Xero - Accounting-SaaS aus Neuselland - 500 Beiträge pro Seite

eröffnet am 08.01.14 15:08:52 von

neuester Beitrag 17.06.19 09:26:48 von

neuester Beitrag 17.06.19 09:26:48 von

Beiträge: 24

ID: 1.190.171

ID: 1.190.171

Aufrufe heute: 0

Gesamt: 1.919

Gesamt: 1.919

Aktive User: 0

ISIN: NZXROE0001S2 · WKN: A1H4J8

71,25

EUR

-2,06 %

-1,50 EUR

Letzter Kurs 09:27:03 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5400 | +191,89 | |

| 1,8100 | +64,55 | |

| 1,4000 | +30,84 | |

| 1,7500 | +30,60 | |

| 6,1500 | +22,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2001 | -22,57 | |

| 2,6100 | -31,32 | |

| 0,5100 | -36,25 | |

| 7,0000 | -62,10 | |

| 12,300 | -73,38 |

...und insoweit immer als potentieller gamechanger interessant zu beobachten;

leider anscheinend nur in Oz handelbar.

Interessant für mich auch die Quelle der Anregung: http://brontecapital.blogspot.de/2014/01/xero-and-precious-p…

...wenn schon ein in der Wolle gefärbter Shortseller eine Bude gut findet, höre ich zu.

Aktie -wie leider bei solchen Werten gewohnt- astronomisch teuer und fundamental gar nicht bewertbar,

aber anschauen kann man sich es ja allemal.

Link zu einem Research-report: http://www.xero.com/media/813463/201311_first_nz_capital.pdf

leider anscheinend nur in Oz handelbar.

Interessant für mich auch die Quelle der Anregung: http://brontecapital.blogspot.de/2014/01/xero-and-precious-p…

...wenn schon ein in der Wolle gefärbter Shortseller eine Bude gut findet, höre ich zu.

Aktie -wie leider bei solchen Werten gewohnt- astronomisch teuer und fundamental gar nicht bewertbar,

aber anschauen kann man sich es ja allemal.

Link zu einem Research-report: http://www.xero.com/media/813463/201311_first_nz_capital.pdf

grrrr....

grrrr....Die Tippfehler in den Threadtiteln verfolgen einen auf ewig...

Zitat von R-BgO: ...und insoweit immer als potentieller gamechanger interessant zu beobachten;

leider anscheinend nur in Oz handelbar.

Interessant für mich auch die Quelle der Anregung: http://brontecapital.blogspot.de/2014/01/xero-and-precious-p…

...wenn schon ein in der Wolle gefärbter Shortseller eine Bude gut findet, höre ich zu.

Aktie -wie leider bei solchen Werten gewohnt- astronomisch teuer und fundamental gar nicht bewertbar,

aber anschauen kann man sich es ja allemal.

Link zu einem Research-report: http://www.xero.com/media/813463/201311_first_nz_capital.pdf

... ja klingt wirklich wie ein echtes Schnäppchen. Umsatz lt. Research-Studie in 2014 70,9 Mio.US-$ und nur ne Market-Cap von 3,5 Mrd. US-$. Immerhin sinkt das KUV bis 2016 auf weniger als 14 und das KGV liegt nur noch bei -[also minus] 86,4. Dagegen war jedes Unternehmen (auch die inzwischen insolventen) zu Neuer Markt-Zeiten fast geschenkt.

Viele Grüße

il

Antwort auf Beitrag Nr.: 46.186.273 von ilsubstanzinvestore am 08.01.14 20:42:49tja, ist halt nur für Substanzinvestoren geeignet...

aber 'ne Salesforce z.B. war auch immer alles andere als billig

aber 'ne Salesforce z.B. war auch immer alles andere als billig

By Suze Metherell

June 16 (BusinessDesk) -

Xero, the cloud-based accounting software firm, continued to boost sales last month, with annualised revenue of $100 million for the first time.

Annualised revenue, which Xero recognises on a customer subscription basis, reached $100 million in May, with monthly recurring subscription revenue of $8.6 million, the Wellington-based company said in a statement. That's up from annual revenue of $93 million in March. Xero reported operating revenue of $70.1 million in the 12 months ended March 31.

