Tinka resources (Seite 31)

eröffnet am 25.07.14 06:04:06 von

neuester Beitrag 17.06.22 15:52:16 von

neuester Beitrag 17.06.22 15:52:16 von

Beiträge: 541

ID: 1.196.712

ID: 1.196.712

Aufrufe heute: 0

Gesamt: 30.725

Gesamt: 30.725

Aktive User: 0

ISIN: CA8875221001 · WKN: A0B884 · Symbol: TK

0,1400

CAD

0,00 %

0,0000 CAD

Letzter Kurs 18.04.24 TSX Venture

Neuigkeiten

15.04.24 · Accesswire |

14.03.24 · Accesswire |

28.02.24 · Accesswire |

14.12.23 · Accesswire |

17.08.23 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 31,90 | +18,10 | |

| 0,8000 | +17,65 | |

| 0,5500 | +14,61 | |

| 0,8200 | +12,33 | |

| 11,420 | +11,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2100 | -7,63 | |

| 2,1800 | -9,17 | |

| 69,01 | -9,53 | |

| 4,2300 | -17,86 | |

| 47,85 | -97,99 |

Beitrag zu dieser Diskussion schreiben

Sentient IV acquires common shares of Tinka Resources Limited

MONTREAL, April 28, 2017 /CNW Telbec/ - Sentient Executive GP IV, Limited ("Sentient IV") announces that it has acquired control over 6,000,000 common shares (the "Purchased Shares") of Tinka Resources Limited ("Tinka") by private agreement at a price of $0.6565 per Purchased Share. The Purchased Shares, together with common shares of Tinka acquired since November 7, 2016, represent approximately 4.03% of the outstanding common shares of Tinka (the "Tinka Shares").

Prior to the acquisition of the Purchased Shares, Sentient IV had control over 45,867,893 Tinka Shares (representing approximately 22.19% of the then outstanding Tinka Shares) and the right to acquire 6,976,744 Tinka Shares through 6,976,744 common share purchase warrants issued by Tinka (the "Tinka Warrants"). In the event all of the Tinka Warrants are fully exercised, Sentient IV would acquire control over a maximum of 52,844,637 Tinka Shares (including the 45,867,893 Tinka Shares over which Sentient IV has control). These combined holdings would represent approximately 24.73% of the then outstanding Tinka Shares, calculated on a partially diluted basis assuming the full exercise of the Tinka Warrants held by Sentient IV only.

Immediately after the acquisition of the Purchased Shares, Sentient IV has control over 51,867,893 Tinka Shares (representing approximately 24.38% of the outstanding Tinka Shares) and the right to acquire 6,976,744 Tinka Shares through the Tinka Warrants. In the event all of the Tinka Warrants are fully exercised, Sentient IV would acquire control over a maximum of 58,844,637 Tinka Shares (including the 51,867,893 Tinka Shares over which Sentient IV has control). These combined holdings would represent approximately 26.78% of the outstanding Tinka Shares, calculated on a partially diluted basis assuming the full exercise of the Tinka Warrants held by Sentient IV only.

Sentient IV acquired the Purchased Shares for investment purposes only and not with a view to materially affecting control of Tinka... .

http://www.newswire.ca/news-releases/sentient-iv-acquires-co…

MONTREAL, April 28, 2017 /CNW Telbec/ - Sentient Executive GP IV, Limited ("Sentient IV") announces that it has acquired control over 6,000,000 common shares (the "Purchased Shares") of Tinka Resources Limited ("Tinka") by private agreement at a price of $0.6565 per Purchased Share. The Purchased Shares, together with common shares of Tinka acquired since November 7, 2016, represent approximately 4.03% of the outstanding common shares of Tinka (the "Tinka Shares").

