RM2 International - 500 Beiträge pro Seite

eröffnet am 05.10.15 16:11:41 von

neuester Beitrag 01.09.19 12:22:12 von

neuester Beitrag 01.09.19 12:22:12 von

Beiträge: 14

ID: 1.219.572

ID: 1.219.572

Aufrufe heute: 0

Gesamt: 1.915

Gesamt: 1.915

Aktive User: 0

ISIN: LU1914372336 · WKN: A2PAC9

0,0005

USD

+400,00 %

+0,0004 USD

Letzter Kurs 22.06.21 Nasdaq OTC

Neuigkeiten

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 0,6800 | +312,12 | |

| 9,0000 | +17,65 | |

| 1,6800 | +15,87 | |

| 1,0900 | +11,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,0700 | -12,45 | |

| 446,00 | -13,43 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 | |

| 0,5338 | -31,13 |

...macht eine neue Art von Paletten;

Geschäftsmodell ist mir noch nicht völlig klar, aber nehme sie mal in die peergroup zu Brambles.

Geschäftsmodell ist mir noch nicht völlig klar, aber nehme sie mal in die peergroup zu Brambles.

von Motley Fool:

Neil Woodford Ramps Up His Stake In RM2 International SA And Netscientific PLCBy G A Chester - Thursday, 1 October, 2015 | More on: NSCIRM2

Top fund manager Neil Woodford has just ramped up his stakes in RM2 International (LSE: RM2) and Netscientific (LSE: NSCI), which seems like a good reason to take a closer look at these potential multi-baggers.

The two companies are in very different businesses, but have some things in common:

*Currently loss-making, but huge potential

*Fundraisings at/near all-time lows announced this week

*Woodford taking the opportunity to significantly increase his investments

RM2 International

RM2 International listed on AIM in January 2014, raising £137m at 88p a share. Woodford soon bought into the company with the launch of his CF Woodford Equity Income Fund in the summer of last year, notifying a 7.5% stake in June. By the end of August this year, his holding was up to over 21%.

A placing by RM2 announced this week to raise £30m is at an all-time low share price of 40p. Woodford has subscribed for shares in the placing, which will take his interest to 27% of the enlarged share capital. Supporters like Woodford are averaging down from higher prices, but new investors today are being offered a low entry point, with the shares currently trading in the market at 43p.

RM2 is seeking to establish “a disruptive presence in global pallet supply and improve the supply chain of manufacturing and distribution businesses through the effective and efficient use and management of composite pallets”. The company has some heavyweight non-executive directors on board, including Paul Walsh (chief executive of Diageo from 2000 to 2013) and Stuart Rose (boss of Marks & Spencer from 2004 to 2010).

RM2 is not only currently loss-making ($25m over the last six months), but also has virtually no revenue at this stage. This week’s placing follows hot on the heels of a setback. The company had expected a substantial upswing in production and revenue to begin in Q3 this year and accelerate through Q4. However, feedback from customers has led management to drop a friction coating method for pallets in favour of a new gel-based system, which has delayed production and revenue targets to 2016.

My problem with RM2 is not that it’s had a hiccup — to be expected with a developing business — but that I haven’t been able to find any detail on the long-term revenue opportunity for the company and the kind of margins it hopes to make. However, it’s very likely Woodford has a far better idea of RM2’s prospects than me!

nix Neues...

Antwort auf Beitrag Nr.: 51.990.092 von R-BgO am 16.03.16 10:23:526 April 2016

RM2 International S.A.

RM2 enters into landmark alliance with Zhenshi for production of game-changing pallet

RM2 (LSE-AIM: RM2), the sustainable composite pallet innovator, is pleased to announce that it has entered into a strategic cost-saving manufacturing agreement with Zhenshi Holding Group Company Limited of China ("Zhenshi"). Zhenshi is a major shareholder of China Jushi Co. Ltd. ("Jushi"), one of the largest manufacturers of fibreglass in the world, producing over 1.1 million tonnes of glass fibre annually. Fibreglass is one of the key raw materials used in the manufacture of RM2's BLOCKpal pallet.

The agreement will allow for the mass production of the RM2 BLOCKpal pallet in Tongxiang, at a facility owned by Zhenshi Group Huamei New Materials Co., Ltd, adjacent to the principal Jushi glass fibre manufacturing plant. Initial production is expected to be deployed in Q1 2017 and will target circa 1.5 million pallets per annum, with projected growth to at least 5 million pallets per annum in the medium term. Pallets produced at the facility will initially be deployed with RM2's customers in North America and Europe.

RM2 and Zhenshi believe that there is a significant strategic opportunity for BLOCKpal deployment in the domestic Chinese and other Asian markets as Chinese logistics develop and as China palletizes its vast supply chain. The two companies will also develop additional areas where their resources and expertise are complementary, particularly in the area of logistics.

This agreement allows RM2 to address the volume demands of its clients whilst significantly reducing Cost Per Unit (CPU). Some of RM2's manufacturing assets will be transferred to China and, as a consequence of reduced production in Canada, RM2 will fall well short of its 2016 production target. Management analysis has demonstrated that the CPU benefits support this decision. The Company continues to seek to improve and optimise its manufacturing processes and remains committed to volume production in North America and will update the market on these plans over the coming months.

President Zhang, Chairman of Zhenshi and President of Jushi, commented: "We believe that large parts of the Chinese logistics chain will become palletized over the coming years. We are convinced, after our own extensive research, that the BLOCKpal is the optimum product in the market. Partnering with RM2 allows us to seize first mover advantage as China moves to palletize its economy in a region of the world with limited forestry resources for the manufacture of wooden pallets. Introducing the BLOCKPal pallet to China will put us on a cleaner and more sustainable path. China needs to reduce its logistics costs and we believe that the widespread use of sustainable, reusable pallets will be a key component of that. We will use all our resources to ensure maximum penetration of the BLOCKpal pallet in China and the broader Asian markets and we look forward to further developing our collaboration with RM2."

