Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share | Diskussion im Forum

eröffnet am 17.09.15 13:06:55 von

neuester Beitrag 18.12.23 18:35:21 von

neuester Beitrag 18.12.23 18:35:21 von

Beiträge: 117

ID: 1.218.621

ID: 1.218.621

Aufrufe heute: 1

Gesamt: 6.811

Gesamt: 6.811

Aktive User: 0

ISIN: US7185461040 · WKN: A1JWQU · Symbol: PSX

155,42

USD

+1,38 %

+2,11 USD

Letzter Kurs 19:41:30 NYSE

Neuigkeiten

03.04.24 · Business Wire (engl.) |

02.04.24 · wO Newsflash |

01.04.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

29.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,0800 | +43,06 | |

| 0,5070 | +31,52 | |

| 5,0000 | +22,55 | |

| 1,3100 | +21,30 | |

| 558,15 | +19,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8300 | -5,68 | |

| 43,00 | -5,81 | |

| 6,4290 | -6,89 | |

| 1.050,01 | -14,28 | |

| 12,210 | -44,47 |

Beitrag zu dieser Diskussion schreiben

Paul Singer mal wieder:

29.11.

Phillips 66 Stock Is Rising. Activist Elliott Takes $1 Billion Stake, Wants Changes.

https://www.marketwatch.com/articles/phillips-66-stock-activ…

...

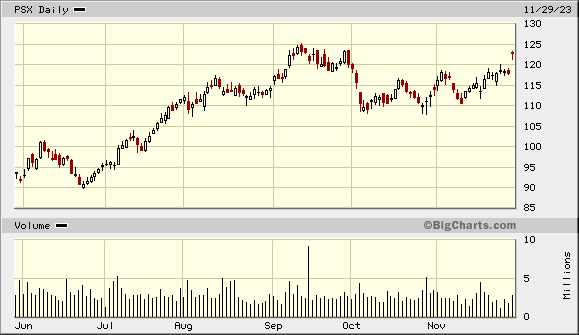

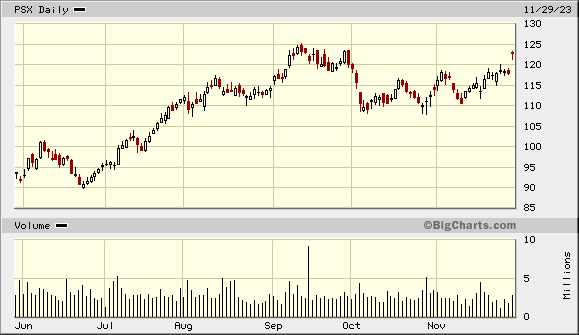

Elliott Investment Management has taken a $1 billion stake in Phillips 66, the activist investor disclosed in a letter to the refiner’s board on Wednesday.

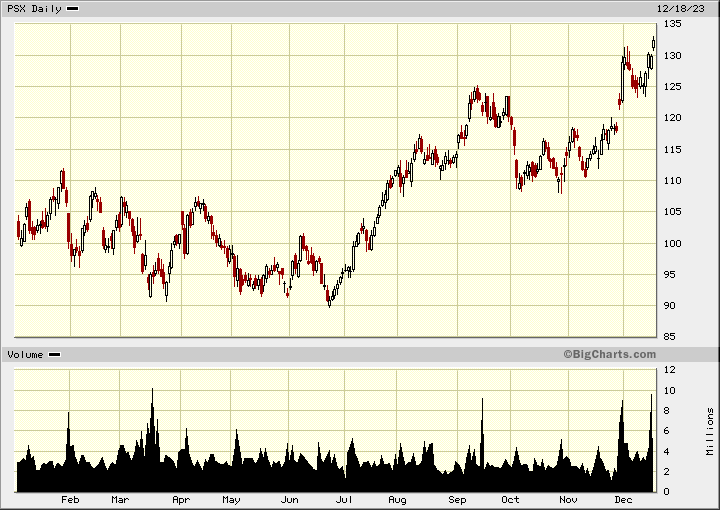

Phillips 66 stock rose 4.2% to $122.98 Wednesday morning. This year, the stock is up 18%.