The company is chasing sales growth in lieu of profit, raising $180 million from investors last year to help fund its aspirations to grab one million customers worldwide, and target the US market for that growth.

Australian customers now exceed 120,000 and UK clients are more than 50,000 with 70 percent of its annualised subscription revenue from outside New Zealand, it said. Xero had 109,000 Australian customers and 47,000 UK clients as at March 31.

In April, Xero said it had slowed its cash burn with its cash outflow at $5.6 million in the three months ended March 31, slowing from an outflow of $6.5 million in the December quarter, and up from $2.5 million a year earlier.

The NZX-listed company's shares rose 0.5 percent to $29.30 today, and have shed 9.8 percent this year.

June 16 (BusinessDesk) -

Xero, the cloud-based accounting software firm, continued to boost sales last month, with annualised revenue of $100 million for the first time.

Annualised revenue, which Xero recognises on a customer subscription basis, reached $100 million in May, with monthly recurring subscription revenue of $8.6 million, the Wellington-based company said in a statement. That's up from annual revenue of $93 million in March. Xero reported operating revenue of $70.1 million in the 12 months ended March 31.

The company is chasing sales growth in lieu of profit, raising $180 million from investors last year to help fund its aspirations to grab one million customers worldwide, and target the US market for that growth.

Australian customers now exceed 120,000 and UK clients are more than 50,000 with 70 percent of its annualised subscription revenue from outside New Zealand, it said. Xero had 109,000 Australian customers and 47,000 UK clients as at March 31.

In April, Xero said it had slowed its cash burn with its cash outflow at $5.6 million in the three months ended March 31, slowing from an outflow of $6.5 million in the December quarter, and up from $2.5 million a year earlier.

The NZX-listed company's shares rose 0.5 percent to $29.30 today, and have shed 9.8 percent this year.

erste Position gekauft

23 July 2014 Annual Meeting - Wellington

25 July 2014 Investor Briefing - Auckland

20 November 2014 Half Year Interim Report release

25 July 2014 Investor Briefing - Auckland

20 November 2014 Half Year Interim Report release

Melbourne, Aug 22, 2014 (ABN Newswire) - Leading online accounting software company Xero Limited (ASX:XRO) (NZE:XRO) announces that it has almost doubled customer numbers in Australia in the last 12 months, with over 147,000 paying customers in Australia.

Recognition of this milestone and strategic partnerships will be an important feature of Australian MD Chris Ridd's keynote at Xero's annual partner conference Xerocon in Sydney today. Xerocon is expected to be the largest accounting technology conference in Australia this year, with 1,300 paying attendees and 82 exhibitors attending.

Xero will also announce that from September this year, Telstra, one of its strategic partners, will be giving its business mobile customers the opportunity to experience the benefits of cloud computing first hand, by offering eligible customers a six month free trial of Xero.

In addition to this continued collaboration with Telstra, Xero will announce a new strategic partnership with CGU, part of the IAG group which is Australia's largest general insurer. CGU is working with Xero to simplify the task of calculating insurance premiums for Workers' Compensation.

After being heralded by Forbes magazine earlier this year as the 'World's most innovative growth company', the development team in Australia has grown to over 50, and is helping to increase the velocity of feature development for Xero globally.

Recognition of this milestone and strategic partnerships will be an important feature of Australian MD Chris Ridd's keynote at Xero's annual partner conference Xerocon in Sydney today. Xerocon is expected to be the largest accounting technology conference in Australia this year, with 1,300 paying attendees and 82 exhibitors attending.

Xero will also announce that from September this year, Telstra, one of its strategic partners, will be giving its business mobile customers the opportunity to experience the benefits of cloud computing first hand, by offering eligible customers a six month free trial of Xero.

In addition to this continued collaboration with Telstra, Xero will announce a new strategic partnership with CGU, part of the IAG group which is Australia's largest general insurer. CGU is working with Xero to simplify the task of calculating insurance premiums for Workers' Compensation.

After being heralded by Forbes magazine earlier this year as the 'World's most innovative growth company', the development team in Australia has grown to over 50, and is helping to increase the velocity of feature development for Xero globally.

zum HJ weiter schnelles Wachstum, aber die Kosten steigen noch schneller;

cash-burn derzeit gut 20 Mio. pro Quartal, Vorräte reichen für 7-8 Quartale...

cash-burn derzeit gut 20 Mio. pro Quartal, Vorräte reichen für 7-8 Quartale...

