessment.

Late last year, the company also unveiled a maiden resource for the Adi Rassi copper-gold deposit - the fifth deposit defined by the company at Asmara. The junior mineral explorer reported an inferred mineral resource of 15.77 million tonnes at Adi Rassi, with an average grade of 0.54% copper and 0.33 grams per tonne (g/t) gold.

"Although Sunridge's main focus has recently been completing the Asmara Project feasibility study and moving the four established deposits on the Asmara Project toward production, it is important to realize that the area remains highly prospective for new gold and base metal deposits" said president and CEO, Michael Hopley, in a statement earlier this month.

Indeed, the Kodadu volcanogenic-massive sulphide (VMS) target will see a program consisting of around 20 drill holes, specifically aiming for the oxide gold cap within the upper oxidized zones.

The junior explorer said that a 2009 trenching program by the company, in which 87 samples were taken, returned 28 gold values of over 0.2 grams per tonne (g/t), with the best values being 10.67 g/t over 14.7m, 2.3 g/t over 8m and 1.79 g/t over 13.3m.

It added that gold mineralization that has been found running parallel and about 100 metres west of Kodadu will also be drill tested.

Sunridge's upcoming feasibility study will now include early mining of the direct shipping ore (DSO) from Debarwa, and early heap-leaching of the surface gold material from the project, allowing more revenue to be generated earlier.

As a result, cash flow is expected a year earlier than presented in the prefeasibility study, now anticipated in 2015. Initial capital costs are also anticipated to be lower due to the new operating scenarios.

The company is targeting that full production at 4 million tonnes per year would be reached roughly 2 years after the start of mining activities.

http://www.proactiveinvestors.com/companies/news/40031/sunri…

SGCNF SGC

SGC

Hallo

ich freue mich, daß es jetzt auch einen Thread zu sunridge gibt. Ich beobachte die (und viele andere) schon eine ganze Weile. Bin allerdings erst seit 6 Monaten mit dem Thema Aktien vertraut, aber ich arbeite im Prinzip tag und nacht daran, zu lernen. Hab noch keine einzige Aktie, bin vorsichtig, aber irgendwann, ist das ERSTE Mal und vielleicht Sunridge.

Hier noch ein Beitrag von mir: Bei Kitco gibt es zwei Übersichten über Seniors und Juniors im Miningsektor von Bill Matlack. Sunridge ist da schon seit Monaten ein Strong buy!

http://www.kitco.com/ind/Matlack/01212012B.html

ich beobachte im Prinzip alle strong buys von dort und vergleiche das mit anderen Quellen. Einige werte werden auch hier in w:o diskutiert. hier mal die mit srongbuy bewerteten: MolyMines PolyMetMining CollosusMinerals UranerzEnergy.

Gruß es Karlchen

(nicht der GROSSE)

ich freue mich, daß es jetzt auch einen Thread zu sunridge gibt. Ich beobachte die (und viele andere) schon eine ganze Weile. Bin allerdings erst seit 6 Monaten mit dem Thema Aktien vertraut, aber ich arbeite im Prinzip tag und nacht daran, zu lernen. Hab noch keine einzige Aktie, bin vorsichtig, aber irgendwann, ist das ERSTE Mal und vielleicht Sunridge.

Hier noch ein Beitrag von mir: Bei Kitco gibt es zwei Übersichten über Seniors und Juniors im Miningsektor von Bill Matlack. Sunridge ist da schon seit Monaten ein Strong buy!

http://www.kitco.com/ind/Matlack/01212012B.html

ich beobachte im Prinzip alle strong buys von dort und vergleiche das mit anderen Quellen. Einige werte werden auch hier in w:o diskutiert. hier mal die mit srongbuy bewerteten: MolyMines PolyMetMining CollosusMinerals UranerzEnergy.

Gruß es Karlchen

(nicht der GROSSE)

Final bottom in gold stocks coming

By Jordan Roy-Byrne

February 1, 2013

http://www.resourceinvestor.com/2013/02/01/final-bottom-in-g…

By Jordan Roy-Byrne

February 1, 2013

http://www.resourceinvestor.com/2013/02/01/final-bottom-in-g…

Sunridge Gold reveals "encouraging" channel samples at Kodadu, drill results expected next month

http://www.proactiveinvestors.com/companies/news/40727/sunri…" target="_blank" rel="nofollow ugc noopener">http://www.proactiveinvestors.com/companies/news/40727/sunri…

http://www.proactiveinvestors.com/companies/news/40727/sunri…" target="_blank" rel="nofollow ugc noopener">http://www.proactiveinvestors.com/companies/news/40727/sunri…

