Nyrstar - Metallgigant am Wanken 2,24 € - 500 Beiträge pro Seite

eröffnet am 19.11.13 10:38:30 von

neuester Beitrag 04.05.17 12:06:36 von

neuester Beitrag 04.05.17 12:06:36 von

Beiträge: 34

ID: 1.188.486

ID: 1.188.486

Aufrufe heute: 0

Gesamt: 3.623

Gesamt: 3.623

Aktive User: 0

ISIN: BE0974294267 · WKN: A2AKN7

0,0722

EUR

+1,12 %

+0,0008 EUR

Letzter Kurs 17:35:36 Lang & Schwarz

Neuigkeiten

19.04.24 · globenewswire |

12.03.24 · globenewswire |

19.09.23 · globenewswire |

27.06.23 · globenewswire |

19.06.23 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 0,6000 | +20,00 | |

| 13,170 | +15,32 | |

| 3,9000 | +14,71 | |

| 11,180 | +14,08 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 18,680 | -10,41 | |

| 1,8300 | -10,73 | |

| 0,6800 | -15,00 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 |

Durch Zufall bin ich auf Nyrstar aufmerksam geworden.

Es handelt sich um eine großen Produzten von Blei und Zink,

mit 3,3 Mrd. € Umsatz und 7.000 Beschäftigten (2011).

Blei

Zink

Irgendein Projekt muss allerdings aus dem Ruder gelaufen sein,

sonst wäre es nicht zu solchen Kursrückgängen gekommen.

Da sich die Rohstoffe relativ stabil gehalten haben.

Der Kursverlauf lässt jedenfalls schreckliches (für das Unternehmen) erahnen.

Es stellt sich die Frage, ob es das Unternehmen schaffen kann.

Früher hätte ich bedenkenlos zugegriffen, heute warte ich aber erst eine Bodenbildung ab.

Gruß codiman

Es handelt sich um eine großen Produzten von Blei und Zink,

mit 3,3 Mrd. € Umsatz und 7.000 Beschäftigten (2011).

Blei

Zink

Irgendein Projekt muss allerdings aus dem Ruder gelaufen sein,

sonst wäre es nicht zu solchen Kursrückgängen gekommen.

Da sich die Rohstoffe relativ stabil gehalten haben.

Der Kursverlauf lässt jedenfalls schreckliches (für das Unternehmen) erahnen.

Es stellt sich die Frage, ob es das Unternehmen schaffen kann.

Früher hätte ich bedenkenlos zugegriffen, heute warte ich aber erst eine Bodenbildung ab.

Gruß codiman

Denke, das die Rohstoffbranche nun die kommende lange Deflationswelle abbildet. M.E. werden die nächsten 3-5 Jahre gigantische Firmeninsolvenzen auf uns zukommen.Die Notenbankpolitik (billiges Geld, fragt sich bloss für wen???) und die Europäische Planwirtschaft mit faschistischen Auswüchsen des Sozialismus werden ihr Werk vollbringen. NWO lässt grüßen-danach ist Geld und Kapital in den Händen einiger weniger und der Rest der Welt ist Pleite und versklavt. Ablenkung in jeglicher Hinsicht von den Schuldigen ist auch geboten, obwohl eh nur ein Bruchteil der Menschheit hinter die Kulissen zu schauen fähig ist.

Hier etwas von Reuters:

Shares of Belgium's Nyrstar NYR.BR , the world's largest producer of zinc, fall as much as 5.7 percent, extending a 10-day bear run that has already cost it some 28 percent of its share value over problems with Finnish minder Talvivaara. Talvivaara TLV1V.HE , which has an agreement with Nyrstar for the delivery of zinc in concentrate, recently said it would seek a court-supervised overhaul of its business. Nyrstar said it was mulling short-term financial support. ID:nL5N0J019I KBC analyst Wouter Vanderhaeghen says investors are aware that the 240 million euros ($324.6 million) Nyrstar has paid for 1.25 million tonnes of zinc in concentrate from Talvivaara could be lost. Nyrstar's market cap is currently 403 million euros, according to Thomson Reuters data. "There's clearly panic around the shares, I don't think the downward trend is over yet," Vanderhaeghen says. Since the start of 2013, Nyrstar's shares have lost more than half of their value since the start of the year, reaching their lowest point in four years.

Reuters messaging rm://robertjan.bartunek.thomsonreuters.com@reuters.net

Shares of Belgium's Nyrstar NYR.BR , the world's largest producer of zinc, fall as much as 5.7 percent, extending a 10-day bear run that has already cost it some 28 percent of its share value over problems with Finnish minder Talvivaara. Talvivaara TLV1V.HE , which has an agreement with Nyrstar for the delivery of zinc in concentrate, recently said it would seek a court-supervised overhaul of its business. Nyrstar said it was mulling short-term financial support. ID:nL5N0J019I KBC analyst Wouter Vanderhaeghen says investors are aware that the 240 million euros ($324.6 million) Nyrstar has paid for 1.25 million tonnes of zinc in concentrate from Talvivaara could be lost. Nyrstar's market cap is currently 403 million euros, according to Thomson Reuters data. "There's clearly panic around the shares, I don't think the downward trend is over yet," Vanderhaeghen says. Since the start of 2013, Nyrstar's shares have lost more than half of their value since the start of the year, reaching their lowest point in four years.

Reuters messaging rm://robertjan.bartunek.thomsonreuters.com@reuters.net

Antwort auf Beitrag Nr.: 45.869.480 von fmhbolero am 19.11.13 15:16:28Im Klartext:

Nystar hat eine Liefereinbarung für Zinkkonzentrat mit dem Finnischen Minenbetreiber Talvivaara TLV1V.HE abgeschlossen

und für die Lieferung von 1,25 Mio Tonnen Zinkkonzentrat 240 Mio € bezahlt.

Talvivaara ist jetzt pleite und/oder kann nicht mehr liefern und Nyrstar

kann das Geld abschreiben und hat wahrscheinlich auch Produktionsausfälle

was zu fehlenden Einnahmen führt und das Unternehmen zusätzlich belastet.

Ausserdem benötig Nyrstar kurzfristig Kapital.

Die Anleger sind in Panik und der Analyst ist nicht der Meinung, dass sich

daran etwas kurzfristig ändert, wie man am Kurs erkennen kann.

Nystar hat eine Liefereinbarung für Zinkkonzentrat mit dem Finnischen Minenbetreiber Talvivaara TLV1V.HE abgeschlossen

und für die Lieferung von 1,25 Mio Tonnen Zinkkonzentrat 240 Mio € bezahlt.

Talvivaara ist jetzt pleite und/oder kann nicht mehr liefern und Nyrstar

kann das Geld abschreiben und hat wahrscheinlich auch Produktionsausfälle

was zu fehlenden Einnahmen führt und das Unternehmen zusätzlich belastet.

Ausserdem benötig Nyrstar kurzfristig Kapital.

Die Anleger sind in Panik und der Analyst ist nicht der Meinung, dass sich

daran etwas kurzfristig ändert, wie man am Kurs erkennen kann.

Nyrstar Advances After Offering Short-Term Support to Talvivaara

By Firat Kayakiran & John Martens - Nov 20, 2013 2:10 PM GMT+0100

Facebook Share

Tweet

LinkedIn

Google +1

0 COMMENTS

Print

QUEUE

Q

Nyrstar (NYR) NV rose in Brussels, ending a 10-day slump, as the smelter offered short-term support to supplier Talvivaara Mining Co. (TALV) and said it wouldn’t breach financing agreements in the event of an impairment.

Nyrstar advanced as much as 12 percent, the biggest gain since Sept. 14, 2012, after losing almost a third of its value in two weeks. The company was up 9.5 percent at 2.30 euros as of 1:52 p.m. in Brussels.

Talvivaara, a Finnish nickel miner with an off-take agreement with Nyrstar, on Nov. 15 filed for a corporate reorganization to raise funds and avoid bankruptcy. Nyrstar in 2010 agreed to pay $335 million for all of Talvivaara’s zinc concentrate until 1.25 million metric tons is delivered. It received 13,700 tons this year to the end of October.

“Talvivaara’s filing for corporate restructuring created a lot of speculation on its sustainability and the impact for Nyrstar,” Wouter Vanderhaeghen, an analyst at KBC Securities NV in Brussels, wrote today in a note. “In a worst case scenario where Talvivaara goes bankrupt, we believe that Nyrstar would lose around 10 percent to 15 percent of its” earnings before interest, tax, depreciation and amortization.

Talvivaara, which has suffered from weakening nickel prices and a slow production ramp-up at its mine in northern Finland, failed to raise additional cash from investors for a voluntary reorganization, it said last week. Some investors declined to provide more funds and others decided to wait until a corporate reorganization is completed, Talvivaara said.

Balance Sheet

An impairment to the Talvivaara asset on Nyrstar’s balance sheet wouldn’t lead to a breach of financing arrangements, the smelter said today. Nyrstar’s outstanding bonds don’t have covenants and it’s “comfortably” within balance sheet-related covenants on a 400 million-euro revolving facility.

Its 525 million euros of 5.375 percent notes due May 2016 rose 3.279, or 32.79 euros per 1,000-euro face amount, to 74.196 today, according to prices compiled by Bloomberg.

Nyrstar has been in discussion with Talvivaara since it filed for restructuring and is seeking to provide operational and “other support” to the Finnish miner, it said today. “Any other support that would be offered by Nyrstar would only be limited and short term in nature, and would be subject to a number of conditions that Nyrstar believes are necessary to restructure the company and its operations.”

Bankruptcy would result in 1,600 lost jobs, Talvivaara Chief Executive Officer Pekka Pera said last week. He declined to say whether it received or sought any acquisition approaches.

Talvivaara withdrew a 2013 output forecast of 18,000 tons in July after producing 4,508 tons of nickel in the first half. It produced 2,595 tons of the metal and 5,645 tons of zinc in the third quarter. At current prices, it needs to produce 30,000 tons of nickel a year to be profitable, Pera said.

