Noble Group Ltd.

eröffnet am 14.08.15 16:37:27 von

neuester Beitrag 10.08.23 13:10:52 von

neuester Beitrag 10.08.23 13:10:52 von

Beiträge: 51

ID: 1.217.163

ID: 1.217.163

Aufrufe heute: 0

Gesamt: 5.990

Gesamt: 5.990

Aktive User: 0

ISIN: BMG6542T1505 · WKN: A2DQQG

0,0400

EUR

-2,44 %

-0,0010 EUR

Letzter Kurs 16.11.18 Frankfurt

Werte aus der Branche Industrie/Mischkonzerne

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6087 | +14,85 | |

| 2,0700 | +13,11 | |

| 7,4250 | +7,07 | |

| 1,1030 | +6,57 | |

| 1,2400 | +5,98 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7500 | -7,41 | |

| 6,2000 | -7,67 | |

| 6,5375 | -9,20 | |

| 35,90 | -10,92 | |

| 71,00 | -11,25 |

Beitrag zu dieser Diskussion schreiben

10.8.2023

Founder of Failed Commodity Trader Noble Sues Over Restructuring

https://news.bloomberglaw.com/securities-law/founder-of-fail…

Elman argues that deal was unfair to minority shareholders

Legal action in Hong Kong seeks disclosure of documents

...

Founder of Failed Commodity Trader Noble Sues Over Restructuring

https://news.bloomberglaw.com/securities-law/founder-of-fail…

Elman argues that deal was unfair to minority shareholders

Legal action in Hong Kong seeks disclosure of documents

...

31.5.

Embattled Noble Group Can’t Repay Remaining Bond on Time

https://www.bnnbloomberg.ca/embattled-noble-group-can-t-repa…

...

Noble Group Holdings Ltd., once Asia’s largest commodity trader before being hit by years of losses and collapsing into a restructuring, is seeking to defer repaying its last remaining bond that comes due next month.

The company has struggled since emerging from a multibillion-dollar debt restructuring in 2018, and earlier this year handed ownership of its trading unit to bondholders. Now it’s in talks to defer repayment of its so-called Asset Co.’s bond, as it won’t be able to sell its assets before the note comes due next month, according to a filing from a UK-based subsidiary.

“Asset Co. lacks an ability to repay the bond on its maturity in June 2022,” according to the annual report of the subsidiary, General Alumina Holdings Ltd., which is dated April 29. “As a result, management of Asset Co. is in constructive negotiations with bondholders to defer the maturity date of the bond for at least two years.”

In a statement to Bloomberg, the company said “it is not a secret that Noble Group Holdings Ltd. is in constructive discussions with holders of the 2022 notes to extend the term, which is why it’s stated in the GAJ annual report.”

...

Following the restructuring of two bonds tied to its trading unit earlier this year, parent Noble Group Holdings owns just two assets: a majority stake in Jamaican alumina refinery Jamalco, and an indirect 8.3% shareholding in Harbour Energy Plc.

Production at Jamalco has been halted since a fire caused major damage in August. And because the stake in Harbour Energy is held through an investment partnership with private equity group EIG Partners, that has limited Noble’s ability to sell it.

They’re the last remaining pieces of the once Singapore-listed Noble in which its former shareholders own a stake. Some Singaporean shareholders lost their savings in when the company collapsed in 2018.

In the annual report, General Alumina Holdings said that a “limited availability of cash” and “inability to monetize its assets until the repayment date of the bond” explained the need to defer repayment of the Asset Co. bond.

“In the case of unsuccessful negotiations with the bondholders, Asset Co. will incur a breach of non-payment, which could then lead to passing of control of Asset Co. to the bondholders,” it said.

...

Embattled Noble Group Can’t Repay Remaining Bond on Time

https://www.bnnbloomberg.ca/embattled-noble-group-can-t-repa…

...

Noble Group Holdings Ltd., once Asia’s largest commodity trader before being hit by years of losses and collapsing into a restructuring, is seeking to defer repaying its last remaining bond that comes due next month.

The company has struggled since emerging from a multibillion-dollar debt restructuring in 2018, and earlier this year handed ownership of its trading unit to bondholders. Now it’s in talks to defer repayment of its so-called Asset Co.’s bond, as it won’t be able to sell its assets before the note comes due next month, according to a filing from a UK-based subsidiary.

