Höegh - LNG-Spezialist - 500 Beiträge pro Seite

eröffnet am 18.07.14 12:19:55 von

neuester Beitrag 21.12.18 15:59:35 von

neuester Beitrag 21.12.18 15:59:35 von

Beiträge: 54

ID: 1.196.530

ID: 1.196.530

Aufrufe heute: 0

Gesamt: 29.846

Gesamt: 29.846

Aktive User: 0

ISIN: BMG454221059 · WKN: A1JCJE

2,2450

EUR

+0,45 %

+0,0100 EUR

Letzter Kurs 10.05.21 Frankfurt

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9600 | +22,77 | |

| 38.600,00 | +9,66 | |

| 1,3025 | +9,00 | |

| 4,8700 | +7,51 | |

| 16,800 | +6,87 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0500 | -12,50 | |

| 11,560 | -13,64 | |

| 1.050,01 | -14,28 | |

| 12,100 | -17,12 | |

| 1,3900 | -17,51 |

war ein Tipp von DJHLS, kommt als peer-group Ergänzung zu Golar, Exmar, BG, Cheniere auf die watchlist

sehe gerade, dass der Threadtitel Höegh-LNG hätte lauten müssen, weil es noch Schwesterunternehmen gibt:

http://www.hoegh.com/ikbViewer/page/hoeghcom/home

http://www.hoegh.com/ikbViewer/page/hoeghcom/home

Lithuania gets its first LNG cargo

Lithuania has received its first ever cargo of liquefied natural gas at the Klaipeda port onboard the 160,000 cbm Golar Seal.The 2013-built LNG tanker docked at Höegh LNG’s FSRU Independence this morning, October 28, carrying a cargo from Statoil’s Hammerfest terminal in Norway, shipping data says.

According to shipping data, while sailing to the Klaipeda port, the LNG tanker docked and unloaded about one third of its cargo at the Dutch Gate import terminal.

This is a historic moment for the Baltic state since it begins a new era in the country’s energy imports. Until now, Lithuania was completely dependent on gas supplies from Russian gas giant Gazprom.

Lithuania’s President Dalia Grybauskaitė said yesterday at the welcoming ceremony that the Klaipėda LNG terminal, if necessary, will also be able to cover 90 percent of the three Baltic States’ gas supply needs.

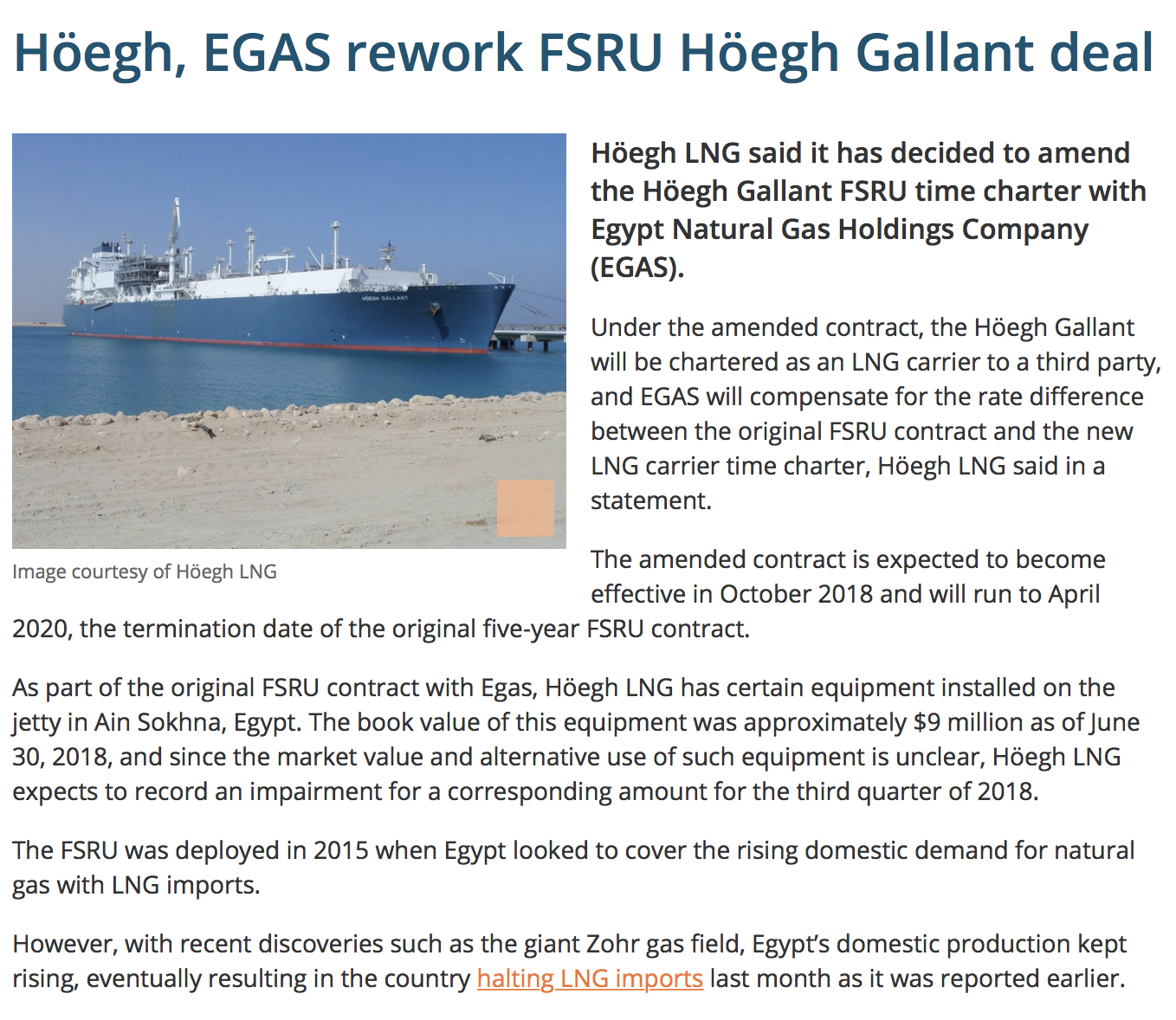

Hoegh LNG signs time charter deal with EGAS

Höegh LNG has signed a time charter party contract with EGAS of Egypt for the FSRU Höegh Gallant.According to a statement by Höegh LNG, the contract is for a period of five years and expected to generate an average annual EBITDA of around USD 40 million.

The company signed in May a letter of intent with EGAS for the charter of the 170.000 cbm Höegh Gallant, which is expected to be delivered from Korea’s Hyundai Heavy later this week.

The FSRU will start to serve as Egypt’s LNG import terminal by the end of the first quarter 2015, Höegh LNG said.

The LNG project that would allow Egypt to add importing facilities to already existing export facilities has been constantly delayed for two years deepening the energy shortage issues throughout the country.

Declining domestic production has led to gas shortages and diverting of gas set for exports to the domestic market.

Hoegh LNG strikes Colombia FSRU deal

Höegh LNG of Norway said it has been awarded an FSRU contract by Sociedad Portuaria El Cayao (SPEC) for a new LNG import terminal in Cartagena, on the Atlantic coast of Colombia.The contract is subject to SPEC obtaining necessary environmental licenses for the project, which is expected to start operations mid-2016, the company said in a statement.

The FSRU contract is for twenty years, but includes options for SPEC to reduce the term to five, ten or fifteen years. SPEC will confirm the initial contract term before the start of operations, Höegh said.

The contract is expected to generate an average annual EBITDA of USD 40-45 million, depending on the term of the contract.

Hoegh LNG will employ the Höegh Challenger FSRU, with a capacity of 170,000 cbm, currently under construction at Hyundai Heavy Industries’ shipyard in Ulsan, South Korea.

Hoegh LNG orders fifth FSRU at HHI

Höegh LNG of Norway has declared its option for a fifth FSRU at Hyundai Heavy Industries in South Korea.The FSRU, which will be delivered during the first half of 2017, has full trading capability and increased regasification capacity compared to the previous four FSRUs ordered at the yard, Höegh said in a statement.

With this order, the company has seven modern, large size and fuel efficient FSRUs in operation or under construction, the most modern FSRU fleet in the market.

President and Chief Executive Officer Sveinung J.S. Støhle says, “Monday this week we secured long term contracts for the last two of the four FSRUs in our current expansion program, and we therefore continue to follow our successful strategy by ordering additional FSRUs when new contracts have been secured. The order at HHI is the initial part of the company’s next expansion program, and we continue to see strong growth in the FSRU market over the next three to four years, and contrary to some of our competitors the company’s main focus will remain the FSRU segment where we intend to continue building our position.”

GTT receives tech order for Hoegh LNG's fifth FSRU

GTT of France received an order for a new FSRU being built by the Korean shipbuilding company Hyundai Heavy Industries.The regasification unit is expected to be delivered in 2017 and will be built with GTT’s Mark III technology. The cargo tanks will be equipped with an optimized containment system configuration to allow all partial filling ability.

This FSRU will be the fifth one in the series at HHI and the seventh one in total owned by Norway’s Höegh LNG, and equipped with GTT membrane.

