Mart Resources / Nigerdelta - Wachstum und Dividende - 500 Beiträge pro Seite

eröffnet am 15.02.13 17:44:06 von

neuester Beitrag 28.07.14 15:13:26 von

neuester Beitrag 28.07.14 15:13:26 von

Beiträge: 94

ID: 1.179.523

ID: 1.179.523

Aufrufe heute: 0

Gesamt: 11.034

Gesamt: 11.034

Aktive User: 0

ISIN: CA5729031024 · WKN: A0CAKJ

0,1680

EUR

+0,60 %

+0,0010 EUR

Letzter Kurs 30.03.16 Tradegate

Hallo, ich hätte zwar nie gedacht, daß ich mal einen Ölwert vorstelle, noch dazu im Nigerdelta mit all den damit verbundenen negativen Schlagzeilen, aber dennoch:

Mart Resources Inc.

gelistet an der TSX-V und in D,

Symbol: MMT

WKN: A0CAKJ

Kurs heute: 2,08 $

ausgegebene Aktien: knapp 360 mio Stücke

marketcap: knapp 750 mio $

Warum ich die Aktie interessant finde ?

Das erklärt sich am Besten anhand dreier Grafiken.

Die bekomme ich hier allerdings nicht vernünftig eingestellt.

Es fehlen die Textangaben (Jahreszahlen, Mengen, Beträge).

Ihr müßt dazu in die entsprechende Präsentation schauen,

auf Seite 15, 16 und 17:

http://www.martresources.com/wp-content/uploads/2012/06/Mart-Resources-AGM-Presentation_28Jun12.pdf

Außerdem wird seit 2010 Dividende gezahlt, 0,05 $ / Quartal. Quelle ebenfalls obiger link, Seite 5.

Aus der Präsentation zur AGM im Juni 2012:

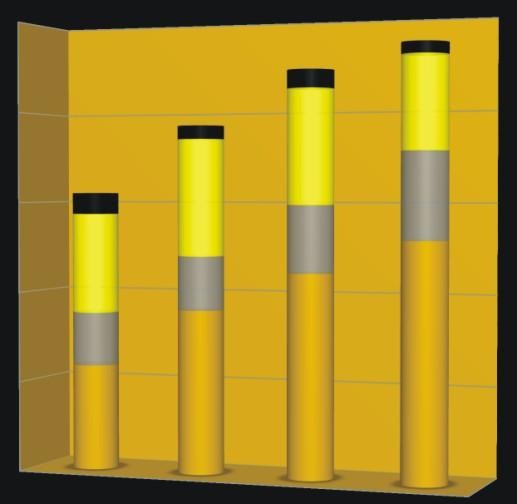

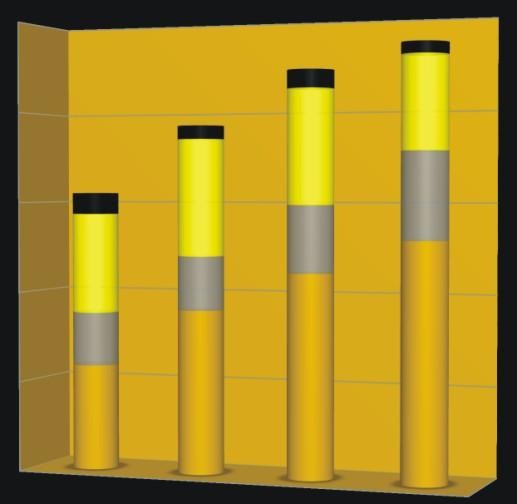

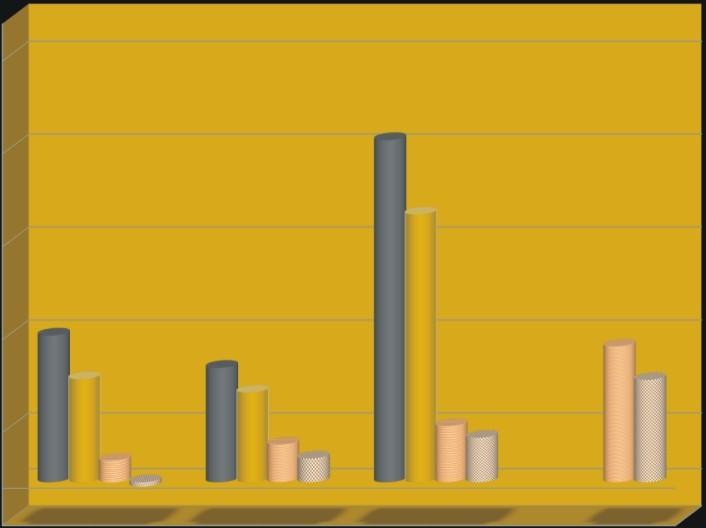

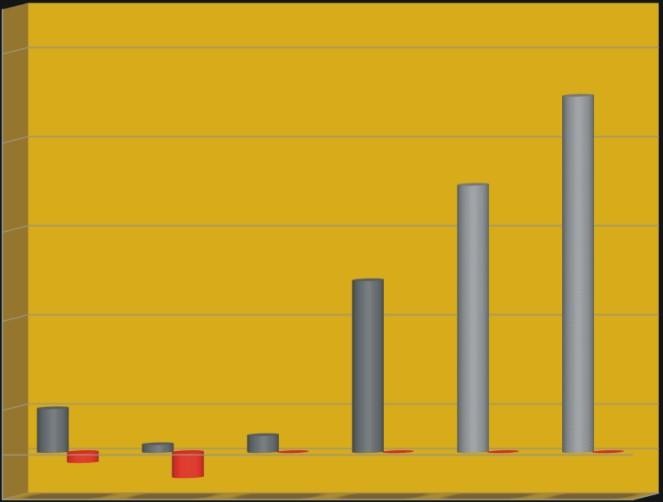

Grafik 1 - Reserven:

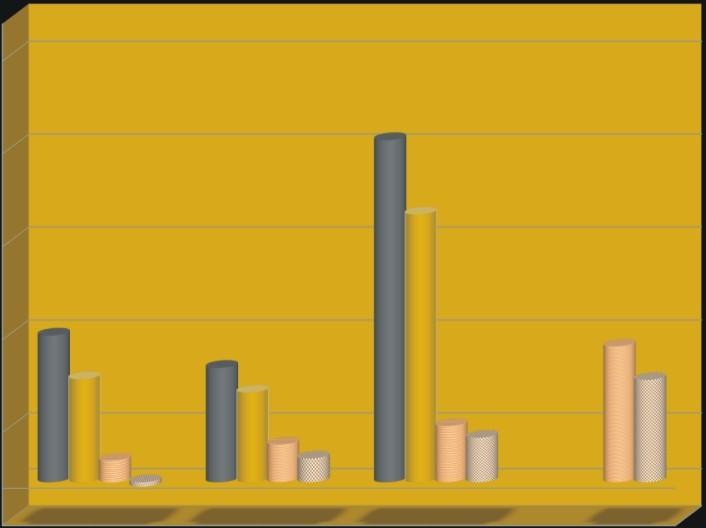

Grafik 2 - Öl-Verkauf und cash flow:

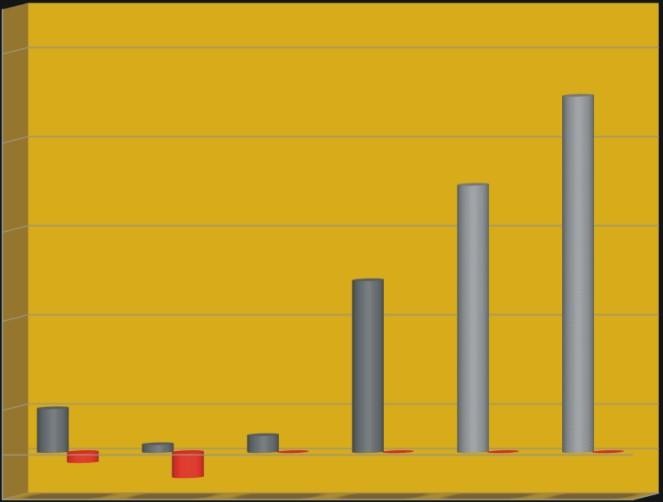

Grafik 3 - cash position:

Kursverlauf 5 Jahre:

Kursverlauf 1 Jahr:

Quelle der Kursgrafiken: http://www.stockhouse.com/companies/overview/v.mmt

Mart Resources Inc.

gelistet an der TSX-V und in D,

Symbol: MMT

WKN: A0CAKJ

Kurs heute: 2,08 $

ausgegebene Aktien: knapp 360 mio Stücke

marketcap: knapp 750 mio $

Warum ich die Aktie interessant finde ?

Das erklärt sich am Besten anhand dreier Grafiken.

Die bekomme ich hier allerdings nicht vernünftig eingestellt.

Es fehlen die Textangaben (Jahreszahlen, Mengen, Beträge).

Ihr müßt dazu in die entsprechende Präsentation schauen,

auf Seite 15, 16 und 17:

http://www.martresources.com/wp-content/uploads/2012/06/Mart-Resources-AGM-Presentation_28Jun12.pdf

Außerdem wird seit 2010 Dividende gezahlt, 0,05 $ / Quartal. Quelle ebenfalls obiger link, Seite 5.

Aus der Präsentation zur AGM im Juni 2012:

Grafik 1 - Reserven:

Grafik 2 - Öl-Verkauf und cash flow:

Grafik 3 - cash position:

Kursverlauf 5 Jahre:

Kursverlauf 1 Jahr:

Quelle der Kursgrafiken: http://www.stockhouse.com/companies/overview/v.mmt

Die core property von Mart ist das

Umusadege Oil Field.