“Asset Co. lacks an ability to repay the bond on its maturity in June 2022,” according to the annual report of the subsidiary, General Alumina Holdings Ltd., which is dated April 29. “As a result, management of Asset Co. is in constructive negotiations with bondholders to defer the maturity date of the bond for at least two years.”

In a statement to Bloomberg, the company said “it is not a secret that Noble Group Holdings Ltd. is in constructive discussions with holders of the 2022 notes to extend the term, which is why it’s stated in the GAJ annual report.”

...

Following the restructuring of two bonds tied to its trading unit earlier this year, parent Noble Group Holdings owns just two assets: a majority stake in Jamaican alumina refinery Jamalco, and an indirect 8.3% shareholding in Harbour Energy Plc.

Production at Jamalco has been halted since a fire caused major damage in August. And because the stake in Harbour Energy is held through an investment partnership with private equity group EIG Partners, that has limited Noble’s ability to sell it.

They’re the last remaining pieces of the once Singapore-listed Noble in which its former shareholders own a stake. Some Singaporean shareholders lost their savings in when the company collapsed in 2018.

In the annual report, General Alumina Holdings said that a “limited availability of cash” and “inability to monetize its assets until the repayment date of the bond” explained the need to defer repayment of the Asset Co. bond.

“In the case of unsuccessful negotiations with the bondholders, Asset Co. will incur a breach of non-payment, which could then lead to passing of control of Asset Co. to the bondholders,” it said.

...

Hey faultcode,

betrifft das den Alt-Aktionäre überhaupt noch? Die Aktie ist doch mausetot, oder?

betrifft das den Alt-Aktionäre überhaupt noch? Die Aktie ist doch mausetot, oder?

17.12.2021

The Latest Twist in Its Epic Collapse Is Noble Group’s Second Restructure in Three Years

https://finance.yahoo.com/news/latest-twist-epic-collapse-no…

...

The epic downfall of what was once Asia’s largest commodity trader took another turn, with Noble Group Holdings Ltd. laying out plans for its second restructuring in three years.

The company said Friday it had reached an in-principle agreement with creditors and will reorganize the ownership of some assets after its debt reached an “unsustainable” level. The process will see its debt fall to about $500 million from about $1.5 billion now.

Formerly a behemoth of Asia’s commodity trading landscape, with a market value of more than $10 billion, Noble has collapsed into a shell of its former self amid accusations of improper accounting -- which the company denies -- and billions of dollars in losses. The trader undertook a multibillion-dollar debt restructuring in 2018 which converted much of its debt to equity and handed control to a group of hedge fund creditors led by Taconic Capital Advisors.

The latest restructuring is expected to be completed by March 31. Bloomberg News previously reported the plan.

A cloud has hung over Noble for the past three years amid a probe by a trio of Singaporean authorities into whether the company made false accounting declarations. The investigation -- announced in late 2018 and just days before its previous reorganization was due to be completed -- saw the city-state refuse to have the new entity relist.

A company spokesman on Friday confirmed that the Singaporean probe was ongoing.

The fresh reorganization will see Noble’s so-called TradingCo cease to be a part of the parent and form a new “segregated” business, it said. An interest payment on the trading arm’s 2023 notes that was due Monday will be deferred to Jan. 25. The company will make further announcements about the 2022 notes that mature on June 20.

Noble also said it will exit freight and liquefied natural gas. A presentation released alongside the announcement underlined the company’s shrinking ambitions, outlining plans for the trading group to concentrate on energy and raw materials in Asia, be lower risk and focus on returns. Previously Noble had highlighted its role as diversified, risk-seeking and growth-focused.

The company has already implemented organizational changes and isn’t planning further headcount reductions in 2022, the spokesman said.

Friday’s announcement comes as the company struggles to turn a profit, with Noble reporting a $72 million loss in the nine months ended Sept. 30. One of its key assets, an alumina refinery in Jamaica, was seriously damaged by a fire in August and isn’t due to restart production until the middle of 2022.

The company has also seen the departure of a series of executives, including former chairman James Dubow last week.

...

The Latest Twist in Its Epic Collapse Is Noble Group’s Second Restructure in Three Years

https://finance.yahoo.com/news/latest-twist-epic-collapse-no…

...

The epic downfall of what was once Asia’s largest commodity trader took another turn, with Noble Group Holdings Ltd. laying out plans for its second restructuring in three years.