To contact the reporters on this story: Firat Kayakiran in London at fkayakiran@bloomberg.net; John Martens in Brussels at jmartens1@bloomberg.net

By Firat Kayakiran & John Martens - Nov 20, 2013 2:10 PM GMT+0100

Facebook Share

Tweet

Google +1

0 COMMENTS

QUEUE

Q

Nyrstar (NYR) NV rose in Brussels, ending a 10-day slump, as the smelter offered short-term support to supplier Talvivaara Mining Co. (TALV) and said it wouldn’t breach financing agreements in the event of an impairment.

Nyrstar advanced as much as 12 percent, the biggest gain since Sept. 14, 2012, after losing almost a third of its value in two weeks. The company was up 9.5 percent at 2.30 euros as of 1:52 p.m. in Brussels.

Talvivaara, a Finnish nickel miner with an off-take agreement with Nyrstar, on Nov. 15 filed for a corporate reorganization to raise funds and avoid bankruptcy. Nyrstar in 2010 agreed to pay $335 million for all of Talvivaara’s zinc concentrate until 1.25 million metric tons is delivered. It received 13,700 tons this year to the end of October.

“Talvivaara’s filing for corporate restructuring created a lot of speculation on its sustainability and the impact for Nyrstar,” Wouter Vanderhaeghen, an analyst at KBC Securities NV in Brussels, wrote today in a note. “In a worst case scenario where Talvivaara goes bankrupt, we believe that Nyrstar would lose around 10 percent to 15 percent of its” earnings before interest, tax, depreciation and amortization.

Talvivaara, which has suffered from weakening nickel prices and a slow production ramp-up at its mine in northern Finland, failed to raise additional cash from investors for a voluntary reorganization, it said last week. Some investors declined to provide more funds and others decided to wait until a corporate reorganization is completed, Talvivaara said.

Balance Sheet

An impairment to the Talvivaara asset on Nyrstar’s balance sheet wouldn’t lead to a breach of financing arrangements, the smelter said today. Nyrstar’s outstanding bonds don’t have covenants and it’s “comfortably” within balance sheet-related covenants on a 400 million-euro revolving facility.

Its 525 million euros of 5.375 percent notes due May 2016 rose 3.279, or 32.79 euros per 1,000-euro face amount, to 74.196 today, according to prices compiled by Bloomberg.

Nyrstar has been in discussion with Talvivaara since it filed for restructuring and is seeking to provide operational and “other support” to the Finnish miner, it said today. “Any other support that would be offered by Nyrstar would only be limited and short term in nature, and would be subject to a number of conditions that Nyrstar believes are necessary to restructure the company and its operations.”

Bankruptcy would result in 1,600 lost jobs, Talvivaara Chief Executive Officer Pekka Pera said last week. He declined to say whether it received or sought any acquisition approaches.

Talvivaara withdrew a 2013 output forecast of 18,000 tons in July after producing 4,508 tons of nickel in the first half. It produced 2,595 tons of the metal and 5,645 tons of zinc in the third quarter. At current prices, it needs to produce 30,000 tons of nickel a year to be profitable, Pera said.

To contact the reporters on this story: Firat Kayakiran in London at fkayakiran@bloomberg.net; John Martens in Brussels at jmartens1@bloomberg.net

und ...

Regulated information

20 November 2013

Following the application of the Talvivaara Mining Company Plc ("Talvivaara") for the commencement of corporate restructuring proceedings on Friday 15 November, Nyrstar has been involved in on-going discussions with Talvivaara and other stakeholders on the most appropriate course of action for Talvivaara. As discussions are on-going Nyrstar is unable to comment on the likely outcome. Nyrstar would like its zinc streaming arrangement with Talvivaara to continue and is therefore exploring opportunities to provide further operational or other support, along with other stakeholders. However any other support that would be offered by Nyrstar would only be limited and short term in nature, and would be subject to a number of conditions that Nyrstar believes are necessary to restructure the company and its operations. It should also be noted that Nyrstar has received approximately 13,700 tonnes of zinc in concentrate under the zinc streaming agreement in 2013 up to the end of October, while its own mines are expected to produce between 265,000 to 280,000 tonnes this year.

Nyrstar continues to maintain a solid financial position. As of Friday, 15 November, Nyrstar had in excess of EUR 500 million of liquidity headroom in the form of committed facilities and cash and cash equivalents. Nyrstar's bonds are all covenant free and covenants on the Structured Commodity Trade Finance facility and other committed facilities are only balance sheet related (not linked to the income statement) and Nyrstar is comfortably within them. It should also be noted that in the event that a potential impairment of the Talvivaara asset on the Nyrstar balance sheet were to materialise, Nyrstar would not be in breach of any of its financing arrangements as of today.

Nyrstar remains committed to actively managing near term profitability and cash generation by delivering sustainable operational improvements, particularly in the current challenging metal price environment. Nyrstar Management is focused on delivering working capital improvements, through optimising physical inventory levels, delivering its cost savings programme (Project Lean) that aims to deliver EUR 75 million of annualised savings by the end of 2014, and through reducing capital expenditure, with the aim to be at the lower end of its 2013 guidance of EUR 200-230 million (2012 EUR 248 million). Management is also focused on improving the performance of its mining portfolio and has in place a mining improvement programme, which has identified and is implementing actions to improve both the cost, production and gross profit results of the mines which have not performed to expectations.

Regulated information

20 November 2013

Following the application of the Talvivaara Mining Company Plc ("Talvivaara") for the commencement of corporate restructuring proceedings on Friday 15 November, Nyrstar has been involved in on-going discussions with Talvivaara and other stakeholders on the most appropriate course of action for Talvivaara. As discussions are on-going Nyrstar is unable to comment on the likely outcome. Nyrstar would like its zinc streaming arrangement with Talvivaara to continue and is therefore exploring opportunities to provide further operational or other support, along with other stakeholders. However any other support that would be offered by Nyrstar would only be limited and short term in nature, and would be subject to a number of conditions that Nyrstar believes are necessary to restructure the company and its operations. It should also be noted that Nyrstar has received approximately 13,700 tonnes of zinc in concentrate under the zinc streaming agreement in 2013 up to the end of October, while its own mines are expected to produce between 265,000 to 280,000 tonnes this year.

Nyrstar continues to maintain a solid financial position. As of Friday, 15 November, Nyrstar had in excess of EUR 500 million of liquidity headroom in the form of committed facilities and cash and cash equivalents. Nyrstar's bonds are all covenant free and covenants on the Structured Commodity Trade Finance facility and other committed facilities are only balance sheet related (not linked to the income statement) and Nyrstar is comfortably within them. It should also be noted that in the event that a potential impairment of the Talvivaara asset on the Nyrstar balance sheet were to materialise, Nyrstar would not be in breach of any of its financing arrangements as of today.

Nyrstar remains committed to actively managing near term profitability and cash generation by delivering sustainable operational improvements, particularly in the current challenging metal price environment. Nyrstar Management is focused on delivering working capital improvements, through optimising physical inventory levels, delivering its cost savings programme (Project Lean) that aims to deliver EUR 75 million of annualised savings by the end of 2014, and through reducing capital expenditure, with the aim to be at the lower end of its 2013 guidance of EUR 200-230 million (2012 EUR 248 million). Management is also focused on improving the performance of its mining portfolio and has in place a mining improvement programme, which has identified and is implementing actions to improve both the cost, production and gross profit results of the mines which have not performed to expectations.

Nachtrag:

Geschichte[Bearbeiten]

Nyrstar wurde am 31. August 2007 durch den Zusammenschluss der Zinkhüttenaktivitäten der belgischen Umicore und der Zink- und Bleihüttenaktivitäten der australischen Zinifex gegründet .

Am 29. Oktober 2007 erfolgte die Erstnotiz der Nyrstar an der Euronext-Börse in Brüssel über eine Neuemission. Das Unternehmen war vom 4. März 2008 bis zum 3. März 2009 und ist erneut seit dem 20. Juni 2011 im Aktienindex BEL 20 gelistet.[1]

Glencore kaufte bislang die gesamte Zinkproduktion von Nyrstar auf, um sie zu handeln und ist mit acht Prozent am Unternehmen beteiligt. Die europäischen Wettbewerbsbehörden genehmigten 2012 die Fusion von Glencore und Xstrata unter der Bedingung, dass Glencore sich von der Beteiligung trenne.[2]

Glencore kauft die gesamte Zinkproduktion auf und hat ein Interesse, dass das Unternehmen weiter besteht.

Ich werde wohl eine kleine Position eingehen.

Geschichte[Bearbeiten]

Nyrstar wurde am 31. August 2007 durch den Zusammenschluss der Zinkhüttenaktivitäten der belgischen Umicore und der Zink- und Bleihüttenaktivitäten der australischen Zinifex gegründet .

Am 29. Oktober 2007 erfolgte die Erstnotiz der Nyrstar an der Euronext-Börse in Brüssel über eine Neuemission. Das Unternehmen war vom 4. März 2008 bis zum 3. März 2009 und ist erneut seit dem 20. Juni 2011 im Aktienindex BEL 20 gelistet.[1]

Glencore kaufte bislang die gesamte Zinkproduktion von Nyrstar auf, um sie zu handeln und ist mit acht Prozent am Unternehmen beteiligt. Die europäischen Wettbewerbsbehörden genehmigten 2012 die Fusion von Glencore und Xstrata unter der Bedingung, dass Glencore sich von der Beteiligung trenne.[2]

Glencore kauft die gesamte Zinkproduktion auf und hat ein Interesse, dass das Unternehmen weiter besteht.

Ich werde wohl eine kleine Position eingehen.

yrstar: LESOP Executive Share Acquisition

Regulated information

6 January 2014

Today, several members of the Nyrstar Management Committee notified the Belgian Financial Services and Markets Authority (FSMA) that they acquired Nyrstar NV shares. The acquisition took place in the framework of the management incentive program known as the Leveraged Employee Stock Ownership Plan (LESOP) that was approved by the company's shareholders at the Annual General Meeting (AGM) of 24 April 2013. The LESOP has been made available amongst Nyrstar's executive management, including the members of the Nyrstar Management Committee.

