Länderlisten: positiv, negativ und unentschieden: politische Risiken

eröffnet am 13.02.16 20:47:15 von

neuester Beitrag 26.07.23 13:27:49 von

neuester Beitrag 26.07.23 13:27:49 von

Beiträge: 32

ID: 1.226.641

ID: 1.226.641

Aufrufe heute: 2

Gesamt: 3.274

Gesamt: 3.274

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 47 Minuten | 6870 | |

| vor 57 Minuten | 6179 | |

| vor 1 Stunde | 4745 | |

| vor 1 Stunde | 4514 | |

| vor 1 Stunde | 3364 | |

| heute 19:35 | 2673 | |

| vor 48 Minuten | 2346 | |

| vor 42 Minuten | 2098 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.176,00 | +1,32 | 210 | |||

| 2. | 2. | 143,06 | +7,53 | 92 | |||

| 3. | 19. | 0,1945 | +5,71 | 91 | |||

| 4. | 3. | 2.322,80 | -0,19 | 63 | |||

| 5. | 43. | 0,0262 | +63,75 | 49 | |||

| 6. | 9. | 43,75 | -3,42 | 48 | |||

| 7. | 17. | 4,7480 | +3,15 | 40 | |||

| 8. | 5. | 717,15 | +6,85 | 36 |

Beitrag zu dieser Diskussion schreiben

25.7.

Netanyahu Has Unnerved Investors and Stoked a Painful Selloff in Israel

https://finance.yahoo.com/news/netanyahu-unnerved-investors-…

...

The selloff rocking Israeli markets deepened on Tuesday, with stocks, bonds and the currency all tumbling in the wake of a new law that curbs judicial oversight and heightens concern about the agenda of Benjamin Netanyahu’s government.

Morgan Stanley closed a recommendation to buy the nation’s foreign bonds, echoing Moody’s Investors Service in warning of heightened risk as Israel’s government pushes ahead on a legal overhaul. The shekel tumbled for a fourth-straight session against the dollar, underperforming more than 150 currencies tracked by Bloomberg.

“I expect this selloff to continue,” said Saed Abukarsh, Dubai-based chief portfolio manager and co-founder at Ark Capital Management. “Investor sentiment will be heavily impacted given that this will be viewed as an initial step in the total overhaul of the Israeli legal structure.”

...

=> na ja:

https://tradingeconomics.com/israel/stock-market

Netanyahu Has Unnerved Investors and Stoked a Painful Selloff in Israel

https://finance.yahoo.com/news/netanyahu-unnerved-investors-…

...

The selloff rocking Israeli markets deepened on Tuesday, with stocks, bonds and the currency all tumbling in the wake of a new law that curbs judicial oversight and heightens concern about the agenda of Benjamin Netanyahu’s government.

Morgan Stanley closed a recommendation to buy the nation’s foreign bonds, echoing Moody’s Investors Service in warning of heightened risk as Israel’s government pushes ahead on a legal overhaul. The shekel tumbled for a fourth-straight session against the dollar, underperforming more than 150 currencies tracked by Bloomberg.

“I expect this selloff to continue,” said Saed Abukarsh, Dubai-based chief portfolio manager and co-founder at Ark Capital Management. “Investor sentiment will be heavily impacted given that this will be viewed as an initial step in the total overhaul of the Israeli legal structure.”

...

=> na ja:

https://tradingeconomics.com/israel/stock-market

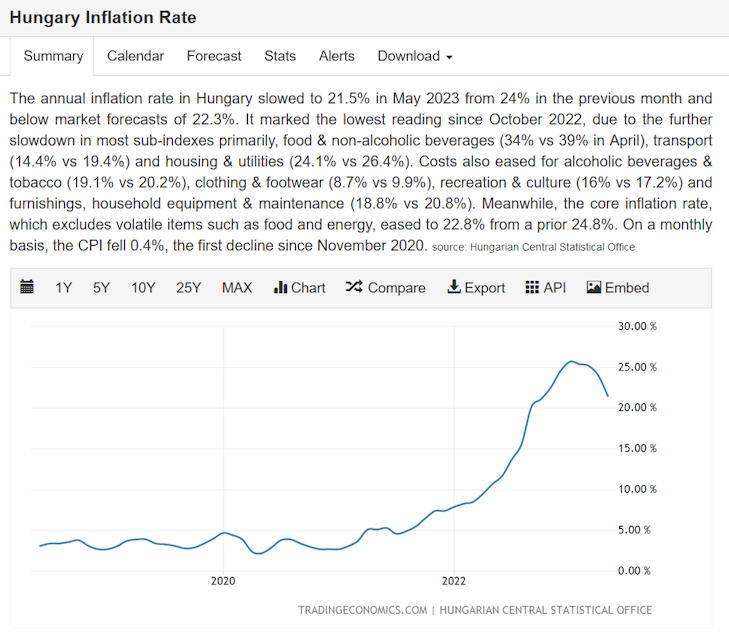

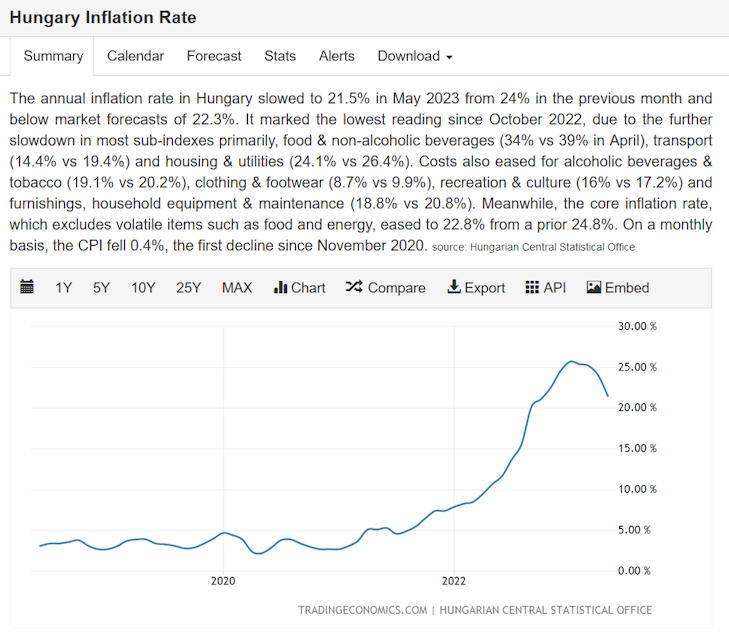

Abseits der Geo-Politik tat sich in Ungarn zuletzt Bemerkenwertes:

16.6.

Hungary’s Orban Becomes Chief Marketer of EMEA’s Best Bonds

https://finance.yahoo.com/news/hungary-orban-becomes-chief-m…

...

Prime Minister Viktor Orban is intensifying efforts to get Hungarians to put their savings in government bonds rather than bank deposits, appealing to their patriotism while pledging to “crush” inflation.

Orban’s cabinet has tightened limits on fund managers’ ability to invest in assets other than government debt and it’s introducing a new 13% levy on interest gains from bank savings. In his weekly radio address aired on Friday, Orban referenced the proximity of Russia’s invasion in Ukraine as he made another appeal for Hungarians to lend their money to the Treasury.

“In times of war, you can support your country by keeping your savings in government bonds and bills,” Orban said.

The yield on Hungary’s 10-year bonds has dropped to 7.2% from peaks above 10% last year, making them the best performers among bonds tracked by Bloomberg in Europe, the Middle East and Africa. Analysts at Goldman Sachs wrote in a report dated Thursday that Hungary’s local-currency bonds are among those with the most to gain from a disinflationary trend across emerging markets.

With the central bank starting to cut key interest rates, Orban is stepping up his calls to domestic savers to help plug financing gaps. Meanwhile the local currency, the forint, has been weakening this week after touching a 14-month high on Monday, dropping as much as 1.5% in a single session on Thursday.

...

...

https://tradingeconomics.com/hungary/inflation-cpi

16.6.

Hungary’s Orban Becomes Chief Marketer of EMEA’s Best Bonds

https://finance.yahoo.com/news/hungary-orban-becomes-chief-m…

...

Prime Minister Viktor Orban is intensifying efforts to get Hungarians to put their savings in government bonds rather than bank deposits, appealing to their patriotism while pledging to “crush” inflation.

Orban’s cabinet has tightened limits on fund managers’ ability to invest in assets other than government debt and it’s introducing a new 13% levy on interest gains from bank savings. In his weekly radio address aired on Friday, Orban referenced the proximity of Russia’s invasion in Ukraine as he made another appeal for Hungarians to lend their money to the Treasury.

“In times of war, you can support your country by keeping your savings in government bonds and bills,” Orban said.

The yield on Hungary’s 10-year bonds has dropped to 7.2% from peaks above 10% last year, making them the best performers among bonds tracked by Bloomberg in Europe, the Middle East and Africa. Analysts at Goldman Sachs wrote in a report dated Thursday that Hungary’s local-currency bonds are among those with the most to gain from a disinflationary trend across emerging markets.

With the central bank starting to cut key interest rates, Orban is stepping up his calls to domestic savers to help plug financing gaps. Meanwhile the local currency, the forint, has been weakening this week after touching a 14-month high on Monday, dropping as much as 1.5% in a single session on Thursday.

...

...

https://tradingeconomics.com/hungary/inflation-cpi

Antwort auf Beitrag Nr.: 73.927.298 von faultcode am 30.05.23 17:01:4916.6.