Investor update

www.xero.com/media/3952620/fy15-investor-update.pdf

mächtiger Satz Ende Februar...

Accel investiert 100 MUSD

Accel investiert 100 MUSD

Wettbewerb

Christopher Adams: Xero has the Google factor over MYOB5:00 AM Tuesday Mar 3, 2015

As rivalry between Australasian accounting software foes Xero and MYOB heats up, an investment blog has found a novel method of comparing the two companies' prospects.

Motley Fool Australia analyst Matt Joass, a Xero shareholder, reckons Google search results should raise "a big red flag" for prospective investors in Melbourne-based, private equity-owned MYOB's widely anticipated initial public offering.

His article revisits the battle between social media rivals Facebook and MySpace.

"Once Facebook had overtaken MySpace in Google search term popularity it was already game over for MySpace - in only a matter of months Facebook was also winning on user count and engagement."

According to Joass, Xero overtook its more well-established Australian competitor in New Zealand Google search popularity in mid-2011, while the Kiwi firm has also jumped ahead of MYOB in searches across the Tasman, as well as globally, more recently.

The article came as the two companies traded shots over the annual result MYOB released on Thursday, which included a 16 per cent rise in revenue to A$287 million ($296 million) and a 15 per cent lift in operating profit to A$138 million.

In a somewhat unusual move, Xero dispatched a press release in response to MYOB's result.

The Wellington-based firm's managing director for Australia and New Zealand, Chris Ridd, said MYOB's 16 per cent rate of revenue growth - well below Xero's 82 per cent - highlighted the importance of having a multiple-market growth strategy.

In addition to Australasia, Xero is also pushing into the US and Britain.

The New Zealand company had just 277,000 customers in Australasia at the end of September - compared with MYOB's roughly 1.2 million - but is growing fast.

Ridd said Xero, which last week announced a $147 million capital raising with two North American investors, was adding 300 customers every business day in Australia, with more than 100 of those new users switching over from MYOB.

A MYOB spokeswoman hit back, telling another media outlet that Ridd was comparing companies with very different business styles, while also noting that the Australian firm's cloud user base had grown by 88 per cent over the past two years.

Xero shares closed down 30c at $24.40 last night.

inzwischen sogar in Dtld. handelbar...

GB kam gestern, Verlust verdoppelt

GB kam gestern, Verlust verdoppelt

Notification to Xero Shareholders - Change of Auditor

Xero Limited (NZX/ASX: XRO) (Xero) notifies its shareholders thatPricewaterhouseCoopers (PwC) has resigned as external auditor of Xero and its

subsidiaries, effective 2 October 2015. PwC will continue to provide

accounting and advisory services to Xero. The resignation of PwC as external

auditor of Xero and its subsidiaries will enable PwC to recommend Xero's

offerings to private businesses.

Xero's Board of Directors have appointed Ernst & Young as the external

auditor of Xero and its subsidiaries, effective upon PwC's resignation as

external auditor of Xero and its subsidiaries on 2 October 2015.

We appreciate the exceptional service and support from PwC. PwC has been

Xero's external auditor for over eight years, appointed soon after Xero's

listing on the NZX in 2007. During this time Xero has established itself as a

global company providing a small business platform to over half a million

subscribers worldwide. Xero sincerely thanks PwC for their expertise during

these early years.

Zahlen sollen am 5.11. kommen

es gibt echt wenig laufende Infos;

aus dem letzten "update" von November:"At the same time as providing you with a Notice under the Financial Markets Conduct Act 2013, we thought it was a good opportunity to share some updates before we end what has been an amazing year for Xero.

This month Xero has completed its 2 year re-platform project to Amazon Web Services (AWS). This has been an incredible challenge for our team as we migrated more than 1.4 petabytes of data and 59 billion records to the AWS platform. As a 24x7 business, moving to an entirely new platform can best be described as ‘changing the engines on a passenger jet while it’s still ying’. Amazingly our team managed this while releasing even more Xero features than the year before.

As well as providing the platform for millions of customers, AWS unlocks machine learning technology, allows us to ship software even faster and improve margins. It’s an exciting time to be in technology."

