Silver Bull Resources - explosiver Junior Explorer - 500 Beiträge pro Seite

eröffnet am 26.03.13 15:28:51 von

neuester Beitrag 01.02.21 21:06:10 von

neuester Beitrag 01.02.21 21:06:10 von

Beiträge: 137

ID: 1.180.291

ID: 1.180.291

Aufrufe heute: 0

Gesamt: 16.238

Gesamt: 16.238

Aktive User: 0

ISIN: US8274581003 · WKN: A1H97Y

0,0850

USD

+6,25 %

+0,0050 USD

Letzter Kurs 18.09.20 Nasdaq OTC

Neuigkeiten

27.02.24 · globenewswire |

31.10.23 · globenewswire |

17.10.23 · globenewswire |

14.10.23 · globenewswire |

06.09.23 · globenewswire |

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +30,77 | |

| 2,90 | +25,00 | |

| 575,00 | +21,05 | |

| 0,7419 | +18,60 | |

| 1,8504 | +10,80 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2.500,00 | -13,79 | |

| 9,0000 | -14,29 | |

| 9,0900 | -17,36 | |

| 11,100 | -20,71 | |

| 2,1400 | -45,41 |

Silver Bull Resources

Stock Symbol NYSE:SVBL, TSX:SVB

Die mexikanische Flagship Property "Sierra Mojada" (Silber und Zink) wird mit jeder Resourcen-Kalkulation wertvoller, aktuell wird ein neuer NI 43-101 erstellt (fertig in den nächsten Tagen).

http://www.silverbullresources.com/s/sierra_mojada.asp?Repor…

Stock Symbol NYSE:SVBL, TSX:SVB

Die mexikanische Flagship Property "Sierra Mojada" (Silber und Zink) wird mit jeder Resourcen-Kalkulation wertvoller, aktuell wird ein neuer NI 43-101 erstellt (fertig in den nächsten Tagen).

http://www.silverbullresources.com/s/sierra_mojada.asp?Repor…

Antwort auf Beitrag Nr.: 44.305.257 von Heftie am 26.03.13 15:28:51ein wenig mehr Basisinfos dürften es zur Thread-Eröffnung schon sein:

aktuelle Präsentation: http://www.silverbullresources.com/i/pdf/Presentation.pdf

Sedar-Direktlink: http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

Symbol: SVB.TO

Shares (fully diluted): 179,55 Millionen

MK (fully diluted): ~80MCAD

Cash (Ende Januar 2013): 1,65 Millionen $

As of January 31, 2013, we had cash and cash on hand of $1,656,000 and working capital of $903,000 as compared to cash and cash on hand of $3,201,000 and working capital of $2,925,000 as of October 31, 2012. The decrease in our liquidity and working capital were primarily the result of the exploration activities at the Sierra Mojada Property and general and administrative expense.

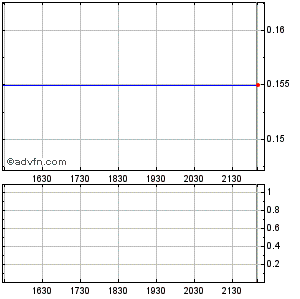

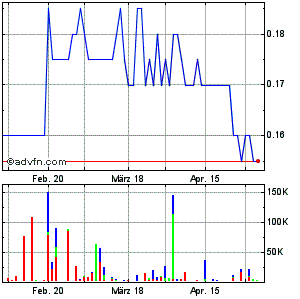

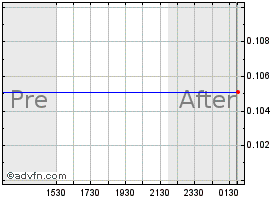

Kurs:

das Hauptprojekt Sierra Mojada:

http://www.silverbullresources.com/s/sierra_mojada.asp?Repor…

The Sierra Mojada project lies within a historical high grade silver, lead, zinc mining district discovered in 1879, located 250km North of the city of Torreon in Coahuila State, Mexico. The project is 100% owned and operated by Silver Bull Resources, Inc. and is part of a large land package consisting of 40 mining concessions totalling 21,167 hectares (52,305 acres). The main zone of mineralization found at Sierra Mojada extends over 6 kilometers in an East-West direction along the base of the Sierra Mojada Range coincident with the Sierra Mojada fault. Over 54 historical mine shafts lie along this strike, mining to depths in-excess of 200 meters. The area has not been mined with modern mining technology and processes.

die Ressource:

Sierra Mojada: scratching the surface on a northern Mexico Carbonate Replacement Deposit (“CRD”):

Silver Resource: 167.5Moz Indicated @ 72.5g/t Ag (25g/t cutoff)

Zinc Resource: 2.2Blbs Zn Indicated

Lead Resource: 538Mlbs Pb Inferred

Copper Resource: 126Mlbs Cu Inferred

Open Pit!

Bzgl. PEA:

Preliminary Economic Assessment JDS Energy & Mining Inc. has been retained to complete Silver Bull’s maiden Preliminary Economic Assessment (“PEA”) on the silver and zinc mineralization at the Sierra Mojada Property. Work on the PEA will commence once a number of milestones are met including; completion of the updated NI 43-101 resource report and receipt of results from the first phase of the metallurgical program. The PEA is expected to be completed in the third quarter of calendar year 2013.

P.S.: FS ist für 2014 angekündigt (ohne Quartals- oder Monatsangabe)!

was man wissen sollte:

Pursuant to the terms of a joint venture agreement between the Company and AngloGold which was terminated effective August 16, 2012, exploration costs were funded 100% by AngloGold through the Company’s wholly owned subsidiary, Dome Gabon SARL. AngloGold would typically fund in advance of exploration costs. Funds received in excess of exploration costs are reflected as a payable to Anglogold on the Company’s condensed consolidated balance sheet. As of January 31, 2013, the payable to AngloGold was $512,338.

bzgl. laufender Kosten:

We recorded a general and administrative expense of $778,000 for the three months ended January 31, 2013 as compared to $883,000 for the comparable period last year. The $105,000 decrease was mainly the result of a $42,000 decrease in personnel cost, a $34,000 decrease in professional services, a $66,000 decrease in directors’ fees and a $68,000 decrease in provision for uncollectible value-added taxes which was offset by a $103,000 increase in office and administrative expense as described below.

aktuelle Präsentation: http://www.silverbullresources.com/i/pdf/Presentation.pdf

Sedar-Direktlink: http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issu…

Symbol: SVB.TO

Shares (fully diluted): 179,55 Millionen

MK (fully diluted): ~80MCAD

Cash (Ende Januar 2013): 1,65 Millionen $

As of January 31, 2013, we had cash and cash on hand of $1,656,000 and working capital of $903,000 as compared to cash and cash on hand of $3,201,000 and working capital of $2,925,000 as of October 31, 2012. The decrease in our liquidity and working capital were primarily the result of the exploration activities at the Sierra Mojada Property and general and administrative expense.

Kurs:

das Hauptprojekt Sierra Mojada:

http://www.silverbullresources.com/s/sierra_mojada.asp?Repor…

The Sierra Mojada project lies within a historical high grade silver, lead, zinc mining district discovered in 1879, located 250km North of the city of Torreon in Coahuila State, Mexico. The project is 100% owned and operated by Silver Bull Resources, Inc. and is part of a large land package consisting of 40 mining concessions totalling 21,167 hectares (52,305 acres). The main zone of mineralization found at Sierra Mojada extends over 6 kilometers in an East-West direction along the base of the Sierra Mojada Range coincident with the Sierra Mojada fault. Over 54 historical mine shafts lie along this strike, mining to depths in-excess of 200 meters. The area has not been mined with modern mining technology and processes.

die Ressource:

Sierra Mojada: scratching the surface on a northern Mexico Carbonate Replacement Deposit (“CRD”):

Silver Resource: 167.5Moz Indicated @ 72.5g/t Ag (25g/t cutoff)

Zinc Resource: 2.2Blbs Zn Indicated

Lead Resource: 538Mlbs Pb Inferred

Copper Resource: 126Mlbs Cu Inferred

Open Pit!

Bzgl. PEA:

Preliminary Economic Assessment JDS Energy & Mining Inc. has been retained to complete Silver Bull’s maiden Preliminary Economic Assessment (“PEA”) on the silver and zinc mineralization at the Sierra Mojada Property. Work on the PEA will commence once a number of milestones are met including; completion of the updated NI 43-101 resource report and receipt of results from the first phase of the metallurgical program. The PEA is expected to be completed in the third quarter of calendar year 2013.

