Spectral Medical gegen Sepsis und septischen Schock - 3 Mrd. $ Marktpotenzial - 500 Beiträge pro Seite

eröffnet am 26.11.15 11:12:59 von

neuester Beitrag 31.05.17 11:22:11 von

neuester Beitrag 31.05.17 11:22:11 von

Beiträge: 7

ID: 1.222.086

ID: 1.222.086

Aufrufe heute: 0

Gesamt: 8.086

Gesamt: 8.086

Aktive User: 0

ISIN: CA8475771033 · WKN: A12HJ9 · Symbol: EDT

0,4250

CAD

-3,41 %

-0,0150 CAD

Letzter Kurs 24.04.24 Toronto

Neuigkeiten

10.04.24 · globenewswire |

02.04.24 · globenewswire |

28.03.24 · globenewswire |

28.02.24 · globenewswire |

21.02.24 · globenewswire |

Werte aus der Branche Gesundheitswesen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8800 | +51,58 | |

| 0,5750 | +26,18 | |

| 1,5000 | +13,64 | |

| 5,3000 | +12,77 | |

| 6,2500 | +10,62 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4240 | -12,37 | |

| 0,5925 | -15,36 | |

| 1,5500 | -30,49 | |

| 2,1500 | -36,79 | |

| 73,27 | -49,61 |

Von der Spectral-Website:

Sepsis is a life threatening condition caused by the body's response to infection. Afflicting approximately 1,000,000 Americans each year, this deadly condition costs the US healthcare system billions annually, and, with few effective therapies available, sepsis is becoming a major concern for healthcare practitioners.

Spectral is seeking U.S. FDA approval for its lead product, Toraymyxin, a treatment for severe sepsis and septic shock. Toraymyxin is a therapeutic hemoperfusion device that removes endotoxin, the most important microbial trigger for sepsis, from the bloodstream. Directed by the Company’s Endotoxin Activity Assay (EAA™), the only FDA cleared, CE marked diagnostic for the detection of endotoxin, Spectral’s EUPHRATES trial is the world’s first theranostics trial in the area of sepsis.

Toraymyxin was approved for therapeutic use in Japan in 1994 and Europe in 2002 and has been used safely and effectively in more than 100,000 patients to date. In March 2009 and November 2010 respectively, Spectral obtained the exclusive development and commercial rights in the U.S. and Canada for Toraymyxin.

More than one million patients in the United States are diagnosed with sepsis each year.

Approximately one third of these patients progress to severe sepsis and septic shock, representing a significant unmet need and a greater than $1 billion market opportunity for Spectral.

Spectral continues to provide high quality reagents in which royalty revenue is earned from license for the Company’s proprietary Troponin I and other reagent technologies. License arrangements are held with industry leaders.

Spectral is listed on the Toronto Stock Exchange under the symbol EDT and the OTCQX under the symbol EDTXF.

http://www.spectraldx.com/

Hier die aktuelle Investorenpräsentation:

http://spectraldx.com/assets/spectral-medical-ir-nov2015.pdf

Dadurch dass Toraymyxin schon seit Jahren in Japan und Europa eingesetzt wurde, sehe ich kaum ein Risiko hinsichtlich der geplanten Zulassung in Kanada und den USA.

Das Marktpotenzial in den USA soll sich auf 1 Mrd. $ belaufen:

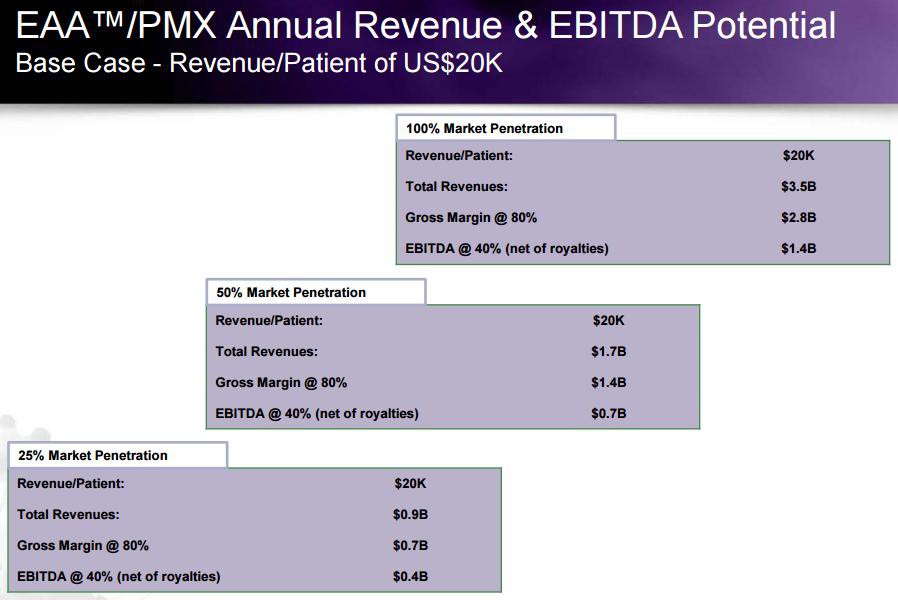

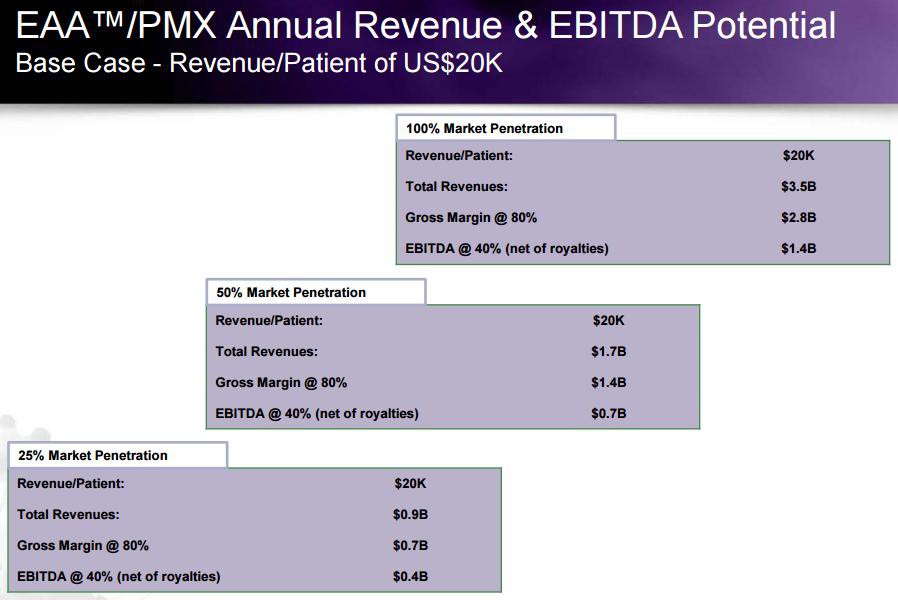

Die Technologie scheint definitiv zu funktionieren und man erreicht eine deutliche Reduzierung der Mortalität. Insofern halte ich es für sehr wahrscheinlich, dass die Marktdurchdringung zügig erfolgen wird. Und dann klingelt, wie in der Grafik ersichtlich, ordentlich die Kasse.

Börsenwert aktuell 160 Mio. CAD, 8,4 Mio. CAD Cash, keine Schulden. 70% institutionelle Investoren. Globales Marktpotenzial 3 Mrd. $. Kein Wettbewerber mit vergleichbarem Produkt.

Angenommen die FDA erteilt die Zulassung und sie erreichen schon 2017 25% Marktdurchdringung, dann könnte das Ergebnis schon doppelt so hoch ausfallen wie die aktuelle Börsenbewertung. Mit anderen Worten: hier scheint mir ein potenzieller Vervielfacher zu schlummern, den dato in Deutschland niemand kennt.

ISIN: CA8475771033

Kurs: 0,556 EUR

Kürzel Kanada: EDT.TO

Kurs: 0,80 CAD

Hinweis: Ich bin hier (noch) nicht investiert.

M@trix

Sepsis is a life threatening condition caused by the body's response to infection. Afflicting approximately 1,000,000 Americans each year, this deadly condition costs the US healthcare system billions annually, and, with few effective therapies available, sepsis is becoming a major concern for healthcare practitioners.

Spectral is seeking U.S. FDA approval for its lead product, Toraymyxin, a treatment for severe sepsis and septic shock. Toraymyxin is a therapeutic hemoperfusion device that removes endotoxin, the most important microbial trigger for sepsis, from the bloodstream. Directed by the Company’s Endotoxin Activity Assay (EAA™), the only FDA cleared, CE marked diagnostic for the detection of endotoxin, Spectral’s EUPHRATES trial is the world’s first theranostics trial in the area of sepsis.

Toraymyxin was approved for therapeutic use in Japan in 1994 and Europe in 2002 and has been used safely and effectively in more than 100,000 patients to date. In March 2009 and November 2010 respectively, Spectral obtained the exclusive development and commercial rights in the U.S. and Canada for Toraymyxin.

