Länderlisten: positiv, negativ und unentschieden: politische Risiken (Seite 2)

eröffnet am 13.02.16 20:47:15 von

neuester Beitrag 26.07.23 13:27:49 von

neuester Beitrag 26.07.23 13:27:49 von

Beiträge: 32

ID: 1.226.641

ID: 1.226.641

Aufrufe heute: 2

Gesamt: 3.262

Gesamt: 3.262

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 6412 | |

| vor 47 Minuten | 4699 | |

| vor 22 Minuten | 4509 | |

| heute 18:00 | 3177 | |

| vor 34 Minuten | 2746 | |

| vor 57 Minuten | 2692 | |

| heute 20:23 | 2036 | |

| vor 1 Stunde | 1670 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.716,00 | -0,19 | 203 | |||

| 2. | 2. | 137,93 | -2,26 | 92 | |||

| 3. | 7. | 6,6640 | -0,97 | 70 | |||

| 4. | 5. | 0,1835 | -2,65 | 56 | |||

| 5. | 8. | 3,7675 | +0,74 | 55 | |||

| 6. | Neu! | 674,50 | -22,31 | 45 | |||

| 7. | 17. | 7,2825 | -0,24 | 45 | |||

| 8. | 4. | 2.391,66 | +0,52 | 40 |

Beitrag zu dieser Diskussion schreiben

3.5.

NATO Entry May Shield Finland From Investment Risks, Report Says

https://ampvideo.bnnbloomberg.ca/nato-entry-may-shield-finla…

...

Finland may become more attractive to foreign investors if Russia’s Nordic neighbor joins the NATO defense bloc, according to ETLA Research Institute.

The country, which shares a 1,300 kilometers (800 miles) border with Russia, is expected to bid for membership in the North Atlantic Treaty Organization as early as this month after their former imperial master’s invasion of Ukraine triggered a tectonic shift in Finns’ backing for entry into the alliance.

NATO entry would most likely cement Finland’s position as an investment destination, even though the financial markets do not yet show an increase in the country risk, ETLA’s Managing Director Aki Kangasharju and Head of Forecasting Markku Lehmus write.

Russia has repeatedly said a NATO entry by both Finland and its western neighbor Sweden, which are among the world’s most developed nations with stable democracies and highly trusted political institutions, would have “serious military and political consequences.”

Overall, the immediate economic impact of the Russia’s war in Ukraine is likely to be small on Finland, but the situation could worsen, ETLA said.

...

NATO Entry May Shield Finland From Investment Risks, Report Says

https://ampvideo.bnnbloomberg.ca/nato-entry-may-shield-finla…

...

Finland may become more attractive to foreign investors if Russia’s Nordic neighbor joins the NATO defense bloc, according to ETLA Research Institute.

The country, which shares a 1,300 kilometers (800 miles) border with Russia, is expected to bid for membership in the North Atlantic Treaty Organization as early as this month after their former imperial master’s invasion of Ukraine triggered a tectonic shift in Finns’ backing for entry into the alliance.

NATO entry would most likely cement Finland’s position as an investment destination, even though the financial markets do not yet show an increase in the country risk, ETLA’s Managing Director Aki Kangasharju and Head of Forecasting Markku Lehmus write.

Russia has repeatedly said a NATO entry by both Finland and its western neighbor Sweden, which are among the world’s most developed nations with stable democracies and highly trusted political institutions, would have “serious military and political consequences.”

Overall, the immediate economic impact of the Russia’s war in Ukraine is likely to be small on Finland, but the situation could worsen, ETLA said.

...

kein Wunder, daß sich Saudi-Arabien nun an den Hals von China schmeißt (*):

...

Foreign direct investment into Saudi Arabia was $5.4 billion in 2020, less than half the level of a decade ago and well below the $19 billion that the country had targeted. It was on track to top $6 billion in 2021 based on data through the third quarter. That excludes the $12.4 billion sale of a stake in a Saudi pipeline company to foreign investors.

