Arianne Phosphate - D'Arianne Phosphate / DAN JE9

eröffnet am 26.10.13 13:20:20 von

neuester Beitrag 24.01.24 20:17:33 von

neuester Beitrag 24.01.24 20:17:33 von

Beiträge: 121

ID: 1.187.683

ID: 1.187.683

Aufrufe heute: 0

Gesamt: 10.111

Gesamt: 10.111

Aktive User: 0

ISIN: CA04035D1024 · WKN: A1W18D · Symbol: DRRSF

0,2082

USD

+1,86 %

+0,0038 USD

Letzter Kurs 19:43:30 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | +14,29 | |

| 37,18 | +10,00 | |

| 6,7700 | +9,90 | |

| 2,4000 | +9,89 | |

| 15.700,00 | +9,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,7400 | -10,01 | |

| 6,3600 | -10,04 | |

| 1,2000 | -10,45 | |

| 0,7696 | -13,53 | |

| 47,96 | -97,97 |

Beitrag zu dieser Diskussion schreiben

Naja, gestern ging es 41% nach oben, mal sehen wie es heute weiter geht und ob vielleicht eine News kommt.

Info

by @newswire on 6 Mar 2023, 13:00

ARIANNE RECEIVES FULL REPORT CONFIRMING THE ABILITY TO USE ITS CONCENTRATE IN ADVANCED BATTERY APPLICATIONS

-physical samples of the purified phosphoric acid have also been received

DAN: TSX-V (Canada)

JE9N: FSE (Germany)

DRRSF: OTCQX (USA)

SAGUENAY, QC, March 6, 2023 /CNW/ - Arianne Phosphate (the "Company" or "Arianne") (TSXV: DAN) (OTC: DRRSF) (FRANKFURT: JE9N), a development-stage phosphate mining company, advancing the Lac à Paul project in Quebec's Saguenay-Lac-Saint-Jean region, is pleased to announce that it has received the detailed report on tests confirming the use of the Company's high-purity phosphate concentrate in the production of lithium-iron-phosphate ("LFP") batteries.

These tests were performed (see Press Release dated June 21, 2022) using phosphoric acid samples produced by Prayon Technologies, a division of PRAYON S.A. ("Prayon"), a world leader in the production of purified phosphoric acid and, a necessary ingredient in the production of LFP batteries. The report extensively details the full process of converting Arianne's phosphate concentrate into acid, reviewed various methods of doing so, optimized performance/recoveries and provided full specifications. Aside from the reports, Arianne also received samples of the purified phosphoric acid made from its phosphate concentrate and produced through the process. Both reports and samples are currently being made available to companies interested in having access to Arianne's phosphate concentrate or, products made from it.

Due to the inherent technical, economic and safety benefits of the LFP battery, adoption rates have been rapidly increasing. Many leading automobile companies such as Tesla, Ford and Volkswagen are pursuing these batteries for use in their cars and driving demand for the critical materials required for their production. As well, use of the LFP in energy storage systems is also driving demand and will represent a significant market. In looking at independent research, annual demand growth for phosphate concentrate can triple by 2030 from its current annual rate of 2% and, will drive the requirement to construct new facilities to produce the necessary phosphoric acid.

Understanding the potential of this market, Arianne has done extensive work with Prayon on the ability to build and/or partner with those interested in constructing a new Merchant Grade Acid production facility, as a first step. In that capacity, Arianne completed a pre-feasibility study with Prayon (see Press Release dated October 30, 2019) several years ago and, given the demand for purified phosphoric acid, the Company continues to look at opportunities to expand further downstream and be a producer for the LFP market.

