Fusionex - Big-Data Software - 500 Beiträge pro Seite

eröffnet am 03.11.14 14:58:31 von

neuester Beitrag 31.08.19 10:37:10 von

neuester Beitrag 31.08.19 10:37:10 von

Beiträge: 20

ID: 1.201.771

ID: 1.201.771

Aufrufe heute: 0

Gesamt: 3.965

Gesamt: 3.965

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 01.04.24, 10:52 | 257 | |

| gestern 21:20 | 209 | |

| vor 1 Stunde | 182 | |

| gestern 19:37 | 139 | |

| 22.06.20, 20:50 | 136 | |

| heute 00:34 | 115 | |

| gestern 22:23 | 99 | |

| gestern 23:03 | 85 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.737,36 | -0,56 | 198 | |||

| 2. | 2. | 147,05 | -1,92 | 95 | |||

| 3. | 7. | 6,6320 | -1,43 | 70 | |||

| 4. | 5. | 0,1810 | -1,90 | 51 | |||

| 5. | Neu! | 713,65 | -23,14 | 46 | |||

| 6. | 8. | 3,7700 | +0,80 | 45 | |||

| 7. | 17. | 7,2900 | -0,21 | 43 | |||

| 8. | 4. | 2.390,60 | 0,00 | 41 |

...kommen aus Malaysia und sind vor kurzem in London an den AIM gegangen;

echter Microcap, hoch bewertet

aber schnell wachsend

W hat einen Artikelstamm für die WKN: A1KATK ,

hat einen Artikelstamm für die WKN: A1KATK ,

erlaubt aber weder Anzeige noch Verknüpfung

echter Microcap, hoch bewertet

aber schnell wachsend

W

hat einen Artikelstamm für die WKN: A1KATK ,

hat einen Artikelstamm für die WKN: A1KATK ,erlaubt aber weder Anzeige noch Verknüpfung

Partnerschaften

..

23 June 2014

EMC forges an alliance with Fusionex with a combined go-to-market strategy with GIANT

United States, June 23, 2014 — Fusionex, a specialist in Analytics and Big Data has established a significant technology alliance with EMC Computer Systems. This alliance will see both parties jointly marketing, promoting and selling a combined Big Data and Analytics portfolio.

The combined portfolio comprises of a wide range of Big Data and Analytics software and solutions including GIANT, an in-house Analytics software developed by Fusionex as well as EMC solutions such as Isilon and Pivotal. This alliance aims to bring end-to-end Big Data and Analytics capabilities to several key industries such as finance, retail, travel and hospitality, and government.

Fusionex is an IT software group with a multinational presence that is listed on the London Stock Exchange. Fusionex’s core business centers around analytics, helping customers manage, analyze and derive insights from their data. Fusionex has garnered a string of accreditations and global awards, including more recently, the Asia Pacific ICT Alliance (APICTA) award for Best Application & Infrastructure, as well as the Big Data World Asia Data Analytics & Innovation award.

This strategic partnership is aimed to provide a symbiotic approach, where Fusionex will be able to leverage on EMC’s technology platform and market reach. On the other hand, EMC will be able to tap into Fusionex’s expertise and know-how in business intelligence (BI), analytics and Big Data. In turn, both parties are committed to promote and resell a combined product solution to each party’s new and existing customers resulting in a faster return of investment (ROI) to end users.

16 May 2014

Avnet partners Fusionex to broaden GIANT’s distribution network

London, United Kingdom, May 16, 2014 — Fusionex, a multi-award winning software provider listed on the London Stock Exchange which specialises in Analytics and Big Data, and Avnet, a fortune 500 group listed on the New York Stock Exchange, have commenced a significant technology partnership to make Fusionex GIANT more accessible to organisations across the globe. Through this strategic partnership which forms part of Fusionex’s partner channel network, Avnet is able to leverage of Fusionex’s expertise and know-how particularly in the field of business intelligence (BI), analytics and Big Data. In turn, Fusionex will be able to leverage on Avnet’s vast distribution network, with Avnet committed to promote and resell Fusionex GIANT.

Avnet is one of the largest distributors of computer products serving customers globally and hence provides a vital link in the technology supply chain. In addition to its core distribution services, Avnet brings a breadth and depth of service capabilities, including device programming, computer system configuration and integration, and technical seminars. Its business encompasses more than 700 suppliers and more than 100,000 customers worldwide.

This partnership will see a jointly beneficial approach where both parties will be able to bundle their respective products and packages, thus eliminating the need for quality assurance where end users are concerned, providing them with the peace of mind that the bundled package product including hardware would be jointly certified by Fusionex and Avnet.

Trading Update

15 October 2015Fusionex International plc

("Fusionex", "the Company" or “the Group”)

Trading Update

Fusionex, an award-winning and market leading international software provider specialising in Business Intelligence, Analytics and Big Data, is pleased to provide the following trading update for the year ended 30 September 2015.

During the period, the Group has made significant progress securing new client mandates for its big data analytics platform, GIANT, in addition to further broadening its geographical reach, particularly in the Asia Pacific region.

Demand for the Company’s award winning GIANT solution remains strong. Management is confident that a combination of the Group’s strong market position within the Asia Pacific region, positive sales momentum underpinned by new GIANT mandates, and on-going investment in R&D will continue to generate exciting growth.

The Board anticipates that the Company’s full year results will be ahead of market expectations.

Kurs hat sich am 21./22.1. mal locker halbiert...

Kommentar der Firma:22 January 2016 - Statement in response to share price movement

Fusionex International plc

("Fusionex", "the Company" or “the Group”)

Statement in response to share price movement

Fusionex International plc notes the drop in its share price post yesterday’s announcement of its preliminary results for the year ended 30 September 2015. The Company understands that the share price may have been affected by commentary regarding perceived poor cash collection in the period. Consequently the Directors wish to clarify the position.

Cash collection for the year was adversely affected by an increase in trade receivables as a result of the business moving increasingly to channel partners which enable Fusionex to support scalable growth and wider market reach. These channel partners however require extended terms of trade, which is not unusual in the software industry and has resulted in this increase in receivables. Since the year end, and in the ordinary course of business, RM23.4m (£3.8m) of the year-end receivables of RM28.5m (£4.6m) has been collected.

Antwort auf Beitrag Nr.: 51.684.904 von R-BgO am 08.02.16 13:29:58

(ShareCast News) - Shares in Fusionex International fell to their lowest level since their 2012 flotation after results that divided opinion.

The Malaysian software developer, which specialises in the buzzy areas of Big Data and the Internet of Things, generated revenue of 77m Mayalsian ringgit (£12.5m) in the year to 30 September, growth of 35% on the previous year.

Gross profits of MYR 58.9m were up 33%, while profit before tax of MYR 25m was up 28% on the period year, with EPS growth of 28% to MYR 0.58.

Profit was flattered by higher capitalisation of development costs which rose MYR 5.3m over the prior year, some analysts noted, rising as a percent of sales from 19.5% to 21.4% over the prior year.

Fusionex's main product is Big Data analytics software, GIANT, which has enjoyed a strong take-up during the year of 36 customers, including blue chip global organisations and government agencies.

The balance sheet displayed cash and equivalents of MYR 57.7m at the year end, since boosted by a significantly over-subscribed £14m placing in London at a price of 325p.

"The new financial year has started on a very strong note with good new wins already secured for GIANT," said chief executive Ivan Teh, "coupled with a very strong pipeline, and therefore the outlook for 2016 and beyond is very positive and exciting for Fusionex."

October's fundraising was carried out by broker Panmure Gordon, where analyst George O'Connor said the results beat his forecasts due to better than expected GIANT sales.

He said GIANT was the "900lb Gorilla position" in its market, with the balance sheet cash fueling a year of investment that will lift sales to MYR 99m but see a loss before tax from increased spending on R&D, marketing and general headcount, a move into the new geographies of Vietnam, Australia, China and Taiwan, together with increased hosting charges from off-premise GIANT sales.

Shore Capital's Peter McNally noted that that underlying operating margins appear to be declining, by his calculations.

He also pointed out that when adding capitalisation of development costs back in, EBITDA is MYR 16.5m resulting in margins of 21.4% rather than the 42.8% at the headline level

"While consensus estimates are likely to be upgraded and the company is showing significant growth, we think the shares are still too expensive at 25.6x EBITDA for 2016, or a PE of 34.4x," he said.

McNally added: "While we recognise this is a growing company that is still building its product, a backstop for valuation can be seen through the sales multiple which is currently 10.8x on an enterprise value basis."