More than one million patients in the United States are diagnosed with sepsis each year.

Approximately one third of these patients progress to severe sepsis and septic shock, representing a significant unmet need and a greater than $1 billion market opportunity for Spectral.

Spectral continues to provide high quality reagents in which royalty revenue is earned from license for the Company’s proprietary Troponin I and other reagent technologies. License arrangements are held with industry leaders.

Spectral is listed on the Toronto Stock Exchange under the symbol EDT and the OTCQX under the symbol EDTXF.

http://www.spectraldx.com/

Hier die aktuelle Investorenpräsentation:

http://spectraldx.com/assets/spectral-medical-ir-nov2015.pdf

Dadurch dass Toraymyxin schon seit Jahren in Japan und Europa eingesetzt wurde, sehe ich kaum ein Risiko hinsichtlich der geplanten Zulassung in Kanada und den USA.

Das Marktpotenzial in den USA soll sich auf 1 Mrd. $ belaufen:

Die Technologie scheint definitiv zu funktionieren und man erreicht eine deutliche Reduzierung der Mortalität. Insofern halte ich es für sehr wahrscheinlich, dass die Marktdurchdringung zügig erfolgen wird. Und dann klingelt, wie in der Grafik ersichtlich, ordentlich die Kasse.

Börsenwert aktuell 160 Mio. CAD, 8,4 Mio. CAD Cash, keine Schulden. 70% institutionelle Investoren. Globales Marktpotenzial 3 Mrd. $. Kein Wettbewerber mit vergleichbarem Produkt.

Angenommen die FDA erteilt die Zulassung und sie erreichen schon 2017 25% Marktdurchdringung, dann könnte das Ergebnis schon doppelt so hoch ausfallen wie die aktuelle Börsenbewertung. Mit anderen Worten: hier scheint mir ein potenzieller Vervielfacher zu schlummern, den dato in Deutschland niemand kennt.

ISIN: CA8475771033

Kurs: 0,556 EUR

Kürzel Kanada: EDT.TO

Kurs: 0,80 CAD

Hinweis: Ich bin hier (noch) nicht investiert.