John Walsh, CEO of RM2, commented: "This is a strategic, long term agreement with Zhenshi which will allow us to offer even greater savings to our existing and future customers in North America and Europe due to the lower CPU, whilst also giving RM2 access to the vast Chinese market. This agreement will enable RM2 to produce pallets at a greater rate and at significantly lower cost, while at the same time, Zhenshi's extensive corporate holdings and relationships makes it uniquely positioned to open the Asian market for the BLOCKpal pallet. RM2 has taken steps to ensure we have the pallets available to service our customers during this transition of our manufacturing assets."

RM2 International S.A.

RM2 enters into landmark alliance with Zhenshi for production of game-changing pallet

RM2 (LSE-AIM: RM2), the sustainable composite pallet innovator, is pleased to announce that it has entered into a strategic cost-saving manufacturing agreement with Zhenshi Holding Group Company Limited of China ("Zhenshi"). Zhenshi is a major shareholder of China Jushi Co. Ltd. ("Jushi"), one of the largest manufacturers of fibreglass in the world, producing over 1.1 million tonnes of glass fibre annually. Fibreglass is one of the key raw materials used in the manufacture of RM2's BLOCKpal pallet.

The agreement will allow for the mass production of the RM2 BLOCKpal pallet in Tongxiang, at a facility owned by Zhenshi Group Huamei New Materials Co., Ltd, adjacent to the principal Jushi glass fibre manufacturing plant. Initial production is expected to be deployed in Q1 2017 and will target circa 1.5 million pallets per annum, with projected growth to at least 5 million pallets per annum in the medium term. Pallets produced at the facility will initially be deployed with RM2's customers in North America and Europe.

RM2 and Zhenshi believe that there is a significant strategic opportunity for BLOCKpal deployment in the domestic Chinese and other Asian markets as Chinese logistics develop and as China palletizes its vast supply chain. The two companies will also develop additional areas where their resources and expertise are complementary, particularly in the area of logistics.

This agreement allows RM2 to address the volume demands of its clients whilst significantly reducing Cost Per Unit (CPU). Some of RM2's manufacturing assets will be transferred to China and, as a consequence of reduced production in Canada, RM2 will fall well short of its 2016 production target. Management analysis has demonstrated that the CPU benefits support this decision. The Company continues to seek to improve and optimise its manufacturing processes and remains committed to volume production in North America and will update the market on these plans over the coming months.

President Zhang, Chairman of Zhenshi and President of Jushi, commented: "We believe that large parts of the Chinese logistics chain will become palletized over the coming years. We are convinced, after our own extensive research, that the BLOCKpal is the optimum product in the market. Partnering with RM2 allows us to seize first mover advantage as China moves to palletize its economy in a region of the world with limited forestry resources for the manufacture of wooden pallets. Introducing the BLOCKPal pallet to China will put us on a cleaner and more sustainable path. China needs to reduce its logistics costs and we believe that the widespread use of sustainable, reusable pallets will be a key component of that. We will use all our resources to ensure maximum penetration of the BLOCKpal pallet in China and the broader Asian markets and we look forward to further developing our collaboration with RM2."

John Walsh, CEO of RM2, commented: "This is a strategic, long term agreement with Zhenshi which will allow us to offer even greater savings to our existing and future customers in North America and Europe due to the lower CPU, whilst also giving RM2 access to the vast Chinese market. This agreement will enable RM2 to produce pallets at a greater rate and at significantly lower cost, while at the same time, Zhenshi's extensive corporate holdings and relationships makes it uniquely positioned to open the Asian market for the BLOCKpal pallet. RM2 has taken steps to ensure we have the pallets available to service our customers during this transition of our manufacturing assets."

17 March 2016

RM2 International S.A.

RM2 Pallets Accepted into Supply Chain of Canada's Largest Retailer

RM2 (LSE-AIM: RM2), the sustainable composite pallet innovator, is pleased to announce that Loblaw Companies Ltd (TSX: L) ("Loblaw"), Canada's largest retailer employing approximately 192,000 full- and part-time employees, has begun accepting RM2 pallets in its supply chain network. RM2 will continue to work with Loblaw to further implement a programme of pallet deployment in the coming years.

Loblaw Executive Vice President of Supply Chain, Rob Wiebe, commented: "We are very pleased to begin accepting RM2 pallets in our distribution centres, and we look forward to working with selected vendors to support this important sustainability and efficiency initiative."

John Walsh, Chief Executive Officer of RM2, said: "Loblaw is greatly respected as an innovative retailer with a deserved reputation as a champion of environmental responsibility. We are delighted to be chosen to partner with them and their supplier community to bring cost efficiencies, greater sustainability and innovation into the supply chain."

RM2 International S.A.

RM2 Pallets Accepted into Supply Chain of Canada's Largest Retailer

RM2 (LSE-AIM: RM2), the sustainable composite pallet innovator, is pleased to announce that Loblaw Companies Ltd (TSX: L) ("Loblaw"), Canada's largest retailer employing approximately 192,000 full- and part-time employees, has begun accepting RM2 pallets in its supply chain network. RM2 will continue to work with Loblaw to further implement a programme of pallet deployment in the coming years.

Loblaw Executive Vice President of Supply Chain, Rob Wiebe, commented: "We are very pleased to begin accepting RM2 pallets in our distribution centres, and we look forward to working with selected vendors to support this important sustainability and efficiency initiative."

John Walsh, Chief Executive Officer of RM2, said: "Loblaw is greatly respected as an innovative retailer with a deserved reputation as a champion of environmental responsibility. We are delighted to be chosen to partner with them and their supplier community to bring cost efficiencies, greater sustainability and innovation into the supply chain."

Mr. Schneider lag (bisher?) ganz gut mit seiner Einschätzung aus 2014:

http://seekingalpha.com/article/2494725-10-more-overvalued-s…RM2 International is a UK-listed start-up manufacturing composite-based shipping pallets. The company claims to have a lighter, more durable pallet than polymer or wood pallets. The company generated only $0.1M in revenues over the last reported twelve months ended December 2013, while incurring a horrific net loss of -$77M over that period. Moreover, the company will have to expend substantial capital to manufacture these pallets.