The company said Friday it had reached an in-principle agreement with creditors and will reorganize the ownership of some assets after its debt reached an “unsustainable” level. The process will see its debt fall to about $500 million from about $1.5 billion now.

Formerly a behemoth of Asia’s commodity trading landscape, with a market value of more than $10 billion, Noble has collapsed into a shell of its former self amid accusations of improper accounting -- which the company denies -- and billions of dollars in losses. The trader undertook a multibillion-dollar debt restructuring in 2018 which converted much of its debt to equity and handed control to a group of hedge fund creditors led by Taconic Capital Advisors.

The latest restructuring is expected to be completed by March 31. Bloomberg News previously reported the plan.

A cloud has hung over Noble for the past three years amid a probe by a trio of Singaporean authorities into whether the company made false accounting declarations. The investigation -- announced in late 2018 and just days before its previous reorganization was due to be completed -- saw the city-state refuse to have the new entity relist.

A company spokesman on Friday confirmed that the Singaporean probe was ongoing.

The fresh reorganization will see Noble’s so-called TradingCo cease to be a part of the parent and form a new “segregated” business, it said. An interest payment on the trading arm’s 2023 notes that was due Monday will be deferred to Jan. 25. The company will make further announcements about the 2022 notes that mature on June 20.

Noble also said it will exit freight and liquefied natural gas. A presentation released alongside the announcement underlined the company’s shrinking ambitions, outlining plans for the trading group to concentrate on energy and raw materials in Asia, be lower risk and focus on returns. Previously Noble had highlighted its role as diversified, risk-seeking and growth-focused.

The company has already implemented organizational changes and isn’t planning further headcount reductions in 2022, the spokesman said.

Friday’s announcement comes as the company struggles to turn a profit, with Noble reporting a $72 million loss in the nine months ended Sept. 30. One of its key assets, an alumina refinery in Jamaica, was seriously damaged by a fire in August and isn’t due to restart production until the middle of 2022.

The company has also seen the departure of a series of executives, including former chairman James Dubow last week.

...

Moin,

im Zuge meines Depot-Ausmistens zum Jahresende bin ich auf meinen Noble-Schrott gestoßen.

Da ich natürlich gerne zumindest einen Verlustvortrag realisieren möchte, würde ich die Teile gern verkaufen. Das ist aber momentan nicht möglich.

Dem bis zum Juni 2020 bestehenden Umtauschangebot von 1:10 für alte zu neuen Noble bin ich nicht explizit nachgekommen, da ich keine Benachrichtigung von meiner Bank erhalten hatte.

Kann ich davon ausgehen, dass der Umtausch automatisch von der Clearingstelle in Singapur veranlasst wurde und ich dann irgendwann in 2021 neue Noble-Aktien eingebucht bekomme?

Thx für Hinweise

im Zuge meines Depot-Ausmistens zum Jahresende bin ich auf meinen Noble-Schrott gestoßen.

Da ich natürlich gerne zumindest einen Verlustvortrag realisieren möchte, würde ich die Teile gern verkaufen. Das ist aber momentan nicht möglich.

Dem bis zum Juni 2020 bestehenden Umtauschangebot von 1:10 für alte zu neuen Noble bin ich nicht explizit nachgekommen, da ich keine Benachrichtigung von meiner Bank erhalten hatte.

Kann ich davon ausgehen, dass der Umtausch automatisch von der Clearingstelle in Singapur veranlasst wurde und ich dann irgendwann in 2021 neue Noble-Aktien eingebucht bekomme?