P.S.: FS ist für 2014 angekündigt (ohne Quartals- oder Monatsangabe)!

was man wissen sollte:

Pursuant to the terms of a joint venture agreement between the Company and AngloGold which was terminated effective August 16, 2012, exploration costs were funded 100% by AngloGold through the Company’s wholly owned subsidiary, Dome Gabon SARL. AngloGold would typically fund in advance of exploration costs. Funds received in excess of exploration costs are reflected as a payable to Anglogold on the Company’s condensed consolidated balance sheet. As of January 31, 2013, the payable to AngloGold was $512,338.

bzgl. laufender Kosten:

We recorded a general and administrative expense of $778,000 for the three months ended January 31, 2013 as compared to $883,000 for the comparable period last year. The $105,000 decrease was mainly the result of a $42,000 decrease in personnel cost, a $34,000 decrease in professional services, a $66,000 decrease in directors’ fees and a $68,000 decrease in provision for uncollectible value-added taxes which was offset by a $103,000 increase in office and administrative expense as described below.

Antwort auf Beitrag Nr.: 44.306.099 von Kongo-Otto am 26.03.13 16:41:31Verdammt gute Infos, hatte ich vorhin so nicht zur Hand.

Danke!!

Danke!!

Antwort auf Beitrag Nr.: 44.306.463 von Heftie am 26.03.13 17:18:14nix zu danken.

Hier noch mehr:

ein Interview mit dem CEO vom Dezember 2012:

und hier einige Erwähnungen von SVB auf "The Gold Report":

http://www.theaureport.com/pub/co/5491#quote

hier der Link zur Übersicht über die Insider-Aktivitäten:

http://www.canadianinsider.com/node/7?menu_tickersearch=SVB+…

(in den letzten 6 Monaten gab es keine Insider-Aktivitäten!)

übrigens, was mich noch etwas "stört":

das durchschnittliche tägliche Handelsvolumen der letzten 3 Monate beträgt lediglich 38 605 Shares am TSX!

Also sehr dünner Umsatz!

Hier noch mehr:

ein Interview mit dem CEO vom Dezember 2012:

und hier einige Erwähnungen von SVB auf "The Gold Report":

http://www.theaureport.com/pub/co/5491#quote

hier der Link zur Übersicht über die Insider-Aktivitäten:

http://www.canadianinsider.com/node/7?menu_tickersearch=SVB+…

(in den letzten 6 Monaten gab es keine Insider-Aktivitäten!)

übrigens, was mich noch etwas "stört":

das durchschnittliche tägliche Handelsvolumen der letzten 3 Monate beträgt lediglich 38 605 Shares am TSX!

Also sehr dünner Umsatz!

Antwort auf Beitrag Nr.: 44.306.099 von Kongo-Otto am 26.03.13 16:41:31Sauber, Kongo!!!

Gruss

rolleg

Gruss

rolleg

...Bonita muchacha hermosa...

http://www.wallstreet-online.de/diskussion/1172052-2321-2330…

P&L

SEPPi

http://www.wallstreet-online.de/diskussion/1172052-2321-2330…

P&L

SEPPi

Zitat von Kongo-Otto: ein wenig mehr Basisinfos dürften es zur Thread-Eröffnung schon sein:

Cash (Ende Januar 2013): 1,65 Millionen $

+ US$9.1 Million Public Offering of Units at $0.40

http://www.stockhouse.com/companies/stories/t.svb/8731088

Historical Prices on TSX 01.03-26.03

http://finance.yahoo.com/q/hp?s=SVB.TO&a=02&b=1&c=2013&d=02&…

Mar 26, 2013 0.44 0.44 0.44 0.44 25,200 0.44

Mar 25, 2013 0.43 0.45 0.43 0.45 84,200 0.45

Mar 22, 2013 0.43 0.43 0.42 0.43 54,600 0.43

Mar 21, 2013 0.41 0.41 0.41 0.41 2,100 0.41

Mar 20, 2013 0.40 0.40 0.40 0.40 11,100 0.40

Mar 19, 2013 0.39 0.41 0.39 0.40 117,800 0.40

Mar 18, 2013 0.39 0.39 0.37 0.38 84,300 0.38

Mar 15, 2013 0.36 0.38 0.36 0.37 158,800 0.37

Mar 14, 2013 0.38 0.38 0.36 0.36 45,000 0.36

Mar 13, 2013 0.37 0.38 0.37 0.38 44,000 0.38

Mar 12, 2013 0.35 0.37 0.35 0.37 81,500 0.37

Mar 11, 2013 0.34 0.34 0.33 0.33 51,000 0.33

Mar 8, 2013 0.31 0.31 0.31 0.31 0 0.31

Mar 7, 2013 0.31 0.31 0.31 0.31 0 0.31

Mar 6, 2013 0.31 0.31 0.31 0.31 0 0.31

Mar 5, 2013 0.31 0.31 0.31 0.31 7,000 0.31

Mar 4, 2013 0.33 0.33 0.33 0.33 0 0.33

Mar 1, 2013 0.33 0.33 0.33 0.33 0 0.33

Historical Prices 01.03.-26.03-Silver Bull Resources, Inc. (SVBL)

-NYSE MKT

http://finance.yahoo.com/q/hp?s=SVBL&a=02&b=1&c=2013&d=02&e=…

Mar 26, 2013 0.44 0.45 0.42 0.43 154,500 0.43

Mar 25, 2013 0.42 0.45 0.40 0.43 308,100 0.43

Mar 22, 2013 0.42 0.43 0.40 0.43 197,700 0.43

Mar 21, 2013 0.41 0.41 0.39 0.41 223,300 0.41

Mar 20, 2013 0.40 0.41 0.38 0.40 250,500 0.40

Mar 19, 2013 0.38 0.39 0.38 0.39 553,500 0.39

Mar 18, 2013 0.39 0.39 0.36 0.38 904,900 0.38

Mar 15, 2013 0.35 0.36 0.35 0.36 444,200 0.36

Mar 14, 2013 0.36 0.37 0.36 0.36 93,000 0.36

Mar 13, 2013 0.36 0.36 0.35 0.36 261,500 0.36

Mar 12, 2013 0.34 0.35 0.33 0.35 364,800 0.35

Mar 11, 2013 0.33 0.34 0.33 0.34 109,200 0.34

Mar 8, 2013 0.32 0.33 0.31 0.33 57,400 0.33

Mar 7, 2013 0.31 0.32 0.30 0.31 669,300 0.31

Mar 6, 2013 0.31 0.33 0.30 0.31 241,300 0.31

Mar 5, 2013 0.32 0.32 0.30 0.31 618,800 0.31

Mar 4, 2013 0.34 0.34 0.31 0.33 195,300 0.33

Mar 1, 2013 0.34 0.34 0.31 0.34 245,300 0.34

sind eben live zu sehen auf dem Goldforum!

Antwort auf Beitrag Nr.: 44.451.117 von maurer_35 am 17.04.13 14:54:37Hilf mir mal bitte weiter, welches Goldforum??

Antwort auf Beitrag Nr.: 44.466.681 von Heftie am 19.04.13 09:14:32Guckst Du hier:

http://www.europeangoldforum.org/egf13/company-webcast/SVBL:…

http://www.europeangoldforum.org/egf13/company-webcast/SVBL:…

Silver Bull Resources dubbed attractive investment by PI Financial

Friday, April 26, 2013 by Mourad Haroutunian

http://www.proactiveinvestors.com.au/companies/news/42486/si…

Friday, April 26, 2013 by Mourad Haroutunian

http://www.proactiveinvestors.com.au/companies/news/42486/si…

Mean consensus OUTPERFORM

# of Analysts 1

average target price 1,35 $

Last Close Price 0,37 $

Spread / Highest target 261%

Spread / Average Target 261%

Spread / Lowest Target 261%

http://www.4-traders.com/SILVER-BULL-RESOURCES-INC-8473250/c…

# of Analysts 1

average target price 1,35 $

Last Close Price 0,37 $

Spread / Highest target 261%

Spread / Average Target 261%

Spread / Lowest Target 261%

http://www.4-traders.com/SILVER-BULL-RESOURCES-INC-8473250/c…

Silver Bull Resources Files NI 43-101 Technical Report on SEDAR

http://silverinvestingnews.com/16776/silver-bull-resources-f…

.....Silver Bull President and CEO Tim Barry said:

The filing of this report represents a significant milestone for Silver Bull. It defines Sierra Mojada as one of the largest undeveloped silver resources in Mexico, as well as providing a significant upgrade on the overall geological understanding of Sierra Mojada. We believe this is the most comprehensive report put out yet on the deposit and provides an extremely good basis for the Preliminary Economic Assessment planned for completion in Q3 2013.

http://silverinvestingnews.com/16776/silver-bull-resources-f…

.....Silver Bull President and CEO Tim Barry said:

The filing of this report represents a significant milestone for Silver Bull. It defines Sierra Mojada as one of the largest undeveloped silver resources in Mexico, as well as providing a significant upgrade on the overall geological understanding of Sierra Mojada. We believe this is the most comprehensive report put out yet on the deposit and provides an extremely good basis for the Preliminary Economic Assessment planned for completion in Q3 2013.

Zitat von Kongo-Otto: übrigens, was mich noch etwas "stört":

das durchschnittliche tägliche Handelsvolumen der letzten 3 Monate beträgt lediglich 38 605 Shares am TSX!

