UBS AG stuft Skyworks Solutions auf buy - Die letzten 30 Beiträge | Diskussion im Forum

eröffnet am 04.05.13 10:40:29 von

neuester Beitrag 16.02.24 12:29:17 von

neuester Beitrag 16.02.24 12:29:17 von

Beiträge: 57

ID: 1.181.529

ID: 1.181.529

Aufrufe heute: 0

Gesamt: 8.369

Gesamt: 8.369

Aktive User: 0

ISIN: US83088M1027 · WKN: 857760 · Symbol: SWKS

102,95

USD

+1,81 %

+1,83 USD

Letzter Kurs 25.04.24 Nasdaq

Neuigkeiten

17.04.24 · Business Wire (engl.) |

27.02.24 · Business Wire (engl.) |

30.01.24 · Business Wire (engl.) |

16.01.24 · Business Wire (engl.) |

Werte aus der Branche Halbleiter

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,900 | +43,42 | |

| 156,00 | +29,02 | |

| 5.010,00 | +25,09 | |

| 20,400 | +20,00 | |

| 1,0000 | +19,23 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,5000 | -12,02 | |

| 5,0100 | -12,11 | |

| 2,5200 | -14,58 | |

| 3,3050 | -17,58 | |

| 13,590 | -22,56 |

Beitrag zu dieser Diskussion schreiben

Up......Ist hier jemand noch investiert und verfolgt die Aktie?

Gar keine Beiträge zu der Firma?

Da in Deutschland durch die Altparteien alles zerstört wird suche ich Aktien außerhalb Deutschlands (mit Ausnahmen) Skyworks ist ja erstmal gut zurückgekommen und überlege hier einzusteigen.

Da in Deutschland durch die Altparteien alles zerstört wird suche ich Aktien außerhalb Deutschlands (mit Ausnahmen) Skyworks ist ja erstmal gut zurückgekommen und überlege hier einzusteigen.

