Teekay Offshore Acquires ALP Maritime Services and Orders Four Long-Haul Towage Newbuildings - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 04.11.14 10:35:27 von

neuester Beitrag 27.07.19 11:10:44 von

neuester Beitrag 27.07.19 11:10:44 von

Beiträge: 23

ID: 1.201.828

ID: 1.201.828

Aufrufe heute: 0

Gesamt: 778

Gesamt: 778

Aktive User: 0

ISIN: MHY8565J1010 · WKN: A0MR2M

1,3566

EUR

+0,31 %

+0,0042 EUR

Letzter Kurs 22.01.20 Frankfurt

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 0,6800 | +312,12 | |

| 1,4300 | +40,20 | |

| 0,8841 | +31,96 | |

| 11,300 | +29,14 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | -11,11 | |

| 11,690 | -11,51 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 | |

| 0,5338 | -31,13 |

HAMILTON, BERMUDA--(Marketwired - Feb. 21, 2014) - Editors Note: There is one photo associated with this press release. Teekay Offshore Partners L.P. (Teekay Offshore or the Partnership) (NYSE:TOO) today announced that it has agreed …

Lesen sie den ganzen Artikel: Teekay Offshore Acquires ALP Maritime Services and Orders Four Long-Haul Towage Newbuildings

Lesen sie den ganzen Artikel: Teekay Offshore Acquires ALP Maritime Services and Orders Four Long-Haul Towage Newbuildings

habe zur Ergänzung von TK Corp und TK LNG auch mal ein paar Stücke hiervon genommen...

zwischendrin noch einmal aufgestockt, aber Jahreszahlen gestern sind netto minus;

Bilanz schon recht hoch gehebelt, aber Ausschüttung sehr attraktiv

CC kommt morgen

Bilanz schon recht hoch gehebelt, aber Ausschüttung sehr attraktiv

CC kommt morgen

verdoppelt

Dividendensenkung von 56c auf 11c:

HAMILTON, BERMUDA–(Marketwired – Dec. 16, 2015) – Teekay Offshore GP LLC, the general partner of Teekay Offshore Partners L.P. (Teekay Offshore or the Partnership) (NYSE:TOO), has approved a plan to reduce its quarterly cash distributions to $0.11 per common unit, down from $0.56 per common unit in the third quarter of 2015, commencing with the fourth quarter of 2015 distribution payable in February 2016. The Partnership expects to use a significant portion of its internally generated cash flow to fund equity capital requirements on its future profitable growth projects and reduce debt levels, eliminating the need to access the equity capital markets for the foreseeable future.

habe gestern noch ein paar der B-preferreds gekauft:

8,5% bei 22,40/25,00 = 89,6% von pari ergeben 9,49% laufende Verzinsung

8,5% bei 22,40/25,00 = 89,6% von pari ergeben 9,49% laufende Verzinsung

HAMILTON, BERMUDA–(Marketwired – July 26, 2017) –

Teekay Corporation (Teekay or Teekay Parent) (NYSE:TK) and Teekay Offshore Partners L.P. (Teekay Offshore or the Partnership) (NYSE:TOO) today announced that they have agreed to enter into a strategic partnership with Brookfield Business Partners L.P. (NYSE:BBU)(TSX:BBU.UN), together with its institutional partners (collectively Brookfield).

This transaction is part of a comprehensive solution for Teekay Offshore, which includes a $640 million equity investment and other financing initiatives detailed below.