Hoegh LNG’s third quarter income drops

Höegh LNG of Norway reported USD 33.8 million in total income in the third quarter of 2014, down from USD 36.7 million in the same quarter last year.The company’s consolidated operating loss before depreciation was USD 3.9 million in the quarter compared to an operating profit before depreciation (EBITDA) of USD 1.2 million in the same quarter last year.

“HLNG’s Q3 results are affected by non-recurring expenses from moving two FSRU’s from construction into their operational phase, with some technical challenges during the start-up and commissioning phase of the FSRU Lampung, and I am very pleased that these where identified and resolved by our Lampung team, and the FSRU is now in operation under her 20 year charter,” Sveinung J.S. Støhle, CEO of Höegh LNG said.

Stohle added that the FSRU Independence arrived at Klaipeda on schedule and is now in the commissioning phase. In addition, the company has been very successful in securing new business for the two remaining newbuilt FSRU’s, having secured long term contract for the Höegh Gallant and also FSRU#4.

INTERVIEW: Hoegh LNG eyes eight FSRU, CEO says

(Quelle: http://www.lngworldnews.com/interview-hoegh-lng-eyes-eight-…)Auszüge:

...

In an interview with LNG World News, Höegh LNG’s President and CEO Sveinung J.S. Støhle, discusses the company’s LNG business, oil slump implicationson the global LNG industry, as well as the usage of liquefied natural gas as fuel for ships, and the company’s plans for the future.

...

Compared to land based import terminals, FSRUs are less capital intensive, quicker to build and more flexible and have therefore become the preferred solution for new importers and countries without required LNG import infrastructure in place. Höegh LNG has identified around 30 potential FSRU projects world-wide and over the next five years we expect an average of two to four FSRU contracts to be signed per year.

Our ambition is to sign one to two of these per year. Once we have secured a contract for our seventh FSRU, we will continue with our business model to always have one uncommitted FSRU under construction, by ordering our eight FSRU.”

...

What are pros and cons of the floating liquefaction market for you?

“An FLNG is cost-competitive to land based terminals, it takes half the time to construct and has the flexibility to be moved to another location. However, it is a less mature market although we notice that this is changing.

Höegh LNG has a technical solution for an FLNG and has performed several paid field specific studies for customers. We continue to focus on the North American projects, where we have two exclusivity agreements and have performed pre-FEED studies.

...

The oil prices dropped dramatically last year causing several projects to be delayed or even cancelled. It also had a huge effect on the spot prices.

How do you see this, and what implications will these fluctuations have on the global LNG industry, and Hoegh LNG’s business?

“As mentioned above, the LNG prices has gone down as a consequence of the oil prices. Lower LNG prices will normally lead to higher demand for LNG, especially in price sensitive markets such as India and China, and this should increase demand for new LNG import capacity.

These market trends are conducive to our growth strategy and we will continue with our business model and we aim to have 12 units (on water and under construction) by 2019.”

In January this year, IMO’s regulations regarding NOx and SOx emissions came on stream prompting many shipowners to switch to LNG as fuel for their fleets. A big part Höegh LNG’s fleet already uses natural gas as fuel.

...

Hoegh LNG’s focus for the future?

“Höegh LNG’s main focus is FSRUs where we are the leading provider. Höegh LNG’s FSRUs are based on constructing new assets with the latest and most efficient technology, with capacities tailored to the requirements of our customers.

Secondly, we will continue focusing on FLNG. Due to the capital requirements and technical specification, Höegh LNG will order after contract award based on a long term agreement with a credit worthy counterparty.

We have not been so active in the LNGC segment for the last four years as the returns have been too low. However, Höegh LNG orders LNGCs at the back of a long-term contract if the investment is accretive for Höegh LNG Partners LP.”

Delfin, Hoegh LNG partner up on FLNG project

Delfin LNG said it has signed a joint development agreement with Höegh LNG in relation to its US-based Delfin liquefied natural gas deepwater port project.The project is a planned floating liquefaction, deepwater port designed to export liquefied natural gas from the Gulf of Mexico and is positioned to be the first floating deepwater liquefaction project in the United States, the company said in a statement.

The Delfin LNG project consists of onshore gas compression facilities, a 42-inch pipeline to transport natural gas offshore, and a deepwater port with four moorings and four floating liquefaction vessels. The project is planned to have an ultimate LNG send-out capacity of 13 million metric tonnes per annum.

Höegh LNG will act as a co-owner, owner’s engineer and operator of the floating liquefaction vessels.

Antwort auf Beitrag Nr.: 49.192.973 von R-BgO am 27.02.15 10:56:42http://www.lngworldnews.com/interview-hoegh-lng-eyes-eight-f…

Antwort auf Beitrag Nr.: 49.213.412 von R-BgO am 02.03.15 09:39:16

The 170,000 cbm FSRU is scheduled for delivery in the second quarter of 2015 and features a Mark III membrane containment system and a Wärtsila-Hyundai DFDE engine. It has an overall length of 294 meters and breadth of 46 meters.

As it was revealed in an interview for LNG World News, the company that recently ordered its seventh FSRU is looking to secure a deal for its newbuild and place an order for an eight vessel.

Höegh LNG has identified around 30 potential FSRU projects world-wide and over the next five years the expects an average of two to four FSRU contracts to be signed per year. With this, Höegh LNG expects to sign one or two such contracts per year

Out of the company’s newbuilds,

*FSRU Independence is already in operation in Lihuania while the

*Höegh Gallant has arrived in Egypt off Ain Sukhna where it will start its five-year charter deal with EGAS. The fifth FSRU,

*Höegh Challenger, has been chartered by Sociedad Portuaria El Cayao (SPEC) for a new LNG import terminal in Cartagena, on the Atlantic coast of Colombia, for a period of 20 years.

Hoegh LNG names sixth FSRU

Oslo-based Höegh LNG informed that the sixth FRSU under construction at Hyundai Heavy Industries has been named Höegh Grace. The 170,000 cbm FSRU is scheduled for delivery in the second quarter of 2015 and features a Mark III membrane containment system and a Wärtsila-Hyundai DFDE engine. It has an overall length of 294 meters and breadth of 46 meters.

As it was revealed in an interview for LNG World News, the company that recently ordered its seventh FSRU is looking to secure a deal for its newbuild and place an order for an eight vessel.

Höegh LNG has identified around 30 potential FSRU projects world-wide and over the next five years the expects an average of two to four FSRU contracts to be signed per year. With this, Höegh LNG expects to sign one or two such contracts per year

Out of the company’s newbuilds,

*FSRU Independence is already in operation in Lihuania while the

*Höegh Gallant has arrived in Egypt off Ain Sukhna where it will start its five-year charter deal with EGAS. The fifth FSRU,

*Höegh Challenger, has been chartered by Sociedad Portuaria El Cayao (SPEC) for a new LNG import terminal in Cartagena, on the Atlantic coast of Colombia, for a period of 20 years.

Höegh LNG -Höegh Gallant commences commercial operations in Egypt

Published: 07:00 CEST 30-04-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. ("HLNG" or the "Company") is pleased to announce that its Floating Storage and Regas Unit (FSRU) Höegh Gallant successfully completed all performance and commissioning tests on 29 April 2015, and has commenced commercial operations under its five years FSRU contract with Egas in Egypt.

Sveinung J.S. Støhle, President and CEO of HLNG, states in a comment: "We are very proud to have commenced commercial operations on our third FSRU in the last six months, which shows the strength and depth of our technical and operational expertise. In addition, our project with Egas is a prime example of the speed and flexibility an FSRU solution offers for importing LNG; the contract was signed only five months before commercial operations commenced. I am particularly pleased with our ability to deliver the optimal technical solution to Egas in such a short time and within budget, and I am looking forward to servicing Egas in their efforts to supply Egypt's fast growing natural gas market."

Four companies bid to build FSRU in Mumbai port

India Gas Solutions, a BP-Reliance Industries JV, informed that four companies have submitted bids to build an LNG import facility on India’s west coast. According to Mumbai Port Trust’s chairman R.M. Parmar, Excelerate Energy, Mitsui and Co of Japan, Hoegh LNG and IMC Infrastructure have all participated in the initial tender.

IGS is looking to build a 5 mtpa FSRU unit at the Mumbai port together with the accompanying infrastructure with the costs estimated at 30 billion rupees, Reuters reports.

According to Parmar, the projects is expected to be finished in 2018 and the Mumbai Port Trust will charge a fee from the company that gets selected to construct and operate the FSRU.

1 Indian rupee = 0.015664 USD

Höegh LNG - Awarded FSRU Contract in Chile

Published: 07:01 CEST 27-05-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. (the "Company" or "Höegh LNG") on 26 May 2015 signed an FSRU contract with Octopus LNG SpA ("Octopus") for the Penco-Lirquén LNG import terminal to be located in Concepción Bay, Chile. The contract is for a period of 20 years and is expected to generate an average annual EBITDA of around USD 36 million. The contract is subject to Octopus completing financing and obtaining necessary environmental approvals, and the planned start-up is in the second quarter 2018. The Company will service the contract with an FSRU from its newbuilding program currently in progress. The FSRU will be offered to Höegh LNG Partners LP in due course.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "We are delighted to have been awarded the contract with Octopus for their new LNG import terminal in Chile, and look forward to completing the project together with our client. Our modern FSRU solutions offer our client the most cost efficient way of importing LNG to meet an increasing demand for natural gas used in power production in Chile. With this contract we have full contract coverage for our FSRU fleet and are therefore contemplating the next step in our FSRU expansion program."