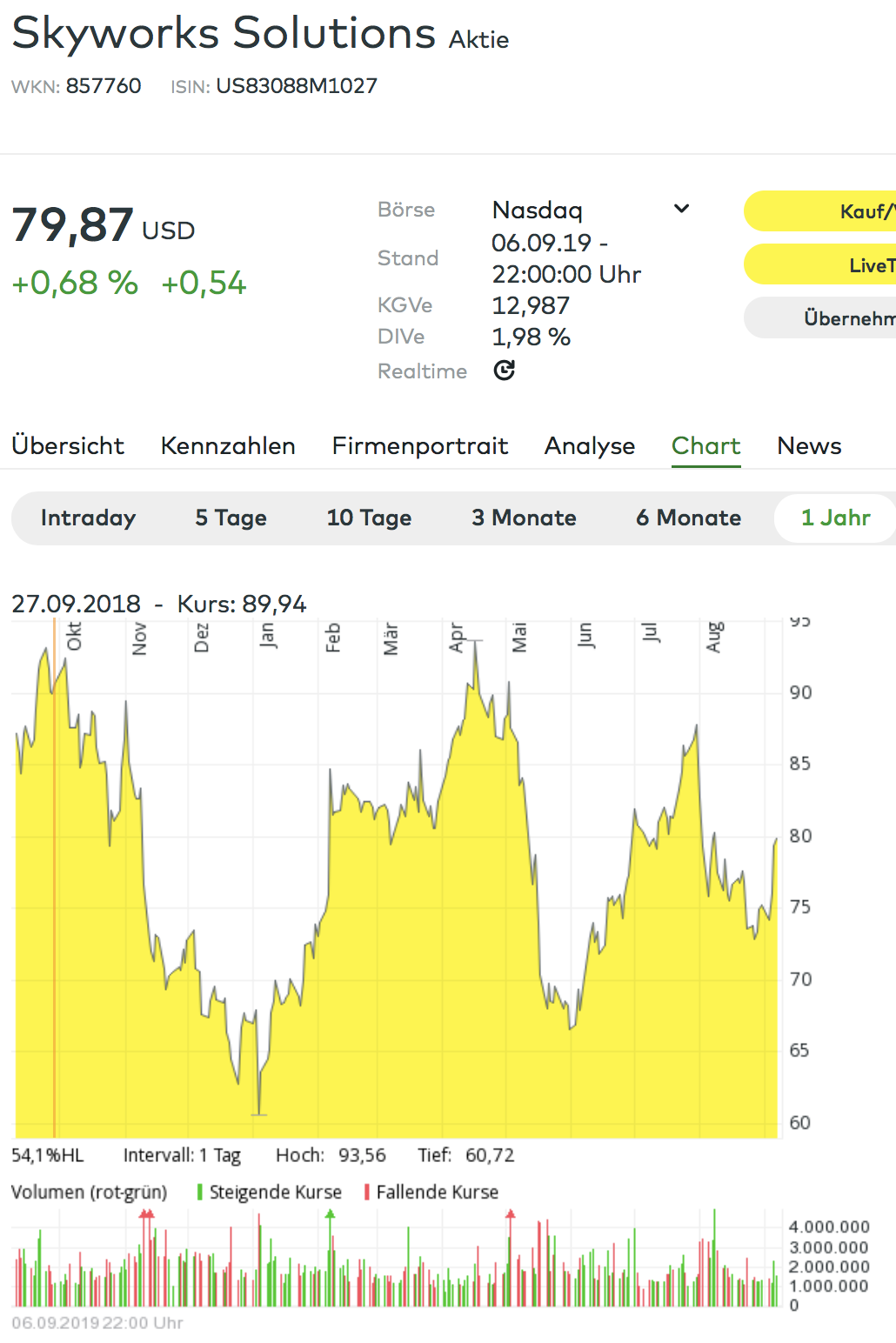

Eine Aktie die sehr gut gelaufen ist, seit 3 Monaten eher absteigend, wo kann es hier hingehen?

Die hatten ein starke erste Quartal mit einem Rekordumsatz von 1,5 Mrd. $. Das entspricht einem Anstieg von 69 % im Jahresvergleich. Und der mega starke operative Cashflow von 485 Mio. $ verzückt mich. Die fahren im Windschatten von Apple, die für 56 % der Umsätze stehen. Für das laufende Quartal ist man ebenfalls optimistisch. 50 % Umsatzwachstum auf bis zu 1,2 Mrd. $ und ein Gewinnwachstum um 75 % auf 2,34 $ je Aktie. Damit wäre das 2022er-KGV von 17 doch echt klasse und ein gutes längerfristiges Investment.

Hallo

Wie seht ihr die jetzige Situation mit Apple ?

Meines Wissens nach macht Skyworks 20- 25% des Umsatzes mit Apple. Was könnte passieren wenn Apple auch noch auf die glorreiche Idee kommt diese Produkte selber herzustellen ?

Gerne eure Meinung dazu.

MfG

Wie seht ihr die jetzige Situation mit Apple ?

Meines Wissens nach macht Skyworks 20- 25% des Umsatzes mit Apple. Was könnte passieren wenn Apple auch noch auf die glorreiche Idee kommt diese Produkte selber herzustellen ?

Gerne eure Meinung dazu.

MfG

heute

Kauf zu $79,60 und short call Jan20@$80 zu $5,80 Prämie;ergibt Einstand von $73,80 und maximal Rendite von 8,7% für 4 Monate

Antwort auf Beitrag Nr.: 59.176.368 von R-BgO am 09.11.18 10:27:37Skyworks Updates Q1 FY19 Guidance and Sets Date for Q1 FY19 Earnings Release and Conference Call

IRVINE, Calif.--(BUSINESS WIRE)--Jan. 8, 2019--

Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today updated its guidance for the first fiscal quarter ended December 28, 2018. The company now expects:

-Revenue of approximately $970 million, compared to the prior guidance of revenue between $1.000 billion and $1.020 billion; and

-Non-GAAP diluted earnings per share in the range of $1.81 to $1.84, compared to the prior guidance of $1.91 at the midpoint of the prior guidance revenue range.