"The industry is starting to recognize the importance of sourcing all critical minerals required in the production of batteries, not just lithium," said Brian Ostroff, President of Arianne. "I believe it is just a matter of time before we see a rush into phosphate similar to what we have seen in other critical materials. Arianne is one of very few companies that have already gone through the process to qualify its material for use in the LFP; a process that takes considerable time and money. Further, the Company's Lac à Paul project is fully permitted, shovel-ready and, in a jurisdiction that stands to benefit greatly from various government initiatives to secure critical materials from a safe, secure region. The world will certainly require more phosphate, Arianne is first-up to be able to provide for this growth."

Qualified Person

Raphael Gaudreault, eng., Qualified Person by NI 43-101, has approved this release. Mr. Gaudreault is also the Company's Chief Operating Officer.

About Arianne Phosphate:

Arianne Phosphate ("Arianne Phosphate Inc.") (www.arianne-inc.com) is developing the Lac à Paul phosphate deposits located approximately 200 km north of the Saguenay/Lac St. Jean area of Quebec, Canada. These deposits will produce a high quality igneous apatite concentrate grading 39% P2O5 with little or no contaminants (Feasibility Study released in 2013). The Company has 190,270,681 shares outstanding.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Follow Arianne on:

Facebook: https://www.facebook.com/ariannephosphate

Twitter: http://twitter.com/arianne_dan

YouTube: http://www.youtube.com/user/ArianneResources

Flickr: http://www.flickr.com/photos/arianneresources

Resource Investing News: http://resourceinvestingnews.com/?s=Arianne

Cautionary Statements Regarding Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). Forward-looking information includes, but is not limited to, anticipated quality and production of the apatite concentrate at the Lac à Paul project. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved. Forward-looking information is subject to be known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: volatile stock price; risks related to changes in commodity prices; sources and cost of power facilities; the estimation of initial and sustaining capital requirements; the estimation of labor and operating costs; the general global markets and economic conditions; the risk associated with exploration, development and operations of mineral deposits; the estimation of mineral reserves and resources; the risks associated with uninsurable risks arising during the course of exploration, development and production; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support mining, processing, development and exploration activities; the risks associated with changes in the mining regulatory regime governing the Company; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at Lac à Paul project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issue of common shares; the risk of litigation. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, no material adverse change in commodity prices, exploration and development plans proceeding in accordance with plans and such plans achieving their stated expected outcomes, receipt of required regulatory approval, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is made as of the date of this press release, and the Company does not undertake to update such forward-looking information except in accordance with applicable securities laws.

SOURCE Arianne Phosphate Inc.

Cision View original content: http://www.newswire.ca/en/releases/archive/March2023/06/c104…

by @newswire on 6 Mar 2023, 13:00

ARIANNE RECEIVES FULL REPORT CONFIRMING THE ABILITY TO USE ITS CONCENTRATE IN ADVANCED BATTERY APPLICATIONS

-physical samples of the purified phosphoric acid have also been received

DAN: TSX-V (Canada)

JE9N: FSE (Germany)

DRRSF: OTCQX (USA)

SAGUENAY, QC, March 6, 2023 /CNW/ - Arianne Phosphate (the "Company" or "Arianne") (TSXV: DAN) (OTC: DRRSF) (FRANKFURT: JE9N), a development-stage phosphate mining company, advancing the Lac à Paul project in Quebec's Saguenay-Lac-Saint-Jean region, is pleased to announce that it has received the detailed report on tests confirming the use of the Company's high-purity phosphate concentrate in the production of lithium-iron-phosphate ("LFP") batteries.

These tests were performed (see Press Release dated June 21, 2022) using phosphoric acid samples produced by Prayon Technologies, a division of PRAYON S.A. ("Prayon"), a world leader in the production of purified phosphoric acid and, a necessary ingredient in the production of LFP batteries. The report extensively details the full process of converting Arianne's phosphate concentrate into acid, reviewed various methods of doing so, optimized performance/recoveries and provided full specifications. Aside from the reports, Arianne also received samples of the purified phosphoric acid made from its phosphate concentrate and produced through the process. Both reports and samples are currently being made available to companies interested in having access to Arianne's phosphate concentrate or, products made from it.