Also sehr dünner Umsatz!

Dafür hat es an der OTC wesentlich mehr Volumen.

Etwas seltsam, da die Heimatbörse ja Toronto ist:

Average Vol (3m)

207,659

Aber egal, Hauptsache Silver Bull werden aktiv gehandelt

Empfehlung für SVBL:

The Next Silver Takeout

Autor: Bob Moriarty

May 17, 2013

http://www.321gold.com/editorials/moriarty/moriarty051713.ht…

It always seems that it is darkest just before the dawn. I recall well the pain of junior resource owners in mid-2001. The XAU was up 36% over the prior six months but it seemed it would take forever to value to come into the space.

I just went back and reread the very first piece I ever wrote about junior mining stocks from May of 2001. Read it, you will be surprised at how well I captured not only the moment but also what was going to happen over the next decade. We didn’t even start 321gold until two months later, at the time we had a computer online business. It was a good call then and it’s a good call now.

I could change the date on the piece and post the article today and it would be just as timely as it was then. All investors today hate gold, hate silver and consider the penny dreadfuls the spawn of the devil. That’s a really good time to be buying.

I went to Mexico a week or so ago and saw what will be the next silver company to be taken out. It’s named Silver Bull and the name qualifies under the Truth in Advertising statutes. The company reported about 163 million ounces of silver in a 43-101 resource and they have about 159 million shares. So they have just over an ounce of silver per share. Someone who can add is going to take them out. Soon.

And while they report $.35 per ounce of silver, if you take into account the very real 2.4 billion pounds for zinc, the real cost to a buyer is in the $.19 an ounce range. In Mexico they call that, “El Goodo Dealo.”

There will be big news shortly. The giant resource silver deposit is one of the most unusual I have ever seen. The entire deposit is an oxide of silver and zinc rather than the typical sulfide ore I am used to seeing. Silver and zinc are very active metals; they react and form combinations with just about everything so you virtually never find large oxide silver deposits.

The market is waiting for news about metal recovery processes and recovery rates. With that information in hand, it reduces risk. In addition, there will be a PEA released in the next month or so.

Everyone in the resource sector (with perhaps the sole exception of your author) is caught with that deer in the headlight stare right now. But I can assure my readers that neither the Apocalypse nor the 2nd Coming of Christ is scheduled for next week. The market is stumbling around like an old man fumbling in the dark for his dentures but better times come soon.

Silver Bull has young and aggressive management in the form of company President and CEO Tim Barry. He was former VP of Exploration for Metalline Mining, the prior name for SVB. He ousted the welded in place Jurassic age management and kick started the company. He has increased the resource some 250% since 2011 and made it as attractive as possible for a potential buyer.

Coeur D’Alene Mines owns some 10.9% of the shares today. They are a natural buyer or counter bidder should another major take a run at the company. Recent takeouts were in the $1.70 an ounce range so I would expect SBV to attract worth a 300-700% return.

The company is well cashed up with cash in the bank around $10 million so they will have no problems keeping the doors open. Management is young, they are starting to tell their story and for those who like silver, the company is most attractive.

Silver Bull is not an advertiser. Yet. I don’t own shares. Yet. I’m on the road as I write this. But they will be taken out and it will be at a lot higher price. Do your own due diligence.

Silver Bull Resources

SVB-T $.37 (May 17, 2013)

SVBL Amex 159 million shares

www.silverbullresources.com

The Next Silver Takeout

Autor: Bob Moriarty

May 17, 2013

http://www.321gold.com/editorials/moriarty/moriarty051713.ht…

It always seems that it is darkest just before the dawn. I recall well the pain of junior resource owners in mid-2001. The XAU was up 36% over the prior six months but it seemed it would take forever to value to come into the space.

I just went back and reread the very first piece I ever wrote about junior mining stocks from May of 2001. Read it, you will be surprised at how well I captured not only the moment but also what was going to happen over the next decade. We didn’t even start 321gold until two months later, at the time we had a computer online business. It was a good call then and it’s a good call now.

I could change the date on the piece and post the article today and it would be just as timely as it was then. All investors today hate gold, hate silver and consider the penny dreadfuls the spawn of the devil. That’s a really good time to be buying.

I went to Mexico a week or so ago and saw what will be the next silver company to be taken out. It’s named Silver Bull and the name qualifies under the Truth in Advertising statutes. The company reported about 163 million ounces of silver in a 43-101 resource and they have about 159 million shares. So they have just over an ounce of silver per share. Someone who can add is going to take them out. Soon.

And while they report $.35 per ounce of silver, if you take into account the very real 2.4 billion pounds for zinc, the real cost to a buyer is in the $.19 an ounce range. In Mexico they call that, “El Goodo Dealo.”

There will be big news shortly. The giant resource silver deposit is one of the most unusual I have ever seen. The entire deposit is an oxide of silver and zinc rather than the typical sulfide ore I am used to seeing. Silver and zinc are very active metals; they react and form combinations with just about everything so you virtually never find large oxide silver deposits.

The market is waiting for news about metal recovery processes and recovery rates. With that information in hand, it reduces risk. In addition, there will be a PEA released in the next month or so.

Everyone in the resource sector (with perhaps the sole exception of your author) is caught with that deer in the headlight stare right now. But I can assure my readers that neither the Apocalypse nor the 2nd Coming of Christ is scheduled for next week. The market is stumbling around like an old man fumbling in the dark for his dentures but better times come soon.

Silver Bull has young and aggressive management in the form of company President and CEO Tim Barry. He was former VP of Exploration for Metalline Mining, the prior name for SVB. He ousted the welded in place Jurassic age management and kick started the company. He has increased the resource some 250% since 2011 and made it as attractive as possible for a potential buyer.

Coeur D’Alene Mines owns some 10.9% of the shares today. They are a natural buyer or counter bidder should another major take a run at the company. Recent takeouts were in the $1.70 an ounce range so I would expect SBV to attract worth a 300-700% return.

The company is well cashed up with cash in the bank around $10 million so they will have no problems keeping the doors open. Management is young, they are starting to tell their story and for those who like silver, the company is most attractive.

Silver Bull is not an advertiser. Yet. I don’t own shares. Yet. I’m on the road as I write this. But they will be taken out and it will be at a lot higher price. Do your own due diligence.

Silver Bull Resources

SVB-T $.37 (May 17, 2013)

SVBL Amex 159 million shares

www.silverbullresources.com

Corporate Video

Silver Bull in 3 minutes:

http://player.vimeo.com/video/45313482?title=0&byline=0&port…

Silver Bull in 3 minutes:

http://player.vimeo.com/video/45313482?title=0&byline=0&port…

Silver Bull Announces Updated Metallurgical Test Results On The Silver Mineralization At The Sierra Mojada Project, Coahuila, Mexico

HIGHLIGHTS INCLUDE:

- An overall average silver recovery of 73.2% with peak values ~89.0%

- Recovery of between 40% - 50% of the "low grade" zinc mineralization at the SART stage, previously thought unrecoverable. (low grade zinc resource is estimated at 1.53 billion pounds of indicated zinc metal)

- A mining and metallurgical flow sheet that will recover silver, zinc, and potentially lead

- Greater than 98% recycling of cyanide via the SART process -- Cyanide is one of the most expensive reagents used in the leaching process, so the recycling of this will have a significant positive effect in lowering the overall costs.

- Room to optimize and improve recoveries to 75%-80%

...http://www.silverbullresources.com/s/news.asp?ReportID=59065…

HIGHLIGHTS INCLUDE:

- An overall average silver recovery of 73.2% with peak values ~89.0%

- Recovery of between 40% - 50% of the "low grade" zinc mineralization at the SART stage, previously thought unrecoverable. (low grade zinc resource is estimated at 1.53 billion pounds of indicated zinc metal)

- A mining and metallurgical flow sheet that will recover silver, zinc, and potentially lead

- Greater than 98% recycling of cyanide via the SART process -- Cyanide is one of the most expensive reagents used in the leaching process, so the recycling of this will have a significant positive effect in lowering the overall costs.

- Room to optimize and improve recoveries to 75%-80%

...http://www.silverbullresources.com/s/news.asp?ReportID=59065…

Neue Empfehlung nach den letzten Testergebnissen:

Target: 0,95$

http://www.stockhouse.com/news/press-releases/2013/07/04/pi-…

PI Financial Corp. updates coverage on Silver Bull Resources (TSX: SVB) (NYSE MKT: SVBL). Following the release of positive test results from the silver mineralization zone at the company's flagship project in Mexico, analyst Philip Ker reiterated his buy recommendation, maintaining his 12-month target of $0.95, a premium of 137% to the $0.40 price the day the report was issued.

InvestmentPitch.com has produced a "video news alert" based on this report. If this link is not enabled, please visit http://www.InvestmentPitch.com and enter "Silver Bull" in the search box.