“First fiscal quarter results were impacted by unit weakness across our largest smartphone customers,” said Liam K. Griffin, president and chief executive officer of Skyworks. “Despite these near-term challenges, our broad markets business tracked in-line with our prior outlook. In addition, cash flow generation continued to be strong, allowing us to return cash to shareholders through share repurchases and dividends.”

This update is preliminary in nature, based on information available to management as of the date of this release, and is subject to further changes upon completion of our standard quarter-end closing procedures. Skyworks’ independent registered public accounting firm has not completed its review of our results for the first fiscal quarter ended December 28, 2018. We undertake no obligation to update the information in this release in the event facts or circumstances change after the date of this release.

IRVINE, Calif.--(BUSINESS WIRE)--Jan. 8, 2019--

Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today updated its guidance for the first fiscal quarter ended December 28, 2018. The company now expects:

-Revenue of approximately $970 million, compared to the prior guidance of revenue between $1.000 billion and $1.020 billion; and

-Non-GAAP diluted earnings per share in the range of $1.81 to $1.84, compared to the prior guidance of $1.91 at the midpoint of the prior guidance revenue range.

“First fiscal quarter results were impacted by unit weakness across our largest smartphone customers,” said Liam K. Griffin, president and chief executive officer of Skyworks. “Despite these near-term challenges, our broad markets business tracked in-line with our prior outlook. In addition, cash flow generation continued to be strong, allowing us to return cash to shareholders through share repurchases and dividends.”

This update is preliminary in nature, based on information available to management as of the date of this release, and is subject to further changes upon completion of our standard quarter-end closing procedures. Skyworks’ independent registered public accounting firm has not completed its review of our results for the first fiscal quarter ended December 28, 2018. We undertake no obligation to update the information in this release in the event facts or circumstances change after the date of this release.

Hallo zusammen, der Wert wird in einigen foolishen Kommentaren zum Kauf angepriesen, so bin ich auf den Wert aufmerksam geworden. Was denkt ihr wie esmit dem Wert weiter geht?

Antwort auf Beitrag Nr.: 58.949.550 von R-BgO am 13.10.18 10:04:16

yep

und Wachstum ist auch zum Erliegen gekommen...

wahrscheinlich GewinnRÜCKgang fürs Gesamtjahr...

Sehr schöne Umschreibung des Unternehmens:

https://www.fool.com/investing/2018/03/19/if-you-love-the-in…

https://www.fool.com/investing/2018/03/19/if-you-love-the-in…

Antwort auf Beitrag Nr.: 57.102.072 von R-BgO am 23.02.18 14:17:05Letztlich eine super Langfristanlage, denke ich. Einzige Sorge bleibt Apple.... wenn die den Hahn zudrehen, wird es ungemütlich.

Skyworks and Sequans Launch Industry’s Most Advanced LTE-M/NB-IoT Connectivity Solution for the Internet of Things

Skyworks' RF Front-end Integrated with Sequans' Monarch LTE Platform in World’s Smallest Form Factor

IRVINE, Calif. & PARIS--(BUSINESS WIRE)--Feb. 23, 2018--

Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, and Sequans Communications S.A. (NYSE: SQNS), maker of the world’s most highly-optimized LTE-M/NB-IoT chip for the Internet of Things (IoT), have built upon their successful multi-year collaboration to deliver the smallest, turnkey connectivity engine for next generation LTE devices that can operate globally.

Specifically, the new solution combines Skyworks’ industry-leading front-ends with Sequans’ advanced Monarch LTE-M/NB-IoT platform to create an all-in-one design that is compliant with Release 13/14 of the 3GPP LTE standard. The single SKU device simplifies the design process, shortens development time and significantly accelerates the launch of numerous space-constrained IoT products such as sensors, trackers and wearables, where the size is extremely important.

“Through our collaboration with Skyworks, we have created one of the most critical LTE engines for IoT available in the world today,” said Georges Karam, Sequans CEO. “Our comprehensive and powerful module incorporates every major component needed to enable the widespread deployment of LTE devices on any band, in an extremely small and thin package. This new form factor represents a truly ground-breaking architecture for a broad range of applications.”

