Fortive Corp - spin-off von Danaher - 500 Beiträge pro Seite

eröffnet am 10.07.16 12:29:57 von

neuester Beitrag 13.01.20 16:08:10 von

neuester Beitrag 13.01.20 16:08:10 von

Beiträge: 13

ID: 1.234.942

ID: 1.234.942

Aufrufe heute: 0

Gesamt: 2.223

Gesamt: 2.223

Aktive User: 0

ISIN: US34959J1088 · WKN: A2AJ0F

75,42

EUR

-0,03 %

-0,02 EUR

Letzter Kurs 22:24:17 Lang & Schwarz

Neuigkeiten

04.04.24 · Business Wire (engl.) |

28.03.24 · Business Wire (engl.) |

19.03.24 · Business Wire (engl.) |

12.03.24 · Business Wire (engl.) |

06.03.24 · Business Wire (engl.) |

Werte aus der Branche Industrie/Mischkonzerne

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6087 | +14,85 | |

| 2,6600 | +14,66 | |

| 15,600 | +13,54 | |

| 1,5680 | +11,84 | |

| 138,50 | +8,63 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,9700 | -3,55 | |

| 17,300 | -3,89 | |

| 22,775 | -6,96 | |

| 10,500 | -7,08 | |

| 3,6000 | -14,29 |

...Stücke wurden gestern eingebucht, bin gespannt;

besonders interessiert mich die Division Teletrac Navman.

Musste ein bisschen suchen, bevor ich was zur Bilanz gefunden habe:

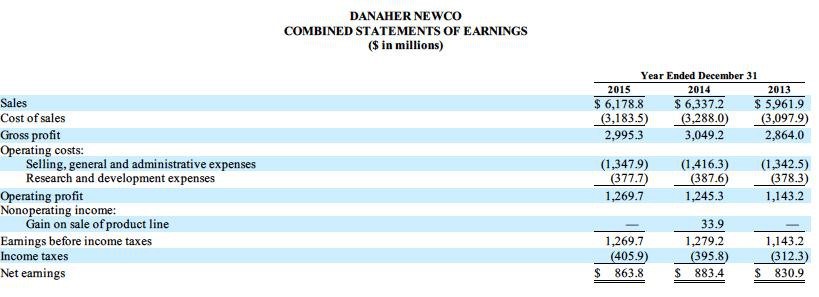

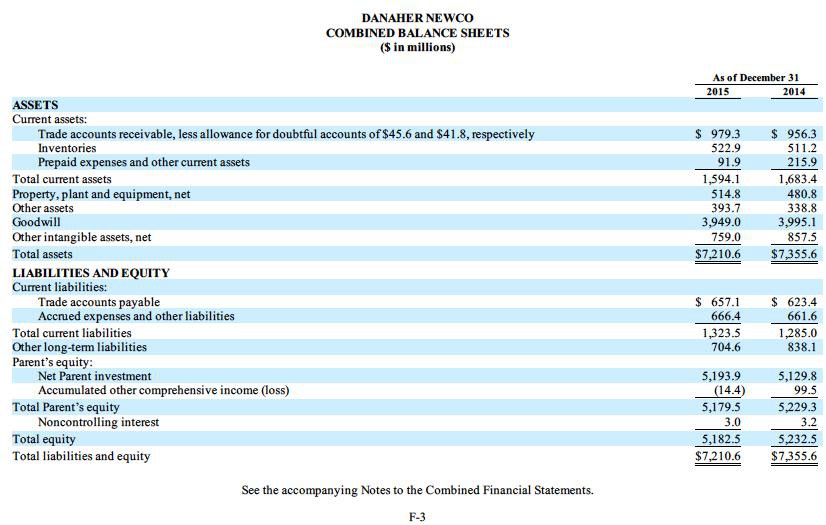

(aus dem 10-12 B/A vom 5.5.2016)

besonders interessiert mich die Division Teletrac Navman.

Musste ein bisschen suchen, bevor ich was zur Bilanz gefunden habe:

(aus dem 10-12 B/A vom 5.5.2016)

und hier gibt es die Vorgeschichte im

Alt-Thread: Danaher besser als Berkshire Hathaway? habe ein paar

Stücke zugekauft

Hab auch aufgestockt, bin mit dem Management bei Danaher voll zufrieden und werde es auch bei Fortive sein. Sind richtig gut die Jungs und Mädels.

Fortive (FTV) to Acquire Landauer (LDR) in $770M Deal

Fortive Corporation (NYSE: FTV) announced today that it has entered into a definitive merger agreement with Landauer (NYSE: LDR), pursuant to which Fortive will acquire Landauer by making a cash tender offer to acquire all of the outstanding shares of Landauer’s common stock for $67.25 per share, for a total enterprise value of approximately $770 million including assumed indebtedness and net of acquired cash.