RM2's key assets consisted of a September 2013 $3M acquisition of a logistics tracking company plus a plant in Ottawa valued at $14M to make these composite pallets. In Q4 2013, RM2 was recapitalized including insiders issuing themselves 46M in virtually-free $0.01 shares. In January 2014, management and Cenkos Securities used financial alchemy to turn this modest asset into a high-flying £137M ($223M) AIM IPO valued at £283M ($460M) at that time. RM2 shares are currently trading at £0.745 ($1.21) per share, below the £0.88 ($1.43) IPO price.

Since the IPO, no updates have been published except for 2013 financials released in June 2014. I adjusted the enterprise value of $418M as of December 2013 (which included $29M of net debt) to $276M to adjust for IPO cash proceeds and an estimated 1H 2014 operating cash burn of $80M. The estimated 1H cash burn includes management's stated plans for expanding manufacturing capacity, operating expenses, and a one-time $40M liability payment.

Until recently, much of the management team was ex-investment bankers with no relevant industry experience. It was this management group that likely used their industry network to pull-off the large IPO. The company recently went on a hiring spree to assemble a team with relevant industry experience, although the CEO remains an ex-investment banker. Judging from the lack of news this year, the new management team is still settling in.

RM2 does not list any patents in its literature and filings. A patent search on RM2 International and Plastics Research Corporation (a defaulting manufacturing entity that RM2 took over) came up empty. The pultrusion process that RM2 uses to make these composite pallets has been around for a long time (see this pultrusion machine patent issued in 1972 which has a schematic diagram quite similar to the one in RM2's IPO prospectus). Thus, even if RM2 has some initial success in renting composite pallets, the pallet market behemoth - Brambles (OTCPK:BMBLY), along with Peco, iGPS, and other peers can duplicate the process, thereby nipping RM2 in the bud.

Moreover, this is a mature business that carries average market valuations. Brambles trades at an EV/Revenues ratio of just under 3x. At that multiple, RM2 would need revenues of $100M to justify its current valuation, as opposed to the $0.1M in revenues currently on the books. Given the mature, slow-growing industry and no sustainable competitive advantage to obtain market share, it is unlikely that revenues will ever reach close to $100M.

Basically, there is little tangible evidence to justify RM2's grandiose valuation - no real revenues have been reported, massive losses, no proprietary technology, mature industry, etc. Catalysts for RM2 stock to implode could be 1) release of 1H 2014 results, 2) insider lock-up expiration in January 2015, among other events. Sooner or later, gravity will bring these shares down to earth.

22 December 2016

RM2 International S.A.

Manufacturing operations update

RM2, the sustainable composite pallet innovator, is pleased to update shareholders on progress at its new manufacturing operations in Mexico and China.

Both initiatives are on track. Pultrusion began in Mexico this month and the finished BLOCKPal product will be available in January. The Company has agreed with its manufacturing partner, Jabil Circuit Inc (Jabil), the specific monthly ramp-up of production during the first half of 2017 with full production in Mexico expected in Q3 2017. The process in China is approximately 10-12 weeks behind Mexico.

Kevin Mazula, COO and Head of Manufacturing at RM2, commented: "We are extremely grateful for the commitment and co-operation we have received from our partners Zhenshi in China and Jabil in Mexico. As a result of the swift progress we have made we are very confident that we will meet the deployment timetables that we outlined to our customers in North America."

John Walsh, RM2's CEO commented: "It is very gratifying to report that both these operations are well on track. Our strategic partnerships with Zhenshi and Jabil have transformed RM2's long term manufacturing cost base and capabilities. We now have excellent visibility for cost efficient production and volumes during 2017 and beyond. I look forward to giving a further production update in Q1 2017."

RM2 International S.A.

Manufacturing operations update

RM2, the sustainable composite pallet innovator, is pleased to update shareholders on progress at its new manufacturing operations in Mexico and China.

Both initiatives are on track. Pultrusion began in Mexico this month and the finished BLOCKPal product will be available in January. The Company has agreed with its manufacturing partner, Jabil Circuit Inc (Jabil), the specific monthly ramp-up of production during the first half of 2017 with full production in Mexico expected in Q3 2017. The process in China is approximately 10-12 weeks behind Mexico.

Kevin Mazula, COO and Head of Manufacturing at RM2, commented: "We are extremely grateful for the commitment and co-operation we have received from our partners Zhenshi in China and Jabil in Mexico. As a result of the swift progress we have made we are very confident that we will meet the deployment timetables that we outlined to our customers in North America."

John Walsh, RM2's CEO commented: "It is very gratifying to report that both these operations are well on track. Our strategic partnerships with Zhenshi and Jabil have transformed RM2's long term manufacturing cost base and capabilities. We now have excellent visibility for cost efficient production and volumes during 2017 and beyond. I look forward to giving a further production update in Q1 2017."

neuer CEO...

29 March 2018

RM2 International S.A.

("RM2" or the "Company")

US$36m Placing, Pref. Share Conversion and Notice of EGM

Conditional Placing of 2,535,211,265 new Ordinary Shares at a Placing Price of 1 pence each to raise US$36 million before expenses and Conditional Conversion of All Convertible Preferred Shares into 3,156,907,940 new Ordinary Shares

Introduction

Your Board announces today that the Company has conditionally raised US$36 million before fees and expenses by a Placing (to be effected in two tranches) of 2,535,211,265 new Ordinary Shares to existing institutional investors, certain directors and members of senior management at a Placing Price of 1 pence per Placing Share. For the Placing to proceed, the Company requires Shareholders' approval to authorise the Directors to disapply existing Shareholders' pre-emption rights in relation to the issue of the Placing Shares and the Conversion Shares on a non pre-emptive basis.

The Company is today posting a circular to Shareholders to give you notice of the General Meeting to consider and, if thought fit, approve the Resolutions to grant this authority (the "Circular"). The General Meeting is to be held at 5 Rue de la Chapelle, Luxembourg, L-1325, Luxembourg at 7 a.m. BST/8 a.m. CEST on 13 April 2018. The formal notice of General Meeting is set out at the end of the Circular. The Circular is also available on the Company's website.