“Skyworks’ partnership with an industry leader like Sequans allows us to fully optimize our innovative wireless engines, advanced packaging and system level expertise for emerging IoT markets,” said John O’Neill, Skyworks’ vice president of marketing. “For our worldwide customers, it means smaller and simplified designs, accelerated carrier certifications and a much faster time to market.”

The solution has been pre-certified with leading operators through existing certifications of Sequans’ Monarch platform, making it the most advanced offering available today.

“This is an exciting product for IoT device designers, especially for wearable IoT devices in need of compact solutions,” said Cameron Coursey, vice president of AT&T’s Internet of Things Solutions. “The Sequans/Skyworks platform brings together the technologies of two industry leaders to give AT&T’s IoT customers a total solution for launching their IoT devices on AT&T’s network as quickly as possible.”

About the Skyworks/Sequans Turnkey Platform

The feature-rich product includes an integrated baseband, SRAM, RF transceiver, RF front-end, passives and power management in a single 8.8 x 10.8 x 0.95 mm package with proprietary RF shielding. It is compliant with 3GPP Release 13/14 LTE Advanced Pro specifications, including VoLTE support, is optimized for LTE UE categories M1, NB1, and NB2 and operates across broad frequency ranges (700 MHz to 2.1 GHz) to support global deployment and roaming capability. Proprietary power management techniques offer improved battery life.

Units are available now for lead customers and partners. Broader availability is planned for the second calendar quarter of 2018. Customers should contact their respective Skyworks or Sequans representatives for more details.

Skyworks' RF Front-end Integrated with Sequans' Monarch LTE Platform in World’s Smallest Form Factor

IRVINE, Calif. & PARIS--(BUSINESS WIRE)--Feb. 23, 2018--

Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, and Sequans Communications S.A. (NYSE: SQNS), maker of the world’s most highly-optimized LTE-M/NB-IoT chip for the Internet of Things (IoT), have built upon their successful multi-year collaboration to deliver the smallest, turnkey connectivity engine for next generation LTE devices that can operate globally.

Specifically, the new solution combines Skyworks’ industry-leading front-ends with Sequans’ advanced Monarch LTE-M/NB-IoT platform to create an all-in-one design that is compliant with Release 13/14 of the 3GPP LTE standard. The single SKU device simplifies the design process, shortens development time and significantly accelerates the launch of numerous space-constrained IoT products such as sensors, trackers and wearables, where the size is extremely important.

“Through our collaboration with Skyworks, we have created one of the most critical LTE engines for IoT available in the world today,” said Georges Karam, Sequans CEO. “Our comprehensive and powerful module incorporates every major component needed to enable the widespread deployment of LTE devices on any band, in an extremely small and thin package. This new form factor represents a truly ground-breaking architecture for a broad range of applications.”

“Skyworks’ partnership with an industry leader like Sequans allows us to fully optimize our innovative wireless engines, advanced packaging and system level expertise for emerging IoT markets,” said John O’Neill, Skyworks’ vice president of marketing. “For our worldwide customers, it means smaller and simplified designs, accelerated carrier certifications and a much faster time to market.”

The solution has been pre-certified with leading operators through existing certifications of Sequans’ Monarch platform, making it the most advanced offering available today.

“This is an exciting product for IoT device designers, especially for wearable IoT devices in need of compact solutions,” said Cameron Coursey, vice president of AT&T’s Internet of Things Solutions. “The Sequans/Skyworks platform brings together the technologies of two industry leaders to give AT&T’s IoT customers a total solution for launching their IoT devices on AT&T’s network as quickly as possible.”

About the Skyworks/Sequans Turnkey Platform

The feature-rich product includes an integrated baseband, SRAM, RF transceiver, RF front-end, passives and power management in a single 8.8 x 10.8 x 0.95 mm package with proprietary RF shielding. It is compliant with 3GPP Release 13/14 LTE Advanced Pro specifications, including VoLTE support, is optimized for LTE UE categories M1, NB1, and NB2 and operates across broad frequency ranges (700 MHz to 2.1 GHz) to support global deployment and roaming capability. Proprietary power management techniques offer improved battery life.