Octopus' General Manager, Alfonso Ardizzoni, said in a statement "We appreciate Höegh LNG's FSRU expertise, which allowed us to present a competitive and successful bid in the recent public tender process ran by the Comisión Nacional de Energía for the supply of electricity to distribution companies in the Sistema Interconectado Central, the Chilean main electric grid. Höegh LNG's technology is a key service component of the natural gas delivery chain that will enable the construction of our El Campesino Power Plant as well as supplying the growing demand of natural gas in the Bio Bio region. We expect the LNG import terminal to substantially increase the reliability and competitiveness of the power generation and natural gas markets in Chile and are looking forward to a long term relationship with Höegh LNG".

About Octopus

Octopus LNG SpA is a project development company created to provide LNG storage and regasification services to power generators and industrial users in the Bio Bio region of Chile. Octopus is 50% owned by Biobiogenera, which is a joint venture between Andes Mining & Energy (a Chile-based independent power producer) and Beacon Investments (a Chile-based industrial group). The remaining 50% participation is held by Cheniere Energy, a Houston-based energy company primarily engaged in LNG-related businesses.

Höegh LNG - Contemplating issuing unsecured bonds

Published: 10:00 CEST 28-05-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. is contemplating issuing senior unsecured bonds denominated in USD in the Nordic bond market with maturity in June 2020.

The net proceeds from the contemplated bond issue are intended for general corporate purposes.

Danske Bank Markets, DNB Markets, Nordea Markets, Pareto Securities and Swedbank Norway are engaged as joint lead managers for the contemplated bond issue.

Antwort auf Beitrag Nr.: 49.863.220 von R-BgO am 28.05.15 10:04:30

Höegh LNG - Successful placement of new unsecured bonds

Reference is made to the notification sent earlier today 28 May 2015 regarding a potential bond issue by Höegh LNG Holdings Ltd. ("HLNG"). HLNG has successfully completed the issuance of a USD 130 million senior unsecured bond in the Nordic bond market with maturity date expected to be 5 June 2020. The bond issue will be swapped from floating to fixed interest rate.

The bond issue was oversubscribed.

The net proceeds from the bond issue shall be used for general corporate purposes.

An application will be made for the bonds to be listed on Oslo Børs.

Danske Bank Markets, DNB Markets, Nordea Markets, Pareto Securites and Swedbank Norway have acted as Joint Lead Managers for the bond issue.

ging schnell:

Published: 19:43 CEST 28-05-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG - Successful placement of new unsecured bonds

Reference is made to the notification sent earlier today 28 May 2015 regarding a potential bond issue by Höegh LNG Holdings Ltd. ("HLNG"). HLNG has successfully completed the issuance of a USD 130 million senior unsecured bond in the Nordic bond market with maturity date expected to be 5 June 2020. The bond issue will be swapped from floating to fixed interest rate.

The bond issue was oversubscribed.

The net proceeds from the bond issue shall be used for general corporate purposes.

An application will be made for the bonds to be listed on Oslo Børs.

Danske Bank Markets, DNB Markets, Nordea Markets, Pareto Securites and Swedbank Norway have acted as Joint Lead Managers for the bond issue.

Höegh LNG - Places order for additional FSRU plus options at Hyundai Heavy Industries

Published: 14:24 CEST 01-06-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") is pleased to announce that the Company has ordered its FSRU#8 at Hyundai Heavy Industries (HHI) in South Korea. FSRU#8 is designed to the highest specifications, has full trading capability, regas capacity of 750 MMscf/day, and will be delivered in Q1 2018. The agreement with HHI also includes a firm priced option for an FSRU#9, with a predefined delivery window. With this order, the Company has eight, large size and fuel efficient FSRUs in operation or under construction, and possesses the most modern FSRU fleet in the market.

President and Chief Executive Officer Sveinung J.S. Støhle says: "After signing the long term contract with Octopus LNG last week we stay firm to our business model with the order of FSRU#8 + options. Our plan to grow our FSRU fleet step-by-step with the objective to double it by 2019 remains firmly in place. We continue to see strong demand for our FSRU services, and with the highest technical specification on our newbuild FSRUs at competitive prices, Höegh LNG remains the leading company in the FSRU segment and we are very well positioned to continue increasing our market share in the coming years."

Antwort auf Beitrag Nr.: 49.681.197 von R-BgO am 30.04.15 11:49:35

The 159,800 cbm LNG carrier Woodside Rogers will dock next to the FSRU in Ain Sokhna on Wednesday with a cargo loaded at the port of Dampier, shipping data reveals.

Dampier serves as a loading point for two Woodside-operated LNG export facilities, Pluto and North West Shelf.

The Höegh Gallant FSRU was chartered by the Egyptian Natural Gas Company on a five-year deal.

During the course of this year, Egypt finalized LNG import deals with Trafigura, Vitol, Noble, Gazprom and Algeria’s Sonatrach totaling 90 cargoes, while negotiations with BP for additional 21 shipments of the chilled gas are still in progress.

Energy shortages, increased domestic demand for gas and decline in output have turned Egypt from a net exporter to a net importer of gas.

Egypt expects first Australian LNG shipment

Höegh Gallant FSRU, that began operations in Egypt in April, is set to receive the first delivery of Australian LNG.The 159,800 cbm LNG carrier Woodside Rogers will dock next to the FSRU in Ain Sokhna on Wednesday with a cargo loaded at the port of Dampier, shipping data reveals.

Dampier serves as a loading point for two Woodside-operated LNG export facilities, Pluto and North West Shelf.

The Höegh Gallant FSRU was chartered by the Egyptian Natural Gas Company on a five-year deal.

During the course of this year, Egypt finalized LNG import deals with Trafigura, Vitol, Noble, Gazprom and Algeria’s Sonatrach totaling 90 cargoes, while negotiations with BP for additional 21 shipments of the chilled gas are still in progress.

Energy shortages, increased domestic demand for gas and decline in output have turned Egypt from a net exporter to a net importer of gas.

PGN FSRU Lampung six months on idle

Lampung floating storage and regasification unit moored off the Sumatran coast has been on idle for months as low oil prices and faltering LNG demand hit Indonesia. The 170,132 cbm vessel with a regasification capacity of 360 mmscf per day has been idling off the coast without regasifying any liquefied natural gas for six months, Perusahan Gas Negara said.

PGN operates the vessel on a 20-year time charter with Höegh LNG. It has only commenced operations in July 2014.

The Lampung FSRU was scheduled to receive 14 cargoes since the start of the year but has still not received any.

Chairani Rachmatullah, gas and fuel division head at Perusahaan Listrik Negara told Reuters that electricity demand has shown a significant drop causing LNG to be less competitive.

Indonesia’s LNG demand growth has been slower than predicted and only posted a slight rise of 0.7 percent in 2014.

Höegh LNG - LNG Libra sold

Published: 11:08 CEST 16-07-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") is pleased to announce that the Company has sold the LNG carrier LNG Libra (built 1979) to a Chinese energy company for around USD 20 million. The Company has received 15% of the purchase price and will receive the remaining 85% by the end of the first quarter 2016, after the vessel has completed her current charter with Gas Natural.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "LNG Libra was acquired to meet the bid conditions for a specific FSRU project as a conversion candidate, however, we succeeded in placing one of our newbuild FSRUs instead. Since HLNG's main focus is newbuild FSRUs and these have become the preferred solution among LNG importers, LNG Libra is today a non-core asset, and therefore we are very pleased with having completed this transaction in a very challenging LNG shipping market."

Höegh LNG - Agreement to Transfer the FSRU Höegh Gallant to Höegh LNG Partners and other update

Published: 07:00 CEST 13-08-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") today announced an agreement to sell the entity that owns the FSRU Höegh Gallant to Höegh LNG Partners LP ("HMLP" or the "Partnership") for a purchase price of USD 370 million, subject to certain post-closing purchase price adjustments. The existing debt related to the Höegh Gallant is approximately USD183 million and will continue to be outstanding. The purchase price will be settled by the cancellation of a USD140 million demand note from HMLP to Höegh LNG and the issuance of a seller's credit of USD47 million, due in 18 months with an interest rate of 8% per annum. The transaction is expected to be completed by the end of September 2015 and is subject to customary closing conditions.

Höegh Gallant is operating under a charter with the government-owned Egyptian Natural Gas Holding Company ("EGAS") that expires in April 2020. Additionally, HMLP has the right to cause HLNG to charter the vessel from the expiry of the EGAS charter until July 2025 at a rate equal to 90% of the rate payable pursuant to the current charter.

The transaction has been approved by the Board of Directors of the Company as well as the Board of Directors of Höegh LNG Partners.