In the letter, Elliott highlighted drivers of the stock’s underperformance, and said that after some improvements, the stock could reach more than $200, about 75% higher than today’s current price.

“We have engaged in discussions with Elliott Management, and we welcome their perspectives and the perspectives of other shareholders on our strategy and the actions we are taking to drive long-term sustainable growth and value creation,” said President and CEO Mark Lashier in an emailed statement to Barron’s.

“Phillips 66 continues to invest in returns-focused growth opportunities, and with a portfolio of diversified, integrated assets, we are well positioned to continue driving long-term shareholder value,” he continued. “We remain committed to acting in the best interests of our shareholders.”

...

=>

29.11.

Phillips 66 Stock Is Rising. Activist Elliott Takes $1 Billion Stake, Wants Changes.

https://www.marketwatch.com/articles/phillips-66-stock-activ…

...

Elliott Investment Management has taken a $1 billion stake in Phillips 66, the activist investor disclosed in a letter to the refiner’s board on Wednesday.

Phillips 66 stock rose 4.2% to $122.98 Wednesday morning. This year, the stock is up 18%.

In the letter, Elliott highlighted drivers of the stock’s underperformance, and said that after some improvements, the stock could reach more than $200, about 75% higher than today’s current price.

“We have engaged in discussions with Elliott Management, and we welcome their perspectives and the perspectives of other shareholders on our strategy and the actions we are taking to drive long-term sustainable growth and value creation,” said President and CEO Mark Lashier in an emailed statement to Barron’s.

“Phillips 66 continues to invest in returns-focused growth opportunities, and with a portfolio of diversified, integrated assets, we are well positioned to continue driving long-term shareholder value,” he continued. “We remain committed to acting in the best interests of our shareholders.”

...