Highlights

Brookfield is attracted to Teekay Offshore’s high-quality contracted cash flows and market leading positions in the offshore production and logistics space

Comprehensive solution significantly strengthens Teekay Offshore’s balance sheet

Fully finances Teekay Offshore’s existing growth projects, which are expected to provide significant near-term cash flow growth

Positions Teekay Offshore to better service its customers and take advantage of future growth opportunities

Teekay Offshore has ordered two shuttle tanker newbuildings, which will serve under the Master Agreement with Statoil, with the option to order two additional vessels under similar terms

“We are excited to have Brookfield join us as a strategic partner and co-sponsor of Teekay Offshore, which is a strong endorsement of Teekay Offshore’s leading market positions in the marine infrastructure space,” commented Kenneth Hvid, Teekay’s President and CEO. “The combination of Teekay’s operational platform and Brookfield’s global business platform and access to long-term capital is a complementary fit and creates one of the world’s strongest offshore marine infrastructure companies. Out of the range of alternatives evaluated, we believe this comprehensive solution represents the best possible outcome for all of our long-term stakeholders and positions Teekay Offshore to benefit from an energy market recovery. This transaction maintains the stability of Teekay Offshore’s significant forward cash flows and also improves Teekay Parent’s financial position by eliminating all of its financial guarantees to Teekay Offshore and increasing its own liquidity by approximately $140 million. This will enhance Teekay Parent’s ability to be a supportive sponsor to all of its Daughter companies going forward.”

“Brookfield’s co-sponsorship in Teekay Offshore provides both immediate and long-term benefits,” commented Ingvild Sæther, President and CEO of Teekay Offshore Group Ltd. “This transaction fully finances Teekay Offshore’s existing growth projects which, when delivered over the next few quarters, are expected to contribute an incremental $200 million of run-rate annual cash flow from vessel operations. Longer-term, the co-sponsorship of Brookfield and Teekay will provide greater access to capital, which will enable Teekay Offshore to better service its customers and take advantage of future growth opportunities as the global energy markets recover. Our recent order of shuttle tanker newbuildings to service Teekay Offshore’s North Sea Master Agreement with Statoil is just one example of the customer demand we are already seeing for our offshore production and logistics services.”

“Teekay Offshore has established itself as a global leader in the provision of marine services to the offshore oil production industry,” said Cyrus Madon, CEO of Brookfield Business Partners. “Our investment represents an opportunity to acquire a high quality, highly contracted business with presence in attractive markets, and we look forward to supporting Teekay Offshore with its continued growth.”

Summary of the Comprehensive Solution

Brookfield and Teekay will invest $610 million and $30 million, respectively, in Teekay Offshore at a price of $2.50 per common unit and receive 65.5 million Teekay Offshore warrants (Warrants) on a pro rata basis. Following the investment, Brookfield will own approximately 60 percent and Teekay will own approximately 14 percent of the common units of Teekay Offshore;

Brookfield will acquire from Teekay Parent both a 49 percent interest in Teekay Offshore GP LLC (TOO GP), the general partner of Teekay Offshore, and an option to acquire an additional 2 percent of TOO GP. On closing, Brookfield will have the right to elect four members to the nine-member Board of Directors of TOO GP;

Teekay Offshore will repurchase and cancel all $304 million of the outstanding Series C-1 and Series D preferred units from the existing unitholders for an aggregate amount of approximately $250 million in cash, which will save approximately $28 million in annual distributions;

Teekay Offshore has reached agreement in principle with the lenders of the Arendal Spirit UMS debt facility to extend the mandatory prepayment date out to September 30, 2018, in exchange for a certain principal prepayment, subject to receipt of lenders’ final internal approvals;

Brookfield will acquire from Teekay Parent an existing $200 million intercompany loan previously extended to Teekay Offshore in exchange for $140 million in cash and 11.4 million of the Warrants to be issued to Brookfield. Brookfield has agreed to extend the maturity date of the intercompany loan from 2019 to 2022;

Teekay Offshore will transfer its shuttle tanker business into a new, wholly-owned, non-recourse subsidiary, Teekay Shuttle Tankers LLC (ShuttleCo). As part of the formation of ShuttleCo, a majority of Teekay Offshore’s shuttle tanker fleet will be refinanced with a new $600 million, five-year debt facility, and two 50 percent-owned vessels will be refinanced with a new $71 million, four-year debt facility. In addition, an existing $250 million debt facility secured by the three East Coast Canada newbuildings, and an existing $143 million private placement project bond financing secured by two vessels, will be transferred from Teekay Offshore to ShuttleCo;

