Wann und wie kommt der nächste Crash? (Seite 5)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 1

Gesamt: 179.884

Gesamt: 179.884

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 55 Minuten | 3290 | |

| vor 55 Minuten | 2500 | |

| vor 1 Stunde | 1759 | |

| heute 08:27 | 1260 | |

| vor 1 Stunde | 1177 | |

| vor 58 Minuten | 1129 | |

| vor 1 Stunde | 988 | |

| vor 1 Stunde | 876 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.769,62 | -0,03 | 169 | |||

| 2. | 2. | 142,66 | -2,11 | 136 | |||

| 3. | 5. | 6,7400 | +2,21 | 67 | |||

| 4. | 4. | 6,8400 | -7,57 | 65 | |||

| 5. | 3. | 2.383,17 | +0,94 | 61 | |||

| 6. | 7. | 0,4047 | +0,67 | 36 | |||

| 7. | 6. | 3,7250 | +3,33 | 35 | |||

| 8. | 9. | 6,6560 | +5,48 | 34 |

Beitrag zu dieser Diskussion schreiben

Jonathan Ruffer, Chairman, Ruffer LLP, London, UK:

6.10.

This fund manager is holding 60% cash — and expecting a stock-market crash

Ruffer’s main claim to fame is to have successfully sidestepped the 2000-2003 and 2007-2009 market collapses

https://www.marketwatch.com/story/this-fund-manager-is-holdi…

...

There’s bearish, there’s really bearish, and then there’s Ruffer & Co.

I don’t want to spook everyone managing their own retirement portfolio. But the London-based money managers, who successfully anticipated the dot-com collapse and the global financial crisis, are expecting an almighty stock-market crash — and are now holding nearly 60% of their flagship Total Return fund in cash and short-term bonds.

Plus another 20% or so in longer-term inflation-linked bonds and gold. And holdings in safe-haven Japanese yen. And put options on the market, which will pay out if things fall apart.

Total stock-market exposure? Er … 15%.

The fund is now hiding even deeper in its bunker than it was in 2007, before the global financial crisis, co-manager Steve Russell says.

...

Investment Review: October 2023

https://www.ruffer.co.uk/en/thinking/articles/investment-rev…

...

In summary, the world has more than a tinge of aurora borealis. It is a dystopian world where everyone is a victim, the central authorities in the West buy off every dissatisfaction with money they haven’t got, and a new order awaits its time, still to come.

If you know where to look, there are eternal truths that are observable by eternal pieces of evidence. In the field, it is rheumatism in the knee which heralds the change from father to son; in the West, it’s the day that the cost of paying the interest on a nation’s borrowings overtakes the (sharply rising) defence budget.

Just as with the yen, we’ve seen this all before, and we know how it ends, but that doesn’t mean the journey won’t be bumpy along the way.

6.10.

This fund manager is holding 60% cash — and expecting a stock-market crash

Ruffer’s main claim to fame is to have successfully sidestepped the 2000-2003 and 2007-2009 market collapses

https://www.marketwatch.com/story/this-fund-manager-is-holdi…

...

There’s bearish, there’s really bearish, and then there’s Ruffer & Co.

I don’t want to spook everyone managing their own retirement portfolio. But the London-based money managers, who successfully anticipated the dot-com collapse and the global financial crisis, are expecting an almighty stock-market crash — and are now holding nearly 60% of their flagship Total Return fund in cash and short-term bonds.

Plus another 20% or so in longer-term inflation-linked bonds and gold. And holdings in safe-haven Japanese yen. And put options on the market, which will pay out if things fall apart.

Total stock-market exposure? Er … 15%.

The fund is now hiding even deeper in its bunker than it was in 2007, before the global financial crisis, co-manager Steve Russell says.

...

Investment Review: October 2023

https://www.ruffer.co.uk/en/thinking/articles/investment-rev…

...

In summary, the world has more than a tinge of aurora borealis. It is a dystopian world where everyone is a victim, the central authorities in the West buy off every dissatisfaction with money they haven’t got, and a new order awaits its time, still to come.

If you know where to look, there are eternal truths that are observable by eternal pieces of evidence. In the field, it is rheumatism in the knee which heralds the change from father to son; in the West, it’s the day that the cost of paying the interest on a nation’s borrowings overtakes the (sharply rising) defence budget.

Just as with the yen, we’ve seen this all before, and we know how it ends, but that doesn’t mean the journey won’t be bumpy along the way.

Oct. 3, 2023 at 4:58 p.m. ET

Washington Watch: Kevin McCarthy ousted: Here’s who could replace him as House speaker

https://www.marketwatch.com/story/kevin-mccarthy-ousted-here…

...

Steve Scalise

Matt Gaetz, the Florida Republican who led the charge to oust McCarthy, said he was open to supporting Rep. Steve Scalise of Louisiana. Scalise is the No. 2 House Republican but is also undergoing treatment for blood cancer. Gaetz said that treatment wasn’t a factor in his support.

Tom Emmer

Minnesota Republican Tom Emmer is the House’s No. 3 Republican and has been mentioned by other members as a potential replacement. Some of the GOP’s hard-right faction have said Emmer would deliver more conservative results for the party, according to a Washington Post report. Emmer is a cryptocurrency supporter and co-chairman of the Congressional Blockchain Caucus.