M@trix

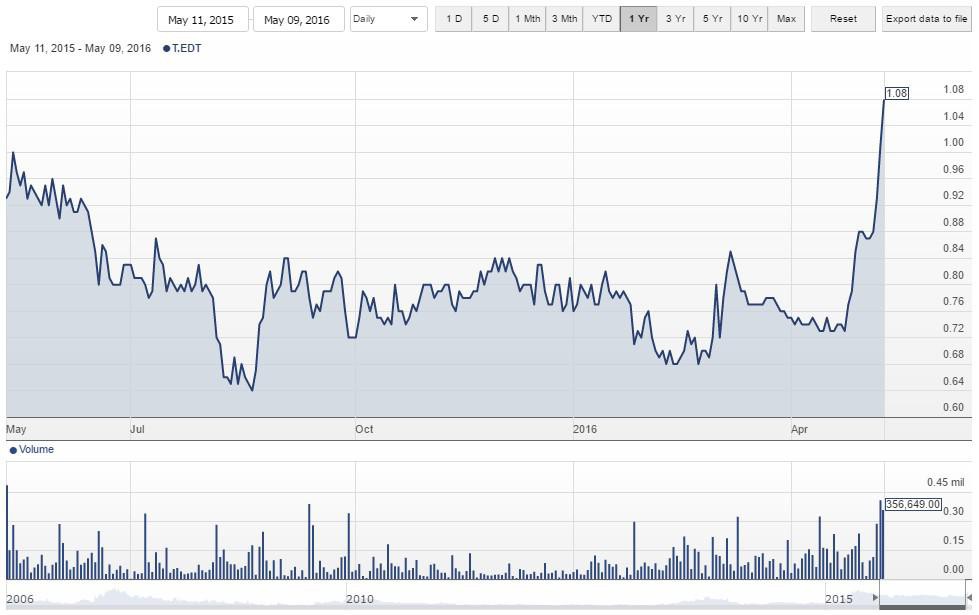

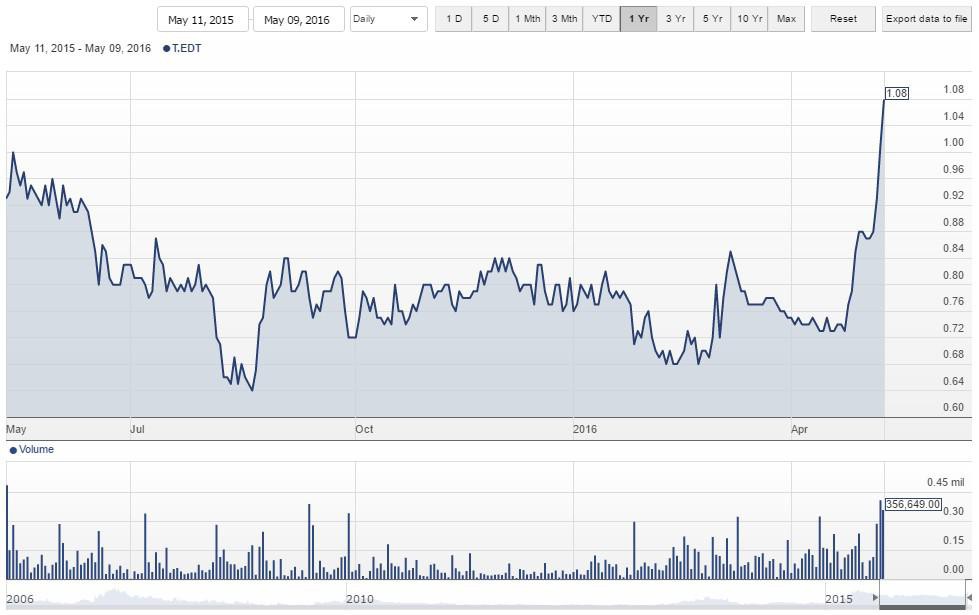

Spectral wurde "wach geküsst".

Wie im Initialbeitrag erläutert hat die Aktie noch jede mange Potenzial, wenn die FDA "mitspielt".

Wie im Initialbeitrag erläutert hat die Aktie noch jede mange Potenzial, wenn die FDA "mitspielt".

Und weiter geht's:

Kurzfristig nun schon gut gelaufen. Kann man über Teilgewinnmitnahmen nachdenken.

M@trix

Kurzfristig nun schon gut gelaufen. Kann man über Teilgewinnmitnahmen nachdenken.

M@trix

Antwort auf Beitrag Nr.: 52.371.816 von M@trix am 10.05.16 08:53:48

Erste Position

Hey Matrix, ich habe den Rücksetzer heute mal dafür genutzt mit einer kleinen Position rein zugehen, bist du auch noch dabei?

Bei Spectral war ich mal investiert, wie man oben nachlesen kann. Anfang Oktober 2016 gab das Unternehmen enttäuschende Ergebnisse aus einer Phase III Studie bekannt und der Kurs stürzte daraufhin erwartungsgemäß ab. Nach einem Hoch von über 1,80 CAD ging es bis auf 0,20 CAD runter. Seit etwa zwei Monaten geht es wieder aufwärts, was daran liegt, dass Spectral Toraymyxin trotz der relativ schwachen Effizienz-Ergebnisse an den US Markt bringen will. Die Begründung:

• Treatment proven to be safe

• 5% mortality reduction at 28 days in the per protocol group

• Mortality benefit increased as a function of the amount of endotoxin removed

• Cardiovascular function improved

• Use of vasopressors decreased

• Organ function improved

Ich denke Spectral hat in der Tat gute Chancen, dass Toraymyxin zugelassen wird. Und da es gegen septischen Schock keine alternative Behandlungsmethode gibt, könnte das für Spectral dennoch ein gutes Geschäft werden. Dazu:

Canada's Spectral hoping to win U.S. approval for sepsis treatment

[...] The technology has been in use in Japan and parts of Europe for years but has never been approved for wide use in the United States because, in the view of the FDA, it has never been tested in trial large enough to prove its effectiveness and safety. [...]

[...] Sepsis costs the U.S. healthcare system about $20 billion a year, according to the Sepsis Alliance, a San Diego-based patient advocacy organization. [...]

There are no specific FDA-approved medicines for the treatment of sepsis, and there have been several high-profile clinical failures.

The only drug to win FDA endorsement - Eli Lilly & Co's Xigris - was pulled off the market in 2011, a decade after approval, when follow-up clinical trials showed its use did not reduce mortality.

The U.S. Centers for Disease Control and Prevention estimates that up to half of the estimated 1 million annual cases of sepsis in the United States result in death.

Every year, about 350,000 patients in North America are diagnosed with septic shock. Even a 15 percent cut in the mortality rate would be sufficient to justify an estimated $20,000 price tag per treatment, Walker said.