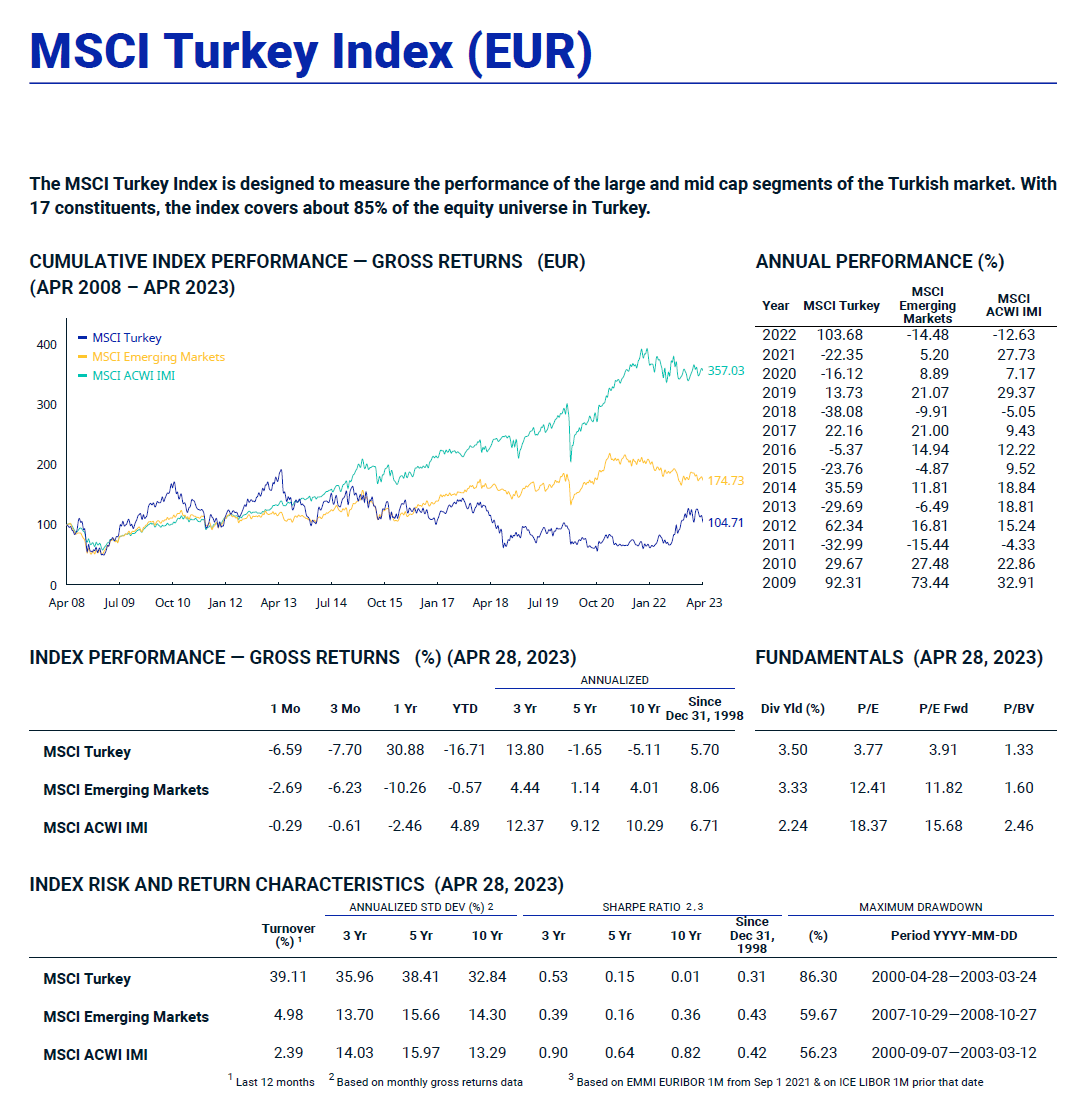

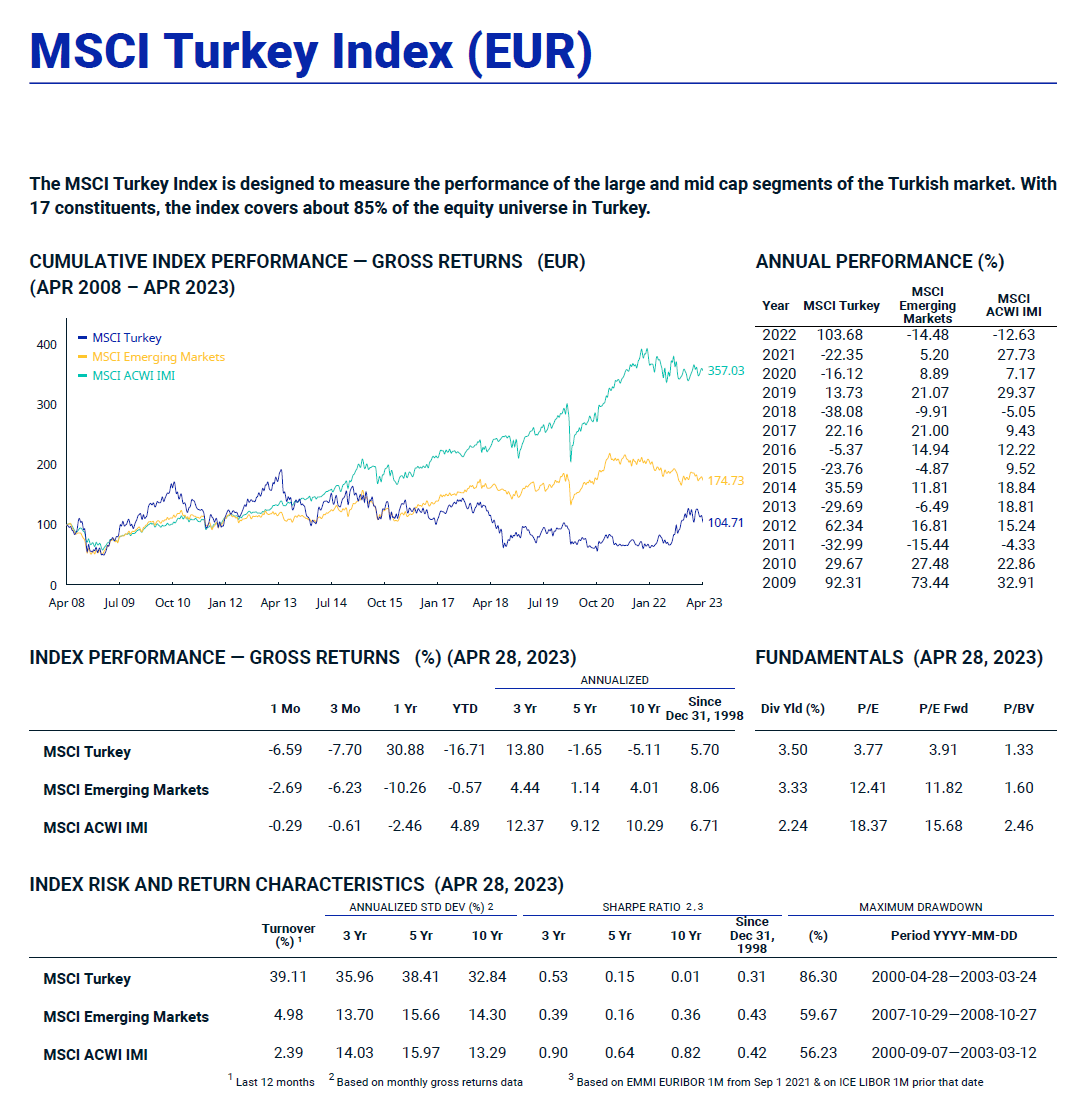

Turkey’s Lira Heads for Longest Run of Losses in 24 Years

https://www.bnnbloomberg.ca/turkey-s-lira-heads-for-longest-…

...

The lira is headed for its longest run of weekly losses this century as Turkey’s new economic team curbs its intervention in the currency market.

The Turkish currency depreciated another 1% this week, after last week’s 11% slide. It’s now been falling since early March, in the longest streak of losses since 1999.

The declines have quickened following President Recep Tayyip Erdogan’s re-election on May 28. In the 18 months before the vote, the central bank used up nearly $200 billion of reserves trying to bolster the currency, yet it remained one of the worst performers in emerging markets.

Erdogan has now appointed two former Wall Street bankers — Mehmet Simsek and Hafize Gaye Erkan — to run the country’s finances, signaling a potential shift from heavy state intervention in favor of allowing the market to determine the currency’s fair value.

...

For many foreign investors, the lira is finding its equilibrium. Expectations are growing for capital inflows into the country’s bonds and stocks to increase. Overseas investors purchased a total of $287 million of Turkish bonds and stocks last week, the biggest inflow since December, the latest central bank data showed.

...

Turkey’s Lira Heads for Longest Run of Losses in 24 Years

https://www.bnnbloomberg.ca/turkey-s-lira-heads-for-longest-…

...

The lira is headed for its longest run of weekly losses this century as Turkey’s new economic team curbs its intervention in the currency market.

The Turkish currency depreciated another 1% this week, after last week’s 11% slide. It’s now been falling since early March, in the longest streak of losses since 1999.

The declines have quickened following President Recep Tayyip Erdogan’s re-election on May 28. In the 18 months before the vote, the central bank used up nearly $200 billion of reserves trying to bolster the currency, yet it remained one of the worst performers in emerging markets.

Erdogan has now appointed two former Wall Street bankers — Mehmet Simsek and Hafize Gaye Erkan — to run the country’s finances, signaling a potential shift from heavy state intervention in favor of allowing the market to determine the currency’s fair value.

...

For many foreign investors, the lira is finding its equilibrium. Expectations are growing for capital inflows into the country’s bonds and stocks to increase. Overseas investors purchased a total of $287 million of Turkish bonds and stocks last week, the biggest inflow since December, the latest central bank data showed.

...