Assuming the Shareholders approve the Placing, the issuance of the first tranche of 1,279,049,295 new Ordinary Shares (gross proceeds of $18,162,500) (the First Tranche Subscription) will take place immediately following the General Meeting. The issuance of the second tranche of 1,256,161,970 new Ordinary Shares (gross proceeds of $17,837,500) (the Second Tranche Subscription) would occur ten business days following a drawdown notice issued by the Company and is subject to the satisfaction of the Key Performance Indicators described herein. The Board believes that raising equity finance using the flexibility provided by a non pre-emptive placing is the only viable option for the Company at this time. This allows investors the opportunity to participate in the Placing to raise urgent funding for the Company's survival and avoids the requirement for a prospectus, which is a costly and time consuming process.

Should the Placing prove successful and subject to shareholder authorization, the Board intends shortly afterwards to make an open offer at the Placing Price of up to the pound sterling equivalent of €5.0 million (the Open Offer), the maximum permitted without requiring the Company to publish a prospectus under the EU Prospectus Directive. The Open Offer would be made available to all Shareholders to allow those Shareholders who could not participate in the Placing to have the opportunity to invest. Authorization for the Open Offer would be sought from the Shareholders at the General Meeting of the Company to be held on 13 April 2018.

For the Placing to proceed, the holders of 120,457,808 Convertible Preferred Shares who are subscribing in the Placing for at least 75% of the same quantum of Placing Shares (expressed in British pound sterling) have agreed to convert their Convertible Preferred Shares into 3,026,761,003 Ordinary Shares at the Placing Price (the Participating Conversion Shares) and the holders of 14,357,963 Convertible Preferred Shares who are not subscribing in the Placing have agreed to convert their Convertible Preferred Shares into 130,146,937 Ordinary Shares in application of the anti-dilution provisions in the Company's Articles (the Non-Participating Conversion Shares). Both the Participating Conversion Shares and the Non-Participating Conversion Shares include the payment of all accrued dividends on such shares.

The Participating Conversion Shares and the Non-Participating Conversion Shares are collectively referred to herein as the Conversion Shares. The Conversion Shares will represent approximately 65.2 per cent. of the First Tranche Enlarged Share Capital and 51.8 per cent. of the Enlarged Share Capital assuming issuance of Shares pursuant to the Second Tranche Subscription. Following conversion of the Convertible Preferred Shares into the Conversion Shares (the Conversion), no Convertible Preferred Shares will remain outstanding and the Company's equity will consist of a single class of Ordinary Shares.

The Conversion Shares will be issued by using distributable reserves (to the extent available) and share premium, and will, when issued, be subject to the Articles, be credited as fully paid and will rank pari passu in all respects with the Ordinary Shares then in issue, including the right to receive all dividends and other distributions declared, made or paid in respect of such Ordinary Shares after the date of First Admission.

In order to issue such Conversion Shares, the Company requires Shareholders' approval including authorization to the Board to disapply existing Shareholders' pre-emption rights in relation to the issuance of the Conversion Shares on a non pre-emptive basis.

The Board therefore requests Shareholders to vote in favor of the authorization to the Board to proceed to increase the subscribed share capital by an amount of US$36 million and to the issue of the Placing Shares and the Conversion Shares within the limits of the authorized share capital and to authorize the Directors to disapply existing Shareholders' pre-emption rights in relation to such issue of the Placing Shares and the Conversion Shares.

The Company intends to use the net proceeds of the Placing to fund: (i) the retrofitting of existing inventory of RM2 Blockpals with ELIoT track and trace devices, (ii) the production of new RM2 ELIoT Pallets and (iii) its sales and general administrative costs.

This announcement (and the Circular) provides you with information about the Placing and the issue of the Conversion Shares and explains why the Board considers these matters to be in the best interests of the Company and its Shareholders, and why the Directors recommend that you vote in favour of the Resolutions to be proposed at the General Meeting.

The primary reason for the Resolutions is for the Company to be able to raise sufficient funds for the Company to augment its product offering and to meet its ongoing working capital obligations and to enable the Company to continue as a going concern.

If all of the Resolutions relating to the Placing are not successfully passed at the General Meeting, and no other source of funds has become available to the Company prior to the General Meeting, the Chairman of the General Meeting will table for immediate vote either (i) the resolution authorizing the Company to dispose of all or substantially all of its assets if at such time there is a viable offer for such assets or (ii) the resolution authorizing the dissolution with immediate effect and voluntary liquidation of the Company.

RM2 International S.A.

("RM2" or the "Company")

US$36m Placing, Pref. Share Conversion and Notice of EGM

Conditional Placing of 2,535,211,265 new Ordinary Shares at a Placing Price of 1 pence each to raise US$36 million before expenses and Conditional Conversion of All Convertible Preferred Shares into 3,156,907,940 new Ordinary Shares

Introduction

Your Board announces today that the Company has conditionally raised US$36 million before fees and expenses by a Placing (to be effected in two tranches) of 2,535,211,265 new Ordinary Shares to existing institutional investors, certain directors and members of senior management at a Placing Price of 1 pence per Placing Share. For the Placing to proceed, the Company requires Shareholders' approval to authorise the Directors to disapply existing Shareholders' pre-emption rights in relation to the issue of the Placing Shares and the Conversion Shares on a non pre-emptive basis.

The Company is today posting a circular to Shareholders to give you notice of the General Meeting to consider and, if thought fit, approve the Resolutions to grant this authority (the "Circular"). The General Meeting is to be held at 5 Rue de la Chapelle, Luxembourg, L-1325, Luxembourg at 7 a.m. BST/8 a.m. CEST on 13 April 2018. The formal notice of General Meeting is set out at the end of the Circular. The Circular is also available on the Company's website.

Assuming the Shareholders approve the Placing, the issuance of the first tranche of 1,279,049,295 new Ordinary Shares (gross proceeds of $18,162,500) (the First Tranche Subscription) will take place immediately following the General Meeting. The issuance of the second tranche of 1,256,161,970 new Ordinary Shares (gross proceeds of $17,837,500) (the Second Tranche Subscription) would occur ten business days following a drawdown notice issued by the Company and is subject to the satisfaction of the Key Performance Indicators described herein. The Board believes that raising equity finance using the flexibility provided by a non pre-emptive placing is the only viable option for the Company at this time. This allows investors the opportunity to participate in the Placing to raise urgent funding for the Company's survival and avoids the requirement for a prospectus, which is a costly and time consuming process.