Target: 0,95$

http://www.stockhouse.com/news/press-releases/2013/07/04/pi-…

PI Financial Corp. updates coverage on Silver Bull Resources (TSX: SVB) (NYSE MKT: SVBL). Following the release of positive test results from the silver mineralization zone at the company's flagship project in Mexico, analyst Philip Ker reiterated his buy recommendation, maintaining his 12-month target of $0.95, a premium of 137% to the $0.40 price the day the report was issued.

InvestmentPitch.com has produced a "video news alert" based on this report. If this link is not enabled, please visit http://www.InvestmentPitch.com and enter "Silver Bull" in the search box.

Aus dem Video von InvestmentPitch.com, Zitat Analyst Philip Ker:

"We continue to be optimistic of Silver Bull to further de-risk Sierra Mojada and believe the positive metallurgy demonstrated today will be a principal component to investigate project economics in an upcoming Preliminary Economic Assessment that is anticipated later in the 3rd quarter of 2013.

We continue to value shares of Silver Bull in an in-situ basis only at this time and have only attributed value to half of the in-situ zinc within the deposit."

"We continue to be optimistic of Silver Bull to further de-risk Sierra Mojada and believe the positive metallurgy demonstrated today will be a principal component to investigate project economics in an upcoming Preliminary Economic Assessment that is anticipated later in the 3rd quarter of 2013.

We continue to value shares of Silver Bull in an in-situ basis only at this time and have only attributed value to half of the in-situ zinc within the deposit."

Antwort auf Beitrag Nr.: 44.974.975 von rolleg am 03.07.13 15:35:30Die recovery Zahlen sind mMn mehr schlecht als recht!Silber weit unter 80% und Zinc sogar unter 50% ist alles andere als perfekt!

....habe viel bessere erwartet,Ag um die 90% und Zinc über 80%!

Wie seht ihr das?

....habe viel bessere erwartet,Ag um die 90% und Zinc über 80%!

Wie seht ihr das?

Antwort auf Beitrag Nr.: 44.988.745 von SEPP_EIXLBERGER am 05.07.13 10:49:34Das ist nur Low Grade Zink, und zwar IMO ein großer Schritt nach vorne, nachdem SVBL zuvor nicht damit gerechnet hatten, dieses Zink überhaupt verwenden zu können!

"low grade" zinc mineralization at the SART stage, previously thought unrecoverable.

High grade zinc ist noch gar nicht getestet, da dieses ja unter der Silberschicht liegt.

Aber wenn sogar schon low grade um die 50% recovery bringt, dann wird high grade keinesfalls schlechter sein, da es ja dann nicht als Beiprodukt von Silber gewonnen wird, sondern als reiner Zinkabbau....

"low grade" zinc mineralization at the SART stage, previously thought unrecoverable.

High grade zinc ist noch gar nicht getestet, da dieses ja unter der Silberschicht liegt.

Aber wenn sogar schon low grade um die 50% recovery bringt, dann wird high grade keinesfalls schlechter sein, da es ja dann nicht als Beiprodukt von Silber gewonnen wird, sondern als reiner Zinkabbau....

Antwort auf Beitrag Nr.: 44.990.069 von Heftie am 05.07.13 13:25:42Seppi,

damit wurden alle Fragen geklärt, oder?

Danke Heftie!

cu

rolleg

damit wurden alle Fragen geklärt, oder?

Danke Heftie!

cu

rolleg

Neuer Artikel von Bob Moriarty auf 321gold.com:

SART and Silver Bull

http://www.321gold.com/editorials/moriarty/moriarty072513.ht…

Bob Moriarty

Archives

Jul 25, 2013

I first wrote about Silver Bull Resources (SVB-T) in May. The company has a giant silver/zinc project in the State of Coahuila, Mexico, called Sierra Mojada. Using a cutoff grade of 25-g/t silver, the latest 43-101 shows an amazing 163 million ounces of silver and 2.4 billion pounds of zinc in an indicated resource. That’s over an ounce of silver and 30 pounds of zinc per share. In dollar terms, that’s $21 worth of silver and $24 worth of zinc in the ground for every $.38 share.

In my piece, I predicted that SVB would be the next silver takeover target. We all understand that at market tops, majors are in a rush to see how much they can spend to pick up assets at the most expensive price they can. And at bottoms they gnash their teeth and write off all the overpriced deposits they were so anxious to pick up at the top.

As you come off the bottom the majors start to nibble again, seeking to replace their young they have been consuming for years. SVB is at the sweet spot, if you ignore the value of the zinc totally, the silver resource is the cheapest I know of in a reasonable country to operate in. Silver in the ground was worth twice as much 12 years ago.

While I was on the visit, SVB President Tim Barry advised us to watch their news releases in the near future for some good news about a process they were examining called SART for use in the recovery of silver and zinc given their oxide deposit.

SART stands for Sulphidization, Acidification, Recycling and Thickening. It’s a new process for reprocessing cyanide developed by Lakefield Research in 1998.

Let me get into a little chemistry first so you can understand it. Some metals react more than others do. The reason boat owners put a zinc anode on their boats and engines is that all metals react in a water environment. You install a sacrificial zinc bar so the zinc will react before the copper or bronze or more valuable metals.

When you use a cyanide process to recover gold or silver, the cyanide will interact first with zinc, then with copper, then with silver, then with gold. It should be easy to see that the cyanide actually prefers the least valuable metals. Cyanide is expensive and many times the profitability of a particular project depends mostly on cyanide consumption. If you have a lot of copper or zinc in a project, you may not be able to make money using a leach process unless you get rid of the copper or zinc first.

On July 2, 2013 SVB announced the results of metallurgical tests on their mineralization. SVB has a pretty unusual type of rock. It’s an oxide silver and zinc. Because of their reactivity, you rarely find oxide silver. It literally washes away except in the acrid climate of Northern Mexico where there is little rain. In any case, the majors want to see every project derisked before they will consider an offer. 163 million ounces of silver that you can’t recover doesn’t have much value to anyone.

But SVB got excellent recovery numbers for silver with an average recovery of 73% and high recoveries up to 89%. That’s very important to someone considering making an offer for the company. Better yet by installing a $13 million SART plant they can save $54 million a year in cyanide costs and recover up to 99% of the zinc.

Here’s how the math works. The SART plant costs $13 million to install. It costs $39 million a year to operate but saves $54 million in cyanide and produces $16 million a year in previously unrecoverable zinc. By spending $39 million a year, SVB can add $70 million in revenue or savings.

The big unknown with Silver Bull has always been metallurgy. The oxide mineralization is pretty unusual. The latest announcement reduces the risk to anyone thinking of taking them over. Given that Coeur D’Alene Mines already owns 9.9% of SVB, someone is going to make an offer soon. The company has about $10 million in the bank so there is no real risk of them diluting themselves into never-never land. The management is excellent and a PEA will be released soon.

I believe we have had a major, major bottom in gold, silver and all resource stocks. SVB is going to be one of the first to recover and probably will be the silver stock to own over the next year or two. With the latest results from the labs, they would have been worth 500% more than they are today when silver was at $8. There is a lot of upside no matter what the markets do.

Silver Bull is an advertiser and we are biased. Please do your own due diligence.

Silver Bull Resources

SVB-T $.365 (Jul 24, 2013)

SVBL Amex 159 million shares

www.silverbullresources.com

SART and Silver Bull

http://www.321gold.com/editorials/moriarty/moriarty072513.ht…

Bob Moriarty

Archives

Jul 25, 2013

I first wrote about Silver Bull Resources (SVB-T) in May. The company has a giant silver/zinc project in the State of Coahuila, Mexico, called Sierra Mojada. Using a cutoff grade of 25-g/t silver, the latest 43-101 shows an amazing 163 million ounces of silver and 2.4 billion pounds of zinc in an indicated resource. That’s over an ounce of silver and 30 pounds of zinc per share. In dollar terms, that’s $21 worth of silver and $24 worth of zinc in the ground for every $.38 share.

In my piece, I predicted that SVB would be the next silver takeover target. We all understand that at market tops, majors are in a rush to see how much they can spend to pick up assets at the most expensive price they can. And at bottoms they gnash their teeth and write off all the overpriced deposits they were so anxious to pick up at the top.

As you come off the bottom the majors start to nibble again, seeking to replace their young they have been consuming for years. SVB is at the sweet spot, if you ignore the value of the zinc totally, the silver resource is the cheapest I know of in a reasonable country to operate in. Silver in the ground was worth twice as much 12 years ago.

While I was on the visit, SVB President Tim Barry advised us to watch their news releases in the near future for some good news about a process they were examining called SART for use in the recovery of silver and zinc given their oxide deposit.

SART stands for Sulphidization, Acidification, Recycling and Thickening. It’s a new process for reprocessing cyanide developed by Lakefield Research in 1998.