Antwort auf Beitrag Nr.: 73.858.843 von faultcode am 16.05.23 16:02:52Chapeau Herr Erdoğan! So ein Wahlsieg macht schon was her:

https://tradingeconomics.com/turkey/currency

https://tradingeconomics.com/turkey/currency

die Türkei -- ein echter Hinterhergucker:

...

https://www.msci.com/documents/10199/a7c2f0db-d4a1-439b-ac87…

...

https://www.msci.com/documents/10199/a7c2f0db-d4a1-439b-ac87…

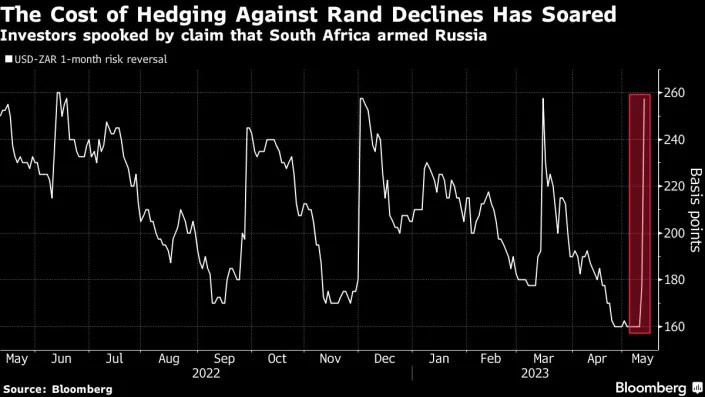

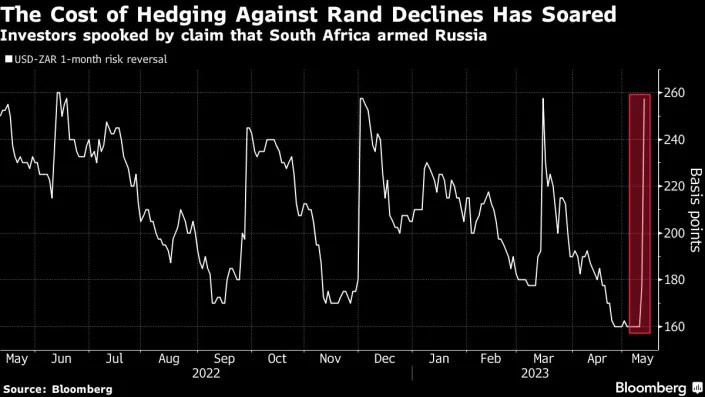

Südafrika:

12.5.2023

Rand at Record Low on Fears Russia Row Will Hit US Trade Ties

https://news.yahoo.com/rand-record-low-fears-russia-07371101…

...

The rand slumped to its weakest level on record against the dollar and government bond yields soared amid investor concern a diplomatic row between Pretoria and the US may put trade worth billions of dollars to South Africa at risk.

...

South Africa’s preferential access to US markets under a two-decade-old agreement is in focus after the US ambassador to Pretoria, Reuben Brigety, accused the country of supplying arms to Russia. The nation’s Presidency described the comments as “disappointing,” adding that no evidence had been produced to back up the claim, but that the countries had agreed on an independent investigation.

“The rand hitting a record low versus the dollar clearly highlights that investors have lost confidence in domestic policy makers in South Africa and are fearful that the US will impose sanctions,” said Lee Hardman, a currency strategist at MUFG Bank Ltd.

...

The US ambassador’s claim that armaments were collected by a Russian ship at the Simon’s Town naval base in Cape Town in December came with the rand already under pressure because of ongoing energy shortages that are undermining the economy. Investors are now asking questions about President Cyril Ramaphosa’s grip on his administration.

...

12.5.2023

Rand at Record Low on Fears Russia Row Will Hit US Trade Ties

https://news.yahoo.com/rand-record-low-fears-russia-07371101…

...

The rand slumped to its weakest level on record against the dollar and government bond yields soared amid investor concern a diplomatic row between Pretoria and the US may put trade worth billions of dollars to South Africa at risk.

...

South Africa’s preferential access to US markets under a two-decade-old agreement is in focus after the US ambassador to Pretoria, Reuben Brigety, accused the country of supplying arms to Russia. The nation’s Presidency described the comments as “disappointing,” adding that no evidence had been produced to back up the claim, but that the countries had agreed on an independent investigation.

“The rand hitting a record low versus the dollar clearly highlights that investors have lost confidence in domestic policy makers in South Africa and are fearful that the US will impose sanctions,” said Lee Hardman, a currency strategist at MUFG Bank Ltd.

...

The US ambassador’s claim that armaments were collected by a Russian ship at the Simon’s Town naval base in Cape Town in December came with the rand already under pressure because of ongoing energy shortages that are undermining the economy. Investors are now asking questions about President Cyril Ramaphosa’s grip on his administration.

...

Antwort auf Beitrag Nr.: 59.432.199 von faultcode am 13.12.18 15:22:12

eigentlich ist Frankreich mMn mittlerweile (wieder) unter negativ einzuordnen.

Ärger, eigentlich eher Ausschreitungen, wegen Anhebung des Regel-Rentenalters auf 64 Jahre

19.1.

Aus für "Rente wie Gott in Frankreich"?

Die Gewerkschaften in Frankreich nennen die geplante Rentenreform "brutal" und protestieren vehement. Die Regierung sagt, sie müsse kommende Milliardendefizite auffangen. Wie funktioniert das Rentensystem eigentlich?

https://www.tagesschau.de/ausland/europa/frankreich-rentensy…

...