Spectral - which has a market value of about $160 million but generated just $3.08 million in revenue in 2015 - hopes to capture about half of the estimated $3 billion market within five years of FDA approval, he said.

If approved, Cormark's Novak expects the product to achieve peak annual sales of more than $800 million.

http://www.reuters.com/article/us-spectral-medical-sepsis-id…

Spectral wird in Kürze der FDA neue Daten vorlegen:

"It is also the intention of the Company to release further detailed results of the clinical trial at a scientific meeting soon after the filing of PMA."

Ferner:

• Details of clinical data to be released after submission of final PMA module

• Publication of results in medical journal and presentation at major medical conference after submission of Module 4

• Potential FDA approval by end of 2017

Börsenwert aktuell 110 Mio. CAD, Cash war bei Jahresende 5 Mio. CAD.

Bei FDA-Zulassung dürfte hier EINIGES an Neubewertungspotenzial vorhanden sein. Zwar ist die Effizienz weiter in Frage gestellt, aber aufgrund der anderen Vorteile und dem Sicherheitsprofil sowie dass es keine Alternativen gibt, dürfte doch ein beträchtliches geschäftliches Potenzial bestehen.

Für mich ein spannender Wert für die Watchlist, von dem man an schwachen Tagen ein paar spekulativ ins Depot legen kann.

M@trix

• Treatment proven to be safe

• 5% mortality reduction at 28 days in the per protocol group

• Mortality benefit increased as a function of the amount of endotoxin removed

• Cardiovascular function improved

• Use of vasopressors decreased

• Organ function improved

Ich denke Spectral hat in der Tat gute Chancen, dass Toraymyxin zugelassen wird. Und da es gegen septischen Schock keine alternative Behandlungsmethode gibt, könnte das für Spectral dennoch ein gutes Geschäft werden. Dazu:

Canada's Spectral hoping to win U.S. approval for sepsis treatment

[...] The technology has been in use in Japan and parts of Europe for years but has never been approved for wide use in the United States because, in the view of the FDA, it has never been tested in trial large enough to prove its effectiveness and safety. [...]

[...] Sepsis costs the U.S. healthcare system about $20 billion a year, according to the Sepsis Alliance, a San Diego-based patient advocacy organization. [...]

There are no specific FDA-approved medicines for the treatment of sepsis, and there have been several high-profile clinical failures.

The only drug to win FDA endorsement - Eli Lilly & Co's Xigris - was pulled off the market in 2011, a decade after approval, when follow-up clinical trials showed its use did not reduce mortality.

The U.S. Centers for Disease Control and Prevention estimates that up to half of the estimated 1 million annual cases of sepsis in the United States result in death.

Every year, about 350,000 patients in North America are diagnosed with septic shock. Even a 15 percent cut in the mortality rate would be sufficient to justify an estimated $20,000 price tag per treatment, Walker said.

Spectral - which has a market value of about $160 million but generated just $3.08 million in revenue in 2015 - hopes to capture about half of the estimated $3 billion market within five years of FDA approval, he said.

If approved, Cormark's Novak expects the product to achieve peak annual sales of more than $800 million.

http://www.reuters.com/article/us-spectral-medical-sepsis-id…

Spectral wird in Kürze der FDA neue Daten vorlegen:

"It is also the intention of the Company to release further detailed results of the clinical trial at a scientific meeting soon after the filing of PMA."

Ferner:

• Details of clinical data to be released after submission of final PMA module

• Publication of results in medical journal and presentation at major medical conference after submission of Module 4

• Potential FDA approval by end of 2017

Börsenwert aktuell 110 Mio. CAD, Cash war bei Jahresende 5 Mio. CAD.

Bei FDA-Zulassung dürfte hier EINIGES an Neubewertungspotenzial vorhanden sein. Zwar ist die Effizienz weiter in Frage gestellt, aber aufgrund der anderen Vorteile und dem Sicherheitsprofil sowie dass es keine Alternativen gibt, dürfte doch ein beträchtliches geschäftliches Potenzial bestehen.

Für mich ein spannender Wert für die Watchlist, von dem man an schwachen Tagen ein paar spekulativ ins Depot legen kann.

M@trix

Antwort auf Beitrag Nr.: 54.797.725 von M@trix am 25.04.17 11:05:10Spectral Files Final PMA Module for Toraymyxin(TM) With FDA

TORONTO, ONTARIO--(Marketwired - May 30, 2017) - Spectral Medical Inc., ("Spectral" or the "Company"), (TSX:EDT), a Phase III company developing the first treatment for patients with septic shock guided by a companion diagnostic, today announced that it has submitted the fourth and final module of its PMA application to the United States Food and Drug Administration ("FDA") based on further analysis of the EUPHRATES trial - a randomized, blinded trial of patients in endotoxemic septic shock comparing use of Toraymyxin™ ("the PMX cartridge") versus sham hemoperfusion.

