iCar Asia - Internet start-up - 500 Beiträge pro Seite

eröffnet am 13.02.14 14:24:12 von

neuester Beitrag 09.07.19 12:36:47 von

neuester Beitrag 09.07.19 12:36:47 von

Beiträge: 17

ID: 1.191.453

ID: 1.191.453

Aufrufe heute: 0

Gesamt: 1.856

Gesamt: 1.856

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 12:15 | 828 | |

| 20.04.24, 12:11 | 505 | |

| gestern 23:15 | 439 | |

| 06.03.17, 11:10 | 310 | |

| heute 03:00 | 263 | |

| 22.04.08, 12:27 | 241 | |

| 15.05.11, 11:34 | 241 | |

| heute 01:20 | 231 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.015,00 | -0,90 | 194 | |||

| 2. | 2. | 9,6900 | -33,06 | 188 | |||

| 3. | 3. | 162,13 | +12,06 | 143 | |||

| 4. | 4. | 0,1940 | +1,57 | 72 | |||

| 5. | 5. | 6,7090 | -2,94 | 31 | |||

| 6. | 6. | 0,0211 | -32,59 | 29 | |||

| 7. | 7. | 1,3500 | -0,74 | 29 | |||

| 8. | 15. | 2,4120 | -1,47 | 26 |

in Australien gelistet; WKN A1J21X, anscheinend w:o bisher nicht bekannt

http://www.icarasia.com/press/icar-asia-limited-on-track-and…

wie man sehen kann, schnell wachsend aber noch deutlich cash-negativ

bin über iProperty drauf gestossen

leider nur in Oz handelbar

wie man sehen kann, schnell wachsend aber noch deutlich cash-negativ

bin über iProperty drauf gestossen

leider nur in Oz handelbar

und hier gibt es eine sehr schöne Übersichtspräsentation: http://assets.icarasia.com/wp-content/uploads/iCQ_SEPT2013_I…

Zielmärkte Thailand, Malaysia und Indonesien

watchlist

Zielmärkte Thailand, Malaysia und Indonesien

watchlist

iCar Asia Limited extends dominant market position

in ASEAN’s three largest automotive markets, gears up for revenue growth in 2015.Posted on January 27th, 2015

26January, 2015 – iCar Asia Limited (ASX:ICQ), owner of ASEAN’s number 1 network of automotive portals today released its latest quarterly Appendix 4C. Cash receiptsfor the period increased by 162% over the prior corresponding period to $1.1m, the first time cash receipts have surpassed $1m in a quarter, whilst net operating cash outflow was $3.0m. The Company finished the period with $15.4m in cash and cash equivalents.

During the last quarter of 2015, iCar Asia acquired Thailand’s number 1 automotive website, One2car.com, a significant strategic milestone for the Company. All markets demonstrated strong growth in all core operating metrics, while dealer engagement in both Malaysia and Indonesia via iCar Asia’s market-leading Response Management System (RMS) increased significantly.

Malaysia – Extending Dominant Position

iCar Asia’s Malaysian site, Carlist.mycontinues to go from strength to strength, further growing its already market dominant position. Highlights in December included:

Over 1.3 million people visiting the site during the month.

A record 170,000 people sending leads to sellers.

1,531 unique dealers paying for Feature Listings.

87% of all listings “self up-loaded” by Dealersvia the market-leading RMS system.

Sellers used the RMS to “bump”almost95,000 car listings during the month of December, an increase of 25% over November alone.

Damon Rielly, CEO of iCar Asia said, “Carlist.my continues to grow and extend its already significant leadership position. We have some very exciting and innovative products that will be released in 2015 that will deepen our engagement with Dealers and automotive brands, and should result in further increases in our audience and continuing dominance in the market.”

appendix4C-carlist-matrix

Indonesia–Number 1 Automotive Site

iCar Asia’s Indonesia business, Mobil123.comcontinues to grow rapidly, with its leadership position in Indonesia continuing to increase. The key highlights of a strong December performance were:

Audience further increasing to a record of over 1.5m people visiting the site.

