Hannon Armstrong - Energy Efficiency REIT - 500 Beiträge pro Seite

eröffnet am 30.04.14 16:51:54 von

neuester Beitrag 28.02.19 10:46:39 von

neuester Beitrag 28.02.19 10:46:39 von

Beiträge: 25

ID: 1.193.942

ID: 1.193.942

Aufrufe heute: 0

Gesamt: 3.456

Gesamt: 3.456

Aktive User: 0

ISIN: US41068X1000 · WKN: A1T9C5 · Symbol: 6HA

22,880

EUR

+0,09 %

+0,020 EUR

Letzter Kurs 18.04.24 Tradegate

Neuigkeiten

17.04.24 · Business Wire (engl.) |

15.02.24 · Business Wire (engl.) |

02.02.24 · Business Wire (engl.) |

01.02.24 · Business Wire (engl.) |

10.01.24 · Business Wire (engl.) |

Werte aus der Branche Immobilien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6327 | +34,62 | |

| 0,72 | +26,32 | |

| 119.000,00 | +19,00 | |

| 72,00 | +14,29 | |

| 2,1300 | +13,30 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 81,90 | -18,10 | |

| 12,964 | -25,92 | |

| 2,7500 | -28,39 | |

| 0,5130 | -33,70 | |

| 2,0500 | -37,88 |

hat gerade ein follow-on offering gemacht:

Hannon Armstrong Sustainable Infrastructure Capital, Inc. Announces the Closing of its Public Offering of Common Stock

Company Release - 04/29/2014 16:05

ANNAPOLIS, Md., April 29, 2014 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. (the "Company") (NYSE: HASI) announced today the closing of its underwritten public offering of 5,750,000 shares of common stock at a price of $13.00 per share. This amount includes the exercise in full by the underwriters of their option to purchase up to an additional 750,000 shares of common stock.

BofA Merrill Lynch, UBS Investment Bank and Wells Fargo Securities acted as joint book-running managers for the offering. Baird, RBC Capital Markets and FBR acted as co-managers.

The offering of shares was made under the Company's registration statement, which was declared effective by the Securities and Exchange Commission (the "SEC") on April 23, 2014. The offering was made only by means of a prospectus, copies of which may be obtained from: BofA Merrill Lynch, 222 Broadway, New York, New York 10038 Attention: Prospectus Department, or by e-mailing dg.prospectus_requests@baml.com; from UBS Securities, LLC, 299 Park Avenue, New York, New York 10171, Attention: Prospectus Department, or by telephone at 888-827-7275; or from Wells Fargo Securities, LLC, 375 Park Avenue, 4th Floor, New York, New York 10152, Attention: Equity Syndicate, or by telephone at 800-326-5897, or by e-mailing cmclientsupport@wellsfargo.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Hannon Armstrong Sustainable Infrastructure Capital, Inc.:

Hannon Armstrong makes debt and equity investments in sustainable infrastructure projects. The Company focuses on profitable projects that increase energy efficiency, provide cleaner energy, positively impact the environment, or make more efficient use of natural resources. The Company began its business more than 30 years ago, and since 2000, using its direct origination platform, it has provided or arranged over $4.5 billion of financing in more than 475 sustainable infrastructure transactions. Hannon Armstrong targets projects that have high credit quality obligors, fully contracted revenue streams and inherent economic value.

The Company, based in Annapolis, MD, intends to elect to be taxed as a real estate investment trust, or REIT, for federal income tax purposes beginning with its taxable year ended December 31, 2013.

Hannon Armstrong Sustainable Infrastructure Capital, Inc. Announces the Closing of its Public Offering of Common Stock

Company Release - 04/29/2014 16:05

ANNAPOLIS, Md., April 29, 2014 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. (the "Company") (NYSE: HASI) announced today the closing of its underwritten public offering of 5,750,000 shares of common stock at a price of $13.00 per share. This amount includes the exercise in full by the underwriters of their option to purchase up to an additional 750,000 shares of common stock.

BofA Merrill Lynch, UBS Investment Bank and Wells Fargo Securities acted as joint book-running managers for the offering. Baird, RBC Capital Markets and FBR acted as co-managers.

The offering of shares was made under the Company's registration statement, which was declared effective by the Securities and Exchange Commission (the "SEC") on April 23, 2014. The offering was made only by means of a prospectus, copies of which may be obtained from: BofA Merrill Lynch, 222 Broadway, New York, New York 10038 Attention: Prospectus Department, or by e-mailing dg.prospectus_requests@baml.com; from UBS Securities, LLC, 299 Park Avenue, New York, New York 10171, Attention: Prospectus Department, or by telephone at 888-827-7275; or from Wells Fargo Securities, LLC, 375 Park Avenue, 4th Floor, New York, New York 10152, Attention: Equity Syndicate, or by telephone at 800-326-5897, or by e-mailing cmclientsupport@wellsfargo.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Hannon Armstrong Sustainable Infrastructure Capital, Inc.:

Hannon Armstrong makes debt and equity investments in sustainable infrastructure projects. The Company focuses on profitable projects that increase energy efficiency, provide cleaner energy, positively impact the environment, or make more efficient use of natural resources. The Company began its business more than 30 years ago, and since 2000, using its direct origination platform, it has provided or arranged over $4.5 billion of financing in more than 475 sustainable infrastructure transactions. Hannon Armstrong targets projects that have high credit quality obligors, fully contracted revenue streams and inherent economic value.

The Company, based in Annapolis, MD, intends to elect to be taxed as a real estate investment trust, or REIT, for federal income tax purposes beginning with its taxable year ended December 31, 2013.

Hannon Armstrong Sustainable Infrastructure Capital, Inc. Announces Annualized 6.1% Dividend or $0.22 per Share Quarterly Dividend

Company Release - 03/13/2014 18:52

ANNAPOLIS, Md., March 13, 2014 /PRNewswire/ -- Hannon Armstrong Sustainable

Infrastructure Capital, Inc. ("Hannon Armstrong" or the "Company;" NYSE: HASI), a leading provider of debt and equity for sustainable infrastructure projects, today announced that its Board of Directors declared a quarterly cash dividend of $0.22 per share of common stock, payable on April 9, 2014, to stockholders of record on March 27, 2014.

Based upon the Company's common stock closing price of $14.38 per share on March 13, 2014, the dividend represents an annualized yield of 6.1%.

Company Release - 03/13/2014 18:52

ANNAPOLIS, Md., March 13, 2014 /PRNewswire/ -- Hannon Armstrong Sustainable

Infrastructure Capital, Inc. ("Hannon Armstrong" or the "Company;" NYSE: HASI), a leading provider of debt and equity for sustainable infrastructure projects, today announced that its Board of Directors declared a quarterly cash dividend of $0.22 per share of common stock, payable on April 9, 2014, to stockholders of record on March 27, 2014.

Based upon the Company's common stock closing price of $14.38 per share on March 13, 2014, the dividend represents an annualized yield of 6.1%.

bin hierüber dran gekommen: http://seekingalpha.com/article/1800152-solar-income-really

nachgelegt; Divi soll ab Q4 26c betragen

wollte eigentlich nochmal nachlegen, aber der Kurs ist mir weggelaufen...

KGV 45 finde ich schon sehr sportlich

KGV 45 finde ich schon sehr sportlich

Antwort auf Beitrag Nr.: 49.399.037 von R-BgO am 23.03.15 15:51:14

HASI, HASI!

Hannon Armstrong (NYSE:HASI) declares $0.26/share quarterly dividend, in line with previous.Forward yield 5.69%Payable April 9; for shareholders of record March 30; ex-div March 26.

Wollte mir welche ins Depot legen, aber mir ist der Kurs auch wechgelaufen, Korrektur abwarten und schauen wo er sich einpendelt. In dem Überkauften Bereich macht es keinen Sinn. Im Chart sieht man den ungesunden Auswuchs deutlich.

Die Herren von Zacks Equity Research meinen:

http://www.zacks.com/stock/news/167263/hannon-armstrong-hasi…

Zitat von R-BgO: wollte eigentlich nochmal nachlegen, aber der Kurs ist mir weggelaufen...

KGV 45 finde ich schon sehr sportlich

HASI, HASI!