Landauer is a leading global provider of subscription-based technical and analytical services to determine occupational and environmental radiation exposure, as well as a leading domestic provider of outsourced medical physics services. Headquartered in Glenwood, Illinois, Landauer generated annual revenues of $143 million in 2016, and greater than 80% of these revenues were considered by Landauer to be recurring. Upon closing of the acquisition, Landauer will become part of Fortive’s Field Solutions platform (comprising Fluke, Qualitrol and Industrial Scientific) within Fortive’s Professional Instrumentation segment. Fortive completed the previously-announced acquisition of Industrial Scientific on August 25, 2017.

James A. Lico, Fortive’s President and Chief Executive Officer, stated, “As a recognized leader in personal and environmental radiation measurement and monitoring and outsourced medical physics services, Landauer is expected to strengthen our safety-as-a-service position and improve our recurring revenue, growth and margin profile."

Lico continued, "Through application of the Fortive Business System, we believe that we will drive both accelerated growth and synergies within our Field Solutions Platform. We look forward to welcoming the Landauer team to Fortive."

The acquisition has been unanimously approved by the Board of Directors of each company, and the Landauer Board of Directors has unanimously recommended that Landauer shareholders tender their shares into the offer. The offer is subject to customary conditions, including, among others, the tender of a majority of the outstanding shares into the offer (on a fully diluted basis) and receipt of applicable regulatory approvals. A certain stockholder representing approximately 5% of Landauer's outstanding shares has indicated they intend to tender their shares into the offer. The transaction is expected to be completed by the end of 2017.

Fortive expects to finance the transaction with available cash and credit.

Wed, 06 Sep 2017 08:01:35 -0400

Fortive Corporation (NYSE: FTV) announced today that it has entered into a definitive merger agreement with Landauer (NYSE: LDR), pursuant to which Fortive will acquire Landauer by making a cash tender offer to acquire all of the outstanding shares of Landauer’s common stock for $67.25 per share, for a total enterprise value of approximately $770 million including assumed indebtedness and net of acquired cash.

Landauer is a leading global provider of subscription-based technical and analytical services to determine occupational and environmental radiation exposure, as well as a leading domestic provider of outsourced medical physics services. Headquartered in Glenwood, Illinois, Landauer generated annual revenues of $143 million in 2016, and greater than 80% of these revenues were considered by Landauer to be recurring. Upon closing of the acquisition, Landauer will become part of Fortive’s Field Solutions platform (comprising Fluke, Qualitrol and Industrial Scientific) within Fortive’s Professional Instrumentation segment. Fortive completed the previously-announced acquisition of Industrial Scientific on August 25, 2017.

James A. Lico, Fortive’s President and Chief Executive Officer, stated, “As a recognized leader in personal and environmental radiation measurement and monitoring and outsourced medical physics services, Landauer is expected to strengthen our safety-as-a-service position and improve our recurring revenue, growth and margin profile."

Lico continued, "Through application of the Fortive Business System, we believe that we will drive both accelerated growth and synergies within our Field Solutions Platform. We look forward to welcoming the Landauer team to Fortive."

The acquisition has been unanimously approved by the Board of Directors of each company, and the Landauer Board of Directors has unanimously recommended that Landauer shareholders tender their shares into the offer. The offer is subject to customary conditions, including, among others, the tender of a majority of the outstanding shares into the offer (on a fully diluted basis) and receipt of applicable regulatory approvals. A certain stockholder representing approximately 5% of Landauer's outstanding shares has indicated they intend to tender their shares into the offer. The transaction is expected to be completed by the end of 2017.

Fortive expects to finance the transaction with available cash and credit.

Wed, 06 Sep 2017 08:01:35 -0400

läuft weiter extrem gut

Antwort auf Beitrag Nr.: 58.582.364 von R-BgO am 31.08.18 13:21:59

.

.

Fortive Commences Split-off Exchange Offer for Its Automation and Specialty Business in Connection with Altra Transaction

Tuesday, August 28, 2018 5:05 am PDT

EVERETT, Wash.--(BUSINESS WIRE)--

Fortive Corporation (NYSE: FTV) (“Fortive”) announced today that it has commenced an exchange offer related to the split-off of its Automation & Specialty platform (excluding Fortive’s Hengstler and Dynapar businesses) (the “A&S Business”). The split-off transaction is in connection with the previously announced combination of Fortive’s A&S Business with Altra Industrial Motion Corp. (NASDAQ: AIMC) (“Altra”).