Patrick McHenry

Patrick McHenry, a North Carolina Republican who leads the House Financial Services Committee, is another possibility. He was one of the negotiators of the deal with the Biden administration to raise the debt ceiling — which could actually hurt him with some conservatives.

McHenry is now speaker pro tempore, or temporary speaker, until the election of a new speaker.

Elise Stefanik

New York Rep. Elise Stefanik is the House GOP Conference Chair, the highest-ranking Republican woman in Congress. She is close to former President Donald Trump.

The fight over McCarthy’s speakership played out after lawmakers extended until Nov. 17 funding for the federal government. The move avoided a shutdown but only kicks the funding can down the road. It’s unclear how long it will take to elect a new speaker, but having the battle now keeps it distanced from a key deadline.

“From a governance standpoint, having this fight early in the government-funding window is far better than on the eve of November 17 when funding expires,” said Chris Krueger of TD Cowen, in a note.

Washington Watch: Kevin McCarthy ousted: Here’s who could replace him as House speaker

https://www.marketwatch.com/story/kevin-mccarthy-ousted-here…

...

Steve Scalise

Matt Gaetz, the Florida Republican who led the charge to oust McCarthy, said he was open to supporting Rep. Steve Scalise of Louisiana. Scalise is the No. 2 House Republican but is also undergoing treatment for blood cancer. Gaetz said that treatment wasn’t a factor in his support.

Tom Emmer

Minnesota Republican Tom Emmer is the House’s No. 3 Republican and has been mentioned by other members as a potential replacement. Some of the GOP’s hard-right faction have said Emmer would deliver more conservative results for the party, according to a Washington Post report. Emmer is a cryptocurrency supporter and co-chairman of the Congressional Blockchain Caucus.

Patrick McHenry

Patrick McHenry, a North Carolina Republican who leads the House Financial Services Committee, is another possibility. He was one of the negotiators of the deal with the Biden administration to raise the debt ceiling — which could actually hurt him with some conservatives.

McHenry is now speaker pro tempore, or temporary speaker, until the election of a new speaker.

Elise Stefanik

New York Rep. Elise Stefanik is the House GOP Conference Chair, the highest-ranking Republican woman in Congress. She is close to former President Donald Trump.

The fight over McCarthy’s speakership played out after lawmakers extended until Nov. 17 funding for the federal government. The move avoided a shutdown but only kicks the funding can down the road. It’s unclear how long it will take to elect a new speaker, but having the battle now keeps it distanced from a key deadline.

“From a governance standpoint, having this fight early in the government-funding window is far better than on the eve of November 17 when funding expires,” said Chris Krueger of TD Cowen, in a note.

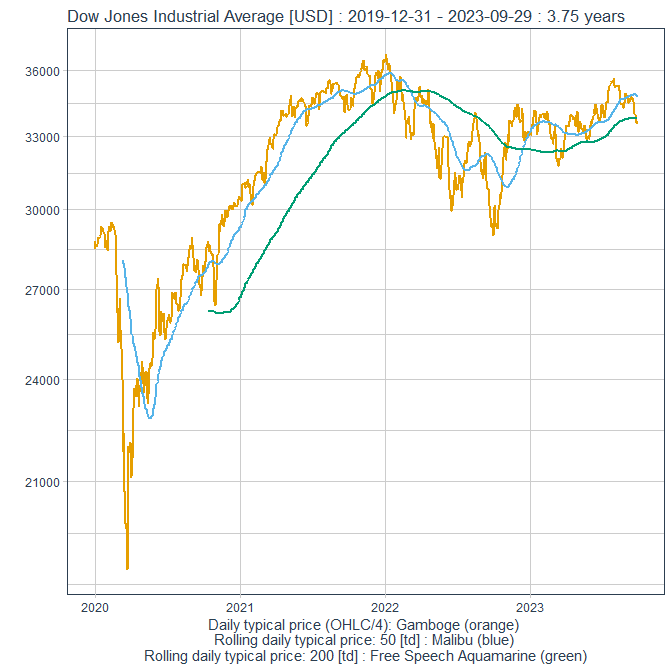

Tags: DJIA, Death Cross

wieder kleiner Erst-Posi bei der Instone Real Estate Group: https://www.wallstreet-online.de/diskussion/1300847-91-100/i…

29.9.

Volatility, gold and stocks to avoid: Citi delivers its shutdown playbook

https://www.marketwatch.com/story/volatility-gold-and-stocks…

...