Ach ja,hab den Grandich ganz vergessen:

http://www.grandich.com/2013/02/grandich-client-sunridge-gol…

http://www.grandich.com/2013/02/grandich-client-sunridge-gol…

Press Release

Sunridge Gold Drills 51 Metres of 1.71 g/t Gold at Kodadu Target, Asmara Project, Eritrea

Thursday Mar 7, 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=575…

Sunridge Gold Drills 51 Metres of 1.71 g/t Gold at Kodadu Target, Asmara Project, Eritrea

Thursday Mar 7, 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=575…

Sunridge Gold's Kodadu drill program proves successful for start of initial resource work

Friday, March 08, 2013 by Deborah Bacal

http://www.proactiveinvestors.com.au/companies/news/40547/su…

Friday, March 08, 2013 by Deborah Bacal

http://www.proactiveinvestors.com.au/companies/news/40547/su…

Sunridge Gold's Kodadu work has potential to add value to Asmara project, says broker

Saturday, March 09, 2013 by Deborah Bacal

http://www.proactiveinvestors.com.au/companies/news/40608/su…

Saturday, March 09, 2013 by Deborah Bacal

http://www.proactiveinvestors.com.au/companies/news/40608/su…

Thu May 23, 2013

Sunridge Gold Completes Initial Resource Estimate for Near Surface Gold on Kodadu Target, Asmara Project, Eritrea

Sunridge Gold Corp. ("Sunridge" or the "Company") (TSX.V:SGC; OTCQX:SGCNF) reports that it has completed an initial independent NI43-101 and JORC compliant mineral resource estimate for the near surface oxide gold cap (gossan), which is part of the Kodadu volcanogenic-massive-sulphide ("VMS") target, located on the Asmara project, Eritrea.

HIGHLIGHTS:

•Inferred Mineral Resource of 990,000 tonnes with an average grade of 1.24 g/t gold & 1.6 g/t silver

•Contained metal = 39,000 ounces of gold & 51,000 ounces of silver in the near surface oxide

•Less than 25 km from planned central operating facility near the Emba Derho deposit

•Initial metallurgical results show gold can be recovered by heap-leaching

•The resources area is open for expansion

•Further expansion drilling planned in 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=585…

Sunridge Gold Completes Initial Resource Estimate for Near Surface Gold on Kodadu Target, Asmara Project, Eritrea

Sunridge Gold Corp. ("Sunridge" or the "Company") (TSX.V:SGC; OTCQX:SGCNF) reports that it has completed an initial independent NI43-101 and JORC compliant mineral resource estimate for the near surface oxide gold cap (gossan), which is part of the Kodadu volcanogenic-massive-sulphide ("VMS") target, located on the Asmara project, Eritrea.

HIGHLIGHTS:

•Inferred Mineral Resource of 990,000 tonnes with an average grade of 1.24 g/t gold & 1.6 g/t silver

•Contained metal = 39,000 ounces of gold & 51,000 ounces of silver in the near surface oxide

•Less than 25 km from planned central operating facility near the Emba Derho deposit

•Initial metallurgical results show gold can be recovered by heap-leaching

•The resources area is open for expansion

•Further expansion drilling planned in 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=585…

Sunridge Gold's path to production shines as potential partners circle

Thursday, July 11, 2013 by Deborah Bacal

http://www.proactiveinvestors.com.au/companies/news/45432/su…

Thursday, July 11, 2013 by Deborah Bacal

http://www.proactiveinvestors.com.au/companies/news/45432/su…

Grandich Client Sunridge Gold

posted on July 11, 2013 at 8:21 AM.

"Please note – I’ve sold portions of other holdings in order to almost double my position in SGC. It has become among my holdings the most out of whack share price versus value of their projects. I simply can’t imagine how they can ‘t become a target of one or more companies at these levels given how advanced their projects now are and the incredible value of the metals within them."

http://www.grandich.com/2013/07/grandich-client-sunridge-gol…" target="_blank" rel="nofollow ugc noopener">

http://www.grandich.com/2013/07/grandich-client-sunridge-gol…

posted on July 11, 2013 at 8:21 AM.

"Please note – I’ve sold portions of other holdings in order to almost double my position in SGC. It has become among my holdings the most out of whack share price versus value of their projects. I simply can’t imagine how they can ‘t become a target of one or more companies at these levels given how advanced their projects now are and the incredible value of the metals within them."

http://www.grandich.com/2013/07/grandich-client-sunridge-gol…" target="_blank" rel="nofollow ugc noopener">

http://www.grandich.com/2013/07/grandich-client-sunridge-gol…

Peter Grandich | Thursday, July 11, 2013:

"I’ve stated for months now that the junior resource industry has been badly damaged and even long after metals prices and the market has bottomed, much of what we knew the industry to be will have either been changed dramatically or be gone forever.

