Union Pacific zahlt 50 Cents Dividende (Seite 2)

eröffnet am 01.12.14 18:12:16 von

neuester Beitrag 27.07.23 09:29:19 von

neuester Beitrag 27.07.23 09:29:19 von

Beiträge: 85

ID: 1.203.536

ID: 1.203.536

Aufrufe heute: 0

Gesamt: 10.638

Gesamt: 10.638

Aktive User: 0

ISIN: US9078181081 · WKN: 858144 · Symbol: UNP

227,85

EUR

+5,10 %

+11,05 EUR

Letzter Kurs 14:45:19 Tradegate

Neuigkeiten

13:45 Uhr · Business Wire (engl.) |

18.04.24 · Business Wire (engl.) |

10.04.24 · Business Wire (engl.) |

28.03.24 · Business Wire (engl.) |

02.02.24 · Aktienwelt360 |

Werte aus der Branche Verkehr

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0100 | +304,00 | |

| 0,7200 | +56,42 | |

| 0,5643 | +30,81 | |

| 12,790 | +19,42 | |

| 2,1400 | +16,30 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 35,45 | -11,38 | |

| 1,2600 | -11,89 | |

| 0,9100 | -12,50 | |

| 0,6000 | -15,25 | |

| 8,2702 | -49,26 |

Beitrag zu dieser Diskussion schreiben

Die Rally auf Schienen: Das sind die Gewinner-Aktien

Die Konsumwut der Verbraucher lässt auch die Logistikbranche boomen. Profiteure sind die Bahngesellschaften, die gleichzeitig mit Klimaschutz punkten, und ihre Zulieferer.

https://www.finanzen.net/nachricht/aktien/volle-fahrt-die-ra…

Antwort auf Beitrag Nr.: 67.544.687 von biviol1 am 21.03.21 14:40:07für den baranteil von 90$ pro ksu aktie erstmal cp gekauft.

FreightWaves

Wed, March 24, 2021, 4:29 PM

Canadian Pacific (NYSE: CP) announced plans to acquire Kansas City Southern (NYSE: KSU) for $29 billion on Sunday morning. Here are five initial impressions from Wall Street transportation analysts about this proposed transaction.

Wall Street likes the deal

The merger of CP and Kansas City Southern (KCS) would be combining two of the smallest Class I railroads. It would also be integrating two railroads that are striving to reach an operating ratio (OR) in the mid-50s. OR, represented in a percentage such as 55%, is a tool investors use to gauge the financial health of a company, with a lower OR implying improved financial health.

"We believe the fit of the two rail systems and strategic logic is good. Both railroads have track records of delivering volume growth and the significant extension of CP's reach should allow meaningful revenue synergies," said a Monday note from UBS (NYSE: UBS) transportation analyst Tom Wadewitz.

However, like other observers, Wall Street will also be watching how the Surface Transportation Board, the regulatory body that would approve the merger, considers CP's proposed acquisition, noting that the board has been mindful of shippers' concerns in recent and ongoing proceedings.

Could the third time be a charm?

CP has considered merging with two other Class I railroads — CSX (NYSE: CSX) and Norfolk Southern (NYSE: NSC) — in the past seven years. But this merger would be different because it would be with a much smaller railroad revenuewise.

"The regulatory consideration is an important one because in 2016, during CP's attempted takeover of Norfolk Southern (NSC), the attempt ended after heightened scrutiny from the Obama administration on antitrust issues," said Deutsche Bank (NYSE: DB) analyst Amit Mehrotra. "But we note at that time NSC rejected CP's offer, whereas [this] announcement is a friendly deal, and KSU is only about one-fourth the size of NSC from a revenue standpoint — i.e., pro forma for the deal CPKC will still be the smallest Class I rail." CPKC stands for the name for the new company.

Could this result in more mergers and acquisitions?

Although analysts are uncertain whether the CP-KCS transaction will result in a wave of mergers and acquisitions with the freight railroad industry, the proposed acquisition points to an industry that seeks to pivot to growth after implementing precision scheduled railroading (PSR), an operational tool that seeks to streamline operations and cut costs.

"This transaction could get other railroads thinking about the urge to merge. Aside from other mergers, CPKC is targeting nearly $800 [million] in revenue synergies by 2025. These are likely to be spread fairly evenly over the time frame and come from three main buckets: intermodal/automotive, bulk and carload," said Cowen (NASDAQ: COWN) analyst Jason Seidl in a Monday note. "Some of these wins will undoubtedly be taken off the highway as a complete interline service should make for a more reliable rail product. On its deal call, management mentioned that it plans to offer new services as well due to the increased reach and specifically mentioned some routes east of Chicago. Some of these could be taken from other rail operators in our view."

Bascome Majors, analyst for Susquehanna Financial Group (OTC: SQCF), said, "To be clear, we wouldn't expect other Class I deals to be announced near term, with executives, boards and advisers of other rails closely watching the CP-KSU litmus test for the STB's current merger appetite before diving in. But if CP-KSU were to show signs of regulatory traction, a full-fledged final round of Class I consolidation could follow in 2022-2025."