Hannon Armstrong (NYSE:HASI) declares $0.26/share quarterly dividend, in line with previous.Forward yield 5.69%Payable April 9; for shareholders of record March 30; ex-div March 26.

Wollte mir welche ins Depot legen, aber mir ist der Kurs auch wechgelaufen, Korrektur abwarten und schauen wo er sich einpendelt. In dem Überkauften Bereich macht es keinen Sinn. Im Chart sieht man den ungesunden Auswuchs deutlich.

Die Herren von Zacks Equity Research meinen:

http://www.zacks.com/stock/news/167263/hannon-armstrong-hasi…

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Antwort auf Beitrag Nr.: 49.410.089 von bolero6 am 24.03.15 17:39:33Ende April haben sie eine KE über 4,6 Mio. Stück gemacht;

sieht bisher nicht nach einem Rücksetzer aus

sieht bisher nicht nach einem Rücksetzer aus

Ergebnis 2015

8 MUSD Gewinn => 2% vom EKbei aktuellem Kurs von 16,48 haben wir

KGV von 85

Divi von 6,5%

Kann nur hoffen, dass die gewachsene Bilanz auch wachsende Erträge bringen wird...

Hannon Armstrong Announces $144 million Land Investment Leased to Over 20 Solar Projects With Investment Grade Off-takers

Hannon Armstrong - Investing in the Future of Energy(SM) (PRNewsFoto/Hannon Armstrong) (PRNewsFoto/Hannon Armstrong)

ANNAPOLIS, Md., Feb. 10, 2017 /PRNewswire/ --

Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today announced a $144 million investment to acquire over 4,000 acres of land that is leased under long-term contracts to over 20 individual solar projects with investment grade off-takers. The projects have an aggregate capacity of over 690 megawatts direct current (DC).

"We continue to find ways to optimize the capital stack for our clients' projects, creating economic value for the client and Hannon Armstrong," said Hannon Armstrong President and CEO Jeffrey Eckel. "The investment in over 20 individual projects in this transaction supports the continued growth of our very diverse portfolio of assets."

Following this transaction, the Company now has invested approximately $375 million in real estate and owns more than 20,000 acres of land that are leased under long-term agreements to over 45 renewable energy projects and has the rights to payments from land leases for over 50 additional projects. The projects are located in over 15 states.

Hannon Armstrong - Investing in the Future of Energy(SM) (PRNewsFoto/Hannon Armstrong) (PRNewsFoto/Hannon Armstrong)

ANNAPOLIS, Md., Feb. 10, 2017 /PRNewswire/ --

Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today announced a $144 million investment to acquire over 4,000 acres of land that is leased under long-term contracts to over 20 individual solar projects with investment grade off-takers. The projects have an aggregate capacity of over 690 megawatts direct current (DC).

"We continue to find ways to optimize the capital stack for our clients' projects, creating economic value for the client and Hannon Armstrong," said Hannon Armstrong President and CEO Jeffrey Eckel. "The investment in over 20 individual projects in this transaction supports the continued growth of our very diverse portfolio of assets."

Following this transaction, the Company now has invested approximately $375 million in real estate and owns more than 20,000 acres of land that are leased under long-term agreements to over 45 renewable energy projects and has the rights to payments from land leases for over 50 additional projects. The projects are located in over 15 states.

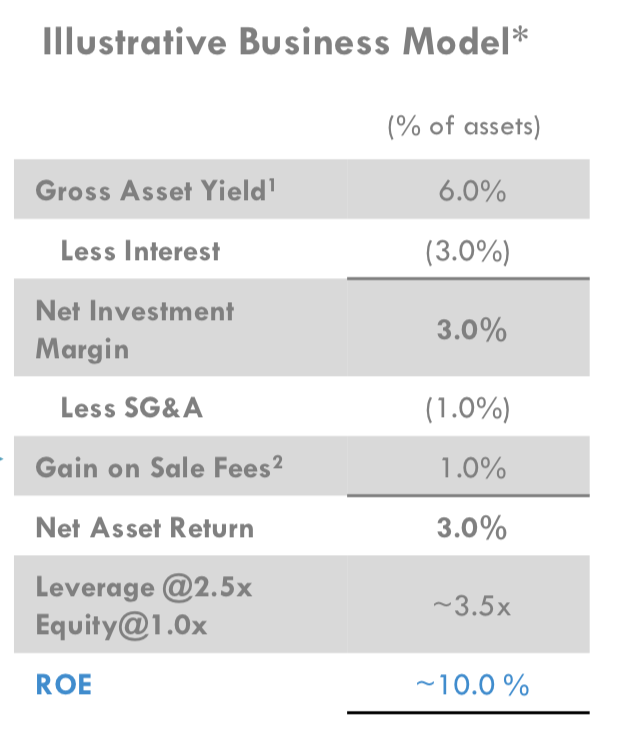

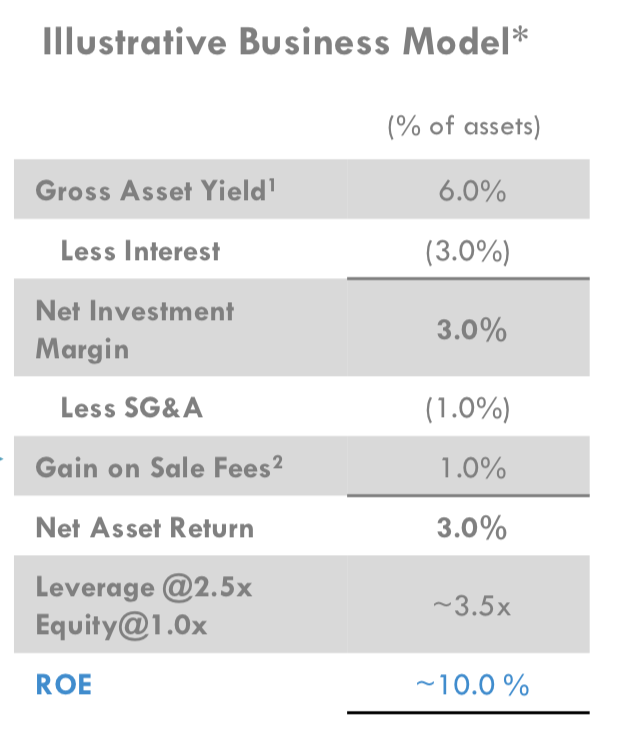

Antwort auf Beitrag Nr.: 51.991.325 von R-BgO am 16.03.16 12:10:25inzwischen sind wir bei 3% auf'S EK;

lt. Präsentation haben sie aber 10%

Wachstum verschleiert halt Einiges...

lt. Präsentation haben sie aber 10%

Wachstum verschleiert halt Einiges...

bin am trump wahlsiegtag mit einer kleinen posi eingestiegen...will aber dieses jahr nochmal nachkaufen. warte mal den märz zinsentscheid noch ab

bin vorgestern mit der nächsten tranche rein...

Hannon Armstrong Announces $0.33 per Share Quarterly Dividend, Expands Board and Finance Team

Wed March 15, 2017 6:02 PM|PR Newswire|About: HASI

ANNAPOLIS, Md., March 15, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure markets, including energy efficiency and renewable energy, announced today its quarterly dividend, the addition of Rebecca A. Blalock, the former chief information officer of Southern Company, as a new Board member and a new Deputy Chief Financial Officer and a new Chief Accounting Officer. "We are investing in our growth with additional electric power, cyber security, risk, finance and accounting capabilities," said Jeffrey Eckel, Chairman, President & CEO of Hannon Armstrong. "These changes further solidify the base from which we intend to grow the business."

Quarterly Dividend

The Board of Directors declared a quarterly cash dividend of $0.33 per share of common stock payable on April 13, 2017, to stockholders of record on April 5, 2017. Based upon the Company's common stock closing price of $18.42 per share on March 14, 2017, the dividend represents an annualized yield of 7.2%.