Due to the inherent technical, economic and safety benefits of the LFP battery, adoption rates have been rapidly increasing. Many leading automobile companies such as Tesla, Ford and Volkswagen are pursuing these batteries for use in their cars and driving demand for the critical materials required for their production. As well, use of the LFP in energy storage systems is also driving demand and will represent a significant market. In looking at independent research, annual demand growth for phosphate concentrate can triple by 2030 from its current annual rate of 2% and, will drive the requirement to construct new facilities to produce the necessary phosphoric acid.

Understanding the potential of this market, Arianne has done extensive work with Prayon on the ability to build and/or partner with those interested in constructing a new Merchant Grade Acid production facility, as a first step. In that capacity, Arianne completed a pre-feasibility study with Prayon (see Press Release dated October 30, 2019) several years ago and, given the demand for purified phosphoric acid, the Company continues to look at opportunities to expand further downstream and be a producer for the LFP market.

"The industry is starting to recognize the importance of sourcing all critical minerals required in the production of batteries, not just lithium," said Brian Ostroff, President of Arianne. "I believe it is just a matter of time before we see a rush into phosphate similar to what we have seen in other critical materials. Arianne is one of very few companies that have already gone through the process to qualify its material for use in the LFP; a process that takes considerable time and money. Further, the Company's Lac à Paul project is fully permitted, shovel-ready and, in a jurisdiction that stands to benefit greatly from various government initiatives to secure critical materials from a safe, secure region. The world will certainly require more phosphate, Arianne is first-up to be able to provide for this growth."

Qualified Person

Raphael Gaudreault, eng., Qualified Person by NI 43-101, has approved this release. Mr. Gaudreault is also the Company's Chief Operating Officer.

About Arianne Phosphate:

Arianne Phosphate ("Arianne Phosphate Inc.") (www.arianne-inc.com) is developing the Lac à Paul phosphate deposits located approximately 200 km north of the Saguenay/Lac St. Jean area of Quebec, Canada. These deposits will produce a high quality igneous apatite concentrate grading 39% P2O5 with little or no contaminants (Feasibility Study released in 2013). The Company has 190,270,681 shares outstanding.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Follow Arianne on:

Facebook: https://www.facebook.com/ariannephosphate

Twitter: http://twitter.com/arianne_dan

YouTube: http://www.youtube.com/user/ArianneResources

Flickr: http://www.flickr.com/photos/arianneresources

Resource Investing News: http://resourceinvestingnews.com/?s=Arianne

Cautionary Statements Regarding Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). Forward-looking information includes, but is not limited to, anticipated quality and production of the apatite concentrate at the Lac à Paul project. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved. Forward-looking information is subject to be known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: volatile stock price; risks related to changes in commodity prices; sources and cost of power facilities; the estimation of initial and sustaining capital requirements; the estimation of labor and operating costs; the general global markets and economic conditions; the risk associated with exploration, development and operations of mineral deposits; the estimation of mineral reserves and resources; the risks associated with uninsurable risks arising during the course of exploration, development and production; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support mining, processing, development and exploration activities; the risks associated with changes in the mining regulatory regime governing the Company; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at Lac à Paul project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issue of common shares; the risk of litigation. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, no material adverse change in commodity prices, exploration and development plans proceeding in accordance with plans and such plans achieving their stated expected outcomes, receipt of required regulatory approval, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is made as of the date of this press release, and the Company does not undertake to update such forward-looking information except in accordance with applicable securities laws.

SOURCE Arianne Phosphate Inc.

Cision View original content: http://www.newswire.ca/en/releases/archive/March2023/06/c104…

Arianne habe ich schon "ewig" auf der Watchlist und war auch schon mal investiert - es kam aber bisher nicht zum Durchbruch. Bisher. Nun sehe ich erneut gute Chancen und habe daher jüngst eine initiale Position (110.000 St.) aufgebaut.