Shares in Fusionex were down 35% to 215p by the close on Thursday, versus their IPO price of 150p.

Fusionex shares fall by a third as results divide analyst opinion

Thu, 21 January 2016(ShareCast News) - Shares in Fusionex International fell to their lowest level since their 2012 flotation after results that divided opinion.

The Malaysian software developer, which specialises in the buzzy areas of Big Data and the Internet of Things, generated revenue of 77m Mayalsian ringgit (£12.5m) in the year to 30 September, growth of 35% on the previous year.

Gross profits of MYR 58.9m were up 33%, while profit before tax of MYR 25m was up 28% on the period year, with EPS growth of 28% to MYR 0.58.

Profit was flattered by higher capitalisation of development costs which rose MYR 5.3m over the prior year, some analysts noted, rising as a percent of sales from 19.5% to 21.4% over the prior year.

Fusionex's main product is Big Data analytics software, GIANT, which has enjoyed a strong take-up during the year of 36 customers, including blue chip global organisations and government agencies.

The balance sheet displayed cash and equivalents of MYR 57.7m at the year end, since boosted by a significantly over-subscribed £14m placing in London at a price of 325p.

"The new financial year has started on a very strong note with good new wins already secured for GIANT," said chief executive Ivan Teh, "coupled with a very strong pipeline, and therefore the outlook for 2016 and beyond is very positive and exciting for Fusionex."

October's fundraising was carried out by broker Panmure Gordon, where analyst George O'Connor said the results beat his forecasts due to better than expected GIANT sales.

He said GIANT was the "900lb Gorilla position" in its market, with the balance sheet cash fueling a year of investment that will lift sales to MYR 99m but see a loss before tax from increased spending on R&D, marketing and general headcount, a move into the new geographies of Vietnam, Australia, China and Taiwan, together with increased hosting charges from off-premise GIANT sales.

Shore Capital's Peter McNally noted that that underlying operating margins appear to be declining, by his calculations.

He also pointed out that when adding capitalisation of development costs back in, EBITDA is MYR 16.5m resulting in margins of 21.4% rather than the 42.8% at the headline level

"While consensus estimates are likely to be upgraded and the company is showing significant growth, we think the shares are still too expensive at 25.6x EBITDA for 2016, or a PE of 34.4x," he said.

McNally added: "While we recognise this is a growing company that is still building its product, a backstop for valuation can be seen through the sales multiple which is currently 10.8x on an enterprise value basis."

Shares in Fusionex were down 35% to 215p by the close on Thursday, versus their IPO price of 150p.

Antwort auf Beitrag Nr.: 51.684.904 von R-BgO am 08.02.16 13:29:58

(ShareCast News) -

With shares in Fusionex International having lost almost two thirds of their value in four days, chairman John Croft has dipped into his personal coffers in order to prove the software group's board is confident in the business.

The company revealed on Tuesday that Croft splashed out roughly £20,000 as he bought 13,800 shares at a price of 148p apiece on Monday, to more than double his stake to 24,800 shares.

When the Malaysian company issued results last Thursday its shares fell to 215p, their lowest level since their 2012 flotation, with investors lamenting the sharp rise in outstanding receivables payments and raising concerns about aggressive investment plans that will send it into the red this year.

Since then they have collapsed to 113.45p despite Croft's attempted intervention.

As well as the chairman's purchase, Fusionex issued a clarification on Monday to try and placate investors, saying it understood that the share price may have been affected by commentary regarding perceived poor cash collection in the period.

Looking to clarify the position, the company said: "Cash collection for the year was adversely affected by an increase in trade receivables as a result of the business moving increasingly to channel partners which enable Fusionex to support scalable growth and wider market reach.

"These channel partners however require extended terms of trade, which is not unusual in the software industry and has resulted in this increase in receivables."

Since the year end, Fusionex has collected receivables of 23.4m Malaysian ringgit (£3.8m) out of the year-end receivables of RM28.5m (£4.6m).

Plans to swell the customer base of GIANT, its flagship Big Data analytics software, from the current 36 customers to 90 in the current year will lift sales to MYR 99m but send the group into the red due to increased spending on R&D, marketing and general headcount, a move into the new geographies of Vietnam, Australia, China and Taiwan, together with increased hosting charges from off-premise GIANT sales.

Fusionex crashes to new low despite assurances and director dealing

Tue, 26 January 2016(ShareCast News) -

With shares in Fusionex International having lost almost two thirds of their value in four days, chairman John Croft has dipped into his personal coffers in order to prove the software group's board is confident in the business.

The company revealed on Tuesday that Croft splashed out roughly £20,000 as he bought 13,800 shares at a price of 148p apiece on Monday, to more than double his stake to 24,800 shares.

When the Malaysian company issued results last Thursday its shares fell to 215p, their lowest level since their 2012 flotation, with investors lamenting the sharp rise in outstanding receivables payments and raising concerns about aggressive investment plans that will send it into the red this year.

Since then they have collapsed to 113.45p despite Croft's attempted intervention.

As well as the chairman's purchase, Fusionex issued a clarification on Monday to try and placate investors, saying it understood that the share price may have been affected by commentary regarding perceived poor cash collection in the period.

Looking to clarify the position, the company said: "Cash collection for the year was adversely affected by an increase in trade receivables as a result of the business moving increasingly to channel partners which enable Fusionex to support scalable growth and wider market reach.

"These channel partners however require extended terms of trade, which is not unusual in the software industry and has resulted in this increase in receivables."

Since the year end, Fusionex has collected receivables of 23.4m Malaysian ringgit (£3.8m) out of the year-end receivables of RM28.5m (£4.6m).

Plans to swell the customer base of GIANT, its flagship Big Data analytics software, from the current 36 customers to 90 in the current year will lift sales to MYR 99m but send the group into the red due to increased spending on R&D, marketing and general headcount, a move into the new geographies of Vietnam, Australia, China and Taiwan, together with increased hosting charges from off-premise GIANT sales.

Antwort auf Beitrag Nr.: 51.685.495 von R-BgO am 08.02.16 14:21:48

weiter viele "Wins"

zum Halbjahr

haben sie wenigstens die schwarze Null gehalten;weiter viele "Wins"

Antwort auf Beitrag Nr.: 53.421.111 von R-BgO am 06.10.16 13:29:37

Bursa Malaysia signs agreement with Fusionex on Enterprise Data Analytics solutions

Bursa Malaysia Berhad (“Bursa Malaysia” or “The Exchange”) has recently signed an agreement with Fusionex International (“Fusionex”) to provide services related to Enterprise Data Analytics (EDA) to facilitate highly accessible, accurate and timely information at the Exchange that will provide better strategic insights and applications for improved customer-centric decisions.

EDA is the discovery and communication of meaningful patterns in data. Especially valuable in areas rich with recorded information, analytics relies on the simultaneous application of statistics, computer programming and operations research to quantify performance.

By implementing EDA to complement the Exchange’s trading platform, Bursa Malaysia will increase its capability to process large amounts of complex data with high performance and speed, enabling it to, among other things, keep track and identify patterns and trends in the multitude of stock and price movements in the market.

Bursa Malaysia Chief Executive Officer, Datuk Seri Tajuddin Atan said, "We are pleased to appoint Fusionex as our preferred vendor to help integrate enterprise data analytics at the Exchange. By leveraging on the big data revolution we intend to provide greater value to the capital market by enhancing our processes, towards identifying new customer and product insights.

Bursa Malaysia has fully embraced digitalization as a strategy and transformative tool. Digitalization is a process that is ongoing in every sector, industry and community in the global economy, and Bursa Malaysia will continue to tap into new technological innovations to further develop the marketplace and improve the effectiveness and accessibility of the exchange.”

Fusionex Chief Executive Officer, Dato’ Seri Ivan Teh said, “Bursa Malaysia’s vision to raise the bar and to bring itself to the next level is really exemplary. We are excited and enthusiastic to be selected by Bursa Malaysia as their partner as they embark on this journey to be among the most advanced data-driven organizations in this region.”

Bursa Malaysia has taken an important step towards becoming a forward-moving, data-driven stock exchange, powered by analytics, insights and information. Bursa Malaysia will be able to view company performance, stock prices, and stock movements with ease in numerous areas including investor analytics, market performance, market risk analysis, peer comparisons and sentiment analysis.

z.B.:

2 September 2016Bursa Malaysia signs agreement with Fusionex on Enterprise Data Analytics solutions

Bursa Malaysia Berhad (“Bursa Malaysia” or “The Exchange”) has recently signed an agreement with Fusionex International (“Fusionex”) to provide services related to Enterprise Data Analytics (EDA) to facilitate highly accessible, accurate and timely information at the Exchange that will provide better strategic insights and applications for improved customer-centric decisions.

