Europa's Banken: Schicksalsjahr 2016

eröffnet am 31.07.16 19:44:34 von

neuester Beitrag 05.12.23 15:03:17 von

neuester Beitrag 05.12.23 15:03:17 von

Beiträge: 158

ID: 1.236.043

ID: 1.236.043

Aufrufe heute: 0

Gesamt: 10.244

Gesamt: 10.244

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 36 Minuten | 24246 | |

| vor 30 Minuten | 4589 | |

| vor 14 Minuten | 4275 | |

| vor 1 Stunde | 3536 | |

| vor 13 Minuten | 2312 | |

| vor 1 Stunde | 1975 | |

| vor 1 Stunde | 1733 | |

| vor 1 Minute | 1305 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.092,13 | -0,38 | 213 | |||

| 2. | 2. | 161,16 | +11,39 | 196 | |||

| 3. | 8. | 9,6200 | -33,70 | 195 | |||

| 4. | 3. | 0,1975 | +3,40 | 71 | |||

| 5. | 9. | 748,92 | -1,70 | 33 | |||

| 6. | 19. | 6,7580 | -2,26 | 32 | |||

| 7. | 50. | 56,20 | +1,08 | 28 | |||

| 8. | 11. | 0,1914 | -1,75 | 26 |

Beitrag zu dieser Diskussion schreiben

5.12.

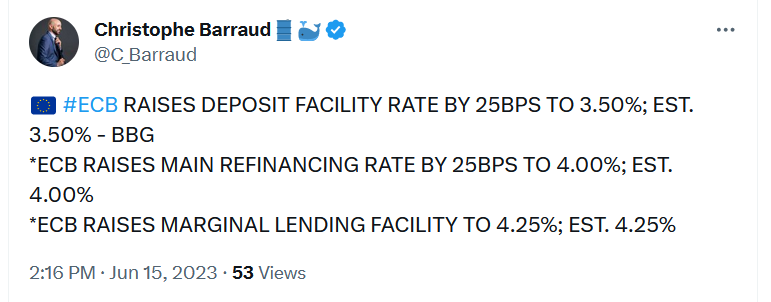

Schnabel ECB Rate U-Turn Prompts Market Bets on Earlier Cut

https://finance.yahoo.com/news/schnabel-ecb-rate-u-turn-1009…

...