Prior to the acquisition of the Purchased Shares, Sentient IV had control over 45,867,893 Tinka Shares (representing approximately 22.19% of the then outstanding Tinka Shares) and the right to acquire 6,976,744 Tinka Shares through 6,976,744 common share purchase warrants issued by Tinka (the "Tinka Warrants"). In the event all of the Tinka Warrants are fully exercised, Sentient IV would acquire control over a maximum of 52,844,637 Tinka Shares (including the 45,867,893 Tinka Shares over which Sentient IV has control). These combined holdings would represent approximately 24.73% of the then outstanding Tinka Shares, calculated on a partially diluted basis assuming the full exercise of the Tinka Warrants held by Sentient IV only.

Immediately after the acquisition of the Purchased Shares, Sentient IV has control over 51,867,893 Tinka Shares (representing approximately 24.38% of the outstanding Tinka Shares) and the right to acquire 6,976,744 Tinka Shares through the Tinka Warrants. In the event all of the Tinka Warrants are fully exercised, Sentient IV would acquire control over a maximum of 58,844,637 Tinka Shares (including the 51,867,893 Tinka Shares over which Sentient IV has control). These combined holdings would represent approximately 26.78% of the outstanding Tinka Shares, calculated on a partially diluted basis assuming the full exercise of the Tinka Warrants held by Sentient IV only.

Sentient IV acquired the Purchased Shares for investment purposes only and not with a view to materially affecting control of Tinka... .

http://www.newswire.ca/news-releases/sentient-iv-acquires-co…

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Nach meinen bescheidenen Fährigkeiten der Charttechnik, kann der Kurs in den kommenden Tagen durchaus wieder steigen. Jetzt müssen nur noch die kommenden Bohrergebnisse stimmen, dann gehts wieder ab!

Doug Beattie MODULE 7- ZINC MINING IN PERU.

Man beachte die Aufzeichnungen stammen aus dem JAhr 2016 (!).

https://www.docdroid.net/IYhDszm/module-7-zinc-mining-in-per…

In seinem Bericht auch Tinka. S. 40-42

Man beachte die Aufzeichnungen stammen aus dem JAhr 2016 (!).

https://www.docdroid.net/IYhDszm/module-7-zinc-mining-in-per…

In seinem Bericht auch Tinka. S. 40-42

Antwort auf Beitrag Nr.: 54.714.060 von trobs am 11.04.17 07:05:51

Und es kommt noch besser!! Nachdem sie dort Michael Ballanger alias MarkITorpedo gesperrt hatten, tauchte wenige Stunden später ein Typ auf, der den gleichen Mist verzapft, diesmal aber unter dem Namen Zipperhead! Den meisten war natürlich direkt klar was gespielt wird, nur ein dummer deutscher User (Hallo Hochtief ) bekam natürlich gar nix gebacken und fiel auf den Mist rein!

) bekam natürlich gar nix gebacken und fiel auf den Mist rein!

Auf jeden Fall Michael Ballanger alias MarkITorpedo alias Zipperhead UND alle "drei" sind nun gesperrt

Zitat von trobs: MarkITorpedo is Michael Ballanger (UPDATED)

I'd just like to thank Tommy Humphreys for tipping me off that the basher trying his very hardest to get people to sell their shares of Tinka Resources over at CEO.ca is none other than Michael Ballanger, the guy who used to consult for Tinka but was fired by the company last year for being a twat. Sour grapes, Mikey?

UPDATE: It's a measure of the absolute intellectual dumbassery of this abject idiot Ballanger that he thought he could be anonymous on the internet. You have to wonder what century these faded heroes think they're living in.

UPDATE 2: A wonderful, face-saving, lawyer-dodging lie from Tommy H:

![]()

... Why the two-faced Giustra fellator Humphreys should decide to dox Ballanger and then just hours later go back on his word is an issue you should take up with his paymaster Frankie, not IKN.

Und es kommt noch besser!! Nachdem sie dort Michael Ballanger alias MarkITorpedo gesperrt hatten, tauchte wenige Stunden später ein Typ auf, der den gleichen Mist verzapft, diesmal aber unter dem Namen Zipperhead! Den meisten war natürlich direkt klar was gespielt wird, nur ein dummer deutscher User (Hallo Hochtief

) bekam natürlich gar nix gebacken und fiel auf den Mist rein!