Which railroads would be affected by this?

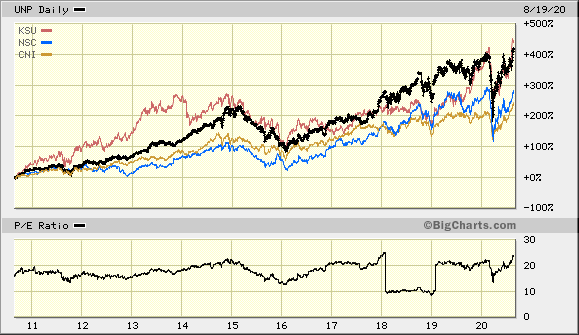

Competing Canadian railway CN (NYSE: CNI) is likely to be affected by the merger since it has a T-shaped network consisting of the two Canadian coasts and the U.S. Gulf Coast. The CP-KCS combination would also have a T-shaped network.

But Union Pacific (NYSE: UNP) could face a potential share shift, particularly for automotive and intermodal traffic, because of its cross-border network with Mexico. BNSF (NYSE: BRK) could also be exposed as well to potential competition for grain transport in the Upper Midwest.

"The potential combination of CP and KSU would create a stronger north-south railroad competitor to UNP and CNI," Wadewitz said. "UNP has an efficient route structure from Chicago to Texas and the border at Laredo and CP/KSU would also become a stronger competitor on traffic running north-south in the U.S. We would expect CP and KSU to move a portion of their interchange traffic with other railroads onto the new combined system if the deal is approved."

But there is still a lot of regulatory uncertainty

Despite initial expectations that STB would likely approve the deal, industry consolidation in the 1980s and 1990s has led to a field consisting of seven Class I railroads. Regulators — and shippers especially — are wary of additional consolidation.

"To be clear, we do believe the STB will ultimately approve the CP-KSU merger. But we're also prepared for the process to drag on beyond the mid-2022 approval timeline management laid out today, with an approval potentially including conditions offering modest concessions to customers and competitors," Majors said.

https://www.bnnbloomberg.ca/video/very-encouraged-by-respons…

FreightWaves

Wed, March 24, 2021, 4:29 PM

Canadian Pacific (NYSE: CP) announced plans to acquire Kansas City Southern (NYSE: KSU) for $29 billion on Sunday morning. Here are five initial impressions from Wall Street transportation analysts about this proposed transaction.

Wall Street likes the deal

The merger of CP and Kansas City Southern (KCS) would be combining two of the smallest Class I railroads. It would also be integrating two railroads that are striving to reach an operating ratio (OR) in the mid-50s. OR, represented in a percentage such as 55%, is a tool investors use to gauge the financial health of a company, with a lower OR implying improved financial health.

"We believe the fit of the two rail systems and strategic logic is good. Both railroads have track records of delivering volume growth and the significant extension of CP's reach should allow meaningful revenue synergies," said a Monday note from UBS (NYSE: UBS) transportation analyst Tom Wadewitz.

However, like other observers, Wall Street will also be watching how the Surface Transportation Board, the regulatory body that would approve the merger, considers CP's proposed acquisition, noting that the board has been mindful of shippers' concerns in recent and ongoing proceedings.

Could the third time be a charm?

CP has considered merging with two other Class I railroads — CSX (NYSE: CSX) and Norfolk Southern (NYSE: NSC) — in the past seven years. But this merger would be different because it would be with a much smaller railroad revenuewise.

"The regulatory consideration is an important one because in 2016, during CP's attempted takeover of Norfolk Southern (NSC), the attempt ended after heightened scrutiny from the Obama administration on antitrust issues," said Deutsche Bank (NYSE: DB) analyst Amit Mehrotra. "But we note at that time NSC rejected CP's offer, whereas [this] announcement is a friendly deal, and KSU is only about one-fourth the size of NSC from a revenue standpoint — i.e., pro forma for the deal CPKC will still be the smallest Class I rail." CPKC stands for the name for the new company.

Could this result in more mergers and acquisitions?

Although analysts are uncertain whether the CP-KCS transaction will result in a wave of mergers and acquisitions with the freight railroad industry, the proposed acquisition points to an industry that seeks to pivot to growth after implementing precision scheduled railroading (PSR), an operational tool that seeks to streamline operations and cut costs.

"This transaction could get other railroads thinking about the urge to merge. Aside from other mergers, CPKC is targeting nearly $800 [million] in revenue synergies by 2025. These are likely to be spread fairly evenly over the time frame and come from three main buckets: intermodal/automotive, bulk and carload," said Cowen (NASDAQ: COWN) analyst Jason Seidl in a Monday note. "Some of these wins will undoubtedly be taken off the highway as a complete interline service should make for a more reliable rail product. On its deal call, management mentioned that it plans to offer new services as well due to the increased reach and specifically mentioned some routes east of Chicago. Some of these could be taken from other rail operators in our view."