Given one of my livelihoods is being a compensated consultant to companies that make up that industry, such a belief shall likely not be beneficial to me. You can be assured some will not like hearing those words from my mouth (It’s already been expressed by some recent clients who I now call “ex”).

There’s no joy in this stance and losing millions of dollars speculating on juniors and many client companies throughout the ordeal is not exactly what the doctor ordered for my sanity. However, as much as a few poor souls would have you think, me and Hebrew National have one thing in common – we both answer to a higher authority.

I felt both gold and the mining shares bottomed of late and the lift we’re seeing in gold now should help us begin a decent rally off the lows in mining shares for at least the foreseeable future. With that in mind, I’m going to give short but to the point analogies of Grandich clients ; plus one former client who dislike an honest evaluation of mine to the point that it help lead to me ouster."

Sunridge Gold – I’ve just about doubled my position in SGC, including biding for 500K shares this morning. My thinking may be only logical to me but when I look at what’s left of my portfolio (its about 75% less than two years ago) and I say what company remains that has the most assets in the ground and selling for the least, its SGC hands down. So like a gambler who’s getting killed at a crap table (been there, done that), I’ve decided to press but will be killed if the man yells “seven-out”!

http://www.grandich.com/2013/07/grandich-list-of-clients/

"I’ve stated for months now that the junior resource industry has been badly damaged and even long after metals prices and the market has bottomed, much of what we knew the industry to be will have either been changed dramatically or be gone forever.

Given one of my livelihoods is being a compensated consultant to companies that make up that industry, such a belief shall likely not be beneficial to me. You can be assured some will not like hearing those words from my mouth (It’s already been expressed by some recent clients who I now call “ex”).

There’s no joy in this stance and losing millions of dollars speculating on juniors and many client companies throughout the ordeal is not exactly what the doctor ordered for my sanity. However, as much as a few poor souls would have you think, me and Hebrew National have one thing in common – we both answer to a higher authority.

I felt both gold and the mining shares bottomed of late and the lift we’re seeing in gold now should help us begin a decent rally off the lows in mining shares for at least the foreseeable future. With that in mind, I’m going to give short but to the point analogies of Grandich clients ; plus one former client who dislike an honest evaluation of mine to the point that it help lead to me ouster."

Sunridge Gold – I’ve just about doubled my position in SGC, including biding for 500K shares this morning. My thinking may be only logical to me but when I look at what’s left of my portfolio (its about 75% less than two years ago) and I say what company remains that has the most assets in the ground and selling for the least, its SGC hands down. So like a gambler who’s getting killed at a crap table (been there, done that), I’ve decided to press but will be killed if the man yells “seven-out”!

http://www.grandich.com/2013/07/grandich-list-of-clients/

Schon auffällig, das Kaufinteresse in den letzten Tagen!

Wenn Grandich recht behält, sollte der Tiefpunkt überwunden sein...

Wenn Grandich recht behält, sollte der Tiefpunkt überwunden sein...

Das Volumen zieht nun auch in den USA an...

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

The Grandich Letter

posted on July 16, 2013 at 7:59 AM

...

"Sunridge Gold Corporation in recent days has become my single largest holdings (don’t get too exciting as doing similar moves in recent years has cost me plenty). I’ve done so for two key reasons:

They have the most attractive portfolio of projects that can bring the fastest and highest returns to a major or majors and a source that has been very alert to companies going into play feels Asian-based metals and mining companies are all over the part of the world SGC is located and SGC is dirt cheap for them.

Management has gone quiet on this front and while I’m not trying to read into something that’s not there to begin with, I’ve known some of the SGC players for well more than a decade and I’m speculating I’ve learn to read their voices (I also do windows).

I also believe neighbor Nevsun Resources (who some key players at SGC were once part of and I believe remains friends with) would IMHO not let SGC go out cheap. They have more than enough cash and/or equity to acquire SGC and in the end, I’m speculating SGC management would have a higher comfort level with NSU management versus an Asian-based firm – all things being equal.

We found the .20 level resistance yesterday (I bought 500k more shares yesterday) and it should be since the 200-Day M.A. sits there. I would limit any buying with a .20 limit but also wouldn’t try much below there on the belief whether or not a possible deal is coming, the share price is heading much higher. The answer to the natural typical follow-up question is “what do you think its worth?”. Some where between 3x-5x its current price.