EDA is the discovery and communication of meaningful patterns in data. Especially valuable in areas rich with recorded information, analytics relies on the simultaneous application of statistics, computer programming and operations research to quantify performance.

By implementing EDA to complement the Exchange’s trading platform, Bursa Malaysia will increase its capability to process large amounts of complex data with high performance and speed, enabling it to, among other things, keep track and identify patterns and trends in the multitude of stock and price movements in the market.

Bursa Malaysia Chief Executive Officer, Datuk Seri Tajuddin Atan said, "We are pleased to appoint Fusionex as our preferred vendor to help integrate enterprise data analytics at the Exchange. By leveraging on the big data revolution we intend to provide greater value to the capital market by enhancing our processes, towards identifying new customer and product insights.

Bursa Malaysia has fully embraced digitalization as a strategy and transformative tool. Digitalization is a process that is ongoing in every sector, industry and community in the global economy, and Bursa Malaysia will continue to tap into new technological innovations to further develop the marketplace and improve the effectiveness and accessibility of the exchange.”

Fusionex Chief Executive Officer, Dato’ Seri Ivan Teh said, “Bursa Malaysia’s vision to raise the bar and to bring itself to the next level is really exemplary. We are excited and enthusiastic to be selected by Bursa Malaysia as their partner as they embark on this journey to be among the most advanced data-driven organizations in this region.”

Bursa Malaysia has taken an important step towards becoming a forward-moving, data-driven stock exchange, powered by analytics, insights and information. Bursa Malaysia will be able to view company performance, stock prices, and stock movements with ease in numerous areas including investor analytics, market performance, market risk analysis, peer comparisons and sentiment analysis.

24 October 2016

Trading Update

Fusionex, a multi-award winning international software solutions provider specialising in Big Data Analytics, Artificial Intelligence and the Internet of Things (“IoT”), is pleased to provide the following trading update for the year ended 30 September 2016 (“FY2016”).

Building on momentum achieved in the first half of the 2016 financial year, Fusionex has continued to deliver on its strategy and make progress throughout the rest of the year. In particular, the Group successfully launched the next generation of its proprietary Big Data Analytics (“BDA”) platform, ‘GIANT 2016’, in June 2016. In addition to providing blue-chip enterprise organisations with the most complete BDA software in its space, GIANT 2016 has opened up a new addressable market across small and medium sized businesses (“SMEs”). The pipeline for GIANT 2016 is substantial.

The Group’s steady progress has underpinned a strong FY2016 financial performance. The Board anticipates that revenue will be in line with market expectations and, despite the significant planned investment in the marketing and promotion of Fusionex’s products, EBITDA is expected to be significantly ahead of market expectations.

The Board expects the positive momentum experienced in FY2016 to continue in the current year.

Trading Update

Fusionex, a multi-award winning international software solutions provider specialising in Big Data Analytics, Artificial Intelligence and the Internet of Things (“IoT”), is pleased to provide the following trading update for the year ended 30 September 2016 (“FY2016”).

Building on momentum achieved in the first half of the 2016 financial year, Fusionex has continued to deliver on its strategy and make progress throughout the rest of the year. In particular, the Group successfully launched the next generation of its proprietary Big Data Analytics (“BDA”) platform, ‘GIANT 2016’, in June 2016. In addition to providing blue-chip enterprise organisations with the most complete BDA software in its space, GIANT 2016 has opened up a new addressable market across small and medium sized businesses (“SMEs”). The pipeline for GIANT 2016 is substantial.

The Group’s steady progress has underpinned a strong FY2016 financial performance. The Board anticipates that revenue will be in line with market expectations and, despite the significant planned investment in the marketing and promotion of Fusionex’s products, EBITDA is expected to be significantly ahead of market expectations.

The Board expects the positive momentum experienced in FY2016 to continue in the current year.

Antwort auf Beitrag Nr.: 53.421.177 von R-BgO am 06.10.16 13:36:3013 December 2016

Fusionex wins contract with Asian bank to fast-track Big Data management

Fusionex, a multi award-winning, leading software solutions provider specializing in Big Data Analytics (BDA), the Internet of Things (IoT), Artificial Intelligence, and Deep Learning, is pleased to announce a GIANT win with a large Asian Bank for the provision of a Big Data management solution. This win, which goes into the millions over time, will see a major upgrade of the client’s legacy manual data management system into an automated and efficient structure, entailing seamless data collection and smart-processing, to enable sales forecast, customer portfolio analysis, sentiment analysis, budgeting, planning, disclosure management, risk management, documentation authoring as well as market analysis among its key objectives.

The bank is seeking to combine a multitude of data sources, be it in house data or external data to mine and find meaningful insights as well as drive a data-driven culture within the bank as well as its partners, as it leapfrogs into the world of cognitive computing and digital banking via Big Data.

Over half a century old, the client has built up a presence in thousands of locations, consisting of conventional branches, satellite branches, savings, loans and services offices. The client has also developed a variety of established businesses including commercial, corporate, retail, consumer, micro, banking. Other businesses include trade finance, cash management, treasury and capital market services, and financial services.

The solution that Fusionex is rolling out for the client includes the ability to generate powerful insights for senior management very swiftly and ‘on-demand’. Where in the past, the duration normally taken to produce such information and insight could have taken days or weeks, the new Fusionex platform is poised to reduce such wait time to mere minutes or even via an ‘on-demand’ mode for mission critical areas – representing massive savings in cost, time and efficiency for the bank.

The ability to pull data from various disparate sources was also key to the client’s savings in time and cost. Previously, manpower had to be allocated to manually track down spreadsheets and documents in order to produce reports. All this hand-cranking and data-crunching proved to be an immense task for the bank, yet with minimal results and was error-prone. The bank was cognizant of the blistering pace in which technology and industry was moving at, and decided to invest and work with Fusionex to leapfrog to the next level.

With Fusionex’s Data Management & Analytics solution applied for the client, collating and consolidating information from a huge variety of data points will be done automatically for the most part, speedily, and with ease. Connecting the wide-ranging number and formats of data (structured, semi-structured as well as unstructured) points onto a singular system meant that if new data is entered via the data points, the information / insights displayed would be updated within seconds to reflect the new input. Speed and agility is of the essence so the Bank wasted no time in embarking on this journey.

Fusionex GIANT also acts as a central hub to facilitate any amendments made with a user tracking security feature. This enables the client to keep a close track of changes being made to its data and is empowered with the ability to identify who exactly made each edit, including time stamp and location, to ensure accountability. Clearly, security is of paramount importance in the financial services industry. This is just one of the many security and traceability features Fusionex offers.

Ivan Teh, Fusionex Managing Director and Chief Executive Officer, commented: “We are delighted to be working with this forward-thinking Client. This win clearly shows that data management and analytics, if done properly, can bring about significant productivity, cost and efficiency gains in the financial services sector, amongst other industries. We are already seeing an immense step-up in this space. The team looks forward to working closely with the client especially in the areas of ‘fast data’, streaming capabilities, deep leaning and artificial intelligence to bring about a next-generation of experience and powerful insights. As this is just the start of a journey with this new client, we look forward to a successful roll-out leading to more joint successes together."

Fusionex wins contract with Asian bank to fast-track Big Data management

Fusionex, a multi award-winning, leading software solutions provider specializing in Big Data Analytics (BDA), the Internet of Things (IoT), Artificial Intelligence, and Deep Learning, is pleased to announce a GIANT win with a large Asian Bank for the provision of a Big Data management solution. This win, which goes into the millions over time, will see a major upgrade of the client’s legacy manual data management system into an automated and efficient structure, entailing seamless data collection and smart-processing, to enable sales forecast, customer portfolio analysis, sentiment analysis, budgeting, planning, disclosure management, risk management, documentation authoring as well as market analysis among its key objectives.

The bank is seeking to combine a multitude of data sources, be it in house data or external data to mine and find meaningful insights as well as drive a data-driven culture within the bank as well as its partners, as it leapfrogs into the world of cognitive computing and digital banking via Big Data.

Over half a century old, the client has built up a presence in thousands of locations, consisting of conventional branches, satellite branches, savings, loans and services offices. The client has also developed a variety of established businesses including commercial, corporate, retail, consumer, micro, banking. Other businesses include trade finance, cash management, treasury and capital market services, and financial services.