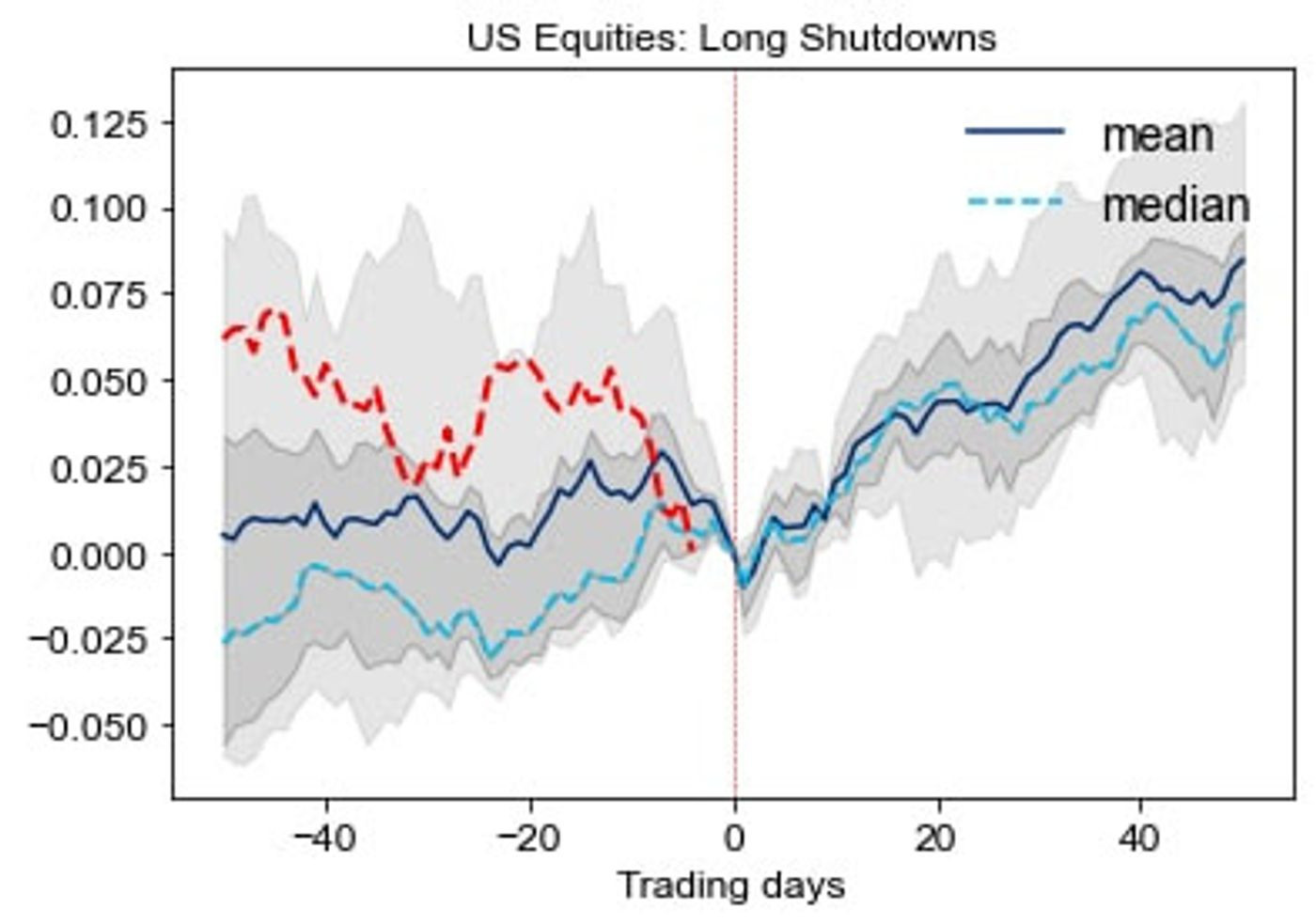

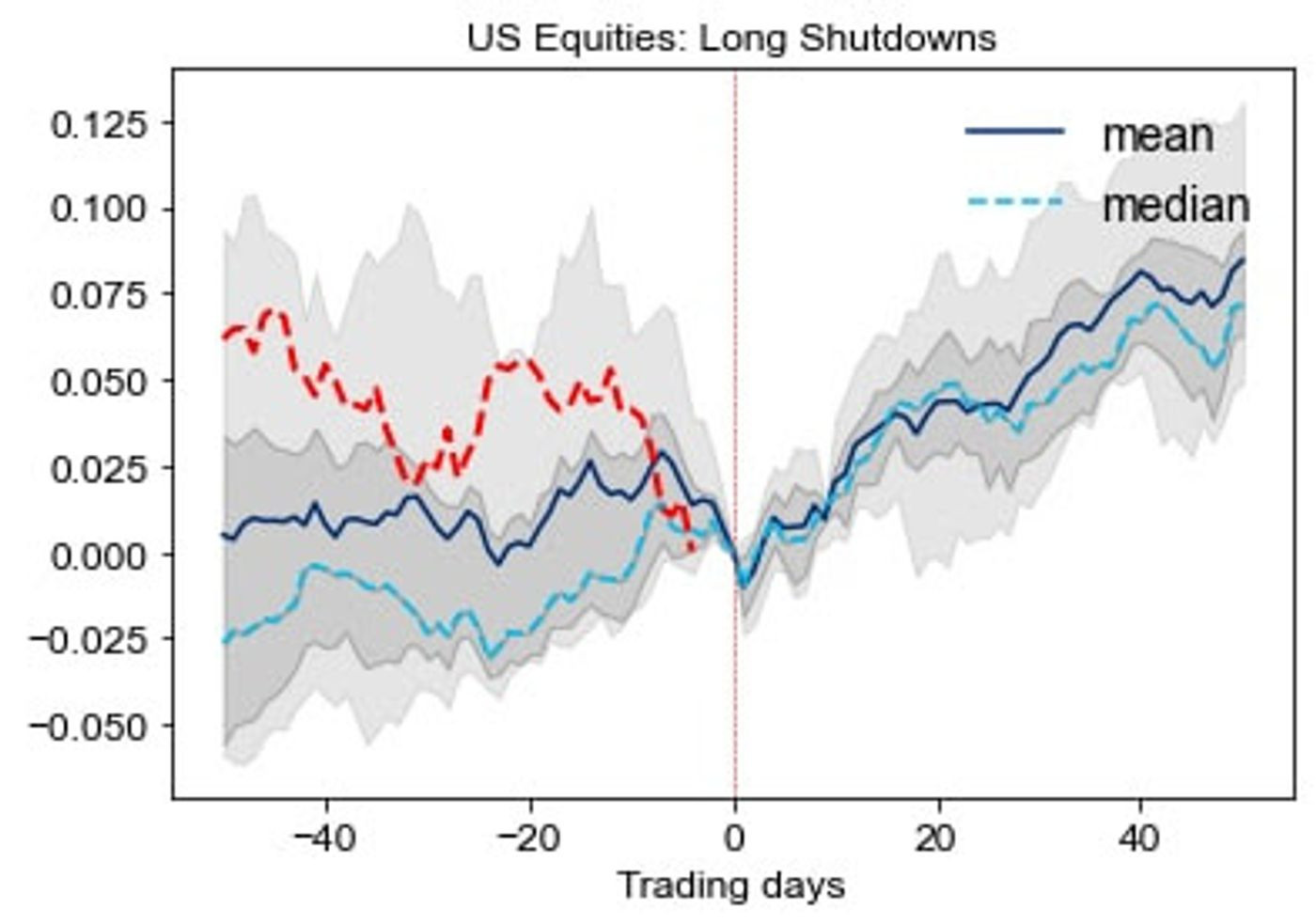

A research team at Citigroup, led by David Glass, has looked at what occurred to various assets during and after previous shutdowns.

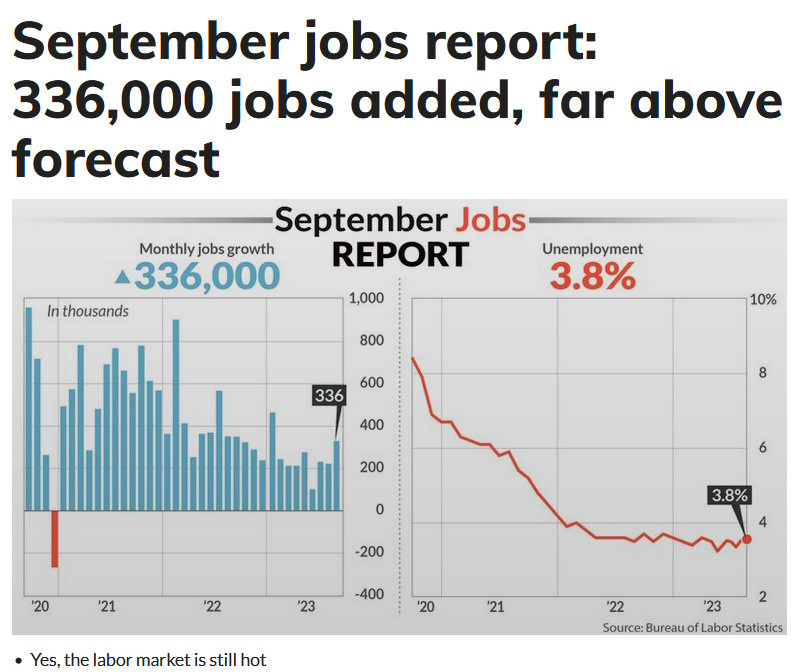

First thing to note is that Citi thinks a shutdown is likely, but may be short. Still, as millions of government employees aren’t paid, and with discretionary government spending comprising about 1.9% of gross domestic product, the shutdown could trim GDP by 0.1 of a percentage point per week.

However, if the government reopens relatively quickly that impact to growth would likely swiftly reverse, as retroactive wage payments are disbursed, says Citi. But the market as a whole may not get off so lightly as heightened uncertainty, amid a dearth of official data, causes volatility to spike.

...

Volatility in fixed income also tends to rise, but is usually relatively short-lived. In fact, the bank finds that overall shutdowns have relatively little impact on fixed income assets.

...

Stock market performance depends on shutdown duration. “Equities are not thrown off their unconditional rise around shutdowns, although longer ones tend to be anticipated with a several percentage point sell off into the event (as now) and a reversal after 10-15 days (note the average of the 3 ‘long’ shutdown is 23 days) a pattern that is not evident when we examine shutdowns of less than 5 days,” says the Citi team.

Recent market performance suggests equities may be anticipating a longer shutdown this time, says Citi, “although this sell-off has not come in a vacuum with rising rates a distinguishing feature.”

...

In summary, Citi says: “For those wishing to hedge a prolonged shutdown, gold may be a better bet than the dollar and government exposed equities provide an interesting lens to view the political risks.”

Volatility, gold and stocks to avoid: Citi delivers its shutdown playbook

https://www.marketwatch.com/story/volatility-gold-and-stocks…

...

A research team at Citigroup, led by David Glass, has looked at what occurred to various assets during and after previous shutdowns.