Leads achieving another record of more than 96,000 people sending a lead to a seller.

The successful launch of the RMS in Indonesia resulted in over 1,300 individual dealerships logging in and performing at least one action, well ahead of expectations.

The number of vehicles that were self-uploaded grew from approximately 3% prior to the RMS launch to 29% during the RMS’s first active month.

Mr Rielly said, “We are extremely excited with the performance ofMobil123.com. The successful launch and stronger than expected early dealer engagement with our market-leading RMS product has been extremely encouraging. Coupled with the great changes in user experience on our site, including by way of our new approach to new car content, we believe we are set for very strong growth in 2015.”

Appendix4C-mobil123-matrix

Thailand –Dominant number 1 with successful One2car.com acquisition

iCar Asia’sacquisition of Thailand’s number 1 automotive website,One2car.comwas successfully completed on 11 December, 2014, giving iCar Asia a dominant position in the market. Initiatives are underway to integrate One2car.com and iCar Asia’s existing Thailand business, Thaicar.com, which are expected to yield material efficiencies and position the combined business for strong growth in 2015. Other immediate objectives in Thailand are:

Drive growth in the core operating metrics of Listings, Audience & Leads (Lead tracking will be implemented and measureable beginning in the month of January).

Create additional revenue generating products for car Dealers.

Integrate and release iCar Asia’s market-leading RMS technology .

Release a “Version 2.0” of One2car.com, opening up further revenue opportunities in the new car space.

Mr Rielly said, “It’s a very exciting time for our business in Thailand, one2car.com will be our hero brand as we concentrate on using its dominant position to change and improve the way people buy and sell cars in Thailand.”

Appendix4C-thailand-matrix

Mr Rielly continued, “The December quarter wrapped up a fantastic 2014 for iCar Asia. We set out to create a clear leadership position in ASEAN’s three largest automotive countries, and we have delivered upon that objective. We are very well placed for 2015, and intend to begin to execute on our strategy to drive revenue to our market-leading businesses..”

kleine Testposi eröffnet

Impairment of Indonesian asset, mobil123.com

Posted on February 17th, 201517 February, 2015 – iCar Asia Limited (ASX:ICQ), owner of ASEAN’s number 1 network of automotive portals, today announced the impairment of their Indonesian automotive website, mobil123.com.

Said Mr Damon Rielly, CEO of iCar Asia, “We intend to continue investing aggressively in growing our leadership position in the Indonesia market with our website, Mobil123.com. As a result, we will further delay reaching a position of positive cashflow while we position ourselves for the future.”

The current carrying value of mobil123.com assets have been deemed to be impaired as a result of the delay in reaching positive cashflow. As such the carrying value of the Indonesian non-current assets will be reduced to zero. This decision it is expected will adversely impact 2014 earnings by $3.0m and as a consequence increase the full year loss after tax for 2014 to around $16.7m.

Damon Rielly, CEO of iCar Asia said, “Mobil123.com is continuously extending its market-leading position with record audience and lead results over the last quarter. We have also seen strong Dealer engagement with our newly launched Response Management System (RMS), the market opportunity remains tremendous in the medium to long term.”

iCar Asia will release its 2014 full year results on Thursday 26th February.

iCar Asia Limited delivers another record quarter of cash collections

Posted on April 26th, 2016

26 April, 2016 – iCar Asia Limited (‘iCar Asia’ or the ‘Company’), owner of ASEAN’s number 1 network of automotive portals today released its Appendix 4C for the first quarter of 2016. The Company reported another record quarter of cash collections, totalling A$2.07m, an increase of 46% over the same period in 2015, driven by strong receipts in Thailand. Net operating cash outflow also reduced for a fourth consecutive quarter to A$1.99m, a reduction of 46% over the same period in 2015. The Company finished the quarter with A$16.26m in cash and cash equivalents.