Bis 64 statt bis 62 arbeiten - gegen Macrons Rentenpläne werden in Frankreich heute massive Proteste erwartet.

https://www.tagesschau.de/ausland/europa/frankreich-proteste…

Zitat von faultcode: ..."Unentschieden":

...

Frankreich (obwohl manche Grossunternehmen hervorragend geführt werden - ich hoffe immer noch auf eine Wende in der dortigen Steuerkultur)

...

eigentlich ist Frankreich mMn mittlerweile (wieder) unter negativ einzuordnen.

Ärger, eigentlich eher Ausschreitungen, wegen Anhebung des Regel-Rentenalters auf 64 Jahre

19.1.

Aus für "Rente wie Gott in Frankreich"?

Die Gewerkschaften in Frankreich nennen die geplante Rentenreform "brutal" und protestieren vehement. Die Regierung sagt, sie müsse kommende Milliardendefizite auffangen. Wie funktioniert das Rentensystem eigentlich?

https://www.tagesschau.de/ausland/europa/frankreich-rentensy…

...

Bis 64 statt bis 62 arbeiten - gegen Macrons Rentenpläne werden in Frankreich heute massive Proteste erwartet.

https://www.tagesschau.de/ausland/europa/frankreich-proteste…

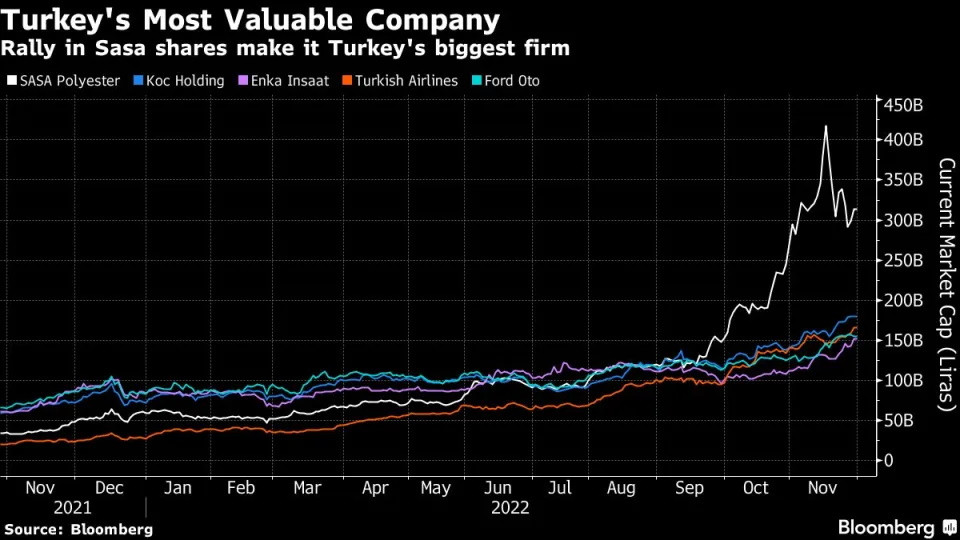

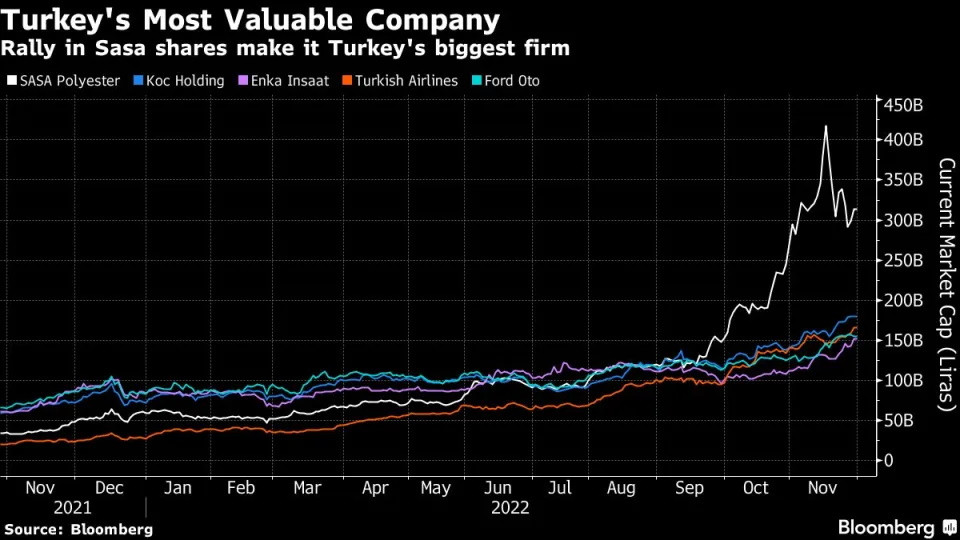

Türkei:

30.11.

Turkey’s Most Valuable Stock ‘Too High’ After GameStop-Like Surge

https://finance.yahoo.com/news/turkey-most-valuable-stock-to…

...

It’s Turkey’s own version of GameStop Corp.