First thing to note is that Citi thinks a shutdown is likely, but may be short. Still, as millions of government employees aren’t paid, and with discretionary government spending comprising about 1.9% of gross domestic product, the shutdown could trim GDP by 0.1 of a percentage point per week.

However, if the government reopens relatively quickly that impact to growth would likely swiftly reverse, as retroactive wage payments are disbursed, says Citi. But the market as a whole may not get off so lightly as heightened uncertainty, amid a dearth of official data, causes volatility to spike.

...

Volatility in fixed income also tends to rise, but is usually relatively short-lived. In fact, the bank finds that overall shutdowns have relatively little impact on fixed income assets.

...

Stock market performance depends on shutdown duration. “Equities are not thrown off their unconditional rise around shutdowns, although longer ones tend to be anticipated with a several percentage point sell off into the event (as now) and a reversal after 10-15 days (note the average of the 3 ‘long’ shutdown is 23 days) a pattern that is not evident when we examine shutdowns of less than 5 days,” says the Citi team.

Recent market performance suggests equities may be anticipating a longer shutdown this time, says Citi, “although this sell-off has not come in a vacuum with rising rates a distinguishing feature.”

...

In summary, Citi says: “For those wishing to hedge a prolonged shutdown, gold may be a better bet than the dollar and government exposed equities provide an interesting lens to view the political risks.”

26.9.

Bond Traders Roiled by Fed See US Shutdown as Next Big Wild Card

https://finance.yahoo.com/news/bond-traders-roiled-fed-see-0…

...

To judge by recent history, a US government shutdown won’t be a huge event for the bond market. If anything, it could even provide a little short-term relief, since Treasuries usually rally when investors need somewhere to hide.

But it’s also adding a big dose of what financial markets hate the most: uncertainty.

Less than four months after resolving a standoff over the debt limit that threatened to push the US into default, the dysfunction in Washington is taking center stage on Wall Street again. And that’s complicating the lives of analysts and investors already trying to gauge the Federal Reserve’s interest-rate path as the US economy defies gloomy forecasts, inflation remains stubbornly elevated and growth sputters elsewhere around the world.

“Investors will definitely see this as a near-term market event risk that creates volatility,” said Jean Boivin, a former Bank of Canada official who now heads the BlackRock Investment Institute.

...

Bond Traders Roiled by Fed See US Shutdown as Next Big Wild Card

https://finance.yahoo.com/news/bond-traders-roiled-fed-see-0…

...

To judge by recent history, a US government shutdown won’t be a huge event for the bond market. If anything, it could even provide a little short-term relief, since Treasuries usually rally when investors need somewhere to hide.

But it’s also adding a big dose of what financial markets hate the most: uncertainty.

Less than four months after resolving a standoff over the debt limit that threatened to push the US into default, the dysfunction in Washington is taking center stage on Wall Street again. And that’s complicating the lives of analysts and investors already trying to gauge the Federal Reserve’s interest-rate path as the US economy defies gloomy forecasts, inflation remains stubbornly elevated and growth sputters elsewhere around the world.

“Investors will definitely see this as a near-term market event risk that creates volatility,” said Jean Boivin, a former Bank of Canada official who now heads the BlackRock Investment Institute.

...

21.8.

Goldman Sachs: A government shutdown would be ‘manageable’ for the economy. That’s why it’s likely to happen

https://www.msn.com/en-us/money/markets/goldman-sachs-a-gove…

...

Goldman Sachs is warning clients that Washington is on a collision course with its first government shutdown in five years.

“The ingredients for a shutdown — a thin House majority, a dispute on spending levels and potential complications from various political issues — are present,” Goldman Sachs economists wrote in a Sunday night report.

Goldman Sachs concluded a shutdown is “more likely than not” later this year, pointing to brewing fights over aid for Ukraine, funding for Justice Department investigations and border security as potential stumbling blocks.

...

Goldman Sachs: A government shutdown would be ‘manageable’ for the economy. That’s why it’s likely to happen

https://www.msn.com/en-us/money/markets/goldman-sachs-a-gove…

...

Goldman Sachs is warning clients that Washington is on a collision course with its first government shutdown in five years.

“The ingredients for a shutdown — a thin House majority, a dispute on spending levels and potential complications from various political issues — are present,” Goldman Sachs economists wrote in a Sunday night report.

Goldman Sachs concluded a shutdown is “more likely than not” later this year, pointing to brewing fights over aid for Ukraine, funding for Justice Department investigations and border security as potential stumbling blocks.

...

Antwort auf Beitrag Nr.: 59.956.552 von faultcode am 25.02.19 14:20:32 25.02.2019

Jeremy Grantham/GMO warnte zuletzt jedes Jahr vor einer "bubble" in den US-Märkten:

...

Grantham has built a reputation for calling major stock-market bubbles, including in 2000 and 2007. In January 2022, he warned of a “superbubble” spanning across stocks, bonds, real estate and commodities while pointing to stimulus from the Federal Reserve.

...

21.8.

Jeremy Grantham’s GMO plans its first ETF, a fund that will target quality stocks

The GMO U.S. Quality ETF will be actively managed, according to an SEC filing.

https://www.marketwatch.com/story/jeremy-granthams-gmo-plans…

...

aber jetzt auch einen auf ETF machen

Zitat von faultcode: aus dem GMO White Paper, Jan 2019:

Key Points

• A new model suggests that from early 2017 through much of 2018, the U.S. stock market was a bubble.