The solution that Fusionex is rolling out for the client includes the ability to generate powerful insights for senior management very swiftly and ‘on-demand’. Where in the past, the duration normally taken to produce such information and insight could have taken days or weeks, the new Fusionex platform is poised to reduce such wait time to mere minutes or even via an ‘on-demand’ mode for mission critical areas – representing massive savings in cost, time and efficiency for the bank.

The ability to pull data from various disparate sources was also key to the client’s savings in time and cost. Previously, manpower had to be allocated to manually track down spreadsheets and documents in order to produce reports. All this hand-cranking and data-crunching proved to be an immense task for the bank, yet with minimal results and was error-prone. The bank was cognizant of the blistering pace in which technology and industry was moving at, and decided to invest and work with Fusionex to leapfrog to the next level.

With Fusionex’s Data Management & Analytics solution applied for the client, collating and consolidating information from a huge variety of data points will be done automatically for the most part, speedily, and with ease. Connecting the wide-ranging number and formats of data (structured, semi-structured as well as unstructured) points onto a singular system meant that if new data is entered via the data points, the information / insights displayed would be updated within seconds to reflect the new input. Speed and agility is of the essence so the Bank wasted no time in embarking on this journey.

Fusionex GIANT also acts as a central hub to facilitate any amendments made with a user tracking security feature. This enables the client to keep a close track of changes being made to its data and is empowered with the ability to identify who exactly made each edit, including time stamp and location, to ensure accountability. Clearly, security is of paramount importance in the financial services industry. This is just one of the many security and traceability features Fusionex offers.

Ivan Teh, Fusionex Managing Director and Chief Executive Officer, commented: “We are delighted to be working with this forward-thinking Client. This win clearly shows that data management and analytics, if done properly, can bring about significant productivity, cost and efficiency gains in the financial services sector, amongst other industries. We are already seeing an immense step-up in this space. The team looks forward to working closely with the client especially in the areas of ‘fast data’, streaming capabilities, deep leaning and artificial intelligence to bring about a next-generation of experience and powerful insights. As this is just the start of a journey with this new client, we look forward to a successful roll-out leading to more joint successes together."

Antwort auf Beitrag Nr.: 53.817.030 von R-BgO am 02.12.16 15:38:51

Umsatz +23%

es wurde eine

schwarze Null;Umsatz +23%

SHIT!

26 May 2017The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 ("MAR")

Fusionex International plc

("Fusionex" or the "Company")

Proposed cancellation of admission of the Company's ordinary shares to trading on AIM, posting of documents and extraordinary general meeting.

The Board of Fusionex today announces that the Company intends to seek the approval of the holders of ordinary shares of no par value in the capital of the Company (the "Shares") (the "Shareholders") to cancel the admission of the Shares to trading on AIM (the "Proposal" or the "Cancellation").

Hard copies of the following documents (collectively the "Documents") will be sent to Shareholders later today:

· a circular (the "Circular") containing a notice of an extraordinary general meeting ("Extraordinary General Meeting") which will take place at Main Conference Room, Level 12, Tower A, Plaza 33, No.1, Jalan Kemajuan, Section 13, 46200 Petaling Jaya, Selangor, Malaysia on 15 June 2017 at 10:00am (BST) / 5:00pm (MYT) for the purpose of considering and, if thought fit, passing a resolution to approve the Cancellation; and

· a form of proxy for use by Shareholders at the Extraordinary General Meeting.

Electronic copies of the Documents together with the Company's annual report and accounts for the year ended 30 September 2016 are available from the Company's website: www.fusionex-international.com in accordance with rules 20 and 26 of the AIM Rules for Companies (the "AIM Rules").

Under the AIM Rules, it is a requirement that the Cancellation must be approved by not less than 75 per cent. of votes cast by Shareholders given in general meeting. Under the AIM Rules, the Cancellation also requires a notice period of not less than 20 clear business days from the date on which notice of the intended Cancellation is notified via the Regulatory Information Service and is given to the London Stock Exchange.

The Extraordinary General Meeting is to be held for the purpose of considering, and if thought fit, passing the following resolution (the "Resolution"), to take effect as a resolution of the Company requiring 75 per cent. of the votes cast (in person or by proxy) to be in favour: THAT, the admission of the ordinary shares each of no par value in the capital of the Company to trading on AIM, a market operated by the London Stock Exchange Group plc, be cancelled and that the directors of the Company be authorised to take all steps which they consider to be necessary or desirable in order to effect such cancellation.

All of the Directors whose shareholdings in aggregate represent 41.93 per cent. of the issued ordinary share capital of the Company, have given irrevocable undertakings to vote in favour of the Resolution.

Subject to the passing of the Resolution at the proposed Extraordinary General Meeting on 15 June 2017, Cancellation will occur no earlier than five clear business days after the proposed Extraordinary General Meeting and it is therefore anticipated that trading in the Shares on AIM will cease at 16.30 (BST) on 26 June 2017, with Cancellation expected to take effect at 7:00 am (BST) on 27 June 2017. Any change to these dates will be notified by an announcement on the Regulatory Information Service.

Pursuant to Rule 41 of the AIM Rules, the Directors have notified the London Stock Exchange of the date of the proposed Cancellation.

The Circular sets out the following, further details of which can also be found below within this announcement:

· the background to the Proposal;

· why the Board has decided to proceed with the Proposal, subject to Shareholders' approval; and

· why the Directors believe that the Proposal is in the best interests of the Company and

Shareholders as a whole and why the Board recommends that Shareholders vote in favour of the Resolution at the forthcoming Extraordinary General Meeting.

In addition, the Directors wish to highlight that the Cancellation is being proposed because they consider it is a better alternative to the current AIM listing and it should not be misinterpreted as a sign of weakness in Fusionex's future trading prospects, which, the management believes, are positive both in the short and longer term.

Should Cancellation be approved by Shareholders at the Extraordinary General Meeting, the Company intends to put in place a matched bargain settlement facility which should facilitate Shareholders buying and selling Shares on a matched bargain basis following Cancellation. The Board is reviewing several matched bargain settlement facilities and the Company intends to make an announcement in respect of such a facility ahead of the date of Cancellation.

Background to, and reasons for, the Proposal

The Directors believe that, for the 15 months preceding the date of this document, the performance of the Company's share price has been disappointing. The Directors believe that the development of the business, in terms of general trading, strategic partnerships and underlying operational infrastructure, the growth potential of big data analytics, the Internet of Things and the strength of the Company's management team have not been adequately reflected in the value attributed by the public market to the Company's shares.

The current trading value attributed to the Shares has led the Directors to question whether the current listing, is as attractive as it was at the time of the Company's admission to AIM in December 2012 and whether it remains in the best interests of the Company. The Directors believe the reasons for this under-valuation are multiple and complex, but specifically include a lack of liquidity, and in part, a lack of in-depth independent research into the Company. It is not possible to attribute this to one single factor however the Directors believe that the current political uncertainty in Europe is unhelpful, which makes the public markets in the United Kingdom less attractive for Fusionex than at the time of the IPO. These are factors beyond the control of Fusionex and its Board of Directors, which has led the Directors to decide on this course of action.

In addition to the above, the Directors also believe that the costs of remaining listed on AIM could be better spent within the business. The cost involved with being a compliant Company from a regulatory perspective and with maintaining the Company's admission to trading are, in the Directors' opinion, disproportionate to the current benefits to the Company.

The Directors therefore believe that the Cancellation will, accordingly, reduce the Company's recurring administrative costs, allowing the funds currently spent on such expenses to be better spent in running and growing the business in a private capacity.

After careful consideration of the matters laid out above, the Directors have therefore concluded that the commercial disadvantages of maintaining the admission to trading on AIM of the Shares at this time in the Company's development outweigh the potential benefits, and that it is therefore no longer in the Company's or its Shareholders' best interests to maintain the admission to trading on AIM of the Shares.

Cancellation of admission of ordinary shares to trading on AIM

Cancellation

The AIM Rules require (i) the cancellation of admission to trading on AIM to be approved by not less than 75%of Shareholders given in general meeting, and (ii) a notice period to be given to the London Stock Exchange of not less than 20 clear business days from the date on which notice of the intended Cancellation is notified via the Regulatory Information Service. Pursuant to Rule 41 of the AIM Rules, the Directors have notified the London Stock Exchange of the date of the Cancellation.