Sveinung J.S. Støhle, President and CEO of Höegh LNG, stated "We are delighted to have reached an agreement with HMLP for the first drop-down into the MLP. Höegh LNG has a strong pipeline of drop-down candidates, making HMLP a robust vehicle for funding our FSRU expansion already under way, and where we continue to see very strong market growth in the coming years."

Transfer of FSRU Independence to HMLP - Update

Höegh LNG and HMLP continue to await the consent of the charterer as to the proposed drop down of the FSRU Independence. No assurance can be given at this point regarding the timing of such consent or terms of such transaction.

Höegh LNG : Contemplated Private Placement

Published: 16:30 CEST 09-09-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Bermuda, 9 September 2015

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company", ticker code "HLNG") has retained ABG Sundal Collier, DNB Markets and Pareto Securities (collectively referred to as the "Joint Bookrunners") to advise on and effect a private placement of up to 6,920,000 new common shares in the Company, equivalent to 9.90% of the issued shares in the Company, directed towards Norwegian and international investors after the close of the Oslo Stock Exchange today, 9 September 2015 (the "Private Placement").

The net proceeds to the Company from the Private Placement will provide financial resources to support Höegh LNG's growth strategy to become one of the world's leading providers of floating LNG services. More specifically, the Company intends to use the net proceeds from the Private Placement to:

Finance further growth by ordering additional FSRU newbuildings.

For general corporate purposes.

The subscription price in the Private Placement will be set on or around close of market price on 9 September 2015 based on an accelerated bookbuilding process. The minimum order application has been set to the number of shares that equals an aggregate purchase price of at least NOK 5,000,000. The bookbuilding period will commence today (9 September 2015) at 16:30 hours (CET) and close on 10 September 2015 at 08:00 hours (CET). The Company and the Joint Bookrunners may, however, at any time and for any reason resolve to close or extend the bookbuilding period at their own sole discretion.

Leif Höegh & Co Ltd., the largest shareholder in the Company, has pre-subscribed for 15% of the Private Placement.

The Company will announce the number of shares placed and the final subscription price in the Private Placement through a stock exchange notice expected to be sent before opening of the Oslo Stock Exchange tomorrow 10 September 2015.

Notification of allotment and payment instructions will be sent to the applicants on or about 10 September 2015 through a notification to be issued by the Joint Bookrunners. Settlement of the allocated shares is expected to take place through a delivery versus payment transaction on or about 14 September 2015.

The subscribers in the Private Placement will be delivered existing and unencumbered shares in the Company that are already listed on the Oslo Stock Exchange, pursuant to a share lending agreement entered into between Höegh LNG, the Joint Bookrunners and the Company's largest shareholder, Leif Höegh & Co Ltd., in order to facilitate delivery of listed shares to investors on a delivery versus payment basis.

Antwort auf Beitrag Nr.: 50.589.557 von R-BgO am 09.09.15 16:45:42

Bermuda, 10 September 2015

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company", ticker code "HLNG") today announces that the Company has raised NOK 844 million (USD ~100 million equivalent) in gross proceeds through a private placement of 6,920,000 new common shares, each with a par value of USD 0.01 at a subscription price of NOK 122 per share (the "Private Placement").

...

Commenting on today's announcement, Sveinung J. S. Støhle, President & CEO of Höegh LNG, said, "We are very pleased to have concluded this fundraising supporting Höegh LNG's growth strategy. With the support from existing and new shareholders, the Company has broadened its shareholder base, increased the free float in its share and further strengthened its financial position. This enables the Company to take an even more active role in the growing LNG industry and further strengthen its competitive position in the FSRU segment."

Höegh LNG : Raises NOK 844 million (USD ~100 million) in a Private Placement

Published: 07:00 CEST 10-09-2015 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Bermuda, 10 September 2015

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company", ticker code "HLNG") today announces that the Company has raised NOK 844 million (USD ~100 million equivalent) in gross proceeds through a private placement of 6,920,000 new common shares, each with a par value of USD 0.01 at a subscription price of NOK 122 per share (the "Private Placement").

...

Commenting on today's announcement, Sveinung J. S. Støhle, President & CEO of Höegh LNG, said, "We are very pleased to have concluded this fundraising supporting Höegh LNG's growth strategy. With the support from existing and new shareholders, the Company has broadened its shareholder base, increased the free float in its share and further strengthened its financial position. This enables the Company to take an even more active role in the growing LNG industry and further strengthen its competitive position in the FSRU segment."

Hoegh, Bechtel win Malahat LNG pre-FEED job

Steelhead LNG said it has signed an agreement with Höegh LNG, for Höegh LNG and Bechtel to perform the pre-front end engineering and design work for its proposed Malahat LNG project.The Malahat LNG project consists of floating natural gas liquefaction and export facilities located on the shoreline of Malahat Nation-owned land, approximately eight kilometres south of Mill Bay, British Columbia, on the east coast of Vancouver Island, the company said in a statement.

The pre-FEED work, which will commence immediately, and run through to Spring 2016, will include proof of concept studies for developing floating LNG production/storage/offloading facilities for up to 6 million tonnes per annum of LNG at the proposed site.

Further, the pre-FEED work will include establishing a basis of design appropriate to support the FEED phase. Engineering design and studies undertaken through pre-FEED will also support the environmental assessment and facilities permitting processes.

Steelhead has already signed a pre-construction agreement with Williams’ unit Northwest Pipeline.

ob sie den auch kriegen?:

Egypt to charter third FSRU late next yearEgypt is reportedly on the lookout for a third floating storage and regasification unit to be set up in late 2016 or early 2017.

According to the Egyptian Natural Gas Holding company’s head, Khaled Abdel Badie, the third FSRU would provide gas to the industry and power generators, Reuters reports.

Egypt’s industries recently had to start rationing power, even stopping production due to electricity shortages.

The country has already chartered two floating storage and regasification units, the Höegh Gallant provided by Höegh LNG and the FSRU BW Singapore provided by the Singapore-based BW.

Both FSRU’s are moored in Egypt’s port of Ain Sokhna.

unschön:

Hoegh LNG Partners says to restate earningsNew York-listed Hoegh LNG Partners, a unit of Hoegh LNG, informed on Wednesday it is planning to restate more than two years of financial reports as they should not be relied upon.

The Partnership said the restatement decision comes following the review of certain Indonesian withholding and value added tax payments for the years of 2013, 2014 and the first half of 2015.

The impact of the restatement of the withholding and value added taxes will also affect recognition of certain revenue for reimbursable tax amounts, recognition of the direct financing lease and amortization of deferred debt issuance cost, Hoegh LNG Partners said.

As a result of the identified accounting errors, Hoegh LNG Partners expects to report a material weakness in its internal control over financial reporting.

The Partnership added it is covered by Höegh LNG Holding for all non-budgeted, non-creditable Indonesian value added taxes and non-budgeted Indonesian withholding taxes, including any related impact on cash flow, arising out of such restatement.

If an indemnification payment is received from HLNG, the amount will be recorded as a contribution to equity, the company said.

Hoegh LNG Partners was formed by Norway’s Hoegh LNG to own, operate and acquire FSRUs , LNG carriers and other LNG infrastructure assets under long-term charters.

Höegh LNG : Putting FLNG activities on hold and allocating all resources to FSRUs

Published: 07:00 CET 16-02-2016 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") today announced its decision to put all FLNG activities on hold and to allocate all resources and capital to its core business; FSRUs, because this is where the Company sees the highest return on invested capital and the most promising market prospects.

The Company's decision is a consequence of the oversupplied LNG market and deteriorating energy and financial markets, which mean that investment decisions for new LNG production facilities, including the FLNG segment, will continue to be challenging for the foreseeable future.

However, the market conditions for FSRUs continue to be favourable driven by the strong growth in new LNG supplies at very competitive prices. The Company sees a high level of project activity for new FSRU projects, promoted by both LNG producers as well as LNG importers and downstream gas consumers.

Höegh LNG will not engage in further new FLNG developments, however, will complete its obligations towards existing FLNG customers. All FLNG employees will be transferred to the FSRU business. The Company has consequently decided to impair the book value of its FLNG assets for an amount of USD 37 million in the fourth quarter of 2015. These intangible assets are substantially all related to the offshore FLNG FPSO FEED study that the Company completed in 2009, prior to the IPO in 2011.

Furthermore, the strategic change is expected to lead to a reduction in annual net SG&A expenses of approximately USD 3 million going forward.

Sveinung J.S. Støhle, President & CEO of Höegh LNG, stated "given the overall market outlook for LNG and the current state of the financial markets, we believe focusing solely on FSRUs is financially and commercially the best strategy for Höegh LNG. We are fully committed to build on our position as the leading FSRU provider, and will take this opportunity to sharpen our focus and strengthen our FSRU team to ensure that we reach our ambition of growing our fleet to 12 FSRUs by 2019."

Höegh LNG signed on 1 December 2016 an FSRU contract with Quantum Power Ghana Gas Limited ("Quantum Power") for the Tema LNG import terminal located close to Accra in Ghana ("Tema LNG Project"). The Tema LNG Project is supported by the Ghana National Petroleum Corporation (GNPC), Ghana's national oil and gas company.