Bascome Majors, analyst for Susquehanna Financial Group (OTC: SQCF), said, "To be clear, we wouldn't expect other Class I deals to be announced near term, with executives, boards and advisers of other rails closely watching the CP-KSU litmus test for the STB's current merger appetite before diving in. But if CP-KSU were to show signs of regulatory traction, a full-fledged final round of Class I consolidation could follow in 2022-2025."

Which railroads would be affected by this?

Competing Canadian railway CN (NYSE: CNI) is likely to be affected by the merger since it has a T-shaped network consisting of the two Canadian coasts and the U.S. Gulf Coast. The CP-KCS combination would also have a T-shaped network.

But Union Pacific (NYSE: UNP) could face a potential share shift, particularly for automotive and intermodal traffic, because of its cross-border network with Mexico. BNSF (NYSE: BRK) could also be exposed as well to potential competition for grain transport in the Upper Midwest.

"The potential combination of CP and KSU would create a stronger north-south railroad competitor to UNP and CNI," Wadewitz said. "UNP has an efficient route structure from Chicago to Texas and the border at Laredo and CP/KSU would also become a stronger competitor on traffic running north-south in the U.S. We would expect CP and KSU to move a portion of their interchange traffic with other railroads onto the new combined system if the deal is approved."

But there is still a lot of regulatory uncertainty

Despite initial expectations that STB would likely approve the deal, industry consolidation in the 1980s and 1990s has led to a field consisting of seven Class I railroads. Regulators — and shippers especially — are wary of additional consolidation.

"To be clear, we do believe the STB will ultimately approve the CP-KSU merger. But we're also prepared for the process to drag on beyond the mid-2022 approval timeline management laid out today, with an approval potentially including conditions offering modest concessions to customers and competitors," Majors said.

https://www.bnnbloomberg.ca/video/very-encouraged-by-respons…

https://futureforfreight.com/investors/press-release/

😡 mich ein wenig an. war zwar klar das da was kommt, aber

zumindest fette beute für 3 jahre.

😡 mich ein wenig an. war zwar klar das da was kommt, aber

zumindest fette beute für 3 jahre.

Habe um 170 Euro zugeschlagen, zwei Tage später hätte ich sie um 161 gekriegt :-) Ist aber nicht dramatisch, die vererbe ich meinem Junior

Ich denke am 29 04 21

Antwort auf Beitrag Nr.: 66.515.219 von Srtmtim am 20.01.21 04:55:03wann kommen hier die Zahlen ?

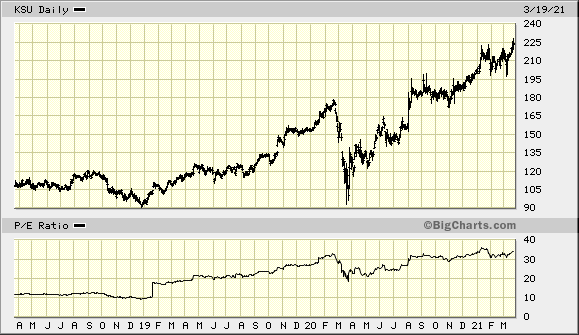

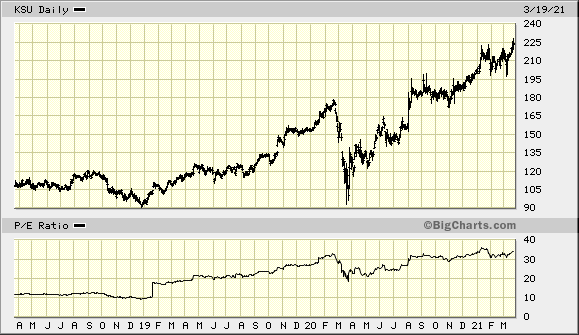

Hat jemand Ideen zu einem vertretbaren Einstiegspreis? Ich möchte hier langfristig investieren, will allerdings nicht zum ATH einsteigen. Wäre dankbar für Anregungen.

teuer

aber dankt psr sollten die gewinnen weiter stark wachsen

Die US-Regierung hat eine positive Zwischenbilanz des Handelsabkommens mit China gezogen. Er sei zufrieden damit, wie China seinen Verpflichtungen zum Kauf von US-Importen zunehmend nachkomme, sagte Larry Kudlow, der Wirtschaftsberater von Präsident Trump, am Donnerstag.

https://www.finanznachrichten.de/nachrichten-2020-08/5046906…" target="_blank" rel="nofollow ugc noopener">

https://www.finanznachrichten.de/nachrichten-2020-08/5046906…

13:45 Uhr · Business Wire (engl.) · Union Pacific |

02.02.24 · Aktienwelt360 · Canadian National Railway |