Units are available now for lead customers and partners. Broader availability is planned for the second calendar quarter of 2018. Customers should contact their respective Skyworks or Sequans representatives for more details.

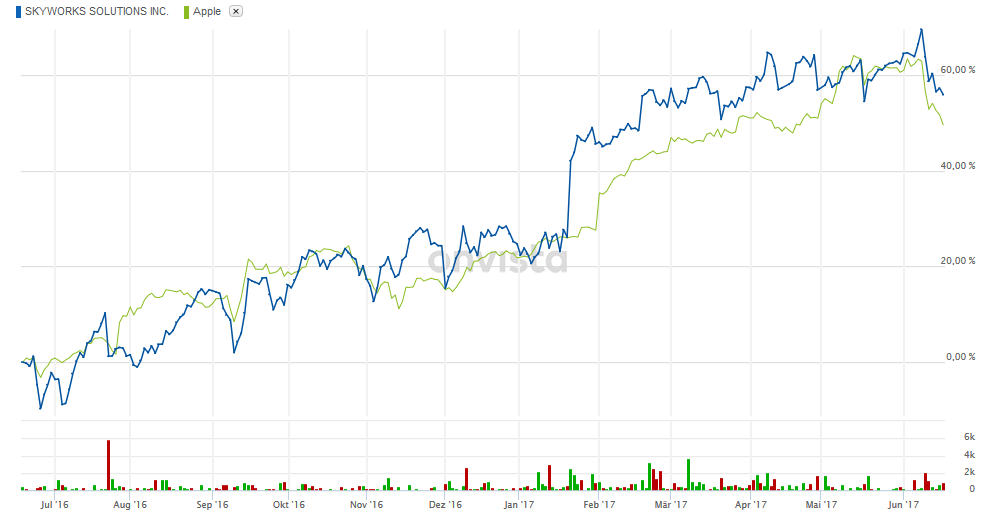

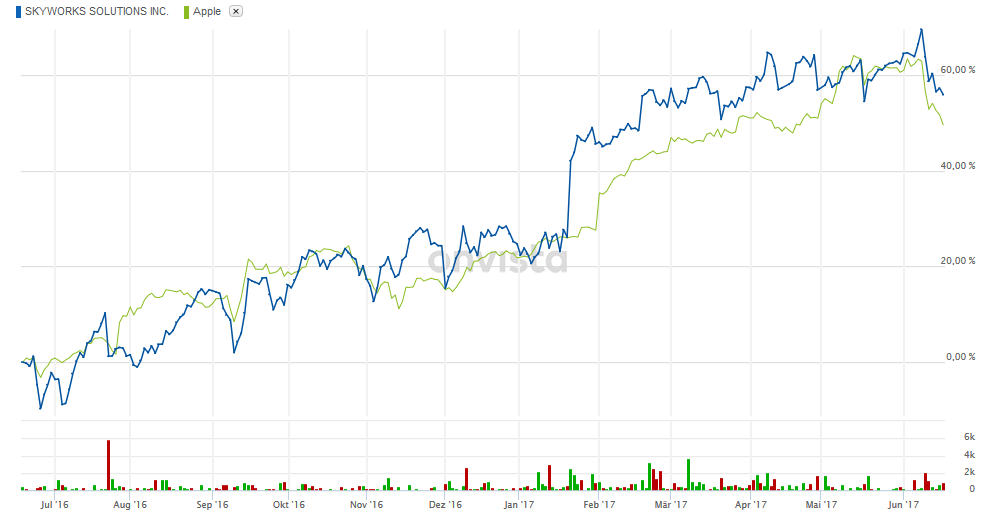

Antwort auf Beitrag Nr.: 54.513.009 von Oberkassel am 10.03.17 17:47:48M.E. ist es fast egal, ob man bei Apple oder Skyworks investiert ist- die Charts verlaufen quasi identisch zueinander.