=>

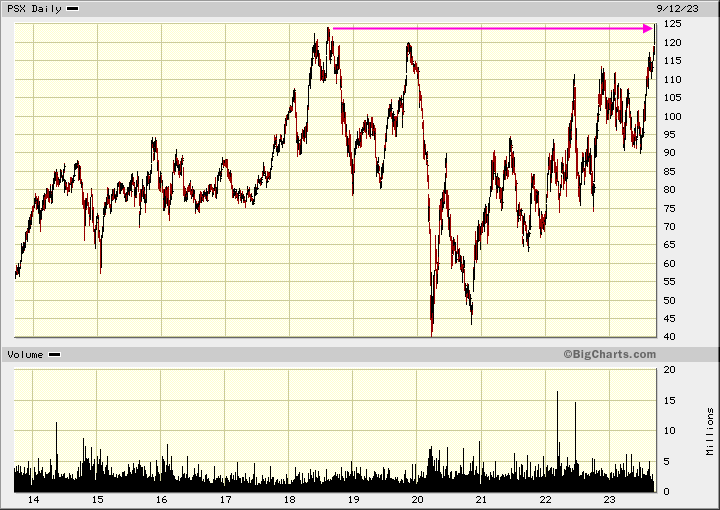

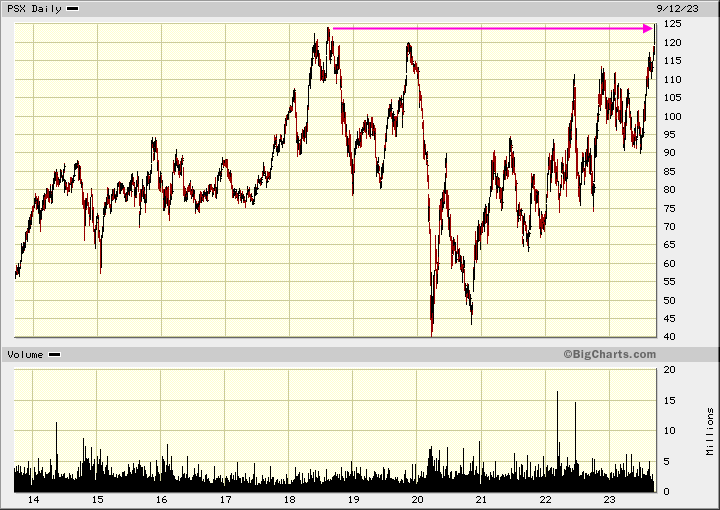

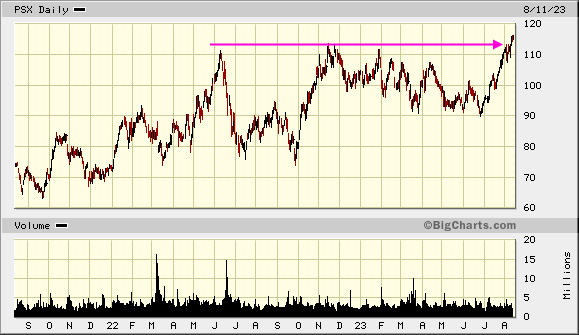

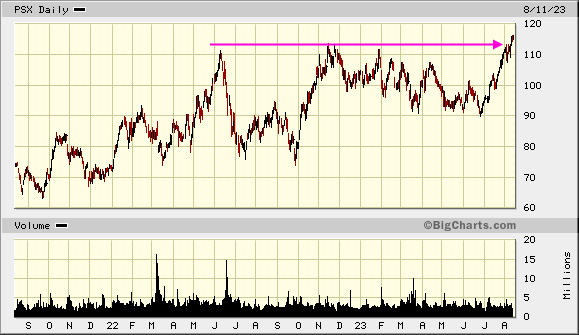

Antwort auf Beitrag Nr.: 74.303.619 von faultcode am 11.08.23 16:32:04auch hier nun ein neues Allzeithoch:

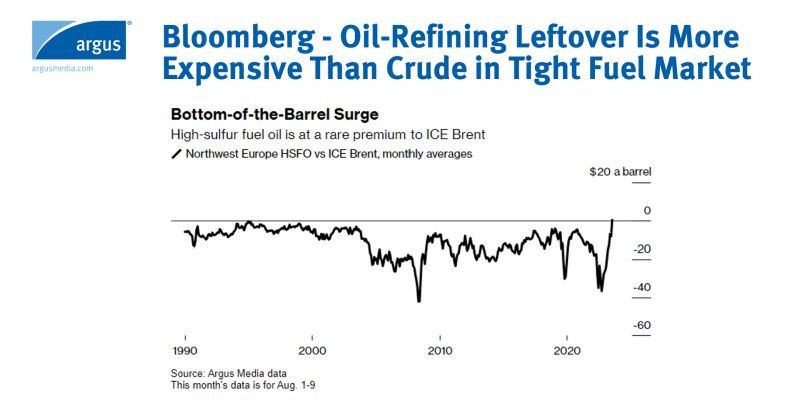

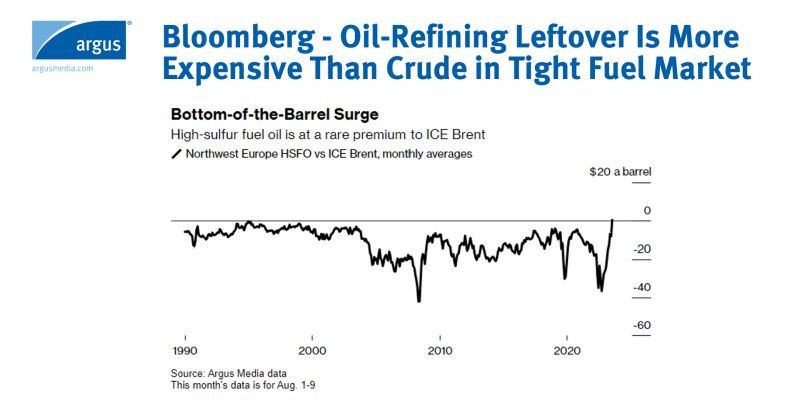

Antwort auf Beitrag Nr.: 74.303.619 von faultcode am 11.08.23 16:32:04high sulfur fuel:

https://twitter.com/ArgusMedia/status/1689829512635203584

https://twitter.com/ArgusMedia/status/1689829512635203584

fast nichts ist momentan so wertvoll wie Kapazitäten zur Öl-Raffinerie, nicht nur in den USA, sondern auch in Europa:

Ein anderer Kurs-Treiber hier könnte auch der zuletzt stattgefundene Sentiment-Wechsel beim Reiz-Thema "ESG" mMn sein: in den letzten Jahren gab's genügend große Asset Manager, die in "Schmutzaktien" wie Phillips 66 und Co. einfach nicht investieren duften

Das könnte sich momentan allmählich wieder ändern.