Oil production commenced from the Umusadege field in 2008 and has produced over 3 million barrels of oil as of September, 2011.

The field production increased to approximately 10,525 barrels per day by May, 2011.

Our development program continually focuses on developing and evaluating the field’s production and reserve potential.

Quelle: http://www.martresources.com/about-us/

Umusadege Oil Field.

Oil production commenced from the Umusadege field in 2008 and has produced over 3 million barrels of oil as of September, 2011.

The field production increased to approximately 10,525 barrels per day by May, 2011.

Our development program continually focuses on developing and evaluating the field’s production and reserve potential.

Quelle: http://www.martresources.com/about-us/

Hier findet man die quarterlies, annuals und MD&As:

http://www.martresources.com/investor-relations/financial-re…

http://www.martresources.com/investor-relations/financial-re…

Canadian office:

Mart Resources Inc.

310, 1167 Kensington Crescent

NW Calgary, Alberta T2N 1X7

CanadaTel: +1 403 270 1841

Fax: +1 403 521 0443

info@martresources.com

http://www.martresources.com

Mart Resources Inc.

310, 1167 Kensington Crescent

NW Calgary, Alberta T2N 1X7

CanadaTel: +1 403 270 1841

Fax: +1 403 521 0443

info@martresources.com

http://www.martresources.com

Umusadege Field Summary

Discovered

Discovered by the UMU-‐1 well in 1974.

Six wells have been completed for production including the most recent UMU-‐9 well. Field production from UMU-‐1,5,6,7,8 and 9 currently averaging over 12,000 bopd.

Central processing facilities upgraded to 35,000 bopd capacity and export via pipeline system to AGIP Brass River Terminal.

UMU-9 well flowed at a combined stabilized rate of 11,718 bopd from the 5 zonestested.

The UMU-9 well is the first well drilled on the eastern extension of the Umusadegefield which had previously no assigned proved reserves.

Furtherwells planned for 2012/13 include UMU-10 and UMU-11 and possibly a horizontal well.

Quelle: http://www.martresources.com/wp-content/uploads/2012/06/Mart… Seite 8

Discovered

Discovered by the UMU-‐1 well in 1974.

Six wells have been completed for production including the most recent UMU-‐9 well. Field production from UMU-‐1,5,6,7,8 and 9 currently averaging over 12,000 bopd.

Central processing facilities upgraded to 35,000 bopd capacity and export via pipeline system to AGIP Brass River Terminal.

UMU-9 well flowed at a combined stabilized rate of 11,718 bopd from the 5 zonestested.

The UMU-9 well is the first well drilled on the eastern extension of the Umusadegefield which had previously no assigned proved reserves.

Furtherwells planned for 2012/13 include UMU-10 and UMU-11 and possibly a horizontal well.

Quelle: http://www.martresources.com/wp-content/uploads/2012/06/Mart… Seite 8

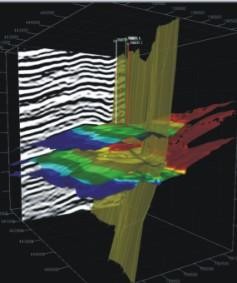

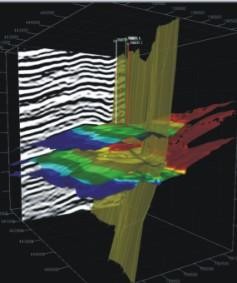

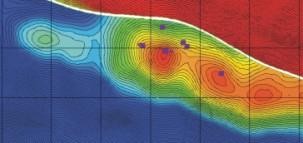

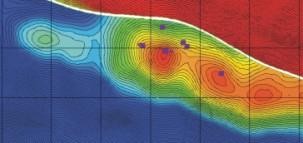

Hier eine Darstellung der property-Entwicklung.

In der Bildmitte die existierenden Wellen, incl. der geplanten UMU-10 Bohrung

Links und rechts davon, also westlich und östlich, die zukünftig zu explorierenden Teile der property

Dazu das work program für 201272013 aus folfender Präsentation

http://www.martresources.com/wp-content/uploads/2012/10/Mart…

Seite 5

In der Bildmitte die existierenden Wellen, incl. der geplanten UMU-10 Bohrung

Links und rechts davon, also westlich und östlich, die zukünftig zu explorierenden Teile der property

Dazu das work program für 201272013 aus folfender Präsentation

http://www.martresources.com/wp-content/uploads/2012/10/Mart…

Seite 5

News vom 9. Januar bezüglich UMU-10 Testbohrung:

http://www.martresources.com/wp-content/uploads/2010/06/umu-…

U.U.:

"• 1,943 barrels of oil per day (“bopd”) stabilized flow rate achieved during clean up from the XXI sand on a reduced 28/64 choke.

• Four more tests remain to be done on sands perforated and completed in the UMU-10 well."

http://www.martresources.com/wp-content/uploads/2010/06/umu-…

U.U.:

"• 1,943 barrels of oil per day (“bopd”) stabilized flow rate achieved during clean up from the XXI sand on a reduced 28/64 choke.

• Four more tests remain to be done on sands perforated and completed in the UMU-10 well."

Wir sind ja in Nigeria  :

:

Auch aus obiger news:

"As previously reported, there was no production from the Umusadege field in November 2012 through December 20, 2012 due to a shutdown of the export pipeline that started on Octobern 30, 2012."

:

:Auch aus obiger news:

"As previously reported, there was no production from the Umusadege field in November 2012 through December 20, 2012 due to a shutdown of the export pipeline that started on Octobern 30, 2012."

Lage von Usumadege:

Man erkennt die Pipeline von Usumadege zu Avia.

Es soll eine Pipeline gebaut werden zur Einspeisung des Öls in die Shell-Pipeline. Hierfür sind in 2012 bereits Ausgaben getätigt worden (siehe financials), Fertigstellung ist geplant für die 2. Jahreshälfte 2013 (siehe hierzu http://www.martresources.com/wp-content/uploads/2012/10/Mart…, Seite 5)

Die Kapazität soll um die 40.000 bopd betragen, womit die Produktion gesteigert werden soll !

Ich habe die ca. 40.000 bopd vorhin irgendwo gelesen, aber finde es verdammt nochmal nicht mehr, muß also hier link-/Quellenmäßig gerade mal passen.

Man erkennt die Pipeline von Usumadege zu Avia.

Es soll eine Pipeline gebaut werden zur Einspeisung des Öls in die Shell-Pipeline. Hierfür sind in 2012 bereits Ausgaben getätigt worden (siehe financials), Fertigstellung ist geplant für die 2. Jahreshälfte 2013 (siehe hierzu http://www.martresources.com/wp-content/uploads/2012/10/Mart…, Seite 5)

Die Kapazität soll um die 40.000 bopd betragen, womit die Produktion gesteigert werden soll !

Ich habe die ca. 40.000 bopd vorhin irgendwo gelesen, aber finde es verdammt nochmal nicht mehr, muß also hier link-/Quellenmäßig gerade mal passen.

Nicht Avia - Agip ...

guter wert. bis jetzt der traum eines jeden anlegers. 2009 eingestiegen und alle halben jahre 100% dividentenrendite, daß wäre klasse

Tja, bin spät auf Mart aufmerksam geworden. Und auch das war nur ein Zufall. Wäre man hier schon länger drin gewesen, wäre bereits jetzt ein 20-bagger drin gewesen ...

Hätte, wäre, wenn

Gruß, praesens

Hätte, wäre, wenn

Gruß, praesens

Antwort auf Beitrag Nr.: 44.148.500 von praesens am 15.02.13 23:41:09

schöner chartverlauf aber leider 3 jahre zu spät vorgestellt.dann komm lieber mit rüber zu northland die sind wieder ganz billig und wenn alles gut wird bald wieder ganz teuer.

schöner chartverlauf aber leider 3 jahre zu spät vorgestellt.dann komm lieber mit rüber zu northland die sind wieder ganz billig und wenn alles gut wird bald wieder ganz teuer.

schöner chartverlauf aber leider 3 jahre zu spät vorgestellt.dann komm lieber mit rüber zu northland die sind wieder ganz billig und wenn alles gut wird bald wieder ganz teuer.

schöner chartverlauf aber leider 3 jahre zu spät vorgestellt.dann komm lieber mit rüber zu northland die sind wieder ganz billig und wenn alles gut wird bald wieder ganz teuer.

Ich bin der Meinung das die Aktie noch einiges an Potential hat.

Außerdem ist die Dividende jetzt schon richtig gut!

Wird die Pipeline fertig gestellt können sich die Aktionäre

auf noch mehr Dividende freuen.

Bin sehr froh diese Aktie im Depot zu haben.

Werde die Position noch aufstocken!!

Außerdem ist die Dividende jetzt schon richtig gut!

Wird die Pipeline fertig gestellt können sich die Aktionäre

auf noch mehr Dividende freuen.

Bin sehr froh diese Aktie im Depot zu haben.

Werde die Position noch aufstocken!!

Nächster Schub kommt wenn die Pipeline läuft im Q3/Q4. Produktion kann sich dann verdoppeln. Entweder dann in die Erwartung der News oder spätestens mit den News verkaufen, es sei denn MMT kann bis dahin neues Potential/Projekte zeigen.

Antwort auf Beitrag Nr.: 44.146.915 von praesens am 15.02.13 17:44:06Klasse-Thread-Eröffnung! Gute, informative Präsentation! Sowas ist mittlerweile leider sehr selten geworden in W-O-Land!