Board of Director Expansion, Creation of Finance and Risk Committee and Committee Realignment

The Company announced the appointment of Rebecca A. Blalock as an independent member to its Board of Directors. "Becky Blalock brings significant energy market and cyber risk management expertise to the Board," said Jeffrey Eckel, Chairman, President & CEO of Hannon Armstrong. "Her work on the EPRI Board, among others, will bring incremental insight on the continued evolution of the U.S. power sector, and we are pleased to welcome her to Hannon Armstrong's Board of Directors." With the addition of Ms. Blalock, the Board of Directors now consists of seven members, six of whom are independent members.

Ms. Blalock has extensive experience in the energy and information technology industries, having served in a variety of roles for over 30 years at Southern Company and its subsidiaries, most recently as its Senior Vice President and Chief Information Officer from 2002 to 2011. She currently serves on the Board of Directors of Aspen Aerogels, Inc., an energy efficiency technology company and the Electric Power Research Institute, a non-profit electric industry research institute and is presently the Managing Partner at Advisory Capital, a firm that provides strategic insights for companies involved in the energy, information technology, healthcare and telecommunications industries. Ms. Blalock holds a BBA in Marketing from the State University of West Georgia, an MBA in Finance from Mercer University and completed the Program for Management Development (PMD) at Harvard Business School.

The Company also announced its Board of Directors has established a Finance and Risk Committee, consisting of Mr. O'Neil (Chair) and Ms. Blalock, with responsibility for overseeing the Company's financing objectives and related risk exposures. Effective May 15, 2017, Mr. O'Neil will rotate off the Compensation Committee and be replaced by Mr. Osgood and Ms. Blalock with Mr. Cirilli remaining the Chair. There were no changes to the Audit Committee (Osgood (Chair), O'Neil, Osborne) or the Nominating and Corporate Governance Committee (Brenner (Chair), Cirilli).

Finance Team Expansion

The Company also announced that Justin Cressall has joined the Company as Deputy Chief Financial Officer and Charles Melko has been appointed Chief Accounting Officer. "The addition of Justin and Chuck to the team expands our expertise in the areas that will be critical as we continue to grow," continued Eckel.

Mr. Cressall has extensive capital markets and asset management experience, having previously served as Managing Director in the Ares Credit Group of Ares Management, L.P. and at American Capital, Ltd. Previously, Mr. Cressall was a Senior Vice President and Treasurer at Platinum Underwriters Holdings, Ltd. (PTP), a publicly traded reinsurance company. In addition, Mr. Cressall was a Director in the Transaction Services Division at KPMG LLP, where he focused on financial services. Mr. Cressall holds a B.A. from Tufts University in Economics. He also holds an M.B.A. from the University of Toronto in management and professional accounting. Mr. Cressall is a Chartered Accountant.

Mr. Melko joined Hannon Armstrong in 2016 as a Senior Vice President and Controller of the Company. Prior to this role, he served in a number of roles at PricewaterhouseCoopers LLP (PwC), including as a Senior Manager in the National Professional Services Group where he focused on complex financial instruments accounting issues for energy clients. Mr. Melko received a Bachelor of Science degree in Accountancy, a Master of Business Administration degree and a Master of Science degree in Accountancy from Wheeling Jesuit University. He holds a CPA license in West Virginia and Maryland.

Hannon Armstrong Announces $0.33 per Share Quarterly Dividend, Expands Board and Finance Team

Wed March 15, 2017 6:02 PM|PR Newswire|About: HASI

ANNAPOLIS, Md., March 15, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure markets, including energy efficiency and renewable energy, announced today its quarterly dividend, the addition of Rebecca A. Blalock, the former chief information officer of Southern Company, as a new Board member and a new Deputy Chief Financial Officer and a new Chief Accounting Officer. "We are investing in our growth with additional electric power, cyber security, risk, finance and accounting capabilities," said Jeffrey Eckel, Chairman, President & CEO of Hannon Armstrong. "These changes further solidify the base from which we intend to grow the business."

Quarterly Dividend

The Board of Directors declared a quarterly cash dividend of $0.33 per share of common stock payable on April 13, 2017, to stockholders of record on April 5, 2017. Based upon the Company's common stock closing price of $18.42 per share on March 14, 2017, the dividend represents an annualized yield of 7.2%.

Board of Director Expansion, Creation of Finance and Risk Committee and Committee Realignment

The Company announced the appointment of Rebecca A. Blalock as an independent member to its Board of Directors. "Becky Blalock brings significant energy market and cyber risk management expertise to the Board," said Jeffrey Eckel, Chairman, President & CEO of Hannon Armstrong. "Her work on the EPRI Board, among others, will bring incremental insight on the continued evolution of the U.S. power sector, and we are pleased to welcome her to Hannon Armstrong's Board of Directors." With the addition of Ms. Blalock, the Board of Directors now consists of seven members, six of whom are independent members.

Ms. Blalock has extensive experience in the energy and information technology industries, having served in a variety of roles for over 30 years at Southern Company and its subsidiaries, most recently as its Senior Vice President and Chief Information Officer from 2002 to 2011. She currently serves on the Board of Directors of Aspen Aerogels, Inc., an energy efficiency technology company and the Electric Power Research Institute, a non-profit electric industry research institute and is presently the Managing Partner at Advisory Capital, a firm that provides strategic insights for companies involved in the energy, information technology, healthcare and telecommunications industries. Ms. Blalock holds a BBA in Marketing from the State University of West Georgia, an MBA in Finance from Mercer University and completed the Program for Management Development (PMD) at Harvard Business School.

The Company also announced its Board of Directors has established a Finance and Risk Committee, consisting of Mr. O'Neil (Chair) and Ms. Blalock, with responsibility for overseeing the Company's financing objectives and related risk exposures. Effective May 15, 2017, Mr. O'Neil will rotate off the Compensation Committee and be replaced by Mr. Osgood and Ms. Blalock with Mr. Cirilli remaining the Chair. There were no changes to the Audit Committee (Osgood (Chair), O'Neil, Osborne) or the Nominating and Corporate Governance Committee (Brenner (Chair), Cirilli).

Finance Team Expansion

The Company also announced that Justin Cressall has joined the Company as Deputy Chief Financial Officer and Charles Melko has been appointed Chief Accounting Officer. "The addition of Justin and Chuck to the team expands our expertise in the areas that will be critical as we continue to grow," continued Eckel.

Mr. Cressall has extensive capital markets and asset management experience, having previously served as Managing Director in the Ares Credit Group of Ares Management, L.P. and at American Capital, Ltd. Previously, Mr. Cressall was a Senior Vice President and Treasurer at Platinum Underwriters Holdings, Ltd. (PTP), a publicly traded reinsurance company. In addition, Mr. Cressall was a Director in the Transaction Services Division at KPMG LLP, where he focused on financial services. Mr. Cressall holds a B.A. from Tufts University in Economics. He also holds an M.B.A. from the University of Toronto in management and professional accounting. Mr. Cressall is a Chartered Accountant.

Mr. Melko joined Hannon Armstrong in 2016 as a Senior Vice President and Controller of the Company. Prior to this role, he served in a number of roles at PricewaterhouseCoopers LLP (PwC), including as a Senior Manager in the National Professional Services Group where he focused on complex financial instruments accounting issues for energy clients. Mr. Melko received a Bachelor of Science degree in Accountancy, a Master of Business Administration degree and a Master of Science degree in Accountancy from Wheeling Jesuit University. He holds a CPA license in West Virginia and Maryland.

Hannon Armstrong Announces Q2 2017 GAAP Earnings per Share of $0.23 and Core Earnings per Share of $0.34

EPS of $0.34 beats by $0.02

ANNAPOLIS, Md., Aug. 2, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our" or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today reported earnings as shown in the table below:

https://mma.prnewswire.com/media/461537/hannon_armstrong_sus…

For the Three Months Ended

June 30, 2017

For the Three Months Ended

June 30, 2016

$ in thousands

Per Share

$ in thousands

Per Share

GAAP Net income

$ 12,340

$ 0.23

$ 3,747

$ 0.09

Core Earnings (1)

$ 17,866

$ 0.34

$ 12,724

$ 0.32

For the Six Months Ended

June 30, 2017

For the Six Months Ended

June 30, 2016

$ in thousands

Per Share

$ in thousands

Per Share

GAAP Net income

$ 19,539

$ 0.38

$ 6,916

$ 0.16

Core Earnings (1)

$ 33,362

$ 0.66

$ 24,920

$ 0.64

"We enjoyed an excellent second quarter, driven by approximately $200 million of utility privatization investments for the U.S. Army," said President & CEO, Jeffrey Eckel. "This is another example of a Hannon Armstrong investment saving money for the U.S. tax-payer, creating jobs, and improving infrastructure for our service men and women."