Operating Update

iCar Asia delivered strong operational results in the first quarter of 2016. Key highlights include:

Audience: A record audience of 6.9m Unique Visitors to iCar Asia Classified websites in March, up 30% year on year.

Leads: A record 624,000 unique, individual car buyers sent leads to car sellers across Malaysia, Indonesia and Thailand in March.

Depth Products: A refined guaranteed top search results product called ‘The Boss’ was launched in Malaysia, with over 370 make/model/location combinations sold in March alone.

The Company also recently announced the appointment of new CEO, Hamish Stone, who is expected to join the business in June 2016. The second quarter will further see new depth products being launched, including ‘Hot Deals’ in Malaysia, which profiles special offers for consumers based on the type of car they are interested in purchasing. In Indonesia, ‘Super Jari’ will be launched – a full service offering to manage the digital promotion of vehicle inventory for car sellers. The Company also expects to rollout further improvements to its mobile apps, and to further expand into the private seller & new car markets by way of new product offerings. This strong product focus is expected to further consolidate iCar Asia’s market leading positionsin ASEAN’s three largest automotive markets and translate to longterm revenue growth.

Posted on April 26th, 2016

26 April, 2016 – iCar Asia Limited (‘iCar Asia’ or the ‘Company’), owner of ASEAN’s number 1 network of automotive portals today released its Appendix 4C for the first quarter of 2016. The Company reported another record quarter of cash collections, totalling A$2.07m, an increase of 46% over the same period in 2015, driven by strong receipts in Thailand. Net operating cash outflow also reduced for a fourth consecutive quarter to A$1.99m, a reduction of 46% over the same period in 2015. The Company finished the quarter with A$16.26m in cash and cash equivalents.

Operating Update

iCar Asia delivered strong operational results in the first quarter of 2016. Key highlights include:

Audience: A record audience of 6.9m Unique Visitors to iCar Asia Classified websites in March, up 30% year on year.

Leads: A record 624,000 unique, individual car buyers sent leads to car sellers across Malaysia, Indonesia and Thailand in March.

Depth Products: A refined guaranteed top search results product called ‘The Boss’ was launched in Malaysia, with over 370 make/model/location combinations sold in March alone.

The Company also recently announced the appointment of new CEO, Hamish Stone, who is expected to join the business in June 2016. The second quarter will further see new depth products being launched, including ‘Hot Deals’ in Malaysia, which profiles special offers for consumers based on the type of car they are interested in purchasing. In Indonesia, ‘Super Jari’ will be launched – a full service offering to manage the digital promotion of vehicle inventory for car sellers. The Company also expects to rollout further improvements to its mobile apps, and to further expand into the private seller & new car markets by way of new product offerings. This strong product focus is expected to further consolidate iCar Asia’s market leading positionsin ASEAN’s three largest automotive markets and translate to longterm revenue growth.

blöder Zeitpunkt,

am multi-year low:iCar Asia Ltd (ASX:ICQ) has been granted a trading halt by the ASX, pending details of a capital raising.

The halt will remain in place until the opening of trade on Friday 2nd September 2016, or earlier if an announcement is made to the market.

Antwort auf Beitrag Nr.: 53.183.799 von R-BgO am 01.09.16 14:30:54iCar Asia – Underwritten $23 million Capital Raising – $17.5m successfully raised by Placement, $5m committed by major shareholder subject to shareholder approval

2 September 2016 –

iCar Asia Limited (“ICQ”) today announced the successful completion of an underwritten placement of ordinary shares to institutional and sophisticated investors (Placement).

Bell Potter Securities Limited acted as lead manager and underwriter for the Placement. The proceeds of the Placement will be used to expedite growth by investing in innovative new product and technology, increased marketing, enhanced employee capability and geographical expansion with the goal of accelerating iCar’s revenue profile and future profitability.