Thx für Hinweise

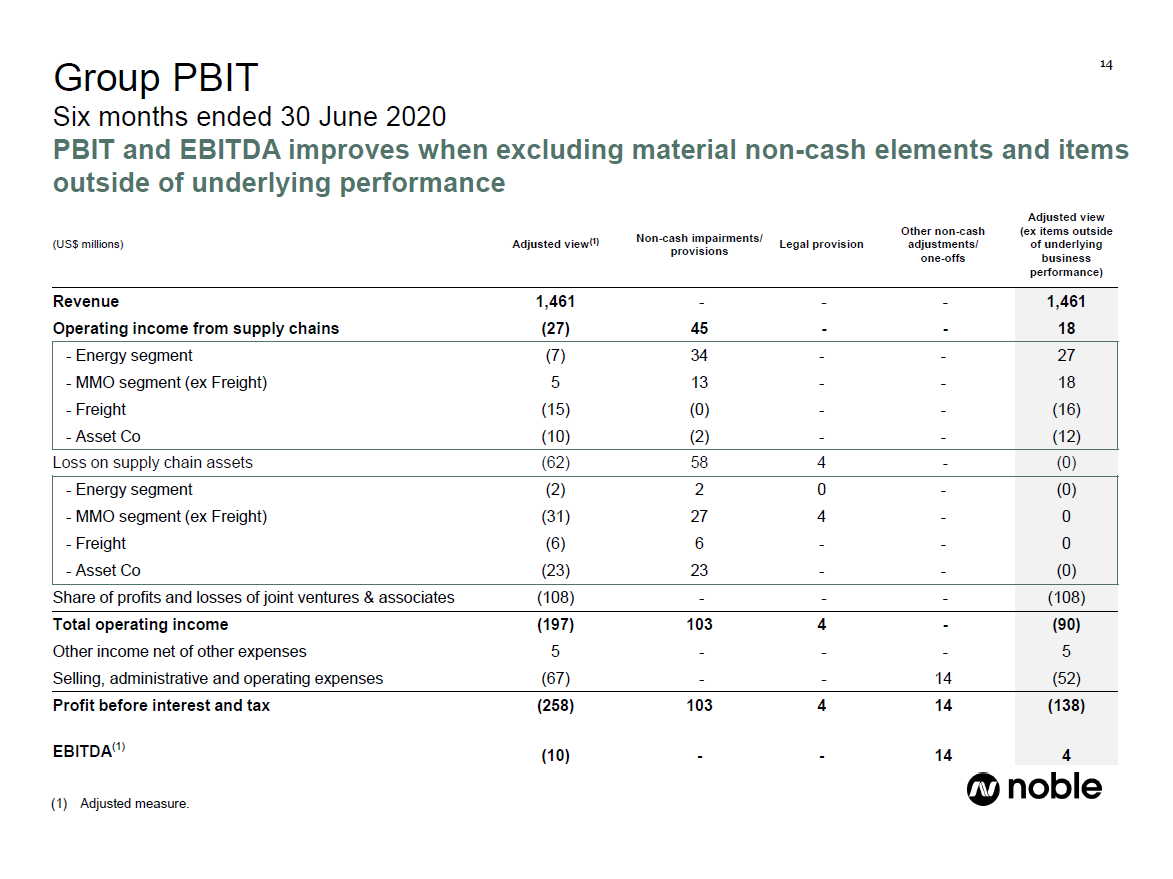

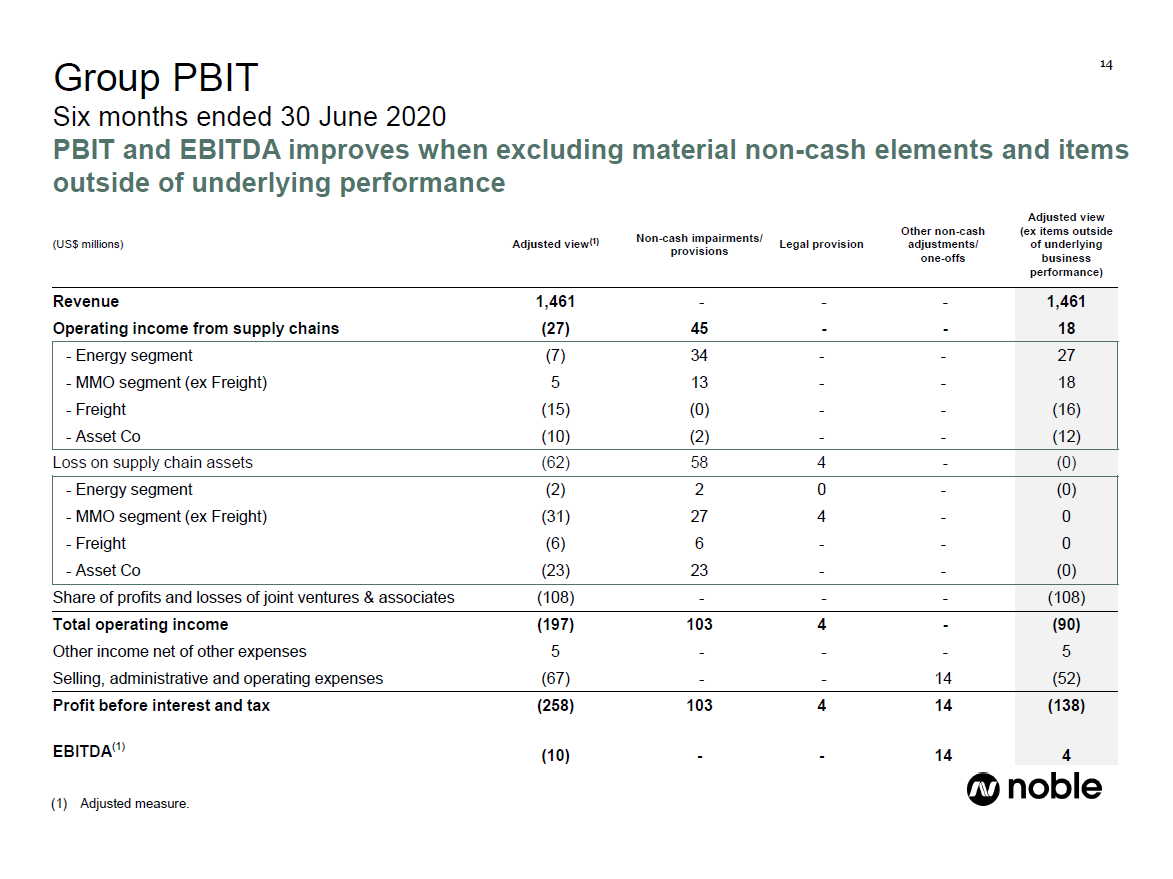

Antwort auf Beitrag Nr.: 62.202.594 von faultcode am 20.12.19 00:02:58die letzten Ergebnisse sind: Noble Group Holdings Limited 1H 2020 Presentation (u.a.)

...

Robust Group cash position of US 452 million with net debt of US 1 328 million at 30 June 2020

...

]Jamalco reorganization in progress, paving the way for an IPO in future

...

Jamalco is a joint venture between Noble Group and Clarendon Alumina Production (CAP) with a focus on bauxite mining and alumina production. --> http://www.jamalco.com/jamalco/

PBIT = Profit Before Interest and Taxes

...

Robust Group cash position of US 452 million with net debt of US 1 328 million at 30 June 2020

...

]Jamalco reorganization in progress, paving the way for an IPO in future

...

Jamalco is a joint venture between Noble Group and Clarendon Alumina Production (CAP) with a focus on bauxite mining and alumina production. --> http://www.jamalco.com/jamalco/

PBIT = Profit Before Interest and Taxes

Antwort auf Beitrag Nr.: 59.827.992 von faultcode am 08.02.19 19:01:05

aus: https://www.noblegroupholdings.com/faq-shareholder/