Q2 2017 Highlights

Grew balance sheet to more than $2.2 billion, now totaling over 165 separate investments

Closed approximately $690 million of transactions in the first half of 2017, compared to approximately $470 million in the same period in 2016

Delivered $0.23 GAAP EPS in the second quarter of 2017, compared to $0.09 in the second quarter 2016

Delivered $0.34 Core EPS in second quarter 2017, compared to $0.32 in second quarter 2016

Declared $0.33 per share quarterly dividend, for an annualized yield of 5.7% based on our closing stock price of $23.20 on August 1, 2017

Debt to equity ratio of 2.0 to 1

54% fixed-rate debt level

Diversified pipeline of over $2.5 billion

(1) The difference between GAAP Net income and Core Earnings is primarily the result of adjusting for a return of capital from our equity investments in renewable energy projects and adding back non-cash equity-based compensation. A reconciliation of our GAAP Net income to Core Earnings is included in this press release.

Portfolio

Our Portfolio totaled approximately $2.1 billion as of June 30, 2017, and included approximately $0.5 billion of energy efficiency, approximately $1.4 billion of renewable energy (wind and solar), and approximately $0.2 billion other sustainable infrastructure investments. The following is an analysis of our Portfolio by type of obligor as of June 30, 2017:

Investment Grade

Government (1)

Commercial (2)

Commercial

Non-Investment

Grade (3)

Subtotal,

Debt and

Real Estate

Equity

Method

Investments

Total

($ in millions)

Financing receivables and

investments

$

736

$

504

$

26

$

1,266

$

-

$

1,266

Real estate (4)

-

298

-

298

21

319

Equity investments in renewable energy projects

-

-

-

-

530

530

Total

$

736

$

802

$

26

$

1,564

$

551

$

2,115

Average Remaining Balance (5)

$

13

$

9

$

9

$

11

$

20

$

12

(1)

Transactions where the ultimate obligor is the U.S. federal government or state or local governments where the obligors are rated investment grade (either by an independent rating agency or based upon our internal credit analysis). This amount includes $525 million of U.S. federal government transactions and $211 million of transactions where the ultimate obligors are state or local governments. Transactions may have guaranties of energy savings from third party service providers, the majority of which are entities rated investment grade by an independent rating agency.

(2)

Transactions where the projects or the ultimate obligors are commercial entities that have been rated investment grade (either by an independent rating agency or based on our internal credit analysis). Of this total, $10 million of the transactions have been rated investment grade by an independent rating agency. Commercial investment grade financing receivables include $311 million of internally rated residential solar loans made on a non-recourse basis to special purpose subsidiaries of the SunPower Corporation, for which we rely on certain limited indemnities, warranties, and other obligations of the SunPower Corporation or its other subsidiaries.

(3)

Transactions where the projects or the ultimate obligors are commercial entities that have ratings below investment grade (either by an independent rating agency or using our internal credit analysis).

(4)

Includes the real estate and the lease intangible assets (including those held through equity method investments) from which we receive scheduled lease payments, typically under long-term triple net lease agreements.

(5)

Excludes approximately 125 transactions each with outstanding balances that are less than $1 million and that in the aggregate total $48 million.

Second Quarter Financial Results

Revenue grew by approximately $6.4 million, or 29%, for the three months, and approximately $9.7 million, or 23%, for the six months ended June 30, 2017, as compared to the same periods last year. Increases were primarily driven by growth in the Portfolio to $2.1 billion as of June 30, 2017 from $1.4 billion as of June 30, 2016 as well as higher gain on sale income for both the quarter and year to date. GAAP equity method income grew by approximately $7.3 million for the three months and approximately $11.2 million for the six months ended June 30, 2017, compared to the same periods last year due to both additional investments and increased allocations of income from certain projects.

The growth in both revenue and income from the equity method investments was offset by an approximately $4.3 million increase in interest expense for the three months, and an approximately $6.8 million increase for the six months ended June 30, 2017, as compared to the same periods last year. This increase was primarily the result of higher average levels of debt outstanding in 2017 as compared to 2016.

Other expenses (compensation and benefits and general and administrative expenses) increased by approximately $0.7 million for the three months, and by approximately $1.4 million for the six months ended June 30, 2017, as compared to the same periods in 2016 due to additional costs associated with the growth in the size of the Company.

Core Earnings grew by approximately $5.1 million for the three months, and by approximately $8.4 million for the six months ended June 30, 2017, over the same periods last year primarily as a result of growth in the balance sheet and gain on sale income offset by higher interest expense and higher SG&A as described above.

A reconciliation of our GAAP Net income to Core Earnings is included in this press release.

An analysis of our fixed-rate debt and leverage ratios is shown in the chart below.

As of

June 30, 2017

% of Total

December 31, 2016

% of Total

($ in millions)

Floating-rate borrowings (1)

$ 599

46%

$ 320

33%

Fixed-rate debt (2)

$ 715

54%

$ 655

67%

Total

$ 1,314

100%

$ 975

100%

Leverage (3)

2.0 to 1

1.7 to 1

(1)

Floating-Rate Borrowings include borrowings under our floating-rate credit facilities and approximately $207 million and $37 million of nonrecourse debt that has not been hedged as of June 30, 2017 and December 31, 2016, respectively.

(2)

Fixed-rate debt also includes the present notional value of nonrecourse debt that is hedged using interest rate swaps.

(3)

Leverage, as measured by our debt-to-equity ratio. This calculation excludes securitizations that are not consolidated on our balance sheet (where the collateral is typically financing receivables with U.S. government obligors).

"We are continuing to pursue opportunities to lower the spread on our debt. As an example, this quarter, we refinanced a 2015 loan agreement related to certain of our wind equity method investments at a lower cost," said Executive Vice President & Chief Financial Officer, Brendan Herron. "While this loan is presently floating rate, we expect to convert it to fixed-rate debt and enter into a number of other fixed-rate debt transactions over the next several months. As a result, we expect to be at the high end of our fixed-rate debt target by year end."

Conference Call and Webcast Information

Hannon Armstrong will host an investor conference call today, August 2, 2017, at 5:00 pm eastern time. The conference call can be accessed live over the phone by dialing 1-800-211-3767, or for international callers, 1-719-457-2552. A replay will be available beginning two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 6048982. The replay will be available until August 9, 2017.

A webcast of the conference call will also be available through the Investor Relations section of our website, at www.hannonarmstrong.com. A copy of this press release is also available on our website.

EPS of $0.34 beats by $0.02

ANNAPOLIS, Md., Aug. 2, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our" or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today reported earnings as shown in the table below:

https://mma.prnewswire.com/media/461537/hannon_armstrong_sus…

For the Three Months Ended

June 30, 2017

For the Three Months Ended

June 30, 2016

$ in thousands

Per Share

$ in thousands

Per Share

GAAP Net income

$ 12,340

$ 0.23

$ 3,747

$ 0.09

Core Earnings (1)

$ 17,866

$ 0.34

$ 12,724

$ 0.32

For the Six Months Ended

June 30, 2017

For the Six Months Ended

June 30, 2016

$ in thousands

Per Share

$ in thousands

Per Share

GAAP Net income

$ 19,539

$ 0.38

$ 6,916

$ 0.16

Core Earnings (1)

$ 33,362

$ 0.66

$ 24,920

$ 0.64

"We enjoyed an excellent second quarter, driven by approximately $200 million of utility privatization investments for the U.S. Army," said President & CEO, Jeffrey Eckel. "This is another example of a Hannon Armstrong investment saving money for the U.S. tax-payer, creating jobs, and improving infrastructure for our service men and women."