Key elements of the exchange offer:

* Fortive stockholders have the option to exchange some, all or none of their shares of Fortive common stock for shares of common stock of Stevens Holding Company, Inc. (“Newco”), a Fortive subsidiary formed to hold the A&S Business, subject to proration as described below. In the combination, shares of Newco common stock will convert automatically into the right to receive shares of Altra common stock.

Tendering Fortive stockholders are expected to receive approximately $108.70 of Altra common stock for every $100 of Fortive common stock tendered, subject to the upper limit described below.

* Fortive will determine the prices at which shares of Fortive common stock and shares of Newco common stock (and ultimately shares of Altra common stock) will be exchanged by reference to the simple arithmetic average of the daily volume-weighted average prices of Fortive common stock and Altra common stock, respectively, on the New York Stock Exchange and the NASDAQ Global Market on each of the last full three trading days ending on and including the third trading day preceding the expiration date of the exchange offer period.

* Fortive expects to issue 35,000,000 shares of Newco common stock in the exchange offer. The number of shares of Fortive common stock that will be accepted in the exchange offer will depend on the final exchange ratio and the number of shares of Fortive common stock tendered.

* The exchange offer and withdrawal rights are scheduled to expire at 8:00 a.m., New York City time, on September 26, 2018, unless the exchange offer is extended or terminated.

* The exchange offer is designed to permit Fortive stockholders to exchange all or a portion of their shares of Fortive common stock for shares of Newco common stock (which will convert into shares of Altra common stock) at a discount of 8 percent to the per-share value of Altra common stock, subject to an upper limit of 2.3203 shares of Newco common stock for each share of Fortive common stock tendered in the exchange offer.

The aggregate number of shares of Altra common stock issued in the combination is expected to result in holders of shares of Newco common stock before the combination and Newco employees collectively owning approximately 54 percent of the issued and outstanding shares of Altra common stock on a fully diluted basis immediately after the combination.

The final exchange ratio used to determine the number of shares of Newco common stock that Fortive stockholders participating in the exchange offer will receive for each share of Fortive common stock accepted for exchange will be announced by press release no later than 9:00 a.m., New York City time, on September 24, 2018, the second to last full trading day prior to the expiration date (unless the exchange offer is terminated or extended). Fortive will also announce whether the upper limit on the number of shares that can be received for each share of Fortive common stock tendered will be in effect, through http://investors.fortive.com/altra and by press release, no later than 9:00 a.m., New York City time, on September 24, 2018, the second to last full trading day prior to the expiration date (unless the exchange offer is terminated or extended).

nix kapieren...

..

.

Fortive Commences Split-off Exchange Offer for Its Automation and Specialty Business in Connection with Altra Transaction

Tuesday, August 28, 2018 5:05 am PDT

EVERETT, Wash.--(BUSINESS WIRE)--

Fortive Corporation (NYSE: FTV) (“Fortive”) announced today that it has commenced an exchange offer related to the split-off of its Automation & Specialty platform (excluding Fortive’s Hengstler and Dynapar businesses) (the “A&S Business”). The split-off transaction is in connection with the previously announced combination of Fortive’s A&S Business with Altra Industrial Motion Corp. (NASDAQ: AIMC) (“Altra”).

Key elements of the exchange offer:

* Fortive stockholders have the option to exchange some, all or none of their shares of Fortive common stock for shares of common stock of Stevens Holding Company, Inc. (“Newco”), a Fortive subsidiary formed to hold the A&S Business, subject to proration as described below. In the combination, shares of Newco common stock will convert automatically into the right to receive shares of Altra common stock.

Tendering Fortive stockholders are expected to receive approximately $108.70 of Altra common stock for every $100 of Fortive common stock tendered, subject to the upper limit described below.

* Fortive will determine the prices at which shares of Fortive common stock and shares of Newco common stock (and ultimately shares of Altra common stock) will be exchanged by reference to the simple arithmetic average of the daily volume-weighted average prices of Fortive common stock and Altra common stock, respectively, on the New York Stock Exchange and the NASDAQ Global Market on each of the last full three trading days ending on and including the third trading day preceding the expiration date of the exchange offer period.

* Fortive expects to issue 35,000,000 shares of Newco common stock in the exchange offer. The number of shares of Fortive common stock that will be accepted in the exchange offer will depend on the final exchange ratio and the number of shares of Fortive common stock tendered.

* The exchange offer and withdrawal rights are scheduled to expire at 8:00 a.m., New York City time, on September 26, 2018, unless the exchange offer is extended or terminated.