Shares of Sasa Polyester Sanayi AS have skyrocketed this year, making the polyester maker the country’s most valuable listed firm, yet even its chairman doesn’t know the cause and is questioning its bloated market value.

“I keep telling people that it’s too high and shouldn’t be purchased,” Ibrahim Erdemoglu told daily newspaper Ekonomi. He and others sold some stock when the price rose to 80 liras last month, prior to it soaring to a closing peak of 186.3 liras on Nov. 16. It has since retraced some of those gains, falling 9.2% to 126.8 liras in Wednesday trading.

At its peak, Sasa had gained 605% this year, echoing GameStop’s 688% surge during the meme stock frenzy of 2021. And as was the case with GameStop, the advance has fueled interest from retail investors and left market watchers baffled.

“Analysts haven’t been able to explain this price for a long time,” but Sasa has become “a phenomenon of some sorts” that attracted mom-and-pop buyers, said Tuna Cetinkaya, deputy chief executive officer at Info Yatirim in Istanbul. Cetinkaya sees the chairman’s comments as an effort to warn small investors, because “there’s a real possibility of pain for many.”

Turkish Stock Market’s 80% Rally Fuels World’s Top Gains in 2022

Just three years ago, Sasa, which Erdemoglu acquired from Sabanci Holding in 2015, commanded a market value less than 2% of its current level. The stock trades at 406 times its last annual earnings, according to Bloomberg data, compared with 6.2 times for Turkey’s benchmark Borsa Istanbul 100 Index.

For Erdemoglu, the price is “disturbing,” he said in the interview.

30.11.

Turkey’s Most Valuable Stock ‘Too High’ After GameStop-Like Surge

https://finance.yahoo.com/news/turkey-most-valuable-stock-to…

...

It’s Turkey’s own version of GameStop Corp.

Shares of Sasa Polyester Sanayi AS have skyrocketed this year, making the polyester maker the country’s most valuable listed firm, yet even its chairman doesn’t know the cause and is questioning its bloated market value.

“I keep telling people that it’s too high and shouldn’t be purchased,” Ibrahim Erdemoglu told daily newspaper Ekonomi. He and others sold some stock when the price rose to 80 liras last month, prior to it soaring to a closing peak of 186.3 liras on Nov. 16. It has since retraced some of those gains, falling 9.2% to 126.8 liras in Wednesday trading.

At its peak, Sasa had gained 605% this year, echoing GameStop’s 688% surge during the meme stock frenzy of 2021. And as was the case with GameStop, the advance has fueled interest from retail investors and left market watchers baffled.

“Analysts haven’t been able to explain this price for a long time,” but Sasa has become “a phenomenon of some sorts” that attracted mom-and-pop buyers, said Tuna Cetinkaya, deputy chief executive officer at Info Yatirim in Istanbul. Cetinkaya sees the chairman’s comments as an effort to warn small investors, because “there’s a real possibility of pain for many.”

Turkish Stock Market’s 80% Rally Fuels World’s Top Gains in 2022

Just three years ago, Sasa, which Erdemoglu acquired from Sabanci Holding in 2015, commanded a market value less than 2% of its current level. The stock trades at 406 times its last annual earnings, according to Bloomberg data, compared with 6.2 times for Turkey’s benchmark Borsa Istanbul 100 Index.

For Erdemoglu, the price is “disturbing,” he said in the interview.

Antwort auf Beitrag Nr.: 72.061.028 von faultcode am 26.07.22 19:22:20

<es scheint sich auch hier um eine (US) dollarized economy zu handeln: https://en.wikipedia.org/wiki/Economy_of_Pakistan>

https://twitter.com/RobinBrooksIIF/status/155190951099371929…

Pakistan (2)

wie so oft, weiß auch hier Robin Brooks (offenbar) des Übels tiefere Ursache:<es scheint sich auch hier um eine (US) dollarized economy zu handeln: https://en.wikipedia.org/wiki/Economy_of_Pakistan>

https://twitter.com/RobinBrooksIIF/status/155190951099371929…

Pakistan (1)