Q2 2017 Highlights

Grew balance sheet to more than $2.2 billion, now totaling over 165 separate investments

Closed approximately $690 million of transactions in the first half of 2017, compared to approximately $470 million in the same period in 2016

Delivered $0.23 GAAP EPS in the second quarter of 2017, compared to $0.09 in the second quarter 2016

Delivered $0.34 Core EPS in second quarter 2017, compared to $0.32 in second quarter 2016

Declared $0.33 per share quarterly dividend, for an annualized yield of 5.7% based on our closing stock price of $23.20 on August 1, 2017

Debt to equity ratio of 2.0 to 1

54% fixed-rate debt level

Diversified pipeline of over $2.5 billion

(1) The difference between GAAP Net income and Core Earnings is primarily the result of adjusting for a return of capital from our equity investments in renewable energy projects and adding back non-cash equity-based compensation. A reconciliation of our GAAP Net income to Core Earnings is included in this press release.

Portfolio

Our Portfolio totaled approximately $2.1 billion as of June 30, 2017, and included approximately $0.5 billion of energy efficiency, approximately $1.4 billion of renewable energy (wind and solar), and approximately $0.2 billion other sustainable infrastructure investments. The following is an analysis of our Portfolio by type of obligor as of June 30, 2017:

Investment Grade

Government (1)

Commercial (2)

Commercial

Non-Investment

Grade (3)

Subtotal,

Debt and

Real Estate

Equity

Method

Investments

Total

($ in millions)

Financing receivables and

investments

$

736

$

504

$

26

$

1,266

$

-

$

1,266

Real estate (4)

-

298

-

298

21

319

Equity investments in renewable energy projects

-

-

-

-

530

530

Total

$

736

$

802

$

26

$

1,564

$

551

$

2,115

Average Remaining Balance (5)

$

13

$

9

$

9

$

11

$

20

$

12

(1)

Transactions where the ultimate obligor is the U.S. federal government or state or local governments where the obligors are rated investment grade (either by an independent rating agency or based upon our internal credit analysis). This amount includes $525 million of U.S. federal government transactions and $211 million of transactions where the ultimate obligors are state or local governments. Transactions may have guaranties of energy savings from third party service providers, the majority of which are entities rated investment grade by an independent rating agency.

(2)

Transactions where the projects or the ultimate obligors are commercial entities that have been rated investment grade (either by an independent rating agency or based on our internal credit analysis). Of this total, $10 million of the transactions have been rated investment grade by an independent rating agency. Commercial investment grade financing receivables include $311 million of internally rated residential solar loans made on a non-recourse basis to special purpose subsidiaries of the SunPower Corporation, for which we rely on certain limited indemnities, warranties, and other obligations of the SunPower Corporation or its other subsidiaries.

(3)

Transactions where the projects or the ultimate obligors are commercial entities that have ratings below investment grade (either by an independent rating agency or using our internal credit analysis).

(4)

Includes the real estate and the lease intangible assets (including those held through equity method investments) from which we receive scheduled lease payments, typically under long-term triple net lease agreements.

(5)

Excludes approximately 125 transactions each with outstanding balances that are less than $1 million and that in the aggregate total $48 million.

Second Quarter Financial Results

Revenue grew by approximately $6.4 million, or 29%, for the three months, and approximately $9.7 million, or 23%, for the six months ended June 30, 2017, as compared to the same periods last year. Increases were primarily driven by growth in the Portfolio to $2.1 billion as of June 30, 2017 from $1.4 billion as of June 30, 2016 as well as higher gain on sale income for both the quarter and year to date. GAAP equity method income grew by approximately $7.3 million for the three months and approximately $11.2 million for the six months ended June 30, 2017, compared to the same periods last year due to both additional investments and increased allocations of income from certain projects.

The growth in both revenue and income from the equity method investments was offset by an approximately $4.3 million increase in interest expense for the three months, and an approximately $6.8 million increase for the six months ended June 30, 2017, as compared to the same periods last year. This increase was primarily the result of higher average levels of debt outstanding in 2017 as compared to 2016.

Other expenses (compensation and benefits and general and administrative expenses) increased by approximately $0.7 million for the three months, and by approximately $1.4 million for the six months ended June 30, 2017, as compared to the same periods in 2016 due to additional costs associated with the growth in the size of the Company.

Core Earnings grew by approximately $5.1 million for the three months, and by approximately $8.4 million for the six months ended June 30, 2017, over the same periods last year primarily as a result of growth in the balance sheet and gain on sale income offset by higher interest expense and higher SG&A as described above.

A reconciliation of our GAAP Net income to Core Earnings is included in this press release.

An analysis of our fixed-rate debt and leverage ratios is shown in the chart below.

As of

June 30, 2017

% of Total

December 31, 2016

% of Total

($ in millions)

Floating-rate borrowings (1)

$ 599

46%

$ 320

33%

Fixed-rate debt (2)

$ 715

54%

$ 655

67%

Total

$ 1,314

100%

$ 975

100%

Leverage (3)

2.0 to 1

1.7 to 1

(1)

Floating-Rate Borrowings include borrowings under our floating-rate credit facilities and approximately $207 million and $37 million of nonrecourse debt that has not been hedged as of June 30, 2017 and December 31, 2016, respectively.

(2)

Fixed-rate debt also includes the present notional value of nonrecourse debt that is hedged using interest rate swaps.

(3)

Leverage, as measured by our debt-to-equity ratio. This calculation excludes securitizations that are not consolidated on our balance sheet (where the collateral is typically financing receivables with U.S. government obligors).

"We are continuing to pursue opportunities to lower the spread on our debt. As an example, this quarter, we refinanced a 2015 loan agreement related to certain of our wind equity method investments at a lower cost," said Executive Vice President & Chief Financial Officer, Brendan Herron. "While this loan is presently floating rate, we expect to convert it to fixed-rate debt and enter into a number of other fixed-rate debt transactions over the next several months. As a result, we expect to be at the high end of our fixed-rate debt target by year end."

Conference Call and Webcast Information

Hannon Armstrong will host an investor conference call today, August 2, 2017, at 5:00 pm eastern time. The conference call can be accessed live over the phone by dialing 1-800-211-3767, or for international callers, 1-719-457-2552. A replay will be available beginning two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 6048982. The replay will be available until August 9, 2017.

A webcast of the conference call will also be available through the Investor Relations section of our website, at www.hannonarmstrong.com. A copy of this press release is also available on our website.

Hannon Armstrong Sustainable Infrastructure Capital, Inc. Announces Public Offering of Convertible Notes

ANNAPOLIS, Md., Aug. 15, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI) announced today that it is commencing an underwritten public offering, subject to market conditions and other factors, of $135 million aggregate principal amount of convertible senior notes due 2022. The Company also plans to grant to the underwriters a 30‑day over-allotment option to purchase up to an additional $15 million aggregate principal amount of the notes. The Company intends to use the net proceeds from this offering to repay outstanding borrowings under one or both of its senior secured revolving credit facility and its recourse credit facility, or for general corporate purposes. The interest rate, conversion rate and other terms of the notes will be determined at the time of pricing the offering.

Deutsche Bank Securities, BofA Merrill Lynch and J.P. Morgan are acting as joint book-running managers for the offering. Nomura and Oppenheimer & Co. are acting as co-managers.

A registration statement relating to these securities has been filed with the Securities and Exchange Commission ("SEC") and has become effective. The offering will be made by means of a preliminary prospectus supplement and accompanying prospectus. A copy of the preliminary prospectus supplement and accompanying prospectus related to the offering can be obtained by contacting Deutsche Bank Securities Inc., 60 Wall Street, New York, New York 10005, Attention: Prospectus Group, Email: prospectus.cpdg@db.com; BofA Merrill Lynch, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte NC 28255-0001, Attention: Prospectus Department, Email: dg.prospectus_requests@baml.com or J.P. Morgan Securities Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, email: prospectus-eq_fi@jpmchase.com, 3rd Floor.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any of the Company's securities, nor shall there be any sale of such securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

ANNAPOLIS, Md., Aug. 15, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI) announced today that it is commencing an underwritten public offering, subject to market conditions and other factors, of $135 million aggregate principal amount of convertible senior notes due 2022. The Company also plans to grant to the underwriters a 30‑day over-allotment option to purchase up to an additional $15 million aggregate principal amount of the notes. The Company intends to use the net proceeds from this offering to repay outstanding borrowings under one or both of its senior secured revolving credit facility and its recourse credit facility, or for general corporate purposes. The interest rate, conversion rate and other terms of the notes will be determined at the time of pricing the offering.

