Tuniu - chinesisches Online-Reisebüro - 500 Beiträge pro Seite

eröffnet am 29.09.15 16:55:20 von

neuester Beitrag 18.09.19 11:58:14 von

neuester Beitrag 18.09.19 11:58:14 von

Beiträge: 7

ID: 1.219.326

ID: 1.219.326

Aufrufe heute: 0

Gesamt: 1.618

Gesamt: 1.618

Aktive User: 0

ISIN: US89977P1066 · WKN: A1128G · Symbol: TOUR

0,8239

USD

+3,38 %

+0,0269 USD

Letzter Kurs 00:30:48 Nasdaq

Neuigkeiten

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,7800 | +75,60 | |

| 0,7000 | +45,83 | |

| 4,2100 | +27,19 | |

| 11,200 | +11,55 | |

| 4,6300 | +11,30 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5200 | -4,10 | |

| 0,5600 | -6,67 | |

| 32,09 | -9,61 | |

| 9,4600 | -10,25 | |

| 2,4100 | -16,61 |

Corporate Profile

Tuniu (Nasdaq:TOUR) is a leading online leisure travel company in China that offers a large selection of packaged tours, including organized and self-guided tours, as well as travel-related services for leisure travelers through its website tuniu.comand mobile platform. Tuniu has over 1,000,000 stock keeping units (SKUs) of packaged tours, covering over 140 countries worldwide and all the popular tourist attractions in China. Tuniu provides one-stop leisure travel solutions and a compelling customer experience through its online platform and offline service network, including over 1,100 tour advisors, a 24/7 call center and 130 regional service centers.

The Company's goal is to become the destination for Chinese consumer seeking leisure travel products and services. Tuniu aims to further expand its online leisure travel market share by expanding product offerings, increasing customer base, enhancing customer loyalty and strengthening supply chain management. The Company also intends to continue to pursue mobile strategies, invest in technology infrastructure, and to pursue strategic alliances and acquisitions.

Tuniu (Nasdaq:TOUR) is a leading online leisure travel company in China that offers a large selection of packaged tours, including organized and self-guided tours, as well as travel-related services for leisure travelers through its website tuniu.comand mobile platform. Tuniu has over 1,000,000 stock keeping units (SKUs) of packaged tours, covering over 140 countries worldwide and all the popular tourist attractions in China. Tuniu provides one-stop leisure travel solutions and a compelling customer experience through its online platform and offline service network, including over 1,100 tour advisors, a 24/7 call center and 130 regional service centers.

The Company's goal is to become the destination for Chinese consumer seeking leisure travel products and services. Tuniu aims to further expand its online leisure travel market share by expanding product offerings, increasing customer base, enhancing customer loyalty and strengthening supply chain management. The Company also intends to continue to pursue mobile strategies, invest in technology infrastructure, and to pursue strategic alliances and acquisitions.

blutet GuV-mäßig wie ein Schwein...

http://media.corporate-ir.net/media_files/IROL/25/253272/Tun…

Antwort auf Beitrag Nr.: 50.735.742 von R-BgO am 29.09.15 16:56:53Kurs verläuft passend

Antwort auf Beitrag Nr.: 53.950.364 von R-BgO am 24.12.16 00:08:51

Tuniu unfazed by competition from Ctrip and Fosun

Jan 24.2017

Conor Yang, chief financial officer for China’s Tuniu.com, has told Bloomberg TV that the business is aiming for “non-GAAP break even” by 2018.

Nasdaq-listed Tunui focuses on outbound luxury packages for Chinese individual and group travellers and recently celebrated its 10th anniversary.

Bloomberg asked Yang about the competitive landscape in China, suggesting that its recent addition of air ticketing and accommodation-only bookings was a move to compete directly with Ctrip.

Yang disagreed with this, saying that Tuniu has added these options in order to service demand for independent travel, and that its air and hotel inventory was targetted at destinations where there was a demand for tours.