Arianne vereinigt in ihrem Project Lac à Paul mehrere spannende Themen: Phosphat zum Düngen und Phosphat zum Einsatz in Batterien/Akkus – beides extrem wichtig.

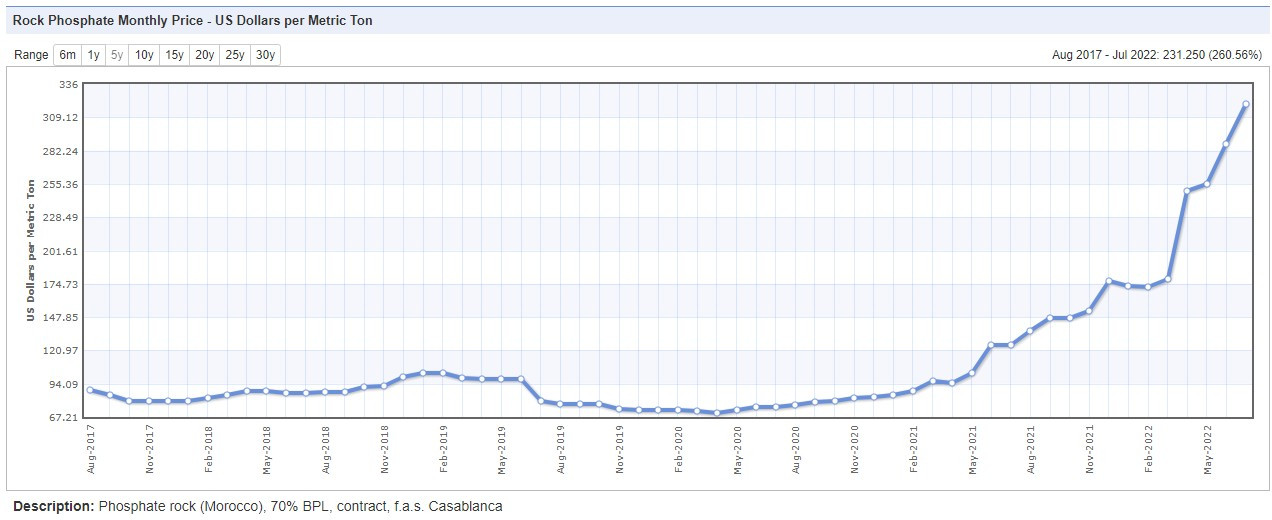

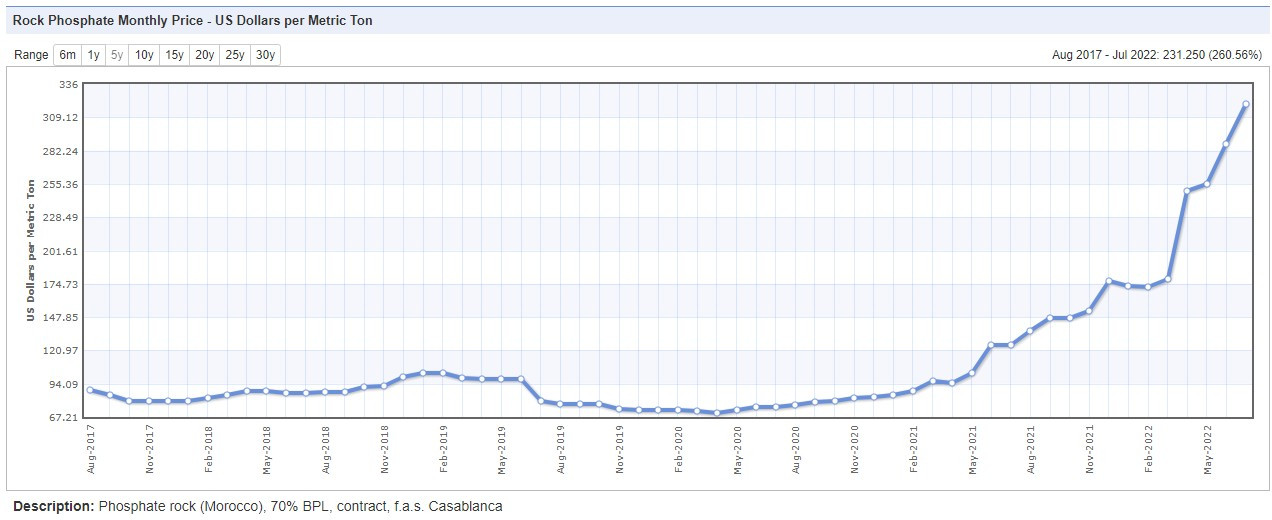

Phosphat wird primär zum Düngen gebraucht (85% der Anwendung). 70% des Phosphats stammen derzeit aus Nordafrika (vor allem Marokko) und dem Nahen Osten. Russland ist der einzige Produzent von hochreinem Phosphat. Und damit haben wir auch schon eine Erklärung für die Preisentwicklung der letzten Monate:

Quelle: https://www.indexmundi.com/commodities/?commodity=rock-phosp…

Lac à Paul ist das einige Großprojekt für Phosphatgestein aus einer risikoarmen Region, das in den nächsten Jahren in Betrieb gehen soll. Die Laufzeit des Projektes lag per Machbarkeitsstudie von 2013 schon bei 26 Jahren und dürfte deutlich ausweitbar sein. Es verfügt über 78 Mio. Tonen hochgradigen Phosphats.

Auf China und Russland entfallen derzeit 40% der Produktion von Phosphatdünger, China hat den Export aber schon 2021 begrenzt. Und somit ist schon klar, worauf ich hinaus will: Das Projekt WIRD kommen (müssen), wenn sich der Konflikt mit Russland/China weiter zuspitzt.

Daneben ist die Anwendung in Batterien, genauer „Lithium-Eisen-Phosphat-Batterien“ (LFP), extrem aussichtsreich. Dazu lesenswert:

https://sonnen.de/wissen/4-gruende-fuer-lithium-eisenphospha…

https://www.super-b.com/de/lithium-eisenphosphat-batterien/v…