A significant portion of Teekay Offshore’s Norwegian Kroner (NOK) bond series due to mature in late-2018 and early-2019 is expected to be repurchased with proceeds from a new five-year, up to $250 million U.S. dollar denominated bond offering by ShuttleCo in the Norwegian bond market; and

Certain financial institutions providing interest rate swaps to Teekay Offshore have agreed to (i) lower the fixed interest rate on the swaps, (ii) extend the termination option of the swaps by two years to 2021, and (iii) eliminate the financial guarantee and security package currently provided by Teekay Parent in return for a certain prepayment amount and fee.

Distribution Declarations

As a condition of Brookfield’s equity investment, Teekay Offshore has agreed to reduce its existing common unit distribution to reinvest cash in the business and further strengthen the Partnership’s balance sheet. For the quarter ended June 30, 2017, TOO GP has declared a cash distribution of $0.01 per common unit. The cash distribution on the Teekay Offshore common units is payable on August 11, 2017 to all unitholders of record on August 7, 2017.

In addition, TOO GP has declared cash distributions of $0.4531 and $0.5313 per Teekay Offshore Series A Preferred unit and Series B Preferred unit, respectively, for the period from May 15, 2017 to August 14, 2017. The cash distributions on the preferred units are payable on August 15, 2017 to all unitholders of record on August 8, 2017.