...

Jeremy Grantham/GMO warnte zuletzt jedes Jahr vor einer "bubble" in den US-Märkten:

...

Grantham has built a reputation for calling major stock-market bubbles, including in 2000 and 2007. In January 2022, he warned of a “superbubble” spanning across stocks, bonds, real estate and commodities while pointing to stimulus from the Federal Reserve.

...

21.8.

Jeremy Grantham’s GMO plans its first ETF, a fund that will target quality stocks

The GMO U.S. Quality ETF will be actively managed, according to an SEC filing.

https://www.marketwatch.com/story/jeremy-granthams-gmo-plans…

...

aber jetzt auch einen auf ETF machen

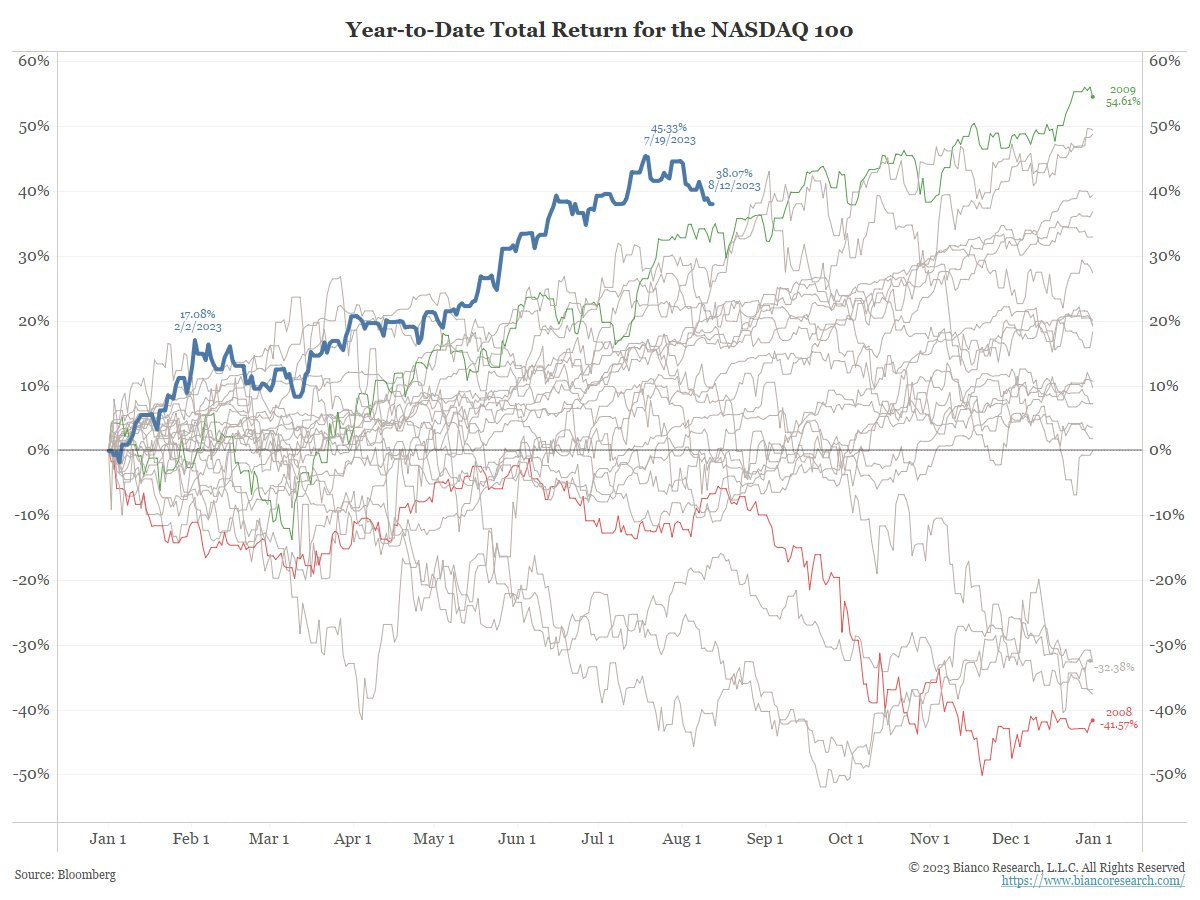

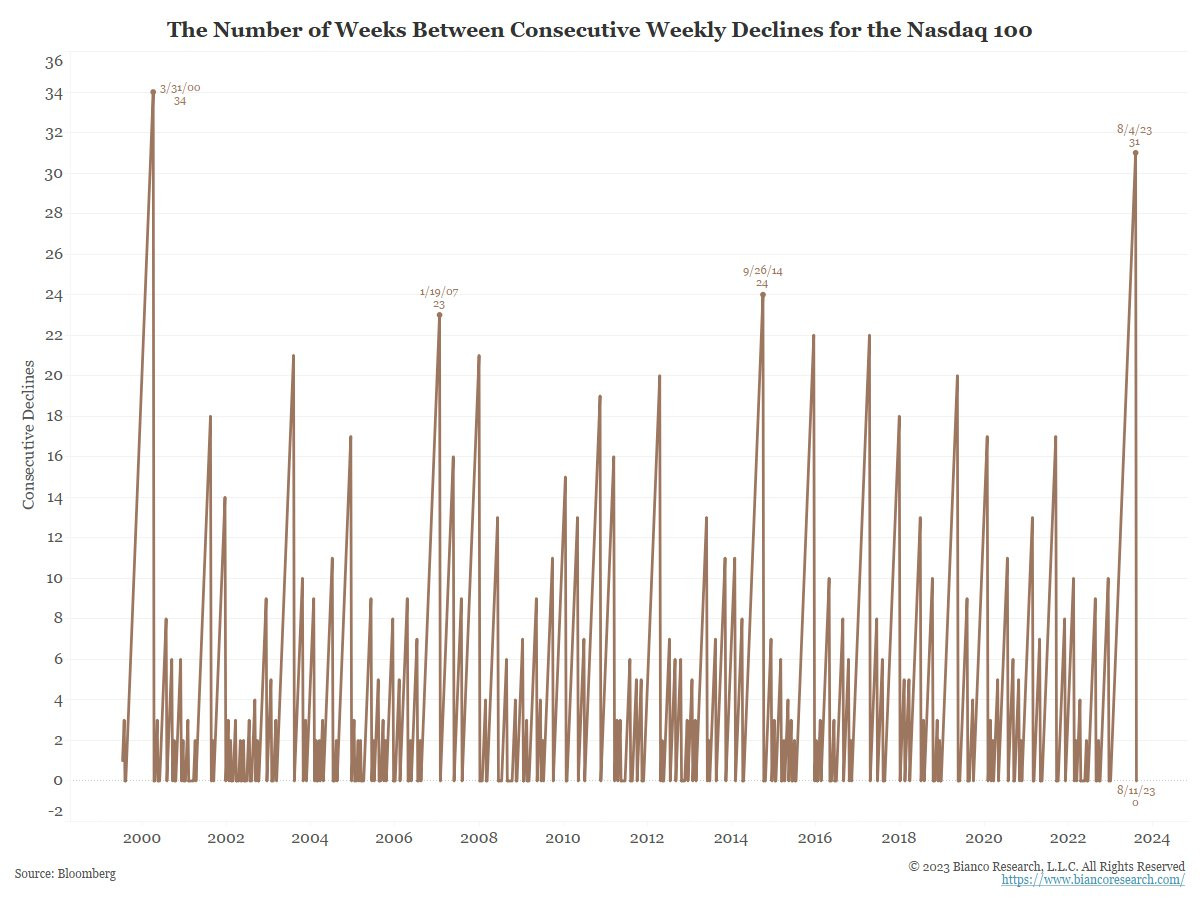

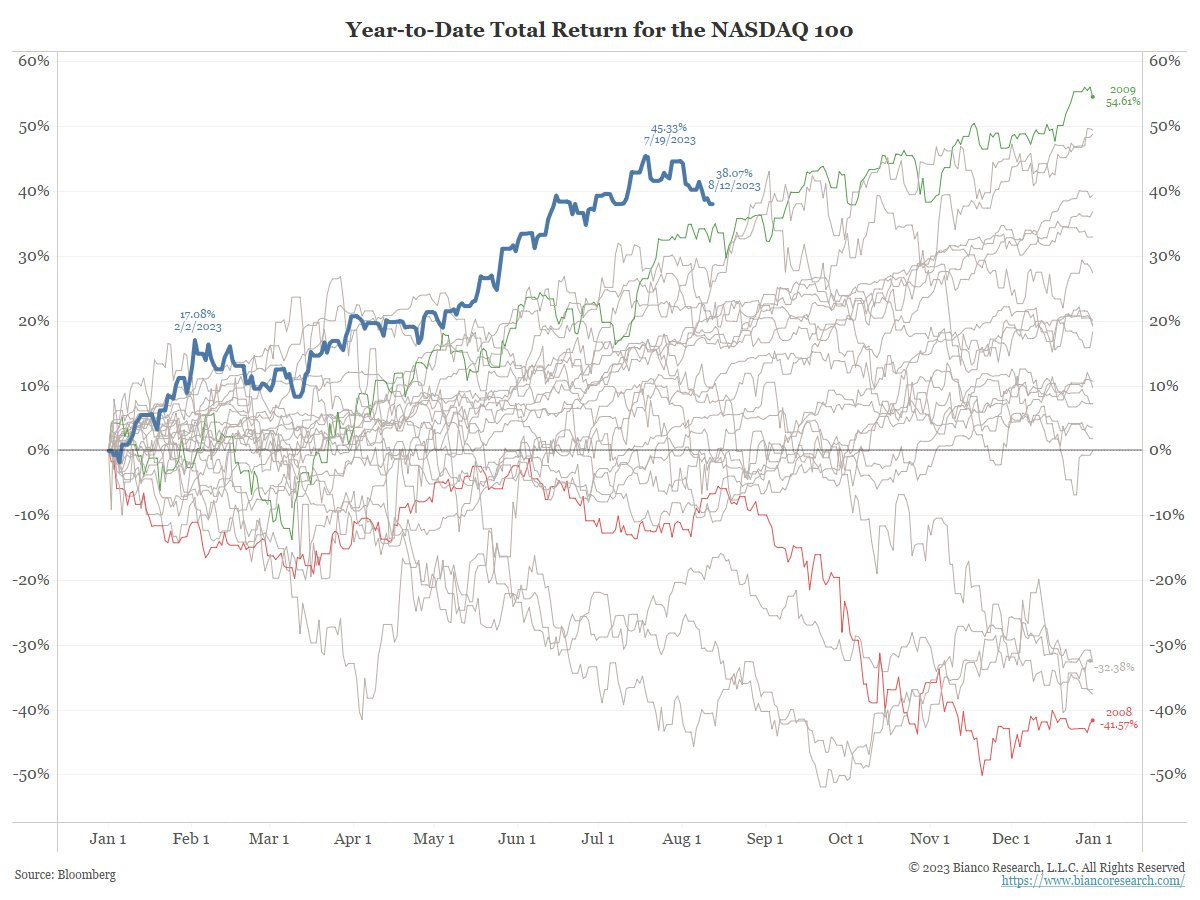

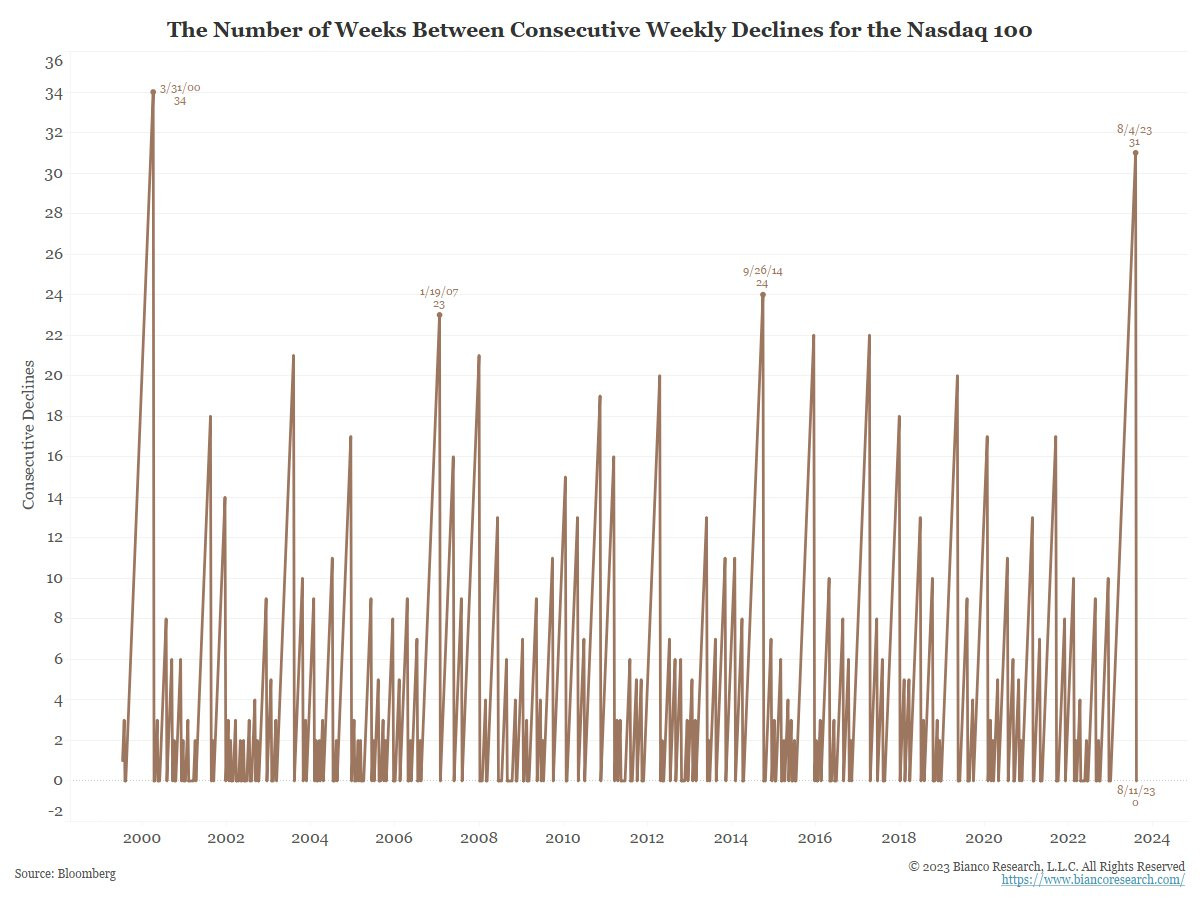

NASDAQ 100 (NDX):

...

It has been 31 weeks since the NDX had consecutive weeks of decline.

The last time the NDX went this long without consecutive losing weeks was the peak of the NASDAQ bubble in 2000, 22 years ago!

That streak marked the peak of a tech bubble and an 80% decline!

https://twitter.com/biancoresearch/status/169038054407948288…

...

...

It has been 31 weeks since the NDX had consecutive weeks of decline.

The last time the NDX went this long without consecutive losing weeks was the peak of the NASDAQ bubble in 2000, 22 years ago!

That streak marked the peak of a tech bubble and an 80% decline!

https://twitter.com/biancoresearch/status/169038054407948288…

...