The LESOP is an executive compensation program which allows eligible participants to purchase shares of the company at a discount of 20%, whereby the shares are subject to a holding period of three years. The shares can be purchased with own personal contributions, or alternatively, with a combination of personal contributions and an additional financing provided by a financial institution. The number of shares that an eligible participant can purchase with his or her personal contribution is capped, such cap being 50,000 shares for each member of the Nyrstar Management Committee. The members of the Nyrstar Management Committee that participated in the LESOP each acquired 500,000 shares, including 50,000 that were acquired via their own personal contribution.

Regulated information

6 January 2014

Today, several members of the Nyrstar Management Committee notified the Belgian Financial Services and Markets Authority (FSMA) that they acquired Nyrstar NV shares. The acquisition took place in the framework of the management incentive program known as the Leveraged Employee Stock Ownership Plan (LESOP) that was approved by the company's shareholders at the Annual General Meeting (AGM) of 24 April 2013. The LESOP has been made available amongst Nyrstar's executive management, including the members of the Nyrstar Management Committee.

The LESOP is an executive compensation program which allows eligible participants to purchase shares of the company at a discount of 20%, whereby the shares are subject to a holding period of three years. The shares can be purchased with own personal contributions, or alternatively, with a combination of personal contributions and an additional financing provided by a financial institution. The number of shares that an eligible participant can purchase with his or her personal contribution is capped, such cap being 50,000 shares for each member of the Nyrstar Management Committee. The members of the Nyrstar Management Committee that participated in the LESOP each acquired 500,000 shares, including 50,000 that were acquired via their own personal contribution.

Am 6. Februar gibt es Zahlen !

16 January 2014

Nyrstar NV plans to release its 2013 Full Year Results at 7:00am Central European time, on Thursday 6 February 2014.

16 January 2014

Nyrstar NV plans to release its 2013 Full Year Results at 7:00am Central European time, on Thursday 6 February 2014.

Nyrstar announces 2013 Full Year Results

Related content

28 Jan - Nyrstar: Notice in relation the 4.25% Convertible Bonds..

16 Jan - Nyrstar Announces 2013 Full Year Reporting Date and Web..

15 Jan - Nyrstar: Shareholder Notification

Structural progress despite operational challenges in mining

Regulated Information

6 February 2014

HIGHLIGHTS

Group underlying EBITDA of EUR185 million down 16% on 2012 (EUR 221 million)

Metals Processing EUR 149 million, driven by higher realised premiums and the recognition of the EUR 45 million termination fee from Glencore, partially offset by lower acid prices

Mining EBITDA EUR 78 million, adversely impacted by lower copper, silver and gold prices, operational challenges during H1 2013 and significant reduction in deliveries from Talvivaara during H2 2013.

Delivered significant cost savings through Project Lean, EUR 43 million by end of 2013; on track to deliver target of EUR 75 million by end of 2014

Strategic hedges for zinc, gold and silver partially offset challenging metal price environment

PAT of EUR (195) million impacted by impairments and impairment reversals

Impairment of EUR 194 million (after tax) related to write-downs at an number of mining operations

Reversal of EUR 139 million (after tax) historic (2008) impairments of Balen and Port Pirie smelters due to improvements in the valuation of these two assets driven by a reduction in energy costs and a more favourable metal price outlook compared to 2008

Significant improvement of PAT in H2 2013 versus H1 2013 prior to impact of impairments and impairment reversals

No impairment on Talvivaara zinc streaming agreement in 2013 - Nyrstar actively involved in Talvivaara's corporate reorganisation process

The Board of Directors has decided not to propose to shareholders a distribution for the full year 2013, reflecting its commitment to support the opportunities identified by the company's growth plans

Solid financial position and significant committed undrawn liquidity headroom and cash on hand

Net debt of EUR 670 million (EUR 756 million at the end of H1 2013)

Committed undrawn liquidity headroom and cash on hand of 721 million at end of 2013

Successfully refinanced the EUR 120 million bonds maturing in 2014 with new EUR 120 million convertible bonds due 2018 with attractive terms

Significant reduction in capital expenditure through disciplined approach resulting in capital expenditure of EUR 200 million, 19% down on 2012, and at the low end of full year guidance

Metals Processing and Mining segments production in line with guidance

Metals Processing production in H2 2013 a new half-yearly record, as a result zinc metal production of approximately 1,088kt at top end of full year guidance

Mining segment achieved full year guidance for all metals (excluding lead); although down on 2012 due to operational challenges

Structural progress towards delivering Nyrstar's strategic mission

Reorganisation of company into three distinct segments: Mining, Metals Processing (formerly the Smelting Segment) and Marketing, Sourcing and Sales

Commenced asset level Mining Strategic Review, focused on identifying opportunities to make a step change improvement in the Mining segment's operational performance; not envisaged to be capital consumptive

Started implementing recommendations of Smelting Strategic Review and continued to make significant progress on the proposed Port Pirie Redevelopment

Established a strong marketing, sourcing and sales team to actively support Nyrstar's industrial strategy

Entered into a strategic off-take and marketing agreement with Noble Group

Commenting on the 2013 full year results, Roland Junck, Chief Executive Officer of Nyrstar, said:

"Despite a challenging year, we continue our transformation and are confident we have the right plans in place to reach our strategic targets. Our Group underlying EBITDA of EUR 185 million decreased 16% from 2012. This decline was partly driven by tough macroeconomic headwinds and markedly weaker commodity prices, particularly copper, gold and silver prices, and also company-specific challenges; however, particularly from H2 onwards, we note solid underlying performance, especially in cash generation, cost control and our capital expenditures.

Metals Processing was up 10% on 2012 at EUR 149 million. This was driven by higher realized premiums and the recognition of the EUR 45 million termination fee from Glencore that compensated Nyrstar for agreeing to end the European component of its commodity grade metal off-take contract, partially offset by lower acid prices in 2013.

Mining segment EBITDA was down 40% on 2012 at EUR 78 million; adversely impacted by lower commodity prices, operational challenges during the first half and significantly reduced deliveries from Talvivaara. We remain keenly focused on improving the performance of our Mining segment and during H2 2013 we commenced an asset level Mining Strategic Review aimed at identifying opportunities to make a step change improvement in the Mining segment's operational and financial performance.

We continue to seek sustainable cost reductions across our entire business through Project Lean and achieved costs savings at the end of 2013 of EUR 43 million and are confident of achieving our targeted cost savings of EUR 75 million by the end of 2014.

Net debt at the end of 2013 was EUR 670 million, down 11% on H1 2013 and we have committed undrawn liquidity headroom and cash on hand of EUR 721 million at end of 2013. Metals Processing segment generated strong cash flows driven by effective management of working capital and capital expenditure. During the year we successfully refinanced the EUR 120 million bond maturing in 2014 with new EUR 120 million convertible bonds due 2018 with attractive terms.

As a result of our disciplined capital management approach, capital expenditure in 2013 was significantly down on 2012 at EUR 200 million and at bottom of full year guidance.

Our operational performance was impacted by a number of planned maintenance shuts across our Metals Processing segment and, disappointingly, operational events across our Mining segment. Most notably a two month suspension of mining operations at Campo Morado due to a licensing issue. However, whilst own mine zinc in concentrate production in H2 2013 was down marginally on H1 2013 this largely reflected the focus on gold at El Toqui. Full year own zinc in concentrate production was 271,000 tonnes (in line with our guidance although down 4% on 2012). Lead in concentrate production was marginally down on our guidance whilst the production of other metals (copper, gold and silver) was in line. Deliveries of zinc in concentrate from Talvivaara during H2 2013 were significantly down on H1 2013 (30kt in H1 2013 to 14kt in H2). Talvivaara's liquidity position weakened further in H2 2013 and Nyrstar is now actively participating with a number of stakeholders in Talvivaara's corporate reorganization process which commenced in Q4 2013.

Our Metals Processing Segment had a strong year, with a new half-yearly record in zinc metal production in H2 2013, as a result zinc metal production was at top end of our guidance (and in line with 2012). Production of other metals in Metals Processing (lead, copper, silver, gold and indium) was broadly in line with H1 2013 and above 2012 performance.

Our marketing, sourcing and sales team in H1 2013 reached agreement to terminate the European component of the commodity grade zinc metal offtake agreement with Glencore. In H2 2013, Nyrstar successfully concluded negotiations for a strategic offtake and marketing partnership with Noble Group for 200,000 tonnes per annum of commodity grade zinc metal. In parallel with the partnership in Europe with Noble, we have also established a strong marketing, sourcing and sales group which will actively position Nyrstar within key markets.

Looking ahead, we recognise that 2014 is an important year for Nyrstar and while there are early signs of improving conditions across the markets in which we operate, we are conscious of the need for a prudent and disciplined approach to managing the business ensuring it is sustainable for the long term. With this in mind, we continue to actively progress the Port Pirie redevelopment and the initiatives identified following the outcome of the Smelting Strategic Review, supported by a more advanced Marketing, Sourcing and Sales strategy, and look forward to results of the Mining Strategic Review. We continue to execute the Group strategy and remain convinced that our unique industrial footprint, ownership of raw materials and commercial focus provide a unique opportunity to generate value to our shareholders.

Related content

28 Jan - Nyrstar: Notice in relation the 4.25% Convertible Bonds..

16 Jan - Nyrstar Announces 2013 Full Year Reporting Date and Web..

15 Jan - Nyrstar: Shareholder Notification

Structural progress despite operational challenges in mining

Regulated Information

6 February 2014

HIGHLIGHTS

Group underlying EBITDA of EUR185 million down 16% on 2012 (EUR 221 million)

Metals Processing EUR 149 million, driven by higher realised premiums and the recognition of the EUR 45 million termination fee from Glencore, partially offset by lower acid prices

Mining EBITDA EUR 78 million, adversely impacted by lower copper, silver and gold prices, operational challenges during H1 2013 and significant reduction in deliveries from Talvivaara during H2 2013.