Should the Placing prove successful and subject to shareholder authorization, the Board intends shortly afterwards to make an open offer at the Placing Price of up to the pound sterling equivalent of €5.0 million (the Open Offer), the maximum permitted without requiring the Company to publish a prospectus under the EU Prospectus Directive. The Open Offer would be made available to all Shareholders to allow those Shareholders who could not participate in the Placing to have the opportunity to invest. Authorization for the Open Offer would be sought from the Shareholders at the General Meeting of the Company to be held on 13 April 2018.

For the Placing to proceed, the holders of 120,457,808 Convertible Preferred Shares who are subscribing in the Placing for at least 75% of the same quantum of Placing Shares (expressed in British pound sterling) have agreed to convert their Convertible Preferred Shares into 3,026,761,003 Ordinary Shares at the Placing Price (the Participating Conversion Shares) and the holders of 14,357,963 Convertible Preferred Shares who are not subscribing in the Placing have agreed to convert their Convertible Preferred Shares into 130,146,937 Ordinary Shares in application of the anti-dilution provisions in the Company's Articles (the Non-Participating Conversion Shares). Both the Participating Conversion Shares and the Non-Participating Conversion Shares include the payment of all accrued dividends on such shares.

The Participating Conversion Shares and the Non-Participating Conversion Shares are collectively referred to herein as the Conversion Shares. The Conversion Shares will represent approximately 65.2 per cent. of the First Tranche Enlarged Share Capital and 51.8 per cent. of the Enlarged Share Capital assuming issuance of Shares pursuant to the Second Tranche Subscription. Following conversion of the Convertible Preferred Shares into the Conversion Shares (the Conversion), no Convertible Preferred Shares will remain outstanding and the Company's equity will consist of a single class of Ordinary Shares.

The Conversion Shares will be issued by using distributable reserves (to the extent available) and share premium, and will, when issued, be subject to the Articles, be credited as fully paid and will rank pari passu in all respects with the Ordinary Shares then in issue, including the right to receive all dividends and other distributions declared, made or paid in respect of such Ordinary Shares after the date of First Admission.

In order to issue such Conversion Shares, the Company requires Shareholders' approval including authorization to the Board to disapply existing Shareholders' pre-emption rights in relation to the issuance of the Conversion Shares on a non pre-emptive basis.

The Board therefore requests Shareholders to vote in favor of the authorization to the Board to proceed to increase the subscribed share capital by an amount of US$36 million and to the issue of the Placing Shares and the Conversion Shares within the limits of the authorized share capital and to authorize the Directors to disapply existing Shareholders' pre-emption rights in relation to such issue of the Placing Shares and the Conversion Shares.

The Company intends to use the net proceeds of the Placing to fund: (i) the retrofitting of existing inventory of RM2 Blockpals with ELIoT track and trace devices, (ii) the production of new RM2 ELIoT Pallets and (iii) its sales and general administrative costs.

This announcement (and the Circular) provides you with information about the Placing and the issue of the Conversion Shares and explains why the Board considers these matters to be in the best interests of the Company and its Shareholders, and why the Directors recommend that you vote in favour of the Resolutions to be proposed at the General Meeting.

The primary reason for the Resolutions is for the Company to be able to raise sufficient funds for the Company to augment its product offering and to meet its ongoing working capital obligations and to enable the Company to continue as a going concern.

If all of the Resolutions relating to the Placing are not successfully passed at the General Meeting, and no other source of funds has become available to the Company prior to the General Meeting, the Chairman of the General Meeting will table for immediate vote either (i) the resolution authorizing the Company to dispose of all or substantially all of its assets if at such time there is a viable offer for such assets or (ii) the resolution authorizing the dissolution with immediate effect and voluntary liquidation of the Company.

Antwort auf Beitrag Nr.: 57.655.430 von R-BgO am 29.04.18 12:36:0913 April 2018

RM2 International S.A.

Result of EGM, Trading Update and Total Voting Rights

Results of EGM

RM2 International S.A. ("RM2" or the "Company"), the sustainable smart pallet innovator, is pleased to announce that all of the resolutions put to Shareholders concerning the Placing, the Conversion and the Open Offer (as announced on 29 March 2018) at the Company's Extraordinary General Meeting of Shareholders held today were duly passed.

Accordingly, the Company has now completed the issuance of 1,279,049,295 First Tranche Placing Shares at the Placing Price, raising gross proceeds of US$18,162,500, and the issuance of 3,156,907,940 Conversion Shares.

As noted in the Company's 29 March 2018 announcement, the Board intends to launch shortly an open offer to all Shareholders at the Placing Price of up to the pound sterling equivalent of €5.0 million. Further information on the Open Offer will be made available in due course.

Trading Update

The Company is pleased to also announce it has entered into a Phase 1 agreement for an initial deployment of RM2 ELIoT pallets through June 30, 2018 with a Fortune 500 company in North America following a year-long trial with this blue-chip customer's supplier network.

In addition, the Company has also completed a major trial with a North American company and discussions on a large-scale implementation are expected to commence. The Company has also expanded ongoing trials with other major US-based customers.