+ ein sehr interessanter Wert ists auch noch! Nur schade, daß "man" (Du, ich, "Alle"(?) ...) erst jetzt drauf aufmerksam werden!

Dicker Daumen jedenfalls!

VG, tp

P.S.: die ~40k bopd, die Du in #9 gesucht hast, stehen doch (beinahe) in #5: Central processing facilities upgraded to 35,000 bopd capacity

+ ein sehr interessanter Wert ists auch noch! Nur schade, daß "man" (Du, ich, "Alle"(?) ...) erst jetzt drauf aufmerksam werden!

Dicker Daumen jedenfalls!

VG, tp

P.S.: die ~40k bopd, die Du in #9 gesucht hast, stehen doch (beinahe) in #5: Central processing facilities upgraded to 35,000 bopd capacity

Hallo tradepunk,

danke für die Blumen !

Mit der Quelle zu den 35.000 bopd hat Du Recht.

Ich hatte mich versteift auf diese Quelle mit gut 40.000 bopd - Brett vor´m Kopf ...

Gruß, praesens

danke für die Blumen !

Mit der Quelle zu den 35.000 bopd hat Du Recht.

Ich hatte mich versteift auf diese Quelle mit gut 40.000 bopd - Brett vor´m Kopf ...

Gruß, praesens

@Preasens

Danke für die gute Darlegung.

Ich habe vor ein paar Tagen gekauft und nach meiner Recherche nochmals nachgekauft. Super Aktie, der Chart hat eh schon alles gesagt, die Fundamentalzahlen bestätigen es.

Ich könne mir vorstellen, dass irgendwann Ende 2013 auf die Dividende 10 Cent/Quartal erhöht wird.

@Börsenkrieger

Danke für den guten Tipp!

Die Goldeule

Danke für die gute Darlegung.

Ich habe vor ein paar Tagen gekauft und nach meiner Recherche nochmals nachgekauft. Super Aktie, der Chart hat eh schon alles gesagt, die Fundamentalzahlen bestätigen es.

Ich könne mir vorstellen, dass irgendwann Ende 2013 auf die Dividende 10 Cent/Quartal erhöht wird.

@Börsenkrieger

Danke für den guten Tipp!

Die Goldeule

Antwort auf Beitrag Nr.: 44.160.007 von goldeule am 19.02.13 19:20:20Danke, goldeule !

boersenkrieger ist hier auch investiert ? - Na dann mal ein "schön Dich wieder zu treffen".

Mart und das Potential ...

... klar, im nachhinein ist man immer schlauer und kann sagen, daß nicht nochmal ein 20-bagger drin sein wird.

Aber das muß es ja auch nicht.

Ich lehne mich mal aus dem Fenster, obwohl solche Prognosen letztendlich reiner Humbug sind:

100 % halte ich allemal für möglich bei Inbetriebnahme der neuen Pipeline und Verdoppelung der Förder-/Einspeisemenge.

Darüberhinaus wird die Ressource auf Umusadege ausgeweitet werden können ...?

Werden andere properties akquiriert werden können, die vielleicht auch erfolgreich sein können / werden ...?

Daneben frage ich mich, ob nicht für Mart ein Verlassen der TSX-V und ein listing in einem Segment eines big boards Sinn macht ...?

Gruß, praesens

boersenkrieger ist hier auch investiert ? - Na dann mal ein "schön Dich wieder zu treffen".

Mart und das Potential ...

... klar, im nachhinein ist man immer schlauer und kann sagen, daß nicht nochmal ein 20-bagger drin sein wird.

Aber das muß es ja auch nicht.

Ich lehne mich mal aus dem Fenster, obwohl solche Prognosen letztendlich reiner Humbug sind:

100 % halte ich allemal für möglich bei Inbetriebnahme der neuen Pipeline und Verdoppelung der Förder-/Einspeisemenge.

Darüberhinaus wird die Ressource auf Umusadege ausgeweitet werden können ...?

Werden andere properties akquiriert werden können, die vielleicht auch erfolgreich sein können / werden ...?

Daneben frage ich mich, ob nicht für Mart ein Verlassen der TSX-V und ein listing in einem Segment eines big boards Sinn macht ...?

Gruß, praesens

http://www.marketwire.com/press-release/mart-resources-inc-u…

"Mart Resources, Inc.

TSX VENTURE : MMT

March 01, 2013 08:30 ET

Mart Resources, Inc.: UMU-10 Well Update and December 2012 and January 2013 Operational Update

CALGARY, ALBERTA--(Marketwire - March 1, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT)

Testing of the UMU-10 well has been successfully completed on three sands and oil has flowed to surface and testing has been concluded. The Company will release updated results once the review and evaluation of the test data is completed.

The rig has now been skidded to the last drill slot on the pad and the rig is being set up and upgraded to prepare for the UMU-11 well.

The Operator plans to return to the UMU-10 well after drilling the UMU-11 well to carry out testing operations on the two remaining oil zones.

Umusadege field production averaged 11,459 barrels of oil per day ("bopd") during January 2013; average field production based on production days was 11,841 bopd during January 2013.

Umusadege field net deliveries into the export pipeline were approximately 355,000 barrels of oil ("bbls") in January 2013 before pipeline losses.

Umusadege field production and deliveries into the export pipeline were shut down during November and for 24 days in December 2012. Umusadege field production averaged 2,705 bopd during December 2012; average field production based on production days was 11,980 bopd during December 2012. Umusadege field net deliveries into the export pipeline were approximately 89,000 bbls in December 2012 before pipeline losses.

Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are pleased to announce additional initial flow rate test results for the UMU-10 well, updates on Umusadege field production, and an update on the progress to tie into the Shell Export Pipeline.

UMU-10 Well Test Results

The UMU-10 well encountered 479 feet of gross hydrocarbon pay in 20 sands. Six of these sands, XVIIa & XVIIb (commingled), XVIIIa, XIX, XXb, and XXI, have been perforated and completed for production. Any two of these zones can be produced simultaneously using dual string sliding sleeve completion technology. The sands completed in UMU-10 are expected to access 161 feet of the total 479 feet of gross pay in the well.

Flow rate tests during initial testing operations have now been completed on the XVIIa&b (commingled) sands and the XVIIIa sand and oil has flowed to surface. The results of these tests will be released once the review and evaluation of the test data is completed.

As previously announced, the first extended flow rate test was conducted on the XXI sand, the deepest of the sands to be tested, at a stabilized rate of 1,943 bopd during initial well testing. During the test of the XXI sand, the well flowed 55.3 API gravity oil through 3 1/2 inch tubing on a 28/64 inch choke at a flowing tubing pressure of 1260 psi. BS&W was 5% with a gas/oil ratio of approximately 588 standard cubic feet per barrel.

The rig has now been skidded to the last drill slot on the pad and the rig is being set up and upgraded to prepare for the UMU-11 well. The Operator plans to return to the UMU-10 well after drilling the UMU-11 well to carry out the remaining two testing operations on sands XXb and XIX in the long string. Multirate flow testing will then be performed on all sands completed in the long string: XIX, XXb, and XXI.

December 2012 and January 2013 Production Update

Umusadege field production during December 2012 averaged 2,705 bopd. Umusadege field downtime during December 2012 totaled 24 days. The average field production based on producing days was 11,980 bopd in December 2012.

Total crude oil deliveries into the export pipeline from the Umusadege field for December 2012 were approximately 89,000 bbls before pipeline losses. Pipeline and export facility losses for December 2012 as reported to Mart by the pipeline operator were 14,919 bbls or approximately 16.7% of total crude deliveries.

Umusadege field production during January 2013 averaged 11,459 bopd. Umusadege field downtime during January 2013 totaled 1 day. The average field production based on producing days was 11,841 bopd in January 2013.

Total crude oil deliveries into the export pipeline from the Umusadege field for January 2013 were approximately 367,000 bbls before pipeline losses. Pipeline and export facility losses for January 2013 have not yet been reported to Mart by the pipeline operator.

In December 2012, 600,000 bbls were lifted from the export facility on behalf of Mart and its co-venturers. Payment for these sales of oil were received in January and February 2013, and Mart and its co-venturers owe the exporter approximately 300,000 bbls as of the end of January in connection with the December 2012 liftings.

Production from the Umusadege field has been down for approximately 10 days in February 2013 due to a maintenance shutdown by the pipeline operator.

Shell Export Pipeline

Mart and its co-venturers are proceeding with plans to provide a second independent export pipeline for Umusadege field production. The pipe arrived in Nigeria in late December and has been trucked to site. Right-of-way agreements required for the construction of the pipeline have been negotiated and completed, and clearing of the pipeline right-of-way is underway and ongoing. It is anticipated that ditching operations will begin shortly, and the pipeline construction contractor will begin working from two locations: one near the Umusadege field and one near the midpoint between Umusadege and the Shell Export station. Other pipeline and facility design and specification requirements are being completed and necessary equipment is being procured and will be delivered concurrent with the pipeline construction.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

INVESTOR RELATIONS:

Investors are also welcome to contact one of the following investor relations specialists for all corporate updates and investor inquiries:

FronTier Consulting Ltd.

Mart toll free # 1-888-875-7485

Attn: Sam Grier

Timea Carlsen

Email: inquiries@martresources.com"

"Mart Resources, Inc.

TSX VENTURE : MMT

March 01, 2013 08:30 ET

Mart Resources, Inc.: UMU-10 Well Update and December 2012 and January 2013 Operational Update

CALGARY, ALBERTA--(Marketwire - March 1, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT)

Testing of the UMU-10 well has been successfully completed on three sands and oil has flowed to surface and testing has been concluded. The Company will release updated results once the review and evaluation of the test data is completed.