Delivered significant cost savings through Project Lean, EUR 43 million by end of 2013; on track to deliver target of EUR 75 million by end of 2014

Strategic hedges for zinc, gold and silver partially offset challenging metal price environment

PAT of EUR (195) million impacted by impairments and impairment reversals

Impairment of EUR 194 million (after tax) related to write-downs at an number of mining operations

Reversal of EUR 139 million (after tax) historic (2008) impairments of Balen and Port Pirie smelters due to improvements in the valuation of these two assets driven by a reduction in energy costs and a more favourable metal price outlook compared to 2008

Significant improvement of PAT in H2 2013 versus H1 2013 prior to impact of impairments and impairment reversals

No impairment on Talvivaara zinc streaming agreement in 2013 - Nyrstar actively involved in Talvivaara's corporate reorganisation process

The Board of Directors has decided not to propose to shareholders a distribution for the full year 2013, reflecting its commitment to support the opportunities identified by the company's growth plans

Solid financial position and significant committed undrawn liquidity headroom and cash on hand

Net debt of EUR 670 million (EUR 756 million at the end of H1 2013)

Committed undrawn liquidity headroom and cash on hand of 721 million at end of 2013

Successfully refinanced the EUR 120 million bonds maturing in 2014 with new EUR 120 million convertible bonds due 2018 with attractive terms

Significant reduction in capital expenditure through disciplined approach resulting in capital expenditure of EUR 200 million, 19% down on 2012, and at the low end of full year guidance

Metals Processing and Mining segments production in line with guidance

Metals Processing production in H2 2013 a new half-yearly record, as a result zinc metal production of approximately 1,088kt at top end of full year guidance

Mining segment achieved full year guidance for all metals (excluding lead); although down on 2012 due to operational challenges

Structural progress towards delivering Nyrstar's strategic mission

Reorganisation of company into three distinct segments: Mining, Metals Processing (formerly the Smelting Segment) and Marketing, Sourcing and Sales

Commenced asset level Mining Strategic Review, focused on identifying opportunities to make a step change improvement in the Mining segment's operational performance; not envisaged to be capital consumptive

Started implementing recommendations of Smelting Strategic Review and continued to make significant progress on the proposed Port Pirie Redevelopment

Established a strong marketing, sourcing and sales team to actively support Nyrstar's industrial strategy

Entered into a strategic off-take and marketing agreement with Noble Group

Commenting on the 2013 full year results, Roland Junck, Chief Executive Officer of Nyrstar, said:

"Despite a challenging year, we continue our transformation and are confident we have the right plans in place to reach our strategic targets. Our Group underlying EBITDA of EUR 185 million decreased 16% from 2012. This decline was partly driven by tough macroeconomic headwinds and markedly weaker commodity prices, particularly copper, gold and silver prices, and also company-specific challenges; however, particularly from H2 onwards, we note solid underlying performance, especially in cash generation, cost control and our capital expenditures.

Metals Processing was up 10% on 2012 at EUR 149 million. This was driven by higher realized premiums and the recognition of the EUR 45 million termination fee from Glencore that compensated Nyrstar for agreeing to end the European component of its commodity grade metal off-take contract, partially offset by lower acid prices in 2013.

Mining segment EBITDA was down 40% on 2012 at EUR 78 million; adversely impacted by lower commodity prices, operational challenges during the first half and significantly reduced deliveries from Talvivaara. We remain keenly focused on improving the performance of our Mining segment and during H2 2013 we commenced an asset level Mining Strategic Review aimed at identifying opportunities to make a step change improvement in the Mining segment's operational and financial performance.

We continue to seek sustainable cost reductions across our entire business through Project Lean and achieved costs savings at the end of 2013 of EUR 43 million and are confident of achieving our targeted cost savings of EUR 75 million by the end of 2014.

Net debt at the end of 2013 was EUR 670 million, down 11% on H1 2013 and we have committed undrawn liquidity headroom and cash on hand of EUR 721 million at end of 2013. Metals Processing segment generated strong cash flows driven by effective management of working capital and capital expenditure. During the year we successfully refinanced the EUR 120 million bond maturing in 2014 with new EUR 120 million convertible bonds due 2018 with attractive terms.

As a result of our disciplined capital management approach, capital expenditure in 2013 was significantly down on 2012 at EUR 200 million and at bottom of full year guidance.

Our operational performance was impacted by a number of planned maintenance shuts across our Metals Processing segment and, disappointingly, operational events across our Mining segment. Most notably a two month suspension of mining operations at Campo Morado due to a licensing issue. However, whilst own mine zinc in concentrate production in H2 2013 was down marginally on H1 2013 this largely reflected the focus on gold at El Toqui. Full year own zinc in concentrate production was 271,000 tonnes (in line with our guidance although down 4% on 2012). Lead in concentrate production was marginally down on our guidance whilst the production of other metals (copper, gold and silver) was in line. Deliveries of zinc in concentrate from Talvivaara during H2 2013 were significantly down on H1 2013 (30kt in H1 2013 to 14kt in H2). Talvivaara's liquidity position weakened further in H2 2013 and Nyrstar is now actively participating with a number of stakeholders in Talvivaara's corporate reorganization process which commenced in Q4 2013.

Our Metals Processing Segment had a strong year, with a new half-yearly record in zinc metal production in H2 2013, as a result zinc metal production was at top end of our guidance (and in line with 2012). Production of other metals in Metals Processing (lead, copper, silver, gold and indium) was broadly in line with H1 2013 and above 2012 performance.

Our marketing, sourcing and sales team in H1 2013 reached agreement to terminate the European component of the commodity grade zinc metal offtake agreement with Glencore. In H2 2013, Nyrstar successfully concluded negotiations for a strategic offtake and marketing partnership with Noble Group for 200,000 tonnes per annum of commodity grade zinc metal. In parallel with the partnership in Europe with Noble, we have also established a strong marketing, sourcing and sales group which will actively position Nyrstar within key markets.

Looking ahead, we recognise that 2014 is an important year for Nyrstar and while there are early signs of improving conditions across the markets in which we operate, we are conscious of the need for a prudent and disciplined approach to managing the business ensuring it is sustainable for the long term. With this in mind, we continue to actively progress the Port Pirie redevelopment and the initiatives identified following the outcome of the Smelting Strategic Review, supported by a more advanced Marketing, Sourcing and Sales strategy, and look forward to results of the Mining Strategic Review. We continue to execute the Group strategy and remain convinced that our unique industrial footprint, ownership of raw materials and commercial focus provide a unique opportunity to generate value to our shareholders.

Es geht weiter:

Talvivaara soars on loan agreement with Nyrstar

Tue, 01 April 2014

Article viewed 52 times

Tweet

Share on Facebook

Shares soared in Finnish nickel and zinc miner Talvivaara as it secured a loan, from Belgian zinc giant Nyrstar, that looks to have solved its 'critical' funding issues.

Nyrstar, with which Talvivaara has a zinc streaming agreement, has agreed to loan Talvivaara up to a maximum of €20m in several tranches calculated against future deliveries of zinc.

On February 24th Talvivaara said it had €5.9m cash but that in the absence of further funding its liquidity situation was "critical". Nyrstar is Talvivaara's main creditor, having paid €232m in advance for zinc.

It said the new inter-company loan addressed its current financing needs and reduced the company's overall funding gap before it reached sustainable positive cash flow, and that it was also looking to identify potential investors to participate in a "long-term, overall financial solution" for the group.

If Talvivaara finds such a solution, Nyrstar has agreed to offer a "streaming holiday" that would exempt the Finnish miner from delivering up to 80,000 tonnes from its streaming agreement, with Nyrstar still able purchase zinc ore from Talvivaara at market prices and also ending the loan financing.

Shares in Talvivaara were up 41.7% to 5.23p at 10:45 on Tuesday, having fallen from more than 20p in the previous 12 months.

Talvivaara soars on loan agreement with Nyrstar

Tue, 01 April 2014

Article viewed 52 times

Tweet

Share on Facebook

Shares soared in Finnish nickel and zinc miner Talvivaara as it secured a loan, from Belgian zinc giant Nyrstar, that looks to have solved its 'critical' funding issues.

Nyrstar, with which Talvivaara has a zinc streaming agreement, has agreed to loan Talvivaara up to a maximum of €20m in several tranches calculated against future deliveries of zinc.

On February 24th Talvivaara said it had €5.9m cash but that in the absence of further funding its liquidity situation was "critical". Nyrstar is Talvivaara's main creditor, having paid €232m in advance for zinc.

It said the new inter-company loan addressed its current financing needs and reduced the company's overall funding gap before it reached sustainable positive cash flow, and that it was also looking to identify potential investors to participate in a "long-term, overall financial solution" for the group.

If Talvivaara finds such a solution, Nyrstar has agreed to offer a "streaming holiday" that would exempt the Finnish miner from delivering up to 80,000 tonnes from its streaming agreement, with Nyrstar still able purchase zinc ore from Talvivaara at market prices and also ending the loan financing.

Shares in Talvivaara were up 41.7% to 5.23p at 10:45 on Tuesday, having fallen from more than 20p in the previous 12 months.

Regulated Information

30 April 2014

Nyrstar NV ('Nyrstar' or the 'Company') announced today its first quarter 2014 interim management statement. Nyrstar's management will host an analyst and investor conference call at 09:00 CET to discuss this announcement. Conference call details can be found at the end of the press release.

Nyrstar delivers a solid operational performance for the first quarter of 2014; on track to meet full year guidance

Mining: Third consecutive quarter of steady positive performance since segment formation; quarterly zinc production from own mines of ca. 73,000 tonnes;

Metals Processing: Strong first quarter result for zinc metal of ca. 280,000 tonnes

Nyrstar in advanced stages of announcing its final investment decision for the Port Pirie Redevelopment

Reported 2014 benchmark zinc treatment charge terms up 6%; significant volumes of zinc concentrates already settled at a higher base TC

Ongoing strengthening of the Euro against the US dollar, and low precious metals prices during the quarter will negatively impact earnings if sustained

30 April 2014

Nyrstar NV ('Nyrstar' or the 'Company') announced today its first quarter 2014 interim management statement. Nyrstar's management will host an analyst and investor conference call at 09:00 CET to discuss this announcement. Conference call details can be found at the end of the press release.