Shuttle Tanker Newbuilding Order

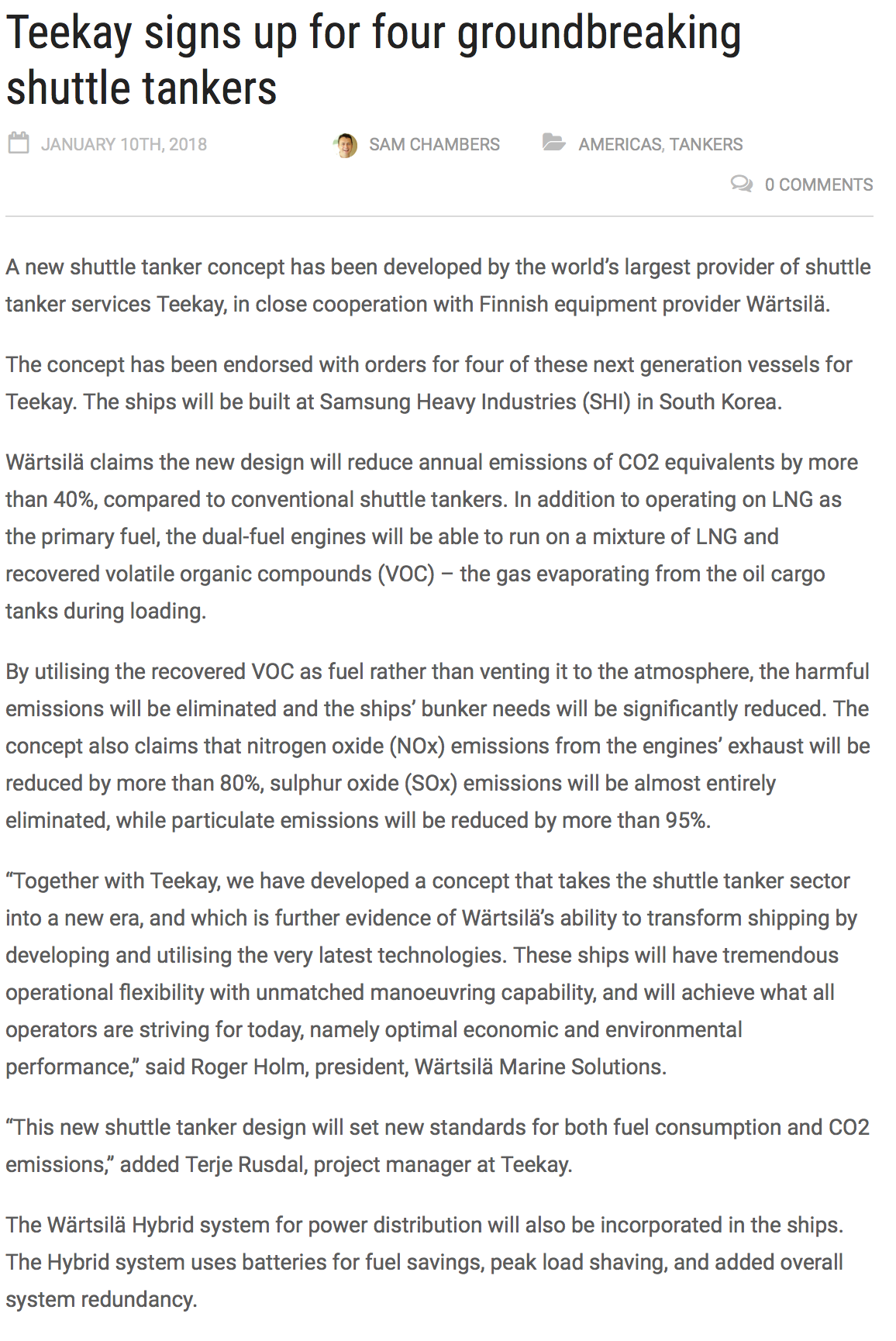

In addition to the formation of ShuttleCo, Teekay Offshore has entered into conditional shipbuilding contracts with Samsung Heavy Industries Co., Ltd. to construct two Suezmax-size, DP2 shuttle tanker newbuildings, with options to order up to two additional vessels. These newbuilding vessels will be constructed based on the Partnership’s New Shuttle Spirit design which incorporates proven technologies to increase fuel efficiency and reduce emissions, including LNG propulsion technology. Upon delivery in 2019 and 2020, these new vessels will provide shuttle tanker services in the North Sea under the Partnership’s existing Master Agreement with Statoil ASA (Statoil), which will free up required vessel capacity to service Teekay Offshore’s contract of affreightment (CoA) portfolio in the North Sea.

The strategic partnership with Brookfield, and related transactions, has been approved by the Board of Directors of Teekay, TOO GP, and Brookfield. Teekay Offshore’s Conflicts Committee, comprised of independent members of the board of directors of TOO GP, also approved the transactions between Teekay Offshore and Brookfield and Teekay Offshore and Teekay. Closing of the transactions, which remains subject to customary conditions, including, among others, regulatory approvals, is expected to occur in the third quarter of 2017.

DNB Markets acted as global coordinator and financial advisor to Teekay Offshore. Houlihan Lokey Capital, Inc. and Potter Anderson & Corroon acted as independent financial and legal advisors to Teekay Offshore’s Conflicts Committee.

Teekay Corporation (Teekay or Teekay Parent) (NYSE:TK) and Teekay Offshore Partners L.P. (Teekay Offshore or the Partnership) (NYSE:TOO) today announced that they have agreed to enter into a strategic partnership with Brookfield Business Partners L.P. (NYSE:BBU)(TSX:BBU.UN), together with its institutional partners (collectively Brookfield).

This transaction is part of a comprehensive solution for Teekay Offshore, which includes a $640 million equity investment and other financing initiatives detailed below.