...

15.1.2022

U.S. Businesses Sour on Saudi Arabia in Blow to Crown Prince’s Growth Plans

Surprise tax hits, unpaid bills and stolen intellectual property undo government’s effort to shift economy away from oil

https://www.wsj.com/articles/u-s-businesses-sour-on-saudi-ar…

(*)

15.3.

Saudi Arabia reportedly considering accepting yuan instead of dollar for oil sales

https://news.yahoo.com/saudi-arabia-reportedly-considering-a…

...

Foreign direct investment into Saudi Arabia was $5.4 billion in 2020, less than half the level of a decade ago and well below the $19 billion that the country had targeted. It was on track to top $6 billion in 2021 based on data through the third quarter. That excludes the $12.4 billion sale of a stake in a Saudi pipeline company to foreign investors.

...

15.1.2022

U.S. Businesses Sour on Saudi Arabia in Blow to Crown Prince’s Growth Plans

Surprise tax hits, unpaid bills and stolen intellectual property undo government’s effort to shift economy away from oil

https://www.wsj.com/articles/u-s-businesses-sour-on-saudi-ar…

(*)

15.3.

Saudi Arabia reportedly considering accepting yuan instead of dollar for oil sales

https://news.yahoo.com/saudi-arabia-reportedly-considering-a…

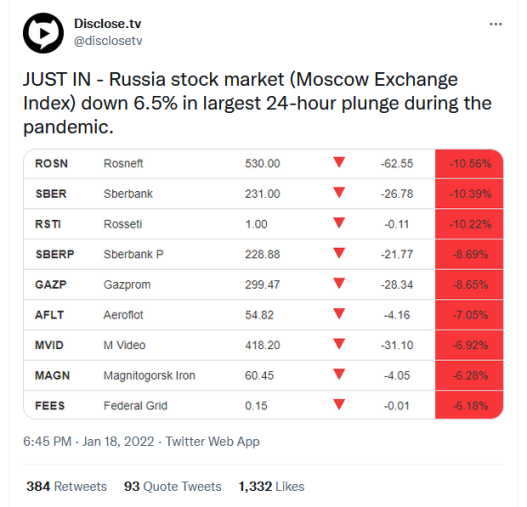

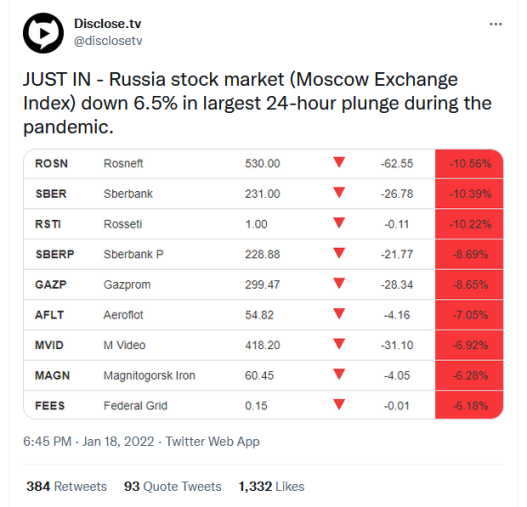

Antwort auf Beitrag Nr.: 66.140.686 von faultcode am 20.12.20 23:26:13Russland heute:

https://twitter.com/disclosetv/status/1483495669558128642

https://twitter.com/disclosetv/status/1483495669558128642

Antwort auf Beitrag Nr.: 69.483.361 von faultcode am 01.10.21 23:12:43

..und die Währung:

Zitat von faultcode: ...=> die Erdoğakratie ist eine Katastrophe für den türkischen Aktienmarkt

..und die Währung:

Antwort auf Beitrag Nr.: 52.984.231 von faultcode am 03.08.16 20:33:4403.08.2016

so ist es:

=> die Erdoğakratie ist eine Katastrophe für den türkischen Aktienmarkt

Zitat von faultcode: ...