Ein anderer Kurs-Treiber hier könnte auch der zuletzt stattgefundene Sentiment-Wechsel beim Reiz-Thema "ESG" mMn sein: in den letzten Jahren gab's genügend große Asset Manager, die in "Schmutzaktien" wie Phillips 66 und Co. einfach nicht investieren duften

Das könnte sich momentan allmählich wieder ändern.

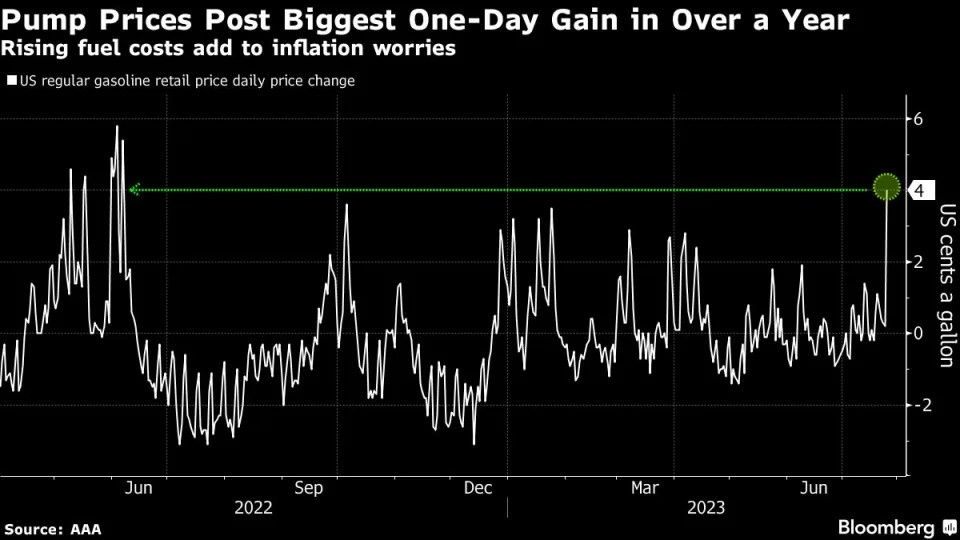

25.7.

Gasoline Prices in US Rises Most in a Year, Hurting Inflation Fight

https://finance.yahoo.com/news/gasoline-prices-us-rises-most…

...

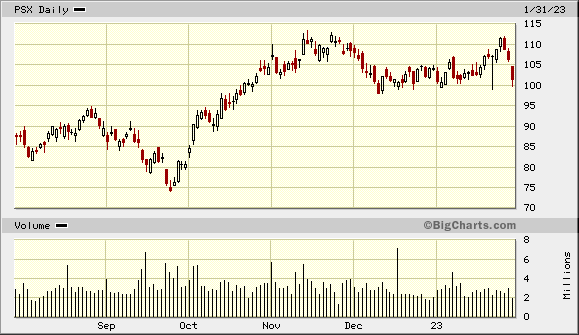

bei Öl läuft nun vielfach "sell the news":

31.1.

Phillips 66 Reports Fourth-Quarter 2022 Financial Results

https://www.wallstreet-online.de/nachricht/16497628-phillips…

...

Phillips 66 (NYSE: PSX), a diversified energy company, announces fourth-quarter 2022 earnings of $1.9 billion, compared with earnings of $5.4 billion in the third quarter of 2022.

Excluding special items of $15 million, the company had adjusted earnings of $1.9 billion in the fourth quarter, compared with third-quarter adjusted earnings of $3.1 billion.

“Our integrated portfolio positioned us to generate robust earnings and cash flow in 2022, supported by a favorable market environment, solid operations and strong safety performance,” said Mark Lashier, President and CEO of Phillips 66. “During 2022 we increased shareholder distributions and strengthened our balance sheet by repaying debt. Since July 2022, we have returned $2.4 billion to shareholders through share repurchases and dividends as we progress toward our commitment to return $10 billion to $12 billion by year-end 2024.

...