* The exchange offer is designed to permit Fortive stockholders to exchange all or a portion of their shares of Fortive common stock for shares of Newco common stock (which will convert into shares of Altra common stock) at a discount of 8 percent to the per-share value of Altra common stock, subject to an upper limit of 2.3203 shares of Newco common stock for each share of Fortive common stock tendered in the exchange offer.

The aggregate number of shares of Altra common stock issued in the combination is expected to result in holders of shares of Newco common stock before the combination and Newco employees collectively owning approximately 54 percent of the issued and outstanding shares of Altra common stock on a fully diluted basis immediately after the combination.

The final exchange ratio used to determine the number of shares of Newco common stock that Fortive stockholders participating in the exchange offer will receive for each share of Fortive common stock accepted for exchange will be announced by press release no later than 9:00 a.m., New York City time, on September 24, 2018, the second to last full trading day prior to the expiration date (unless the exchange offer is terminated or extended). Fortive will also announce whether the upper limit on the number of shares that can be received for each share of Fortive common stock tendered will be in effect, through http://investors.fortive.com/altra and by press release, no later than 9:00 a.m., New York City time, on September 24, 2018, the second to last full trading day prior to the expiration date (unless the exchange offer is terminated or extended).

Antwort auf Beitrag Nr.: 58.608.462 von R-BgO am 04.09.18 10:51:25Thread: Altra Industrial Motion

Antwort auf Beitrag Nr.: 58.612.353 von R-BgO am 04.09.18 16:39:35kompliziert...:

Fortive Announces Final Proration Factor of 11.6114 percent for Shares Tendered in Split-Off Exchange Offer in Connection with Altra Transaction; Completes Merger

Everett, WA, October 1, 2018–

Fortive Corporation (NYSE: FTV) announced today the final proration factor of 11.6114 percent in its split-off exchange offer for Fortive common stock in connection with the previously announced separation of Fortive’s Automation and Specialty platform (excluding Fortive’s Hengstler and Dynapar businesses) (the “A&S Business”) and merger of Stevens Holding Company, Inc., the Fortive subsidiary holding the A&S Business, with a subsidiary of Altra Industrial Motion Corp. (NASDAQ: AIMC) (the “Merger”).

Fortive also announced today the closing of the Merger.

Exchange Offer Results

Pursuant to the exchange offer, which expired at 8:00 a.m., New York City time, on September 26, 2018, Fortive has accepted 15,824,931 shares of Fortive common stock for 35,000,000 shares of Stevens Holding common stock.

A total of 128,334,418 shares of Fortive common stock were validly tendered (and not withdrawn) in the exchange offer, including 1,044,789 shares tendered by odd-lot shareholders (excluding plan participants in Fortive savings plans). Such odd-lot shareholders were not subject to proration, and their shares were fully accepted in the offer. The remaining validly tendered shares of Fortive common stock were accepted in the exchange on a pro rata basis using the final proration factor. Shares of Fortive common stock that were validly tendered but not accepted for exchange will be returned to tendering shareholders.

Under the terms of the exchange offer, 35,000,000 shares of Stevens Holding common stock were available for distribution in exchange for shares of Fortive common stock accepted in the offer. The final exchange ratio for the exchange offer was set at 2.2117 shares of Stevens Holding common stock for each share of Fortive common stock validly tendered and not properly withdrawn. In the Merger, each share of Stevens Holding common stock automatically converted into the right to receive one share of Altra common stock. Accordingly, Fortive shareholders who tendered their shares of Fortive common stock as part of the exchange offer received 2.2117 shares of Altra common stock, subject to treatment of fractional shares described below, for each share of Fortive common stock tendered and accepted for exchange. Fortive accepted the maximum of 15,824,931 shares of Fortive common stock for exchange in the offer.

Whole shares of Altra common stock in uncertificated form will be received by Fortive shareholders whose shares of Fortive common stock were accepted in the exchange. Under the terms of the exchange offer, fractional shares of Altra common stock will not be issued. Rather, the respective tendering shareholders that otherwise would have received fractional interests will be paid in cash the dollar amount (rounded to the nearest whole cent), after deducting any required withholding taxes, on a pro rata basis, without interest, of such fractional interests determined by the closing price of a share of Altra common stock on the NASDAQ Global Market on the last business day prior to the closing of the merger.

Closing of Merger

Effective October 1, 2018, Stevens Holding merged with a subsidiary of Altra and became a wholly owned subsidiary of Altra, whereby Stevens Holding common stock was converted to Altra common stock. As part of this transaction, in addition to Fortive shareholders receiving 35,000,000 shares of Altra common stock (subject to cash in lieu of fractional shares of Altra common stock), Fortive also received approximately $1.4 billion in cash proceeds and retirement of outstanding debt securities.