) bekam natürlich gar nix gebacken und fiel auf den Mist rein!Auf jeden Fall Michael Ballanger alias MarkITorpedo alias Zipperhead UND alle "drei" sind nun gesperrt

Doug Beattie hat nochmal zugeschlagen:

@ocotilloredux I am not sure what sort of crown pillar Trevali left at surface but the mining commenced very close to it. They are currently mining down around 250-300 m depth now moving downwards about 75 m a year so will be mining deeper than Tinka's deposits shortly and at grades much less than the West Zone. The original mine from St. Joe's days is mined out to almost 500 m depth but they will likely ramp across from Magistral to get at this ore since they will be getting desperate in a few years time for feed. So Santander's resources will be looking like a sick cousin to Tinka in five years time due to the 4-5 km haul up the ramp to surface. Operating costs last year, according to the recent NI 43-101 were $US47.50/t. Cerro Lindo is less than $US30/t. With the top of ore at Tinka in the ~125 m depth range, this is as easy peasy as it comes for bulk ramp mining. Very similar to Cerro Lindo but twice the zinc grade (no 0.8% copper kicker mind you) and definitely not the potential economies of scale (yet). But Votorantim (Milpo) has a handful of smelters in South America that will be running low on internal feed in the next 10-15 years so I hope they see the wisdom of making a move here. As I disclosed a week or two ago, I sold most of my position in the low 70's but like a few here, we are looking for re-entry points.

@ceo.ca

@ocotilloredux I am not sure what sort of crown pillar Trevali left at surface but the mining commenced very close to it. They are currently mining down around 250-300 m depth now moving downwards about 75 m a year so will be mining deeper than Tinka's deposits shortly and at grades much less than the West Zone. The original mine from St. Joe's days is mined out to almost 500 m depth but they will likely ramp across from Magistral to get at this ore since they will be getting desperate in a few years time for feed. So Santander's resources will be looking like a sick cousin to Tinka in five years time due to the 4-5 km haul up the ramp to surface. Operating costs last year, according to the recent NI 43-101 were $US47.50/t. Cerro Lindo is less than $US30/t. With the top of ore at Tinka in the ~125 m depth range, this is as easy peasy as it comes for bulk ramp mining. Very similar to Cerro Lindo but twice the zinc grade (no 0.8% copper kicker mind you) and definitely not the potential economies of scale (yet). But Votorantim (Milpo) has a handful of smelters in South America that will be running low on internal feed in the next 10-15 years so I hope they see the wisdom of making a move here. As I disclosed a week or two ago, I sold most of my position in the low 70's but like a few here, we are looking for re-entry points.

@ceo.ca

Zinc Market Outlook

...

Summarizing the information in the chart above, we have seen a decline of 8.1% in mined zinc production during the past 3 years, and announced new 2016 mine closures and production cutbacks of another 6.4% of 2014 zinc output. Mine closures since 2013 have already impacted the supply/demand balance for zinc as evidenced by the significant reduction of warehoused zinc reported by the London Metals Exchange (LME-see graph below). During the past three years, surplus zinc stored within the LME has dropped from 1,250,000 to 445,000 tonnes, or 65%. Several commodity analysts forecast that the LME warehouse stocks will continue to decline and that the LME warehouse stockpile could drop to a dangerously low level below 200,000 tonnes by the end of 2016. Such a significant decline could be the catalyst to a significant increase in zinc price.

Another issue impacting current and future zinc production is that the average grade of zinc mines has fallen from approximately 7% in 2000 to about 5% in 2014, or nearly a 30% decline in the quality of mined ore on a worldwide basis. Mining these lower grade zinc ores requires a higher zinc price to ensure profitability.

http://www.solitarioresources.com/zinc.php

...