The contract is for a period of 20 years with a five year extension option for charterer and is expected to generate an average annual EBITDA of around USD 36 million. The contract is subject to Quantum Power obtaining necessary governmental approvals, financial close and both parties' board approval. The infrastructure construction for the project is planned to start mid 2017 and expected delivery time for the FSRU is 6 - 12 months following commencement of the construction work. The FSRU will be provided from Höegh LNG's portfolio of FSRUs, including units under construction, the planned conversion FSRU or planned newbuilding orders.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "We are delighted to have been awarded the contract with Quantum Power for their new LNG import terminal in Ghana, and look forward to completing the project together with our client. Our modern FSRU solutions offer our client the quickest, most cost efficient and flexible way of importing LNG. With this contract we have full contract coverage for our FSRU fleet."

Quantum Power's CEO, Matty Vengerik, said in a statement "We are delighted to partner with Höegh LNG to deploy this cost-efficient and clean fuel supply infrastructure solution to Ghana. This is the first such project to be implemented in sub-Saharan Africa. Höegh LNG's FSRU solution is a key service component of the natural gas delivery chain that will enable the execution of the Tema LNG Project as well as supplying the growing demand of natural gas in the Tema region and beyond. We expect the LNG import terminal to transform the reliability and competitiveness of the power generation and natural gas markets in Ghana and are looking forward to a long term relationship with Höegh LNG."

The contract is for a period of 20 years with a five year extension option for charterer and is expected to generate an average annual EBITDA of around USD 36 million. The contract is subject to Quantum Power obtaining necessary governmental approvals, financial close and both parties' board approval. The infrastructure construction for the project is planned to start mid 2017 and expected delivery time for the FSRU is 6 - 12 months following commencement of the construction work. The FSRU will be provided from Höegh LNG's portfolio of FSRUs, including units under construction, the planned conversion FSRU or planned newbuilding orders.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "We are delighted to have been awarded the contract with Quantum Power for their new LNG import terminal in Ghana, and look forward to completing the project together with our client. Our modern FSRU solutions offer our client the quickest, most cost efficient and flexible way of importing LNG. With this contract we have full contract coverage for our FSRU fleet."

Quantum Power's CEO, Matty Vengerik, said in a statement "We are delighted to partner with Höegh LNG to deploy this cost-efficient and clean fuel supply infrastructure solution to Ghana. This is the first such project to be implemented in sub-Saharan Africa. Höegh LNG's FSRU solution is a key service component of the natural gas delivery chain that will enable the execution of the Tema LNG Project as well as supplying the growing demand of natural gas in the Tema region and beyond. We expect the LNG import terminal to transform the reliability and competitiveness of the power generation and natural gas markets in Ghana and are looking forward to a long term relationship with Höegh LNG."

Published: 07:00 CET 07-12-2016 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Entering into agreement for its next series of FSRUs with Samsung Heavy Industries in South Korea

Hamilton, Bermuda, 7 December 2016 -

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") is pleased to announce that it has signed a Letter of Intent ("LOI") for one firm and three optional FSRUs at Samsung Heavy Industries (SHI) in South Korea.

The 170,000 m3 FSRUs have regasification capacity of 750 MMScf/day and full trading capabilities. The vessels have scheduled delivery dates of two units in 2019 and two units in 2020. Complete shipbuilding contract for the firm vessel is expected to be signed by mid-January 2017.

President and Chief Executive Officer Sveinung J.S. Støhle says in a comment: "Last week we secured a new FSRU employment contract, and today we follow up with the ordering of our next series of FSRU newbuildings, in line with our declared strategy. With this agreement with SHI, whose selection has been subject to a competitive international tender, Höegh LNG has taken advantage of a very favorable newbuilding market to position itself for further expansion in the FSRU segment."

Höegh LNG : Entering into agreement for its next series of FSRUs with Samsung Heavy Industries in South Korea

Hamilton, Bermuda, 7 December 2016 -

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") is pleased to announce that it has signed a Letter of Intent ("LOI") for one firm and three optional FSRUs at Samsung Heavy Industries (SHI) in South Korea.

The 170,000 m3 FSRUs have regasification capacity of 750 MMScf/day and full trading capabilities. The vessels have scheduled delivery dates of two units in 2019 and two units in 2020. Complete shipbuilding contract for the firm vessel is expected to be signed by mid-January 2017.

President and Chief Executive Officer Sveinung J.S. Støhle says in a comment: "Last week we secured a new FSRU employment contract, and today we follow up with the ordering of our next series of FSRU newbuildings, in line with our declared strategy. With this agreement with SHI, whose selection has been subject to a competitive international tender, Höegh LNG has taken advantage of a very favorable newbuilding market to position itself for further expansion in the FSRU segment."

Published: 16:35 CET 15-12-2016 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Signed 20 year FSRU charter agreement in Pakistan

Hamilton, Bermuda, 15 December 2016, Höegh LNG Holdings Ltd. today announced that Höegh LNG on 15 December 2016 signed an FSRU contract with Global Energy Infrastructure Limited ("GEIL") for GEIL's LNG import project in Port Qasim near Karachi, Pakistan. The project is the first private LNG import terminal in Pakistan and will be located at the LNG zone in Port Qasim. On 29 September 2016, GEIL signed a long-term LNG supply agreement with Qatargas.

The charter is for a period of 20 years with two five year extension options for charterer and is expected to generate an average annual EBITDA of around USD 36 million. The contract is subject to both parties' board approval. The construction of the terminal is planned to commence early 2017 and expected start-up is second quarter of 2018. The FSRU will be provided from Höegh LNG's portfolio of FSRUs, including units under construction, the planned conversion FSRU or from new FSRU's on order.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "We are delighted to have been awarded the contract with GEIL for their new LNG import terminal in Pakistan, and look forward to completing the project together with our client and the other partners. Our modern FSRU solutions offer our client the quickest, the most cost efficient and the flexible way of importing LNG. With this contract we have full contract coverage for our FSRU fleet of 9 units on the water and under construction."

GEIL's Group CEO, Mr. Ahmet Caliskan, stated that "We are delighted to conclude this 20-year agreement between GEIL and Höegh LNG. As the leading provider, we have full confidence in Höegh LNG's modern FSRUs and management capacity. In addition to this major milestone, we have already executed a 1.3 MTPA for 20 years LNG supply with Qatargas. Furthermore, we are near signing an additional 3 MPTA of LNG supply with two major LNG producers as well as nearing to sign the EPC contract for the facility. Being the first private LNG project in Pakistan, this terminal is a landmark energy investment, which will give gas purchasers the opportunity to access competitive long term gas supply from the world's safest and reliable LNG producers and will help to secure the nation's energy requirements."

Höegh LNG : Signed 20 year FSRU charter agreement in Pakistan

Hamilton, Bermuda, 15 December 2016, Höegh LNG Holdings Ltd. today announced that Höegh LNG on 15 December 2016 signed an FSRU contract with Global Energy Infrastructure Limited ("GEIL") for GEIL's LNG import project in Port Qasim near Karachi, Pakistan. The project is the first private LNG import terminal in Pakistan and will be located at the LNG zone in Port Qasim. On 29 September 2016, GEIL signed a long-term LNG supply agreement with Qatargas.

The charter is for a period of 20 years with two five year extension options for charterer and is expected to generate an average annual EBITDA of around USD 36 million. The contract is subject to both parties' board approval. The construction of the terminal is planned to commence early 2017 and expected start-up is second quarter of 2018. The FSRU will be provided from Höegh LNG's portfolio of FSRUs, including units under construction, the planned conversion FSRU or from new FSRU's on order.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "We are delighted to have been awarded the contract with GEIL for their new LNG import terminal in Pakistan, and look forward to completing the project together with our client and the other partners. Our modern FSRU solutions offer our client the quickest, the most cost efficient and the flexible way of importing LNG. With this contract we have full contract coverage for our FSRU fleet of 9 units on the water and under construction."

GEIL's Group CEO, Mr. Ahmet Caliskan, stated that "We are delighted to conclude this 20-year agreement between GEIL and Höegh LNG. As the leading provider, we have full confidence in Höegh LNG's modern FSRUs and management capacity. In addition to this major milestone, we have already executed a 1.3 MTPA for 20 years LNG supply with Qatargas. Furthermore, we are near signing an additional 3 MPTA of LNG supply with two major LNG producers as well as nearing to sign the EPC contract for the facility. Being the first private LNG project in Pakistan, this terminal is a landmark energy investment, which will give gas purchasers the opportunity to access competitive long term gas supply from the world's safest and reliable LNG producers and will help to secure the nation's energy requirements."

Published: 07:05 CET 18-01-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : New FSRU contract with HHI and contract allocation update

Hamilton, Bermuda, 18 January 2017 -

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") is pleased to announce that it has signed a new Shipbuilding Contract (SBC) with Hyundai Heavy Industries Co., Ltd. (HHI) for a new Floating Storage and Regasification Unit (FSRU) for delivery in Q4 2018 (FSRU #9). The FSRU will have a storage capacity of 170,000 m3 and a max regasification capacity of 1,000 MMscf/day and with full trading capabilities.