As previously communicated, the trial did not meet its primary end point, but did show a non-statistically significant mortality reduction at 28 days of slightly less than five per cent in the per protocol population of patients with septic shock, Endotoxin Activity Assay ("EAA") ≥ 0.6 and Multiple Organ Dysfunction Score (MODS) > 9 (n=244), when treated with the PMX cartridge.

A further detailed analysis of the EUPHRATES trial data base, however, has shown that there appears to be an upper limit to a patient's pre-treatment burden of endotoxin as measured by the EAA, above which the trial could not demonstrate benefit for the PMX cartridge. This magnitude of burden, when EAA is ≥ 0.9, has recently been described in an article in press for upcoming publication.

In patients with septic shock, MODS>9 and a baseline EAA ≥ 0.6 and < 0.9 (n=194) the PMX treatment group demonstrated an absolute reduction in mortality of 14% at 14 days (p =0.0103), 10.7% at 28 days (p = 0.0474) and 11% at 90 days (p = 0.0383), when baseline APACHE and mean arterial pressure were controlled in each arm. At 28 days, the relative reduction in mortality was 30%. Survival over time analysis showed a statistically significant and sustained increase in survival at all three time points: 52% risk reduction at 14 days (Hazard Ratio ["HR"] 0.48, p= 0.0189), 42% risk reduction at 28 days (HR 0.585, p = 0.0429) and 41% risk reduction at 90 days (HR 0.594, p=0.0373).

In this patient population, an improvement in organ function was seen in the PMX treated group compared to the sham group. There was a statistically significant increase in mean arterial blood pressure 72 hours post treatment for the PMX group (p=0.0462) and a substantial increase in days alive and free from mechanical ventilator support [median difference of 14 days, (p=0.0043)].

Furthermore, the trial data indicates that for patients where no bacteria could be identified by culture yet were highly endotoxemic (approximately one third of the n=194 group), treatment with the PMX cartridge had a 28 day mortality of 21% versus 42% for the sham group (p=0.046), a relative risk reduction of 50%. These patients appear to be at higher risk for baseline mortality, with endotoxemia likely due to translocation of endotoxin from the gastro-intestinal system. With no microbiology targets to treat there are fewer options left to help these patients.

"The design of the EUPHRATES trial, using a targeted diagnostic and therapeutic, has allowed major progress to be made in understanding the pathophysiology of endotoxemic septic shock. We found that a patient population, identified by the EAA and with clinical features of significant organ dysfunction, may benefit from use of the PMX cartridge. The trial also demonstrated the ease of use of the products, based on approximately 95% of patients being treated within protocol timelines and a very low rate of clotting of the cartridge. The safety of the PMX cartridge has been demonstrated by the lack of any serious unanticipated adverse device effects. This is a significant step forward in demonstrating a potential benefit in a personalized approach to the treatment of patients with endotoxemic septic shock", stated Dr. Paul Walker, president and CEO of Spectral. "The EUPHRATES trial also demonstrated that over one third of septic shock patients continue to die despite the highest level of care provided by top North American medical centres," added Dr. Walker.

Key Results of the EUPHRATES trial will be presented at the International Nephrology Congress in Vicenza, Italy on June 14, 2017 and will be the subject of a manuscript currently in preparation for submission to a major peer-reviewed medical journal. The Company plans a live webcast of the Vicenza presentation.

---

Ich denke Spectral wird ein Go seitens der FDA bekommen. Beim Kurs gab es einen - m.E. initiierten -

Shake-Out. Es wurden also Stopp-Loss abgegriffen und die Aktie ist daher aus meiner Sicht nun nach unten relativ "abgesichert". Ich erwarte daher schon bald den Start einer neuen Ausbruchsbewegung nach oben, da der Markt beginnen wird, eine Zulassung einzupreisen.

M@trix

TORONTO, ONTARIO--(Marketwired - May 30, 2017) - Spectral Medical Inc., ("Spectral" or the "Company"), (TSX:EDT), a Phase III company developing the first treatment for patients with septic shock guided by a companion diagnostic, today announced that it has submitted the fourth and final module of its PMA application to the United States Food and Drug Administration ("FDA") based on further analysis of the EUPHRATES trial - a randomized, blinded trial of patients in endotoxemic septic shock comparing use of Toraymyxin™ ("the PMX cartridge") versus sham hemoperfusion.