Let me get into a little chemistry first so you can understand it. Some metals react more than others do. The reason boat owners put a zinc anode on their boats and engines is that all metals react in a water environment. You install a sacrificial zinc bar so the zinc will react before the copper or bronze or more valuable metals.

When you use a cyanide process to recover gold or silver, the cyanide will interact first with zinc, then with copper, then with silver, then with gold. It should be easy to see that the cyanide actually prefers the least valuable metals. Cyanide is expensive and many times the profitability of a particular project depends mostly on cyanide consumption. If you have a lot of copper or zinc in a project, you may not be able to make money using a leach process unless you get rid of the copper or zinc first.

On July 2, 2013 SVB announced the results of metallurgical tests on their mineralization. SVB has a pretty unusual type of rock. It’s an oxide silver and zinc. Because of their reactivity, you rarely find oxide silver. It literally washes away except in the acrid climate of Northern Mexico where there is little rain. In any case, the majors want to see every project derisked before they will consider an offer. 163 million ounces of silver that you can’t recover doesn’t have much value to anyone.

But SVB got excellent recovery numbers for silver with an average recovery of 73% and high recoveries up to 89%. That’s very important to someone considering making an offer for the company. Better yet by installing a $13 million SART plant they can save $54 million a year in cyanide costs and recover up to 99% of the zinc.

Here’s how the math works. The SART plant costs $13 million to install. It costs $39 million a year to operate but saves $54 million in cyanide and produces $16 million a year in previously unrecoverable zinc. By spending $39 million a year, SVB can add $70 million in revenue or savings.

The big unknown with Silver Bull has always been metallurgy. The oxide mineralization is pretty unusual. The latest announcement reduces the risk to anyone thinking of taking them over. Given that Coeur D’Alene Mines already owns 9.9% of SVB, someone is going to make an offer soon. The company has about $10 million in the bank so there is no real risk of them diluting themselves into never-never land. The management is excellent and a PEA will be released soon.

I believe we have had a major, major bottom in gold, silver and all resource stocks. SVB is going to be one of the first to recover and probably will be the silver stock to own over the next year or two. With the latest results from the labs, they would have been worth 500% more than they are today when silver was at $8. There is a lot of upside no matter what the markets do.

Silver Bull is an advertiser and we are biased. Please do your own due diligence.

Silver Bull Resources

SVB-T $.365 (Jul 24, 2013)

SVBL Amex 159 million shares

www.silverbullresources.com

News: Silver Bull's Underground Sampling Extends the High Grade Mineralization on the Shallow Silver Zone With Results Up to 1620g/t Silver, 19.75% Lead, and 45% Zinc on the Sierra Mojada Project

http://www.marketwire.com/press-release/silver-bulls-undergr…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Aug. 15, 2013) - Silver Bull Resources, Inc. (TSX:SVB)(NYSE MKT:SVBL) ("Silver Bull") is pleased to announce the results of underground channel samples targeting the north, east, and western extensions to the Shallow Silver Zone on the Sierra Mojada Project in Coahuila, Northern Mexico.

Channel sample highlights include:

NORTH EXTENSION: 1620g/t Ag over 1 meter, 1530g/t Ag over 0.6 meters, 1520g/t Ag over 1 meter, 1055g/t Ag over 1.27 meters, 781 g/t Ag over 2 meters.

EAST EXTENSION: 1035g/t Ag & 28.3% Zn over 1 meter, 527g/t Ag & 17.4% Pb over 1 meter, 801g/t Ag & 19.6% Pb over 1.3 meters, 433g/t Ag & 18.95% Pb over 1 meter.

WEST EXTENSION: 566g/t Ag & 10.15% Zn over 1.5 meters, 391g/t Ag & 1.16% Cu over 1.5 meters, 327g/t Ag & 2.59% Zn over 1.5 meters, 307g/t Ag & 1% Cu over 1.5 meters.

All channel samples were taken along the walls of historical underground workings and lie outside the present silver resource of 162.9 million ounces of indicated silver (25g/t cutoff) and show the continued extension of the high grade mineralization in the north, east and westerly directions.

The channel samples mentioned in this news release target the extension of the high grade mineralization previously defined within the Shallow Silver Zone. Continuous 1 to 2 meter long chip samples were taken along the walls of historical underground workings at the north, east and western extents of the Shallow Silver Zone. The purpose of the program was to extend the high grade mineralization of the Shallow Silver Zone, better understand the geology and controls on the mineralization, and confirm the overall grades of the silver and zinc historically mined.

Approximately 440 meters of underground workings were sampled along the eastern extension, 330 meters along the northern extension, and 160 meters along the western extension. Of the 527 channel samples taken, 82 samples recorded values over 100g/t silver with a peak value of 1620g/t silver, 142 samples recorded values over 3% zinc with a peak value of 45% zinc, and 53 samples recorded values over 25% lead with a peak value of 19.75% lead.

Tim Barry, President and CEO of Silver Bull states, "It is important to realize that all of these channel samples fall outside the present 162.9 million ounce silver resource and clearly show that there is significant upside still left to be developed at Sierra Mojada. In the current market conditions the focus of the company right now is to finish up our metallurgical program and put out a Preliminary Economic Assessment on the significant silver and zinc resource we have defined at Sierra Mojada to date. We expect to have this report to the market out towards the end of September."

To view a location map (Figure 1) of the areas sampled, click the following link: http://media3.marketwire.com/docs/814svb.jpg.

The locations of the channel samples in relation to the Shallow Silver Zone (blue). Approximately 440m of underground workings of Eastern extension, 330m of the Northern extension and 160 meters of the Western extension were sampled.

A selection of results are shown below.

Area Sample Type Channel ID Ag (g/t) Cu (%) Pb (%) Zn (%)