Reference is further made to the stock exchange notices in December 2016 where Höegh LNG reported it had signed two 20 years FSRU charters with each of Quantum Power ("QP") for the Tema LNG Project in Ghana and Global Energy Infrastructure Limited ("GEIL") for the LNG import project in Port Qasim near Karachi, Pakistan. Both projects have start-up in Q2 2018. (See stock exchange notices dated 1 and 15 December 2016, respectively.)

The Company has spent considerable efforts optimizing its FSRU portfolio, maximizing charter revenues from FSRUs under construction and reducing overall technical risks. The Company has therefore decided to allocate FSRU#7 (HHI HN 2552) to serve the QP charter in Ghana and to allocate FSRU #9 (HHI HN 2909) to the GEI charter in Pakistan. The initial period of the GEI charter from Q2 2018 will be covered by an interim FSRU from Höegh LNG's portfolio until the new FSRU is delivered.

The FSRU newbuilding program that the Company entered into with Samsung Heavy Industries Co., Ltd. (SHI) on 17 January 2017 for one firm (FSRU #10) plus three options is unaffected by the above allocation as the first delivery from SHI is scheduled for May 2019.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "First of all I am very pleased that Höegh LNG through its newbuilding program and market position has been able to establish a contract coverage solution which is in line with our strategy of building new FSRUs. Secondly, I am proud to see that through Höegh LNG's innovative approach and in-house design of our FSRUs coupled with our long-standing relationship with HHI, Höegh LNG has been able to secure a newbuilt FSRU in the shortest possible time. With this order, Höegh LNG now has 10 large size newbuilt FSRUs in operation or under construction, preserving our position as the market leader in the FSRU segment."

Höegh LNG : New FSRU contract with HHI and contract allocation update

Hamilton, Bermuda, 18 January 2017 -

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") is pleased to announce that it has signed a new Shipbuilding Contract (SBC) with Hyundai Heavy Industries Co., Ltd. (HHI) for a new Floating Storage and Regasification Unit (FSRU) for delivery in Q4 2018 (FSRU #9). The FSRU will have a storage capacity of 170,000 m3 and a max regasification capacity of 1,000 MMscf/day and with full trading capabilities.

Reference is further made to the stock exchange notices in December 2016 where Höegh LNG reported it had signed two 20 years FSRU charters with each of Quantum Power ("QP") for the Tema LNG Project in Ghana and Global Energy Infrastructure Limited ("GEIL") for the LNG import project in Port Qasim near Karachi, Pakistan. Both projects have start-up in Q2 2018. (See stock exchange notices dated 1 and 15 December 2016, respectively.)

The Company has spent considerable efforts optimizing its FSRU portfolio, maximizing charter revenues from FSRUs under construction and reducing overall technical risks. The Company has therefore decided to allocate FSRU#7 (HHI HN 2552) to serve the QP charter in Ghana and to allocate FSRU #9 (HHI HN 2909) to the GEI charter in Pakistan. The initial period of the GEI charter from Q2 2018 will be covered by an interim FSRU from Höegh LNG's portfolio until the new FSRU is delivered.

The FSRU newbuilding program that the Company entered into with Samsung Heavy Industries Co., Ltd. (SHI) on 17 January 2017 for one firm (FSRU #10) plus three options is unaffected by the above allocation as the first delivery from SHI is scheduled for May 2019.

Höegh LNG's President and Chief Executive Officer, Sveinung J. S. Støhle, said in a comment: "First of all I am very pleased that Höegh LNG through its newbuilding program and market position has been able to establish a contract coverage solution which is in line with our strategy of building new FSRUs. Secondly, I am proud to see that through Höegh LNG's innovative approach and in-house design of our FSRUs coupled with our long-standing relationship with HHI, Höegh LNG has been able to secure a newbuilt FSRU in the shortest possible time. With this order, Höegh LNG now has 10 large size newbuilt FSRUs in operation or under construction, preserving our position as the market leader in the FSRU segment."

Published: 09:00 CET 19-01-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG - Contemplating issuing unsecured bonds

Hamilton, Bermuda 19 January 2017 - Höegh LNG Holdings Ltd. is contemplating the issuance of senior unsecured bonds in the Norwegian bond market with maturity in February 2022.

The net proceeds from the contemplated bond issue shall be used for the part refinancing of the bond issue with ticker HLNG01 (ISIN: NO001066095.4) and general corporate purposes.

Danske Bank Markets, DNB Markets and Nordea are engaged as joint lead managers for the bond issue.

Höegh LNG - Contemplating issuing unsecured bonds

Hamilton, Bermuda 19 January 2017 - Höegh LNG Holdings Ltd. is contemplating the issuance of senior unsecured bonds in the Norwegian bond market with maturity in February 2022.

The net proceeds from the contemplated bond issue shall be used for the part refinancing of the bond issue with ticker HLNG01 (ISIN: NO001066095.4) and general corporate purposes.

Danske Bank Markets, DNB Markets and Nordea are engaged as joint lead managers for the bond issue.

Antwort auf Beitrag Nr.: 54.115.907 von R-BgO am 19.01.17 10:12:38Published: 16:18 CET 19-01-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG - Successful placement of new unsecured bonds

Hamilton, Bermuda, 19 January 2017 -

Reference is made to the notification sent earlier today regarding a potential bond issue by Höegh LNG Holdings Ltd. ("HLNG"). HLNG has successfully completed a new senior unsecured bond issue of NOK 1,500 million in the Nordic bond market with maturity date 1 February 2022. The bond issue was substantially oversubscribed and will be swapped from floating 3M NIBOR to fixed USD interest rate.

The net proceeds from the contemplated bond issue shall be used for the part refinancing of the bond issue with ticker HLNG01 (ISIN: NO001066095.4) and general corporate purposes. An application will be made for the bonds to be listed on Oslo Børs.

Danske Bank Markets, DNB Markets and Nordea Markets acted as joint lead managers for the bond issue.

Höegh LNG - Successful placement of new unsecured bonds

Hamilton, Bermuda, 19 January 2017 -

Reference is made to the notification sent earlier today regarding a potential bond issue by Höegh LNG Holdings Ltd. ("HLNG"). HLNG has successfully completed a new senior unsecured bond issue of NOK 1,500 million in the Nordic bond market with maturity date 1 February 2022. The bond issue was substantially oversubscribed and will be swapped from floating 3M NIBOR to fixed USD interest rate.

The net proceeds from the contemplated bond issue shall be used for the part refinancing of the bond issue with ticker HLNG01 (ISIN: NO001066095.4) and general corporate purposes. An application will be made for the bonds to be listed on Oslo Børs.

Danske Bank Markets, DNB Markets and Nordea Markets acted as joint lead managers for the bond issue.

Published: 12:12 CET 07-02-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Höegh LNG Joins a Leading Consortium to Advance an LNG Import Project in Pakistan

Hamilton, Bermuda, 7 February 2017 -

Qatar Petroleum (QP), Total, Mitsubishi, ExxonMobil, and Höegh LNG today announced their commitment to advance a liquefied natural gas (LNG) import project in Pakistan in collaboration with Global Energy Infrastructure Limited (GEIL).

The Consortium will seek to develop a project that includes a Floating Storage and Regasification Unit (FSRU), a jetty and a pipeline to shore to provide a timely and reliable natural gas supply to Pakistan. The FSRU will have a minimum regasification capacity of 750 million cubic feet per day by 2018.

Commenting on this occasion, Mr. Saad Sherida Al-Kaabi, President and CEO of Qatar Petroleum said: "This Consortium will bring together partners with a proven track record of industry-leading performance and a history of delivering projects on time and on budget, while focusing on environmental stewardship."

"Forming this Consortium with Total, Mitsubishi, ExxonMobil and Höegh LNG represents a significant milestone that complements Pakistan's successful effort to meet the growing demand for clean-burning natural gas in this important market. Qatar Petroleum is proud to partner with these distinguished companies to help meet Pakistan's energy needs," Mr. Al-Kaabi concluded.

Pakistan has a large demand for natural gas and a well-established gas market and distribution system.

The companies forming the Consortium are global leaders in producing, shipping and marketing LNG with a strong track record of delivering on project execution in a very competitive global LNG market.

Natural gas is a cost-competitive fuel and can deliver significant environmental benefits. This project has the potential to deliver substantial, reliable natural gas supplies to the public and private sectors in Pakistan. The FSRU has been committed with Höegh LNG, and the consortium is promptly advancing through the necessary technical and commercial milestones.

Höegh LNG : Höegh LNG Joins a Leading Consortium to Advance an LNG Import Project in Pakistan

Hamilton, Bermuda, 7 February 2017 -

Qatar Petroleum (QP), Total, Mitsubishi, ExxonMobil, and Höegh LNG today announced their commitment to advance a liquefied natural gas (LNG) import project in Pakistan in collaboration with Global Energy Infrastructure Limited (GEIL).

The Consortium will seek to develop a project that includes a Floating Storage and Regasification Unit (FSRU), a jetty and a pipeline to shore to provide a timely and reliable natural gas supply to Pakistan. The FSRU will have a minimum regasification capacity of 750 million cubic feet per day by 2018.