Nyrstar delivers a solid operational performance for the first quarter of 2014; on track to meet full year guidance

Mining: Third consecutive quarter of steady positive performance since segment formation; quarterly zinc production from own mines of ca. 73,000 tonnes;

Metals Processing: Strong first quarter result for zinc metal of ca. 280,000 tonnes

Nyrstar in advanced stages of announcing its final investment decision for the Port Pirie Redevelopment

Reported 2014 benchmark zinc treatment charge terms up 6%; significant volumes of zinc concentrates already settled at a higher base TC

Ongoing strengthening of the Euro against the US dollar, and low precious metals prices during the quarter will negatively impact earnings if sustained

Die Nachfrage nach Zink steig, sagt der Chef:

MB ZINC CONF: Zinc demand from building sector growing – Nyrstar

May 13, 2014 - 16:22 GMT Location: Istanbul

KEYWORDS: Zinc , galvanising , building sector , automotive , steel

Growing demand for zinc from the building sector could counteract a possible decline from the automotive industry as steel comes under threat from increased aluminium usage in cars, Bob Katsiouleris, senior vp of Nyrstar, said.

Signs of an uptick of zinc demand from the building sector have caught some producers "a little bit by surprise", Katsiouleris told delegates at Metal Bulletin's 18th Zinc Conference in Istanbul. Growth in the use of zinc in buildings has been driven by more demand in sectors such as housing, sheets, infrastructure,

Der Preis steigt auch.

MB ZINC CONF: Zinc demand from building sector growing – Nyrstar

May 13, 2014 - 16:22 GMT Location: Istanbul

KEYWORDS: Zinc , galvanising , building sector , automotive , steel

Growing demand for zinc from the building sector could counteract a possible decline from the automotive industry as steel comes under threat from increased aluminium usage in cars, Bob Katsiouleris, senior vp of Nyrstar, said.

Signs of an uptick of zinc demand from the building sector have caught some producers "a little bit by surprise", Katsiouleris told delegates at Metal Bulletin's 18th Zinc Conference in Istanbul. Growth in the use of zinc in buildings has been driven by more demand in sectors such as housing, sheets, infrastructure,

Der Preis steigt auch.

Nyrstar: 2014 LESOP Executive Share Acquisition

Regulated Information

18 June 2014

Today, several members of the Nyrstar Management Committee notified the Belgian Financial Services and Markets Authority (FSMA) that they acquired Nyrstar NV shares. The acquisition took place in the framework of the management incentive program known as the 2014 Leveraged Employee Stock Ownership Plan (2014 LESOP) that was approved by the Company's shareholders at the Annual General Meeting (AGM) of 30 April 2014. The 2014 LESOP has been made available amongst Nyrstar's executive management, including the members of the Nyrstar Management Committee.

The 2014 LESOP is an executive compensation program which allows eligible participants to purchase shares of the Company at a discount of 20 per cent, whereby the shares are subject to a holding period of three years. The shares can be purchased with own personal contributions, or alternatively, with a combination of personal contributions and an additional financing provided by a financial institution. The number of shares that an eligible participant can purchase with his or her personal contribution is capped, such cap being 50,000 shares for each member of the Nyrstar Management Committee. The members of the Nyrstar Management Committee that participated in the 2014 LESOP each acquired 500,000 shares, including 50,000 shares that were acquired via their own personal contribution and 450,000 shares acquired through financing with an external financial institution.

Further information on this incentive scheme can be found in the explanatory note for the AGM of 30 April 2014 AGM, which is available on the website of Nyrstar

(see http://www.nyrstar.com/investors/en/shareholderinformation/P…

- Ends -

Regulated Information

18 June 2014

Today, several members of the Nyrstar Management Committee notified the Belgian Financial Services and Markets Authority (FSMA) that they acquired Nyrstar NV shares. The acquisition took place in the framework of the management incentive program known as the 2014 Leveraged Employee Stock Ownership Plan (2014 LESOP) that was approved by the Company's shareholders at the Annual General Meeting (AGM) of 30 April 2014. The 2014 LESOP has been made available amongst Nyrstar's executive management, including the members of the Nyrstar Management Committee.

The 2014 LESOP is an executive compensation program which allows eligible participants to purchase shares of the Company at a discount of 20 per cent, whereby the shares are subject to a holding period of three years. The shares can be purchased with own personal contributions, or alternatively, with a combination of personal contributions and an additional financing provided by a financial institution. The number of shares that an eligible participant can purchase with his or her personal contribution is capped, such cap being 50,000 shares for each member of the Nyrstar Management Committee. The members of the Nyrstar Management Committee that participated in the 2014 LESOP each acquired 500,000 shares, including 50,000 shares that were acquired via their own personal contribution and 450,000 shares acquired through financing with an external financial institution.

Further information on this incentive scheme can be found in the explanatory note for the AGM of 30 April 2014 AGM, which is available on the website of Nyrstar

(see http://www.nyrstar.com/investors/en/shareholderinformation/P…

- Ends -

Ich habe mir nochmal die Guidance für 2014 angesehen.

nyrstar rechnet mit einem durchschnittlichen Preis pro Tonne / Zink von 2.000 USD.

Mittlerweile stehen wir beim Zinkpreis aber 2.170 USD !

Inwieweit die Zinkpreise gehedged sind wissen wir nicht, aber schlecht ist die Entwicklung nicht.

Nyrstar maintains its 2014 full year production guidance as follows:

Production Guidance

Mining

Zinc (own mines) 280,000 - 310,000 tonnes

Lead 15,000 - 18,000 tonnes

Copper 12,500 - 14,000 tonnes

Silver 4,750,000 - 5,250,000 troy ounces

Gold 65,000 - 70,000 troy ounces

Smelting

Zinc market metal 1.0 - 1.1 million tonnes

Treatment Charges (TC)

Zinc concentrate TC settlements achieved by major Asian-based smelters for 2014 have been widely reported to be on the following terms:

Base TC of USD 223.50/dmt (dry metric tonne) at a basis zinc price of USD 2,000/tonne.

Escalators of 8.5% from a zinc price of USD 2,000/tonne to USD 2,500/t, 6.5% from a zinc price of USD 2,500/tonne to USD 3,000/t, 4% from a zinc price of USD 3,000/tonne to USD 3,500/t, and flat thereafter.

De-escalator of 3% from a zinc price of USD 2,000/tonne to USD 1,500/t, and flat thereafter.

This represents a 6% improvement from the 2013 benchmark TC of USD 210.50/dmt, at a basis price of USD 2,000/t.

nyrstar rechnet mit einem durchschnittlichen Preis pro Tonne / Zink von 2.000 USD.

Mittlerweile stehen wir beim Zinkpreis aber 2.170 USD !

Inwieweit die Zinkpreise gehedged sind wissen wir nicht, aber schlecht ist die Entwicklung nicht.

Nyrstar maintains its 2014 full year production guidance as follows:

Production Guidance

Mining

Zinc (own mines) 280,000 - 310,000 tonnes

Lead 15,000 - 18,000 tonnes

Copper 12,500 - 14,000 tonnes

Silver 4,750,000 - 5,250,000 troy ounces

Gold 65,000 - 70,000 troy ounces

Smelting

Zinc market metal 1.0 - 1.1 million tonnes

Treatment Charges (TC)

Zinc concentrate TC settlements achieved by major Asian-based smelters for 2014 have been widely reported to be on the following terms:

Base TC of USD 223.50/dmt (dry metric tonne) at a basis zinc price of USD 2,000/tonne.

Escalators of 8.5% from a zinc price of USD 2,000/tonne to USD 2,500/t, 6.5% from a zinc price of USD 2,500/tonne to USD 3,000/t, 4% from a zinc price of USD 3,000/tonne to USD 3,500/t, and flat thereafter.

De-escalator of 3% from a zinc price of USD 2,000/tonne to USD 1,500/t, and flat thereafter.

This represents a 6% improvement from the 2013 benchmark TC of USD 210.50/dmt, at a basis price of USD 2,000/t.

Nyrstar Proceeding with Port Pirie Redevelopment

SHARE THIS:

Share on facebook

Share on twitter

Follow on Google+

Share on linkedin

More Sharing Services

By Anonymous

Proquest LLC

Nyrstar announced on May 16 the signing of a binding agreement with the government of South Australia and the Australian Export Finance and Insurance Corp. (EFIC) for the final funding and support package for the redevelopment of Nyrstar's Port Pirie, South Australia, smelter Into an advanced metals recovery and refining facility.