https://teslamag.de/news/lfp-verbessert-tesla-q4-model-y-m3p…

Ganz aktuell:

Daimler Trucks shifts to LFP battery chemistry as the growing electric passenger car market sucks up nickel and cobalt.

https://europe.autonews.com/automakers/daimler-trucks-shifts…

Alle Genehmigungen für Lac à Paul liegen vor, lokalpolitisch wird das Projekt unterstützt (auch finanziell), ebenso gibt es bereits seit langem zwei Abnahmeverträge. Was fehlt also?

1. Die Zustimmung der First Nations.

2. Die Finanzierung. Es braucht für das Projekt 1,2 Mrd. USD. Das ist schon eine mächtige Summe. Indes hat unsere Regierung gerade Uniper für 8 Mrd. EUR übernommen… Wo ein (politischer) Wille, da ein Weg.

Ich bin daher davon überzeugt, dass 2. mit weiter steigenden Phosphat-Preisen und den Bestrebungen, von China und Russland (sowie den Ländern im Nahen Osten) unabhängig zu werden, kein Thema ist. Somit liegt in 1. der Schlüssel. Hierzu hat sich das Unternehmen schon sehr lange nicht mehr geäußert, sodass ich da um Klärung bemüht bin.

Im Moment kommt Arianne bei 190 Mio. ausstehenden Aktien auf einen Börsenwert von 80 Mio. CAD bzw. 60 Mio. USD. Natürlich wird da eine immense Verwässerung kommen, wenn das Projekt finanziert wird – ABER dem steht eben der Wert des Projektes gegenüber, der dann realisiert wird. Und die o.g. Angaben basieren auf einer Machbarkeitsstudie, die noch mit wesentlich niedrigeren Preise kalkuliert wurde (zugegebenerweise sind auch die Energiekosten natürlich nun deutlich höher).