Antwort auf Beitrag Nr.: 54.513.009 von Oberkassel am 10.03.17 17:47:48Mich würde ja mal interessieren, ob Du bei Skyworks zwischenzeitlich raus warst oder die ganze Zeit investiert geblieben bist- so wie ich. Früher hieß ich hier übrigens noch "startrek1975" hier im Board. War verdammt lange ruhig hier!

Antwort auf Beitrag Nr.: 54.460.347 von Oberkassel am 03.03.17 17:39:47

So lange die Unterstützung bei 91.8 hält, sind 101 das Ziel

Alternatives Szenario: ein Fall unter 91.8 würde einen weiteren Rückgang auf 86.9 auslösen

Analyse: der RSI liegt über der Neutralitätszone von 50. Der MACD liegt unter der Signallinie und ist positiv. Die Aktie könnte kurzfristig wieder zurückgehen. Es wird darauf hingewiesen, dass die Volumina seit einigen Tagen ansteigen.

Widerstandslinien: 101,00 / 102,90 / 104,80

Pivotpunkt: 91,80

Unterstützungslinien: 91,80 / 88,60 / 86,90

Oberkassler

A Double Upgrade for Skyworks Solutions: What You Need to Know

https://www.fool.com/investing/2017/03/08/a-double-upgrade-f…

So lange die Unterstützung bei 91.8 hält, sind 101 das Ziel

Alternatives Szenario: ein Fall unter 91.8 würde einen weiteren Rückgang auf 86.9 auslösen

Analyse: der RSI liegt über der Neutralitätszone von 50. Der MACD liegt unter der Signallinie und ist positiv. Die Aktie könnte kurzfristig wieder zurückgehen. Es wird darauf hingewiesen, dass die Volumina seit einigen Tagen ansteigen.

Widerstandslinien: 101,00 / 102,90 / 104,80

Pivotpunkt: 91,80

Unterstützungslinien: 91,80 / 88,60 / 86,90

Oberkassler

Highly Integrated Solution Incorporates Low Noise Amplifiers; Leverages SkyBlue™ Technology to Deliver Industry Leading Power Efficiency

Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today introduced SkyOne Ultra 3.0, a highly integrated front-end solution for premium mobile device and smartphone manufacturers worldwide utilizing Skyworks' powerful SkyBlue enabling technology for industry-leading efficiency. SkyOne Ultra 3.0 is a fully optimized front-end system that incorporates all of the high performance RF and analog functionality including power amplification, duplex filtering and antenna switching into a single device. The module integrates low noise receive amplifiers, allowing customers to achieve much better sensitivity levels than previously possible. SkyOne Ultra 3.0 supports all major carrier aggregation (CA) combinations, meets class 2 high power user equipment (HPUE) requirements and addresses 2.5G/3G/4G handsets for more than 23 bands of LTE.

Source: businesswire

https://finviz.com/quote.ashx?t=SWKS&ty=c&ta=0&p=w

Zahlen kommen am 27.04.2017.

Oberkassler

Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today introduced SkyOne Ultra 3.0, a highly integrated front-end solution for premium mobile device and smartphone manufacturers worldwide utilizing Skyworks' powerful SkyBlue enabling technology for industry-leading efficiency. SkyOne Ultra 3.0 is a fully optimized front-end system that incorporates all of the high performance RF and analog functionality including power amplification, duplex filtering and antenna switching into a single device. The module integrates low noise receive amplifiers, allowing customers to achieve much better sensitivity levels than previously possible. SkyOne Ultra 3.0 supports all major carrier aggregation (CA) combinations, meets class 2 high power user equipment (HPUE) requirements and addresses 2.5G/3G/4G handsets for more than 23 bands of LTE.

Source: businesswire

https://finviz.com/quote.ashx?t=SWKS&ty=c&ta=0&p=w

Zahlen kommen am 27.04.2017.