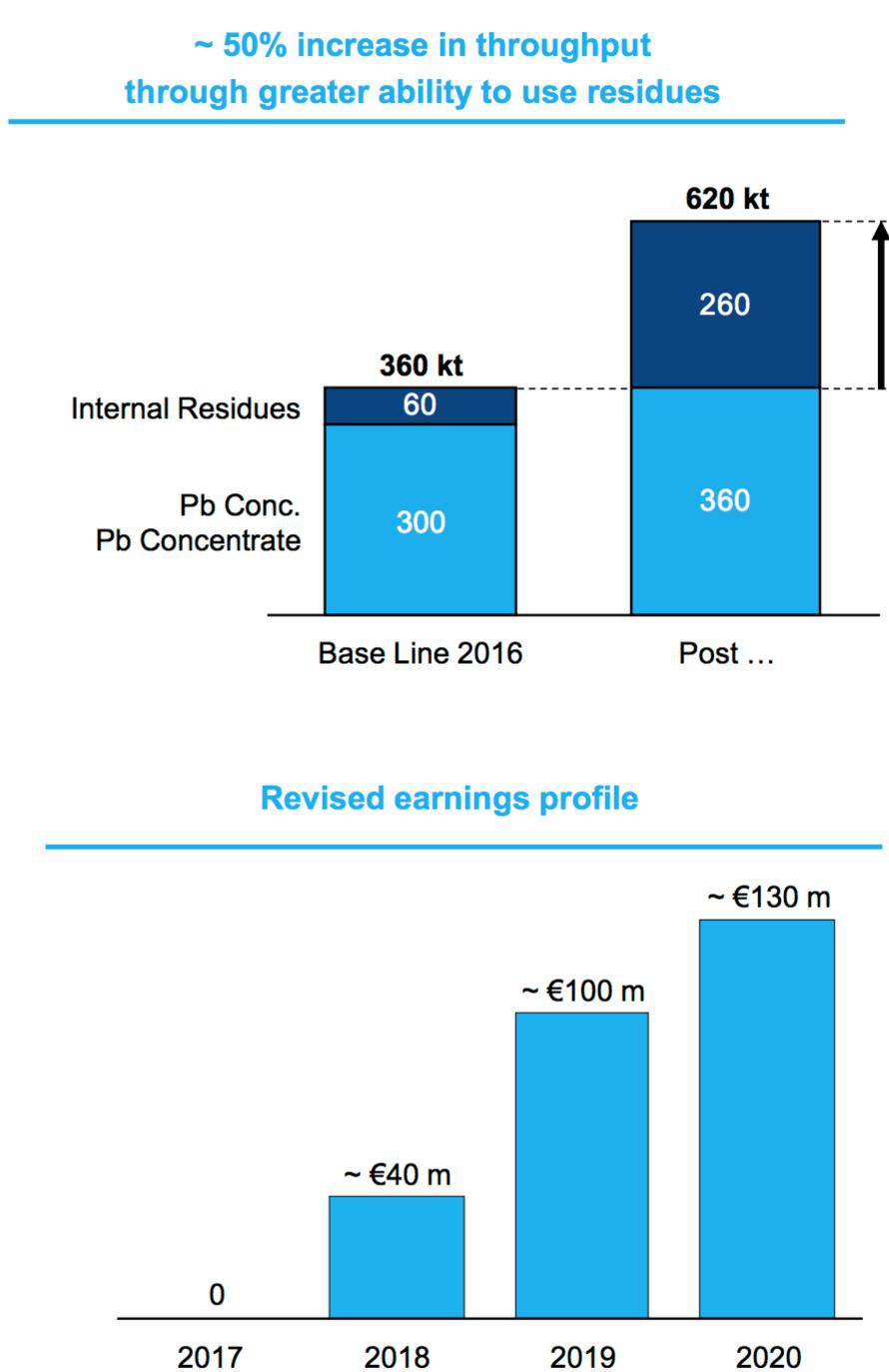

Nyrstar estimates plant throughput at Port Pirie will Increase by about 50% upon completion. Increased furnace flexibility will add significant value by allowing the processing of a wider range of high-value and high-margin concentrates and residues from Nyrstar's network of smelters. Concentrates from the company's mines and residues from its zinc smelting network are expected to account for approximately 50% of feed material requirements.

The redevelopment project includes construction of a new and increased-capacity sulphuric acid plant. During the feasibility process, Nyrstar explored the potential for a third party to build, own, and operate the acid plant; however, the company concluded it would be more beneficial for it to retain full operational control and subsequent marketing benefits.

When the redevelopment project is complete, Port Pirie will have capacity to produce a range of metals, including about 250,000 metric tons per year (mt/y) of refined lead, 40,000 mt/y of zinc in fume, 7,000 mt/y of copper in matte, and 25 million oz/y of silver doré, containing about 100,000 oz/y of gold. The zinc plant at the site will be shut down.

Construction work on the Port Pirie project will begin in early 2015, and the redeveloped facility is scheduled to be fully operational by the end of 2016.

Capital cost for the project Is estimated at about A$514 million, supported by an innovative, three-part funding package. First, Nyrstar's direct contribution will total about $A103 million. Second, third-party project level financing guar- anteed by EFIC and the government of South Australia will contribute about A$291 million. And third, Nyrstar intends to enter into a transaction for the forward sale of silver output from the redeveloped Port Pirie facility for an upfront payment of about A$120 million.

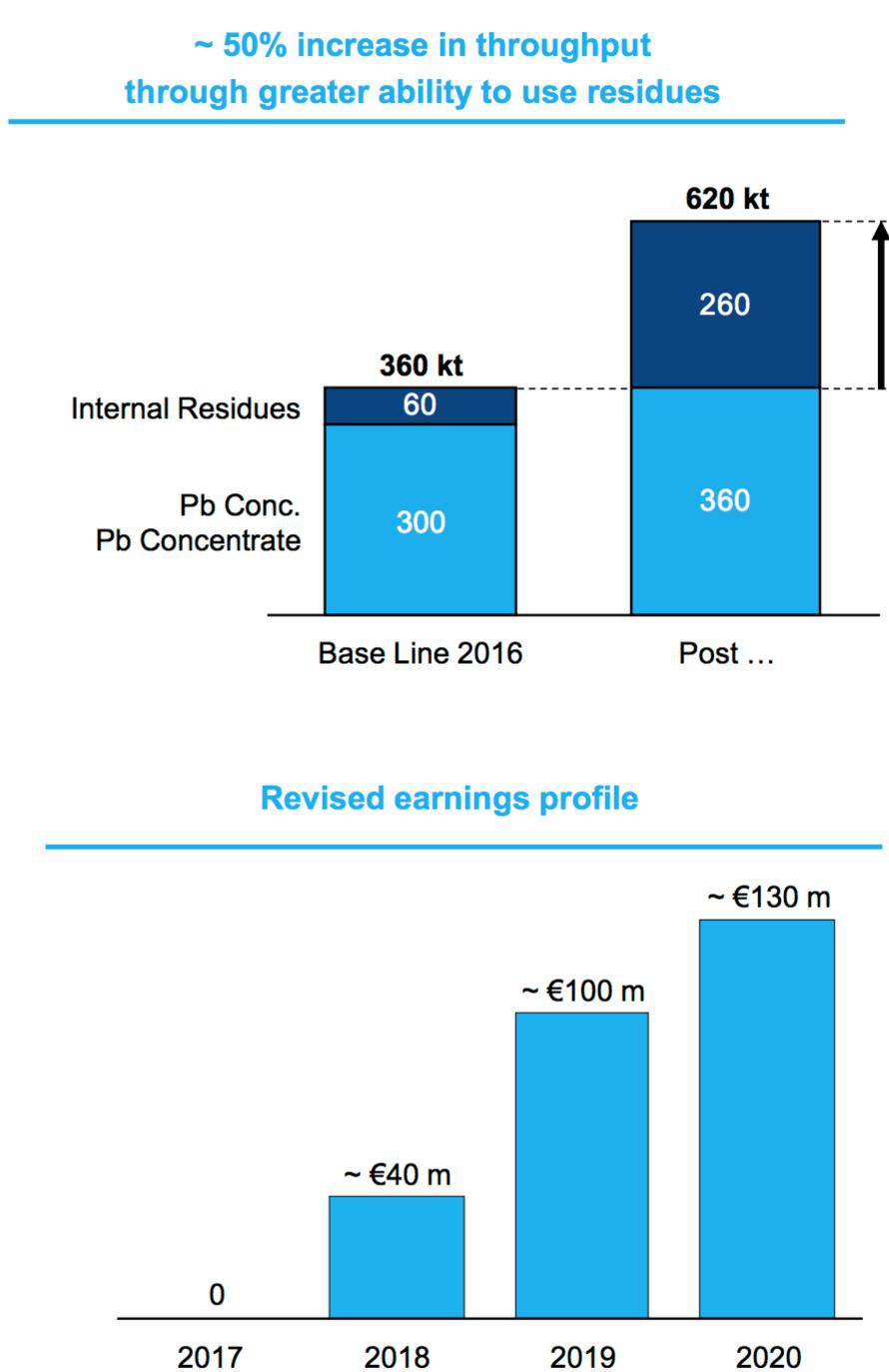

Nyrstar forecasts operating costs/mt of market metal at Port Pirie will decline by about 20% in local currency terms once the project is fully operational, which will in turn drive improved EBITDA and free cash flow. The company expects the project to generate a post-tax leveraged IRR of 25% to 30%, using internal economic and flat metal price assumptions for the duration of the project

SHARE THIS:

Share on facebook

Share on twitter

Follow on Google+

Share on linkedin

More Sharing Services

By Anonymous

Proquest LLC

Nyrstar announced on May 16 the signing of a binding agreement with the government of South Australia and the Australian Export Finance and Insurance Corp. (EFIC) for the final funding and support package for the redevelopment of Nyrstar's Port Pirie, South Australia, smelter Into an advanced metals recovery and refining facility.

Nyrstar estimates plant throughput at Port Pirie will Increase by about 50% upon completion. Increased furnace flexibility will add significant value by allowing the processing of a wider range of high-value and high-margin concentrates and residues from Nyrstar's network of smelters. Concentrates from the company's mines and residues from its zinc smelting network are expected to account for approximately 50% of feed material requirements.

The redevelopment project includes construction of a new and increased-capacity sulphuric acid plant. During the feasibility process, Nyrstar explored the potential for a third party to build, own, and operate the acid plant; however, the company concluded it would be more beneficial for it to retain full operational control and subsequent marketing benefits.

When the redevelopment project is complete, Port Pirie will have capacity to produce a range of metals, including about 250,000 metric tons per year (mt/y) of refined lead, 40,000 mt/y of zinc in fume, 7,000 mt/y of copper in matte, and 25 million oz/y of silver doré, containing about 100,000 oz/y of gold. The zinc plant at the site will be shut down.

Construction work on the Port Pirie project will begin in early 2015, and the redeveloped facility is scheduled to be fully operational by the end of 2016.

Capital cost for the project Is estimated at about A$514 million, supported by an innovative, three-part funding package. First, Nyrstar's direct contribution will total about $A103 million. Second, third-party project level financing guar- anteed by EFIC and the government of South Australia will contribute about A$291 million. And third, Nyrstar intends to enter into a transaction for the forward sale of silver output from the redeveloped Port Pirie facility for an upfront payment of about A$120 million.

Nyrstar forecasts operating costs/mt of market metal at Port Pirie will decline by about 20% in local currency terms once the project is fully operational, which will in turn drive improved EBITDA and free cash flow. The company expects the project to generate a post-tax leveraged IRR of 25% to 30%, using internal economic and flat metal price assumptions for the duration of the project

Zitat von codiman: Ich habe mir nochmal die Guidance für 2014 angesehen.

nyrstar rechnet mit einem durchschnittlichen Preis pro Tonne / Zink von 2.000 USD.

Mittlerweile stehen wir beim Zinkpreis aber 2.170 USD !