The rig has now been skidded to the last drill slot on the pad and the rig is being set up and upgraded to prepare for the UMU-11 well.

The Operator plans to return to the UMU-10 well after drilling the UMU-11 well to carry out testing operations on the two remaining oil zones.

Umusadege field production averaged 11,459 barrels of oil per day ("bopd") during January 2013; average field production based on production days was 11,841 bopd during January 2013.

Umusadege field net deliveries into the export pipeline were approximately 355,000 barrels of oil ("bbls") in January 2013 before pipeline losses.

Umusadege field production and deliveries into the export pipeline were shut down during November and for 24 days in December 2012. Umusadege field production averaged 2,705 bopd during December 2012; average field production based on production days was 11,980 bopd during December 2012. Umusadege field net deliveries into the export pipeline were approximately 89,000 bbls in December 2012 before pipeline losses.

Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are pleased to announce additional initial flow rate test results for the UMU-10 well, updates on Umusadege field production, and an update on the progress to tie into the Shell Export Pipeline.

UMU-10 Well Test Results

The UMU-10 well encountered 479 feet of gross hydrocarbon pay in 20 sands. Six of these sands, XVIIa & XVIIb (commingled), XVIIIa, XIX, XXb, and XXI, have been perforated and completed for production. Any two of these zones can be produced simultaneously using dual string sliding sleeve completion technology. The sands completed in UMU-10 are expected to access 161 feet of the total 479 feet of gross pay in the well.

Flow rate tests during initial testing operations have now been completed on the XVIIa&b (commingled) sands and the XVIIIa sand and oil has flowed to surface. The results of these tests will be released once the review and evaluation of the test data is completed.

As previously announced, the first extended flow rate test was conducted on the XXI sand, the deepest of the sands to be tested, at a stabilized rate of 1,943 bopd during initial well testing. During the test of the XXI sand, the well flowed 55.3 API gravity oil through 3 1/2 inch tubing on a 28/64 inch choke at a flowing tubing pressure of 1260 psi. BS&W was 5% with a gas/oil ratio of approximately 588 standard cubic feet per barrel.

The rig has now been skidded to the last drill slot on the pad and the rig is being set up and upgraded to prepare for the UMU-11 well. The Operator plans to return to the UMU-10 well after drilling the UMU-11 well to carry out the remaining two testing operations on sands XXb and XIX in the long string. Multirate flow testing will then be performed on all sands completed in the long string: XIX, XXb, and XXI.

December 2012 and January 2013 Production Update

Umusadege field production during December 2012 averaged 2,705 bopd. Umusadege field downtime during December 2012 totaled 24 days. The average field production based on producing days was 11,980 bopd in December 2012.

Total crude oil deliveries into the export pipeline from the Umusadege field for December 2012 were approximately 89,000 bbls before pipeline losses. Pipeline and export facility losses for December 2012 as reported to Mart by the pipeline operator were 14,919 bbls or approximately 16.7% of total crude deliveries.

Umusadege field production during January 2013 averaged 11,459 bopd. Umusadege field downtime during January 2013 totaled 1 day. The average field production based on producing days was 11,841 bopd in January 2013.

Total crude oil deliveries into the export pipeline from the Umusadege field for January 2013 were approximately 367,000 bbls before pipeline losses. Pipeline and export facility losses for January 2013 have not yet been reported to Mart by the pipeline operator.

In December 2012, 600,000 bbls were lifted from the export facility on behalf of Mart and its co-venturers. Payment for these sales of oil were received in January and February 2013, and Mart and its co-venturers owe the exporter approximately 300,000 bbls as of the end of January in connection with the December 2012 liftings.

Production from the Umusadege field has been down for approximately 10 days in February 2013 due to a maintenance shutdown by the pipeline operator.

Shell Export Pipeline

Mart and its co-venturers are proceeding with plans to provide a second independent export pipeline for Umusadege field production. The pipe arrived in Nigeria in late December and has been trucked to site. Right-of-way agreements required for the construction of the pipeline have been negotiated and completed, and clearing of the pipeline right-of-way is underway and ongoing. It is anticipated that ditching operations will begin shortly, and the pipeline construction contractor will begin working from two locations: one near the Umusadege field and one near the midpoint between Umusadege and the Shell Export station. Other pipeline and facility design and specification requirements are being completed and necessary equipment is being procured and will be delivered concurrent with the pipeline construction.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

INVESTOR RELATIONS:

Investors are also welcome to contact one of the following investor relations specialists for all corporate updates and investor inquiries:

FronTier Consulting Ltd.

Mart toll free # 1-888-875-7485

Attn: Sam Grier

Timea Carlsen

Email: inquiries@martresources.com"

www.marketwire.com/press-release/mart-resources-inc-february…

"Mart Resources, Inc.

TSX VENTURE : MMT

March 08, 2013 09:18 ET

Mart Resources, Inc.: February 2013 Production Update

- Umusadege field production averaged 6,458 barrels of oil per day ("bopd") during February 2013 based on calendar days; average field production based on production days was 12,740 bopd during February 2013.

- Umusadege field net deliveries into the export pipeline were approximately 181,000 barrels of oil ("bbls") in February 2013 before pipeline losses.

CALGARY, ALBERTA--(Marketwire - March 8, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production for February 2013.

February 2013 Production Update

Umusadege field production during February 2013 averaged 6,458 bopd. Umusadege field downtime during February 2013 was 14 days due mainly to maintenance on the export pipeline performed by the pipeline operator. The average field production based on producing days was 12,740 bopd in February 2013.

Total crude oil deliveries into the export pipeline from the Umusadege field for February 2013 were approximately 181,000 bbls before pipeline losses. Pipeline and export facility losses for January 2013 as reported by the operator were 52,842 bbls or approximately 14.1% of total crude deliveries. February pipeline and export facility losses have not yet been reported by the pipeline operator.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

INVESTOR RELATIONS:

Investors are also welcome to contact the following investor relations specialists for all corporate updates and investor inquiries:

FronTier Consulting Ltd.

Mart toll free # 1-888-875-7485

Email: inquiries@martresources.com

..."

"Mart Resources, Inc.

TSX VENTURE : MMT

March 08, 2013 09:18 ET

Mart Resources, Inc.: February 2013 Production Update

- Umusadege field production averaged 6,458 barrels of oil per day ("bopd") during February 2013 based on calendar days; average field production based on production days was 12,740 bopd during February 2013.

- Umusadege field net deliveries into the export pipeline were approximately 181,000 barrels of oil ("bbls") in February 2013 before pipeline losses.

CALGARY, ALBERTA--(Marketwire - March 8, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production for February 2013.

February 2013 Production Update

Umusadege field production during February 2013 averaged 6,458 bopd. Umusadege field downtime during February 2013 was 14 days due mainly to maintenance on the export pipeline performed by the pipeline operator. The average field production based on producing days was 12,740 bopd in February 2013.

Total crude oil deliveries into the export pipeline from the Umusadege field for February 2013 were approximately 181,000 bbls before pipeline losses. Pipeline and export facility losses for January 2013 as reported by the operator were 52,842 bbls or approximately 14.1% of total crude deliveries. February pipeline and export facility losses have not yet been reported by the pipeline operator.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

INVESTOR RELATIONS:

Investors are also welcome to contact the following investor relations specialists for all corporate updates and investor inquiries:

FronTier Consulting Ltd.

Mart toll free # 1-888-875-7485

Email: inquiries@martresources.com

..."

http://www.marketwire.com/press-release/mart-resources-inc-u…

"Mart Resources, Inc.

TSX VENTURE : MMT

March 11, 2013 09:27 ET

Mart Resources, Inc.: UMU-10 Well Testing Update and Umusadege Operational Update

CALGARY, ALBERTA--(Marketwire - March 11, 2013) -

From the three sands tested to date, the UMU-10 well has produced at a combined rate of 5,019 barrels of oil per day ("bopd") from the XXI, XVIIa, and XVIIb oil sands, and 609 barrels of condensate per day from the XVIIIa gas/condensate sand.

3,076 bopd stabilized flow rate achieved during maximum efficient rate ("MER") testing from the XVIIa & XVIIb oil sands (commingled) on a 32/64 choke.

609 barrels per day ("bpd") of condensate, and 4.26 million cubic feet per day ("MMcf/d") of gas stabilized flow rates achieved during MER testing from the XVIIIa gas sand on a restricted 20/64 choke.

The rig has now been skidded to the last drill slot on the pad and the rig is being set up and upgraded to prepare for the UMU-11 well. It is anticipated that the UMU-11 well will spud during March 2013 to develop previously appraised oil reservoirs.

The Operator plans to return to the UMU-10 well to carry out testing operations on the two remaining untested oil zones following the drilling of UMU-11.

The construction contract for the Umugini pipeline has been awarded, and it is anticipated that ditching operations will commence shortly.

Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited (together "the Co-venturers") are pleased to announce additional flow rate test results for the UMU-10 well, and provide the following update on Umusadege field operations and progress on the new export pipeline.

UMU-10 Well Test Results

The UMU-10 well encountered 479 feet of gross hydrocarbon pay in 20 sands. Six of these sands, XVIIa & XVIIb (commingled), XVIIIa, XIX, XXb, and XXI, have been perforated and completed for production. Any two of these sands can be produced simultaneously using dual string sliding sleeve completion technology. The sands completed in UMU-10 are expected to access 161 feet of the total 479 feet of gross pay in the well.