Deutsche Bank Securities, BofA Merrill Lynch and J.P. Morgan are acting as joint book-running managers for the offering. Nomura and Oppenheimer & Co. are acting as co-managers.

A registration statement relating to these securities has been filed with the Securities and Exchange Commission ("SEC") and has become effective. The offering will be made by means of a preliminary prospectus supplement and accompanying prospectus. A copy of the preliminary prospectus supplement and accompanying prospectus related to the offering can be obtained by contacting Deutsche Bank Securities Inc., 60 Wall Street, New York, New York 10005, Attention: Prospectus Group, Email: prospectus.cpdg@db.com; BofA Merrill Lynch, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte NC 28255-0001, Attention: Prospectus Department, Email: dg.prospectus_requests@baml.com or J.P. Morgan Securities Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, email: prospectus-eq_fi@jpmchase.com, 3rd Floor.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any of the Company's securities, nor shall there be any sale of such securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

ANNAPOLIS, Md., Oct. 23, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," or the "Company;" NYSE: HASI), a leading investor in sustainable infrastructure markets, including energy efficiency and renewable energy, today announced that the Company will release its third quarter 2017 results after the market close on Wednesday, November 1, 2017, to be followed by a conference call at 5:00 p.m. (Eastern Time).

Hannon Armstrong Announces Q3 2017 GAAP Earnings per Share of $0.14 and Core Earnings per Share of $0.31

Company Release - 11/1/2017 4:15 PM ET

ANNAPOLIS, Md., Nov. 1, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our" or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today reported earnings as shown in the table below:

Hannon Armstrong - Investing in the Future of Energy(SM) (PRNewsFoto/Hannon Armstrong)

"Given rising interest rates and a flattening yield curve, we have moved to fix out rates, extend maturities and increase our leverage. With transactions either closed, locked or committed, we will have approximately 94% of our debt at fixed interest rates and leverage above 2:1 to 1. The transactions taken together further strengthen our balance sheet and significantly improve liquidity," said President and CEO, Jeffrey Eckel. "In light of these steps, we are now expecting the moderately higher borrowing costs will result in our annual core earnings per share to be at, or a bit below, the low point of our previously announced guidance range." He went on to say: "Our focus for the remainder of the year will be on converting our pipeline into completed transactions and continuing to build our pipeline to support a successful 2018."

Highlights

Approximately $645 million of additional fixed-rate debt – leading to approximately 94% fixed-rate debt level based on the following transactions

3.57%, $134 million, 24 year fully amortizing debt closed in September

3.86%, $164 million, 25 year fully amortizing debt closed in October

4.125%, $150 million debut convertible notes with a 20.0% conversion premium, closed in August

the conversion of approximately $198 million of floating-rate debt to amortizing fixed-rate debt with anticipated closing in the fourth quarter

Assigned our first investment grade corporate rating of BBB (low) LT Issuer Rating by DBRS, Inc.

Debt to equity ratio of 2.1 to 1 as of September 30, 2017

Grew balance sheet to more than $2.3 billion, widely diversified across approximately 170 separate investments

Closed approximately $751 million of transactions year to date 2017, compared to approximately $712 million in the same period in 2016

Delivered $0.14 GAAP EPS in the third quarter of 2017, compared to $0.07 in the third quarter 2016

Delivered $0.31 Core EPS in the third quarter 2017, compared to $0.29 in the third quarter 2016

Declared $0.33 per share quarterly dividend, for an annualized yield of 5.5% based on our closing stock price of $24.06 on October 31, 2017

Diversified pipeline of over $2.5 billion

"While we estimate the difference in core earnings, between the low end of our targeted fixed debt range of 60% and our approximately 94% fixed we expect in Q4, is up to $0.10 per year, we believe that reducing our exposure to rising interest rates was prudent," said Chief Financial Officer Brendan Herron. "These actions further strengthen our balance sheet, continue to diversify our lender base and extend maturities to 2019 and beyond."

(1)

The difference between GAAP net income and core earnings is primarily the result of adjusting for a return on capital from our equity investments in renewable energy projects and adding back non-cash equity-based compensation. A reconciliation of our GAAP net income to core earnings is included in this press release.

Portfolio

Our Portfolio totaled approximately $2.0 billion as of September 30, 2017, and included approximately $0.4 billion of energy efficiency, approximately $1.4 billion of renewable energy (wind and solar), and approximately $0.2 billion other sustainable infrastructure investments. The following is an analysis of our Portfolio by type of obligor as of September 30, 2017:

Transactions where the ultimate obligor is the U.S. federal government or state or local governments where the obligors are rated investment grade (either by an independent rating agency or based upon our internal credit analysis). This amount includes $474 million of U.S. federal government transactions and $205 million of transactions where the ultimate obligors are state or local governments. Transactions may have guaranties of energy savings from third party service providers, the majority of which are entities rated investment grade by an independent rating agency.

(2)

Transactions where the projects or the ultimate obligors are commercial entities that have been rated investment grade (either by an independent rating agency or based on our internal credit analysis). Of this total, $10 million of the transactions have been rated investment grade by an independent rating agency. Commercial investment grade financing receivables include $310 million of internally rated residential solar loans made on a non-recourse basis to special purpose subsidiaries of the SunPower Corporation, for which we rely on certain limited indemnities, warranties, and other obligations of the SunPower Corporation or its other subsidiaries.

(3)

Transactions where the projects or the ultimate obligors are commercial entities that have ratings below investment grade (either by an independent rating agency or using our internal credit analysis).

(4)

Includes the real estate and the lease intangible assets (including those held through equity method investments) from which we receive scheduled lease payments, typically under long-term triple net lease agreements.

(5)

Excludes approximately 130 transactions each with outstanding balances that are less than $1 million and that in the aggregate total $51 million.

Third Quarter Financial Results

Revenue grew by approximately $7.4 million, or 39%, for the three months, and approximately $17.1 million, or 28%, for the nine months ended September 30, 2017, as compared to the same periods last year. Increases were primarily driven by growth in the Portfolio to $2.0 billion as of September 30, 2017 from $1.4 billion as of September 30, 2016 as well as higher gain on sale income for both the quarter and year to date. GAAP equity method income grew by approximately $5.5 million for the three months and approximately $16.7 million for the nine months ended September 30, 2017, compared to the same periods last year, due to both additional investments and increased income allocations from certain projects.

The growth in both revenue and income from the equity method investments was offset by an approximately $7.0 million increase in interest expense for the three months, and an approximately $13.8 million increase interest expense for the nine months ended September 30, 2017, as compared to the same periods last year. This increase was primarily the result of higher average outstanding borrowings, including higher fixed-rate debt and an increase in interest rates.

Other expenses (compensation and benefits and general and administrative expenses) increased by approximately $1.4 million for the three months, and by approximately $2.8 million for the nine months ended September 30, 2017, as compared to the same periods in 2016 due primarily to additional costs associated with the growth in the Company.

Core earnings grew by approximately $3.9 million for the three months, and by approximately $12.3 million for the nine months ended September 30, 2017, over the same periods last year due to factors described above.

A reconciliation of our GAAP net income to core earnings is included in this press release.

An analysis of our fixed-rate debt and leverage ratios as of September 30, 2017 and a pro forma analysis including the transactions closed, locked or committed as of September 30, 2017, are shown in the charts below.

Floating-rate borrowings include borrowings under our floating-rate credit facilities ("credit facilities") and approximately $236 million and $37 million of nonrecourse debt that has not been hedged as of September 30, 2017 and December 31, 2016, respectively.

(2)

Fixed-rate debt also includes the present notional value of nonrecourse debt that is hedged using interest rate swaps.

(3)

Leverage, as measured by our debt-to-equity ratio. This calculation excludes securitizations that are not consolidated on our balance sheet (where the collateral is typically financing receivables with U.S. government obligors).