The Placement raised approximately $17.5 million through the issue of approximately 54,687,500 ordinary shares at an issue price of 32 cents per share, representing a 11.1% discount to the last closing price of iCar shares on 30 August 2016.

In conjunction with the Placement, Catcha Group Pte Ltd (which beneficially holds 28.55% of the shares in iCar) has agreed to commit to a A$5.0 million placement within approximately 2 months, on the same price and terms as the Placement, subject to shareholder approval at a general meeting of iCar Asia Limited. Catcha Group Pte Ltd will not be entitled to vote on this resolution at the meeting. In addition, non-executive director Syed Khalil Syed Ibrahim proposes to subscribe for shares in iCar to the value of $500,000 on the same price and terms as the Placement, subject to shareholder approval at the general meeting. If shareholder approval is received, iCar will have raised a total of $23 million through this exercise.

At 30 June 2016, iCar had $13 million in cash on hand.

The trading halt will now be lifted and normal trading of iCar shares on the ASX will resume at market open today.

iCar CEO Hamish Stone said, “We’re pleased with the strong demand from both new and existing shareholders. This commitment demonstrates the ongoing support and confidence in our growth strategy and outlook from investors.”

The Placement is expected to settle on Tuesday, 6 September 2016, and the Placement shares will be issued on Wednesday, 7 September 2016.

2 September 2016 –

iCar Asia Limited (“ICQ”) today announced the successful completion of an underwritten placement of ordinary shares to institutional and sophisticated investors (Placement).

Bell Potter Securities Limited acted as lead manager and underwriter for the Placement. The proceeds of the Placement will be used to expedite growth by investing in innovative new product and technology, increased marketing, enhanced employee capability and geographical expansion with the goal of accelerating iCar’s revenue profile and future profitability.

The Placement raised approximately $17.5 million through the issue of approximately 54,687,500 ordinary shares at an issue price of 32 cents per share, representing a 11.1% discount to the last closing price of iCar shares on 30 August 2016.

In conjunction with the Placement, Catcha Group Pte Ltd (which beneficially holds 28.55% of the shares in iCar) has agreed to commit to a A$5.0 million placement within approximately 2 months, on the same price and terms as the Placement, subject to shareholder approval at a general meeting of iCar Asia Limited. Catcha Group Pte Ltd will not be entitled to vote on this resolution at the meeting. In addition, non-executive director Syed Khalil Syed Ibrahim proposes to subscribe for shares in iCar to the value of $500,000 on the same price and terms as the Placement, subject to shareholder approval at the general meeting. If shareholder approval is received, iCar will have raised a total of $23 million through this exercise.

At 30 June 2016, iCar had $13 million in cash on hand.

The trading halt will now be lifted and normal trading of iCar shares on the ASX will resume at market open today.

iCar CEO Hamish Stone said, “We’re pleased with the strong demand from both new and existing shareholders. This commitment demonstrates the ongoing support and confidence in our growth strategy and outlook from investors.”

The Placement is expected to settle on Tuesday, 6 September 2016, and the Placement shares will be issued on Wednesday, 7 September 2016.

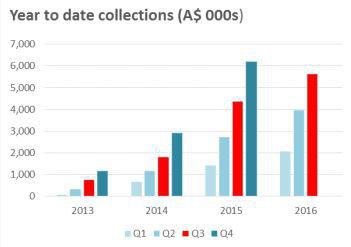

iCar Asia Limited reports 2016 year to date cash flows up 29% on prior year

28 October, 2016 –

iCar Asia Limited (‘iCar Asia’ or the ‘Company’), owner of ASEAN’s number 1 network of automotive portals today released its Appendix 4C for the third quarter of 2016. The

Company reported that year to date 2016 cash collections were up 29% on the prior year, totaling A$5.63m.

Year to date net operating cash outflow was A$8.70m, 12% favourable to the same period in the prior year.