Ich glaube, dass Arianne eine Perle ist, die einfach noch niemand bzw. niemand mehr auf dem Schirm hat. Das kann sich aber nun ändern, insbesondere da „in Zusammenarbeit mit mehreren Teilnehmern der Batterieindustrie“ das Phosphat bereits erfolgreich getestet wurde:

https://www.arianne-inc.com/news/arianne-phosphate-receives-positive-results-from-tests-surrounding-the-use-of-its-concentrate-in-advanced-battery-applications/" target="_blank" rel="nofollow ugc noopener">https://www.arianne-inc.com/news/arianne-phosphate-receives-positive-results-from-tests-surrounding-the-use-of-its-concentrate-in-advanced-battery-applications/

Website:

https://www.arianne-inc.com/

Kurs in den USA:

https://finance.yahoo.com/quote/DRRSF?p=DRRSF

Kurs und Diskussion in Kanada:

https://stockhouse.com/companies/quote?symbol=v.dan

SEDAR:

https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&iss… (hier lohnt sich die letzte MD&A)

Klar – man muss natürlich schon die Frage stellen, warum es hier nun nicht zügiger voran geht. Genau diese Frage habe ich ans Unternehmen gerichtet und hoffe auf baldige Antwort. Jedenfalls gibt es auf dem aktuellen Kursniveau m.E. wenig Risiken. Die laufenden Kosten sind überschaubar und es gibt keine relevanten Schulden. Daher sieht der „worst case“ m.E. so aus, dass sich einfach weiterhin „nichts tut“ und die Aktie „vor sich hin dümpelt“. Indes: WENN sie mit den First Nations und/oder der Finanzierung weiterkommen, dann steht hier aus meiner Sicht SOFORT eine erhebliche Neubewertung an.

Zuletzt: Die Aktie ist sehr markteng/illiquide. Das sollte man beachten.

M@trix

Arianne vereinigt in ihrem Project Lac à Paul mehrere spannende Themen: Phosphat zum Düngen und Phosphat zum Einsatz in Batterien/Akkus – beides extrem wichtig.

Phosphat wird primär zum Düngen gebraucht (85% der Anwendung). 70% des Phosphats stammen derzeit aus Nordafrika (vor allem Marokko) und dem Nahen Osten. Russland ist der einzige Produzent von hochreinem Phosphat. Und damit haben wir auch schon eine Erklärung für die Preisentwicklung der letzten Monate:

Quelle: https://www.indexmundi.com/commodities/?commodity=rock-phosp…

Lac à Paul ist das einige Großprojekt für Phosphatgestein aus einer risikoarmen Region, das in den nächsten Jahren in Betrieb gehen soll. Die Laufzeit des Projektes lag per Machbarkeitsstudie von 2013 schon bei 26 Jahren und dürfte deutlich ausweitbar sein. Es verfügt über 78 Mio. Tonen hochgradigen Phosphats.

Auf China und Russland entfallen derzeit 40% der Produktion von Phosphatdünger, China hat den Export aber schon 2021 begrenzt. Und somit ist schon klar, worauf ich hinaus will: Das Projekt WIRD kommen (müssen), wenn sich der Konflikt mit Russland/China weiter zuspitzt.

Daneben ist die Anwendung in Batterien, genauer „Lithium-Eisen-Phosphat-Batterien“ (LFP), extrem aussichtsreich. Dazu lesenswert:

https://sonnen.de/wissen/4-gruende-fuer-lithium-eisenphospha…

https://www.super-b.com/de/lithium-eisenphosphat-batterien/v…

https://teslamag.de/news/lfp-verbessert-tesla-q4-model-y-m3p…

Ganz aktuell:

Daimler Trucks shifts to LFP battery chemistry as the growing electric passenger car market sucks up nickel and cobalt.

https://europe.autonews.com/automakers/daimler-trucks-shifts…

Alle Genehmigungen für Lac à Paul liegen vor, lokalpolitisch wird das Projekt unterstützt (auch finanziell), ebenso gibt es bereits seit langem zwei Abnahmeverträge. Was fehlt also?