The second question about skin in the game is legit. Unfortunately, when it comes to juniors, most historically don’t have much skin in the game because:

The principles involved are usually not very wealthy themselves

Feel they are putting the elbows to the ground in their job and the options they receive are their leverage to success

May have skin in game but do it in ways that they don’t have to report it regulatory wise (offshore, in other names, companies, etc)

In SGC case, I’ve known management for years and their work level is as high as it can be no matter how many shares one may own or not. That’s why I’m not concern about a supposed lack of incentive to do their best."

http://www.grandich.com/2013/07/if-i-could-only-buy-one/

posted on July 16, 2013 at 7:59 AM

...

"Sunridge Gold Corporation in recent days has become my single largest holdings (don’t get too exciting as doing similar moves in recent years has cost me plenty). I’ve done so for two key reasons:

They have the most attractive portfolio of projects that can bring the fastest and highest returns to a major or majors and a source that has been very alert to companies going into play feels Asian-based metals and mining companies are all over the part of the world SGC is located and SGC is dirt cheap for them.

Management has gone quiet on this front and while I’m not trying to read into something that’s not there to begin with, I’ve known some of the SGC players for well more than a decade and I’m speculating I’ve learn to read their voices (I also do windows).

I also believe neighbor Nevsun Resources (who some key players at SGC were once part of and I believe remains friends with) would IMHO not let SGC go out cheap. They have more than enough cash and/or equity to acquire SGC and in the end, I’m speculating SGC management would have a higher comfort level with NSU management versus an Asian-based firm – all things being equal.

We found the .20 level resistance yesterday (I bought 500k more shares yesterday) and it should be since the 200-Day M.A. sits there. I would limit any buying with a .20 limit but also wouldn’t try much below there on the belief whether or not a possible deal is coming, the share price is heading much higher. The answer to the natural typical follow-up question is “what do you think its worth?”. Some where between 3x-5x its current price.

The second question about skin in the game is legit. Unfortunately, when it comes to juniors, most historically don’t have much skin in the game because:

The principles involved are usually not very wealthy themselves

Feel they are putting the elbows to the ground in their job and the options they receive are their leverage to success

May have skin in game but do it in ways that they don’t have to report it regulatory wise (offshore, in other names, companies, etc)

In SGC case, I’ve known management for years and their work level is as high as it can be no matter how many shares one may own or not. That’s why I’m not concern about a supposed lack of incentive to do their best."

http://www.grandich.com/2013/07/if-i-could-only-buy-one/

Expert Comments:

Peter Grandich, The Grandich Letter (6/10/13) "The recently completed bankable feasibility study demonstrated that Sunridge Gold Corp.'s Asmara mine can produce a tremendous amount of copper, zinc, gold and silver and with very strong economics; management is looking to finance the project through a combination of debt, selling offtake and government participation. Alternatively, I believe Sunridge can soon have options from the large mining companies interested in copper and zinc."

Adam Lucas, Ocean Equities (5/24/13) "Sunridge Gold Corp. has announced that it has completed an initial resource estimate for the near surface oxide gold cap at the Kodadu target in the Asmara project in Eritrea. Total contained metal for the resource is 39 Koz gold and 51 Koz silver in the near surface oxide ore, with an average grade of 1.24 g/t gold and 1.6 g/t silver. . .located only 25km from the Emba Derho deposit, Kodadu may act as a future source of ore for the Asmara project, adding further value to the project. The deposit appears to have additional exploration potential and may increase in size through further resource definition."

Stefan Ioannou, Haywood Securities (5/23/13) "Sunridge Gold Corp. recently announced the (summary) results of a positive feasibility study (headed by SENET) for the company's 90%-owned polymetallic Asmara project. . .we look to finalization of the Eritrean government's (ENAMCO) paid project interest as a key catalyst for Sunridge. A fair valuation (purchase price) should lend additional comfort with respect to (Sunridge's share of) the Asmara project's economics, which are already underpinned by a robust feasibility study."

Peter Grandich, The Grandich Letter (5/23/13) "In my 30 years on Wall Street, Sunridge Gold Corp.'s projects are the most undervalued relative to what historically was paid for similar assets of any company I have owned or even known about. Eritrea and Madagascar, where the company's projects are located, are a lot better than the general perception."

Thibaut Lepouttre, Caesars Report (5/22/13) "Sunridge Gold Corp. has announced the results of the independent feasibility study on the Asmara project in Eritrea. The feasibility study has outlined a three-stage development plan, whereby only $46M is needed for the start of the production of the direct shippable copper ore and the gold leach stage. . .the average annual production for the first eight years will be ~ 42 Koz gold, 1Moz silver, 65 Mlb copper and in excess of 180 Mlbs zinc. As we like the combination of precious metals and zinc, the company might be attractive to both precious metals and base metals investors."

http://www.theaureport.com/pub/co/993#quote

Peter Grandich, The Grandich Letter (6/10/13) "The recently completed bankable feasibility study demonstrated that Sunridge Gold Corp.'s Asmara mine can produce a tremendous amount of copper, zinc, gold and silver and with very strong economics; management is looking to finance the project through a combination of debt, selling offtake and government participation. Alternatively, I believe Sunridge can soon have options from the large mining companies interested in copper and zinc."