North Extension Channel CH1608 1620 0.12 0 0.03

North Extension Channel CH1512 1530 0.3 0 0.04

North Extension Channel CH1405 1520 0.13 0 0.03

North Extension Channel CH2003 1055 0.06 0 0.01

North Extension Channel CH1310 781 0.14 0 0.03

North Extension Channel CH1709 664 1.5 0 0.03

North Extension Channel CH1710 641 0.3 0 0.03

North Extension Channel CH1309 638 0.1 0 0.03

North Extension Channel CH1503 633 0.16 0 0.03

North Extension Channel CH1405 597 0.16 0.06 0.03

North Extension Channel CH2403 503 0.16 0.01 0.05

North Extension Channel CH1705 482 0.09 0 0.02

North Extension Channel CH1512 450 0.42 0.02 0.05

North Extension Channel CH2506 434 0.1 0 0

North Extension Channel CH1414 283 0.15 0 0.04

North Extension Channel CH2908 281 1.12 0 0.02

North Extension Channel CH1610 252 0.09 0.08 0.04

North Extension Channel CH2909 244 0.55 0 0.01

North Extension Channel CH1308 229 0.23 0.01 0.06

North Extension Channel CH2905 217 0.88 0 0.01

North Extension Channel CH1411 207 0.07 0 0.04

North Extension Channel CH1704 203 0.36 0 0.07

North Extension Channel CH2801 198 0.09 0 0.01

North Extension Channel CH1603 191 0.06 0 0.27

North Extension Channel CH2907 188 0.18 0 0.02

North Extension Channel CH1704 184 0.02 0 0

North Extension Channel CH2505 176 0 0 0

North Extension Channel CH2504 166 0.2 0 0

North Extension Channel CH2802 163 0.13 0 0.01

North Extension Channel CH2401 160 0.12 0 0

North Extension Channel CH1706 153 0.35 0 0.05

North Extension Channel CH1505 151 0.5 0 0.02

North Extension Channel CH1407 150 0.15 0 0.04

North Extension Channel CH2402 150 0.04 0 0

North Extension Channel CH1606 150 0.17 0 0.04

North Extension Channel CH1609 144 0.25 0 0.03

North Extension Channel CH1707 134 0.73 0 0.06

North Extension Channel CH2503 130 0.08 0.01 0.01

North Extension Channel CH3010 130 0.12 0 0.03

North Extension Channel CH1503 100 0.16 0 0.02

West Extension Channel CH25693 566 2.25 1.73 10.15

West Extension Channel CH40687 391 1.16 0.11 0.69

West Extension Channel CH25695 327 0.74 0.50 2.59

West Extension Channel CH25703 307 1.02 0.08 0.94

West Extension Channel CH40686 287 2.63 0.90 8.29

West Extension Channel CH25725 216 0.21 1.56 0.51

West Extension Channel CH40689 171 0.29 0.47 0.44

West Extension Channel CH25672 170 0.00 1.30 8.34

West Extension Channel CH40685 166 1.53 5.02 6.13

West Extension Channel CH25722 156 0.85 1.89 1.94

West Extension Channel CH25714 150 0.76 0.25 0.65

West Extension Channel CH40679 147 0.30 0.06 0.78

West Extension Channel CH25713 128 1.92 0.12 3.46

West Extension Channel CH25674 114 0.01 0.75 6.96

West Extension Channel CH25726 110 0.41 0.78 2.04

West Extension Channel CH25710 109 0.37 2.08 17.90

West Extension Channel CH25704 86 0.32 0.06 0.69

West Extension Channel CH40683 76 0.50 0.54 3.37

West Extension Channel CH25686 76 0.74 0.05 1.66

West Extension Channel CH25709 72 0.14 0.12 0.43

West Extension Channel CH25712 66 0.04 2.46 9.75

West Extension Channel CH25685 65 1.53 0.29 1.97

West Extension Channel CH40680 62 0.34 0.14 3.20

West Extension Channel CH25699 62 0.04 0.39 1.62

West Extension Channel CH25680 59 1.28 0.17 0.92

West Extension Channel CH25669 45 0.04 1.25 23.50

West Extension Channel CH25716 37 0.04 2.16 7.08

West Extension Channel CH25718 34 0.34 0.04 0.94

West Extension Channel CH40682 32 0.03 0.16 0.67

West Extension Channel CH25697 31 0.03 0.26 1.90

East Extension Channel CH2503 1035 0.00 4.29 28.30

East Extension Channel CH1328 801 0.00 19.60 32.10

East Extension Channel CH1136 527 0.00 17.40 16.45

East Extension Channel CH1375 433 0.00 18.95 0.84

East Extension Channel CH1905 336 0.00 2.17 1.12

East Extension Channel CH3002 318 0.00 1.81 21.00

East Extension Channel CH1309 314 0.00 3.10 19.40

East Extension Channel CH1323 278 0.00 19.75 1.58

East Extension Channel CH2508 228 0.00 1.68 11.55

East Extension Channel CH1140 225 0.00 10.70 21.30

East Extension Channel CH2704 206 0.00 3.64 15.85

East Extension Channel CH1903 204 0.00 2.72 1.56

East Extension Channel CH1137 196 0.00 3.03 9.33

East Extension Channel CH1914 177 0.00 2.56 13.05

East Extension Channel CH1507 176 0.00 5.27 11.30

East Extension Channel CH1803 166 0.00 6.50 36.52

East Extension Channel CH1804 150 0.00 4.95 45.30

East Extension Channel CH1506 142 0.00 5.02 17.40

East Extension Channel CH1901 129 0.00 3.45 6.64

East Extension Channel CH1909 120 0.00 0.45 4.05

East Extension Channel CH1314 87 0.00 1.14 1.76

East Extension Channel CH1904 84 0.00 0.84 1.12

East Extension Channel CH1142 83 0.00 2.19 19.40

East Extension Channel CH1802 76 0.00 6.91 29.71

East Extension Channel CH1808 73 0.00 5.45 22.20

East Extension Channel CH1910 69 0.00 4.16 2.76

East Extension Channel CH1267 62 0.00 0.32 0.54

East Extension Channel CH1310 59 0.00 1.71 13.40

East Extension Channel CH2509 56 0.00 2.15 14.50

About the Shallow Silver Zone: The "Shallow Silver Zone" is an oxide silver deposit (+/- zinc, lead & copper), hosted along an east-west trending fracture-karst system set in a cretaceous limestone-dolomite sequence. At a 25g/t cutoff grade the Shallow Silver Zone has an indicated resource of 72.9 million tonnes at an average grade of 69.5 g/t for 162.9 million contained troy ounces of silver. The mineralized body averages between 30m - 90m thick, up to 200m wide and remains open in all directions. Approximately 60% of the current 3.8 kilometer strike length is at or near surface before dipping at around 6 degrees to the east.

Sample Analysis and QA/QC: All samples have been analyzed at ALS Chemex in North Vancouver, BC, Canada. Samples are first tested with the "ME-ICP41m" procedure which analyzes for 35 elements using a near total aqua regia digestion. Samples with silver values above 100ppm are re-analyzed using the Ag-GRA21 procedure which is a fire assay with a gravimetric finish. Samples with zinc, lead, and copper values above 10,000ppm (1%) are re-analyzed using the AA46 procedure which is a near total aqua regia digestion with an atomic absorption finish.

A rigorous procedure is in place regarding sample collection, chain of custody and data entry. Certified standards and blanks, as well as duplicate samples are routinely inserted into all sample shipments to ensure integrity of the assay process.

About Silver Bull: Silver Bull is a US registered mineral exploration company listed on both the NYSE MKT and TSX stock exchanges and based out of Vancouver, Canada. The flag ship "Sierra Mojada" project is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Silver Bull also has 2 mineral licenses in Gabon, Central Africa, which are prospective for gold, manganese, and iron ore.

The technical information of this news release has been reviewed and approved by Tim Barry, MAusIMM, a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

Tim Barry, MAusIMM

Chief Executive Officer, President and Director

Cautionary Note to U.S. Investors concerning estimates of Indicated and Inferred Resources: This press release uses the terms "indicated resources" and "inferred resources" which are defined in, and required to be disclosed by, NI 43-101. We advise U.S. investors that these terms are not recognized by the United States Securities and Exchange Commission (the "SEC"). The estimation of indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.

Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward-looking statements: This news release contains forward-looking statements regarding future events and Silver Bull's future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended (the "Securities Act"), and the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding indicated and inferred resource estimates and the timing of the preparation and completion of the metallurgical program and a Preliminary Economic Analysis. These statements are based on current expectations, estimates, forecasts, and projections about Silver Bull's exploration projects, the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull's management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, including such factors as the results of exploration activities and whether the results continue to support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended October 31, 2012, as amended, and our other periodic and current reports filed with the SEC and available on www.sec.gov and with the Canadian securities commissions available on www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Contact Information

Silver Bull Resources, Inc.

Matt Hallaran

Investor Relations

+1 604 336 8096

info@silverbullresources.com

http://www.marketwire.com/press-release/silver-bulls-undergr…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Aug. 15, 2013) - Silver Bull Resources, Inc. (TSX:SVB)(NYSE MKT:SVBL) ("Silver Bull") is pleased to announce the results of underground channel samples targeting the north, east, and western extensions to the Shallow Silver Zone on the Sierra Mojada Project in Coahuila, Northern Mexico.

Channel sample highlights include:

NORTH EXTENSION: 1620g/t Ag over 1 meter, 1530g/t Ag over 0.6 meters, 1520g/t Ag over 1 meter, 1055g/t Ag over 1.27 meters, 781 g/t Ag over 2 meters.

EAST EXTENSION: 1035g/t Ag & 28.3% Zn over 1 meter, 527g/t Ag & 17.4% Pb over 1 meter, 801g/t Ag & 19.6% Pb over 1.3 meters, 433g/t Ag & 18.95% Pb over 1 meter.

WEST EXTENSION: 566g/t Ag & 10.15% Zn over 1.5 meters, 391g/t Ag & 1.16% Cu over 1.5 meters, 327g/t Ag & 2.59% Zn over 1.5 meters, 307g/t Ag & 1% Cu over 1.5 meters.

All channel samples were taken along the walls of historical underground workings and lie outside the present silver resource of 162.9 million ounces of indicated silver (25g/t cutoff) and show the continued extension of the high grade mineralization in the north, east and westerly directions.

The channel samples mentioned in this news release target the extension of the high grade mineralization previously defined within the Shallow Silver Zone. Continuous 1 to 2 meter long chip samples were taken along the walls of historical underground workings at the north, east and western extents of the Shallow Silver Zone. The purpose of the program was to extend the high grade mineralization of the Shallow Silver Zone, better understand the geology and controls on the mineralization, and confirm the overall grades of the silver and zinc historically mined.

Approximately 440 meters of underground workings were sampled along the eastern extension, 330 meters along the northern extension, and 160 meters along the western extension. Of the 527 channel samples taken, 82 samples recorded values over 100g/t silver with a peak value of 1620g/t silver, 142 samples recorded values over 3% zinc with a peak value of 45% zinc, and 53 samples recorded values over 25% lead with a peak value of 19.75% lead.

Tim Barry, President and CEO of Silver Bull states, "It is important to realize that all of these channel samples fall outside the present 162.9 million ounce silver resource and clearly show that there is significant upside still left to be developed at Sierra Mojada. In the current market conditions the focus of the company right now is to finish up our metallurgical program and put out a Preliminary Economic Assessment on the significant silver and zinc resource we have defined at Sierra Mojada to date. We expect to have this report to the market out towards the end of September."

To view a location map (Figure 1) of the areas sampled, click the following link: http://media3.marketwire.com/docs/814svb.jpg.

The locations of the channel samples in relation to the Shallow Silver Zone (blue). Approximately 440m of underground workings of Eastern extension, 330m of the Northern extension and 160 meters of the Western extension were sampled.

A selection of results are shown below.