Da scheint bei Weitem noch nicht alles eingepreist zu sein.

so ist es:

=> die Erdoğakratie ist eine Katastrophe für den türkischen Aktienmarkt

Antwort auf Beitrag Nr.: 51.740.074 von faultcode am 13.02.16 20:49:59

He accelerated von Koskull’s program of cuts, which had coincided with Russia being tied to a string of Nordic money laundering scandals.

...

Overall, international banks have scaled back their presence in Russia since 2014 amid weak economic growth and escalating sanctions imposed by the U.S. and the European Union. Citigroup Inc. shifted most of its brokerage operations out of the country this year, while Morgan Stanley gave up its local banking license in 2019. Deutsche Bank AG and Credit Suisse Group AG are among others that have that have reduced their Russian presence.

18.12.2020

Nordea Will Exit Russia After Years of Cuts Targeting Risk

https://www.bloombergquint.com/business/nordea-plans-full-ru…

Zitat von faultcode: ..."Negativländer":

...

Russland

...

He accelerated von Koskull’s program of cuts, which had coincided with Russia being tied to a string of Nordic money laundering scandals.

...

Overall, international banks have scaled back their presence in Russia since 2014 amid weak economic growth and escalating sanctions imposed by the U.S. and the European Union. Citigroup Inc. shifted most of its brokerage operations out of the country this year, while Morgan Stanley gave up its local banking license in 2019. Deutsche Bank AG and Credit Suisse Group AG are among others that have that have reduced their Russian presence.