Summarizing the information in the chart above, we have seen a decline of 8.1% in mined zinc production during the past 3 years, and announced new 2016 mine closures and production cutbacks of another 6.4% of 2014 zinc output. Mine closures since 2013 have already impacted the supply/demand balance for zinc as evidenced by the significant reduction of warehoused zinc reported by the London Metals Exchange (LME-see graph below). During the past three years, surplus zinc stored within the LME has dropped from 1,250,000 to 445,000 tonnes, or 65%. Several commodity analysts forecast that the LME warehouse stocks will continue to decline and that the LME warehouse stockpile could drop to a dangerously low level below 200,000 tonnes by the end of 2016. Such a significant decline could be the catalyst to a significant increase in zinc price.

Another issue impacting current and future zinc production is that the average grade of zinc mines has fallen from approximately 7% in 2000 to about 5% in 2014, or nearly a 30% decline in the quality of mined ore on a worldwide basis. Mining these lower grade zinc ores requires a higher zinc price to ensure profitability.

http://www.solitarioresources.com/zinc.php

Antwort auf Beitrag Nr.: 54.756.517 von Popeye82 am 19.04.17 02:35:15

_________________________________________________________________

"Zusammenfassung und Schlussfolgerung Studien über den Rohstoffbedarf für Zukunftstechnologien geben wertvolle Hinweise auf mögliche Bedarfsänderungen bei mineralischen Rohstoffen. Besonders hohe Nachfragezuwächse wurden in einer Studie von ANGERER et al. (2009) für Gallium, Indium, Scandium, Germanium, Neodym und Tantal ermittelt. Für diese Elektronikmetalle legt die BGR hiermit eine erste Einschätzung des Lagerstättenpotenzials und der Verfügbarkeit bis 2030 vor (s. Tab. 5). Das Ergebnis der Untersuchungen legt nahe, dass für Indium, Scandium und Tantal auch bei stark zunehmender Nachfrage keine Versorgungsengpässe zu erwarten sind."

Sorry, aber ich verstehe deine Frage gerade nicht recht. Beantwortest du mitsamt deines Auszuges nicht selbst meine Behauptung?

@ max: entschuldige die verwirrung. wollte den popeye zitieren.

Zitat von Popeye82: es spricht jedoch fundamental nicht viel für indium, da es anscheinend in hülle und fülle als beiprodukt fast überall auf der welt gefördert und aufbereitet wird

______________________________________________________________________

Frage:

Wie kommst Du darauf dass es in Hülle und Fülle abgebaut wird?

Also ich kann mich noch an vor ein paar Jahren dunkel dranerinnern

-als "Spieler" wie Adex, Geodex usw. glaube ich im Zusammenhang diskutiert wurden-

dass da im Prinzip die GANZ gegenteilige Aussage gemacht wurde,

und zwar ungefähr so:

"noch ein paar Jahre, dann ist ALLE"

_________________________________________________________________

"Zusammenfassung und Schlussfolgerung Studien über den Rohstoffbedarf für Zukunftstechnologien geben wertvolle Hinweise auf mögliche Bedarfsänderungen bei mineralischen Rohstoffen. Besonders hohe Nachfragezuwächse wurden in einer Studie von ANGERER et al. (2009) für Gallium, Indium, Scandium, Germanium, Neodym und Tantal ermittelt. Für diese Elektronikmetalle legt die BGR hiermit eine erste Einschätzung des Lagerstättenpotenzials und der Verfügbarkeit bis 2030 vor (s. Tab. 5). Das Ergebnis der Untersuchungen legt nahe, dass für Indium, Scandium und Tantal auch bei stark zunehmender Nachfrage keine Versorgungsengpässe zu erwarten sind."

Sorry, aber ich verstehe deine Frage gerade nicht recht. Beantwortest du mitsamt deines Auszuges nicht selbst meine Behauptung?