Oberkassler

gestern kamen gute

Jahreszahlen

Antwort auf Beitrag Nr.: 52.980.829 von R-BgO am 03.08.16 14:07:34Immer wieder gerne gelesen, auch wenn ich scheinbar der einzige bin, der noch investiert ist.

https://www.thecerbatgem.com/2016/10/27/skyworks-solutions-i…

https://www.thecerbatgem.com/2016/10/27/skyworks-solutions-i…

Strategically Positions Company to Meet Growing Demand for Highly Integrated Solutions Requiring Filters

WOBURN, Mass.--(BUSINESS WIRE)--

Skyworks Solutions, Inc. (NASDAQ: SWKS) an innovator of high performance analog semiconductors connecting people, places and things, today announced that for $76.5 million, it has acquired the remaining 34 percent interest it did not already own in the filter joint venture it created with Panasonic in 2014.

At the core of the joint venture was Panasonic's engineering and process talent, expertise in filter design and leading edge products, as well as 412 fundamental filter patents and patent applications for surface acoustic wave (SAW) and temperature compensated (TC) SAW devices.

In August 2015, Skyworks expanded its production capacity with the addition of a 405,000 square foot facility in Osaka to help meet the growing demand for highly integrated solutions leveraging filter technology. To date, total production has exceeded more than two billion filters. The acquisition is not expected to impact Skyworks' consolidated financial statements as operations have been consolidated with Skyworks' financial statements since the date of the initial joint venture.

"With this acquisition, Skyworks has strengthened its leadership position as one of the world's largest providers of high performance, integrated-filter solutions," said Liam K. Griffin, president and chief executive officer of Skyworks. "Given the proliferation of frequency bands, the addition of LTE capabilities and market demand for always-on connectivity, the need for filters has never been higher. Our strategic investment uniquely enables us to deliver end-to-end solutions for some of the fastest growing and most demanding applications in the world requiring high performance filter technology. Together with external partners, we are successfully addressing the low, mid and high band performance requirements across premium smartphones and IoT applications."

According to a recent Research and Markets report, the global radio frequency filter market is expected to grow at a CAGR of 15 percent during the period 2016-2020 and the rise in the number of frequency bands, modulation schemes and power amplifier modes to support increased mobile data traffic is resulting in high RF front-end complexity.

WOBURN, Mass.--(BUSINESS WIRE)--

Skyworks Solutions, Inc. (NASDAQ: SWKS) an innovator of high performance analog semiconductors connecting people, places and things, today announced that for $76.5 million, it has acquired the remaining 34 percent interest it did not already own in the filter joint venture it created with Panasonic in 2014.

At the core of the joint venture was Panasonic's engineering and process talent, expertise in filter design and leading edge products, as well as 412 fundamental filter patents and patent applications for surface acoustic wave (SAW) and temperature compensated (TC) SAW devices.

In August 2015, Skyworks expanded its production capacity with the addition of a 405,000 square foot facility in Osaka to help meet the growing demand for highly integrated solutions leveraging filter technology. To date, total production has exceeded more than two billion filters. The acquisition is not expected to impact Skyworks' consolidated financial statements as operations have been consolidated with Skyworks' financial statements since the date of the initial joint venture.

"With this acquisition, Skyworks has strengthened its leadership position as one of the world's largest providers of high performance, integrated-filter solutions," said Liam K. Griffin, president and chief executive officer of Skyworks. "Given the proliferation of frequency bands, the addition of LTE capabilities and market demand for always-on connectivity, the need for filters has never been higher. Our strategic investment uniquely enables us to deliver end-to-end solutions for some of the fastest growing and most demanding applications in the world requiring high performance filter technology. Together with external partners, we are successfully addressing the low, mid and high band performance requirements across premium smartphones and IoT applications."

According to a recent Research and Markets report, the global radio frequency filter market is expected to grow at a CAGR of 15 percent during the period 2016-2020 and the rise in the number of frequency bands, modulation schemes and power amplifier modes to support increased mobile data traffic is resulting in high RF front-end complexity.