18.12.2020

Nordea Will Exit Russia After Years of Cuts Targeting Risk

https://www.bloombergquint.com/business/nordea-plans-full-ru…

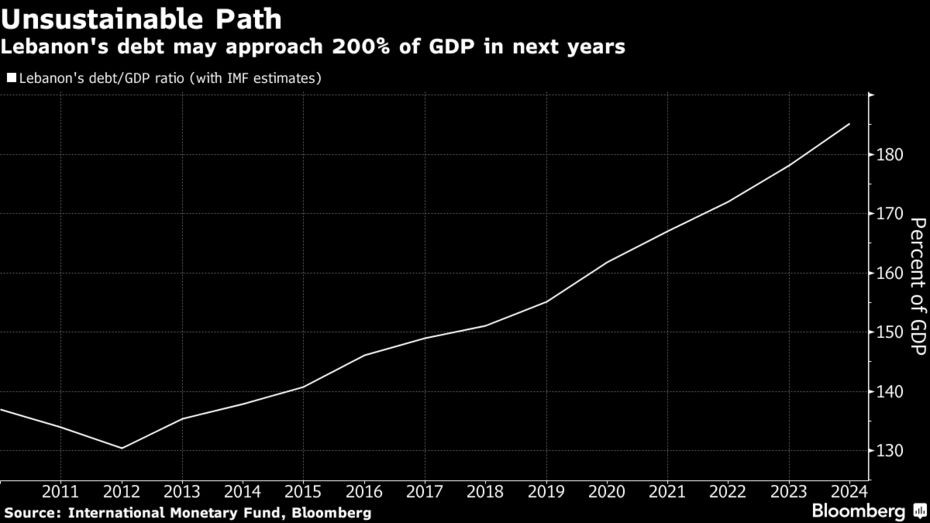

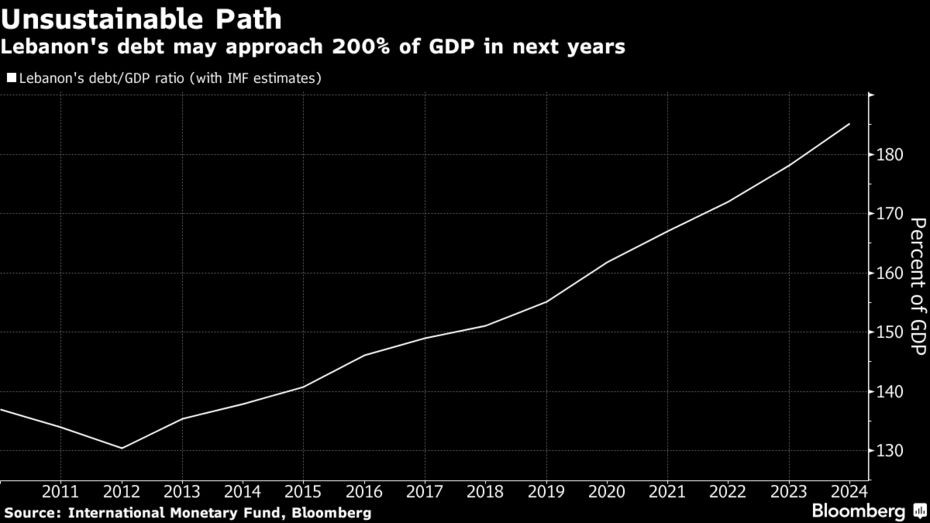

Libanon:

Top 3 in 2019: Griechenland, Russland, Rumänien (aus 94 Märkten)

19.12.

Last Year’s Pariah Turns Into One of 2019’s Best Stock Markets

https://www.bnnbloomberg.ca/last-year-s-pariah-turns-into-on…

...A year ago this day, Romanian stocks were plummeting amid prospects of a “greed tax.” Fast-forward to today, the levy is set to be scrapped, and the market is on track to become one of 2019’s top equity performers globally.

Optimism about a new, market-friendly government at the helm has helped the country’s stocks turn from pariah to darling, with the benchmark BET Index up 34% this year. That’s the third-best performance among 94 markets tracked by Bloomberg.

Shares in the European Union’s second-poorest nation are benefiting from improving earnings, fast economic growth, and still-cheap valuations after the index hit a two-year low in January. Also boosting the market is an impending FTSE Russell upgrade from frontier to secondary emerging market. That has triggered fresh inflows as well as speculation that MSCI Inc. may follow suit.

Romania’s Prime Minister Ludovic Orban, whose minority administration took over last month, has pledged to scrap some of his predecessor’s controversial policies, including a so-called “greed tax” on banks. His government also wants to raise money by floating power generator Hidroelectrica SA and other state-run businesses.

“Several state-owned companies could go public, and we encourage the government to use the stock exchange to its full potential,” said Adrian Tanase, chief executive officer of the Bucharest Stock Exchange. “The listing of Hidroelectrica could be decisive for the MSCI upgrade and it will generate a domino effect for the liquidity of other important companies.”

To be sure, local and parliamentary elections in 2020 might pose risks for the local stock market once more next year, said Alexandru Ilisie, investment director at OTP Asset Management in Bucharest. And for MSCI to follow FTSE’s steps and consider an upgrade to emerging markets, trading volume would have to improve from the current levels, according to Hasnain Malik, head of equity strategy at Tellimer in Dubai....

Antwort auf Beitrag Nr.: 51.740.074 von faultcode am 13.02.16 20:49:59

von Ruchir Sharma: chief global strategist at Morgan Stanley Investment Management

=>

...

What is one big thing investors should know about India?

Forget the India/China comparisons. Apart from the large populations, these two great nations of Asia have nothing in common. Nothing. Everything you say about China, the opposite is basically true of India. Where China is more homogenous, India is as heterogeneous as they come. The risks China’s leaders have taken for economic liberalization are very different compared with what Indian leaders have done over time.

People always think of China as an authoritarian state-driven model, but the share of the Chinese government in the economy has come down dramatically over time. They took some big calculated risks with reforms, often with new leadership—not because of crisis, which is usually the catalyst for other emerging markets. During the reform of the state-owned enterprises in the 1990s, they let go of 70 million employees. That is what kept China ahead of the curve. In the past few years, China is showing some signs of reverting, but that doesn’t’ take away from the big picture. China gave its people much more economic freedom than India did. And that is ironic.

Give us an example of India’s failure in this regard.