@ max: entschuldige die verwirrung. wollte den popeye zitieren.

@Max

Sehr schön dargestellt!!

Gwen Preston’s thoughts on zinc

Lots to talk about zinc these days. I describe it as sort of the metal that’s guaranteed to perform this year. Sure, we’ve had a big price move already, but it’s really a classic case of fundamentals. There’s declining supply. There’s rising demand. There’s basically no new concentrates entering the market. So, the market is going to be in deficit for a few years, and the stockpiles are getting drawn down.

What’s interesting about…the reason that you watch stockpiles is that zinc responds…the zinc price moves along sideways, until stockpiles get to near a critical level. And so, critical level is usually, like, six or seven weeks of global consumption. And as soon as it gets down towards that level, the price takes off. We saw that happen in 2005.

Guess what? That’s exactly what’s setting up right now. The price move has clearly already started. The fundamental supply-demand situation is more extreme this time than it was in 2005, which is why most analysts are still forecasting some fairly good upside in the price of zinc alone. I mentioned there’s a real lack of concentrate. Treatment charges are what smelters charge to process a zinc concentrate.

When there’s a lot of zinc concentrate available, treatment charges are, like, $200 a ton. In the last year, they’ve fallen, like, dramatically. They’re at $50 a ton. It is the key signal that there just is not enough zinc concentrate out there. Smelters in China are shutting down and suspending operations left and right, right now, because they just can’t get concentrate to process. So, that’s very bullish. I do want to mention, however, that zinc bull markets don’t last very long.

So, the price has already made a big move. I think the price will continue rising this year. But the zinc price itself probably does not have a long run ahead of it. That said, there is still opportunity right now in zinc equities. Equities don’t move until the price has already established itself on an upward trend. And I think there’s sort of two main reasons for that. One is that, that sideways move that zinc like to do does include, sort of, 20% to 30% moves.

So, when zinc moves 20% or 30%, people just don’t pay attention. They’re like, “Ah, it’s just waving along again.” So, it has to go to about 40% before people are like, “Oh, wait. There is actually something happening here.” Especially because zinc is, for a metal, like, crying wolf. People have literally been calling for a zinc price move for seven years. So, it’s no surprise that we ignored it when it happened this time around.

Read more at http://www.stockhouse.com/companies/bullboard/v.tk/tinka-res…

Sehr schön dargestellt!!

Gwen Preston’s thoughts on zinc

Lots to talk about zinc these days. I describe it as sort of the metal that’s guaranteed to perform this year. Sure, we’ve had a big price move already, but it’s really a classic case of fundamentals. There’s declining supply. There’s rising demand. There’s basically no new concentrates entering the market. So, the market is going to be in deficit for a few years, and the stockpiles are getting drawn down.

What’s interesting about…the reason that you watch stockpiles is that zinc responds…the zinc price moves along sideways, until stockpiles get to near a critical level. And so, critical level is usually, like, six or seven weeks of global consumption. And as soon as it gets down towards that level, the price takes off. We saw that happen in 2005.

Guess what? That’s exactly what’s setting up right now. The price move has clearly already started. The fundamental supply-demand situation is more extreme this time than it was in 2005, which is why most analysts are still forecasting some fairly good upside in the price of zinc alone. I mentioned there’s a real lack of concentrate. Treatment charges are what smelters charge to process a zinc concentrate.

When there’s a lot of zinc concentrate available, treatment charges are, like, $200 a ton. In the last year, they’ve fallen, like, dramatically. They’re at $50 a ton. It is the key signal that there just is not enough zinc concentrate out there. Smelters in China are shutting down and suspending operations left and right, right now, because they just can’t get concentrate to process. So, that’s very bullish. I do want to mention, however, that zinc bull markets don’t last very long.

So, the price has already made a big move. I think the price will continue rising this year. But the zinc price itself probably does not have a long run ahead of it. That said, there is still opportunity right now in zinc equities. Equities don’t move until the price has already established itself on an upward trend. And I think there’s sort of two main reasons for that. One is that, that sideways move that zinc like to do does include, sort of, 20% to 30% moves.