We are on track to deliver $1 billion of annualized savings by year-end 2023. In addition, we continue to grow our NGL business with the integration of DCP Midstream and recently reached an agreement to acquire all public common units. We remain committed to operating excellence and disciplined capital allocation as we execute our strategic priorities.”

...

=>

31.1.

Phillips 66 Reports Fourth-Quarter 2022 Financial Results

https://www.wallstreet-online.de/nachricht/16497628-phillips…

...

Phillips 66 (NYSE: PSX), a diversified energy company, announces fourth-quarter 2022 earnings of $1.9 billion, compared with earnings of $5.4 billion in the third quarter of 2022.

Excluding special items of $15 million, the company had adjusted earnings of $1.9 billion in the fourth quarter, compared with third-quarter adjusted earnings of $3.1 billion.

“Our integrated portfolio positioned us to generate robust earnings and cash flow in 2022, supported by a favorable market environment, solid operations and strong safety performance,” said Mark Lashier, President and CEO of Phillips 66. “During 2022 we increased shareholder distributions and strengthened our balance sheet by repaying debt. Since July 2022, we have returned $2.4 billion to shareholders through share repurchases and dividends as we progress toward our commitment to return $10 billion to $12 billion by year-end 2024.

...

We are on track to deliver $1 billion of annualized savings by year-end 2023. In addition, we continue to grow our NGL business with the integration of DCP Midstream and recently reached an agreement to acquire all public common units. We remain committed to operating excellence and disciplined capital allocation as we execute our strategic priorities.”

...

=>

15.1.

Chevron expands Venezuelan crude sales to other oil refiners

https://www.ajot.com/news/chevron-expands-venezuelan-crude-s…

...

Chevron Corp. sold a cargo of Venezuelan oil to another US refiner in the first such transaction since sanctions against the Latin American nation were eased less than two months ago.

Phillips 66 bought half-a-million barrels of a type of sludgy oil known as Hamaca from Chevron, according to a person with knowledge of the situation who asked not to be identified. The crude will be processed at the refiner’s Sweeny, Texas, complex about 65 miles (105 kilometers) south of Houston, the person said.

Chevron is expanding Venezuelan crude sales beyond its own refining network just weeks after US sanctions relief allowed the oil giant to return key managers to the country and resume drilling. The transactions appear to advance President Joe Biden’s dual objectives of re-engagement with the Nicolas Maduro regime and increasing crude supplies available to American fuel makers.

The cargo of Hamaca will be loaded onto the tanker Carina Voyager in Venezuela this month, according to another person who requested anonymity while discussing non-public information. Phillips 66 was one of the largest buyers of Venezuelan oil prior to the imposition of sanctions about four years ago.

...

Chevron expands Venezuelan crude sales to other oil refiners

https://www.ajot.com/news/chevron-expands-venezuelan-crude-s…

...

Chevron Corp. sold a cargo of Venezuelan oil to another US refiner in the first such transaction since sanctions against the Latin American nation were eased less than two months ago.

Phillips 66 bought half-a-million barrels of a type of sludgy oil known as Hamaca from Chevron, according to a person with knowledge of the situation who asked not to be identified. The crude will be processed at the refiner’s Sweeny, Texas, complex about 65 miles (105 kilometers) south of Houston, the person said.

Chevron is expanding Venezuelan crude sales beyond its own refining network just weeks after US sanctions relief allowed the oil giant to return key managers to the country and resume drilling. The transactions appear to advance President Joe Biden’s dual objectives of re-engagement with the Nicolas Maduro regime and increasing crude supplies available to American fuel makers.

The cargo of Hamaca will be loaded onto the tanker Carina Voyager in Venezuela this month, according to another person who requested anonymity while discussing non-public information. Phillips 66 was one of the largest buyers of Venezuelan oil prior to the imposition of sanctions about four years ago.

...

Antwort auf Beitrag Nr.: 72.222.093 von faultcode am 18.08.22 14:16:446.1.

Phillips 66 Reaches Agreement to Acquire Publicly Held Common Units of DCP Midstream, LP

https://www.wallstreet-online.de/nachricht/16403252-phillips…

...