Flow rate tests conducted during initial testing operations have now been completed on the XVIIa & XVIIb (commingled) sands and the XVIIIa sand. A stabilized flow rate of 3,076 bopd was recorded from the 33 foot (gross pay) XVIIa & XVIIb commingled sands of 49 API gravity oil through 2 7/8 inch tubing (short string) on a 32/64 inch choke at a flowing tubing pressure of 680 psi. Water production has reduced to zero after cleanup with a gas/oil ratio of 125 standard cubic feet per barrel.

The flow rate tests of the 18 foot (gross pay) XVIIIa gas/condensate sand recorded a stabilized test rate of 609 bpd of condensate and 4.26 MMcf/d of gas during testing operations conducted through 2 7/8 inch tubing (short string) on a 20/64 inch choke at a flowing tubing pressure of 2,400 psi. The well flowed gas and 53 API gravity condensate with basic sand and water ("BS&W") of 11%.

The gas/condensate sand completed in XVIIIa is expected to be produced after the XVIIa & XVIIb sands are fully depleted. This is consistent with the field development strategy of the Operator, which focuses on bringing the oil zones on production in the near term through additional development drilling. The gas from the XVIIIa sand is expected to be utilized as fuel for the new central processing gas fired generators.

As previously announced, the first extended flow rate test was conducted on the XXI sand, the deepest of the sands to be tested, at a stabilized rate of 1,943 bopd during initial well testing. During the test of the XXI sand, the well flowed 55.3 API gravity oil through 3 1/2 inch tubing on a 28/64 inch choke at a flowing tubing pressure of 1,260 psi. BS&W was 5% with a gas/oil ratio of approximately 588 standard cubic feet per barrel.

The Operator plans to return to the UMU-10 well after drilling the UMU-11 well to carry out the remaining testing operations on sands XXb and XIX in the long string. Using a coiled tubing unit, the multirate flow testing will then be performed on all sands completed in the long string: XIX, XXb, and XXI.

Umusadege Field Development Activity Update

Field development is continuing with the UMU-11 well, to be drilled from the same surface location as UMU-9 and UMU-10. The rig has been skidded to the last drill slot on the existing drill pad and the rig is being set up and upgraded to prepare for the UMU-11 well. The well is expected to spud during March 2013. The oil reservoirs expected to be completed in the UMU-11 well are the XIIb, XIIc, XVIa, and XVIb sands, which had a combined 79 feet of oil pay in UMU-10.

During 2013, horizontal wells are anticipated to be drilled to develop the shallow oil reservoirs in the main accumulation. Sourcing of a second rig has begun, which, if successful, will perform the horizontal drilling activities. Once a second rig has been leased and mobilized, horizontal drilling is anticipated to begin with the horizontal sidetrack wells from the existing UMU-3 and UMU-4 vertical wellbores.

The new Central Production Facility is expected to be commissioned during March 2013. This facility has been designed to handle the full field capacity anticipated from the existing reserves, as well as the potential for prospective resources in the field.

March 2013 Production Update

Umusadege field production has been down the first 11 days of March 2013 due to maintenance being performed on the export pipeline by the pipeline operator. The pipeline operator has advised that the pipeline will be operational at the beginning of next week.

Umugini Pipeline and Shell Export Pipeline

Mart and its co-venturers are proceeding with plans to provide a second independent export pipeline for Umusadege field production. The construction contract for the Umugini pipeline has been awarded, and more than 90% of the pipe has arrived by truck to the Umusadege site. It is anticipated that ditching operations will commence shortly. The pipeline contractor will begin working from two locations: one near the Umusadege field and one near the midpoint between Umusadege and the Shell Export station. The Umugini pipeline will connect the Umusadege field to the Shell Export pipeline. The Shell export pipeline will deliver Umusadege crude to the Shell Forcados terminal. Negotiations regarding the crude handling agreement with the export pipeline and terminal operators are nearing completion.

Wade Cherwayko, Chairman & CEO of Mart Resources stated: "Mart and its partners are very pleased with the initial clean up and flow test results from the first three zones of the UMU-10 well. We look forward to receiving results from the remaining flow tests, and are making preparations to begin drilling UMU-11."

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

INVESTOR RELATIONS:

Investors are also welcome to contact the following investor relations specialists for all corporate updates and investor inquiries:

FronTier Consulting Ltd.

Mart toll free # 1-888-875-7485

Email: inquiries@martresources.com

..."

"Mart Resources, Inc.

TSX VENTURE : MMT

March 11, 2013 09:27 ET

Mart Resources, Inc.: UMU-10 Well Testing Update and Umusadege Operational Update

CALGARY, ALBERTA--(Marketwire - March 11, 2013) -

From the three sands tested to date, the UMU-10 well has produced at a combined rate of 5,019 barrels of oil per day ("bopd") from the XXI, XVIIa, and XVIIb oil sands, and 609 barrels of condensate per day from the XVIIIa gas/condensate sand.

3,076 bopd stabilized flow rate achieved during maximum efficient rate ("MER") testing from the XVIIa & XVIIb oil sands (commingled) on a 32/64 choke.

609 barrels per day ("bpd") of condensate, and 4.26 million cubic feet per day ("MMcf/d") of gas stabilized flow rates achieved during MER testing from the XVIIIa gas sand on a restricted 20/64 choke.

The rig has now been skidded to the last drill slot on the pad and the rig is being set up and upgraded to prepare for the UMU-11 well. It is anticipated that the UMU-11 well will spud during March 2013 to develop previously appraised oil reservoirs.

The Operator plans to return to the UMU-10 well to carry out testing operations on the two remaining untested oil zones following the drilling of UMU-11.

The construction contract for the Umugini pipeline has been awarded, and it is anticipated that ditching operations will commence shortly.

Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited (together "the Co-venturers") are pleased to announce additional flow rate test results for the UMU-10 well, and provide the following update on Umusadege field operations and progress on the new export pipeline.

UMU-10 Well Test Results

The UMU-10 well encountered 479 feet of gross hydrocarbon pay in 20 sands. Six of these sands, XVIIa & XVIIb (commingled), XVIIIa, XIX, XXb, and XXI, have been perforated and completed for production. Any two of these sands can be produced simultaneously using dual string sliding sleeve completion technology. The sands completed in UMU-10 are expected to access 161 feet of the total 479 feet of gross pay in the well.

Flow rate tests conducted during initial testing operations have now been completed on the XVIIa & XVIIb (commingled) sands and the XVIIIa sand. A stabilized flow rate of 3,076 bopd was recorded from the 33 foot (gross pay) XVIIa & XVIIb commingled sands of 49 API gravity oil through 2 7/8 inch tubing (short string) on a 32/64 inch choke at a flowing tubing pressure of 680 psi. Water production has reduced to zero after cleanup with a gas/oil ratio of 125 standard cubic feet per barrel.

The flow rate tests of the 18 foot (gross pay) XVIIIa gas/condensate sand recorded a stabilized test rate of 609 bpd of condensate and 4.26 MMcf/d of gas during testing operations conducted through 2 7/8 inch tubing (short string) on a 20/64 inch choke at a flowing tubing pressure of 2,400 psi. The well flowed gas and 53 API gravity condensate with basic sand and water ("BS&W") of 11%.

The gas/condensate sand completed in XVIIIa is expected to be produced after the XVIIa & XVIIb sands are fully depleted. This is consistent with the field development strategy of the Operator, which focuses on bringing the oil zones on production in the near term through additional development drilling. The gas from the XVIIIa sand is expected to be utilized as fuel for the new central processing gas fired generators.

As previously announced, the first extended flow rate test was conducted on the XXI sand, the deepest of the sands to be tested, at a stabilized rate of 1,943 bopd during initial well testing. During the test of the XXI sand, the well flowed 55.3 API gravity oil through 3 1/2 inch tubing on a 28/64 inch choke at a flowing tubing pressure of 1,260 psi. BS&W was 5% with a gas/oil ratio of approximately 588 standard cubic feet per barrel.

The Operator plans to return to the UMU-10 well after drilling the UMU-11 well to carry out the remaining testing operations on sands XXb and XIX in the long string. Using a coiled tubing unit, the multirate flow testing will then be performed on all sands completed in the long string: XIX, XXb, and XXI.

Umusadege Field Development Activity Update

Field development is continuing with the UMU-11 well, to be drilled from the same surface location as UMU-9 and UMU-10. The rig has been skidded to the last drill slot on the existing drill pad and the rig is being set up and upgraded to prepare for the UMU-11 well. The well is expected to spud during March 2013. The oil reservoirs expected to be completed in the UMU-11 well are the XIIb, XIIc, XVIa, and XVIb sands, which had a combined 79 feet of oil pay in UMU-10.

During 2013, horizontal wells are anticipated to be drilled to develop the shallow oil reservoirs in the main accumulation. Sourcing of a second rig has begun, which, if successful, will perform the horizontal drilling activities. Once a second rig has been leased and mobilized, horizontal drilling is anticipated to begin with the horizontal sidetrack wells from the existing UMU-3 and UMU-4 vertical wellbores.

The new Central Production Facility is expected to be commissioned during March 2013. This facility has been designed to handle the full field capacity anticipated from the existing reserves, as well as the potential for prospective resources in the field.

March 2013 Production Update

Umusadege field production has been down the first 11 days of March 2013 due to maintenance being performed on the export pipeline by the pipeline operator. The pipeline operator has advised that the pipeline will be operational at the beginning of next week.