=> u.a. heißt es da:

If you held your shares of Noble Group Limited at 5:00pm (Singapore time) on 21 November 2018, then you are entitled (subject to certain conditions) to receive one share of Noble Group Holdings Limited for every ten shares of Noble Group Limited you held at that time (fractional entitlements will be rounded up to the nearest whole share of Noble Group Holdings Limited.)

=> ansonsten zieht sich die Reorg bis 2020 demnach hin:

UNDER THE TERMS OF THE COURT APPROVED RESTRUCTURING, IF YOU ARE ENTITLED TO RECEIVE SHARES OF NOBLE GROUP HOLDINGS LIMITED, YOU MUST REGISTER WITH LUCID ISSUER SERVICES LIMITED BY 19 MARCH 2020 OR YOU WILL LOSE YOUR ENTITLEMENT.

Noble Group Holdings Ltd.

wie ging's eigentlich weiter?aus: https://www.noblegroupholdings.com/faq-shareholder/

=> u.a. heißt es da:

If you held your shares of Noble Group Limited at 5:00pm (Singapore time) on 21 November 2018, then you are entitled (subject to certain conditions) to receive one share of Noble Group Holdings Limited for every ten shares of Noble Group Limited you held at that time (fractional entitlements will be rounded up to the nearest whole share of Noble Group Holdings Limited.)