1. Die Zustimmung der First Nations.

2. Die Finanzierung. Es braucht für das Projekt 1,2 Mrd. USD. Das ist schon eine mächtige Summe. Indes hat unsere Regierung gerade Uniper für 8 Mrd. EUR übernommen… Wo ein (politischer) Wille, da ein Weg.

Ich bin daher davon überzeugt, dass 2. mit weiter steigenden Phosphat-Preisen und den Bestrebungen, von China und Russland (sowie den Ländern im Nahen Osten) unabhängig zu werden, kein Thema ist. Somit liegt in 1. der Schlüssel. Hierzu hat sich das Unternehmen schon sehr lange nicht mehr geäußert, sodass ich da um Klärung bemüht bin.

Im Moment kommt Arianne bei 190 Mio. ausstehenden Aktien auf einen Börsenwert von 80 Mio. CAD bzw. 60 Mio. USD. Natürlich wird da eine immense Verwässerung kommen, wenn das Projekt finanziert wird – ABER dem steht eben der Wert des Projektes gegenüber, der dann realisiert wird. Und die o.g. Angaben basieren auf einer Machbarkeitsstudie, die noch mit wesentlich niedrigeren Preise kalkuliert wurde (zugegebenerweise sind auch die Energiekosten natürlich nun deutlich höher).

Ich glaube, dass Arianne eine Perle ist, die einfach noch niemand bzw. niemand mehr auf dem Schirm hat. Das kann sich aber nun ändern, insbesondere da „in Zusammenarbeit mit mehreren Teilnehmern der Batterieindustrie“ das Phosphat bereits erfolgreich getestet wurde:

https://www.arianne-inc.com/news/arianne-phosphate-receives-positive-results-from-tests-surrounding-the-use-of-its-concentrate-in-advanced-battery-applications/" target="_blank" rel="nofollow ugc noopener">https://www.arianne-inc.com/news/arianne-phosphate-receives-positive-results-from-tests-surrounding-the-use-of-its-concentrate-in-advanced-battery-applications/

Website:

https://www.arianne-inc.com/

Kurs in den USA:

https://finance.yahoo.com/quote/DRRSF?p=DRRSF

Kurs und Diskussion in Kanada:

https://stockhouse.com/companies/quote?symbol=v.dan

SEDAR:

https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&iss… (hier lohnt sich die letzte MD&A)

Klar – man muss natürlich schon die Frage stellen, warum es hier nun nicht zügiger voran geht. Genau diese Frage habe ich ans Unternehmen gerichtet und hoffe auf baldige Antwort. Jedenfalls gibt es auf dem aktuellen Kursniveau m.E. wenig Risiken. Die laufenden Kosten sind überschaubar und es gibt keine relevanten Schulden. Daher sieht der „worst case“ m.E. so aus, dass sich einfach weiterhin „nichts tut“ und die Aktie „vor sich hin dümpelt“. Indes: WENN sie mit den First Nations und/oder der Finanzierung weiterkommen, dann steht hier aus meiner Sicht SOFORT eine erhebliche Neubewertung an.

Zuletzt: Die Aktie ist sehr markteng/illiquide. Das sollte man beachten.

M@trix

Interview des Vorstandes

Sämtliche Indikatoren bullisch!

https://www.arianne-inc.com/news/arianne-phosphate-optimizes…

Sehr gut, damit können 2 voneinander unabhängige Märkte bedient werden.

Sehr gut, damit können 2 voneinander unabhängige Märkte bedient werden.