Noble Group Ltd. (Seite 3)

eröffnet am 14.08.15 16:37:27 von

neuester Beitrag 10.08.23 13:10:52 von

neuester Beitrag 10.08.23 13:10:52 von

Beiträge: 51

ID: 1.217.163

ID: 1.217.163

Aufrufe heute: 0

Gesamt: 5.990

Gesamt: 5.990

Aktive User: 0

ISIN: BMG6542T1505 · WKN: A2DQQG

0,0400

EUR

-2,44 %

-0,0010 EUR

Letzter Kurs 16.11.18 Frankfurt

Werte aus der Branche Industrie/Mischkonzerne

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6087 | +14,85 | |

| 15,600 | +13,54 | |

| 130,00 | +5,69 | |

| 0,7600 | +5,56 | |

| 0,5978 | +5,25 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1200 | -9,01 | |

| 26,65 | -11,83 | |

| 3,6000 | -14,29 | |

| 1,3000 | -16,13 | |

| 6,5900 | -26,61 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 56.872.487 von R-BgO am 30.01.18 12:19:10https://www.bloomberg.com/news/articles/2018-01-29/noble-gro…

* Creditors will swap half of $3.5 billion in debt into equity

* Current shareholders will get just 10% of the new company

https://www.bloomberg.com/news/articles/2018-01-30/noble-gro…

* Stock in Singapore pares decline after plummeting 23% at open

* Commodity trader plans debt-for-equity swap with creditors

=>

p.s.: mit meiner Anschauungs-Long-Position von Mitt Juli '17 liege ich mit Schluss gestern Abend bei -60%

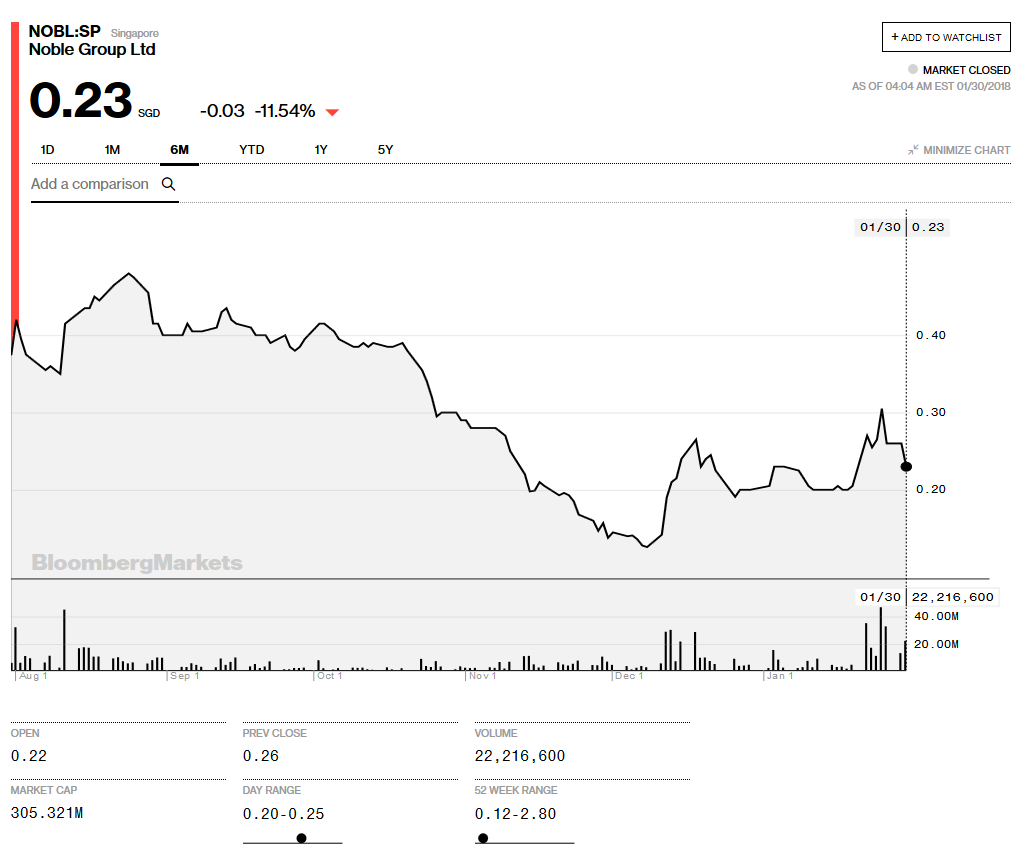

CGP-Chart SGX in Singapore Dollar (free!) --> https://www.bloomberg.com/quote/NOBL:SP