Umugini Pipeline and Shell Export Pipeline

Mart and its co-venturers are proceeding with plans to provide a second independent export pipeline for Umusadege field production. The construction contract for the Umugini pipeline has been awarded, and more than 90% of the pipe has arrived by truck to the Umusadege site. It is anticipated that ditching operations will commence shortly. The pipeline contractor will begin working from two locations: one near the Umusadege field and one near the midpoint between Umusadege and the Shell Export station. The Umugini pipeline will connect the Umusadege field to the Shell Export pipeline. The Shell export pipeline will deliver Umusadege crude to the Shell Forcados terminal. Negotiations regarding the crude handling agreement with the export pipeline and terminal operators are nearing completion.

Wade Cherwayko, Chairman & CEO of Mart Resources stated: "Mart and its partners are very pleased with the initial clean up and flow test results from the first three zones of the UMU-10 well. We look forward to receiving results from the remaining flow tests, and are making preparations to begin drilling UMU-11."

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

INVESTOR RELATIONS:

Investors are also welcome to contact the following investor relations specialists for all corporate updates and investor inquiries:

FronTier Consulting Ltd.

Mart toll free # 1-888-875-7485

Email: inquiries@martresources.com

..."

http://www.marketwire.com/press-release/mart-announces-005-p…

"Mart Resources, Inc.

TSX VENTURE : MMT

March 12, 2013 08:30 ET

Mart Announces $0.05 Per Common Share Dividend

CALGARY, ALBERTA--(Marketwire - March 12, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") is pleased to announce the declaration of a quarterly dividend of $0.05 per common share. The dividend is payable on April 9, 2013 to shareholders of record at the close of business on March 22, 2013. The ex-dividend date is March 20, 2013.

Pursuant to the Company's dividend policy, the declaration of regular quarterly dividends is determined quarterly based upon Mart's cash flows, liquidity, capital expenditure budgets, earnings, financial condition and other factors as the Board of Directors may consider appropriate from time to time.

..."

"Mart Resources, Inc.

TSX VENTURE : MMT

March 12, 2013 08:30 ET

Mart Announces $0.05 Per Common Share Dividend

CALGARY, ALBERTA--(Marketwire - March 12, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") is pleased to announce the declaration of a quarterly dividend of $0.05 per common share. The dividend is payable on April 9, 2013 to shareholders of record at the close of business on March 22, 2013. The ex-dividend date is March 20, 2013.

Pursuant to the Company's dividend policy, the declaration of regular quarterly dividends is determined quarterly based upon Mart's cash flows, liquidity, capital expenditure budgets, earnings, financial condition and other factors as the Board of Directors may consider appropriate from time to time.

..."

Na dann schreib ich auch mal was:

Die Perspektiven von Mart sind super, die Dividende liegt bei 11% und könnte nächstes Jahr, wenn alles glatt läuft, deutlich steigen.

Jetzt geb es eine längere Blockade der AGIP-Pipeline wegen Wartung, das ist natürlich ungünstig. Kein Cashflow, Dividende wird ausgezahlt und fliesst ab, die Pipeline muss gebaut werden - Es drohte Cashknappheit! Zumindest temporär, das hätte aber den Pipelinebau verzögert u.s.w. - Daher auch die mässige Kursentwicklung in letzter Zeit.

Jetzt gibt es die Möglichkeit, die temporäre Lücken mit einem Kredit zu überbrücken. Möglicherweise ist das auch eine Forderung von Shell, denn die brauchen zuverlässige Vertragspartner.

Fazit:

Ausnahmsweise sehe ich diesen Kredit positiv!

Mart Resources, Inc.: Arrangement of US $100 Million Secured Term Loan Facility and Umusadege Operational Update

- Mart has arranged a US $100 million secured term loan facility with Guaranty Trust Bank PLC to be available to fund field development activities on the Umusadege field and Mart's ongoing working capital requirements. - Umusadege field production continues to be shut down due to maintenance being performed on the export pipeline by the pipeline operator. The pipeline operator has advised that the maintenance operations are nearing completion, but no exact date can be given as to when production can re-commence.

CALGARY, ALBERTA, Mar 26, 2013 (MARKETWIRE via COMTEX) -- Mart Resources, Inc. CA:MMT +7.19% ("Mart" or the "Company") is pleased to announce the arrangement of a new loan facility, and with its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited provide the following update on Umusadege field operations.

Arrangement of US $100 million Secured Term Loan Facility

Mart, through its wholly-owned Nigerian subsidiary, has arranged a US $100 million secured term loan facility with Guaranty Trust Bank PLC with the intent to finance capital expenditures required for further field development activities and Mart's ongoing working capital requirements.

The secured loan facility has a term of five years and bears interest at 90 days LIBOR plus 4% (floor of 8.25%).

Wade Cherwayko, Chairman & CEO of Mart Resources stated: "Mart is very pleased to have made this arrangement with Guaranty Trust Bank PLC and anticipates that the additional flexibility the facility can provide will enable Mart to move ahead quickly with development and potential growth plans."

March 2013 Production Update

Umusadege field production continues to be shut down due to maintenance being performed on the export pipeline by the pipeline operator. The pipeline operator has advised that the maintenance operations are nearing completion, but no exact date can be given as to when repairs will be completed and production can re-commence. Mart will provide an update regarding this situation as it progresses.

Common share dividend

Following previous announcement, Mart is pleased to confirm that a quarterly dividend of $0.05 per common share will be paid on April 9, 2013 to shareholders of record at the close of business on March 22, 2013. The ex-dividend date was March 20, 2013.

Die Goldeule

Die Perspektiven von Mart sind super, die Dividende liegt bei 11% und könnte nächstes Jahr, wenn alles glatt läuft, deutlich steigen.

Jetzt geb es eine längere Blockade der AGIP-Pipeline wegen Wartung, das ist natürlich ungünstig. Kein Cashflow, Dividende wird ausgezahlt und fliesst ab, die Pipeline muss gebaut werden - Es drohte Cashknappheit! Zumindest temporär, das hätte aber den Pipelinebau verzögert u.s.w. - Daher auch die mässige Kursentwicklung in letzter Zeit.

Jetzt gibt es die Möglichkeit, die temporäre Lücken mit einem Kredit zu überbrücken. Möglicherweise ist das auch eine Forderung von Shell, denn die brauchen zuverlässige Vertragspartner.

Fazit:

Ausnahmsweise sehe ich diesen Kredit positiv!

Mart Resources, Inc.: Arrangement of US $100 Million Secured Term Loan Facility and Umusadege Operational Update

- Mart has arranged a US $100 million secured term loan facility with Guaranty Trust Bank PLC to be available to fund field development activities on the Umusadege field and Mart's ongoing working capital requirements. - Umusadege field production continues to be shut down due to maintenance being performed on the export pipeline by the pipeline operator. The pipeline operator has advised that the maintenance operations are nearing completion, but no exact date can be given as to when production can re-commence.

CALGARY, ALBERTA, Mar 26, 2013 (MARKETWIRE via COMTEX) -- Mart Resources, Inc. CA:MMT +7.19% ("Mart" or the "Company") is pleased to announce the arrangement of a new loan facility, and with its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited provide the following update on Umusadege field operations.

Arrangement of US $100 million Secured Term Loan Facility

Mart, through its wholly-owned Nigerian subsidiary, has arranged a US $100 million secured term loan facility with Guaranty Trust Bank PLC with the intent to finance capital expenditures required for further field development activities and Mart's ongoing working capital requirements.

The secured loan facility has a term of five years and bears interest at 90 days LIBOR plus 4% (floor of 8.25%).

Wade Cherwayko, Chairman & CEO of Mart Resources stated: "Mart is very pleased to have made this arrangement with Guaranty Trust Bank PLC and anticipates that the additional flexibility the facility can provide will enable Mart to move ahead quickly with development and potential growth plans."

March 2013 Production Update

Umusadege field production continues to be shut down due to maintenance being performed on the export pipeline by the pipeline operator. The pipeline operator has advised that the maintenance operations are nearing completion, but no exact date can be given as to when repairs will be completed and production can re-commence. Mart will provide an update regarding this situation as it progresses.

Common share dividend

Following previous announcement, Mart is pleased to confirm that a quarterly dividend of $0.05 per common share will be paid on April 9, 2013 to shareholders of record at the close of business on March 22, 2013. The ex-dividend date was March 20, 2013.

Die Goldeule

Bin mit den Pipelineproblemen seit 2 Wochen erst mal raus und warte ab. Dass Dividenden vielleicht nicht aus dem CashFlow bezahlt werden können, wird weiter belasten. Shorties erledigen den Rest, hoffentlich demnächst wieder weiter unten rein.

Ach, es gibt ja einen Thread inzwischen zu mart..

hatte auch mal nachgekauft. aber zu früh bei 1,90 CAD.

bin eigentlich immernoch positiv gestimmt. was mich aber richtig schockiert hat ist:

(ich denke auch vor allem das hat den kurs zusätzlich runtergezogen bei mart)

...ich seh die aktie immer noch chancenreich aber auch als hochspekulativ.