So vom Bauchgefühl her könnte es sein, dass sie ggü. dem Wettbewerb 'n Tick zu langsam sind?

Antwort auf Beitrag Nr.: 54.308.441 von R-BgO am 13.02.17 16:42:34

zum Halbjahr waren sie erstmals

EBITDA-positiv

Antwort auf Beitrag Nr.: 54.308.441 von R-BgO am 13.02.17 16:42:34

Hempton thinks so:

http://brontecapital.blogspot.com/2018/08/xero_1.html

aja, und die Zahlen sind da:

Revenue was up 37 percent to NZ$256.5 million and operating revenue for the six month period was NZ$256.5 million, with Xero attributing the figure to subscriber growth.

The company ended the first-half with nearly 1.6 million subscribers, of which 380,000 were added in the last 12 months.

Xero boasts 657,000 subscribers in Australia, 324,000 subscribers in New Zealand, 355,000 subscribers in the United Kingdom, 178,000 subscribers in North America, and 65,000 subscribers in the rest of the world.

https://www.zdnet.com/article/xero-falls-deeper-into-the-red…

Revenue was up 37 percent to NZ$256.5 million and operating revenue for the six month period was NZ$256.5 million, with Xero attributing the figure to subscriber growth.

The company ended the first-half with nearly 1.6 million subscribers, of which 380,000 were added in the last 12 months.

Xero boasts 657,000 subscribers in Australia, 324,000 subscribers in New Zealand, 355,000 subscribers in the United Kingdom, 178,000 subscribers in North America, and 65,000 subscribers in the rest of the world.

https://www.zdnet.com/article/xero-falls-deeper-into-the-red…

Antwort auf Beitrag Nr.: 59.177.313 von haowenshan am 09.11.18 11:58:21

sieht so aus, als ob sie Hempton's Rat folgen und richtig Gas geben...