Area Sample Type Channel ID Ag (g/t) Cu (%) Pb (%) Zn (%)

North Extension Channel CH1608 1620 0.12 0 0.03

North Extension Channel CH1512 1530 0.3 0 0.04

North Extension Channel CH1405 1520 0.13 0 0.03

North Extension Channel CH2003 1055 0.06 0 0.01

North Extension Channel CH1310 781 0.14 0 0.03

North Extension Channel CH1709 664 1.5 0 0.03

North Extension Channel CH1710 641 0.3 0 0.03

North Extension Channel CH1309 638 0.1 0 0.03

North Extension Channel CH1503 633 0.16 0 0.03

North Extension Channel CH1405 597 0.16 0.06 0.03

North Extension Channel CH2403 503 0.16 0.01 0.05

North Extension Channel CH1705 482 0.09 0 0.02

North Extension Channel CH1512 450 0.42 0.02 0.05

North Extension Channel CH2506 434 0.1 0 0

North Extension Channel CH1414 283 0.15 0 0.04

North Extension Channel CH2908 281 1.12 0 0.02

North Extension Channel CH1610 252 0.09 0.08 0.04

North Extension Channel CH2909 244 0.55 0 0.01

North Extension Channel CH1308 229 0.23 0.01 0.06

North Extension Channel CH2905 217 0.88 0 0.01

North Extension Channel CH1411 207 0.07 0 0.04

North Extension Channel CH1704 203 0.36 0 0.07

North Extension Channel CH2801 198 0.09 0 0.01

North Extension Channel CH1603 191 0.06 0 0.27

North Extension Channel CH2907 188 0.18 0 0.02

North Extension Channel CH1704 184 0.02 0 0

North Extension Channel CH2505 176 0 0 0

North Extension Channel CH2504 166 0.2 0 0

North Extension Channel CH2802 163 0.13 0 0.01

North Extension Channel CH2401 160 0.12 0 0

North Extension Channel CH1706 153 0.35 0 0.05

North Extension Channel CH1505 151 0.5 0 0.02

North Extension Channel CH1407 150 0.15 0 0.04

North Extension Channel CH2402 150 0.04 0 0

North Extension Channel CH1606 150 0.17 0 0.04

North Extension Channel CH1609 144 0.25 0 0.03

North Extension Channel CH1707 134 0.73 0 0.06

North Extension Channel CH2503 130 0.08 0.01 0.01

North Extension Channel CH3010 130 0.12 0 0.03

North Extension Channel CH1503 100 0.16 0 0.02

West Extension Channel CH25693 566 2.25 1.73 10.15

West Extension Channel CH40687 391 1.16 0.11 0.69

West Extension Channel CH25695 327 0.74 0.50 2.59

West Extension Channel CH25703 307 1.02 0.08 0.94

West Extension Channel CH40686 287 2.63 0.90 8.29

West Extension Channel CH25725 216 0.21 1.56 0.51

West Extension Channel CH40689 171 0.29 0.47 0.44

West Extension Channel CH25672 170 0.00 1.30 8.34

West Extension Channel CH40685 166 1.53 5.02 6.13

West Extension Channel CH25722 156 0.85 1.89 1.94

West Extension Channel CH25714 150 0.76 0.25 0.65

West Extension Channel CH40679 147 0.30 0.06 0.78

West Extension Channel CH25713 128 1.92 0.12 3.46

West Extension Channel CH25674 114 0.01 0.75 6.96

West Extension Channel CH25726 110 0.41 0.78 2.04

West Extension Channel CH25710 109 0.37 2.08 17.90

West Extension Channel CH25704 86 0.32 0.06 0.69

West Extension Channel CH40683 76 0.50 0.54 3.37

West Extension Channel CH25686 76 0.74 0.05 1.66

West Extension Channel CH25709 72 0.14 0.12 0.43

West Extension Channel CH25712 66 0.04 2.46 9.75

West Extension Channel CH25685 65 1.53 0.29 1.97

West Extension Channel CH40680 62 0.34 0.14 3.20

West Extension Channel CH25699 62 0.04 0.39 1.62

West Extension Channel CH25680 59 1.28 0.17 0.92

West Extension Channel CH25669 45 0.04 1.25 23.50

West Extension Channel CH25716 37 0.04 2.16 7.08

West Extension Channel CH25718 34 0.34 0.04 0.94

West Extension Channel CH40682 32 0.03 0.16 0.67

West Extension Channel CH25697 31 0.03 0.26 1.90

East Extension Channel CH2503 1035 0.00 4.29 28.30

East Extension Channel CH1328 801 0.00 19.60 32.10

East Extension Channel CH1136 527 0.00 17.40 16.45

East Extension Channel CH1375 433 0.00 18.95 0.84

East Extension Channel CH1905 336 0.00 2.17 1.12

East Extension Channel CH3002 318 0.00 1.81 21.00

East Extension Channel CH1309 314 0.00 3.10 19.40

East Extension Channel CH1323 278 0.00 19.75 1.58

East Extension Channel CH2508 228 0.00 1.68 11.55

East Extension Channel CH1140 225 0.00 10.70 21.30

East Extension Channel CH2704 206 0.00 3.64 15.85

East Extension Channel CH1903 204 0.00 2.72 1.56

East Extension Channel CH1137 196 0.00 3.03 9.33

East Extension Channel CH1914 177 0.00 2.56 13.05

East Extension Channel CH1507 176 0.00 5.27 11.30

East Extension Channel CH1803 166 0.00 6.50 36.52

East Extension Channel CH1804 150 0.00 4.95 45.30

East Extension Channel CH1506 142 0.00 5.02 17.40

East Extension Channel CH1901 129 0.00 3.45 6.64

East Extension Channel CH1909 120 0.00 0.45 4.05

East Extension Channel CH1314 87 0.00 1.14 1.76

East Extension Channel CH1904 84 0.00 0.84 1.12

East Extension Channel CH1142 83 0.00 2.19 19.40

East Extension Channel CH1802 76 0.00 6.91 29.71

East Extension Channel CH1808 73 0.00 5.45 22.20

East Extension Channel CH1910 69 0.00 4.16 2.76

East Extension Channel CH1267 62 0.00 0.32 0.54

East Extension Channel CH1310 59 0.00 1.71 13.40

East Extension Channel CH2509 56 0.00 2.15 14.50

About the Shallow Silver Zone: The "Shallow Silver Zone" is an oxide silver deposit (+/- zinc, lead & copper), hosted along an east-west trending fracture-karst system set in a cretaceous limestone-dolomite sequence. At a 25g/t cutoff grade the Shallow Silver Zone has an indicated resource of 72.9 million tonnes at an average grade of 69.5 g/t for 162.9 million contained troy ounces of silver. The mineralized body averages between 30m - 90m thick, up to 200m wide and remains open in all directions. Approximately 60% of the current 3.8 kilometer strike length is at or near surface before dipping at around 6 degrees to the east.

Sample Analysis and QA/QC: All samples have been analyzed at ALS Chemex in North Vancouver, BC, Canada. Samples are first tested with the "ME-ICP41m" procedure which analyzes for 35 elements using a near total aqua regia digestion. Samples with silver values above 100ppm are re-analyzed using the Ag-GRA21 procedure which is a fire assay with a gravimetric finish. Samples with zinc, lead, and copper values above 10,000ppm (1%) are re-analyzed using the AA46 procedure which is a near total aqua regia digestion with an atomic absorption finish.

A rigorous procedure is in place regarding sample collection, chain of custody and data entry. Certified standards and blanks, as well as duplicate samples are routinely inserted into all sample shipments to ensure integrity of the assay process.

About Silver Bull: Silver Bull is a US registered mineral exploration company listed on both the NYSE MKT and TSX stock exchanges and based out of Vancouver, Canada. The flag ship "Sierra Mojada" project is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Silver Bull also has 2 mineral licenses in Gabon, Central Africa, which are prospective for gold, manganese, and iron ore.

The technical information of this news release has been reviewed and approved by Tim Barry, MAusIMM, a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

Tim Barry, MAusIMM

Chief Executive Officer, President and Director

Cautionary Note to U.S. Investors concerning estimates of Indicated and Inferred Resources: This press release uses the terms "indicated resources" and "inferred resources" which are defined in, and required to be disclosed by, NI 43-101. We advise U.S. investors that these terms are not recognized by the United States Securities and Exchange Commission (the "SEC"). The estimation of indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.

Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward-looking statements: This news release contains forward-looking statements regarding future events and Silver Bull's future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended (the "Securities Act"), and the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding indicated and inferred resource estimates and the timing of the preparation and completion of the metallurgical program and a Preliminary Economic Analysis. These statements are based on current expectations, estimates, forecasts, and projections about Silver Bull's exploration projects, the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull's management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, including such factors as the results of exploration activities and whether the results continue to support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended October 31, 2012, as amended, and our other periodic and current reports filed with the SEC and available on www.sec.gov and with the Canadian securities commissions available on www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Contact Information

Silver Bull Resources, Inc.