=>

30.1.2018:

* Creditors will swap half of $3.5 billion in debt into equity

* Current shareholders will get just 10% of the new company

https://www.bloomberg.com/news/articles/2018-01-30/noble-gro…

* Stock in Singapore pares decline after plummeting 23% at open

* Commodity trader plans debt-for-equity swap with creditors

=>

p.s.: mit meiner Anschauungs-Long-Position von Mitt Juli '17 liege ich mit Schluss gestern Abend bei -60%

CGP-Chart SGX in Singapore Dollar (free!) --> https://www.bloomberg.com/quote/NOBL:SP

=>

30.1.2018:

Antwort auf Beitrag Nr.: 56.843.281 von faultcode am 26.01.18 19:11:46

10% recovery ist doch noch ganz passabel...

Antwort auf Beitrag Nr.: 56.843.203 von faultcode am 26.01.18 19:07:58

1:26 am ET January 26, 2018 (Dow Jones)

0626 GMT - Investors continue to be in wait-and-see mode on Noble, meaning today the debt-laden commodities company's shares have unwound some of this week's pop.

Trading was halted yesterday afternoon for news pending amid reports that a long-awaited debt-restructuring deal may be near.

But the company said late Thursday that it "has not concluded" any deal on debt or asset sales.

Shares are down 11% today, reversing most of yesterday's 15% jump to 3-month highs and cutting the week's surge to 32%...

Nach trading halt: 0.26SGD ==> -14.75%

Quote in Singapur: https://www.bloomberg.com/quote/NOBL:SP1:26 am ET January 26, 2018 (Dow Jones)

0626 GMT - Investors continue to be in wait-and-see mode on Noble, meaning today the debt-laden commodities company's shares have unwound some of this week's pop.

Trading was halted yesterday afternoon for news pending amid reports that a long-awaited debt-restructuring deal may be near.

But the company said late Thursday that it "has not concluded" any deal on debt or asset sales.

Shares are down 11% today, reversing most of yesterday's 15% jump to 3-month highs and cutting the week's surge to 32%...

‘more pain’ ahead ==> debt-to-equity swap (was denn sonst??)

25.1.:Noble Group Strikes Restructure Deal With Lenders

https://www.bloomberg.com/news/articles/2018-01-25/noble-gro…

* Agreement involves debt-to-equity swap and a new investor

* Trader’s bonds extend rally to highest levels since May

=>

Noble Group Ltd. has reached the outline of an agreement with its creditors to restructure about $3.5 billion in debt, paving the way for an investor to take a controlling stake in the company...

The agreement with bondholders and lenders was reached after meetings in London earlier this week, according to Debtwire. If implemented, the plan would give Noble access to working capital at a cheaper cost, and allow creditors to cash-in on shares obtained from a debt-to-equity swap via a sale to the strategic investor, it said.

A framework had been agreed between the parties, with some issues to be worked through, according to the report...

...

New Company

Under the agreement reported by Debtwire, Noble Group would set up a new company, in which employees would own stakes with the option to increase their share if performance targets are met.

Current equity holders, including founder Richard Elman -- who at one point turned a tiny trader into a $10 billion empire -- and China’s sovereign wealth fund, would have a smaller shareholding than employees, according to the report. Creditors would be given a controlling stake, before selling on to the strategic investor, and the company would resurface with about $600 million in debt.

Noble Group said this week it remains in talks with potential investors after a Chinese company, Cedar Holdings Group, was reported by Bloomberg to have made an approach to shareholders.