At 30 September the Company finished the period with A$25.90m in cash and cash equivalents. This included the receipt of A$17.50m raised (pre-fees) from a placement during the period. A further A$5.50m will be received in connection with the placement during October.

Operating update

The business has seen some recent strong operational results. Key highlights for September 2016 include:

Solid growth in listings with total vehicles for sale across the Company increasing over 53,000 (15%) since January 2016 with the success of regional expansion strategies in all markets.

Strong audience growth year on year with increases of 22% in Malaysia and 19% in Thailand.

Bump volumes continue to increase month on month with 260% growth in Indonesia and 14% growth in Thailand since January 2016.

CEO of iCar Asia Limited, Mr. Hamish Stone commented: “iCar Asia continues to build momentum through the year. The Company is focused on driving value to customers through increased vibrancy coming into the marketplace. Marketing is delivering a more engaged car buying audience and the product optimizations in Q3 improved conversion across our key customer flows. The Company is starting to see the influence of these improvements through the listings growth achieved across all the markets, with dealers increasing their engagement with our product.”

Further improvements on the product in Q4 across all markets will help build on this momentum going into 2017. Our Dealer Application, revamped consumer mobile experience and messaging functionality are expected to deliver further improvements in engagement between our customers, and result in more cars being successfully traded through our platforms.”

Mr. Stone concluded: “The Company’s strategic direction has been clearly defined and we are focused on building the business for the long-term. The successful capital raising in September showed strong investor confidence in the iCar story and that the Company has both the capital and the competitive position to define the digital automotive future in ASEAN.”

28 October, 2016 –

iCar Asia Limited (‘iCar Asia’ or the ‘Company’), owner of ASEAN’s number 1 network of automotive portals today released its Appendix 4C for the third quarter of 2016. The

Company reported that year to date 2016 cash collections were up 29% on the prior year, totaling A$5.63m.

Year to date net operating cash outflow was A$8.70m, 12% favourable to the same period in the prior year.

At 30 September the Company finished the period with A$25.90m in cash and cash equivalents. This included the receipt of A$17.50m raised (pre-fees) from a placement during the period. A further A$5.50m will be received in connection with the placement during October.

Operating update

The business has seen some recent strong operational results. Key highlights for September 2016 include:

Solid growth in listings with total vehicles for sale across the Company increasing over 53,000 (15%) since January 2016 with the success of regional expansion strategies in all markets.

Strong audience growth year on year with increases of 22% in Malaysia and 19% in Thailand.

Bump volumes continue to increase month on month with 260% growth in Indonesia and 14% growth in Thailand since January 2016.

CEO of iCar Asia Limited, Mr. Hamish Stone commented: “iCar Asia continues to build momentum through the year. The Company is focused on driving value to customers through increased vibrancy coming into the marketplace. Marketing is delivering a more engaged car buying audience and the product optimizations in Q3 improved conversion across our key customer flows. The Company is starting to see the influence of these improvements through the listings growth achieved across all the markets, with dealers increasing their engagement with our product.”

Further improvements on the product in Q4 across all markets will help build on this momentum going into 2017. Our Dealer Application, revamped consumer mobile experience and messaging functionality are expected to deliver further improvements in engagement between our customers, and result in more cars being successfully traded through our platforms.”

Mr. Stone concluded: “The Company’s strategic direction has been clearly defined and we are focused on building the business for the long-term. The successful capital raising in September showed strong investor confidence in the iCar story and that the Company has both the capital and the competitive position to define the digital automotive future in ASEAN.”

nur 6% Umsatzwachstum in 2016...