...was bringt es den dieben 40% abzustauben (bei ENI) bis die produktion gestoppt wird. mit 5-10% kann mart dagegen sehr gut leben... und für die gut organsierten diebe wär das auch ein konstantes "einkommen"

Nigeria: Eni and Shell Halt Production Over Rampant Oil Theft

March 28, 2013

Eni [NYSE: E] and Royal Dutch Shell [NYSE: RDS] announced last weekend that they plan to suspend operations in parts of Nigeria due to persistent oil thefts . . . on March 22, Shell declared “force majeure” on oil exports – a legal term to remove liability due to exceptional catastrophes -- and announced plans to temporarily shutdown its 150,000 barrel per day pipeline next month in order to “give the company time to clear away illegal connections that have drained an estimated 60,000 barrels of oil a day from the line” . . . the next day, Eni announced it would also halt its activity in parts of the country due to the oil thefts . . . Nigeria’s finance ministry claimed oil theft had reached 400,000 barrels of oil per day last year . . . Nigeria’s out-of-control oil theft is proving to be a major problem for its oil sector and raises concerns over the reliability of the country to protect its pipelines . . . the temporary suspensions could act as a wake up call for the Nigeria to step up security, as the government is heavily dependent upon revenue from the oil industry . . . however, efforts to date to stop the theft had met little success.

"

...das gabs immer schon in nigeria.. aber derzeit hat es seinen höhepunkt erreicht leider.

hatte auch mal nachgekauft. aber zu früh bei 1,90 CAD.

bin eigentlich immernoch positiv gestimmt. was mich aber richtig schockiert hat ist:

(ich denke auch vor allem das hat den kurs zusätzlich runtergezogen bei mart)

...ich seh die aktie immer noch chancenreich aber auch als hochspekulativ.

...was bringt es den dieben 40% abzustauben (bei ENI) bis die produktion gestoppt wird. mit 5-10% kann mart dagegen sehr gut leben... und für die gut organsierten diebe wär das auch ein konstantes "einkommen"

Nigeria: Eni and Shell Halt Production Over Rampant Oil Theft

March 28, 2013

Eni [NYSE: E] and Royal Dutch Shell [NYSE: RDS] announced last weekend that they plan to suspend operations in parts of Nigeria due to persistent oil thefts . . . on March 22, Shell declared “force majeure” on oil exports – a legal term to remove liability due to exceptional catastrophes -- and announced plans to temporarily shutdown its 150,000 barrel per day pipeline next month in order to “give the company time to clear away illegal connections that have drained an estimated 60,000 barrels of oil a day from the line” . . . the next day, Eni announced it would also halt its activity in parts of the country due to the oil thefts . . . Nigeria’s finance ministry claimed oil theft had reached 400,000 barrels of oil per day last year . . . Nigeria’s out-of-control oil theft is proving to be a major problem for its oil sector and raises concerns over the reliability of the country to protect its pipelines . . . the temporary suspensions could act as a wake up call for the Nigeria to step up security, as the government is heavily dependent upon revenue from the oil industry . . . however, efforts to date to stop the theft had met little success.

"

...das gabs immer schon in nigeria.. aber derzeit hat es seinen höhepunkt erreicht leider.

@goldeule und praesens

danke für die postings nr. 18 und 19

mittlerweile leider etwas kritischer hier

danke für die postings nr. 18 und 19

mittlerweile leider etwas kritischer hier

Antwort auf Beitrag Nr.: 44.382.203 von Boersenkrieger am 08.04.13 01:25:51achso, link:

http://www.lignet.com/InBriefs/Eni-and-Shell-Halt-Nigerian-P…

http://www.lignet.com/InBriefs/Eni-and-Shell-Halt-Nigerian-P…

Die neue Pipeline wird unterirdisch verlegt, mit Betondeckel obendrauf. Ich glaube nicht, dass in Zukunft das ein grosses Thema ist für Mart.

Sicherlich ist Diebstahl auch so nicht ausgeschlossen, aber man kann annehmen, dass die leichten Ziele zuerst drankommen...

Die Goldeule

Sicherlich ist Diebstahl auch so nicht ausgeschlossen, aber man kann annehmen, dass die leichten Ziele zuerst drankommen...

Die Goldeule

Antwort auf Beitrag Nr.: 44.384.677 von goldeule am 08.04.13 13:17:25denke ich auch... weiss nur nicht ob es trotzdem irgendwelche schwachstellen gibt aber ich glaub ich hab eine phobie

bin weiter long hier und eher zukufer als verkäufer (auch wenn ich die tage einige verschiedene goldaktien eingekauft hab... irgendwie bin ich recht bullish derzeit)

bin weiter long hier und eher zukufer als verkäufer (auch wenn ich die tage einige verschiedene goldaktien eingekauft hab... irgendwie bin ich recht bullish derzeit)

...und nun gehts weiter...

Umusadege production resumes

Production from the Umusadege field resumed on April 17, 2013, following notice given by Nigerian Agip Oil Co., the pipeline operator, that maintenance and repairs to the export pipeline have been completed. Production and deliveries into the export pipeline from the Umusadege field are expected to be increased to normal levels over the next several days.

Umusadege production resumes

Production from the Umusadege field resumed on April 17, 2013, following notice given by Nigerian Agip Oil Co., the pipeline operator, that maintenance and repairs to the export pipeline have been completed. Production and deliveries into the export pipeline from the Umusadege field are expected to be increased to normal levels over the next several days.

http://www.marketwire.com/press-release/mart-resources-inc-m…

Mart Resources, Inc.

TSX VENTURE : MMT

April 15, 2013 09:34 ET

Mart Resources, Inc.: March 2013 Production Update

- Umusadege field production and deliveries into the export pipeline were shut down during all of March 2013.

- 320,000 barrels of oil were nominated on behalf of the Umusadege field in March 2013 with payment to be received in mid-April.

CALGARY, ALBERTA--(Marketwired - April 15, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production for March 2013.

March 2013 Production Update

Due to an ongoing shutdown of the export pipeline that started on February 24, 2013, there was no production from the Umusadege field in March 2013 due mainly to maintenance and repairs on the export pipeline performed by the pipeline operator. During March 2013 there was a shipment of crude oil of 320,000 barrels of oil ("bbls") on behalf of the Umusadege field based on oil nominated for delivery. The Umusadege field's nominated and shipped oil volume was higher than the volume of oil delivered, which leads to an "over lift" position. Mart and its co-venturers therefore owe oil to Nigerian Agip Oil Company ("AGIP") for the amount of oil over lifted. Mart and its co-venturers expect to receive payment in mid-April 2013 for the over lift of 320,000 bbls shipped in March 2013 and expect to repay the over lift volume out of production subsequent to the reopening of the export pipeline.

AGIP, the pipeline operator, has advised that repairs to the export pipeline are progressing, but that the pipeline has not yet returned to normal operations. Mart will continue to monitor the situation and provide updates regarding Umusadege field operations and the status of pipeline operations as information is received from AGIP.

Pipeline and export facility losses for February 2013 as reported by AGIP were 42,270 bbls or approximately 25.5% of total crude deliveries, based on the net volume of 166,000 bbls reported as received by AGIP in February 2013.

Mart Presenting at Oil Council Asia Assembly in Hong Kong

Wade Cherwayko, Chairman and CEO of Mart, will be a presenter at the Oil Council Asia Assembly in Hong Kong on April 24-25, 2013. A link containing the location and details of the conference will be available on Mart's website under News & Presentations / Corporate Presentations - www.martresources.com.

..."

Mart Resources, Inc.

TSX VENTURE : MMT

April 15, 2013 09:34 ET

Mart Resources, Inc.: March 2013 Production Update

- Umusadege field production and deliveries into the export pipeline were shut down during all of March 2013.

- 320,000 barrels of oil were nominated on behalf of the Umusadege field in March 2013 with payment to be received in mid-April.

CALGARY, ALBERTA--(Marketwired - April 15, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production for March 2013.

March 2013 Production Update

Due to an ongoing shutdown of the export pipeline that started on February 24, 2013, there was no production from the Umusadege field in March 2013 due mainly to maintenance and repairs on the export pipeline performed by the pipeline operator. During March 2013 there was a shipment of crude oil of 320,000 barrels of oil ("bbls") on behalf of the Umusadege field based on oil nominated for delivery. The Umusadege field's nominated and shipped oil volume was higher than the volume of oil delivered, which leads to an "over lift" position. Mart and its co-venturers therefore owe oil to Nigerian Agip Oil Company ("AGIP") for the amount of oil over lifted. Mart and its co-venturers expect to receive payment in mid-April 2013 for the over lift of 320,000 bbls shipped in March 2013 and expect to repay the over lift volume out of production subsequent to the reopening of the export pipeline.

AGIP, the pipeline operator, has advised that repairs to the export pipeline are progressing, but that the pipeline has not yet returned to normal operations. Mart will continue to monitor the situation and provide updates regarding Umusadege field operations and the status of pipeline operations as information is received from AGIP.

Pipeline and export facility losses for February 2013 as reported by AGIP were 42,270 bbls or approximately 25.5% of total crude deliveries, based on the net volume of 166,000 bbls reported as received by AGIP in February 2013.

Mart Presenting at Oil Council Asia Assembly in Hong Kong

Wade Cherwayko, Chairman and CEO of Mart, will be a presenter at the Oil Council Asia Assembly in Hong Kong on April 24-25, 2013. A link containing the location and details of the conference will be available on Mart's website under News & Presentations / Corporate Presentations - www.martresources.com.

..."

http://www.marketwire.com/press-release/mart-resources-inc-p…

"Mart Resources, Inc.

TSX VENTURE : MMT

April 18, 2013 09:28 ET

Mart Resources, Inc.: Pipeline Maintenance and Repairs Completed and Production from Umusadege Field Resumes

- Umusadege field production and deliveries into the export pipeline resumed on April 17, 2013.

- Maintenance and repairs on the export pipeline completed by the pipeline operator and pipeline operator returning to normal operations.

CALGARY, ALBERTA--(Marketwired - April 18, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production operations.