Debtwire said Cedar is a candidate to enter the company and that talks with other strategic investors had been held.

die Leiche zuckt, aber "Noble Group says to expect ‘more pain’ ahead"

2017-12-15https://www.ft.com/content/3e236506-83a8-36ba-8aab-b52a508d2…

=>

A deal between Noble Group, the troubled commodity trader, and its creditors could involve a debt-for equity swap that would further dilute existing shareholders, its chairman has warned.

Speaking at a shareholder meeting to approve the sale of its oil business to Vitol Group, Noble’s Paul Brough said there would be “more pain” ahead as it tries to restructure its debts to stave off the threat of insolvency.

“As we go forward, I think there will be more pain, but there is hope as well,” Mr Brough was reported as saying by Bloomberg. “So it remains to be seen exactly what the restructuring looks like. We have been talking to our creditors for about a month now. We expect to receive a proposal soon.”

Noble’s biggest shareholder is its founder Richard Elman. He owns 18.3 per cent of the company. Another big investor is China Investment Corporation, China’s powerful sovereign wealth fund. It has a 9.5 per cent stake.

...

Mr Brough told shareholders that Noble expected its lenders to extend a covenant waiver on a $1.1bn credit facility that expires next week.

Noble has $3.7bn of net debt. A $380m bond is due in March and the $1.1bn credit facility has to repaid or refinance in May.

Noble to sell US-based ethanol producer

8.12.http://www.straitstimes.com/business/companies-markets/noble…

=>

Troubled commodity trader Noble Group has found a new buyer in Mercuria Investments US, Inc to dispose of its US-based ethanol producer for a base consideration of US$15.5 million - US$3 million higher than its previous offer from Zeeland Farm Services.

On Nov 27, 2017, Noble had said it would sell its ethanol producing unit - Noble Americas South Bend Ethanol (Nasbe) - to Zeeland Farm for US$12.5 million, plus adjustments for working capital, inventory and debt.

However, in a Singapore Exchange (SGX) filing on Friday, Noble said it has entered into a new equity purchase agreement on Dec 7, 2017, with Mercuria Investments, a unit of Mercuria Energy, on the same terms as its deal with Zeeland Farm, except for the deletion of the provision relating to the go-shop period, and an increase in the base consideration of US$3 million.

Noble is expected to terminate its agreement with Zeeland Farm on Dec 11 at 12.01am (New York time). A termination fee of US$2 million will be incurred.

...

Noble is set to hold a shareholder meeting in Singapore on Dec 15 to vote on the sale of majority of its oil business to Vitol Group. In addition, a coupon payment is due on Dec 24 for Noble's US$400 million perpetual securities, which have collapsed 46 US cents in the past year to 8.5 US cents on Thursday, according to Bloomberg. Noble has already deferred payment on the notes once.

Noble Group to sell four ships to cut debt

https://www.reuters.com/article/us-noble-grp-m-a/noble-group…=>

Struggling commodity trader Noble Group Ltd said on Wednesday it would sell four dry bulk carrier vessels for about $95 million, as it looks to cut debt to keep its business running.

Net proceeds from the disposal, following repayment of bank loans associated with the ships and other costs, will amount to about $30 million, the company said in a statement.

=> immerhin kann man noch überhaupt etwas verkaufen

Zumindest zeigt man guten Willen in dieser Hinsicht; sonst siehe oben.

Zumindest zeigt man guten Willen in dieser Hinsicht; sonst siehe oben. Saukomisch:

https://iceberg-research.com/2017/11/28/open-letter-to-noble…"You lost a fortune but a few people have thrived. For example the current CEO Will Randall, the former CEO Yusuf Alireza and a few others made dozens of millions. They are now excessively rich. We don’t know exactly how much because Noble still refuses to disclose their individual remunerations. When asked to justify this policy, Noble claims the disclosure would “hurt its standing”. “Its what?”, you may ask. Its standing… They have a standing at Noble. This is the corporate version of the middle finger and it is pointed at you and at the shareholders who lost everything."

Bin ja schon länger bei Bestand Null, aber jetzt werfe ich sie auch aus meinem Excel.

Antwort auf Beitrag Nr.: 56.142.341 von faultcode am 09.11.17 13:38:10

Antwort auf Beitrag Nr.: 56.142.341 von faultcode am 09.11.17 13:38:10

umsortiert in Teilportfolio "death-row":