Adam Lucas, Ocean Equities (5/24/13) "Sunridge Gold Corp. has announced that it has completed an initial resource estimate for the near surface oxide gold cap at the Kodadu target in the Asmara project in Eritrea. Total contained metal for the resource is 39 Koz gold and 51 Koz silver in the near surface oxide ore, with an average grade of 1.24 g/t gold and 1.6 g/t silver. . .located only 25km from the Emba Derho deposit, Kodadu may act as a future source of ore for the Asmara project, adding further value to the project. The deposit appears to have additional exploration potential and may increase in size through further resource definition."

Stefan Ioannou, Haywood Securities (5/23/13) "Sunridge Gold Corp. recently announced the (summary) results of a positive feasibility study (headed by SENET) for the company's 90%-owned polymetallic Asmara project. . .we look to finalization of the Eritrean government's (ENAMCO) paid project interest as a key catalyst for Sunridge. A fair valuation (purchase price) should lend additional comfort with respect to (Sunridge's share of) the Asmara project's economics, which are already underpinned by a robust feasibility study."

Peter Grandich, The Grandich Letter (5/23/13) "In my 30 years on Wall Street, Sunridge Gold Corp.'s projects are the most undervalued relative to what historically was paid for similar assets of any company I have owned or even known about. Eritrea and Madagascar, where the company's projects are located, are a lot better than the general perception."

Thibaut Lepouttre, Caesars Report (5/22/13) "Sunridge Gold Corp. has announced the results of the independent feasibility study on the Asmara project in Eritrea. The feasibility study has outlined a three-stage development plan, whereby only $46M is needed for the start of the production of the direct shippable copper ore and the gold leach stage. . .the average annual production for the first eight years will be ~ 42 Koz gold, 1Moz silver, 65 Mlb copper and in excess of 180 Mlbs zinc. As we like the combination of precious metals and zinc, the company might be attractive to both precious metals and base metals investors."

http://www.theaureport.com/pub/co/993#quote

"Why Stephan Bogner Believes You Should Be 100% Invested in Precious Metals"

Source: Brian Sylvester of The Gold Report (7/15/13)

http://www.theaureport.com/pub/na/15439

Source: Brian Sylvester of The Gold Report (7/15/13)

http://www.theaureport.com/pub/na/15439

Grandich Client Sunridge Gold

posted on July 23, 2013 at 9:27 AM

I believe Sunridge Gold is a major takeover target. I think we’re going to see many companies who have been hiding in the weeds come out now that the coast appears clear in gold and the worse over in the brutal junior resource bear market. SGC is a very attractive play that can be a near term producer with enormous upside potential. I control nearly 5 million shares.

Getting above $.20 is bullish and in this environment hard to not believe it can pop to key resistance at $.30. A buyer of the company could pay $.50 -$1 and not be close to overpaying.

http://www.grandich.com/2013/07/grandich-client-sunridge-gol…

posted on July 23, 2013 at 9:27 AM

I believe Sunridge Gold is a major takeover target. I think we’re going to see many companies who have been hiding in the weeds come out now that the coast appears clear in gold and the worse over in the brutal junior resource bear market. SGC is a very attractive play that can be a near term producer with enormous upside potential. I control nearly 5 million shares.

Getting above $.20 is bullish and in this environment hard to not believe it can pop to key resistance at $.30. A buyer of the company could pay $.50 -$1 and not be close to overpaying.

http://www.grandich.com/2013/07/grandich-client-sunridge-gol…

427k in den ersten 30 Handelsminuten!

Da sammelt offenbar jemand kräftig ein...

Da sammelt offenbar jemand kräftig ein...

TD Securities kaufen 238k in den ersten 30 Handelsminuten...

Peter Grandich on August 1, 2013

"Lawrence Roulston wrote an excellent piece on Sunridge Gold and is spot-on in the belief they’re a very attractive takeover target."

http://www.grandich.com/2013/08/

"Lawrence Roulston wrote an excellent piece on Sunridge Gold and is spot-on in the belief they’re a very attractive takeover target."

http://www.grandich.com/2013/08/

Antwort auf Beitrag Nr.: 45.162.795 von Videomart am 01.08.13 16:29:58Lawrence Roulston's Resource Opportunities

July 2013-2

Company Update

Sunridge Gold

(SGC-TSXV)

Sunridge, with a feasibility study completed

on its Asmara project in Eritrea,

is now working toward securing financing

for mine development and

obtaining the permits needed to develop

and operate the mine. They are

making good progress on both fronts.