Total Voting Rights

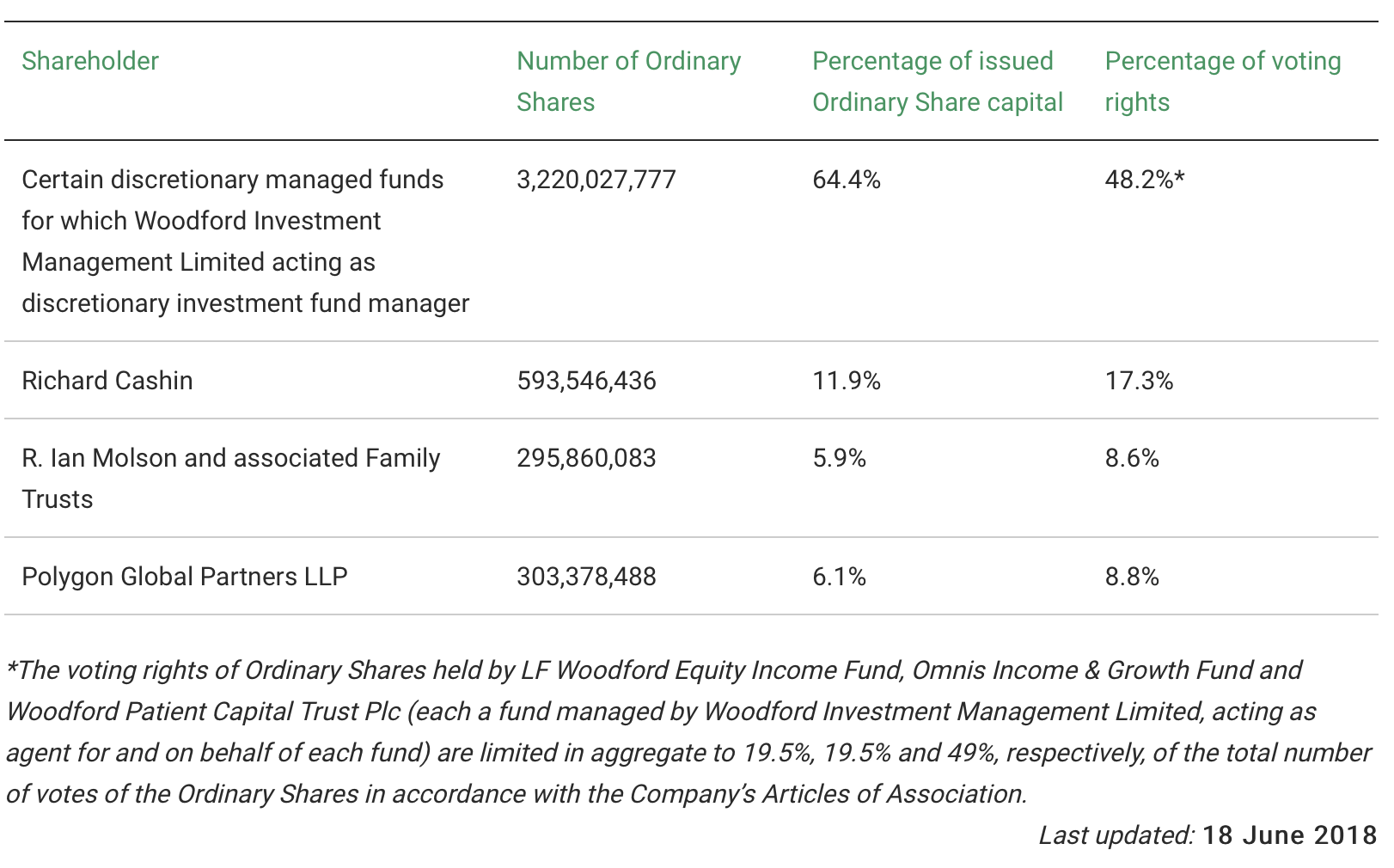

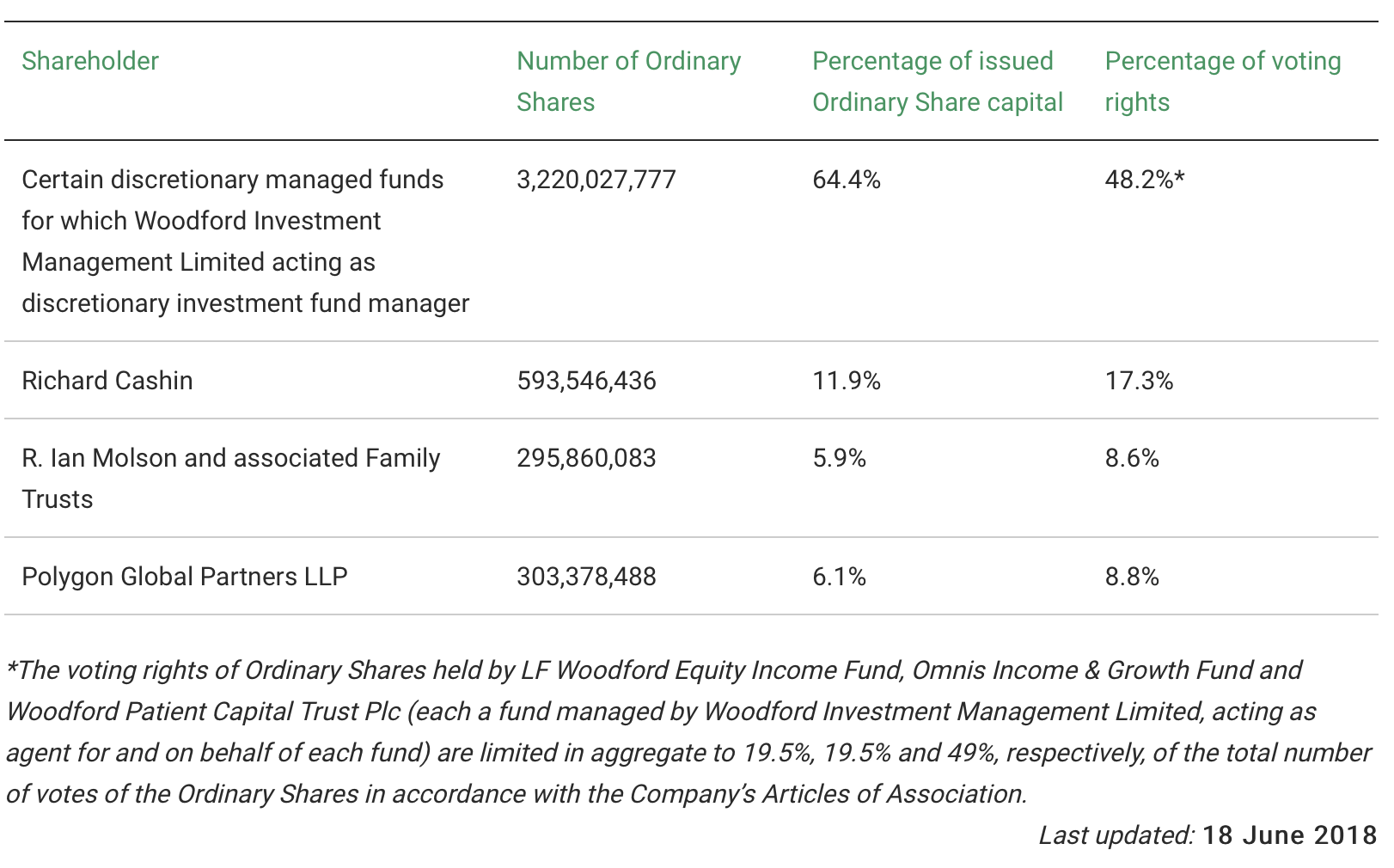

Application has been made for the First Tranche Placing Shares and the Conversion Shares, accounting for, in aggregate, 4,435,957,235 new Ordinary Shares, to be admitted to trading on AIM, which is expected to become effective on or around 19 April 2018. Following the issue of the First Tranche Placing Shares and the Conversion Shares, the Company's issued share capital is comprised of 4,843,019,891 Ordinary Shares, of which 2,916,334 Ordinary Shares are held by the Company as non-voting treasury stock ("Treasury Shares").

The total number of voting rights in the Company is calculated as the number of outstanding Ordinary Shares, less the Treasury Shares, less the Ordinary Shares not able to be voted on due to restrictions applicable to certain holders as specified in the Company's Articles of Association, which results in a total voting rights figure of 3,237,160,379. Shareholders may use this figure of 3,237,160,379 as the denominator for the calculations by which they will determine if they are required to notify their interest in, or change their interest in, the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

RM2 International S.A.

Result of EGM, Trading Update and Total Voting Rights

Results of EGM

RM2 International S.A. ("RM2" or the "Company"), the sustainable smart pallet innovator, is pleased to announce that all of the resolutions put to Shareholders concerning the Placing, the Conversion and the Open Offer (as announced on 29 March 2018) at the Company's Extraordinary General Meeting of Shareholders held today were duly passed.

Accordingly, the Company has now completed the issuance of 1,279,049,295 First Tranche Placing Shares at the Placing Price, raising gross proceeds of US$18,162,500, and the issuance of 3,156,907,940 Conversion Shares.