Matt Hallaran

Investor Relations

+1 604 336 8096

info@silverbullresources.com

Silver Bull President & CEO Tim Barry Provides Corporate Update at the Precious Metals Summit and Denver Gold Forum Conferences in Colorado (with Video Feed)

Vancouver, British Columbia - September 17, 2013 - Silver Bull Resources, Inc. (TSX: SVB, NYSE MKT: SVBL) ("Silver Bull") is pleased to announce that company President & CEO, Tim Barry, will be presenting at the Precious Metals Summit in Vale, Colorado on Thursday, September 19th 2013 at 4:30pm MDT. We invite you to view the live webcast by clicking the following link:

Precious Metals Summit webcast link:

http://www.gowebcasting.com/conferences/2013/09/18/precious-…

If you are unable to view the live presentation as it happens, website visitors will also have the option to view the archived presentation which will be available at the same link approximately 90 minutes after the presentation concludes.

Mr. Barry will also be presenting at the Denver Gold Forum on Monday, September 23th, 2013 at 10:30am MDT. The webcast of this presentation will be streamed live and will be made available on demand thereafter at the same link.

Denver Gold Forum webcast link:

http://www.denvergoldforum.org/dgf13/company-webcast/SVBL:US…

Vancouver, British Columbia - September 17, 2013 - Silver Bull Resources, Inc. (TSX: SVB, NYSE MKT: SVBL) ("Silver Bull") is pleased to announce that company President & CEO, Tim Barry, will be presenting at the Precious Metals Summit in Vale, Colorado on Thursday, September 19th 2013 at 4:30pm MDT. We invite you to view the live webcast by clicking the following link:

Precious Metals Summit webcast link:

http://www.gowebcasting.com/conferences/2013/09/18/precious-…

If you are unable to view the live presentation as it happens, website visitors will also have the option to view the archived presentation which will be available at the same link approximately 90 minutes after the presentation concludes.

Mr. Barry will also be presenting at the Denver Gold Forum on Monday, September 23th, 2013 at 10:30am MDT. The webcast of this presentation will be streamed live and will be made available on demand thereafter at the same link.

Denver Gold Forum webcast link:

http://www.denvergoldforum.org/dgf13/company-webcast/SVBL:US…

Hier die aktuelle Powerpoint Präsentation vom Precious Metals Summit in Denver:

http://static.gowebcasting.com/documents/files/events/event_…

Speziell Slide 24 (Near Resource Extension Zones) wurde von Tim explizit angesprochen: In Channel Samples von alten Schächten direkt neben der Shallow Silver Zone wurden bis zu 1,6 kg Silber pro Tonne gefunden.

Nach der PEA Fertigstellung (Q3 2013) wird bei den ca. 9 km entfernten Zielen "Dormidos" und "Palamos Negros" (Slide 26 bis 28) gebohrt. Tim würde "nichts lieber präsentieren als einen Fund in einem komplett neuen Gebiet".

Zugehöriges Video:

http://www.gowebcasting.com/events/precious-metals-summit-co…

http://static.gowebcasting.com/documents/files/events/event_…

Speziell Slide 24 (Near Resource Extension Zones) wurde von Tim explizit angesprochen: In Channel Samples von alten Schächten direkt neben der Shallow Silver Zone wurden bis zu 1,6 kg Silber pro Tonne gefunden.

Nach der PEA Fertigstellung (Q3 2013) wird bei den ca. 9 km entfernten Zielen "Dormidos" und "Palamos Negros" (Slide 26 bis 28) gebohrt. Tim würde "nichts lieber präsentieren als einen Fund in einem komplett neuen Gebiet".

Zugehöriges Video:

http://www.gowebcasting.com/events/precious-metals-summit-co…

Und gleich die nächste Präsentation von Tim (Denver Gold Forum, 23. Sepember):

http://www.denvergoldforum.org/dgf13/company-webcast/SVBL:US

Im großen und ganzen identisch mit der Präsentation von vor wenigen Tagen.

Starter Pit in der Mitte des Vorkommens wird ca. 60 Mio Unzen Silber bei einem Mine Life von etwa 5-6 Jahren haben. Dieses Starter Pit wäre ideal, um schnell das benötigte Fremdkapital abzuzahlen.

Er geht aber auch kurz auf das geplante Bohrungprogramm auf Slide 23 ein ("Underground Phase 2", schwarzer Rahmen). Geologisch sieht diese Zone exakt aus wie "Underground Phase 1 (weißer Rahmen). Bohr-Equipment ist bereits im Besitz, daher können die Resourcen hier sehr kostengünstig erweiter werden!

http://www.denvergoldforum.org/dgf13/company-webcast/SVBL:US

Im großen und ganzen identisch mit der Präsentation von vor wenigen Tagen.

Starter Pit in der Mitte des Vorkommens wird ca. 60 Mio Unzen Silber bei einem Mine Life von etwa 5-6 Jahren haben. Dieses Starter Pit wäre ideal, um schnell das benötigte Fremdkapital abzuzahlen.

Er geht aber auch kurz auf das geplante Bohrungprogramm auf Slide 23 ein ("Underground Phase 2", schwarzer Rahmen). Geologisch sieht diese Zone exakt aus wie "Underground Phase 1 (weißer Rahmen). Bohr-Equipment ist bereits im Besitz, daher können die Resourcen hier sehr kostengünstig erweiter werden!

Silver Bull Completes Positive Preliminary Economic Assessment For the Sierra Mojada Project, Coahuila, Mexico

http://www.silverbullresources.com/s/news.asp?ReportID=60602…

http://www.silverbullresources.com/s/news.asp?ReportID=60602…

Gecko Research Podcast with Silver Bull CEO Tim Barry

PODCAST: Silver Bull Resources CEO, Tim Barry, Sheds Light on the Company's Impressive PEA

Another interview was just posted in our Podcast section. On Tuesday of this week, Silver Bull released a PEA on its flagship property La Mojada, currently the largest Mexican silver deposit in the Indicated category not already owned by a major. It is evident that La Mojada one day in the not too distant future will become a mine. This is rare in today's price environment and reaffirms to us the quality of this company.

We spoke to CEO Tim Barry this morning and he shed some light on the release as well as went through the most important numbers for our listeners.

Tim also talks about what's next for the company and how they will bring the project along towards a feasibility study as well as the permitting process. Sitting on roughly $6.5 million in cash, Silver Bull is well funded through 2014 and further.

PODCAST

http://www.geckoresearch.com/Silver_Bull_Resources_Sheds_Lig…

PODCAST: Silver Bull Resources CEO, Tim Barry, Sheds Light on the Company's Impressive PEA

Another interview was just posted in our Podcast section. On Tuesday of this week, Silver Bull released a PEA on its flagship property La Mojada, currently the largest Mexican silver deposit in the Indicated category not already owned by a major. It is evident that La Mojada one day in the not too distant future will become a mine. This is rare in today's price environment and reaffirms to us the quality of this company.

We spoke to CEO Tim Barry this morning and he shed some light on the release as well as went through the most important numbers for our listeners.

Tim also talks about what's next for the company and how they will bring the project along towards a feasibility study as well as the permitting process. Sitting on roughly $6.5 million in cash, Silver Bull is well funded through 2014 and further.

PODCAST

http://www.geckoresearch.com/Silver_Bull_Resources_Sheds_Lig…

Seeking Alpha:

Silver Bull Resources Is Getting Its Ducks In A Row

http://seekingalpha.com/article/1731832-silver-bull-resource…

The Investment Doctor

Seeking Alpha

October 7, 2013 09:16AM

Introduction

In this article I'll have a closer look at Silver Bull Resources (SVBL ~ SVB.T), which aims to develop a silver-zinc project in Mexico. I've been closely following the company for a while now, and was waiting to see an independent study on the viability of its project before writing about it. As Silver Bull has released its long-expected Preliminary Economic Assessment, I feel confident enough to initiate a long position.

I will start with an overview of the Sierra Mojada project and discuss the numbers in the Preliminary Economic Assessment and I will make some cash flow projections. I'll discuss the influence of dilution on the NPV/share and how the project might get financed. This will result in my investment thesis at the end of this article.

Executive Summary

In this article I'll prove why Silver Bull Resources might be an attractive investment, as its recently completed PEA outlines a 5Moz+ per year production rate at very competitive single-dollar cash costs. As the company won't only produce silver but also zinc and maybe copper and lead as well, it has a lot of options to finance the $300M capex by closing offtake agreements for the by-products. But even if the company would have to issue 200M new shares to raise money, the after-tax NPV/share would still be 130% higher than the current share price.

However, I don't think Silver Bull will ever reach the production phase as its expected output of 5.5M oz silver and in excess of 50 million pounds of zinc might be enticing for companies such as First Majestic Silver ( AG) and Nyrstar to try to get their hands on an exciting Mexican low-cost project.

There are obviously risks involved with any potential investment in Silver Bull Resources, but I feel the potential of the company outweighs the risks as the independent NI43-compliant PEA has shown this project is feasible.