As previously communicated, the trial did not meet its primary end point, but did show a non-statistically significant mortality reduction at 28 days of slightly less than five per cent in the per protocol population of patients with septic shock, Endotoxin Activity Assay ("EAA") ≥ 0.6 and Multiple Organ Dysfunction Score (MODS) > 9 (n=244), when treated with the PMX cartridge.

A further detailed analysis of the EUPHRATES trial data base, however, has shown that there appears to be an upper limit to a patient's pre-treatment burden of endotoxin as measured by the EAA, above which the trial could not demonstrate benefit for the PMX cartridge. This magnitude of burden, when EAA is ≥ 0.9, has recently been described in an article in press for upcoming publication.

In patients with septic shock, MODS>9 and a baseline EAA ≥ 0.6 and < 0.9 (n=194) the PMX treatment group demonstrated an absolute reduction in mortality of 14% at 14 days (p =0.0103), 10.7% at 28 days (p = 0.0474) and 11% at 90 days (p = 0.0383), when baseline APACHE and mean arterial pressure were controlled in each arm. At 28 days, the relative reduction in mortality was 30%. Survival over time analysis showed a statistically significant and sustained increase in survival at all three time points: 52% risk reduction at 14 days (Hazard Ratio ["HR"] 0.48, p= 0.0189), 42% risk reduction at 28 days (HR 0.585, p = 0.0429) and 41% risk reduction at 90 days (HR 0.594, p=0.0373).

In this patient population, an improvement in organ function was seen in the PMX treated group compared to the sham group. There was a statistically significant increase in mean arterial blood pressure 72 hours post treatment for the PMX group (p=0.0462) and a substantial increase in days alive and free from mechanical ventilator support [median difference of 14 days, (p=0.0043)].

Furthermore, the trial data indicates that for patients where no bacteria could be identified by culture yet were highly endotoxemic (approximately one third of the n=194 group), treatment with the PMX cartridge had a 28 day mortality of 21% versus 42% for the sham group (p=0.046), a relative risk reduction of 50%. These patients appear to be at higher risk for baseline mortality, with endotoxemia likely due to translocation of endotoxin from the gastro-intestinal system. With no microbiology targets to treat there are fewer options left to help these patients.

"The design of the EUPHRATES trial, using a targeted diagnostic and therapeutic, has allowed major progress to be made in understanding the pathophysiology of endotoxemic septic shock. We found that a patient population, identified by the EAA and with clinical features of significant organ dysfunction, may benefit from use of the PMX cartridge. The trial also demonstrated the ease of use of the products, based on approximately 95% of patients being treated within protocol timelines and a very low rate of clotting of the cartridge. The safety of the PMX cartridge has been demonstrated by the lack of any serious unanticipated adverse device effects. This is a significant step forward in demonstrating a potential benefit in a personalized approach to the treatment of patients with endotoxemic septic shock", stated Dr. Paul Walker, president and CEO of Spectral. "The EUPHRATES trial also demonstrated that over one third of septic shock patients continue to die despite the highest level of care provided by top North American medical centres," added Dr. Walker.

Key Results of the EUPHRATES trial will be presented at the International Nephrology Congress in Vicenza, Italy on June 14, 2017 and will be the subject of a manuscript currently in preparation for submission to a major peer-reviewed medical journal. The Company plans a live webcast of the Vicenza presentation.

---

Ich denke Spectral wird ein Go seitens der FDA bekommen. Beim Kurs gab es einen - m.E. initiierten -

Shake-Out. Es wurden also Stopp-Loss abgegriffen und die Aktie ist daher aus meiner Sicht nun nach unten relativ "abgesichert". Ich erwarte daher schon bald den Start einer neuen Ausbruchsbewegung nach oben, da der Markt beginnen wird, eine Zulassung einzupreisen.

M@trix

Antwort auf Beitrag Nr.: 55.048.321 von M@trix am 31.05.17 11:17:03GMP update

Spectral Medical Inc.

EDT-TSX

May 30, 2017

Revised trial data shows significant potential

Spectral announced it has filed its fourth and final module of its PMA application with the FDA. The company analysed in further details the EUPHRATES trial database and identified significant patient response to treatment when endotoxin levels were below 0.9 according to the company’s Endotoxin Activity Assay (EAA) test. This sub segment of the population accounted for almost 80% of the patients treated in Spectral’s trial, hence, it does not limit much the market potential.