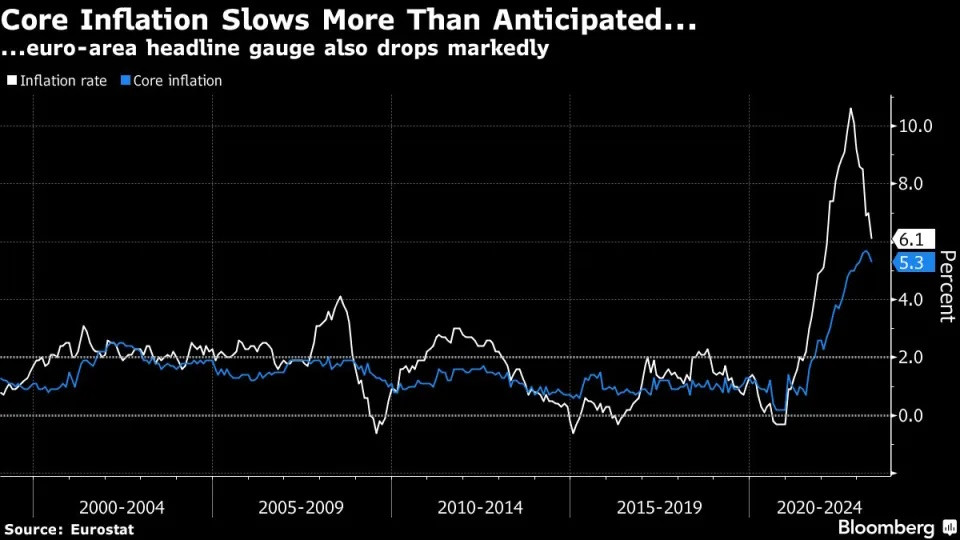

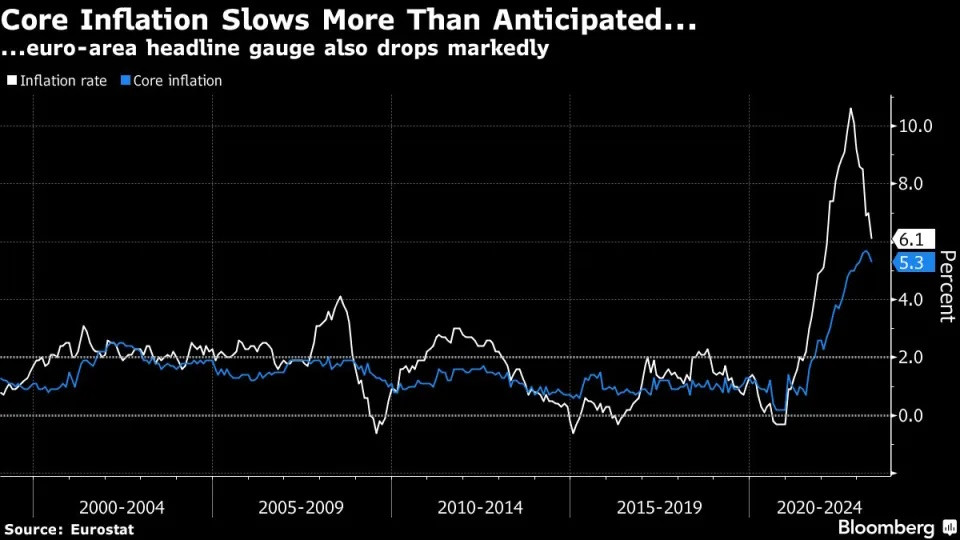

One of the European Central Bank’s most hawkish officials said inflation is showing a “remarkable” slowdown, a U-turn prompting markets to ramp up bets on an interest-rate cut as early as March.

Executive Board member Isabel Schnabel, speaking in a Reuters interview, said that the consumer-price data released last week now make another hike in borrowing costs “rather unlikely,” and refused to be drawn on the prospect that a reduction could even transpire within six months.

Money markets ramped up bets on faster and deeper rate cuts after the comments, almost fully pricing a quarter-point drop by March and 150-basis-points of decreases by the end of next year. The odds of a move in the first quarter were almost zero three weeks ago, while late last month only three quarter-point cuts were priced for next year.

Schnabel spoke days after a report showed euro-area inflation slowed to 2.4%, far lower than economists had anticipated and approaching the ECB’s 2% target. So-called core price growth — which strips out volatile elements such as energy — has also retreated.

“The November flash release was a very pleasant surprise,” she said according to a transcript of the Dec. 1 interview published Tuesday on the ECB’s website. “Most importantly, underlying inflation, which has proven more stubborn, is now also falling more quickly than we had expected. This is quite remarkable. All in all, inflation developments have been encouraging.”

...

Schnabel ECB Rate U-Turn Prompts Market Bets on Earlier Cut

https://finance.yahoo.com/news/schnabel-ecb-rate-u-turn-1009…

...

One of the European Central Bank’s most hawkish officials said inflation is showing a “remarkable” slowdown, a U-turn prompting markets to ramp up bets on an interest-rate cut as early as March.

Executive Board member Isabel Schnabel, speaking in a Reuters interview, said that the consumer-price data released last week now make another hike in borrowing costs “rather unlikely,” and refused to be drawn on the prospect that a reduction could even transpire within six months.

Money markets ramped up bets on faster and deeper rate cuts after the comments, almost fully pricing a quarter-point drop by March and 150-basis-points of decreases by the end of next year. The odds of a move in the first quarter were almost zero three weeks ago, while late last month only three quarter-point cuts were priced for next year.

Schnabel spoke days after a report showed euro-area inflation slowed to 2.4%, far lower than economists had anticipated and approaching the ECB’s 2% target. So-called core price growth — which strips out volatile elements such as energy — has also retreated.

“The November flash release was a very pleasant surprise,” she said according to a transcript of the Dec. 1 interview published Tuesday on the ECB’s website. “Most importantly, underlying inflation, which has proven more stubborn, is now also falling more quickly than we had expected. This is quite remarkable. All in all, inflation developments have been encouraging.”

...

30.10.

It’s Time to Short European Banks After Rally, JPMorgan Says

https://finance.yahoo.com/news/time-short-european-banks-ral…

...

Following a strong performance by European banking stocks this year, investors should now bet on declines in the sector as lenders are at risk from a looming peak in bond yields, according to JPMorgan Chase & Co. strategists.

Any drop in yields, or interest-rate cuts by the European Central Bank next year, will reduce banks’ profitability, strategists led by Mislav Matejka wrote in a note Monday. They are also vulnerable to any signs of a recession in the region, the team said, advising opening a short on the sector and downgrading it to underweight from neutral.

“Banks could suffer if economies enter contraction, and if some of the very benign credit backdrop changes next year, with spreads widening and delinquencies rising,” they wrote in a note. Credit risks look likely to rise, particularly for lenders exposed to high-yield corporates, small-and-medium enterprises and commercial real estate, as refinancing needs are set to increase from next year.

...

28.10.

Lagardes Kurs übers Hochzinsplateau braucht ihre volle Ausdauer

https://de.finance.yahoo.com/nachrichten/lagardes-kurs-%C3%B…

26.10.

Leitzins: EZB legt Zinspause ein - Guidance für APP und PEPP bestätigt

https://www.finanzen.net/nachricht/zinsen/zinsentscheid-leit…

...