Most of the studies have been completed

in support of the mining license

application. Formal submission is expected

imminently. The government is

anxious to see the project move forward

quickly, meaning that the mining

license application will be handled

expeditiously and is not expected to

delay project development.

The state-owned Eritrea National Mining

Corporation (ENAMCO) last July

agreed to acquire a 30% paid participating

interest in the project. Negotiations

are continuing with regard to setting

a purchase price, which will be on

commercial terms.

ENAMCO will then contribute 33 percent

of the capital expenditures as incurred.

The government also holds a

10 percent carried interest, which will

apply to the interest of both parties.

Financing efforts are being coordinated

by a financial group with considerable

success in arranging financing

for mining projects. In support of the

financing efforts, a leading independent

engineering firm is presently reviewing

the feasibility study on behalf

of potential lenders. There is a high

level of interest from lenders, recognizing

the very favorable economics of

this project and the success enjoyed by

Nevsun (NSU-TSX) in developing and

operating their Bisha mine in Eritrea.

The Asmara feasibility study contemplates

a three phase development plan.

The first phase will be to mine the

116,000 tonnes of high-grade ore

(15.6% copper, 3 g/t gold and 77 g/t

silver) which will be direct shipped to

a smelter. Mining that direct shipping

ore (DSO) will span about six months

and produce more than $100 million of

revenue, with only modest operating

expense. The capital expense incurred

in the DSO will be directly applicable

to the main project.

At the same time as mining the DSO,

mining of the gold oxide “caps” overlying

three of the base metal deposits

will begin, with the gold recovered by

heap leaching, producing five years of

cash flows, again with modest capital

expenditures and operating costs.

While mining the DSO and the gold

caps, the company would develop the

main ore bodies and construct the

processing facility. Production for the

first 1.25 years would come from an

enriched “supergene” zone, generating

high levels of cash flow early in the

mine life. Mining would be a combination

of open pit and underground, using

conventional flotation recovery.

The capital requirements, net of the

cash flow from the DSO ore and the

gold heap leach, would be about $350

million.

The Asmara projects is well located

for mine development, as it is less than

an hour drive from the main city in

Eritrea and only a couple of hours

from the port. The project has good

grades, it is easy to mine and it has

favorable metallurgy. The government

is highly supportive of mining, as

demonstrated by the success of the

Nevsun project.

North American investors may have

concerns about investing in Eritrea,

but that concern is misplaced. Nevsun

successfully developed and is profitably

operating its Bisha mine, which

involved participation of international

financial firms.

There are many mining companies that

would very much like to develop this

project. The biggest concern for shareholders

at this time is that Sunridge

will receive a takeover offer before

investors begin to recognize the value

of the large and highly attractive metal

deposits that they hold. Any offer

would be priced at a premium to the

market price at the time of the offer.

The share price will almost certainly

begin to track higher as investors gain

better insights into the nature of this

project and as investor sentiment improves

toward resources.

Price July 29, 2013: C$0.185

Shares Outstanding: 175 million

Shares Fully Diluted: 236 million

Market Cap: C$32.3 million

Contact: Investor Relations

604-688-1263

www.sunridgegold.com

http://www.grandich.com/wp-content/uploads/2013/08/Resource+…

July 2013-2

Company Update

Sunridge Gold

(SGC-TSXV)

Sunridge, with a feasibility study completed

on its Asmara project in Eritrea,

is now working toward securing financing

for mine development and

obtaining the permits needed to develop

and operate the mine. They are

making good progress on both fronts.

Most of the studies have been completed

in support of the mining license

application. Formal submission is expected

imminently. The government is

anxious to see the project move forward

quickly, meaning that the mining

license application will be handled

expeditiously and is not expected to

delay project development.

The state-owned Eritrea National Mining

Corporation (ENAMCO) last July

agreed to acquire a 30% paid participating

interest in the project. Negotiations

are continuing with regard to setting

a purchase price, which will be on

commercial terms.

ENAMCO will then contribute 33 percent

of the capital expenditures as incurred.

The government also holds a

10 percent carried interest, which will

apply to the interest of both parties.

Financing efforts are being coordinated

by a financial group with considerable

success in arranging financing

for mining projects. In support of the

financing efforts, a leading independent

engineering firm is presently reviewing

the feasibility study on behalf

of potential lenders. There is a high

level of interest from lenders, recognizing

the very favorable economics of

this project and the success enjoyed by

Nevsun (NSU-TSX) in developing and

operating their Bisha mine in Eritrea.