Highlights

Brookfield is attracted to Teekay Offshore’s high-quality contracted cash flows and market leading positions in the offshore production and logistics space

Comprehensive solution significantly strengthens Teekay Offshore’s balance sheet

Fully finances Teekay Offshore’s existing growth projects, which are expected to provide significant near-term cash flow growth

Positions Teekay Offshore to better service its customers and take advantage of future growth opportunities

Teekay Offshore has ordered two shuttle tanker newbuildings, which will serve under the Master Agreement with Statoil, with the option to order two additional vessels under similar terms

“We are excited to have Brookfield join us as a strategic partner and co-sponsor of Teekay Offshore, which is a strong endorsement of Teekay Offshore’s leading market positions in the marine infrastructure space,” commented Kenneth Hvid, Teekay’s President and CEO. “The combination of Teekay’s operational platform and Brookfield’s global business platform and access to long-term capital is a complementary fit and creates one of the world’s strongest offshore marine infrastructure companies. Out of the range of alternatives evaluated, we believe this comprehensive solution represents the best possible outcome for all of our long-term stakeholders and positions Teekay Offshore to benefit from an energy market recovery. This transaction maintains the stability of Teekay Offshore’s significant forward cash flows and also improves Teekay Parent’s financial position by eliminating all of its financial guarantees to Teekay Offshore and increasing its own liquidity by approximately $140 million. This will enhance Teekay Parent’s ability to be a supportive sponsor to all of its Daughter companies going forward.”

“Brookfield’s co-sponsorship in Teekay Offshore provides both immediate and long-term benefits,” commented Ingvild Sæther, President and CEO of Teekay Offshore Group Ltd. “This transaction fully finances Teekay Offshore’s existing growth projects which, when delivered over the next few quarters, are expected to contribute an incremental $200 million of run-rate annual cash flow from vessel operations. Longer-term, the co-sponsorship of Brookfield and Teekay will provide greater access to capital, which will enable Teekay Offshore to better service its customers and take advantage of future growth opportunities as the global energy markets recover. Our recent order of shuttle tanker newbuildings to service Teekay Offshore’s North Sea Master Agreement with Statoil is just one example of the customer demand we are already seeing for our offshore production and logistics services.”

“Teekay Offshore has established itself as a global leader in the provision of marine services to the offshore oil production industry,” said Cyrus Madon, CEO of Brookfield Business Partners. “Our investment represents an opportunity to acquire a high quality, highly contracted business with presence in attractive markets, and we look forward to supporting Teekay Offshore with its continued growth.”

Summary of the Comprehensive Solution

Brookfield and Teekay will invest $610 million and $30 million, respectively, in Teekay Offshore at a price of $2.50 per common unit and receive 65.5 million Teekay Offshore warrants (Warrants) on a pro rata basis. Following the investment, Brookfield will own approximately 60 percent and Teekay will own approximately 14 percent of the common units of Teekay Offshore;

Brookfield will acquire from Teekay Parent both a 49 percent interest in Teekay Offshore GP LLC (TOO GP), the general partner of Teekay Offshore, and an option to acquire an additional 2 percent of TOO GP. On closing, Brookfield will have the right to elect four members to the nine-member Board of Directors of TOO GP;

Teekay Offshore will repurchase and cancel all $304 million of the outstanding Series C-1 and Series D preferred units from the existing unitholders for an aggregate amount of approximately $250 million in cash, which will save approximately $28 million in annual distributions;

Teekay Offshore has reached agreement in principle with the lenders of the Arendal Spirit UMS debt facility to extend the mandatory prepayment date out to September 30, 2018, in exchange for a certain principal prepayment, subject to receipt of lenders’ final internal approvals;

Brookfield will acquire from Teekay Parent an existing $200 million intercompany loan previously extended to Teekay Offshore in exchange for $140 million in cash and 11.4 million of the Warrants to be issued to Brookfield. Brookfield has agreed to extend the maturity date of the intercompany loan from 2019 to 2022;

Teekay Offshore will transfer its shuttle tanker business into a new, wholly-owned, non-recourse subsidiary, Teekay Shuttle Tankers LLC (ShuttleCo). As part of the formation of ShuttleCo, a majority of Teekay Offshore’s shuttle tanker fleet will be refinanced with a new $600 million, five-year debt facility, and two 50 percent-owned vessels will be refinanced with a new $71 million, four-year debt facility. In addition, an existing $250 million debt facility secured by the three East Coast Canada newbuildings, and an existing $143 million private placement project bond financing secured by two vessels, will be transferred from Teekay Offshore to ShuttleCo;