Subject to the passing of the Resolution at the Extraordinary General Meeting on 15 June 2017, Cancellation will occur no earlier than five clear business days after the Extraordinary General Meeting and it is therefore anticipated that trading in the Shares on AIM will cease at 16:30 (BST) on 26 June 2017, with Cancellation expected to take effect at 7.00 a.m. (BST) on 27 June 2017.

Trading in the Shares after Cancellation

Whilst the Directors believe that the Cancellation is in the interests of the Company and the Shareholders as a whole, they recognise that the Cancellation will make it more difficult for Shareholders to buy and sell Shares should they wish to do so. Following the Cancellation, although the Shares will remain transferable subject to and in accordance with the Articles of Association, the Shares will no longer be tradable on AIM.

Accordingly, the Board intends, following the Cancellation, to put in place a matched bargain settlement facility (the "Proposed Facility") which should facilitate Shareholders buying and selling Shares on a matched bargain basis following Cancellation. Shareholders or persons wishing to acquire or sell Shares will be able to do so via the Proposed Facility. In the event that matched bargain settlement facility provider is able to match that order with an opposite sell or buy instruction, the matched bargain settlement facility provider would contact both parties to effect the order. The Board is reviewing several matched bargain settlement facilities and the Company intends to make an announcement in respect of such a facility ahead of the date of Cancellation.

The Board's choice of matched bargain settlement facility provider will determine whether the Company's existing CREST facility will remain in place following Cancellation and therefore whether Shareholders will be able to elect to hold their Shares in dematerialised form. If the Company's CREST facility is ceased, Shareholders who hold their Shares through CREST will be issued share certificates in respect of their Shares. The Board will use reasonable endeavours to enable Shareholders to continue to be able to hold their Shares through CREST, but there can be no assurance that a CREST facility will continue to be available following Cancellation.

Following the implementation of the Proposed Facility, the Board intends to monitor its popularity amongst Shareholders and will review it at regular intervals to consider whether it remains cost effective.

Effects of Cancellation on Shareholders

Market for the Shares

The principal effect of the proposed Cancellation is that there would no longer be a formal market mechanism enabling Shareholders to trade their Shares on AIM or any other recognised market or trading exchange. The underlying liquidity in the Shares is low and, in the opinion of the Directors, is likely to remain that way for the foreseeable future. As described above, the Company intends to, shortly following Cancellation, put in place the Proposed Facility to serve as a limited platform for Shareholders and other persons to seek to buy or sell Shares. However, the Proposed Facility is likely to offer a substantially lesser degree of liquidity and potentially less attractive share prices than are currently available via the Company's quotation on AIM.

Taxation

Shareholders who are in any doubt about their tax position should consult with their own independent professional adviser as soon as possible.

Loss of shareholder protections

Shareholders should also be aware that the Company will no longer be bound by the AIM Rules following Cancellation. As a consequence, investors will not be able to benefit from certain of the protections provided by the AIM Rules. For example, the Company will no longer be required to announce material events, interim or final results or transactions (including related party transactions) and certain previously prescribed corporate governance procedures may not be adhered to by the Company in the future. Shareholders' approval will also not be required for reverse takeovers and/or fundamental changes in the Company's business. Following the Cancellation, the relationship agreement entered into at the time of the Company's admission to AIM in December 2012 and disclosed in the Company's admission document at that time, will terminate. The Company will no longer be bound to comply with the corporate governance requirements applicable to UK-quoted companies and the Company would also no longer be required to have a nominated adviser, nor be required to retain a broker.

The Company will continue to be bound by applicable provisions of Jersey law, which is in certain respects different from the laws of other relevant jurisdictions with which Shareholders may be familiar (including the United Kingdom), and its Articles of Association following completion of the Cancellation. The Circular does not contain a full summary of the applicable provisions of Jersey law, its differences with the laws of other relevant jurisdictions or of the provisions of the Articles of Association.

The Directors intend to keep Shareholders informed of the Company's progress from time to time and remain committed to high standards of corporate governance. Accordingly, following Cancellation, the Directors intend to:

· hold an annual general meeting and, when required, other general meetings, in accordance with applicable statutory requirements and the Articles of Association;

· make available to all Shareholders an annual report and the Company's annual financial statements;

· comply with all public filing requirements under the Act, including the filing of the Company's accounts with the Jersey Financial Services Commission within the applicable period;

· maintain an 'investors' section on the Company's website at www.fusionex-international.com providing information on any significant events or developments in which Shareholders may be interested. Shareholders should, however, be aware that there will be no obligation on the Company to update this section of the website as is presently required under the AIM Rules and other currently applicable regulation; and

· comply with corporate governance standards appropriate for a company with the number of Shareholders it has.

Takeover Code

The City Code on Takeovers and Mergers (the "Takeover Code") currently applies to the Company and as such the Shareholders benefit from a number of protections contained in the Takeover Code. Following Cancellation, the Company's Shares will no longer be admitted to trading on a relevant public market and the Company's place of central management and control will not be in the United Kingdom, the Channel Islands or the Isle of Man. Pursuant to paragraphs 3(a)(i) and (ii) to the Introduction to the Takeover Code, the Company will accordingly no longer be subject to the Takeover Code.

Shareholders should note that, if the Cancellation becomes effective, they will not receive the protections afforded by the Takeover Code in the event that there is a subsequent offer to acquire their Shares.

Brief details of the Takeover Code and the protections given by the Takeover Code are described below.

Before giving your consent to the Cancellation, you may want to take independent professional advice from an appropriate financial, legal or other professional adviser in relation to the effects of the Cancellation on you as a Shareholder.

The Takeover Code

The Takeover Code is issued and administered by the Panel on Takeovers and Mergers of the United Kingdom (the "Panel"). The Company is presently a company to which the Takeover Code applies and its Shareholders are accordingly entitled to the protections afforded by the Takeover Code.

The Takeover Code and the Panel operate principally to ensure that shareholders are treated fairly and are not denied an opportunity to decide on the merits of a takeover and that shareholders of the same class are afforded equivalent treatment by an offeror. The Takeover Code also provides an orderly framework within which takeovers are conducted. In addition, it is designed to promote, in conjunction with other regulatory regimes, the integrity of the financial markets.

The General Principles and Rules of the Takeover Code

The Takeover Code is based upon a number of general principles (the "General Principles") which are essentially statements of standards of commercial behaviour. The General Principles apply to all transactions with which the Takeover Code is concerned. They are expressed in broad general terms and the Takeover Code does not define the precise extent of, or the limitations on, their application. They are applied by the Panel in accordance with their spirit to achieve their underlying purpose.

In addition to the General Principles, the Takeover Code contains a series of rules (the "Rules"), of which some are effectively expansions of the General Principles and examples of their application and others are provisions governing specific aspects of takeover procedure. Although most of the Rules are expressed in more detailed language than the General Principles, they are not framed in technical language and, like the General Principles, are to be interpreted to achieve their underlying purpose. Therefore, their spirit must be observed as well as their letter. The Panel may derogate or grant a waiver to a person from the application of a Rule in certain circumstances.

Giving up the protection of the Takeover Code

Shareholders will be giving up certain important protections upon Cancellation. Your attention is drawn in particular to the following protections under the Takeover Code:

(i) all holders of Shares must be afforded equivalent treatment and, moreover, if a person acquires 30 per cent. or more of the shares in the Company (other than in the context of a voluntary offer to all Shareholders) such person would be required to make a mandatory offer to all of the other Shareholders;

(ii) the holders of Shares must have sufficient time and information to enable them to reach a properly informed decision on any bid; where it advises the holders of Shares, the Board must give its views on the effects of implementation of the bid on employment, conditions of employment and the locations of the Company's place of business;

(iii) the Board would be required to act in the interests of the Company as a whole and must not deny any holders of Shares the opportunity to decide on the merits of a bid for the Company; and

(iv) if a bid for the Company were to be made, the Board would be required to obtain competent independent advice as to whether the financial terms of any offer (including any alternative offers) are fair and reasonable and the substance of such advice must be made known to Shareholders.

The Jersey framework for takeovers following Cancellation

Certain brief details of the Jersey legal framework for takeovers, which following Cancellation

will continue to be applicable to the Company, alongside other relevant provisions of the

Articles of Association, as appropriate, are described below.

Acquisitions

A Jersey public limited company may be acquired in a number of ways, including by means of a "scheme of arrangement" between the company and its shareholders, by means of a takeover offer or by means of a statutory merger.