Umusadege Production Resumes

Production from the Umusadege field resumed on April 17, 2013 following notice given by Nigerian Agip Oil Company, the pipeline operator, that maintenance and repairs to the export pipeline have been completed. Production and deliveries into the export pipeline from the Umusadege field are expected to be increased to normal levels over the next several days.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

Note: Except where expressly stated otherwise, all production figures set out in this press release, including barrels of oil per day ("bopd"), reflect gross Umusadege field production rather than production attributable to Mart. Mart's share of total gross production before taxes and royalties from the Umusadege field fluctuates between 82.5% (before capital cost recovery) and 50% (after capital cost recovery).

..."

"Mart Resources, Inc.

TSX VENTURE : MMT

April 18, 2013 09:28 ET

Mart Resources, Inc.: Pipeline Maintenance and Repairs Completed and Production from Umusadege Field Resumes

- Umusadege field production and deliveries into the export pipeline resumed on April 17, 2013.

- Maintenance and repairs on the export pipeline completed by the pipeline operator and pipeline operator returning to normal operations.

CALGARY, ALBERTA--(Marketwired - April 18, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") and its co-venturers, Midwestern Oil and Gas Company Plc. (Operator of the Umusadege field) and SunTrust Oil Company Limited are providing the following update on Umusadege field production operations.

Umusadege Production Resumes

Production from the Umusadege field resumed on April 17, 2013 following notice given by Nigerian Agip Oil Company, the pipeline operator, that maintenance and repairs to the export pipeline have been completed. Production and deliveries into the export pipeline from the Umusadege field are expected to be increased to normal levels over the next several days.

Additional information regarding Mart is available on the Company's website at www.martresources.com and under the Company's profile on SEDAR at www.sedar.com.

Note: Except where expressly stated otherwise, all production figures set out in this press release, including barrels of oil per day ("bopd"), reflect gross Umusadege field production rather than production attributable to Mart. Mart's share of total gross production before taxes and royalties from the Umusadege field fluctuates between 82.5% (before capital cost recovery) and 50% (after capital cost recovery).

..."

Q1 results auf sedar.com

Die news von Mart dazu:

http://www.marketwire.com/press-release/mart-announces-finan…

"Mart Resources, Inc.

TSX VENTURE : MMT

May 23, 2013 08:30 ET

Mart Announces Financial and Operating Results For the Three Months Ended March 31, 2013

CALGARY, ALBERTA--(Marketwired - May 23, 2013) - Mart Resources, Inc. (TSX VENTURE:MMT) ("Mart" or the "Company") is pleased to announce its financial and operating results (all amounts in United States dollars unless noted) for the three months ended March 31, 2013 ("Q113"):

THREE MONTHS ENDED MARCH 31, 2013

Mart's share of average daily oil produced and sold for Q113 from the Umusadege field was 2,571 barrels of oil per day ("bopd") compared to 6,936 bopd for the three months ended March 31, 2012 ("Q112"). There was a prolonged shutdown that started on February 24, 2013 and ended subsequent to the end of Q113, on April 17, 2013 as a result of repairs and maintenance of the export pipeline. During Q113, the Umusadege field was shut down for a total of 46 days (Q112: 18 days) due to various disruptions, repairs and maintenance of the export pipeline.

On March 12, 2013 Mart declared a quarterly dividend of CAD $0.05 per common share. The quarterly dividend was paid on April 9, 2013 for an aggregate amount of $17.5 million.

Net income for Q113 was $1.9 million ($0.005 per share) compared to net income of $37.9 million ($0.113 per share) for Q112. The lower net income during the period was due to the export pipeline shutdowns caused by repairs and maintenance that resulted in decreased revenue during the period.

Funds flow from production operations was $13.1 million ($0.037 per share) for Q113 compared to $55.0 million ($0.163 per share) for Q112 (see Note 1 to the Financial and Operating Results table below regarding Non-IFRS measures).

Mart's share of Umusadege field oil produced and sold in Q113 was 231,384 barrels of oil ("bbls") compared to 631,202 bbls for Q112.

The average price received by Mart for oil in Q113 was $110.01 per barrel of oil ("bbl") compared to $115.61 per bbl for Q112.

Mart's share of pipeline and export facility losses for Q113 totaled 51,152 bbls, or approximately 17.6% of crude deliveries from the Umusadege field for the period.

FINANCIAL AND OPERATING RESULTS

The following table provides a summary of Mart's selected financial and operating results for the three months ended March 31, 2013 and 2012 and the twelve months ended December 31, 2012:

USD $ 000's

(except oil produced and sold, share, per share amounts, and oil prices) 3 months ended 3 months ended 12 months ended

Mar 31, 2013 Mar 31, 2012 Dec 31, 2012

Mart's share of the Umusadege Field:

Barrels of oil produced and sold 231,384 631,202 1,844,389

Average sales price per barrel $110.01 $115.61 $103.43

Mart's percentage share of total Umusadege oil produced and sold during the period

54.0%

82.5%

66.7%

Mart's share of petroleum sales after royalties, content development levy and community development costs

19,822

61,884

161,390

Funds flow from production operations (1)

13,139

54,960

137,743

Per share - basic $0.037 $0.163 $0.398

Net income 1,909 37,907 58,046

Per share - basic $0.005 $0.113 $0.168

Per share - diluted $0.005 $0.109 $0.163

Total assets 241,453 237,132 281,506

Total bank debt Nil Nil Nil

Weighted average shares outstanding for periods ended:

Basic 356,296,165 336,752,599 345,715,889

Diluted 359,825,372 348,471,587 355,617,583

Note:

Indicates non-IFRS measures. Non-IFRS measures are informative measures commonly used in the oil and gas industry. Such measures do not conform to IFRS and may not be comparable to those reported by other companies nor should they be viewed as an alternative to other measures of financial performance calculated in accordance with IFRS. For the purposes of this table, the Company defines "Funds flow from production operations" as net petroleum sales less royalties, content development levy, community development costs and production costs. Funds flow from production operations is intended to give a comparative indication of the Company's net petroleum sales less production costs as shown in the following table:

USD $ 000's 3 months ended

Mar 31, 2013 3 months ended

Mar 31, 2012 12 months

ended

Dec 31, 2012

Petroleum sales 25,455 72,974 190,761

Less: Royalties, content development levy and community development costs

5,633

11,090

29,371

Net petroleum sales 19,822 61,884 161,390

Less: Production costs 6,683 6,924 23,647

Funds flow from production operations 13,139 54,960 137,743

OUTLOOK AND OPERATIONS UPDATE:

Dividend

On March 12, 2013, Mart declared a quarterly cash dividend of CDN $0.05 per common share that was paid to shareholders on April 9, 2013 for an aggregate amount of CDN $17.8 million.

UMU-10 Well

The Company announced on November 5, 2012 that the UMU-10 well encountered 479 feet of gross hydrocarbon pay in 20 sands. The results of the well tests conducted have been previously press released.

The operator of the Umusadege field plans to return to the UMU-10 well after drilling the UMU-11 well (discussed below) to carry out the remaining testing operations on sands XXb and XIX in the long string as a coiled tubing unit is required. Multirate flow testing will then be performed on all sands completed in the long string: XIX, XXb, and XXI.

Umusadege Field Development Activity Update

It is anticipated that drilling activities on the Umusadege field will include at least one additional vertical development well, one horizontal development well and one exploration well.

Umusadege field development is continuing with the UMU-11 well, to be drilled from the same surface location as UMU-9 and UMU-10. The rig has been skidded to the last drill slot on the existing drill pad and the rig is being set up and upgraded to prepare for the UMU-11 well. The well is expected to spud in the second quarter of 2013. The oil reservoirs expected to be completed in the UMU-11 well are the XIIb, XIIc, XVIa, and XVIb sands, which had a combined 79 feet of oil pay in UMU-10.

The horizontal well is planned to be the sidetrack well from the existing UMU-3 vertical wellbore. It will develop the shallow oil reservoirs in the main accumulation using a second rig.

The exploration drilling is planned for the East prospect within the Umusadege farmout area.

The new Central Production Facility is expected to be commissioned during the second quarter of 2013. This facility has been designed to handle the full field capacity anticipated from the existing reserves, as well as the potential for production from prospective resources in the Umusadege farmout area.

Umugini Pipeline and Trans Forcados Export Pipeline

Mart and its co-venturers are currently constructing a second independent export pipeline (known as the Umugini Pipeline) for Umusadege field production. The pipeline contractor is currently working from two locations: one near the Umusadege field and one near the midpoint between Umusadege and the Trans Forcados export pipeline station. The Umugini pipeline will connect the Umusadege field to the Trans Forcados export pipeline. The Trans Forcados export pipeline will deliver Umusadege crude to the Forcados export terminal. Negotiations regarding the crude handling agreement with the export pipeline owners and terminal operators are continuing.

Production Update

Production from the Umusadege field that was shut down on February 24, 2013 resumed on April 17, 2013 following notice given by Nigerian Agip Oil Company, the pipeline operator, that maintenance and repairs to the export pipeline have been completed.

Umusadege field production during April 2013 averaged 4,148 bopd. Umusadege field downtime during April 2013 totaled 18.5 days. The average field production based on producing days was 10,864 bopd in April 2013.

Total crude oil deliveries into the export pipeline from the Umusadege field for April 2013 were approximately 150,500 bbls before pipeline losses, of which 124,500 bbls were from new production from the Umusadege field with the additional amount being deliveries from storage tanks injected into the export pipeline when pipeline operations resumed.

Loan facility