As noted in the Company's 29 March 2018 announcement, the Board intends to launch shortly an open offer to all Shareholders at the Placing Price of up to the pound sterling equivalent of €5.0 million. Further information on the Open Offer will be made available in due course.

Trading Update

The Company is pleased to also announce it has entered into a Phase 1 agreement for an initial deployment of RM2 ELIoT pallets through June 30, 2018 with a Fortune 500 company in North America following a year-long trial with this blue-chip customer's supplier network.

In addition, the Company has also completed a major trial with a North American company and discussions on a large-scale implementation are expected to commence. The Company has also expanded ongoing trials with other major US-based customers.

Total Voting Rights

Application has been made for the First Tranche Placing Shares and the Conversion Shares, accounting for, in aggregate, 4,435,957,235 new Ordinary Shares, to be admitted to trading on AIM, which is expected to become effective on or around 19 April 2018. Following the issue of the First Tranche Placing Shares and the Conversion Shares, the Company's issued share capital is comprised of 4,843,019,891 Ordinary Shares, of which 2,916,334 Ordinary Shares are held by the Company as non-voting treasury stock ("Treasury Shares").

The total number of voting rights in the Company is calculated as the number of outstanding Ordinary Shares, less the Treasury Shares, less the Ordinary Shares not able to be voted on due to restrictions applicable to certain holders as specified in the Company's Articles of Association, which results in a total voting rights figure of 3,237,160,379. Shareholders may use this figure of 3,237,160,379 as the denominator for the calculations by which they will determine if they are required to notify their interest in, or change their interest in, the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