=> ansonsten zieht sich die Reorg bis 2020 demnach hin:

UNDER THE TERMS OF THE COURT APPROVED RESTRUCTURING, IF YOU ARE ENTITLED TO RECEIVE SHARES OF NOBLE GROUP HOLDINGS LIMITED, YOU MUST REGISTER WITH LUCID ISSUER SERVICES LIMITED BY 19 MARCH 2020 OR YOU WILL LOSE YOUR ENTITLEMENT.

Antwort auf Beitrag Nr.: 59.827.788 von faultcode am 08.02.19 18:44:46=> ich habe meine Ordinary Shares einfach zum Bid verkauft, weil diese Position (mittlerweile) einfach zu klein ist, um sie eventuell gebührenpflichtig irgendwie in die New Noble-shares überzuführen; mit dann Listing wo??

=> das herauszuklamüsern oder zu antizipieren ist mir nun zu aufwendig

=> bereits am 31.1. schrieb Noble (http://thisisnoble.com/newsroom/1358-sgx-announcement-action…):

There is currently no publicly quoted price or market for trading either the unlisted shares of New Noble or the shares of Old Noble. The Board of Directors of New Noble is reviewing alternative liquidity opportunities for New Noble shareholders and will update them on any developments in due course.

=> die New Noble-shares müssen eh ne neue ISIN bekommen, und dann guck ich mal weiter, in welcher (finanziellen) Verfassung die New Noble starten wird

--> hoffentlich nur mit sehr wenig Schulden, wenn überhaupt; alles andere würde ich kritisch sehen

=> das herauszuklamüsern oder zu antizipieren ist mir nun zu aufwendig

=> bereits am 31.1. schrieb Noble (http://thisisnoble.com/newsroom/1358-sgx-announcement-action…):

There is currently no publicly quoted price or market for trading either the unlisted shares of New Noble or the shares of Old Noble. The Board of Directors of New Noble is reviewing alternative liquidity opportunities for New Noble shareholders and will update them on any developments in due course.

=> die New Noble-shares müssen eh ne neue ISIN bekommen, und dann guck ich mal weiter, in welcher (finanziellen) Verfassung die New Noble starten wird

--> hoffentlich nur mit sehr wenig Schulden, wenn überhaupt; alles andere würde ich kritisch sehen

SGX Announcement - Application for the Winding-Up of Noble Group Limited

1.2.19http://thisisnoble.com/newsroom/1359-sgx-announcement-applic…

=>

• Application for winding-up of Noble Group Limited (“Old Noble”) to be heard on 8 February 2019,

liquidation process is a procedural step and as anticipated in the circular to shareholders dated 10

August 2018 (“Circular”)

• The liquidation process will have no impact on the business or financial position of Noble Group Holdings Limited (“New Noble”)

• The winding-up application and liquidation process will have no impact on the rights of shareholders of Old Noble to receive shares in New Noble

...

The liquidation of Old Noble has no impact on the right of shareholders of Old Noble to receive

shares in New Noble. Shareholders of Old Noble are again reminded to take the necessary action to claim the shares of New Noble to which they are entitled by registering with the trustee, Lucid Issuer Services Limited (“Lucid”), via the website www.lucid-is.com/nghlregistration and providing the necessary information required by Lucid.

...

Antwort auf Beitrag Nr.: 59.140.440 von faultcode am 05.11.18 15:53:27

https://www.bloomberg.com/news/articles/2018-12-11/noble-gro…

=>

...

-- Trader seeks to push through restructuring via Bermudan court

-- Singapore authorities had blocked relisting of co.’s shares

...Noble Group Ltd. is seeking to pursue its debt restructuring via a Bermudan court, using a local kind of insolvency process, after a key element of its survival plan was blocked by Singapore authorities.

The embattled commodity trader will apply for a Dec. 14 hearing in Bermuda to allow its reorganization through a court-appointed officer, it said in a statement on Tuesday. That means installing a so-called provisional liquidator, according to people familiar with the matter, who the company hopes would implement its “plan B” restructuring.

It’s the latest development in a long-running saga, in which Singapore regulators got involved last month by announcing a probe into the company’s accounts. They followed up by halting a relisting of its shares in the city-state, effectively blocking a $3.5 billion restructuring plan. Once Asia’s largest commodity trader, Noble has been reduced to a rump by billions of dollars in losses and writedowns as well as accusations of inflated profits, which were first made by Iceberg Research in 2015.