Inwieweit die Zinkpreise gehedged sind wissen wir nicht, aber schlecht ist die Entwicklung nicht.

Nyrstar maintains its 2014 full year production guidance as follows:

Production Guidance

Mining

Zinc (own mines) 280,000 - 310,000 tonnes

Lead 15,000 - 18,000 tonnes

Copper 12,500 - 14,000 tonnes

Silver 4,750,000 - 5,250,000 troy ounces

Gold 65,000 - 70,000 troy ounces

Smelting

Zinc market metal 1.0 - 1.1 million tonnes

Treatment Charges (TC)

Zinc concentrate TC settlements achieved by major Asian-based smelters for 2014 have been widely reported to be on the following terms:

Base TC of USD 223.50/dmt (dry metric tonne) at a basis zinc price of USD 2,000/tonne.

Escalators of 8.5% from a zinc price of USD 2,000/tonne to USD 2,500/t, 6.5% from a zinc price of USD 2,500/tonne to USD 3,000/t, 4% from a zinc price of USD 3,000/tonne to USD 3,500/t, and flat thereafter.

De-escalator of 3% from a zinc price of USD 2,000/tonne to USD 1,500/t, and flat thereafter.

This represents a 6% improvement from the 2013 benchmark TC of USD 210.50/dmt, at a basis price of USD 2,000/t.

Jetzt kommen wir wieder zurück zu den ~300.000 Tonnen Zink

die auf Basis 2.000 US Dollar je Tonne kalkuliert wurden.

Der Preis steht aktuell bei 2.250 also 250 US Dollar je Tonne höher.

Meiner Meinung nach könnte das Auswirkungen auf das Ergebnis von Nyrstar haben.

Pat Mohr

„Zink ist das nächste große Thema für Anleger.“

Geschrieben von Björn Junker • 2. Juli 2014 • Druckversion

Patricia Mohr, Analystin der Scotiabank und eine der renommiertesten Rohstoffexpertinnen überhaupt, ist der Ansicht, dass Zink derzeit die besten Chancen unter den Industriemetallen bietet.

Der Anstieg des chinesischen Einkaufsmanagerindex für Juni von 49,4 im Mai auf 50,8 und eine breite Verbesserung der Industrieaktivitäten in den USA – plus 4,3% im Jahresvergleich vor allem in den Sektoren Automobile, Geschäftsausrüstung und Materialien – habe die Stimmung am Markt gebessert, merkte die Expertin an.

Eine Verbesserung des Architecture Billings Index (ABI) des American Institute of Architects – ein führender Indikator kommerzieller und institutioneller Bauaktivitäten – deute ebenfalls auf eine moderate Erholung der Zink intensiven Bauaktivitäten außerhalb des Privatsektors hin, so Mohr weiter. Genauso wichtig sei, dass die Marktteilnehmer davon ausgingen, dass sowohl der Markt für veredeltes Zink als auch für Konzentrat Mitte des Jahrzehnts in ein Defizit übergehen könnten, da viele Minen ausgebeutet seien und nicht ausreichend nach neuen Vorkommen exploriert werde, um mit der Nachfrage Schritt zu halten.

Vor allem letzteres deckt sich mit den Informationen, die uns schon Steve Williams, CEO des kanadischen Zinkexplorers Pasinex Resources (WKN A1JWFY / CSX PSE) im Interview Anfang April gab:

„[..]in den nächsten drei bis vier Jahren dürfte auf dem Zinkmarkt wahrscheinlich eine Angebotsknappheit eintreten, da einige bedeutende Zinkminen schließen werden. Minen, die entweder vor kurzem geschlossen wurden oder in den kommenden Jahren stillgelegt werden dürften, umfassen einige sehr große Zinkproduzenten wie Brunswick in Kanada, Lisheen in Irland, Century in Australien und Perseverance in Kanada. Das wird eine große Lücke in der Zinkproduktion reißen. Das bedeutet, wir sollten in den nächsten Jahren auf Grund dieser Schließungen (und der anhaltend hohen Nachfrage) einen starken Zinkpreis sehen.“ (Das vollständige Interview finden Sie HIER)

Und Pasinex hofft natürlich, zu den Profiteuren einer positiven Zinkpreisentwicklung gehören zu können. Die Chancen darauf sind gestiegen, da das Unternehmen gerade erste, positive Bohrergebnisse von seinem Projekt Pinargozu in der Türkei melden konnte, dabei unter anderem auf 39% Zink über fast 17 Meter stieß. (Pasinex Resources erbohrt herausragende 39% Zink in der Türkei) Natürlich steht Pasinex und Pinargozu noch ganz am Anfang der Entwicklung, das richtige Metall scheint sich das Unternehmen aber schon einmal ausgesucht zu haben

„Zink ist das nächste große Thema für Anleger.“

Geschrieben von Björn Junker • 2. Juli 2014 • Druckversion

Patricia Mohr, Analystin der Scotiabank und eine der renommiertesten Rohstoffexpertinnen überhaupt, ist der Ansicht, dass Zink derzeit die besten Chancen unter den Industriemetallen bietet.

Der Anstieg des chinesischen Einkaufsmanagerindex für Juni von 49,4 im Mai auf 50,8 und eine breite Verbesserung der Industrieaktivitäten in den USA – plus 4,3% im Jahresvergleich vor allem in den Sektoren Automobile, Geschäftsausrüstung und Materialien – habe die Stimmung am Markt gebessert, merkte die Expertin an.

Eine Verbesserung des Architecture Billings Index (ABI) des American Institute of Architects – ein führender Indikator kommerzieller und institutioneller Bauaktivitäten – deute ebenfalls auf eine moderate Erholung der Zink intensiven Bauaktivitäten außerhalb des Privatsektors hin, so Mohr weiter. Genauso wichtig sei, dass die Marktteilnehmer davon ausgingen, dass sowohl der Markt für veredeltes Zink als auch für Konzentrat Mitte des Jahrzehnts in ein Defizit übergehen könnten, da viele Minen ausgebeutet seien und nicht ausreichend nach neuen Vorkommen exploriert werde, um mit der Nachfrage Schritt zu halten.

Vor allem letzteres deckt sich mit den Informationen, die uns schon Steve Williams, CEO des kanadischen Zinkexplorers Pasinex Resources (WKN A1JWFY / CSX PSE) im Interview Anfang April gab:

„[..]in den nächsten drei bis vier Jahren dürfte auf dem Zinkmarkt wahrscheinlich eine Angebotsknappheit eintreten, da einige bedeutende Zinkminen schließen werden. Minen, die entweder vor kurzem geschlossen wurden oder in den kommenden Jahren stillgelegt werden dürften, umfassen einige sehr große Zinkproduzenten wie Brunswick in Kanada, Lisheen in Irland, Century in Australien und Perseverance in Kanada. Das wird eine große Lücke in der Zinkproduktion reißen. Das bedeutet, wir sollten in den nächsten Jahren auf Grund dieser Schließungen (und der anhaltend hohen Nachfrage) einen starken Zinkpreis sehen.“ (Das vollständige Interview finden Sie HIER)

Und Pasinex hofft natürlich, zu den Profiteuren einer positiven Zinkpreisentwicklung gehören zu können. Die Chancen darauf sind gestiegen, da das Unternehmen gerade erste, positive Bohrergebnisse von seinem Projekt Pinargozu in der Türkei melden konnte, dabei unter anderem auf 39% Zink über fast 17 Meter stieß. (Pasinex Resources erbohrt herausragende 39% Zink in der Türkei) Natürlich steht Pasinex und Pinargozu noch ganz am Anfang der Entwicklung, das richtige Metall scheint sich das Unternehmen aber schon einmal ausgesucht zu haben

Zitat von codiman: Ich habe mir nochmal die Guidance für 2014 angesehen.

nyrstar rechnet mit einem durchschnittlichen Preis pro Tonne / Zink von 2.000 USD.

Mittlerweile stehen wir beim Zinkpreis aber 2.170 USD !

Inwieweit die Zinkpreise gehedged sind wissen wir nicht, aber schlecht ist die Entwicklung nicht.

Nyrstar maintains its 2014 full year production guidance as follows:

Production Guidance

Mining

Zinc (own mines) 280,000 - 310,000 tonnes

Lead 15,000 - 18,000 tonnes

Copper 12,500 - 14,000 tonnes

Silver 4,750,000 - 5,250,000 troy ounces

Gold 65,000 - 70,000 troy ounces

Smelting

Zinc market metal 1.0 - 1.1 million tonnes

Treatment Charges (TC)

Zinc concentrate TC settlements achieved by major Asian-based smelters for 2014 have been widely reported to be on the following terms:

Base TC of USD 223.50/dmt (dry metric tonne) at a basis zinc price of USD 2,000/tonne.

Escalators of 8.5% from a zinc price of USD 2,000/tonne to USD 2,500/t, 6.5% from a zinc price of USD 2,500/tonne to USD 3,000/t, 4% from a zinc price of USD 3,000/tonne to USD 3,500/t, and flat thereafter.

De-escalator of 3% from a zinc price of USD 2,000/tonne to USD 1,500/t, and flat thereafter.

This represents a 6% improvement from the 2013 benchmark TC of USD 210.50/dmt, at a basis price of USD 2,000/t.

BUZZ-Nyrstar at two-month high after KBC upgrade

Reuters - UK Focus – Thu, Jul 17, 2014 10:15 BST

ShareTweet

Companies:

Nyrstar NVDISTRIBUIDORA INTERNACIONAL DE ALIMENTACION SHARES

RELATED QUOTES

Symbol Price Change

NYR.BR 2.89 -0.01

DI6.F 6.401 +0.007

** Shares (Frankfurt: DI6.F - news) in Belgium's Nyrstar (Brussels: NYR.BR - news) , the world's largest zinc smelter, rise to a two-month high after broker KBC Securities upgrades to "buy."

** Shares rise as much as 7.0 percent to 2.7410 euros and are the second strongest performers on Euronext Brussels.

** KBC Securities cites surge of LME zinc prices to a near three-year high due to improved sentiment on the global economy and rust-inhibiting zinc in particular.