The Asmara feasibility study contemplates

a three phase development plan.

The first phase will be to mine the

116,000 tonnes of high-grade ore

(15.6% copper, 3 g/t gold and 77 g/t

silver) which will be direct shipped to

a smelter. Mining that direct shipping

ore (DSO) will span about six months

and produce more than $100 million of

revenue, with only modest operating

expense. The capital expense incurred

in the DSO will be directly applicable

to the main project.

At the same time as mining the DSO,

mining of the gold oxide “caps” overlying

three of the base metal deposits

will begin, with the gold recovered by

heap leaching, producing five years of

cash flows, again with modest capital

expenditures and operating costs.

While mining the DSO and the gold

caps, the company would develop the

main ore bodies and construct the

processing facility. Production for the

first 1.25 years would come from an

enriched “supergene” zone, generating

high levels of cash flow early in the

mine life. Mining would be a combination

of open pit and underground, using

conventional flotation recovery.

The capital requirements, net of the

cash flow from the DSO ore and the

gold heap leach, would be about $350

million.

The Asmara projects is well located

for mine development, as it is less than

an hour drive from the main city in

Eritrea and only a couple of hours

from the port. The project has good

grades, it is easy to mine and it has

favorable metallurgy. The government

is highly supportive of mining, as

demonstrated by the success of the

Nevsun project.

North American investors may have

concerns about investing in Eritrea,

but that concern is misplaced. Nevsun

successfully developed and is profitably

operating its Bisha mine, which

involved participation of international

financial firms.

There are many mining companies that

would very much like to develop this

project. The biggest concern for shareholders

at this time is that Sunridge

will receive a takeover offer before

investors begin to recognize the value

of the large and highly attractive metal

deposits that they hold. Any offer

would be priced at a premium to the

market price at the time of the offer.

The share price will almost certainly

begin to track higher as investors gain

better insights into the nature of this

project and as investor sentiment improves

toward resources.

Price July 29, 2013: C$0.185

Shares Outstanding: 175 million

Shares Fully Diluted: 236 million

Market Cap: C$32.3 million

Contact: Investor Relations

604-688-1263

www.sunridgegold.com

http://www.grandich.com/wp-content/uploads/2013/08/Resource+…

Grösster Käufer heute:

Canaccord Genuity Corp. mit 211.000 Stücken...

Canaccord Genuity Corp. mit 211.000 Stücken...

Grösster Käufer einmal mehr BMO Nesbitt Burns Inc. mit 145 k.

Im Gegensatz zu anderen Goldwerten Sunridge heut ohne Kursverlust...

Im Gegensatz zu anderen Goldwerten Sunridge heut ohne Kursverlust...

Gesamtvolumen bereits über 2 Millionen Shares!

Hier ist definitiv etwas im Gange...

Hier ist definitiv etwas im Gange...

Grandich Client Sunridge Gold

posted on August 8, 2013 at 7:24 AM

"I couldn’t go a week without having to put the work clothes back on yesterday. Many friends and readers kept asking about the trading in Sunridge Gold.

Fundamentally, I think Lawrence Roulston hit it on the head in this recent comment and please note the part he speaks of many companies having an interest in SGC. I fully agree with his assessment that we could be disappointed that a takeover occurred before we were able to see full value.

Technically, the stock has formed a bullish flag formation on the short term and is close to a major breakout on the long-term. If that occurs, there’s no technical argument that prevents it from running to key resistance at 0.52 Cad."

posted on August 8, 2013 at 7:24 AM

"I couldn’t go a week without having to put the work clothes back on yesterday. Many friends and readers kept asking about the trading in Sunridge Gold.

Fundamentally, I think Lawrence Roulston hit it on the head in this recent comment and please note the part he speaks of many companies having an interest in SGC. I fully agree with his assessment that we could be disappointed that a takeover occurred before we were able to see full value.

Technically, the stock has formed a bullish flag formation on the short term and is close to a major breakout on the long-term. If that occurs, there’s no technical argument that prevents it from running to key resistance at 0.52 Cad."

Potential Mining & Exploration Takeover Targets

posted on August 14, 2013 at 10:01 AM

"With gold and silver poised to resume their secular bull market and the horrific bear market in mining and exploration stocks apparently now behind us, I anticipate a “marked” increase in mergers and acquisitions (M&A) in the mining and exploration area.