Commenting on this occasion, Mr. Saad Sherida Al-Kaabi, President and CEO of Qatar Petroleum said: "This Consortium will bring together partners with a proven track record of industry-leading performance and a history of delivering projects on time and on budget, while focusing on environmental stewardship."

"Forming this Consortium with Total, Mitsubishi, ExxonMobil and Höegh LNG represents a significant milestone that complements Pakistan's successful effort to meet the growing demand for clean-burning natural gas in this important market. Qatar Petroleum is proud to partner with these distinguished companies to help meet Pakistan's energy needs," Mr. Al-Kaabi concluded.

Pakistan has a large demand for natural gas and a well-established gas market and distribution system.

The companies forming the Consortium are global leaders in producing, shipping and marketing LNG with a strong track record of delivering on project execution in a very competitive global LNG market.

Natural gas is a cost-competitive fuel and can deliver significant environmental benefits. This project has the potential to deliver substantial, reliable natural gas supplies to the public and private sectors in Pakistan. The FSRU has been committed with Höegh LNG, and the consortium is promptly advancing through the necessary technical and commercial milestones.

Zahlen kamen heute, Divi +25%;

habe mit Kauf in Oslo versechsfacht

habe mit Kauf in Oslo versechsfacht

Published: 13:51 CEST 18-07-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Nakilat and Höegh LNG sign MoU to collaborate on FSRU projects

Hamilton, Bermuda, 18 July 2017 -

Nakilat and Höegh LNG sign MoU to collaborate on FSRU projects

Höegh LNG today signed a Memorandum of Understanding (MoU) with Nakilat, exploring collaboration for Floating Storage and Regasification Unit (FSRU) business.

FSRU is the leading-edge technology for the liquefied natural gas (LNG) market. It is essentially a floating LNG import terminal, this technology has become a strategic solution for countries without LNG receiving terminal infrastructure, enabling better accessibility of clean energy. Among the significant benefits of FSRU are the ability to serve attractive markets which would otherwise not be able to utilize natural gas, pose lesser transportation risks and have the flexibility to be relocated or used as an LNG carrier.

Nakilat's Managing Director Eng. Abdullah Al-Sulaiti said, "Nakilat views this strategic alliance with Höegh LNG, a leading owner and operator of FSRUs, as a huge stepping stone for further growth. This agreement paves the way for greater business opportunities to create substantial platforms for local players to get involved in the project, exposing them to innovative technologies and expertise that would be beneficial to their growth and the development of Qatar's energy and maritime industry. Nakilat is always looking at opportunities of diversifying solutions to deliver clean energy worldwide, supporting the rising global demand of LNG."

Mr Sveinung J.S. Støhle, President and CEO of Höegh LNG said, "We are pleased and very proud to be partnering with Nakilat, the largest LNG carrier company and look forward to jointly contribute to expanding the global market for LNG. The alliance with Nakilat is a confirmation of Höegh LNG's leading position in the FSRU market and offers the opportunity to further accelerate our market presence beyond the projects we undertake on a sole basis."

Höegh LNG : Nakilat and Höegh LNG sign MoU to collaborate on FSRU projects

Hamilton, Bermuda, 18 July 2017 -

Nakilat and Höegh LNG sign MoU to collaborate on FSRU projects

Höegh LNG today signed a Memorandum of Understanding (MoU) with Nakilat, exploring collaboration for Floating Storage and Regasification Unit (FSRU) business.

FSRU is the leading-edge technology for the liquefied natural gas (LNG) market. It is essentially a floating LNG import terminal, this technology has become a strategic solution for countries without LNG receiving terminal infrastructure, enabling better accessibility of clean energy. Among the significant benefits of FSRU are the ability to serve attractive markets which would otherwise not be able to utilize natural gas, pose lesser transportation risks and have the flexibility to be relocated or used as an LNG carrier.

Nakilat's Managing Director Eng. Abdullah Al-Sulaiti said, "Nakilat views this strategic alliance with Höegh LNG, a leading owner and operator of FSRUs, as a huge stepping stone for further growth. This agreement paves the way for greater business opportunities to create substantial platforms for local players to get involved in the project, exposing them to innovative technologies and expertise that would be beneficial to their growth and the development of Qatar's energy and maritime industry. Nakilat is always looking at opportunities of diversifying solutions to deliver clean energy worldwide, supporting the rising global demand of LNG."

Mr Sveinung J.S. Støhle, President and CEO of Höegh LNG said, "We are pleased and very proud to be partnering with Nakilat, the largest LNG carrier company and look forward to jointly contribute to expanding the global market for LNG. The alliance with Nakilat is a confirmation of Höegh LNG's leading position in the FSRU market and offers the opportunity to further accelerate our market presence beyond the projects we undertake on a sole basis."

Published: 08:43 CEST 24-07-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Secures debt financing for FSRU#8

Hamilton, Bermuda, 24 July 2017 -

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") has received commitment letters for a USD 230 million debt financing for FSRU#8 (the "Facility"). The Facility comprises a 12 year export credit agency ("ECA") term loan of up to USD 150 million backed by Garantiinstituttet for Eksportkreditt ("GIEK") and Eksportkreditt of Norway, and a 5 year non-amortising commercial bank loan of up to USD 80 million funded by ABN AMRO Bank, Danske Bank, Nordea and Swedbank.

The Facility is available to fund 65% of the delivered cost of the FSRU with no employment requirement, increasing to 75% upon securing long-term employment. The interest rate will be swapped from floating to fixed, and at the current market conditions the fixed interest rate is expected to come in at around 4.1%. The Facility is subject to final documentation.

Sveinung J.S. Støhle, President & CEO of Höegh LNG, stated: "With this transaction, Höegh LNG is executing on its financial strategy of diversifying funding sources, while obtaining a flexible and competitive debt financing structure that supports the Company's growth strategy. The favourable financing terms reflects Höegh LNG's strong balance sheet and track-record in securing and operating long-term FSRU contracts. We are very pleased with the excellent support we get from the leading ECAs and banks participating in this transaction."

Höegh LNG : Secures debt financing for FSRU#8

Hamilton, Bermuda, 24 July 2017 -

Höegh LNG Holdings Ltd. ("Höegh LNG" or the "Company") has received commitment letters for a USD 230 million debt financing for FSRU#8 (the "Facility"). The Facility comprises a 12 year export credit agency ("ECA") term loan of up to USD 150 million backed by Garantiinstituttet for Eksportkreditt ("GIEK") and Eksportkreditt of Norway, and a 5 year non-amortising commercial bank loan of up to USD 80 million funded by ABN AMRO Bank, Danske Bank, Nordea and Swedbank.

The Facility is available to fund 65% of the delivered cost of the FSRU with no employment requirement, increasing to 75% upon securing long-term employment. The interest rate will be swapped from floating to fixed, and at the current market conditions the fixed interest rate is expected to come in at around 4.1%. The Facility is subject to final documentation.

Sveinung J.S. Støhle, President & CEO of Höegh LNG, stated: "With this transaction, Höegh LNG is executing on its financial strategy of diversifying funding sources, while obtaining a flexible and competitive debt financing structure that supports the Company's growth strategy. The favourable financing terms reflects Höegh LNG's strong balance sheet and track-record in securing and operating long-term FSRU contracts. We are very pleased with the excellent support we get from the leading ECAs and banks participating in this transaction."

Drewry: FSRUs fetch higher returns than LNG carriers

http://www.lngworldnews.com/drewry-fsrus-fetch-higher-return…

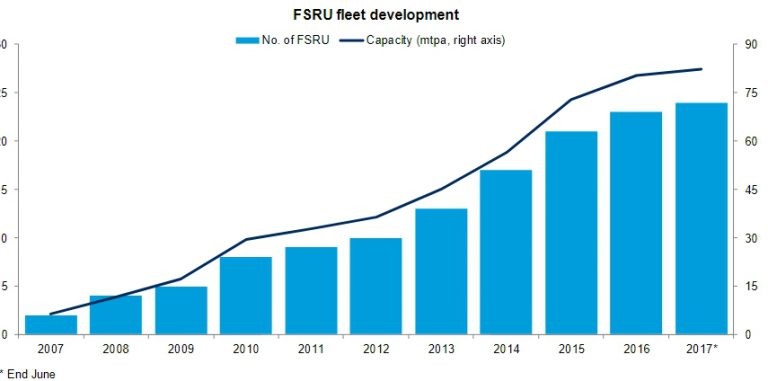

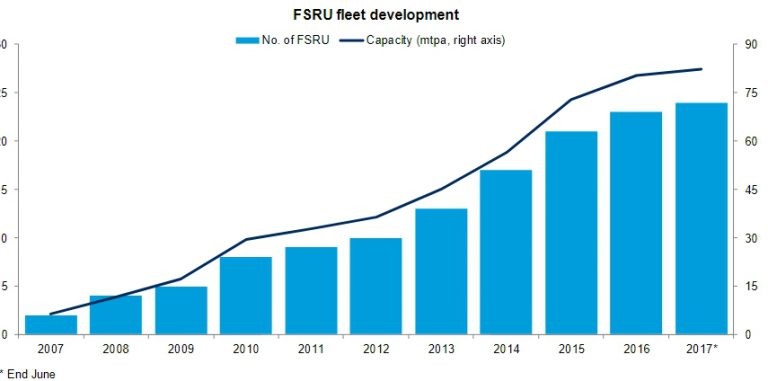

Despite falling freight rates for FSRUs, investment returns at current asset prices and charter rates are higher compared with standard LNG vessels, according to the global shipping consultancy Drewry.