Antwort auf Beitrag Nr.: 53.760.228 von R-BgO am 23.11.16 22:47:47

Thread: --- Quo Vadis Ebay? --- - Deutschland, mobile.de

Thread: Scout24 AG - Plattformanbieter geht an die Börse - Deutschland, Autoscout 24

Thread: Carsales.com - australischer Marktführer - Australien, Asien & Südamerika

Thread: Cars.com - USA

Thread: Auto Trader - UK

Thread: CarGurus - USA

Thread: Schibsted ASA (SCH) - Investor Seminar 2014 - Frankreich, Leboncoin

habe das Gefühl, sie werden links und rechts überholt,

globale peer group:Thread: --- Quo Vadis Ebay? --- - Deutschland, mobile.de

Thread: Scout24 AG - Plattformanbieter geht an die Börse - Deutschland, Autoscout 24

Thread: Carsales.com - australischer Marktführer - Australien, Asien & Südamerika

Thread: Cars.com - USA

Thread: Auto Trader - UK

Thread: CarGurus - USA

Thread: Schibsted ASA (SCH) - Investor Seminar 2014 - Frankreich, Leboncoin

Antwort auf Beitrag Nr.: 53.183.799 von R-BgO am 01.09.16 14:30:54schlimmer geht immer...:

$10.0 Million Underwritten Non-Renounceable Rights Issue and $5.0 Million Loan Facility

Posted on November 15th, 2017

Overview

-1 for 5.8 non-renounceable Rights Issue to raise approximately $10.0 million at an issue price of $0.18 per share

-Eligible shareholders to receive 1 attaching unlisted option for each new share subscribed under the

Rights Issue, exercisable at $0.20 until an expiry date of 18 months from the date of issue

-Right Issue fully underwritten by Bell Potter Securities Limited

-Funds from the Rights Issue to be used to accelerate the growth of the Company by investing in marketing, business development and technology

-$5.0 million secured loan facility provided by Catcha Group Pte Ltd to be used for working capital purposes if and when required and which may be drawn down subject to a related issue of options to Catcha Group Pte Ltd which is subject to shareholder approval

iCar Asia Limited (‘iCar Asia’ or the ‘Company’) is pleased to announce a 1 for 5.8 non-renounceable rights issue of fully paid ordinary shares (New Shares) in the Company to Eligible Shareholders (Offer) at $0.18 per New Share (Offer Price) to raise approximately $10.0 million before transaction costs. Eligible Shareholders who subscribe to the Offer will also receive 1 attaching unlisted option for every New Share subscribed for, exercisable at $0.20 until an expiry date of 18 months from the date of issue.

The Offer is to be fully underwritten by Bell Potter Securities Limited who is acting as Lead Manager and Underwriter to the Offer.

Following the Offer, the Company will have access to up to $41.0 million1 in funding sources which gives it the financial flexibility to execute its New Car2 and other growth strategies.

iCar Asia Executive Chairman Georg Chmiel said “In 2017, the company started to significantly accelerate its growth rate as well as grow its market share in many dimensions across the core markets of Malaysia, Thailand and Indonesia. The additional funds raised under the Offer will allow the company to accelerate this growth in both the used and new car segment by making additional investments and pursue additional growth opportunities. The objectives of the Offer are to provide the company with capital to reach profitability and positive cash flow. As a Board, we fully support this transaction and appreciate the support we receive from Catcha Group as the company’s largest shareholder.”

Use of Funds

The Board intends to use the proceeds of the Offer across the following 3 key areas:

Marketing, so as to:

(i) Grow the Company’s position in the New Car sales category through marketing of the

New Car platform;

(ii) Maintain its position as the leading online Used Car3 marketplace;

(iii) Increase the number of car shows and sales events to build transaction volumes

across its New Car and Used Car product offerings;

Business development, so as to

(i) Invest in sales and operations to support roll-out of the New Car business;

(ii) Expand into adjacent market segments including auto finance, insurance, inspection

and warranty services;

Technology, so as to

(i) Continue investment in and optimisation of the New Car platform;

(ii) Deliver further innovations in mobile app functionality to drive further user

engagement and extend the Company’s competitive technical advantage;

(iii) Expand artificial intelligence capability to enable further application in the New Car

and Used Car segments.