A significant portion of Teekay Offshore’s Norwegian Kroner (NOK) bond series due to mature in late-2018 and early-2019 is expected to be repurchased with proceeds from a new five-year, up to $250 million U.S. dollar denominated bond offering by ShuttleCo in the Norwegian bond market; and

Certain financial institutions providing interest rate swaps to Teekay Offshore have agreed to (i) lower the fixed interest rate on the swaps, (ii) extend the termination option of the swaps by two years to 2021, and (iii) eliminate the financial guarantee and security package currently provided by Teekay Parent in return for a certain prepayment amount and fee.

Distribution Declarations

As a condition of Brookfield’s equity investment, Teekay Offshore has agreed to reduce its existing common unit distribution to reinvest cash in the business and further strengthen the Partnership’s balance sheet. For the quarter ended June 30, 2017, TOO GP has declared a cash distribution of $0.01 per common unit. The cash distribution on the Teekay Offshore common units is payable on August 11, 2017 to all unitholders of record on August 7, 2017.

In addition, TOO GP has declared cash distributions of $0.4531 and $0.5313 per Teekay Offshore Series A Preferred unit and Series B Preferred unit, respectively, for the period from May 15, 2017 to August 14, 2017. The cash distributions on the preferred units are payable on August 15, 2017 to all unitholders of record on August 8, 2017.

Shuttle Tanker Newbuilding Order

In addition to the formation of ShuttleCo, Teekay Offshore has entered into conditional shipbuilding contracts with Samsung Heavy Industries Co., Ltd. to construct two Suezmax-size, DP2 shuttle tanker newbuildings, with options to order up to two additional vessels. These newbuilding vessels will be constructed based on the Partnership’s New Shuttle Spirit design which incorporates proven technologies to increase fuel efficiency and reduce emissions, including LNG propulsion technology. Upon delivery in 2019 and 2020, these new vessels will provide shuttle tanker services in the North Sea under the Partnership’s existing Master Agreement with Statoil ASA (Statoil), which will free up required vessel capacity to service Teekay Offshore’s contract of affreightment (CoA) portfolio in the North Sea.

The strategic partnership with Brookfield, and related transactions, has been approved by the Board of Directors of Teekay, TOO GP, and Brookfield. Teekay Offshore’s Conflicts Committee, comprised of independent members of the board of directors of TOO GP, also approved the transactions between Teekay Offshore and Brookfield and Teekay Offshore and Teekay. Closing of the transactions, which remains subject to customary conditions, including, among others, regulatory approvals, is expected to occur in the third quarter of 2017.

DNB Markets acted as global coordinator and financial advisor to Teekay Offshore. Houlihan Lokey Capital, Inc. and Potter Anderson & Corroon acted as independent financial and legal advisors to Teekay Offshore’s Conflicts Committee.

Antwort auf Beitrag Nr.: 55.405.790 von R-BgO am 27.07.17 16:17:43

nur leider sind sie damit lediglich wieder grob da, wo ich sie gekauft habe...

und der Verlust bei den common units dürfte nun eingeloggt sein.

Aktie +16%,

bei beiden preferreds fast plus 30%;nur leider sind sie damit lediglich wieder grob da, wo ich sie gekauft habe...

und der Verlust bei den common units dürfte nun eingeloggt sein.

Antwort auf Beitrag Nr.: 54.409.798 von R-BgO am 25.02.17 11:36:03

noch ein paar B's für ,30 dazu geholt,

jetzt habe ich gleich viele von A und B

Closing sollte within Q3 sein...

Antwort auf Beitrag Nr.: 55.406.054 von R-BgO am 27.07.17 16:50:46

heute drastisch verbilligt,

nachdem Closing erfolgt

Antwort auf Beitrag Nr.: 55.406.201 von R-BgO am 27.07.17 17:03:38

Thread: Teekay Offshore Partners pref. B

der Vollständigkeit halber:

Thread: Teekay Offshore Partners pref. AThread: Teekay Offshore Partners pref. B

Q1 sah richtig solide aus...