Scheme of arrangement

A "scheme of arrangement" is a statutory procedure under the Companies (Jersey) Law 1991 (as amended) (the "Act") pursuant to which the Royal Court of Jersey may approve a compromise or arrangement between a Jersey company and its shareholders or a class of them. In a "scheme of arrangement," a company would make an initial application to the Royal Court of Jersey to convene a meeting or meetings of its shareholders at which a majority in number of shareholders representing 3/4ths of the voting rights of the shareholders present and voting either in person or by proxy at the meeting must agree to the compromise or arrangement. If the relevant proportion of shareholders so agree, the company will return to the Royal Court of Jersey to request the court to sanction the arrangement. Upon such a scheme of arrangement being so sanctioned by the Royal Court of Jersey and becoming effective in accordance with its terms and the Act, it will bind the company and such shareholders.

Takeover offer

In addition to the compulsory purchase provisions contained in the Articles of Association, Articles 116 to 124A of the Act set out the provisions dealing with takeover offers of Jersey companies and details certain "squeeze out" provisions. Under the Act, if, following a takeover offer (which is defined as "an offer to acquire all the shares, or all the shares of any class or classes, in a company (other than shares which at the date of the offer are already held by the offeror), being an offer on terms which are the same in relation to all the shares to which the offer relates"), an offeror has acquired or contracted to acquire not less than nine-tenths in number of the shares of a no par value company to which the offer relates, the offeror may give notice, in accordance with the Act to the holders of those shares to which the offer relates which the offeror has not acquired or contracted to acquire, that it desires to acquire those shares.

Subject to the provisions of the Act, upon service of the notice by the offeror, it shall become entitled and be bound to acquire the shares. A minority shareholder also has a right, pursuant to the Act, to be bought out by an offeror. Where a notice is given under the Act to the holder of any shares, the Royal Court of Jersey may, on an application made by the shareholder within 6 weeks from the date on which the notice was given, order that the offeror shall not be entitled and bound to acquire the shares or specify terms of acquisition different from those of the offer.

The Act permits a scheme of arrangement or takeover offer to be made relating only to a particular class or classes of a company's shares.

Mergers

The Act permits two or more companies (at least one of which must be a company incorporated in Jersey) to merge to form one successor company (which may be one of the merging companies or a new company). In the case of a company incorporated in Jersey, any such merger is subject to the approval of its board of directors, and to approval by special resolution of the company (and, where applicable, by special resolution if each class of shares where there is more than one class of shares in issue), in addition to certain other substantive and procedural requirements.

Further Information

Current trading and prospects

The Company released its Annual Report for the year ended 30 September 2016 on 16 March 2017. In the following months since the financial year end 2016 and the issuance of the Annual Report, the share price of the Company continues to disappoint, despite the Company's strong performance. The Company remains committed to the statements set out in the Annual Report and will be continuing the strategies and prospects set out therein to push towards strengthening the Company's future.

The Company is in a strong position in its areas of focus. Its business prospects remain positive and the Company continues to secure wins and contracts; with the Company's current customer base and foothold poised to increase even further as a result of these wins.

Future strategy of the Company

Following the completion of this exercise, the Board intends to continue with the direction and strategies set out in its Annual Report by capitalizing opportunities and continuing on its course towards quality and innovative investments.

Irrevocable undertakings

The Company has received irrevocable undertakings to vote in favour of the Resolution at the proposed Extraordinary General Meeting from all of the Directors in respect of their respective holdings of, in aggregate, 22,809,966 Shares, representing approximately 41.93 per cent. of the total current issued ordinary share capital of the Company.

The aforesaid irrevocable undertakings will lapse if the Extraordinary General Meeting is not held or the Resolution is not put to Shareholders or in the event that the Resolution is not passed.

Recommendation

The Board considers the Resolution as set out in the Notice of Extraordinary General Meeting to be in the best interests of the Company and its Shareholders as a whole. Accordingly, the Directors unanimously recommend Shareholders to vote in favour of the Resolution. The Directors intend to vote their own beneficial holdings in favour of the Resolution, which, in aggregate, amounts to 22,809,966 Shares, representing approximately 41.93 per cent. of the issued ordinary share capital of the Company as at the date of this document.

-ENDS-

Antwort auf Beitrag Nr.: 56.283.197 von R-BgO am 27.11.17 10:54:10

unter der Nummer kennt sie keiner:

Antwort auf Beitrag Nr.: 57.633.399 von R-BgO am 26.04.18 11:57:31

sie wollen mir eine e-mail schreiben...

hier ging jemand dran:

+603 77115200sie wollen mir eine e-mail schreiben...

Antwort auf Beitrag Nr.: 56.283.197 von R-BgO am 27.11.17 10:54:10

der obenstehendes Link auf der Webseite ist tot, aber das hier scheint der Text zu sein:

Antwort auf Beitrag Nr.: 57.633.828 von R-BgO am 26.04.18 12:35:16

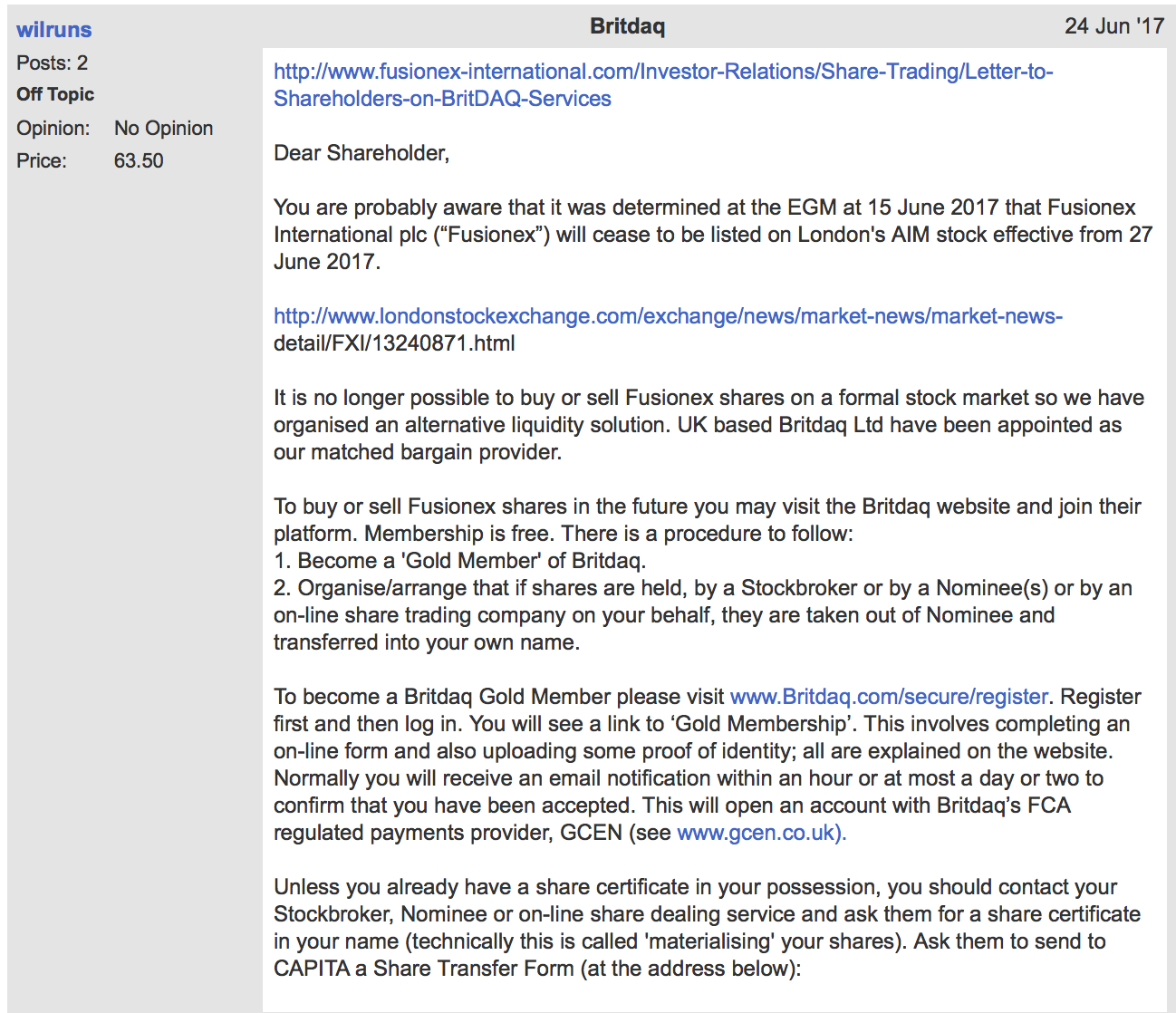

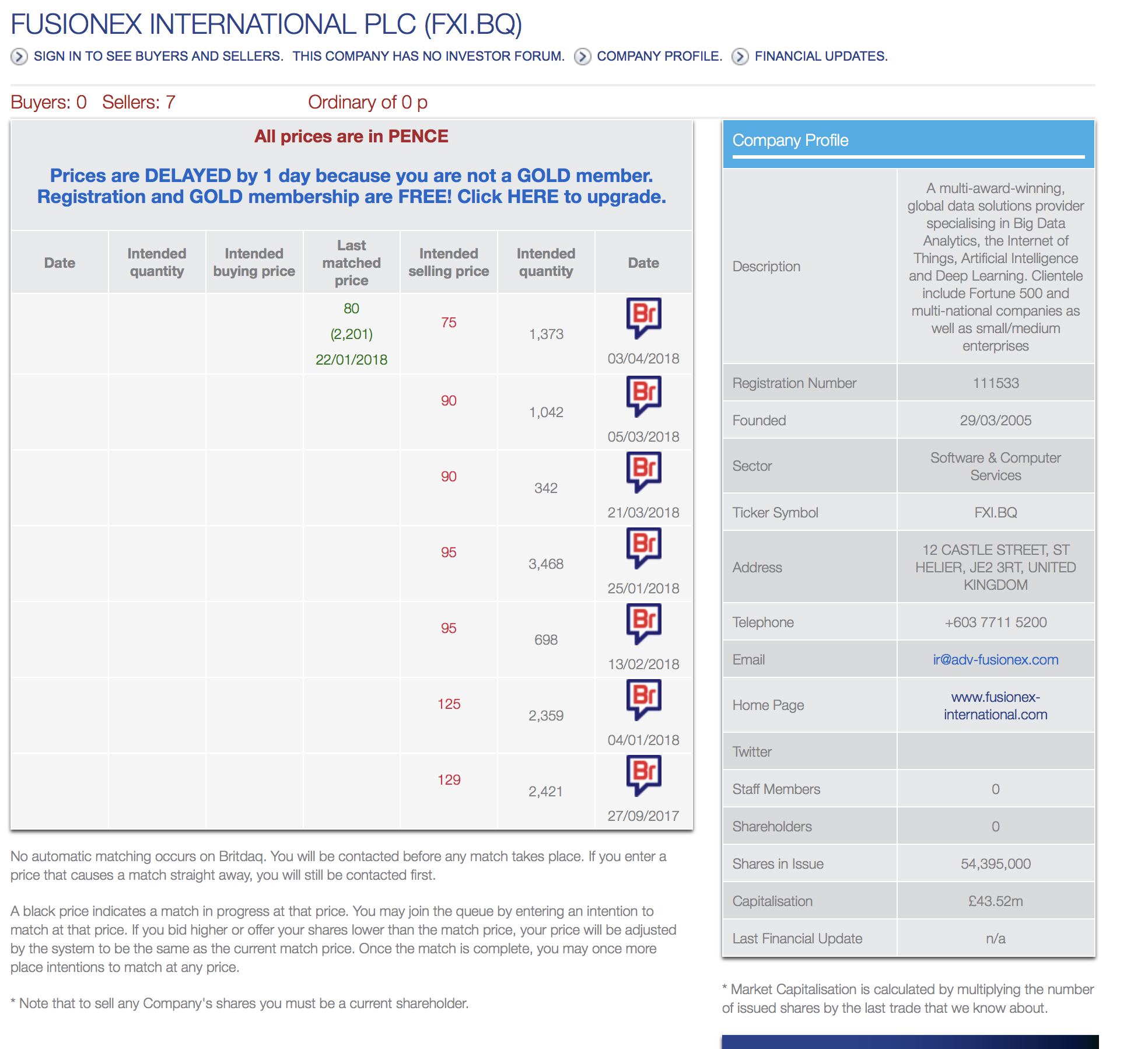

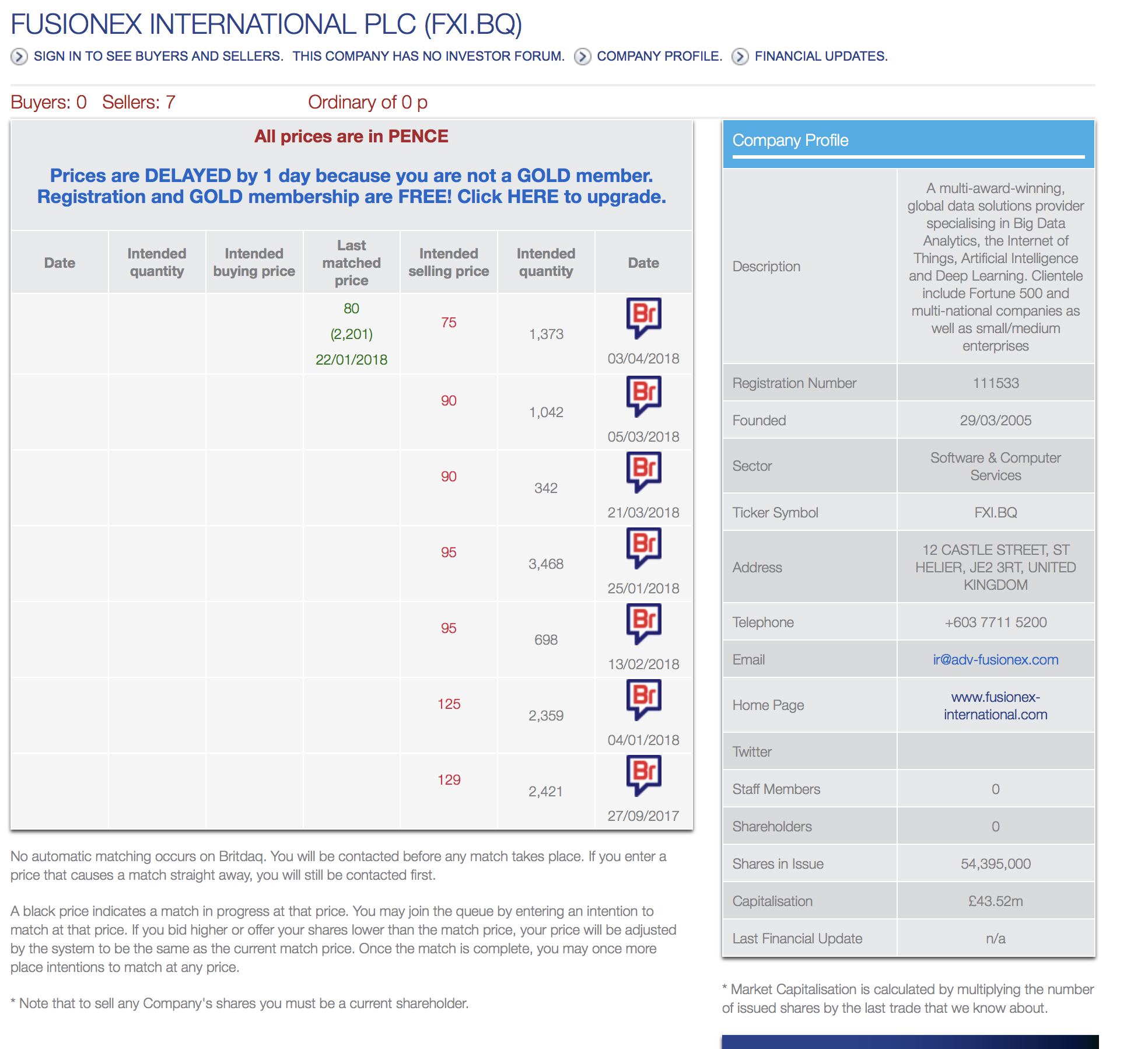

und das hier findet sich unter Britdaq:

https://www.britdaq.com/company/471

Antwort auf Beitrag Nr.: 57.633.855 von R-BgO am 26.04.18 12:38:09

Antwort auf Beitrag Nr.: 57.633.813 von R-BgO am 26.04.18 12:33:54

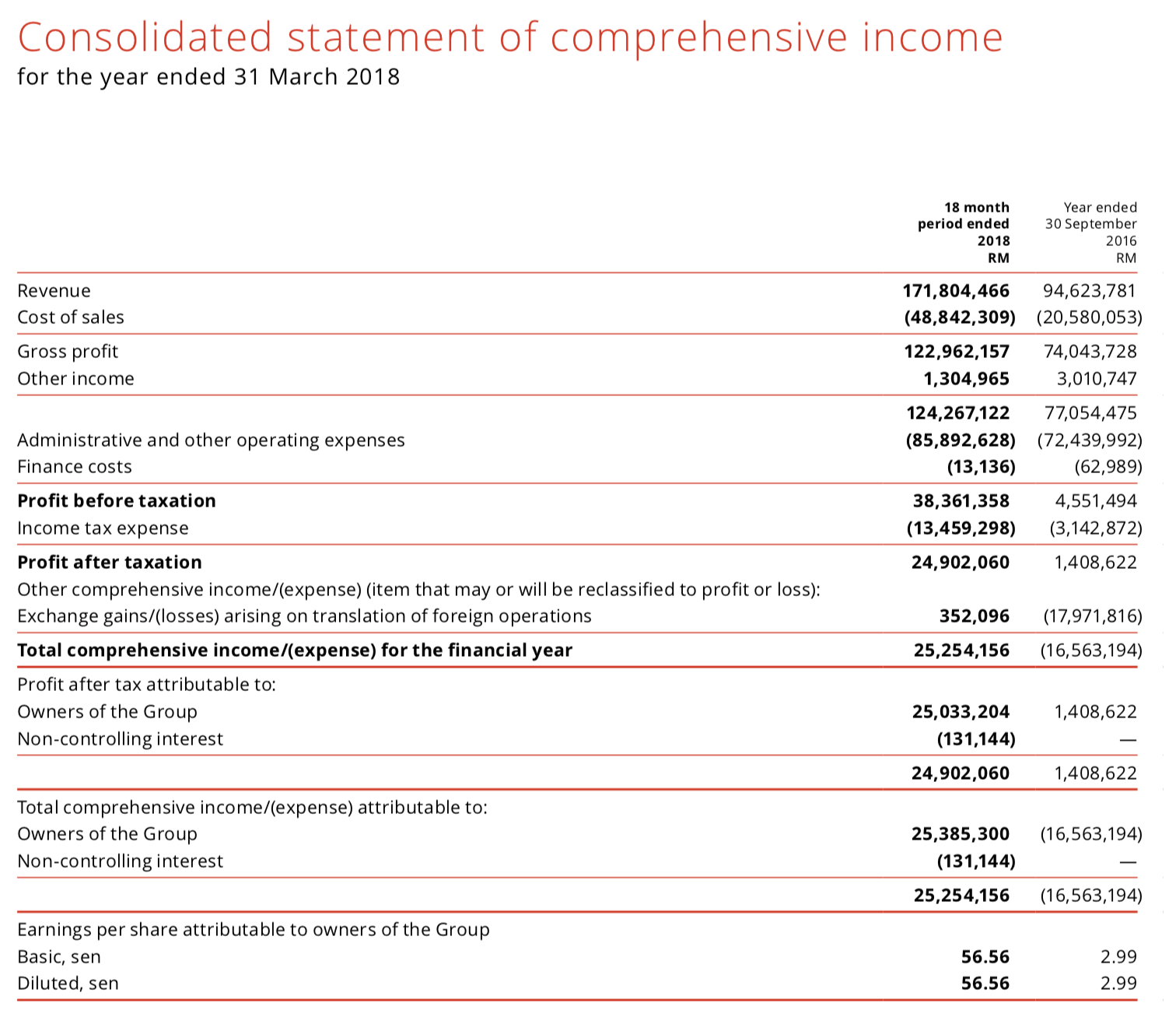

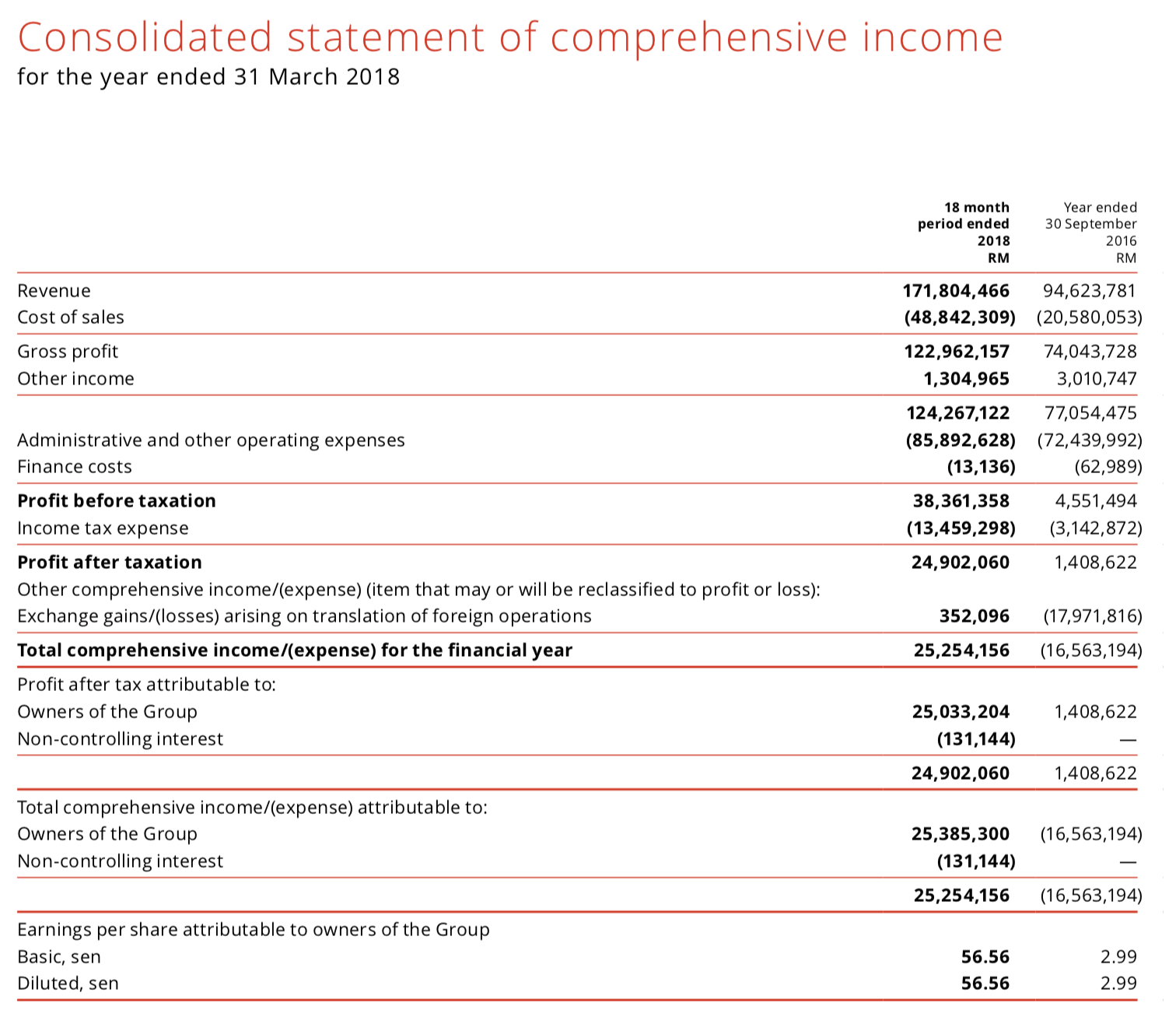

Der noch zu finassierende report wird 1.10.2016-31.3.2018 abdecken.

Ungewöhnlich.

ging ein paar Mal hin und her inzwischen...

ein Ergebnis ist, dass sie ein 18-Monats Geschäftsjahr eingeschoben haben, weil sie FY-end auf den März verlegt haben.Der noch zu finassierende report wird 1.10.2016-31.3.2018 abdecken.

Ungewöhnlich.

Antwort auf Beitrag Nr.: 57.884.775 von R-BgO am 01.06.18 10:41:24

Auszug:

ein Wunder!

heute auf Nachfrage per e-mail den Report erhalten;Auszug:

Antwort auf Beitrag Nr.: 59.041.861 von R-BgO am 24.10.18 14:13:22

im September

soll der nächste Report kommen... Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 196 | ||

| 93 | ||

| 65 | ||

| 50 | ||

| 46 | ||

| 43 | ||

| 42 | ||

| 37 | ||

| 33 | ||

| 27 |

| Wertpapier | Beiträge | |

|---|---|---|

| 23 | ||

| 21 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 19 | ||

| 19 | ||

| 18 | ||

| 15 | ||

| 15 |