So, when zinc moves 20% or 30%, people just don’t pay attention. They’re like, “Ah, it’s just waving along again.” So, it has to go to about 40% before people are like, “Oh, wait. There is actually something happening here.” Especially because zinc is, for a metal, like, crying wolf. People have literally been calling for a zinc price move for seven years. So, it’s no surprise that we ignored it when it happened this time around.

Read more at http://www.stockhouse.com/companies/bullboard/v.tk/tinka-res…

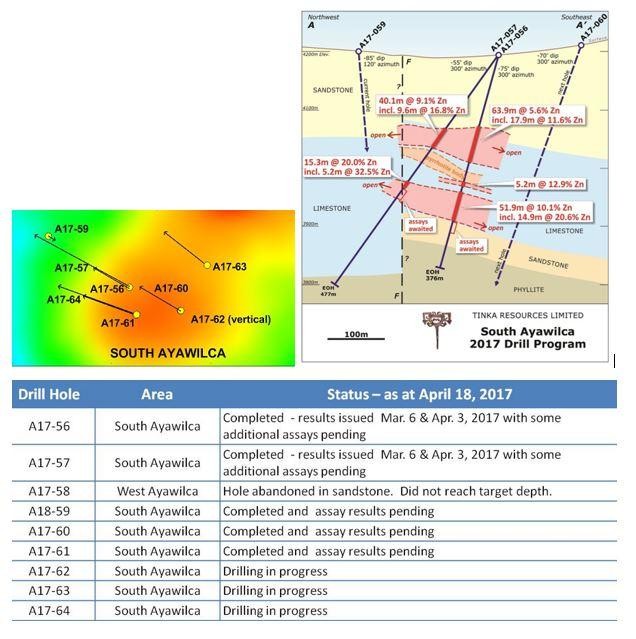

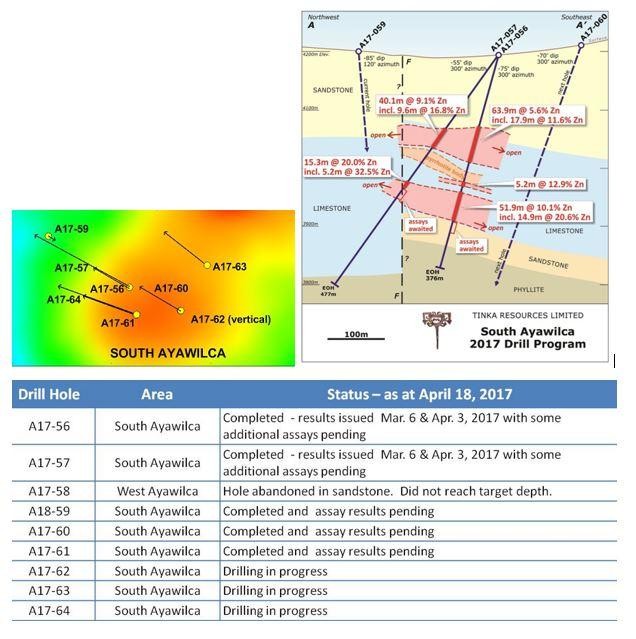

Damit man sieht, wie spannend die nächsten News werden habe ich drei versch. Infos von Tinka zusammenkopiert. Die Bohrlöcher 59, 60 und 61 werden wohl enormen Einfluss auf den Kurs haben...

Stand des Bohrprogrammes (vom 18.04.2017):

https://www.tinkaresources.com/projects/2017-drill-program" target="_blank" rel="nofollow ugc noopener">

https://www.tinkaresources.com/projects/2017-drill-program

https://www.tinkaresources.com/projects/2017-drill-program" target="_blank" rel="nofollow ugc noopener">

https://www.tinkaresources.com/projects/2017-drill-program