In the 194 patients incurring septic shock with multiple organ dysfunction score (MODS) of >9 and a baseline EAA ≥0.6 and <0.9, the treated group demonstrated a reduction in mortality of 10.7% at 28 days vs the 5% reduction originally disclosed in October 2016 for the entire population treated of 244 patients. Furthermore, the reduction in mortality rate remained at similar levels of 11% even at 90 days, suggesting lasting effects of the treatment.

Spectral also disclosed that for patients where no bacteria could be identified by culture but were still highly endotoxemic, which is approximately one third of the 194 patient sub segment, Spectral’s ToraymyxinTM column had a mortality of 21% vs 42% for the sham group at 28 days, a relative risk reduction of 50%.

Valuation and recommendation

Maintaining our SPECULATIVE BUY rating. Today’s announcement by Spectral is significant as the company has been able to prove the efficacy of its treatment on a large sub segment of the treated population. The reduction in mortality rates disclosed are substantial and, in our view, materially increase the likelihood of an FDA approval. It could take up to 180 days for the FDA to review the application and render a decision. Hence, we anticipate news before the end of 2017.

There are currently no FDA approved therapies for the treatment of sepsis in the US and potentially a large addressable market in excess of $2b. While the investment risks on Spectral are binary and contingent on FDA approval, in our view, current valuation nonetheless offers an appealing risk/reward trade-off. Under a scenario where the FDA approves Toraymyxin, the company could become an appealing takeover candidate given the large addressable market and limited competition.

Our positive stance on Spectral is supported by the following: (1) a unique treatment addressing a large market, (2) an appealing risk/return trade-off and (3) a potential takeout candidate. Our target is derived from a 10-year, 2-stage DCF assuming: (1) a discount rate of 18%, (2) a market share of ~5% and ~10% at the end of the first and second stage, and (3) a terminal growth rate of 3%.

Spectral Medical Inc.

EDT-TSX

May 30, 2017

Revised trial data shows significant potential

Spectral announced it has filed its fourth and final module of its PMA application with the FDA. The company analysed in further details the EUPHRATES trial database and identified significant patient response to treatment when endotoxin levels were below 0.9 according to the company’s Endotoxin Activity Assay (EAA) test. This sub segment of the population accounted for almost 80% of the patients treated in Spectral’s trial, hence, it does not limit much the market potential.

In the 194 patients incurring septic shock with multiple organ dysfunction score (MODS) of >9 and a baseline EAA ≥0.6 and <0.9, the treated group demonstrated a reduction in mortality of 10.7% at 28 days vs the 5% reduction originally disclosed in October 2016 for the entire population treated of 244 patients. Furthermore, the reduction in mortality rate remained at similar levels of 11% even at 90 days, suggesting lasting effects of the treatment.

Spectral also disclosed that for patients where no bacteria could be identified by culture but were still highly endotoxemic, which is approximately one third of the 194 patient sub segment, Spectral’s ToraymyxinTM column had a mortality of 21% vs 42% for the sham group at 28 days, a relative risk reduction of 50%.

Valuation and recommendation

Maintaining our SPECULATIVE BUY rating. Today’s announcement by Spectral is significant as the company has been able to prove the efficacy of its treatment on a large sub segment of the treated population. The reduction in mortality rates disclosed are substantial and, in our view, materially increase the likelihood of an FDA approval. It could take up to 180 days for the FDA to review the application and render a decision. Hence, we anticipate news before the end of 2017.

There are currently no FDA approved therapies for the treatment of sepsis in the US and potentially a large addressable market in excess of $2b. While the investment risks on Spectral are binary and contingent on FDA approval, in our view, current valuation nonetheless offers an appealing risk/reward trade-off. Under a scenario where the FDA approves Toraymyxin, the company could become an appealing takeover candidate given the large addressable market and limited competition.

Our positive stance on Spectral is supported by the following: (1) a unique treatment addressing a large market, (2) an appealing risk/return trade-off and (3) a potential takeout candidate. Our target is derived from a 10-year, 2-stage DCF assuming: (1) a discount rate of 18%, (2) a market share of ~5% and ~10% at the end of the first and second stage, and (3) a terminal growth rate of 3%.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -11,11 | |

| 0,00 | |

| +1,47 | |

| -2,59 | |

| +2,89 | |

| +1,43 | |

| -2,99 | |

| -0,74 | |

| +0,52 | |

| -0,48 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 204 | ||

| 190 | ||

| 147 | ||

| 69 | ||

| 32 | ||

| 29 | ||

| 29 | ||

| 26 | ||

| 25 | ||

| 25 |