Elsewhere, he noted that Tuniu works closely with one of its major backers HNA Group to source seat and bed inventory. HNA owns “dozen of airlines in and out of China” and also has investments in the hotel space, most recently taking a 25% stake in Hilton.

JD.com, a Chinese online marketplace, is another investor in Tuniu. Yang said that Tuniu has an exclusive deal to power the vacation packages channel on the site, with “many of their clients converting to our clients.”

Yang was also asked about competition from Thomas Cook China, a JV between the eponymous UK-based vertically integrated tour operator and Fosun, another massive Chinese conglomerate which also owns Club Med.

This JV is a more direct threat to Tuniu than Ctrip, although Yang appears unconcerned.

“We have been in the market for ten years so we know the online leisure sector well and we will continue to grow the gap with our peers. We have the best pricing, 1.7 million different options for travellers and, most importantly, the service level needed to make sure our customers are satisfied”.

He also pointed out that online only accounts for “10% plus” of China’s leisure travel market and that “Ctrip, us and others are taking share from offline travel agents.”

Looking ahead, when asked about the path to profitability, he noted that margins had been improving and would continue to do so as the business focussed on operational efficiencies. He said that Tuniu is on track to achieve “non-GAAP breakeven” by 2018.

never mind:

https://www.tnooz.com/article/tuniu-unphased-competition-ctr…Tuniu unfazed by competition from Ctrip and Fosun

Jan 24.2017

Conor Yang, chief financial officer for China’s Tuniu.com, has told Bloomberg TV that the business is aiming for “non-GAAP break even” by 2018.

Nasdaq-listed Tunui focuses on outbound luxury packages for Chinese individual and group travellers and recently celebrated its 10th anniversary.

Bloomberg asked Yang about the competitive landscape in China, suggesting that its recent addition of air ticketing and accommodation-only bookings was a move to compete directly with Ctrip.

Yang disagreed with this, saying that Tuniu has added these options in order to service demand for independent travel, and that its air and hotel inventory was targetted at destinations where there was a demand for tours.

Elsewhere, he noted that Tuniu works closely with one of its major backers HNA Group to source seat and bed inventory. HNA owns “dozen of airlines in and out of China” and also has investments in the hotel space, most recently taking a 25% stake in Hilton.

JD.com, a Chinese online marketplace, is another investor in Tuniu. Yang said that Tuniu has an exclusive deal to power the vacation packages channel on the site, with “many of their clients converting to our clients.”

Yang was also asked about competition from Thomas Cook China, a JV between the eponymous UK-based vertically integrated tour operator and Fosun, another massive Chinese conglomerate which also owns Club Med.

This JV is a more direct threat to Tuniu than Ctrip, although Yang appears unconcerned.

“We have been in the market for ten years so we know the online leisure sector well and we will continue to grow the gap with our peers. We have the best pricing, 1.7 million different options for travellers and, most importantly, the service level needed to make sure our customers are satisfied”.

He also pointed out that online only accounts for “10% plus” of China’s leisure travel market and that “Ctrip, us and others are taking share from offline travel agents.”

Looking ahead, when asked about the path to profitability, he noted that margins had been improving and would continue to do so as the business focussed on operational efficiencies. He said that Tuniu is on track to achieve “non-GAAP breakeven” by 2018.