Wie sieht das steuerlich aus, wenn man TOO-Aktien kauft? Werden die als Aktien behandelt, d. h. Kapitalertragssteuer wird gleich durch die Bank abgezogen, oder muß man die Kapitalerträge aus den Units wegen der Limited Partnership mit dem persönlichen Einkommensteuersatz über die Steuererklärung versteuern?

Q2 mit dickem write-down

Offshore meldet inzwischen früher, als der Rest der Truppe;

Q3 kam bereits am 1.11., die anderen erst morgen.Möglicherweise wird auch künftig nicht mehr bei TK Corp., sondern bei BBU konsolidiert:

Antwort auf Beitrag Nr.: 59.212.339 von R-BgO am 14.11.18 14:37:08

die sind von 22+ Ende August bis in die 16,xx gestern abgesoffen, während

* die B "nur" von 24+ auf 19,xx und

* die E von 24+ auf 21,xx

-beide auch erst im November- runtergegangen sind;

besondere Kaufgelegenheit?

ein Rätsel:

zuletzt sind alle TOO-Papiere weiter südwärts gerauscht, aber besonders auffällig ist es bei den A-preferreds;die sind von 22+ Ende August bis in die 16,xx gestern abgesoffen, während

* die B "nur" von 24+ auf 19,xx und

* die E von 24+ auf 21,xx

-beide auch erst im November- runtergegangen sind;

besondere Kaufgelegenheit?

Antwort auf Beitrag Nr.: 59.212.642 von R-BgO am 14.11.18 15:09:23

TOO Much Debt…

November 4, 2018

I wrote about Teekay Offshore (TOO – USA) on January 1, 2018 following the end of tax loss selling season. At the time, my thesis was that reported numbers were a mess of 1-time events that investors couldn’t follow, yet new growth projects were coming online and a more stabilized cash flow stream would evolve.

In the interim, you were paying about 5-times stabilized distributable cash flow (DCF) for a business with long-term contracts in place. Additionally, Brookfield was now in control and they would add a lot of adult supervision while growth projects came online.

In particular, Brookfield would focus on de-leveraging, using their imprimatur to refinance debt and dramatically reduce overall interest costs which currently consume about 70% of normalized pre-tax cash flow.

A combination of de-levering, lower interest costs and renaming the company “Brookfield Offshore” would bring about a dramatic re-rating of the valuation. Looking forward 3 years, you could see a company with 60 to 80 cents a share of DCF, trading at a value of 10 to 15 times that DCF or $6 to $12 a share.

Over the course of the year, the thesis hasn’t played out as expected.

The new projects have come online, but the 1-time charges seem to continue each quarter. This quarter it was the chaos of re-financing the debt (fx/currency forwards/interest rate swaps/etc.). I can look past that for another quarter or two.

The bigger issue is that the debt is not being paid down—in fact it looks like it will increase.

On the conference call, management talked about bidding on multi-billion dollar projects. Where will they get the capital from? As it is, there’s an $800 million shuttle-tanker building program underway and the funding for that is unclear. What is clear is that debt isn’t getting paid down.

I had thought that with some debt amortization TOO could re-finance their debt to be more in line with their only other large shuttle tanker competitor, Knot Offshore Partners (KNOP – USA). KNOP is paying LIBOR + 2.125 on their most recent debt refinancing. That’s a whole lot better than the 8% that TOO is paying. Saving 3% a year would be almost $100 million a year in interest savings, or 25 cents a share in added DCF—which at a 10 multiple is more than the share price.

In any case, when my thesis is proven wrong; I sell—even if it is cheap. If these guys want to pile on more debt during a pending debt crisis, I don’t need to be involved.