The global floating storage and regasification unit fleet has grown at an annual growth rate of 21 percent over the last five years, and currently, there are 24 FSRUs operational with an aggregate LNG import capacity of 82 mtpa.

An additional 74 mtpa FSRU import capacity is under construction or in the planning stage.

“FSRUs are attractive because of various advantages they have over land-based terminals, such as low cost, quick commencement and flexibility,” Drewry said.

However, of late rates for FSRUs have come under pressure and are currently around $100,000/d, markedly lower than $120,000-130,000/d in 2013-15.

Drewry notes there are a number of reasons for this, first being the growing number of players in the FSRU segment, which is creating competition.

Other reasons are the falling asset prices of FSRU’s making it possible to charter out vessels at lower rates, while further pressure on charter rates is being put by older LNG vessels looking for an FSRU conversion.

Despite falling rates, owning an FSRU gives a better return than an LNG vessel.

Drewry has calculated the rate of return on a newbuild FSRU to be 16 percent that currently costs $250 million and earns a long-term (20 years) charter rate of $100,000/d.

Meanwhile, the rate of return on a newbuild standard LNG vessel is just 13 percent that currently costs $185 million and earns a long-term charter rate of $70,000/d.

“Therefore, despite falling charter rates, FSRUs are proving to be a better investment option than standard LNG carriers,” Drewry said.

“We expect long-term charter rates for LNG carriers to improve in the coming years as the market is expected to tighten. However, we do not believe that charter rates for FSRUs will significantly change because of increasing competition and a growing understanding of FSRU technology,” Drewry’s Shrest Sharma said.

Drewry expects charter rates for FSRUs to stay in the range of $90,000-$100,000/d for the next three to four years, still higher than equivalent LNG charter rates.

http://www.lngworldnews.com/drewry-fsrus-fetch-higher-return…

Despite falling freight rates for FSRUs, investment returns at current asset prices and charter rates are higher compared with standard LNG vessels, according to the global shipping consultancy Drewry.

The global floating storage and regasification unit fleet has grown at an annual growth rate of 21 percent over the last five years, and currently, there are 24 FSRUs operational with an aggregate LNG import capacity of 82 mtpa.

An additional 74 mtpa FSRU import capacity is under construction or in the planning stage.

“FSRUs are attractive because of various advantages they have over land-based terminals, such as low cost, quick commencement and flexibility,” Drewry said.

However, of late rates for FSRUs have come under pressure and are currently around $100,000/d, markedly lower than $120,000-130,000/d in 2013-15.

Drewry notes there are a number of reasons for this, first being the growing number of players in the FSRU segment, which is creating competition.

Other reasons are the falling asset prices of FSRU’s making it possible to charter out vessels at lower rates, while further pressure on charter rates is being put by older LNG vessels looking for an FSRU conversion.

Despite falling rates, owning an FSRU gives a better return than an LNG vessel.

Drewry has calculated the rate of return on a newbuild FSRU to be 16 percent that currently costs $250 million and earns a long-term (20 years) charter rate of $100,000/d.

Meanwhile, the rate of return on a newbuild standard LNG vessel is just 13 percent that currently costs $185 million and earns a long-term charter rate of $70,000/d.

“Therefore, despite falling charter rates, FSRUs are proving to be a better investment option than standard LNG carriers,” Drewry said.

“We expect long-term charter rates for LNG carriers to improve in the coming years as the market is expected to tighten. However, we do not believe that charter rates for FSRUs will significantly change because of increasing competition and a growing understanding of FSRU technology,” Drewry’s Shrest Sharma said.

Drewry expects charter rates for FSRUs to stay in the range of $90,000-$100,000/d for the next three to four years, still higher than equivalent LNG charter rates.

Antwort auf Beitrag Nr.: 54.430.028 von R-BgO am 28.02.17 14:59:53weiter verbilligt

Antwort auf Beitrag Nr.: 56.109.278 von R-BgO am 06.11.17 11:34:27

Warum ist denn die Holding so runtergekommen seit September?

Ich hatte auf die Partners (HMLP) geschielt. Divi gut 9%.

Zitat von R-BgO: weiter verbilligt

Warum ist denn die Holding so runtergekommen seit September?

Ich hatte auf die Partners (HMLP) geschielt. Divi gut 9%.

Antwort auf Beitrag Nr.: 56.162.678 von mge am 11.11.17 23:47:19ich weiß es auch nicht...

=============================================================

Published: 07:00 CET 16-11-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Agreement to transfer the remaining 49% interest in Höegh Grace to Höegh LNG Partners LP

Hamilton, Bermuda, 16 November 2017 -

Höegh LNG Holdings Ltd. ("Höegh LNG") today announced an agreement to transfer the remaining 49% ownership interest in Höegh LNG Colombia Holding Ltd. ("Grace Holding"), the sole owner of the entities that own and operate Höegh Grace, to Höegh LNG Partners LP ("HMLP") for a purchase price of USD 172.5 million, less USD 86.6 million in pro-rata indebtedness related to Höegh Grace expected to be outstanding at the closing date of the transaction. HMLP intends to settle the purchase price with a combination of cash at hand and a drawing under its revolving credit facility granted by Höegh LNG. The purchase price will be subject to certain post-closing adjustments for net working capital.

HMLP purchased the initial 51% ownership interest in Grace Holding in January 2017.

The transaction has been approved by the Board of Directors of Höegh LNG, the Board of Directors of HMLP and HMLP's Conflicts Committee. The transaction is expected to be completed by the beginning of January 2018, subject to customary closing conditions.

Sveinung J.S. Støhle, President and CEO of Höegh LNG, stated "We are delighted to have reached an agreement with HMLP for the third drop-down to the MLP. Funded by a well-received offering of HMLP's perpetual preferred equity earlier this autumn, the transaction demonstrates Höegh LNG's diversified capital markets access. With a leading position in the FSRU market, Höegh LNG remains committed to provide HMLP with further growth opportunities through accretive drop-downs of FSRUs on long-term contracts."

=============================================================

Published: 07:00 CET 16-11-2017 /GlobeNewswire /Source: Höegh LNG / : HLNG /ISIN: BMG454221059

Höegh LNG : Agreement to transfer the remaining 49% interest in Höegh Grace to Höegh LNG Partners LP

Hamilton, Bermuda, 16 November 2017 -

Höegh LNG Holdings Ltd. ("Höegh LNG") today announced an agreement to transfer the remaining 49% ownership interest in Höegh LNG Colombia Holding Ltd. ("Grace Holding"), the sole owner of the entities that own and operate Höegh Grace, to Höegh LNG Partners LP ("HMLP") for a purchase price of USD 172.5 million, less USD 86.6 million in pro-rata indebtedness related to Höegh Grace expected to be outstanding at the closing date of the transaction. HMLP intends to settle the purchase price with a combination of cash at hand and a drawing under its revolving credit facility granted by Höegh LNG. The purchase price will be subject to certain post-closing adjustments for net working capital.

HMLP purchased the initial 51% ownership interest in Grace Holding in January 2017.

The transaction has been approved by the Board of Directors of Höegh LNG, the Board of Directors of HMLP and HMLP's Conflicts Committee. The transaction is expected to be completed by the beginning of January 2018, subject to customary closing conditions.

Sveinung J.S. Støhle, President and CEO of Höegh LNG, stated "We are delighted to have reached an agreement with HMLP for the third drop-down to the MLP. Funded by a well-received offering of HMLP's perpetual preferred equity earlier this autumn, the transaction demonstrates Höegh LNG's diversified capital markets access. With a leading position in the FSRU market, Höegh LNG remains committed to provide HMLP with further growth opportunities through accretive drop-downs of FSRUs on long-term contracts."

Antwort auf Beitrag Nr.: 56.162.678 von mge am 11.11.17 23:47:19vielleicht deswegen?:

Pakistan FSRU consortium dissolves

The consortium between Höegh LNG, Qatar Petroleum, Total, Mitsubishi and ExxonMobil formed to advance an LNG import project in Pakistan has been dissolved.

“The consortium has spent considerable time and resources on finding its final form and structure,” Höegh LNG said on Thursday, adding that by mid-November no agreement with Global Energy Infrastructure could be found which led to the subsequent dissolution of the consortium, that was formed in February.

Prior to forming the consortium, in December 2016, Höegh LNG signed a 20-year FSRU contract with Global Energy Infrastructure, which among other was conditional on GEI putting in place the associated infrastructure required to connect the FSRU to the domestic pipeline grid.

The confirmation of the dissolution follows earlier reports that ExxonMobil had already given up on the project and set its sights on a rival development.

Höegh LNG said that due to the withdrawal of LNG sellers from the consortium, and the delays to the original start-up date for the project, the company is evaluating its options in regard to the FSRU agreement it has signed with GEI.