Zum weiteren geldpolitischen Kurs heißt es: "Auf der Grundlage seiner derzeitigen Einschätzung ist der EZB-Rat der Ansicht, dass die Leitzinsen ein Niveau erreicht haben, das, wenn es für einen ausreichend langen Zeitraum beibehalten wird, einen wesentlichen Beitrag zur rechtzeitigen Rückkehr der Inflation zum Zielwert leisten wird."

Die künftigen Beschlüsse des EZB-Rats würden dafür sorgen, dass die Leitzinsen so lange wie nötig auf einem hinreichend restriktiven Niveau gehalten würden.

...

Leitzins: EZB legt Zinspause ein - Guidance für APP und PEPP bestätigt

https://www.finanzen.net/nachricht/zinsen/zinsentscheid-leit…

...

Zum weiteren geldpolitischen Kurs heißt es: "Auf der Grundlage seiner derzeitigen Einschätzung ist der EZB-Rat der Ansicht, dass die Leitzinsen ein Niveau erreicht haben, das, wenn es für einen ausreichend langen Zeitraum beibehalten wird, einen wesentlichen Beitrag zur rechtzeitigen Rückkehr der Inflation zum Zielwert leisten wird."

Die künftigen Beschlüsse des EZB-Rats würden dafür sorgen, dass die Leitzinsen so lange wie nötig auf einem hinreichend restriktiven Niveau gehalten würden.

...

29.9.

Euro-Zone Core Inflation Hits 1-Year Low, Backing ECB Pause

https://finance.yahoo.com/news/euro-zone-core-inflation-hits…

...

Euro-area core inflation eased to its slowest pace in a year, supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

...

Friday’s data offer the most definitive sign yet that the growth in core prices, a key metric as monetary policy was tightened, is firmly on the way down following a summer during which statistical distortions propped it up.

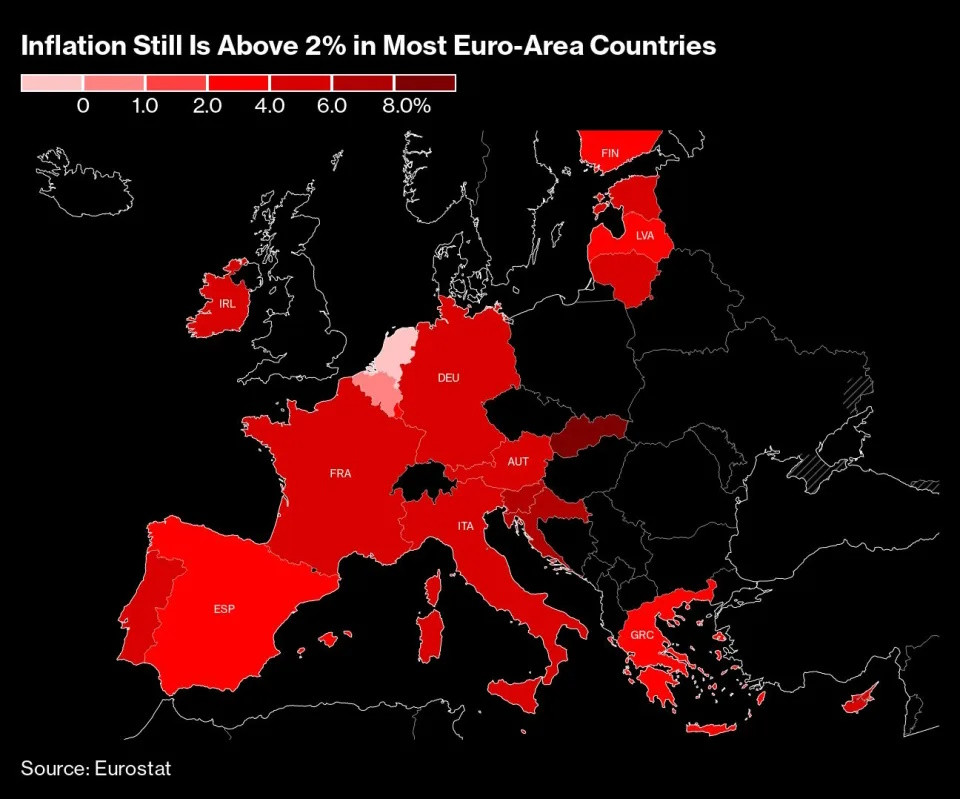

But with both measures still more than double the ECB’s 2% goal, markets are bracing for what officials say will be an extended period of elevated borrowing costs. Highlighting the divergent trends in the 20-member euro zone, German inflation plunged to a two-year low this month, while Spain’s reading jumped back above 3%.

...