$10.0 Million Underwritten Non-Renounceable Rights Issue and $5.0 Million Loan Facility

Posted on November 15th, 2017

Overview

-1 for 5.8 non-renounceable Rights Issue to raise approximately $10.0 million at an issue price of $0.18 per share

-Eligible shareholders to receive 1 attaching unlisted option for each new share subscribed under the

Rights Issue, exercisable at $0.20 until an expiry date of 18 months from the date of issue

-Right Issue fully underwritten by Bell Potter Securities Limited

-Funds from the Rights Issue to be used to accelerate the growth of the Company by investing in marketing, business development and technology

-$5.0 million secured loan facility provided by Catcha Group Pte Ltd to be used for working capital purposes if and when required and which may be drawn down subject to a related issue of options to Catcha Group Pte Ltd which is subject to shareholder approval

iCar Asia Limited (‘iCar Asia’ or the ‘Company’) is pleased to announce a 1 for 5.8 non-renounceable rights issue of fully paid ordinary shares (New Shares) in the Company to Eligible Shareholders (Offer) at $0.18 per New Share (Offer Price) to raise approximately $10.0 million before transaction costs. Eligible Shareholders who subscribe to the Offer will also receive 1 attaching unlisted option for every New Share subscribed for, exercisable at $0.20 until an expiry date of 18 months from the date of issue.

The Offer is to be fully underwritten by Bell Potter Securities Limited who is acting as Lead Manager and Underwriter to the Offer.

Following the Offer, the Company will have access to up to $41.0 million1 in funding sources which gives it the financial flexibility to execute its New Car2 and other growth strategies.

iCar Asia Executive Chairman Georg Chmiel said “In 2017, the company started to significantly accelerate its growth rate as well as grow its market share in many dimensions across the core markets of Malaysia, Thailand and Indonesia. The additional funds raised under the Offer will allow the company to accelerate this growth in both the used and new car segment by making additional investments and pursue additional growth opportunities. The objectives of the Offer are to provide the company with capital to reach profitability and positive cash flow. As a Board, we fully support this transaction and appreciate the support we receive from Catcha Group as the company’s largest shareholder.”

Use of Funds

The Board intends to use the proceeds of the Offer across the following 3 key areas:

Marketing, so as to:

(i) Grow the Company’s position in the New Car sales category through marketing of the

New Car platform;

(ii) Maintain its position as the leading online Used Car3 marketplace;

(iii) Increase the number of car shows and sales events to build transaction volumes

across its New Car and Used Car product offerings;

Business development, so as to

(i) Invest in sales and operations to support roll-out of the New Car business;

(ii) Expand into adjacent market segments including auto finance, insurance, inspection

and warranty services;

Technology, so as to

(i) Continue investment in and optimisation of the New Car platform;

(ii) Deliver further innovations in mobile app functionality to drive further user

engagement and extend the Company’s competitive technical advantage;

(iii) Expand artificial intelligence capability to enable further application in the New Car

and Used Car segments.

rund 20% dilution p.a. machen sich auf Dauer bemerkbar....