Antwort auf Beitrag Nr.: 47.814.341 von R-BgO am 18.09.14 15:05:56

und jetzt teurer

wieder zurückgekauft

Antwort auf Beitrag Nr.: 52.046.765 von startrek1975 am 23.03.16 17:54:19Anscheinend nicht mehr.

Ist noch jemand investiert, so wie ich?

Antwort auf Beitrag Nr.: 51.852.466 von startrek1975 am 27.02.16 14:39:11ja, danke, hab's gelesen ! Gerade keine Kohle. Gruß B.

Antwort auf Beitrag Nr.: 51.850.132 von Betterway am 26.02.16 22:42:42http://www.fool.com/investing/general/2016/02/26/skyworks-so…

Antwort auf Beitrag Nr.: 51.802.516 von R-BgO am 22.02.16 09:20:09erstaunliche Kundenpalette: GM, Huawai, VW, um nur einige zu nennen. Zeit fuer denWiedereinstieg.

Gruß B

Gruß B

SkyBlue™ Surpasses Targets Achieved with Envelope Tracking While Simplifying Implementation; Products Incorporating Technology Shipping to Tier One Customer

BARCELONA, Spain--(BUSINESS WIRE)-- Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today launched SkyBlue™, a new and revolutionary enabling technology that enhances both the power capability and efficiency in LTE amplifiers and front-end solutions. Designs utilizing SkyBlue™ technology not only deliver twice the power of envelope and average power tracking systems available on the market today, but across much broader power ranges. These efficiencies can be more than 15-20 percent in medium to high power ranges where an LTE system operates. Further, these efficiency and power enhancements are achieved with a much simpler implementation when compared to envelope tracking, making it easier for OEMs worldwide to deploy. The end result is envelope tracking-like system efficiency with the simplicity of average power tracking. In the first half of 2016, Skyworks will commence shipments of products leveraging SkyBlue™ with a tier one customer.

"While average power tracking is currently the most popular method to achieve higher power and efficiency gains in LTE amplifiers, Skyworks believes SkyBlue™ will quickly replace this technology as it delivers industry-leading performance in a straightforward design," said Peter L. Gammel, chief technology officer for Skyworks Solutions. "Customers and OEMs can use their existing infrastructure to implement SkyBlue™, enabling some of the highest performing platforms with the shortest times to market when compared to competing envelope tracking alternatives which are more difficult to calibrate."

Skyworks plans to leverage SkyBlue™ throughout its next generation of highly integrated SkyOne®, SkyOne®Ultra and SkyLiTE™ product families, as well as its multimode, multiband power amplifiers covering all application segments.

BARCELONA, Spain--(BUSINESS WIRE)-- Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today launched SkyBlue™, a new and revolutionary enabling technology that enhances both the power capability and efficiency in LTE amplifiers and front-end solutions. Designs utilizing SkyBlue™ technology not only deliver twice the power of envelope and average power tracking systems available on the market today, but across much broader power ranges. These efficiencies can be more than 15-20 percent in medium to high power ranges where an LTE system operates. Further, these efficiency and power enhancements are achieved with a much simpler implementation when compared to envelope tracking, making it easier for OEMs worldwide to deploy. The end result is envelope tracking-like system efficiency with the simplicity of average power tracking. In the first half of 2016, Skyworks will commence shipments of products leveraging SkyBlue™ with a tier one customer.

"While average power tracking is currently the most popular method to achieve higher power and efficiency gains in LTE amplifiers, Skyworks believes SkyBlue™ will quickly replace this technology as it delivers industry-leading performance in a straightforward design," said Peter L. Gammel, chief technology officer for Skyworks Solutions. "Customers and OEMs can use their existing infrastructure to implement SkyBlue™, enabling some of the highest performing platforms with the shortest times to market when compared to competing envelope tracking alternatives which are more difficult to calibrate."

Skyworks plans to leverage SkyBlue™ throughout its next generation of highly integrated SkyOne®, SkyOne®Ultra and SkyLiTE™ product families, as well as its multimode, multiband power amplifiers covering all application segments.