I was really on the fence about TOO going into earnings—I saw the value of the shuttle tanker fleet which is a global duopoly that earns excess returns and wanted to own that business as demand increases with the rebound of offshore oil. However, I don’t like debt and this debt looks like it will grow. I wish I had sold when I sold a lot of my other positions a few weeks back. In any case, I bought mine at around 2.25 and sold for around 2.05 or a 9% loss. I also got 3 pennies of dividends along the way that I’m not including. I’ve had some big winners this year, they’re balanced out with 2 smaller losses—TOO and St. Joe (JOE – USA).

hhhhmmmm....

http://adventuresincapitalism.com/2018/11/04/too-much-debt/TOO Much Debt…

November 4, 2018

I wrote about Teekay Offshore (TOO – USA) on January 1, 2018 following the end of tax loss selling season. At the time, my thesis was that reported numbers were a mess of 1-time events that investors couldn’t follow, yet new growth projects were coming online and a more stabilized cash flow stream would evolve.

In the interim, you were paying about 5-times stabilized distributable cash flow (DCF) for a business with long-term contracts in place. Additionally, Brookfield was now in control and they would add a lot of adult supervision while growth projects came online.

In particular, Brookfield would focus on de-leveraging, using their imprimatur to refinance debt and dramatically reduce overall interest costs which currently consume about 70% of normalized pre-tax cash flow.

A combination of de-levering, lower interest costs and renaming the company “Brookfield Offshore” would bring about a dramatic re-rating of the valuation. Looking forward 3 years, you could see a company with 60 to 80 cents a share of DCF, trading at a value of 10 to 15 times that DCF or $6 to $12 a share.

Over the course of the year, the thesis hasn’t played out as expected.

The new projects have come online, but the 1-time charges seem to continue each quarter. This quarter it was the chaos of re-financing the debt (fx/currency forwards/interest rate swaps/etc.). I can look past that for another quarter or two.

The bigger issue is that the debt is not being paid down—in fact it looks like it will increase.

On the conference call, management talked about bidding on multi-billion dollar projects. Where will they get the capital from? As it is, there’s an $800 million shuttle-tanker building program underway and the funding for that is unclear. What is clear is that debt isn’t getting paid down.

I had thought that with some debt amortization TOO could re-finance their debt to be more in line with their only other large shuttle tanker competitor, Knot Offshore Partners (KNOP – USA). KNOP is paying LIBOR + 2.125 on their most recent debt refinancing. That’s a whole lot better than the 8% that TOO is paying. Saving 3% a year would be almost $100 million a year in interest savings, or 25 cents a share in added DCF—which at a 10 multiple is more than the share price.

In any case, when my thesis is proven wrong; I sell—even if it is cheap. If these guys want to pile on more debt during a pending debt crisis, I don’t need to be involved.

I was really on the fence about TOO going into earnings—I saw the value of the shuttle tanker fleet which is a global duopoly that earns excess returns and wanted to own that business as demand increases with the rebound of offshore oil. However, I don’t like debt and this debt looks like it will grow. I wish I had sold when I sold a lot of my other positions a few weeks back. In any case, I bought mine at around 2.25 and sold for around 2.05 or a 9% loss. I also got 3 pennies of dividends along the way that I’m not including. I’ve had some big winners this year, they’re balanced out with 2 smaller losses—TOO and St. Joe (JOE – USA).

TOO meldet jetzt immer etwas vor dem Rest des Rudels:

Q4 war profitabel aufgrund eines Settlements mit Petrobras;Es sieht so aus, als ob das Bluten (fast) gestoppt wäre, aber es wird höchste Eisenbahn für deleveraging...

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -2,56 | |

| -1,06 | |

| -0,38 | |

| +70,59 | |

| -1,29 | |

| +1,83 | |

| -0,51 | |

| +0,83 | |

| +6,77 | |

| -14,23 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 198 | ||

| 95 | ||

| 69 | ||

| 50 | ||

| 46 | ||

| 42 | ||

| 40 | ||

| 38 | ||

| 35 | ||

| 27 |