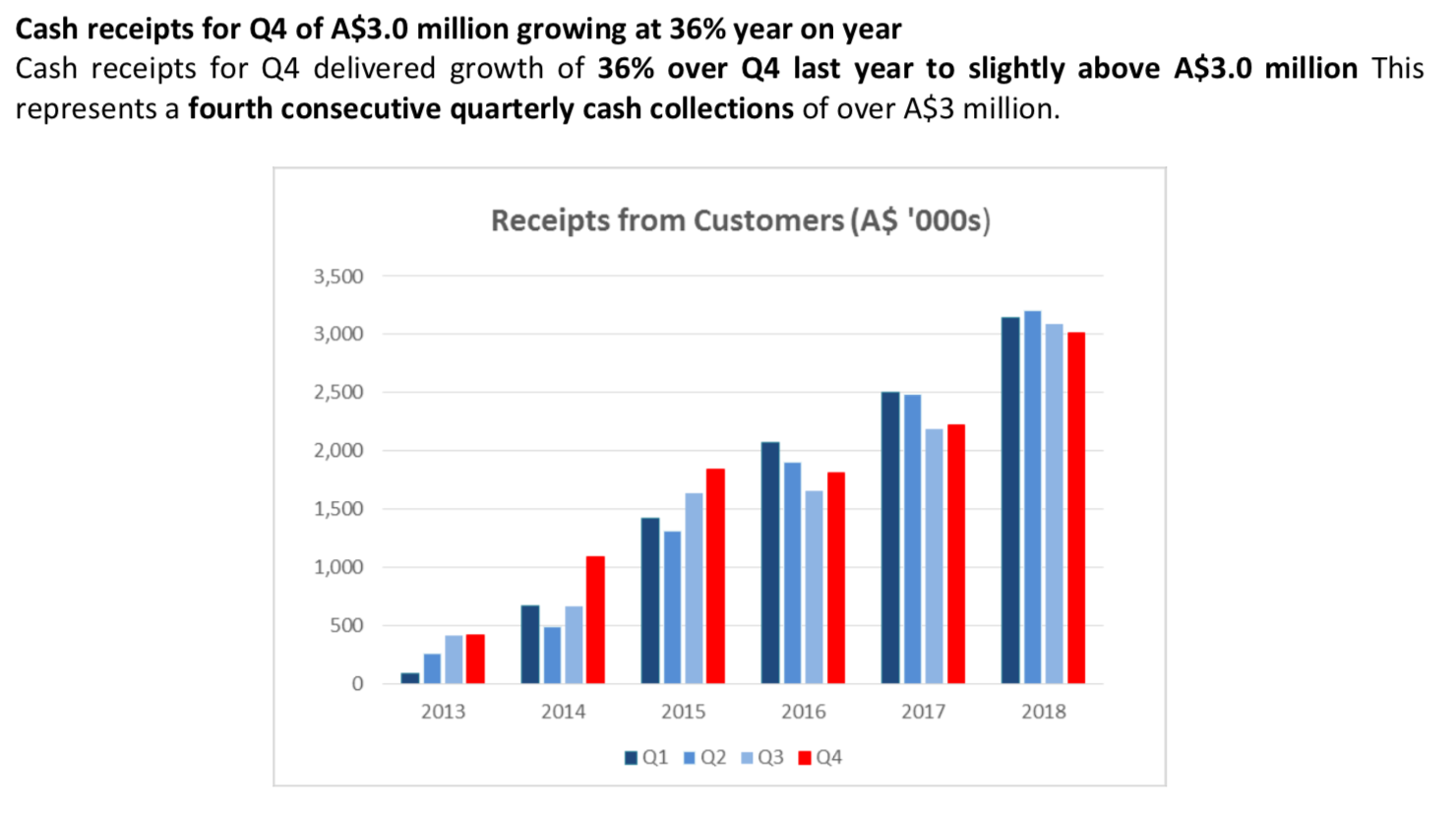

aus dem Announcement vom 11.1.2019:

sie sind winzig:

so langsam könnte es was werden...

sie behaupten, dass Thailand und Malaysia Ende 2018 "profitabel" geworden sind;Frage ist u.a. -WENN es upside geben sollte-, wer profitiert?:

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 203 | ||

| 190 | ||

| 147 | ||

| 69 | ||

| 31 | ||

| 29 | ||

| 29 | ||

| 25 | ||

| 25 | ||

| 25 |

| Wertpapier | Beiträge | |

|---|---|---|

| 24 | ||

| 24 | ||

| 23 | ||

| 23 | ||

| 22 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 20 | ||

| 20 |