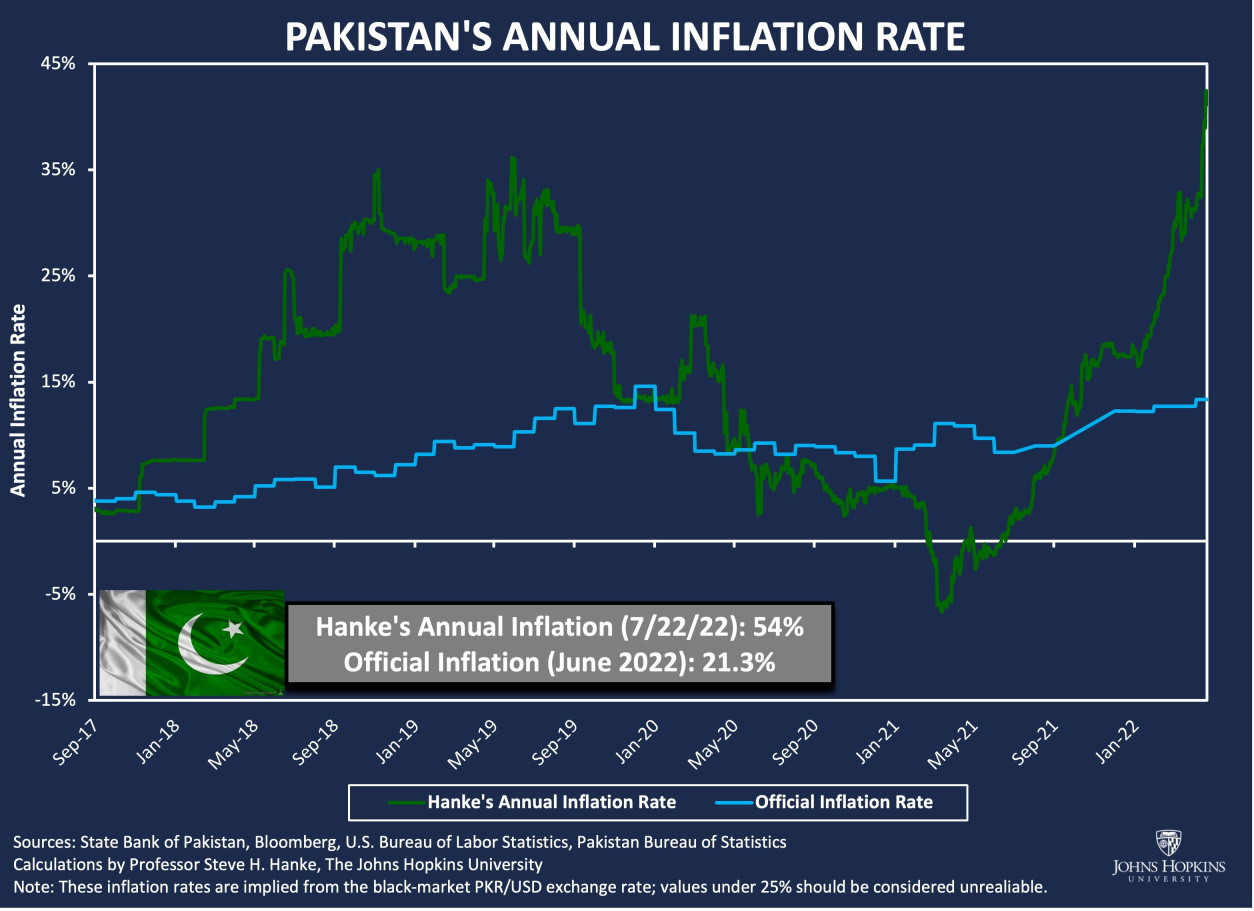

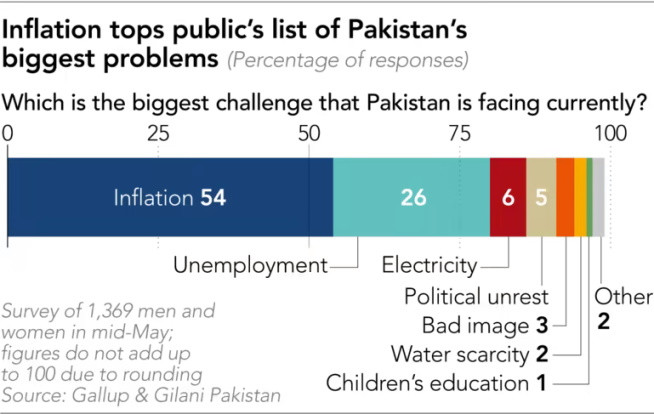

eher unbemerkt im Westen spielt sich in Pakistan schon etwas länger (wieder) eine Tragödie ab, die im Wesentlichen heißt: Inflation22.7.

https://twitter.com/steve_hanke/status/1550306636870209536

Pakistan ist das viert-bevölkerungsreichste Land der Welt:

26.7.

Pakistan's punishing inflation changes life as 225m people know it

Poor skimp on food while those better off carpool, buy solar, aim to emigrate

https://asia.nikkei.com/Spotlight/Asia-Insight/Pakistan-s-pu…

...

...

Acting central bank Gov. Murtaza Syed assured Reuters on Saturday that the country's external financing needs will be "fully met" over the next 12 months. He insisted that Pakistan had reacted faster to the financial pressure than authorities in Sri Lanka and was less vulnerable than many other emerging markets, thanks to IMF backing. And despite the rupee's steep fall, he was confident that "unwarranted" market fears would dissipate soon.

Some analysts previously told Nikkei that the IMF arrangement was indeed an important step toward restoring market confidence and securing other sources of funding. But with the IMF money still weeks away, widespread fear of a default persists, while Pakistan's 225 million are haunted by the threat of further global shocks and domestic instability.

Imran Khan, ousted in a no-confidence vote in April, continues to peddle an unsubstantiated conspiracy theory that he was the victim of a U.S.-led plot to remove him from office. He is demanding fresh elections, and in a sign that his message still resonates, Khan's party thrived in by-elections this month in Punjab, the nation's most populous province. How long Sharif's government will last is anyone's guess.

...