Noble Group said last week that it intended to push through its mammoth debt-for-equity restructuring by an “alternative process” that may include a court-appointed officer. The company was considering a “pre-pack” administration, a procedure that allows for a restructuring in court through a pre-agreed plan with creditors, according to a person familiar with the matter.

Alternative Plan

In August, Noble said in a circular that if its first choice failed, the alternative restructuring would involve filing for administration in the U.K. Under that scenario, creditors would aim to swiftly take control of assets and existing shareholders and perpetual bondholders could be wiped out. That also risks triggering clauses allowing some counterparties to walk away from supply contracts, making it harder for Noble to stay in business.

Noble said on Tuesday that its day-to-day operations are unaffected, trade finance facilities will continue to be available and payments to customers and suppliers will be made as usual. The court will appoint an officer to Noble Group only and not to any of its subsidiaries. The effective restructuring date is now expected to be Dec. 18, assuming the court approves it, according to the company.

The company said that current shareholders of Noble would still receive shares in the restructured entity should the plan B restructuring go ahead. Still, it’s not clear how easy it will be for them to be traded as they wouldn’t be listed.

Noble also warned that should the plan B fail, it would be “forced to enter into a full liquidation process”, which would entirely wipe out shareholders and perpetual bondholders, as well as imposing hefty losses on other creditors.

In November, just days before the company was due to complete its reorganization, a trio of Singaporean authorities said they were probing whether Noble made false accounting declarations. Last week, authorities said Noble can’t relist as a new entity in Singapore and that there were “significant uncertainties about the financial position of New Noble”.

Noble Group to Appoint Provisional Liquidator to Enact Debt Deal

11.12.2018https://www.bloomberg.com/news/articles/2018-12-11/noble-gro…

=>

...

-- Trader seeks to push through restructuring via Bermudan court

-- Singapore authorities had blocked relisting of co.’s shares

...Noble Group Ltd. is seeking to pursue its debt restructuring via a Bermudan court, using a local kind of insolvency process, after a key element of its survival plan was blocked by Singapore authorities.

The embattled commodity trader will apply for a Dec. 14 hearing in Bermuda to allow its reorganization through a court-appointed officer, it said in a statement on Tuesday. That means installing a so-called provisional liquidator, according to people familiar with the matter, who the company hopes would implement its “plan B” restructuring.

It’s the latest development in a long-running saga, in which Singapore regulators got involved last month by announcing a probe into the company’s accounts. They followed up by halting a relisting of its shares in the city-state, effectively blocking a $3.5 billion restructuring plan. Once Asia’s largest commodity trader, Noble has been reduced to a rump by billions of dollars in losses and writedowns as well as accusations of inflated profits, which were first made by Iceberg Research in 2015.

Noble Group said last week that it intended to push through its mammoth debt-for-equity restructuring by an “alternative process” that may include a court-appointed officer. The company was considering a “pre-pack” administration, a procedure that allows for a restructuring in court through a pre-agreed plan with creditors, according to a person familiar with the matter.

Alternative Plan

In August, Noble said in a circular that if its first choice failed, the alternative restructuring would involve filing for administration in the U.K. Under that scenario, creditors would aim to swiftly take control of assets and existing shareholders and perpetual bondholders could be wiped out. That also risks triggering clauses allowing some counterparties to walk away from supply contracts, making it harder for Noble to stay in business.

Noble said on Tuesday that its day-to-day operations are unaffected, trade finance facilities will continue to be available and payments to customers and suppliers will be made as usual. The court will appoint an officer to Noble Group only and not to any of its subsidiaries. The effective restructuring date is now expected to be Dec. 18, assuming the court approves it, according to the company.

The company said that current shareholders of Noble would still receive shares in the restructured entity should the plan B restructuring go ahead. Still, it’s not clear how easy it will be for them to be traded as they wouldn’t be listed.

Noble also warned that should the plan B fail, it would be “forced to enter into a full liquidation process”, which would entirely wipe out shareholders and perpetual bondholders, as well as imposing hefty losses on other creditors.

In November, just days before the company was due to complete its reorganization, a trio of Singaporean authorities said they were probing whether Noble made false accounting declarations. Last week, authorities said Noble can’t relist as a new entity in Singapore and that there were “significant uncertainties about the financial position of New Noble”.