Phillips 66 (NYSE: PSX) and DCP Midstream, LP (“DCP Midstream”) (NYSE: DCP) announced today that they have entered into a definitive agreement pursuant to which Phillips 66 will acquire all of the publicly held common units representing limited partner interests in DCP Midstream for cash consideration of $41.75 per common unit, increasing its economic interest in DCP Midstream to 86.8%.

“We are delivering on our commitment to grow our NGL business,” said Mark Lashier, President and CEO of Phillips 66. “Our wellhead-to-market platform captures the full NGL value chain. As we continue integrating DCP Midstream, we are unlocking significant synergies and growth opportunities.”

In combination with the previously announced realignment of Phillips 66’s economic and governance interests in DCP Midstream, the transaction is expected to generate an incremental $1 billion of adjusted EBITDA for Phillips 66. In addition, Phillips 66 expects to capture operational and commercial synergies of at least $300 million by integrating DCP Midstream into its existing midstream business.

Phillips 66 plans to fund the approximately $3.8 billion cash consideration through a combination of cash and debt while maintaining its current investment grade credit ratings. The transaction is expected to close in the second quarter of 2023, subject to customary closing conditions.

The transaction was unanimously approved by the board of directors of DCP Midstream GP, LLC, the general partner of DCP Midstream GP, LP, the general partner of DCP Midstream, based on the unanimous approval and recommendation of a special committee comprised entirely of independent directors after evaluation of the transaction by the special committee in consultation with independent financial and legal advisors.

Affiliates of Phillips 66, as the holders of a majority of the outstanding DCP Midstream common units, have delivered their consent to approve the transaction. As a result, DCP Midstream has not solicited and is not soliciting approval of the transaction by any other holders of DCP Midstream common units.

...

Phillips 66 Reaches Agreement to Acquire Publicly Held Common Units of DCP Midstream, LP

https://www.wallstreet-online.de/nachricht/16403252-phillips…

...

Phillips 66 (NYSE: PSX) and DCP Midstream, LP (“DCP Midstream”) (NYSE: DCP) announced today that they have entered into a definitive agreement pursuant to which Phillips 66 will acquire all of the publicly held common units representing limited partner interests in DCP Midstream for cash consideration of $41.75 per common unit, increasing its economic interest in DCP Midstream to 86.8%.

“We are delivering on our commitment to grow our NGL business,” said Mark Lashier, President and CEO of Phillips 66. “Our wellhead-to-market platform captures the full NGL value chain. As we continue integrating DCP Midstream, we are unlocking significant synergies and growth opportunities.”

In combination with the previously announced realignment of Phillips 66’s economic and governance interests in DCP Midstream, the transaction is expected to generate an incremental $1 billion of adjusted EBITDA for Phillips 66. In addition, Phillips 66 expects to capture operational and commercial synergies of at least $300 million by integrating DCP Midstream into its existing midstream business.

Phillips 66 plans to fund the approximately $3.8 billion cash consideration through a combination of cash and debt while maintaining its current investment grade credit ratings. The transaction is expected to close in the second quarter of 2023, subject to customary closing conditions.

The transaction was unanimously approved by the board of directors of DCP Midstream GP, LLC, the general partner of DCP Midstream GP, LP, the general partner of DCP Midstream, based on the unanimous approval and recommendation of a special committee comprised entirely of independent directors after evaluation of the transaction by the special committee in consultation with independent financial and legal advisors.

Affiliates of Phillips 66, as the holders of a majority of the outstanding DCP Midstream common units, have delivered their consent to approve the transaction. As a result, DCP Midstream has not solicited and is not soliciting approval of the transaction by any other holders of DCP Midstream common units.

...

9.11.

...

The company’s Board of Directors approved a $5 billion increase to its authorization to repurchase its common stock, which brings the total amount of share repurchases authorized by the Board since 2012 to an aggregate of $20 billion.

...

Phillips 66 Outlines Plans to Increase Shareholder Distributions

https://www.wallstreet-online.de/nachricht/16177334-phillips…

...

The company’s Board of Directors approved a $5 billion increase to its authorization to repurchase its common stock, which brings the total amount of share repurchases authorized by the Board since 2012 to an aggregate of $20 billion.

...

Phillips 66 Outlines Plans to Increase Shareholder Distributions

https://www.wallstreet-online.de/nachricht/16177334-phillips…

Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share