Antwort auf Beitrag Nr.: 53.950.364 von R-BgO am 24.12.16 00:08:51unverändert

Antwort auf Beitrag Nr.: 56.585.081 von R-BgO am 02.01.18 09:51:47

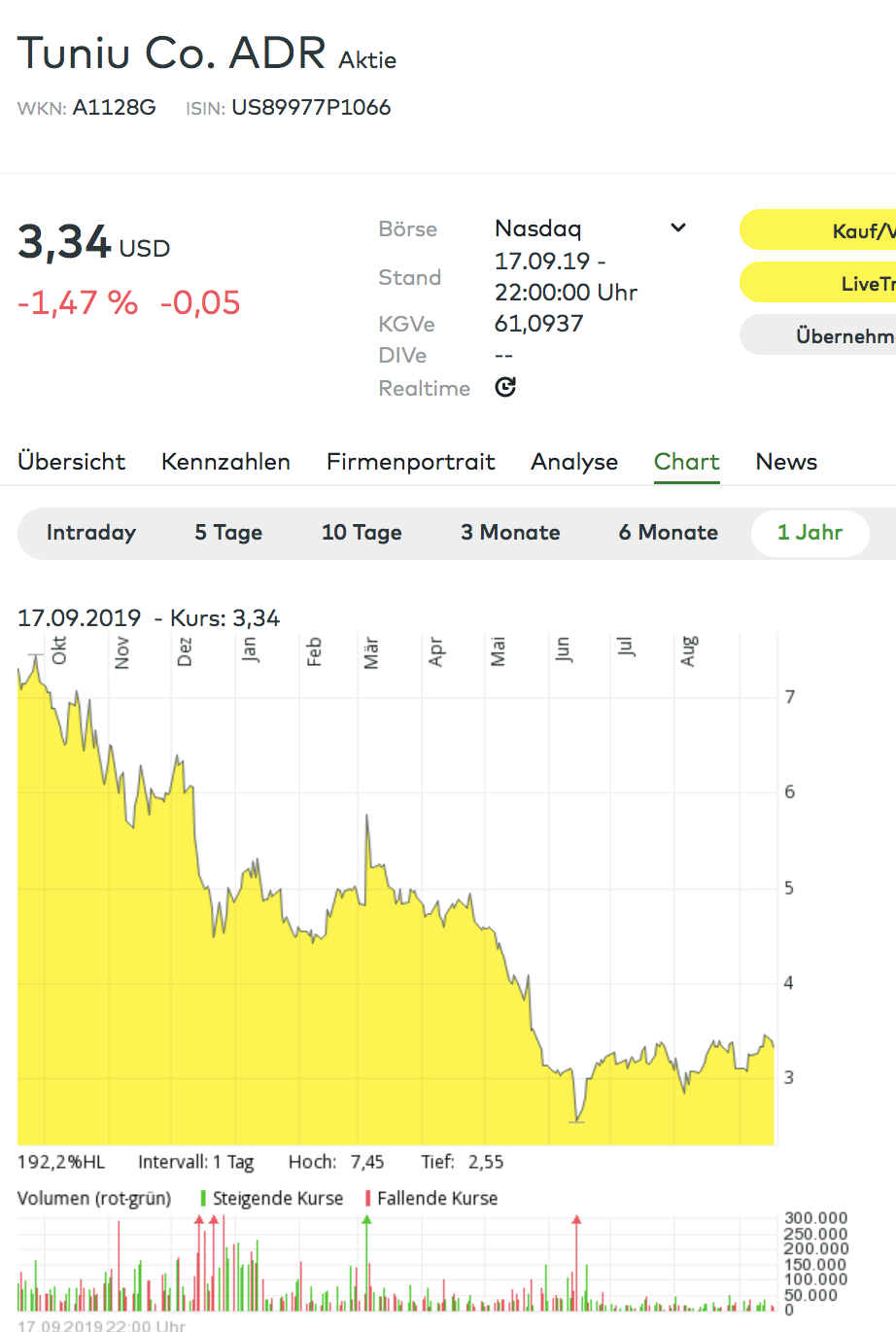

Kurs schmilzt weiter ab

operativ scheinen Siebei geringerem Umsatz

inzwischen Gewinn zu machen;Kurs schmilzt weiter ab

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,49 | |

| +1,21 | |

| +0,20 | |

| +1,04 | |

| -3,25 | |

| +12,30 | |

| +2,68 | |

| +3,81 | |

| +1,87 | |

| +0,29 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 219 | ||

| 147 | ||

| 81 | ||

| 60 | ||

| 49 | ||

| 45 | ||

| 43 | ||

| 41 | ||

| 37 | ||

| 30 |