Look at demonetization [Modi’s government voided 85% of the currency overnight in November 2016]. India wanted to move to a cashless society, but China has moved to a cashless society much quicker with the private sector. In Beijing or Shanghai today in the middle classes, cash is nonexistent. It happened organically through the tech revolution and the development of some great payment solutions, and not through some massive state intervention or something as draconian as demonetization. India’s not going to become the next China.

Indien: India Will Never Be the Next China, Morgan Stanley’s Ruchir Sharma Says

https://www.marketwatch.com/articles/india-china-morgan-stan…von Ruchir Sharma: chief global strategist at Morgan Stanley Investment Management

=>

...

What is one big thing investors should know about India?

Forget the India/China comparisons. Apart from the large populations, these two great nations of Asia have nothing in common. Nothing. Everything you say about China, the opposite is basically true of India. Where China is more homogenous, India is as heterogeneous as they come. The risks China’s leaders have taken for economic liberalization are very different compared with what Indian leaders have done over time.

People always think of China as an authoritarian state-driven model, but the share of the Chinese government in the economy has come down dramatically over time. They took some big calculated risks with reforms, often with new leadership—not because of crisis, which is usually the catalyst for other emerging markets. During the reform of the state-owned enterprises in the 1990s, they let go of 70 million employees. That is what kept China ahead of the curve. In the past few years, China is showing some signs of reverting, but that doesn’t’ take away from the big picture. China gave its people much more economic freedom than India did. And that is ironic.

Give us an example of India’s failure in this regard.

Look at demonetization [Modi’s government voided 85% of the currency overnight in November 2016]. India wanted to move to a cashless society, but China has moved to a cashless society much quicker with the private sector. In Beijing or Shanghai today in the middle classes, cash is nonexistent. It happened organically through the tech revolution and the development of some great payment solutions, and not through some massive state intervention or something as draconian as demonetization. India’s not going to become the next China.

Antwort auf Beitrag Nr.: 59.432.199 von faultcode am 13.12.18 15:22:12‘Yellow vest’ protests in France have pushed company meetings to U.K., says CEO of hotel giant IHG

https://www.marketwatch.com/story/yellow-vest-protests-in-fr…

=>

...France’s “yellow vest” movement is making itself heard from Paris to Provence, but its rallying cry is reverberating in an unexpected place: Britain.

Holiday Inn owner Intercontinental Hotels Group IHG has seen a rise in company-meeting relocations across the Channel among executives fearing the protests in France.

The “gilets jaunes” protesters, who have been railing against French President Emmanuel Macron and his government, have caused chaos in cities across the country, setting fire to buildings and smashing shop fronts.

Keith Barr, chief executive of IHG, the world’s biggest hotels group, told MarketWatch that companies seeking to gather their European employees have been dodging France.

“There has been a movement of corporate business out of France to the U.K. because of the yellow vests,” said Barr, whose company posted better-than-expected full-year operating profit Tuesday. “If you were going to hold meetings and events in Europe, it wouldn’t be in France in the fourth quarter, although I think things have settled a bit now.”..

https://www.marketwatch.com/story/yellow-vest-protests-in-fr…

=>

...France’s “yellow vest” movement is making itself heard from Paris to Provence, but its rallying cry is reverberating in an unexpected place: Britain.

Holiday Inn owner Intercontinental Hotels Group IHG has seen a rise in company-meeting relocations across the Channel among executives fearing the protests in France.

The “gilets jaunes” protesters, who have been railing against French President Emmanuel Macron and his government, have caused chaos in cities across the country, setting fire to buildings and smashing shop fronts.

Keith Barr, chief executive of IHG, the world’s biggest hotels group, told MarketWatch that companies seeking to gather their European employees have been dodging France.

“There has been a movement of corporate business out of France to the U.K. because of the yellow vests,” said Barr, whose company posted better-than-expected full-year operating profit Tuesday. “If you were going to hold meetings and events in Europe, it wouldn’t be in France in the fourth quarter, although I think things have settled a bit now.”..