Euro-Zone Core Inflation Hits 1-Year Low, Backing ECB Pause

https://finance.yahoo.com/news/euro-zone-core-inflation-hits…

...

Euro-area core inflation eased to its slowest pace in a year, supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

...

Friday’s data offer the most definitive sign yet that the growth in core prices, a key metric as monetary policy was tightened, is firmly on the way down following a summer during which statistical distortions propped it up.

But with both measures still more than double the ECB’s 2% goal, markets are bracing for what officials say will be an extended period of elevated borrowing costs. Highlighting the divergent trends in the 20-member euro zone, German inflation plunged to a two-year low this month, while Spain’s reading jumped back above 3%.

...

25.7.

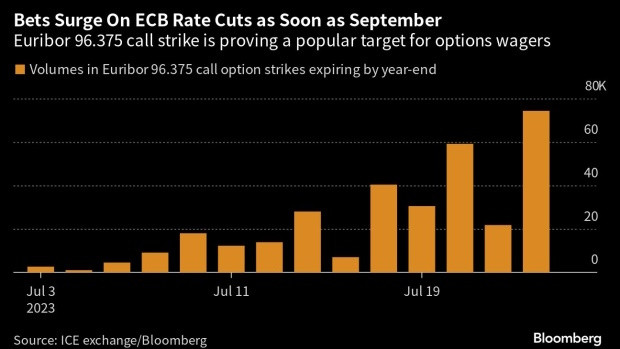

Options Traders Wager on Fastest Ever U-Turn From the ECB

https://www.bnnbloomberg.ca/options-traders-wager-on-fastest…

...

Money-market pricing points to two more rate rises — a 25 basis point hike this week, while odds favor a further increase to a record-high 4%. But options markets — which give investors a cheap way to wager on alternative outcomes — suggest there won’t be a second hike, and cuts could come as soon as September to avoid too harsh a blow to growth.

That would be a quicker about-face than in 2008, when European policy makers sought to rapidly undo the damage of the previous run of hikes, heralding a phase of aggressive monetary-policy easing as the global financial crisis unfolded.

...

9.7.

ECB Rate Hikes to End Soon at ‘High Plateau,’ Villeroy Says

https://www.bloomberg.com/news/articles/2023-07-09/ecb-will-…

• Borrowing costs must stay elevated to impact economy, he says

• Centeno sees inflation coming down ‘faster than the way up’

...

ECB Rate Hikes to End Soon at ‘High Plateau,’ Villeroy Says

https://www.bloomberg.com/news/articles/2023-07-09/ecb-will-…

• Borrowing costs must stay elevated to impact economy, he says

• Centeno sees inflation coming down ‘faster than the way up’

...

6.6.

Lagarde Says Inflation Is Strong, ECB to Hike Further

https://finance.yahoo.com/news/ecb-lagarde-says-price-pressu…

...

“Price pressures remain strong,” Lagarde told European Union lawmakers in Brussels.

“Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary, she said.

...

Lagarde Says Inflation Is Strong, ECB to Hike Further

https://finance.yahoo.com/news/ecb-lagarde-says-price-pressu…

...

“Price pressures remain strong,” Lagarde told European Union lawmakers in Brussels.

“Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary, she said.

...

26.3.

Euro Rally Puts $1.10 in Sight With ECB Now Last Hawk Standing

https://finance.yahoo.com/news/euro-rally-puts-1-10-07000090…

...

Christine Lagarde is cementing her credentials as the biggest hawk among major central bankers despite the mounting banking stress, handing financial markets a reason to buy the euro and sell German bonds.

The president of the European Central Bank last week declared getting euro-area inflation back on target is “non-negotiable” and won’t involve “trade-offs,” days after she boosted interest rates by 50 basis points.

By contrast, Federal Reserve Chair Jerome Powell executed a smaller increase and said US rate setters had considered a pause, while Governor Andrew Bailey’s Bank of England delivered a 25 basis point hike and said inflation was likely to slow “sharply.”

The widening divergence in monetary policy sits at the heart of two trades favored by currency and bond investors.

...

Euro Rally Puts $1.10 in Sight With ECB Now Last Hawk Standing

https://finance.yahoo.com/news/euro-rally-puts-1-10-07000090…

...

Christine Lagarde is cementing her credentials as the biggest hawk among major central bankers despite the mounting banking stress, handing financial markets a reason to buy the euro and sell German bonds.

The president of the European Central Bank last week declared getting euro-area inflation back on target is “non-negotiable” and won’t involve “trade-offs,” days after she boosted interest rates by 50 basis points.

By contrast, Federal Reserve Chair Jerome Powell executed a smaller increase and said US rate setters had considered a pause, while Governor Andrew Bailey’s Bank of England delivered a 25 basis point hike and said inflation was likely to slow “sharply.”

The widening divergence in monetary policy sits at the heart of two trades favored by currency and bond investors.

...