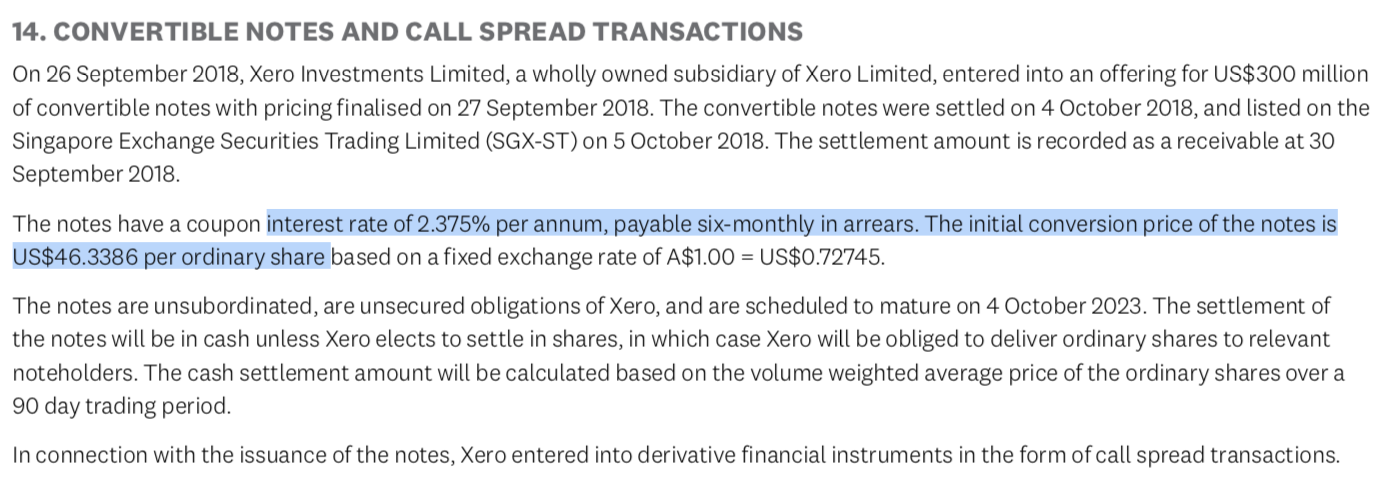

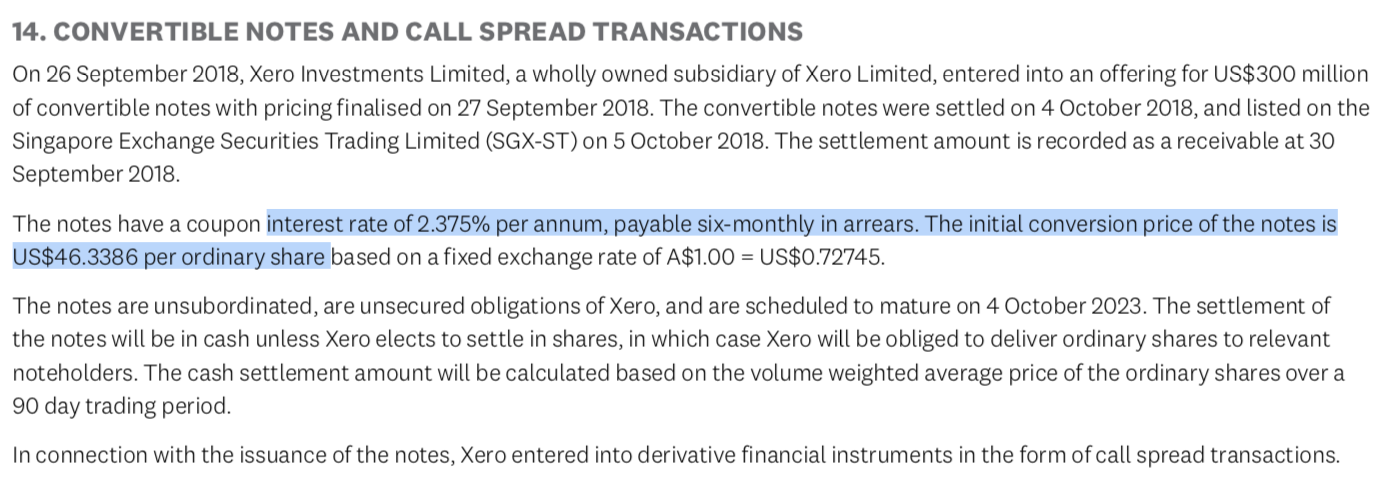

haben sich auch frisches cash beschafft:

Antwort auf Beitrag Nr.: 59.177.313 von haowenshan am 09.11.18 11:58:21

irgendwie passen, dass MYOB rausgeschossen wird...

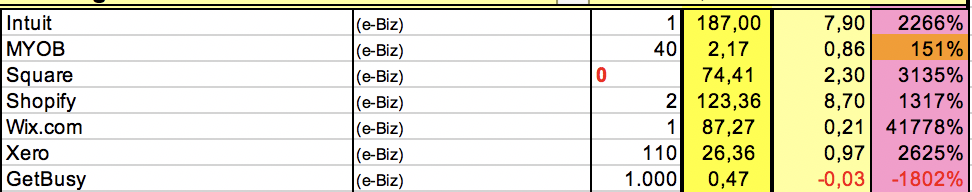

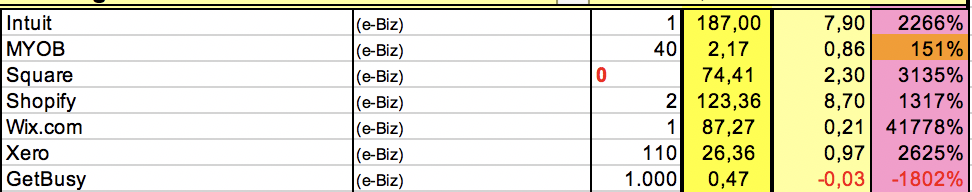

Schön, dass sich mal jemand für meine Exoten interessiert,

in meinem als (e-Biz) bezeichneten Bereich beobachte ich aktuell:

irgendwie passen, dass MYOB rausgeschossen wird...

Auf Basis des Abschlusses zum 31.3.2019 aktuell 15x price-to-sales

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,59 | |

| +0,22 | |

| -0,18 | |

| -1,81 | |

| -0,20 | |

| -2,43 | |

| 0,00 | |

| -0,63 | |

| -0,35 | |

| -0,52 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 236 | ||

| 99 | ||

| 75 | ||

| 68 | ||

| 42 | ||

| 37 | ||

| 34 | ||

| 28 | ||

| 27 | ||

| 25 |