Sunridge Gold - I’ve heard from more than one pass reliable source that the Chinese have greatly increased their interest in mining worldwide and in particular Eritrea. When pressed, SGC management clams up except to say numerous companies worldwide are looking at them and have signed confidentially agreements. I’m extremely bias but I think this is one junior to own ASAP for speculators."

http://www.grandich.com/2013/08/6-potential-mining-explorati…

posted on August 14, 2013 at 10:01 AM

"With gold and silver poised to resume their secular bull market and the horrific bear market in mining and exploration stocks apparently now behind us, I anticipate a “marked” increase in mergers and acquisitions (M&A) in the mining and exploration area.

Sunridge Gold - I’ve heard from more than one pass reliable source that the Chinese have greatly increased their interest in mining worldwide and in particular Eritrea. When pressed, SGC management clams up except to say numerous companies worldwide are looking at them and have signed confidentially agreements. I’m extremely bias but I think this is one junior to own ASAP for speculators."

http://www.grandich.com/2013/08/6-potential-mining-explorati…

Hier nochmal die wichtigsten Informationen zu Sunridge Gold von Lawrence Roulston aus Juli 2013:

Sunridge Gold

(SGC-TSXV)

http://www.grandich.com/wp-content/uploads/2013/08/Sunridge-…

Sunridge Gold

(SGC-TSXV)

http://www.grandich.com/wp-content/uploads/2013/08/Sunridge-…

Sunridge Gold Files Amended NI 43-101 Technical Report On The Feasibility Study For The Asmara Project, Eritrea

Wed Aug 21, 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=598…

Wed Aug 21, 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=598…

In welchem Hochrisiko-Staat sich Sunridge Gold zu etablieren versucht,

sollte natürlich weiterhin nicht verschwiegen werden...

http://www.ethiopianreview.com/forum/viewforum.php?f=2

sollte natürlich weiterhin nicht verschwiegen werden...

http://www.ethiopianreview.com/forum/viewforum.php?f=2

David gegen die Goliaths...

Aktuell frisst das Länderrisiko an der Performance, Eritrea ist "nah dran"...

Aktuell frisst das Länderrisiko an der Performance, Eritrea ist "nah dran"...

Eritrea’s Minerals: A Blessing or Curse?

By Jenny Vaughan on 10:21 am August 25, 2013

http://www.thejakartaglobe.com/business/eritreas-minerals-a-…

By Jenny Vaughan on 10:21 am August 25, 2013

http://www.thejakartaglobe.com/business/eritreas-minerals-a-…

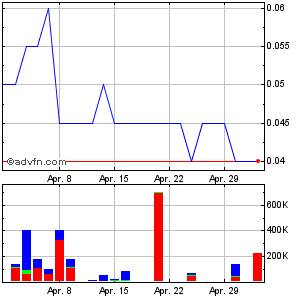

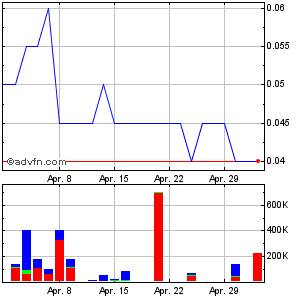

Charts for Sunridge Gold Corp. (SGC:CA)

6 months

6 months

Sunridge Gold Update - Activity On The Asmara Project, Eritrea

Wed Sep 4, 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=601…

Wed Sep 4, 2013

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=601…

Sunridge Gold makes great strides at Asmara project

Wednesday, Sept 4, 2013

by Fiona MacDonald

http://www.proactiveinvestors.com/companies/news/47692/sunri…

Wednesday, Sept 4, 2013

by Fiona MacDonald

http://www.proactiveinvestors.com/companies/news/47692/sunri…

Asmara Project Update—

Timely ENAMCO Negotiations Remain Key

Haywood Securities, 4 September 2013

http://www.grandich.com/wp-content/uploads/2013/09/SGCSep042…

Timely ENAMCO Negotiations Remain Key

Haywood Securities, 4 September 2013

http://www.grandich.com/wp-content/uploads/2013/09/SGCSep042…

Peter Grandich Q&A discussing Syria, the Fed’s QE program, and US job numbers

Published Sep 11, 2013

http://www.smallcappower.com/posts/peter-grandich-expert-int…

Published Sep 11, 2013

http://www.smallcappower.com/posts/peter-grandich-expert-int…

Thu Oct 3, 2013

Sunridge Gold Announces Increased Brokered Private Placement to $4 Million and Appoints New CFO

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=606…

Sunridge Gold Announces Increased Brokered Private Placement to $4 Million and Appoints New CFO

http://www.sunridgegold.com/s/PressReleases.asp?ReportID=606…

Sunridge Gold says fundraiser provides validation of the quality of its flagship asset

By Jeremy Naylor

December 09 2013, 9:36am

http://www.proactiveinvestors.co.uk/companies/stocktube/2404…