(4)

Pro forma adjustments reflect: (i) the $164 million, 25 year fixed-rate debt with yield of 3.86%, closed in October 2017, $130 million of which was used to pay down the credit facilities and (ii) the approximately $198 million of fixed-rate debt to be converted from floating to fixed-rate in the fourth quarter as part of the refinancing of the credit agreement we entered into in June of 2017. The pro forma information is presented as if the transaction described in the preceding sentence all had occurred on September 30, 2017, and is not necessarily indicative of what our actual financial position would have been as of the period indicated, nor does it purport to represent our future financial position.

Conference Call and Webcast Information

Hannon Armstrong will host an investor conference call today, November 1, 2017, at 5:00 pm eastern time. The conference call can be accessed live over the phone by dialing 1-888-245-0932, or for international callers, 1-719-325-4773. A replay will be available two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 3963781. The replay will be available until November 8, 2017.

A webcast of the conference call will also be available through the Investor Relations section of our website, at www.hannonarmstrong.com. A copy of this press release is also available on our website.

Company Release - 11/1/2017 4:15 PM ET

ANNAPOLIS, Md., Nov. 1, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our" or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today reported earnings as shown in the table below:

Hannon Armstrong - Investing in the Future of Energy(SM) (PRNewsFoto/Hannon Armstrong)

"Given rising interest rates and a flattening yield curve, we have moved to fix out rates, extend maturities and increase our leverage. With transactions either closed, locked or committed, we will have approximately 94% of our debt at fixed interest rates and leverage above 2:1 to 1. The transactions taken together further strengthen our balance sheet and significantly improve liquidity," said President and CEO, Jeffrey Eckel. "In light of these steps, we are now expecting the moderately higher borrowing costs will result in our annual core earnings per share to be at, or a bit below, the low point of our previously announced guidance range." He went on to say: "Our focus for the remainder of the year will be on converting our pipeline into completed transactions and continuing to build our pipeline to support a successful 2018."

Highlights

Approximately $645 million of additional fixed-rate debt – leading to approximately 94% fixed-rate debt level based on the following transactions

3.57%, $134 million, 24 year fully amortizing debt closed in September

3.86%, $164 million, 25 year fully amortizing debt closed in October

4.125%, $150 million debut convertible notes with a 20.0% conversion premium, closed in August

the conversion of approximately $198 million of floating-rate debt to amortizing fixed-rate debt with anticipated closing in the fourth quarter

Assigned our first investment grade corporate rating of BBB (low) LT Issuer Rating by DBRS, Inc.

Debt to equity ratio of 2.1 to 1 as of September 30, 2017

Grew balance sheet to more than $2.3 billion, widely diversified across approximately 170 separate investments

Closed approximately $751 million of transactions year to date 2017, compared to approximately $712 million in the same period in 2016

Delivered $0.14 GAAP EPS in the third quarter of 2017, compared to $0.07 in the third quarter 2016

Delivered $0.31 Core EPS in the third quarter 2017, compared to $0.29 in the third quarter 2016

Declared $0.33 per share quarterly dividend, for an annualized yield of 5.5% based on our closing stock price of $24.06 on October 31, 2017

Diversified pipeline of over $2.5 billion

"While we estimate the difference in core earnings, between the low end of our targeted fixed debt range of 60% and our approximately 94% fixed we expect in Q4, is up to $0.10 per year, we believe that reducing our exposure to rising interest rates was prudent," said Chief Financial Officer Brendan Herron. "These actions further strengthen our balance sheet, continue to diversify our lender base and extend maturities to 2019 and beyond."

(1)

The difference between GAAP net income and core earnings is primarily the result of adjusting for a return on capital from our equity investments in renewable energy projects and adding back non-cash equity-based compensation. A reconciliation of our GAAP net income to core earnings is included in this press release.

Portfolio

Our Portfolio totaled approximately $2.0 billion as of September 30, 2017, and included approximately $0.4 billion of energy efficiency, approximately $1.4 billion of renewable energy (wind and solar), and approximately $0.2 billion other sustainable infrastructure investments. The following is an analysis of our Portfolio by type of obligor as of September 30, 2017:

Transactions where the ultimate obligor is the U.S. federal government or state or local governments where the obligors are rated investment grade (either by an independent rating agency or based upon our internal credit analysis). This amount includes $474 million of U.S. federal government transactions and $205 million of transactions where the ultimate obligors are state or local governments. Transactions may have guaranties of energy savings from third party service providers, the majority of which are entities rated investment grade by an independent rating agency.

(2)

Transactions where the projects or the ultimate obligors are commercial entities that have been rated investment grade (either by an independent rating agency or based on our internal credit analysis). Of this total, $10 million of the transactions have been rated investment grade by an independent rating agency. Commercial investment grade financing receivables include $310 million of internally rated residential solar loans made on a non-recourse basis to special purpose subsidiaries of the SunPower Corporation, for which we rely on certain limited indemnities, warranties, and other obligations of the SunPower Corporation or its other subsidiaries.

(3)

Transactions where the projects or the ultimate obligors are commercial entities that have ratings below investment grade (either by an independent rating agency or using our internal credit analysis).

(4)

Includes the real estate and the lease intangible assets (including those held through equity method investments) from which we receive scheduled lease payments, typically under long-term triple net lease agreements.

(5)

Excludes approximately 130 transactions each with outstanding balances that are less than $1 million and that in the aggregate total $51 million.

Third Quarter Financial Results

Revenue grew by approximately $7.4 million, or 39%, for the three months, and approximately $17.1 million, or 28%, for the nine months ended September 30, 2017, as compared to the same periods last year. Increases were primarily driven by growth in the Portfolio to $2.0 billion as of September 30, 2017 from $1.4 billion as of September 30, 2016 as well as higher gain on sale income for both the quarter and year to date. GAAP equity method income grew by approximately $5.5 million for the three months and approximately $16.7 million for the nine months ended September 30, 2017, compared to the same periods last year, due to both additional investments and increased income allocations from certain projects.

The growth in both revenue and income from the equity method investments was offset by an approximately $7.0 million increase in interest expense for the three months, and an approximately $13.8 million increase interest expense for the nine months ended September 30, 2017, as compared to the same periods last year. This increase was primarily the result of higher average outstanding borrowings, including higher fixed-rate debt and an increase in interest rates.

Other expenses (compensation and benefits and general and administrative expenses) increased by approximately $1.4 million for the three months, and by approximately $2.8 million for the nine months ended September 30, 2017, as compared to the same periods in 2016 due primarily to additional costs associated with the growth in the Company.

Core earnings grew by approximately $3.9 million for the three months, and by approximately $12.3 million for the nine months ended September 30, 2017, over the same periods last year due to factors described above.

A reconciliation of our GAAP net income to core earnings is included in this press release.

An analysis of our fixed-rate debt and leverage ratios as of September 30, 2017 and a pro forma analysis including the transactions closed, locked or committed as of September 30, 2017, are shown in the charts below.

Floating-rate borrowings include borrowings under our floating-rate credit facilities ("credit facilities") and approximately $236 million and $37 million of nonrecourse debt that has not been hedged as of September 30, 2017 and December 31, 2016, respectively.

(2)

Fixed-rate debt also includes the present notional value of nonrecourse debt that is hedged using interest rate swaps.

(3)

Leverage, as measured by our debt-to-equity ratio. This calculation excludes securitizations that are not consolidated on our balance sheet (where the collateral is typically financing receivables with U.S. government obligors).

(4)

Pro forma adjustments reflect: (i) the $164 million, 25 year fixed-rate debt with yield of 3.86%, closed in October 2017, $130 million of which was used to pay down the credit facilities and (ii) the approximately $198 million of fixed-rate debt to be converted from floating to fixed-rate in the fourth quarter as part of the refinancing of the credit agreement we entered into in June of 2017. The pro forma information is presented as if the transaction described in the preceding sentence all had occurred on September 30, 2017, and is not necessarily indicative of what our actual financial position would have been as of the period indicated, nor does it purport to represent our future financial position.

Conference Call and Webcast Information

Hannon Armstrong will host an investor conference call today, November 1, 2017, at 5:00 pm eastern time. The conference call can be accessed live over the phone by dialing 1-888-245-0932, or for international callers, 1-719-325-4773. A replay will be available two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 3963781. The replay will be available until November 8, 2017.