Antwort auf Beitrag Nr.: 57.655.442 von R-BgO am 29.04.18 12:38:19

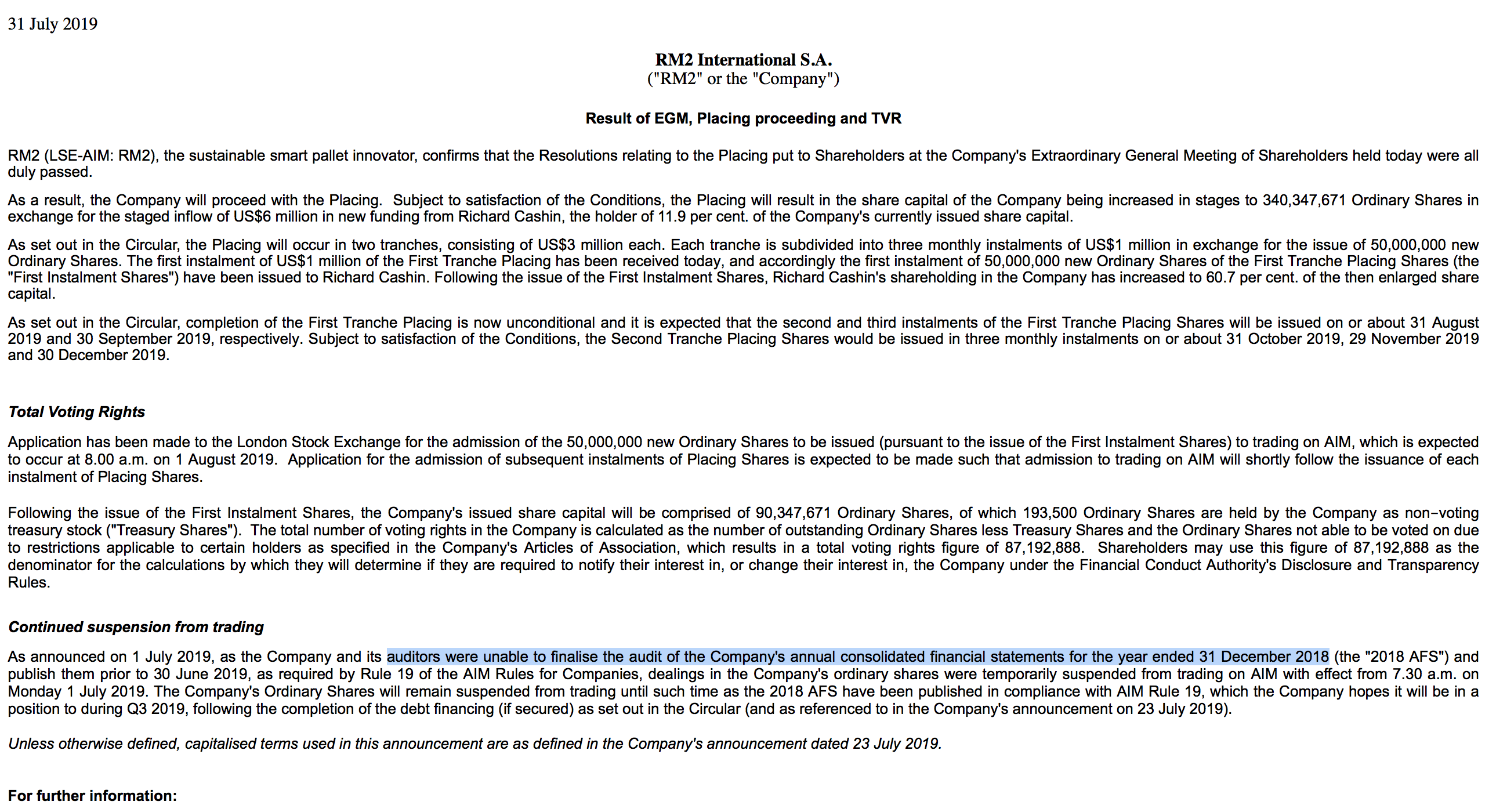

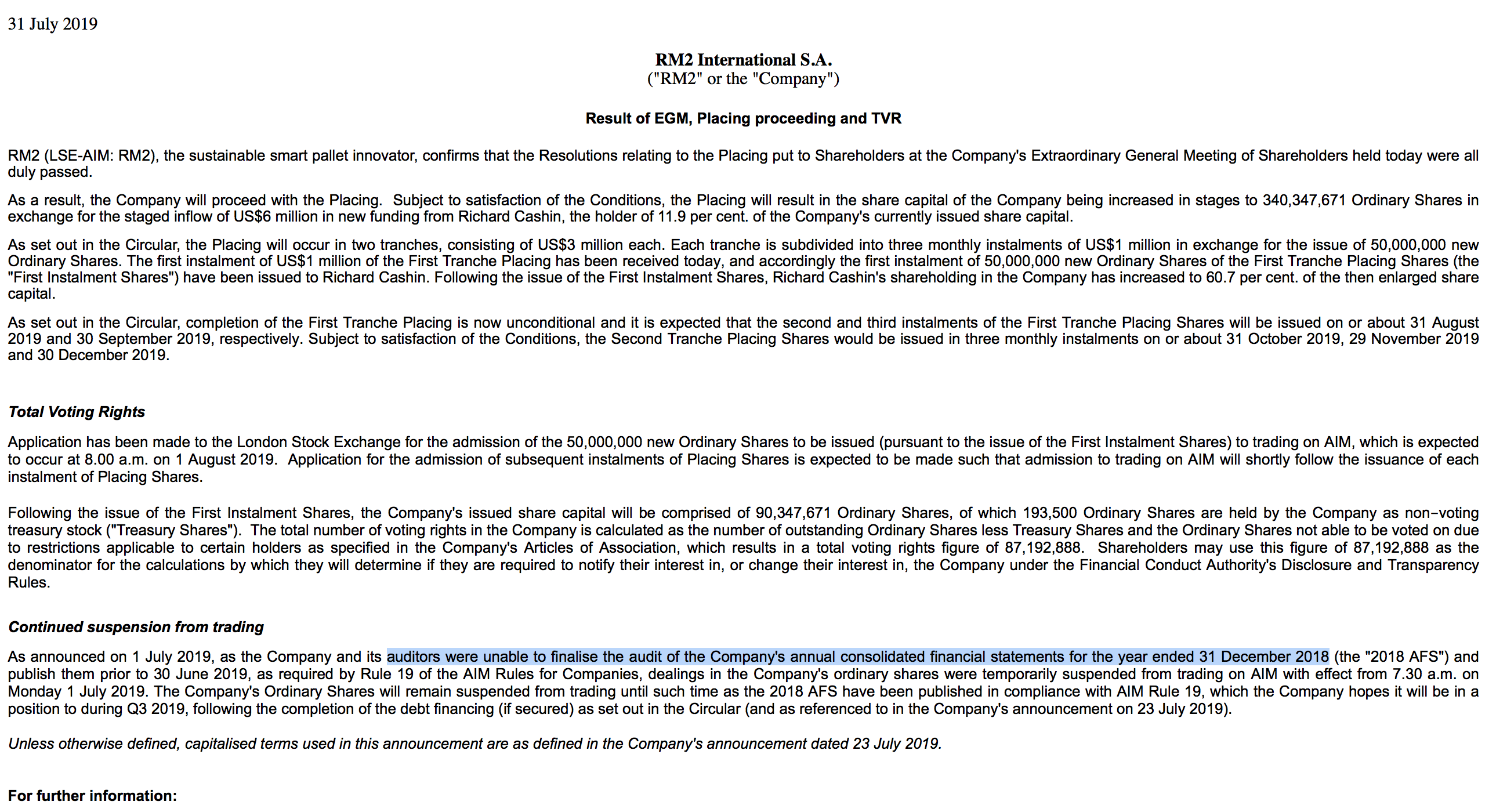

heute reverse-split 200:1

Antwort auf Beitrag Nr.: 59.436.621 von R-BgO am 14.12.18 07:41:45

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 219 | ||

| 135 | ||

| 81 | ||

| 61 | ||

| 49 | ||

| 45 | ||

| 43 | ||

| 41 | ||

| 34 | ||

| 30 |

| Wertpapier | Beiträge | |

|---|---|---|

| 30 | ||

| 23 | ||

| 22 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 20 | ||

| 19 | ||

| 19 | ||

| 19 |