Fortive Announces Final Proration Factor of 11.6114 percent for Shares Tendered in Split-Off Exchange Offer in Connection with Altra Transaction; Completes Merger

Everett, WA, October 1, 2018–

Fortive Corporation (NYSE: FTV) announced today the final proration factor of 11.6114 percent in its split-off exchange offer for Fortive common stock in connection with the previously announced separation of Fortive’s Automation and Specialty platform (excluding Fortive’s Hengstler and Dynapar businesses) (the “A&S Business”) and merger of Stevens Holding Company, Inc., the Fortive subsidiary holding the A&S Business, with a subsidiary of Altra Industrial Motion Corp. (NASDAQ: AIMC) (the “Merger”).

Fortive also announced today the closing of the Merger.

Exchange Offer Results

Pursuant to the exchange offer, which expired at 8:00 a.m., New York City time, on September 26, 2018, Fortive has accepted 15,824,931 shares of Fortive common stock for 35,000,000 shares of Stevens Holding common stock.

A total of 128,334,418 shares of Fortive common stock were validly tendered (and not withdrawn) in the exchange offer, including 1,044,789 shares tendered by odd-lot shareholders (excluding plan participants in Fortive savings plans). Such odd-lot shareholders were not subject to proration, and their shares were fully accepted in the offer. The remaining validly tendered shares of Fortive common stock were accepted in the exchange on a pro rata basis using the final proration factor. Shares of Fortive common stock that were validly tendered but not accepted for exchange will be returned to tendering shareholders.

Under the terms of the exchange offer, 35,000,000 shares of Stevens Holding common stock were available for distribution in exchange for shares of Fortive common stock accepted in the offer. The final exchange ratio for the exchange offer was set at 2.2117 shares of Stevens Holding common stock for each share of Fortive common stock validly tendered and not properly withdrawn. In the Merger, each share of Stevens Holding common stock automatically converted into the right to receive one share of Altra common stock. Accordingly, Fortive shareholders who tendered their shares of Fortive common stock as part of the exchange offer received 2.2117 shares of Altra common stock, subject to treatment of fractional shares described below, for each share of Fortive common stock tendered and accepted for exchange. Fortive accepted the maximum of 15,824,931 shares of Fortive common stock for exchange in the offer.

Whole shares of Altra common stock in uncertificated form will be received by Fortive shareholders whose shares of Fortive common stock were accepted in the exchange. Under the terms of the exchange offer, fractional shares of Altra common stock will not be issued. Rather, the respective tendering shareholders that otherwise would have received fractional interests will be paid in cash the dollar amount (rounded to the nearest whole cent), after deducting any required withholding taxes, on a pro rata basis, without interest, of such fractional interests determined by the closing price of a share of Altra common stock on the NASDAQ Global Market on the last business day prior to the closing of the merger.

Closing of Merger

Effective October 1, 2018, Stevens Holding merged with a subsidiary of Altra and became a wholly owned subsidiary of Altra, whereby Stevens Holding common stock was converted to Altra common stock. As part of this transaction, in addition to Fortive shareholders receiving 35,000,000 shares of Altra common stock (subject to cash in lieu of fractional shares of Altra common stock), Fortive also received approximately $1.4 billion in cash proceeds and retirement of outstanding debt securities.

Antwort auf Beitrag Nr.: 59.081.456 von R-BgO am 29.10.18 09:53:39

operativ war es Stagnation

der spin-off hat die Zahlen für 2018 insgesamt

krass nach oben verzerrt,operativ war es Stagnation

habe mal ein paar von dem genommen:

Thread: Fortive 5% mandatory convertible

Portfoliocheck: Bei Fortive reizt Andreas Halvorsen der Doppeleffekt aus zyklischer Erholung und Spin-off-Phantasie. Im dritten Quartal 2019 wälzte Halvorsen fast sein halbes Depots um: neuer Spitzenreiter ist Amazon, doch vor allem Fortive (ver)lockt...

https://www.wallstreet-online.de/diskussion/1234942-11-20/fo…

https://www.wallstreet-online.de/diskussion/1234942-11-20/fo…

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,50 | |

| +0,31 | |

| +0,03 | |

| -0,21 | |

| +6,69 | |

| -0,40 | |

| +0,17 | |

| +5,90 | |

| +1,56 | |

| +2,34 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 210 | ||

| 92 | ||

| 91 | ||

| 63 | ||

| 49 | ||

| 48 | ||

| 40 | ||

| 36 | ||

| 33 | ||

| 30 |