A webcast of the conference call will also be available through the Investor Relations section of our website, at www.hannonarmstrong.com. A copy of this press release is also available on our website.

Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and Supports Climate Action 100+ Launch

ANNAPOLIS, Md., Dec. 14, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, today announced it has joined the Climate Disclosures Standards Board (CDSB) Initiative, a collective commitment by a leading group of companies to strengthen and align climate-related corporate reporting by pledging to implement the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

"Hannon Armstrong is proud to be the first U.S.-based, public company to commit to the CDSB-led initiative on TCFD implementation, the principles of which have long been embedded in our corporate DNA. In a world increasingly defined by carbon, we believe we will achieve better risk-adjusted returns investing on the right side of the climate change line," said Jeffrey Eckel, President & CEO. "To that end, we are committed to formalizing our governance framework by implementing the TCFD recommendations and further, to engage with other corporates to sharpen their views on how they can drive carbon action."

The Task Force on Climate-related Financial Disclosures, an international consortium of both users and preparers of disclosures covering a broad range of economic sectors and financial markets, has developed voluntary climate related financial disclosures guidelines intended to be useful to investors, lenders, and insurance underwriters. The Task Force structured its recommendations around four thematic areas that represent core elements of how organizations operate: governance, strategy, risk management, and metrics and targets. Hannon Armstrong is also a member of the Ceres Investor Network on Climate Risk and Opportunity.

ANNAPOLIS, Md., Dec. 14, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, today announced it has joined the Climate Disclosures Standards Board (CDSB) Initiative, a collective commitment by a leading group of companies to strengthen and align climate-related corporate reporting by pledging to implement the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

"Hannon Armstrong is proud to be the first U.S.-based, public company to commit to the CDSB-led initiative on TCFD implementation, the principles of which have long been embedded in our corporate DNA. In a world increasingly defined by carbon, we believe we will achieve better risk-adjusted returns investing on the right side of the climate change line," said Jeffrey Eckel, President & CEO. "To that end, we are committed to formalizing our governance framework by implementing the TCFD recommendations and further, to engage with other corporates to sharpen their views on how they can drive carbon action."

The Task Force on Climate-related Financial Disclosures, an international consortium of both users and preparers of disclosures covering a broad range of economic sectors and financial markets, has developed voluntary climate related financial disclosures guidelines intended to be useful to investors, lenders, and insurance underwriters. The Task Force structured its recommendations around four thematic areas that represent core elements of how organizations operate: governance, strategy, risk management, and metrics and targets. Hannon Armstrong is also a member of the Ceres Investor Network on Climate Risk and Opportunity.

Hannon Armstrong Announces $0.33 per Share Quarterly Dividend

ANNAPOLIS, Md., Dec. 12, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today announced that its Board of Directors declared a quarterly cash dividend of $0.33 per share of common stock, payable on January 11, 2018, to stockholders of record on December 26, 2017. Based upon the Company's common stock closing price of $23.24 per share on December 11, 2017, the dividend represents an annualized yield of 5.7%.

"We have decided to move our annual dividend review to the February 2018 Q4 earnings call to coincide with our year-end results and outlook for 2018," said President and CEO Jeffrey Eckel. "Our pipeline remains strong and we remain focused on growing the business."

ANNAPOLIS, Md., Dec. 12, 2017 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," or the "Company") (NYSE: HASI), a leading investor in sustainable infrastructure, including energy efficiency and renewable energy, today announced that its Board of Directors declared a quarterly cash dividend of $0.33 per share of common stock, payable on January 11, 2018, to stockholders of record on December 26, 2017. Based upon the Company's common stock closing price of $23.24 per share on December 11, 2017, the dividend represents an annualized yield of 5.7%.

"We have decided to move our annual dividend review to the February 2018 Q4 earnings call to coincide with our year-end results and outlook for 2018," said President and CEO Jeffrey Eckel. "Our pipeline remains strong and we remain focused on growing the business."

ANNAPOLIS, Md., Feb. 16, 2018 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," or the "Company;" NYSE: HASI), a leading investor in sustainable infrastructure markets, including energy efficiency and renewable energy, today announced that the Company will release its fourth quarter and full year 2017 results after the market close on Wednesday, February 21, 2018, to be followed by a conference call at 5:00 p.m. (Eastern Time).

Hannon Armstrong Announces First Quarter 2018 Results

EPS of $0.27 misses by $-0.04

Revenue of $27.91M (+ 17.3% Y/Y)

ANNAPOLIS, Md., May 3, 2018 /PRNewswire/ -- Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("Hannon Armstrong," "we," "our" or the "Company") (NYSE: HASI), a capital and services provider focused on sustainable infrastructure markets that address climate change, today reported quarterly results.

https://mma.prnewswire.com/media/461537/hannon_armstrong_sus…

Highlights

GAAP loss of $0.03 per share for the quarter, primarily relating to a non-cash HLBV loss on an equity method investment

Core earnings of $0.27 per share for the quarter due to higher fixed rate debt interest expense, investment in compensation and general and administrative expenses and lower originations

Expect 2018 annual Core EPS growth to be 2% to 6%, equivalent to $1.32 at the midpoint, in line with expected dividend level

Increased near term pipeline for gain on sale securitizations; pipeline remains over $2.5 billion

Closed approximately $108 million of new transactions, continue to target $1 billion for the year

Maintained the fixed-rate debt level of 92% as of March 31, 2018

An estimated 27,000 metric tons of annual carbon emissions will be offset by our Q1 2018 transactions equating to a CarbonCount® score of 0.25, or .25 metric tons per $1,000 invested

"We remain on track for both investment and earnings targets as we expect increased securitization activity over the next couple of quarters to more than offset the impact of higher interest expense," said Jeffrey Eckel, President & CEO. "As discussed, we will see increased variability in earnings with lower earning quarters like this one offset by higher earnings in quarters where securitizations increase. Our pipeline remains strong and we continue to work on growing the platform for accretive originations, such as the expansion of commercial energy efficiency."

First Quarter Results

Revenue grew by approximately $4 million, or 17%, for the three months ended March 31, 2018, as compared to the same period in 2017. Increases in the quarter were primarily driven by higher gain on sale and fee income of approximately $3 million due to increased securitization and higher interest and rental income of approximately $1 million due to growth in the Portfolio to $2.0 billion as of March 31, 2018 from $1.9 billion as of March 31, 2017. The revenue growth was offset by an approximately $5 million increase in interest expense for the three months ended March 31, 2018, as compared to the same period in 2017. This increase was primarily the result of higher average outstanding borrowings, a higher percentage of fixed-rate debt and an increase in interest rates.

Other expenses (compensation and benefits and general and administrative expenses) increased by $1 million (GAAP) and by $2 million (core) for the three months ended March 31, 2018, as compared to the same period in 2017 due primarily to the growth of the Company. Income before equity method investments fell by approximately $2 million due in large part to the higher interest and other expenses. For the three months ended March 31, 2018, we recognized a $2 million non-cash loss under GAAP HLBV for our equity investments in renewable energy projects. As a result, we recognized a GAAP loss of $1 million for the quarter as compared to a $7 million profit in the same quarter last year.

Core earnings declined by approximately $1 million for the quarter primarily due to the higher interest expense and higher other expenses. A reconciliation of our GAAP net income to core earnings is included in this press release.

"Rising short-term rates and a flattening yield curve confirmed our decision to fix out rates last year despite the estimate of up to $0.10 per share annualized incremental fixed rate debt cost," said Brendan Herron, Chief Financial Officer. "We certainly saw the impact of that this quarter as we had $5 million of additional interest expense, including approximately $1 million, or $0.02 per share, related to the higher fixed rate debt. We expect increased securitization activity over the next few quarters will allow us to overcome this cost and return to growth in core earnings."

Portfolio

Our Portfolio totaled approximately $2.0 billion as of March 31, 2018, and included approximately $1 billion of behind-the-meter assets, approximately $0.9 billion of grid-connected assets and approximately $0.1 billion of other sustainable infrastructure investments. The following is an analysis of our Portfolio as of March 31, 2018:

Guidance