** KBC says a change of about $100 per tonne of the zinc price has an annual impact of about 28 million euros for Nyrstar's performance. (Reuters messaging rm://philip.blenkinsop.thomsonreuters.com@reuters.net)

Sag ich doch.

Morgen erstmal Zahlen ab 09:00 Uhr. Auf den Ausblick wird es ankommen.

Die Zahlen sind trotz struktureller Probleme garnicht schlecht.

+ Bei der Kosteinsparung pro Jahr hat man von 75 Mio. € pro Jahr 22 Mio € erreicht.

+ Die Nettoverschuldung ist von 756 Mio. € auf 653 Mio. € gesunkenen.

+ Das Nettoverschuldung /EBITDA Ratio liegt jetzt bei 3.1

+ Das Working capital wurde um 132 Mio. € gesenkt

+ Das EBITDA ist um 12 % gestiegen (die Hohen Zinkpreise aus dem Juli haben sich noch nicht ausgewirkt)

- Allerdings ist das Ergebnis mit 66 Mio € immer noch Negativ !

Anlage

http://www.nyrstar.com/investors/en/Nyr_Documents/H12014%20P…

http://www.nyrstar.com/investors/en/Nyr_Documents/H1%202014%…

Ich hatte eigentlich vor bei 3,00 € + X zu verkaufen (= + 30 %). Aber auf Grund der anhaltend hohen Zinkpreise die beim Ergebnis zum Katalysator werden können werde ich NYRSTAR vorerst halten.

Gruß codiman

Gross profit of EUR 637 million, up 1% on H2 2013, up 2% on H1 2013

- Group EBITDA of EUR 110 million, up 12% on H2 2013, up 26% on H1 2013

- Project Lean incremental savings of EUR 22 million; on track to deliver

target EUR 75 million of sustainable cost savings by the end of 2014

- Net debt of EUR 653 million, improved 3% on H2 2013 and improved 14% on H1 2013; LTM H1 2014

Net debt to EBITDA ratio of 3.1x, improved from LTM H2 2013 (3.6x)

- Committed undrawn liquidity headroom and cash on hand of EUR 768 million at the end of H1 2014

- As Nyrstar moves forward with the sequencing and implementation of its SSR projects in 2014 & 2015,

the Company is actively evaluating funding options for this capital spend

- Port Pirie redevelopment approved;

backed by innovative funding package that limits the impact on Nyrstar’s balance sheet

- LTIR of 4.3 lost time injuries per million hours worked; RIR of 11.1

- Nyrstar maintains all aspects of production guidance and provides guidance on its Port Pirie redevelopment project

for the years 2014 to 2016

+ Bei der Kosteinsparung pro Jahr hat man von 75 Mio. € pro Jahr 22 Mio € erreicht.

+ Die Nettoverschuldung ist von 756 Mio. € auf 653 Mio. € gesunkenen.

+ Das Nettoverschuldung /EBITDA Ratio liegt jetzt bei 3.1

+ Das Working capital wurde um 132 Mio. € gesenkt

+ Das EBITDA ist um 12 % gestiegen (die Hohen Zinkpreise aus dem Juli haben sich noch nicht ausgewirkt)

- Allerdings ist das Ergebnis mit 66 Mio € immer noch Negativ !

Anlage

http://www.nyrstar.com/investors/en/Nyr_Documents/H12014%20P…

http://www.nyrstar.com/investors/en/Nyr_Documents/H1%202014%…

Ich hatte eigentlich vor bei 3,00 € + X zu verkaufen (= + 30 %). Aber auf Grund der anhaltend hohen Zinkpreise die beim Ergebnis zum Katalysator werden können werde ich NYRSTAR vorerst halten.

Gruß codiman

Mein Frazösisch ist leider nicht so gut, aber wenn ich das richtig interpretiere,

dann überlegt Nyrstar aufgrund der guten Ergebnisse, Anleihen im Wert von 225.000.000 € vorzeitig zurückzuzahlen.

Kostenersparnis pro Jahr 10.000.000 €.

Nyrstar envisagerait de rembourser anticipativement son obligation à échéance 2015

En marge de la publication de ses résultats pour le premier semestre 2014, Nyrstar a annoncé son intention de rembourser anticipativement sa ligne obligataire à échéance 9 avril 2015, portant sur un montant de 225 millions d’euros.

Il est à noter qu’il n’y a pas de remboursement anticipé (« call ») prévu dans le prospectus de cette émission obligataire. Ce remboursement anticipé pourrait donc se faire via une offre de rachat. Nous ne manquerons pas de vous tenir informé sur Oblis comme à notre habitude.

Sur le marché secondaire, l’obligation en question, qui offre pour rappel un coupon de 5,50%, se traite aux alentours des 100,50% du nominal, équivalent à un rendement annuel de 4,69%.

Elle se traite par coupure de 1.000 euros et ne bénéficie d'aucun rating. L’obligation à échéance 11 mai 2016 et au coupon de 5,375% se traite pour sa part légèrement sous le pair.

- See more at: http://www.oblis.be/fr/news/2014/07/24/nyrstar-envisagerait-…

dann überlegt Nyrstar aufgrund der guten Ergebnisse, Anleihen im Wert von 225.000.000 € vorzeitig zurückzuzahlen.

Kostenersparnis pro Jahr 10.000.000 €.

Nyrstar envisagerait de rembourser anticipativement son obligation à échéance 2015

En marge de la publication de ses résultats pour le premier semestre 2014, Nyrstar a annoncé son intention de rembourser anticipativement sa ligne obligataire à échéance 9 avril 2015, portant sur un montant de 225 millions d’euros.

Il est à noter qu’il n’y a pas de remboursement anticipé (« call ») prévu dans le prospectus de cette émission obligataire. Ce remboursement anticipé pourrait donc se faire via une offre de rachat. Nous ne manquerons pas de vous tenir informé sur Oblis comme à notre habitude.

Sur le marché secondaire, l’obligation en question, qui offre pour rappel un coupon de 5,50%, se traite aux alentours des 100,50% du nominal, équivalent à un rendement annuel de 4,69%.

Elle se traite par coupure de 1.000 euros et ne bénéficie d'aucun rating. L’obligation à échéance 11 mai 2016 et au coupon de 5,375% se traite pour sa part légèrement sous le pair.

- See more at: http://www.oblis.be/fr/news/2014/07/24/nyrstar-envisagerait-…

Nyrstar's (NYRSF) CEO Roland Junck on Q2 2014 Results - Earnings Call Transcript

Jul. 27, 2014 5:32 AM ET | About: Nyrstar NV (NYRSF)

Nyrstar NV (OTC:NYRSF) Q2 2014 Earnings Conference Call July 24, 2014 3:00 AM ET

Amy Rajendran - Group Manager, Investor Relations

Welcome everyone to our webcast this morning to discuss the first half results of 2014. With me today I have a select number of NMC members. We have Roland, Chief Executive Officer; Heinz, Chief Financial Officer; Bob, Senior Vice President, Marketing, Sourcing and Sales and also Acting Senior Vice President to the mining segment; and also we have Michael Morley, Senior Vice President Metals Processing and Chief Development Officer to run you through today’s presentation. There will be a Q&A session at the end. And if there are any other questions, I’m more than happy to take them.

And with that I’d like to hand it over to Roland.

Roland Junck - Chief Executive Officer

Yes, thank you very much, Amy, and good morning everybody. Briefly going through the first half year as you may, gross profit, €637 million, was slightly up by 1% compared to second half 2013, 2% up by first half 2013. But underlying EBITDA out of this gross profit was up by 12% half year on half year and even 26% year-on-year, at the level of €110 million. It’s also a consequence of project lean being actively pursued. We did an additional serving of around €22 million so it – we are confident of that and we are on track to deliver the €75 million of cost reduction, a sustainable cost reduction that we have indicated to be reached by the end of 2014.

Our net debt position has also improved by 3% half year on half year and even 14% year-on-year base, it is now at the €653 million and the net debt to EBITDA ratio has come down as you can see, 3.1 times. The committed undrawn liquidity headroom and cash on hand is higher, €768 million at the end of the first half of 2014. Port Pirie, near Whyalla, the redevelopment had been approved of course based on the agreement, on this innovative funding package that we found in Australia and that actually limits the impact of the significant investment on our balance sheet. And we have also moved ahead with our smelting strategic review project portfolio. That sounds complicated but we have progressed on the different projects which are in that package. I'm sure Michael will come back to that.

On the graphs you see the evolution of gross profit margin and EBITDA margins which have a very positive trend. Now, this has been backed also by the good operational performance. As you know, operation performances are never good enough, but nevertheless on the mining side we reached about 140,000 tons which is 4% up half year on half year, 1% up year-on-year that is Zinc production, Zinc contained from our own mines.

Our average costs have come down, $66 direct operating cost per ton as we measure them, which is an improvement of 1% or 3% on a year-to-year base and we will continue to work on that cost reduction in the second half of this year. We have new mine plans and operational efficiency plans in place. We also have, as you know, already identified two assets as not being core and which we will dispose over time. And last but not least we also got under the streaming agreement with Talvivaara, 17,000 tons of zinc contained in the first half of this year. So, on the metals processing side, the zinc metal has been at the level of 552,000 tons that has been down 3% compared to second half last year, but 6% up compared to the first half 2013, but fundamentally, as you know, we run our capacity flat out, so any plan maintenance or whatever stock has a direct impact on the total production we can do.

http://seekingalpha.com/article/2345625-nyrstars-nyrsf-ceo-r…

Jul. 27, 2014 5:32 AM ET | About: Nyrstar NV (NYRSF)

Nyrstar NV (OTC:NYRSF) Q2 2014 Earnings Conference Call July 24, 2014 3:00 AM ET

Amy Rajendran - Group Manager, Investor Relations

Welcome everyone to our webcast this morning to discuss the first half results of 2014. With me today I have a select number of NMC members. We have Roland, Chief Executive Officer; Heinz, Chief Financial Officer; Bob, Senior Vice President, Marketing, Sourcing and Sales and also Acting Senior Vice President to the mining segment; and also we have Michael Morley, Senior Vice President Metals Processing and Chief Development Officer to run you through today’s presentation. There will be a Q&A session at the end. And if there are any other questions, I’m more than happy to take them.